fe8e704e54272b086e6c0316cfdf460c.ppt

- Количество слайдов: 26

Consumer Staples Presentation August 4, 2009 Shane Connor Josh Drushel Jessica Kirwin

Consumer Staples Presentation August 4, 2009 Shane Connor Josh Drushel Jessica Kirwin

Agenda § § Update of Sector Recommendation Stock Recommendations Summary Questions

Agenda § § Update of Sector Recommendation Stock Recommendations Summary Questions

Consumer Staples Recap § SIM Current Holdings – 11. 65% § S&P 500 – 11. 81% § Sector Characteristics – Stable demand – Defensive (non-cyclical) § International Growth could be a bonus § Class approved 25 bps increase

Consumer Staples Recap § SIM Current Holdings – 11. 65% § S&P 500 – 11. 81% § Sector Characteristics – Stable demand – Defensive (non-cyclical) § International Growth could be a bonus § Class approved 25 bps increase

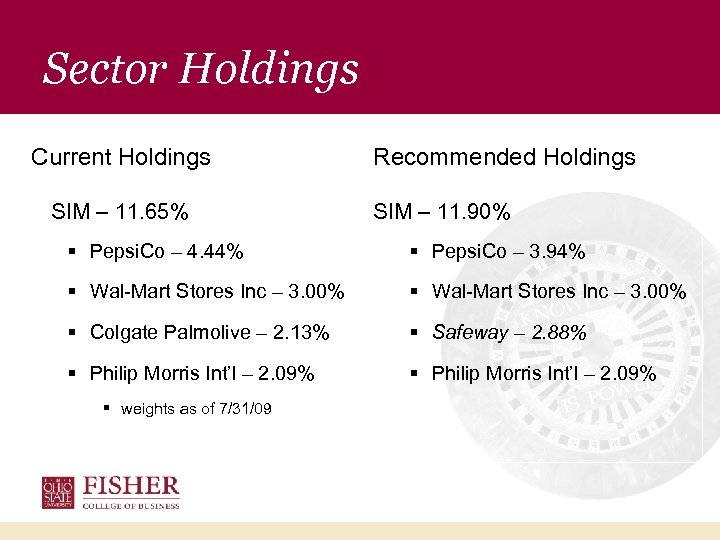

Sector Holdings Current Holdings SIM – 11. 65% Recommended Holdings SIM – 11. 90% § Pepsi. Co – 4. 44% § Pepsi. Co – 3. 94% § Wal-Mart Stores Inc – 3. 00% § Colgate Palmolive – 2. 13% § Safeway – 2. 88% § Philip Morris Int’l – 2. 09% § weights as of 7/31/09

Sector Holdings Current Holdings SIM – 11. 65% Recommended Holdings SIM – 11. 90% § Pepsi. Co – 4. 44% § Pepsi. Co – 3. 94% § Wal-Mart Stores Inc – 3. 00% § Colgate Palmolive – 2. 13% § Safeway – 2. 88% § Philip Morris Int’l – 2. 09% § weights as of 7/31/09

Colgate-Palmolive (NYSE: CL) • Company Overview: CL has been manufacturing and marketing consumer products worldwide since 1803. It operates under two segments which are oral, personal, and home care as well as pet nutrition. • Recommendation: Sell 234 basis points • Investment Thesis: CL is a very stable performer in both good and bad economies, but due to the classes decision that the economy is turning around we feel there are much better opportunities that persist.

Colgate-Palmolive (NYSE: CL) • Company Overview: CL has been manufacturing and marketing consumer products worldwide since 1803. It operates under two segments which are oral, personal, and home care as well as pet nutrition. • Recommendation: Sell 234 basis points • Investment Thesis: CL is a very stable performer in both good and bad economies, but due to the classes decision that the economy is turning around we feel there are much better opportunities that persist.

Industry: Personal and Household Products Company Symbol Forward Price / Earnings Price / Sales 15. 7 15. 1 1. 9 2. 96% CL 18 16. 0 2. 43% AVP 19. 4 17. 4 1. 4 2. 59% EL 19. 9 24. 1 . 9 1. 51% ECL 22. 7 19. 8 1. 7 1. 35% Industry Average Colgate-Palmolive Avon Estee Lauder Ecolab Price / Earnings Dividend Yield

Industry: Personal and Household Products Company Symbol Forward Price / Earnings Price / Sales 15. 7 15. 1 1. 9 2. 96% CL 18 16. 0 2. 43% AVP 19. 4 17. 4 1. 4 2. 59% EL 19. 9 24. 1 . 9 1. 51% ECL 22. 7 19. 8 1. 7 1. 35% Industry Average Colgate-Palmolive Avon Estee Lauder Ecolab Price / Earnings Dividend Yield

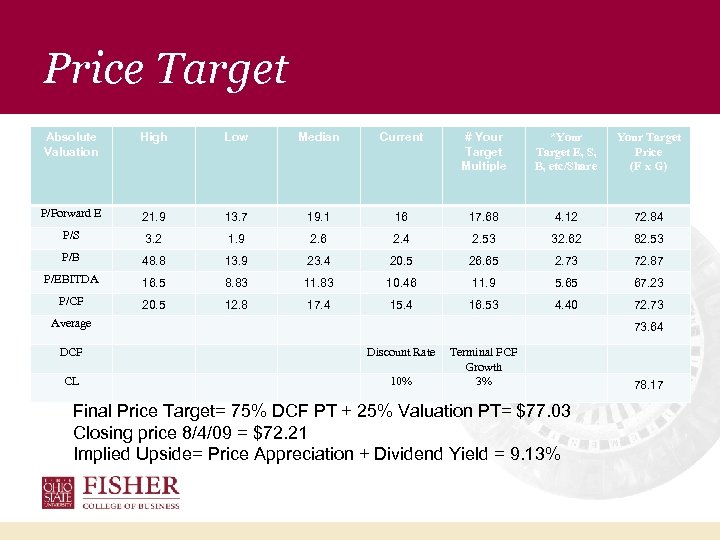

Price Target Absolute Valuation High Low Median Current # Your Target Multiple *Your Target E, S, B, etc/Share Your Target Price (F x G) P/Forward E 21. 9 13. 7 19. 1 16 17. 68 4. 12 72. 84 P/S 3. 2 1. 9 2. 6 2. 4 2. 53 32. 62 82. 53 P/B 48. 8 13. 9 23. 4 20. 5 26. 65 2. 73 72. 87 P/EBITDA 16. 5 8. 83 11. 83 10. 46 11. 9 5. 65 67. 23 P/CF 20. 5 12. 8 17. 4 15. 4 16. 53 4. 40 72. 73 Average 73. 64 DCF Discount Rate CL 10% Terminal FCF Growth 3% Final Price Target= 75% DCF PT + 25% Valuation PT= $77. 03 Closing price 8/4/09 = $72. 21 Implied Upside= Price Appreciation + Dividend Yield = 9. 13% 78. 17

Price Target Absolute Valuation High Low Median Current # Your Target Multiple *Your Target E, S, B, etc/Share Your Target Price (F x G) P/Forward E 21. 9 13. 7 19. 1 16 17. 68 4. 12 72. 84 P/S 3. 2 1. 9 2. 6 2. 4 2. 53 32. 62 82. 53 P/B 48. 8 13. 9 23. 4 20. 5 26. 65 2. 73 72. 87 P/EBITDA 16. 5 8. 83 11. 83 10. 46 11. 9 5. 65 67. 23 P/CF 20. 5 12. 8 17. 4 15. 4 16. 53 4. 40 72. 73 Average 73. 64 DCF Discount Rate CL 10% Terminal FCF Growth 3% Final Price Target= 75% DCF PT + 25% Valuation PT= $77. 03 Closing price 8/4/09 = $72. 21 Implied Upside= Price Appreciation + Dividend Yield = 9. 13% 78. 17

Positives/Risks • Positives - Stable performer in all types of economies - Potential for continued international growth - Safe bet investment • Risks - Recession may only be beginning internationally - Continued loss of market share domestically - Investing in CL and the economy completely turns around

Positives/Risks • Positives - Stable performer in all types of economies - Potential for continued international growth - Safe bet investment • Risks - Recession may only be beginning internationally - Continued loss of market share domestically - Investing in CL and the economy completely turns around

Philip Morris Int’s (NYSE: PM) Company Overview: PM is the leading international tobacco company with 7 of the world’s top 15 brands Recommendation: Hold current position Investment Thesis: PM is a stable performer

Philip Morris Int’s (NYSE: PM) Company Overview: PM is the leading international tobacco company with 7 of the world’s top 15 brands Recommendation: Hold current position Investment Thesis: PM is a stable performer

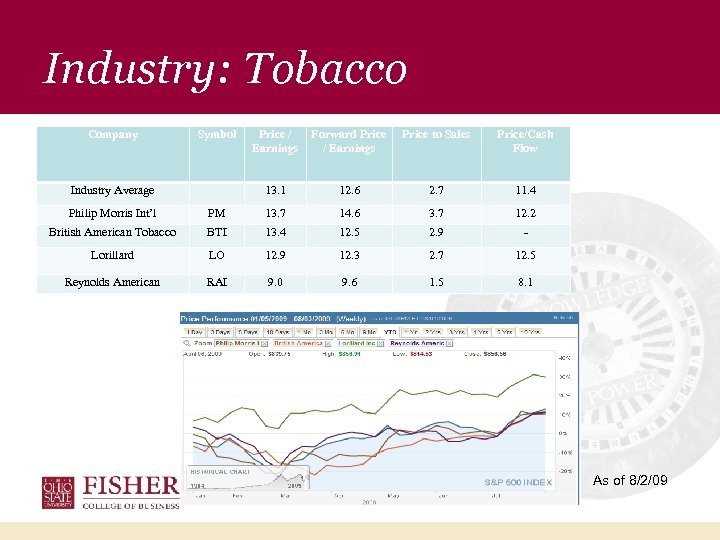

Industry: Tobacco Company Symbol Forward Price / Earnings Price to Sales Price/Cash Flow 13. 1 Industry Average Price / Earnings 12. 6 2. 7 11. 4 Philip Morris Int’l PM 13. 7 14. 6 3. 7 12. 2 British American Tobacco BTI 13. 4 12. 5 2. 9 - Lorillard LO 12. 9 12. 3 2. 7 12. 5 Reynolds American RAI 9. 0 9. 6 1. 5 8. 1 As of 8/2/09

Industry: Tobacco Company Symbol Forward Price / Earnings Price to Sales Price/Cash Flow 13. 1 Industry Average Price / Earnings 12. 6 2. 7 11. 4 Philip Morris Int’l PM 13. 7 14. 6 3. 7 12. 2 British American Tobacco BTI 13. 4 12. 5 2. 9 - Lorillard LO 12. 9 12. 3 2. 7 12. 5 Reynolds American RAI 9. 0 9. 6 1. 5 8. 1 As of 8/2/09

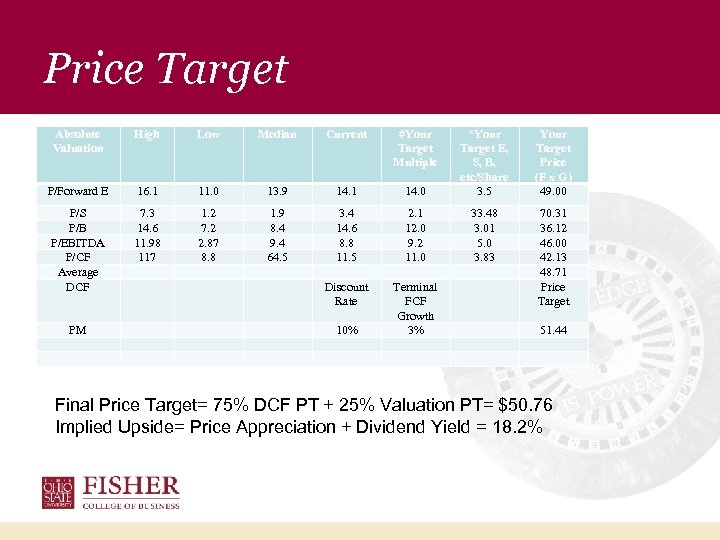

Price Target Absolute Valuation High Low Median Current #Your Target Multiple P/Forward E 16. 1 11. 0 13. 9 14. 1 P/S P/B P/EBITDA P/CF Average DCF 7. 3 14. 6 11. 98 117 1. 2 7. 2 2. 87 8. 8 1. 9 8. 4 9. 4 64. 5 PM 14. 0 *Your Target E, S, B, etc/Share 3. 5 Your Target Price (F x G) 49. 00 3. 4 14. 6 8. 8 11. 5 2. 1 12. 0 9. 2 11. 0 33. 48 3. 01 5. 0 3. 83 Discount Rate Terminal FCF Growth 3% 70. 31 36. 12 46. 00 42. 13 48. 71 Price Target 10% 51. 44 Final Price Target= 75% DCF PT + 25% Valuation PT= $50. 76 Implied Upside= Price Appreciation + Dividend Yield = 18. 2%

Price Target Absolute Valuation High Low Median Current #Your Target Multiple P/Forward E 16. 1 11. 0 13. 9 14. 1 P/S P/B P/EBITDA P/CF Average DCF 7. 3 14. 6 11. 98 117 1. 2 7. 2 2. 87 8. 8 1. 9 8. 4 9. 4 64. 5 PM 14. 0 *Your Target E, S, B, etc/Share 3. 5 Your Target Price (F x G) 49. 00 3. 4 14. 6 8. 8 11. 5 2. 1 12. 0 9. 2 11. 0 33. 48 3. 01 5. 0 3. 83 Discount Rate Terminal FCF Growth 3% 70. 31 36. 12 46. 00 42. 13 48. 71 Price Target 10% 51. 44 Final Price Target= 75% DCF PT + 25% Valuation PT= $50. 76 Implied Upside= Price Appreciation + Dividend Yield = 18. 2%

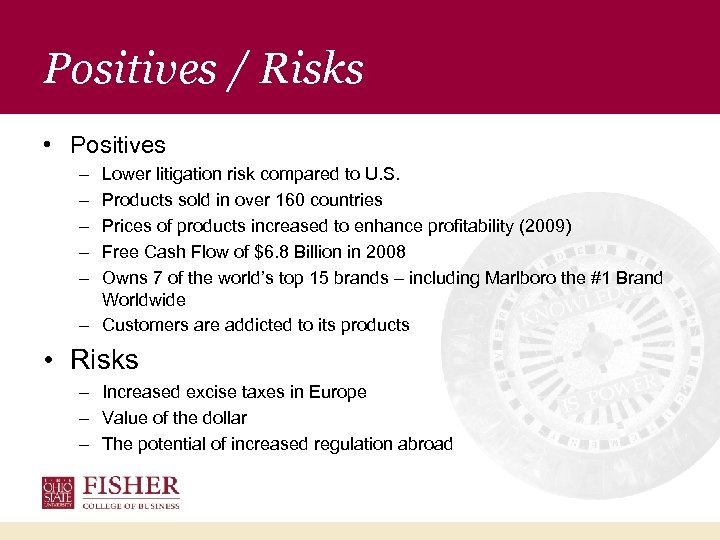

Positives / Risks • Positives – – – Lower litigation risk compared to U. S. Products sold in over 160 countries Prices of products increased to enhance profitability (2009) Free Cash Flow of $6. 8 Billion in 2008 Owns 7 of the world’s top 15 brands – including Marlboro the #1 Brand Worldwide – Customers are addicted to its products • Risks – Increased excise taxes in Europe – Value of the dollar – The potential of increased regulation abroad

Positives / Risks • Positives – – – Lower litigation risk compared to U. S. Products sold in over 160 countries Prices of products increased to enhance profitability (2009) Free Cash Flow of $6. 8 Billion in 2008 Owns 7 of the world’s top 15 brands – including Marlboro the #1 Brand Worldwide – Customers are addicted to its products • Risks – Increased excise taxes in Europe – Value of the dollar – The potential of increased regulation abroad

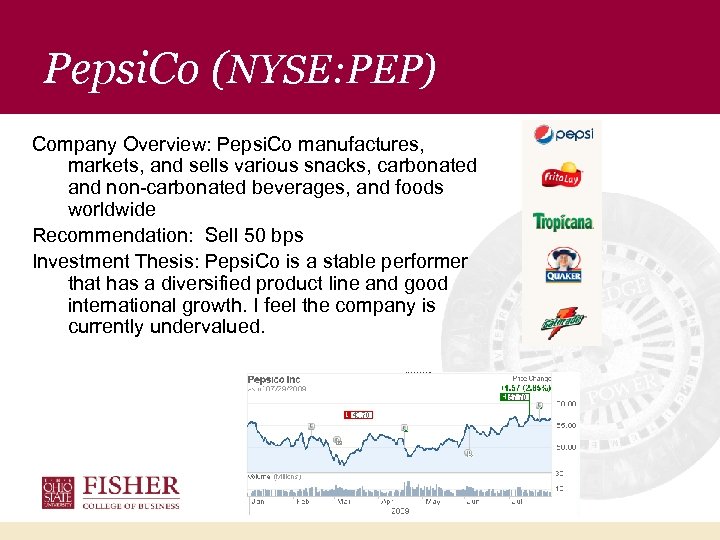

Pepsi. Co (NYSE: PEP) Company Overview: Pepsi. Co manufactures, markets, and sells various snacks, carbonated and non-carbonated beverages, and foods worldwide Recommendation: Sell 50 bps Investment Thesis: Pepsi. Co is a stable performer that has a diversified product line and good international growth. I feel the company is currently undervalued.

Pepsi. Co (NYSE: PEP) Company Overview: Pepsi. Co manufactures, markets, and sells various snacks, carbonated and non-carbonated beverages, and foods worldwide Recommendation: Sell 50 bps Investment Thesis: Pepsi. Co is a stable performer that has a diversified product line and good international growth. I feel the company is currently undervalued.

Merger with PBG and PAS • Pepsi. Co announced today merger agreements with The Pepsi Bottling Group Inc. and Pepsi. Americas, Inc. • Total cost will be 7. 8 billion – Pepsi Bottling Group • $36. 50 / share or. 6432 Pepsi. Co shares – Pepsi. Americas • 25. 50 / share or. 5022 Pepsi. Co shares • Create annual pre-tax synergies of 300 million by 2015

Merger with PBG and PAS • Pepsi. Co announced today merger agreements with The Pepsi Bottling Group Inc. and Pepsi. Americas, Inc. • Total cost will be 7. 8 billion – Pepsi Bottling Group • $36. 50 / share or. 6432 Pepsi. Co shares – Pepsi. Americas • 25. 50 / share or. 5022 Pepsi. Co shares • Create annual pre-tax synergies of 300 million by 2015

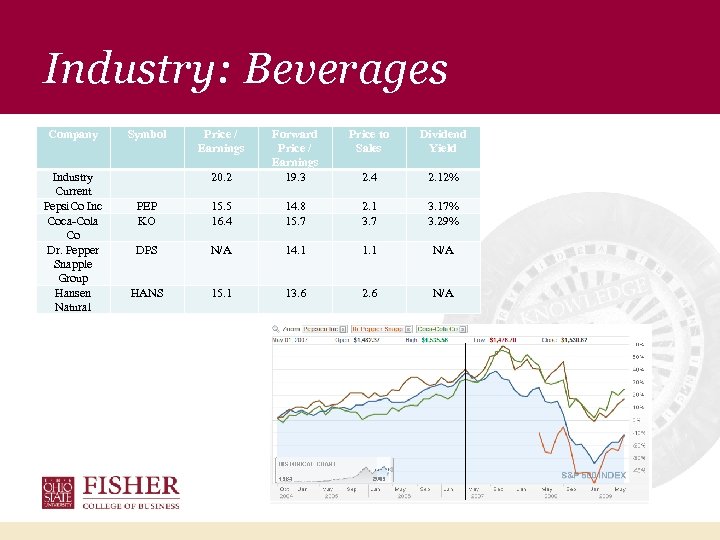

Industry: Beverages Company Industry Current Pepsi. Co Inc Coca-Cola Co Dr. Pepper Snapple Group Hansen Natural Symbol Price / Earnings Price to Sales Dividend Yield 20. 2 Forward Price / Earnings 19. 3 2. 4 2. 12% PEP KO 15. 5 16. 4 14. 8 15. 7 2. 1 3. 7 3. 17% 3. 29% DPS N/A 14. 1 1. 1 N/A HANS 15. 1 13. 6 2. 6 N/A

Industry: Beverages Company Industry Current Pepsi. Co Inc Coca-Cola Co Dr. Pepper Snapple Group Hansen Natural Symbol Price / Earnings Price to Sales Dividend Yield 20. 2 Forward Price / Earnings 19. 3 2. 4 2. 12% PEP KO 15. 5 16. 4 14. 8 15. 7 2. 1 3. 7 3. 17% 3. 29% DPS N/A 14. 1 1. 1 N/A HANS 15. 1 13. 6 2. 6 N/A

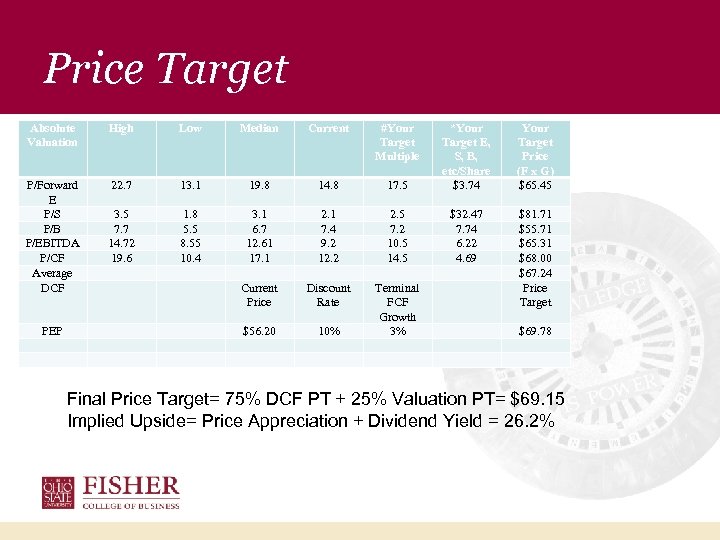

Price Target Absolute Valuation High Low Median Current #Your Target Multiple P/Forward E P/S P/B P/EBITDA P/CF Average DCF 22. 7 13. 1 19. 8 14. 8 3. 5 7. 7 14. 72 19. 6 1. 8 5. 5 8. 55 10. 4 3. 1 6. 7 12. 61 17. 1 PEP 17. 5 *Your Target E, S, B, etc/Share $3. 74 Your Target Price (F x G) $65. 45 2. 1 7. 4 9. 2 12. 2 2. 5 7. 2 10. 5 14. 5 $32. 47 7. 74 6. 22 4. 69 Current Price Discount Rate $56. 20 10% Terminal FCF Growth 3% $81. 71 $55. 71 $65. 31 $68. 00 $67. 24 Price Target $69. 78 Final Price Target= 75% DCF PT + 25% Valuation PT= $69. 15 Implied Upside= Price Appreciation + Dividend Yield = 26. 2%

Price Target Absolute Valuation High Low Median Current #Your Target Multiple P/Forward E P/S P/B P/EBITDA P/CF Average DCF 22. 7 13. 1 19. 8 14. 8 3. 5 7. 7 14. 72 19. 6 1. 8 5. 5 8. 55 10. 4 3. 1 6. 7 12. 61 17. 1 PEP 17. 5 *Your Target E, S, B, etc/Share $3. 74 Your Target Price (F x G) $65. 45 2. 1 7. 4 9. 2 12. 2 2. 5 7. 2 10. 5 14. 5 $32. 47 7. 74 6. 22 4. 69 Current Price Discount Rate $56. 20 10% Terminal FCF Growth 3% $81. 71 $55. 71 $65. 31 $68. 00 $67. 24 Price Target $69. 78 Final Price Target= 75% DCF PT + 25% Valuation PT= $69. 15 Implied Upside= Price Appreciation + Dividend Yield = 26. 2%

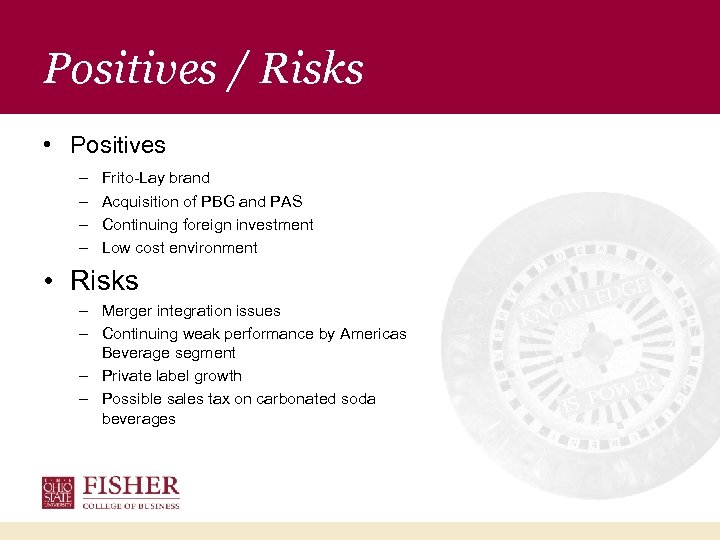

Positives / Risks • Positives – – Frito-Lay brand Acquisition of PBG and PAS Continuing foreign investment Low cost environment • Risks – Merger integration issues – Continuing weak performance by Americas Beverage segment – Private label growth – Possible sales tax on carbonated soda beverages

Positives / Risks • Positives – – Frito-Lay brand Acquisition of PBG and PAS Continuing foreign investment Low cost environment • Risks – Merger integration issues – Continuing weak performance by Americas Beverage segment – Private label growth – Possible sales tax on carbonated soda beverages

Safeway (NYSE: SWY) Company Overview: Safeway is a food and drug retailer founded in 1915 and headquartered in California. They operate over 1, 700 grocery stores in western and central U. S. as well as Canada and Mexico. They are third largest grocery retailer. Recommendation: Buy 288 basis points Investment Thesis: We feel that Safeway is well positioned to benefit from a broad economic recovery. The company has an attractive FCF yield and is aggressively buying back shares.

Safeway (NYSE: SWY) Company Overview: Safeway is a food and drug retailer founded in 1915 and headquartered in California. They operate over 1, 700 grocery stores in western and central U. S. as well as Canada and Mexico. They are third largest grocery retailer. Recommendation: Buy 288 basis points Investment Thesis: We feel that Safeway is well positioned to benefit from a broad economic recovery. The company has an attractive FCF yield and is aggressively buying back shares.

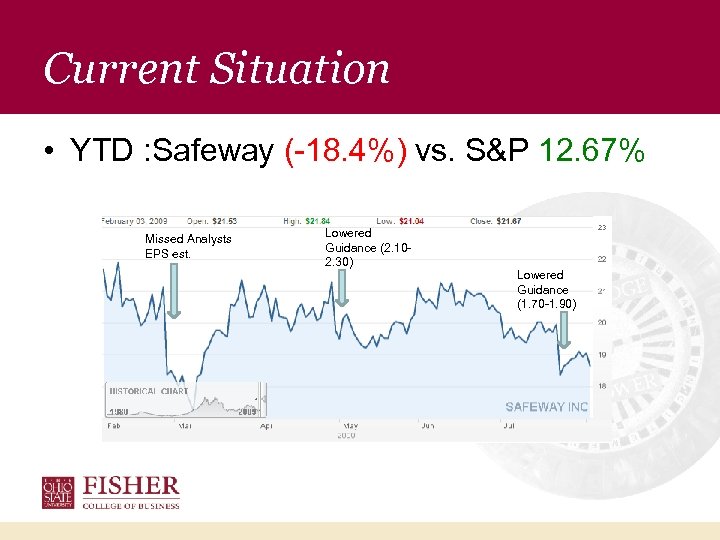

Current Situation • YTD : Safeway (-18. 4%) vs. S&P 12. 67% Missed Analysts EPS est. Lowered Guidance (2. 102. 30) Lowered Guidance (1. 70 -1. 90)

Current Situation • YTD : Safeway (-18. 4%) vs. S&P 12. 67% Missed Analysts EPS est. Lowered Guidance (2. 102. 30) Lowered Guidance (1. 70 -1. 90)

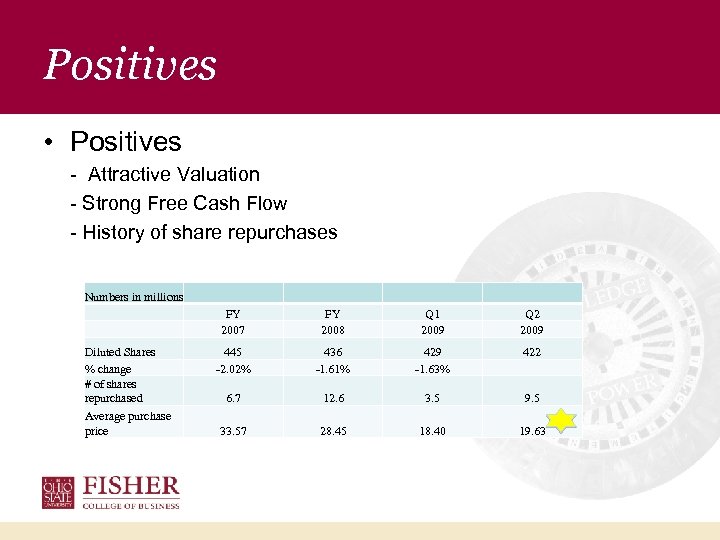

Positives • Positives - Attractive Valuation - Strong Free Cash Flow - History of share repurchases Numbers in millions FY 2007 Diluted Shares % change # of shares repurchased Average purchase price FY 2008 Q 1 2009 Q 2 2009 445 -2. 02% 436 -1. 61% 429 -1. 63% 422 6. 7 12. 6 3. 5 9. 5 33. 57 28. 45 18. 40 19. 63

Positives • Positives - Attractive Valuation - Strong Free Cash Flow - History of share repurchases Numbers in millions FY 2007 Diluted Shares % change # of shares repurchased Average purchase price FY 2008 Q 1 2009 Q 2 2009 445 -2. 02% 436 -1. 61% 429 -1. 63% 422 6. 7 12. 6 3. 5 9. 5 33. 57 28. 45 18. 40 19. 63

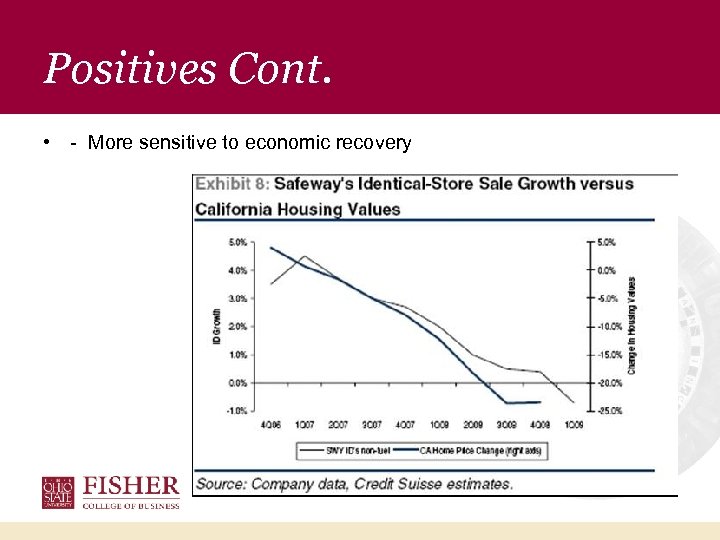

Positives Cont. • - More sensitive to economic recovery

Positives Cont. • - More sensitive to economic recovery

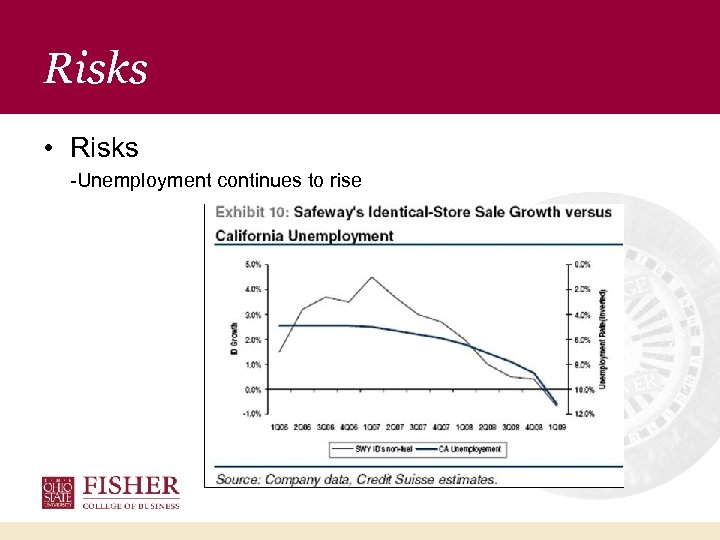

Risks • Risks -Unemployment continues to rise

Risks • Risks -Unemployment continues to rise

Risk Cont. -Food prices (disinflation) -Margin compression -Continuing same store sales declines

Risk Cont. -Food prices (disinflation) -Margin compression -Continuing same store sales declines

Industry: Retail Food Company Symbol Forward Price / Earnings Price to Sales P/CF 9. 7 Industry Price / Earnings 10. 6 . 2 4. 3 Kroger KR 10. 7 10. 2 5. 0 Supervalu Inc. SVU N/A 6. 8 . 1 1. 9 Wal-Mart WMT 14. 5 13. 8 . 5 9. 6 Safeway SWY 8. 3 9. 4 . 2 4

Industry: Retail Food Company Symbol Forward Price / Earnings Price to Sales P/CF 9. 7 Industry Price / Earnings 10. 6 . 2 4. 3 Kroger KR 10. 7 10. 2 5. 0 Supervalu Inc. SVU N/A 6. 8 . 1 1. 9 Wal-Mart WMT 14. 5 13. 8 . 5 9. 6 Safeway SWY 8. 3 9. 4 . 2 4

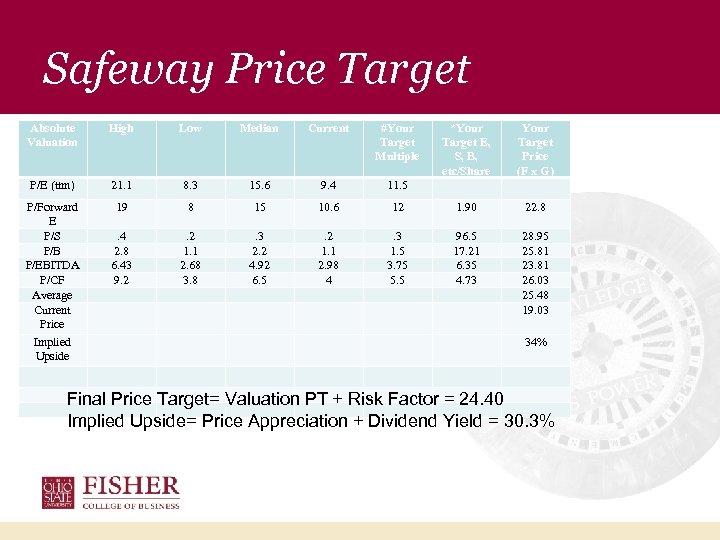

Safeway Price Target Absolute Valuation High Low Median Current #Your Target Multiple *Your Target E, S, B, etc/Share Your Target Price (F x G) P/E (ttm) 21. 1 8. 3 15. 6 9. 4 11. 5 P/Forward E P/S P/B P/EBITDA P/CF Average Current Price Implied Upside 19 8 15 10. 6 12 1. 90 22. 8 . 4 2. 8 6. 43 9. 2 1. 1 2. 68 3. 8 . 3 2. 2 4. 92 6. 5 . 2 1. 1 2. 98 4 . 3 1. 5 3. 75 5. 5 96. 5 17. 21 6. 35 4. 73 28. 95 25. 81 23. 81 26. 03 25. 48 19. 03 34% Final Price Target= Valuation PT + Risk Factor = 24. 40 Implied Upside= Price Appreciation + Dividend Yield = 30. 3%

Safeway Price Target Absolute Valuation High Low Median Current #Your Target Multiple *Your Target E, S, B, etc/Share Your Target Price (F x G) P/E (ttm) 21. 1 8. 3 15. 6 9. 4 11. 5 P/Forward E P/S P/B P/EBITDA P/CF Average Current Price Implied Upside 19 8 15 10. 6 12 1. 90 22. 8 . 4 2. 8 6. 43 9. 2 1. 1 2. 68 3. 8 . 3 2. 2 4. 92 6. 5 . 2 1. 1 2. 98 4 . 3 1. 5 3. 75 5. 5 96. 5 17. 21 6. 35 4. 73 28. 95 25. 81 23. 81 26. 03 25. 48 19. 03 34% Final Price Target= Valuation PT + Risk Factor = 24. 40 Implied Upside= Price Appreciation + Dividend Yield = 30. 3%

Thank You • Questions?

Thank You • Questions?