ae593213c30de8edbae62a2139e97475.ppt

- Количество слайдов: 50

Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 1

Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 1

Try these problems l Ch 6 u. Problem 12 u. Problems 14 -16 (see p 157) l Ch 7 u. Problem 1 u. Problem 5 Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 2

Try these problems l Ch 6 u. Problem 12 u. Problems 14 -16 (see p 157) l Ch 7 u. Problem 1 u. Problem 5 Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 2

New York University/ING Barings Portfolio Diversification and the Capital Asset Pricing Model Prof. Ian Giddy New York University

New York University/ING Barings Portfolio Diversification and the Capital Asset Pricing Model Prof. Ian Giddy New York University

Equity Risk and Return: Summary Investors diversify, because you get a better return for a given risk. l There is a fully-diversified “market portfolio” that we should all choose l The risk of an individual asset can be measured by how much risk it adds to the “market portfolio. ” l Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 5

Equity Risk and Return: Summary Investors diversify, because you get a better return for a given risk. l There is a fully-diversified “market portfolio” that we should all choose l The risk of an individual asset can be measured by how much risk it adds to the “market portfolio. ” l Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 5

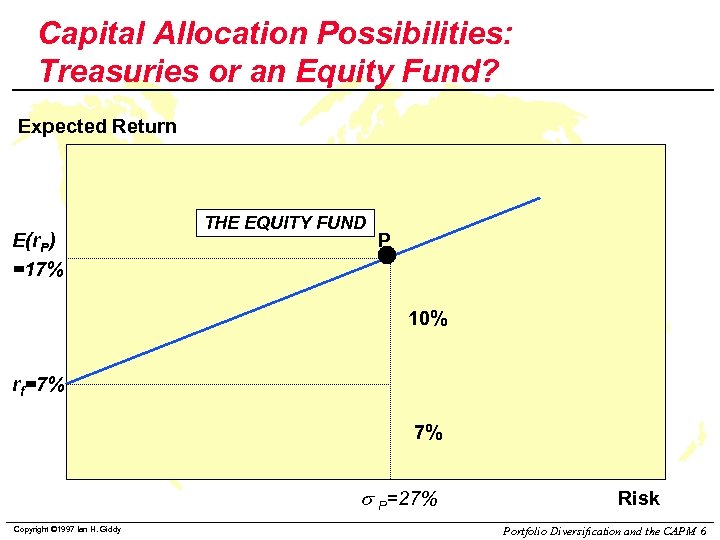

Capital Allocation Possibilities: Treasuries or an Equity Fund? Expected Return E(r. P) =17% THE EQUITY FUND P 10% rf=7% 7% s P=27% Copyright © 1997 Ian H. Giddy Risk Portfolio Diversification and the CAPM 6

Capital Allocation Possibilities: Treasuries or an Equity Fund? Expected Return E(r. P) =17% THE EQUITY FUND P 10% rf=7% 7% s P=27% Copyright © 1997 Ian H. Giddy Risk Portfolio Diversification and the CAPM 6

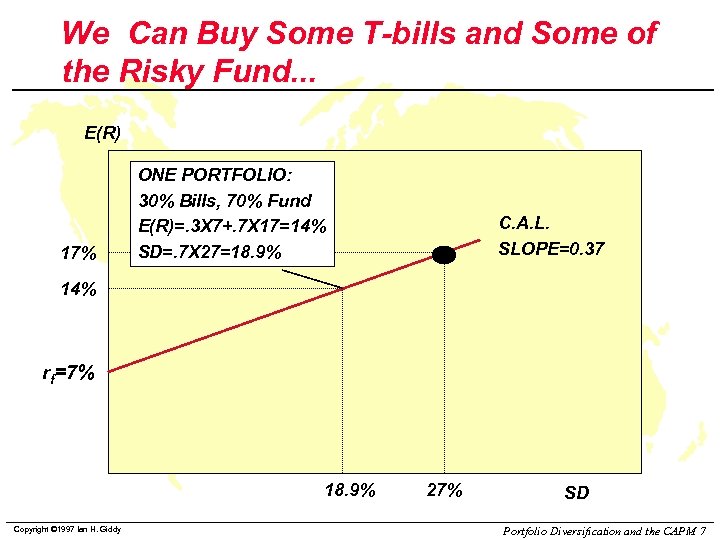

We Can Buy Some T-bills and Some of the Risky Fund. . . E(R) 17% ONE PORTFOLIO: 30% Bills, 70% Fund E(R)=. 3 X 7+. 7 X 17=14% SD=. 7 X 27=18. 9% C. A. L. SLOPE=0. 37 14% rf=7% 18. 9% Copyright © 1997 Ian H. Giddy 27% SD Portfolio Diversification and the CAPM 7

We Can Buy Some T-bills and Some of the Risky Fund. . . E(R) 17% ONE PORTFOLIO: 30% Bills, 70% Fund E(R)=. 3 X 7+. 7 X 17=14% SD=. 7 X 27=18. 9% C. A. L. SLOPE=0. 37 14% rf=7% 18. 9% Copyright © 1997 Ian H. Giddy 27% SD Portfolio Diversification and the CAPM 7

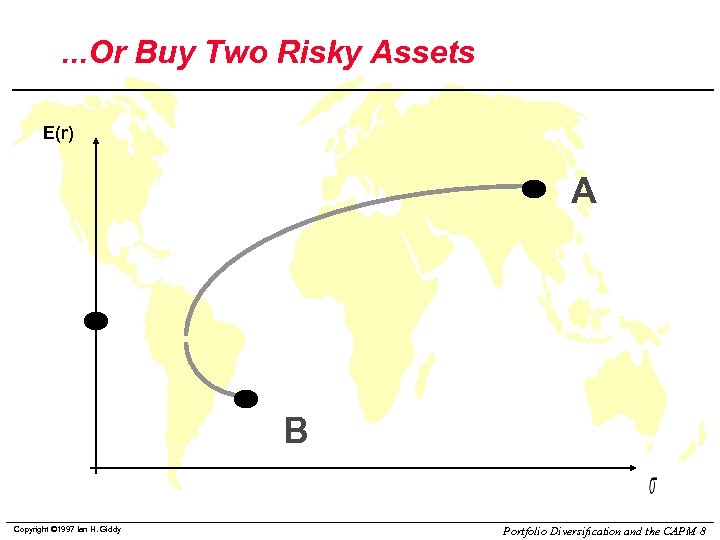

. . . Or Buy Two Risky Assets E(r) A B Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 8

. . . Or Buy Two Risky Assets E(r) A B Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 8

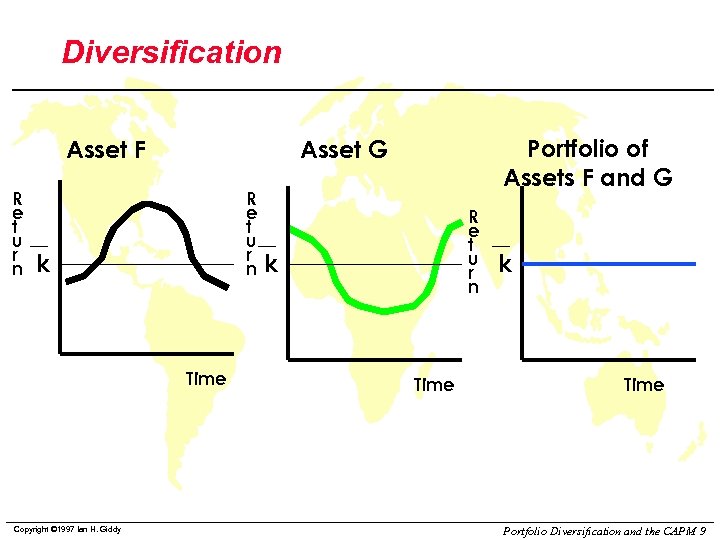

Diversification Asset F R e t u r n k Time Copyright © 1997 Ian H. Giddy Portfolio of Assets F and G Asset G R e t u r n k Time Portfolio Diversification and the CAPM 9

Diversification Asset F R e t u r n k Time Copyright © 1997 Ian H. Giddy Portfolio of Assets F and G Asset G R e t u r n k Time Portfolio Diversification and the CAPM 9

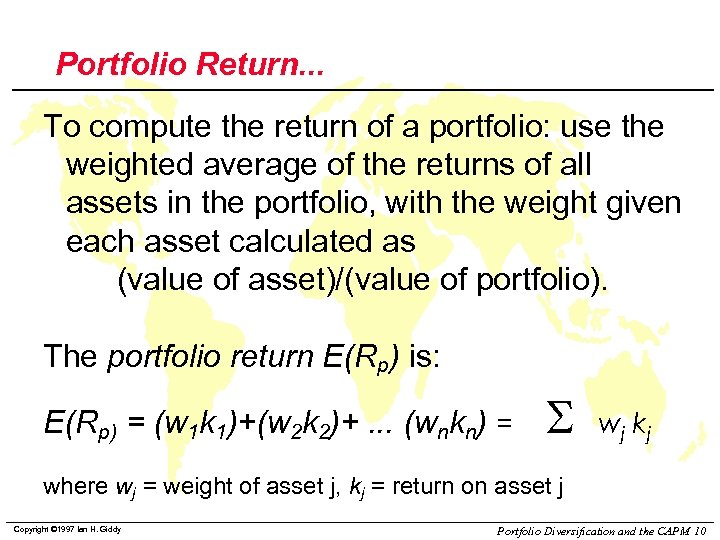

Portfolio Return. . . To compute the return of a portfolio: use the weighted average of the returns of all assets in the portfolio, with the weight given each asset calculated as (value of asset)/(value of portfolio). The portfolio return E(Rp) is: E(Rp) = (w 1 k 1)+(w 2 k 2)+. . . (wnkn) = S wj kj where wj = weight of asset j, kj = return on asset j Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 10

Portfolio Return. . . To compute the return of a portfolio: use the weighted average of the returns of all assets in the portfolio, with the weight given each asset calculated as (value of asset)/(value of portfolio). The portfolio return E(Rp) is: E(Rp) = (w 1 k 1)+(w 2 k 2)+. . . (wnkn) = S wj kj where wj = weight of asset j, kj = return on asset j Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 10

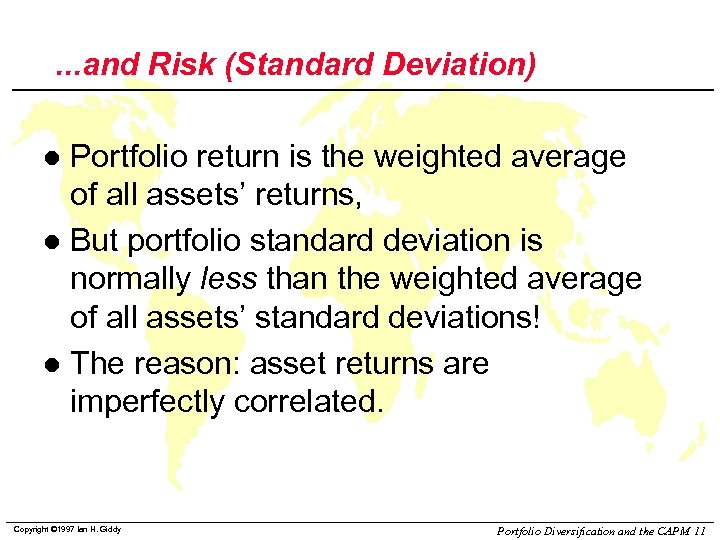

. . . and Risk (Standard Deviation) Portfolio return is the weighted average of all assets’ returns, l But portfolio standard deviation is normally less than the weighted average of all assets’ standard deviations! l The reason: asset returns are imperfectly correlated. l Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 11

. . . and Risk (Standard Deviation) Portfolio return is the weighted average of all assets’ returns, l But portfolio standard deviation is normally less than the weighted average of all assets’ standard deviations! l The reason: asset returns are imperfectly correlated. l Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 11

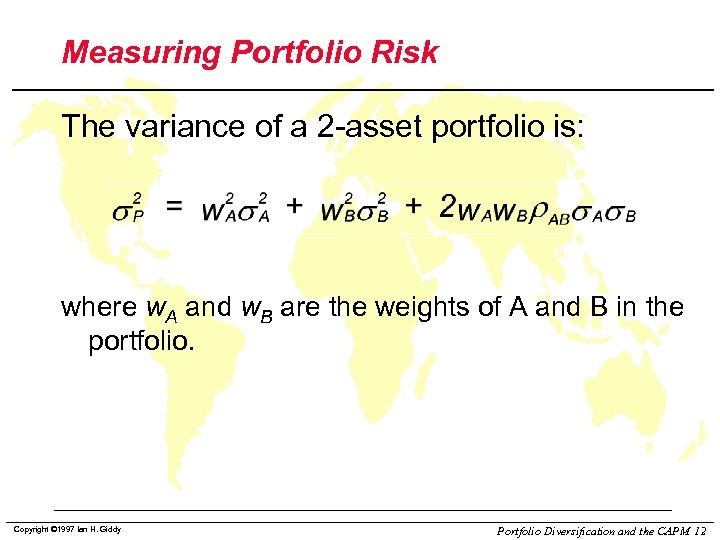

Measuring Portfolio Risk The variance of a 2 -asset portfolio is: where w. A and w. B are the weights of A and B in the portfolio. Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 12

Measuring Portfolio Risk The variance of a 2 -asset portfolio is: where w. A and w. B are the weights of A and B in the portfolio. Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 12

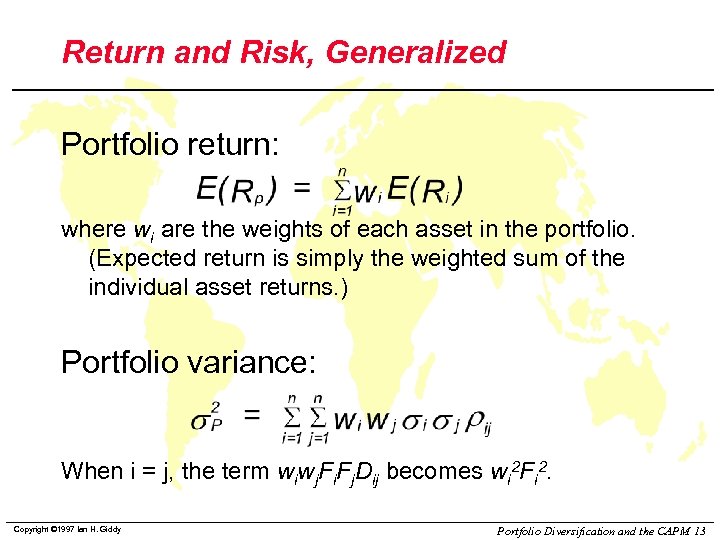

Return and Risk, Generalized Portfolio return: where wi are the weights of each asset in the portfolio. (Expected return is simply the weighted sum of the individual asset returns. ) Portfolio variance: When i = j, the term wiwj. Fi. Fj. Dij becomes wi 2 Fi 2. Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 13

Return and Risk, Generalized Portfolio return: where wi are the weights of each asset in the portfolio. (Expected return is simply the weighted sum of the individual asset returns. ) Portfolio variance: When i = j, the term wiwj. Fi. Fj. Dij becomes wi 2 Fi 2. Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 13

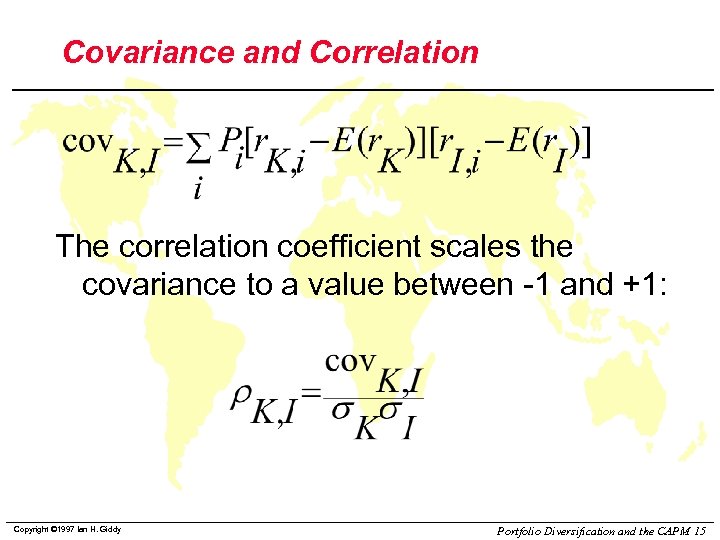

Covariance and Correlation The correlation coefficient scales the covariance to a value between -1 and +1: Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 15

Covariance and Correlation The correlation coefficient scales the covariance to a value between -1 and +1: Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 15

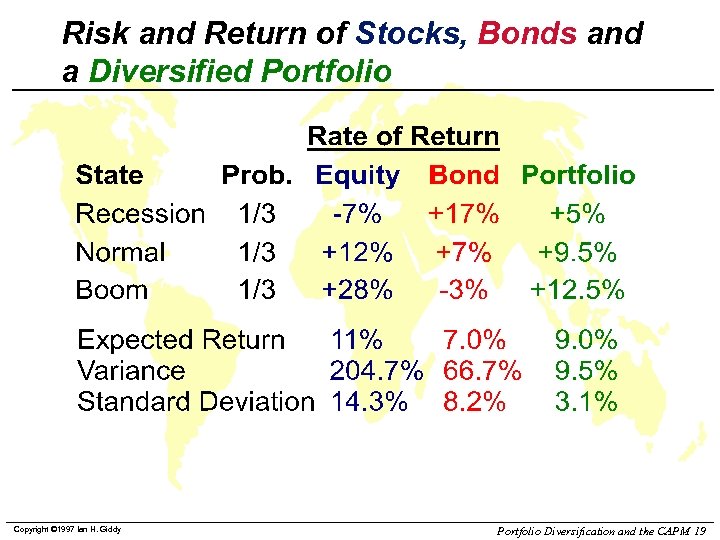

Risk and Return of Stocks, Bonds and a Diversified Portfolio Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 19

Risk and Return of Stocks, Bonds and a Diversified Portfolio Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 19

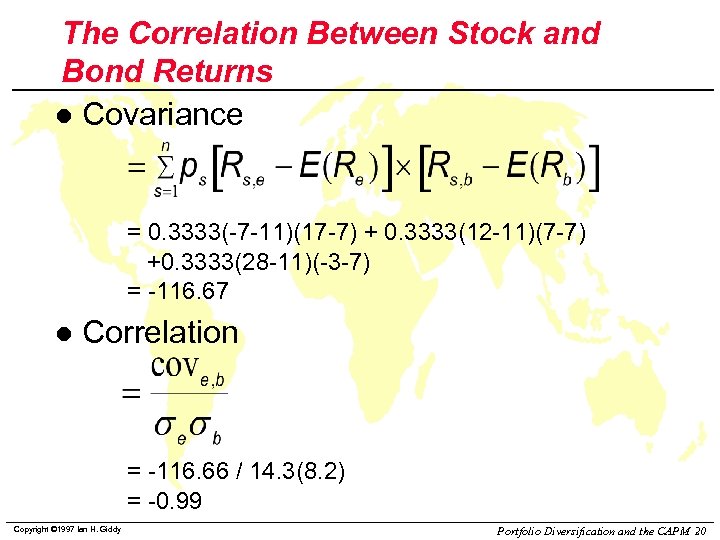

The Correlation Between Stock and Bond Returns l Covariance = 0. 3333(-7 -11)(17 -7) + 0. 3333(12 -11)(7 -7) +0. 3333(28 -11)(-3 -7) = -116. 67 l Correlation = -116. 66 / 14. 3(8. 2) = -0. 99 Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 20

The Correlation Between Stock and Bond Returns l Covariance = 0. 3333(-7 -11)(17 -7) + 0. 3333(12 -11)(7 -7) +0. 3333(28 -11)(-3 -7) = -116. 67 l Correlation = -116. 66 / 14. 3(8. 2) = -0. 99 Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 20

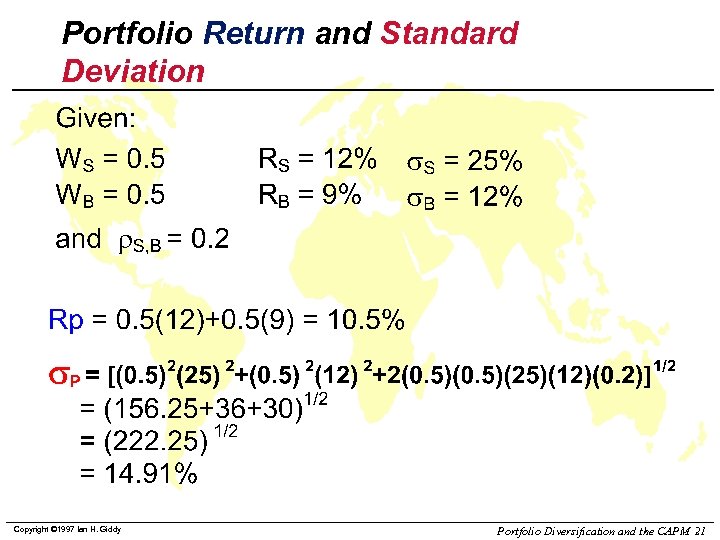

Portfolio Return and Standard Deviation Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 21

Portfolio Return and Standard Deviation Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 21

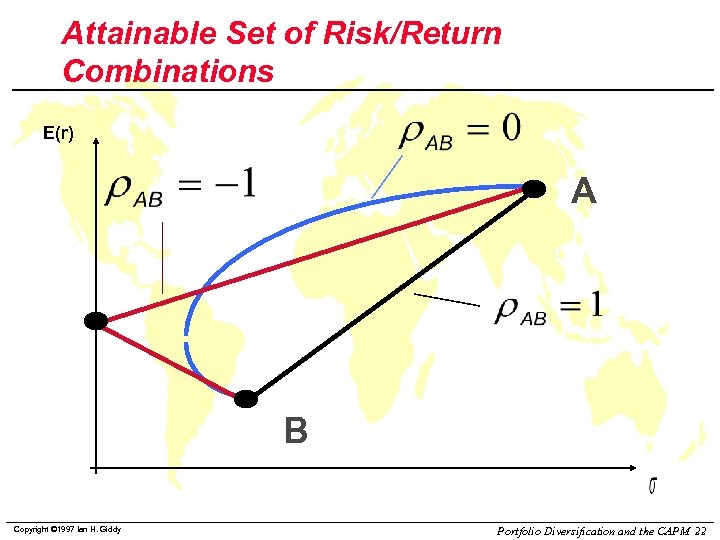

Attainable Set of Risk/Return Combinations E(r) A B Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 22

Attainable Set of Risk/Return Combinations E(r) A B Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 22

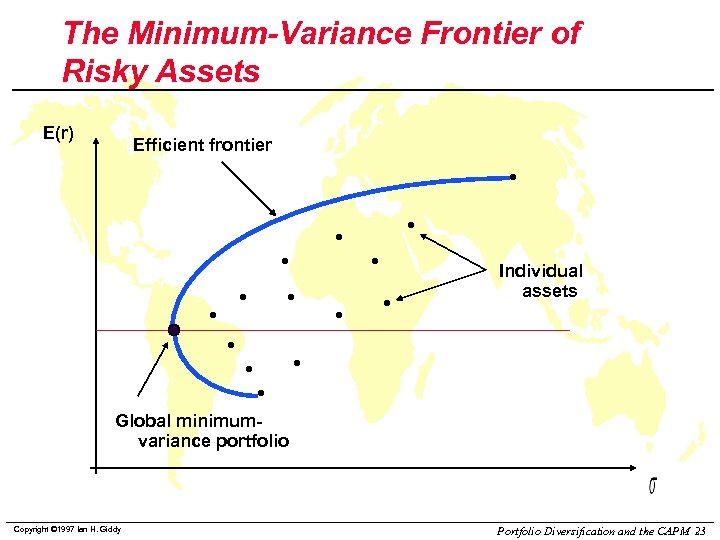

The Minimum-Variance Frontier of Risky Assets E(r) Efficient frontier Individual assets Global minimumvariance portfolio Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 23

The Minimum-Variance Frontier of Risky Assets E(r) Efficient frontier Individual assets Global minimumvariance portfolio Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 23

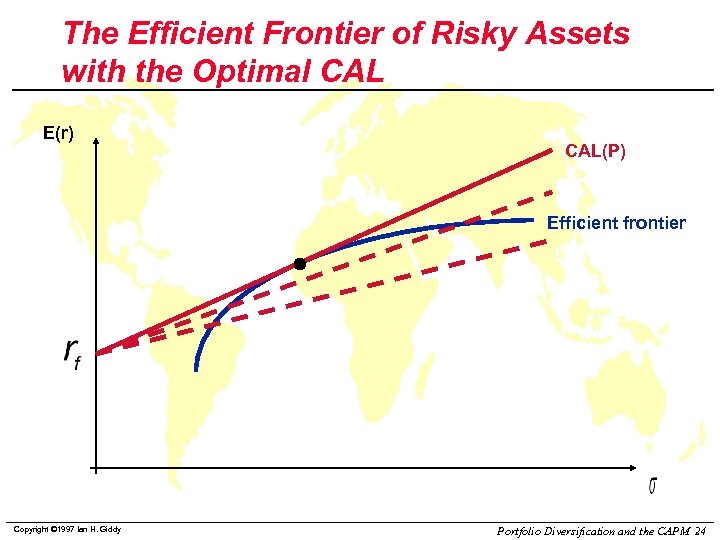

The Efficient Frontier of Risky Assets with the Optimal CAL E(r) CAL(P) Efficient frontier Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 24

The Efficient Frontier of Risky Assets with the Optimal CAL E(r) CAL(P) Efficient frontier Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 24

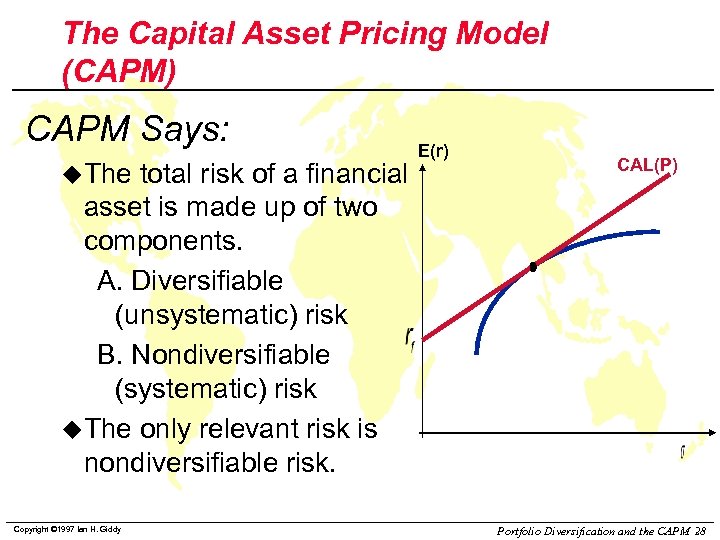

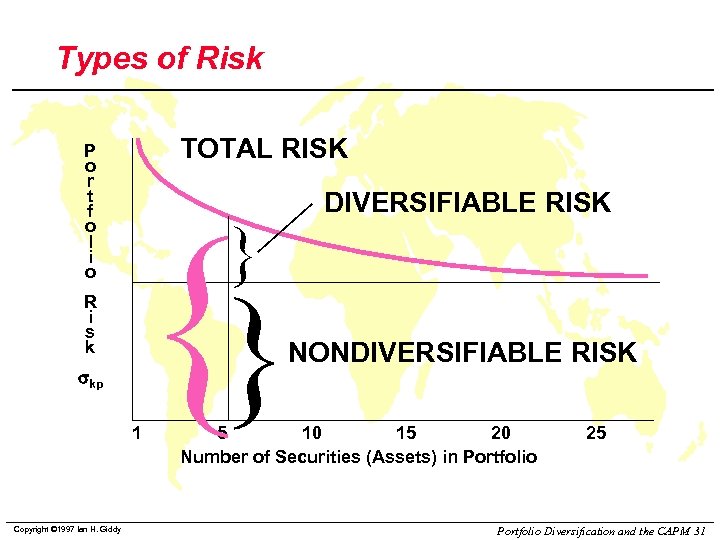

The Capital Asset Pricing Model (CAPM) CAPM Says: u. The total risk of a financial asset is made up of two components. A. Diversifiable (unsystematic) risk B. Nondiversifiable (systematic) risk u. The only relevant risk is nondiversifiable risk. Copyright © 1997 Ian H. Giddy E(r) CAL(P) Portfolio Diversification and the CAPM 28

The Capital Asset Pricing Model (CAPM) CAPM Says: u. The total risk of a financial asset is made up of two components. A. Diversifiable (unsystematic) risk B. Nondiversifiable (systematic) risk u. The only relevant risk is nondiversifiable risk. Copyright © 1997 Ian H. Giddy E(r) CAL(P) Portfolio Diversification and the CAPM 28

Types of Risk TOTAL RISK P o r t f o l i o R i s k skp 1 Copyright © 1997 Ian H. Giddy {} } DIVERSIFIABLE RISK NONDIVERSIFIABLE RISK 5 10 15 20 Number of Securities (Assets) in Portfolio 25 Portfolio Diversification and the CAPM 31

Types of Risk TOTAL RISK P o r t f o l i o R i s k skp 1 Copyright © 1997 Ian H. Giddy {} } DIVERSIFIABLE RISK NONDIVERSIFIABLE RISK 5 10 15 20 Number of Securities (Assets) in Portfolio 25 Portfolio Diversification and the CAPM 31

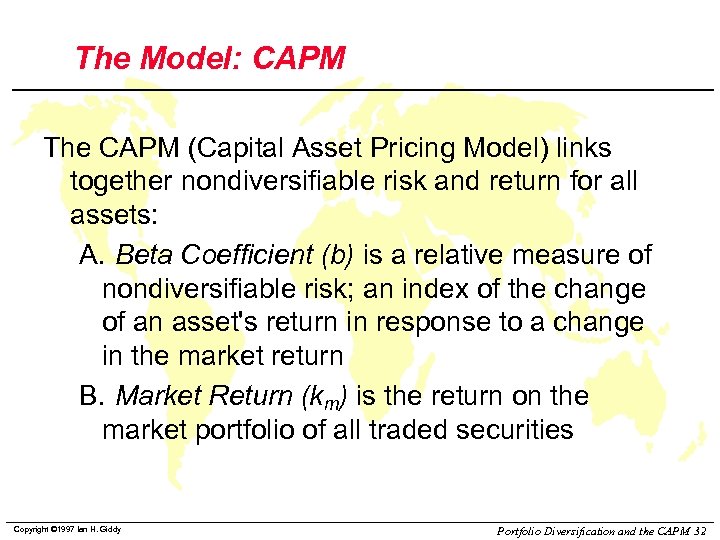

The Model: CAPM The CAPM (Capital Asset Pricing Model) links together nondiversifiable risk and return for all assets: A. Beta Coefficient (b) is a relative measure of nondiversifiable risk; an index of the change of an asset's return in response to a change in the market return B. Market Return (km) is the return on the market portfolio of all traded securities Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 32

The Model: CAPM The CAPM (Capital Asset Pricing Model) links together nondiversifiable risk and return for all assets: A. Beta Coefficient (b) is a relative measure of nondiversifiable risk; an index of the change of an asset's return in response to a change in the market return B. Market Return (km) is the return on the market portfolio of all traded securities Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 32

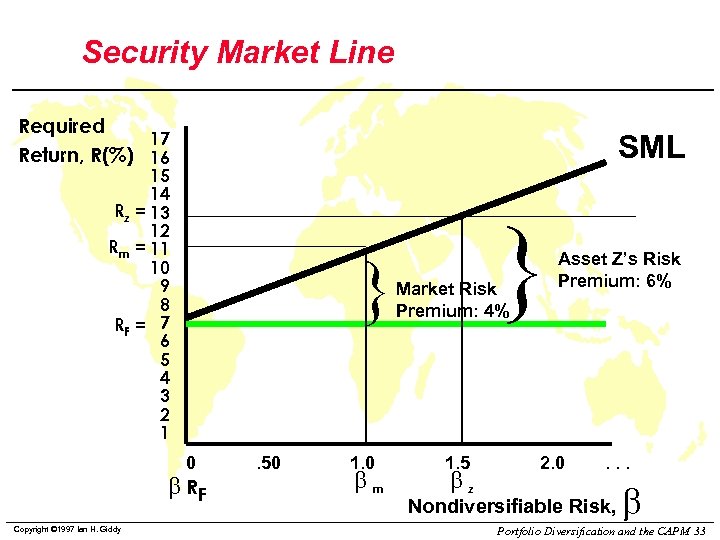

Security Market Line Required 17 Return, R(%) 16 SML 15 14 Rz = 13 12 Rm = 11 10 9 8 RF = 7 6 5 4 3 2 1 } 0 b RF Copyright © 1997 Ian H. Giddy . 50 1. 0 bm } Market Risk Premium: 4% 1. 5 bz Asset Z’s Risk Premium: 6% 2. 0 . . . Nondiversifiable Risk, b Portfolio Diversification and the CAPM 33

Security Market Line Required 17 Return, R(%) 16 SML 15 14 Rz = 13 12 Rm = 11 10 9 8 RF = 7 6 5 4 3 2 1 } 0 b RF Copyright © 1997 Ian H. Giddy . 50 1. 0 bm } Market Risk Premium: 4% 1. 5 bz Asset Z’s Risk Premium: 6% 2. 0 . . . Nondiversifiable Risk, b Portfolio Diversification and the CAPM 33

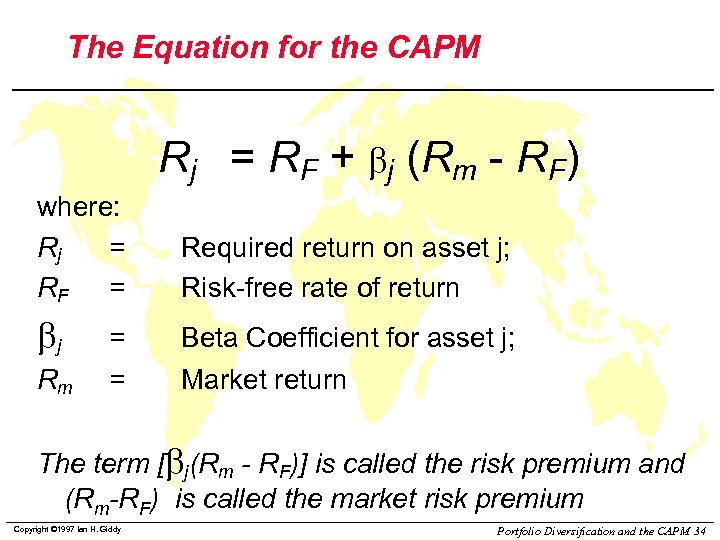

The Equation for the CAPM Rj = RF + bj (Rm - RF) where: Rj = RF = bj Rm = = Required return on asset j; Risk-free rate of return Beta Coefficient for asset j; Market return The term [bj(Rm - RF)] is called the risk premium and (Rm-RF) is called the market risk premium Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 34

The Equation for the CAPM Rj = RF + bj (Rm - RF) where: Rj = RF = bj Rm = = Required return on asset j; Risk-free rate of return Beta Coefficient for asset j; Market return The term [bj(Rm - RF)] is called the risk premium and (Rm-RF) is called the market risk premium Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 34

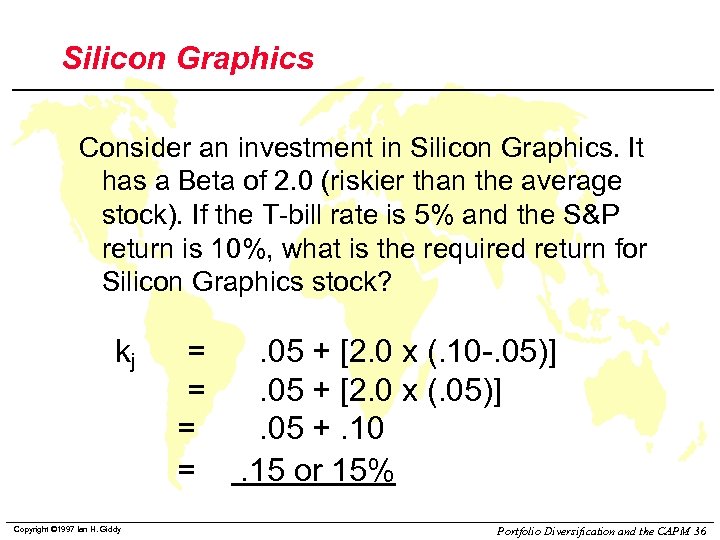

Silicon Graphics Consider an investment in Silicon Graphics. It has a Beta of 2. 0 (riskier than the average stock). If the T-bill rate is 5% and the S&P return is 10%, what is the required return for Silicon Graphics stock? kj Copyright © 1997 Ian H. Giddy = = . 05 + [2. 0 x (. 10 -. 05)]. 05 + [2. 0 x (. 05)]. 05 +. 10. 15 or 15% Portfolio Diversification and the CAPM 36

Silicon Graphics Consider an investment in Silicon Graphics. It has a Beta of 2. 0 (riskier than the average stock). If the T-bill rate is 5% and the S&P return is 10%, what is the required return for Silicon Graphics stock? kj Copyright © 1997 Ian H. Giddy = = . 05 + [2. 0 x (. 10 -. 05)]. 05 + [2. 0 x (. 05)]. 05 +. 10. 15 or 15% Portfolio Diversification and the CAPM 36

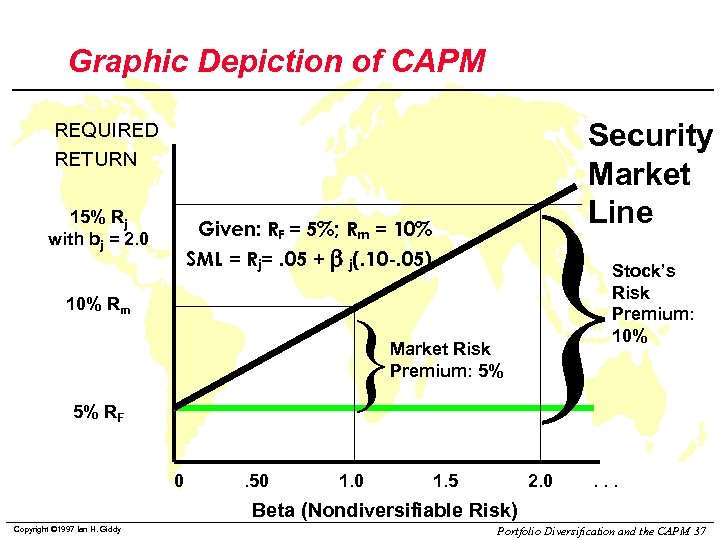

Graphic Depiction of CAPM Security Market Line REQUIRED RETURN 15% Rj with bj = 2. 0 Given: RF = 5%; Rm = 10% SML = Rj=. 05 + b j(. 10 -. 05) 10% Rm } Market Risk Premium: 5% 5% RF 0 . 50 1. 5 } Stock’s Risk Premium: 10% 2. 0 . . . Beta (Nondiversifiable Risk) Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 37

Graphic Depiction of CAPM Security Market Line REQUIRED RETURN 15% Rj with bj = 2. 0 Given: RF = 5%; Rm = 10% SML = Rj=. 05 + b j(. 10 -. 05) 10% Rm } Market Risk Premium: 5% 5% RF 0 . 50 1. 5 } Stock’s Risk Premium: 10% 2. 0 . . . Beta (Nondiversifiable Risk) Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 37

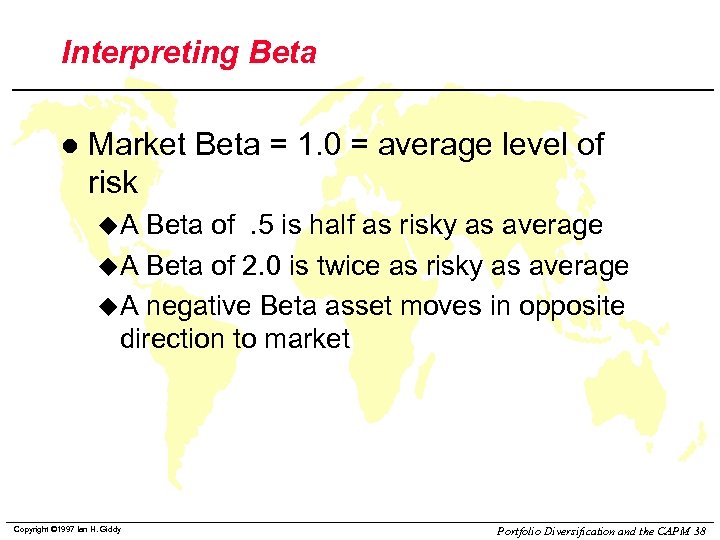

Interpreting Beta l Market Beta = 1. 0 = average level of risk u. A Beta of. 5 is half as risky as average u. A Beta of 2. 0 is twice as risky as average u. A negative Beta asset moves in opposite direction to market Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 38

Interpreting Beta l Market Beta = 1. 0 = average level of risk u. A Beta of. 5 is half as risky as average u. A Beta of 2. 0 is twice as risky as average u. A negative Beta asset moves in opposite direction to market Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 38

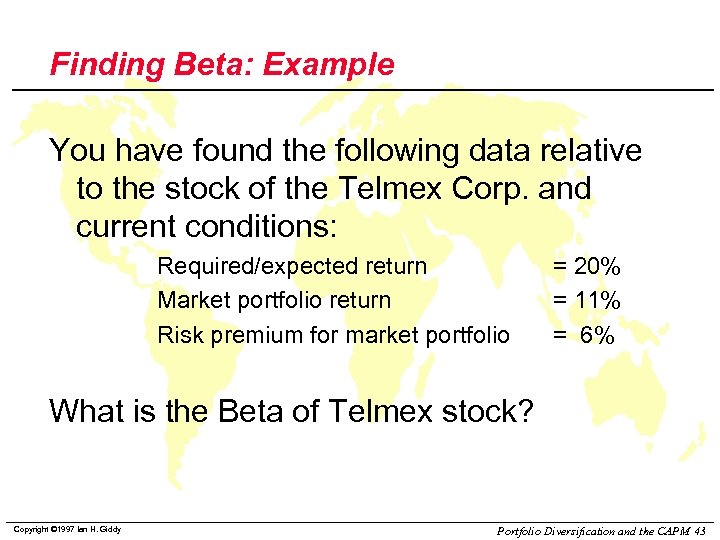

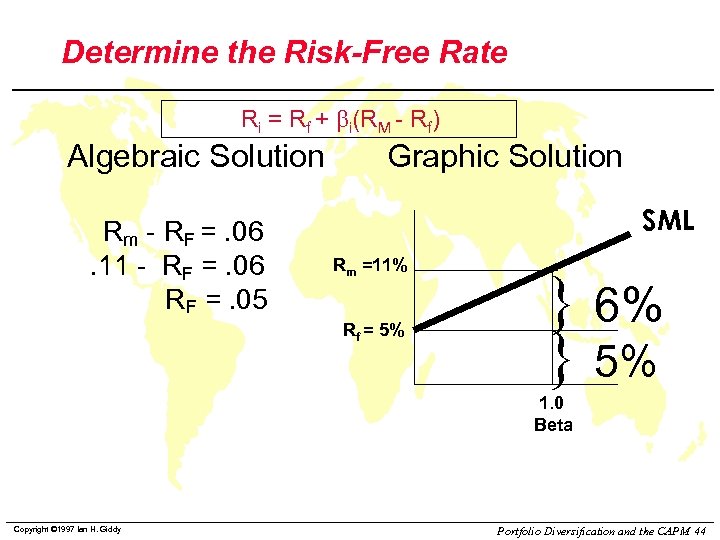

Finding Beta: Example You have found the following data relative to the stock of the Telmex Corp. and current conditions: Required/expected return Market portfolio return Risk premium for market portfolio = 20% = 11% = 6% What is the Beta of Telmex stock? Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 43

Finding Beta: Example You have found the following data relative to the stock of the Telmex Corp. and current conditions: Required/expected return Market portfolio return Risk premium for market portfolio = 20% = 11% = 6% What is the Beta of Telmex stock? Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 43

Determine the Risk-Free Rate Ri = Rf + bi(RM - Rf) Algebraic Solution Rm - RF =. 06. 11 - RF =. 06 RF =. 05 Graphic Solution SML Rm =11% Rf = 5% } 6% } 5% 1. 0 Beta Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 44

Determine the Risk-Free Rate Ri = Rf + bi(RM - Rf) Algebraic Solution Rm - RF =. 06. 11 - RF =. 06 RF =. 05 Graphic Solution SML Rm =11% Rf = 5% } 6% } 5% 1. 0 Beta Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 44

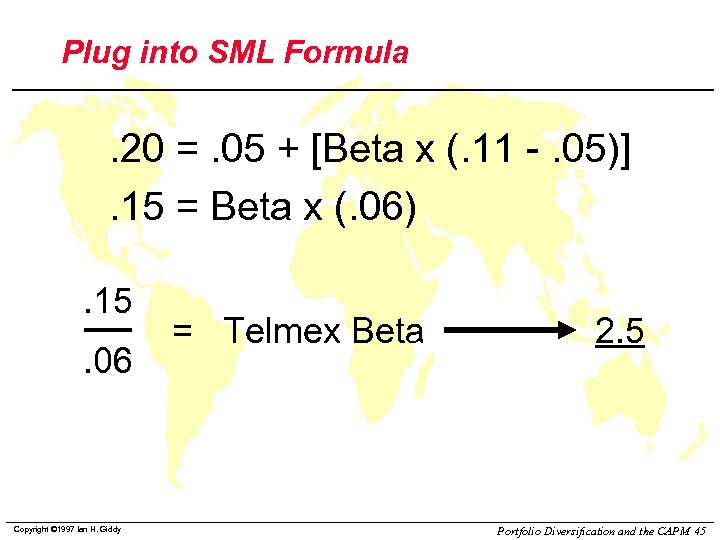

Plug into SML Formula . 20 =. 05 + [Beta x (. 11 -. 05)]. 15 = Beta x (. 06). 15. 06 Copyright © 1997 Ian H. Giddy = Telmex Beta 2. 5 Portfolio Diversification and the CAPM 45

Plug into SML Formula . 20 =. 05 + [Beta x (. 11 -. 05)]. 15 = Beta x (. 06). 15. 06 Copyright © 1997 Ian H. Giddy = Telmex Beta 2. 5 Portfolio Diversification and the CAPM 45

New York University/ING Barings Portfolio Theory Assignment Prof. Ian Giddy New York University

New York University/ING Barings Portfolio Theory Assignment Prof. Ian Giddy New York University

Try these problems l Ch 6 u. Problem 12 u. Problems 14 -16 (see p 157) l Ch 7 u. Problem 1 u. Problem 5 Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 47

Try these problems l Ch 6 u. Problem 12 u. Problems 14 -16 (see p 157) l Ch 7 u. Problem 1 u. Problem 5 Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 47

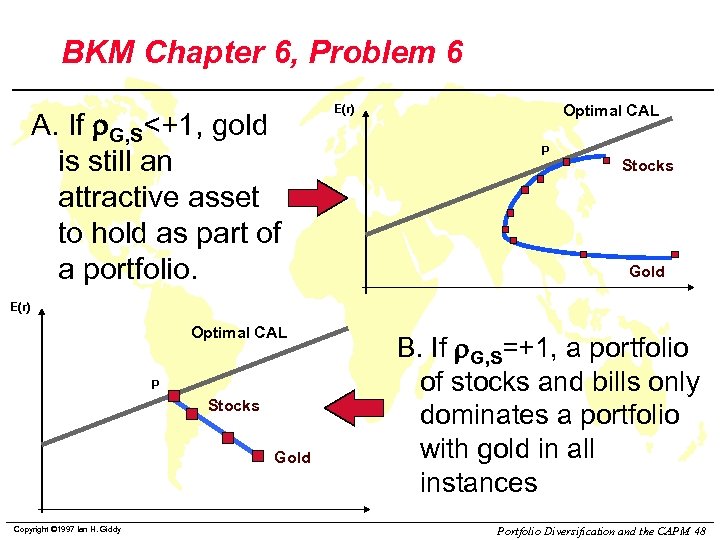

BKM Chapter 6, Problem 6 A. If r. G, S<+1, gold is still an attractive asset to hold as part of a portfolio. Optimal CAL E(r) P Stocks Gold E(r) Optimal CAL P Stocks Gold Copyright © 1997 Ian H. Giddy B. If r. G, S=+1, a portfolio of stocks and bills only dominates a portfolio with gold in all instances Portfolio Diversification and the CAPM 48

BKM Chapter 6, Problem 6 A. If r. G, S<+1, gold is still an attractive asset to hold as part of a portfolio. Optimal CAL E(r) P Stocks Gold E(r) Optimal CAL P Stocks Gold Copyright © 1997 Ian H. Giddy B. If r. G, S=+1, a portfolio of stocks and bills only dominates a portfolio with gold in all instances Portfolio Diversification and the CAPM 48

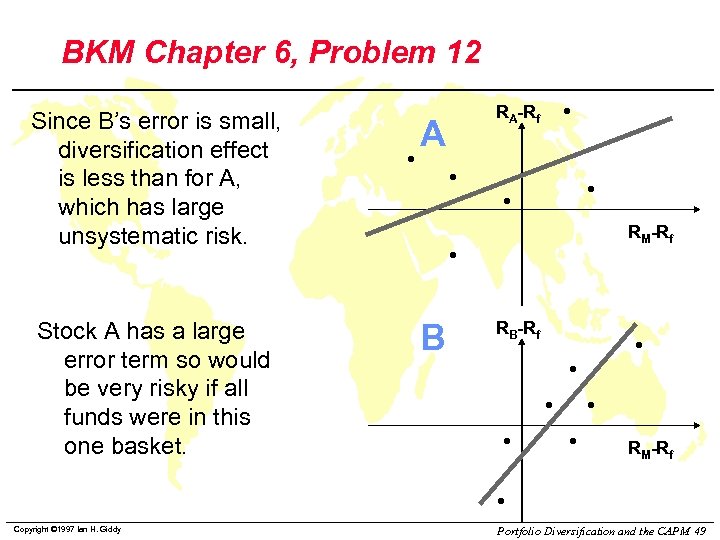

BKM Chapter 6, Problem 12 Since B’s error is small, diversification effect is less than for A, which has large unsystematic risk. Stock A has a large error term so would be very risky if all funds were in this one basket. Copyright © 1997 Ian H. Giddy A RA-Rf RM-Rf B RB-Rf RM-Rf Portfolio Diversification and the CAPM 49

BKM Chapter 6, Problem 12 Since B’s error is small, diversification effect is less than for A, which has large unsystematic risk. Stock A has a large error term so would be very risky if all funds were in this one basket. Copyright © 1997 Ian H. Giddy A RA-Rf RM-Rf B RB-Rf RM-Rf Portfolio Diversification and the CAPM 49

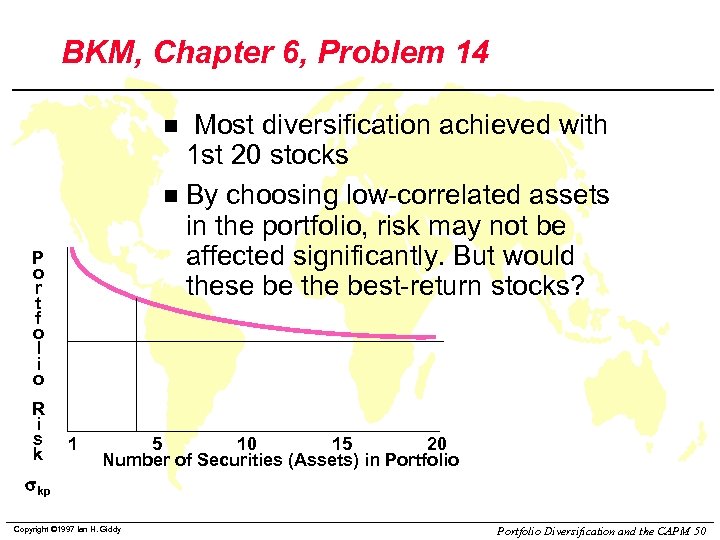

BKM, Chapter 6, Problem 14 Most diversification achieved with 1 st 20 stocks n By choosing low-correlated assets in the portfolio, risk may not be affected significantly. But would these be the best-return stocks? n P o r t f o l i o R i s k 1 5 10 15 20 Number of Securities (Assets) in Portfolio skp Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 50

BKM, Chapter 6, Problem 14 Most diversification achieved with 1 st 20 stocks n By choosing low-correlated assets in the portfolio, risk may not be affected significantly. But would these be the best-return stocks? n P o r t f o l i o R i s k 1 5 10 15 20 Number of Securities (Assets) in Portfolio skp Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 50

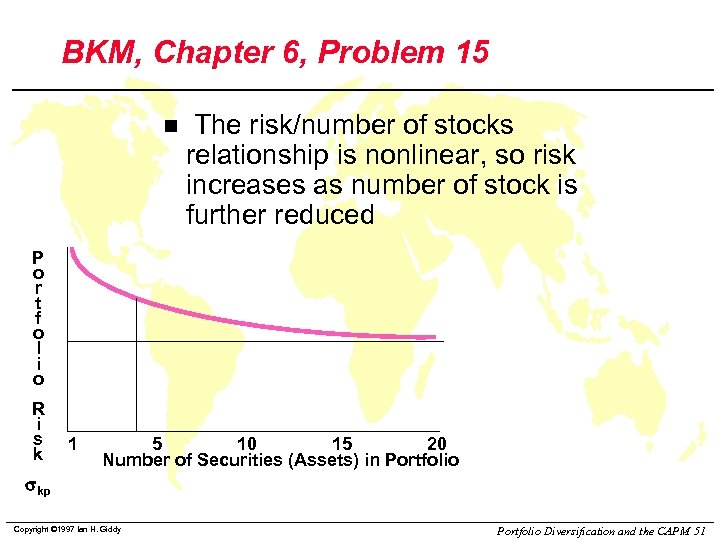

BKM, Chapter 6, Problem 15 n The risk/number of stocks relationship is nonlinear, so risk increases as number of stock is further reduced P o r t f o l i o R i s k 1 5 10 15 20 Number of Securities (Assets) in Portfolio skp Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 51

BKM, Chapter 6, Problem 15 n The risk/number of stocks relationship is nonlinear, so risk increases as number of stock is further reduced P o r t f o l i o R i s k 1 5 10 15 20 Number of Securities (Assets) in Portfolio skp Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 51

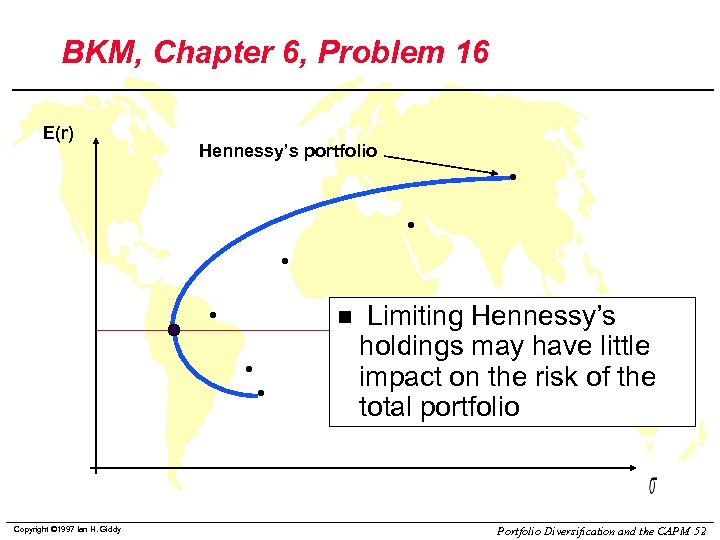

BKM, Chapter 6, Problem 16 E(r) Hennessy’s portfolio n Copyright © 1997 Ian H. Giddy Limiting Hennessy’s holdings may have little impact on the risk of the total portfolio Portfolio Diversification and the CAPM 52

BKM, Chapter 6, Problem 16 E(r) Hennessy’s portfolio n Copyright © 1997 Ian H. Giddy Limiting Hennessy’s holdings may have little impact on the risk of the total portfolio Portfolio Diversification and the CAPM 52

![BKM, Chapter 7, Problem 1 E(RP) = Rf + b[E(RM) - Rf] 20 = BKM, Chapter 7, Problem 1 E(RP) = Rf + b[E(RM) - Rf] 20 =](https://present5.com/presentation/ae593213c30de8edbae62a2139e97475/image-39.jpg) BKM, Chapter 7, Problem 1 E(RP) = Rf + b[E(RM) - Rf] 20 = 5 + b(15 -5) b =15/10 = 1. 5 Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 53

BKM, Chapter 7, Problem 1 E(RP) = Rf + b[E(RM) - Rf] 20 = 5 + b(15 -5) b =15/10 = 1. 5 Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 53

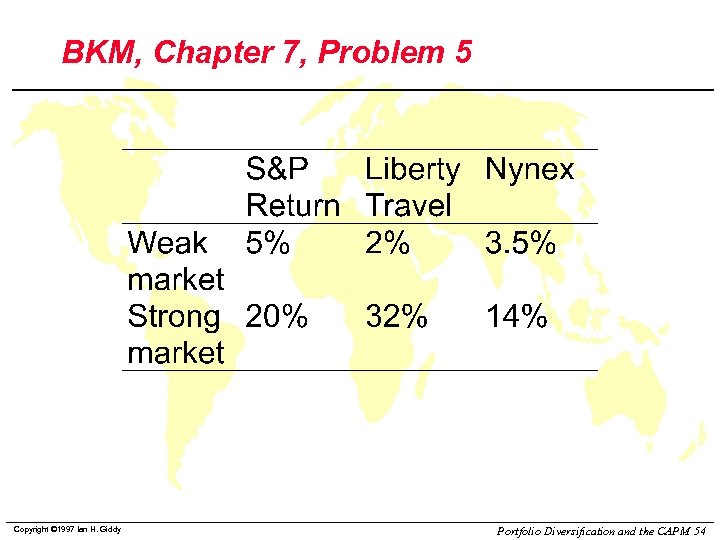

BKM, Chapter 7, Problem 5 Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 54

BKM, Chapter 7, Problem 5 Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 54

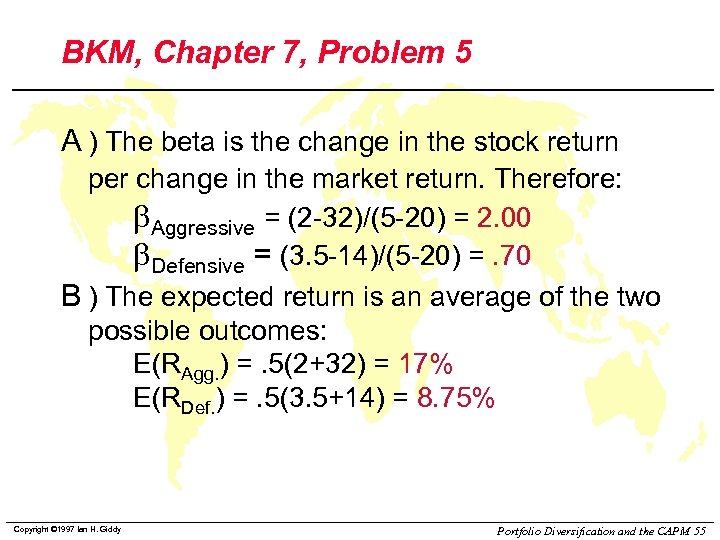

BKM, Chapter 7, Problem 5 A ) The beta is the change in the stock return per change in the market return. Therefore: b. Aggressive = (2 -32)/(5 -20) = 2. 00 b. Defensive = (3. 5 -14)/(5 -20) =. 70 B ) The expected return is an average of the two possible outcomes: E(RAgg. ) =. 5(2+32) = 17% E(RDef. ) =. 5(3. 5+14) = 8. 75% Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 55

BKM, Chapter 7, Problem 5 A ) The beta is the change in the stock return per change in the market return. Therefore: b. Aggressive = (2 -32)/(5 -20) = 2. 00 b. Defensive = (3. 5 -14)/(5 -20) =. 70 B ) The expected return is an average of the two possible outcomes: E(RAgg. ) =. 5(2+32) = 17% E(RDef. ) =. 5(3. 5+14) = 8. 75% Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 55

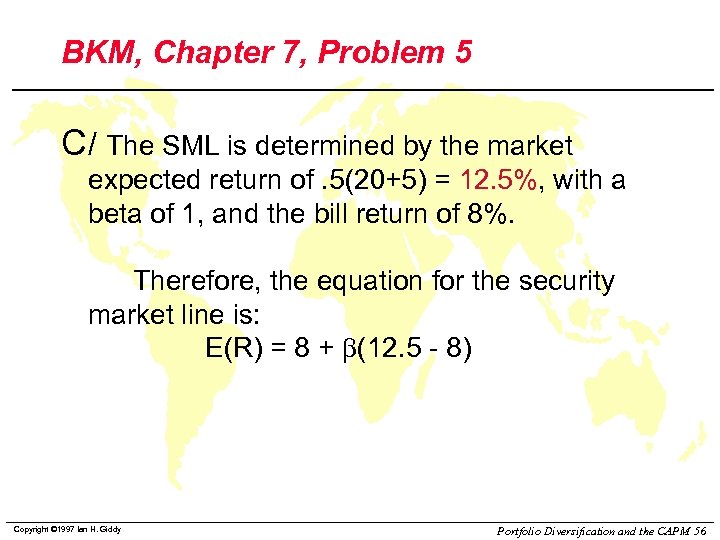

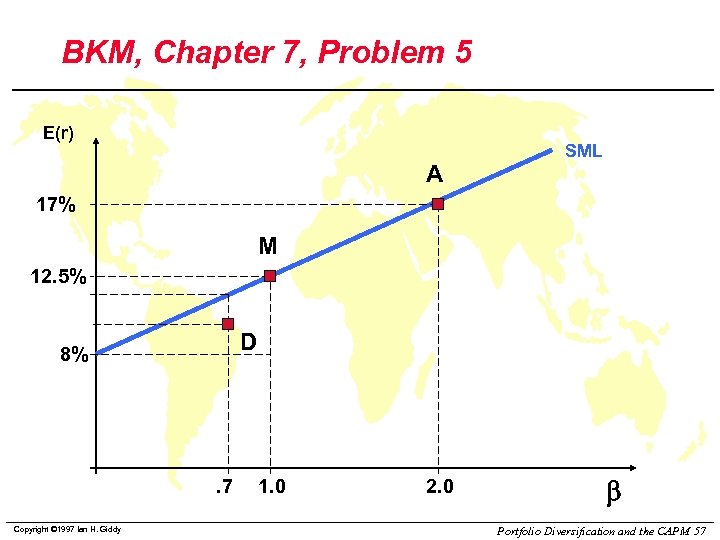

BKM, Chapter 7, Problem 5 C / The SML is determined by the market expected return of. 5(20+5) = 12. 5%, with a beta of 1, and the bill return of 8%. Therefore, the equation for the security market line is: E(R) = 8 + b(12. 5 - 8) Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 56

BKM, Chapter 7, Problem 5 C / The SML is determined by the market expected return of. 5(20+5) = 12. 5%, with a beta of 1, and the bill return of 8%. Therefore, the equation for the security market line is: E(R) = 8 + b(12. 5 - 8) Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 56

BKM, Chapter 7, Problem 5 E(r) A SML 17% M 12. 5% D 8% . 7 Copyright © 1997 Ian H. Giddy 1. 0 2. 0 b Portfolio Diversification and the CAPM 57

BKM, Chapter 7, Problem 5 E(r) A SML 17% M 12. 5% D 8% . 7 Copyright © 1997 Ian H. Giddy 1. 0 2. 0 b Portfolio Diversification and the CAPM 57

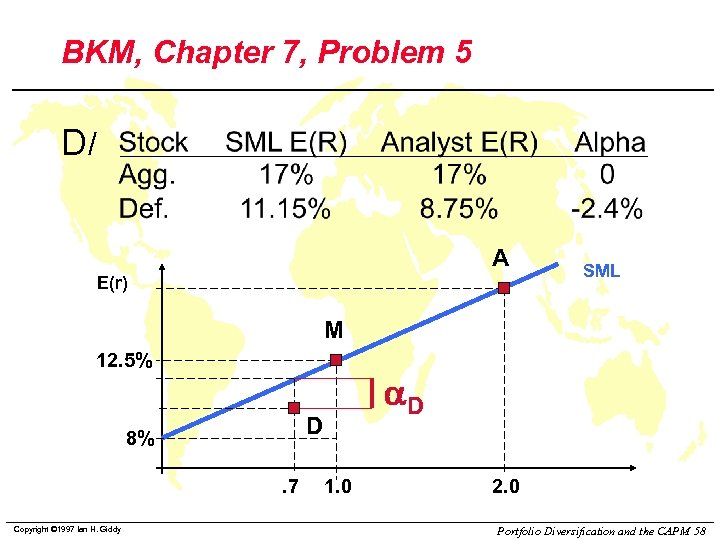

BKM, Chapter 7, Problem 5 D/ A E(r) SML M 12. 5% D 8%. 7 Copyright © 1997 Ian H. Giddy a. D 1. 0 2. 0 Portfolio Diversification and the CAPM 58

BKM, Chapter 7, Problem 5 D/ A E(r) SML M 12. 5% D 8%. 7 Copyright © 1997 Ian H. Giddy a. D 1. 0 2. 0 Portfolio Diversification and the CAPM 58

BKM, Chapter 7, Problem 5 E / The hurdle rate is determined by the project beta. 7. The correct discount rate is 11. 15%, the fair return on the defensive stock. Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 59

BKM, Chapter 7, Problem 5 E / The hurdle rate is determined by the project beta. 7. The correct discount rate is 11. 15%, the fair return on the defensive stock. Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 59

Equity Risk and Return: Summary Investors diversify, because you get a better return for a given risk. l There is a fully-diversified “market portfolio” that we should all choose l The risk of an individual asset can be measured by how much risk it adds to the “market portfolio” l The CAPM tells us how the required return relates to the relevant risk. l Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 60

Equity Risk and Return: Summary Investors diversify, because you get a better return for a given risk. l There is a fully-diversified “market portfolio” that we should all choose l The risk of an individual asset can be measured by how much risk it adds to the “market portfolio” l The CAPM tells us how the required return relates to the relevant risk. l Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 60

Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 61

Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 61

www. giddy. org Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 62

www. giddy. org Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 62

Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 63

Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 63

www. giddy. org Ian Giddy NYU Stern School of Business Tel 212 -998 -0704; Fax 212 -995 -4220 igiddy@stern. nyu. edu http: //www. giddy. org Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 64

www. giddy. org Ian Giddy NYU Stern School of Business Tel 212 -998 -0704; Fax 212 -995 -4220 igiddy@stern. nyu. edu http: //www. giddy. org Copyright © 1997 Ian H. Giddy Portfolio Diversification and the CAPM 64