b029032037e52469db3811bedf09d899.ppt

- Количество слайдов: 66

Convergence* Are you ready? June 2008 *connectedthinking Pw. C

Convergence* Are you ready? June 2008 *connectedthinking Pw. C

Discussion Topics IFRS Overview Convergence ‘defined’ Practical applications for CPAs How to get ready Appendixes: • What the SEC is doing • IASB and FASB Convergence • Differences between IFRS & US GAAP • Educational Resources June 2008 Pricewaterhouse. Coopers 2

Discussion Topics IFRS Overview Convergence ‘defined’ Practical applications for CPAs How to get ready Appendixes: • What the SEC is doing • IASB and FASB Convergence • Differences between IFRS & US GAAP • Educational Resources June 2008 Pricewaterhouse. Coopers 2

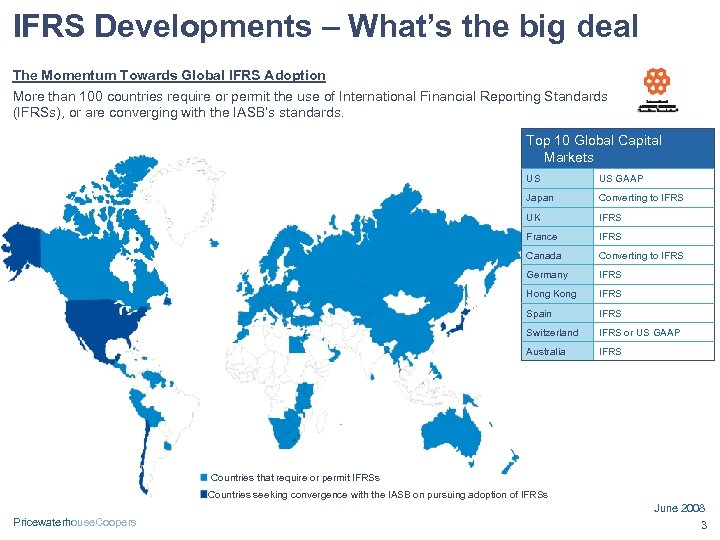

IFRS Developments – What’s the big deal The Momentum Towards Global IFRS Adoption More than 100 countries require or permit the use of International Financial Reporting Standards (IFRSs), or are converging with the IASB’s standards. Top 10 Global Capital Markets US US GAAP Japan Converting to IFRS UK IFRS France IFRS Canada Converting to IFRS Germany IFRS Hong Kong IFRS Spain IFRS Switzerland IFRS or US GAAP Australia IFRS Countries that require or permit IFRSs Countries seeking convergence with the IASB on pursuing adoption of IFRSs June 2008 Pricewaterhouse. Coopers 3

IFRS Developments – What’s the big deal The Momentum Towards Global IFRS Adoption More than 100 countries require or permit the use of International Financial Reporting Standards (IFRSs), or are converging with the IASB’s standards. Top 10 Global Capital Markets US US GAAP Japan Converting to IFRS UK IFRS France IFRS Canada Converting to IFRS Germany IFRS Hong Kong IFRS Spain IFRS Switzerland IFRS or US GAAP Australia IFRS Countries that require or permit IFRSs Countries seeking convergence with the IASB on pursuing adoption of IFRSs June 2008 Pricewaterhouse. Coopers 3

What the Regulators are saying “In 2008, the Division of Corporation Finance and the Office of the Chief Accountant, led by Wayne Carnall and Julie Erhardt, will formally propose to the Commission an updated "roadmap" that lays out a schedule, and appropriate milestones on which the schedule will be conditioned, for continuing the progress that the United States is making in moving to accept IFRS in this country. ” Christopher Cox, Chairman of the U. S. Securities and Exchange Commission February 8, 2008 Remarks to the 'SEC Speaks in 2008' Program of the Practising Law Institute June 2008 Pricewaterhouse. Coopers 4

What the Regulators are saying “In 2008, the Division of Corporation Finance and the Office of the Chief Accountant, led by Wayne Carnall and Julie Erhardt, will formally propose to the Commission an updated "roadmap" that lays out a schedule, and appropriate milestones on which the schedule will be conditioned, for continuing the progress that the United States is making in moving to accept IFRS in this country. ” Christopher Cox, Chairman of the U. S. Securities and Exchange Commission February 8, 2008 Remarks to the 'SEC Speaks in 2008' Program of the Practising Law Institute June 2008 Pricewaterhouse. Coopers 4

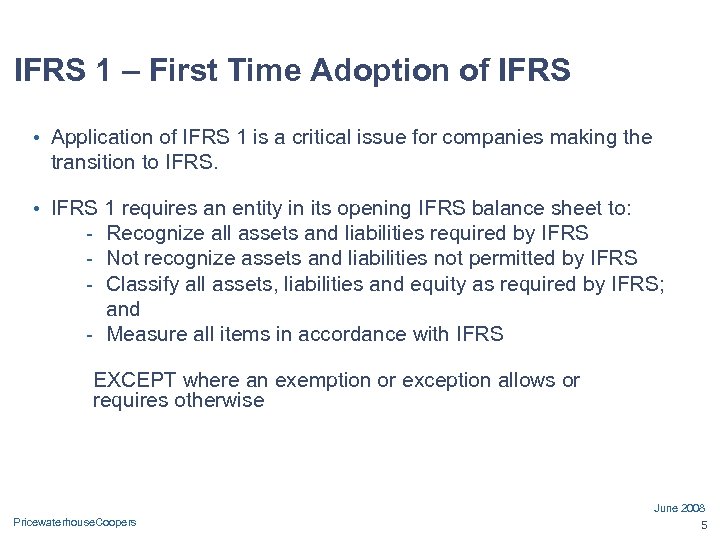

IFRS 1 – First Time Adoption of IFRS • Application of IFRS 1 is a critical issue for companies making the transition to IFRS. • IFRS 1 requires an entity in its opening IFRS balance sheet to: - Recognize all assets and liabilities required by IFRS - Not recognize assets and liabilities not permitted by IFRS - Classify all assets, liabilities and equity as required by IFRS; and - Measure all items in accordance with IFRS EXCEPT where an exemption or exception allows or requires otherwise June 2008 Pricewaterhouse. Coopers 5

IFRS 1 – First Time Adoption of IFRS • Application of IFRS 1 is a critical issue for companies making the transition to IFRS. • IFRS 1 requires an entity in its opening IFRS balance sheet to: - Recognize all assets and liabilities required by IFRS - Not recognize assets and liabilities not permitted by IFRS - Classify all assets, liabilities and equity as required by IFRS; and - Measure all items in accordance with IFRS EXCEPT where an exemption or exception allows or requires otherwise June 2008 Pricewaterhouse. Coopers 5

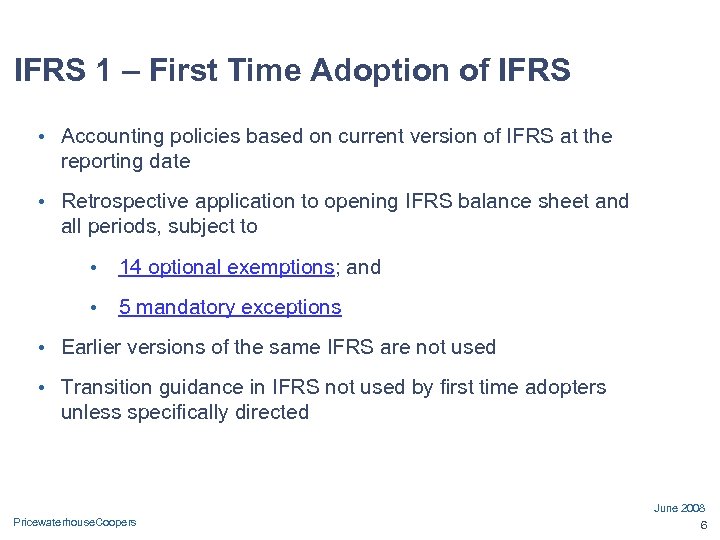

IFRS 1 – First Time Adoption of IFRS • Accounting policies based on current version of IFRS at the reporting date • Retrospective application to opening IFRS balance sheet and all periods, subject to • 14 optional exemptions; and • 5 mandatory exceptions • Earlier versions of the same IFRS are not used • Transition guidance in IFRS not used by first time adopters unless specifically directed June 2008 Pricewaterhouse. Coopers 6

IFRS 1 – First Time Adoption of IFRS • Accounting policies based on current version of IFRS at the reporting date • Retrospective application to opening IFRS balance sheet and all periods, subject to • 14 optional exemptions; and • 5 mandatory exceptions • Earlier versions of the same IFRS are not used • Transition guidance in IFRS not used by first time adopters unless specifically directed June 2008 Pricewaterhouse. Coopers 6

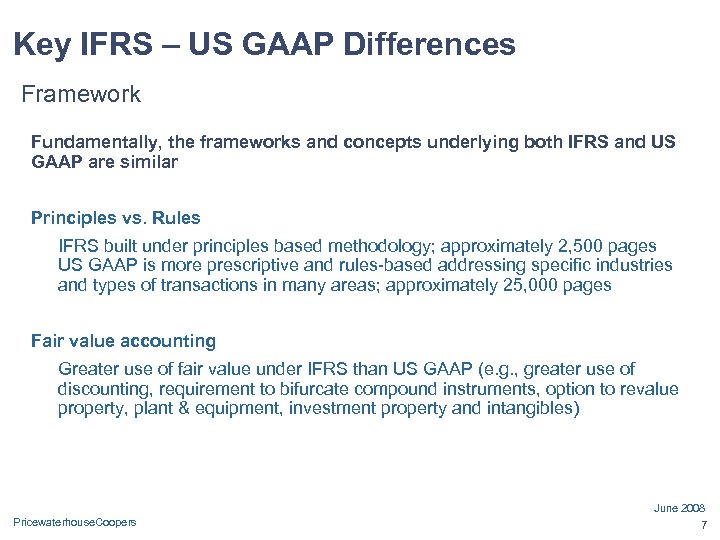

Key IFRS – US GAAP Differences Framework Fundamentally, the frameworks and concepts underlying both IFRS and US GAAP are similar Principles vs. Rules IFRS built under principles based methodology; approximately 2, 500 pages US GAAP is more prescriptive and rules-based addressing specific industries and types of transactions in many areas; approximately 25, 000 pages Fair value accounting Greater use of fair value under IFRS than US GAAP (e. g. , greater use of discounting, requirement to bifurcate compound instruments, option to revalue property, plant & equipment, investment property and intangibles) June 2008 Pricewaterhouse. Coopers 7

Key IFRS – US GAAP Differences Framework Fundamentally, the frameworks and concepts underlying both IFRS and US GAAP are similar Principles vs. Rules IFRS built under principles based methodology; approximately 2, 500 pages US GAAP is more prescriptive and rules-based addressing specific industries and types of transactions in many areas; approximately 25, 000 pages Fair value accounting Greater use of fair value under IFRS than US GAAP (e. g. , greater use of discounting, requirement to bifurcate compound instruments, option to revalue property, plant & equipment, investment property and intangibles) June 2008 Pricewaterhouse. Coopers 7

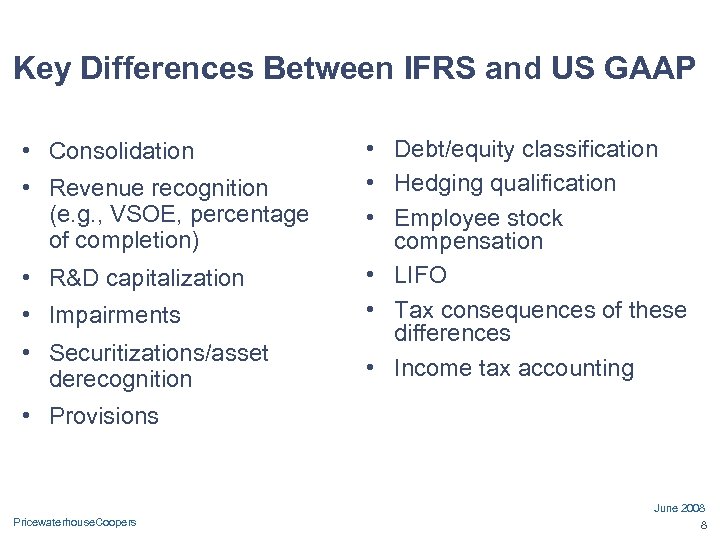

Key Differences Between IFRS and US GAAP • Consolidation • Revenue recognition (e. g. , VSOE, percentage of completion) • R&D capitalization • Impairments • Securitizations/asset derecognition • Debt/equity classification • Hedging qualification • Employee stock compensation • LIFO • Tax consequences of these differences • Income tax accounting • Provisions June 2008 Pricewaterhouse. Coopers 8

Key Differences Between IFRS and US GAAP • Consolidation • Revenue recognition (e. g. , VSOE, percentage of completion) • R&D capitalization • Impairments • Securitizations/asset derecognition • Debt/equity classification • Hedging qualification • Employee stock compensation • LIFO • Tax consequences of these differences • Income tax accounting • Provisions June 2008 Pricewaterhouse. Coopers 8

Market Considerations How many IFRS filers in 2007? • Additional flexibility in capital raising initiatives • Cross border acquisition and divesture activities may require IFRS knowledge • Increased investor interest; effective market communications • Benchmarking with peers • Take steps to influence regulators and tax authorities around the impact and acceptance of IFRS • Being seen as a front runner in the adoption of IFRS in the US • Certain US companies are starting now; do you want to be behind the curve? June 2008 Pricewaterhouse. Coopers 9

Market Considerations How many IFRS filers in 2007? • Additional flexibility in capital raising initiatives • Cross border acquisition and divesture activities may require IFRS knowledge • Increased investor interest; effective market communications • Benchmarking with peers • Take steps to influence regulators and tax authorities around the impact and acceptance of IFRS • Being seen as a front runner in the adoption of IFRS in the US • Certain US companies are starting now; do you want to be behind the curve? June 2008 Pricewaterhouse. Coopers 9

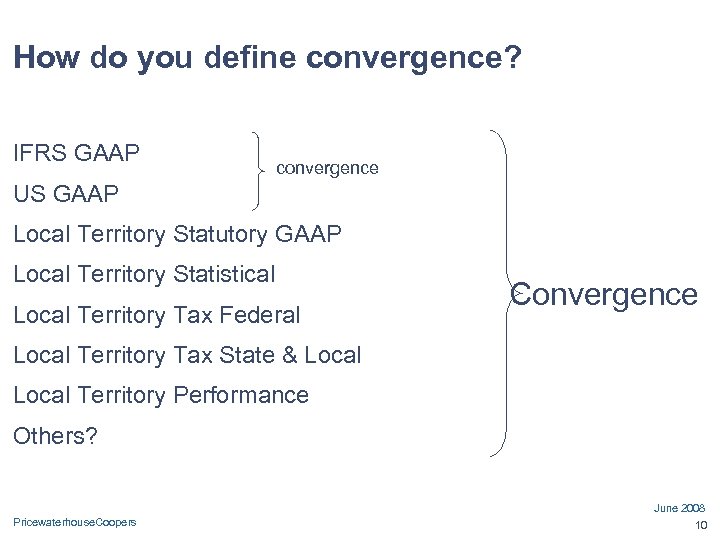

How do you define convergence? IFRS GAAP convergence US GAAP Local Territory Statutory GAAP Local Territory Statistical Local Territory Tax Federal Convergence Local Territory Tax State & Local Territory Performance Others? June 2008 Pricewaterhouse. Coopers 10

How do you define convergence? IFRS GAAP convergence US GAAP Local Territory Statutory GAAP Local Territory Statistical Local Territory Tax Federal Convergence Local Territory Tax State & Local Territory Performance Others? June 2008 Pricewaterhouse. Coopers 10

Dutch Taxonomy Project – http: //www. xbrl-ntp. nl/english “The Dutch government intends to reduce the administrative burden of businesses 25 percent” June 2008 Pricewaterhouse. Coopers 11

Dutch Taxonomy Project – http: //www. xbrl-ntp. nl/english “The Dutch government intends to reduce the administrative burden of businesses 25 percent” June 2008 Pricewaterhouse. Coopers 11

Australian SBR “The benefits to business are ultimately estimated rise to $795 M per year on an ongoing basis” June 2008 Pricewaterhouse. Coopers 12

Australian SBR “The benefits to business are ultimately estimated rise to $795 M per year on an ongoing basis” June 2008 Pricewaterhouse. Coopers 12

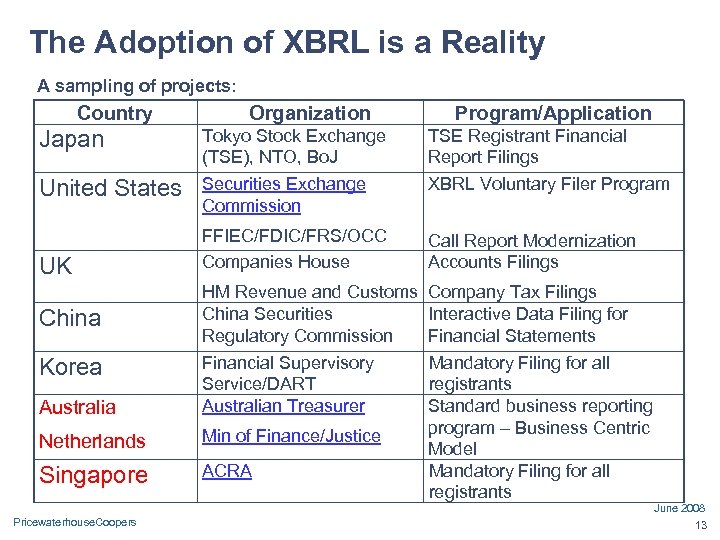

The Adoption of XBRL is a Reality A sampling of projects: Country Organization Program/Application Japan Tokyo Stock Exchange (TSE), NTO, Bo. J TSE Registrant Financial Report Filings United States Securities Exchange Commission XBRL Voluntary Filer Program FFIEC/FDIC/FRS/OCC Companies House Call Report Modernization Accounts Filings UK China HM Revenue and Customs Company Tax Filings China Securities Interactive Data Filing for Regulatory Commission Financial Statements Australia Financial Supervisory Service/DART Australian Treasurer Netherlands Min of Finance/Justice Singapore ACRA Korea Pricewaterhouse. Coopers Mandatory Filing for all registrants Standard business reporting program – Business Centric Model Mandatory Filing for all registrants June 2008 13

The Adoption of XBRL is a Reality A sampling of projects: Country Organization Program/Application Japan Tokyo Stock Exchange (TSE), NTO, Bo. J TSE Registrant Financial Report Filings United States Securities Exchange Commission XBRL Voluntary Filer Program FFIEC/FDIC/FRS/OCC Companies House Call Report Modernization Accounts Filings UK China HM Revenue and Customs Company Tax Filings China Securities Interactive Data Filing for Regulatory Commission Financial Statements Australia Financial Supervisory Service/DART Australian Treasurer Netherlands Min of Finance/Justice Singapore ACRA Korea Pricewaterhouse. Coopers Mandatory Filing for all registrants Standard business reporting program – Business Centric Model Mandatory Filing for all registrants June 2008 13

June 2008 Pricewaterhouse. Coopers 14

June 2008 Pricewaterhouse. Coopers 14

IFRS XBRL Taxonomy Currently available at http: //www. iasb. org/xbrl Supports a range of languages: • Arabic • Dutch • English • French • German • Hungarian • Italian • Portuguese • Spanish being prepared: Polish, Hebrew, Chinese, etc. June 2008 Pricewaterhouse. Coopers 1 15

IFRS XBRL Taxonomy Currently available at http: //www. iasb. org/xbrl Supports a range of languages: • Arabic • Dutch • English • French • German • Hungarian • Italian • Portuguese • Spanish being prepared: Polish, Hebrew, Chinese, etc. June 2008 Pricewaterhouse. Coopers 1 15

What is XBRL? International Supply Chain Standardization effort Relevant to internal and external business information Mandated by economics as it enables significant benefits Mandated by regulators (including SEC) Replaces manual process steps with automation Applicable to business information, related business rules, formulas, controls, processes, resources, etc. http: //www. xbrl. org and http: //xbrl. us ‘Bar Code’ for business information June 2008 Pricewaterhouse. Coopers 16

What is XBRL? International Supply Chain Standardization effort Relevant to internal and external business information Mandated by economics as it enables significant benefits Mandated by regulators (including SEC) Replaces manual process steps with automation Applicable to business information, related business rules, formulas, controls, processes, resources, etc. http: //www. xbrl. org and http: //xbrl. us ‘Bar Code’ for business information June 2008 Pricewaterhouse. Coopers 16

Here is the problem – a simple Income Statement I will give $50 to anyone who can tell me the following: The name of the company The period of the report The currency used The accounting principles used If the accounts are audited or not The exchange on which the company is traded June 2008 Pricewaterhouse. Coopers 17

Here is the problem – a simple Income Statement I will give $50 to anyone who can tell me the following: The name of the company The period of the report The currency used The accounting principles used If the accounts are audited or not The exchange on which the company is traded June 2008 Pricewaterhouse. Coopers 17

How long does it take for you to……. . Aggregate note disclosure information from subsidiaries? Validate the math within company financial statements? Find the disclosures related to specific concepts in F/S? Identify relevant FASB standards and Reg SX regulations? Compare performance with others? Share analytical formulas/models with others? Obtain data from a wide range of disparate ERP systems? Validate and analyze data? If your answer is more than a few seconds, then XBRL can help June 2008 Pricewaterhouse. Coopers 18

How long does it take for you to……. . Aggregate note disclosure information from subsidiaries? Validate the math within company financial statements? Find the disclosures related to specific concepts in F/S? Identify relevant FASB standards and Reg SX regulations? Compare performance with others? Share analytical formulas/models with others? Obtain data from a wide range of disparate ERP systems? Validate and analyze data? If your answer is more than a few seconds, then XBRL can help June 2008 Pricewaterhouse. Coopers 18

Recent Headlines & White Papers Motley Fool – The most important shareholder initiative in a decade (March 24 th) Gartner - XBRL Will Enhance Corporate Disclosure and Corporate Performance Management (April 23 rd) MSN Money – A Revolution for the small investor (April 30 th) Treasury & Risk Magazine – Time to Speak the Same Language (April) FEI Magazine – XBRL: Not Just for External Reporting (May) SEC Proposed Rule to Mandate XBRL (May 30 th) June 2008 Pricewaterhouse. Coopers 19

Recent Headlines & White Papers Motley Fool – The most important shareholder initiative in a decade (March 24 th) Gartner - XBRL Will Enhance Corporate Disclosure and Corporate Performance Management (April 23 rd) MSN Money – A Revolution for the small investor (April 30 th) Treasury & Risk Magazine – Time to Speak the Same Language (April) FEI Magazine – XBRL: Not Just for External Reporting (May) SEC Proposed Rule to Mandate XBRL (May 30 th) June 2008 Pricewaterhouse. Coopers 19

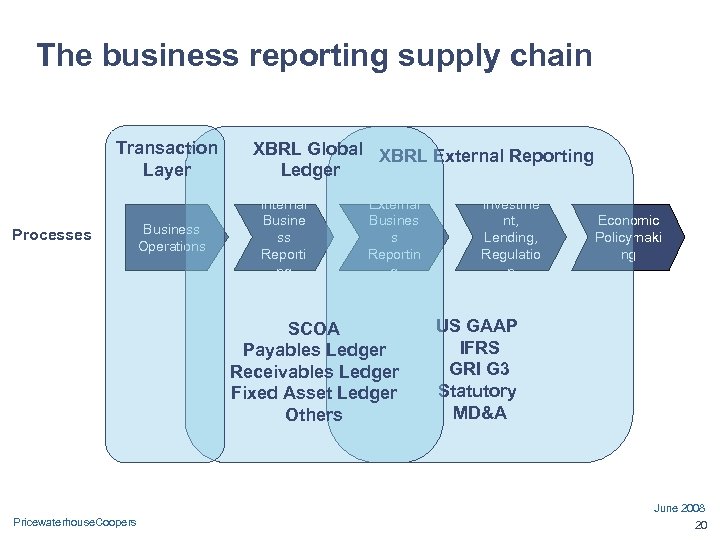

The business reporting supply chain Transaction Layer Processes Business Operations XBRL Global XBRL External Reporting Ledger Internal Busine ss Reporti ng External Busines s Reportin g SCOA Payables Ledger Receivables Ledger Fixed Asset Ledger Others Investme nt, Lending, Regulatio n Economic Policymaki ng US GAAP IFRS GRI G 3 Statutory MD&A June 2008 Pricewaterhouse. Coopers 20

The business reporting supply chain Transaction Layer Processes Business Operations XBRL Global XBRL External Reporting Ledger Internal Busine ss Reporti ng External Busines s Reportin g SCOA Payables Ledger Receivables Ledger Fixed Asset Ledger Others Investme nt, Lending, Regulatio n Economic Policymaki ng US GAAP IFRS GRI G 3 Statutory MD&A June 2008 Pricewaterhouse. Coopers 20

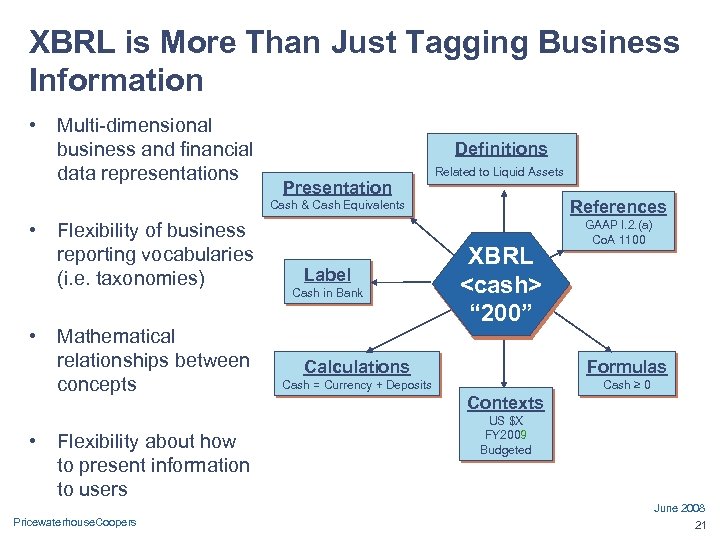

XBRL is More Than Just Tagging Business Information • Multi-dimensional business and financial data representations Definitions Presentation Related to Liquid Assets References Cash & Cash Equivalents • • • Flexibility of business reporting vocabularies (i. e. taxonomies) Mathematical relationships between concepts Flexibility about how to present information to users Label Cash in Bank XBRL

XBRL is More Than Just Tagging Business Information • Multi-dimensional business and financial data representations Definitions Presentation Related to Liquid Assets References Cash & Cash Equivalents • • • Flexibility of business reporting vocabularies (i. e. taxonomies) Mathematical relationships between concepts Flexibility about how to present information to users Label Cash in Bank XBRL

What does XBRL Look Like? What does XBRL look like? What does CALCPA. org look like? Example here • Example here How does it make your life better? • Example here – how to find disclosures • Example here – how to consolidate/aggregate info • Example here – how to access data? • Example here – how to map XBRL GL to your ERP • Case Study here – how to enhance process agility • Case Study here – how to enhance data quality & analysis June 2008 Pricewaterhouse. Coopers 22

What does XBRL Look Like? What does XBRL look like? What does CALCPA. org look like? Example here • Example here How does it make your life better? • Example here – how to find disclosures • Example here – how to consolidate/aggregate info • Example here – how to access data? • Example here – how to map XBRL GL to your ERP • Case Study here – how to enhance process agility • Case Study here – how to enhance data quality & analysis June 2008 Pricewaterhouse. Coopers 22

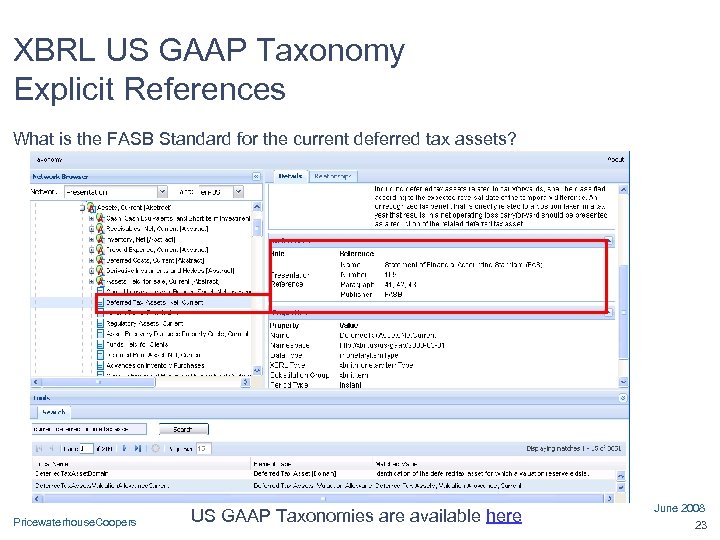

XBRL US GAAP Taxonomy Explicit References What is the FASB Standard for the current deferred tax assets? Pricewaterhouse. Coopers US GAAP Taxonomies are available here June 2008 23

XBRL US GAAP Taxonomy Explicit References What is the FASB Standard for the current deferred tax assets? Pricewaterhouse. Coopers US GAAP Taxonomies are available here June 2008 23

SEC Proposed Rule to Mandate XBRL How – via a new exhibit supplemental to financial statements What - The financial statement footnotes (as block text) and financial statement schedules in first year. After the first year, filer would be required to tag the detailed disclosures within the footnotes and schedules. This would apply to annual and quarterly reports, as well as registration statements containing financial statements for such fiscal periods. See http: //www. sec. gov for details Comments due on August 1, 2008 June 2008 Pricewaterhouse. Coopers 24

SEC Proposed Rule to Mandate XBRL How – via a new exhibit supplemental to financial statements What - The financial statement footnotes (as block text) and financial statement schedules in first year. After the first year, filer would be required to tag the detailed disclosures within the footnotes and schedules. This would apply to annual and quarterly reports, as well as registration statements containing financial statements for such fiscal periods. See http: //www. sec. gov for details Comments due on August 1, 2008 June 2008 Pricewaterhouse. Coopers 24

SEC Proposed Rule to Mandate XBRL When - beginning with fiscal periods ending on or after December 15, 2008. • • In year 1, the proposed rules would apply only to domestic and foreign large accelerated filers that use U. S. GAAP and have a worldwide public float above $5 billion, approximately 500 companies. In year 2, all other domestic and foreign large accelerated filers using U. S. GAAP. In year 3, all remaining filers using U. S. GAAP, including smaller reporting companies, and all foreign private issuers that prepare their financial statements in accordance with IFRS as issued by the IASB A 30 day grace period would be permitted for the first interactive data exhibit of each filer June 2008 Pricewaterhouse. Coopers 25

SEC Proposed Rule to Mandate XBRL When - beginning with fiscal periods ending on or after December 15, 2008. • • In year 1, the proposed rules would apply only to domestic and foreign large accelerated filers that use U. S. GAAP and have a worldwide public float above $5 billion, approximately 500 companies. In year 2, all other domestic and foreign large accelerated filers using U. S. GAAP. In year 3, all remaining filers using U. S. GAAP, including smaller reporting companies, and all foreign private issuers that prepare their financial statements in accordance with IFRS as issued by the IASB A 30 day grace period would be permitted for the first interactive data exhibit of each filer June 2008 Pricewaterhouse. Coopers 25

What do companies need? Software – embedded in your existing tools here and here Taxonomies – basic reporting concepts • • US GAAP XBRL Taxonomies IFRS GAAP Taxonomies Proxy Taxonomy Others Understanding/Awareness – what is new • • Processes Case Studies They do not need to understand the XBRL technology 2008 June Pricewaterhouse. Coopers 26

What do companies need? Software – embedded in your existing tools here and here Taxonomies – basic reporting concepts • • US GAAP XBRL Taxonomies IFRS GAAP Taxonomies Proxy Taxonomy Others Understanding/Awareness – what is new • • Processes Case Studies They do not need to understand the XBRL technology 2008 June Pricewaterhouse. Coopers 26

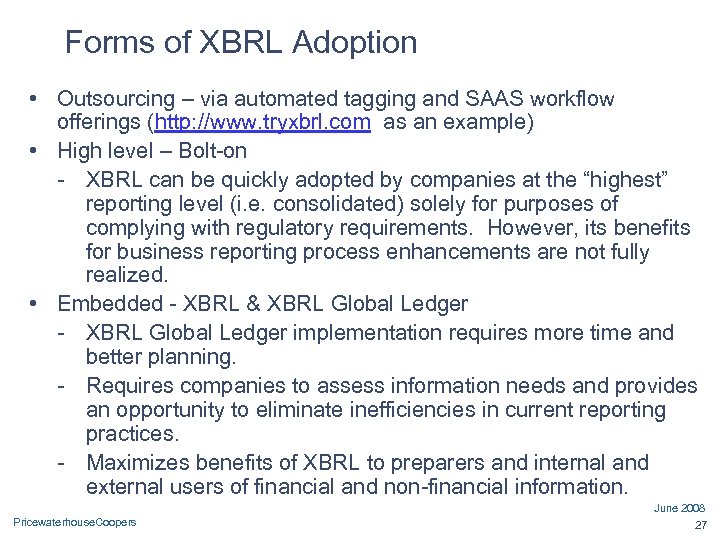

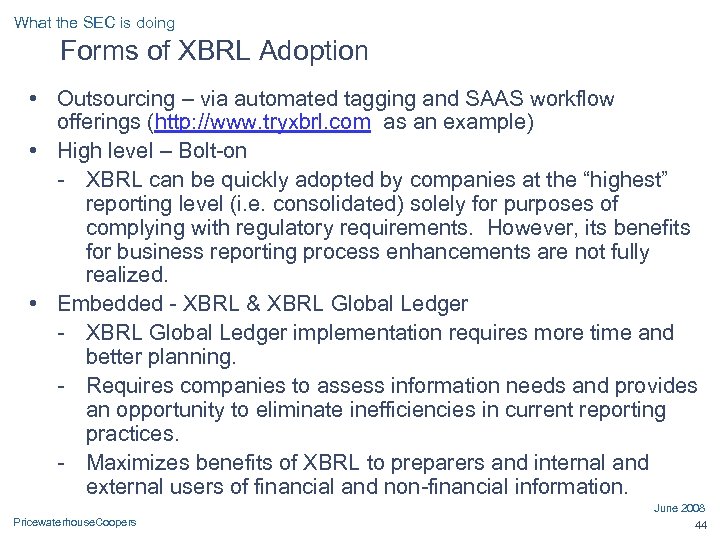

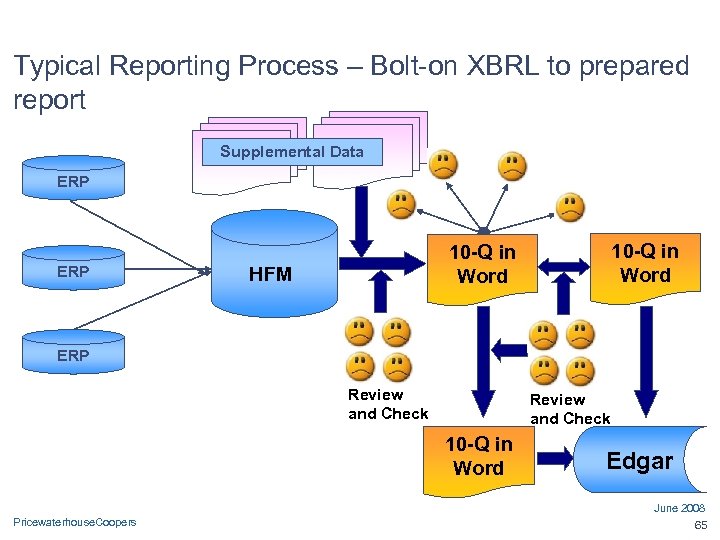

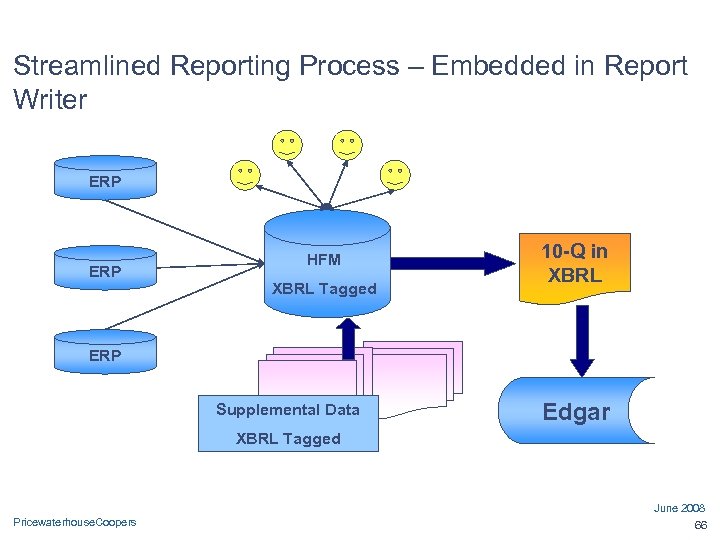

Forms of XBRL Adoption • Outsourcing – via automated tagging and SAAS workflow offerings (http: //www. tryxbrl. com as an example) • High level – Bolt-on - XBRL can be quickly adopted by companies at the “highest” reporting level (i. e. consolidated) solely for purposes of complying with regulatory requirements. However, its benefits for business reporting process enhancements are not fully realized. • Embedded - XBRL & XBRL Global Ledger - XBRL Global Ledger implementation requires more time and better planning. - Requires companies to assess information needs and provides an opportunity to eliminate inefficiencies in current reporting practices. - Maximizes benefits of XBRL to preparers and internal and external users of financial and non-financial information. June 2008 Pricewaterhouse. Coopers 27

Forms of XBRL Adoption • Outsourcing – via automated tagging and SAAS workflow offerings (http: //www. tryxbrl. com as an example) • High level – Bolt-on - XBRL can be quickly adopted by companies at the “highest” reporting level (i. e. consolidated) solely for purposes of complying with regulatory requirements. However, its benefits for business reporting process enhancements are not fully realized. • Embedded - XBRL & XBRL Global Ledger - XBRL Global Ledger implementation requires more time and better planning. - Requires companies to assess information needs and provides an opportunity to eliminate inefficiencies in current reporting practices. - Maximizes benefits of XBRL to preparers and internal and external users of financial and non-financial information. June 2008 Pricewaterhouse. Coopers 27

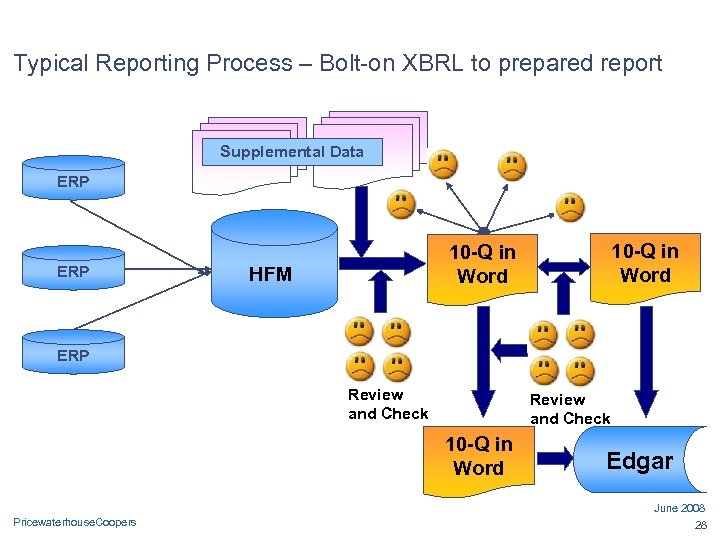

Typical Reporting Process – Bolt-on XBRL to prepared report Supplemental Data ERP 10 -Q in Word HFM ERP Review and Check 10 -Q in Word Edgar June 2008 Pricewaterhouse. Coopers 28

Typical Reporting Process – Bolt-on XBRL to prepared report Supplemental Data ERP 10 -Q in Word HFM ERP Review and Check 10 -Q in Word Edgar June 2008 Pricewaterhouse. Coopers 28

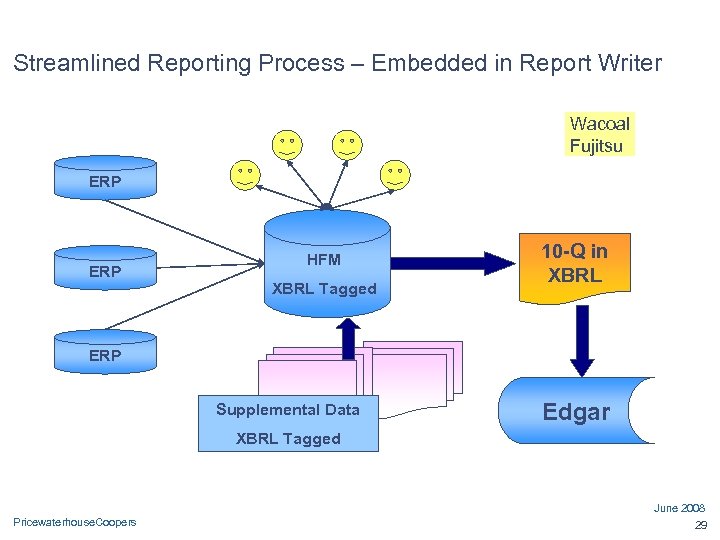

Streamlined Reporting Process – Embedded in Report Writer Wacoal Fujitsu ERP HFM XBRL Tagged 10 -Q in XBRL ERP Supplemental Data Edgar XBRL Tagged June 2008 Pricewaterhouse. Coopers 29

Streamlined Reporting Process – Embedded in Report Writer Wacoal Fujitsu ERP HFM XBRL Tagged 10 -Q in XBRL ERP Supplemental Data Edgar XBRL Tagged June 2008 Pricewaterhouse. Coopers 29

Practical applications for CPAs An Internet standard for business information Accessing data from disparate ledgers, sub-ledgers, transaction ledgers - information useful in tax returns, elimination entries, M-3 reconciliations, internal audits, performance reports, budgets, projections, etc. Analyzing data across a wide range of software applications - any type of analytics, benchmarking, budgeting & planning, control design, process design, validation rules, etc. Reporting - report generation, visualization, management reports, BI dashboards, Business Performance Management Knowledge Sharing - GAAP, GAAS, Tax, Company Policies, SME’s, Training, etc. - Analytics, benchmarking data, controls, business rules, etc. June 2008 Pricewaterhouse. Coopers 30

Practical applications for CPAs An Internet standard for business information Accessing data from disparate ledgers, sub-ledgers, transaction ledgers - information useful in tax returns, elimination entries, M-3 reconciliations, internal audits, performance reports, budgets, projections, etc. Analyzing data across a wide range of software applications - any type of analytics, benchmarking, budgeting & planning, control design, process design, validation rules, etc. Reporting - report generation, visualization, management reports, BI dashboards, Business Performance Management Knowledge Sharing - GAAP, GAAS, Tax, Company Policies, SME’s, Training, etc. - Analytics, benchmarking data, controls, business rules, etc. June 2008 Pricewaterhouse. Coopers 30

What is at stake? June 2008 Pricewaterhouse. Coopers 31

What is at stake? June 2008 Pricewaterhouse. Coopers 31

How to get your members ready What you can do Get the message out – get ready for convergence Make members aware of short term implications/opportunities Provide training on IFRS & XBRL implications Relate to the individual CPA working practices Increase knowledge of relevant projects, taxonomies, and tools Organize members to engage in market collaboration efforts: IFRS and US GAAP Taxonomy Project efforts Industry, Performance, Sustainability efforts Expose members to tool training/enhancements June 2008 Pricewaterhouse. Coopers 32

How to get your members ready What you can do Get the message out – get ready for convergence Make members aware of short term implications/opportunities Provide training on IFRS & XBRL implications Relate to the individual CPA working practices Increase knowledge of relevant projects, taxonomies, and tools Organize members to engage in market collaboration efforts: IFRS and US GAAP Taxonomy Project efforts Industry, Performance, Sustainability efforts Expose members to tool training/enhancements June 2008 Pricewaterhouse. Coopers 32

Convergence* Are you ready? Any Questions? ? *connectedthinking Pw. C

Convergence* Are you ready? Any Questions? ? *connectedthinking Pw. C

What the SEC is doing June 2008 Pricewaterhouse. Coopers 34

What the SEC is doing June 2008 Pricewaterhouse. Coopers 34

What the SEC is doing Chairman Christopher Cox of the SEC “I'd like to invite every public company, [especially] those companies not yet involved in our voluntary filing program, to consider whether they should obtain a copy of this new GAAP set of data tags. . . and its supporting documentation and consider using it alongside your current process as you prepare your calendar 2007 filings or your filings for the fourth quarter of 2007. ” Will XBRL be mandated? “This is the recommendation that we will be seeking from all of the offices within the Spring of next year. ” From the “Major Announcement About Interactive Data in Financial Reporting, Tuesday, September 25, 2007” June 2008 Pricewaterhouse. Coopers 35

What the SEC is doing Chairman Christopher Cox of the SEC “I'd like to invite every public company, [especially] those companies not yet involved in our voluntary filing program, to consider whether they should obtain a copy of this new GAAP set of data tags. . . and its supporting documentation and consider using it alongside your current process as you prepare your calendar 2007 filings or your filings for the fourth quarter of 2007. ” Will XBRL be mandated? “This is the recommendation that we will be seeking from all of the offices within the Spring of next year. ” From the “Major Announcement About Interactive Data in Financial Reporting, Tuesday, September 25, 2007” June 2008 Pricewaterhouse. Coopers 35

What the SEC is doing Proposed Rule to mandate XBRL May 30 th, 2008 Please See http: //www. sec. gov/rules/proposed/2008/33 -8924. pdf for issuance of proposed rule to mandate XBRL for public registrants June 2008 Pricewaterhouse. Coopers 36

What the SEC is doing Proposed Rule to mandate XBRL May 30 th, 2008 Please See http: //www. sec. gov/rules/proposed/2008/33 -8924. pdf for issuance of proposed rule to mandate XBRL for public registrants June 2008 Pricewaterhouse. Coopers 36

What the SEC is doing SEC Proposed Rule to Mandate XBRL – How/What How – via a new exhibit supplemental to financial statements What - The financial statement footnotes (as block text) and financial statement schedules in first year. After the first year, filer would be required to tag the detailed disclosures within the footnotes and schedules. This would apply to annual and quarterly reports, as well as registration statements containing financial statements for such fiscal periods. 60 day public comment period. June 2008 Pricewaterhouse. Coopers 37

What the SEC is doing SEC Proposed Rule to Mandate XBRL – How/What How – via a new exhibit supplemental to financial statements What - The financial statement footnotes (as block text) and financial statement schedules in first year. After the first year, filer would be required to tag the detailed disclosures within the footnotes and schedules. This would apply to annual and quarterly reports, as well as registration statements containing financial statements for such fiscal periods. 60 day public comment period. June 2008 Pricewaterhouse. Coopers 37

What the SEC is doing SEC Proposed Rule to Mandate XBRL – When - beginning with fiscal periods ending on or after December 15, 2008. • In year 1, the proposed rules would apply only to domestic and foreign large accelerated filers that use U. S. GAAP and have a worldwide public float above $5 billion, approximately 500 companies. • In year 2, all other domestic and foreign large accelerated filers using U. S. GAAP. • In year 3, all remaining filers using U. S. GAAP, including smaller reporting companies, and all foreign private issuers that prepare their financial statements in accordance with IFRS as issued by the IASB. June 2008 Pricewaterhouse. Coopers 38

What the SEC is doing SEC Proposed Rule to Mandate XBRL – When - beginning with fiscal periods ending on or after December 15, 2008. • In year 1, the proposed rules would apply only to domestic and foreign large accelerated filers that use U. S. GAAP and have a worldwide public float above $5 billion, approximately 500 companies. • In year 2, all other domestic and foreign large accelerated filers using U. S. GAAP. • In year 3, all remaining filers using U. S. GAAP, including smaller reporting companies, and all foreign private issuers that prepare their financial statements in accordance with IFRS as issued by the IASB. June 2008 Pricewaterhouse. Coopers 38

What the SEC is doing SEC Proposed Rule to Mandate XBRL – Submission Format Interactive data would be required with a company's annual and quarterly reports, transition reports, and Securities Act registration statements Interactive data would also be required to be posted on the company’s corporate web site, if it maintains one June 2008 Pricewaterhouse. Coopers 39

What the SEC is doing SEC Proposed Rule to Mandate XBRL – Submission Format Interactive data would be required with a company's annual and quarterly reports, transition reports, and Securities Act registration statements Interactive data would also be required to be posted on the company’s corporate web site, if it maintains one June 2008 Pricewaterhouse. Coopers 39

What the SEC is doing SEC Proposed Rule to Mandate XBRL – Submission Timing Interactive data would be required to be provided to the Commission, and posted on company websites, at the same time as the related report or registration statement, with two exceptions. • A 30 day grace period would be permitted for the first interactive data exhibit of each filer, • A 30 day grace period would be permitted for the first interactive data exhibit that is required to include the footnotes and schedules tagged in detail. June 2008 Pricewaterhouse. Coopers 40

What the SEC is doing SEC Proposed Rule to Mandate XBRL – Submission Timing Interactive data would be required to be provided to the Commission, and posted on company websites, at the same time as the related report or registration statement, with two exceptions. • A 30 day grace period would be permitted for the first interactive data exhibit of each filer, • A 30 day grace period would be permitted for the first interactive data exhibit that is required to include the footnotes and schedules tagged in detail. June 2008 Pricewaterhouse. Coopers 40

What the SEC is doing SEC Proposed Rule to Mandate XBRL – Liability and Non-Compliance Filers that do not provide or post required interactive data on the date required would be deemed not current with their Exchange Act reports. Data in the interactive data file submitted to us would be subject to liability similar to that of the voluntary program and, as a result, would be subject to only limited liability. June 2008 Pricewaterhouse. Coopers 41

What the SEC is doing SEC Proposed Rule to Mandate XBRL – Liability and Non-Compliance Filers that do not provide or post required interactive data on the date required would be deemed not current with their Exchange Act reports. Data in the interactive data file submitted to us would be subject to liability similar to that of the voluntary program and, as a result, would be subject to only limited liability. June 2008 Pricewaterhouse. Coopers 41

What the SEC is doing What do companies need? Software – embedded in your existing tools here and here Taxonomies – basic reporting concepts • • US GAAP XBRL Taxonomies IFRS GAAP Taxonomies Proxy Taxonomy Others Understanding/Awareness – what is new • • Processes Case Studies You do not need to understand the XBRL technology 2008 June Pricewaterhouse. Coopers 42

What the SEC is doing What do companies need? Software – embedded in your existing tools here and here Taxonomies – basic reporting concepts • • US GAAP XBRL Taxonomies IFRS GAAP Taxonomies Proxy Taxonomy Others Understanding/Awareness – what is new • • Processes Case Studies You do not need to understand the XBRL technology 2008 June Pricewaterhouse. Coopers 42

What the SEC is doing Data Standard vs Data Standardization • XBRL Taxonomies DO NOT create a standard reporting template • XBRL Taxonomies - Common disclosure concepts - Represent a wide range of disclosure concepts • Statutory, financial, tax, statistical, non-financial, etc. - Extensible to represent unique company specific concepts - Both public and private concepts - More than just defining concepts June 2008 Pricewaterhouse. Coopers 43

What the SEC is doing Data Standard vs Data Standardization • XBRL Taxonomies DO NOT create a standard reporting template • XBRL Taxonomies - Common disclosure concepts - Represent a wide range of disclosure concepts • Statutory, financial, tax, statistical, non-financial, etc. - Extensible to represent unique company specific concepts - Both public and private concepts - More than just defining concepts June 2008 Pricewaterhouse. Coopers 43

What the SEC is doing Forms of XBRL Adoption • Outsourcing – via automated tagging and SAAS workflow offerings (http: //www. tryxbrl. com as an example) • High level – Bolt-on - XBRL can be quickly adopted by companies at the “highest” reporting level (i. e. consolidated) solely for purposes of complying with regulatory requirements. However, its benefits for business reporting process enhancements are not fully realized. • Embedded - XBRL & XBRL Global Ledger - XBRL Global Ledger implementation requires more time and better planning. - Requires companies to assess information needs and provides an opportunity to eliminate inefficiencies in current reporting practices. - Maximizes benefits of XBRL to preparers and internal and external users of financial and non-financial information. June 2008 Pricewaterhouse. Coopers 44

What the SEC is doing Forms of XBRL Adoption • Outsourcing – via automated tagging and SAAS workflow offerings (http: //www. tryxbrl. com as an example) • High level – Bolt-on - XBRL can be quickly adopted by companies at the “highest” reporting level (i. e. consolidated) solely for purposes of complying with regulatory requirements. However, its benefits for business reporting process enhancements are not fully realized. • Embedded - XBRL & XBRL Global Ledger - XBRL Global Ledger implementation requires more time and better planning. - Requires companies to assess information needs and provides an opportunity to eliminate inefficiencies in current reporting practices. - Maximizes benefits of XBRL to preparers and internal and external users of financial and non-financial information. June 2008 Pricewaterhouse. Coopers 44

What the SEC is doing What You Can Do Now • Use available resources to get smart on XBRL (see appendix for resources) • Develop plan for assessment/implementation • Consider Relevant Taxonomies - Financial • US GAAP • IFRS - Non-Financial • Proxy • Enhanced Business Reporting Consortium • Global Reporting Initiative June 2008 Pricewaterhouse. Coopers 45

What the SEC is doing What You Can Do Now • Use available resources to get smart on XBRL (see appendix for resources) • Develop plan for assessment/implementation • Consider Relevant Taxonomies - Financial • US GAAP • IFRS - Non-Financial • Proxy • Enhanced Business Reporting Consortium • Global Reporting Initiative June 2008 Pricewaterhouse. Coopers 45

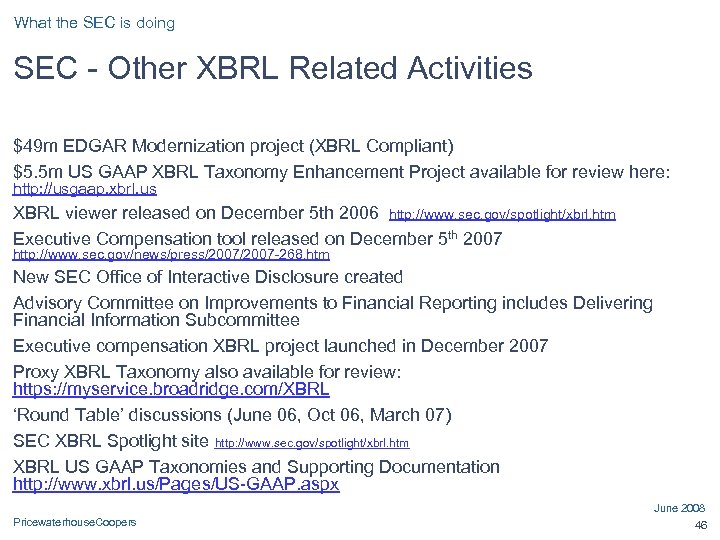

What the SEC is doing SEC - Other XBRL Related Activities $49 m EDGAR Modernization project (XBRL Compliant) $5. 5 m US GAAP XBRL Taxonomy Enhancement Project available for review here: http: //usgaap. xbrl. us XBRL viewer released on December 5 th 2006 http: //www. sec. gov/spotlight/xbrl. htm Executive Compensation tool released on December 5 th 2007 http: //www. sec. gov/news/press/2007 -268. htm New SEC Office of Interactive Disclosure created Advisory Committee on Improvements to Financial Reporting includes Delivering Financial Information Subcommittee Executive compensation XBRL project launched in December 2007 Proxy XBRL Taxonomy also available for review: https: //myservice. broadridge. com/XBRL ‘Round Table’ discussions (June 06, Oct 06, March 07) SEC XBRL Spotlight site http: //www. sec. gov/spotlight/xbrl. htm XBRL US GAAP Taxonomies and Supporting Documentation http: //www. xbrl. us/Pages/US-GAAP. aspx June 2008 Pricewaterhouse. Coopers 46

What the SEC is doing SEC - Other XBRL Related Activities $49 m EDGAR Modernization project (XBRL Compliant) $5. 5 m US GAAP XBRL Taxonomy Enhancement Project available for review here: http: //usgaap. xbrl. us XBRL viewer released on December 5 th 2006 http: //www. sec. gov/spotlight/xbrl. htm Executive Compensation tool released on December 5 th 2007 http: //www. sec. gov/news/press/2007 -268. htm New SEC Office of Interactive Disclosure created Advisory Committee on Improvements to Financial Reporting includes Delivering Financial Information Subcommittee Executive compensation XBRL project launched in December 2007 Proxy XBRL Taxonomy also available for review: https: //myservice. broadridge. com/XBRL ‘Round Table’ discussions (June 06, Oct 06, March 07) SEC XBRL Spotlight site http: //www. sec. gov/spotlight/xbrl. htm XBRL US GAAP Taxonomies and Supporting Documentation http: //www. xbrl. us/Pages/US-GAAP. aspx June 2008 Pricewaterhouse. Coopers 46

IASB and FASB Convergence June 2008 Pricewaterhouse. Coopers 47

IASB and FASB Convergence June 2008 Pricewaterhouse. Coopers 47

IASB and FASB Convergence of IFRS and US GAAP • Overall vision and objective • Short-term convergence • Long-term convergence June 2008 Pricewaterhouse. Coopers 48

IASB and FASB Convergence of IFRS and US GAAP • Overall vision and objective • Short-term convergence • Long-term convergence June 2008 Pricewaterhouse. Coopers 48

IASB and FASB Convergence Overall Vision and Objective • Objective is to create one global set of high-quality standards • Convergence goes beyond US GAAP and IFRS • “Convergence means change. We must not have convergence for the sake of it”—Bob Herz— Chairman FASB • Convergence is a two-way street June 2008 Pricewaterhouse. Coopers 49

IASB and FASB Convergence Overall Vision and Objective • Objective is to create one global set of high-quality standards • Convergence goes beyond US GAAP and IFRS • “Convergence means change. We must not have convergence for the sake of it”—Bob Herz— Chairman FASB • Convergence is a two-way street June 2008 Pricewaterhouse. Coopers 49

IASB and FASB Convergence FASB and IASB Memorandum of Understanding (February 2006) Roadmap for convergence between IFRS and US GAAP between 2006— 2008 General guidelines are as follows • Convergence is best achieved through the development of high quality standards over time • Differences between standards in need of improvement should not be eliminated; new standards should be developed instead • Weaker standards should be replaced with stronger standards June 2008 Pricewaterhouse. Coopers 50

IASB and FASB Convergence FASB and IASB Memorandum of Understanding (February 2006) Roadmap for convergence between IFRS and US GAAP between 2006— 2008 General guidelines are as follows • Convergence is best achieved through the development of high quality standards over time • Differences between standards in need of improvement should not be eliminated; new standards should be developed instead • Weaker standards should be replaced with stronger standards June 2008 Pricewaterhouse. Coopers 50

IASB and FASB Convergence—Accounting standard setters FASB and IASB Overall strategy • Short-term convergence project - High-quality solution achievable in the short-term Coordination of work programs—joint projects • Business combinations • Revenue recognition • Conceptual framework • Consolidation • Fair value measurements June 2008 Pricewaterhouse. Coopers 51

IASB and FASB Convergence—Accounting standard setters FASB and IASB Overall strategy • Short-term convergence project - High-quality solution achievable in the short-term Coordination of work programs—joint projects • Business combinations • Revenue recognition • Conceptual framework • Consolidation • Fair value measurements June 2008 Pricewaterhouse. Coopers 51

Differences between IFRS & US GAAP

Differences between IFRS & US GAAP

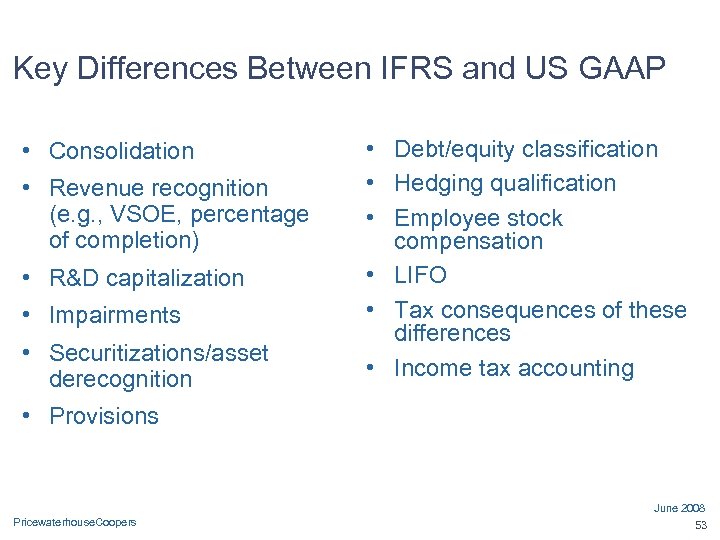

Key Differences Between IFRS and US GAAP • Consolidation • Revenue recognition (e. g. , VSOE, percentage of completion) • R&D capitalization • Impairments • Securitizations/asset derecognition • Debt/equity classification • Hedging qualification • Employee stock compensation • LIFO • Tax consequences of these differences • Income tax accounting • Provisions June 2008 Pricewaterhouse. Coopers 53

Key Differences Between IFRS and US GAAP • Consolidation • Revenue recognition (e. g. , VSOE, percentage of completion) • R&D capitalization • Impairments • Securitizations/asset derecognition • Debt/equity classification • Hedging qualification • Employee stock compensation • LIFO • Tax consequences of these differences • Income tax accounting • Provisions June 2008 Pricewaterhouse. Coopers 53

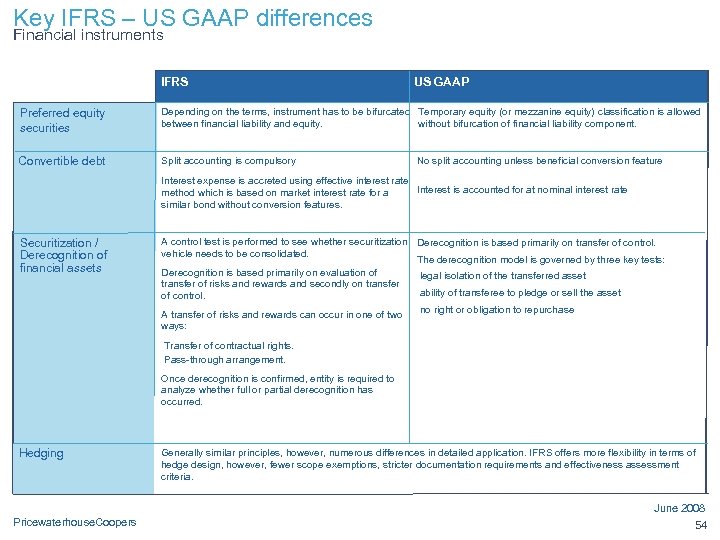

Key IFRS – US GAAP differences Financial instruments IFRS US GAAP Preferred equity securities Depending on the terms, instrument has to be bifurcated Temporary equity (or mezzanine equity) classification is allowed between financial liability and equity. without bifurcation of financial liability component. Convertible debt Split accounting is compulsory No split accounting unless beneficial conversion feature Interest expense is accreted using effective interest rate Interest is accounted for at nominal interest rate method which is based on market interest rate for a similar bond without conversion features. Securitization / Derecognition of financial assets A control test is performed to see whether securitization Derecognition is based primarily on transfer of control. vehicle needs to be consolidated. The derecognition model is governed by three key tests: Derecognition is based primarily on evaluation of legal isolation of the transferred asset transfer of risks and rewards and secondly on transfer ability of transferee to pledge or sell the asset of control. A transfer of risks and rewards can occur in one of two ways: no right or obligation to repurchase Transfer of contractual rights. Pass-through arrangement. Once derecognition is confirmed, entity is required to analyze whether full or partial derecognition has occurred. Hedging Generally similar principles, however, numerous differences in detailed application. IFRS offers more flexibility in terms of hedge design, however, fewer scope exemptions, stricter documentation requirements and effectiveness assessment criteria. June 2008 Pricewaterhouse. Coopers 54

Key IFRS – US GAAP differences Financial instruments IFRS US GAAP Preferred equity securities Depending on the terms, instrument has to be bifurcated Temporary equity (or mezzanine equity) classification is allowed between financial liability and equity. without bifurcation of financial liability component. Convertible debt Split accounting is compulsory No split accounting unless beneficial conversion feature Interest expense is accreted using effective interest rate Interest is accounted for at nominal interest rate method which is based on market interest rate for a similar bond without conversion features. Securitization / Derecognition of financial assets A control test is performed to see whether securitization Derecognition is based primarily on transfer of control. vehicle needs to be consolidated. The derecognition model is governed by three key tests: Derecognition is based primarily on evaluation of legal isolation of the transferred asset transfer of risks and rewards and secondly on transfer ability of transferee to pledge or sell the asset of control. A transfer of risks and rewards can occur in one of two ways: no right or obligation to repurchase Transfer of contractual rights. Pass-through arrangement. Once derecognition is confirmed, entity is required to analyze whether full or partial derecognition has occurred. Hedging Generally similar principles, however, numerous differences in detailed application. IFRS offers more flexibility in terms of hedge design, however, fewer scope exemptions, stricter documentation requirements and effectiveness assessment criteria. June 2008 Pricewaterhouse. Coopers 54

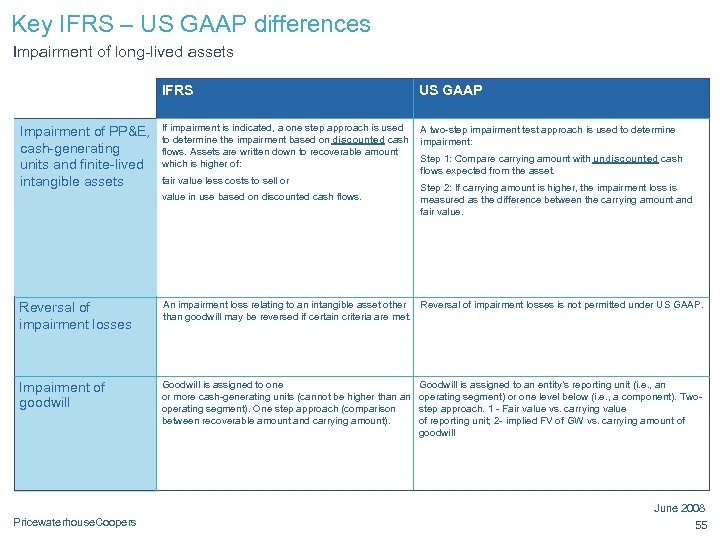

Key IFRS – US GAAP differences Impairment of long-lived assets IFRS Impairment of PP&E, cash-generating units and finite-lived intangible assets US GAAP If impairment is indicated, a one step approach is used to determine the impairment based on discounted cash flows. Assets are written down to recoverable amount which is higher of: A two-step impairment test approach is used to determine impairment: fair value less costs to sell or value in use based on discounted cash flows. Step 1: Compare carrying amount with undiscounted cash flows expected from the asset. Step 2: If carrying amount is higher, the impairment loss is measured as the difference between the carrying amount and fair value. Reversal of impairment losses An impairment loss relating to an intangible asset other Reversal of impairment losses is not permitted under US GAAP. than goodwill may be reversed if certain criteria are met. Impairment of goodwill Goodwill is assigned to one or more cash-generating units (cannot be higher than an operating segment). One step approach (comparison between recoverable amount and carrying amount). Goodwill is assigned to an entity’s reporting unit (i. e. , an operating segment) or one level below (i. e. , a component). Twostep approach. 1 - Fair value vs. carrying value of reporting unit; 2 - implied FV of GW vs. carrying amount of goodwill June 2008 Pricewaterhouse. Coopers 55

Key IFRS – US GAAP differences Impairment of long-lived assets IFRS Impairment of PP&E, cash-generating units and finite-lived intangible assets US GAAP If impairment is indicated, a one step approach is used to determine the impairment based on discounted cash flows. Assets are written down to recoverable amount which is higher of: A two-step impairment test approach is used to determine impairment: fair value less costs to sell or value in use based on discounted cash flows. Step 1: Compare carrying amount with undiscounted cash flows expected from the asset. Step 2: If carrying amount is higher, the impairment loss is measured as the difference between the carrying amount and fair value. Reversal of impairment losses An impairment loss relating to an intangible asset other Reversal of impairment losses is not permitted under US GAAP. than goodwill may be reversed if certain criteria are met. Impairment of goodwill Goodwill is assigned to one or more cash-generating units (cannot be higher than an operating segment). One step approach (comparison between recoverable amount and carrying amount). Goodwill is assigned to an entity’s reporting unit (i. e. , an operating segment) or one level below (i. e. , a component). Twostep approach. 1 - Fair value vs. carrying value of reporting unit; 2 - implied FV of GW vs. carrying amount of goodwill June 2008 Pricewaterhouse. Coopers 55

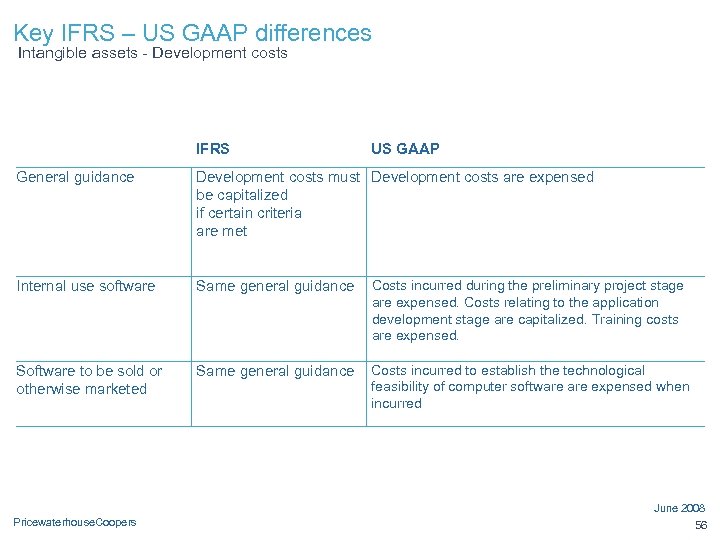

Key IFRS – US GAAP differences Intangible assets - Development costs IFRS US GAAP General guidance Development costs must Development costs are expensed be capitalized if certain criteria are met Internal use software Same general guidance Costs incurred during the preliminary project stage are expensed. Costs relating to the application development stage are capitalized. Training costs are expensed. Software to be sold or otherwise marketed Same general guidance Costs incurred to establish the technological feasibility of computer software expensed when incurred June 2008 Pricewaterhouse. Coopers 56

Key IFRS – US GAAP differences Intangible assets - Development costs IFRS US GAAP General guidance Development costs must Development costs are expensed be capitalized if certain criteria are met Internal use software Same general guidance Costs incurred during the preliminary project stage are expensed. Costs relating to the application development stage are capitalized. Training costs are expensed. Software to be sold or otherwise marketed Same general guidance Costs incurred to establish the technological feasibility of computer software expensed when incurred June 2008 Pricewaterhouse. Coopers 56

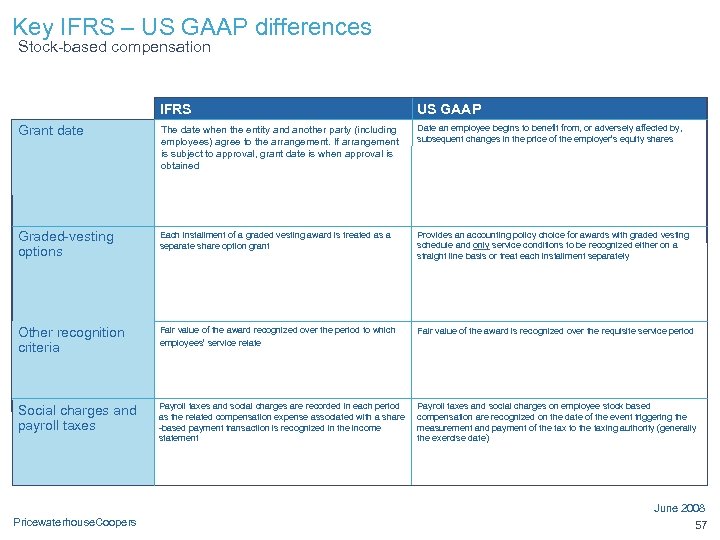

Key IFRS – US GAAP differences Stock-based compensation IFRS US GAAP Grant date The date when the entity and another party (including employees) agree to the arrangement. If arrangement is subject to approval, grant date is when approval is obtained Date an employee begins to benefit from, or adversely affected by, subsequent changes in the price of the employer’s equity shares Graded-vesting options Each installment of a graded vesting award is treated as a separate share option grant Provides an accounting policy choice for awards with graded vesting schedule and only service conditions to be recognized either on a straight line basis or treat each installment separately Other recognition criteria Fair value of the award recognized over the period to which employees’ service relate Fair value of the award is recognized over the requisite service period Social charges and payroll taxes Payroll taxes and social charges are recorded in each period as the related compensation expense associated with a share -based payment transaction is recognized in the income statement Payroll taxes and social charges on employee stock based compensation are recognized on the date of the event triggering the measurement and payment of the tax to the taxing authority (generally the exercise date) June 2008 Pricewaterhouse. Coopers 57

Key IFRS – US GAAP differences Stock-based compensation IFRS US GAAP Grant date The date when the entity and another party (including employees) agree to the arrangement. If arrangement is subject to approval, grant date is when approval is obtained Date an employee begins to benefit from, or adversely affected by, subsequent changes in the price of the employer’s equity shares Graded-vesting options Each installment of a graded vesting award is treated as a separate share option grant Provides an accounting policy choice for awards with graded vesting schedule and only service conditions to be recognized either on a straight line basis or treat each installment separately Other recognition criteria Fair value of the award recognized over the period to which employees’ service relate Fair value of the award is recognized over the requisite service period Social charges and payroll taxes Payroll taxes and social charges are recorded in each period as the related compensation expense associated with a share -based payment transaction is recognized in the income statement Payroll taxes and social charges on employee stock based compensation are recognized on the date of the event triggering the measurement and payment of the tax to the taxing authority (generally the exercise date) June 2008 Pricewaterhouse. Coopers 57

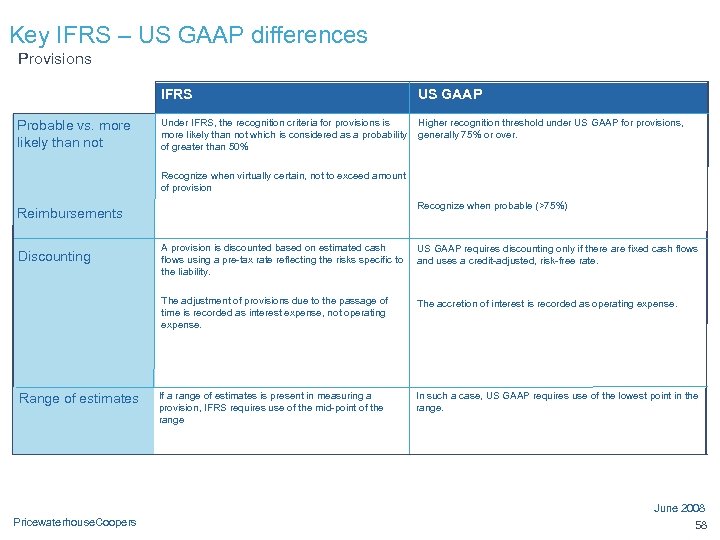

Key IFRS – US GAAP differences Provisions IFRS Probable vs. more likely than not US GAAP Under IFRS, the recognition criteria for provisions is more likely than not which is considered as a probability of greater than 50% Higher recognition threshold under US GAAP for provisions, generally 75% or over. Recognize when virtually certain, not to exceed amount of provision Recognize when probable (>75%) Reimbursements Range of estimates A provision is discounted based on estimated cash flows using a pre-tax rate reflecting the risks specific to the liability. US GAAP requires discounting only if there are fixed cash flows and uses a credit-adjusted, risk-free rate. The adjustment of provisions due to the passage of time is recorded as interest expense, not operating expense. Discounting The accretion of interest is recorded as operating expense. If a range of estimates is present in measuring a provision, IFRS requires use of the mid-point of the range In such a case, US GAAP requires use of the lowest point in the range. June 2008 Pricewaterhouse. Coopers 58

Key IFRS – US GAAP differences Provisions IFRS Probable vs. more likely than not US GAAP Under IFRS, the recognition criteria for provisions is more likely than not which is considered as a probability of greater than 50% Higher recognition threshold under US GAAP for provisions, generally 75% or over. Recognize when virtually certain, not to exceed amount of provision Recognize when probable (>75%) Reimbursements Range of estimates A provision is discounted based on estimated cash flows using a pre-tax rate reflecting the risks specific to the liability. US GAAP requires discounting only if there are fixed cash flows and uses a credit-adjusted, risk-free rate. The adjustment of provisions due to the passage of time is recorded as interest expense, not operating expense. Discounting The accretion of interest is recorded as operating expense. If a range of estimates is present in measuring a provision, IFRS requires use of the mid-point of the range In such a case, US GAAP requires use of the lowest point in the range. June 2008 Pricewaterhouse. Coopers 58

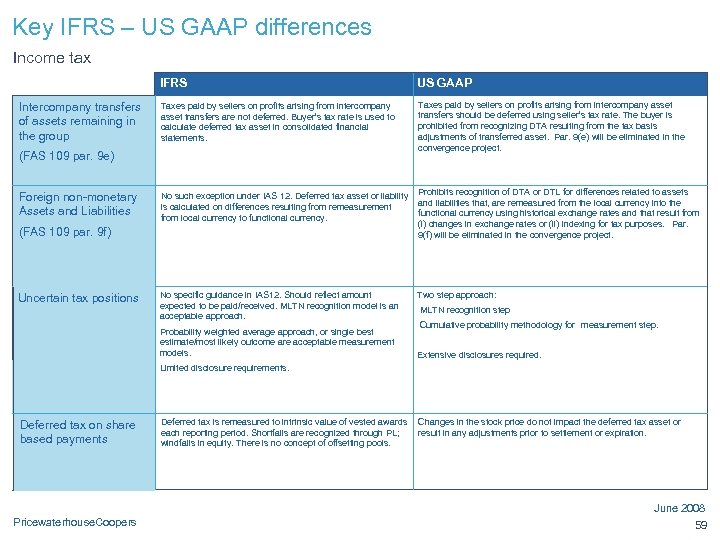

Key IFRS – US GAAP differences Income tax IFRS Intercompany transfers of assets remaining in the group US GAAP Taxes paid by sellers on profits arising from intercompany asset transfers are not deferred. Buyer’s tax rate is used to calculate deferred tax asset in consolidated financial statements. Taxes paid by sellers on profits arising from intercompany asset transfers should be deferred using seller’s tax rate. The buyer is prohibited from recognizing DTA resulting from the tax basis adjustments of transferred asset. Par. 9(e) will be eliminated in the convergence project. No such exception under IAS 12. Deferred tax asset or liability is calculated on differences resulting from remeasurement from local currency to functional currency. Prohibits recognition of DTA or DTL for differences related to assets and liabilities that, are remeasured from the local currency into the functional currency using historical exchange rates and that result from (i) changes in exchange rates or (ii) indexing for tax purposes. Par. 9(f) will be eliminated in the convergence project. No specific guidance in IAS 12. Should reflect amount expected to be paid/received. MLTN recognition model is an acceptable approach. Two step approach: (FAS 109 par. 9 e) Foreign non-monetary Assets and Liabilities (FAS 109 par. 9 f) Uncertain tax positions Probability weighted average approach, or single best estimate/most likely outcome are acceptable measurement models. MLTN recognition step Cumulative probability methodology for measurement step. Extensive disclosures required. Limited disclosure requirements. Deferred tax on share based payments Deferred tax is remeasured to intrinsic value of vested awards each reporting period. Shortfalls are recognized through PL; windfalls in equity. There is no concept of offsetting pools. Changes in the stock price do not impact the deferred tax asset or result in any adjustments prior to settlement or expiration. June 2008 Pricewaterhouse. Coopers 59

Key IFRS – US GAAP differences Income tax IFRS Intercompany transfers of assets remaining in the group US GAAP Taxes paid by sellers on profits arising from intercompany asset transfers are not deferred. Buyer’s tax rate is used to calculate deferred tax asset in consolidated financial statements. Taxes paid by sellers on profits arising from intercompany asset transfers should be deferred using seller’s tax rate. The buyer is prohibited from recognizing DTA resulting from the tax basis adjustments of transferred asset. Par. 9(e) will be eliminated in the convergence project. No such exception under IAS 12. Deferred tax asset or liability is calculated on differences resulting from remeasurement from local currency to functional currency. Prohibits recognition of DTA or DTL for differences related to assets and liabilities that, are remeasured from the local currency into the functional currency using historical exchange rates and that result from (i) changes in exchange rates or (ii) indexing for tax purposes. Par. 9(f) will be eliminated in the convergence project. No specific guidance in IAS 12. Should reflect amount expected to be paid/received. MLTN recognition model is an acceptable approach. Two step approach: (FAS 109 par. 9 e) Foreign non-monetary Assets and Liabilities (FAS 109 par. 9 f) Uncertain tax positions Probability weighted average approach, or single best estimate/most likely outcome are acceptable measurement models. MLTN recognition step Cumulative probability methodology for measurement step. Extensive disclosures required. Limited disclosure requirements. Deferred tax on share based payments Deferred tax is remeasured to intrinsic value of vested awards each reporting period. Shortfalls are recognized through PL; windfalls in equity. There is no concept of offsetting pools. Changes in the stock price do not impact the deferred tax asset or result in any adjustments prior to settlement or expiration. June 2008 Pricewaterhouse. Coopers 59

Educational Resources

Educational Resources

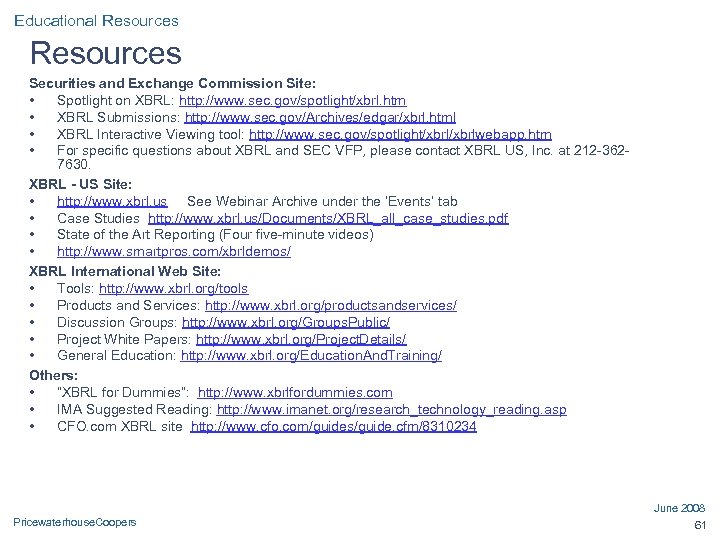

Educational Resources Securities and Exchange Commission Site: • Spotlight on XBRL: http: //www. sec. gov/spotlight/xbrl. htm • XBRL Submissions: http: //www. sec. gov/Archives/edgar/xbrl. html • XBRL Interactive Viewing tool: http: //www. sec. gov/spotlight/xbrlwebapp. htm • For specific questions about XBRL and SEC VFP, please contact XBRL US, Inc. at 212 -3627630. XBRL - US Site: • http: //www. xbrl. us See Webinar Archive under the ‘Events’ tab • Case Studies http: //www. xbrl. us/Documents/XBRL_all_case_studies. pdf • State of the Art Reporting (Four five-minute videos) • http: //www. smartpros. com/xbrldemos/ XBRL International Web Site: • Tools: http: //www. xbrl. org/tools • Products and Services: http: //www. xbrl. org/productsandservices/ • Discussion Groups: http: //www. xbrl. org/Groups. Public/ • Project White Papers: http: //www. xbrl. org/Project. Details/ • General Education: http: //www. xbrl. org/Education. And. Training/ Others: • “XBRL for Dummies”: http: //www. xbrlfordummies. com • IMA Suggested Reading: http: //www. imanet. org/research_technology_reading. asp • CFO. com XBRL site http: //www. cfo. com/guides/guide. cfm/8310234 June 2008 Pricewaterhouse. Coopers 61

Educational Resources Securities and Exchange Commission Site: • Spotlight on XBRL: http: //www. sec. gov/spotlight/xbrl. htm • XBRL Submissions: http: //www. sec. gov/Archives/edgar/xbrl. html • XBRL Interactive Viewing tool: http: //www. sec. gov/spotlight/xbrlwebapp. htm • For specific questions about XBRL and SEC VFP, please contact XBRL US, Inc. at 212 -3627630. XBRL - US Site: • http: //www. xbrl. us See Webinar Archive under the ‘Events’ tab • Case Studies http: //www. xbrl. us/Documents/XBRL_all_case_studies. pdf • State of the Art Reporting (Four five-minute videos) • http: //www. smartpros. com/xbrldemos/ XBRL International Web Site: • Tools: http: //www. xbrl. org/tools • Products and Services: http: //www. xbrl. org/productsandservices/ • Discussion Groups: http: //www. xbrl. org/Groups. Public/ • Project White Papers: http: //www. xbrl. org/Project. Details/ • General Education: http: //www. xbrl. org/Education. And. Training/ Others: • “XBRL for Dummies”: http: //www. xbrlfordummies. com • IMA Suggested Reading: http: //www. imanet. org/research_technology_reading. asp • CFO. com XBRL site http: //www. cfo. com/guides/guide. cfm/8310234 June 2008 Pricewaterhouse. Coopers 61

Educational Resources Suggested Reading Global Ledger Practices Guide for Study http: //www. gl. iphix. net/ ROI on XBRL: http: //www. aicpa. org/pubs/jofa/jun 2007/stantial. htm Hitachi Blogs: • http: //blog. hitachixbrl. com/2007/01/16/the-entity-problem/ • http: //blog. hitachixbrl. com/2007/01/30/relationships-matter/ • http: //blog. hitachixbrl. com/2007/02/13/in-pursuit-of-process/ • http: //blog. hitachixbrl. com/2007/01/09/master-data-management-the-xbrl-way/ • http: //blog. hitachixbrl. com/2006/12/08/adaptation-or-evolution-what-is-your-xbrl-strategy/ XBRL Ledger white paper: http: //www. imanet. org/pdf/8 xbrl. pdf FFIEC White Paper: http: //www. xbrl. org/us/us/FFIEC%20 White%20 Paper%2002 Feb 2006. pdf June 2008 Pricewaterhouse. Coopers 62

Educational Resources Suggested Reading Global Ledger Practices Guide for Study http: //www. gl. iphix. net/ ROI on XBRL: http: //www. aicpa. org/pubs/jofa/jun 2007/stantial. htm Hitachi Blogs: • http: //blog. hitachixbrl. com/2007/01/16/the-entity-problem/ • http: //blog. hitachixbrl. com/2007/01/30/relationships-matter/ • http: //blog. hitachixbrl. com/2007/02/13/in-pursuit-of-process/ • http: //blog. hitachixbrl. com/2007/01/09/master-data-management-the-xbrl-way/ • http: //blog. hitachixbrl. com/2006/12/08/adaptation-or-evolution-what-is-your-xbrl-strategy/ XBRL Ledger white paper: http: //www. imanet. org/pdf/8 xbrl. pdf FFIEC White Paper: http: //www. xbrl. org/us/us/FFIEC%20 White%20 Paper%2002 Feb 2006. pdf June 2008 Pricewaterhouse. Coopers 62

Educational Resources Online demonstrations Microsoft Investor Central • http: //www. microsoft. com/msft/IC/default. aspx Executive Compensation Widget • http: //www. ibanknet. com/widgets/index. shtml Edgar-Online IMetrix • http: //www. edgar-online. com/products/imetrix. aspx Rivet Software Crossfire • http: //www. rivetsoftware. com/content/index. cfm? fuseaction=show. Content&conte nt. ID=195&nav. ID=166 • http: //www. rivetsoftware. com/resources/files/Crossfire. Launch/Crossfire. Analyst. R eport. Creation. htm Google One. Box • http: //www. iphix. net/resources/nunavut. htm June 2008 Pricewaterhouse. Coopers 63

Educational Resources Online demonstrations Microsoft Investor Central • http: //www. microsoft. com/msft/IC/default. aspx Executive Compensation Widget • http: //www. ibanknet. com/widgets/index. shtml Edgar-Online IMetrix • http: //www. edgar-online. com/products/imetrix. aspx Rivet Software Crossfire • http: //www. rivetsoftware. com/content/index. cfm? fuseaction=show. Content&conte nt. ID=195&nav. ID=166 • http: //www. rivetsoftware. com/resources/files/Crossfire. Launch/Crossfire. Analyst. R eport. Creation. htm Google One. Box • http: //www. iphix. net/resources/nunavut. htm June 2008 Pricewaterhouse. Coopers 63

Educational Resources An Article to Read “Speeding toward Convergence: Changes to Come Rapidly for Accounting Profession” Allison M Henry Pennsylvania CPA Journal June 2008 Pricewaterhouse. Coopers 64

Educational Resources An Article to Read “Speeding toward Convergence: Changes to Come Rapidly for Accounting Profession” Allison M Henry Pennsylvania CPA Journal June 2008 Pricewaterhouse. Coopers 64

Typical Reporting Process – Bolt-on XBRL to prepared report Supplemental Data ERP 10 -Q in Word HFM ERP Review and Check 10 -Q in Word Edgar June 2008 Pricewaterhouse. Coopers 65

Typical Reporting Process – Bolt-on XBRL to prepared report Supplemental Data ERP 10 -Q in Word HFM ERP Review and Check 10 -Q in Word Edgar June 2008 Pricewaterhouse. Coopers 65

Streamlined Reporting Process – Embedded in Report Writer ERP HFM XBRL Tagged 10 -Q in XBRL ERP Supplemental Data Edgar XBRL Tagged June 2008 Pricewaterhouse. Coopers 66

Streamlined Reporting Process – Embedded in Report Writer ERP HFM XBRL Tagged 10 -Q in XBRL ERP Supplemental Data Edgar XBRL Tagged June 2008 Pricewaterhouse. Coopers 66