adf276fdb37d5d54b9c2ed0128667e69.ppt

- Количество слайдов: 41

Contact Information www. joelweintraub. com www. healthhumor. com 610 -825 -2179

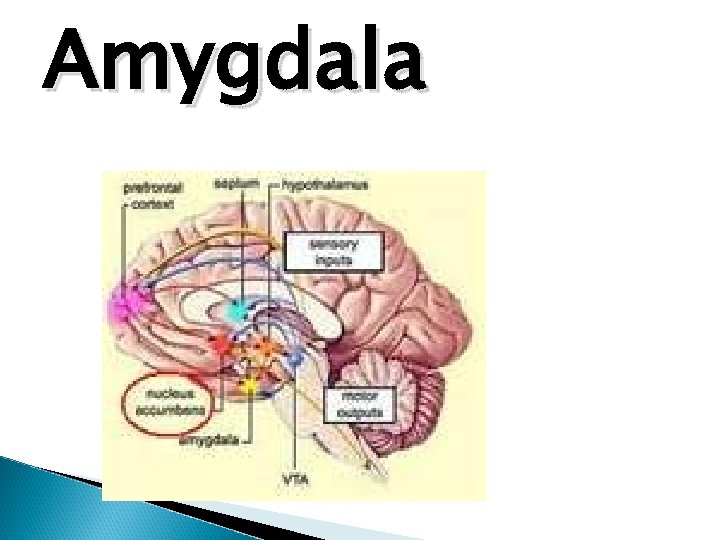

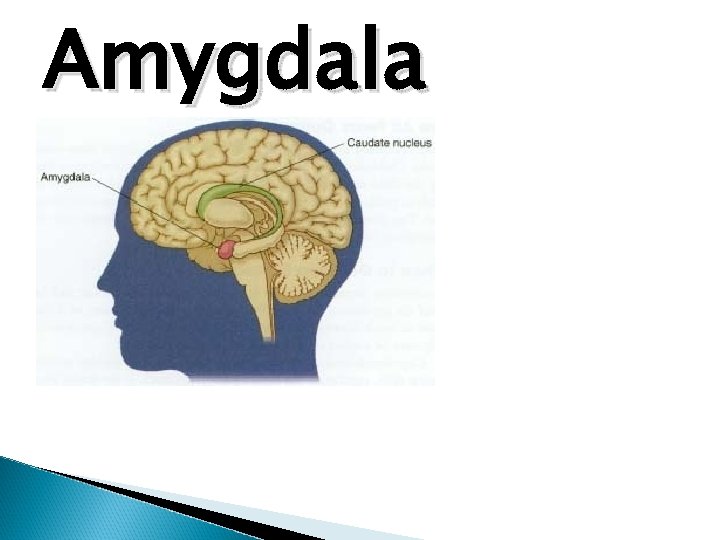

Money and the Brain The Brain and Investing Nucleus Accumbens Intraparietal Sulcus Amygdala Pre-Frontal Cortex

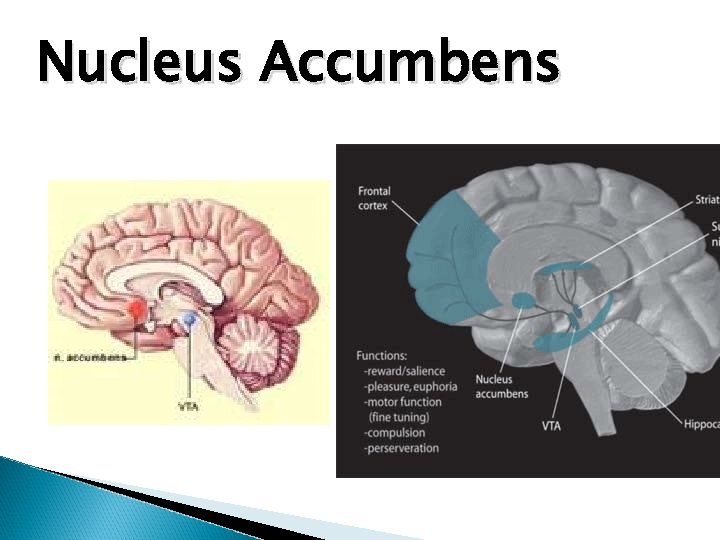

Nucleus Accumbens

What Does the Nucleus Accumbens Do? ●Food ●Water ●Sex ●Money ●Risk

Nucleus Accumbens Brains center for emotional rewards Triggers a feeling of greed from just getting the chance to win NA responds before the pre-frontal cortex is aware of the potential for winning NA flares as if you are on cocaine

When you Win the Lottery You don’t think of the negative when you buy a lottery ticket. You are still in the dream state. After you win now you have details to contend with This is also what occurs when the market is moving up

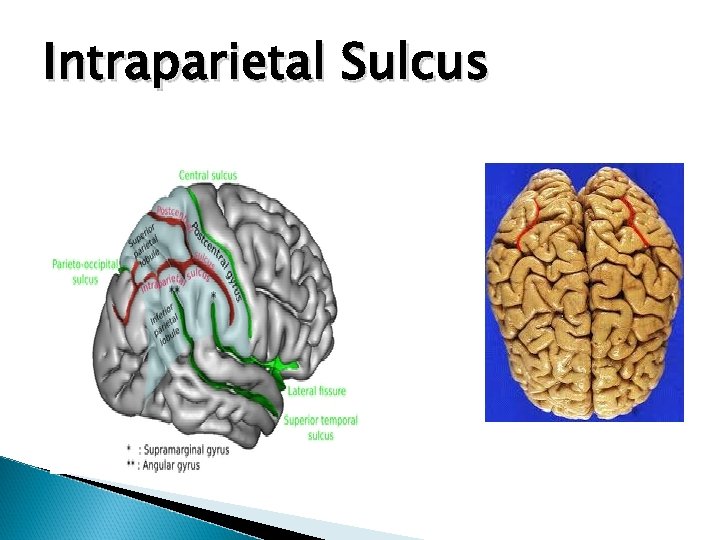

Intraparietal Sulcus Doesn’t like to lose money

Gambling You are guaranteed to win $100 Would you take the chance to double $100 with the risk of losing it all? The Intraparietal Sulcus fires with the chance of losing it all Why will some people double down? Helps us Imagine the Outcome of Future Events ◦ The gambling sets off intense images of fear Most will favor the sure thing

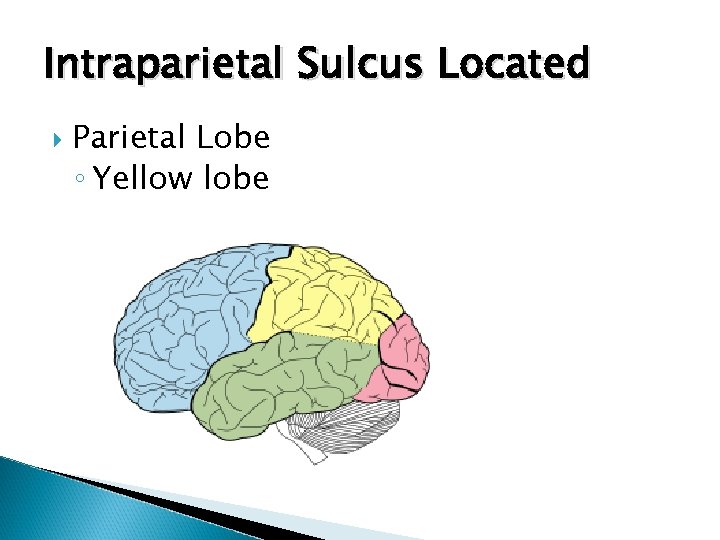

Intraparietal Sulcus Located Parietal Lobe ◦ Yellow lobe

Intraparietal Sulcus

Intraparietal Sulcus Sure loss of $100 You can try to break even but risk losing $200 ◦ Intraparietal Sulcus fires at losing $100 or $200 ◦ The Intraparietal Sulcus does not fire with the chance of breaking even Most will prefer the chance to break even This is why investors don’t want to sell a losing stock

Amgdala How does the amygdala interfere with rational investing?

What is the Amygdala and What Causes it to React? The more recent and vivid an image the greater the impact

Amygdala

Amygdala

How to Reduce Fear in Your Clients

Who has a Better Investing Record? Men By or women what margin % Why?

Who Does Better at Investing? Women 1% gain over men The reason ◦ Men view negative events (natural disasters, crime and financial disasters with anger Women tend to be more fearful than angry

Two Different Viewpoints Through the lens of anger ◦ the world seems more certain, more amenable to our control and less risky Through the lens of fear ◦ the world appears full of uncertainty, beyond our control and rife with risk women trade less frequently hold less volatile portfolios expect lower returns than men

Our Irrational Fear What is riskier? Alligators Bear Deer Shark Snakes

Answer to What is Riskier Deer caused 130, 00 fatalities ◦ 7 X more than all other animals combined

Fear Match Cause of Death with number of annual fatalities ◦ Suicide ◦ Homicide ◦ War ◦ 815, 00 ◦ 520, 00 ◦ 310, 00

Recent Survey with 1000 Investors They thought there was a 51% chance any year that the market could drop by 1/3

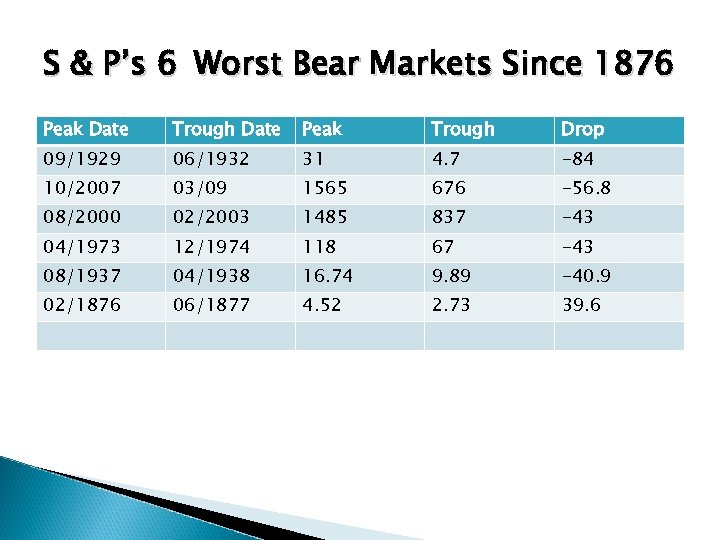

S & P’s 6 Worst Bear Markets Since 1876 Peak Date Trough Date Peak Trough Drop 09/1929 06/1932 31 4. 7 -84 10/2007 03/09 1565 676 -56. 8 08/2000 02/2003 1485 837 -43 04/1973 12/1974 118 67 -43 08/1937 04/1938 16. 74 9. 89 -40. 9 02/1876 06/1877 4. 52 2. 73 39. 6

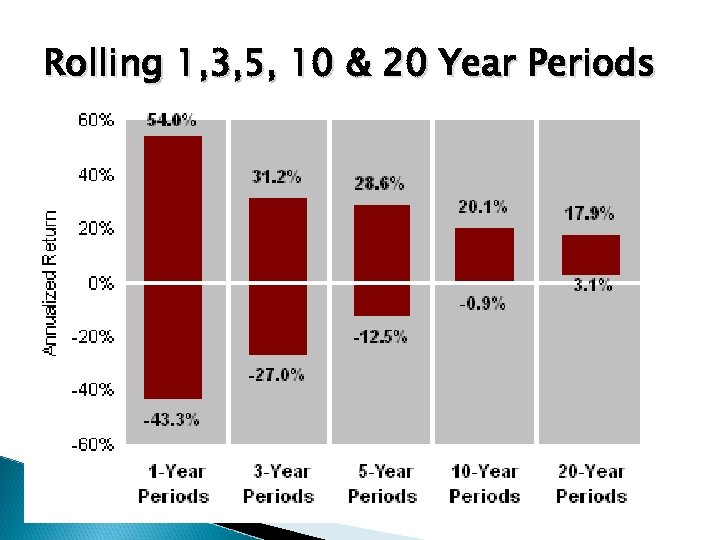

Rolling 1, 3, 5, 10 & 20 Year Periods

Real Risk Inflation eroding savings Only 31% of people surveyed were worried they might run out of money during retirement

Pre-Frontal Cortex This is where you come in

Who wants to be a Millionaire? Emotional vs. Rational Investing Doubling a penny to $1 million How $8, 000 can compound to $1 Million History of the Stock Market Rule of 72 ◦ 72/Rate of Return = Year 72/10% = 7. 2 years 72/7. 2% = 10 years It’s only $1/Day Law of diminishing returns ◦ Do you really need that big house or fancy car?

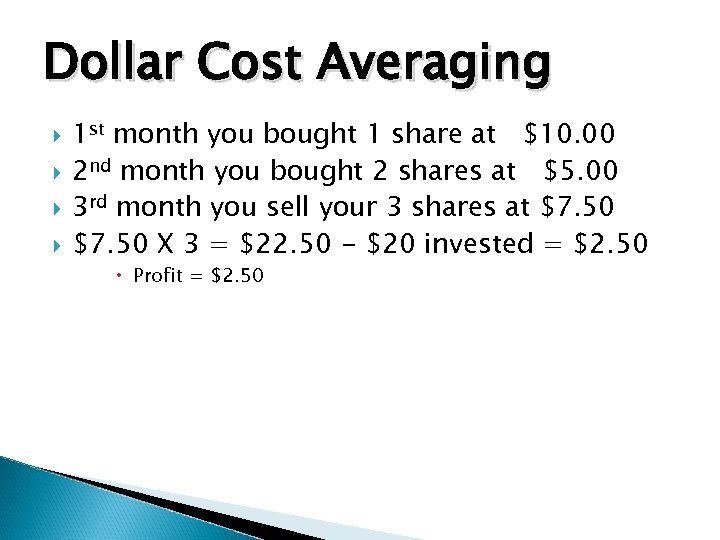

Dollar Cost Averaging Exercise ◦ You invest $10 every month 1 st month the mutual fund is selling for $10. 00 2 nd month the mutual fund is selling for $5. 00 3 rd month the mutual fund is selling for $7. 50 Did you make money, lose money or break even

Dollar Cost Averaging 1 st month you bought 1 share at $10. 00 2 nd month you bought 2 shares at $5. 00 3 rd month you sell your 3 shares at $7. 50 X 3 = $22. 50 - $20 invested = $2. 50 Profit = $2. 50

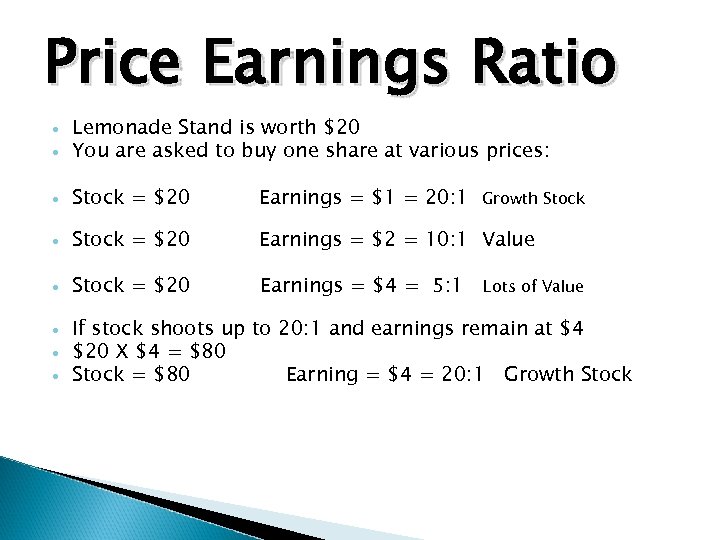

Price Earnings Ratio Lemonade Stand is worth $20 You are asked to buy one share at various prices: Stock = $20 Earnings = $1 = 20: 1 Stock = $20 Earnings = $2 = 10: 1 Value Stock = $20 Earnings = $4 = 5: 1 Growth Stock Lots of Value If stock shoots up to 20: 1 and earnings remain at $4 $20 X $4 = $80 Stock = $80 Earning = $4 = 20: 1 Growth Stock

Stock Market Start with the end in mind How would I feel if the market moved 10 -40% Losing money feels at least 2 x as painful as gaining the same amount Notice the patterns in life

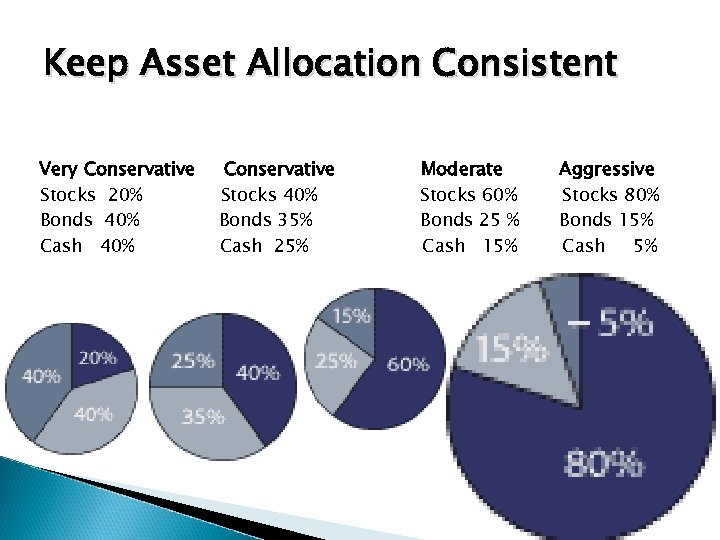

Asset Allocation & Rebalancing Keep consistent ◦Sample Asset Allocation

Keep Asset Allocation Consistent Very Conservative Stocks 20% Bonds 40% Cash 40% Conservative Stocks 40% Bonds 35% Cash 25% Moderate Stocks 60% Bonds 25 % Cash 15% Aggressive Stocks 80% Bonds 15% Cash 5%

Begin With the End in Mind

How to Win In Any Market V U L

When Is It Time to Sell? First Scenario ◦ $100, 000 in mutual fund portfolio Should I sell $10, 000? Market goes down 10% after client sells Market goes up 10% after client sells

When Is It Time to Sell? Second Scenario ◦ $1 million in mutual fund portfolio Should I sell $100, 000? Market goes down 10% after client sells Market goes up 10% after client sells

Motivational Interviewing Don’t tell them what to do Remember you are working as a team

Review The Brain and Investing Nucleus Accumbens Intraparietal Sulcus Amygdala Pre-Frontal Cortex

Contact Information www. joelweintraub. com www. healthhumor. com 610 -825 -2179

adf276fdb37d5d54b9c2ed0128667e69.ppt