CONSINTHERF - SLIDE.pptx

- Количество слайдов: 101

CONSUMPTION & Consumer Markets IN RUSSIAN FEDERATION Andrew V. Galoukhin - assistant professor of Philosophy & Business Ethics

CONSUMPTION & Consumer Markets IN RUSSIAN FEDERATION Andrew V. Galoukhin - assistant professor of Philosophy & Business Ethics

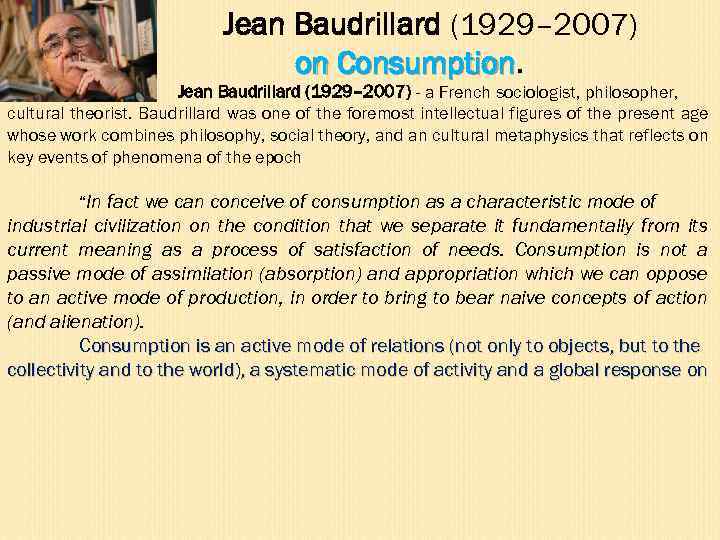

Jean Baudrillard (1929– 2007) on Consumption Jean Baudrillard (1929– 2007) - a French sociologist, philosopher, cultural theorist. Baudrillard was one of the foremost intellectual figures of the present age whose work combines philosophy, social theory, and an cultural metaphysics that reflects on key events of phenomena of the epoch “In fact we can conceive of consumption as a characteristic mode of industrial civilization on the condition that we separate it fundamentally from its current meaning as a process of satisfaction of needs. Consumption is not a passive mode of assimilation (absorption) and appropriation which we can oppose to an active mode of production, in order to bring to bear naive concepts of action (and alienation). Consumption is an active mode of relations (not only to objects, but to the collectivity and to the world), a systematic mode of activity and a global response on

Jean Baudrillard (1929– 2007) on Consumption Jean Baudrillard (1929– 2007) - a French sociologist, philosopher, cultural theorist. Baudrillard was one of the foremost intellectual figures of the present age whose work combines philosophy, social theory, and an cultural metaphysics that reflects on key events of phenomena of the epoch “In fact we can conceive of consumption as a characteristic mode of industrial civilization on the condition that we separate it fundamentally from its current meaning as a process of satisfaction of needs. Consumption is not a passive mode of assimilation (absorption) and appropriation which we can oppose to an active mode of production, in order to bring to bear naive concepts of action (and alienation). Consumption is an active mode of relations (not only to objects, but to the collectivity and to the world), a systematic mode of activity and a global response on

RUSSIA : KEY FACTS&FIGURES Real GDP growth in 2013 was about 1, 8 % Inflation (2013) 6. 29 %

RUSSIA : KEY FACTS&FIGURES Real GDP growth in 2013 was about 1, 8 % Inflation (2013) 6. 29 %

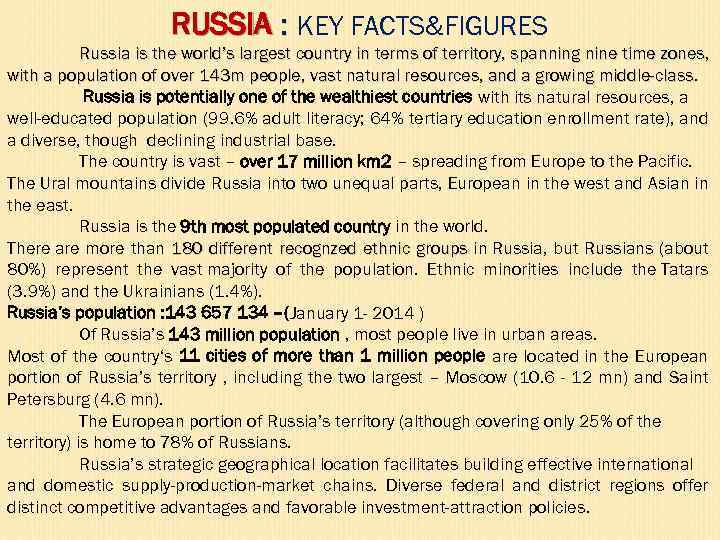

RUSSIA : KEY FACTS&FIGURES Russia is the world’s largest country in terms of territory, spanning nine time zones, with a population of over 143 m people, vast natural resources, and a growing middle-class Russia is potentially one of the wealthiest countries with its natural resources, a well-educated population (99. 6% adult literacy; 64% tertiary education enrollment rate), and a diverse, though declining industrial base. The country is vast – over 17 million km 2 – spreading from Europe to the Pacific. The Ural mountains divide Russia into two unequal parts, European in the west and Asian in the east. Russia is the 9 th most populated country in the world. There are more than 180 different recognzed ethnic groups in Russia, but Russians (about 80%) represent the vast majority of the population. Ethnic minorities include the Tatars (3. 9%) and the Ukrainians (1. 4%). Russia’s population : 143 657 134 –(January 1 - 2014 ) Of Russia’s 143 million population , most people live in urban areas. Most of the country‘s 11 cities of more than 1 million people are located in the European portion of Russia’s territory , including the two largest – Moscow (10. 6 - 12 mn) and Saint Petersburg (4. 6 mn). The European portion of Russia’s territory (although covering only 25% of the territory) is home to 78% of Russians. Russia’s strategic geographical location facilitates building effective international and domestic supply-production-market chains. Diverse federal and district regions offer distinct competitive advantages and favorable investment-attraction policies.

RUSSIA : KEY FACTS&FIGURES Russia is the world’s largest country in terms of territory, spanning nine time zones, with a population of over 143 m people, vast natural resources, and a growing middle-class Russia is potentially one of the wealthiest countries with its natural resources, a well-educated population (99. 6% adult literacy; 64% tertiary education enrollment rate), and a diverse, though declining industrial base. The country is vast – over 17 million km 2 – spreading from Europe to the Pacific. The Ural mountains divide Russia into two unequal parts, European in the west and Asian in the east. Russia is the 9 th most populated country in the world. There are more than 180 different recognzed ethnic groups in Russia, but Russians (about 80%) represent the vast majority of the population. Ethnic minorities include the Tatars (3. 9%) and the Ukrainians (1. 4%). Russia’s population : 143 657 134 –(January 1 - 2014 ) Of Russia’s 143 million population , most people live in urban areas. Most of the country‘s 11 cities of more than 1 million people are located in the European portion of Russia’s territory , including the two largest – Moscow (10. 6 - 12 mn) and Saint Petersburg (4. 6 mn). The European portion of Russia’s territory (although covering only 25% of the territory) is home to 78% of Russians. Russia’s strategic geographical location facilitates building effective international and domestic supply-production-market chains. Diverse federal and district regions offer distinct competitive advantages and favorable investment-attraction policies.

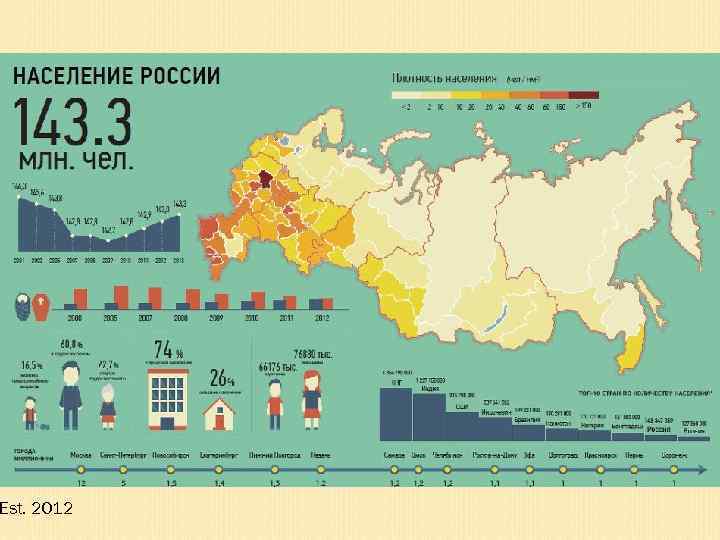

Est. 2012

Est. 2012

RUSSIAN ECONOMY - GENERAL PROFILE RUSSIA is rated the world’s 8 th largest economy of the world in terms of nominal volume of GDP and is the 6 th largest judged by purchasing power parity. Russia is a member of the G 8, G 20 and of the UN Security Council. Russia has a market economy with enormous natural resources, particularly oil and natural gas, and is perceived as a major emerging market economy. It is a developing economy with rich natural resources. Russia has the world's largest reserves of mineral and energy resources, and is the largest producer of oil and natural gas globally. . Oil, petroleum products, natural gas and metals account for over 20 % of Russian GDP. Services are also the biggest sector of the economy. Services account for 58 -60 percent of GDP. Within services the most important segments are: wholesale and retail trade, repair of motor vehicles, personal and household goods (17 – 20 percent of total GDP); public administration, health and education (12 percent); real estate (9 percent) and transport storage and communications (7 percent). Industry contributes 40 percent to total output. Mining (11 percent of GDP), manufacturing (13 percent) and construction (4 percent) are the most important industry segments. Agriculture accounts for the remaining 2 percent Russia’s per capita GDP (USD 17, 618) was the highest among BRIC countries.

RUSSIAN ECONOMY - GENERAL PROFILE RUSSIA is rated the world’s 8 th largest economy of the world in terms of nominal volume of GDP and is the 6 th largest judged by purchasing power parity. Russia is a member of the G 8, G 20 and of the UN Security Council. Russia has a market economy with enormous natural resources, particularly oil and natural gas, and is perceived as a major emerging market economy. It is a developing economy with rich natural resources. Russia has the world's largest reserves of mineral and energy resources, and is the largest producer of oil and natural gas globally. . Oil, petroleum products, natural gas and metals account for over 20 % of Russian GDP. Services are also the biggest sector of the economy. Services account for 58 -60 percent of GDP. Within services the most important segments are: wholesale and retail trade, repair of motor vehicles, personal and household goods (17 – 20 percent of total GDP); public administration, health and education (12 percent); real estate (9 percent) and transport storage and communications (7 percent). Industry contributes 40 percent to total output. Mining (11 percent of GDP), manufacturing (13 percent) and construction (4 percent) are the most important industry segments. Agriculture accounts for the remaining 2 percent Russia’s per capita GDP (USD 17, 618) was the highest among BRIC countries.

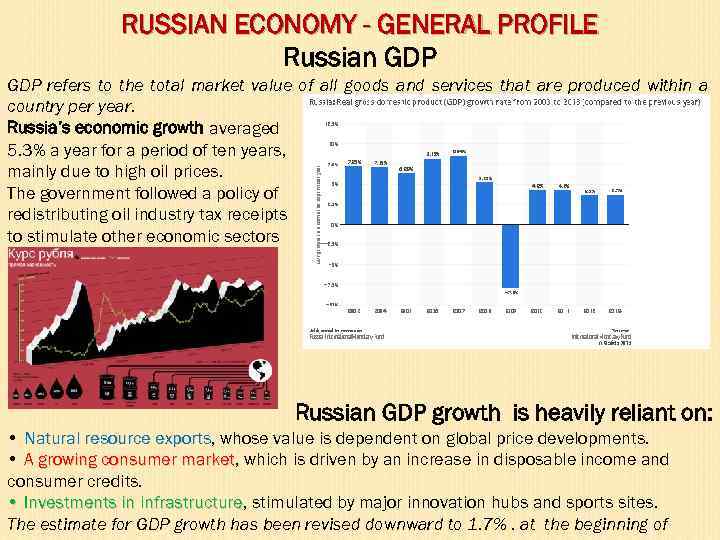

RUSSIAN ECONOMY - GENERAL PROFILE Russian GDP refers to the total market value of all goods and services that are produced within a country per year. Russia’s economic growth averaged 5. 3% a year for a period of ten years, mainly due to high oil prices. The government followed a policy of redistributing oil industry tax receipts to stimulate other economic sectors Russian GDP growth is heavily reliant on: • Natural resource exports, whose value is dependent on global price developments. exports • A growing consumer market, which is driven by an increase in disposable income and market consumer credits. • Investments in infrastructure, stimulated by major innovation hubs and sports sites. infrastructure The estimate for GDP growth has been revised downward to 1. 7%. at the beginning of

RUSSIAN ECONOMY - GENERAL PROFILE Russian GDP refers to the total market value of all goods and services that are produced within a country per year. Russia’s economic growth averaged 5. 3% a year for a period of ten years, mainly due to high oil prices. The government followed a policy of redistributing oil industry tax receipts to stimulate other economic sectors Russian GDP growth is heavily reliant on: • Natural resource exports, whose value is dependent on global price developments. exports • A growing consumer market, which is driven by an increase in disposable income and market consumer credits. • Investments in infrastructure, stimulated by major innovation hubs and sports sites. infrastructure The estimate for GDP growth has been revised downward to 1. 7%. at the beginning of

RUSSIAN ECONOMY – LARGE CONSUMER MARKET Russia is one of the largest consumer markets in the world. Consumer activity in Russia has contributed to dynamic growth in trade, retail, telecommunications and services on the back of rising incomes and the development of consumer lending. Russia is recognized as the 9 th consumer market for its size by World Economic Forum in 2010 -2011. According to the A. T. Kearney Retail Trade Index 2010 "Russia remains Europe's largest consumer market, with rising disposable incomes and an expanding middle class, and it offers massive growth opportunities for retailers with a longterm approach. “ approach Russia's economy and GDP are driven primarily by consumption, " reports Andy Smith, head of equity research at Sberbank CIB. Consumer-oriented sectors already account for two-thirds of Russia's GDP and have contributed more than 60 percent of Russia's economic growth since 2004. 200 “There is a very clear distinction between trends in industry and those in consumer goods and the latter is apparently stronger than the former. ” Source: DT Global Business Consulting Gmb. H and CEEMEA Business Group research)) Private consumption is the real driver of economic growth. According to a report by Sberbank CIB, “Russia's consumer market will be the largest in Europe by 2020 and the fourth largest in the world,

RUSSIAN ECONOMY – LARGE CONSUMER MARKET Russia is one of the largest consumer markets in the world. Consumer activity in Russia has contributed to dynamic growth in trade, retail, telecommunications and services on the back of rising incomes and the development of consumer lending. Russia is recognized as the 9 th consumer market for its size by World Economic Forum in 2010 -2011. According to the A. T. Kearney Retail Trade Index 2010 "Russia remains Europe's largest consumer market, with rising disposable incomes and an expanding middle class, and it offers massive growth opportunities for retailers with a longterm approach. “ approach Russia's economy and GDP are driven primarily by consumption, " reports Andy Smith, head of equity research at Sberbank CIB. Consumer-oriented sectors already account for two-thirds of Russia's GDP and have contributed more than 60 percent of Russia's economic growth since 2004. 200 “There is a very clear distinction between trends in industry and those in consumer goods and the latter is apparently stronger than the former. ” Source: DT Global Business Consulting Gmb. H and CEEMEA Business Group research)) Private consumption is the real driver of economic growth. According to a report by Sberbank CIB, “Russia's consumer market will be the largest in Europe by 2020 and the fourth largest in the world,

RUSSIAN ECONOMY - some realistic estimations of the current state: BMRC – Marketing Research in Russia reports: reports Russia is a vast country with a wealth of natural resources, a well-educated population, and a diverse, but declining, industrial base, but still it continues to experience formidable difficulties in moving from its old centrally planned economy to a modern market economy. One of the biggest problems in the transitions is that Russia has failed to make any progress in restructuring its social welfare programs to target the most needy – among whom are many of the old pensioners – or to pass needed tax reform While approximately 75% of industry has now been privatized, the agricultural sector has undergone little reform since the break-up of the Soviet Union. Stockholder rights remain weak while crime and corruption are rampant in much of the economy. Many economy enterprises continue to operate without hard budget constraints, resulting in barter trade and increased inter-enterprise debts. ” [BMRC – Marketing Research in Russia] Lloyd Donaldson says: “The Russian market is not yet fully formed, has not reached a point of equilibrium. It is still extremely fluid. Social classes, particularly the middle class, are still forming. Yet there are groups of consumers eager to buy a wide range of products. ”[Lloyd Donaldson, publisher of the St Petersburg Press newspaper. ] Donaldson “Russians set out slowly, but then ride fast” Otto von Bismarck (1815 -1898)

RUSSIAN ECONOMY - some realistic estimations of the current state: BMRC – Marketing Research in Russia reports: reports Russia is a vast country with a wealth of natural resources, a well-educated population, and a diverse, but declining, industrial base, but still it continues to experience formidable difficulties in moving from its old centrally planned economy to a modern market economy. One of the biggest problems in the transitions is that Russia has failed to make any progress in restructuring its social welfare programs to target the most needy – among whom are many of the old pensioners – or to pass needed tax reform While approximately 75% of industry has now been privatized, the agricultural sector has undergone little reform since the break-up of the Soviet Union. Stockholder rights remain weak while crime and corruption are rampant in much of the economy. Many economy enterprises continue to operate without hard budget constraints, resulting in barter trade and increased inter-enterprise debts. ” [BMRC – Marketing Research in Russia] Lloyd Donaldson says: “The Russian market is not yet fully formed, has not reached a point of equilibrium. It is still extremely fluid. Social classes, particularly the middle class, are still forming. Yet there are groups of consumers eager to buy a wide range of products. ”[Lloyd Donaldson, publisher of the St Petersburg Press newspaper. ] Donaldson “Russians set out slowly, but then ride fast” Otto von Bismarck (1815 -1898)

RUSSIAN ECONOMY & CONSUMERISM – THEIR HISTORICAL BAKGROUND THE MAIN STAGES OF THE ECONOMIC DEVELOPMENT OF POST-SOVIET RUSSIA [ I ] Initial period of transformational crisis (1990 – 1995). The period was characterized by profound economic and institutional reforms: price reforms liberalization, liquidation of state monopoly on foreign trade, privatization and other measures. These reforms were accompanied by negative trends in economy: fall of GDP, economy decrease of incomes of population and investments, high inflation rates. Inflation, started in 1992, reached its peak in 1994, and increased 10 000% by the end of 1997. Russian health and education systems, which used to be of the highest standard during the Soviet times, were slowly deteriorating. A sharp economic division of society took place. On one hand, a substantial group place of the very rich, who make up between 5 percent and 12 percent of the population, with individual annual incomes of over $60, 000 (in Moscow, $120, 000), was developing. And on the other, there was destitution of the larger part of population with incomes that were close to the poverty line.

RUSSIAN ECONOMY & CONSUMERISM – THEIR HISTORICAL BAKGROUND THE MAIN STAGES OF THE ECONOMIC DEVELOPMENT OF POST-SOVIET RUSSIA [ I ] Initial period of transformational crisis (1990 – 1995). The period was characterized by profound economic and institutional reforms: price reforms liberalization, liquidation of state monopoly on foreign trade, privatization and other measures. These reforms were accompanied by negative trends in economy: fall of GDP, economy decrease of incomes of population and investments, high inflation rates. Inflation, started in 1992, reached its peak in 1994, and increased 10 000% by the end of 1997. Russian health and education systems, which used to be of the highest standard during the Soviet times, were slowly deteriorating. A sharp economic division of society took place. On one hand, a substantial group place of the very rich, who make up between 5 percent and 12 percent of the population, with individual annual incomes of over $60, 000 (in Moscow, $120, 000), was developing. And on the other, there was destitution of the larger part of population with incomes that were close to the poverty line.

RUSSIAN ECONOMY & CONSUMERISM – - THEIR HISTORICAL BAKGROUND THE MAIN STAGES OF THE ECONOMIC DEVELOPMENT OF POST-SOVIET RUSSIA [II] Difficult stabilization, financial crisis (default) of 1998 and gradual recovery of the economy in 1996 – 1999. This period was marked by stabilization of GDP production, and industrial production in the first place. The year of 1997 was the first post-reform year when GDP growth was registered. But 1998 brought a new serious Financial crisis The government implemented a 1000% denomination of national currency (Ruble), turning back prices from thousands rubles to rubles. The exchange rate of US Dollar flew up from 6 to 24 rubles in less than 6 weeks. Small businesses were almost devastated. Prices for consumer goods increased in 4 -5 times with the salaries increased only on 2030%. The crisis gave a boost to the development of national industries, which could not compete with foreign goods with the low dollar rate. It contributed to improvement of foreign trade conditions in the medium term and created incentives for investments in real sector. Soon the results became visible with reviving the industrial enterprises, particularly in production of consumer goods and food processing.

RUSSIAN ECONOMY & CONSUMERISM – - THEIR HISTORICAL BAKGROUND THE MAIN STAGES OF THE ECONOMIC DEVELOPMENT OF POST-SOVIET RUSSIA [II] Difficult stabilization, financial crisis (default) of 1998 and gradual recovery of the economy in 1996 – 1999. This period was marked by stabilization of GDP production, and industrial production in the first place. The year of 1997 was the first post-reform year when GDP growth was registered. But 1998 brought a new serious Financial crisis The government implemented a 1000% denomination of national currency (Ruble), turning back prices from thousands rubles to rubles. The exchange rate of US Dollar flew up from 6 to 24 rubles in less than 6 weeks. Small businesses were almost devastated. Prices for consumer goods increased in 4 -5 times with the salaries increased only on 2030%. The crisis gave a boost to the development of national industries, which could not compete with foreign goods with the low dollar rate. It contributed to improvement of foreign trade conditions in the medium term and created incentives for investments in real sector. Soon the results became visible with reviving the industrial enterprises, particularly in production of consumer goods and food processing.

RUSSIAN ECONOMY & CONSUMERISM – - THEIR HISTORICAL BAKGROUND THE MAIN STAGES OF THE ECONOMIC DEVELOPMENT OF POST-SOVIET RUSSIA [III] Period of economic recovery (2000 – 2008). This period was characterized by growth of GDP, investments, and consumption. The government’s devaluation of the ruble during the 1998 financial crisis gave local producers significant advantages over their foreign competitors. Local consumption was boosted by the introduction of consumer loans and mortgages Among the other drivers of economic growth was an increase in the utilization of industrial capacity constructed in the Soviet period. Between 1999 and 2007 GDP rose by an average of 6. 8% annually. Real fixed capital investments increased by an annual average of 10% between 2000 and 2007, while real personal incomes rose at an average annual rate of 12%. Over these years Russia successfully paid off a substantial portion of its foreign debt and amassed the third largest foreign currency reserves after China and Japan. These achievements have raised business and investor confidence, with new business confidence opportunities emerging in such sectors as telecommunications, retail, pharmaceuticals and the power industry in particular. Between 2000 and 2008, the country posted the world’s largest annual growth in household and consumer expenditure – 11% compared to the world average of 1. 8% and Europe’s 0. 9%.

RUSSIAN ECONOMY & CONSUMERISM – - THEIR HISTORICAL BAKGROUND THE MAIN STAGES OF THE ECONOMIC DEVELOPMENT OF POST-SOVIET RUSSIA [III] Period of economic recovery (2000 – 2008). This period was characterized by growth of GDP, investments, and consumption. The government’s devaluation of the ruble during the 1998 financial crisis gave local producers significant advantages over their foreign competitors. Local consumption was boosted by the introduction of consumer loans and mortgages Among the other drivers of economic growth was an increase in the utilization of industrial capacity constructed in the Soviet period. Between 1999 and 2007 GDP rose by an average of 6. 8% annually. Real fixed capital investments increased by an annual average of 10% between 2000 and 2007, while real personal incomes rose at an average annual rate of 12%. Over these years Russia successfully paid off a substantial portion of its foreign debt and amassed the third largest foreign currency reserves after China and Japan. These achievements have raised business and investor confidence, with new business confidence opportunities emerging in such sectors as telecommunications, retail, pharmaceuticals and the power industry in particular. Between 2000 and 2008, the country posted the world’s largest annual growth in household and consumer expenditure – 11% compared to the world average of 1. 8% and Europe’s 0. 9%.

RUSSIAN ECONOMY & CONSUMERISM – - THEIR HISTORICAL BAKGROUND THE MAIN STAGES OF THE ECONOMIC DEVELOPMENT OF POST-SOVIET RUSSIA [IV] In 2008– 2009 Russia was severely hit by the international financial crisis. There were three elements of the economic crisis in Russia: - a financial crisis that hit Russian banks and firms, - a sharp decline in the price of Russia’s principal export commodities, - a recession marked by low domestic demand. The foundations of the Russian economy were shaken by a slump in commodity prices, collapse in the financial markets, restricted access to external financing, rising unemployment and a consequent drop in internal consumption In 2009 GDP contracted by 7. 9%, while industrial output fell by 10. 8%. Since the outbreak of the crisis the government has increased its efforts to safeguard the economy. The Central Bank implemented a step-by-step ruble devaluation which prevented panic and an eventual bank run. The government has proposed bail-out initiatives for the economy’s largest companies with a view to limiting the negative social impact of massive lay-offs. Some banks and financial services companies have been acquired by governmentcontrolled organizations. A package of tax initiatives encouraging economic activity has been adopted.

RUSSIAN ECONOMY & CONSUMERISM – - THEIR HISTORICAL BAKGROUND THE MAIN STAGES OF THE ECONOMIC DEVELOPMENT OF POST-SOVIET RUSSIA [IV] In 2008– 2009 Russia was severely hit by the international financial crisis. There were three elements of the economic crisis in Russia: - a financial crisis that hit Russian banks and firms, - a sharp decline in the price of Russia’s principal export commodities, - a recession marked by low domestic demand. The foundations of the Russian economy were shaken by a slump in commodity prices, collapse in the financial markets, restricted access to external financing, rising unemployment and a consequent drop in internal consumption In 2009 GDP contracted by 7. 9%, while industrial output fell by 10. 8%. Since the outbreak of the crisis the government has increased its efforts to safeguard the economy. The Central Bank implemented a step-by-step ruble devaluation which prevented panic and an eventual bank run. The government has proposed bail-out initiatives for the economy’s largest companies with a view to limiting the negative social impact of massive lay-offs. Some banks and financial services companies have been acquired by governmentcontrolled organizations. A package of tax initiatives encouraging economic activity has been adopted.

RUSSIAN ECONOMY & CONSUMERISM – - THEIR HISTORICAL BAKGROUND THE MAIN STAGES OF THE ECONOMIC DEVELOPMENT OF POST-SOVIET RUSSIA [V] - Period of economic recovery with trends of stabilization and structural modernization (since 2010 up to now). During 2010– 2012 the Russian economy seemed to had stabilized. Thus, in 2010 Russia’s Gross Domestic Product grew by 4. 5 %, the world’s third highest growth rate among leading economies (4. 3 % in 2011, 3, 4% in 2012, 2– 1, 8% in 2013) GDP - composition, by end use: household consumption: 49. 2% government consumption: 18. 6% investment in fixed capital: 22% investment in inventories: 2. 6% exports of goods and services: 29. 7% imports of goods and services: -22. 1% (2012 est. ) Russia has reduced unemployment to a record low and has lowered inflation below double digit rates. Russia joined the World Trade Organization in 2012, which will reduce trade barriers in Russia foreign goods and services and help open foreign markets to Russian goods and services. At the same time, Russia has sought to cement economic ties with countries in the former Soviet space through a Customs Union with Belarus and Kazakhstan, and, in the next several years, through the creation of a new Russia-led economic bloc called the Eurasian Economic Union.

RUSSIAN ECONOMY & CONSUMERISM – - THEIR HISTORICAL BAKGROUND THE MAIN STAGES OF THE ECONOMIC DEVELOPMENT OF POST-SOVIET RUSSIA [V] - Period of economic recovery with trends of stabilization and structural modernization (since 2010 up to now). During 2010– 2012 the Russian economy seemed to had stabilized. Thus, in 2010 Russia’s Gross Domestic Product grew by 4. 5 %, the world’s third highest growth rate among leading economies (4. 3 % in 2011, 3, 4% in 2012, 2– 1, 8% in 2013) GDP - composition, by end use: household consumption: 49. 2% government consumption: 18. 6% investment in fixed capital: 22% investment in inventories: 2. 6% exports of goods and services: 29. 7% imports of goods and services: -22. 1% (2012 est. ) Russia has reduced unemployment to a record low and has lowered inflation below double digit rates. Russia joined the World Trade Organization in 2012, which will reduce trade barriers in Russia foreign goods and services and help open foreign markets to Russian goods and services. At the same time, Russia has sought to cement economic ties with countries in the former Soviet space through a Customs Union with Belarus and Kazakhstan, and, in the next several years, through the creation of a new Russia-led economic bloc called the Eurasian Economic Union.

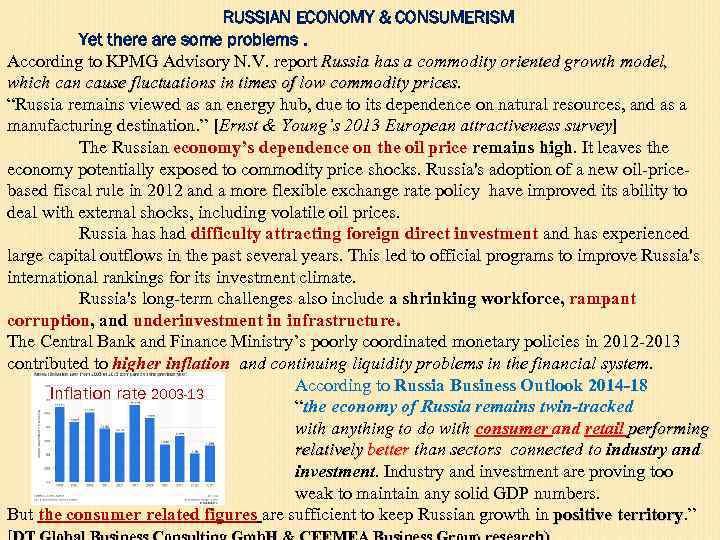

RUSSIAN ECONOMY & CONSUMERISM Yet there are some problems. According to KPMG Advisory N. V. report Russia has a commodity oriented growth model, which can cause fluctuations in times of low commodity prices. “Russia remains viewed as an energy hub, due to its dependence on natural resources, and as a manufacturing destination. ” [Ernst & Young’s 2013 European attractiveness survey] The Russian economy’s dependence on the oil price remains high. It leaves the economy potentially exposed to commodity price shocks. Russia's adoption of a new oil-pricebased fiscal rule in 2012 and a more flexible exchange rate policy have improved its ability to deal with external shocks, including volatile oil prices. Russia has had difficulty attracting foreign direct investment and has experienced large capital outflows in the past several years. This led to official programs to improve Russia's international rankings for its investment climate. Russia's long-term challenges also include a shrinking workforce, rampant corruption, and underinvestment in infrastructure. The Central Bank and Finance Ministry’s poorly coordinated monetary policies in 2012 -2013 contributed to higher inflation and continuing liquidity problems in the financial system. According to Russia Business Outlook 2014 -18 Inflation rate 2003 -13 “the economy of Russia remains twin-tracked with anything to do with consumer and retail performing relatively better than sectors connected to industry and investment. Industry and investment are proving too weak to maintain any solid GDP numbers. But the consumer related figures are sufficient to keep Russian growth in positive territory. ” territory

RUSSIAN ECONOMY & CONSUMERISM Yet there are some problems. According to KPMG Advisory N. V. report Russia has a commodity oriented growth model, which can cause fluctuations in times of low commodity prices. “Russia remains viewed as an energy hub, due to its dependence on natural resources, and as a manufacturing destination. ” [Ernst & Young’s 2013 European attractiveness survey] The Russian economy’s dependence on the oil price remains high. It leaves the economy potentially exposed to commodity price shocks. Russia's adoption of a new oil-pricebased fiscal rule in 2012 and a more flexible exchange rate policy have improved its ability to deal with external shocks, including volatile oil prices. Russia has had difficulty attracting foreign direct investment and has experienced large capital outflows in the past several years. This led to official programs to improve Russia's international rankings for its investment climate. Russia's long-term challenges also include a shrinking workforce, rampant corruption, and underinvestment in infrastructure. The Central Bank and Finance Ministry’s poorly coordinated monetary policies in 2012 -2013 contributed to higher inflation and continuing liquidity problems in the financial system. According to Russia Business Outlook 2014 -18 Inflation rate 2003 -13 “the economy of Russia remains twin-tracked with anything to do with consumer and retail performing relatively better than sectors connected to industry and investment. Industry and investment are proving too weak to maintain any solid GDP numbers. But the consumer related figures are sufficient to keep Russian growth in positive territory. ” territory

RUSSIAN CONSUMERISM Russian consumer market The strong domestic demand consumption is one of the key drivers of the Russian economy. The Russian consumer market is the largest in Eastern Europe, boosted by the country’s vast size, population, large number of urban centers and relatively strong economic growth. Consumer-related sectors, which represent two thirds of GDP, include consumer retail & electronics, financial services, automotive, telecom, media and IT, and real estate. Consumer related sectors, have driven more than 60% of domestic GDP growth since 2004. Around 12% of Ernst & Young’s 2013 European attractiveness survey respondents believe that “the consumer goods sector will drive growth in Foreign Direct Investment (FDI) in the next two years. And a large population with rising disposable income could years income mean huge market opportunities for global consumer goods majors. ” Russia leads the whole of Europe in the sale of key consumables –Pharmaceuticals –Mobile phones –Broadband –Beer –Retail sales in Moscow now exceed Paris and London. Russia is expected to become the largest consumer market in Europe by 2020, whilst its per capita GDP is expected to triple to USD 35, 000.

RUSSIAN CONSUMERISM Russian consumer market The strong domestic demand consumption is one of the key drivers of the Russian economy. The Russian consumer market is the largest in Eastern Europe, boosted by the country’s vast size, population, large number of urban centers and relatively strong economic growth. Consumer-related sectors, which represent two thirds of GDP, include consumer retail & electronics, financial services, automotive, telecom, media and IT, and real estate. Consumer related sectors, have driven more than 60% of domestic GDP growth since 2004. Around 12% of Ernst & Young’s 2013 European attractiveness survey respondents believe that “the consumer goods sector will drive growth in Foreign Direct Investment (FDI) in the next two years. And a large population with rising disposable income could years income mean huge market opportunities for global consumer goods majors. ” Russia leads the whole of Europe in the sale of key consumables –Pharmaceuticals –Mobile phones –Broadband –Beer –Retail sales in Moscow now exceed Paris and London. Russia is expected to become the largest consumer market in Europe by 2020, whilst its per capita GDP is expected to triple to USD 35, 000.

RUSSIAN CONSUMER BOOM From 1998 onwards, the consumer boom in Russia was the result of nearly 10 boom years of economic prosperity and growth in credit facilities. Companies throughout the retail, banking, pharmaceuticals, mobile telecoms and other sectors are already the main beneficiaries of the consumer boom , these companies are playing an increasingly important role in the Russian economy. Nowadays consumer trends in Russia continue to change as consumer power and purchasing activities expand. Favourable conditions: • Russian consumers have no significance debt, though the situation is gradually changing. • The average mortgage debt in Russia is negligible (€ 130 person) compared with € 12, 370 in the Eurozone and € 26, 040 in the USA. • The relatively high level of nationwide savings. • The relatively low unemployment rates. • The developing consumer credit system. • The household incomes have risen significantly over the decade, and consumer expenditures as well.

RUSSIAN CONSUMER BOOM From 1998 onwards, the consumer boom in Russia was the result of nearly 10 boom years of economic prosperity and growth in credit facilities. Companies throughout the retail, banking, pharmaceuticals, mobile telecoms and other sectors are already the main beneficiaries of the consumer boom , these companies are playing an increasingly important role in the Russian economy. Nowadays consumer trends in Russia continue to change as consumer power and purchasing activities expand. Favourable conditions: • Russian consumers have no significance debt, though the situation is gradually changing. • The average mortgage debt in Russia is negligible (€ 130 person) compared with € 12, 370 in the Eurozone and € 26, 040 in the USA. • The relatively high level of nationwide savings. • The relatively low unemployment rates. • The developing consumer credit system. • The household incomes have risen significantly over the decade, and consumer expenditures as well.

LABOR & CONSUMER INCOMES Labor force : 75. 24 million Labor force - by occupation: occupation agriculture: 7. 9% industry: 27. 4% services: 64. 7% (2011) Unemployment rate: 6 % (2013 est. ) 5. 7% (2012 est. ) 6. 6% (2011 est. ) Household income or consumption by percentage share lowest 10%: 5. 7% highest 10%: 42. 4% Approximately 76 000 of citizens are “economically active”, 72 000 of them work: Inflation rate (consumer prices) 1 % (appr. 700 000)- employers 6, 6 % (2013 est. ) 5 % (appr. 3 500 000) – independent, “self-employed” 5. 1% (2012 est. ) 94 % - employees. 8. 4% (2011 est. )

LABOR & CONSUMER INCOMES Labor force : 75. 24 million Labor force - by occupation: occupation agriculture: 7. 9% industry: 27. 4% services: 64. 7% (2011) Unemployment rate: 6 % (2013 est. ) 5. 7% (2012 est. ) 6. 6% (2011 est. ) Household income or consumption by percentage share lowest 10%: 5. 7% highest 10%: 42. 4% Approximately 76 000 of citizens are “economically active”, 72 000 of them work: Inflation rate (consumer prices) 1 % (appr. 700 000)- employers 6, 6 % (2013 est. ) 5 % (appr. 3 500 000) – independent, “self-employed” 5. 1% (2012 est. ) 94 % - employees. 8. 4% (2011 est. )

THE GROWTH IN INCOMES The household incomes have risen significantly over the decade • The average monthly income, was less than US$200 per month in 2003. • This is now averages more than $1, 000 per month Russians aged 30 -34 held the highest average gross income of $12, 987. This age group is increasingly more equipped for the country’s transfer into a capitalist economy, with Russians that completed their education in the 2000 s typically more in demand by employers. • Russians aged 40 -44 were among the top average earners in the country with average gross income of $12, 509. • Low personal income tax (flat) rate at only 13% + very little debt = = Russians have relatively high levels of disposable income

THE GROWTH IN INCOMES The household incomes have risen significantly over the decade • The average monthly income, was less than US$200 per month in 2003. • This is now averages more than $1, 000 per month Russians aged 30 -34 held the highest average gross income of $12, 987. This age group is increasingly more equipped for the country’s transfer into a capitalist economy, with Russians that completed their education in the 2000 s typically more in demand by employers. • Russians aged 40 -44 were among the top average earners in the country with average gross income of $12, 509. • Low personal income tax (flat) rate at only 13% + very little debt = = Russians have relatively high levels of disposable income

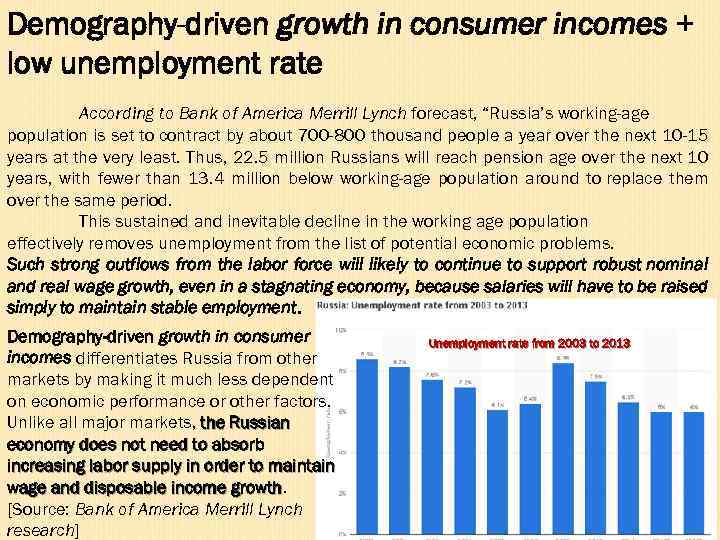

Demography-driven growth in consumer incomes + low unemployment rate According to Bank of America Merrill Lynch forecast, “Russia’s working-age population is set to contract by about 700 -800 thousand people a year over the next 10 -15 years at the very least. Thus, 22. 5 million Russians will reach pension age over the next 10 years, with fewer than 13. 4 million below working-age population around to replace them over the same period. This sustained and inevitable decline in the working age population effectively removes unemployment from the list of potential economic problems. Such strong outflows from the labor force will likely to continue to support robust nominal and real wage growth, even in a stagnating economy, because salaries will have to be raised simply to maintain stable employment. Demography-driven growth in consumer incomes differentiates Russia from other markets by making it much less dependent on economic performance or other factors. Unlike all major markets, the Russian economy does not need to absorb increasing labor supply in order to maintain wage and disposable income growth [Source: Bank of America Merrill Lynch research] Unemployment rate from 2003 to 2013

Demography-driven growth in consumer incomes + low unemployment rate According to Bank of America Merrill Lynch forecast, “Russia’s working-age population is set to contract by about 700 -800 thousand people a year over the next 10 -15 years at the very least. Thus, 22. 5 million Russians will reach pension age over the next 10 years, with fewer than 13. 4 million below working-age population around to replace them over the same period. This sustained and inevitable decline in the working age population effectively removes unemployment from the list of potential economic problems. Such strong outflows from the labor force will likely to continue to support robust nominal and real wage growth, even in a stagnating economy, because salaries will have to be raised simply to maintain stable employment. Demography-driven growth in consumer incomes differentiates Russia from other markets by making it much less dependent on economic performance or other factors. Unlike all major markets, the Russian economy does not need to absorb increasing labor supply in order to maintain wage and disposable income growth [Source: Bank of America Merrill Lynch research] Unemployment rate from 2003 to 2013

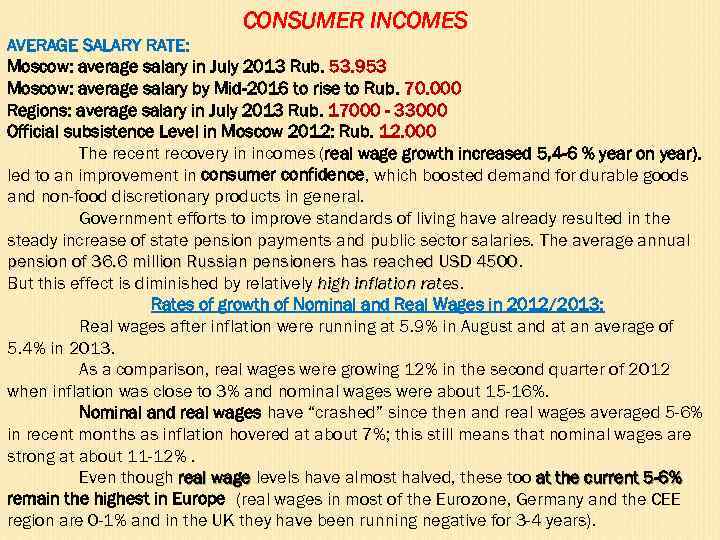

CONSUMER INCOMES AVERAGE SALARY RATE: Moscow: average salary in July 2013 Rub. 53. 953 Moscow: average salary by Mid-2016 to rise to Rub. 70. 000 Regions: average salary in July 2013 Rub. 17000 - 33000 Official subsistence Level in Moscow 2012: Rub. 12. 000 The recent recovery in incomes (real wage growth increased 5, 4 -6 % year on year). led to an improvement in consumer confidence, which boosted demand for durable goods and non-food discretionary products in general. Government efforts to improve standards of living have already resulted in the steady increase of state pension payments and public sector salaries. The average annual pension of 36. 6 million Russian pensioners has reached USD 4500 But this effect is diminished by relatively high inflation rates Rates of growth of Nominal and Real Wages in 2012/2013: Real wages after inflation were running at 5. 9% in August and at an average of 5. 4% in 2013. As a comparison, real wages were growing 12% in the second quarter of 2012 when inflation was close to 3% and nominal wages were about 15 -16%. Nominal and real wages have “crashed” since then and real wages averaged 5 -6% in recent months as inflation hovered at about 7%; this still means that nominal wages are strong at about 11 -12%. Even though real wage levels have almost halved, these too at the current 5 -6% remain the highest in Europe (real wages in most of the Eurozone, Germany and the CEE region are 0 -1% and in the UK they have been running negative for 3 -4 years).

CONSUMER INCOMES AVERAGE SALARY RATE: Moscow: average salary in July 2013 Rub. 53. 953 Moscow: average salary by Mid-2016 to rise to Rub. 70. 000 Regions: average salary in July 2013 Rub. 17000 - 33000 Official subsistence Level in Moscow 2012: Rub. 12. 000 The recent recovery in incomes (real wage growth increased 5, 4 -6 % year on year). led to an improvement in consumer confidence, which boosted demand for durable goods and non-food discretionary products in general. Government efforts to improve standards of living have already resulted in the steady increase of state pension payments and public sector salaries. The average annual pension of 36. 6 million Russian pensioners has reached USD 4500 But this effect is diminished by relatively high inflation rates Rates of growth of Nominal and Real Wages in 2012/2013: Real wages after inflation were running at 5. 9% in August and at an average of 5. 4% in 2013. As a comparison, real wages were growing 12% in the second quarter of 2012 when inflation was close to 3% and nominal wages were about 15 -16%. Nominal and real wages have “crashed” since then and real wages averaged 5 -6% in recent months as inflation hovered at about 7%; this still means that nominal wages are strong at about 11 -12%. Even though real wage levels have almost halved, these too at the current 5 -6% remain the highest in Europe (real wages in most of the Eurozone, Germany and the CEE region are 0 -1% and in the UK they have been running negative for 3 -4 years).

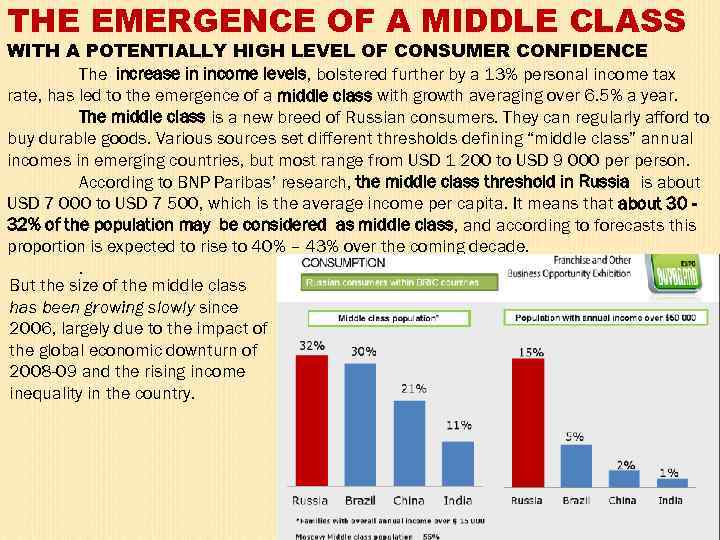

THE EMERGENCE OF A MIDDLE CLASS WITH A POTENTIALLY HIGH LEVEL OF CONSUMER CONFIDENCE The increase in income levels, bolstered further by a 13% personal income tax rate, has led to the emergence of a middle class with growth averaging over 6. 5% a year. The middle class is a new breed of Russian consumers. They can regularly afford to buy durable goods. Various sources set different thresholds defining “middle class” annual incomes in emerging countries, but most range from USD 1 200 to USD 9 000 person. According to BNP Paribas’ research, the middle class threshold in Russia is about USD 7 000 to USD 7 500, which is the average income per capita. It means that about 30 32% of the population may be considered as middle class, and according to forecasts this proportion is expected to rise to 40% – 43% over the coming decade. . But the size of the middle class has been growing slowly since 2006, largely due to the impact of the global economic downturn of 2008 -09 and the rising income inequality in the country.

THE EMERGENCE OF A MIDDLE CLASS WITH A POTENTIALLY HIGH LEVEL OF CONSUMER CONFIDENCE The increase in income levels, bolstered further by a 13% personal income tax rate, has led to the emergence of a middle class with growth averaging over 6. 5% a year. The middle class is a new breed of Russian consumers. They can regularly afford to buy durable goods. Various sources set different thresholds defining “middle class” annual incomes in emerging countries, but most range from USD 1 200 to USD 9 000 person. According to BNP Paribas’ research, the middle class threshold in Russia is about USD 7 000 to USD 7 500, which is the average income per capita. It means that about 30 32% of the population may be considered as middle class, and according to forecasts this proportion is expected to rise to 40% – 43% over the coming decade. . But the size of the middle class has been growing slowly since 2006, largely due to the impact of the global economic downturn of 2008 -09 and the rising income inequality in the country.

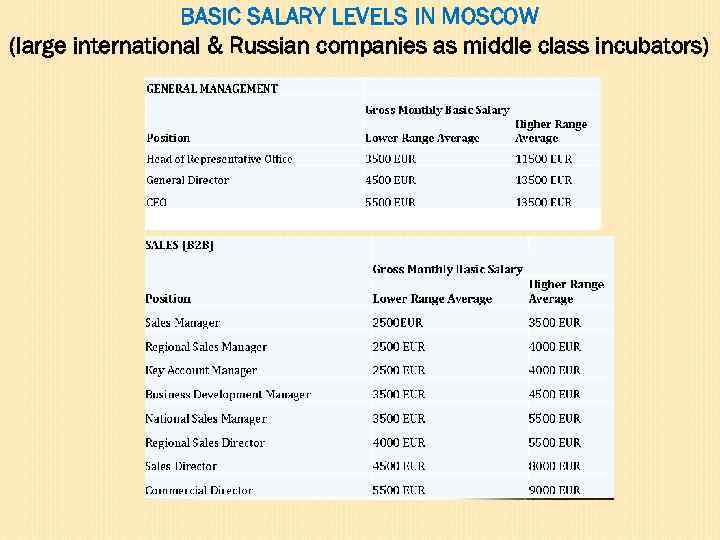

CONSUMER INCOMES – REGIONAL INEQUALITY The middle class population is not evenly distributed across the Russian regions. The highest concentrations are in large cities, especially Moscow, where the income level cities and living standards of the affluent urban population differs significantly from the Russian average. Representing 7. 4% of Russians, Moscow accounted for 18. 6% of the country’s income and 17. 3% of retail sales. The average Muscovite’s annual income is USD 15 600 – nearly 2. 5 times higher than the national average. The living standards and spending patterns of affluent Moscow are a kind of template for other Russian regions. Among the other cities Moscow is the biggest middle class incubator.

CONSUMER INCOMES – REGIONAL INEQUALITY The middle class population is not evenly distributed across the Russian regions. The highest concentrations are in large cities, especially Moscow, where the income level cities and living standards of the affluent urban population differs significantly from the Russian average. Representing 7. 4% of Russians, Moscow accounted for 18. 6% of the country’s income and 17. 3% of retail sales. The average Muscovite’s annual income is USD 15 600 – nearly 2. 5 times higher than the national average. The living standards and spending patterns of affluent Moscow are a kind of template for other Russian regions. Among the other cities Moscow is the biggest middle class incubator.

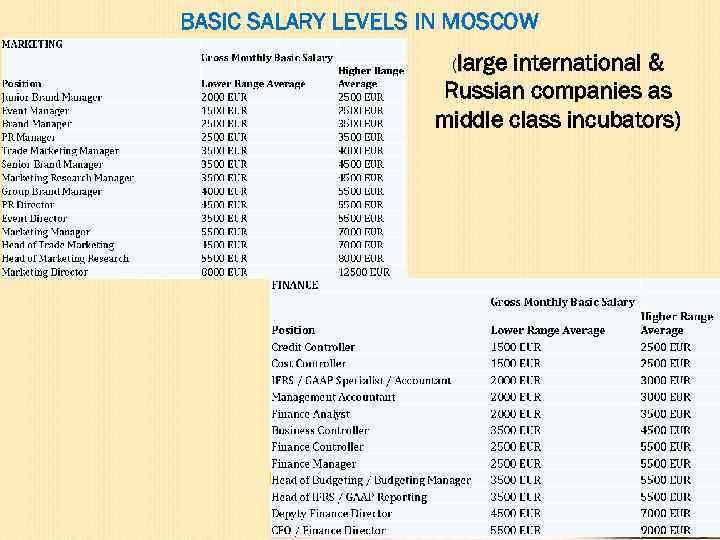

BASIC SALARY LEVELS IN MOSCOW (large international & Russian companies as middle class incubators)

BASIC SALARY LEVELS IN MOSCOW (large international & Russian companies as middle class incubators)

BASIC SALARY LEVELS IN MOSCOW (large international & Russian companies as middle class incubators)

BASIC SALARY LEVELS IN MOSCOW (large international & Russian companies as middle class incubators)

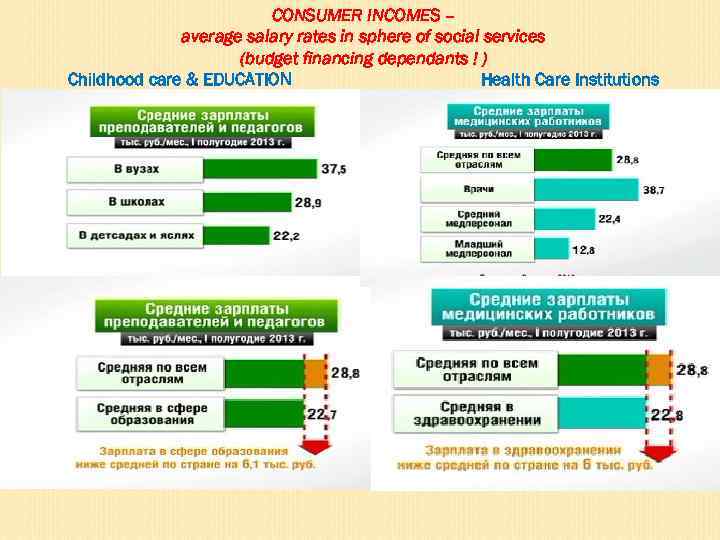

CONSUMER INCOMES – average salary rates in sphere of social services (budget financing dependants ! ) Сhildhood care & EDUCATION Health Care Institutions

CONSUMER INCOMES – average salary rates in sphere of social services (budget financing dependants ! ) Сhildhood care & EDUCATION Health Care Institutions

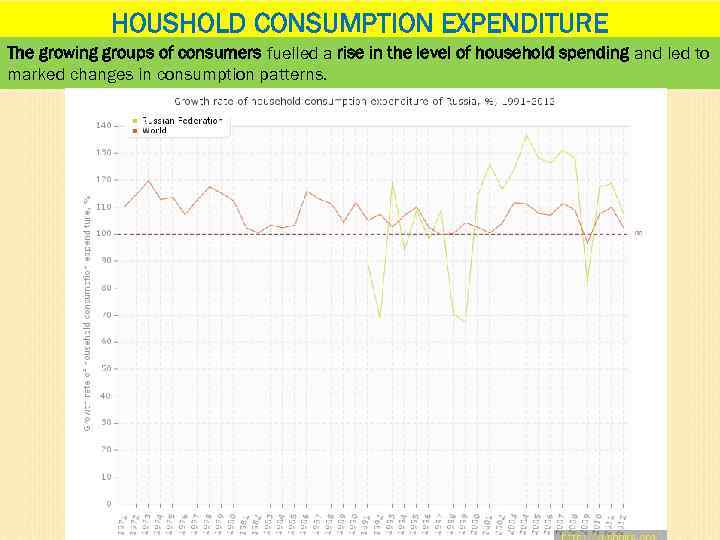

HOUSHOLD CONSUMPTION EXPENDITURE The growing groups of consumers fuelled a rise in the level of household spending and led to marked changes in consumption patterns.

HOUSHOLD CONSUMPTION EXPENDITURE The growing groups of consumers fuelled a rise in the level of household spending and led to marked changes in consumption patterns.

Household consumption expenditure per inhabitant in Russia , dollars 1990 -2012/13

Household consumption expenditure per inhabitant in Russia , dollars 1990 -2012/13

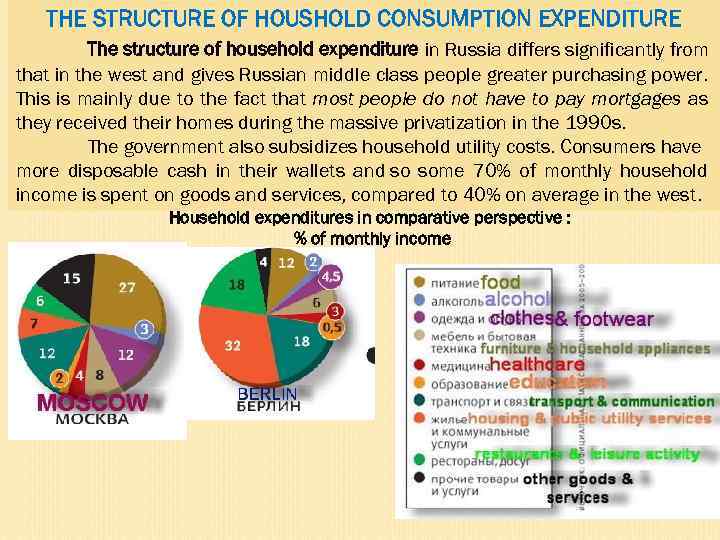

THE STRUCTURE OF HOUSHOLD CONSUMPTION EXPENDITURE The structure of household expenditure in Russia differs significantly from that in the west and gives Russian middle class people greater purchasing power. This is mainly due to the fact that most people do not have to pay mortgages as they received their homes during the massive privatization in the 1990 s. The government also subsidizes household utility costs. Consumers have more disposable cash in their wallets and so some 70% of monthly household income is spent on goods and services, compared to 40% on average in the west. Household expenditures in comparative perspective : % of monthly income

THE STRUCTURE OF HOUSHOLD CONSUMPTION EXPENDITURE The structure of household expenditure in Russia differs significantly from that in the west and gives Russian middle class people greater purchasing power. This is mainly due to the fact that most people do not have to pay mortgages as they received their homes during the massive privatization in the 1990 s. The government also subsidizes household utility costs. Consumers have more disposable cash in their wallets and so some 70% of monthly household income is spent on goods and services, compared to 40% on average in the west. Household expenditures in comparative perspective : % of monthly income

THE STRUCTURE OF HOUSHOLD CONSUMPTION EXPENDITURE Household expenditures in comparative perspective : % of monthly income

THE STRUCTURE OF HOUSHOLD CONSUMPTION EXPENDITURE Household expenditures in comparative perspective : % of monthly income

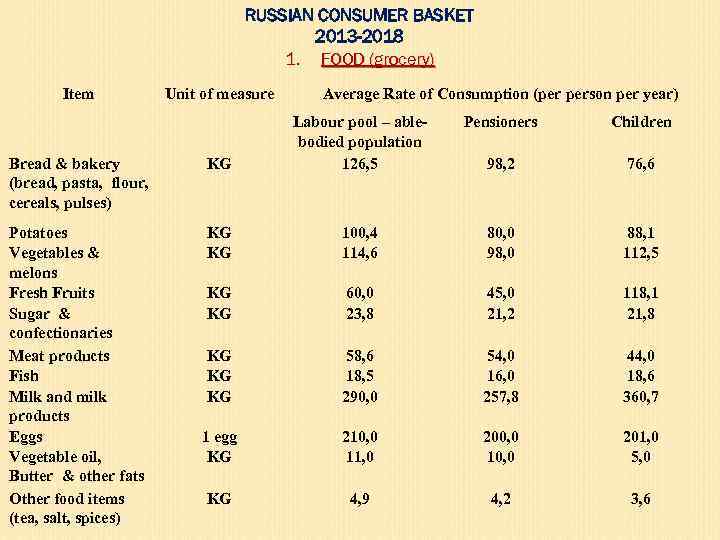

CONSUMER BUSKET IN RUSSIA Consumer basket is a selected list of goods and services, usually food and household items, represented in terms of rates of consumption regarded as standards for sustainable living. On January 1 2013 a new consumer basket was officially established. It will be valid till 2018. RUSSIAN CONSUMER BASKET 2013 -2018 1. FOOD (grocery): Dairy rates of food consumption established in 2013 as a standard for sustainable living of an average Russian citizen: - bread: 300 g - potatoes : 280 g. , - vegetables: 300 g. , - fresh fruits – 160 g. , - sweets – 60 g. , - milk and milk products – 800 g. , - butter and vegetable oil – 40 g. - 1 egg per 2 days; - meat 160 g. ; - fish 350 g. per week.

CONSUMER BUSKET IN RUSSIA Consumer basket is a selected list of goods and services, usually food and household items, represented in terms of rates of consumption regarded as standards for sustainable living. On January 1 2013 a new consumer basket was officially established. It will be valid till 2018. RUSSIAN CONSUMER BASKET 2013 -2018 1. FOOD (grocery): Dairy rates of food consumption established in 2013 as a standard for sustainable living of an average Russian citizen: - bread: 300 g - potatoes : 280 g. , - vegetables: 300 g. , - fresh fruits – 160 g. , - sweets – 60 g. , - milk and milk products – 800 g. , - butter and vegetable oil – 40 g. - 1 egg per 2 days; - meat 160 g. ; - fish 350 g. per week.

RUSSIAN CONSUMER BASKET 2013 -2018 1. FOOD (grocery) Item Unit of measure Average Rate of Consumption (per person per year) Bread & bakery (bread, pasta, flour, cereals, pulses) KG Labour pool – ablebodied population 126, 5 Pensioners Children 98, 2 76, 6 Potatoes Vegetables & melons Fresh Fruits Sugar & confectionaries Meat products Fish Milk and milk products Eggs Vegetable oil, Butter & other fats Other food items (tea, salt, spices) KG KG 100, 4 114, 6 80, 0 98, 0 88, 1 112, 5 KG KG 60, 0 23, 8 45, 0 21, 2 118, 1 21, 8 KG KG KG 58, 6 18, 5 290, 0 54, 0 16, 0 257, 8 44, 0 18, 6 360, 7 1 egg KG 210, 0 11, 0 200, 0 10, 0 201, 0 5, 0 KG 4, 9 4, 2 3, 6

RUSSIAN CONSUMER BASKET 2013 -2018 1. FOOD (grocery) Item Unit of measure Average Rate of Consumption (per person per year) Bread & bakery (bread, pasta, flour, cereals, pulses) KG Labour pool – ablebodied population 126, 5 Pensioners Children 98, 2 76, 6 Potatoes Vegetables & melons Fresh Fruits Sugar & confectionaries Meat products Fish Milk and milk products Eggs Vegetable oil, Butter & other fats Other food items (tea, salt, spices) KG KG 100, 4 114, 6 80, 0 98, 0 88, 1 112, 5 KG KG 60, 0 23, 8 45, 0 21, 2 118, 1 21, 8 KG KG KG 58, 6 18, 5 290, 0 54, 0 16, 0 257, 8 44, 0 18, 6 360, 7 1 egg KG 210, 0 11, 0 200, 0 10, 0 201, 0 5, 0 KG 4, 9 4, 2 3, 6

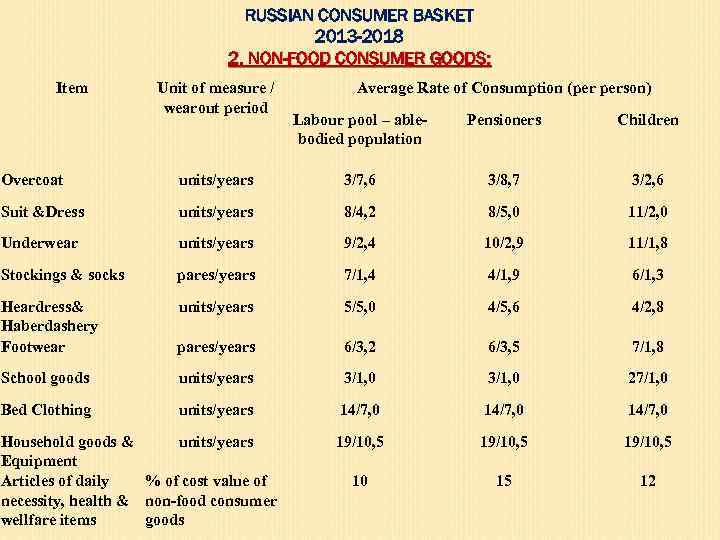

RUSSIAN CONSUMER BASKET 2013 -2018 2. NON-FOOD CONSUMER GOODS: Item Unit of measure / wearout period Average Rate of Consumption (per person) Labour pool – ablebodied population Pensioners Children Overcoat units/years 3/7, 6 3/8, 7 3/2, 6 Suit &Dress units/years 8/4, 2 8/5, 0 11/2, 0 Underwear units/years 9/2, 4 10/2, 9 11/1, 8 Stockings & socks pares/years 7/1, 4 4/1, 9 6/1, 3 Heardress& Haberdashery Footwear units/years 5/5, 0 4/5, 6 4/2, 8 pares/years 6/3, 2 6/3, 5 7/1, 8 School goods units/years 3/1, 0 27/1, 0 Bed Clothing units/years 14/7, 0 19/10, 5 10 15 12 Household goods & units/years Equipment Articles of daily % of cost value of necessity, health & non-food consumer wellfare items goods

RUSSIAN CONSUMER BASKET 2013 -2018 2. NON-FOOD CONSUMER GOODS: Item Unit of measure / wearout period Average Rate of Consumption (per person) Labour pool – ablebodied population Pensioners Children Overcoat units/years 3/7, 6 3/8, 7 3/2, 6 Suit &Dress units/years 8/4, 2 8/5, 0 11/2, 0 Underwear units/years 9/2, 4 10/2, 9 11/1, 8 Stockings & socks pares/years 7/1, 4 4/1, 9 6/1, 3 Heardress& Haberdashery Footwear units/years 5/5, 0 4/5, 6 4/2, 8 pares/years 6/3, 2 6/3, 5 7/1, 8 School goods units/years 3/1, 0 27/1, 0 Bed Clothing units/years 14/7, 0 19/10, 5 10 15 12 Household goods & units/years Equipment Articles of daily % of cost value of necessity, health & non-food consumer wellfare items goods

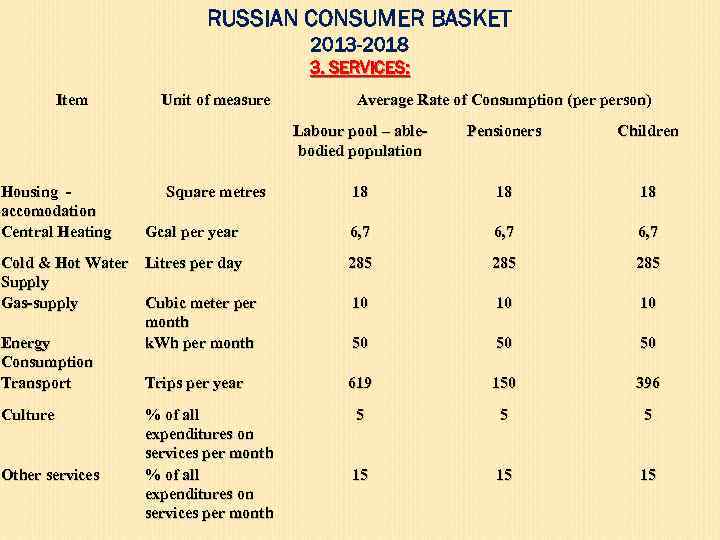

RUSSIAN CONSUMER BASKET 2013 -2018 3. SERVICES: Item Unit of measure Average Rate of Consumption (per person) Labour pool – ablebodied population Housing accomodation Central Heating Square metres Gcal per year Cold & Hot Water Litres per day Supply Gas-supply Cubic meter per month Energy k. Wh per month Consumption Transport Trips per year Culture Other services % of all expenditures on services per month Pensioners Children 18 18 18 6, 7 285 285 10 10 10 50 50 50 619 150 396 5 5 5 15 15 15

RUSSIAN CONSUMER BASKET 2013 -2018 3. SERVICES: Item Unit of measure Average Rate of Consumption (per person) Labour pool – ablebodied population Housing accomodation Central Heating Square metres Gcal per year Cold & Hot Water Litres per day Supply Gas-supply Cubic meter per month Energy k. Wh per month Consumption Transport Trips per year Culture Other services % of all expenditures on services per month Pensioners Children 18 18 18 6, 7 285 285 10 10 10 50 50 50 619 150 396 5 5 5 15 15 15

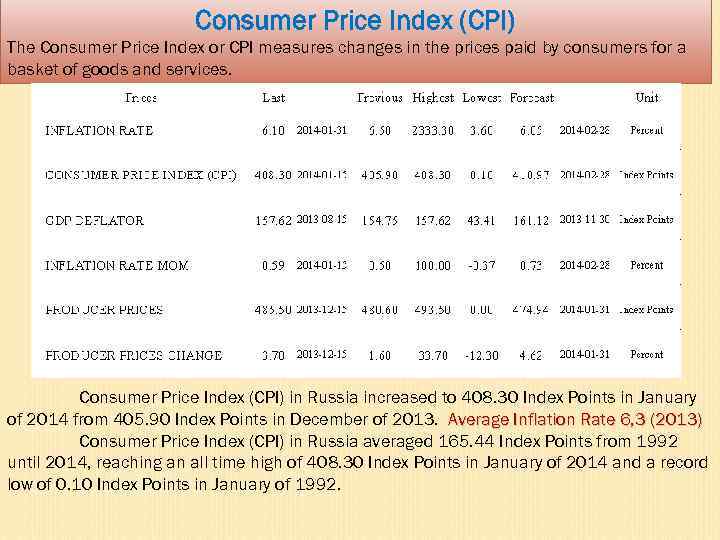

Consumer Price Index (CPI) The Consumer Price Index or CPI measures changes in the prices paid by consumers for a basket of goods and services. Consumer Price Index (CPI) in Russia increased to 408. 30 Index Points in January of 2014 from 405. 90 Index Points in December of 2013. Average Inflation Rate 6, 3 (2013) Consumer Price Index (CPI) in Russia averaged 165. 44 Index Points from 1992 until 2014, reaching an all time high of 408. 30 Index Points in January of 2014 and a record low of 0. 10 Index Points in January of 1992.

Consumer Price Index (CPI) The Consumer Price Index or CPI measures changes in the prices paid by consumers for a basket of goods and services. Consumer Price Index (CPI) in Russia increased to 408. 30 Index Points in January of 2014 from 405. 90 Index Points in December of 2013. Average Inflation Rate 6, 3 (2013) Consumer Price Index (CPI) in Russia averaged 165. 44 Index Points from 1992 until 2014, reaching an all time high of 408. 30 Index Points in January of 2014 and a record low of 0. 10 Index Points in January of 1992.

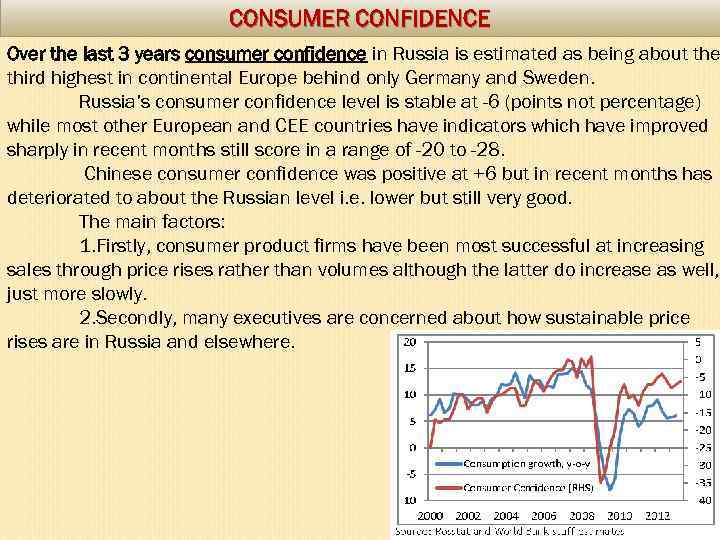

CONSUMER CONFIDENCE Over the last 3 years consumer confidence in Russia is estimated as being about the third highest in continental Europe behind only Germany and Sweden. Russia’s consumer confidence level is stable at -6 (points not percentage) while most other European and CEE countries have indicators which have improved sharply in recent months still score in a range of -20 to -28. Chinese consumer confidence was positive at +6 but in recent months has deteriorated to about the Russian level i. e. lower but still very good. The main factors: 1. Firstly, consumer product firms have been most successful at increasing sales through price rises rather than volumes although the latter do increase as well, just more slowly. 2. Secondly, many executives are concerned about how sustainable price rises are in Russia and elsewhere.

CONSUMER CONFIDENCE Over the last 3 years consumer confidence in Russia is estimated as being about the third highest in continental Europe behind only Germany and Sweden. Russia’s consumer confidence level is stable at -6 (points not percentage) while most other European and CEE countries have indicators which have improved sharply in recent months still score in a range of -20 to -28. Chinese consumer confidence was positive at +6 but in recent months has deteriorated to about the Russian level i. e. lower but still very good. The main factors: 1. Firstly, consumer product firms have been most successful at increasing sales through price rises rather than volumes although the latter do increase as well, just more slowly. 2. Secondly, many executives are concerned about how sustainable price rises are in Russia and elsewhere.

THE PURCHASUNG POWER of The Russian Consumers The growing purchasing power of the middle class has been a key catalyst during the recent consumption boom in Russia. For the last ten years Russia posted the world’s largest annual growth in household and consumer expenditure – 11% compared to the world average of 1. 8% and Europe’s 0. 9%. Annual consumer expenditures were hit hard by the global economic downturn of 2008 -09, seeing a fall of 5. 8% in real terms in 2009, although the indicator rebounded strongly to 4. 7% real growth in 2010. Even during the crisis of 2008 -09, spending levels suffered only temporarily; they recovered rapidly in 2010 across most consumer oriented sectors, regaining pre-crisis levels in some of them. SAVINGS Surviving stage (post-financial crisis) is over; consumers again have an opportunity to keep their savings in the banks and insurance companies and to return to their pre-crisis purchasing habits. Yet Russians continue to be mistrustful of many banks and often save cash at home rather than saving through financial institutions. The Russian savings level remains high at about 8 -9% and with savings and good wage levels combined with almost record low unemployment at 5. 2%, this explains why Russian consumer confidence indicators stay among the best in Europe. The relatively high level of nationwide savings coupled with one of the world’s lowest private debt levels and relatively low unemployment has set a solid foundation to consumer trends for the foreseeable future.

THE PURCHASUNG POWER of The Russian Consumers The growing purchasing power of the middle class has been a key catalyst during the recent consumption boom in Russia. For the last ten years Russia posted the world’s largest annual growth in household and consumer expenditure – 11% compared to the world average of 1. 8% and Europe’s 0. 9%. Annual consumer expenditures were hit hard by the global economic downturn of 2008 -09, seeing a fall of 5. 8% in real terms in 2009, although the indicator rebounded strongly to 4. 7% real growth in 2010. Even during the crisis of 2008 -09, spending levels suffered only temporarily; they recovered rapidly in 2010 across most consumer oriented sectors, regaining pre-crisis levels in some of them. SAVINGS Surviving stage (post-financial crisis) is over; consumers again have an opportunity to keep their savings in the banks and insurance companies and to return to their pre-crisis purchasing habits. Yet Russians continue to be mistrustful of many banks and often save cash at home rather than saving through financial institutions. The Russian savings level remains high at about 8 -9% and with savings and good wage levels combined with almost record low unemployment at 5. 2%, this explains why Russian consumer confidence indicators stay among the best in Europe. The relatively high level of nationwide savings coupled with one of the world’s lowest private debt levels and relatively low unemployment has set a solid foundation to consumer trends for the foreseeable future.

The growth of consumer credit provides additional opportunities in future consumption growth. Increased credit availability throughout the last decade has enabled far more people to finance their purchasing, yet – at less than 10% – private debt as a percentage of Russian GDP is still among the lowest in the world and has substantial further scope. Higher credit card penetration and improved consumer awareness of how to use credit effectively should increase the accessibility of money for impulse or urgent purchases. Currently Russians hold c. 71 credit cards per one thousand people, which is four times lower than the world average of c. 290 cards and 14 times below the level in Brazil, where every citizen has, on average, one credit card, according to Euromonitor. On the other hand, the high average growth of stock (35 -40 percent, y-o-y) in consumer and other household credits resulted in an increase in total household indebtedness to 25 percent of total disposable income in the first 5 months of 2013, from 17 percent in 2011 and 19 percent in 2012. This increasing debt burden puts pressure on consumption, as interest payments have now reached 5 percent, a significant share of the average ousehold’s income. And the net savings rate did not grow in the past months, fluctuating marginally around 1516 percent.

The growth of consumer credit provides additional opportunities in future consumption growth. Increased credit availability throughout the last decade has enabled far more people to finance their purchasing, yet – at less than 10% – private debt as a percentage of Russian GDP is still among the lowest in the world and has substantial further scope. Higher credit card penetration and improved consumer awareness of how to use credit effectively should increase the accessibility of money for impulse or urgent purchases. Currently Russians hold c. 71 credit cards per one thousand people, which is four times lower than the world average of c. 290 cards and 14 times below the level in Brazil, where every citizen has, on average, one credit card, according to Euromonitor. On the other hand, the high average growth of stock (35 -40 percent, y-o-y) in consumer and other household credits resulted in an increase in total household indebtedness to 25 percent of total disposable income in the first 5 months of 2013, from 17 percent in 2011 and 19 percent in 2012. This increasing debt burden puts pressure on consumption, as interest payments have now reached 5 percent, a significant share of the average ousehold’s income. And the net savings rate did not grow in the past months, fluctuating marginally around 1516 percent.

CURRENT AND FUTURE TRENDS IN CONSUMER SPENDING EXPENDITURES ON GROVERIES IN MOSCOW & IN OTHER CITIES RUB/MONTH PER HOUSHOLD

CURRENT AND FUTURE TRENDS IN CONSUMER SPENDING EXPENDITURES ON GROVERIES IN MOSCOW & IN OTHER CITIES RUB/MONTH PER HOUSHOLD

CURRENT AND FUTURE TRENDS IN CONSUMER SPENDING ON HOUSING The housing stock is estimated at 19. 7 million buildings, with 3. 2 billion m 2 of floor space. 72 % of that floor space is estimated to be in urban areas. The predominant housing option is multi-family apartment buildings, which number 3. 2 million buildings with 2. 2 billion m 2 of floor space. Most of the apartments are privately owned, although the common spaces are maintained by municipal management companies. Currently, Russians spend, on average, c. 7% of their income on housing including rent, interest on mortgages, flat refurbishment, utilities etc. (1) Russians have the lowest space per capita; (2) lower mortgage penetration relative to Western European benchmarks (2011: 3% of GDP ) (3) relatively lower utility tariffs. Housing conditions: Owner-occupied apartment 73 % Private house 13 % Rented flat 7 % Municipal housing 6% Hostel 1%

CURRENT AND FUTURE TRENDS IN CONSUMER SPENDING ON HOUSING The housing stock is estimated at 19. 7 million buildings, with 3. 2 billion m 2 of floor space. 72 % of that floor space is estimated to be in urban areas. The predominant housing option is multi-family apartment buildings, which number 3. 2 million buildings with 2. 2 billion m 2 of floor space. Most of the apartments are privately owned, although the common spaces are maintained by municipal management companies. Currently, Russians spend, on average, c. 7% of their income on housing including rent, interest on mortgages, flat refurbishment, utilities etc. (1) Russians have the lowest space per capita; (2) lower mortgage penetration relative to Western European benchmarks (2011: 3% of GDP ) (3) relatively lower utility tariffs. Housing conditions: Owner-occupied apartment 73 % Private house 13 % Rented flat 7 % Municipal housing 6% Hostel 1%

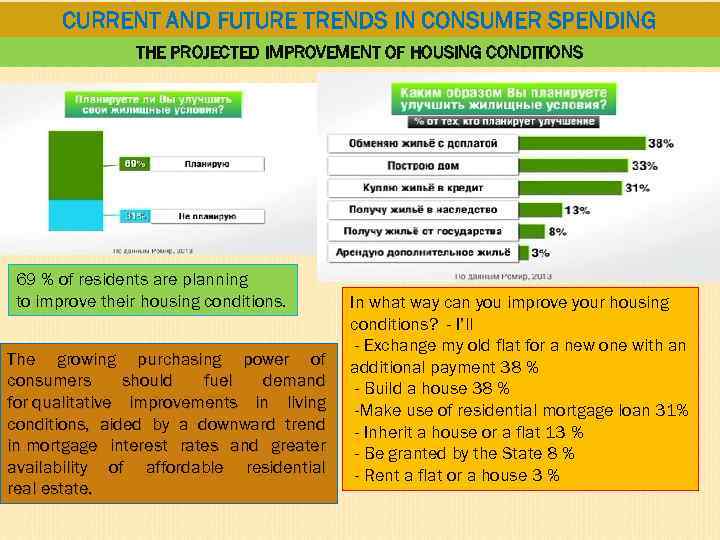

CURRENT AND FUTURE TRENDS IN CONSUMER SPENDING THE PROJECTED IMPROVEMENT OF HOUSING CONDITIONS 69 % of residents are planning to improve their housing conditions. The growing purchasing power of consumers should fuel demand for qualitative improvements in living conditions, aided by a downward trend in mortgage interest rates and greater availability of affordable residential real estate. In what way can you improve your housing conditions? - I’ll - Exchange my old flat for a new one with an additional payment 38 % - Build a house 38 % -Make use of residential mortgage loan 31% - Inherit a house or a flat 13 % - Be granted by the State 8 % - Rent a flat or a house 3 %

CURRENT AND FUTURE TRENDS IN CONSUMER SPENDING THE PROJECTED IMPROVEMENT OF HOUSING CONDITIONS 69 % of residents are planning to improve their housing conditions. The growing purchasing power of consumers should fuel demand for qualitative improvements in living conditions, aided by a downward trend in mortgage interest rates and greater availability of affordable residential real estate. In what way can you improve your housing conditions? - I’ll - Exchange my old flat for a new one with an additional payment 38 % - Build a house 38 % -Make use of residential mortgage loan 31% - Inherit a house or a flat 13 % - Be granted by the State 8 % - Rent a flat or a house 3 %

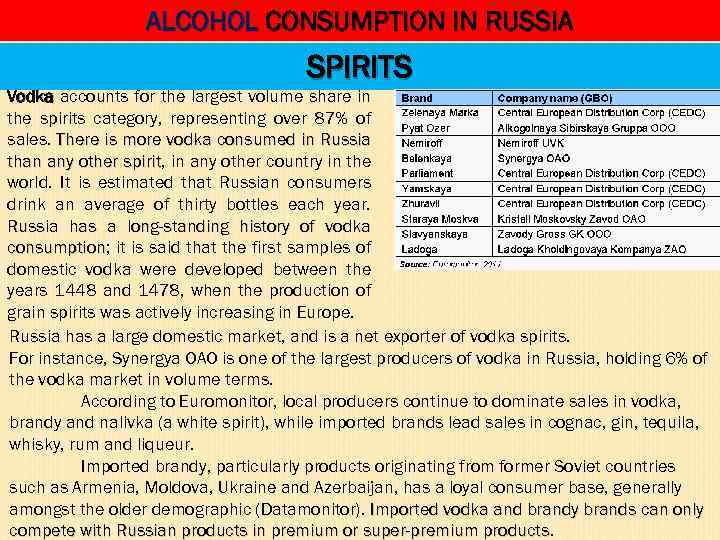

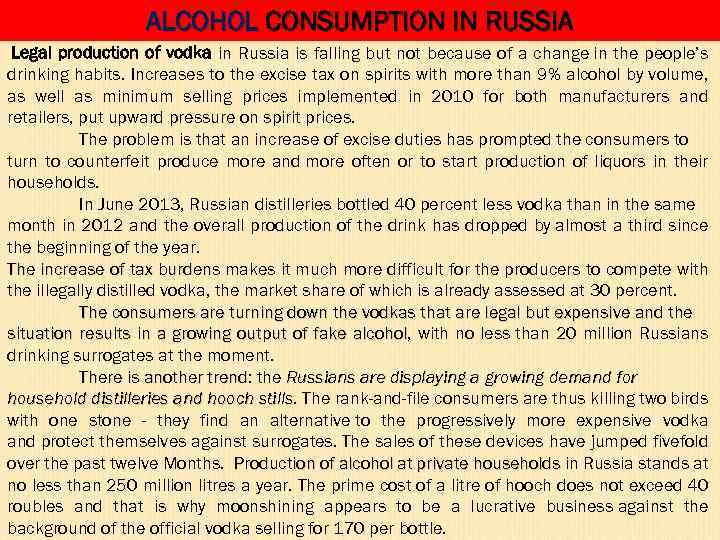

CURRENT AND FUTURE TRENDS IN CONSUMER SPENDING Clothing and footwear. Because of the relatively cold climate, Russians spend a greater portion of their incomes on apparel and footwear, but still c. 60% below the level of Finland where weather conditions are similar. Alcoholic beverages and tobacco – expenditure volumes likely to decline due to: (1) government measures to curb domestic alcohol and tobacco intake; (2) stronger health trends in consumption and lifestyle; and (3) new excise duty legislation set to bring the price of alcohol and tobacco to average European levels in the medium term. Other goods and services Higher disposable incomes, if these can be achieved, will translate into greater demand for financial services (banking and insurance) and other non-food products and services Leisure and recreation The out-of-pocket spend on tourism, leisure and recreation comes account for 4% of income by Russians. • Russians are travelling and spending a significant amount of money overseas. Russians spend on average US$1, 000 per head on their holidays and 72 % of tourists pay for their holidays in cash. Higher disposable incomes should boost demand for these services, benefitting the domestic tourism industry and air carriers such as Aeroflot and Transaero. There is a trend toward larger purchases for future use and additional purchases.

CURRENT AND FUTURE TRENDS IN CONSUMER SPENDING Clothing and footwear. Because of the relatively cold climate, Russians spend a greater portion of their incomes on apparel and footwear, but still c. 60% below the level of Finland where weather conditions are similar. Alcoholic beverages and tobacco – expenditure volumes likely to decline due to: (1) government measures to curb domestic alcohol and tobacco intake; (2) stronger health trends in consumption and lifestyle; and (3) new excise duty legislation set to bring the price of alcohol and tobacco to average European levels in the medium term. Other goods and services Higher disposable incomes, if these can be achieved, will translate into greater demand for financial services (banking and insurance) and other non-food products and services Leisure and recreation The out-of-pocket spend on tourism, leisure and recreation comes account for 4% of income by Russians. • Russians are travelling and spending a significant amount of money overseas. Russians spend on average US$1, 000 per head on their holidays and 72 % of tourists pay for their holidays in cash. Higher disposable incomes should boost demand for these services, benefitting the domestic tourism industry and air carriers such as Aeroflot and Transaero. There is a trend toward larger purchases for future use and additional purchases.

RATHER AN OPTIMISTIC FORECAST The Bank of America Merrill Lynch Economics team forecasts: “We expect the structure of spending to change, benefitting most sectors but driving discretionary spending in particular. We see per capita food expenditure growing by c. 56% (to over RUB 100, 000 pa) driven mostly by qualitative changes in consumption, but non-food spend increasing by over 120% (to over RUB 150, 000 pa) between 2011 and 2020. Nonfood retail, leisure, housing, and financial services will be major winners from the evolving Russian consumer. We forecast 116% growth in per capita expenditure on pharmaceuticals over the same period (to RUB 7, 200 pa) while expenditure on consumer electronics almost doubles (to RUB 11, 000 pa). The key market drivers will be: Disposable income growth as the key catalyst supporting consumption; fragmented nature of Russia’s retail market implies attractive medium-term potential The for organic expansion and consolidation; Non-food retail sales to pick up faster than food sales, helped by a greater slice of disposable incomes being spent on discretionary categories. ” Companies to take advantage of these trends. Most of the companies in the retail sector are likely to take advantage of structural and income growth trends. There are sectors that would benefit from a combination of income and structural growth (food retail, pharma, consumer goods). MGNT, X 5, OKEY, DIXY (among the top six grocers in Russia), PHST ( - Фармстандарт - leading Russian pharma company) and MVID (leading consumer electronics retailer) look long-term sector beneficiaries. According to the most optimistic forecasts consumer spending could almost double to $3 trillion by 2025. [Source : The Bank of America Merrill Lynch Economics team]

RATHER AN OPTIMISTIC FORECAST The Bank of America Merrill Lynch Economics team forecasts: “We expect the structure of spending to change, benefitting most sectors but driving discretionary spending in particular. We see per capita food expenditure growing by c. 56% (to over RUB 100, 000 pa) driven mostly by qualitative changes in consumption, but non-food spend increasing by over 120% (to over RUB 150, 000 pa) between 2011 and 2020. Nonfood retail, leisure, housing, and financial services will be major winners from the evolving Russian consumer. We forecast 116% growth in per capita expenditure on pharmaceuticals over the same period (to RUB 7, 200 pa) while expenditure on consumer electronics almost doubles (to RUB 11, 000 pa). The key market drivers will be: Disposable income growth as the key catalyst supporting consumption; fragmented nature of Russia’s retail market implies attractive medium-term potential The for organic expansion and consolidation; Non-food retail sales to pick up faster than food sales, helped by a greater slice of disposable incomes being spent on discretionary categories. ” Companies to take advantage of these trends. Most of the companies in the retail sector are likely to take advantage of structural and income growth trends. There are sectors that would benefit from a combination of income and structural growth (food retail, pharma, consumer goods). MGNT, X 5, OKEY, DIXY (among the top six grocers in Russia), PHST ( - Фармстандарт - leading Russian pharma company) and MVID (leading consumer electronics retailer) look long-term sector beneficiaries. According to the most optimistic forecasts consumer spending could almost double to $3 trillion by 2025. [Source : The Bank of America Merrill Lynch Economics team]

Current trends in personal consumption expenditures Russian personal consumption expenditures remained relatively strong in 2013 but grew at a lower rate than in 2012. Personal consumption expenditures were up 4. 7 percent in 2013 compared to a very strong 7. 9 percent for 2012. World Bank Research Report : “Consumption, the main growth driver in the past, expanded at a much slower pace than a year ago, despite low unemployment levels and increases in wages and credit. Some of the slowdown in consumer demand can be attributed to the higher burden of interest payments for households as a result of the recent credit boom, along with stubbornly high inflation in 2013. It also reflects a lack of confidence rooted in lingering uncertainty on how the global economy and specifically, the Russian economy will play out. While investors were already in a wait-and-see mode for a while, consumers now appear to have joined them and the players in the Russian economy are sitting on the fence. ” [Source: World Bank Report] Nonetheless, domestic consumption was still relatively strong and this trend is likely to continue in 2014.

Current trends in personal consumption expenditures Russian personal consumption expenditures remained relatively strong in 2013 but grew at a lower rate than in 2012. Personal consumption expenditures were up 4. 7 percent in 2013 compared to a very strong 7. 9 percent for 2012. World Bank Research Report : “Consumption, the main growth driver in the past, expanded at a much slower pace than a year ago, despite low unemployment levels and increases in wages and credit. Some of the slowdown in consumer demand can be attributed to the higher burden of interest payments for households as a result of the recent credit boom, along with stubbornly high inflation in 2013. It also reflects a lack of confidence rooted in lingering uncertainty on how the global economy and specifically, the Russian economy will play out. While investors were already in a wait-and-see mode for a while, consumers now appear to have joined them and the players in the Russian economy are sitting on the fence. ” [Source: World Bank Report] Nonetheless, domestic consumption was still relatively strong and this trend is likely to continue in 2014.

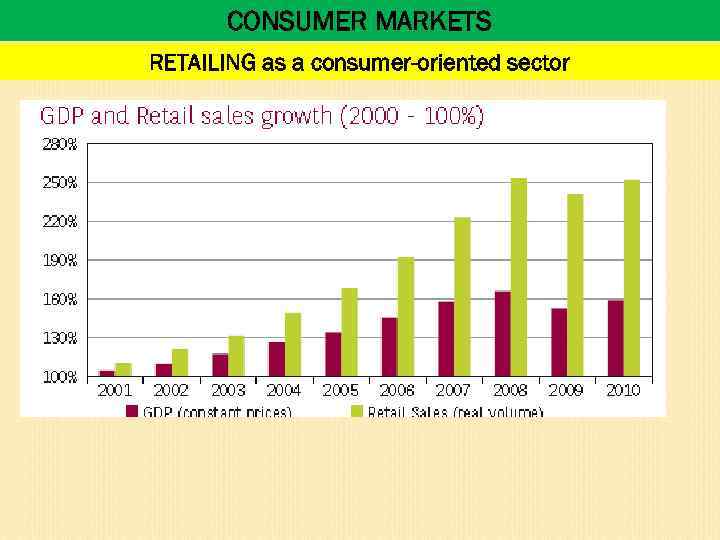

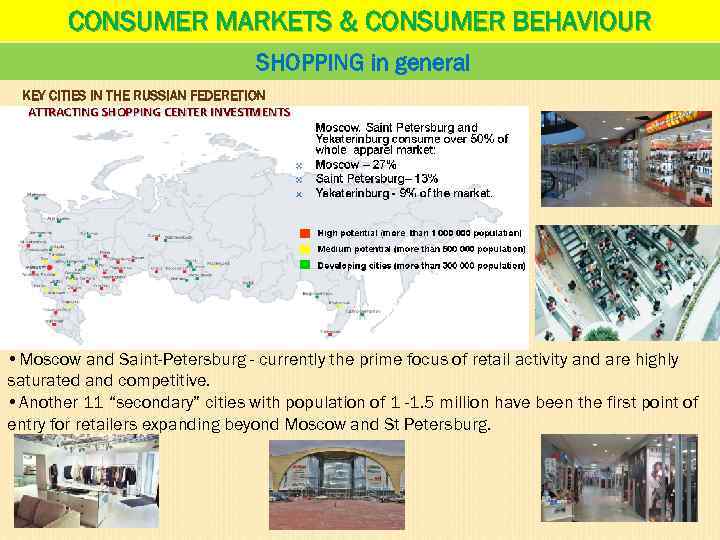

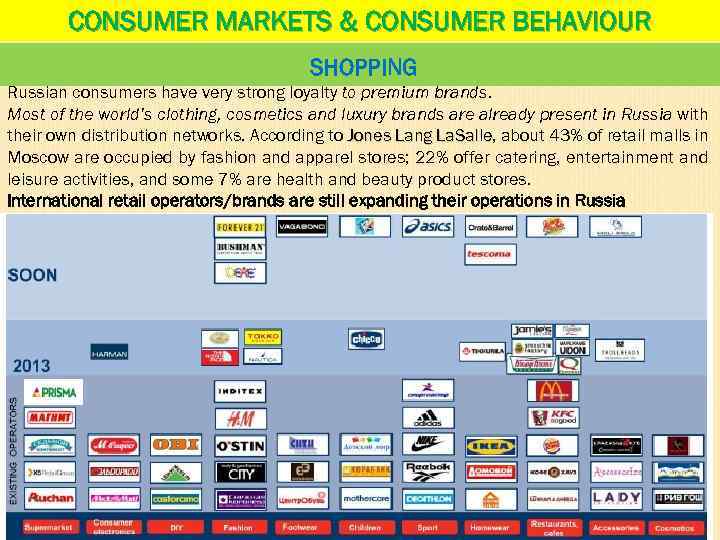

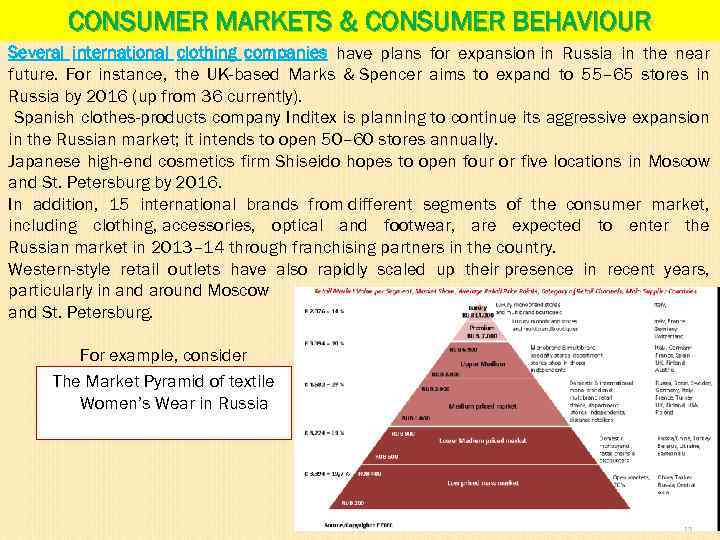

CONSUMER MARKETS RETAILING as a consumer-oriented sector Retail trade is one of the most vigorously developing sectors of Russia’s economy. Over the past 10 years, the Russian retail and wholesale sector has changed dramatically. For instance , over 2001 -11, the Russian retail sector increased its turnover sixfold, created 5 mln new jobs, and doubled its productivity from 15% of the US level to 31% today – the best productivity gain of any major Russian manufacturing and service sector. “At the heart of this improvement has been the growth in modern retail formats, which is estimated to be three to four times as productive as traditional Russian retail formats, but still lag best in class Western peers. ” (Source: Sberbank Investment Research report). The Russian retail sector is highly fragmented compared with Western Europe – the top-three retailers command c. 20% and c. 8% in food and non-food segments versus c. 35% and c. 17%, on average, across our selected peer countries. The consolidation process is likely to continue in two key directions: directions largest federal retailers will likely cement their positions and increase their The geographical footprint through small/mid-sized M&A (mergers and acquisitions) operations. penetration of modern food retail should remain high in Moscow and St. Petersburg, The while other regions offer attractive opportunities for strong organic expansion and still enjoy low competition levels In the consumer retail sector, there an estimated 400, 000 points of sale across Russia including 70, 000 kiosks selling fast-moving food, snacks, beer and cigarettes. This is set to consolidate, and to consolidate quickly.

CONSUMER MARKETS RETAILING as a consumer-oriented sector Retail trade is one of the most vigorously developing sectors of Russia’s economy. Over the past 10 years, the Russian retail and wholesale sector has changed dramatically. For instance , over 2001 -11, the Russian retail sector increased its turnover sixfold, created 5 mln new jobs, and doubled its productivity from 15% of the US level to 31% today – the best productivity gain of any major Russian manufacturing and service sector. “At the heart of this improvement has been the growth in modern retail formats, which is estimated to be three to four times as productive as traditional Russian retail formats, but still lag best in class Western peers. ” (Source: Sberbank Investment Research report). The Russian retail sector is highly fragmented compared with Western Europe – the top-three retailers command c. 20% and c. 8% in food and non-food segments versus c. 35% and c. 17%, on average, across our selected peer countries. The consolidation process is likely to continue in two key directions: directions largest federal retailers will likely cement their positions and increase their The geographical footprint through small/mid-sized M&A (mergers and acquisitions) operations. penetration of modern food retail should remain high in Moscow and St. Petersburg, The while other regions offer attractive opportunities for strong organic expansion and still enjoy low competition levels In the consumer retail sector, there an estimated 400, 000 points of sale across Russia including 70, 000 kiosks selling fast-moving food, snacks, beer and cigarettes. This is set to consolidate, and to consolidate quickly.

CONSUMER MARKETS RETAILING as a consumer-oriented sector

CONSUMER MARKETS RETAILING as a consumer-oriented sector