contracts.ppt

- Количество слайдов: 24

Contract Theory

Basic Principles of Contractual Obligations • Freedom of Contract freedom to: (1) conclude a contract or not, (2) choose one’s partner or partners to a contract, (3) determine the contract’s content, (4) choose the form of the contract • Liability from Contract

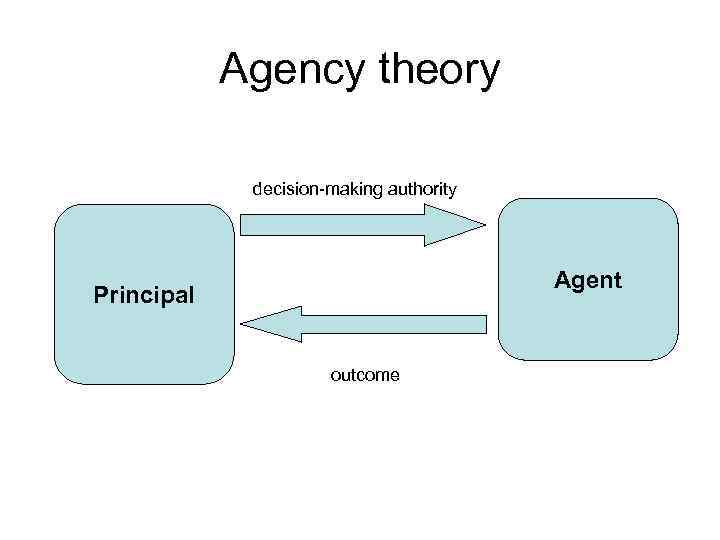

Agency theory decision-making authority Agent Principal outcome

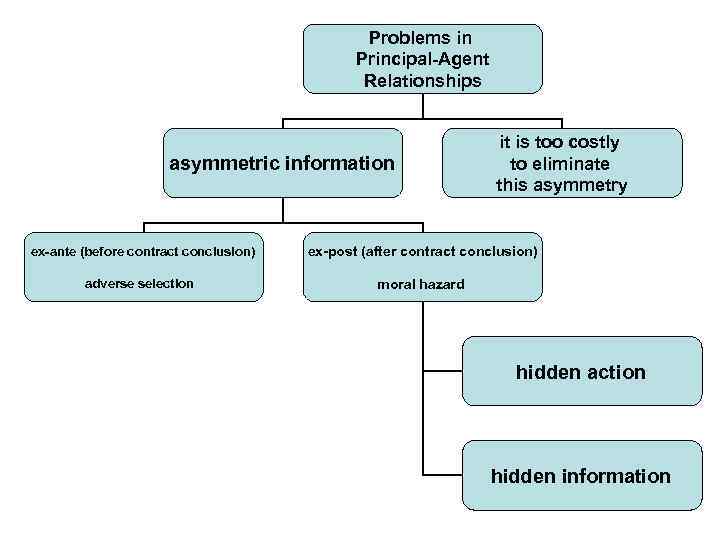

Problems in Principal-Agent Relationships asymmetric information it is too costly to eliminate this asymmetry ex-ante (before contract conclusion) ex-post (after contract conclusion) adverse selection moral hazard hidden action hidden information

Agency costs • monitoring expenditure of the Principal for example: internal audit • the bonding expenditure of the Agent for example: reputation, acquiring specific knowledge (human capital) • residual loss

Moral Hazard: Simple Model Some general comments • welfare losses are generally unavoidable • both P and A are perfect rational • P is blind with respect to the two parameters: the A’s effort level and the actual moves of nature • the information constraints do not concern the future • contracts are complete

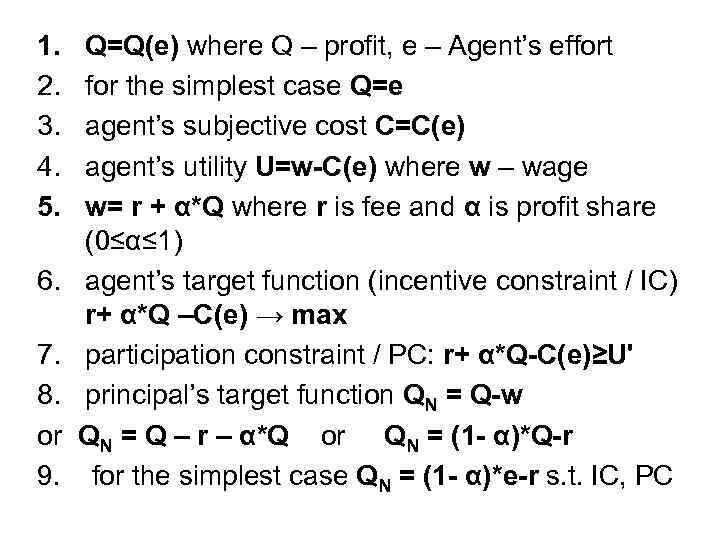

1. 2. 3. 4. 5. 6. 7. 8. or 9. Q=Q(e) where Q – profit, e – Agent’s effort for the simplest case Q=e agent’s subjective cost C=C(e) agent’s utility U=w-C(e) where w – wage w= r + α*Q where r is fee and α is profit share (0≤α≤ 1) agent’s target function (incentive constraint / IC) r+ α*Q –C(e) → max participation constraint / PC: r+ α*Q-C(e)≥Uʹ principal’s target function QN = Q-w QN = Q – r – α*Q or QN = (1 - α)*Q-r for the simplest case QN = (1 - α)*e-r s. t. IC, PC

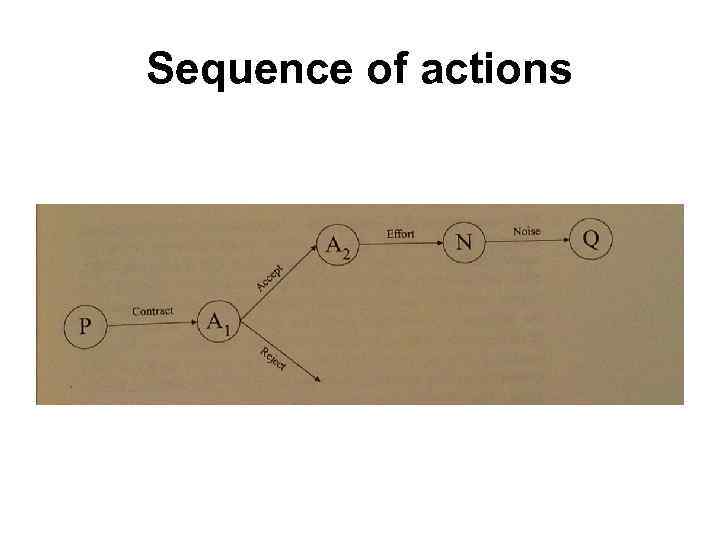

Sequence of actions

Adverse selection Some general comments • Incentives are used to ensure that honesty is the A’s best policy. • Perfect rationality of the principal and agents, perfect foresight, and complete contracts enforceable by courts • There is only one hidden characteristic. The P does not know A’s subjective costs. • The problem of unpredictable events is left aside. Individual expectations are perfectly fulfilled and contracts between individuals, do not have to be changed during the period of their execution.

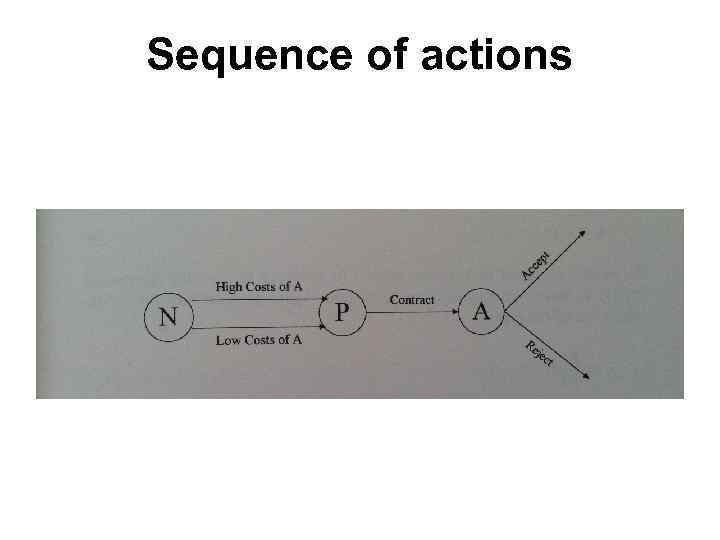

Sequence of actions

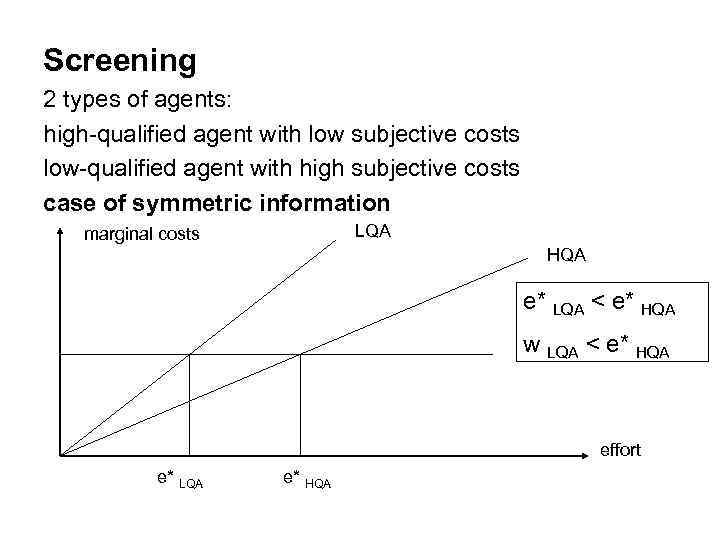

Screening 2 types of agents: high-qualified agent with low subjective costs low-qualified agent with high subjective costs case of symmetric information LQA marginal costs HQA e* LQA < e* HQA w LQA < e* HQA effort e* LQA e* HQA

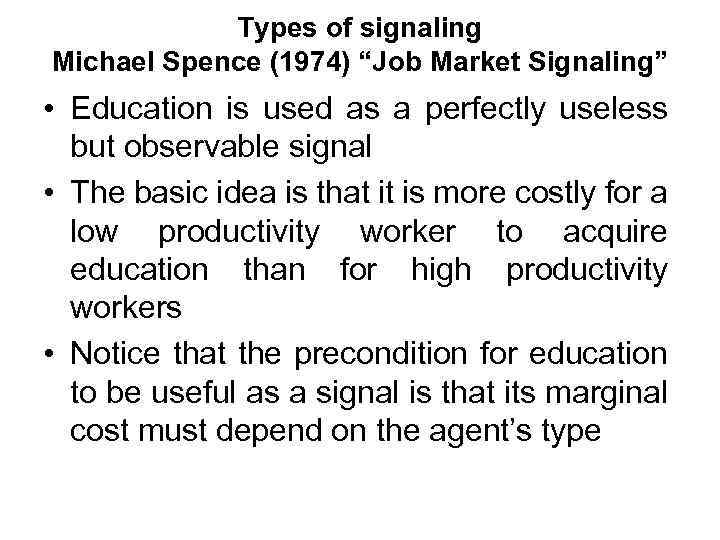

Signaling Sequence of actions 1. nature selects each agent’s type; this is privately observed 2. agents choose a signalling activity 3. based on the observed signal, firms make wage offers 4. agents select one preferred contract 5. outcomes & payoffs realize. Some general comments workers privately know their productivity r r depends on the private type θ, where θ=L (low quality) or θ=H (high quality) 2 firms hire workers on the basis of the expected productivity r. L < E[r] < r. H of a worker on the market

Types of signaling Michael Spence (1974) “Job Market Signaling” • Education is used as a perfectly useless but observable signal • The basic idea is that it is more costly for a low productivity worker to acquire education than for high productivity workers • Notice that the precondition for education to be useful as a signal is that its marginal cost must depend on the agent’s type

Relational Contract Theory

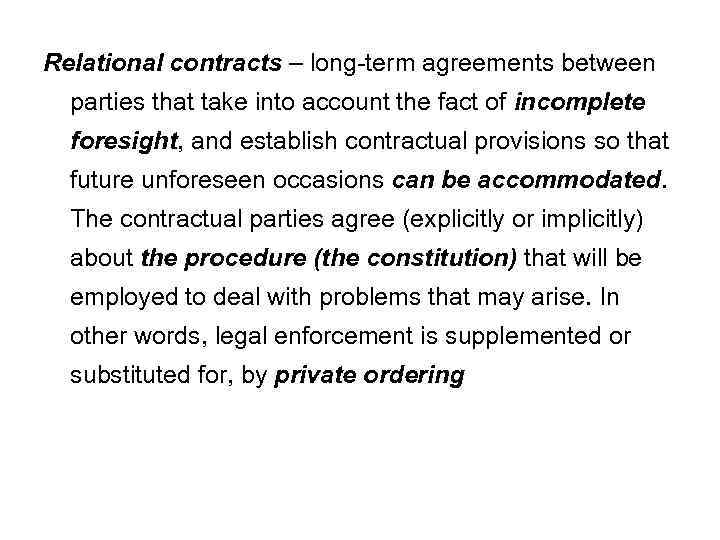

Relational contracts – long-term agreements between parties that take into account the fact of incomplete foresight, and establish contractual provisions so that future unforeseen occasions can be accommodated. The contractual parties agree (explicitly or implicitly) about the procedure (the constitution) that will be employed to deal with problems that may arise. In other words, legal enforcement is supplemented or substituted for, by private ordering

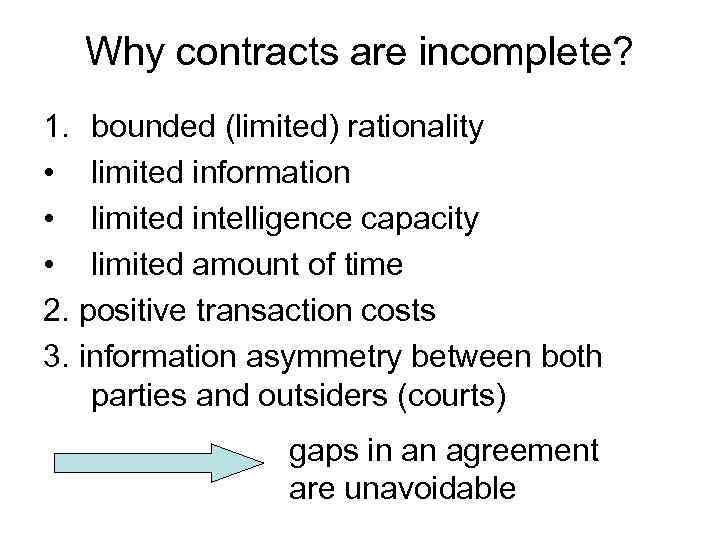

Why contracts are incomplete? 1. bounded (limited) rationality • limited information • limited intelligence capacity • limited amount of time 2. positive transaction costs 3. information asymmetry between both parties and outsiders (courts) gaps in an agreement are unavoidable

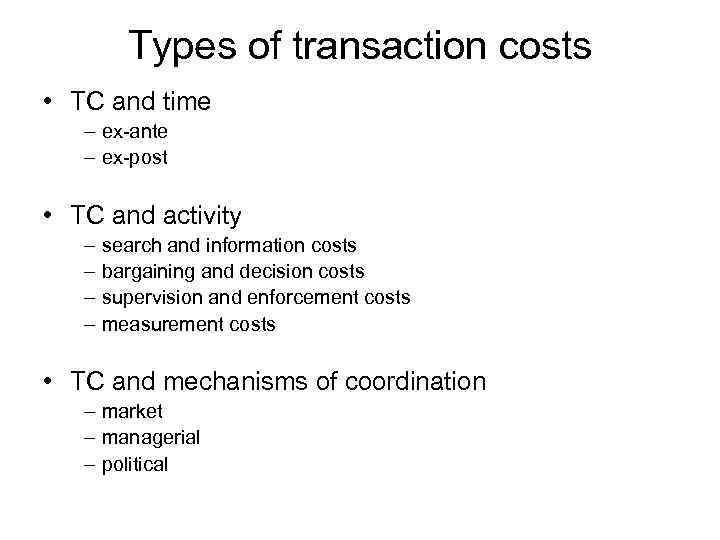

Types of transaction costs • TC and time – ex-ante – ex-post • TC and activity – search and information costs – bargaining and decision costs – supervision and enforcement costs – measurement costs • TC and mechanisms of coordination – market – managerial – political

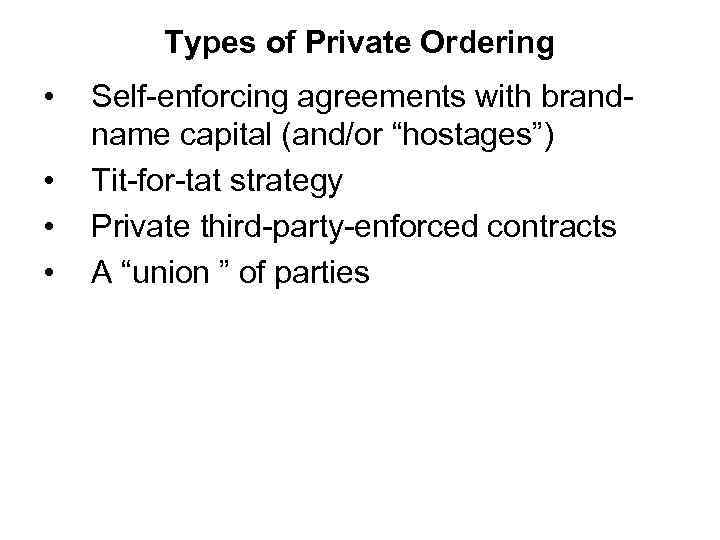

Types of Private Ordering • • Self-enforcing agreements with brandname capital (and/or “hostages”) Tit-for-tat strategy Private third-party-enforced contracts A “union ” of parties

Transaction cost economics Aim: Explain and find the efficient governance structure (firm, market, hybrid) in certain institutional environment

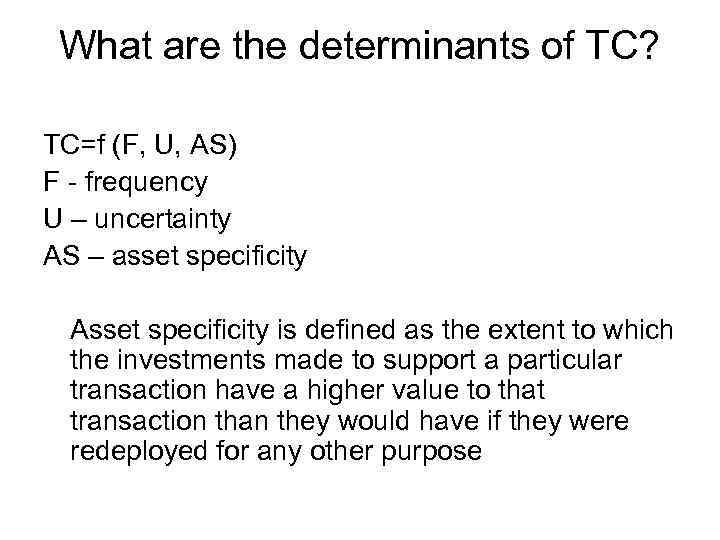

What are the determinants of TC? TC=f (F, U, AS) F - frequency U – uncertainty AS – asset specificity Asset specificity is defined as the extent to which the investments made to support a particular transaction have a higher value to that transaction than they would have if they were redeployed for any other purpose

Asset specificity Williamson • Site specificity, e. g. a natural resource available at a certain location and movable only at great cost; • Physical asset specificity, e. g. a specialized machine tool or complex computer system designed for a single purpose; • Human asset specificity, i. e. , highly specialized human skills, arising in a learning by doing fashion; • Dedicated assets, i. e. a discrete investment in a plant that cannot readily be put to work for other purposes. • Time specificity, an asset is time specific if its value is highly dependent on its reaching the user within a specified, relatively limited period of time. • Procedural asset specificity incorporates notions of human asset specificity and refers to the degree that an agency's workflows and processes are customized to exploit the other party's capabilities.

Contract classification (Macneil) • Classical contract – simple contract of buying and selling on the market. Short-term, all conditions are fixed. • Neoclassical contract is more dynamic and long-term, it takes into consideration the change circumstances. • Relational contract is a contract whose effect is based upon a relationship of trust between the parties. The explicit terms of the contract are just an outline as there are implicit terms and understandings which determine the behaviour of the parties.

Governance structure classification (Williamson) • Market governance - impersonal transactions across well-functioning markets • Trilateral governance - third-party assistance, in the manner of neoclassical contracting, is used • Bilateral governance - the fundamental transformation applies the fundamental transformation - the process according to which transaction-specific investments reduce the field of available alternatives from a large number (i. e. , the exante bargaining situation) to a small number (i. e. , the ex-post bidding situation) • Unified governance - the case of vertical integration

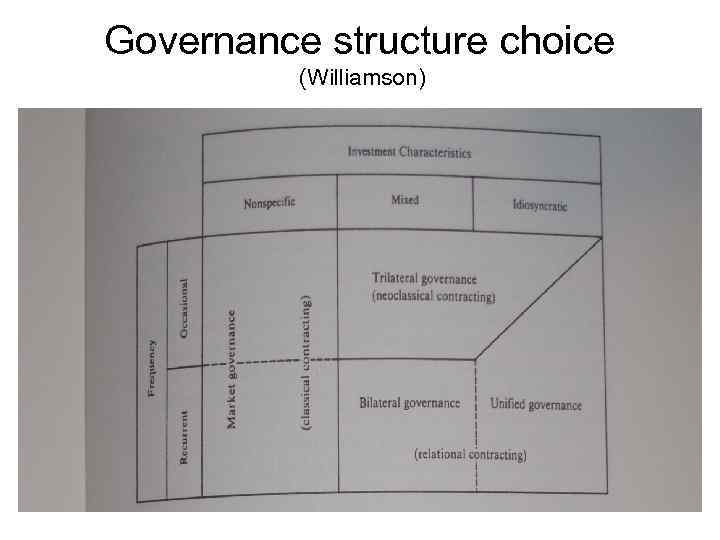

Governance structure choice (Williamson)

contracts.ppt