c8901bd543c12d7eba6d7c9857bf7105.ppt

- Количество слайдов: 64

Contractor Accounting National Business Institute Richard E. Mc. Dermott, Ph. D. Defense Contractors Construction Contractors General Contractors

Defense Contractor Accounting

Session Objectives--Defense v To give students an introductory vocabulary in defense contracting and accounting. v To help students understand the unique problems faced by the Department of Defense in the procurement of sophisticated weapons systems and the role that the contractor’s accountant plays in this process.

Session Objectives--Defense v To show students how to bid government defense contracts. v To give students the steps in the establishment of a defense contractor cost accounting system.

First Step in Procurement Process v Preparation of functional specification --narrative description of the proposed system. v Preparation of detailed design-technical drawings. – The more time you spend on these steps the less time you will spend later.

Pricing Considerations v Two general types of pricing-- prospective (i. e. fixed price) and retroactive (i. e. cost reimbursement). – – Fixed price contracts put contractor at risk. Cost reimbursement put the customer at risk. v There are multiple variations of these two contract forms.

Choose fixed price contract when: v There is a market price for the contract or service (i. e. “off-the-shelf” items). v It is relatively easy to estimate prospectively the cost of a product or service.

Choose cost reimbursement when: It is impossible to estimate the amount of work it will take to complete the project. v Technology beyond “state-of-the-art” is required. v The project is a research and development effort and involves the development of new technology or knowledge. v There are immeasurable contingencies. v

Contract Pricing Arrangements

Contract Pricing Arrangements: v Firm Fixed Price v Fixed Price Incentive--Firm Target v Fixed Price Incentive--Successive Targets v Fixed Price with Redetermination v Fixed Price with Economic Price Adjustment

Contract Pricing Arrangements: v Cost Plus Incentive Fee v Cost Fixed Fee v Cost Contract v Cost Sharing v Time and materials v Labor Hour contract

Firm Fixed Price (FFP) v Refers to a family of pricing arrangements whose common discipline is a ceiling beyond which the Government bears no financial responsibility.

FP Incentive--Firm Target v The ingredients of this type of contract are: Target cost – Target profit – Target price – Price ceiling – Share arrangement –

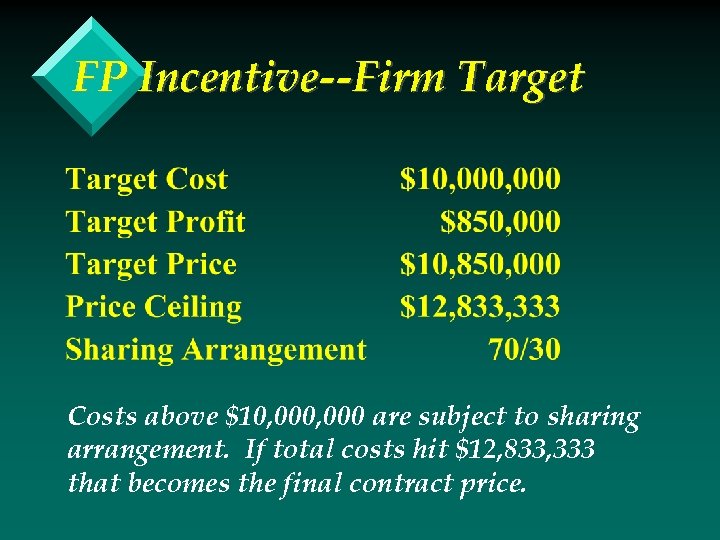

FP Incentive--Firm Target Costs above $10, 000 are subject to sharing arrangement. If total costs hit $12, 833, 333 that becomes the final contract price.

FP Incentive Successive Targets v Long lead-times make it necessary when acquiring a new system to contract for a follow-onquantity before design or production stability has been achieved.

FP Incentive Successive Targets v This arrangement is designed for situations involving the procurement of first or second production quantity of a newly developed item. v There is price uncertainty that precludes finalizing the contract now. The uncertainty will be resolved before the contract if “firmed up. ”

FP Incentive Successive Targets v Negotiate initial target cost. When the contract is “firmed up” if the target cost is decreased, the difference between the final fixed price and the target cost is split between the government and the contractor (contractor receives split in addition to the contract price).

FP Incentive Successive Targets v If the target price is increased at the time of “firm-up” then the contractor has a percentage of the increase deducted from his ceiling on profits.

Fixed Price with Redetermination v The government and contractor agree in advance to have two fixed price contracts--one negotiated now and one to be negotiated later.

FP with Economic Price Adj. v Designed to cope with economic uncertainties that threaten long-run, fixed price type contracts.

FP with Economic Price Adj. v These contracts provide for contract increases or decreases to protect the Government and contractor from the effect of economic changes.

Cost Plus Incentive Fee v Injects an incentive sharing formula into what would otherwise be a costreimbursement with a 100/0 share.

Cost Plus Incentive Fee v Three characteristics differentiate this contract from Fixed Price Incentive Fee or Fixed Price Incentive Target contracts: – – – There is no ceiling price. Total reimbursable costs are the final contract costs. The maximum fee of the contractor is subject to limitations.

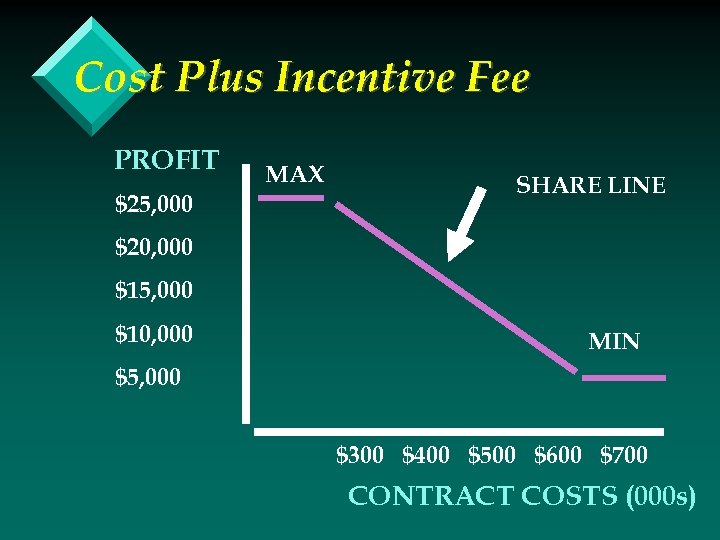

Cost Plus Incentive Fee PROFIT $25, 000 MAX SHARE LINE $20, 000 $15, 000 $10, 000 MIN $5, 000 $300 $400 $500 $600 $700 CONTRACT COSTS (000 s)

Other Contract Types v Cost plus fixed fee--self explanatory. v Cost contract--no profit is paid. Used for research contracts. v Cost sharing--government reimburses contractor a predetermined percentage of costs. Used for research contracts.

Other Contract Types v Time and materials--this arrangement is used to buy labor loaded with indirect costs and profit, and materials which are loaded with indirect costs but no profit. v Labor hour contract--same as above except materials are not purchased under the contract.

Specific guidelines for. . . v Defense Contractors v Construction Contractors v General Contractors

Contract Phases v Preparing to bid v Bidding v Tracking costs v Reporting costs v Managing contracts v Final analysis

Preparing to Bid Contracts

Decide. . . v The number and kind of cost pools you will use. v The types of rates you will use to distribute indirect costs to contracts. v The rate base or denominator activity to be used in calculating the rate.

Typical Rates: v Overhead rates (factory or on-site OH). v Materials handling rates (purchasing & materials handling costs. v General and Administrative (G&A) rates (non overhead administrative costs). v Other. Rate = Estimated Indirect Cost Pool Denominator Activity

Typical Denominator Activities: v Direct or loaded labor dollars v Number of Purchase Orders v Total contract costs v Total direct costs v Machine hours v Material costs v Labor hours

Forward Pricing Rates: v Contractor forecasts rates based on historical and estimated indirect costs and projected denominator volume. v Defense Contract Audit Agency (DCAA) audits proposed rates and makes a recommendation to the Government. v Once rates are accepted they are typically used to bid all contracts for the fiscal year.

Preparing to Bid v Once you have decided on the rates you will use, prepare estimates of indirect costs pools for the year. v Then prepare estimates of company direct contract costs for the coming year (direct labor, direct materials, travel, etc. ) and any other denominator activity to be used in calculating rates.

Preparing to Bid v Calculate rates. – Negotiate calculated rates with Government if you are a defense contractor. v Prepare a pro-forma financial statement based on projected direct and indirect costs.

Problem 1 v Tri. Star is a defense contractor v It has three indirect cost rates – Overhead rate – base is direct labor dollars – Materials handling rate – base is direct material dollars – General and administrative rate (G&A) – base is total costs excluding G&A

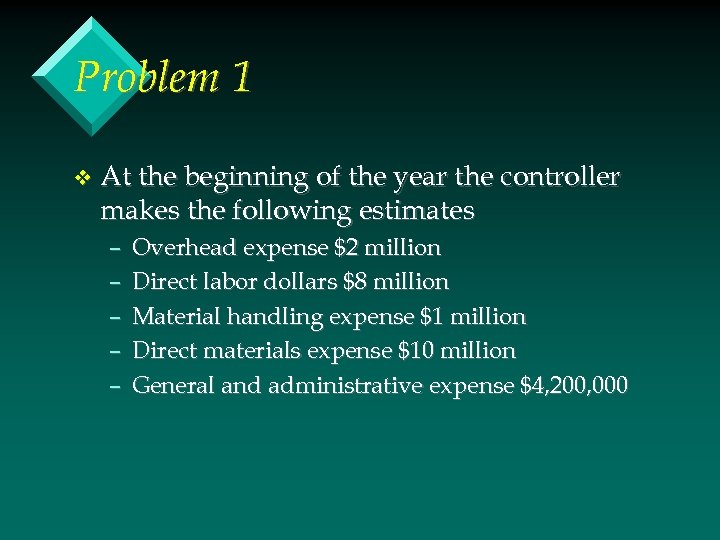

Problem 1 v At the beginning of the year the controller makes the following estimates – – – Overhead expense $2 million Direct labor dollars $8 million Material handling expense $1 million Direct materials expense $10 million General and administrative expense $4, 200, 000

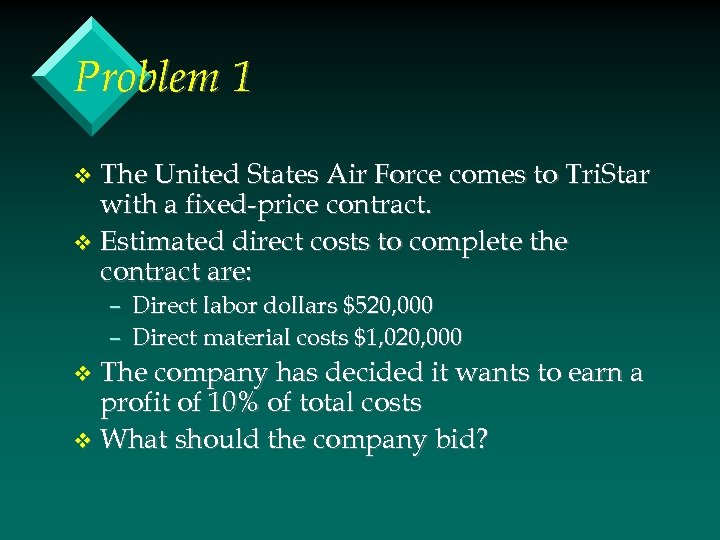

Problem 1 The United States Air Force comes to Tri. Star with a fixed-price contract. v Estimated direct costs to complete the contract are: v – Direct labor dollars $520, 000 – Direct material costs $1, 020, 000 The company has decided it wants to earn a profit of 10% of total costs v What should the company bid? v

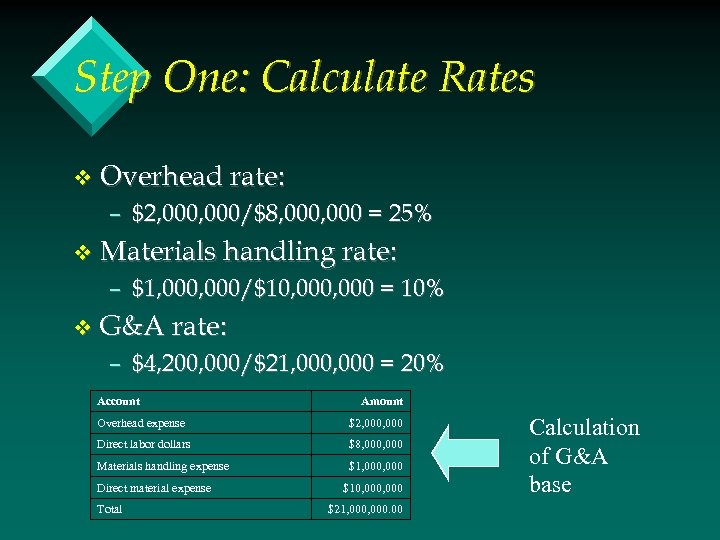

Step One: Calculate Rates v Overhead rate: – $2, 000/$8, 000 = 25% v Materials handling rate: – $1, 000/$10, 000 = 10% v G&A rate: – $4, 200, 000/$21, 000 = 20% Account Amount Overhead expense $2, 000 Direct labor dollars $8, 000 Materials handling expense $1, 000 Direct material expense Total $10, 000 $21, 000. 00 Calculation of G&A base

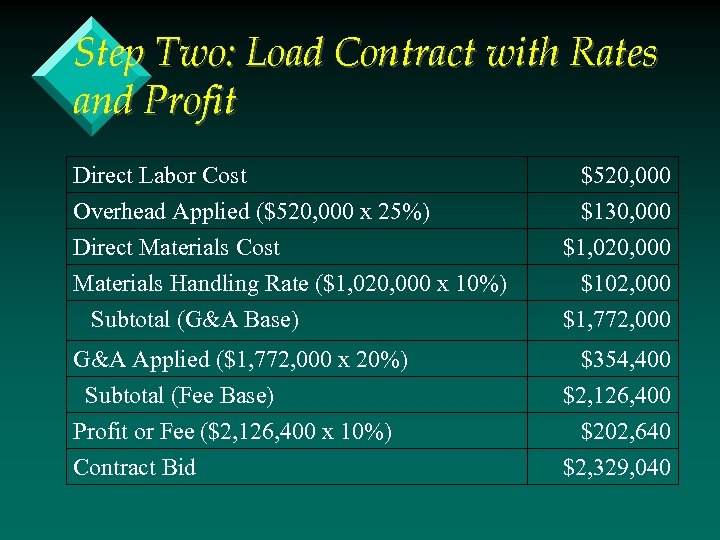

Step Two: Load Contract with Rates and Profit Direct Labor Cost Overhead Applied ($520, 000 x 25%) Direct Materials Cost Materials Handling Rate ($1, 020, 000 x 10%) Subtotal (G&A Base) G&A Applied ($1, 772, 000 x 20%) Subtotal (Fee Base) Profit or Fee ($2, 126, 400 x 10%) Contract Bid $520, 000 $130, 000 $1, 020, 000 $102, 000 $1, 772, 000 $354, 400 $2, 126, 400 $202, 640 $2, 329, 040

Estimating Contract Costs

Estimation Methodologies v Round table estimating v Estimation by comparison v Detailed estimating

Round Table Estimating v Representatives of interested departments such as Engineering, Manufacturing, Contracts and Purchasing are brought together to estimate costs based on market conditions.

Round Table Estimating: v The estimate is developed without the benefit of design drawings. v Advantages of this method include speed of application and low cost. v Disadvantages include greater risk. It should only be used on projects involving existing.

Estimation by Comparison v Products similar to those requested are selected and compared. Costs are adjusted to the new task.

Detailed Estimating: v This method is characterized by a thorough analysis of all components, tasks, etc. Break each product component into parts, operations, and cost elements. – Tools used include specifications, drawings, bill of materials, production rates, production quantities, etc. –

Detailed Estimating: v The most important step is the preparation of the functional specification and detailed design. The more complete these documents are, the easier it will be to price the contract.

Detailed Estimating: v It is often to divide the work statement into two contracts. A cost reimbursement contract for the preparation of a functional specification and detailed design. – A fixed price contract for the manufacture or construction of the product from the completed design documents. –

Bidding the Contract

Bidding a Contract v Review project’s functional specification and detailed design. v Review bidding requirements & contract conditions. Bonding and insurance requirements – Method and timing of progress payments –

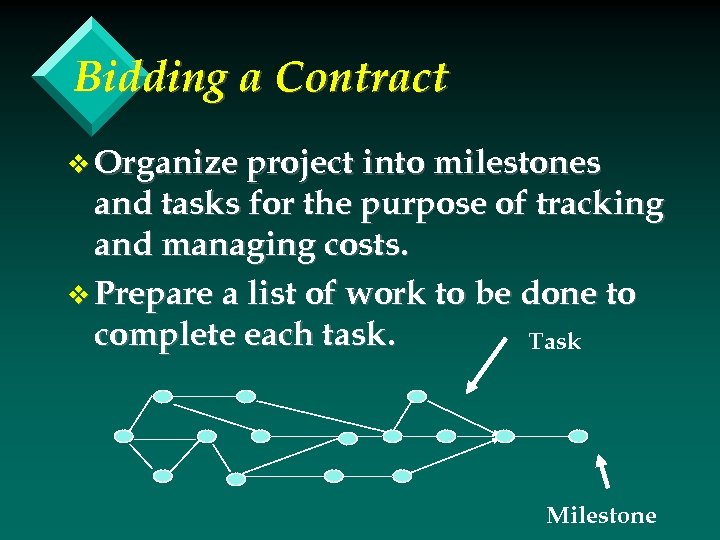

Bidding a Contract v Organize project into milestones and tasks for the purpose of tracking and managing costs. v Prepare a list of work to be done to complete each task. Task Milestone

Bidding a Contract v Verify that you have the technical resources (inhouse or through subcontractors) to do the work.

Assign direct cost estimates to each task. v Determine material quantities and costs for each task. v Determine labor hours and costs by labor category. v Estimate travel and equipment costs. v Get bids from subcontractors. v Estimate contingency costs

Bidding a Contract v Add up the cost of all tasks to determine the estimated direct costs to complete the contract. v Load direct costs using forwardpricing or predetermined rates.

Bidding a Contract v Determine profit mark-up. Add to contract to determine total contract price. v Adjust price if necessary for market factors including competition.

Bidding a Contract v Perform cash flow analysis to determine that you have the working capital to do the job.

Tracking Contract Costs

Track Contract Costs by: v Task – Cost Type u Labor u Material u Equipment u Travel v Use percentage of completion or calculate estimated cost to complete.

Job Costing--Report by Task: v Original Budget v Percent of completion Dollars spent v Budget to-date (i. e “dollars earned”) v Spent-to-date v Estimated cost to complete v Estimated over or under-run at contract completion

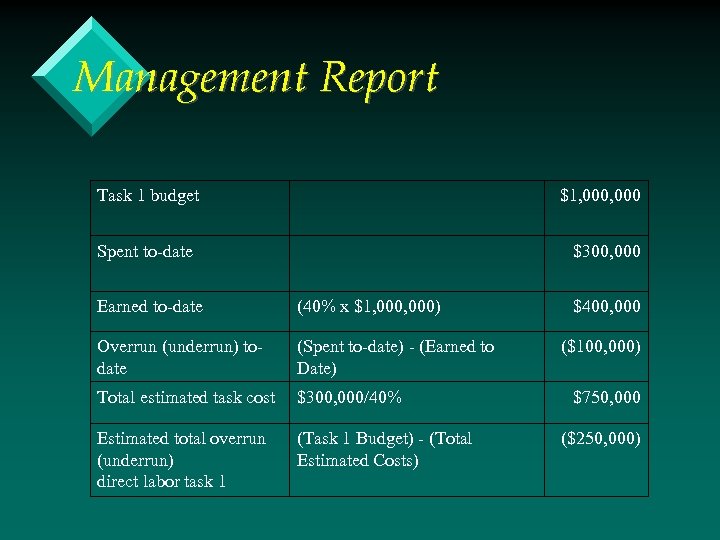

Problem 2 Consolidated Defense Products has a fixedprice contract v Direct labor has been broken into 15 tasks v Task one has a budget of $1, 000 v At the end of October $300, 000 has been charged against task one v The supervisor estimates that the task is 40% complete v Prepare a management report on task one v

Management Report Task 1 budget $1, 000 Spent to-date $300, 000 Earned to-date (40% x $1, 000) Overrun (underrun) todate (Spent to-date) - (Earned to Date) Total estimated task cost $300, 000/40% Estimated total overrun (underrun) direct labor task 1 (Task 1 Budget) - (Total Estimated Costs) $400, 000 ($100, 000) $750, 000 ($250, 000)

Periodic Revenue Earned v Calculation of revenue depends on contract type: Fixed price contracts: Percent of completion is appropriate. – Cost reimbursement--actual costs incurred loaded with forward pricing rates. – Other. –

At end of accounting period v Calculate actual overhead rates, compare to budget. v Calculate actual OH rates. v Prepare income statement, show variances for direct contract costs by contract, indirect costs cost pool. v Incorporate what you have learned into next year’s rates.

The End

c8901bd543c12d7eba6d7c9857bf7105.ppt