1a86d1eb30728aaff44a20d6dcc040bb.ppt

- Количество слайдов: 157

Consumption Autonomous consumption- The minimum level of consumption that would still exist even if a consumer had absolutely no income. (would occur regardless of a change in income)

Consumption Autonomous consumption- The minimum level of consumption that would still exist even if a consumer had absolutely no income. (would occur regardless of a change in income)

Saving Household The NOT spending ability to save is constrained by The amount of disposable income The Do propensity to consume households save if Yd = 0? NO

Saving Household The NOT spending ability to save is constrained by The amount of disposable income The Do propensity to consume households save if Yd = 0? NO

Determinants of C & S Wealth- this is not how much money you make it is made up of savings, assets (stocks and bonds), and real estate Increased wealth. : Inc. C & Dec. S Decreased wealth. : Dec. C & Inc. S Expectations Positive. : Inc C & Dec S Negative. : Dec C & Inc S Household Debt High Debt. : Dec C & Inc S Low Debt. : Inc C & Dec S Taxes Inc. : Dec C & Dec S Dec. : Inc C & Inc S

Determinants of C & S Wealth- this is not how much money you make it is made up of savings, assets (stocks and bonds), and real estate Increased wealth. : Inc. C & Dec. S Decreased wealth. : Dec. C & Inc. S Expectations Positive. : Inc C & Dec S Negative. : Dec C & Inc S Household Debt High Debt. : Dec C & Inc S Low Debt. : Inc C & Dec S Taxes Inc. : Dec C & Dec S Dec. : Inc C & Inc S

MPC & MPS Marginal Propensity to Consume ΔC/ΔYd % of every extra dollar earned that is spent C Usually DI by $1 between 0 and 1 Marginal Propensity to Save ΔS/ΔYd % of every extra dollar earned that is saved MPC + MPS = 1 1 – MPC = MPS 1 – MPS = MPC

MPC & MPS Marginal Propensity to Consume ΔC/ΔYd % of every extra dollar earned that is spent C Usually DI by $1 between 0 and 1 Marginal Propensity to Save ΔS/ΔYd % of every extra dollar earned that is saved MPC + MPS = 1 1 – MPC = MPS 1 – MPS = MPC

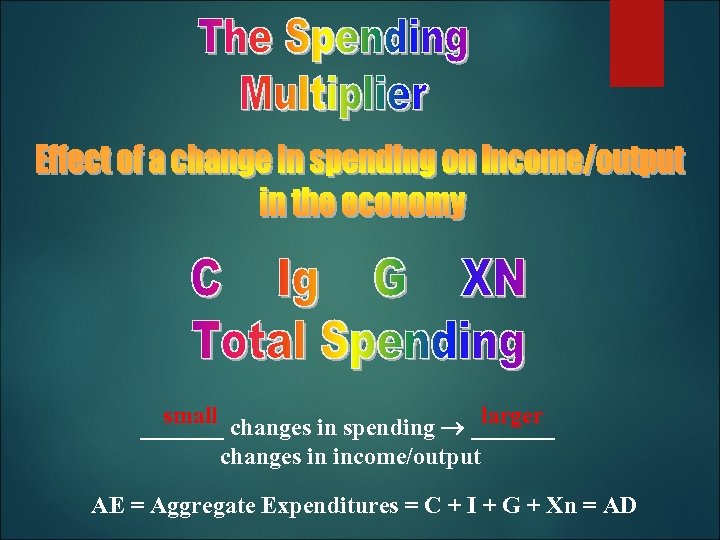

small larger _______ changes in spending _______ changes in income/output AE = Aggregate Expenditures = C + I + G + Xn = AD

small larger _______ changes in spending _______ changes in income/output AE = Aggregate Expenditures = C + I + G + Xn = AD

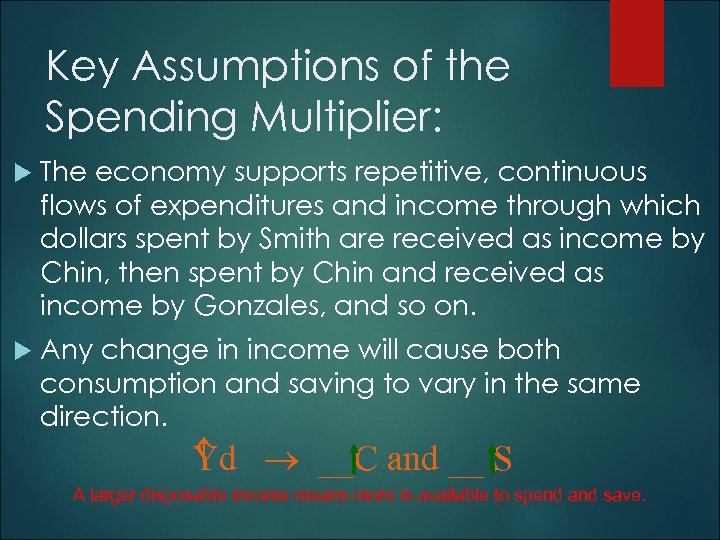

Key Assumptions of the Spending Multiplier: The economy supports repetitive, continuous flows of expenditures and income through which dollars spent by Smith are received as income by Chin, then spent by Chin and received as income by Gonzales, and so on. Any change in income will cause both consumption and saving to vary in the same direction. Y d __C and __ S A larger disposable income means more is available to spend and save.

Key Assumptions of the Spending Multiplier: The economy supports repetitive, continuous flows of expenditures and income through which dollars spent by Smith are received as income by Chin, then spent by Chin and received as income by Gonzales, and so on. Any change in income will cause both consumption and saving to vary in the same direction. Y d __C and __ S A larger disposable income means more is available to spend and save.

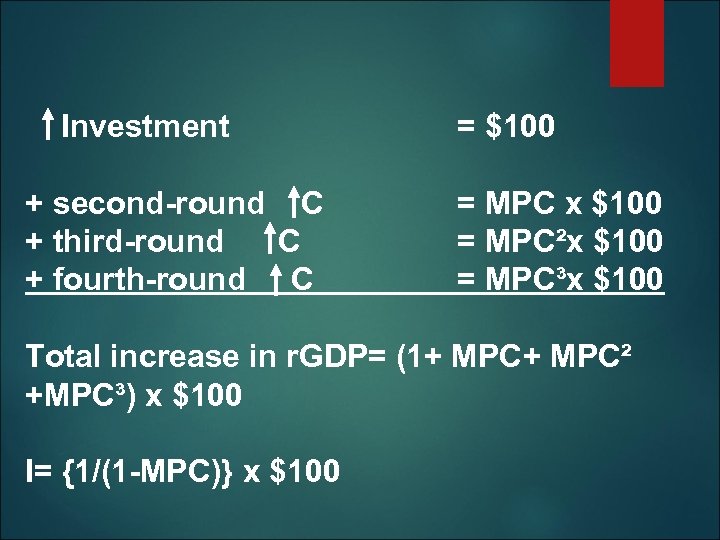

Investment + second-round C + third-round C + fourth-round C = $100 = MPC x $100 = MPC²x $100 = MPC³x $100 Total increase in r. GDP= (1+ MPC² +MPC³) x $100 I= {1/(1 -MPC)} x $100

Investment + second-round C + third-round C + fourth-round C = $100 = MPC x $100 = MPC²x $100 = MPC³x $100 Total increase in r. GDP= (1+ MPC² +MPC³) x $100 I= {1/(1 -MPC)} x $100

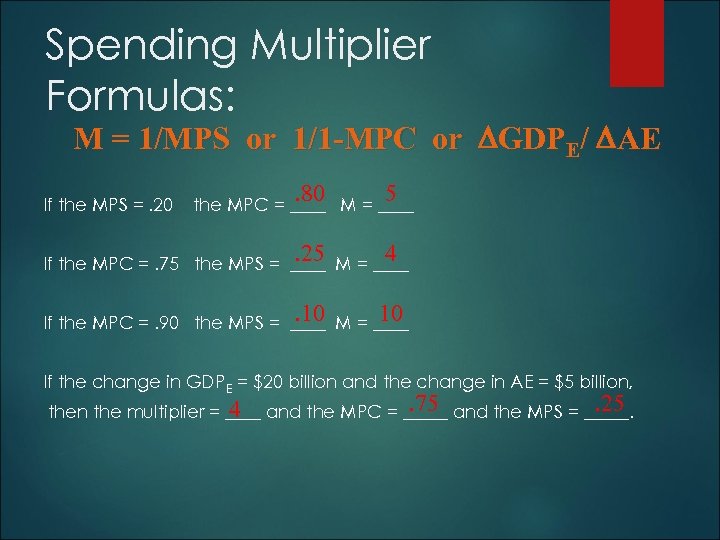

Spending Multiplier Formulas: M = 1/MPS or 1/1 -MPC or GDPE/ AE. 80 5 . 25 If the MPS =. 20 4 the MPC = ____ M = ____ If the MPC =. 75 the MPS = ____ M = ____ . 10 10 If the MPC =. 90 the MPS = ____ M = ____ If the change in GDPE = $20 billion and the change in AE = $5 billion, . 75. 25 4 then the multiplier = ____ and the MPC = _____ and the MPS = _____.

Spending Multiplier Formulas: M = 1/MPS or 1/1 -MPC or GDPE/ AE. 80 5 . 25 If the MPS =. 20 4 the MPC = ____ M = ____ If the MPC =. 75 the MPS = ____ M = ____ . 10 10 If the MPC =. 90 the MPS = ____ M = ____ If the change in GDPE = $20 billion and the change in AE = $5 billion, . 75. 25 4 then the multiplier = ____ and the MPC = _____ and the MPS = _____.

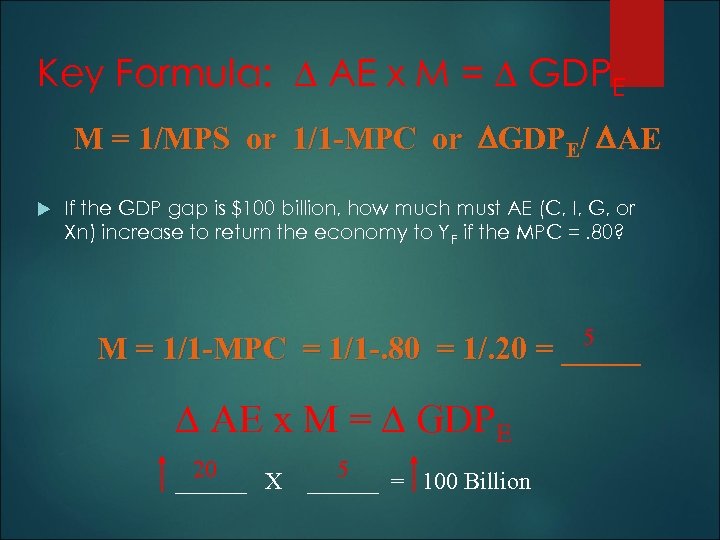

Key Formula: AE x M = GDPE M = 1/MPS or 1/1 -MPC or GDPE/ AE If the GDP gap is $100 billion, how much must AE (C, I, G, or Xn) increase to return the economy to Y F if the MPC =. 80? 5 M = 1/1 -MPC = 1/1 -. 80 = 1/. 20 = _____ AE x M = GDPE 20 ______ X 5 ______ = 100 Billion

Key Formula: AE x M = GDPE M = 1/MPS or 1/1 -MPC or GDPE/ AE If the GDP gap is $100 billion, how much must AE (C, I, G, or Xn) increase to return the economy to Y F if the MPC =. 80? 5 M = 1/1 -MPC = 1/1 -. 80 = 1/. 20 = _____ AE x M = GDPE 20 ______ X 5 ______ = 100 Billion

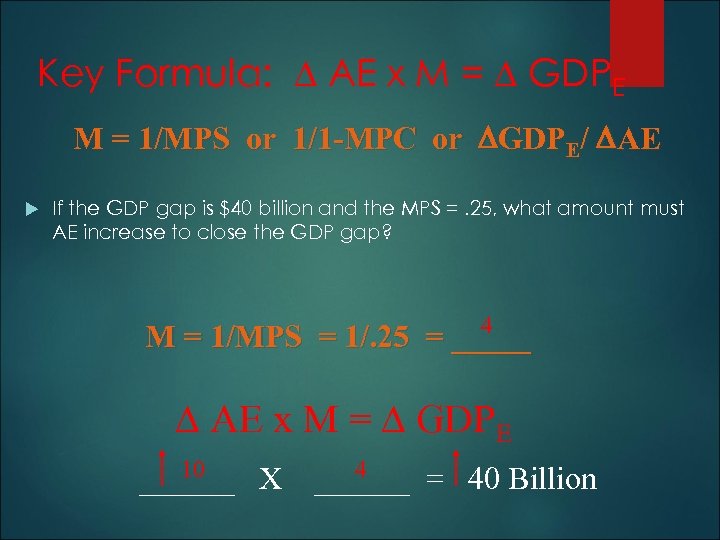

Key Formula: AE x M = GDPE M = 1/MPS or 1/1 -MPC or GDPE/ AE If the GDP gap is $40 billion and the MPS =. 25, what amount must AE increase to close the GDP gap? 4 M = 1/MPS = 1/. 25 = _____ AE x M = GDPE 10 ______ X 4 ______ = 40 Billion

Key Formula: AE x M = GDPE M = 1/MPS or 1/1 -MPC or GDPE/ AE If the GDP gap is $40 billion and the MPS =. 25, what amount must AE increase to close the GDP gap? 4 M = 1/MPS = 1/. 25 = _____ AE x M = GDPE 10 ______ X 4 ______ = 40 Billion

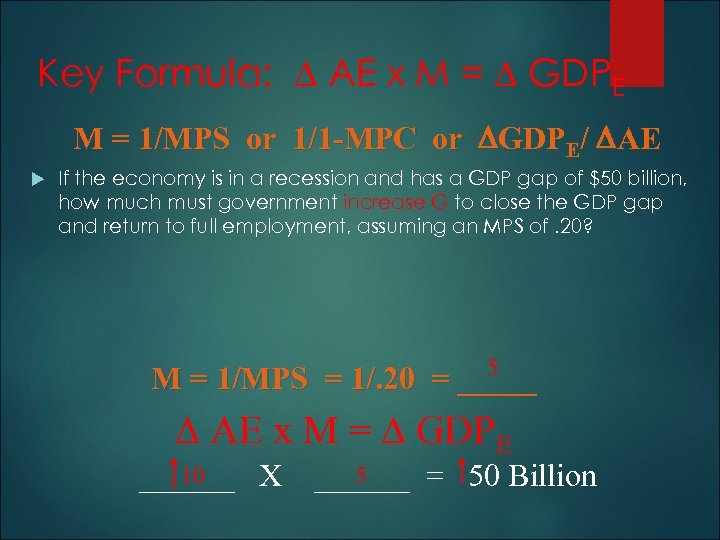

Key Formula: AE x M = GDPE M = 1/MPS or 1/1 -MPC or GDPE/ AE If the economy is in a recession and has a GDP gap of $50 billion, how much must government increase G to close the GDP gap and return to full employment, assuming an MPS of. 20? 5 M = 1/MPS = 1/. 20 = _____ AE x M = GDPE 10 ______ X 5 ______ = 50 Billion

Key Formula: AE x M = GDPE M = 1/MPS or 1/1 -MPC or GDPE/ AE If the economy is in a recession and has a GDP gap of $50 billion, how much must government increase G to close the GDP gap and return to full employment, assuming an MPS of. 20? 5 M = 1/MPS = 1/. 20 = _____ AE x M = GDPE 10 ______ X 5 ______ = 50 Billion

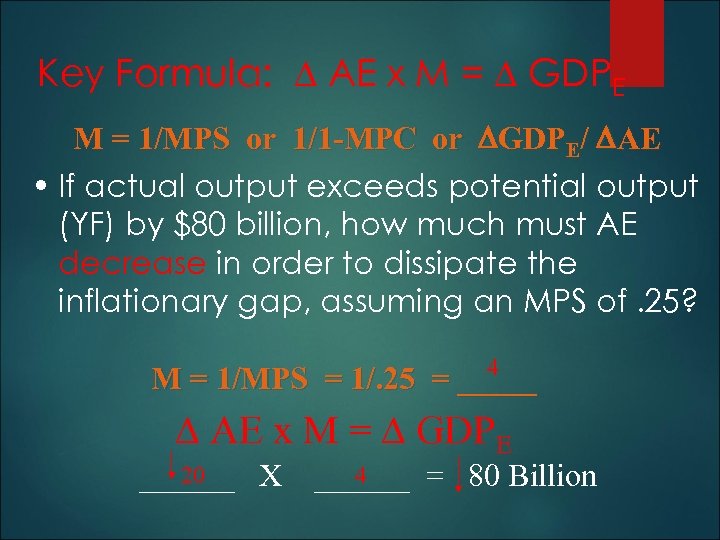

Key Formula: AE x M = GDPE M = 1/MPS or 1/1 -MPC or GDPE/ AE • If actual output exceeds potential output (YF) by $80 billion, how much must AE decrease in order to dissipate the inflationary gap, assuming an MPS of. 25? 4 M = 1/MPS = 1/. 25 = _____ AE x M = GDPE 20 ______ X 4 ______ = 80 Billion

Key Formula: AE x M = GDPE M = 1/MPS or 1/1 -MPC or GDPE/ AE • If actual output exceeds potential output (YF) by $80 billion, how much must AE decrease in order to dissipate the inflationary gap, assuming an MPS of. 25? 4 M = 1/MPS = 1/. 25 = _____ AE x M = GDPE 20 ______ X 4 ______ = 80 Billion

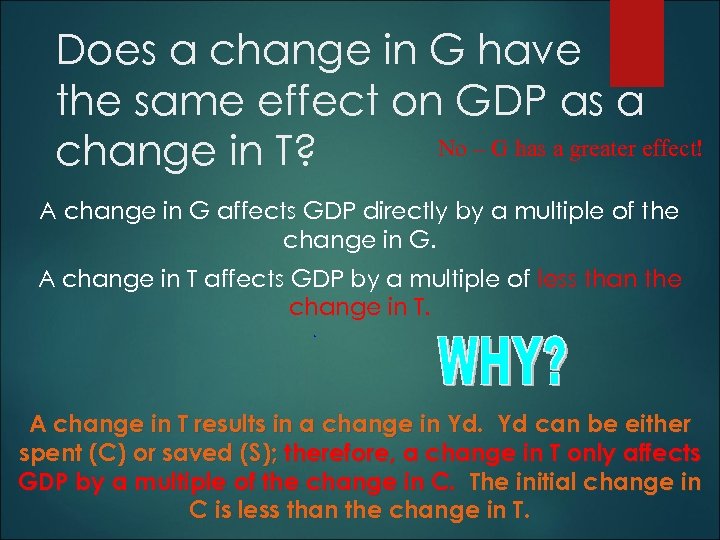

Does a change in G have the same effect on GDP as a No – G has a greater effect! change in T? A change in G affects GDP directly by a multiple of the change in G. A change in T affects GDP by a multiple of less than the change in T. A change in T results in a change in Yd. Yd can be either spent (C) or saved (S); therefore, a change in T only affects GDP by a multiple of the change in C. The initial change in C is less than the change in T.

Does a change in G have the same effect on GDP as a No – G has a greater effect! change in T? A change in G affects GDP directly by a multiple of the change in G. A change in T affects GDP by a multiple of less than the change in T. A change in T results in a change in Yd. Yd can be either spent (C) or saved (S); therefore, a change in T only affects GDP by a multiple of the change in C. The initial change in C is less than the change in T.

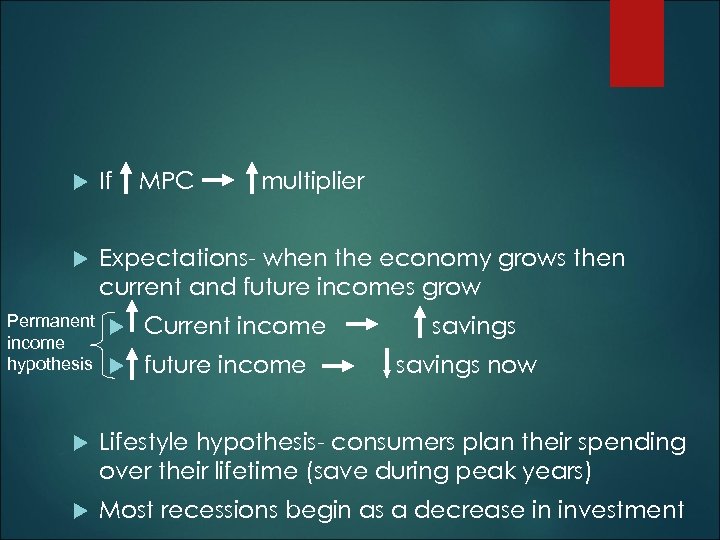

If Expectations- when the economy grows then current and future incomes grow Permanent income hypothesis MPC multiplier Current income future income savings now Lifestyle hypothesis- consumers plan their spending over their lifetime (save during peak years) Most recessions begin as a decrease in investment

If Expectations- when the economy grows then current and future incomes grow Permanent income hypothesis MPC multiplier Current income future income savings now Lifestyle hypothesis- consumers plan their spending over their lifetime (save during peak years) Most recessions begin as a decrease in investment

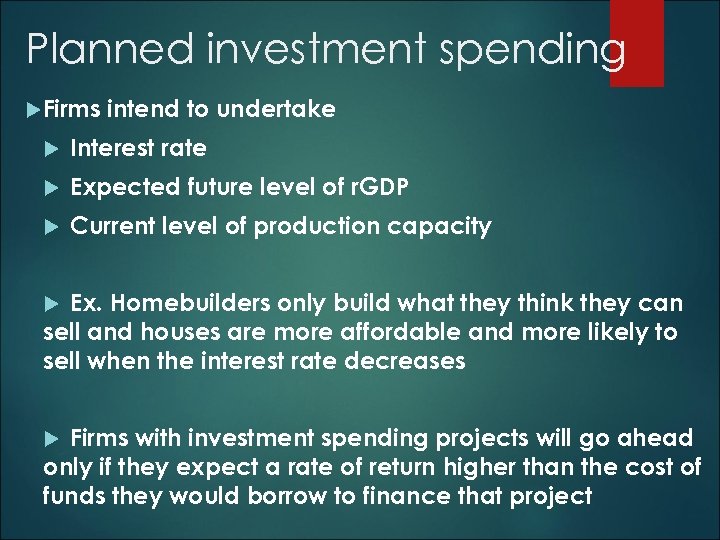

Planned investment spending Firms intend to undertake Interest rate Expected future level of r. GDP Current level of production capacity Ex. Homebuilders only build what they think they can sell and houses are more affordable and more likely to sell when the interest rate decreases Firms with investment spending projects will go ahead only if they expect a rate of return higher than the cost of funds they would borrow to finance that project

Planned investment spending Firms intend to undertake Interest rate Expected future level of r. GDP Current level of production capacity Ex. Homebuilders only build what they think they can sell and houses are more affordable and more likely to sell when the interest rate decreases Firms with investment spending projects will go ahead only if they expect a rate of return higher than the cost of funds they would borrow to finance that project

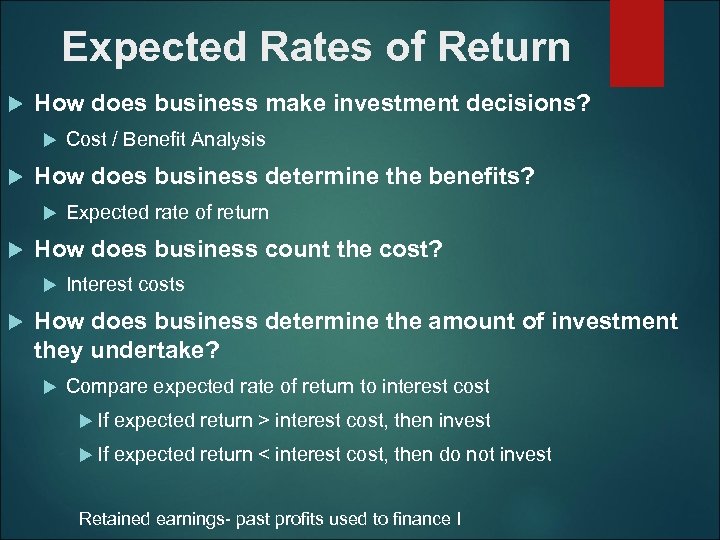

Expected Rates of Return How does business make investment decisions? How does business determine the benefits? Expected rate of return How does business count the cost? Cost / Benefit Analysis Interest costs How does business determine the amount of investment they undertake? Compare expected rate of return to interest cost If expected return > interest cost, then invest If expected return < interest cost, then do not invest Retained earnings- past profits used to finance I

Expected Rates of Return How does business make investment decisions? How does business determine the benefits? Expected rate of return How does business count the cost? Cost / Benefit Analysis Interest costs How does business determine the amount of investment they undertake? Compare expected rate of return to interest cost If expected return > interest cost, then invest If expected return < interest cost, then do not invest Retained earnings- past profits used to finance I

If a firm has enough capacity to produce it is currently selling at, then it will spend only to replace existing technologies and equipment and other structures that wear out or become obsolete Current level of productive capacity has a negative impact on investment Inventory investment- value of change in total inventories held during a given period (because firms can’t accurately predict sales Unplanned inventory investment- actual sales are less than business expected, leading to an unplanned increased in inventories Actual investment spending- sum of planned investment and unplanned inventory investment If there are unplanned inventories leads to a decrease in the following months production which then leads to a slowing economy

If a firm has enough capacity to produce it is currently selling at, then it will spend only to replace existing technologies and equipment and other structures that wear out or become obsolete Current level of productive capacity has a negative impact on investment Inventory investment- value of change in total inventories held during a given period (because firms can’t accurately predict sales Unplanned inventory investment- actual sales are less than business expected, leading to an unplanned increased in inventories Actual investment spending- sum of planned investment and unplanned inventory investment If there are unplanned inventories leads to a decrease in the following months production which then leads to a slowing economy

Growth? 5 machines break and replace all 5 5 machines break and replace 2 5 machines break and replace all 5 and add 2 more

Growth? 5 machines break and replace all 5 5 machines break and replace 2 5 machines break and replace all 5 and add 2 more

Investment Demand Curve (ID) What is the shape of the Investment demand curve? Downward sloping Why? When interest rates are high, fewer investments are profitable; when interest rates are low, more investments are profitable Conversely, there are few investments that yield high rates of return, and many that yield low rates of return

Investment Demand Curve (ID) What is the shape of the Investment demand curve? Downward sloping Why? When interest rates are high, fewer investments are profitable; when interest rates are low, more investments are profitable Conversely, there are few investments that yield high rates of return, and many that yield low rates of return

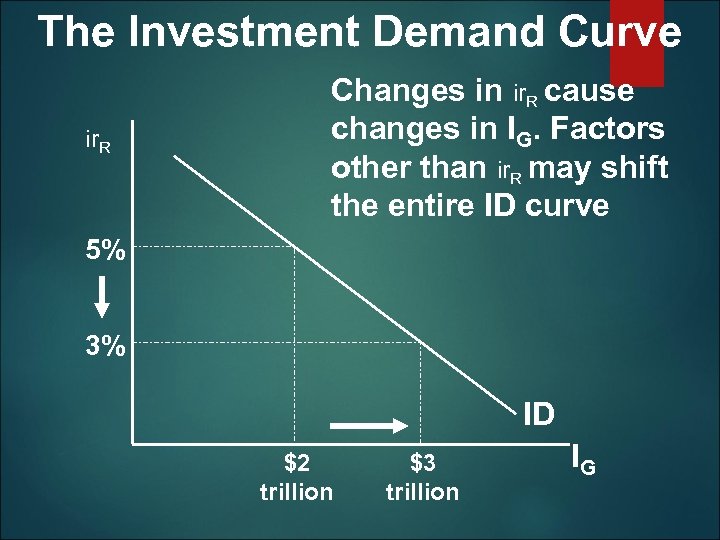

The Investment Demand Curve ir. R Changes in ir. R cause changes in IG. Factors other than ir. R may shift the entire ID curve 5% 3% ID $2 trillion $3 trillion IG

The Investment Demand Curve ir. R Changes in ir. R cause changes in IG. Factors other than ir. R may shift the entire ID curve 5% 3% ID $2 trillion $3 trillion IG

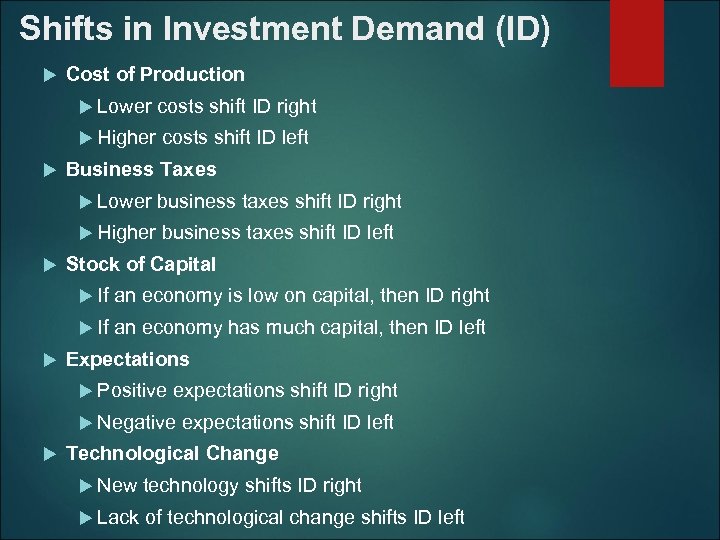

Shifts in Investment Demand (ID) Cost of Production Lower costs shift ID right Higher costs shift ID left Business Taxes Lower business taxes shift ID right Higher business taxes shift ID left Stock of Capital If an economy is low on capital, then ID right If an economy has much capital, then ID left Expectations Positive expectations shift ID right Negative expectations shift ID left Technological Change New technology shifts ID right Lack of technological change shifts ID left

Shifts in Investment Demand (ID) Cost of Production Lower costs shift ID right Higher costs shift ID left Business Taxes Lower business taxes shift ID right Higher business taxes shift ID left Stock of Capital If an economy is low on capital, then ID right If an economy has much capital, then ID left Expectations Positive expectations shift ID right Negative expectations shift ID left Technological Change New technology shifts ID right Lack of technological change shifts ID left

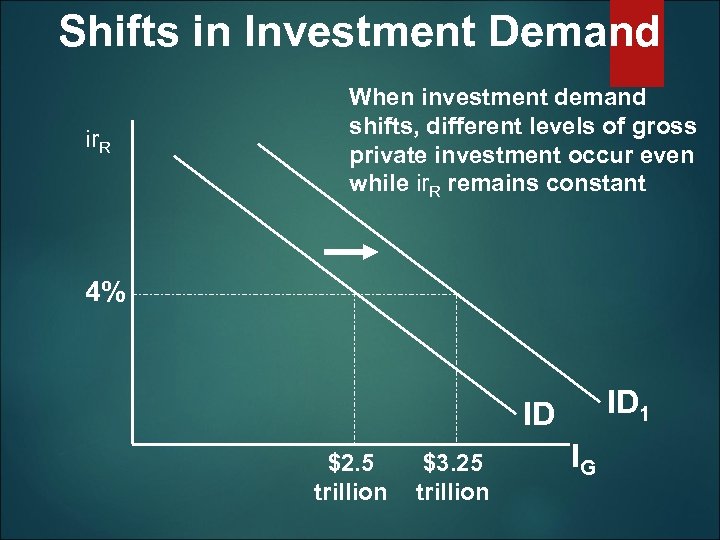

Shifts in Investment Demand ir. R When investment demand shifts, different levels of gross private investment occur even while ir. R remains constant 4% ID 1 ID $2. 5 trillion $3. 25 trillion IG

Shifts in Investment Demand ir. R When investment demand shifts, different levels of gross private investment occur even while ir. R remains constant 4% ID 1 ID $2. 5 trillion $3. 25 trillion IG

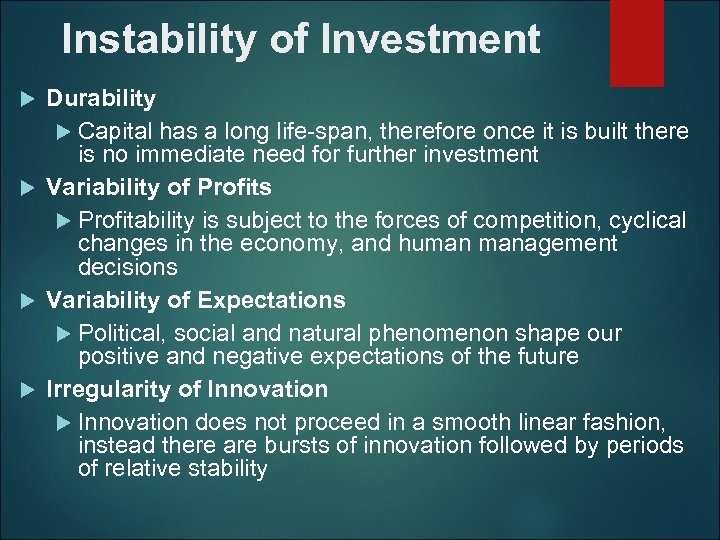

Instability of Investment Durability Capital has a long life-span, therefore once it is built there is no immediate need for further investment Variability of Profits Profitability is subject to the forces of competition, cyclical changes in the economy, and human management decisions Variability of Expectations Political, social and natural phenomenon shape our positive and negative expectations of the future Irregularity of Innovation does not proceed in a smooth linear fashion, instead there are bursts of innovation followed by periods of relative stability

Instability of Investment Durability Capital has a long life-span, therefore once it is built there is no immediate need for further investment Variability of Profits Profitability is subject to the forces of competition, cyclical changes in the economy, and human management decisions Variability of Expectations Political, social and natural phenomenon shape our positive and negative expectations of the future Irregularity of Innovation does not proceed in a smooth linear fashion, instead there are bursts of innovation followed by periods of relative stability

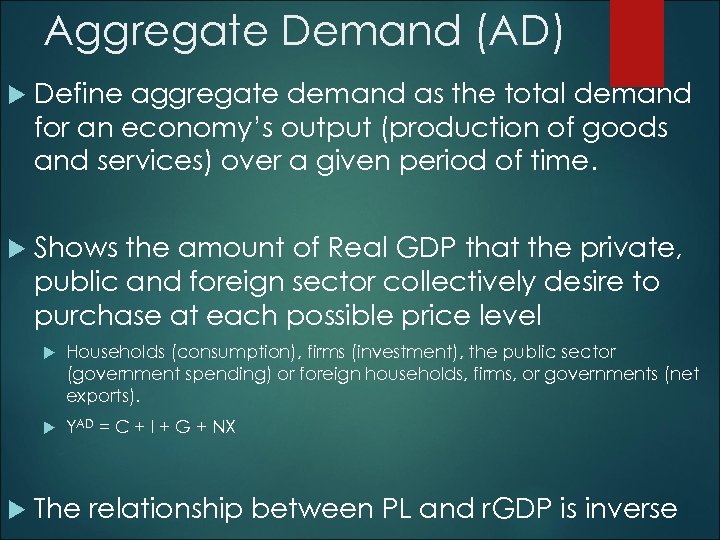

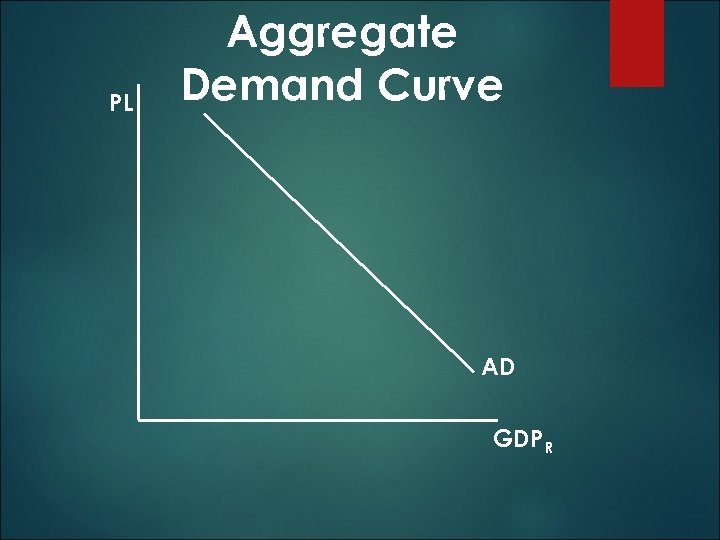

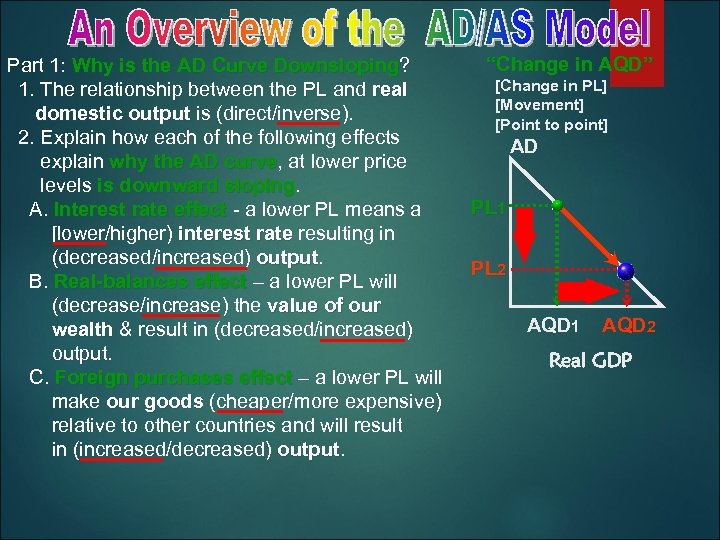

Aggregate Demand (AD) Define aggregate demand as the total demand for an economy’s output (production of goods and services) over a given period of time. Shows the amount of Real GDP that the private, public and foreign sector collectively desire to purchase at each possible price level Households (consumption), firms (investment), the public sector (government spending) or foreign households, firms, or governments (net exports). YAD = C + I + G + NX The relationship between PL and r. GDP is inverse

Aggregate Demand (AD) Define aggregate demand as the total demand for an economy’s output (production of goods and services) over a given period of time. Shows the amount of Real GDP that the private, public and foreign sector collectively desire to purchase at each possible price level Households (consumption), firms (investment), the public sector (government spending) or foreign households, firms, or governments (net exports). YAD = C + I + G + NX The relationship between PL and r. GDP is inverse

PL Aggregate Demand Curve AD GDPR

PL Aggregate Demand Curve AD GDPR

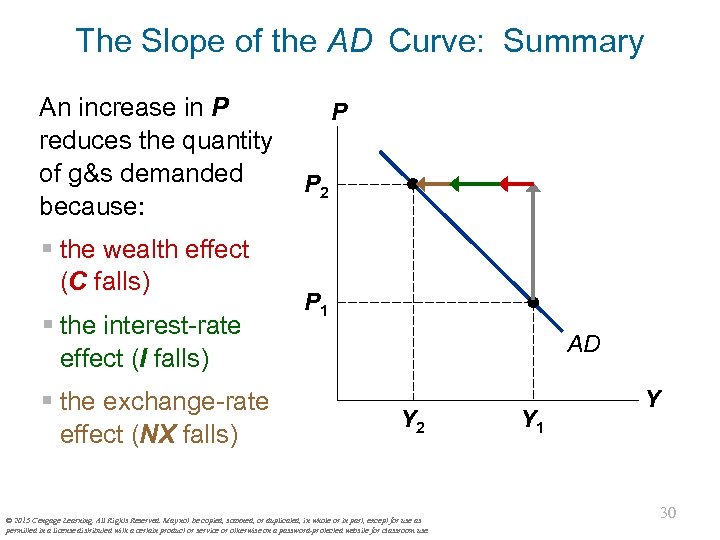

The Wealth Effect (P and C ) Suppose P rises. § The dollars people hold buy fewer g&s, so real wealth is lower. § People feel poorer. Result: C falls. © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 27

The Wealth Effect (P and C ) Suppose P rises. § The dollars people hold buy fewer g&s, so real wealth is lower. § People feel poorer. Result: C falls. © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 27

The Interest-Rate Effect (P and I ) Suppose P rises. § Buying g&s requires more dollars. § To get these dollars, people sell bonds or other assets. § This drives up interest rates. Result: I falls. (Recall, I depends negatively on interest rates. ) © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 28

The Interest-Rate Effect (P and I ) Suppose P rises. § Buying g&s requires more dollars. § To get these dollars, people sell bonds or other assets. § This drives up interest rates. Result: I falls. (Recall, I depends negatively on interest rates. ) © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 28

The Exchange-Rate Effect (P and NX ) Suppose P rises. § U. S. interest rates rise (the interest-rate effect). § Foreign investors desire more U. S. bonds. § Higher demand for $ in foreign exchange market. § U. S. exchange rate appreciates. § U. S. exports more expensive to people abroad, imports cheaper to U. S. residents. Result: NX falls. © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 29

The Exchange-Rate Effect (P and NX ) Suppose P rises. § U. S. interest rates rise (the interest-rate effect). § Foreign investors desire more U. S. bonds. § Higher demand for $ in foreign exchange market. § U. S. exchange rate appreciates. § U. S. exports more expensive to people abroad, imports cheaper to U. S. residents. Result: NX falls. © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 29

The Slope of the AD Curve: Summary An increase in P P reduces the quantity of g&s demanded P 2 because: § the wealth effect (C falls) § the interest-rate effect (I falls) § the exchange-rate effect (NX falls) P 1 AD Y 2 © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. Y 1 Y 30

The Slope of the AD Curve: Summary An increase in P P reduces the quantity of g&s demanded P 2 because: § the wealth effect (C falls) § the interest-rate effect (I falls) § the exchange-rate effect (NX falls) P 1 AD Y 2 © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. Y 1 Y 30

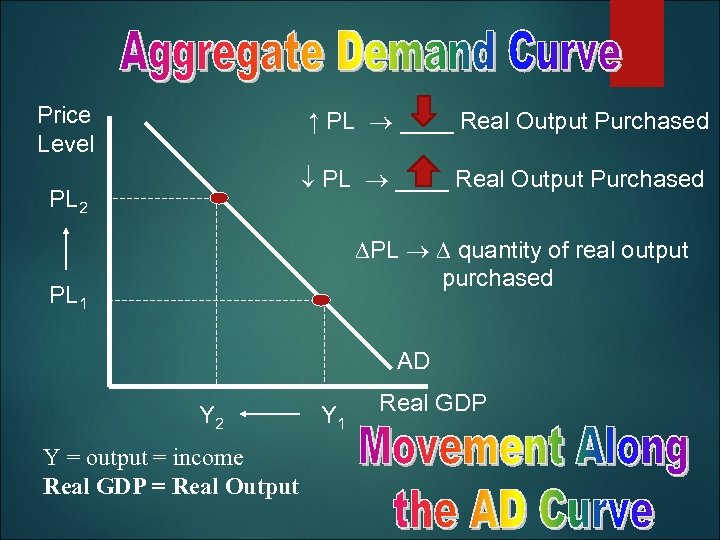

Price Level ↑ PL ____ Real Output Purchased PL 2 PL quantity of real output purchased PL 1 AD Y 2 Y 1 Y = output = income Real GDP = Real Output Real GDP

Price Level ↑ PL ____ Real Output Purchased PL 2 PL quantity of real output purchased PL 1 AD Y 2 Y 1 Y = output = income Real GDP = Real Output Real GDP

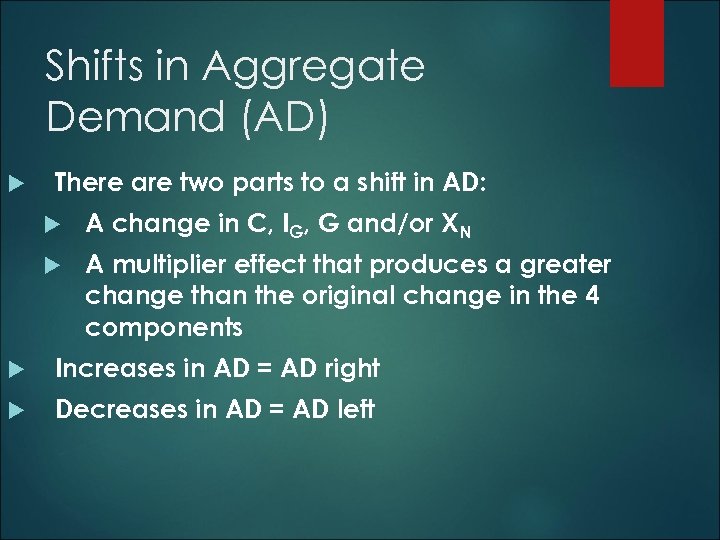

Shifts in Aggregate Demand (AD) There are two parts to a shift in AD: A change in C, IG, G and/or XN A multiplier effect that produces a greater change than the original change in the 4 components Increases in AD = AD right Decreases in AD = AD left

Shifts in Aggregate Demand (AD) There are two parts to a shift in AD: A change in C, IG, G and/or XN A multiplier effect that produces a greater change than the original change in the 4 components Increases in AD = AD right Decreases in AD = AD left

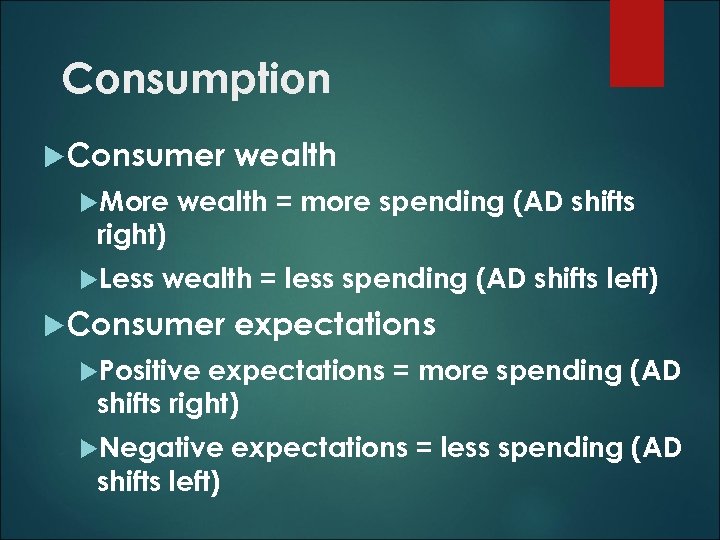

Consumption Consumer More right) Less wealth = more spending (AD shifts wealth = less spending (AD shifts left) Consumer expectations Positive expectations = more spending (AD shifts right) Negative shifts left) expectations = less spending (AD

Consumption Consumer More right) Less wealth = more spending (AD shifts wealth = less spending (AD shifts left) Consumer expectations Positive expectations = more spending (AD shifts right) Negative shifts left) expectations = less spending (AD

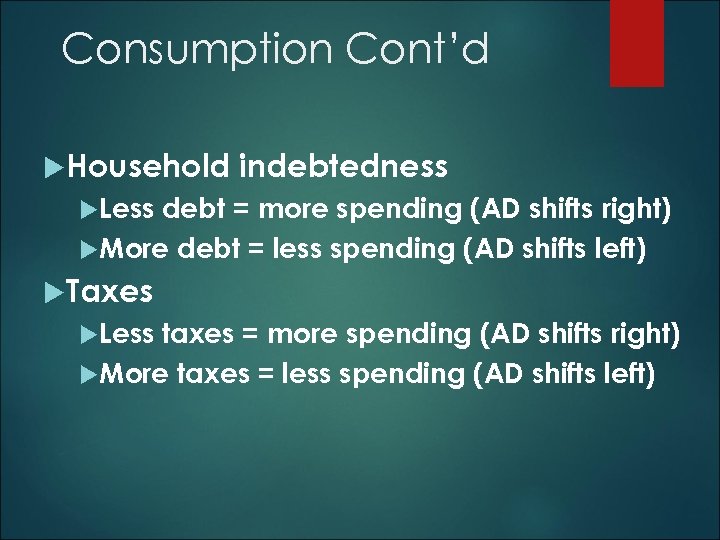

Consumption Cont’d Household indebtedness Less debt = more spending (AD shifts right) More debt = less spending (AD shifts left) Taxes Less taxes = more spending (AD shifts right) More taxes = less spending (AD shifts left)

Consumption Cont’d Household indebtedness Less debt = more spending (AD shifts right) More debt = less spending (AD shifts left) Taxes Less taxes = more spending (AD shifts right) More taxes = less spending (AD shifts left)

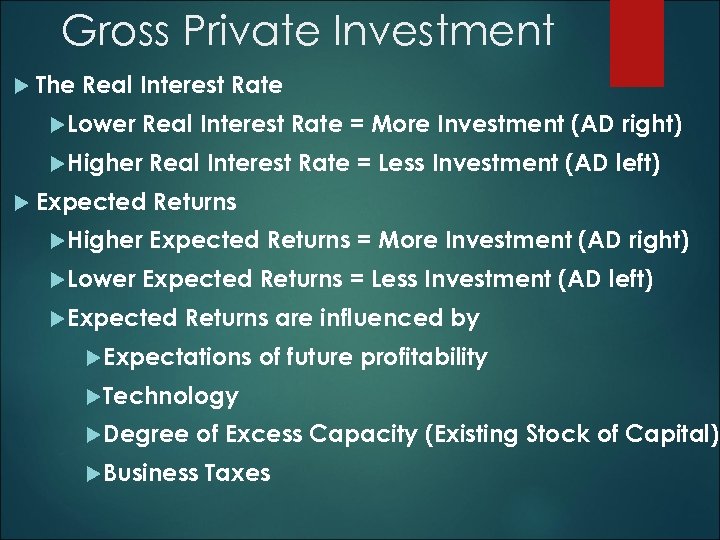

Gross Private Investment The Real Interest Rate Lower Real Interest Rate = More Investment (AD right) Higher Expected Higher Lower Real Interest Rate = Less Investment (AD left) Returns Expected Returns = More Investment (AD right) Expected Returns = Less Investment (AD left) Expected Returns are influenced by Expectations of future profitability Technology Degree of Excess Capacity (Existing Stock of Capital) Business Taxes

Gross Private Investment The Real Interest Rate Lower Real Interest Rate = More Investment (AD right) Higher Expected Higher Lower Real Interest Rate = Less Investment (AD left) Returns Expected Returns = More Investment (AD right) Expected Returns = Less Investment (AD left) Expected Returns are influenced by Expectations of future profitability Technology Degree of Excess Capacity (Existing Stock of Capital) Business Taxes

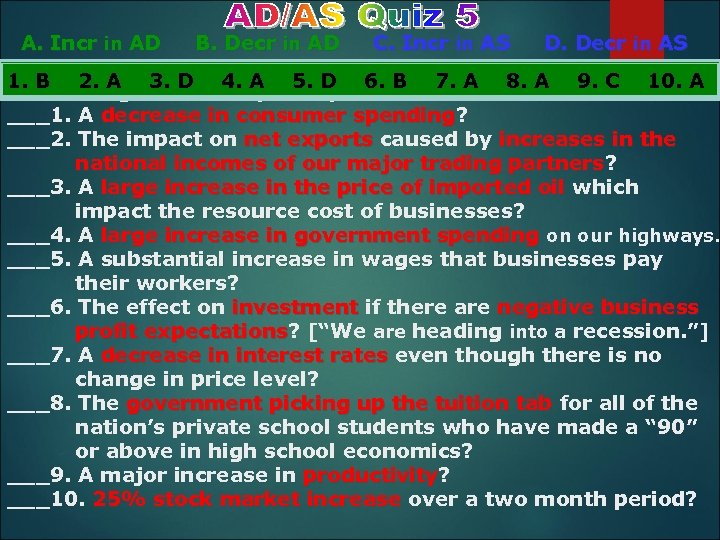

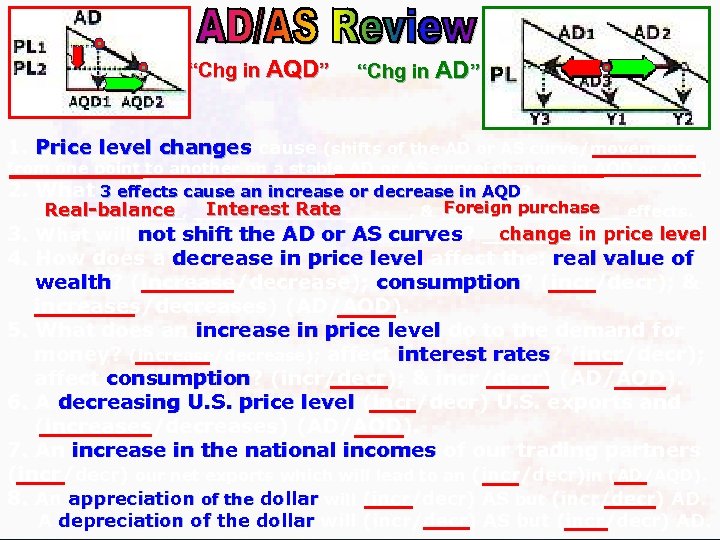

![AD 1 AD 2 PL Change in Consumer Spending Consumer Wealth [increases/decreases] increases decreases AD 1 AD 2 PL Change in Consumer Spending Consumer Wealth [increases/decreases] increases decreases](https://present5.com/presentation/1a86d1eb30728aaff44a20d6dcc040bb/image-36.jpg) AD 1 AD 2 PL Change in Consumer Spending Consumer Wealth [increases/decreases] increases decreases [stocks/houses] [stable prices] Consumer Expectations [about future prices (increases/decreases) increases/decreases Consumer Expectations about future income [positive/negative] positive/negative Consumer Indebtedness [low/high] low high Personal Taxes [increase/decrease] increase decrease Real Interest Rate [stable prices] [increase/decrease] prices increase/decrease High Debt Change in Investment Spending Real Interest Rates [stable prices] [increase/decrease] prices [Positive/Negative] Profit Returns [Business taxes [increase/decrease] [Depleted/Excess] inventory stockpiles in the supply chain Depleted Excess

AD 1 AD 2 PL Change in Consumer Spending Consumer Wealth [increases/decreases] increases decreases [stocks/houses] [stable prices] Consumer Expectations [about future prices (increases/decreases) increases/decreases Consumer Expectations about future income [positive/negative] positive/negative Consumer Indebtedness [low/high] low high Personal Taxes [increase/decrease] increase decrease Real Interest Rate [stable prices] [increase/decrease] prices increase/decrease High Debt Change in Investment Spending Real Interest Rates [stable prices] [increase/decrease] prices [Positive/Negative] Profit Returns [Business taxes [increase/decrease] [Depleted/Excess] inventory stockpiles in the supply chain Depleted Excess

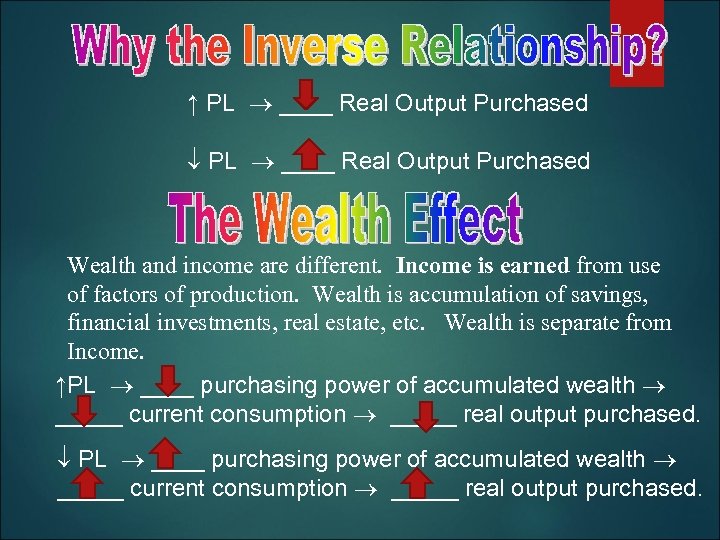

↑ PL ____ Real Output Purchased Wealth and income are different. Income is earned from use of factors of production. Wealth is accumulation of savings, financial investments, real estate, etc. Wealth is separate from Income. ↑PL ____ purchasing power of accumulated wealth _____ current consumption _____ real output purchased.

↑ PL ____ Real Output Purchased Wealth and income are different. Income is earned from use of factors of production. Wealth is accumulation of savings, financial investments, real estate, etc. Wealth is separate from Income. ↑PL ____ purchasing power of accumulated wealth _____ current consumption _____ real output purchased.

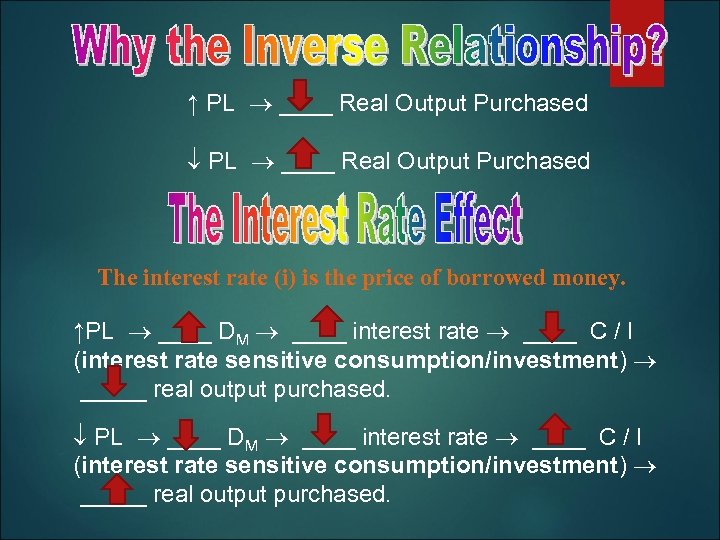

↑ PL ____ Real Output Purchased The interest rate (i) is the price of borrowed money. ↑PL ____ DM ____ interest rate ____ C / I (interest rate sensitive consumption/investment) _____ real output purchased.

↑ PL ____ Real Output Purchased The interest rate (i) is the price of borrowed money. ↑PL ____ DM ____ interest rate ____ C / I (interest rate sensitive consumption/investment) _____ real output purchased.

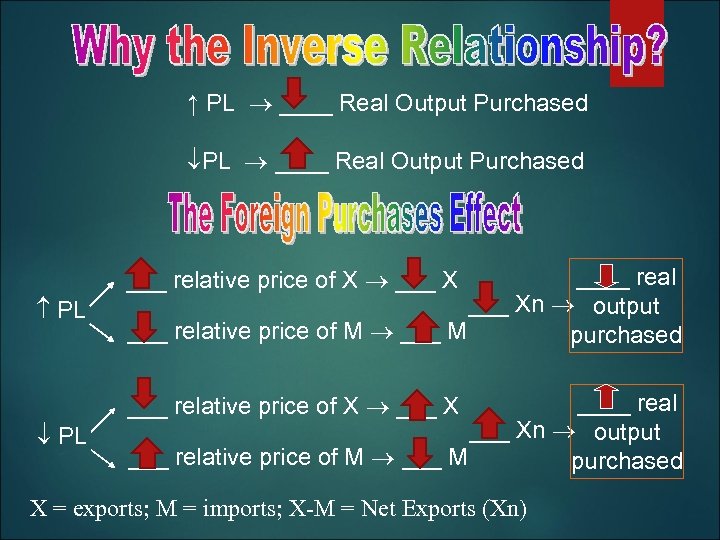

↑ PL ____ Real Output Purchased ____ real ___ Xn output ___ relative price of M ___ M purchased ___ relative price of X ___ X PL X = exports; M = imports; X-M = Net Exports (Xn)

↑ PL ____ Real Output Purchased ____ real ___ Xn output ___ relative price of M ___ M purchased ___ relative price of X ___ X PL X = exports; M = imports; X-M = Net Exports (Xn)

Government Spending More Government Spending (AD shift right) Less Government Spending (AD shift left)

Government Spending More Government Spending (AD shift right) Less Government Spending (AD shift left)

Net Exports Exchange Rates (International value of $) Strong $ = More Imports and Fewer Exports = (AD shift left) Weak $ = Fewer Imports and More Exports = (AD shift right) Relative Income Strong Foreign Economies = More Exports = (AD shift right) Weak Foreign Economies = Less Exports = (AD shift left)

Net Exports Exchange Rates (International value of $) Strong $ = More Imports and Fewer Exports = (AD shift left) Weak $ = Fewer Imports and More Exports = (AD shift right) Relative Income Strong Foreign Economies = More Exports = (AD shift right) Weak Foreign Economies = Less Exports = (AD shift left)

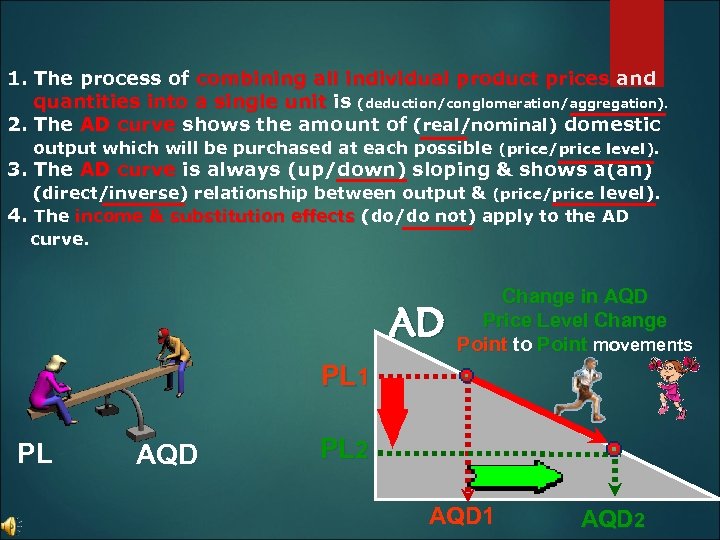

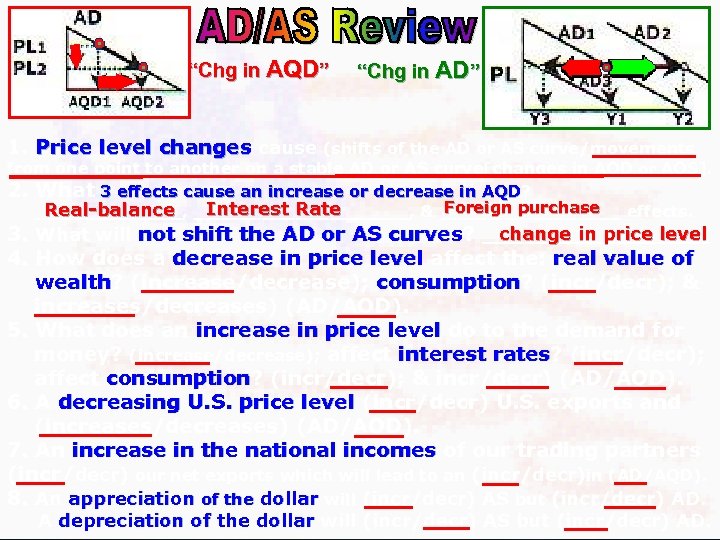

1. The process of combining all individual product prices and quantities into a single unit is (deduction/conglomeration/aggregation). 2. The AD curve shows the amount of (real/nominal) domestic output which will be purchased at each possible (price/price level). 3. The AD curve is always (up/down) sloping & shows a(an) (direct/inverse) relationship between output & (price/price level). 4. The income & substitution effects (do/do not) apply to the AD curve. AD Change in AQD Price Level Change Point to Point movements PL 1 PL AQD PL 2 AQD 1 AQD 2

1. The process of combining all individual product prices and quantities into a single unit is (deduction/conglomeration/aggregation). 2. The AD curve shows the amount of (real/nominal) domestic output which will be purchased at each possible (price/price level). 3. The AD curve is always (up/down) sloping & shows a(an) (direct/inverse) relationship between output & (price/price level). 4. The income & substitution effects (do/do not) apply to the AD curve. AD Change in AQD Price Level Change Point to Point movements PL 1 PL AQD PL 2 AQD 1 AQD 2

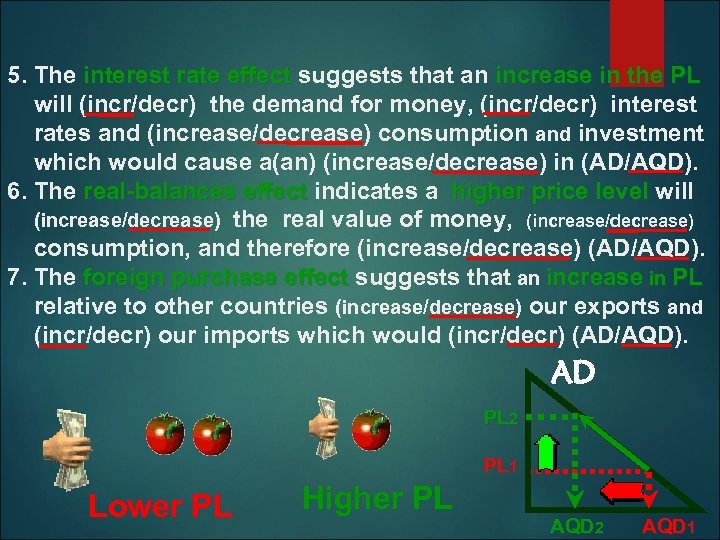

5. The interest rate effect suggests that an increase in the PL will (incr/decr) the demand for money, (incr/decr) interest rates and (increase/decrease) consumption and investment which would cause a(an) (increase/decrease) in (AD/AQD). 6. The real-balances effect indicates a higher price level will (increase/decrease) the real value of money, (increase/decrease) consumption, and therefore (increase/decrease) (AD/AQD). 7. The foreign purchase effect suggests that an increase in PL relative to other countries (increase/decrease) our exports and (incr/decr) our imports which would (incr/decr) (AD/AQD). AD PL 2 PL 1 Lower PL Higher PL AQD 2 AQD 1

5. The interest rate effect suggests that an increase in the PL will (incr/decr) the demand for money, (incr/decr) interest rates and (increase/decrease) consumption and investment which would cause a(an) (increase/decrease) in (AD/AQD). 6. The real-balances effect indicates a higher price level will (increase/decrease) the real value of money, (increase/decrease) consumption, and therefore (increase/decrease) (AD/AQD). 7. The foreign purchase effect suggests that an increase in PL relative to other countries (increase/decrease) our exports and (incr/decr) our imports which would (incr/decr) (AD/AQD). AD PL 2 PL 1 Lower PL Higher PL AQD 2 AQD 1

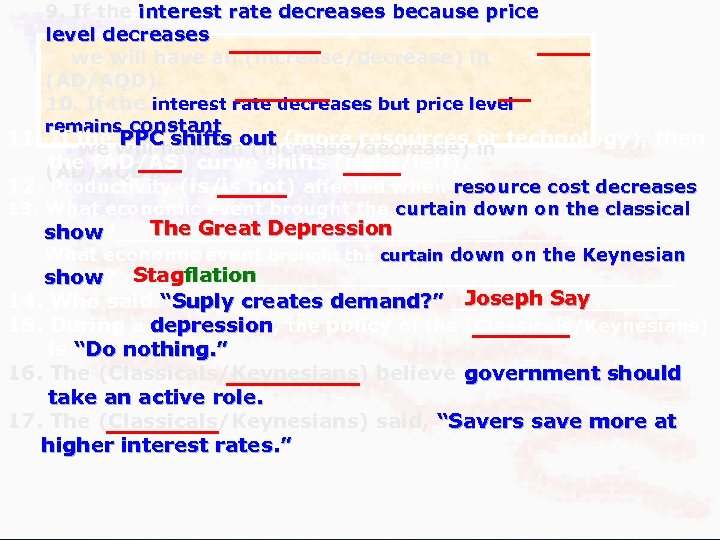

![19. An increase in the price of imported resources [resource cost] would cause the 19. An increase in the price of imported resources [resource cost] would cause the](https://present5.com/presentation/1a86d1eb30728aaff44a20d6dcc040bb/image-44.jpg) 19. An increase in the price of imported resources [resource cost] would cause the (AD/AS) curve to shift (rightward/leftward). 20. A rightward shift of the PPC will shift the (AD/AS) curve to the (right/left). 21. An improvement in productivity [technological improvement] will shift the (AD/AS) curve to the (right/left). Suppose that real domestic output is 40 units, the quantity of inputs is 20 & the price of each input is $8. 22. What is the level of productivity? Productivity(__) = Output(40) 2 Inputs (20) 23. What is the per unit cost of production? Total input cost $160($8 x 20) Per unit production cost ($___) = Units of output (40) 4 24. If the price of each input increased from $8 to $12, productivity would (increase/decrease/ remain unchanged. [affects only per unit cost] 25. Increase in input price [$8 to $12] would shift the (AD/AS) curve (right/left). 26. An increase in the price of imported resources would increase per unit production cost and shift the (AD/AS) curve to the (right/left). 27. A depreciation of the dollar would cause imported inputs to be more expensive & shift the AS curve to the (right/left), however, the cost of our products would decrease so it would shift the AD curve (right/left).

19. An increase in the price of imported resources [resource cost] would cause the (AD/AS) curve to shift (rightward/leftward). 20. A rightward shift of the PPC will shift the (AD/AS) curve to the (right/left). 21. An improvement in productivity [technological improvement] will shift the (AD/AS) curve to the (right/left). Suppose that real domestic output is 40 units, the quantity of inputs is 20 & the price of each input is $8. 22. What is the level of productivity? Productivity(__) = Output(40) 2 Inputs (20) 23. What is the per unit cost of production? Total input cost $160($8 x 20) Per unit production cost ($___) = Units of output (40) 4 24. If the price of each input increased from $8 to $12, productivity would (increase/decrease/ remain unchanged. [affects only per unit cost] 25. Increase in input price [$8 to $12] would shift the (AD/AS) curve (right/left). 26. An increase in the price of imported resources would increase per unit production cost and shift the (AD/AS) curve to the (right/left). 27. A depreciation of the dollar would cause imported inputs to be more expensive & shift the AS curve to the (right/left), however, the cost of our products would decrease so it would shift the AD curve (right/left).

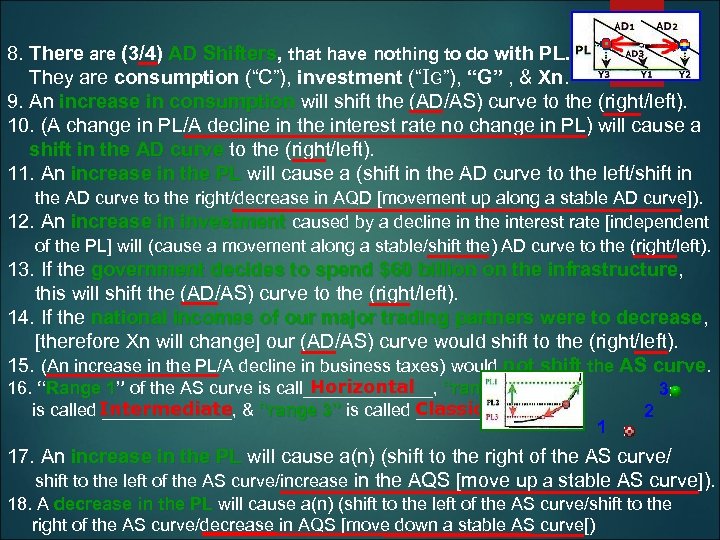

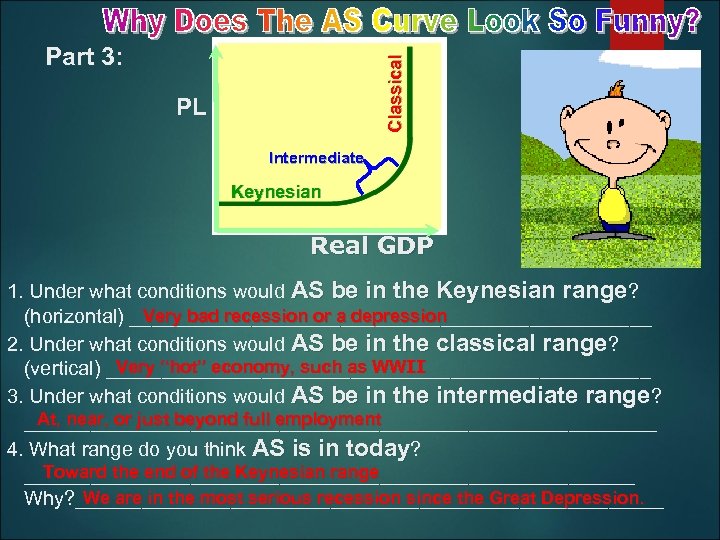

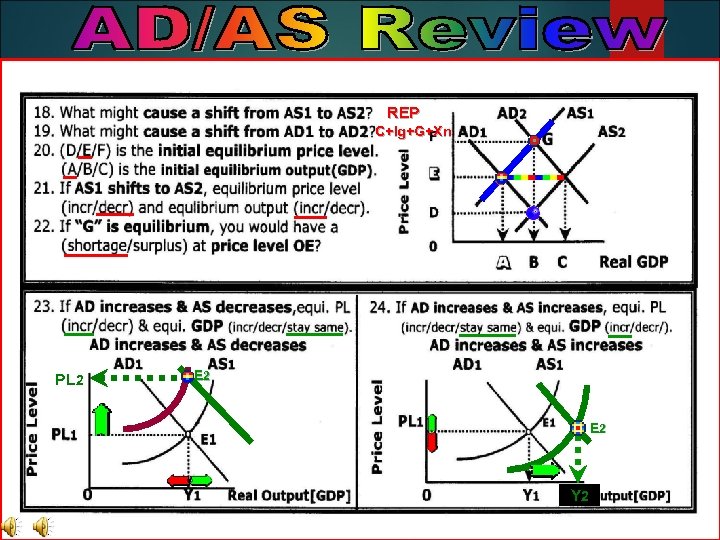

8. There are (3/4) AD Shifters, that have nothing to do with PL. Shifters They are consumption (“C”), investment (“IG”), “G” , & Xn. 9. An increase in consumption will shift the (AD/AS) curve to the (right/left). consumption 10. (A change in PL/A decline in the interest rate no change in PL) will cause a shift in the AD curve to the (right/left). curve 11. An increase in the PL will cause a (shift in the AD curve to the left/shift in PL the AD curve to the right/decrease in AQD [movement up along a stable AD curve]). 12. An increase in investment caused by a decline in the interest rate [independent investment of the PL] will (cause a movement along a stable/shift the) AD curve to the (right/left). 13. If the government decides to spend $60 billion on the infrastructure, infrastructure this will shift the (AD/AS) curve to the (right/left). 14. If the national incomes of our major trading partners were to decrease, decrease [therefore Xn will change] our (AD/AS) curve would shift to the (right/left). 15. (An increase in the PL/A decline in business taxes) would not shift the AS curve Horizontal 16. “Range 1” of the AS curve is call_______, “range 2” Classical Intermediate is called _______, & “range 3” is called _____. 3” 3 1 2 17. An increase in the PL will cause a(n) (shift to the right of the AS curve/ PL shift to the left of the AS curve/increase in the AQS [move up a stable AS curve]). 18. A decrease in the PL will cause a(n) (shift to the left of the AS curve/shift to the PL right of the AS curve/decrease in AQS [move down a stable AS curve[)

8. There are (3/4) AD Shifters, that have nothing to do with PL. Shifters They are consumption (“C”), investment (“IG”), “G” , & Xn. 9. An increase in consumption will shift the (AD/AS) curve to the (right/left). consumption 10. (A change in PL/A decline in the interest rate no change in PL) will cause a shift in the AD curve to the (right/left). curve 11. An increase in the PL will cause a (shift in the AD curve to the left/shift in PL the AD curve to the right/decrease in AQD [movement up along a stable AD curve]). 12. An increase in investment caused by a decline in the interest rate [independent investment of the PL] will (cause a movement along a stable/shift the) AD curve to the (right/left). 13. If the government decides to spend $60 billion on the infrastructure, infrastructure this will shift the (AD/AS) curve to the (right/left). 14. If the national incomes of our major trading partners were to decrease, decrease [therefore Xn will change] our (AD/AS) curve would shift to the (right/left). 15. (An increase in the PL/A decline in business taxes) would not shift the AS curve Horizontal 16. “Range 1” of the AS curve is call_______, “range 2” Classical Intermediate is called _______, & “range 3” is called _____. 3” 3 1 2 17. An increase in the PL will cause a(n) (shift to the right of the AS curve/ PL shift to the left of the AS curve/increase in the AQS [move up a stable AS curve]). 18. A decrease in the PL will cause a(n) (shift to the left of the AS curve/shift to the PL right of the AS curve/decrease in AQS [move down a stable AS curve[)

Aggregate Supply The level of Real GDP (GDPR) that firms will produce at each Price Level (PL) Is producing a unit profitable or not? Short-Run Aggregate Supply (SRAS) Increases in the price-level will increase firm’s profits and create incentives to increase output. As the price-level falls, firm’s profits drop and this creates an incentive to reduce output. However, nomial wages and other input prices are fixed and don’t have time to adjust to price level changes

Aggregate Supply The level of Real GDP (GDPR) that firms will produce at each Price Level (PL) Is producing a unit profitable or not? Short-Run Aggregate Supply (SRAS) Increases in the price-level will increase firm’s profits and create incentives to increase output. As the price-level falls, firm’s profits drop and this creates an incentive to reduce output. However, nomial wages and other input prices are fixed and don’t have time to adjust to price level changes

1. The Sticky-Wage Theory § Imperfection: Nominal wages are sticky in the short run, they adjust sluggishly. § Due to labor contracts, social norms § Firms and workers set the nominal wage in advance based on PE, the price level they expect to prevail. © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 47

1. The Sticky-Wage Theory § Imperfection: Nominal wages are sticky in the short run, they adjust sluggishly. § Due to labor contracts, social norms § Firms and workers set the nominal wage in advance based on PE, the price level they expect to prevail. © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 47

1. The Sticky-Wage Theory § If P > PE, revenue is higher, but labor cost is not. Production is more profitable, so firms increase output and employment. § Hence, higher P causes higher Y, so the SRAS curve slopes upward. © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 48

1. The Sticky-Wage Theory § If P > PE, revenue is higher, but labor cost is not. Production is more profitable, so firms increase output and employment. § Hence, higher P causes higher Y, so the SRAS curve slopes upward. © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 48

2. The Sticky-Price Theory § Imperfection: Many prices are sticky in the short run. § Due to menu costs, the costs of adjusting prices. § Examples: cost of printing new menus, the time required to change price tags § Firms set sticky prices in advance based on PE. © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 49

2. The Sticky-Price Theory § Imperfection: Many prices are sticky in the short run. § Due to menu costs, the costs of adjusting prices. § Examples: cost of printing new menus, the time required to change price tags § Firms set sticky prices in advance based on PE. © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 49

2. The Sticky-Price Theory § Suppose the Fed increases the money supply unexpectedly. In the long run, P will rise. § In the short run, firms without menu costs can raise their prices immediately. § Firms with menu costs wait to raise prices. Meanwhile, their prices are relatively low, which increases demand for their products, so they increase output and employment. § Hence, higher P is associated with higher Y, so the SRAS curve slopes upward. © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 50

2. The Sticky-Price Theory § Suppose the Fed increases the money supply unexpectedly. In the long run, P will rise. § In the short run, firms without menu costs can raise their prices immediately. § Firms with menu costs wait to raise prices. Meanwhile, their prices are relatively low, which increases demand for their products, so they increase output and employment. § Hence, higher P is associated with higher Y, so the SRAS curve slopes upward. © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 50

3. The Misperceptions Theory § Imperfection: Firms may confuse changes in P with changes in the relative price of the products they sell. § If P rises above PE, a firm sees its price rise before realizing all prices are rising. The firm may believe its relative price is rising, and may increase output and employment. § So, an increase in P can cause an increase in Y, making the SRAS curve upward-sloping. © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 51

3. The Misperceptions Theory § Imperfection: Firms may confuse changes in P with changes in the relative price of the products they sell. § If P rises above PE, a firm sees its price rise before realizing all prices are rising. The firm may believe its relative price is rising, and may increase output and employment. § So, an increase in P can cause an increase in Y, making the SRAS curve upward-sloping. © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 51

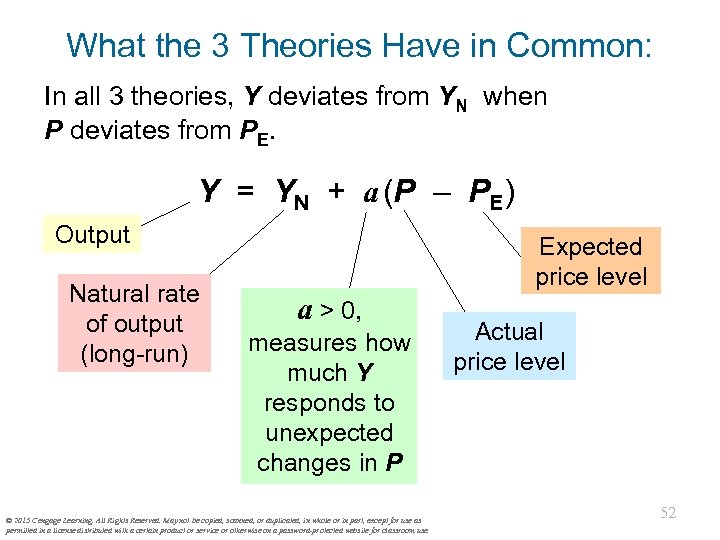

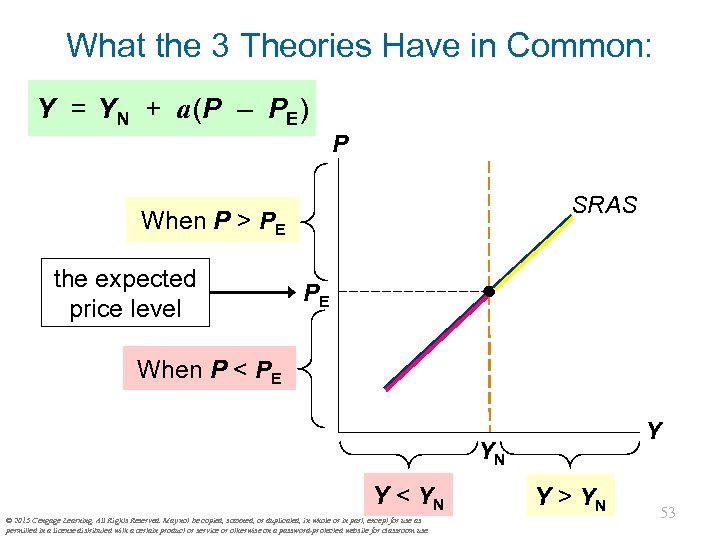

What the 3 Theories Have in Common: In all 3 theories, Y deviates from YN when P deviates from PE. Y = YN + a (P – PE) Output Natural rate of output (long-run) Expected price level a > 0, measures how much Y responds to unexpected changes in P © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. Actual price level 52

What the 3 Theories Have in Common: In all 3 theories, Y deviates from YN when P deviates from PE. Y = YN + a (P – PE) Output Natural rate of output (long-run) Expected price level a > 0, measures how much Y responds to unexpected changes in P © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. Actual price level 52

What the 3 Theories Have in Common: Y = YN + a (P – PE) P SRAS When P > PE the expected price level PE When P < PE Y YN Y < YN © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. Y > YN 53

What the 3 Theories Have in Common: Y = YN + a (P – PE) P SRAS When P > PE the expected price level PE When P < PE Y YN Y < YN © 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. Y > YN 53

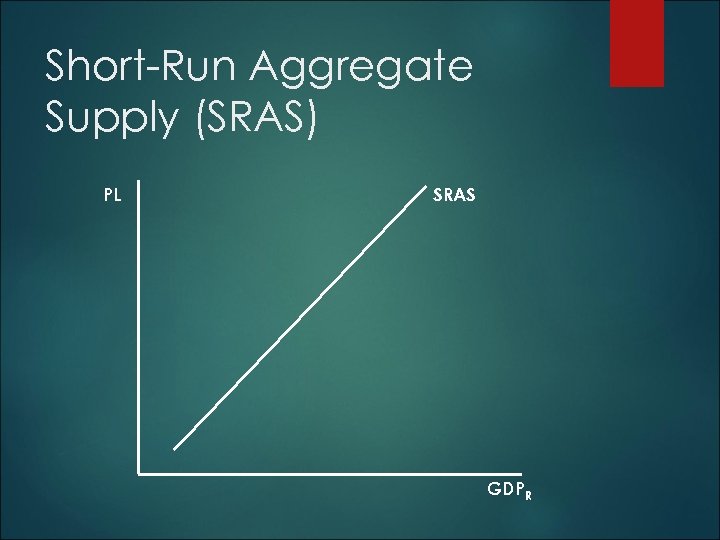

Short-Run Aggregate Supply (SRAS) PL SRAS GDPR

Short-Run Aggregate Supply (SRAS) PL SRAS GDPR

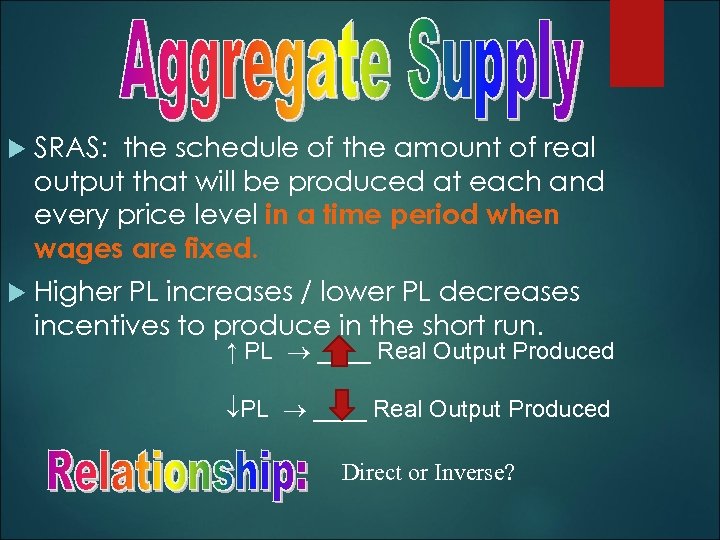

SRAS: the schedule of the amount of real output that will be produced at each and every price level in a time period when wages are fixed. Higher PL increases / lower PL decreases incentives to produce in the short run. ↑ PL ____ Real Output Produced Direct or Inverse?

SRAS: the schedule of the amount of real output that will be produced at each and every price level in a time period when wages are fixed. Higher PL increases / lower PL decreases incentives to produce in the short run. ↑ PL ____ Real Output Produced Direct or Inverse?

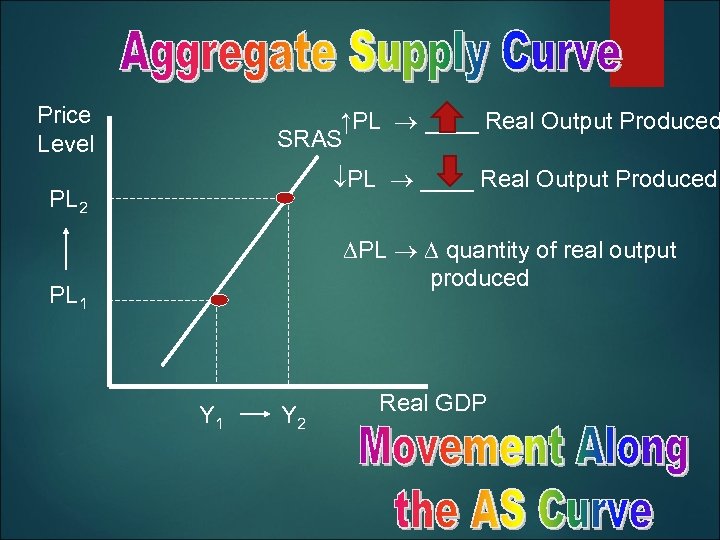

Price Level ↑PL ____ Real Output Produced SRAS PL ____ Real Output Produced PL 2 PL quantity of real output produced PL 1 Y 1 Y 2 Real GDP

Price Level ↑PL ____ Real Output Produced SRAS PL ____ Real Output Produced PL 2 PL quantity of real output produced PL 1 Y 1 Y 2 Real GDP

Input prices (standardized input bought and sold in bulk quantities) Changes in productivity Legal- institutional environment

Input prices (standardized input bought and sold in bulk quantities) Changes in productivity Legal- institutional environment

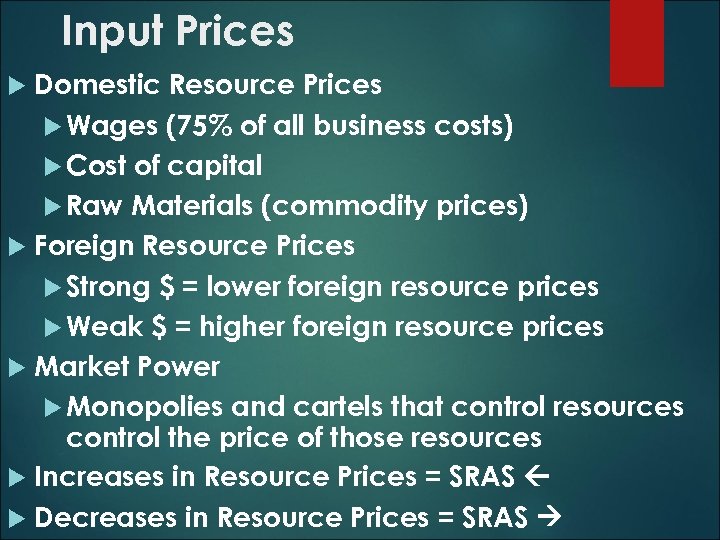

Input Prices Domestic Resource Prices Wages (75% of all business costs) Cost of capital Raw Materials (commodity prices) Foreign Resource Prices Strong $ = lower foreign resource prices Weak $ = higher foreign resource prices Market Power Monopolies and cartels that control resources control the price of those resources Increases in Resource Prices = SRAS Decreases in Resource Prices = SRAS

Input Prices Domestic Resource Prices Wages (75% of all business costs) Cost of capital Raw Materials (commodity prices) Foreign Resource Prices Strong $ = lower foreign resource prices Weak $ = higher foreign resource prices Market Power Monopolies and cartels that control resources control the price of those resources Increases in Resource Prices = SRAS Decreases in Resource Prices = SRAS

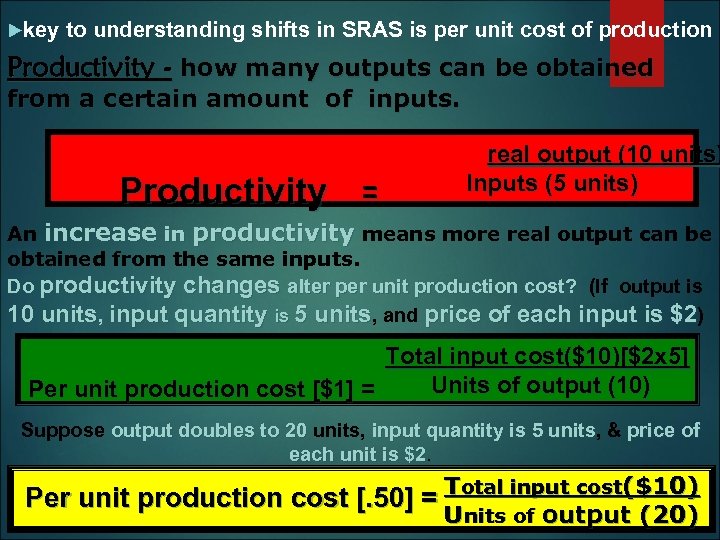

key to understanding shifts in SRAS is per unit cost of production Productivity - how many outputs can be obtained from a certain amount of inputs. Productivity = real output (10 units) Inputs (5 units) An increase in productivity means more real output can be obtained from the same inputs. Do productivity changes alter per unit production cost? (If output is 10 units, input quantity is 5 units, and price of each input is $2) Total input cost($10)[$2 x 5] Units of output (10) Per unit production cost [$1] = Suppose output doubles to 20 units, input quantity is 5 units, & price of units each unit is $2. Per unit production cost [. 50] = Total input cost($10) U nits of output (20)

key to understanding shifts in SRAS is per unit cost of production Productivity - how many outputs can be obtained from a certain amount of inputs. Productivity = real output (10 units) Inputs (5 units) An increase in productivity means more real output can be obtained from the same inputs. Do productivity changes alter per unit production cost? (If output is 10 units, input quantity is 5 units, and price of each input is $2) Total input cost($10)[$2 x 5] Units of output (10) Per unit production cost [$1] = Suppose output doubles to 20 units, input quantity is 5 units, & price of units each unit is $2. Per unit production cost [. 50] = Total input cost($10) U nits of output (20)

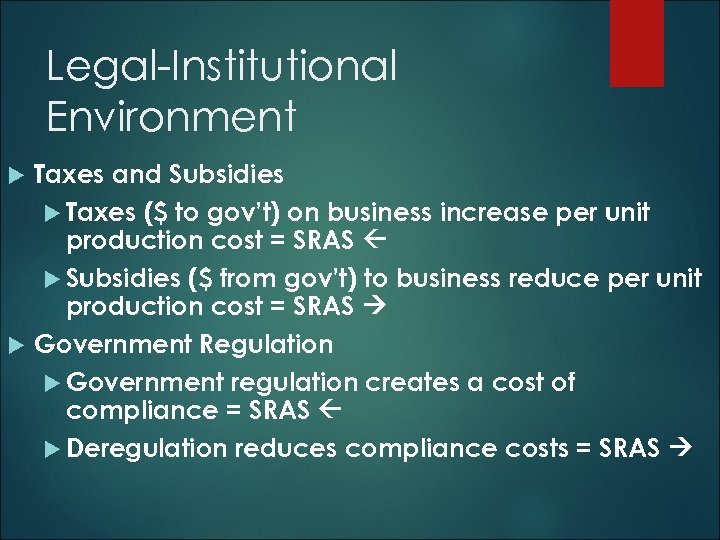

Legal-Institutional Environment Taxes and Subsidies Taxes ($ to gov’t) on business increase per unit production cost = SRAS Subsidies ($ from gov’t) to business reduce per unit production cost = SRAS Government Regulation Government regulation creates a cost of compliance = SRAS Deregulation reduces compliance costs = SRAS

Legal-Institutional Environment Taxes and Subsidies Taxes ($ to gov’t) on business increase per unit production cost = SRAS Subsidies ($ from gov’t) to business reduce per unit production cost = SRAS Government Regulation Government regulation creates a cost of compliance = SRAS Deregulation reduces compliance costs = SRAS

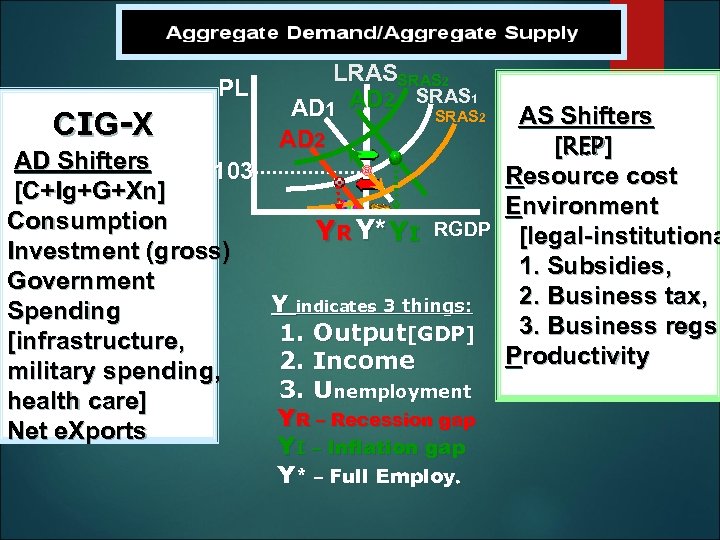

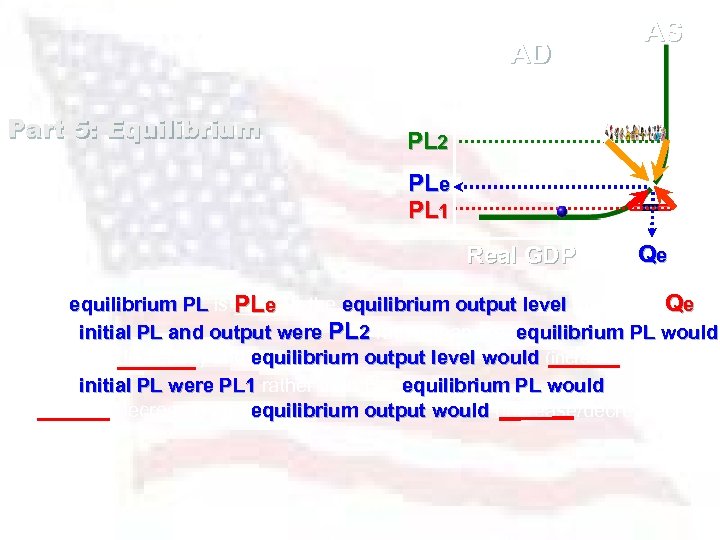

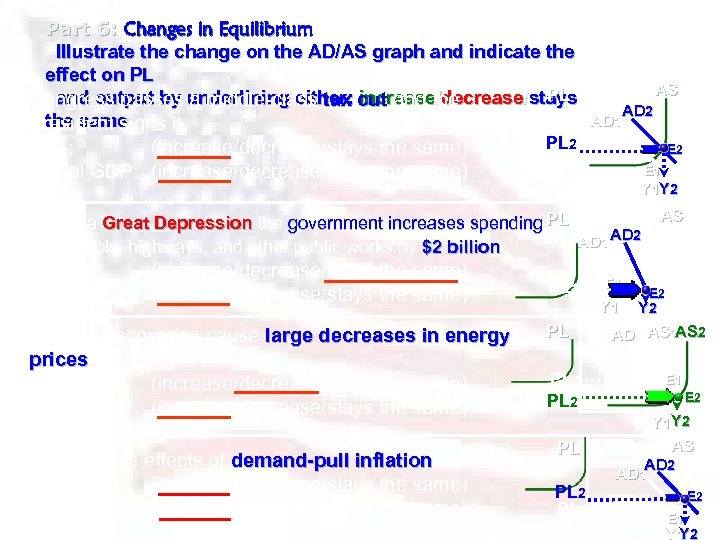

C I G -X PL LRASSRAS 2 AD 2 SRAS 1 AD 1 SRAS 2 AD Shifters 103 [C+Ig+G+Xn] Consumption YR Y* YI RGDP Investment (gross) Government Y indicates 3 things: Spending 1. Output[GDP] [infrastructure, 2. Income military spending, 3. Unemployment health care] YR – Recession gap Net e. Xports YI – Inflation gap Y* – Full Employ. AS Shifters [REP] Resource cost Environment [legal-institutiona 1. Subsidies, 2. Business tax, 3. Business regs. Productivity

C I G -X PL LRASSRAS 2 AD 2 SRAS 1 AD 1 SRAS 2 AD Shifters 103 [C+Ig+G+Xn] Consumption YR Y* YI RGDP Investment (gross) Government Y indicates 3 things: Spending 1. Output[GDP] [infrastructure, 2. Income military spending, 3. Unemployment health care] YR – Recession gap Net e. Xports YI – Inflation gap Y* – Full Employ. AS Shifters [REP] Resource cost Environment [legal-institutiona 1. Subsidies, 2. Business tax, 3. Business regs. Productivity

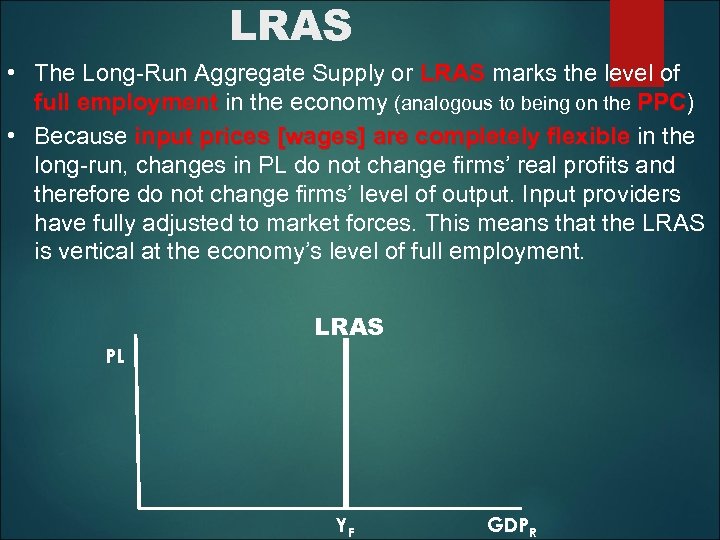

LRAS • The Long-Run Aggregate Supply or LRAS marks the level of LRAS full employment in the economy (analogous to being on the PPC) PPC • Because input prices [wages] are completely flexible in the long-run, changes in PL do not change firms’ real profits and therefore do not change firms’ level of output. Input providers have fully adjusted to market forces. This means that the LRAS is vertical at the economy’s level of full employment. LRAS PL YF GDPR

LRAS • The Long-Run Aggregate Supply or LRAS marks the level of LRAS full employment in the economy (analogous to being on the PPC) PPC • Because input prices [wages] are completely flexible in the long-run, changes in PL do not change firms’ real profits and therefore do not change firms’ level of output. Input providers have fully adjusted to market forces. This means that the LRAS is vertical at the economy’s level of full employment. LRAS PL YF GDPR

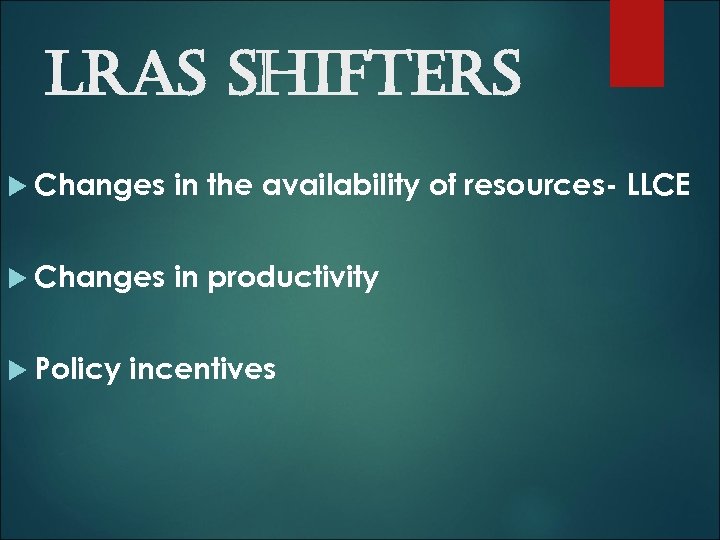

Lr. As shifters Changes in the availability of resources- LLCE Changes in productivity Policy incentives

Lr. As shifters Changes in the availability of resources- LLCE Changes in productivity Policy incentives

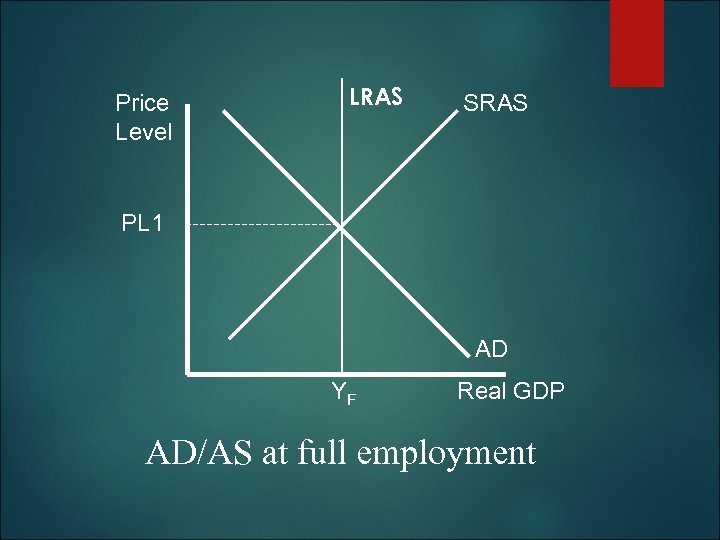

Price Level LRAS SRAS PL 1 AD YF Real GDP AD/AS at full employment

Price Level LRAS SRAS PL 1 AD YF Real GDP AD/AS at full employment

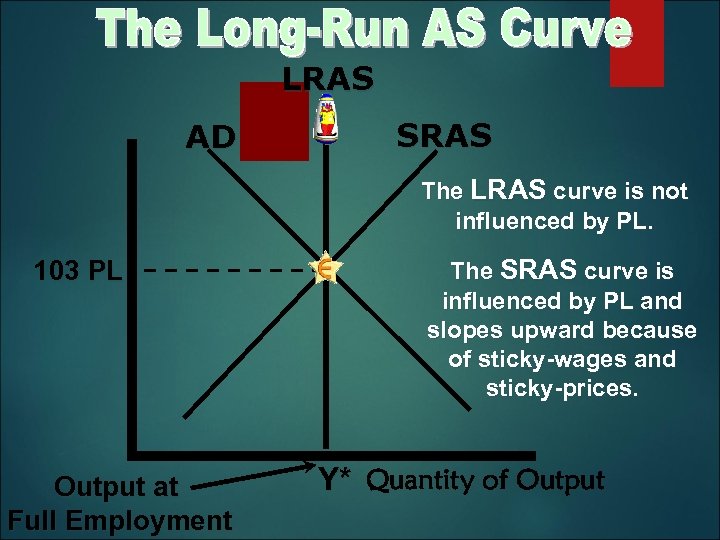

LRAS AD SRAS The LRAS curve is not influenced by PL. 103 PL Output at Full Employment The SRAS curve is influenced by PL and slopes upward because of sticky-wages and sticky-prices. Y* Quantity of Output

LRAS AD SRAS The LRAS curve is not influenced by PL. 103 PL Output at Full Employment The SRAS curve is influenced by PL and slopes upward because of sticky-wages and sticky-prices. Y* Quantity of Output

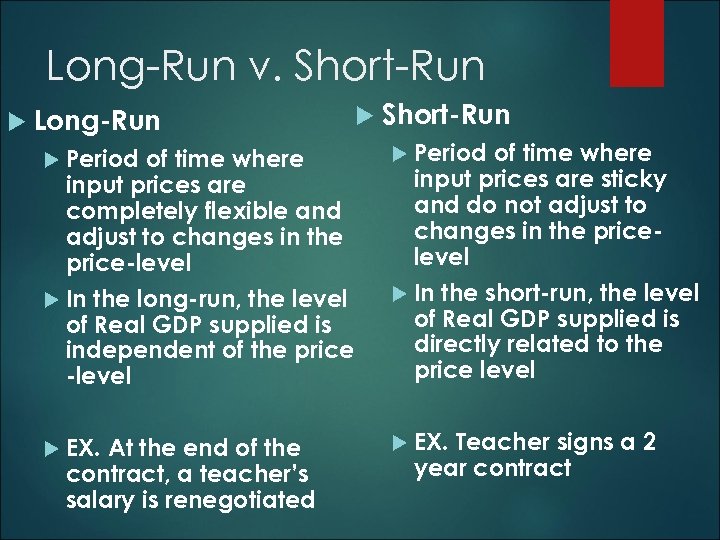

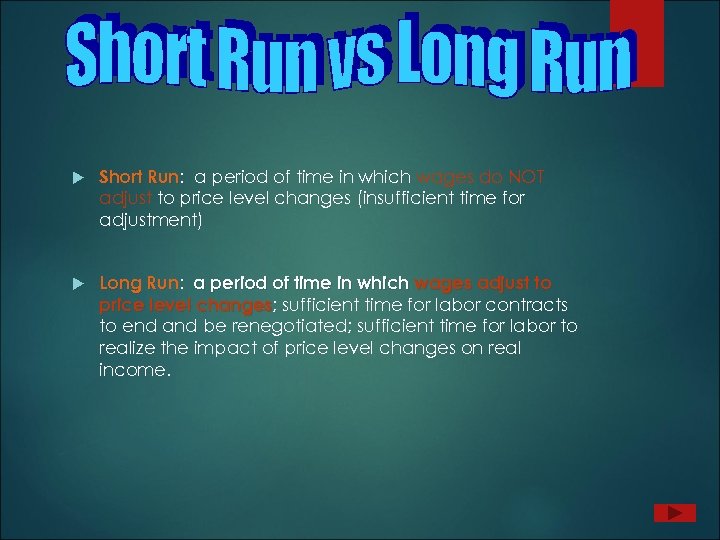

Long-Run v. Short-Run Long-Run Short-Run Period of time where input prices are completely flexible and adjust to changes in the price-level In the long-run, the level of Real GDP supplied is independent of the price -level Period EX. At the end of the contract, a teacher’s salary is renegotiated of time where input prices are sticky and do not adjust to changes in the pricelevel In the short-run, the level of Real GDP supplied is directly related to the price level Teacher signs a 2 year contract

Long-Run v. Short-Run Long-Run Short-Run Period of time where input prices are completely flexible and adjust to changes in the price-level In the long-run, the level of Real GDP supplied is independent of the price -level Period EX. At the end of the contract, a teacher’s salary is renegotiated of time where input prices are sticky and do not adjust to changes in the pricelevel In the short-run, the level of Real GDP supplied is directly related to the price level Teacher signs a 2 year contract

http: //whitenova. com/think. Ec onomics/adas. html

http: //whitenova. com/think. Ec onomics/adas. html

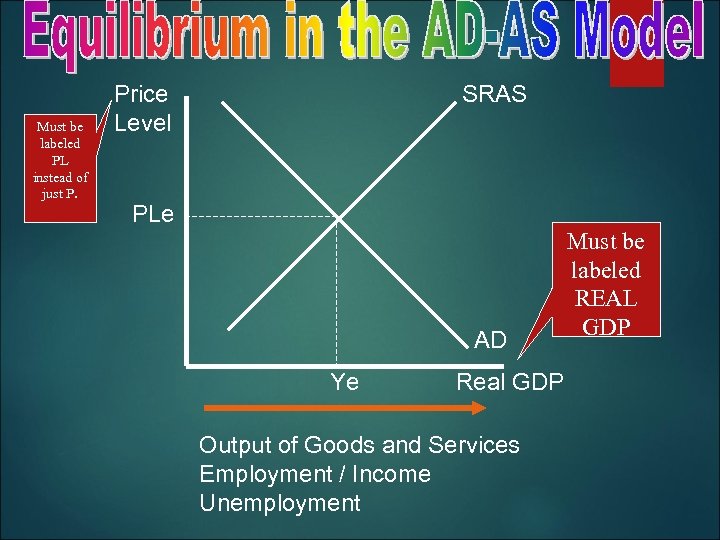

Must be labeled PL instead of just P. SRAS Price Level PLe AD Ye Real GDP Output of Goods and Services Employment / Income Unemployment Must be labeled REAL GDP

Must be labeled PL instead of just P. SRAS Price Level PLe AD Ye Real GDP Output of Goods and Services Employment / Income Unemployment Must be labeled REAL GDP

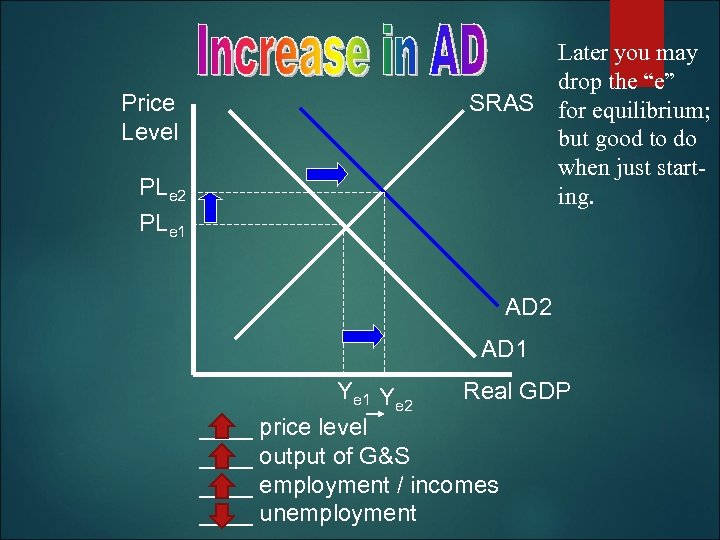

Price Level PLe 2 PLe 1 Later you may drop the “e” SRAS for equilibrium; but good to do when just starting. AD 2 AD 1 Ye 2 Real GDP ____ price level ____ output of G&S ____ employment / incomes ____ unemployment

Price Level PLe 2 PLe 1 Later you may drop the “e” SRAS for equilibrium; but good to do when just starting. AD 2 AD 1 Ye 2 Real GDP ____ price level ____ output of G&S ____ employment / incomes ____ unemployment

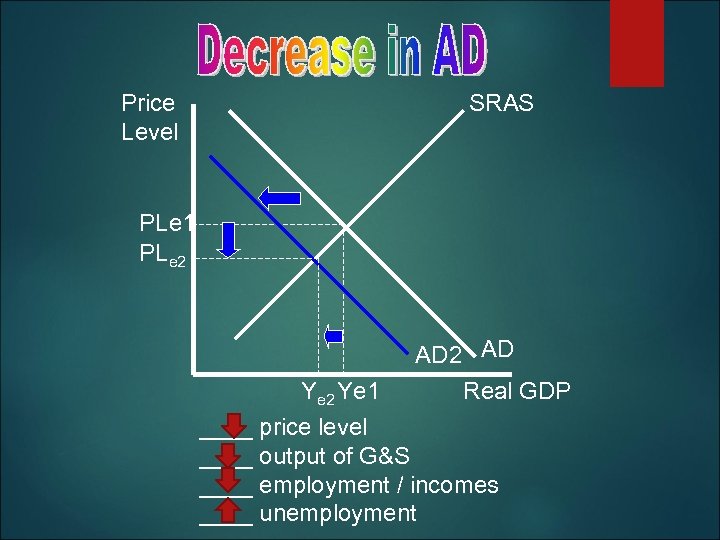

Price Level SRAS PLe 1 PLe 2 AD Real GDP Ye 2 Ye 1 ____ price level ____ output of G&S ____ employment / incomes ____ unemployment

Price Level SRAS PLe 1 PLe 2 AD Real GDP Ye 2 Ye 1 ____ price level ____ output of G&S ____ employment / incomes ____ unemployment

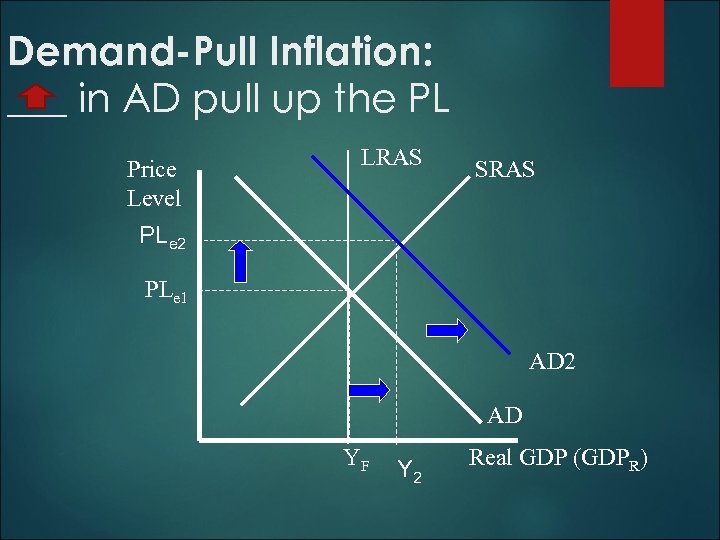

Demand-Pull Inflation: ___ in AD pull up the PL Price Level LRAS SRAS PLe 2 PLe 1 AD 2 AD YF Y 2 Real GDP (GDPR)

Demand-Pull Inflation: ___ in AD pull up the PL Price Level LRAS SRAS PLe 2 PLe 1 AD 2 AD YF Y 2 Real GDP (GDPR)

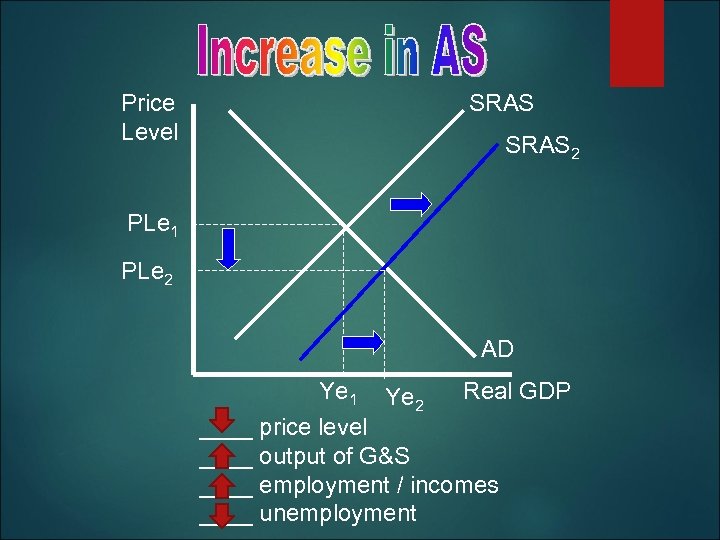

Price Level SRAS 2 PLe 1 PLe 2 AD Ye 1 Ye 2 Real GDP ____ price level ____ output of G&S ____ employment / incomes ____ unemployment

Price Level SRAS 2 PLe 1 PLe 2 AD Ye 1 Ye 2 Real GDP ____ price level ____ output of G&S ____ employment / incomes ____ unemployment

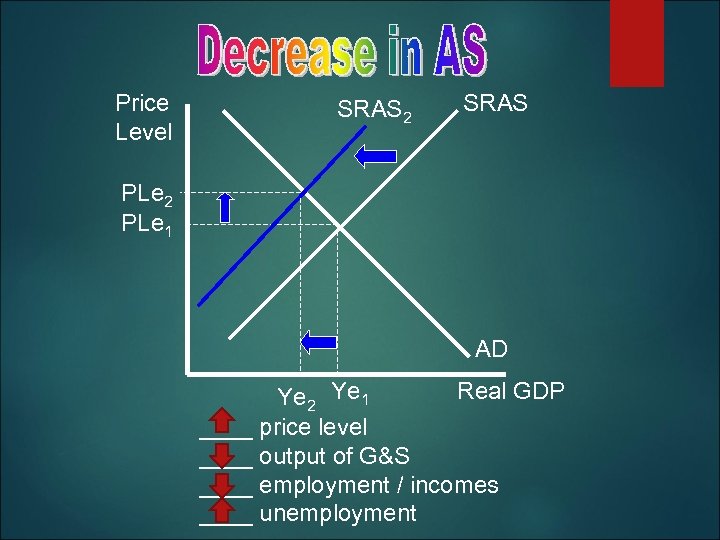

Price Level SRAS 2 SRAS PLe 2 PLe 1 AD Real GDP Ye 2 Ye 1 ____ price level ____ output of G&S ____ employment / incomes ____ unemployment

Price Level SRAS 2 SRAS PLe 2 PLe 1 AD Real GDP Ye 2 Ye 1 ____ price level ____ output of G&S ____ employment / incomes ____ unemployment

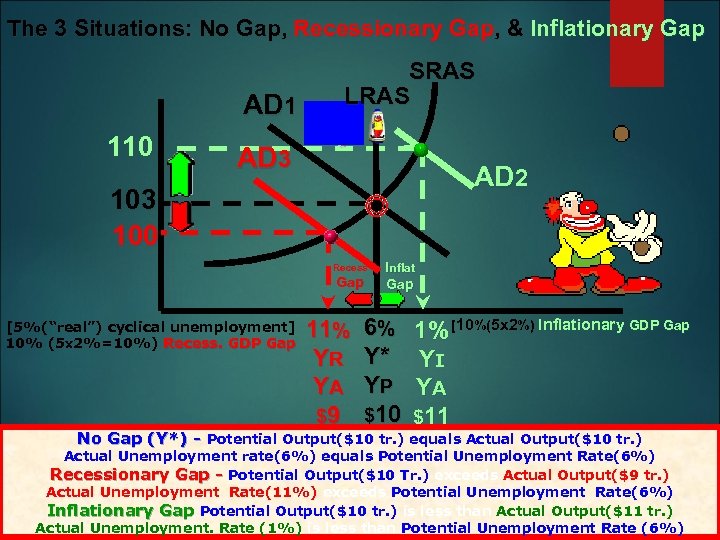

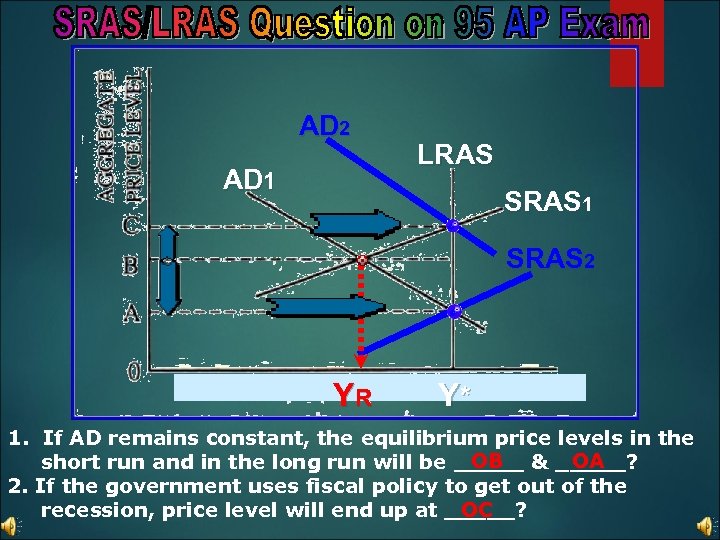

The 3 Situations: No Gap, Recessionary Gap, & Inflationary Gap AD 1 110 SRAS LRAS AD 3 AD 2 103 100 Recess Gap [5%(“real”) cyclical unemployment] 10% (5 x 2%=10%) Recess. GDP Gap 11% YR YA $9 Inflat Gap 6% Y* YP $10 1% [10%(5 x 2%) Inflationary GDP Gap YI YA $11 No Gap (Y*) - Potential Output($10 tr. ) equals Actual Output($10 tr. ) Actual Unemployment rate(6%) equals Potential Unemployment Rate(6%) Recessionary Gap - Potential Output($10 Tr. ) exceeds Actual Output($9 tr. ) Actual Unemployment Rate(11%) exceeds Potential Unemployment Rate(6%) Inflationary Gap Potential Output($10 tr. ) is less than Actual Output($11 tr. ) Actual Unemployment. Rate (1%) is less than Potential Unemployment Rate (6%)

The 3 Situations: No Gap, Recessionary Gap, & Inflationary Gap AD 1 110 SRAS LRAS AD 3 AD 2 103 100 Recess Gap [5%(“real”) cyclical unemployment] 10% (5 x 2%=10%) Recess. GDP Gap 11% YR YA $9 Inflat Gap 6% Y* YP $10 1% [10%(5 x 2%) Inflationary GDP Gap YI YA $11 No Gap (Y*) - Potential Output($10 tr. ) equals Actual Output($10 tr. ) Actual Unemployment rate(6%) equals Potential Unemployment Rate(6%) Recessionary Gap - Potential Output($10 Tr. ) exceeds Actual Output($9 tr. ) Actual Unemployment Rate(11%) exceeds Potential Unemployment Rate(6%) Inflationary Gap Potential Output($10 tr. ) is less than Actual Output($11 tr. ) Actual Unemployment. Rate (1%) is less than Potential Unemployment Rate (6%)

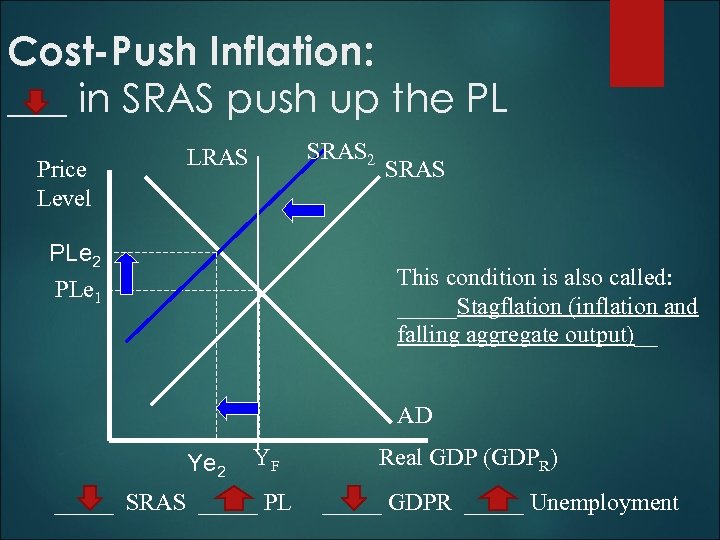

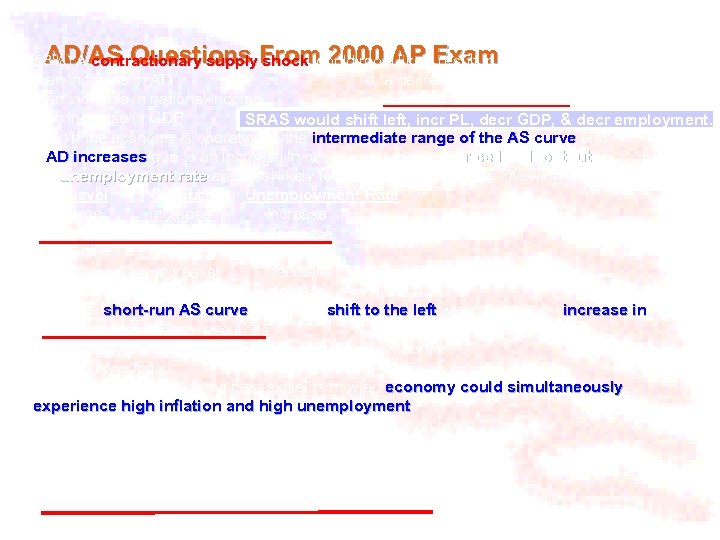

Cost-Push Inflation: ___ in SRAS push up the PL Price Level SRAS 2 LRAS PLe 2 PLe 1 SRAS This condition is also called: _____Stagflation (inflation and falling aggregate output)__ AD Ye 2 YF _____ SRAS _____ PL Real GDP (GDPR) _____ GDPR _____ Unemployment

Cost-Push Inflation: ___ in SRAS push up the PL Price Level SRAS 2 LRAS PLe 2 PLe 1 SRAS This condition is also called: _____Stagflation (inflation and falling aggregate output)__ AD Ye 2 YF _____ SRAS _____ PL Real GDP (GDPR) _____ GDPR _____ Unemployment

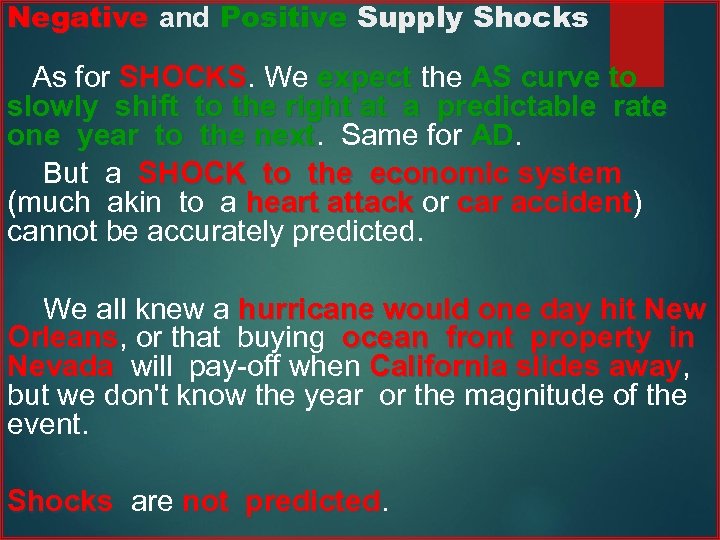

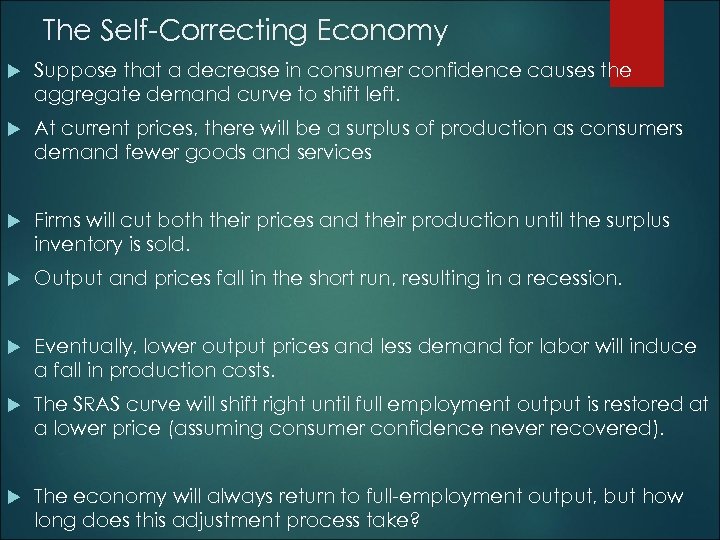

Negative and Positive Supply Shocks As for SHOCKS. We expect the AS curve to SHOCKS expect slowly shift to the right at a predictable rate one year to the next. Same for AD. next AD But a SHOCK to the economic system (much akin to a heart attack or car accident) attack accident cannot be accurately predicted. We all knew a hurricane would one day hit New Orleans, or that buying ocean front property in Orleans Nevada will pay-off when California slides away, Nevada away but we don't know the year or the magnitude of the event. Shocks are not predicted. Shocks predicted

Negative and Positive Supply Shocks As for SHOCKS. We expect the AS curve to SHOCKS expect slowly shift to the right at a predictable rate one year to the next. Same for AD. next AD But a SHOCK to the economic system (much akin to a heart attack or car accident) attack accident cannot be accurately predicted. We all knew a hurricane would one day hit New Orleans, or that buying ocean front property in Orleans Nevada will pay-off when California slides away, Nevada away but we don't know the year or the magnitude of the event. Shocks are not predicted. Shocks predicted

![[“bad news” – job losses; “bad news” – inflation] LRAS AS 2 AD $2. [“bad news” – job losses; “bad news” – inflation] LRAS AS 2 AD $2.](https://present5.com/presentation/1a86d1eb30728aaff44a20d6dcc040bb/image-77.jpg) [“bad news” – job losses; “bad news” – inflation] LRAS AS 2 AD $2. $4. AS 1 110 Inflating PL 1 The economy is stagnating but Stagnating 10% Y* inflating “Stagflation”

[“bad news” – job losses; “bad news” – inflation] LRAS AS 2 AD $2. $4. AS 1 110 Inflating PL 1 The economy is stagnating but Stagnating 10% Y* inflating “Stagflation”

![[“good news”–job gains; “good news”–disinflation] AS 1 AD AS 2 $4. 00 $1. 75 [“good news”–job gains; “good news”–disinflation] AS 1 AD AS 2 $4. 00 $1. 75](https://present5.com/presentation/1a86d1eb30728aaff44a20d6dcc040bb/image-78.jpg) [“good news”–job gains; “good news”–disinflation] AS 1 AD AS 2 $4. 00 $1. 75 PL 1 “Good news, lower prices” “Good news, more jobs” PL 2 Y 1 Y 2

[“good news”–job gains; “good news”–disinflation] AS 1 AD AS 2 $4. 00 $1. 75 PL 1 “Good news, lower prices” “Good news, more jobs” PL 2 Y 1 Y 2

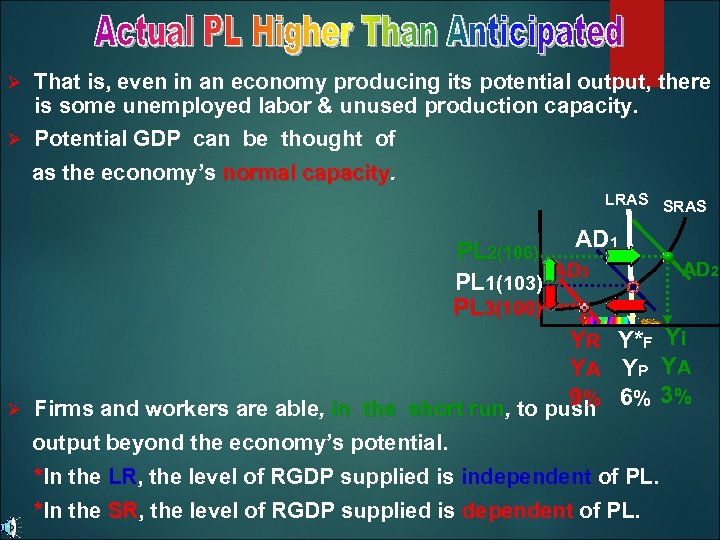

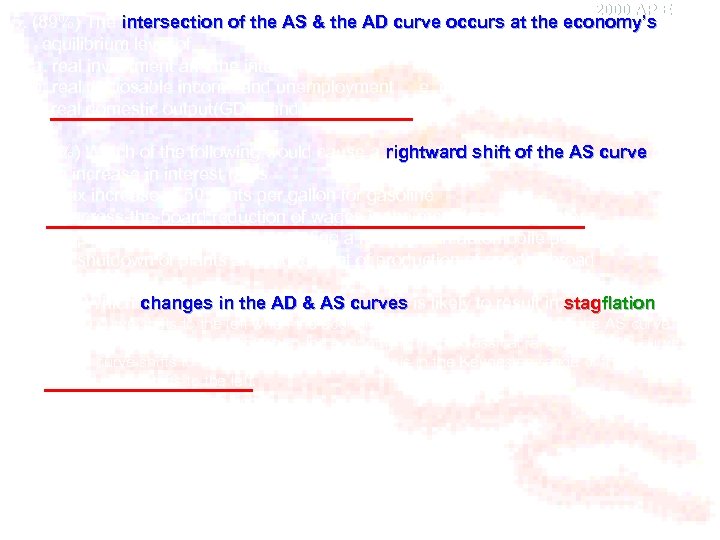

Ø That is, even in an economy producing its potential output, there output is some unemployed labor & unused production capacity. Ø Potential GDP can be thought of as the economy’s normal capacity. LRAS SRAS Ø PL 2(106) AD 1 AD 2 AD 3 PL 1(103) PL 3(100) YR Y*F Yi YA YP YA 9% 6% 3% Firms and workers are able, in the short run, to push run output beyond the economy’s potential. *In the LR, the level of RGDP supplied is independent of PL. LR *In the SR, the level of RGDP supplied is dependent of PL. SR

Ø That is, even in an economy producing its potential output, there output is some unemployed labor & unused production capacity. Ø Potential GDP can be thought of as the economy’s normal capacity. LRAS SRAS Ø PL 2(106) AD 1 AD 2 AD 3 PL 1(103) PL 3(100) YR Y*F Yi YA YP YA 9% 6% 3% Firms and workers are able, in the short run, to push run output beyond the economy’s potential. *In the LR, the level of RGDP supplied is independent of PL. LR *In the SR, the level of RGDP supplied is dependent of PL. SR

![LRAS Price Level AD SRAS AD 2 PL 2[106] [Production cost] E 2 What LRAS Price Level AD SRAS AD 2 PL 2[106] [Production cost] E 2 What](https://present5.com/presentation/1a86d1eb30728aaff44a20d6dcc040bb/image-80.jpg) LRAS Price Level AD SRAS AD 2 PL 2[106] [Production cost] E 2 What if we have unanticipated inflation? inflation What happens in SR to output, employment, and price level? PL 1[103] Y YI RGDP

LRAS Price Level AD SRAS AD 2 PL 2[106] [Production cost] E 2 What if we have unanticipated inflation? inflation What happens in SR to output, employment, and price level? PL 1[103] Y YI RGDP

![LRAS Price Level PL 2[106] SRAS 2 SRAS 1 AD E 3 [Production cost] LRAS Price Level PL 2[106] SRAS 2 SRAS 1 AD E 3 [Production cost]](https://present5.com/presentation/1a86d1eb30728aaff44a20d6dcc040bb/image-81.jpg) LRAS Price Level PL 2[106] SRAS 2 SRAS 1 AD E 3 [Production cost] With unanticipated inflation what happens to output, output employment and price level in the LR? PL 1[103] Y RGDP

LRAS Price Level PL 2[106] SRAS 2 SRAS 1 AD E 3 [Production cost] With unanticipated inflation what happens to output, output employment and price level in the LR? PL 1[103] Y RGDP

![LRAS Price Level PL 1[103] PL 3[101] AD SRAS [Production cost] With unanticipated disinflation, LRAS Price Level PL 1[103] PL 3[101] AD SRAS [Production cost] With unanticipated disinflation,](https://present5.com/presentation/1a86d1eb30728aaff44a20d6dcc040bb/image-82.jpg) LRAS Price Level PL 1[103] PL 3[101] AD SRAS [Production cost] With unanticipated disinflation, what happens disinflation to output, employment and price level in the SR? AD 2 E 2 YR Y RGDP

LRAS Price Level PL 1[103] PL 3[101] AD SRAS [Production cost] With unanticipated disinflation, what happens disinflation to output, employment and price level in the SR? AD 2 E 2 YR Y RGDP

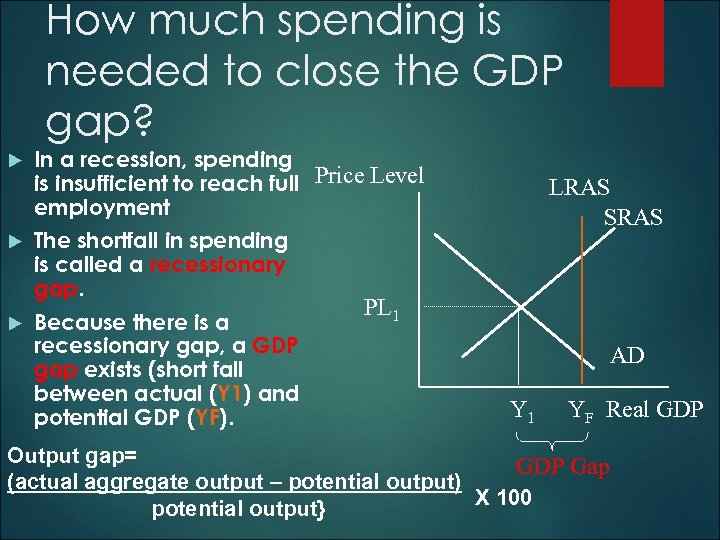

How much spending is needed to close the GDP gap? In a recession, spending is insufficient to reach full Price Level employment The shortfall in spending is called a recessionary gap. Because there is a recessionary gap, a GDP gap exists (short fall between actual (Y 1) and potential GDP (YF). LRAS SRAS PL 1 AD Y 1 YF Real GDP Output gap= GDP Gap (actual aggregate output – potential output) X 100 potential output}

How much spending is needed to close the GDP gap? In a recession, spending is insufficient to reach full Price Level employment The shortfall in spending is called a recessionary gap. Because there is a recessionary gap, a GDP gap exists (short fall between actual (Y 1) and potential GDP (YF). LRAS SRAS PL 1 AD Y 1 YF Real GDP Output gap= GDP Gap (actual aggregate output – potential output) X 100 potential output}

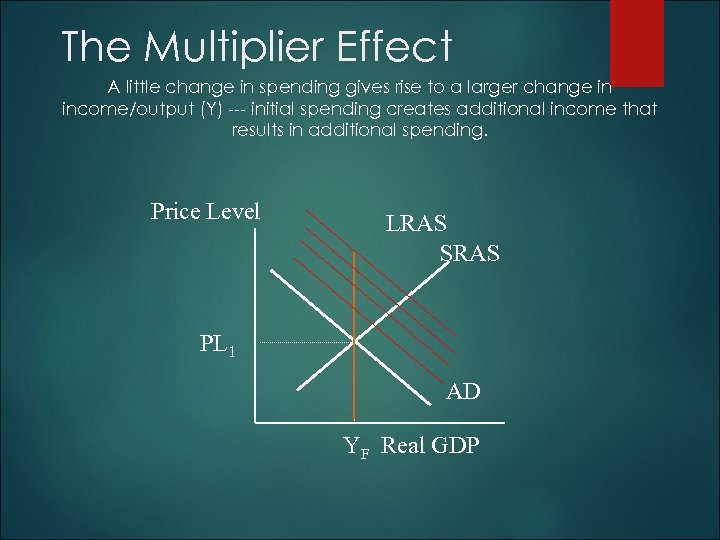

The Multiplier Effect A little change in spending gives rise to a larger change in income/output (Y) --- initial spending creates additional income that results in additional spending. Price Level LRAS SRAS PL 1 AD YF Real GDP

The Multiplier Effect A little change in spending gives rise to a larger change in income/output (Y) --- initial spending creates additional income that results in additional spending. Price Level LRAS SRAS PL 1 AD YF Real GDP

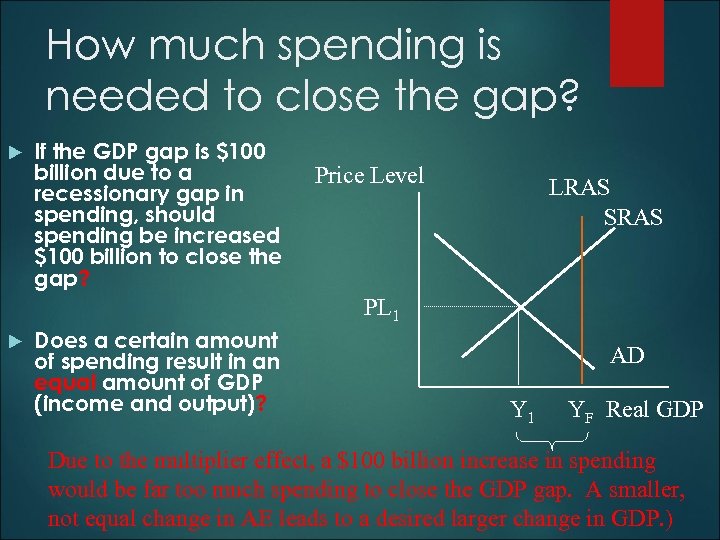

How much spending is needed to close the gap? If the GDP gap is $100 billion due to a recessionary gap in spending, should spending be increased $100 billion to close the gap? Price Level LRAS SRAS PL 1 Does a certain amount of spending result in an equal amount of GDP (income and output)? AD Y 1 YF Real GDP Due to the multiplier effect, a $100 billion increase in spending would be far too much spending to close the GDP gap. A smaller, not equal change in AE leads to a desired larger change in GDP. )

How much spending is needed to close the gap? If the GDP gap is $100 billion due to a recessionary gap in spending, should spending be increased $100 billion to close the gap? Price Level LRAS SRAS PL 1 Does a certain amount of spending result in an equal amount of GDP (income and output)? AD Y 1 YF Real GDP Due to the multiplier effect, a $100 billion increase in spending would be far too much spending to close the GDP gap. A smaller, not equal change in AE leads to a desired larger change in GDP. )

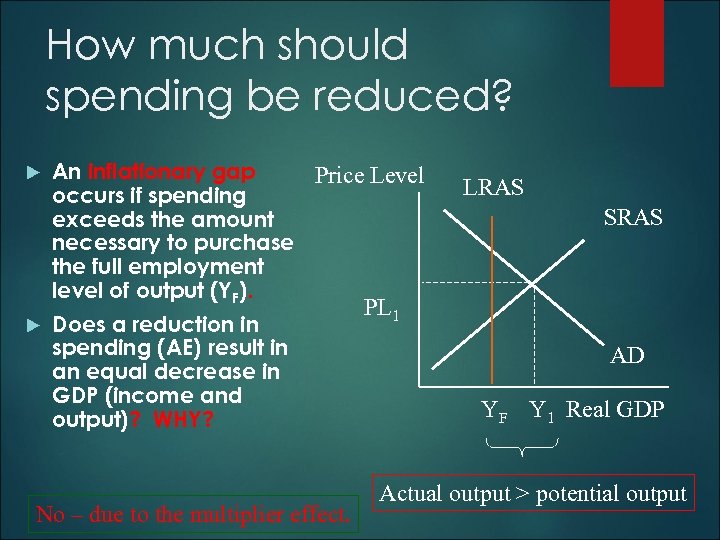

How much should spending be reduced? An inflationary gap Price Level occurs if spending exceeds the amount necessary to purchase the full employment level of output (YF). Does a reduction in spending (AE) result in an equal decrease in GDP (income and output)? WHY? No – due to the multiplier effect. LRAS SRAS PL 1 AD YF Y 1 Real GDP Actual output > potential output

How much should spending be reduced? An inflationary gap Price Level occurs if spending exceeds the amount necessary to purchase the full employment level of output (YF). Does a reduction in spending (AE) result in an equal decrease in GDP (income and output)? WHY? No – due to the multiplier effect. LRAS SRAS PL 1 AD YF Y 1 Real GDP Actual output > potential output

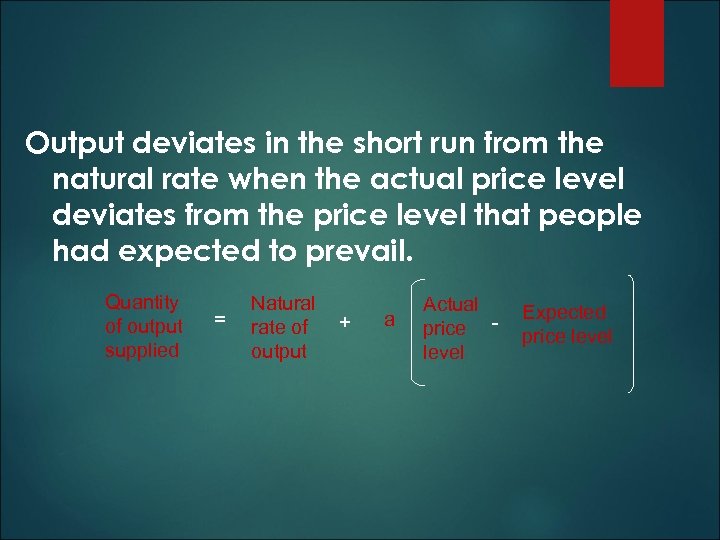

Output deviates in the short run from the natural rate when the actual price level deviates from the price level that people had expected to prevail. Quantity of output supplied = Natural rate of + output a Actual price level - Expected price level

Output deviates in the short run from the natural rate when the actual price level deviates from the price level that people had expected to prevail. Quantity of output supplied = Natural rate of + output a Actual price level - Expected price level

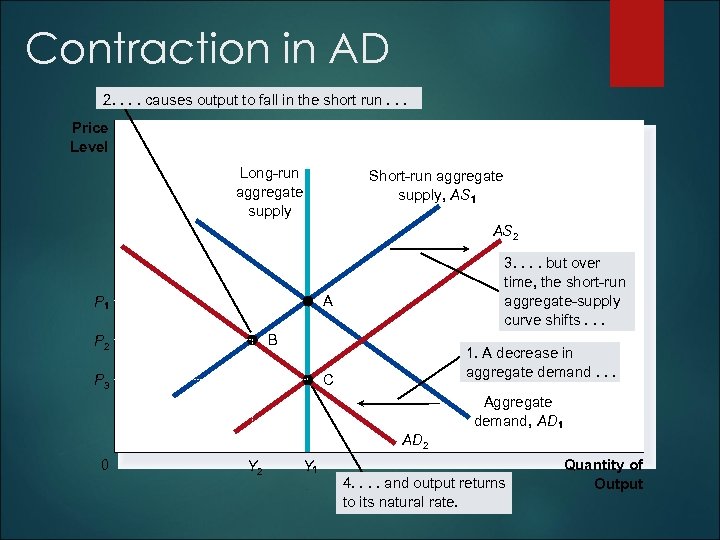

Contraction in AD 2. . causes output to fall in the short run. . . Price Level Long-run aggregate supply Short-run aggregate supply, AS AS 2 3. . but over time, the short-run aggregate-supply curve shifts. . . A P B P 2 P 3 1. A decrease in aggregate demand. . . C Aggregate demand, AD AD 2 0 Y 2 Y 4. . and output returns to its natural rate. Quantity of Output

Contraction in AD 2. . causes output to fall in the short run. . . Price Level Long-run aggregate supply Short-run aggregate supply, AS AS 2 3. . but over time, the short-run aggregate-supply curve shifts. . . A P B P 2 P 3 1. A decrease in aggregate demand. . . C Aggregate demand, AD AD 2 0 Y 2 Y 4. . and output returns to its natural rate. Quantity of Output

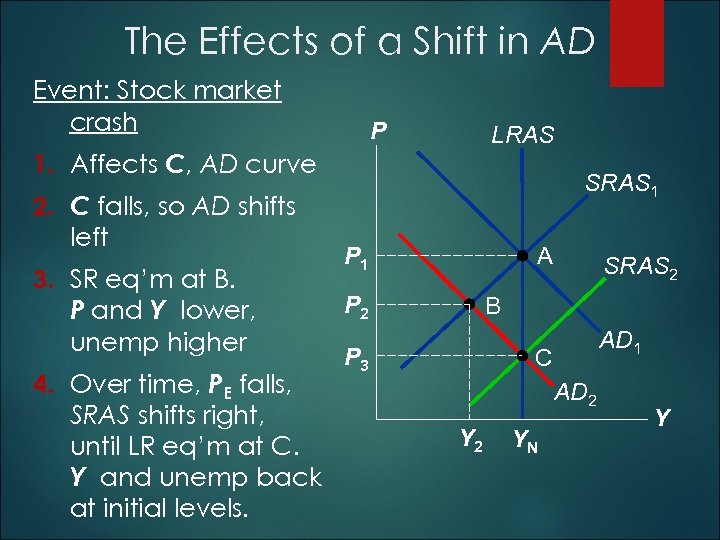

The Effects of a Shift in AD Event: Stock market crash P LRAS 1. Affects C, AD curve 2. C falls, so AD shifts left 3. SR eq’m at B. P and Y lower, unemp higher 4. Over time, PE falls, SRAS shifts right, until LR eq’m at C. Y and unemp back at initial levels. SRAS 1 A P 1 P 2 SRAS 2 B P 3 AD 1 C AD 2 YN Y

The Effects of a Shift in AD Event: Stock market crash P LRAS 1. Affects C, AD curve 2. C falls, so AD shifts left 3. SR eq’m at B. P and Y lower, unemp higher 4. Over time, PE falls, SRAS shifts right, until LR eq’m at C. Y and unemp back at initial levels. SRAS 1 A P 1 P 2 SRAS 2 B P 3 AD 1 C AD 2 YN Y

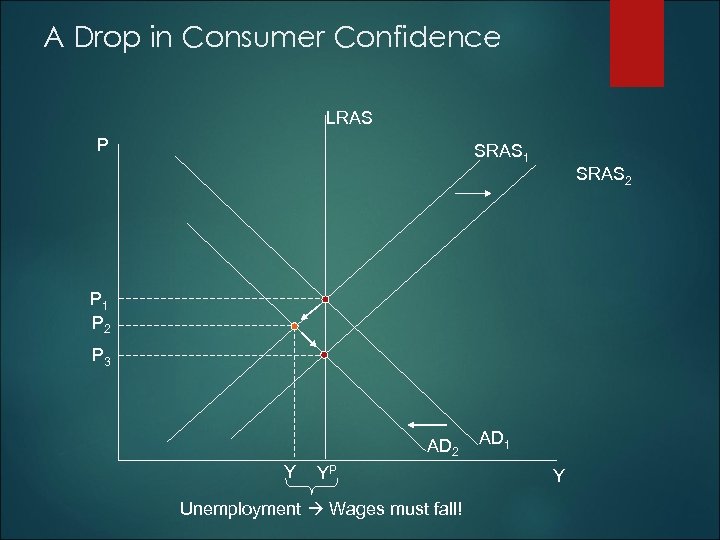

A Drop in Consumer Confidence LRAS P SRAS 1 SRAS 2 P 1 P 2 P 3 AD 2 Y YP Unemployment Wages must fall! AD 1 Y

A Drop in Consumer Confidence LRAS P SRAS 1 SRAS 2 P 1 P 2 P 3 AD 2 Y YP Unemployment Wages must fall! AD 1 Y

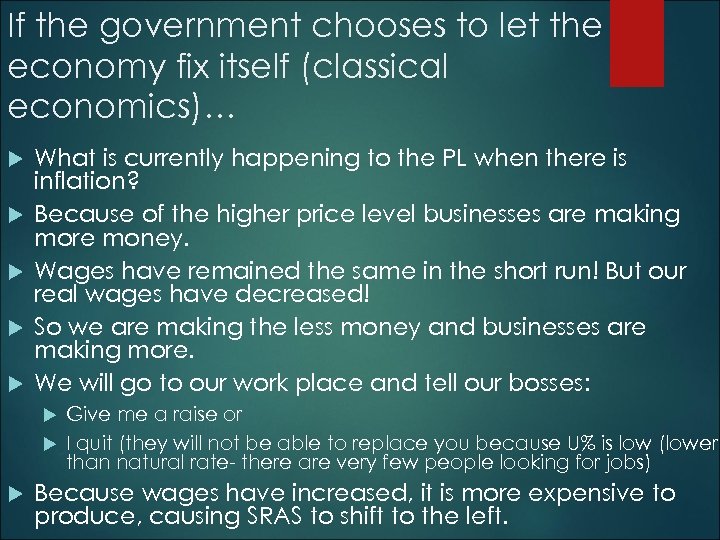

Policy Responses to Recession Policymakers may respond to a recession in one of the following ways: Do nothing and wait for prices and wages to adjust. Take action to increase aggregate demand by using monetary and fiscal policy. It’s harder for the government to shift AS

Policy Responses to Recession Policymakers may respond to a recession in one of the following ways: Do nothing and wait for prices and wages to adjust. Take action to increase aggregate demand by using monetary and fiscal policy. It’s harder for the government to shift AS

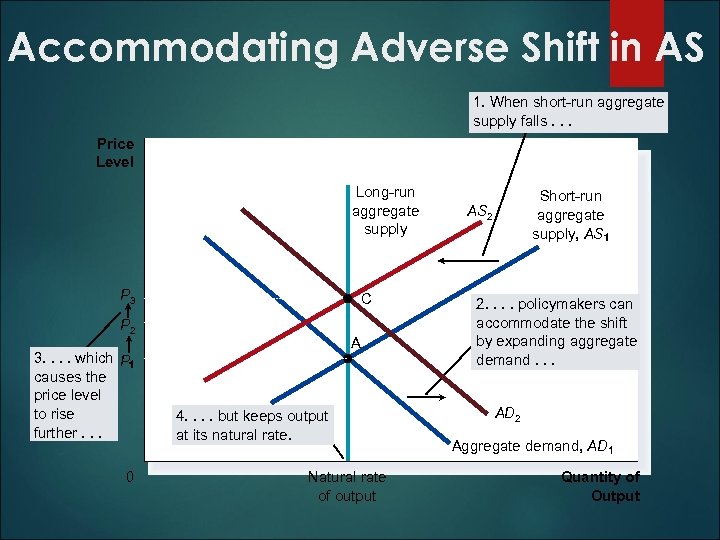

Accommodating Adverse Shift in AS 1. When short-run aggregate supply falls. . . Price Level Long-run aggregate supply P 3 C P 2 3. . which P causes the price level to rise further. . . 0 A 4. . but keeps output at its natural rate. Natural rate of output Short-run aggregate supply, AS AS 2 2. . policymakers can accommodate the shift by expanding aggregate demand. . . AD 2 Aggregate demand, AD Quantity of Output

Accommodating Adverse Shift in AS 1. When short-run aggregate supply falls. . . Price Level Long-run aggregate supply P 3 C P 2 3. . which P causes the price level to rise further. . . 0 A 4. . but keeps output at its natural rate. Natural rate of output Short-run aggregate supply, AS AS 2 2. . policymakers can accommodate the shift by expanding aggregate demand. . . AD 2 Aggregate demand, AD Quantity of Output

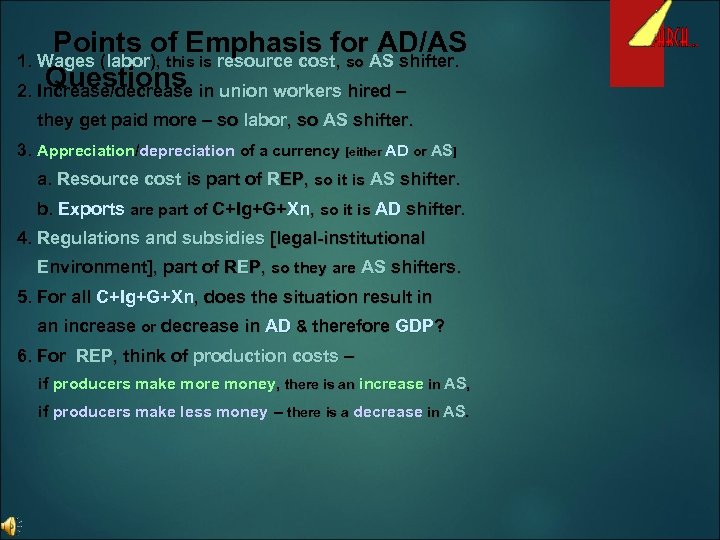

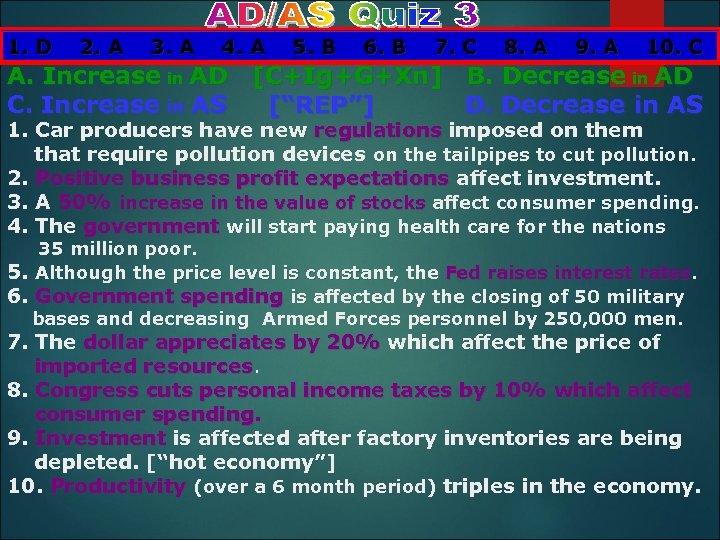

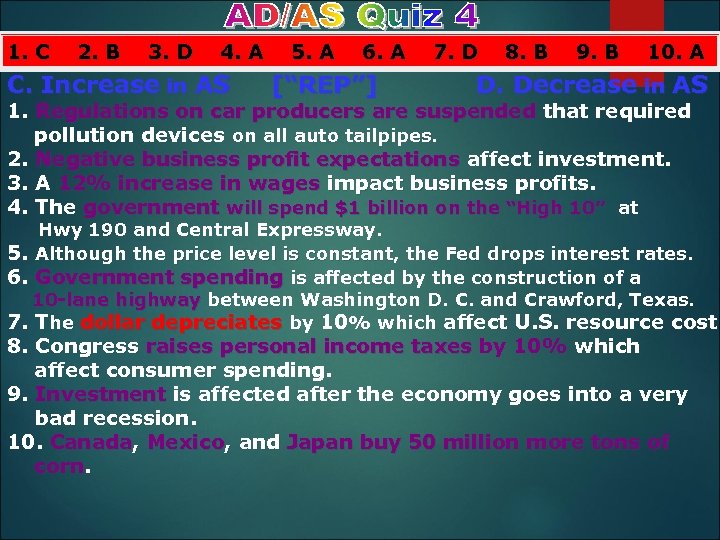

Points of Emphasis for AD/AS Questions 1. Wages (labor), this is resource cost, so AS shifter. 2. Increase/decrease in union workers hired – they get paid more – so labor, so AS shifter. 3. Appreciation/depreciation of a currency [either AD or AS] a. Resource cost is part of REP, so it is AS shifter. b. Exports are part of C+Ig+G+Xn, so it is AD shifter. 4. Regulations and subsidies [legal-institutional Environment], part of REP, so they are AS shifters. 5. For all C+Ig+G+Xn, does the situation result in an increase or decrease in AD & therefore GDP? 6. For REP, think of production costs – if producers make more money, there is an increase in AS, if producers make less money – there is a decrease in AS.

Points of Emphasis for AD/AS Questions 1. Wages (labor), this is resource cost, so AS shifter. 2. Increase/decrease in union workers hired – they get paid more – so labor, so AS shifter. 3. Appreciation/depreciation of a currency [either AD or AS] a. Resource cost is part of REP, so it is AS shifter. b. Exports are part of C+Ig+G+Xn, so it is AD shifter. 4. Regulations and subsidies [legal-institutional Environment], part of REP, so they are AS shifters. 5. For all C+Ig+G+Xn, does the situation result in an increase or decrease in AD & therefore GDP? 6. For REP, think of production costs – if producers make more money, there is an increase in AS, if producers make less money – there is a decrease in AS.

http: //whitenova. com/think. Ec onomics/simul. html

http: //whitenova. com/think. Ec onomics/simul. html

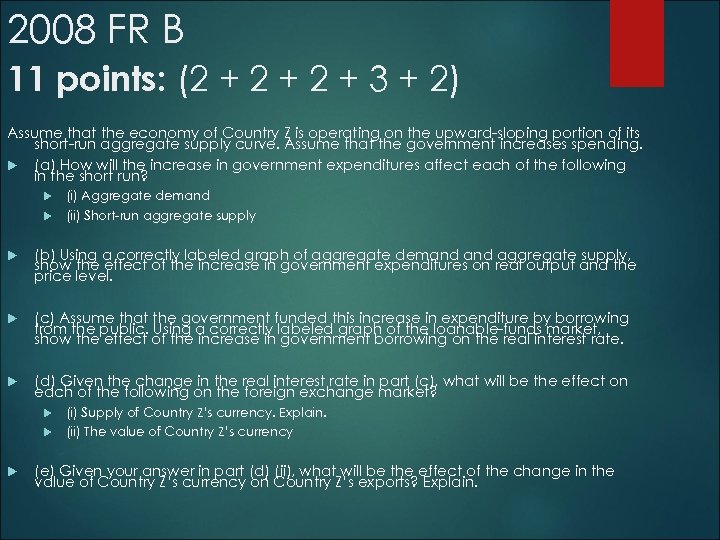

2008 FR B 11 points: (2 + 2 + 3 + 2) Assume that the economy of Country Z is operating on the upward-sloping portion of its short-run aggregate supply curve. Assume that the government increases spending. (a) How will the increase in government expenditures affect each of the following in the short run? (i) Aggregate demand (ii) Short-run aggregate supply (b) Using a correctly labeled graph of aggregate demand aggregate supply, show the effect of the increase in government expenditures on real output and the price level.

2008 FR B 11 points: (2 + 2 + 3 + 2) Assume that the economy of Country Z is operating on the upward-sloping portion of its short-run aggregate supply curve. Assume that the government increases spending. (a) How will the increase in government expenditures affect each of the following in the short run? (i) Aggregate demand (ii) Short-run aggregate supply (b) Using a correctly labeled graph of aggregate demand aggregate supply, show the effect of the increase in government expenditures on real output and the price level.

(c) Assume that the government funded this increase in expenditure by borrowing from the public. Using a correctly labeled graph of the loanable-funds market, show the effect of the increase in government borrowing on the real interest rate. (d) Given the change in the real interest rate in part (c), what will be the effect on each of the following on the foreign exchange market? (i) Supply of Country Z’s currency. Explain. (ii) The value of Country Z’s currency (e) Given your answer in part (d) (ii), what will be the effect of the change in the value of Country Z’s currency on Country Z’s exports? Explain.

(c) Assume that the government funded this increase in expenditure by borrowing from the public. Using a correctly labeled graph of the loanable-funds market, show the effect of the increase in government borrowing on the real interest rate. (d) Given the change in the real interest rate in part (c), what will be the effect on each of the following on the foreign exchange market? (i) Supply of Country Z’s currency. Explain. (ii) The value of Country Z’s currency (e) Given your answer in part (d) (ii), what will be the effect of the change in the value of Country Z’s currency on Country Z’s exports? Explain.

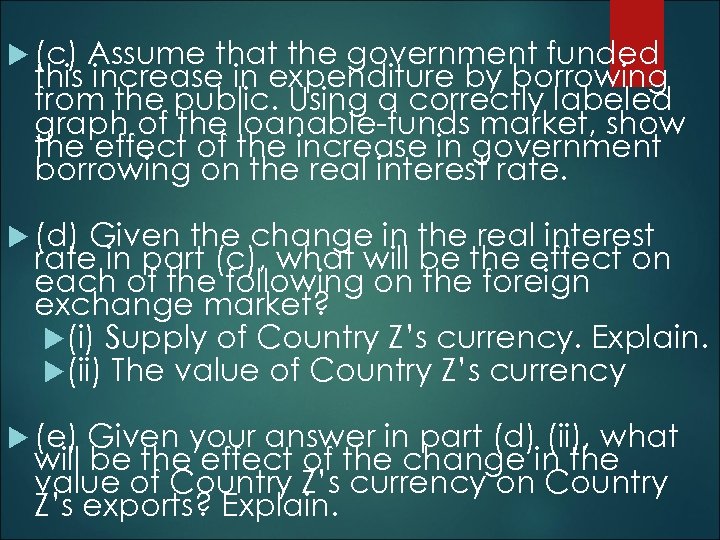

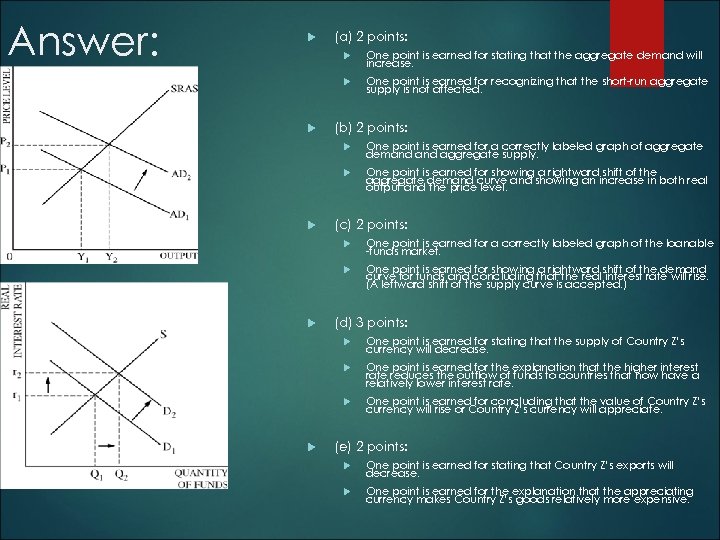

Answer: (a) 2 points: One point is earned for stating that the aggregate demand will increase. One point is earned for recognizing that the short-run aggregate supply is not affected. (b) 2 points: One point is earned for a correctly labeled graph of aggregate demand aggregate supply. One point is earned for showing a rightward shift of the aggregate demand curve and showing an increase in both real output and the price level. (c) 2 points: One point is earned for a correctly labeled graph of the loanable -funds market. One point is earned for showing a rightward shift of the demand curve for funds and concluding that the real interest rate will rise. (A leftward shift of the supply curve is accepted. ) (d) 3 points: One point is earned for the explanation that the higher interest rate reduces the outflow of funds to countries that now have a relatively lower interest rate. One point is earned for stating that the supply of Country Z’s currency will decrease. One point is earned for concluding that the value of Country Z’s currency will rise or Country Z’s currency will appreciate. (e) 2 points: One point is earned for stating that Country Z’s exports will decrease. One point is earned for the explanation that the appreciating currency makes Country Z’s goods relatively more expensive.

Answer: (a) 2 points: One point is earned for stating that the aggregate demand will increase. One point is earned for recognizing that the short-run aggregate supply is not affected. (b) 2 points: One point is earned for a correctly labeled graph of aggregate demand aggregate supply. One point is earned for showing a rightward shift of the aggregate demand curve and showing an increase in both real output and the price level. (c) 2 points: One point is earned for a correctly labeled graph of the loanable -funds market. One point is earned for showing a rightward shift of the demand curve for funds and concluding that the real interest rate will rise. (A leftward shift of the supply curve is accepted. ) (d) 3 points: One point is earned for the explanation that the higher interest rate reduces the outflow of funds to countries that now have a relatively lower interest rate. One point is earned for stating that the supply of Country Z’s currency will decrease. One point is earned for concluding that the value of Country Z’s currency will rise or Country Z’s currency will appreciate. (e) 2 points: One point is earned for stating that Country Z’s exports will decrease. One point is earned for the explanation that the appreciating currency makes Country Z’s goods relatively more expensive.

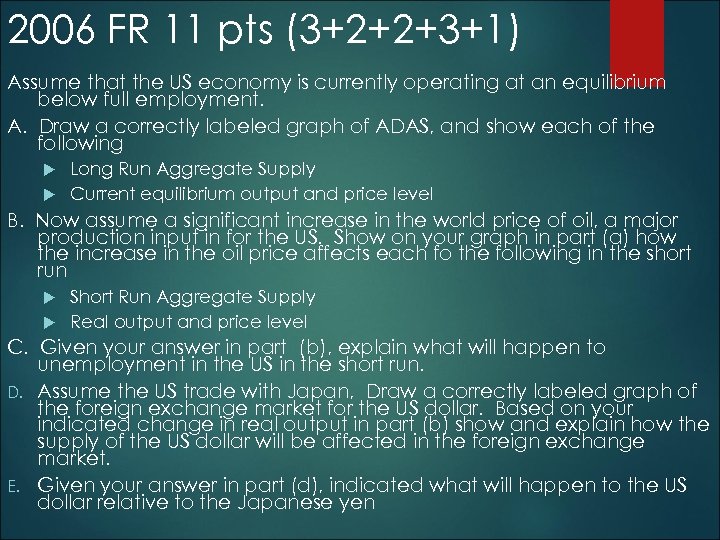

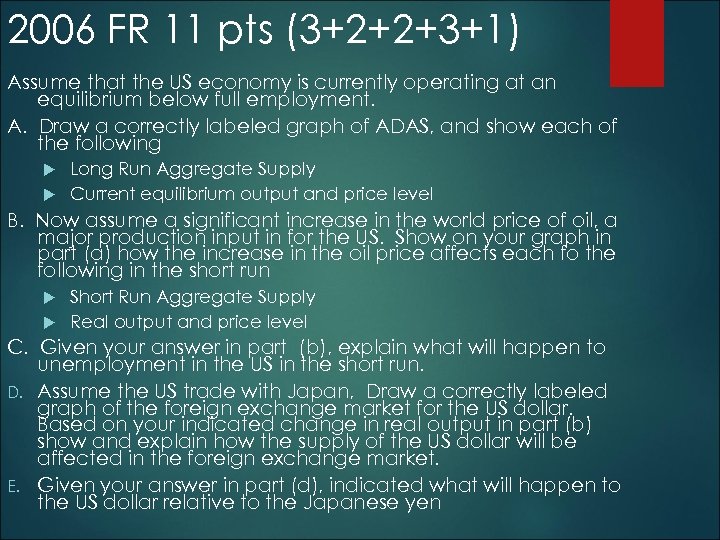

2006 FR 11 pts (3+2+2+3+1) Assume that the US economy is currently operating at an equilibrium below full employment. A. Draw a correctly labeled graph of ADAS, and show each of the following Long Run Aggregate Supply Current equilibrium output and price level B. Now assume a significant increase in the world price of oil, a major production input in for the US. Show on your graph in part (a) how the increase in the oil price affects each fo the following in the short run Short Run Aggregate Supply Real output and price level C. Given your answer in part (b), explain what will happen to unemployment in the US in the short run. D. Assume the US trade with Japan, Draw a correctly labeled graph of the foreign exchange market for the US dollar. Based on your indicated change in real output in part (b) show and explain how the supply of the US dollar will be affected in the foreign exchange market. E. Given your answer in part (d), indicated what will happen to the US dollar relative to the Japanese yen

2006 FR 11 pts (3+2+2+3+1) Assume that the US economy is currently operating at an equilibrium below full employment. A. Draw a correctly labeled graph of ADAS, and show each of the following Long Run Aggregate Supply Current equilibrium output and price level B. Now assume a significant increase in the world price of oil, a major production input in for the US. Show on your graph in part (a) how the increase in the oil price affects each fo the following in the short run Short Run Aggregate Supply Real output and price level C. Given your answer in part (b), explain what will happen to unemployment in the US in the short run. D. Assume the US trade with Japan, Draw a correctly labeled graph of the foreign exchange market for the US dollar. Based on your indicated change in real output in part (b) show and explain how the supply of the US dollar will be affected in the foreign exchange market. E. Given your answer in part (d), indicated what will happen to the US dollar relative to the Japanese yen

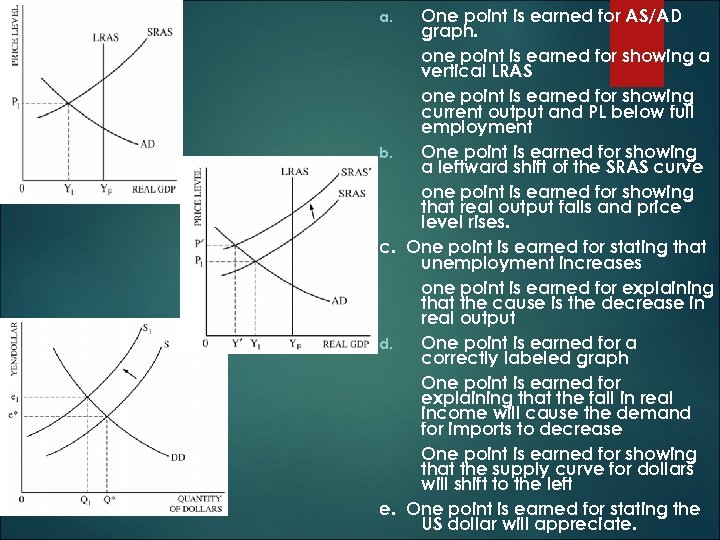

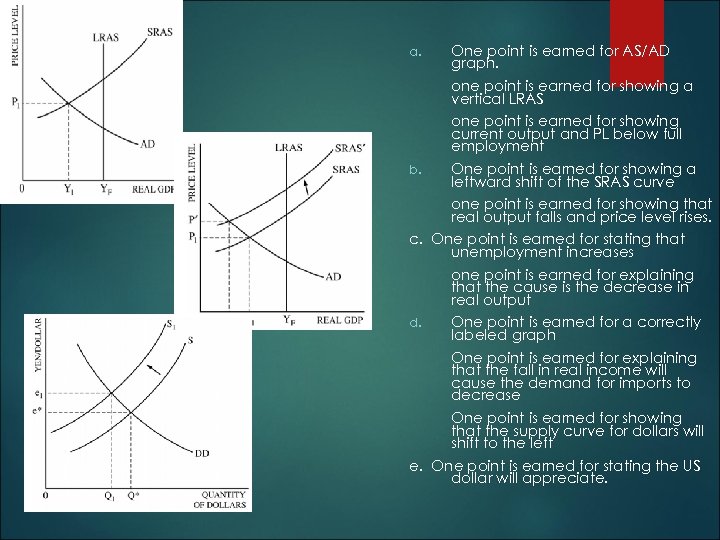

a. Answer: b. c. d. e. One point is earned for AS/AD graph. one point is earned for showing a vertical LRAS one point is earned for showing current output and PL below full employment One point is earned for showing a leftward shift of the SRAS curve one point is earned for showing that real output falls and price level rises. One point is earned for stating that unemployment increases one point is earned for explaining that the cause is the decrease in real output One point is earned for a correctly labeled graph One point is earned for explaining that the fall in real income will cause the demand for imports to decrease One point is earned for showing that the supply curve for dollars will shift to the left One point is earned for stating the US dollar will appreciate.

a. Answer: b. c. d. e. One point is earned for AS/AD graph. one point is earned for showing a vertical LRAS one point is earned for showing current output and PL below full employment One point is earned for showing a leftward shift of the SRAS curve one point is earned for showing that real output falls and price level rises. One point is earned for stating that unemployment increases one point is earned for explaining that the cause is the decrease in real output One point is earned for a correctly labeled graph One point is earned for explaining that the fall in real income will cause the demand for imports to decrease One point is earned for showing that the supply curve for dollars will shift to the left One point is earned for stating the US dollar will appreciate.

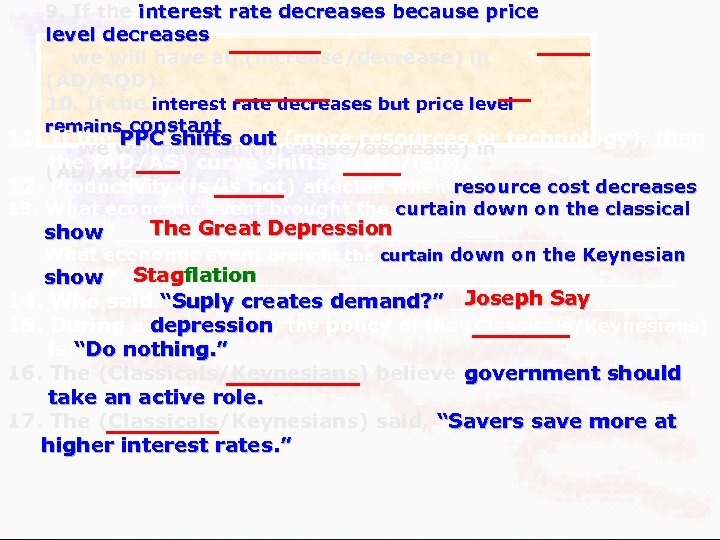

and SHOULD THE GOVERNMENT INTERVENE TO CORRECT PROBLEMS IN THE ECONOMY?

and SHOULD THE GOVERNMENT INTERVENE TO CORRECT PROBLEMS IN THE ECONOMY?

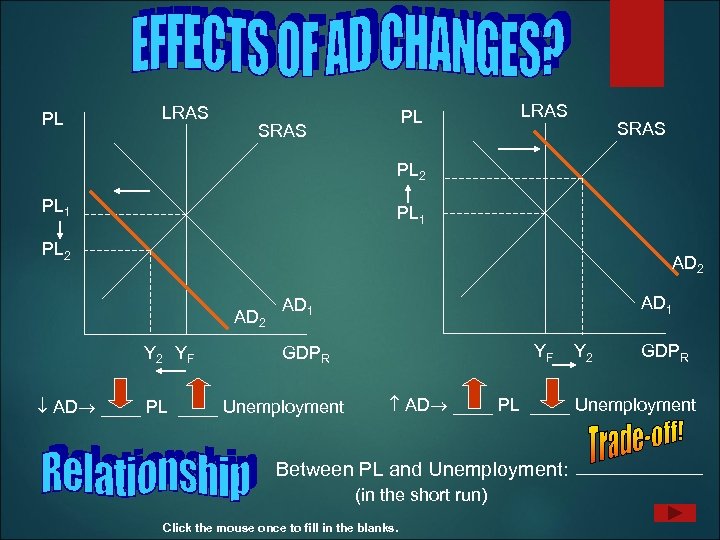

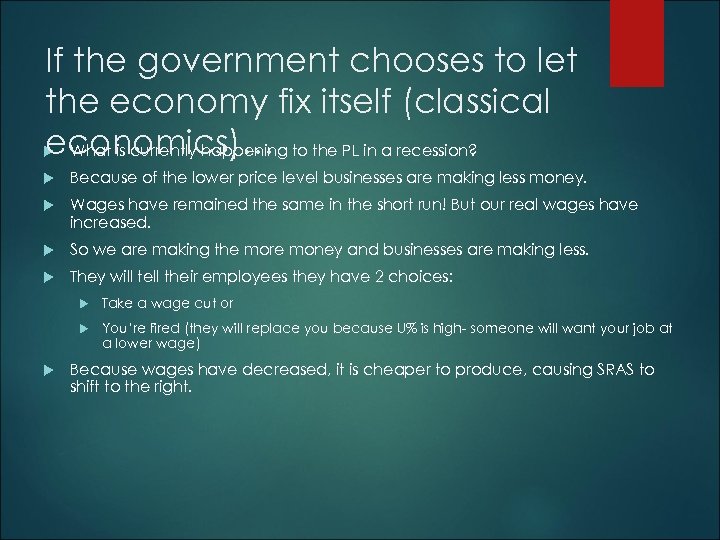

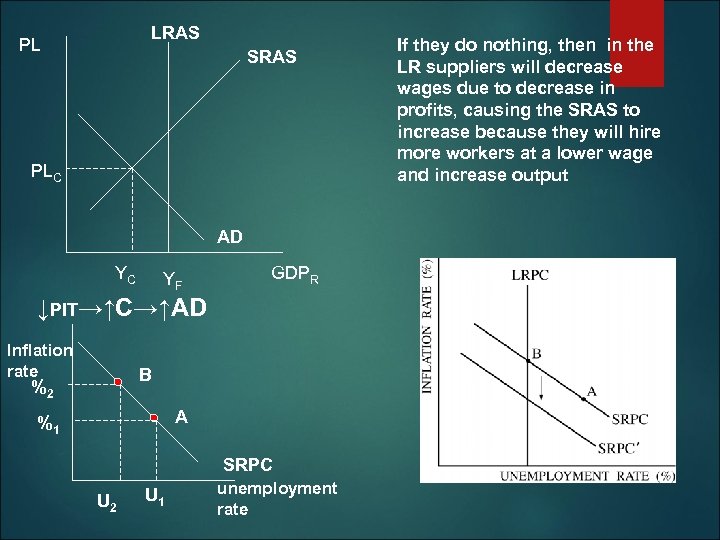

PL LRAS PL SRAS LRAS SRAS PL 2 PL 1 PL 2 AD 2 YF AD 1 YF Y 2 GDPR AD ____ PL ____ Unemployment Between PL and Unemployment: (in the short run) Click the mouse once to fill in the blanks.

PL LRAS PL SRAS LRAS SRAS PL 2 PL 1 PL 2 AD 2 YF AD 1 YF Y 2 GDPR AD ____ PL ____ Unemployment Between PL and Unemployment: (in the short run) Click the mouse once to fill in the blanks.

In the short run there is a TRADE-OFF between INFLATION and UNEMPLOYMENT. To reduce unemployment – inflation occurs To reduce inflation --- unemployment increases Research by an English economist named Phillips documented this relationship. As a result a new model was developed to illustrate the trade-off:

In the short run there is a TRADE-OFF between INFLATION and UNEMPLOYMENT. To reduce unemployment – inflation occurs To reduce inflation --- unemployment increases Research by an English economist named Phillips documented this relationship. As a result a new model was developed to illustrate the trade-off:

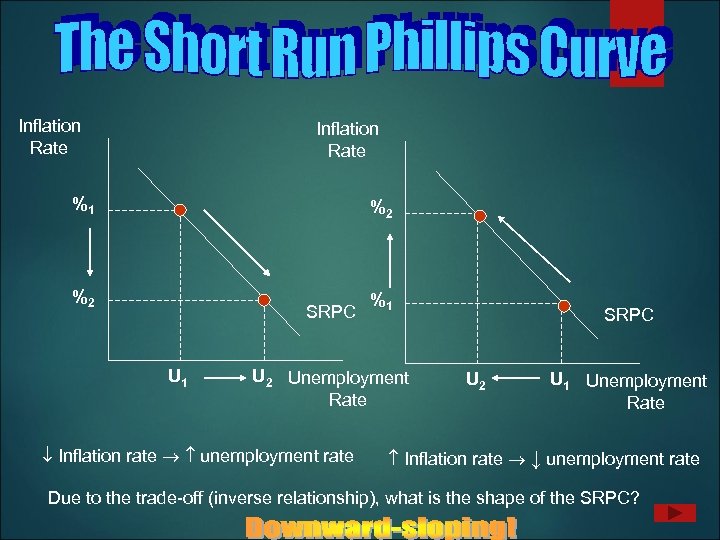

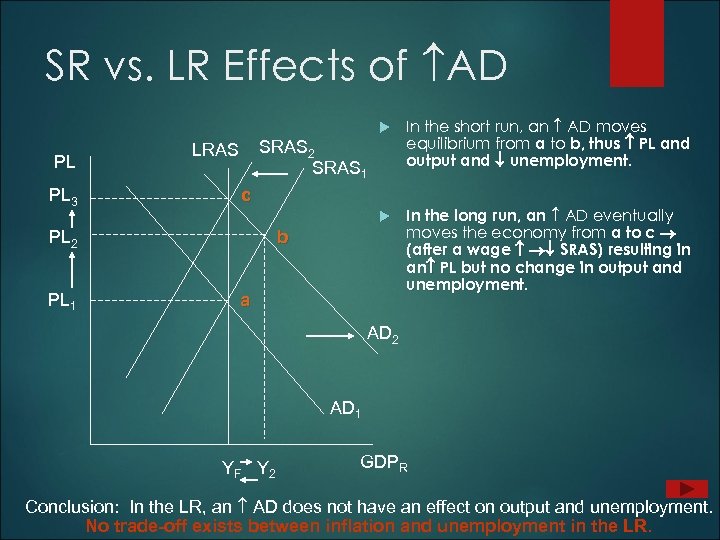

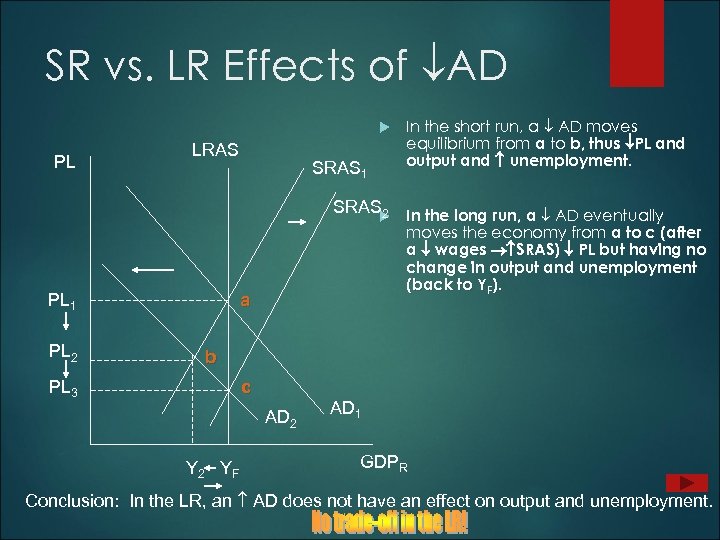

Inflation Rate %1 %2 %2 SRPC U 1 %1 U 2 Unemployment Rate Inflation rate unemployment rate SRPC U 2 U 1 Unemployment Rate Inflation rate ↓ unemployment rate Due to the trade-off (inverse relationship), what is the shape of the SRPC?

Inflation Rate %1 %2 %2 SRPC U 1 %1 U 2 Unemployment Rate Inflation rate unemployment rate SRPC U 2 U 1 Unemployment Rate Inflation rate ↓ unemployment rate Due to the trade-off (inverse relationship), what is the shape of the SRPC?

The trade-off presents a problem for government fiscal (Congress & President) and monetary (The FED) policymakers: Insufficient AD recession policymakers to take steps to __ AD ________ Too much AD inflation policymakers to ___AD __________.

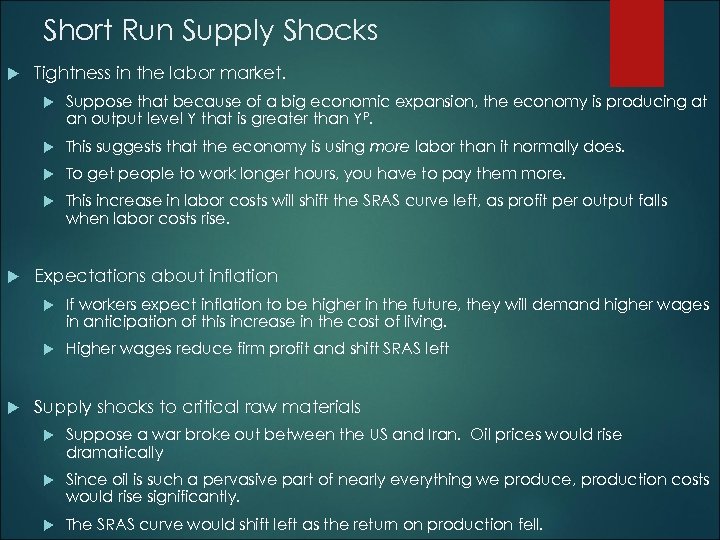

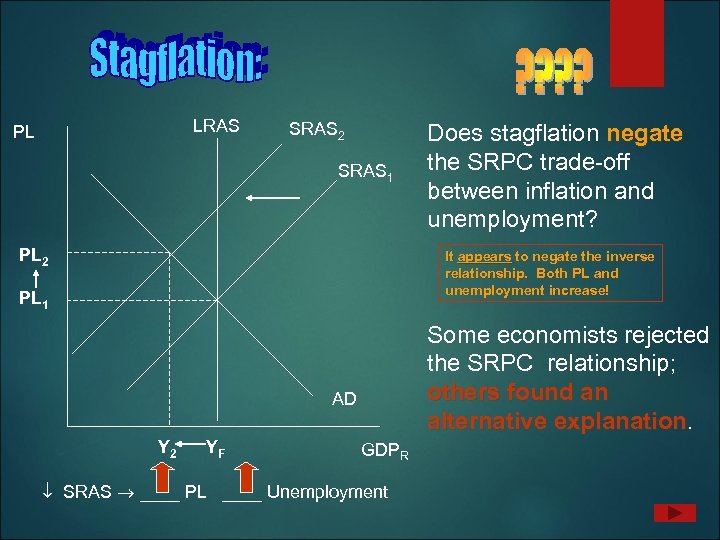

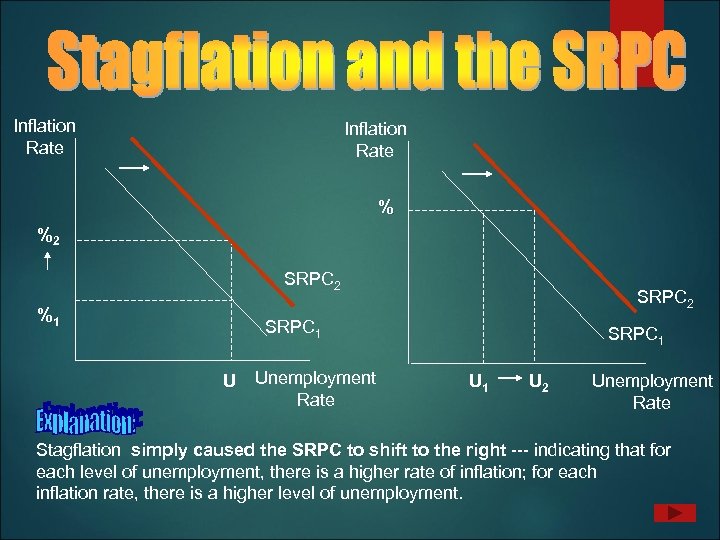

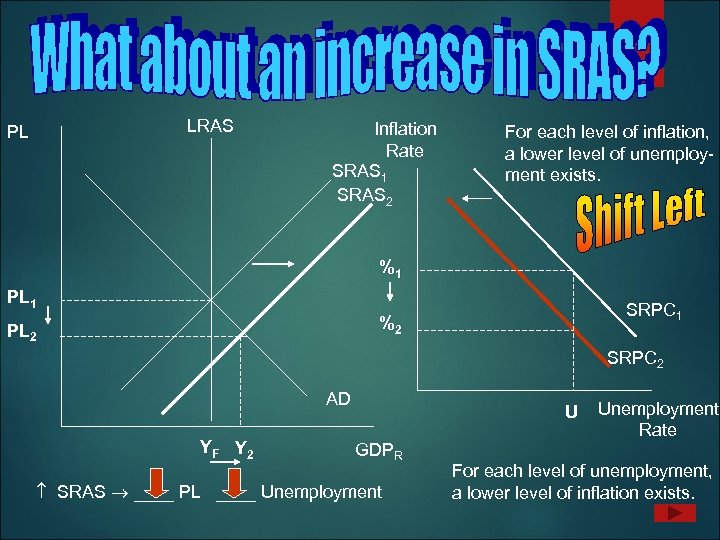

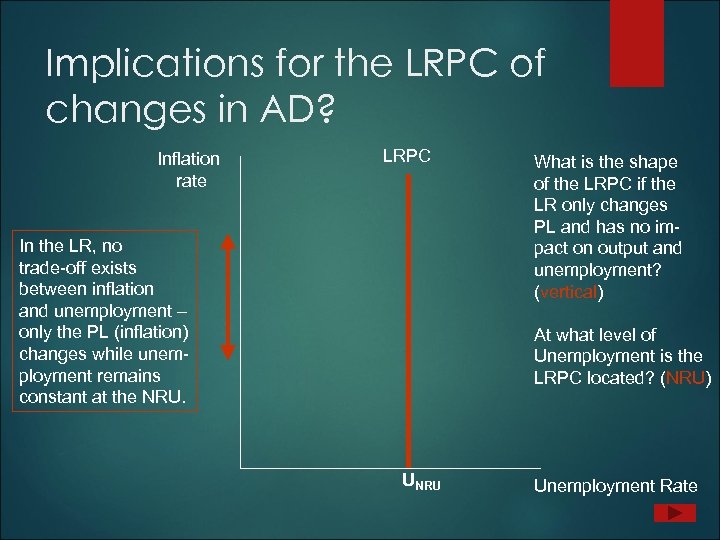

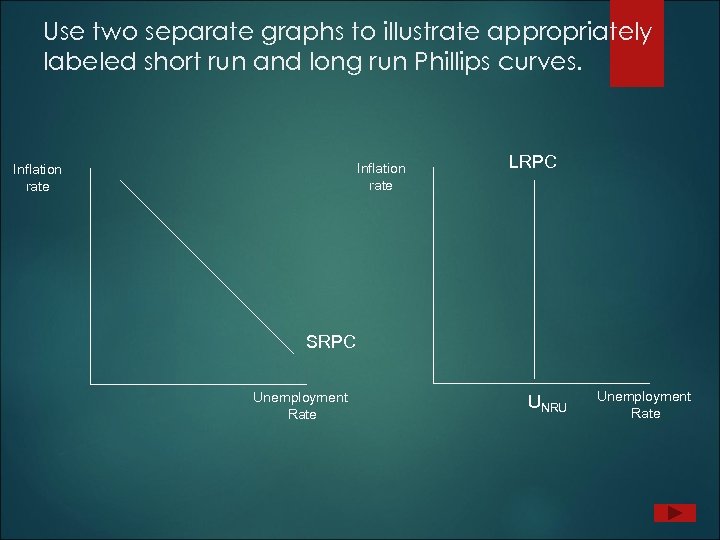

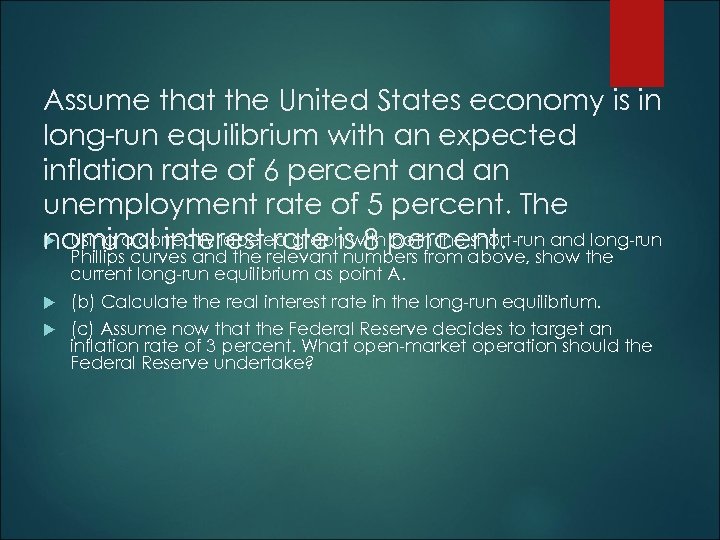

The trade-off presents a problem for government fiscal (Congress & President) and monetary (The FED) policymakers: Insufficient AD recession policymakers to take steps to __ AD ________ Too much AD inflation policymakers to ___AD __________.