cd2c03c6a50f614b51a3f4d7be9080f5.ppt

- Количество слайдов: 12

Contributions Implementation Working Group Implementation update Philip Hind NPM, Data Standards and e-Commerce Program Australian Taxation Office 27 June 2014 V 1. 0 1

Today’s objectives Implementation update - Support tools - Induction - Testing - Readiness tracking - Enabling services - Communication 2

Today’s workshop Implementation readiness - APRA funds - Employers - Payroll provider - SMSF messaging provider - ATO is conducting readiness assessments across all segments - Get particular updates on gateways, SMSF messaging providers and payrolls today 3

Deliverables and release notices Revised Choice form - Sample available first week of July, final published by no later than 31 July E 2 E Testing Framework & Schedule - Publishing first week of July Induction Timetable - Publishing first week of July Alternative date notification form - Publishing first week of July Ramp up arrangements - Publishing second week of July 4

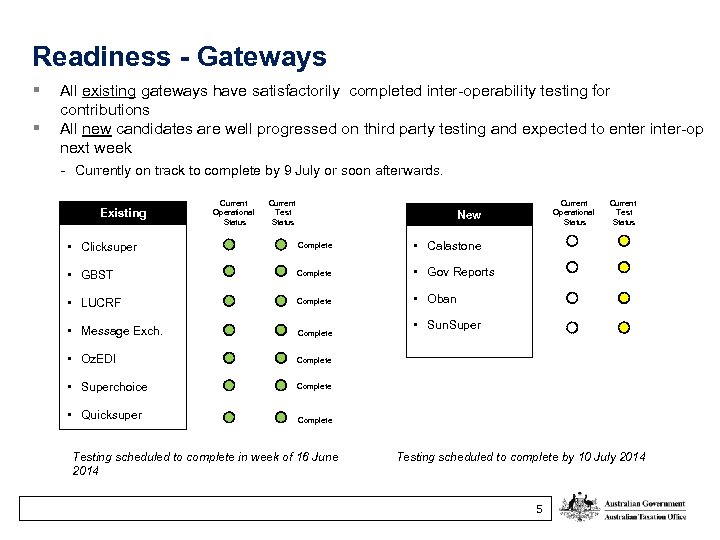

Readiness - Gateways § § All existing gateways have satisfactorily completed inter-operability testing for contributions All new candidates are well progressed on third party testing and expected to enter inter-op next week - Currently on track to complete by 9 July or soon afterwards. Existing Current Operational Status Current Test Status Current Operational Status New • Clicksuper Complete • Calastone • GBST Complete • Gov Reports • LUCRF Complete • Oban • Message Exch. Complete • Oz. EDI Complete • Superchoice Complete • Quicksuper Current Test Status Complete Testing scheduled to complete in week of 16 June 2014 • Sun. Super Testing scheduled to complete by 10 July 2014 5

Readiness - E 2 E testing End to end testing framework document sets out: - entry and exit criteria, test requirements, lead times, scheduling, coordination points, reporting and support tools Framework has been road tested with major funds and payroll providers - ready for publishing next week First iteration of master schedule has been developed - 23 induction cohorts are scheduled - published next week. For inclusion in schedule email Super. Stream. Standards@ato. gov. au with contact details and proposed partner(s)/dates and we will be in touch to discuss. 6

Readiness - key messages Funds, employers and SMSFs: Encouraged to implement as soon as possible Don’t delay – get benefits early and avoid rush later Employers and SMSFs: Talk to your service provider (or default fund) Have a plan and a target start date. 7

Readiness - payroll providers During the past fortnight, there have been four one-day education sessions held for payroll providers in major cities Approx. 80 software providers participated, including many smaller developers not previously engaged with Super. Stream Sponsored by the ATO with support of ABSIA Sessions covered Super. Stream background, core aspects, technical information, third party / end to end certification, and future uses of eb. MS by the ATO. Has accelerated knowledge transfer and readiness planning in the ‘second tier’ of this industry NOTE: Leading 20 payroll providers were already well progressed in their readiness planning and preparations prior to these seminars. Most implementing in Q 3 usually in partnership with a clearing house. 8

Ramp up strategy Induction provides a controlled process for trickle feed of contributions (low volumes) from a known group of senders to known receivers (small number of players) At end of induction, the risk is that trickle becomes a flood and fund cannot adjust to volume processing quickly enough Proposal is to introduce 6 -week ‘waves’ within induction, roughly: – 4 Aug - 12 Sep – 15 Sep – 24 Oct – 3 Nov - 12 Dec (and beyond into new year – as needed) Each wave has a pattern of trickle, slowly growing then followed by ramp up – Sending side switches to full throttle of contributions after crosscertification is obtained (at end of wave period) – Receiving side accepts full volume or moderates further by staggering introduction by USI – Contingency for receiving side is that it does not move to full receiving mode if not able to handle volumes and re-enters in next wave 9

Ramp up (cont. ) Each ‘wave’ would start again with a controlled group of senders and receivers – Follow same pattern: trickle, slowly grow, then ramp up With this sequential patterns, induction would become continuous process broken by waves – New senders and receivers can join at any time provided (say) 6 weeks notice is given and numbers of players can be managed The FVS cross-certification entry would provide key market signal that a USI was ready to receive ‘at volume’ – otherwise volumes controlled to small group within each induction wave Further consultation next week with key stakeholders, then publish a proposed process in mid-July. 10

Support tools - revised choice form Draft form has been revised based on late breaking stakeholder feedback Key late changes are: - removing bank account and service address details from APRA fund nomination (these are obtainable through the FVS or agent) - clearly separating SMSF details from APRA fund details Revised choice form specifications have been updated on the software developer’s homepage; new form available on ATO website by no later than 31 July 2014. Due to change, the ATO will update advice to employers accessing the existing choice form during the month of July: - existing form can be used in the interim - if employer involved in early Super. Stream implementation, guidance provided re additional information needed. A sample of the revised form will be provided to funds and service providers next week to assist with preparation activities. 11

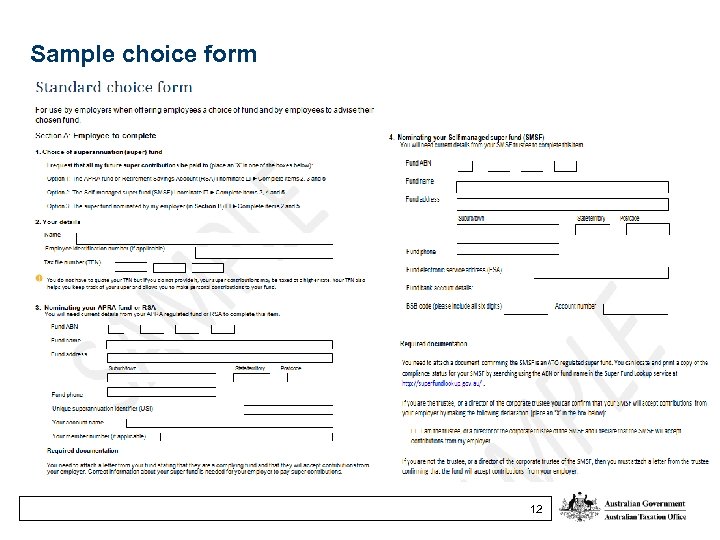

Sample choice form 12

cd2c03c6a50f614b51a3f4d7be9080f5.ppt