5494d3f4fe484f0429bac728bea16989.ppt

- Количество слайдов: 30

Consumers & Eating Out Mintel & Oxygen Overview © 2012 Mintel Group Ltd. All Rights Reserved. Confidential to Mintel

Consumers & Eating Out Mintel & Oxygen Overview © 2012 Mintel Group Ltd. All Rights Reserved. Confidential to Mintel

Every day at Mintel… mintel. com

Every day at Mintel… mintel. com

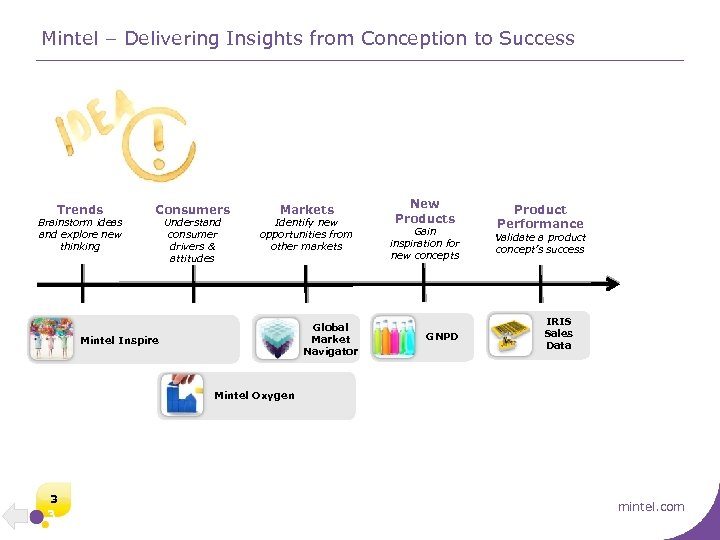

Mintel – Delivering Insights from Conception to Success Trends Brainstorm ideas and explore new thinking Consumers Understand consumer drivers & attitudes Markets Identify new opportunities from other markets Global Market Navigator Mintel Inspire New Products Gain inspiration for new concepts GNPD Product Performance Validate a product concept’s success IRIS Sales Data Mintel Oxygen 3 3 mintel. com

Mintel – Delivering Insights from Conception to Success Trends Brainstorm ideas and explore new thinking Consumers Understand consumer drivers & attitudes Markets Identify new opportunities from other markets Global Market Navigator Mintel Inspire New Products Gain inspiration for new concepts GNPD Product Performance Validate a product concept’s success IRIS Sales Data Mintel Oxygen 3 3 mintel. com

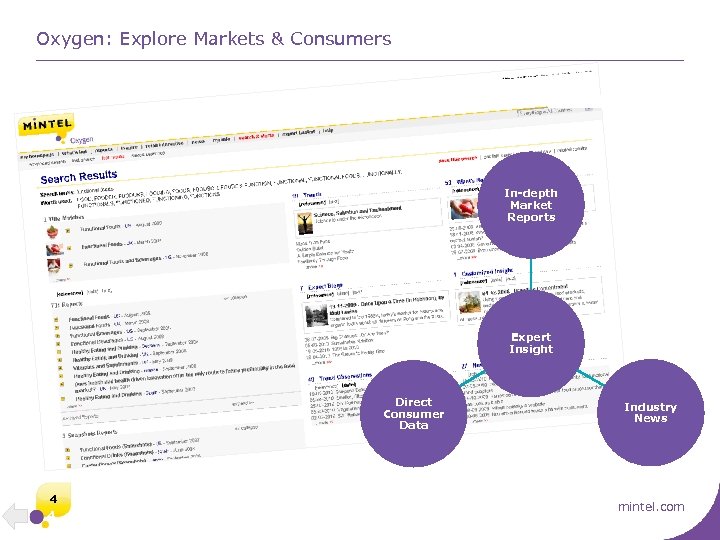

Oxygen: Explore Markets & Consumers In-depth Market Reports Expert Insight Direct Consumer Data 4 4 Industry News mintel. com

Oxygen: Explore Markets & Consumers In-depth Market Reports Expert Insight Direct Consumer Data 4 4 Industry News mintel. com

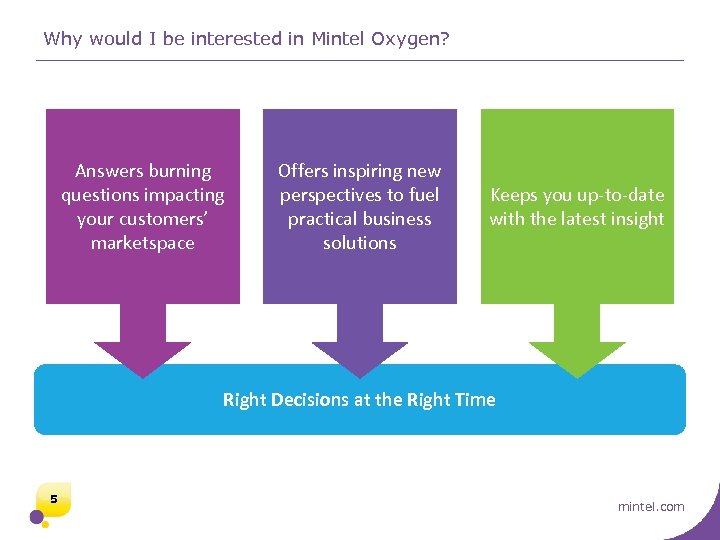

Why would I be interested in Mintel Oxygen? Answers burning questions impacting your customers’ marketspace Offers inspiring new perspectives to fuel practical business solutions Keeps you up-to-date with the latest insight Right Decisions at the Right Time 5 mintel. com

Why would I be interested in Mintel Oxygen? Answers burning questions impacting your customers’ marketspace Offers inspiring new perspectives to fuel practical business solutions Keeps you up-to-date with the latest insight Right Decisions at the Right Time 5 mintel. com

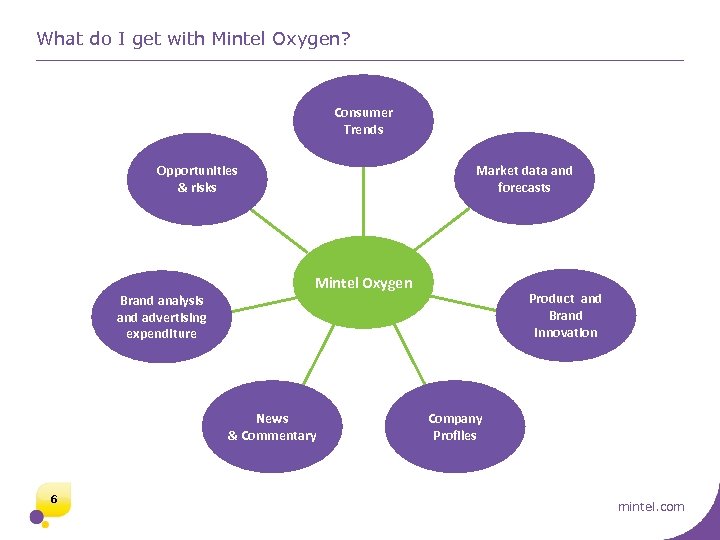

What do I get with Mintel Oxygen? Consumer Trends Market data and forecasts Opportunities & risks Brand analysis and advertising expenditure Mintel Oxygen News & Commentary 6 Product and Brand Innovation Company Profiles mintel. com

What do I get with Mintel Oxygen? Consumer Trends Market data and forecasts Opportunities & risks Brand analysis and advertising expenditure Mintel Oxygen News & Commentary 6 Product and Brand Innovation Company Profiles mintel. com

How is the current economic environment affecting consumer behaviour? 7 mintel. com

How is the current economic environment affecting consumer behaviour? 7 mintel. com

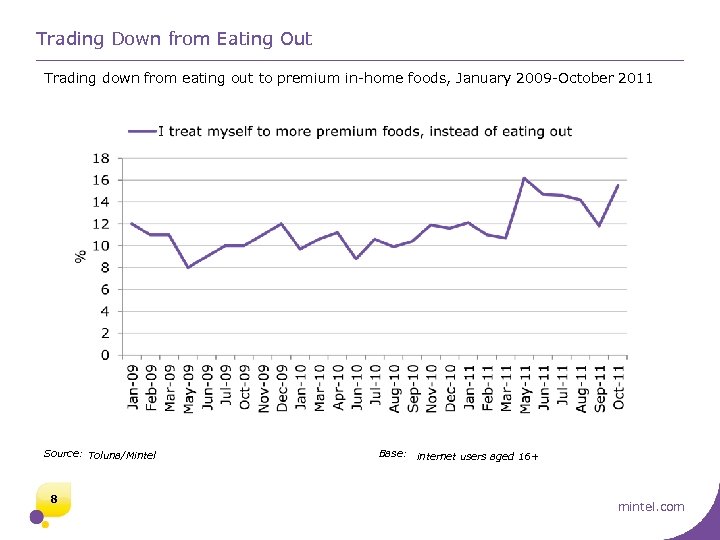

Trading Down from Eating Out Trading down from eating out to premium in-home foods, January 2009 -October 2011 Source: Toluna/Mintel 8 Base: internet users aged 16+ mintel. com

Trading Down from Eating Out Trading down from eating out to premium in-home foods, January 2009 -October 2011 Source: Toluna/Mintel 8 Base: internet users aged 16+ mintel. com

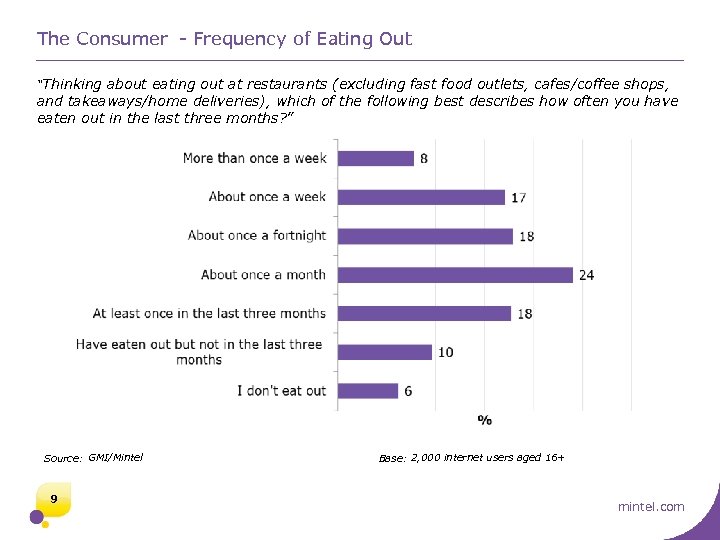

The Consumer - Frequency of Eating Out “Thinking about eating out at restaurants (excluding fast food outlets, cafes/coffee shops, and takeaways/home deliveries), which of the following best describes how often you have eaten out in the last three months? ” Source: GMI/Mintel 9 Base: 2, 000 internet users aged 16+ mintel. com

The Consumer - Frequency of Eating Out “Thinking about eating out at restaurants (excluding fast food outlets, cafes/coffee shops, and takeaways/home deliveries), which of the following best describes how often you have eaten out in the last three months? ” Source: GMI/Mintel 9 Base: 2, 000 internet users aged 16+ mintel. com

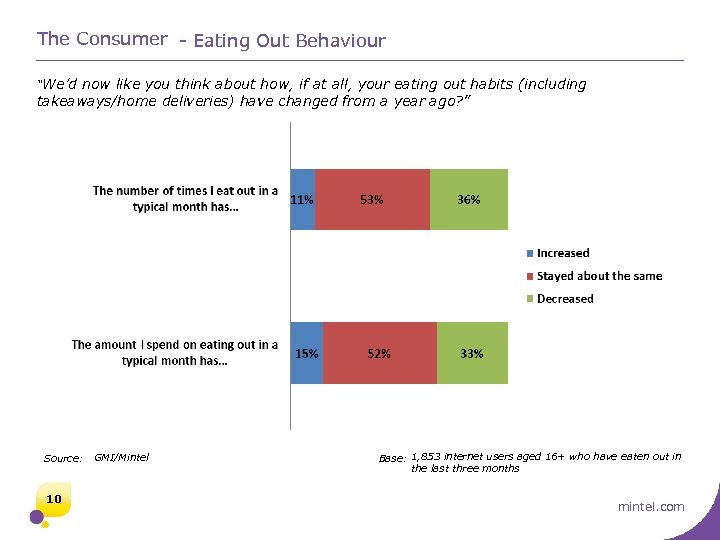

The Consumer - Eating Out Behaviour “We’d now like you think about how, if at all, your eating out habits (including takeaways/home deliveries) have changed from a year ago? ” Source: 10 GMI/Mintel Base: 1, 853 internet users aged 16+ who have eaten out in the last three months mintel. com

The Consumer - Eating Out Behaviour “We’d now like you think about how, if at all, your eating out habits (including takeaways/home deliveries) have changed from a year ago? ” Source: 10 GMI/Mintel Base: 1, 853 internet users aged 16+ who have eaten out in the last three months mintel. com

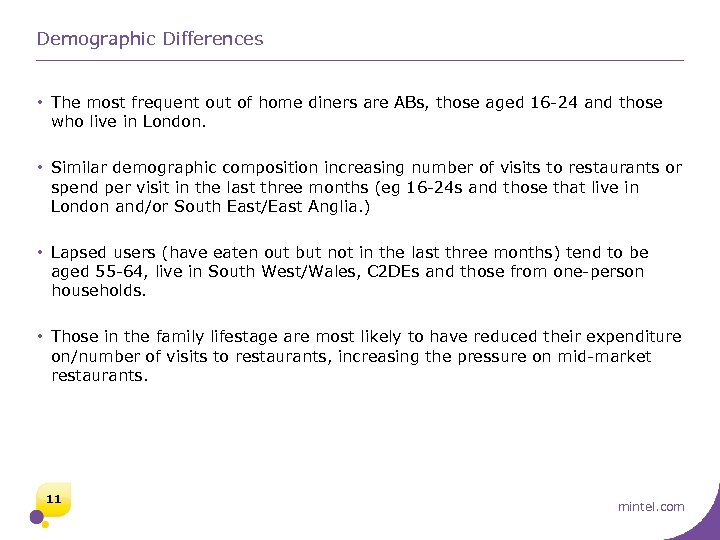

Demographic Differences • The most frequent out of home diners are ABs, those aged 16 -24 and those who live in London. • Similar demographic composition increasing number of visits to restaurants or spend per visit in the last three months (eg 16 -24 s and those that live in London and/or South East/East Anglia. ) • Lapsed users (have eaten out but not in the last three months) tend to be aged 55 -64, live in South West/Wales, C 2 DEs and those from one-person households. • Those in the family lifestage are most likely to have reduced their expenditure on/number of visits to restaurants, increasing the pressure on mid-market restaurants. 11 mintel. com

Demographic Differences • The most frequent out of home diners are ABs, those aged 16 -24 and those who live in London. • Similar demographic composition increasing number of visits to restaurants or spend per visit in the last three months (eg 16 -24 s and those that live in London and/or South East/East Anglia. ) • Lapsed users (have eaten out but not in the last three months) tend to be aged 55 -64, live in South West/Wales, C 2 DEs and those from one-person households. • Those in the family lifestage are most likely to have reduced their expenditure on/number of visits to restaurants, increasing the pressure on mid-market restaurants. 11 mintel. com

How have consumers adapted their eating out habits? 12 mintel. com

How have consumers adapted their eating out habits? 12 mintel. com

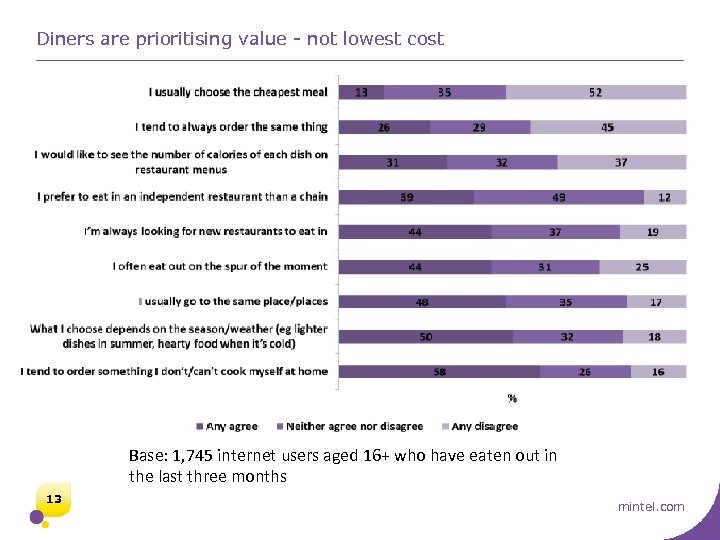

Diners are prioritising value - not lowest cost Base: 1, 745 internet users aged 16+ who have eaten out in the last three months 13 mintel. com

Diners are prioritising value - not lowest cost Base: 1, 745 internet users aged 16+ who have eaten out in the last three months 13 mintel. com

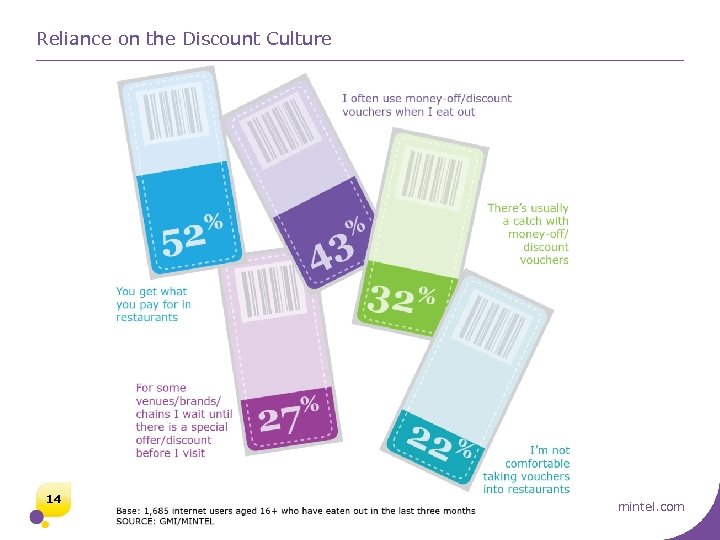

Reliance on the Discount Culture 14 mintel. com

Reliance on the Discount Culture 14 mintel. com

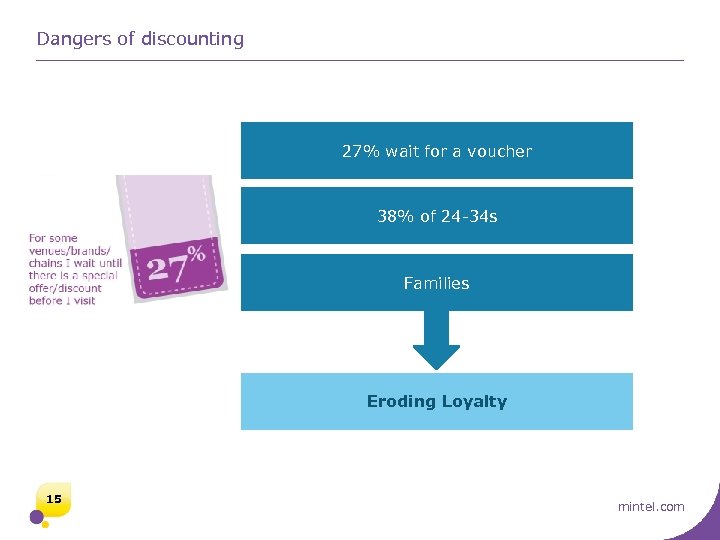

Dangers of discounting 27% wait for a voucher 38% of 24 -34 s Families Eroding Loyalty 15 mintel. com

Dangers of discounting 27% wait for a voucher 38% of 24 -34 s Families Eroding Loyalty 15 mintel. com

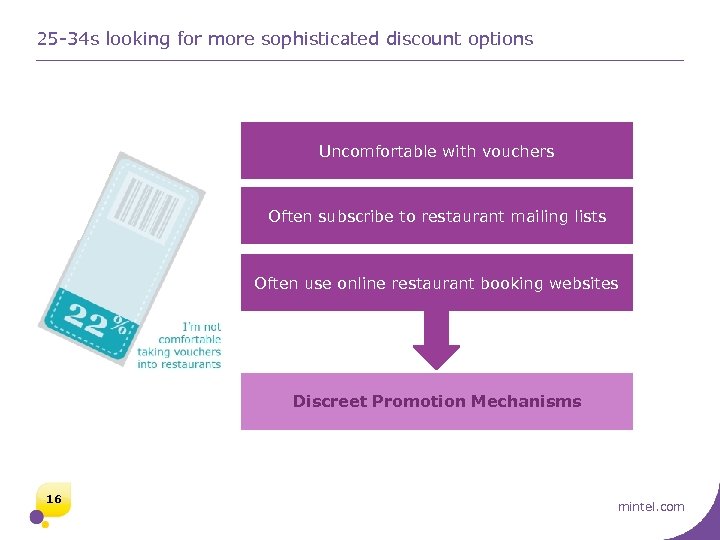

25 -34 s looking for more sophisticated discount options Uncomfortable with vouchers Often subscribe to restaurant mailing lists Often use online restaurant booking websites Discreet Promotion Mechanisms 16 mintel. com

25 -34 s looking for more sophisticated discount options Uncomfortable with vouchers Often subscribe to restaurant mailing lists Often use online restaurant booking websites Discreet Promotion Mechanisms 16 mintel. com

Alternatives to Overt Discounting • Restaurants looking to target these (often older) consumers should look to strategies such as price bundling or added extras/added-value promotions • Restaurants can hope to develop these diners’ bargain-hunting habits into a ‘treasure hunt’ mentality, providing a different route for them to move away from costly blanket promotions towards more targeted and financially more viable, tailored promotions. • More likely to resonate strongly with consumers due to their exclusive nature. 17 mintel. com

Alternatives to Overt Discounting • Restaurants looking to target these (often older) consumers should look to strategies such as price bundling or added extras/added-value promotions • Restaurants can hope to develop these diners’ bargain-hunting habits into a ‘treasure hunt’ mentality, providing a different route for them to move away from costly blanket promotions towards more targeted and financially more viable, tailored promotions. • More likely to resonate strongly with consumers due to their exclusive nature. 17 mintel. com

Summary • Diners are prioritising value for money, not lowest cost, reflected in the finding that more than half believe that you get what you pay for in restaurants. • More than four in ten diners often use money-off vouchers, although nearly a third think that there’s usually a catch with them, highlighting that as such promotions have gained mainstream appeal, diners have also become more ‘savvy’ about them. • Those aged 25 -34 are looking for less crass forms of price promotion than is offered by paper voucher print-outs • Younger diners ‘programmed’ to look for deals/discounts 18 mintel. com

Summary • Diners are prioritising value for money, not lowest cost, reflected in the finding that more than half believe that you get what you pay for in restaurants. • More than four in ten diners often use money-off vouchers, although nearly a third think that there’s usually a catch with them, highlighting that as such promotions have gained mainstream appeal, diners have also become more ‘savvy’ about them. • Those aged 25 -34 are looking for less crass forms of price promotion than is offered by paper voucher print-outs • Younger diners ‘programmed’ to look for deals/discounts 18 mintel. com

How is the market reacting to these changing needs? 19 mintel. com

How is the market reacting to these changing needs? 19 mintel. com

Market Reactions Actively chasing footfall Lifestyle brands • Operators in the eating out market are actively trying to chase footfall with some established full-service brands extended into the fast casual area • Due to the fact that so many brands now sell themselves on the principle of ‘value’, operators are turning to other markets such as music and cultural events, in order to promote themselves as ‘lifestyle brands’ to engage with consumers on other levels 20 mintel. com

Market Reactions Actively chasing footfall Lifestyle brands • Operators in the eating out market are actively trying to chase footfall with some established full-service brands extended into the fast casual area • Due to the fact that so many brands now sell themselves on the principle of ‘value’, operators are turning to other markets such as music and cultural events, in order to promote themselves as ‘lifestyle brands’ to engage with consumers on other levels 20 mintel. com

Market Reactions Store redesigns Snack ranges • Store redesigns are increasingly common in the eating out industry as operators look to add points of interest, add to the sense of ‘experience’ for consumers when dining out as well as to further establish a sense of brand personality • In an attempt to improve the flexibility of their menus, some operators are introducing snack ranges to appeal to varying meal occasions as well as differing budgets 21 mintel. com

Market Reactions Store redesigns Snack ranges • Store redesigns are increasingly common in the eating out industry as operators look to add points of interest, add to the sense of ‘experience’ for consumers when dining out as well as to further establish a sense of brand personality • In an attempt to improve the flexibility of their menus, some operators are introducing snack ranges to appeal to varying meal occasions as well as differing budgets 21 mintel. com

What are the emerging trends and innovations in the eating out market? 22 mintel. com

What are the emerging trends and innovations in the eating out market? 22 mintel. com

New menu/product launches/trends Increasing familiarity with ethnic food Steakhouse trends • Vietnamese soup is now popular in big cities, having filtered down from specialists such as Pho to more mainstream operators • There has been a rising number of steakhouses, rib shacks and American style BBQ venues entering the market in recent years 23 mintel. com

New menu/product launches/trends Increasing familiarity with ethnic food Steakhouse trends • Vietnamese soup is now popular in big cities, having filtered down from specialists such as Pho to more mainstream operators • There has been a rising number of steakhouses, rib shacks and American style BBQ venues entering the market in recent years 23 mintel. com

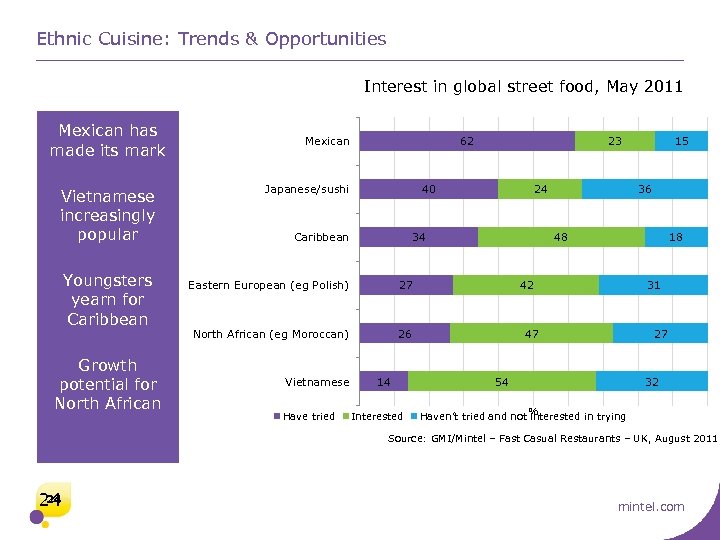

Ethnic Cuisine: Trends & Opportunities Interest in global street food, May 2011 Mexican has made its mark Vietnamese increasingly popular Youngsters yearn for Caribbean Growth potential for North African Mexican 62 Japanese/sushi 23 40 24 34 Caribbean Eastern European (eg Polish) 26 Vietnamese Have tried 14 Interested 36 48 27 North African (eg Moroccan) 15 18 42 31 47 27 54 32 Haven’t tried and not % interested in trying Source: GMI/Mintel – Fast Casual Restaurants – UK, August 2011 24 24 mintel. com

Ethnic Cuisine: Trends & Opportunities Interest in global street food, May 2011 Mexican has made its mark Vietnamese increasingly popular Youngsters yearn for Caribbean Growth potential for North African Mexican 62 Japanese/sushi 23 40 24 34 Caribbean Eastern European (eg Polish) 26 Vietnamese Have tried 14 Interested 36 48 27 North African (eg Moroccan) 15 18 42 31 47 27 54 32 Haven’t tried and not % interested in trying Source: GMI/Mintel – Fast Casual Restaurants – UK, August 2011 24 24 mintel. com

New menu/product launches/trends Trend for hot wraps continues Low-calorie menus rolled out • Mc. Donald’s launched a new range of wraps to its UK restaurant menus in June 2011. The launch is described as the “biggest new food launch in four years” as it joins the permanent menu, under the Deli Choices section. • 37% of consumers claim low-calorie or low-fat is important when choosing a dish in a restaurant 25 • In summer 2011 Pizza Hut announced the launch of the Pizzetta pizzas, marketed as under 500 calories mintel. com

New menu/product launches/trends Trend for hot wraps continues Low-calorie menus rolled out • Mc. Donald’s launched a new range of wraps to its UK restaurant menus in June 2011. The launch is described as the “biggest new food launch in four years” as it joins the permanent menu, under the Deli Choices section. • 37% of consumers claim low-calorie or low-fat is important when choosing a dish in a restaurant 25 • In summer 2011 Pizza Hut announced the launch of the Pizzetta pizzas, marketed as under 500 calories mintel. com

New menu/product launches/trends Superfood trend trickles down into the mass market All-day dining • JD Wetherspoon’s summer 2011 menu included dishes such as three variants of superfood salad. • Brands are tapping into the all-day dining market and consumers' continuing demand for convenience • Proactive way to provide additional reasons to visit, by blurring the boundaries with other eating out market sectors • Venues are diversifying into more specific meal occasions outside their traditional core offering (such as breakfast) in order to create additional revenue streams. 26 mintel. com

New menu/product launches/trends Superfood trend trickles down into the mass market All-day dining • JD Wetherspoon’s summer 2011 menu included dishes such as three variants of superfood salad. • Brands are tapping into the all-day dining market and consumers' continuing demand for convenience • Proactive way to provide additional reasons to visit, by blurring the boundaries with other eating out market sectors • Venues are diversifying into more specific meal occasions outside their traditional core offering (such as breakfast) in order to create additional revenue streams. 26 mintel. com

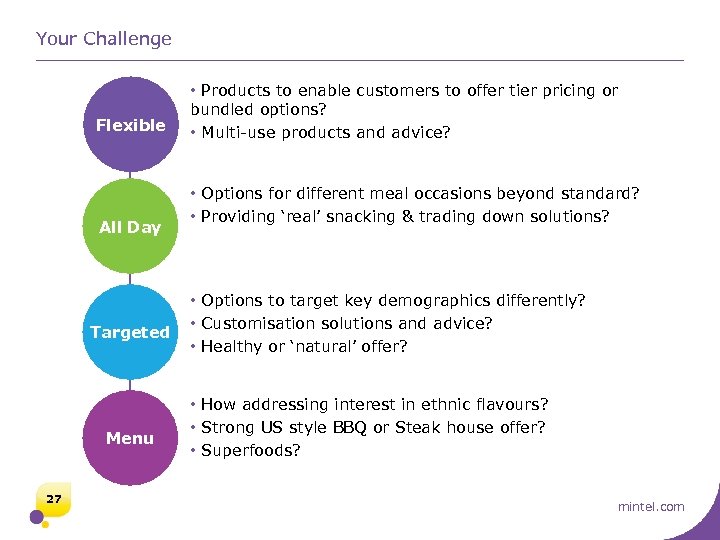

Your Challenge Flexible All Day Targeted Menu 27 • Products to enable customers to offer tier pricing or bundled options? • Multi-use products and advice? • Options for different meal occasions beyond standard? • Providing ‘real’ snacking & trading down solutions? • Options to target key demographics differently? • Customisation solutions and advice? • Healthy or ‘natural’ offer? • How addressing interest in ethnic flavours? • Strong US style BBQ or Steak house offer? • Superfoods? mintel. com

Your Challenge Flexible All Day Targeted Menu 27 • Products to enable customers to offer tier pricing or bundled options? • Multi-use products and advice? • Options for different meal occasions beyond standard? • Providing ‘real’ snacking & trading down solutions? • Options to target key demographics differently? • Customisation solutions and advice? • Healthy or ‘natural’ offer? • How addressing interest in ethnic flavours? • Strong US style BBQ or Steak house offer? • Superfoods? mintel. com

Oxygen Sources • Pizza and Pasta Restaurants - UK - March 2012 • Eating Out: The Decision Making Process - UK - December 2011 • Fast Casual Restaurants - UK - August 2011 • Eating Out Review - UK - July 2011 28 mintel. com

Oxygen Sources • Pizza and Pasta Restaurants - UK - March 2012 • Eating Out: The Decision Making Process - UK - December 2011 • Fast Casual Restaurants - UK - August 2011 • Eating Out Review - UK - July 2011 28 mintel. com

Next Steps • htttp: //portal. mintel. com • Set up alerts and searches • Webinars Consumers and the Economic Outlook - March • Upcoming Reports Pub Catering – May Menu Flavours – June Eating Out Review – July Attitudes towards Family Dining – August • Talk to our analysts and your Account Director. . . 29 mintel. com

Next Steps • htttp: //portal. mintel. com • Set up alerts and searches • Webinars Consumers and the Economic Outlook - March • Upcoming Reports Pub Catering – May Menu Flavours – June Eating Out Review – July Attitudes towards Family Dining – August • Talk to our analysts and your Account Director. . . 29 mintel. com

Stephen Walker UK Account Director Tel Email Twitter 0207 606 4533 swalker@mintel. com @mintelnews Mob 07973 813 473 © 2012 Mintel Group Ltd. All Rights Reserved. Confidential to Mintel mintel. com

Stephen Walker UK Account Director Tel Email Twitter 0207 606 4533 swalker@mintel. com @mintelnews Mob 07973 813 473 © 2012 Mintel Group Ltd. All Rights Reserved. Confidential to Mintel mintel. com