46d8a352b2a7fbf5b46a1a6f8b78cec8.ppt

- Количество слайдов: 27

Coping with Higher Oil Prices March 8, 2006 Robert Bacon & Masami Kojima Oil, Gas, and Mining Policy Division Funded by ESMAP 1

Coping with Higher Oil Prices March 8, 2006 Robert Bacon & Masami Kojima Oil, Gas, and Mining Policy Division Funded by ESMAP 1

Sector-level policies for coping with higher oil prices • 38 country case studies • Overview of policies ØPrice-based ØQuantity-based ØSubstitution and efficiency improvement • Lessons from effective and ineffective policies 2

Sector-level policies for coping with higher oil prices • 38 country case studies • Overview of policies ØPrice-based ØQuantity-based ØSubstitution and efficiency improvement • Lessons from effective and ineffective policies 2

Country case studies • Non-oil producing countries Africa: Ethiopia, Kenya, Madagascar, Malawi, Morocco, Mozambique, Rwanda, Senegal, Tanzania, Zambia, Uganda Asia: Cambodia, Lao PDR, Sri Lanka, South America: Honduras, Nicaragua • Oil-producing net importers Africa: Ghana, Tunisia Asia: Bangladesh, China, India, Indonesia, Kyrgyz Republic, Pakistan, Philippines, Thailand South America: Guatemala, Brazil, Chile • Net oil exporters Africa: Cameroon, Egypt, Nigeria Asia: Kazakhstan, Malaysia, Vietnam South America: Argentina, Mexico, Venezuela • Regional Petro. Caribe 3

Country case studies • Non-oil producing countries Africa: Ethiopia, Kenya, Madagascar, Malawi, Morocco, Mozambique, Rwanda, Senegal, Tanzania, Zambia, Uganda Asia: Cambodia, Lao PDR, Sri Lanka, South America: Honduras, Nicaragua • Oil-producing net importers Africa: Ghana, Tunisia Asia: Bangladesh, China, India, Indonesia, Kyrgyz Republic, Pakistan, Philippines, Thailand South America: Guatemala, Brazil, Chile • Net oil exporters Africa: Cameroon, Egypt, Nigeria Asia: Kazakhstan, Malaysia, Vietnam South America: Argentina, Mexico, Venezuela • Regional Petro. Caribe 3

Policy questions for this study • How is the burden of the higher costs being shared between various parties in the economy? • How can governments encourage savings in petroleum fuel use/cost? • How can governments achieve public “buy-in”? • How can governments design policies for sustained high oil prices and likely trends in oil consumption? 4

Policy questions for this study • How is the burden of the higher costs being shared between various parties in the economy? • How can governments encourage savings in petroleum fuel use/cost? • How can governments achieve public “buy-in”? • How can governments design policies for sustained high oil prices and likely trends in oil consumption? 4

Factors affecting policy formulation • Growth in ratio of oil consumption to GDP expected for low-income countries Long-term policies to address sustained high oil prices and increasing vulnerability needed • Challenges in the transport sector Ø Substantial and rapidly growing oil consumption Ø Reducing oil dependence difficult Full price increase pass-through and appropriate taxes • Challenges in the power sector Ø Droughts affecting hydro potential Ø Fuel substitution difficult for countries with no coal and no natural gas Focus on commercial and technical efficiency gains 5

Factors affecting policy formulation • Growth in ratio of oil consumption to GDP expected for low-income countries Long-term policies to address sustained high oil prices and increasing vulnerability needed • Challenges in the transport sector Ø Substantial and rapidly growing oil consumption Ø Reducing oil dependence difficult Full price increase pass-through and appropriate taxes • Challenges in the power sector Ø Droughts affecting hydro potential Ø Fuel substitution difficult for countries with no coal and no natural gas Focus on commercial and technical efficiency gains 5

Most commonly debated policy questions • Subsidy/tax reduction or no subsidy/no tax reduction • Price control or no price control • Frequency of price adjustments—oil price volatility • When to announce price adjustments (public information campaign vs. danger of hoarding, fuel shortages) 6

Most commonly debated policy questions • Subsidy/tax reduction or no subsidy/no tax reduction • Price control or no price control • Frequency of price adjustments—oil price volatility • When to announce price adjustments (public information campaign vs. danger of hoarding, fuel shortages) 6

Price-based policies • No government intervention: full pass-through of world oil price increase • Partial pass-through direct government intervention Tax reductions or exemptions Product cross-subsidies Temporal cross-subsidies: oil price stabilization funds Direct government subsidies • Squeezing margins of oil companies Price caps, price freeze, requiring written justification, urging public to boycott stations that raise prices Export taxes or bans 7

Price-based policies • No government intervention: full pass-through of world oil price increase • Partial pass-through direct government intervention Tax reductions or exemptions Product cross-subsidies Temporal cross-subsidies: oil price stabilization funds Direct government subsidies • Squeezing margins of oil companies Price caps, price freeze, requiring written justification, urging public to boycott stations that raise prices Export taxes or bans 7

Quantity-based policies • Rationing Fuel rationing (Kyrgyz in response to Kazakhstan’s export ban, diesel in Malaysia), vouchers for subsidized fuels, reduced supply (suspension of new LPG connections in India), rolling black-outs for power • Energy-saving measures Rationing: limits on office and street lighting, hours of business, neon lights, work days, driving, heating and cooling, use of elevators, fuel allocation to government agencies; suspension of government vehicle purchase Promotion of energy-efficient appliances and equipment, public transport Higher taxes or ban on energy inefficient appliances and equipment 8

Quantity-based policies • Rationing Fuel rationing (Kyrgyz in response to Kazakhstan’s export ban, diesel in Malaysia), vouchers for subsidized fuels, reduced supply (suspension of new LPG connections in India), rolling black-outs for power • Energy-saving measures Rationing: limits on office and street lighting, hours of business, neon lights, work days, driving, heating and cooling, use of elevators, fuel allocation to government agencies; suspension of government vehicle purchase Promotion of energy-efficient appliances and equipment, public transport Higher taxes or ban on energy inefficient appliances and equipment 8

Reducing supply costs • • Negotiation with suppliers Price hedging Bulk purchase Strategic reserves 9

Reducing supply costs • • Negotiation with suppliers Price hedging Bulk purchase Strategic reserves 9

Diversifying out of oil • Natural gas (Argentina, Egypt, Pakistan, Philippines, Tunisia) • Coal; coal to liquids (China, Indonesia) • Renewables – hydro, geothermal, etc. • Biofuels Ethanol to substitute gasoline Biodiesel to substitute petroleum diesel Ethanol from sugarcane is the cheapest biofuel today 10

Diversifying out of oil • Natural gas (Argentina, Egypt, Pakistan, Philippines, Tunisia) • Coal; coal to liquids (China, Indonesia) • Renewables – hydro, geothermal, etc. • Biofuels Ethanol to substitute gasoline Biodiesel to substitute petroleum diesel Ethanol from sugarcane is the cheapest biofuel today 10

Winning public buy-in • Government’s perceived legitimacy, public support • Government’s credibility for delivery of public goods • Burden-sharing in acceptable manner, speed of policy adoption, strategic timing • Transparency of policies • Public awareness raising 11

Winning public buy-in • Government’s perceived legitimacy, public support • Government’s credibility for delivery of public goods • Burden-sharing in acceptable manner, speed of policy adoption, strategic timing • Transparency of policies • Public awareness raising 11

Country Experience 12

Country Experience 12

Government response: price-based policies Incorrect assumptions about size and duration of oil price increase led several governments, including reformist economies, to rapidly re-introduce price controls • Magnitude and duration of price shock initially under-estimated Ø Thailand: Planned for 2 months duration at $128 million vs. 19 months at $2. 2 billion • Initial government reaction: re-adopt price control Ø Suspend formula-based automatic pricing mechanisms Chile, India, Pakistan Ø Impose price caps or freezes Argentina, Chile, Honduras, Pakistan, Thailand 13

Government response: price-based policies Incorrect assumptions about size and duration of oil price increase led several governments, including reformist economies, to rapidly re-introduce price controls • Magnitude and duration of price shock initially under-estimated Ø Thailand: Planned for 2 months duration at $128 million vs. 19 months at $2. 2 billion • Initial government reaction: re-adopt price control Ø Suspend formula-based automatic pricing mechanisms Chile, India, Pakistan Ø Impose price caps or freezes Argentina, Chile, Honduras, Pakistan, Thailand 13

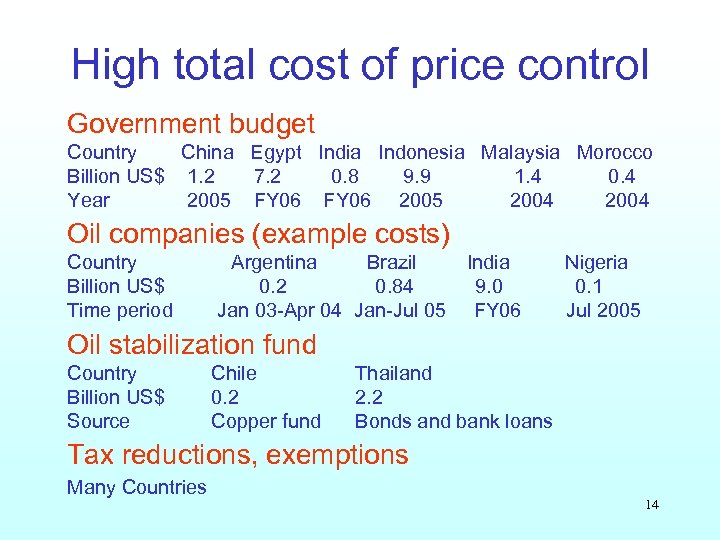

High total cost of price control Government budget Country China Egypt India Indonesia Malaysia Morocco Billion US$ 1. 2 7. 2 0. 8 9. 9 1. 4 0. 4 Year 2005 FY 06 2005 2004 Oil companies (example costs) Country Billion US$ Time period Argentina Brazil 0. 2 0. 84 Jan 03 -Apr 04 Jan-Jul 05 India 9. 0 FY 06 Nigeria 0. 1 Jul 2005 Oil stabilization fund Country Billion US$ Source Chile 0. 2 Copper fund Thailand 2. 2 Bonds and bank loans Tax reductions, exemptions Many Countries 14

High total cost of price control Government budget Country China Egypt India Indonesia Malaysia Morocco Billion US$ 1. 2 7. 2 0. 8 9. 9 1. 4 0. 4 Year 2005 FY 06 2005 2004 Oil companies (example costs) Country Billion US$ Time period Argentina Brazil 0. 2 0. 84 Jan 03 -Apr 04 Jan-Jul 05 India 9. 0 FY 06 Nigeria 0. 1 Jul 2005 Oil stabilization fund Country Billion US$ Source Chile 0. 2 Copper fund Thailand 2. 2 Bonds and bank loans Tax reductions, exemptions Many Countries 14

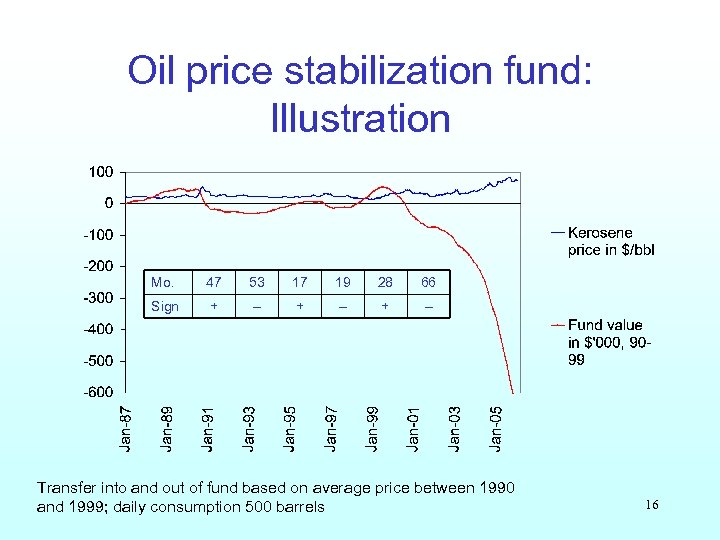

Oil price stabilization fund • Abandoned and not reactivated India, Philippines • Depleted before 2005 Chile: transfer $200 million from copper fund Morocco Thailand (before 2004) Ethiopia (during 2004) • Operational Chile, Malawi, Morocco, Thailand • Talk of introducing or reactivating a stabilization fund Nigeria, Senegal, Zambia • Key issues: Is oil price mean-reverting? How long will it take before the fund becomes self-financing? 15

Oil price stabilization fund • Abandoned and not reactivated India, Philippines • Depleted before 2005 Chile: transfer $200 million from copper fund Morocco Thailand (before 2004) Ethiopia (during 2004) • Operational Chile, Malawi, Morocco, Thailand • Talk of introducing or reactivating a stabilization fund Nigeria, Senegal, Zambia • Key issues: Is oil price mean-reverting? How long will it take before the fund becomes self-financing? 15

Oil price stabilization fund: Illustration Mo. 47 53 17 19 28 66 Sign + – + – Transfer into and out of fund based on average price between 1990 and 1999; daily consumption 500 barrels 16

Oil price stabilization fund: Illustration Mo. 47 53 17 19 28 66 Sign + – + – Transfer into and out of fund based on average price between 1990 and 1999; daily consumption 500 barrels 16

Smuggling and adulteration • Substantial fiscal implications (ex. Cambodia) • Pricing principles that give incentives for smuggling/adulteration entrench criminal elements Ø “Opec boys” in DRC Ø Murder of IOC official in India in November 2005 • Smuggling and adulteration make fair competition difficult • Adulteration can make implementation of other regulations difficult Ø Euro III and IV and diesel adulteration in India 17

Smuggling and adulteration • Substantial fiscal implications (ex. Cambodia) • Pricing principles that give incentives for smuggling/adulteration entrench criminal elements Ø “Opec boys” in DRC Ø Murder of IOC official in India in November 2005 • Smuggling and adulteration make fair competition difficult • Adulteration can make implementation of other regulations difficult Ø Euro III and IV and diesel adulteration in India 17

Reducing consumption • Economic pricing of fuels including externalities addresses optimal consumption • Few countries have announced systematic and policies to save energy, most policies exhortatory • Some governments have mandated or offered incentives for reductions in energy use § § Philippines – active and aggressive promotion by President Thailand – mandatory limits on activities Vietnam – all state agencies to cut gasoline use by 10% Indonesia – all government agencies to implement energysaving measures § Honduras – state of emergency 18

Reducing consumption • Economic pricing of fuels including externalities addresses optimal consumption • Few countries have announced systematic and policies to save energy, most policies exhortatory • Some governments have mandated or offered incentives for reductions in energy use § § Philippines – active and aggressive promotion by President Thailand – mandatory limits on activities Vietnam – all state agencies to cut gasoline use by 10% Indonesia – all government agencies to implement energysaving measures § Honduras – state of emergency 18

Squeezing oil companies: India • Burden sharing: oil companies 51%, government 36%, consumers 13% in FY 06 • IOC, HPCL, BPCL, and IBP all reported firstever losses in 2004– 2005. Their underrecoveries are expected to reach $9 billion in FY 06. • ONGC, OIL, and GAIL in upstream are required to contribute $2. 2 billion toward the shortfall • $2. 6 billion oil bonds issued in 2006 19

Squeezing oil companies: India • Burden sharing: oil companies 51%, government 36%, consumers 13% in FY 06 • IOC, HPCL, BPCL, and IBP all reported firstever losses in 2004– 2005. Their underrecoveries are expected to reach $9 billion in FY 06. • ONGC, OIL, and GAIL in upstream are required to contribute $2. 2 billion toward the shortfall • $2. 6 billion oil bonds issued in 2006 19

Biofuel programs • China: ethanol 20% of gasoline consumed contained ethanol in 2005 • Colombia: 10% ethanol in gasoline • India: 5% ethanol in certain states if ethanol is not more expensive, biodiesel purchase policy • Indonesia: 3% of energy from plant-based fuels by 2025 • Malaysia: biodiesel from palm oil, trial underway • Philippines: coco-biodiesel, ethanol • Thailand: 10% ethanol in gasoline 20

Biofuel programs • China: ethanol 20% of gasoline consumed contained ethanol in 2005 • Colombia: 10% ethanol in gasoline • India: 5% ethanol in certain states if ethanol is not more expensive, biodiesel purchase policy • Indonesia: 3% of energy from plant-based fuels by 2025 • Malaysia: biodiesel from palm oil, trial underway • Philippines: coco-biodiesel, ethanol • Thailand: 10% ethanol in gasoline 20

Compensation schemes • Cash transfer Ø $29 per household to 2. 2 million poor households in Chile Ø $10 per month to 17. 8 million poor households in Indonesia § Inadequate database on the poor § Change to conditional transfer in 2007 Ø $1. 2 -2. 5 per month to the poor in some provinces in China • Education Ø Ghana (elementary and secondary school fee waiver) Ø Indonesia (elementary school fee waiver, scholarships, free books, higher teacher salaries) • Health Ø Ghana (spending on primary health care) Ø Indonesia (free medical treatment at some clinics and hospitals) • Higher pension, minimum wage, civil service salaries Ø Thailand 21

Compensation schemes • Cash transfer Ø $29 per household to 2. 2 million poor households in Chile Ø $10 per month to 17. 8 million poor households in Indonesia § Inadequate database on the poor § Change to conditional transfer in 2007 Ø $1. 2 -2. 5 per month to the poor in some provinces in China • Education Ø Ghana (elementary and secondary school fee waiver) Ø Indonesia (elementary school fee waiver, scholarships, free books, higher teacher salaries) • Health Ø Ghana (spending on primary health care) Ø Indonesia (free medical treatment at some clinics and hospitals) • Higher pension, minimum wage, civil service salaries Ø Thailand 21

Transparency of compensation policies • Is compensation easy to verify? ØUniversal schemes more easily verifiable by individual citizens ØLocation-specific projects more difficult § Road construction • Can benefits be felt immediately? • Is the delivery scheme designed to minimize diversion? 22

Transparency of compensation policies • Is compensation easy to verify? ØUniversal schemes more easily verifiable by individual citizens ØLocation-specific projects more difficult § Road construction • Can benefits be felt immediately? • Is the delivery scheme designed to minimize diversion? 22

Winning public buy-in • Perceived legitimacy, popularity, and credibility of government • Credible compensation scheme Ø Historical record on effective delivery with tangible results • Strategic timing Ø Post election (Ghana, Indonesia, Thailand) Ø After harvest (Morocco), beginning of Ramadan (Indonesia) • Public information Ø Ghana: Identification of winners and losers, impact analysis, and design of compensation schemes informed by PSIA, followed by public debates on TV and radio 23

Winning public buy-in • Perceived legitimacy, popularity, and credibility of government • Credible compensation scheme Ø Historical record on effective delivery with tangible results • Strategic timing Ø Post election (Ghana, Indonesia, Thailand) Ø After harvest (Morocco), beginning of Ramadan (Indonesia) • Public information Ø Ghana: Identification of winners and losers, impact analysis, and design of compensation schemes informed by PSIA, followed by public debates on TV and radio 23

Public buy-in: Indonesia, January 2003 “The fuel demonstrations are symbolic of a wider public dissatisfaction with Ms Megawati's government, and with the corruption and inefficiency that still permeates political and bureaucratic life in Indonesia… The subsidy reductions stand against the background of other decisions that appeared to favor powerful interests. In November, the government sought to relieve five of the country’s largest debtors from repayment obligations… the incident has reinforced the view that wealthy, influential figures continue to receive special treatment— while average Indonesians are faced with price rises they can ill afford. ” Economist Intelligence Unit - Business Asia, 27 January 2003 24

Public buy-in: Indonesia, January 2003 “The fuel demonstrations are symbolic of a wider public dissatisfaction with Ms Megawati's government, and with the corruption and inefficiency that still permeates political and bureaucratic life in Indonesia… The subsidy reductions stand against the background of other decisions that appeared to favor powerful interests. In November, the government sought to relieve five of the country’s largest debtors from repayment obligations… the incident has reinforced the view that wealthy, influential figures continue to receive special treatment— while average Indonesians are faced with price rises they can ill afford. ” Economist Intelligence Unit - Business Asia, 27 January 2003 24

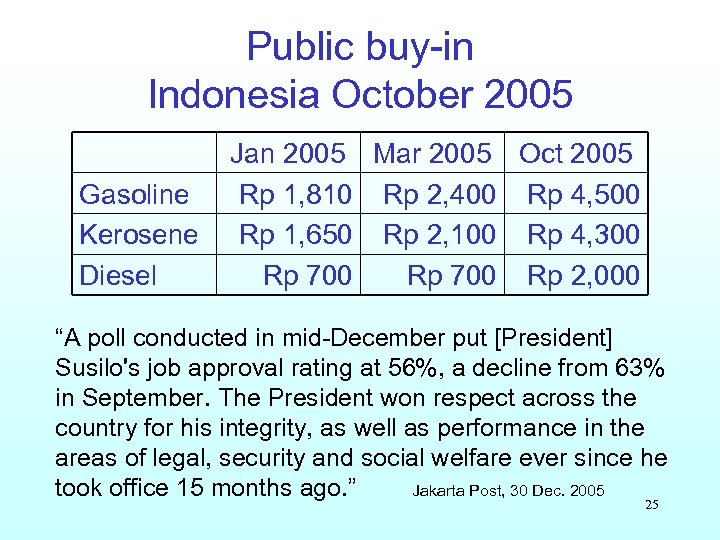

Public buy-in Indonesia October 2005 Gasoline Kerosene Diesel Jan 2005 Mar 2005 Oct 2005 Rp 1, 810 Rp 2, 400 Rp 4, 500 Rp 1, 650 Rp 2, 100 Rp 4, 300 Rp 700 Rp 2, 000 “A poll conducted in mid-December put [President] Susilo's job approval rating at 56%, a decline from 63% in September. The President won respect across the country for his integrity, as well as performance in the areas of legal, security and social welfare ever since he took office 15 months ago. ” Jakarta Post, 30 Dec. 2005 25

Public buy-in Indonesia October 2005 Gasoline Kerosene Diesel Jan 2005 Mar 2005 Oct 2005 Rp 1, 810 Rp 2, 400 Rp 4, 500 Rp 1, 650 Rp 2, 100 Rp 4, 300 Rp 700 Rp 2, 000 “A poll conducted in mid-December put [President] Susilo's job approval rating at 56%, a decline from 63% in September. The President won respect across the country for his integrity, as well as performance in the areas of legal, security and social welfare ever since he took office 15 months ago. ” Jakarta Post, 30 Dec. 2005 25

Concluding remarks • There is no dominating policy for amelioration, and governments will need a combination of policies, each making small contribution. • Over medium term, governments should let fuel prices rise to market levels, and let market forces drive fuel consumption. • Protection given to domestic refineries, poorly maintained infrastructure, and “inefficient” operations all increase supply costs. • Greater efforts should be made to save energy, particularly where fuel substitution opportunities are limited. 26

Concluding remarks • There is no dominating policy for amelioration, and governments will need a combination of policies, each making small contribution. • Over medium term, governments should let fuel prices rise to market levels, and let market forces drive fuel consumption. • Protection given to domestic refineries, poorly maintained infrastructure, and “inefficient” operations all increase supply costs. • Greater efforts should be made to save energy, particularly where fuel substitution opportunities are limited. 26

Concluding remarks • Government’s fiscal position, political support it enjoys, and history of governance all affect success of policies. • Given oil consumption growth in transport, efforts at public transport reform, traffic management, and improving road infrastructure, all of which can reduce fuel consumption, merit serious attention. • Fuel switching among poor households from solid fuels to cleaner commercial energy will be more challenging than ever before. • Recognize the inefficiency of petroleum sectorspecific intervention, and strengthen delivery mechanisms for general assistance targeting the poor. 27

Concluding remarks • Government’s fiscal position, political support it enjoys, and history of governance all affect success of policies. • Given oil consumption growth in transport, efforts at public transport reform, traffic management, and improving road infrastructure, all of which can reduce fuel consumption, merit serious attention. • Fuel switching among poor households from solid fuels to cleaner commercial energy will be more challenging than ever before. • Recognize the inefficiency of petroleum sectorspecific intervention, and strengthen delivery mechanisms for general assistance targeting the poor. 27