18eaeb04f58146f166886953edb04cd0.ppt

- Количество слайдов: 11

Contemporary Economics: An Applications Approach By Robert J. Carbaugh 3 rd Edition Chapter 16: The United States and the Global Economy Copyright © 2005 by South-Western, a division of Thomson Learning. All rights reserved.

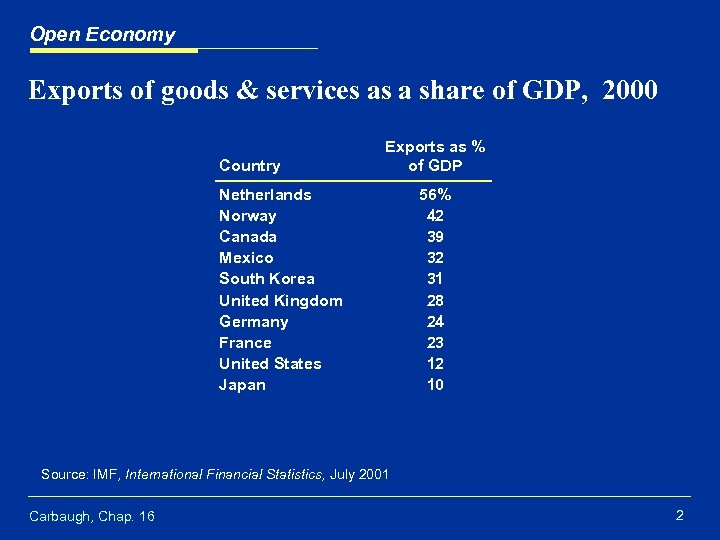

Open Economy Exports of goods & services as a share of GDP, 2000 Country Exports as % of GDP Netherlands Norway Canada Mexico South Korea United Kingdom Germany France United States Japan 56% 42 39 32 31 28 24 23 12 10 Source: IMF, International Financial Statistics, July 2001 Carbaugh, Chap. 16 2

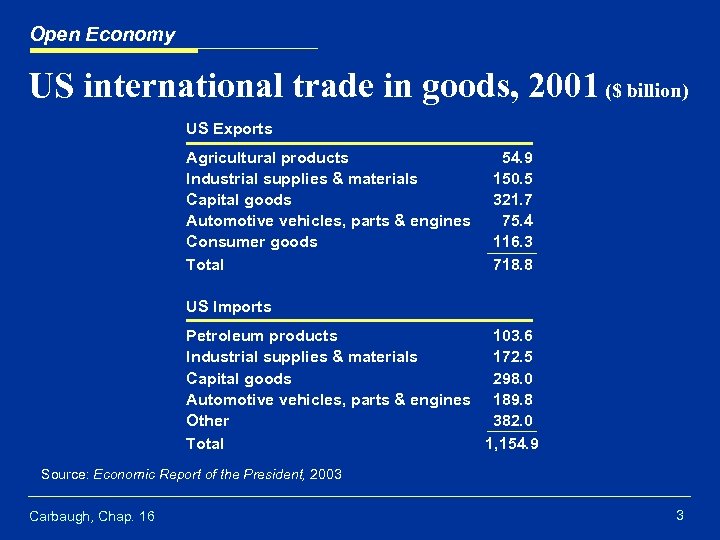

Open Economy US international trade in goods, 2001 ($ billion) US Exports Agricultural products Industrial supplies & materials Capital goods Automotive vehicles, parts & engines Consumer goods Total 54. 9 150. 5 321. 7 75. 4 116. 3 718. 8 US Imports Petroleum products 103. 6 Industrial supplies & materials 172. 5 Capital goods 298. 0 Automotive vehicles, parts & engines 189. 8 Other 382. 0 Total 1, 154. 9 Source: Economic Report of the President, 2003 Carbaugh, Chap. 16 3

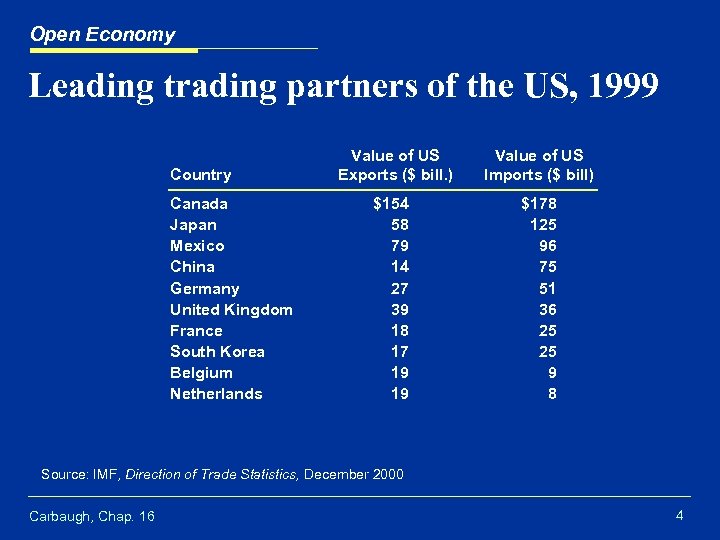

Open Economy Leading trading partners of the US, 1999 Country Canada Japan Mexico China Germany United Kingdom France South Korea Belgium Netherlands Value of US Exports ($ bill. ) Value of US Imports ($ bill) $154 58 79 14 27 39 18 17 19 19 $178 125 96 75 51 36 25 25 9 8 Source: IMF, Direction of Trade Statistics, December 2000 Carbaugh, Chap. 16 4

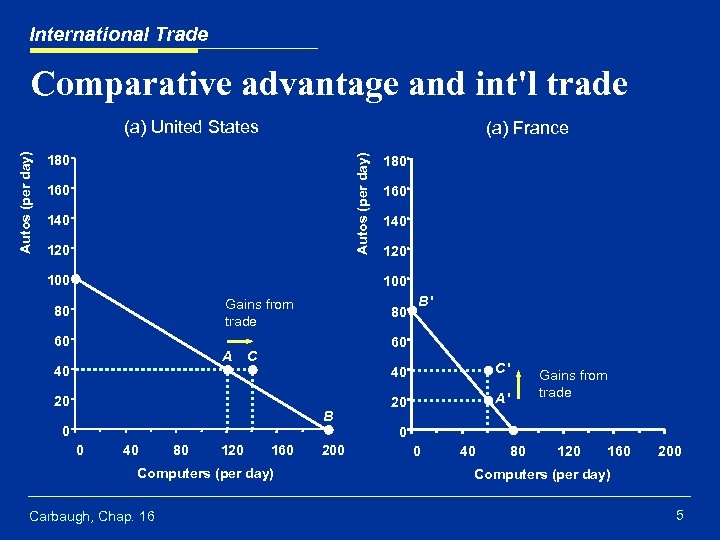

International Trade Comparative advantage and int'l trade (a) France 180 Autos (per day) (a) United States 160 140 120 100 180 160 140 120 100 Gains from trade 80 60 A 80 B' 60 C 40 40 20 B 0 0 40 80 120 160 Computers (per day) Carbaugh, Chap. 16 200 C' 20 A' Gains from trade 0 0 40 80 120 160 200 Computers (per day) 5

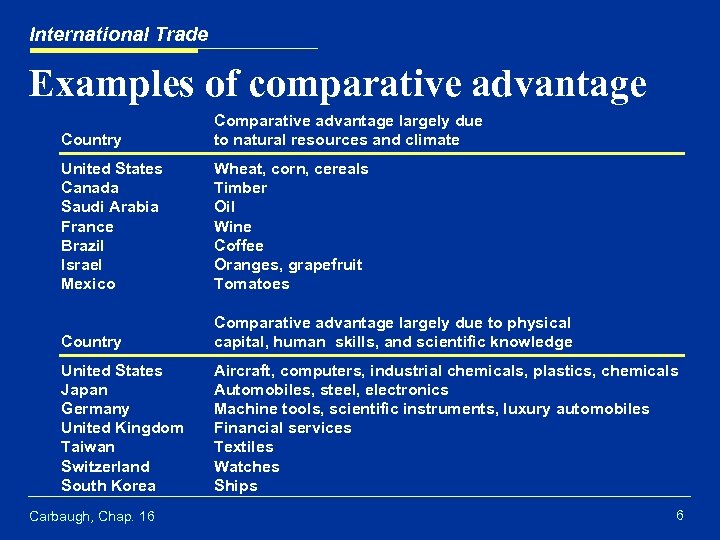

International Trade Examples of comparative advantage Country Comparative advantage largely due to natural resources and climate United States Canada Saudi Arabia France Brazil Israel Mexico Wheat, corn, cereals Timber Oil Wine Coffee Oranges, grapefruit Tomatoes Country Comparative advantage largely due to physical capital, human skills, and scientific knowledge United States Japan Germany United Kingdom Taiwan Switzerland South Korea Aircraft, computers, industrial chemicals, plastics, chemicals Automobiles, steel, electronics Machine tools, scientific instruments, luxury automobiles Financial services Textiles Watches Ships Carbaugh, Chap. 16 6

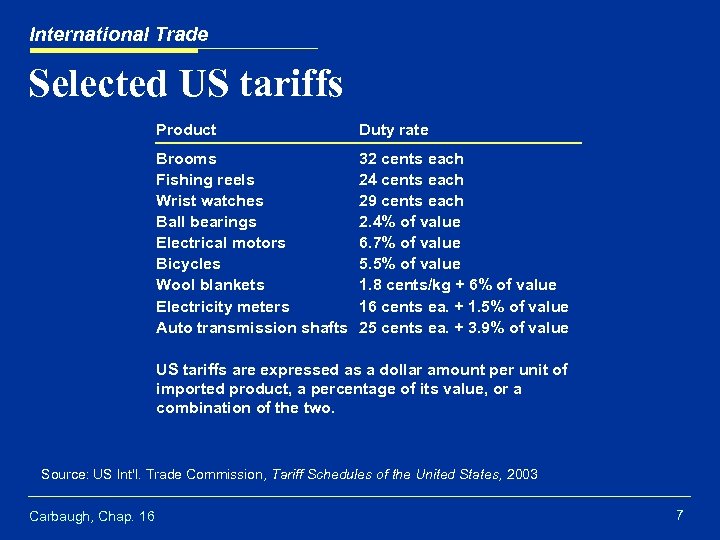

International Trade Selected US tariffs Product Duty rate Brooms Fishing reels Wrist watches Ball bearings Electrical motors Bicycles Wool blankets Electricity meters Auto transmission shafts 32 cents each 24 cents each 29 cents each 2. 4% of value 6. 7% of value 5. 5% of value 1. 8 cents/kg + 6% of value 16 cents ea. + 1. 5% of value 25 cents ea. + 3. 9% of value US tariffs are expressed as a dollar amount per unit of imported product, a percentage of its value, or a combination of the two. Source: US Int'l. Trade Commission, Tariff Schedules of the United States, 2003 Carbaugh, Chap. 16 7

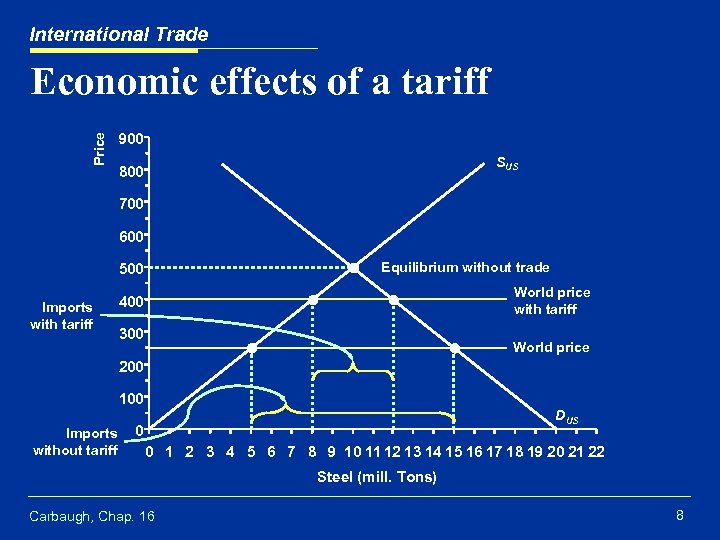

International Trade Price Economic effects of a tariff 900 SUS 800 700 600 Equilibrium without trade 500 Imports with tariff World price with tariff 400 300 World price 200 100 Imports without tariff DUS 0 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 Steel (mill. Tons) Carbaugh, Chap. 16 8

Tariffs Estimated consumer cost of saving US jobs through trade protection Industry Consumer cost per job Meat $1, 850, 000 Maritime transport 1, 138, 775 Dairy 484, 878 Sugar 390, 200 Motor vehicles 208, 824 Textile and apparel 182, 545 Steel 128, 063 Nonrubber footwear 111, 702 Source: US Int'l Trade Commission, Economic Effects of Significant US Import Restraints, December 1995 Carbaugh, Chap. 16 9

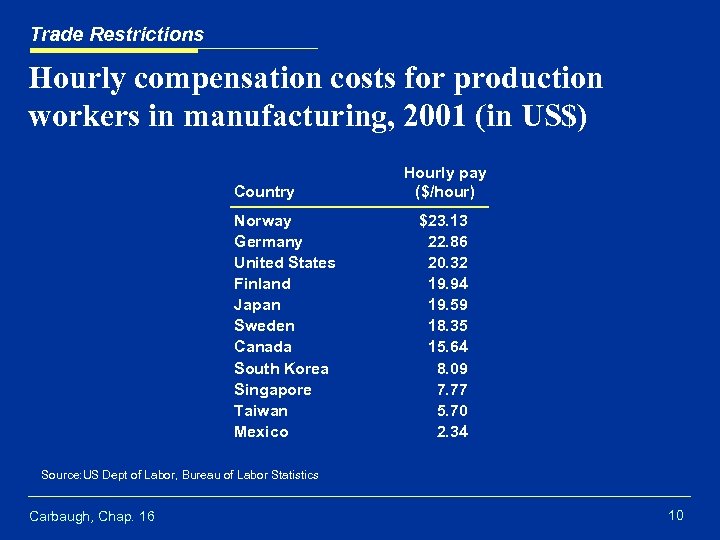

Trade Restrictions Hourly compensation costs for production workers in manufacturing, 2001 (in US$) Country Norway Germany United States Finland Japan Sweden Canada South Korea Singapore Taiwan Mexico Hourly pay ($/hour) $23. 13 22. 86 20. 32 19. 94 19. 59 18. 35 15. 64 8. 09 7. 77 5. 70 2. 34 Source: US Dept of Labor, Bureau of Labor Statistics Carbaugh, Chap. 16 10

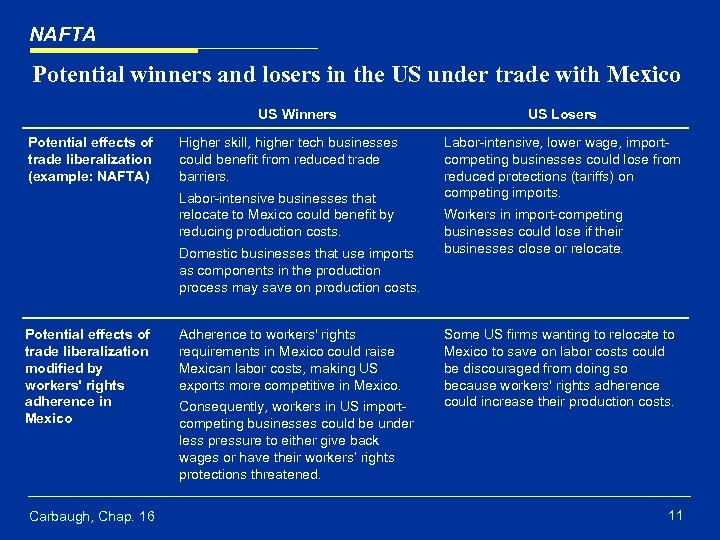

NAFTA Potential winners and losers in the US under trade with Mexico US Winners Potential effects of trade liberalization (example: NAFTA) Higher skill, higher tech businesses could benefit from reduced trade barriers. Labor-intensive businesses that relocate to Mexico could benefit by reducing production costs. Domestic businesses that use imports as components in the production process may save on production costs. Potential effects of trade liberalization modified by workers' rights adherence in Mexico Carbaugh, Chap. 16 Adherence to workers' rights requirements in Mexico could raise Mexican labor costs, making US exports more competitive in Mexico. Consequently, workers in US importcompeting businesses could be under less pressure to either give back wages or have their workers’ rights protections threatened. US Losers Labor-intensive, lower wage, importcompeting businesses could lose from reduced protections (tariffs) on competing imports. Workers in import-competing businesses could lose if their businesses close or relocate. Some US firms wanting to relocate to Mexico to save on labor costs could be discouraged from doing so because workers' rights adherence could increase their production costs. 11

18eaeb04f58146f166886953edb04cd0.ppt