0913d754030403fcb7d13240c104f5ad.ppt

- Количество слайдов: 13

Contributions Implementation Working Group Opening Philip Hind NPM, Data Standards and e-Commerce Program Australian Taxation Office 28 March 2014 V 1. 0 1

Today’s objectives n Implementation update n Provide detail about: - Revised LI - Gateway governance - Induction process - Release of alternate file format and DB formal guidance - SMSF engagement - Enabling services - Governance and meeting arrangements 2

Deliverables and release notices n Revised LI published 27 March n Gateway governance – ATO’s stewardship n Induction and Conformance guides n SMSF messaging provider register v 3. 0 - Release date: 4 April n Fund Validation Service - artefacts - FVS – MIG, user guide, terms and conditions released 19 March - Letter to trustees released 19 March - Developer copy of register release date 4 April n Alternative file format and Defined Benefit guidance - DB guidance released today, file released Monday 3

Phasing of implementation Phase 1: 1 July – 2 November 2014 n Employers required to send minimum contribution information (Regs 7. 07 A and 7. 07 E), but in an electronic format acceptable to trustee n Employers send and funds receive payments, but in an electronic format acceptable to trustee n All other activity – opt-in and by mutual agreement 4

Minimum data and payment requirements These provisions are effective from 1 July 2014 Reg 7. 07 A Employer must give the following information to the fund for a new default member Reg 7. 07 E Employer must give the following information to the fund for a contribution New Member Registration • • • Employee Name Address TFN DOB Sex Contribution • • • Employee Name Address TFN Phone number Payment reference number 5

Phasing of implementation Phase 2: 3 November 2014 – 1 February 2015 n Funds required to receive registrations and contributions in the standard electronic format, except where: n An APRA fund and employer mutually agree to work with alternative file format in accordance with conditions set out in the legal instrument n An APRA fund obtains a later transition-in start date n Employers send and funds receive payments electronically in conformance with Schedule 3 of the standard 6

Phasing of implementation Phase 3: 2 February 2015 – 30 June 2015 n Error messaging and member outcome messages enabled n Employers (large and medium) need to complete transitionin process by 30 June 2015 7

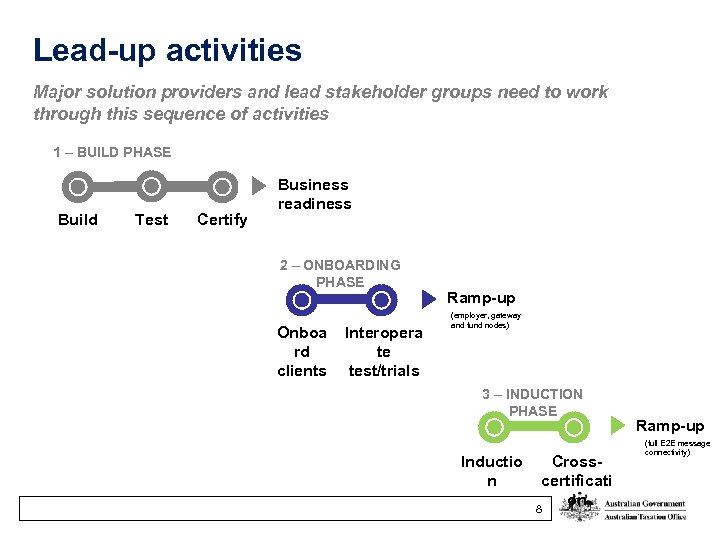

Lead-up activities Major solution providers and lead stakeholder groups need to work through this sequence of activities 1 – BUILD PHASE Build Test Certify Business readiness 2 – ONBOARDING PHASE Onboa rd clients Interopera te test/trials Ramp-up (employer, gateway and fund nodes) 3 – INDUCTION PHASE Inductio n Crosscertificati on 8 Ramp-up (full E 2 E message connectivity)

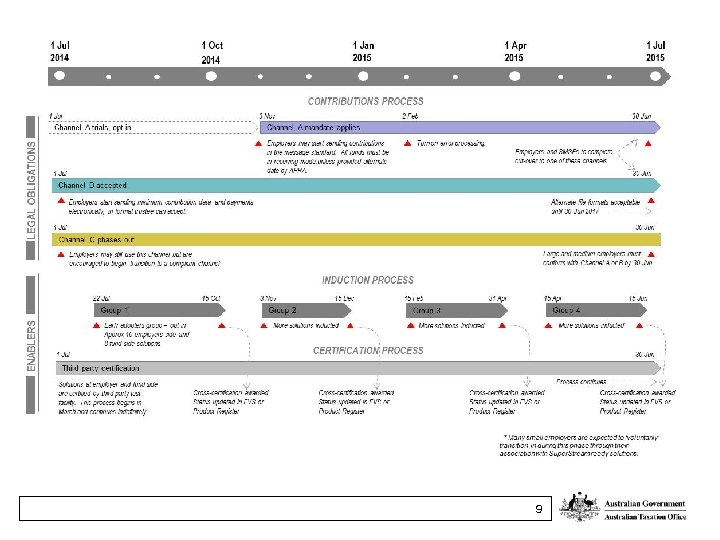

9

Induction Group 1 n The ATO has begun preparing ‘induction group 1’ during July to October 2014 (early trials) - EOI has identified about 44 key participants on employer and fund side to be part of this early implementation group - Key role to be played by payroll, clearing house and default fund solutions in this process 10

Next steps n Sign-off the Legislative Instrument changes n Revise key messages and update content n Work through readiness issues with stakeholders n Prepare Induction Group 1 and Nerve Centre 11

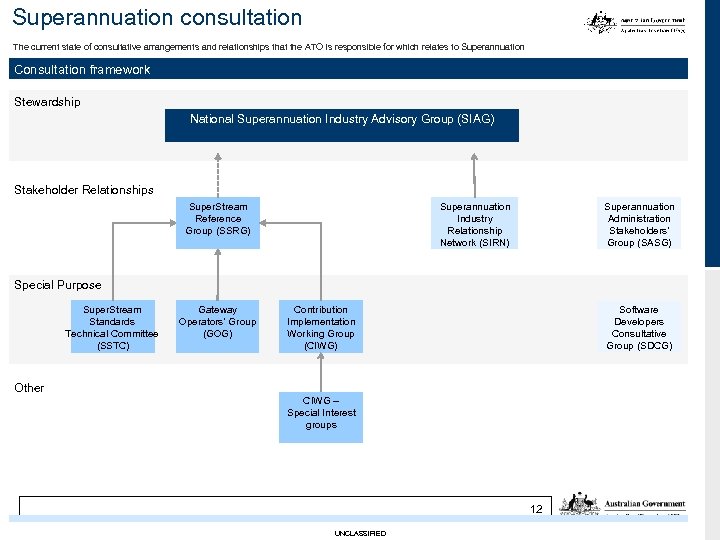

Superannuation consultation The current state of consultative arrangements and relationships that the ATO is responsible for which relates to Superannuation Consultation framework Stewardship National Superannuation Industry Advisory Group (SIAG) Stakeholder Relationships Super. Stream Reference Group (SSRG) Superannuation Industry Relationship Network (SIRN) Superannuation Administration Stakeholders’ Group (SASG) Special Purpose Super. Stream Standards Technical Committee (SSTC) Gateway Operators’ Group (GOG) Contribution Implementation Working Group (CIWG) Software Developers Consultative Group (SDCG) Other CIWG – Special Interest groups 12 UNCLASSIFIED

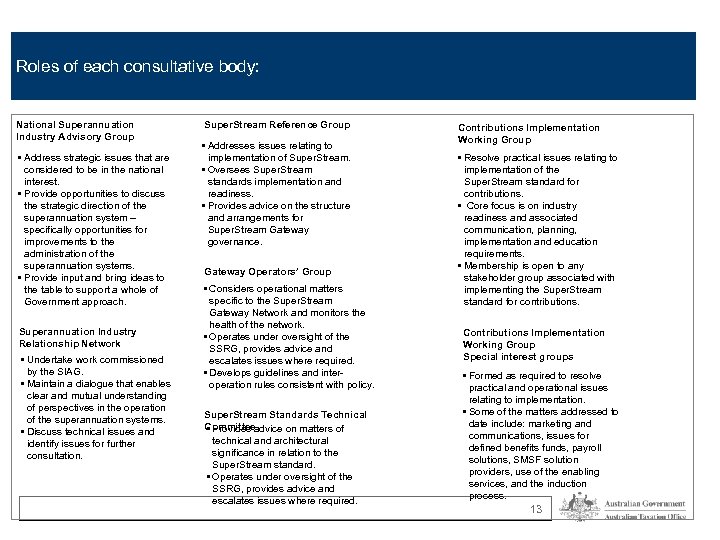

Roles of each consultative body: National Superannuation Industry Advisory Group Address strategic issues that are considered to be in the national interest. Provide opportunities to discuss the strategic direction of the superannuation system – specifically opportunities for improvements to the administration of the superannuation systems. Provide input and bring ideas to the table to support a whole of Government approach. Superannuation Industry Relationship Network Undertake work commissioned by the SIAG. Maintain a dialogue that enables clear and mutual understanding of perspectives in the operation of the superannuation systems. Discuss technical issues and identify issues for further consultation. Super. Stream Reference Group Addresses issues relating to implementation of Super. Stream. Oversees Super. Stream standards implementation and readiness. Provides advice on the structure and arrangements for Super. Stream Gateway governance. Gateway Operators’ Group Considers operational matters specific to the Super. Stream Gateway Network and monitors the health of the network. Operates under oversight of the SSRG, provides advice and escalates issues where required. Develops guidelines and interoperation rules consistent with policy. Super. Stream Standards Technical Committee Provides advice on matters of technical and architectural significance in relation to the Super. Stream standard. Operates under oversight of the SSRG, provides advice and escalates issues where required. Contributions Implementation Working Group Resolve practical issues relating to implementation of the Super. Stream standard for contributions. Core focus is on industry readiness and associated communication, planning, implementation and education requirements. Membership is open to any stakeholder group associated with implementing the Super. Stream standard for contributions. Contributions Implementation Working Group Special interest groups Formed as required to resolve practical and operational issues relating to implementation. Some of the matters addressed to date include: marketing and communications, issues for defined benefits funds, payroll solutions, SMSF solution providers, use of the enabling services, and the induction process. 13

0913d754030403fcb7d13240c104f5ad.ppt