Adv Acc_Chap002.ppt

- Количество слайдов: 38

Copyright © 2011 by the Mc. Graw-Hill Companies, Inc. All rights reserved. 2 Review of the Accounting Process Power. Point Authors: Susan Coomer Galbreath, Ph. D. , CPA Charles W. Caldwell, D. B. A. , CMA Jon A. Booker, Ph. D. , CPA, CIA Cynthia J. Rooney, Ph. D. , CPA Mc. Graw-Hill/Irwin

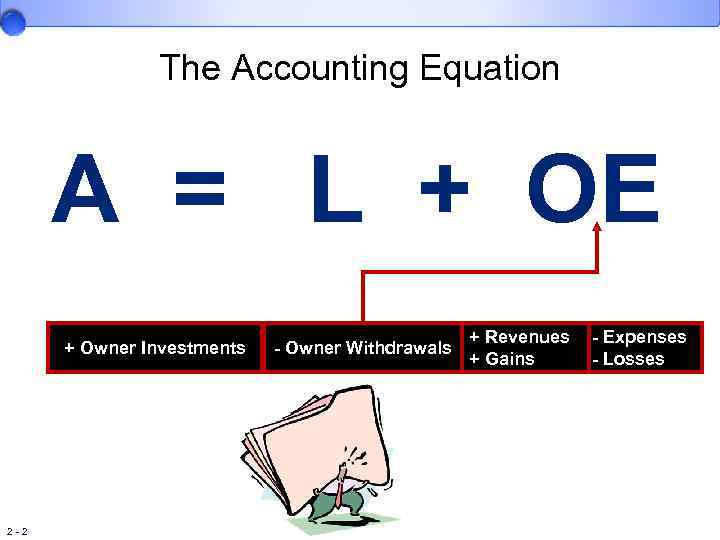

The Accounting Equation A = L + OE + Owner Investments 2 -2 - Owner Withdrawals + Revenues + Gains - Expenses - Losses

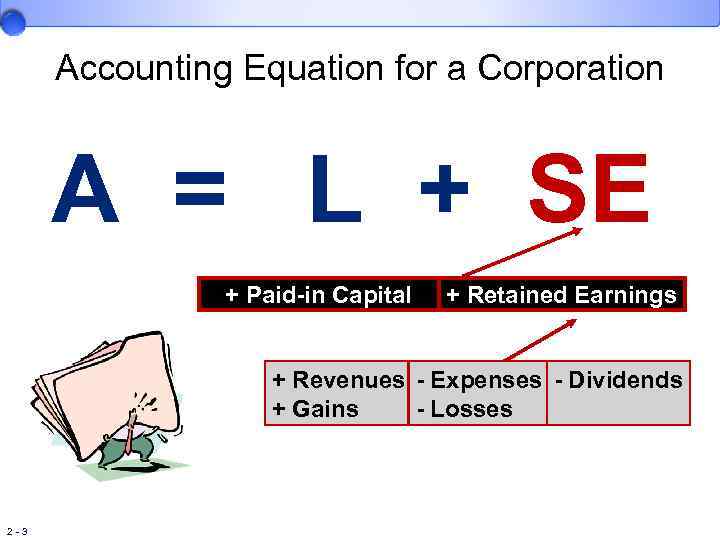

Accounting Equation for a Corporation A = L + SE + Paid-in Capital + Retained Earnings + Revenues - Expenses - Dividends + Gains - Losses 2 -3

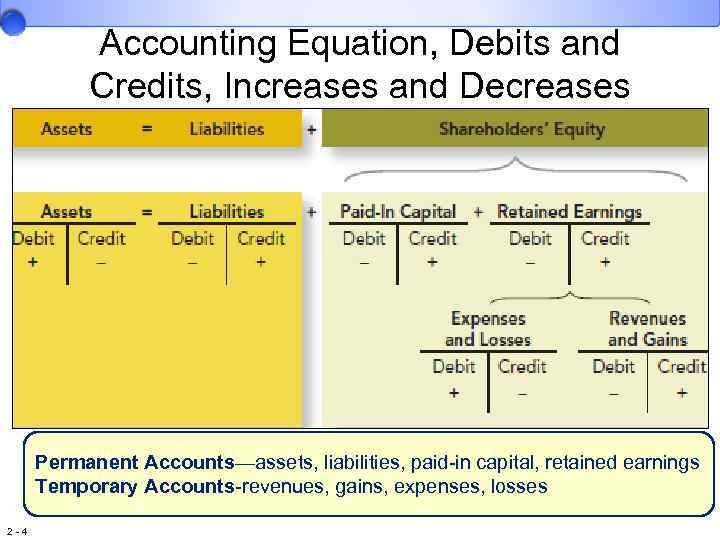

Accounting Equation, Debits and Credits, Increases and Decreases Permanent Accounts—assets, liabilities, paid-in capital, retained earnings Temporary Accounts-revenues, gains, expenses, losses 2 -4

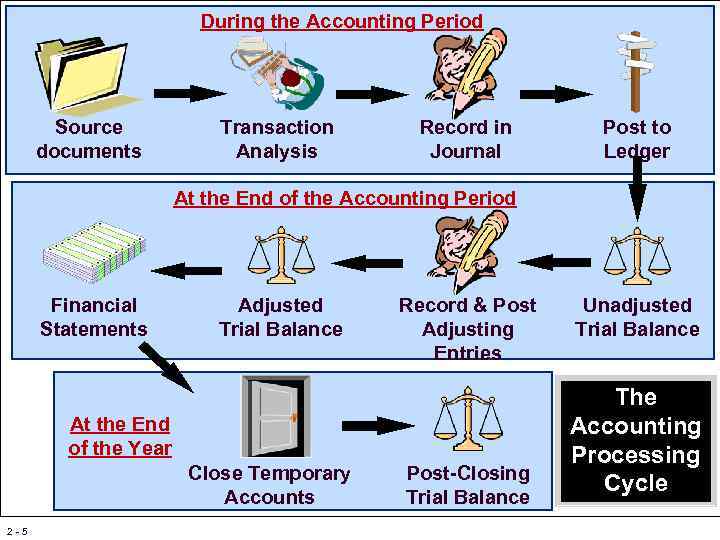

During the Accounting Period Source documents Transaction Analysis Record in Journal Post to Ledger At the End of the Accounting Period Financial Statements Adjusted Trial Balance Record & Post Adjusting Entries At the End of the Year Close Temporary Accounts 2 -5 Post-Closing Trial Balance Unadjusted Trial Balance The Accounting Processing Cycle

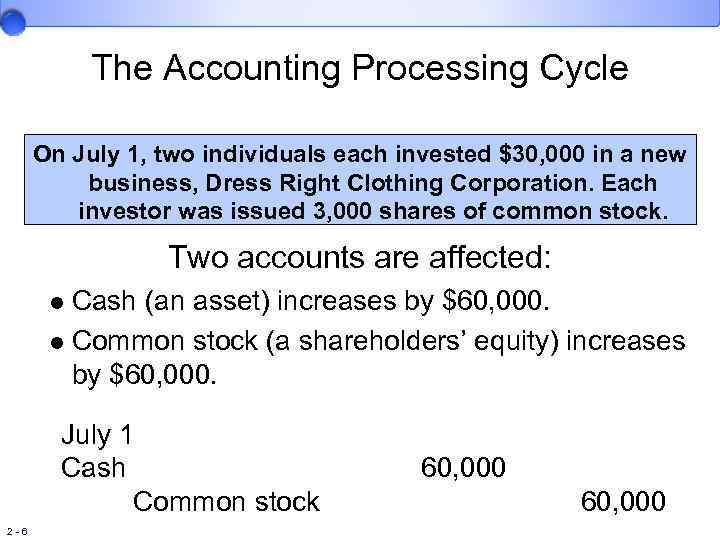

The Accounting Processing Cycle On July 1, two individuals each invested $30, 000 in a new business, Dress Right Clothing Corporation. Each investor was issued 3, 000 shares of common stock. Two accounts are affected: Cash (an asset) increases by $60, 000. l Common stock (a shareholders’ equity) increases by $60, 000. l July 1 Cash Common stock 2 -6 60, 000

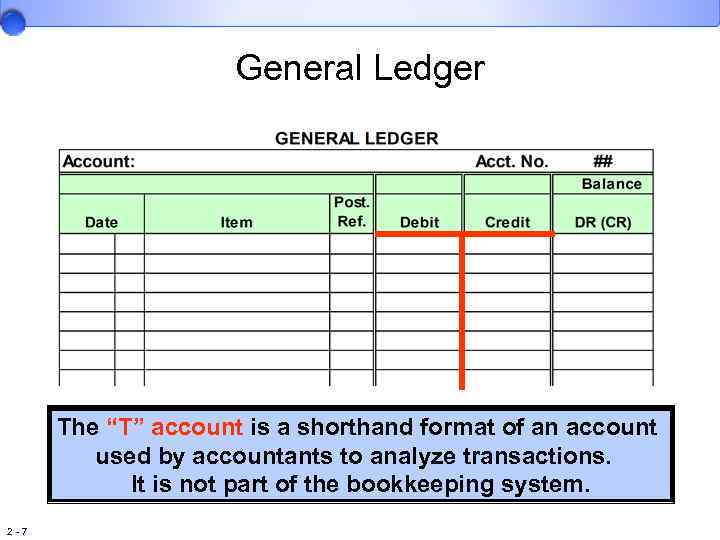

General Ledger The “T” account is a shorthand format of an account used by accountants to analyze transactions. It is not part of the bookkeeping system. 2 -7

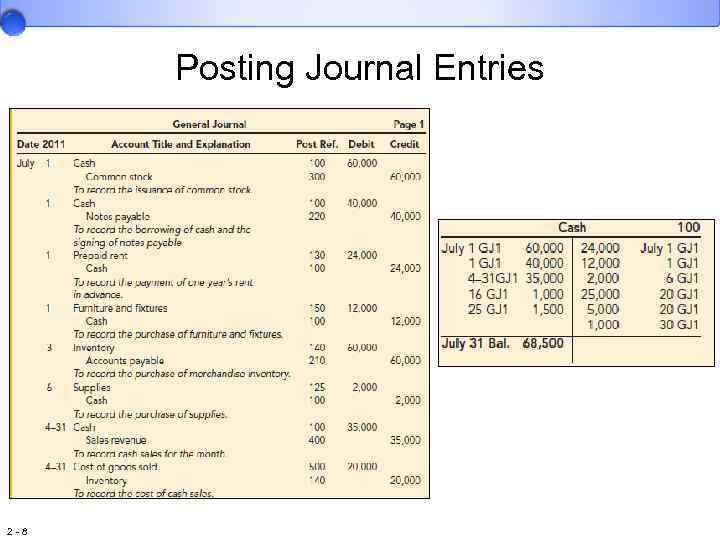

Posting Journal Entries 2 -8

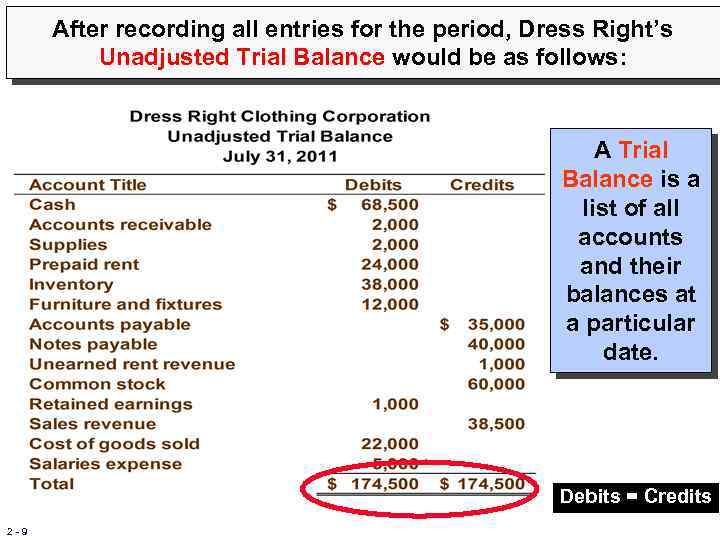

After recording all entries for the period, Dress Right’s Unadjusted Trial Balance would be as follows: A Trial Balance is a list of all accounts and their balances at a particular date. Debits = Credits 2 -9

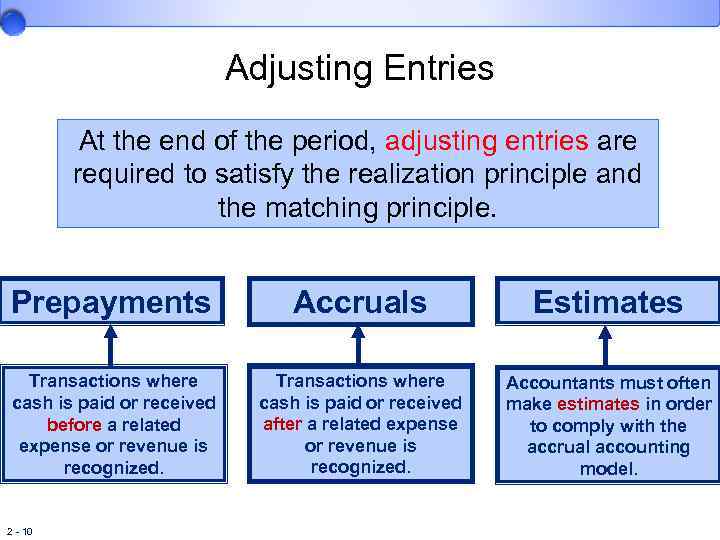

Adjusting Entries At the end of the period, adjusting entries are required to satisfy the realization principle and the matching principle. Prepayments Accruals Estimates Transactions where cash is paid or received before a related expense or revenue is recognized. Transactions where cash is paid or received after a related expense or revenue is recognized. Accountants must often make estimates in order to comply with the accrual accounting model. 2 - 10

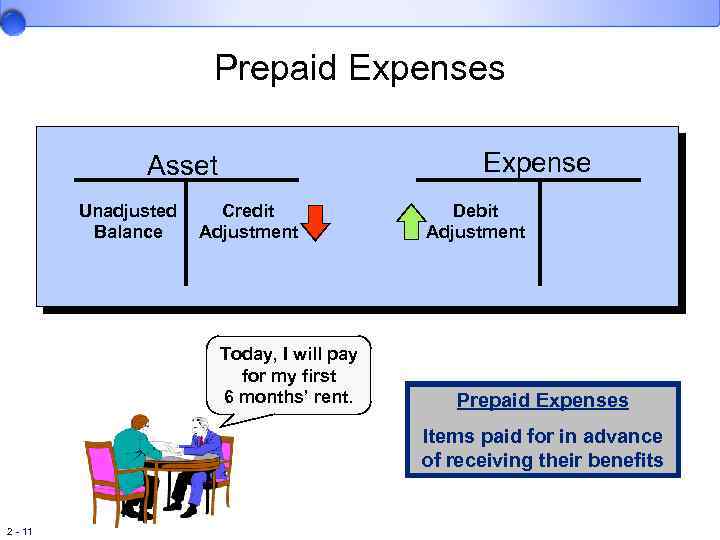

Prepaid Expenses Expense Asset Unadjusted Balance Credit Adjustment Today, I will pay for my first 6 months’ rent. Debit Adjustment Prepaid Expenses Items paid for in advance of receiving their benefits 2 - 11

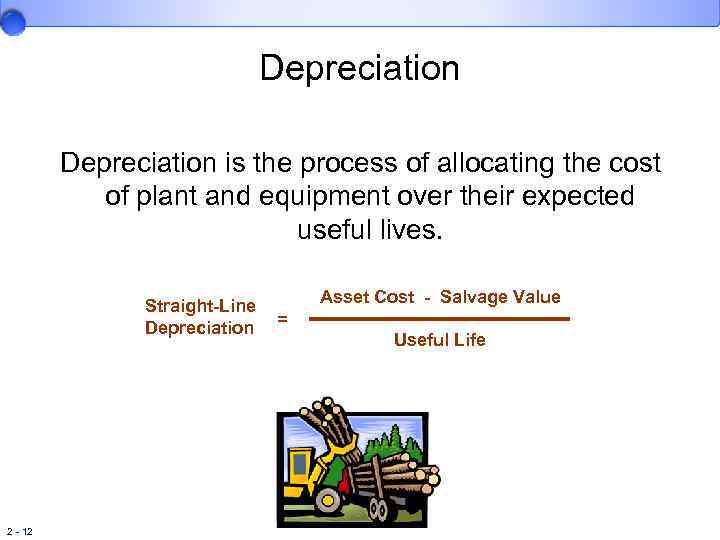

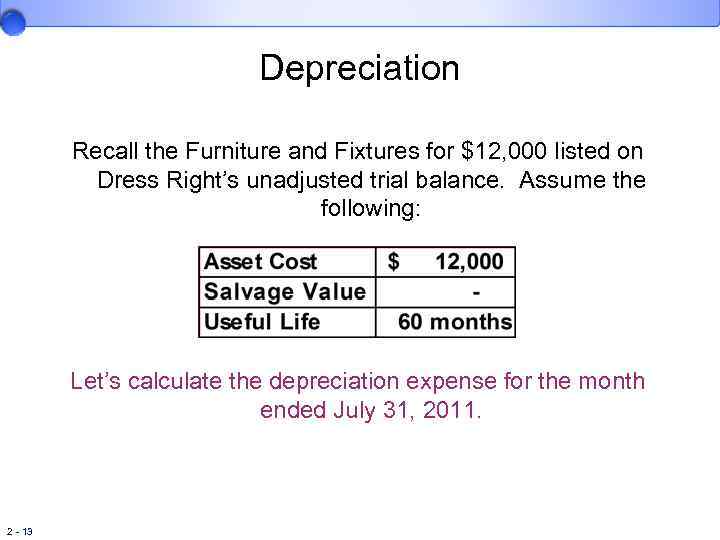

Depreciation is the process of allocating the cost of plant and equipment over their expected useful lives. Straight-Line Depreciation 2 - 12 Asset Cost - Salvage Value = Useful Life

Depreciation Recall the Furniture and Fixtures for $12, 000 listed on Dress Right’s unadjusted trial balance. Assume the following: Let’s calculate the depreciation expense for the month ended July 31, 2011. 2 - 13

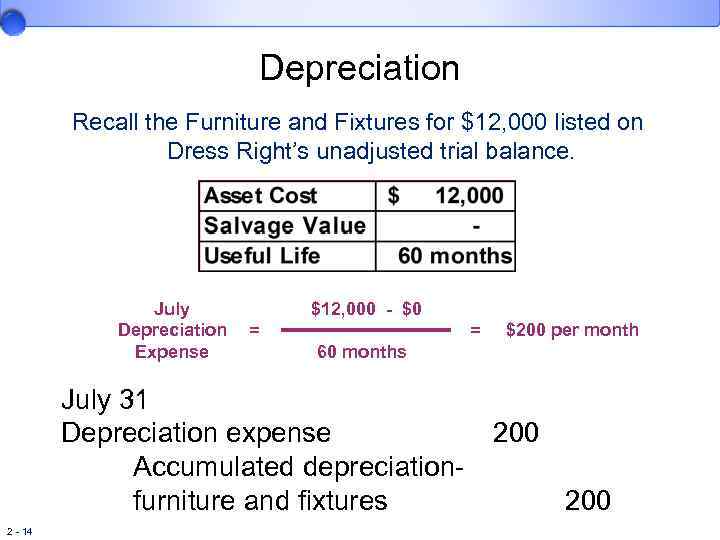

Depreciation Recall the Furniture and Fixtures for $12, 000 listed on Dress Right’s unadjusted trial balance. July Depreciation Expense $12, 000 - $0 = = 60 months July 31 Depreciation expense Accumulated depreciationfurniture and fixtures 2 - 14 $200 per month 200

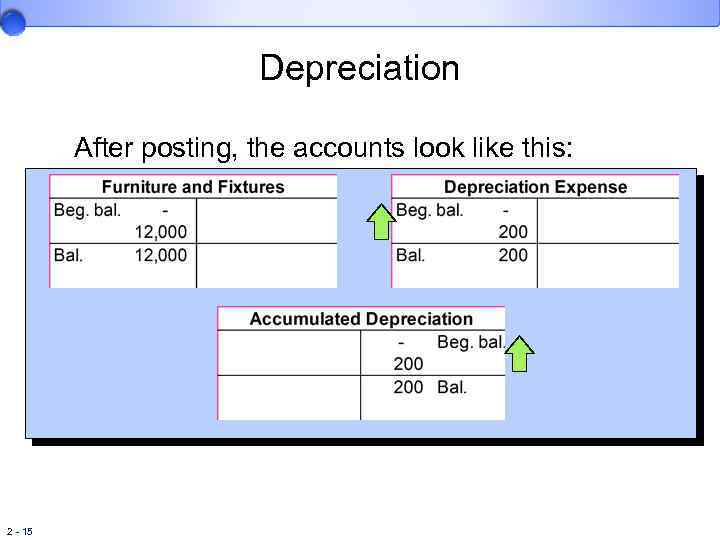

Depreciation After posting, the accounts look like this: 2 - 15

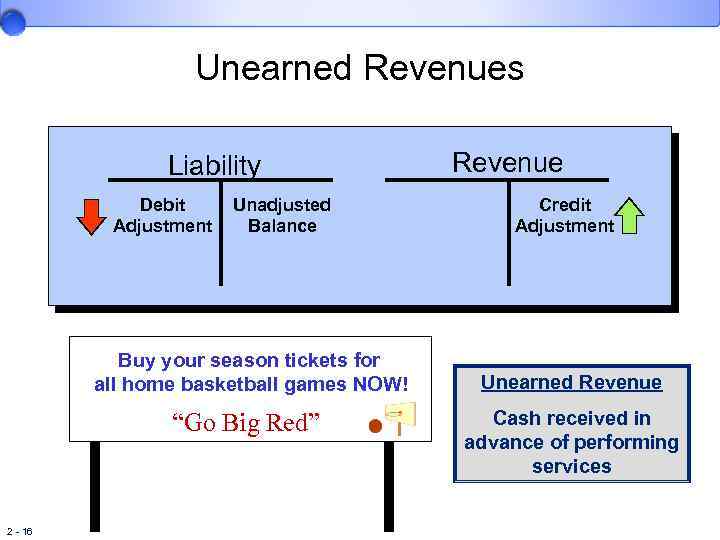

Unearned Revenues Liability Debit Adjustment Unadjusted Balance Buy your season tickets for all home basketball games NOW! “Go Big Red” 2 - 16 Revenue Credit Adjustment Unearned Revenue Cash received in advance of performing services

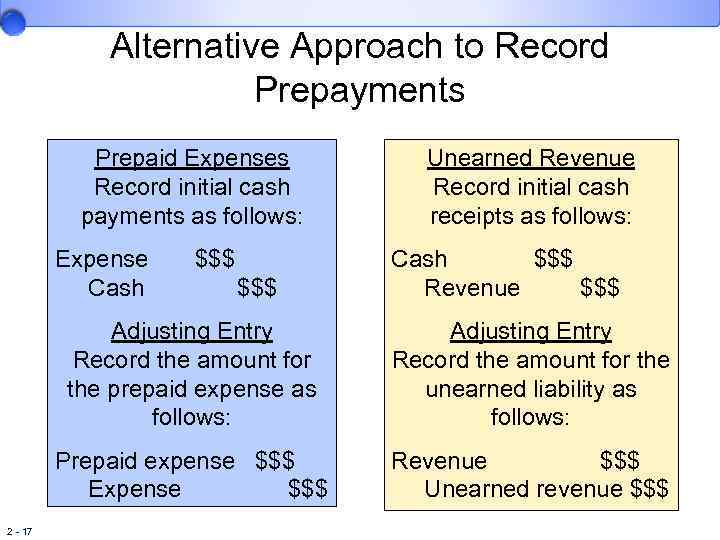

Alternative Approach to Record Prepayments Prepaid Expenses Record initial cash payments as follows: Expense Cash $$$ Unearned Revenue Record initial cash receipts as follows: Cash $$$ Revenue $$$ Adjusting Entry Record the amount for the prepaid expense as follows: Prepaid expense $$$ Expense $$$ 2 - 17 Adjusting Entry Record the amount for the unearned liability as follows: Revenue $$$ Unearned revenue $$$

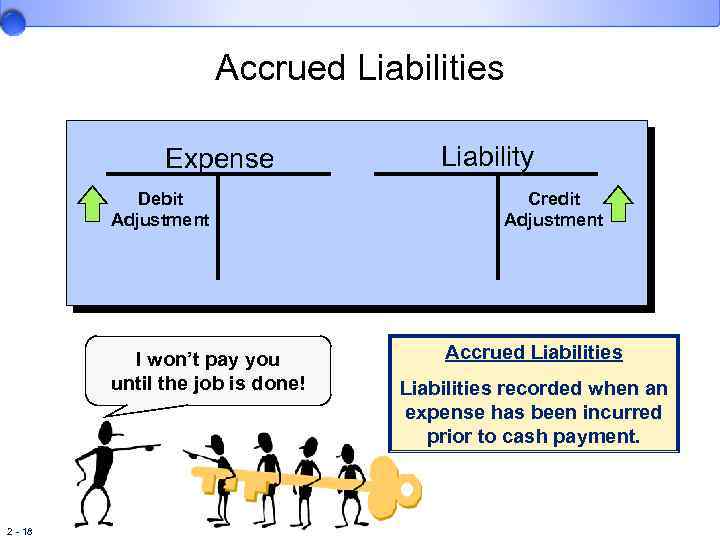

Accrued Liabilities Expense Debit Adjustment I won’t pay you until the job is done! 2 - 18 Liability Credit Adjustment Accrued Liabilities recorded when an expense has been incurred prior to cash payment.

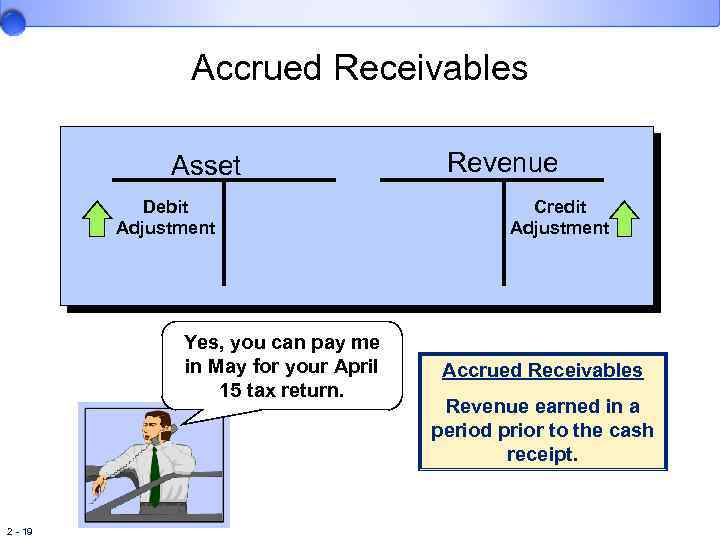

Accrued Receivables Asset Debit Adjustment Yes, you can pay me in May for your April 15 tax return. 2 - 19 Revenue Credit Adjustment Accrued Receivables Revenue earned in a period prior to the cash receipt.

Estimates Accountants often must make estimates of future events to comply with the accrual accounting model. • Examples – Depreciation – Uncollectible accounts $ 2 - 20

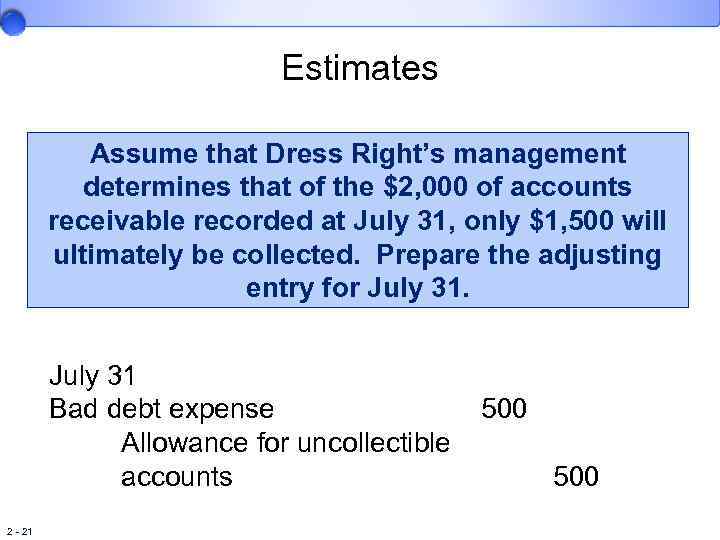

Estimates Assume that Dress Right’s management determines that of the $2, 000 of accounts receivable recorded at July 31, only $1, 500 will ultimately be collected. Prepare the adjusting entry for July 31 Bad debt expense Allowance for uncollectible accounts 2 - 21 500

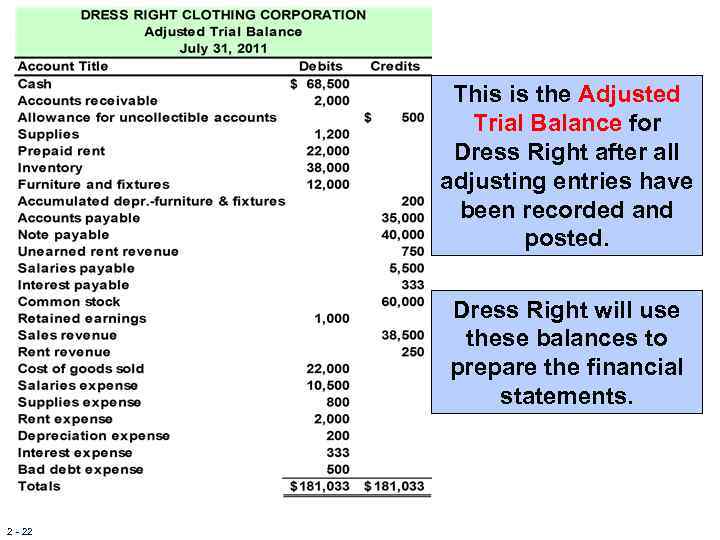

This is the Adjusted Trial Balance for Dress Right after all adjusting entries have been recorded and posted. Dress Right will use these balances to prepare the financial statements. 2 - 22

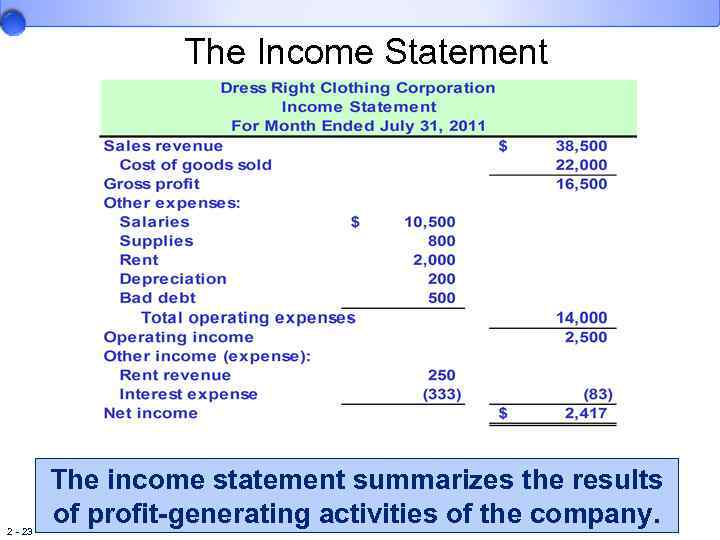

The Income Statement 2 - 23 The income statement summarizes the results of profit-generating activities of the company.

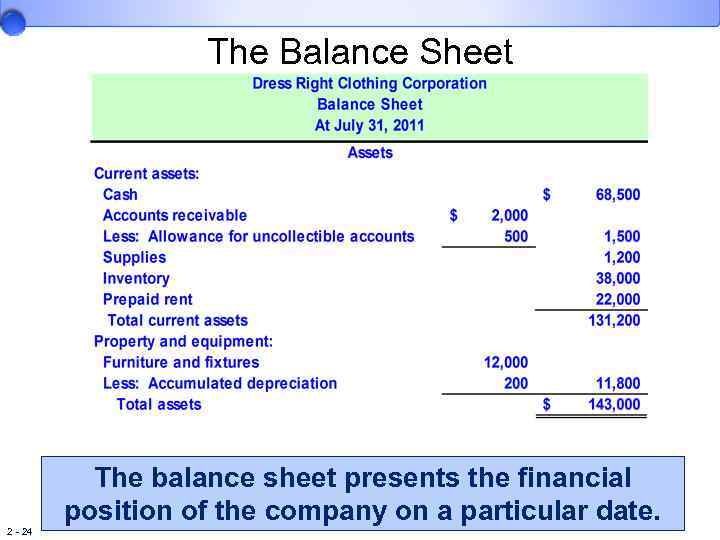

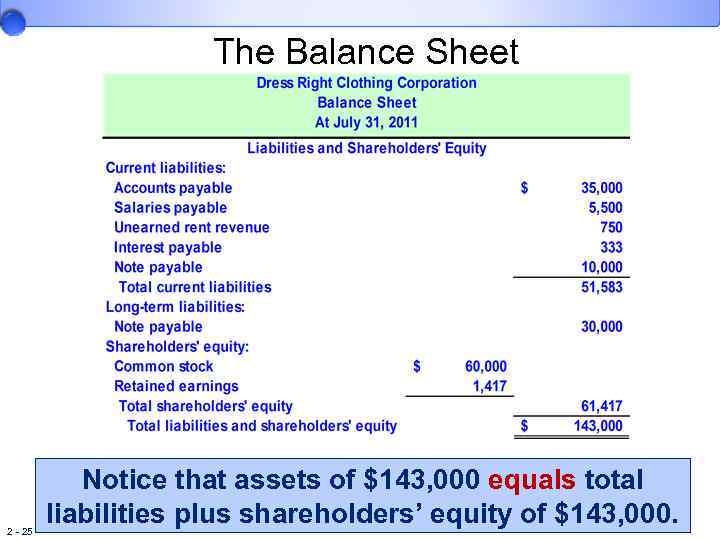

The Balance Sheet 2 - 24 The balance sheet presents the financial position of the company on a particular date.

The Balance Sheet 2 - 25 Notice that assets of $143, 000 equals total liabilities plus shareholders’ equity of $143, 000.

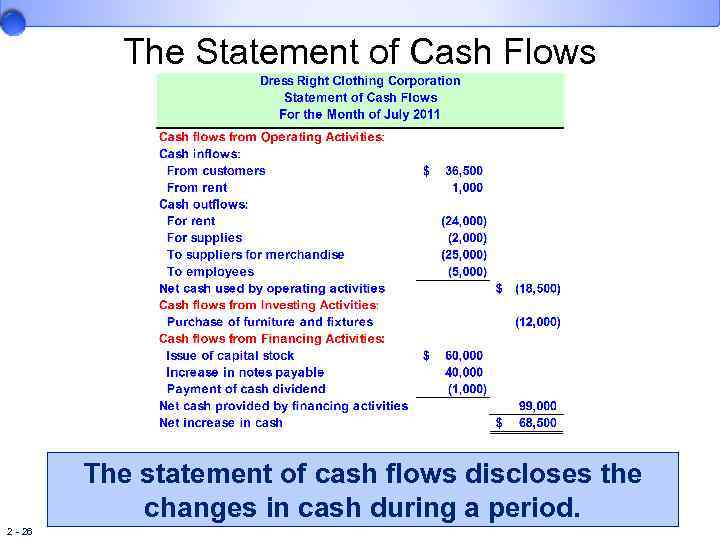

The Statement of Cash Flows The statement of cash flows discloses the changes in cash during a period. 2 - 26

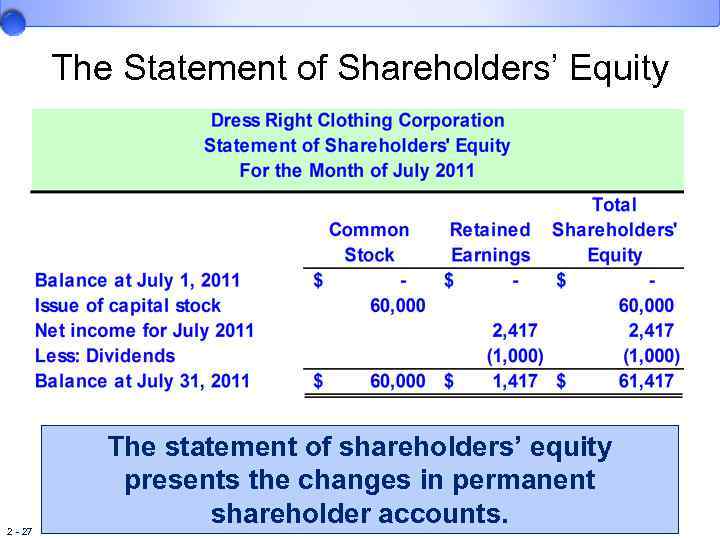

The Statement of Shareholders’ Equity 2 - 27 The statement of shareholders’ equity presents the changes in permanent shareholder accounts.

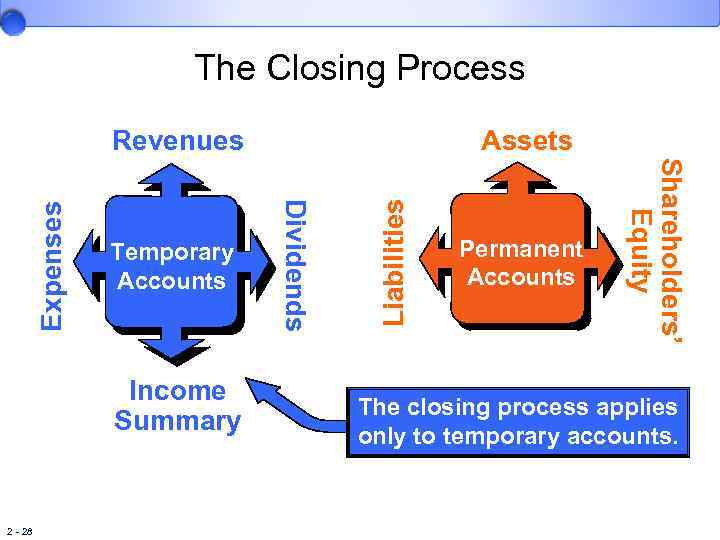

The Closing Process Income Summary 2 - 28 Liabilities Permanent Accounts Shareholders’ Equity Temporary Accounts Assets Dividends Expenses Revenues The closing process applies only to temporary accounts.

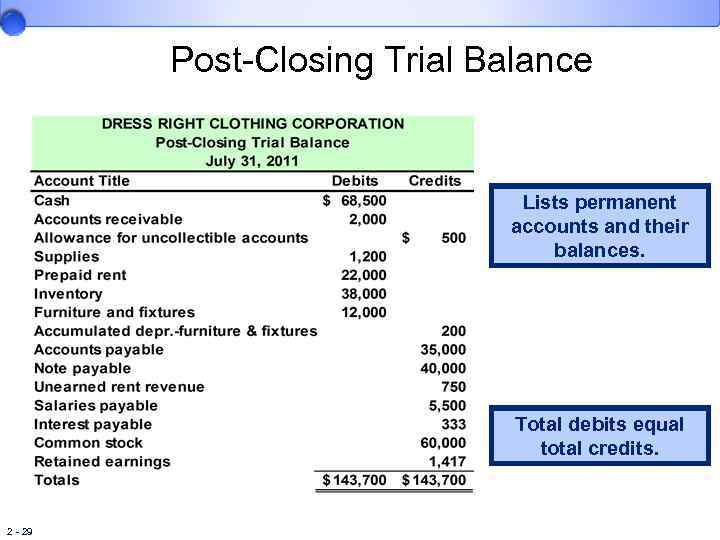

Post-Closing Trial Balance Lists permanent accounts and their balances. Total debits equal total credits. 2 - 29

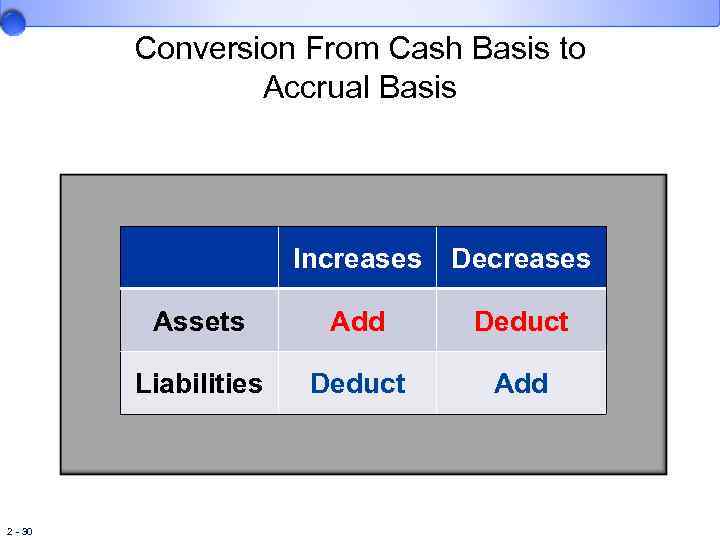

Conversion From Cash Basis to Accrual Basis Increases Assets Add Deduct Liabilities 2 - 30 Decreases Deduct Add

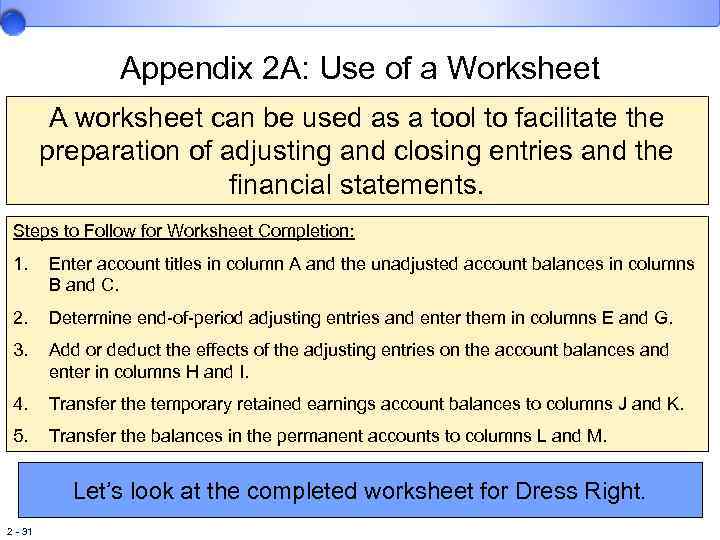

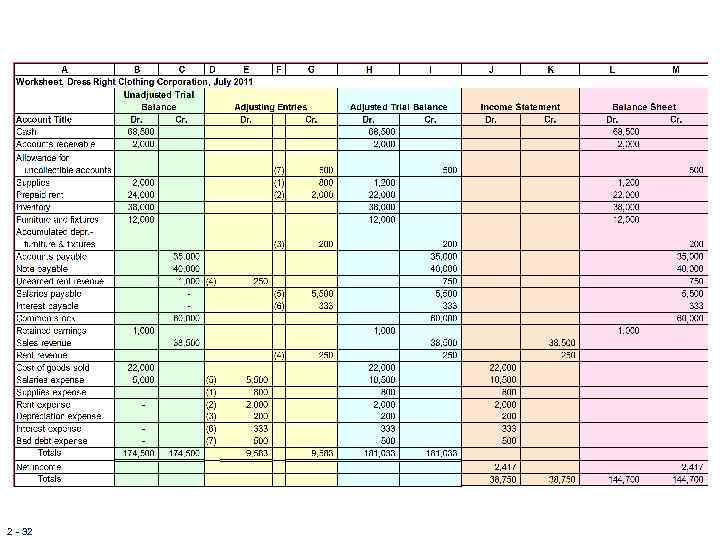

Appendix 2 A: Use of a Worksheet A worksheet can be used as a tool to facilitate the preparation of adjusting and closing entries and the financial statements. Steps to Follow for Worksheet Completion: 1. Enter account titles in column A and the unadjusted account balances in columns B and C. 2. Determine end-of-period adjusting entries and enter them in columns E and G. 3. Add or deduct the effects of the adjusting entries on the account balances and enter in columns H and I. 4. Transfer the temporary retained earnings account balances to columns J and K. 5. Transfer the balances in the permanent accounts to columns L and M. Let’s look at the completed worksheet for Dress Right. 2 - 31

2 - 32

Appendix 2 B: Reversing Entries Reversing entries remove the effects of some of the adjusting entries made at the end of the previous reporting period for the sole purpose of simplifying journal entries made during the new period. Reversing entries are optional and are used most often with accruals. 2 - 33

Appendix 2 C: Subsidiary Ledgers Subsidiary ledgers contain a group of subsidiary accounts associated with particular general ledger control accounts. Subsidiary ledgers are commonly used for accounts receivable, accounts payable, plant and equipment, and investments. For example, there will be a subsidiary ledger for accounts receivable that keeps track of the increases and decreases in the accounts receivable balance for each of the company’s customers purchasing goods and services on credit. After all of the postings are made from the appropriate journals, the balance in the accounts receivable control account should equal the sum of the balances in the accounts receivable subsidiary ledger accounts. 2 - 34

Appendix 2 C: Special Journals Special journals are used to capture the dual effect of repetitive types of transactions in debit/credit form. Special journals simplify the recording process in the following ways: 1. Journalizing the effects of a particular transaction is made more efficient through the use of specifically designed formats. 2. Individual transactions are not posted to the general ledger accounts but are accumulated in the special journals and a summary posting is made on a periodic basis. 3. The responsibility for recording journal entries for the repetitive types of transactions is placed on individuals who have specialized training in handling them. 2 - 35

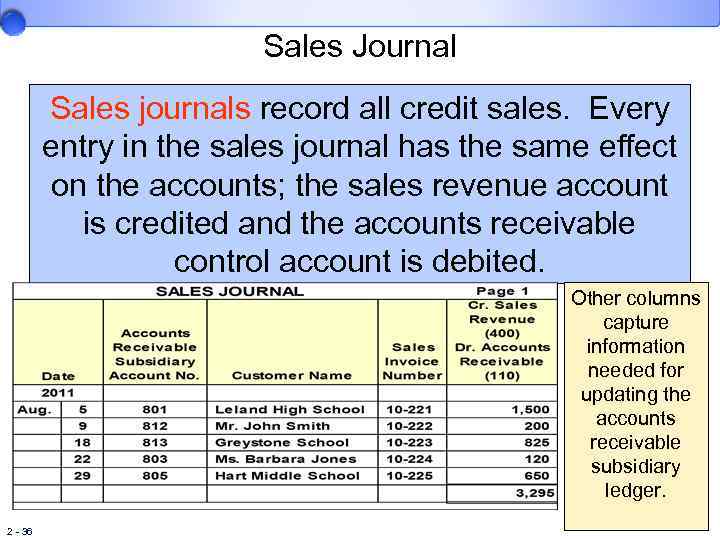

Sales Journal Sales journals record all credit sales. Every entry in the sales journal has the same effect on the accounts; the sales revenue account is credited and the accounts receivable control account is debited. Other columns capture information needed for updating the accounts receivable subsidiary ledger. 2 - 36

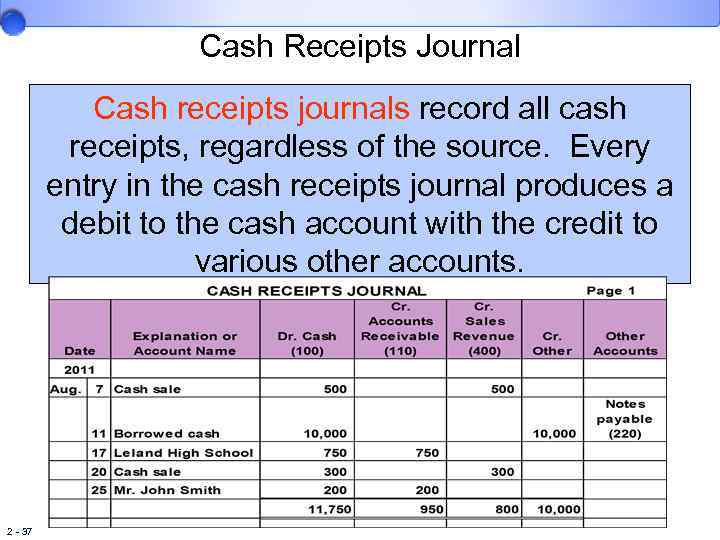

Cash Receipts Journal Cash receipts journals record all cash receipts, regardless of the source. Every entry in the cash receipts journal produces a debit to the cash account with the credit to various other accounts. 2 - 37

End of Chapter 2 2 - 38

Adv Acc_Chap002.ppt