Copyright© 2004 South-Western 1212 The Design of the

- Размер: 1.9 Mегабайта

- Количество слайдов: 50

Описание презентации Copyright© 2004 South-Western 1212 The Design of the по слайдам

Copyright© 2004 South-Western 1212 The Design of the Tax System

Copyright© 2004 South-Western 1212 The Design of the Tax System

Copyright © 2004 South-Western/Thomson Learning“ In this world nothing is certain but death and taxes. ” . . . Benjamin Franklin 0 20 40 60 80 100 Taxes paid in Ben Franklin’s time accounted for 5 percent of the average American’s income.

Copyright © 2004 South-Western/Thomson Learning“ In this world nothing is certain but death and taxes. ” . . . Benjamin Franklin 0 20 40 60 80 100 Taxes paid in Ben Franklin’s time accounted for 5 percent of the average American’s income.

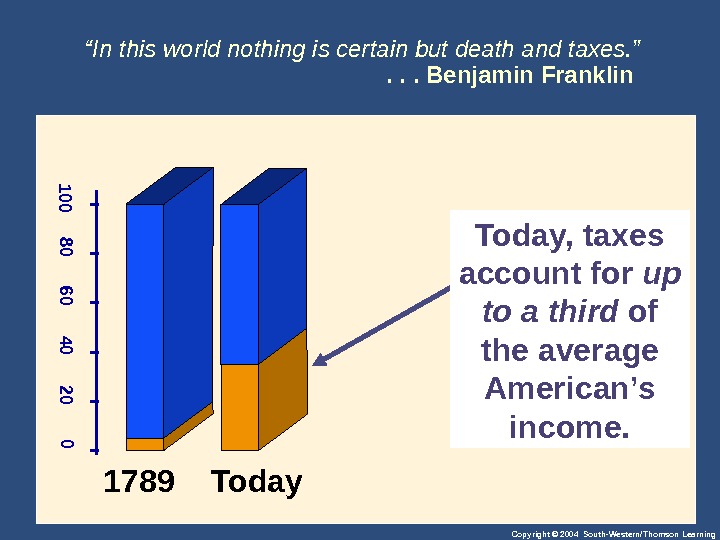

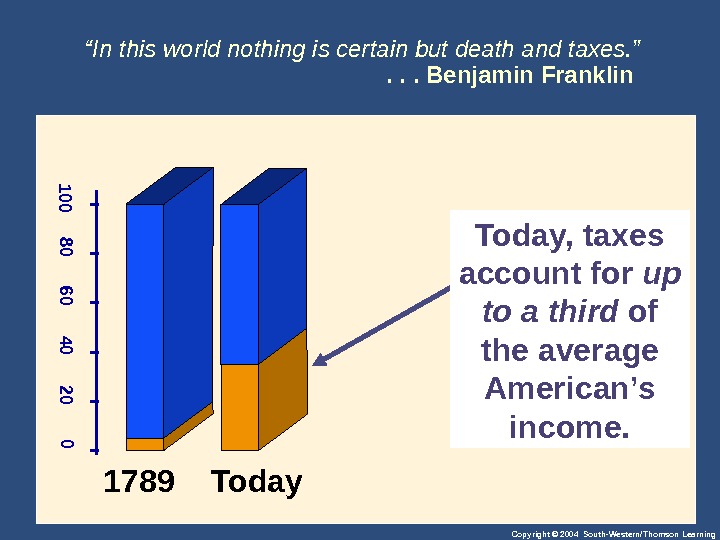

Copyright © 2004 South-Western/Thomson Learning“ In this world nothing is certain but death and taxes. ” . . . Benjamin Franklin 0 20 40 60 80 100 1789 Today, taxes account for up to a third of the average American’s income.

Copyright © 2004 South-Western/Thomson Learning“ In this world nothing is certain but death and taxes. ” . . . Benjamin Franklin 0 20 40 60 80 100 1789 Today, taxes account for up to a third of the average American’s income.

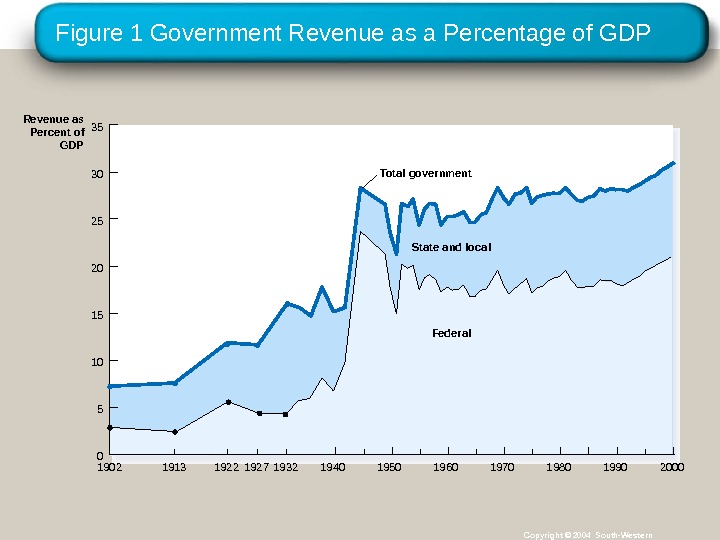

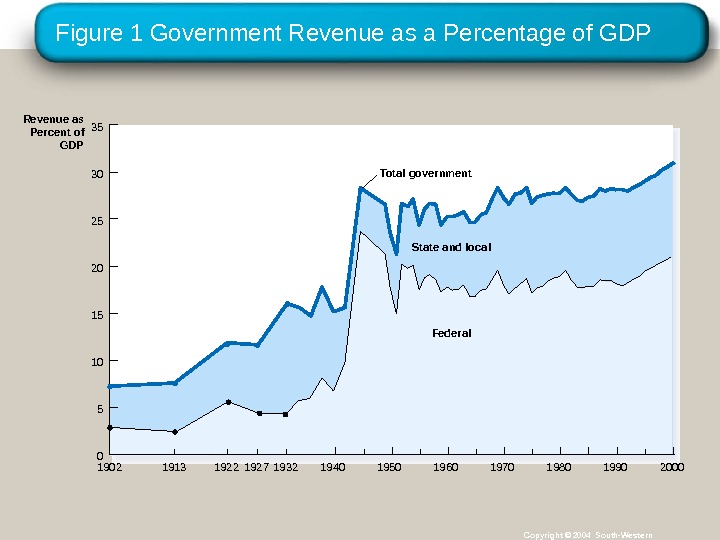

Figure 1 Government Revenue as a Percentage of GDP Copyright © 2004 South-Western. State and local Federal 05101520253035 Revenue as Percent of GDP Total government

Figure 1 Government Revenue as a Percentage of GDP Copyright © 2004 South-Western. State and local Federal 05101520253035 Revenue as Percent of GDP Total government

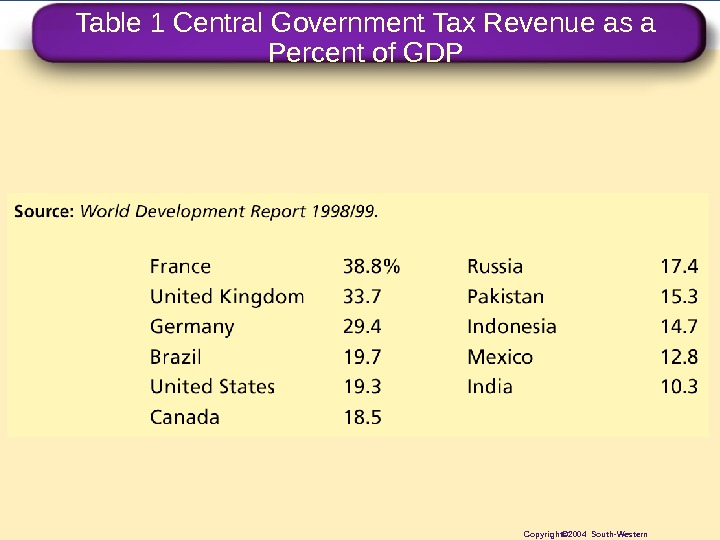

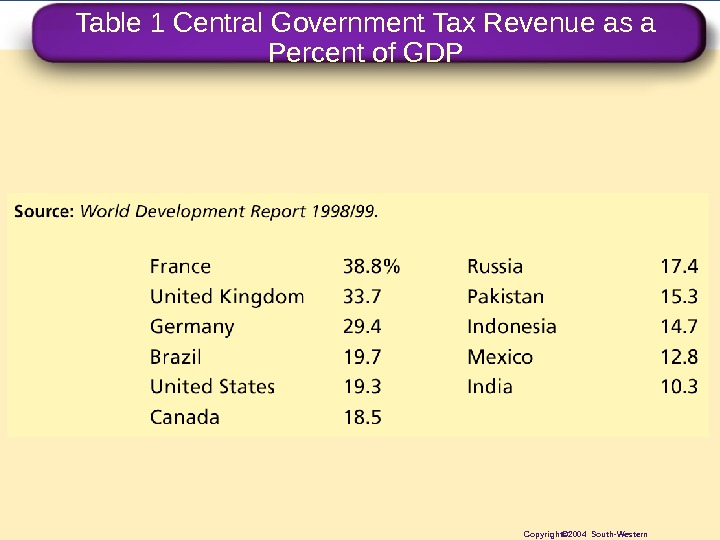

Table 1 Central Government Tax Revenue as a Percent of GDP Copyright© 2004 South-Western

Table 1 Central Government Tax Revenue as a Percent of GDP Copyright© 2004 South-Western

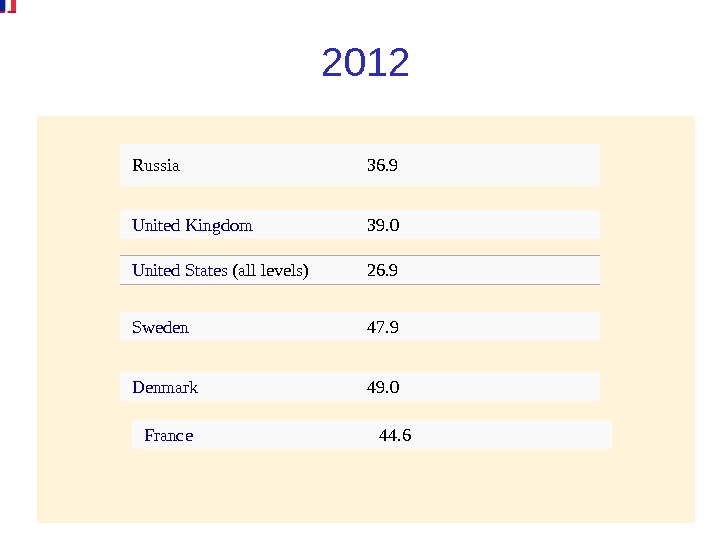

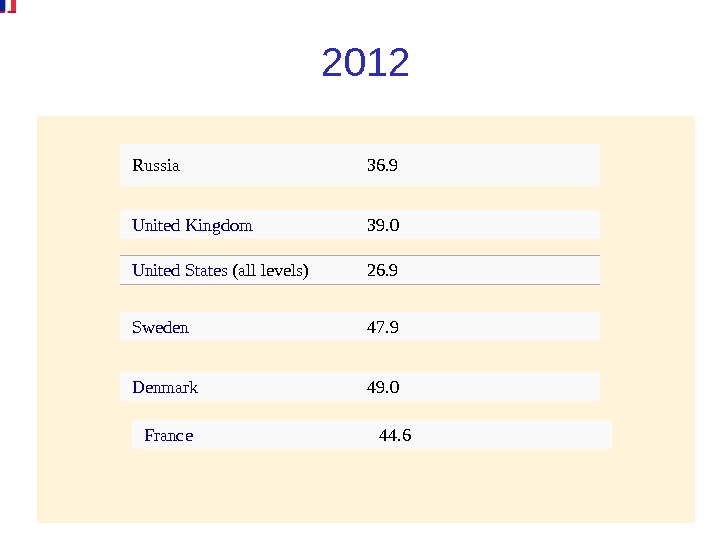

Copyright © 2004 South-Western/Thomson Learning 2012 Russia 36. 9 United. States (alllevels) 26. 9 United. Kingdom 39. 0 Sweden 47. 9 Denmark 49. 0 France 44.

Copyright © 2004 South-Western/Thomson Learning 2012 Russia 36. 9 United. States (alllevels) 26. 9 United. Kingdom 39. 0 Sweden 47. 9 Denmark 49. 0 France 44.

Copyright © 2004 South-Western/Thomson Learning. The Federal Government • The. U. S. federalgovernmentcollectsabout two-thirdsofthetaxesinoureconomy.

Copyright © 2004 South-Western/Thomson Learning. The Federal Government • The. U. S. federalgovernmentcollectsabout two-thirdsofthetaxesinoureconomy.

Copyright © 2004 South-Western/Thomson Learning. The Federal Government • Thelargestsourceofrevenueforthefederal governmentistheindividualincometax.

Copyright © 2004 South-Western/Thomson Learning. The Federal Government • Thelargestsourceofrevenueforthefederal governmentistheindividualincometax.

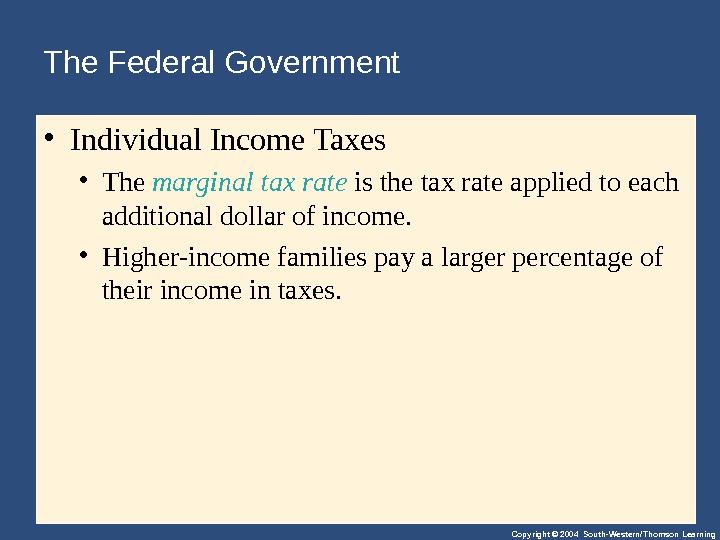

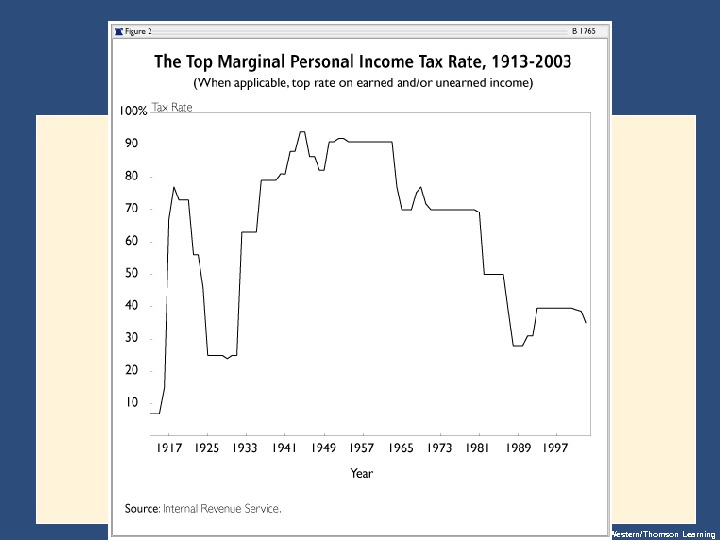

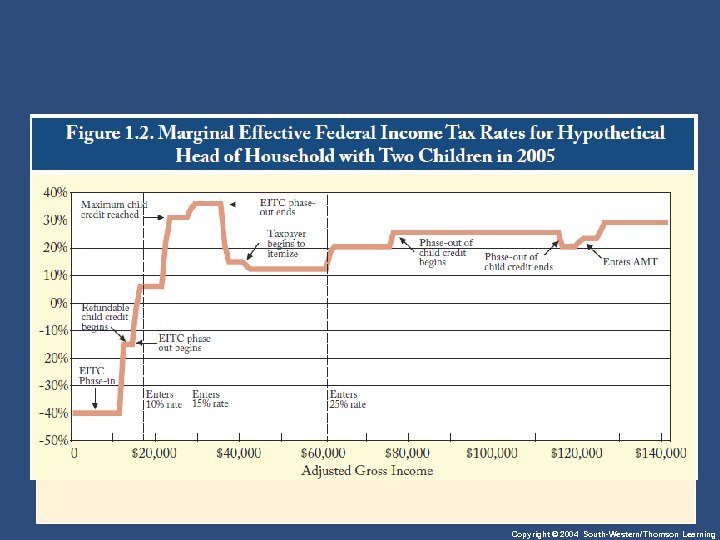

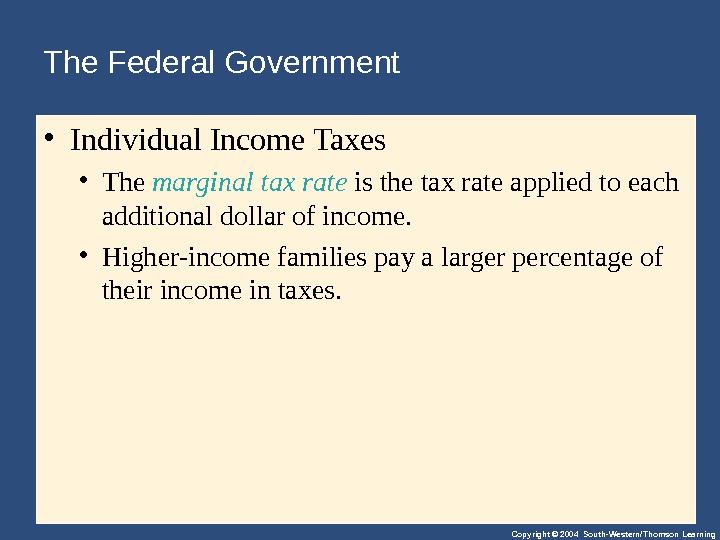

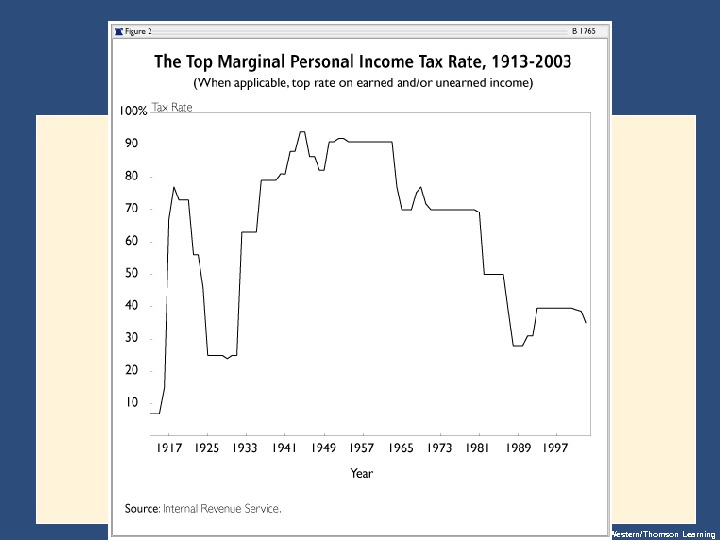

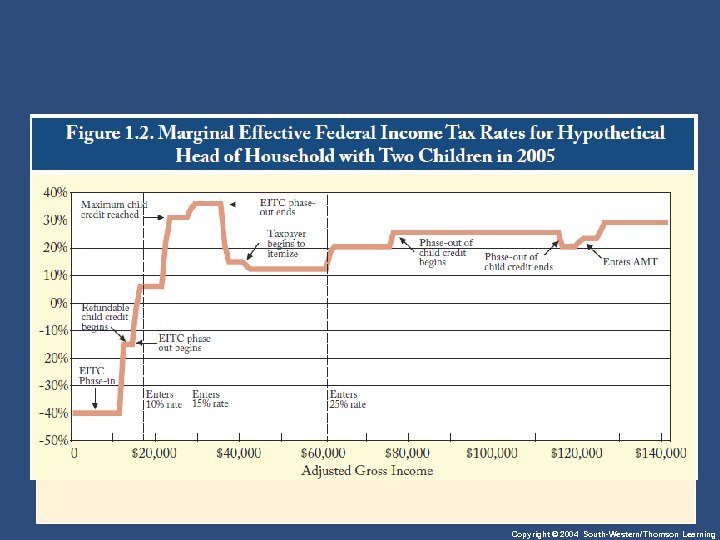

Copyright © 2004 South-Western/Thomson Learning. The Federal Government • Individual. Income. Taxes • The marginal tax rate isthetaxrateappliedtoeach additionaldollarofincome. • Higher-incomefamiliespayalargerpercentageof theirincomeintaxes.

Copyright © 2004 South-Western/Thomson Learning. The Federal Government • Individual. Income. Taxes • The marginal tax rate isthetaxrateappliedtoeach additionaldollarofincome. • Higher-incomefamiliespayalargerpercentageof theirincomeintaxes.

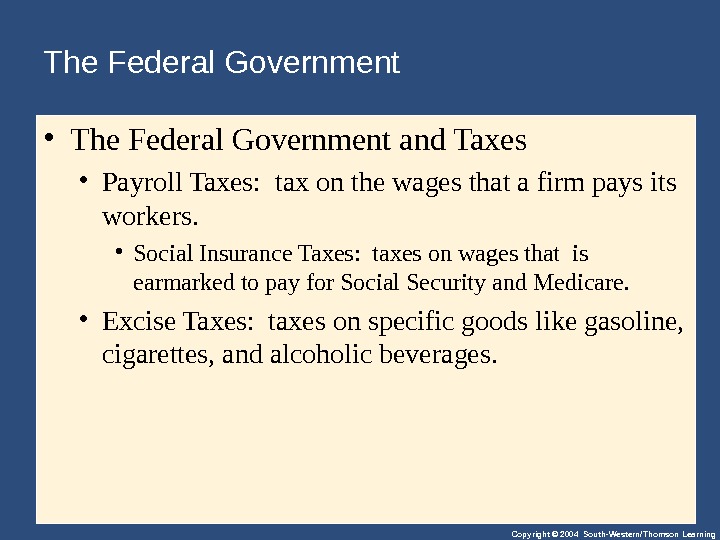

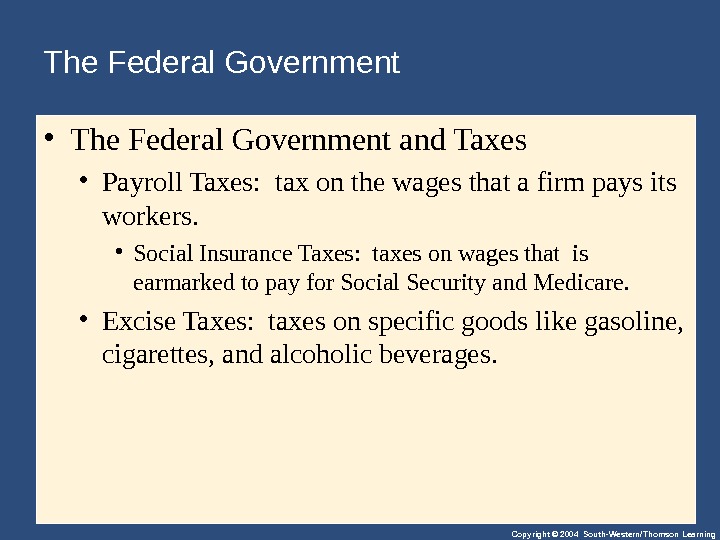

Copyright © 2004 South-Western/Thomson Learning. The Federal Government • The. Federal. Governmentand. Taxes • Payroll. Taxes: taxonthewagesthatafirmpaysits workers. • Social. Insurance. Taxes: taxesonwagesthatis earmarkedtopayfor. Social. Securityand. Medicare. • Excise. Taxes: taxesonspecificgoodslikegasoline, cigarettes, andalcoholicbeverages.

Copyright © 2004 South-Western/Thomson Learning. The Federal Government • The. Federal. Governmentand. Taxes • Payroll. Taxes: taxonthewagesthatafirmpaysits workers. • Social. Insurance. Taxes: taxesonwagesthatis earmarkedtopayfor. Social. Securityand. Medicare. • Excise. Taxes: taxesonspecificgoodslikegasoline, cigarettes, andalcoholicbeverages.

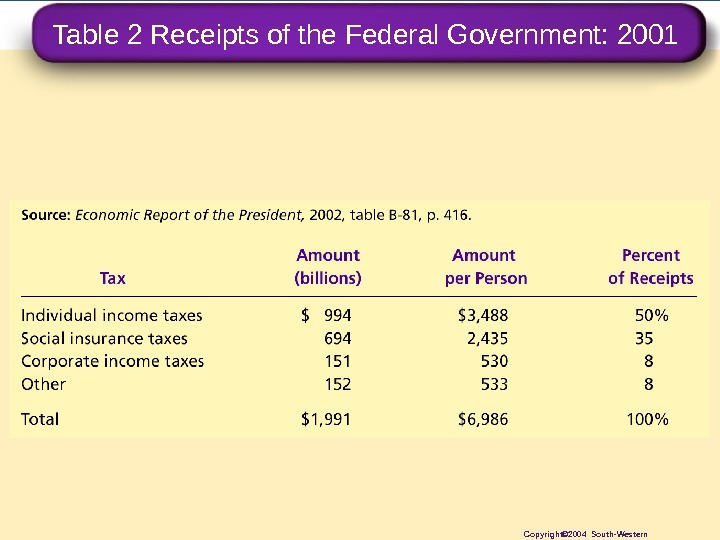

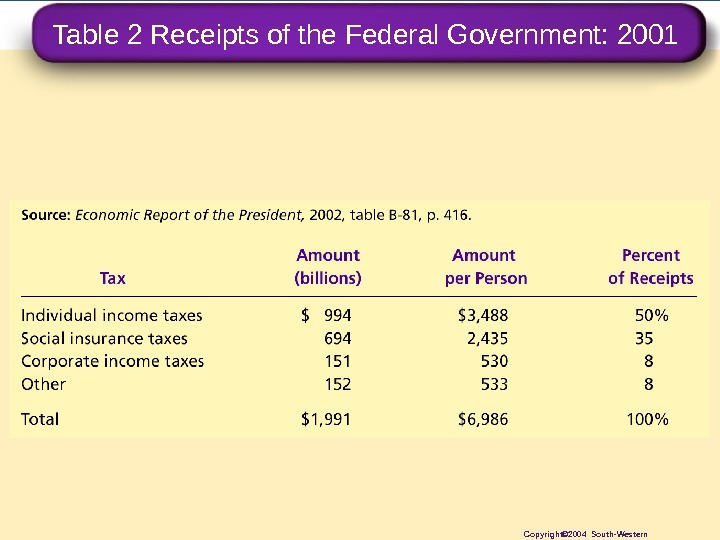

Table 2 Receipts of the Federal Government: 2001 Copyright© 2004 South-Western

Table 2 Receipts of the Federal Government: 2001 Copyright© 2004 South-Western

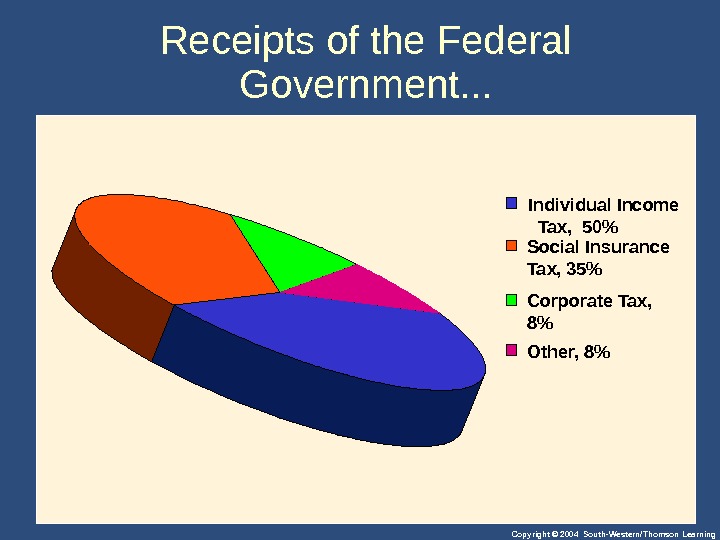

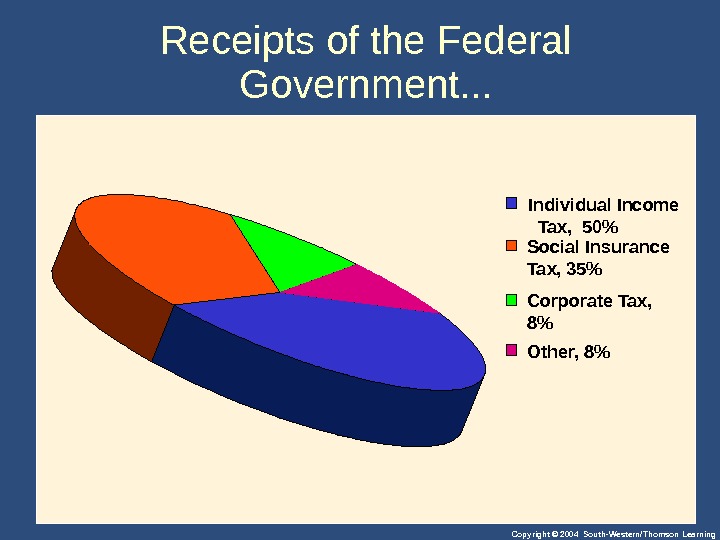

Copyright © 2004 South-Western/Thomson Learning. Receipts of the Federal Government. . . Individual Income Tax, 50% Social Insurance Tax, 35% Corporate Tax, 8% Other, 8%

Copyright © 2004 South-Western/Thomson Learning. Receipts of the Federal Government. . . Individual Income Tax, 50% Social Insurance Tax, 35% Corporate Tax, 8% Other, 8%

Copyright © 2004 South-Western/Thomson Learning. The Federal Government • Federal. Government. Spending • Governmentspendingincludestransferpayments andthepurchaseofpublicgoodsandservices. • Transferpaymentsaregovernmentpaymentsnotmadein exchangeforagoodoraservice. • Transferpaymentsarethelargestofthegovernment’s expenditures.

Copyright © 2004 South-Western/Thomson Learning. The Federal Government • Federal. Government. Spending • Governmentspendingincludestransferpayments andthepurchaseofpublicgoodsandservices. • Transferpaymentsaregovernmentpaymentsnotmadein exchangeforagoodoraservice. • Transferpaymentsarethelargestofthegovernment’s expenditures.

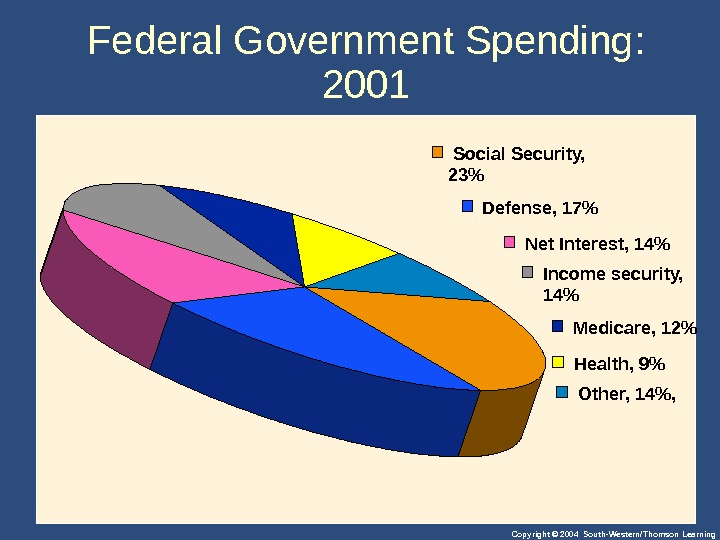

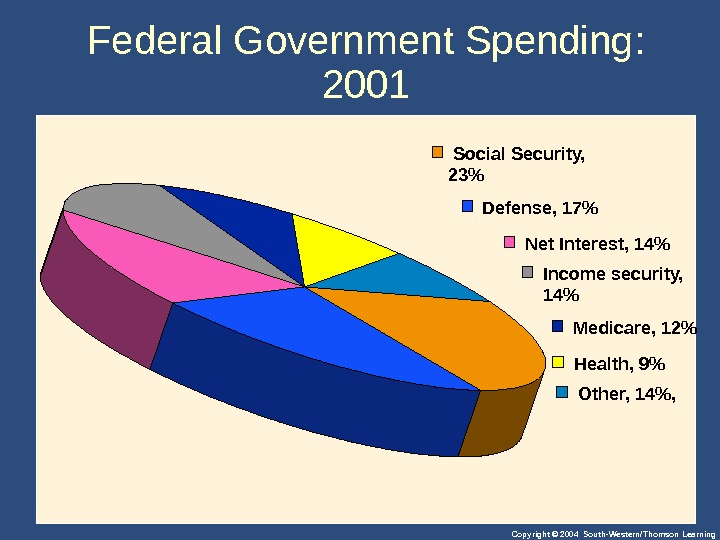

Copyright © 2004 South-Western/Thomson Learning. The Federal Government • Federal. Government. Spending • Expense. Category: • Social. Security • National. Defense • Income. Security • Net. Interest • Medicare • Health • Other

Copyright © 2004 South-Western/Thomson Learning. The Federal Government • Federal. Government. Spending • Expense. Category: • Social. Security • National. Defense • Income. Security • Net. Interest • Medicare • Health • Other

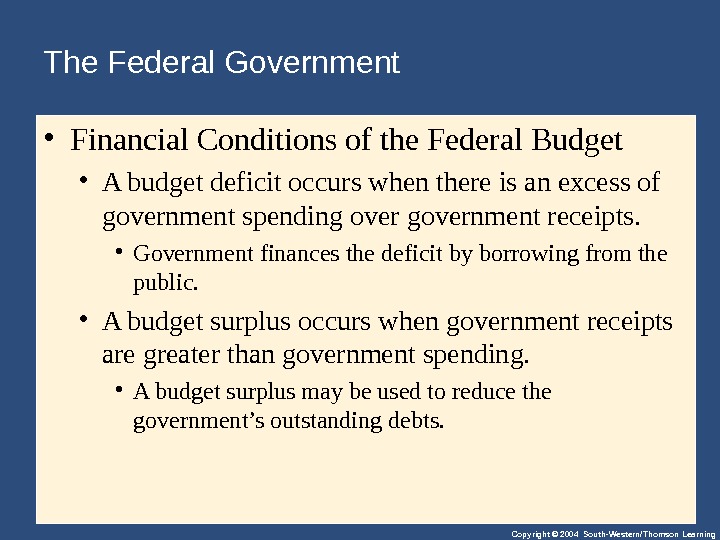

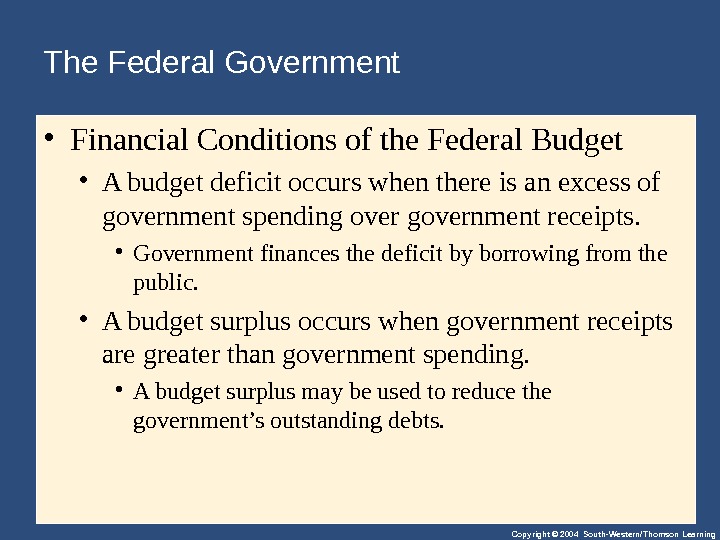

Copyright © 2004 South-Western/Thomson Learning. The Federal Government • Budget. Surplus • A budget surplus isanexcessofgovernment receiptsovergovernmentspending. • Budget. Deficit • A budget deficit isanexcessofgovernment spendingovernmentreceipts.

Copyright © 2004 South-Western/Thomson Learning. The Federal Government • Budget. Surplus • A budget surplus isanexcessofgovernment receiptsovergovernmentspending. • Budget. Deficit • A budget deficit isanexcessofgovernment spendingovernmentreceipts.

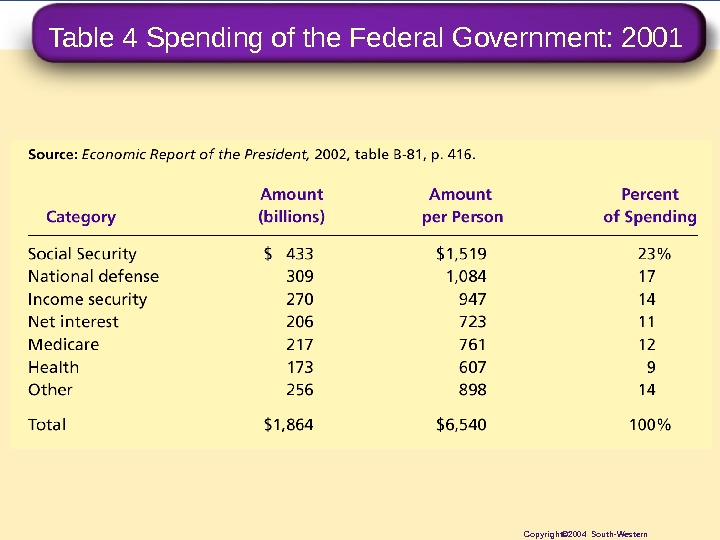

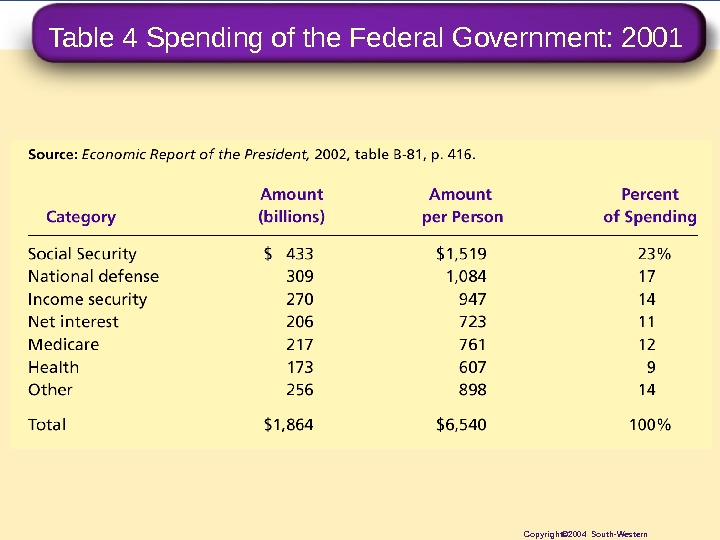

Table 4 Spending of the Federal Government: 2001 Copyright© 2004 South-Western

Table 4 Spending of the Federal Government: 2001 Copyright© 2004 South-Western

Copyright © 2004 South-Western/Thomson Learning. Federal Government Spending: 2001 Social Security, 23% Defense, 17% Net Interest, 14% Income security, 14% Medicare, 12% Health, 9% Other, 14%,

Copyright © 2004 South-Western/Thomson Learning. Federal Government Spending: 2001 Social Security, 23% Defense, 17% Net Interest, 14% Income security, 14% Medicare, 12% Health, 9% Other, 14%,

Copyright © 2004 South-Western/Thomson Learning. The Federal Government • Financial. Conditionsofthe. Federal. Budget • Abudgetdeficitoccurswhenthereisanexcessof governmentspendingovernmentreceipts. • Governmentfinancesthedeficitbyborrowingfromthe public. • Abudgetsurplusoccurswhengovernmentreceipts aregreaterthangovernmentspending. • Abudgetsurplusmaybeusedtoreducethe government’soutstandingdebts.

Copyright © 2004 South-Western/Thomson Learning. The Federal Government • Financial. Conditionsofthe. Federal. Budget • Abudgetdeficitoccurswhenthereisanexcessof governmentspendingovernmentreceipts. • Governmentfinancesthedeficitbyborrowingfromthe public. • Abudgetsurplusoccurswhengovernmentreceipts aregreaterthangovernmentspending. • Abudgetsurplusmaybeusedtoreducethe government’soutstandingdebts.

Copyright © 2004 South-Western/Thomson Learning. State and Local Governments • Stateandlocalgovernmentscollectabout 40 percentoftaxespaid.

Copyright © 2004 South-Western/Thomson Learning. State and Local Governments • Stateandlocalgovernmentscollectabout 40 percentoftaxespaid.

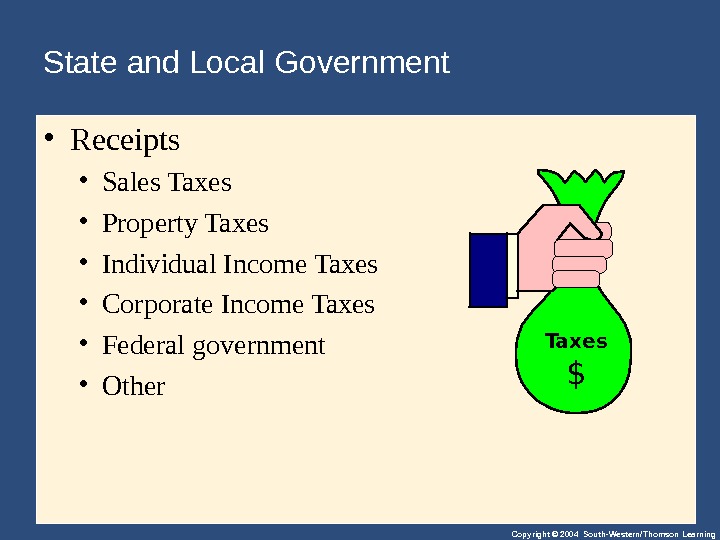

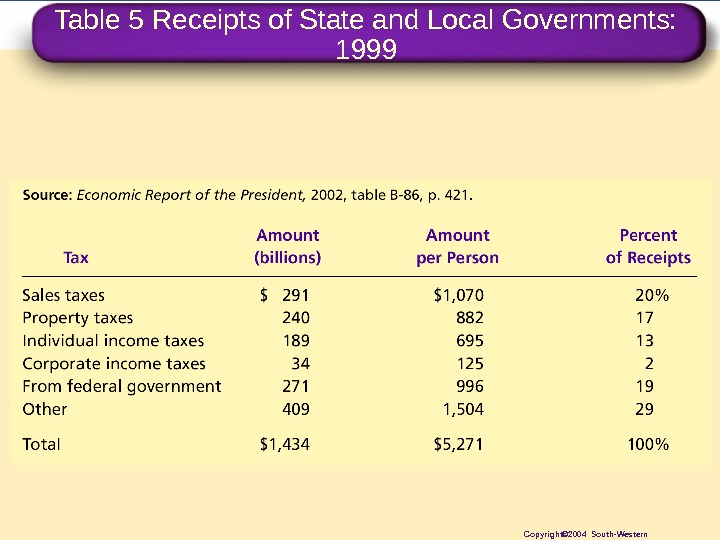

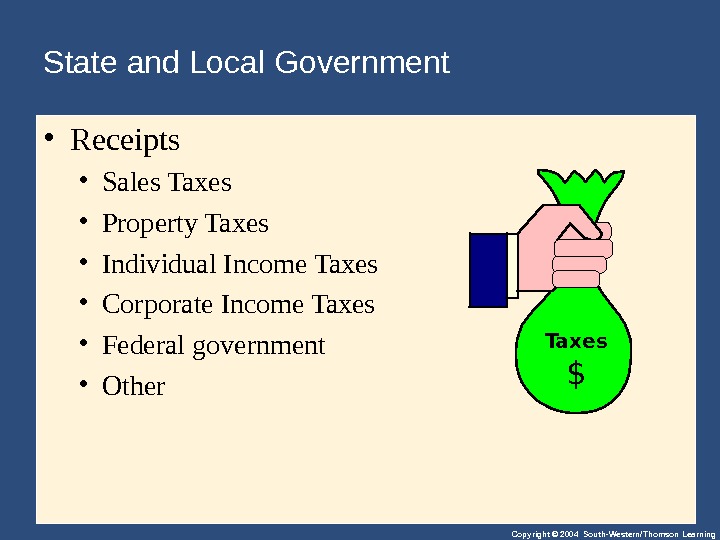

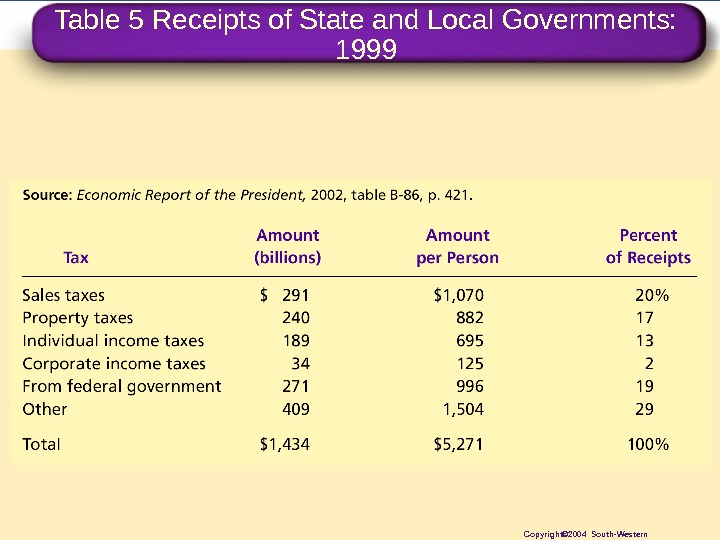

Copyright © 2004 South-Western/Thomson Learning. State and Local Government • Receipts • Sales. Taxes • Property. Taxes • Individual. Income. Taxes • Corporate. Income. Taxes • Federalgovernment • Other Taxes $

Copyright © 2004 South-Western/Thomson Learning. State and Local Government • Receipts • Sales. Taxes • Property. Taxes • Individual. Income. Taxes • Corporate. Income. Taxes • Federalgovernment • Other Taxes $

Table 5 Receipts of State and Local Governments: 1999 Copyright© 2004 South-Western

Table 5 Receipts of State and Local Governments: 1999 Copyright© 2004 South-Western

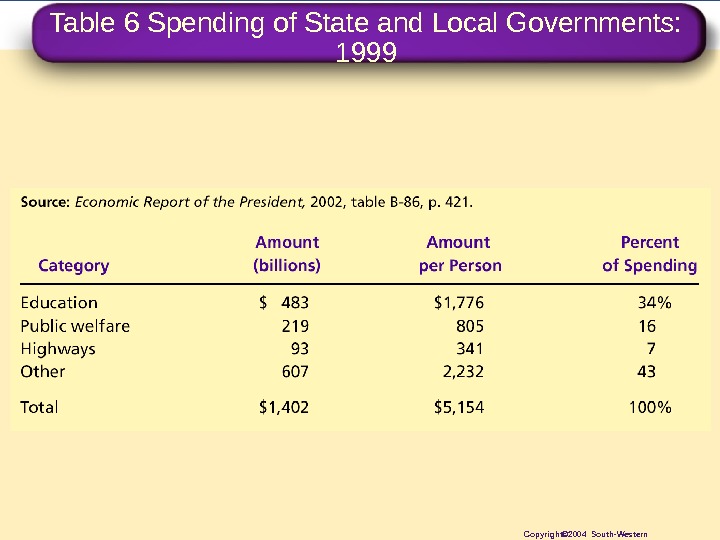

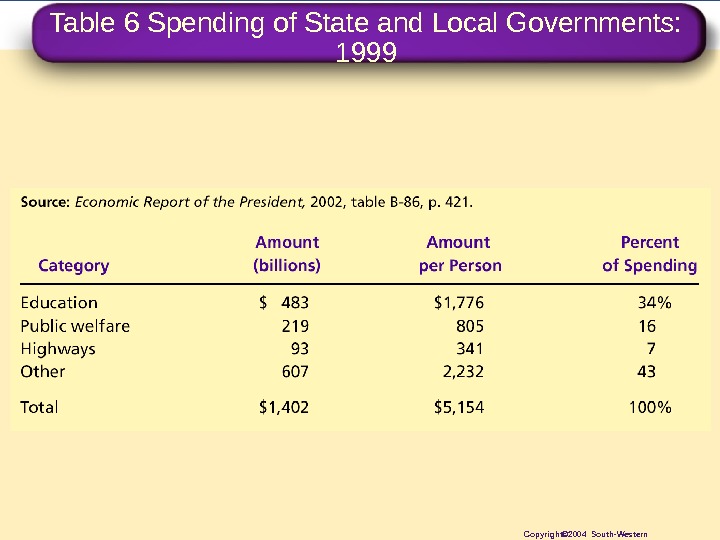

Copyright © 2004 South-Western/Thomson Learning. State and Local Government • Spending • Education • Public. Welfare • Highways • Other

Copyright © 2004 South-Western/Thomson Learning. State and Local Government • Spending • Education • Public. Welfare • Highways • Other

Table 6 Spending of State and Local Governments: 1999 Copyright© 2004 South-Western

Table 6 Spending of State and Local Governments: 1999 Copyright© 2004 South-Western

Copyright © 2004 South-Western/Thomson Learning. TAXES AND EFFICIENCY • Policymakershavetwoobjectivesindesigning ataxsystem. . . • Efficiency • Equity

Copyright © 2004 South-Western/Thomson Learning. TAXES AND EFFICIENCY • Policymakershavetwoobjectivesindesigning ataxsystem. . . • Efficiency • Equity

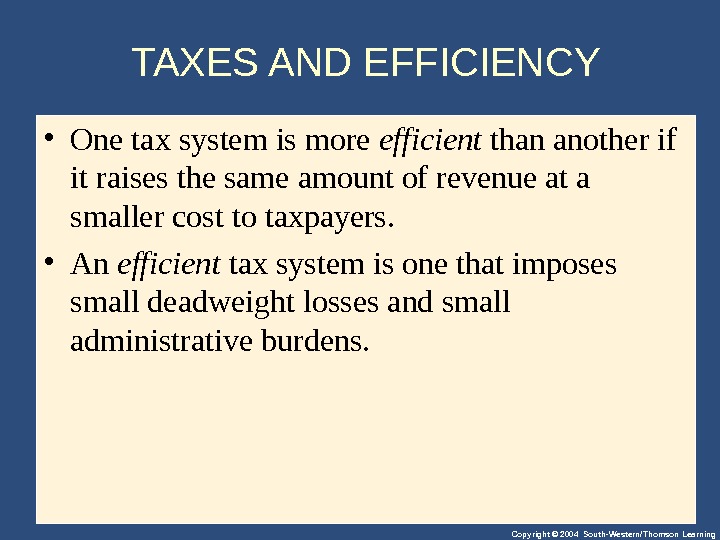

Copyright © 2004 South-Western/Thomson Learning. TAXES AND EFFICIENCY • Onetaxsystemismore efficient thananotherif itraisesthesameamountofrevenueata smallercosttotaxpayers. • An efficient taxsystemisonethatimposes smalldeadweightlossesandsmall administrativeburdens.

Copyright © 2004 South-Western/Thomson Learning. TAXES AND EFFICIENCY • Onetaxsystemismore efficient thananotherif itraisesthesameamountofrevenueata smallercosttotaxpayers. • An efficient taxsystemisonethatimposes smalldeadweightlossesandsmall administrativeburdens.

Copyright © 2004 South-Western/Thomson Learning. TAXES AND EFFICIENCY • The. Costof. Taxesto. Taxpayers • Thetaxpaymentitself • Deadweightlosses • Administrativeburdens

Copyright © 2004 South-Western/Thomson Learning. TAXES AND EFFICIENCY • The. Costof. Taxesto. Taxpayers • Thetaxpaymentitself • Deadweightlosses • Administrativeburdens

Copyright © 2004 South-Western/Thomson Learning. Deadweight Losses • Becausetaxesdistortincentives, theyentail deadweightlosses. • Thedeadweightlossofataxisthereductionofthe economicwell-beingoftaxpayersinexcessofthe amountofrevenueraisedbythegovernment.

Copyright © 2004 South-Western/Thomson Learning. Deadweight Losses • Becausetaxesdistortincentives, theyentail deadweightlosses. • Thedeadweightlossofataxisthereductionofthe economicwell-beingoftaxpayersinexcessofthe amountofrevenueraisedbythegovernment.

Copyright © 2004 South-Western/Thomson Learning. Administrative Burdens • Complyingwithtaxlawscreatesadditional deadweightlosses. • Taxpayersloseadditionaltimeandmoney documenting, computing, andavoidingtaxesover andabovetheactualtaxestheypay. • Theadministrativeburdenofanytaxsystemispart oftheinefficiencyitcreates.

Copyright © 2004 South-Western/Thomson Learning. Administrative Burdens • Complyingwithtaxlawscreatesadditional deadweightlosses. • Taxpayersloseadditionaltimeandmoney documenting, computing, andavoidingtaxesover andabovetheactualtaxestheypay. • Theadministrativeburdenofanytaxsystemispart oftheinefficiencyitcreates.

Copyright © 2004 South-Western/Thomson Learning. Marginal Tax Rates versus Average Tax Rates • The average tax rate istotaltaxespaiddivided bytotalincome. • The marginal tax rate istheextrataxespaidon anadditionaldollarofincome.

Copyright © 2004 South-Western/Thomson Learning. Marginal Tax Rates versus Average Tax Rates • The average tax rate istotaltaxespaiddivided bytotalincome. • The marginal tax rate istheextrataxespaidon anadditionaldollarofincome.

Copyright © 2004 South-Western/Thomson Learning. Lump-Sum Taxes • Alump-sumtaxisataxthatisthesameamount foreveryperson, regardlessofearningsorany actionsthatthepersonmighttake. • ( аккордныйналог)

Copyright © 2004 South-Western/Thomson Learning. Lump-Sum Taxes • Alump-sumtaxisataxthatisthesameamount foreveryperson, regardlessofearningsorany actionsthatthepersonmighttake. • ( аккордныйналог)

Copyright © 2004 South-Western/Thomson Learning. TAXES AND EQUITY • Howshouldtheburdenoftaxesbedivided amongthepopulation? • Howdoweevaluatewhetherataxsystemis fair?

Copyright © 2004 South-Western/Thomson Learning. TAXES AND EQUITY • Howshouldtheburdenoftaxesbedivided amongthepopulation? • Howdoweevaluatewhetherataxsystemis fair?

Copyright © 2004 South-Western/Thomson Learning

Copyright © 2004 South-Western/Thomson Learning

Copyright © 2004 South-Western/Thomson Learning. TAXES AND EQUITY • Principlesof. Taxation • Benefitsprinciple • Ability-to-payprinciple $

Copyright © 2004 South-Western/Thomson Learning. TAXES AND EQUITY • Principlesof. Taxation • Benefitsprinciple • Ability-to-payprinciple $

Copyright © 2004 South-Western/Thomson Learning. Benefits Principle • The benefits principle istheideathatpeople shouldpaytaxesbasedonthebenefitsthey receivefromgovernmentservices. • Anexampleisagasolinetax: • Taxrevenuesfromagasolinetaxareusedtofinance ourhighwaysystem. • Peoplewhodrivethemostalsopaythemosttoward maintainingroads.

Copyright © 2004 South-Western/Thomson Learning. Benefits Principle • The benefits principle istheideathatpeople shouldpaytaxesbasedonthebenefitsthey receivefromgovernmentservices. • Anexampleisagasolinetax: • Taxrevenuesfromagasolinetaxareusedtofinance ourhighwaysystem. • Peoplewhodrivethemostalsopaythemosttoward maintainingroads.

Copyright © 2004 South-Western/Thomson Learning. Ability-to-Pay Principle • The ability-to-pay principle istheideathat taxesshouldbeleviedonapersonaccordingto howwellthatpersoncanshouldertheburden. • Theability-to-payprincipleleadstotwo corollarynotionsofequity. • Verticalequity • Horizontalequity

Copyright © 2004 South-Western/Thomson Learning. Ability-to-Pay Principle • The ability-to-pay principle istheideathat taxesshouldbeleviedonapersonaccordingto howwellthatpersoncanshouldertheburden. • Theability-to-payprincipleleadstotwo corollarynotionsofequity. • Verticalequity • Horizontalequity

Copyright © 2004 South-Western/Thomson Learning. Ability-to-Pay Principle • Vertical equity istheideathattaxpayerswitha greaterabilitytopaytaxesshouldpaylarger amounts. • Forexample, peoplewithhigherincomesshould paymorethanpeoplewithlowerincomes.

Copyright © 2004 South-Western/Thomson Learning. Ability-to-Pay Principle • Vertical equity istheideathattaxpayerswitha greaterabilitytopaytaxesshouldpaylarger amounts. • Forexample, peoplewithhigherincomesshould paymorethanpeoplewithlowerincomes.

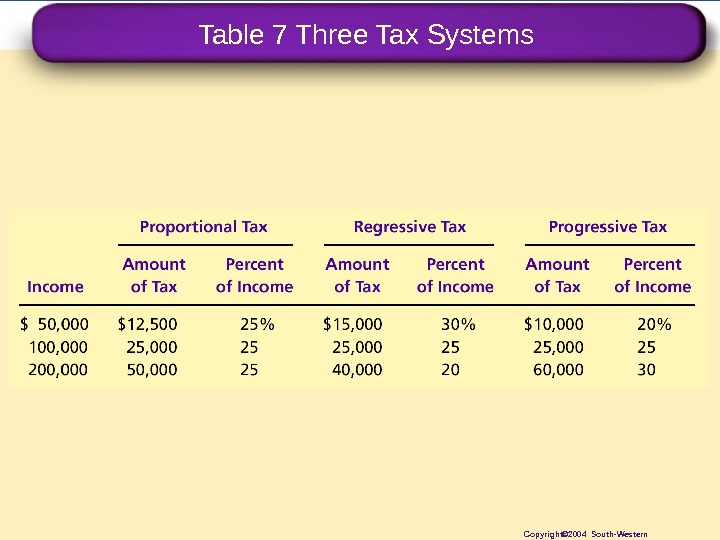

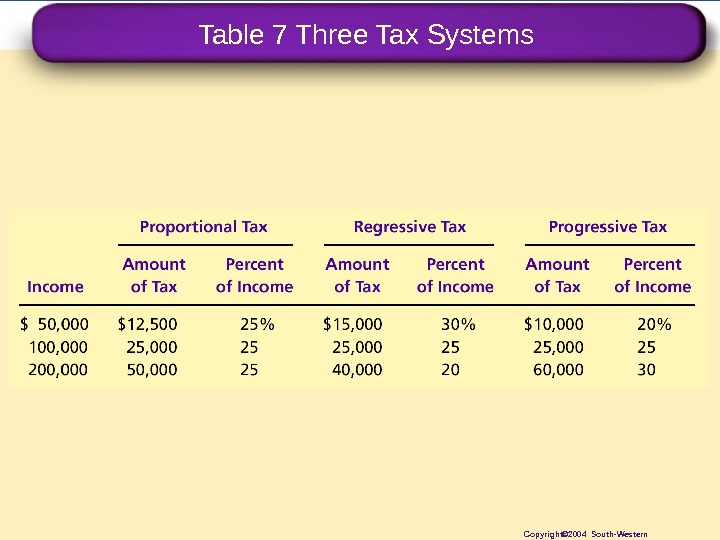

Copyright © 2004 South-Western/Thomson Learning. Ability-to-Pay Principle • Vertical. Equityand. Alternative. Tax. Systems • A proportional tax isoneforwhichhigh-income andlow-incometaxpayerspaythesamefractionof income. • A regressive tax isoneforwhichhigh-income taxpayerspayasmallerfractionoftheirincome thandolow-incometaxpayers. • A progressive tax isoneforwhichhigh-income taxpayerspayalargerfractionoftheirincomethan dolow-incometaxpayers.

Copyright © 2004 South-Western/Thomson Learning. Ability-to-Pay Principle • Vertical. Equityand. Alternative. Tax. Systems • A proportional tax isoneforwhichhigh-income andlow-incometaxpayerspaythesamefractionof income. • A regressive tax isoneforwhichhigh-income taxpayerspayasmallerfractionoftheirincome thandolow-incometaxpayers. • A progressive tax isoneforwhichhigh-income taxpayerspayalargerfractionoftheirincomethan dolow-incometaxpayers.

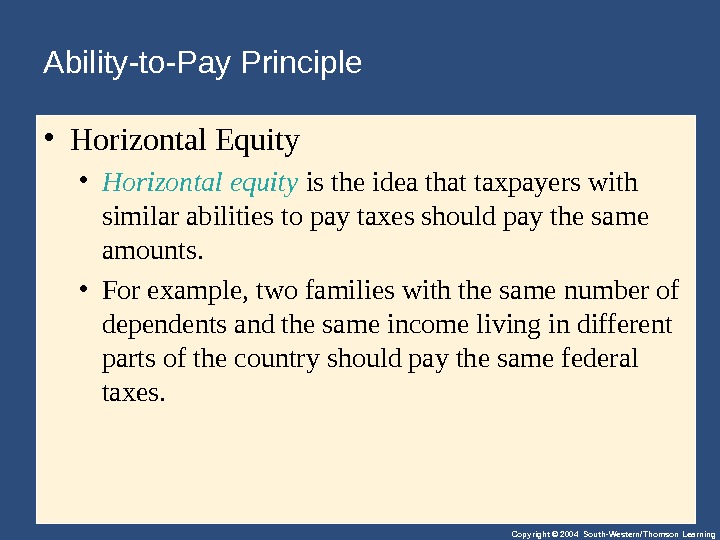

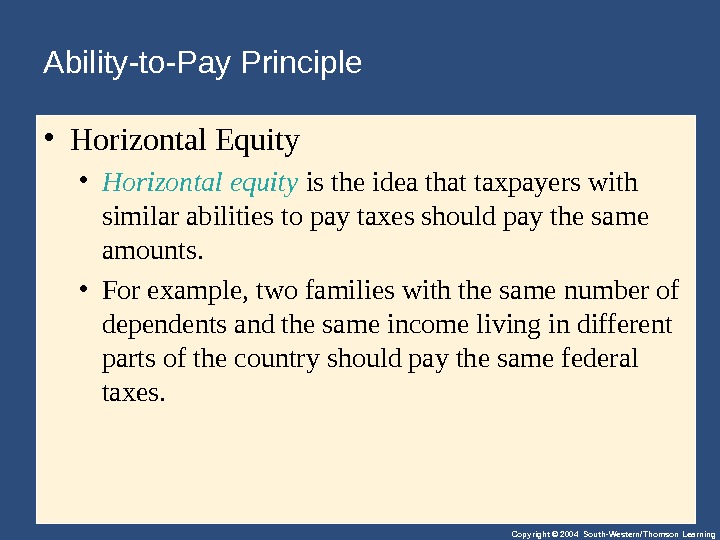

Copyright © 2004 South-Western/Thomson Learning. Ability-to-Pay Principle • Horizontal. Equity • Horizontal equity istheideathattaxpayerswith similarabilitiestopaytaxesshouldpaythesame amounts. • Forexample, twofamilieswiththesamenumberof dependentsandthesameincomelivingindifferent partsofthecountryshouldpaythesamefederal taxes.

Copyright © 2004 South-Western/Thomson Learning. Ability-to-Pay Principle • Horizontal. Equity • Horizontal equity istheideathattaxpayerswith similarabilitiestopaytaxesshouldpaythesame amounts. • Forexample, twofamilieswiththesamenumberof dependentsandthesameincomelivingindifferent partsofthecountryshouldpaythesamefederal taxes.

Table 7 Three Tax Systems Copyright© 2004 South-Western

Table 7 Three Tax Systems Copyright© 2004 South-Western

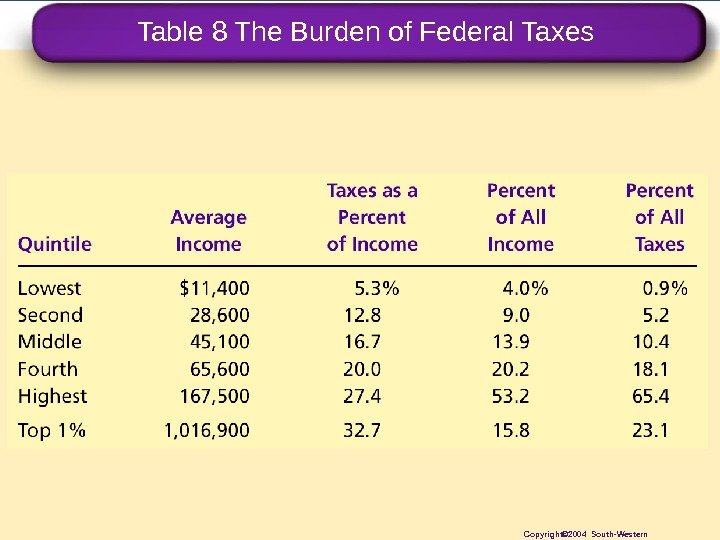

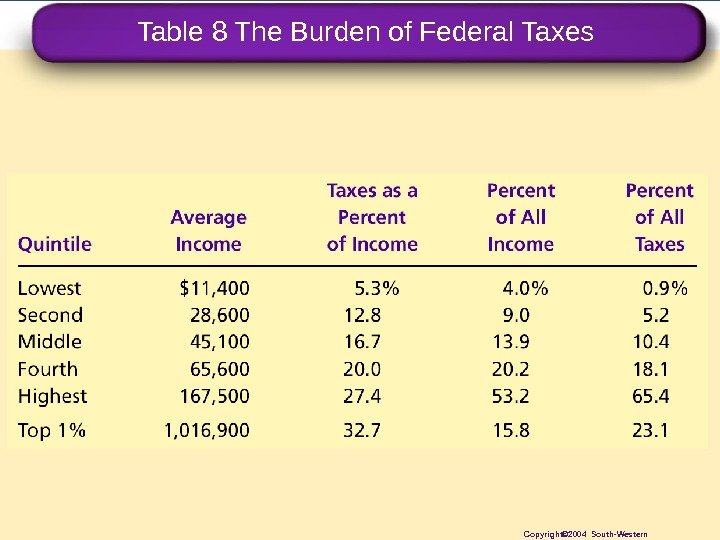

Table 8 The Burden of Federal Taxes Copyright© 2004 South-Western

Table 8 The Burden of Federal Taxes Copyright© 2004 South-Western

Copyright © 2004 South-Western/Thomson Learning

Copyright © 2004 South-Western/Thomson Learning

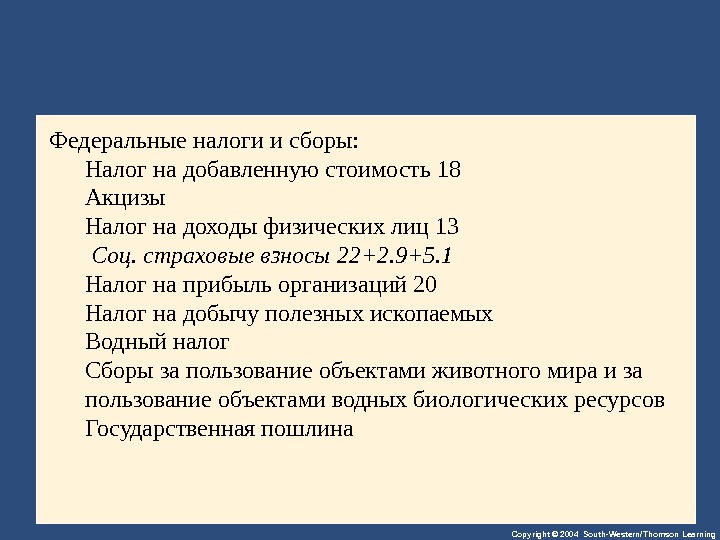

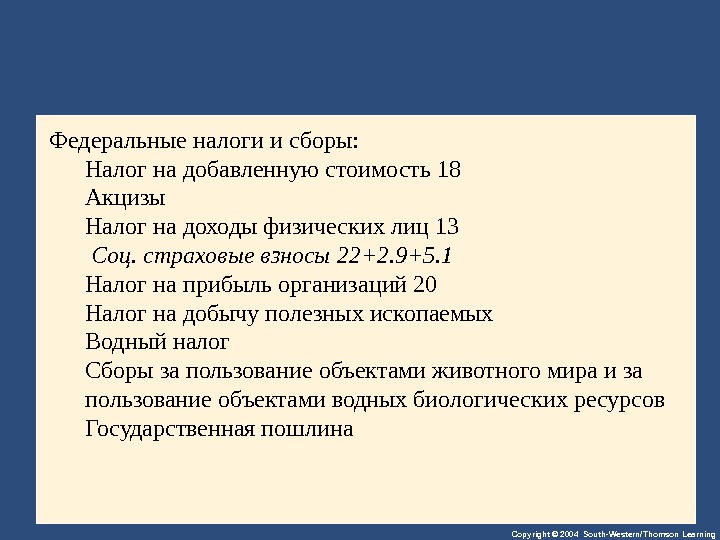

Copyright © 2004 South-Western/Thomson Learning. Федеральныеналогиисборы: Налогнадобавленнуюстоимость18 Акцизы Налогнадоходыфизическихлиц13 Соц. страховые взносы 22+2. 9+5. 1 Налогнаприбыльорганизаций 20 Налогнадобычуполезныхископаемых Водныйналог Сборызапользованиеобъектамиживотногомираиза пользованиеобъектамиводныхбиологическихресурсов Государственнаяпошлина

Copyright © 2004 South-Western/Thomson Learning. Федеральныеналогиисборы: Налогнадобавленнуюстоимость18 Акцизы Налогнадоходыфизическихлиц13 Соц. страховые взносы 22+2. 9+5. 1 Налогнаприбыльорганизаций 20 Налогнадобычуполезныхископаемых Водныйналог Сборызапользованиеобъектамиживотногомираиза пользованиеобъектамиводныхбиологическихресурсов Государственнаяпошлина

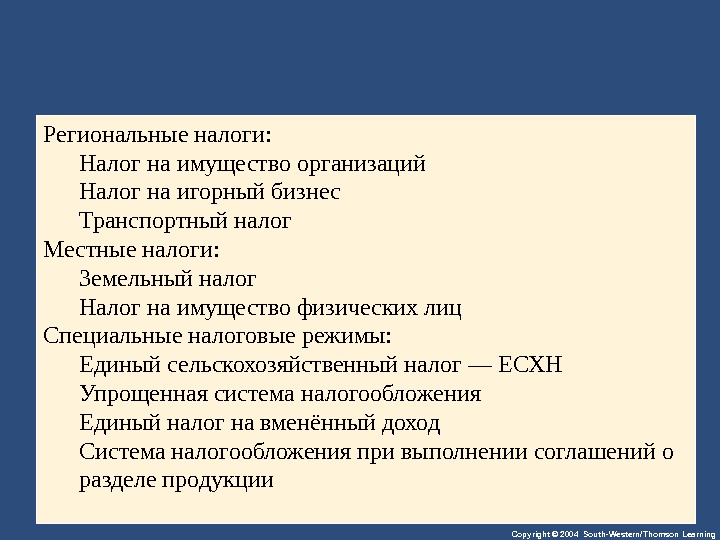

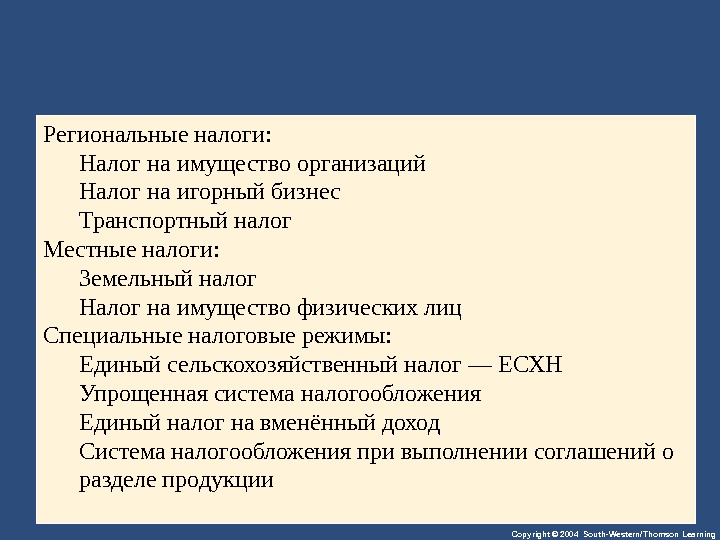

Copyright © 2004 South-Western/Thomson Learning. Региональныеналоги: Налогнаимуществоорганизаций Налогнаигорныйбизнес Транспортныйналог Местныеналоги: Земельныйналог Налогнаимуществофизическихлиц Специальныеналоговыережимы: Единыйсельскохозяйственныйналог—ЕСХН Упрощеннаясистеманалогообложения Единыйналогнавменённыйдоход Системаналогообложенияпривыполнениисоглашенийо разделепродукции

Copyright © 2004 South-Western/Thomson Learning. Региональныеналоги: Налогнаимуществоорганизаций Налогнаигорныйбизнес Транспортныйналог Местныеналоги: Земельныйналог Налогнаимуществофизическихлиц Специальныеналоговыережимы: Единыйсельскохозяйственныйналог—ЕСХН Упрощеннаясистеманалогообложения Единыйналогнавменённыйдоход Системаналогообложенияпривыполнениисоглашенийо разделепродукции

Copyright © 2004 South-Western/Thomson Learning. CASE STUDY: Horizontal Equity and the Marriage Tax • Marriageaffectsthetaxliabilityofacouplein thattaxlawtreatsamarriedcoupleasasingle taxpayer. • Whenacouplegetsmarried, theystoppaying taxesasindividualsandstartpayingtaxesasa family. • Ifeachhasasimilarincome, theirtotaltax liabilityriseswhentheygetmarried.

Copyright © 2004 South-Western/Thomson Learning. CASE STUDY: Horizontal Equity and the Marriage Tax • Marriageaffectsthetaxliabilityofacouplein thattaxlawtreatsamarriedcoupleasasingle taxpayer. • Whenacouplegetsmarried, theystoppaying taxesasindividualsandstartpayingtaxesasa family. • Ifeachhasasimilarincome, theirtotaltax liabilityriseswhentheygetmarried.

Copyright © 2004 South-Western/Thomson Learning. Tax Incidence and Tax Equity • Thedifficultyinformulatingtaxpolicyis balancingtheoftenconflictinggoalsof efficiency and equity. • Thestudyofwhobearstheburdenoftaxesis centraltoevaluatingtaxequity. • Thisstudyiscalled tax incidence.

Copyright © 2004 South-Western/Thomson Learning. Tax Incidence and Tax Equity • Thedifficultyinformulatingtaxpolicyis balancingtheoftenconflictinggoalsof efficiency and equity. • Thestudyofwhobearstheburdenoftaxesis centraltoevaluatingtaxequity. • Thisstudyiscalled tax incidence.

Copyright © 2004 South-Western/Thomson Learning. Tax Incidence and Tax Equity • Flypaper. Theoryof. Tax. Incidence • Accordingtothe flypaper theory , theburdenofa tax, likeaflyonflypaper, stickswhereveritfirst lands. • (thisiswrong, ofcourse)

Copyright © 2004 South-Western/Thomson Learning. Tax Incidence and Tax Equity • Flypaper. Theoryof. Tax. Incidence • Accordingtothe flypaper theory , theburdenofa tax, likeaflyonflypaper, stickswhereveritfirst lands. • (thisiswrong, ofcourse)

Copyright © 2004 South-Western/Thomson Learning. Summary • The. U. S. governmentraisesrevenueusing varioustaxes. • Incometaxesandpayrolltaxesraisethemost revenueforthefederalgovernment. • Salestaxesandpropertytaxesraisethemost revenueforthestateandlocalgovernments.

Copyright © 2004 South-Western/Thomson Learning. Summary • The. U. S. governmentraisesrevenueusing varioustaxes. • Incometaxesandpayrolltaxesraisethemost revenueforthefederalgovernment. • Salestaxesandpropertytaxesraisethemost revenueforthestateandlocalgovernments.

Copyright © 2004 South-Western/Thomson Learning. Summary • Equityandefficiencyarethetwomost importantgoalsofthetaxsystem. • Theefficiencyofataxsystemreferstothe costsitimposesonthetaxpayers. • Theequityofataxsystemconcernswhether thetaxburdenisdistributedfairlyamongthe population.

Copyright © 2004 South-Western/Thomson Learning. Summary • Equityandefficiencyarethetwomost importantgoalsofthetaxsystem. • Theefficiencyofataxsystemreferstothe costsitimposesonthetaxpayers. • Theequityofataxsystemconcernswhether thetaxburdenisdistributedfairlyamongthe population.

Copyright © 2004 South-Western/Thomson Learning. Summary • Accordingtothebenefitsprinciple, itisfairfor peopletopaytaxesbasedonthebenefitsthey receivefromthegovernment. • Accordingtotheability-to-payprinciple, itis fairforpeopletopaytaxesontheircapabilityto handlethefinancialburden.

Copyright © 2004 South-Western/Thomson Learning. Summary • Accordingtothebenefitsprinciple, itisfairfor peopletopaytaxesbasedonthebenefitsthey receivefromthegovernment. • Accordingtotheability-to-payprinciple, itis fairforpeopletopaytaxesontheircapabilityto handlethefinancialburden.

Copyright © 2004 South-Western/Thomson Learning. Summary • Thedistributionoftaxburdensisnotthesame asthedistributionoftaxbills. • Muchofthedebateovertaxpolicyarises becausepeoplegivedifferentweightstothe twogoalsofefficiencyandequity.

Copyright © 2004 South-Western/Thomson Learning. Summary • Thedistributionoftaxburdensisnotthesame asthedistributionoftaxbills. • Muchofthedebateovertaxpolicyarises becausepeoplegivedifferentweightstothe twogoalsofefficiencyandequity.