2c4dc41e89269722aba6d71aeff1f5d4.ppt

- Количество слайдов: 12

Convenient Dependable Secure CDSL Welcomes Convenient Dependable Secure ALL Delegates From Asia - Pacific CSD Group

Convenient Dependable Secure Straight Through Processing Convenient Dependable Secure “STP Today & Tomorrow” Central Depository Services (India) Limited

Convenient Dependable Secure ent Dependable Secure Current Scenario–Focus on Securities Settlement n n CC ( Clearing Corporation) intimates (excluding institutional trades) on net basis securities deliverable to CM (Clearing Member) Instruction from Sellers to transfer securities to CC/CM settlement A/Cs through instructions via n n Internet facility provided by Depositories n n Delivery Instruction Slips (DIS) Limited purpose Po. A Settlement on T+2 day n Pay-in n Pay-out

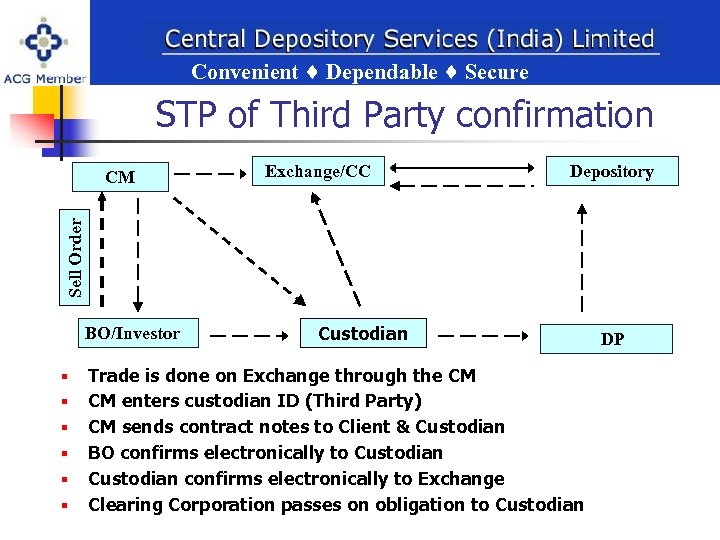

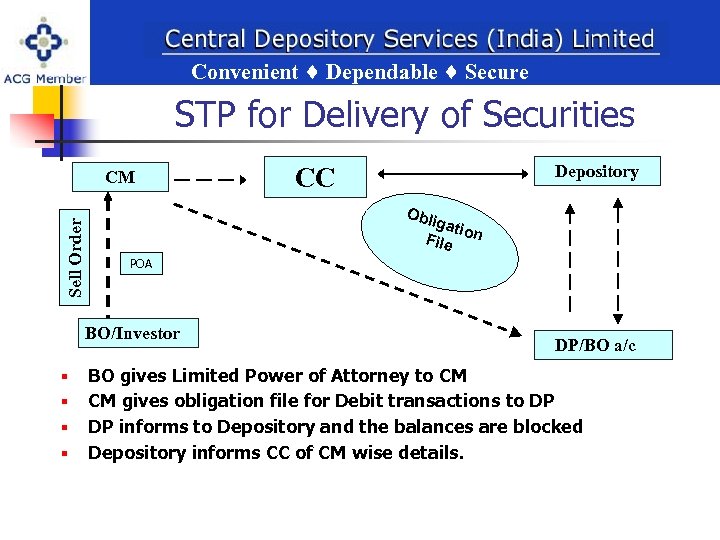

Convenient Dependable Secure ent Dependable Secure Two Process of STP Flow n STP of Third Party confirmation n STP for Delivery of Securities

Convenient Dependable Secure ent Dependable Secure STP of Third Party confirmation Exchange/CC Depository Sell Order CM BO/Investor § § § Custodian Trade is done on Exchange through the CM CM enters custodian ID (Third Party) CM sends contract notes to Client & Custodian BO confirms electronically to Custodian confirms electronically to Exchange Clearing Corporation passes on obligation to Custodian DP

Convenient Dependable Secure ent Dependable Secure STP for Delivery of Securities Sell Order CM Obli gati o File n POA BO/Investor § § Depository CC DP/BO a/c BO gives Limited Power of Attorney to CM CM gives obligation file for Debit transactions to DP DP informs to Depository and the balances are blocked Depository informs CC of CM wise details.

Convenient Dependable Secure ent Dependable Secure Constraints under Current Procedure n Paucity of time – Leading to undeliverable DIS n Manual Process n Signature verification n Data Entry errors take place n Chances of mis-quoting the ISIN / Settlement number n Bank holidays on trading days

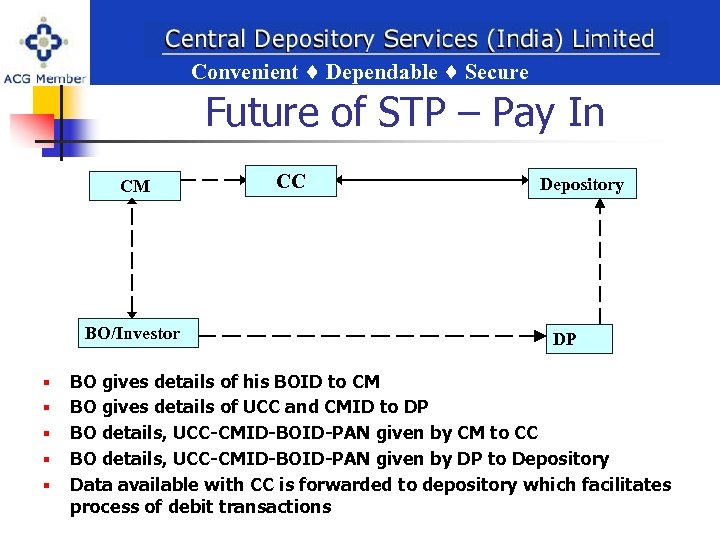

Convenient Dependable Secure ent Dependable Secure Future of STP – Pay In CM BO/Investor § § § CC Depository DP BO gives details of his BOID to CM BO gives details of UCC and CMID to DP BO details, UCC-CMID-BOID-PAN given by CM to CC BO details, UCC-CMID-BOID-PAN given by DP to Depository Data available with CC is forwarded to depository which facilitates process of debit transactions

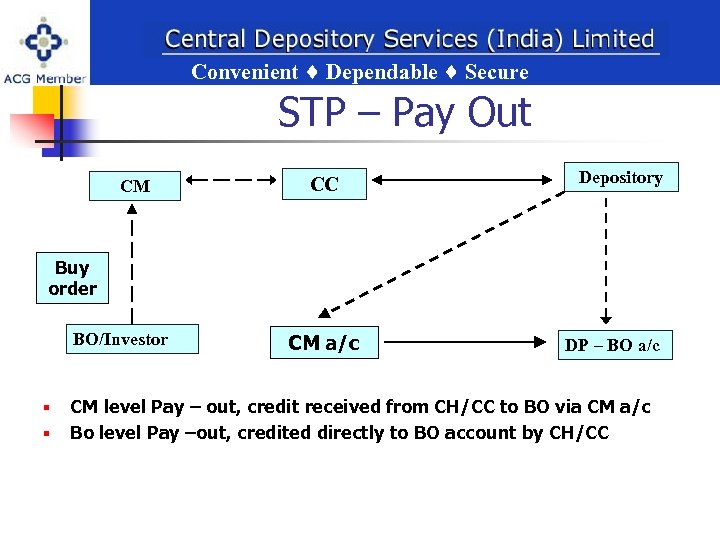

Convenient Dependable Secure ent Dependable Secure STP – Pay Out CM CC Depository Buy order BO/Investor § § CM a/c DP – BO a/c CM level Pay – out, credit received from CH/CC to BO via CM a/c Bo level Pay –out, credited directly to BO account by CH/CC

Convenient Dependable Secure ent Dependable Secure STP - Advantages n Elimination of DIS n Elimination of risk - default of delivery n Helps handle increased volumes of delivery n Elimination of paper/manual intervention n Elimination of data entry errors n Removal of principal hindrance in reduction of settlement period and additional settlement schedules n Elimination of non-entry due to Bank holidays on trading days

Convenient Dependable Secure ent Dependable Secure STP - Advantages n n Reduction of settlement cycle to T+1 or even T+0 settlement Introduction of Securities Lending Borrowing (SLB) n Elimination of Limited POA n Enhanced Transparency – Gross level settlement

Convenient Dependable Secure Thank You ! Convenient Dependable Secure

2c4dc41e89269722aba6d71aeff1f5d4.ppt