Coodes Solicitors Jo Morgan - Partner Stamp Duty Update June 2016

Coodes Solicitors Jo Morgan - Partner Stamp Duty Update June 2016

Coodes Property Team • 22 Conveyancers • Specialist sectors for Buy to Let, Affordables, Equity Release, New Build • Property Conveyancer in each of 9 branches – Truro, St Austell, Penzance, Falmouth, St Ives, Newquay, Liskeard, Launceston, Holsworthy • Follow us! Twitter news and info @Coodes. Property 1

Coodes Property Team • 22 Conveyancers • Specialist sectors for Buy to Let, Affordables, Equity Release, New Build • Property Conveyancer in each of 9 branches – Truro, St Austell, Penzance, Falmouth, St Ives, Newquay, Liskeard, Launceston, Holsworthy • Follow us! Twitter news and info @Coodes. Property 1

SDLT – 3% levy

SDLT – 3% levy

SDLT – 3% - Basics • Prior to 1 April stamp duty paid from £ 125 K upwards • New 3% levy additional to this for second homes completing from 1 April 2016 • If replacing a main residence then exempt or sale of main res within 36 months then refundable

SDLT – 3% - Basics • Prior to 1 April stamp duty paid from £ 125 K upwards • New 3% levy additional to this for second homes completing from 1 April 2016 • If replacing a main residence then exempt or sale of main res within 36 months then refundable

Who is affected? • Purchase of second properties even if new main residence • Transfers of Equity – rules apply on consideration • Buyers of first property where their spouse already owns a property (treated as one unit) • Let to Buys

Who is affected? • Purchase of second properties even if new main residence • Transfers of Equity – rules apply on consideration • Buyers of first property where their spouse already owns a property (treated as one unit) • Let to Buys

SDLT – 3% - technicals • Levy affects FTB buying with another who already owns home • A client with a property anywhere in world triggers levy • Holiday lets, renovations hit • No exemption for 15 properties • Linked transactions • MDR – Multiple dwellings relief • Properties owned by spouse/partner counts even if said partner not purchasing

SDLT – 3% - technicals • Levy affects FTB buying with another who already owns home • A client with a property anywhere in world triggers levy • Holiday lets, renovations hit • No exemption for 15 properties • Linked transactions • MDR – Multiple dwellings relief • Properties owned by spouse/partner counts even if said partner not purchasing

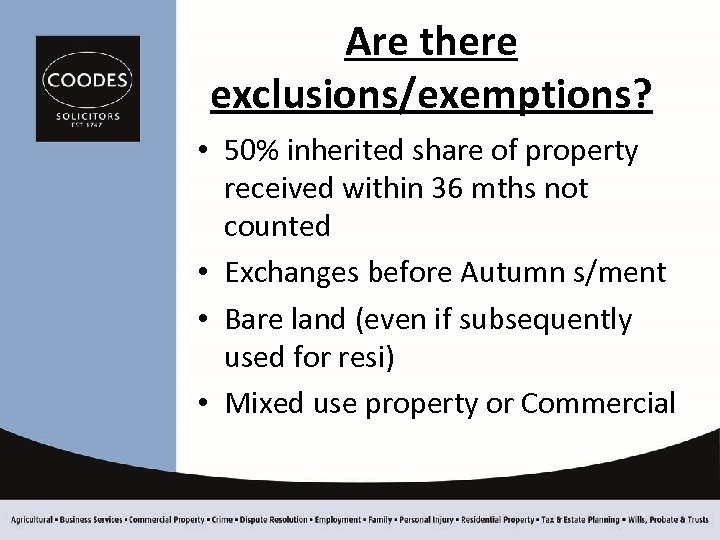

Are there exclusions/exemptions? • 50% inherited share of property received within 36 mths not counted • Exchanges before Autumn s/ment • Bare land (even if subsequently used for resi) • Mixed use property or Commercial

Are there exclusions/exemptions? • 50% inherited share of property received within 36 mths not counted • Exchanges before Autumn s/ment • Bare land (even if subsequently used for resi) • Mixed use property or Commercial

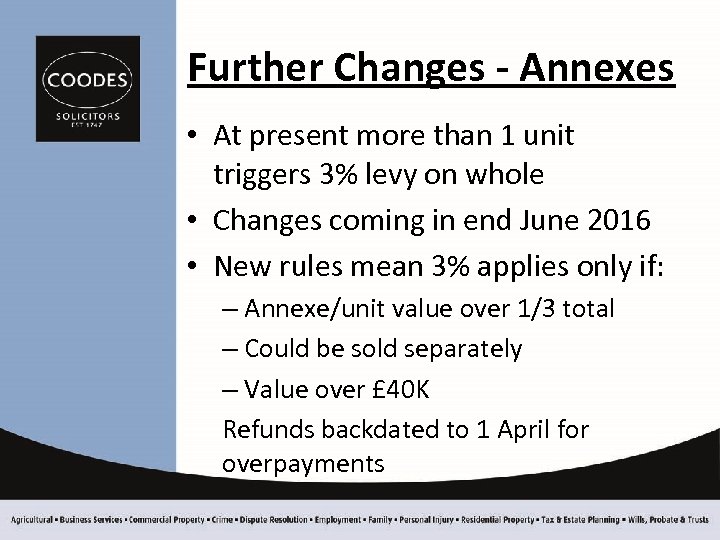

Further Changes - Annexes • At present more than 1 unit triggers 3% levy on whole • Changes coming in end June 2016 • New rules mean 3% applies only if: – Annexe/unit value over 1/3 total – Could be sold separately – Value over £ 40 K Refunds backdated to 1 April for overpayments

Further Changes - Annexes • At present more than 1 unit triggers 3% levy on whole • Changes coming in end June 2016 • New rules mean 3% applies only if: – Annexe/unit value over 1/3 total – Could be sold separately – Value over £ 40 K Refunds backdated to 1 April for overpayments

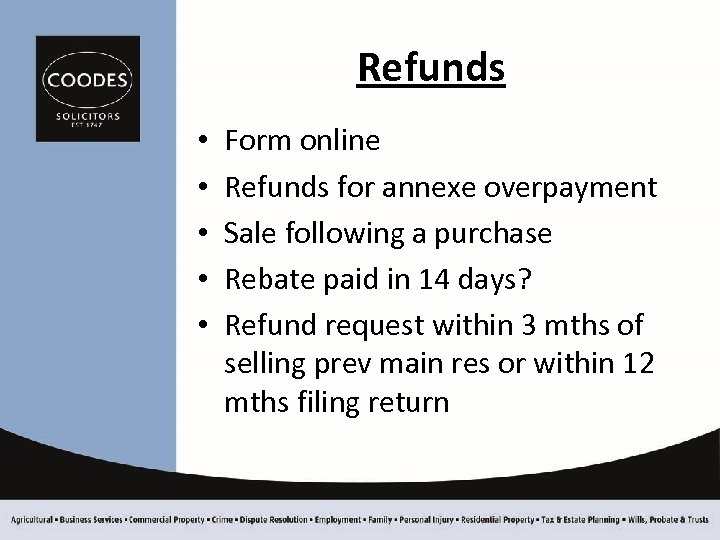

Refunds • • • Form online Refunds for annexe overpayment Sale following a purchase Rebate paid in 14 days? Refund request within 3 mths of selling prev main res or within 12 mths filing return

Refunds • • • Form online Refunds for annexe overpayment Sale following a purchase Rebate paid in 14 days? Refund request within 3 mths of selling prev main res or within 12 mths filing return

Ongoing ‘woolly areas’ • Couples not treated as one unit if separated in ‘circumstances likely to be permanent’ • Await Govt. interpretation

Ongoing ‘woolly areas’ • Couples not treated as one unit if separated in ‘circumstances likely to be permanent’ • Await Govt. interpretation

What can we all do? • Ensure keep up-to-date new legislation • Talk and inform our clients • Clients to be advised in advance at quotation/instruction stage of levy • Ensure specialist tax advice sought early where needed

What can we all do? • Ensure keep up-to-date new legislation • Talk and inform our clients • Clients to be advised in advance at quotation/instruction stage of levy • Ensure specialist tax advice sought early where needed

And finally! • Thankyou!

And finally! • Thankyou!