Controlling Workers Compensation Costs for State Agencies, Colleges, and Universities LARGE PROGRAMS VS. SMALL PROGRAMS ALTERNATIVE PROGRAM STRUCTURES WC FEASIBILITY STUDY

Controlling Workers Compensation Costs for State Agencies, Colleges, and Universities LARGE PROGRAMS VS. SMALL PROGRAMS ALTERNATIVE PROGRAM STRUCTURES WC FEASIBILITY STUDY

Risk and Insurance Management Society (RIMS) RIMS—largest Risk Management related association 10, 000 risk management professionals 3, 500 entities 120 countries 2011 RIMS Benchmark Survey 1, 431 organizations participated Measures the Cost of Risk (first developed in 1962)

Risk and Insurance Management Society (RIMS) RIMS—largest Risk Management related association 10, 000 risk management professionals 3, 500 entities 120 countries 2011 RIMS Benchmark Survey 1, 431 organizations participated Measures the Cost of Risk (first developed in 1962)

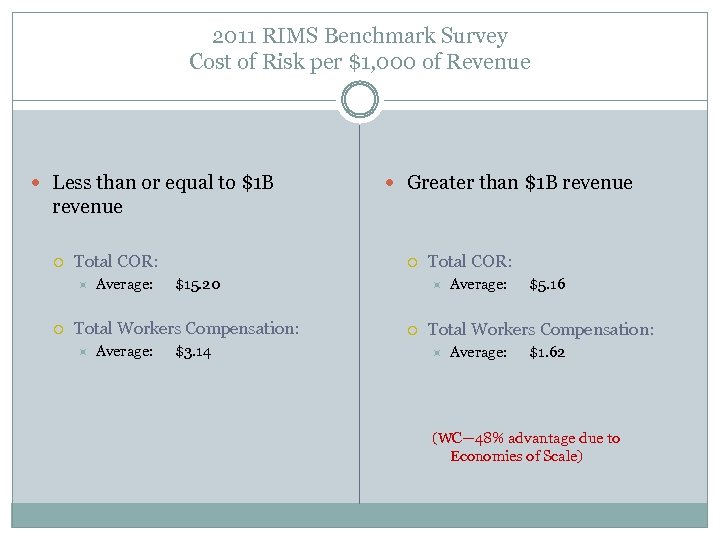

2011 RIMS Benchmark Survey Cost of Risk per $1, 000 of Revenue Less than or equal to $1 B Greater than $1 B revenue Total COR: Average: $15. 20 Total Workers Compensation: Average: $3. 14 Total COR: Average: $5. 16 Total Workers Compensation: Average: $1. 62 (WC— 48% advantage due to Economies of Scale)

2011 RIMS Benchmark Survey Cost of Risk per $1, 000 of Revenue Less than or equal to $1 B Greater than $1 B revenue Total COR: Average: $15. 20 Total Workers Compensation: Average: $3. 14 Total COR: Average: $5. 16 Total Workers Compensation: Average: $1. 62 (WC— 48% advantage due to Economies of Scale)

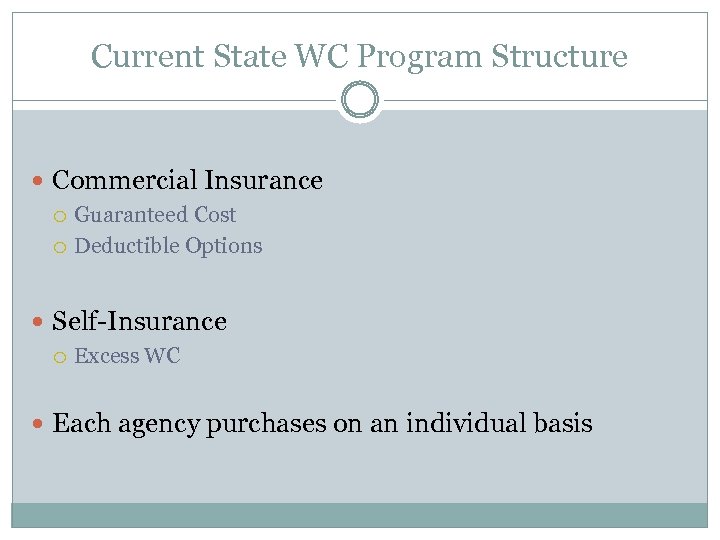

Current State WC Program Structure Commercial Insurance Guaranteed Cost Deductible Options Self-Insurance Excess WC Each agency purchases on an individual basis

Current State WC Program Structure Commercial Insurance Guaranteed Cost Deductible Options Self-Insurance Excess WC Each agency purchases on an individual basis

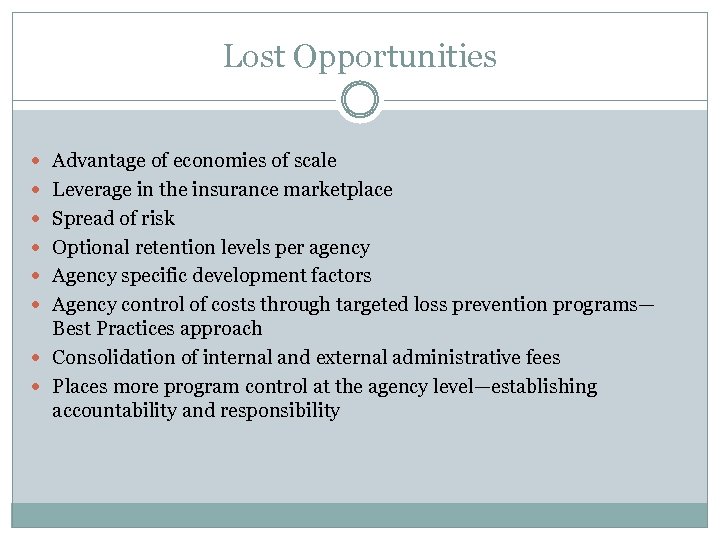

Lost Opportunities Advantage of economies of scale Leverage in the insurance marketplace Spread of risk Optional retention levels per agency Agency specific development factors Agency control of costs through targeted loss prevention programs— Best Practices approach Consolidation of internal and external administrative fees Places more program control at the agency level—establishing accountability and responsibility

Lost Opportunities Advantage of economies of scale Leverage in the insurance marketplace Spread of risk Optional retention levels per agency Agency specific development factors Agency control of costs through targeted loss prevention programs— Best Practices approach Consolidation of internal and external administrative fees Places more program control at the agency level—establishing accountability and responsibility

Proposal Conduct a Self-Insurance Feasibility Study Evaluate combining State entities into one program Analyze Self-Insured retention levels Commercial Insurance Market offerings for large comprehensive WC programs Study establishes savings targets

Proposal Conduct a Self-Insurance Feasibility Study Evaluate combining State entities into one program Analyze Self-Insured retention levels Commercial Insurance Market offerings for large comprehensive WC programs Study establishes savings targets

How to Proceed Engage Large Insurance Brokerage/Consulting Firm Gather 7 to 8 years of WC Data for all entities Payroll Historical loss data Premiums paid All expenses associated (TPA or claim handling fees, legal expense, managed care, medical bill review, etc. ) Also, current program structure and copies of WC policies

How to Proceed Engage Large Insurance Brokerage/Consulting Firm Gather 7 to 8 years of WC Data for all entities Payroll Historical loss data Premiums paid All expenses associated (TPA or claim handling fees, legal expense, managed care, medical bill review, etc. ) Also, current program structure and copies of WC policies

Summary Current system antiquated More efficient systems available Similar existing State insurance programs have already proven to be effective in reducing costs

Summary Current system antiquated More efficient systems available Similar existing State insurance programs have already proven to be effective in reducing costs