8698a383d3f115e05988c89a84b95368.ppt

- Количество слайдов: 38

Consumer Driven Health Plans: Early evidence of take-up, cost and utilization and policy opportunities Stephen T Parente, Ph. D. Sponsored by the Robert Wood Johnson Foundation’s Health Care Financing & Organization Initiative (HCFO) November 30, 2005

Consumer Driven Health Plans: Early evidence of take-up, cost and utilization and policy opportunities Stephen T Parente, Ph. D. Sponsored by the Robert Wood Johnson Foundation’s Health Care Financing & Organization Initiative (HCFO) November 30, 2005

Presentation Overview o o o Employer-based Analysis Overview CDHP Questions National CDHP Take-up Cost & Utilization Comparisons Over Time National HSA Simulation Research Opportunities

Presentation Overview o o o Employer-based Analysis Overview CDHP Questions National CDHP Take-up Cost & Utilization Comparisons Over Time National HSA Simulation Research Opportunities

CDHP Business Enablers n ‘Ready to Lease’ Components of Health Insurance: o o o n Internet o o n Electronic claims processing National panel of physicians National pharmaceutical benefits management firms Consumer-friendly health data web portals Disease management vendors Transaction medium for claims processing 2 -way communication with members ERISA-exemption o o Lack of state oversight Half the US commercial health insurance market is self-insured.

CDHP Business Enablers n ‘Ready to Lease’ Components of Health Insurance: o o o n Internet o o n Electronic claims processing National panel of physicians National pharmaceutical benefits management firms Consumer-friendly health data web portals Disease management vendors Transaction medium for claims processing 2 -way communication with members ERISA-exemption o o Lack of state oversight Half the US commercial health insurance market is self-insured.

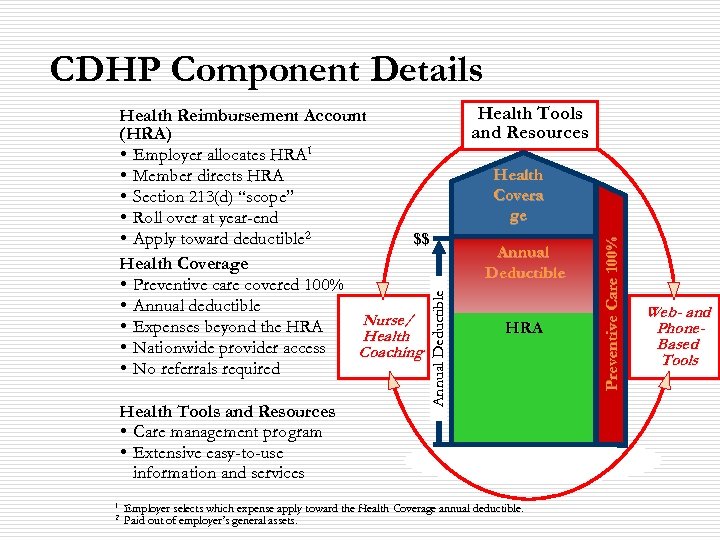

CDHP Component Details Health Tools and Resources • Care management program • Extensive easy-to-use information and services 1 2 Health Tools and Resources Health Covera ge Annual Deductible HRA Employer selects which expense apply toward the Health Coverage annual deductible. Paid out of employer’s general assets. Preventive Care 100% Annual Deductible Health Reimbursement Account (HRA) • Employer allocates HRA 1 • Member directs HRA • Section 213(d) “scope” • Roll over at year-end • Apply toward deductible 2 $$ Health Coverage • Preventive care covered 100% • Annual deductible Nurse/ • Expenses beyond the HRA Health • Nationwide provider access Coaching • No referrals required Web- and Phone. Based Tools

CDHP Component Details Health Tools and Resources • Care management program • Extensive easy-to-use information and services 1 2 Health Tools and Resources Health Covera ge Annual Deductible HRA Employer selects which expense apply toward the Health Coverage annual deductible. Paid out of employer’s general assets. Preventive Care 100% Annual Deductible Health Reimbursement Account (HRA) • Employer allocates HRA 1 • Member directs HRA • Section 213(d) “scope” • Roll over at year-end • Apply toward deductible 2 $$ Health Coverage • Preventive care covered 100% • Annual deductible Nurse/ • Expenses beyond the HRA Health • Nationwide provider access Coaching • No referrals required Web- and Phone. Based Tools

Version 2. 0 - CDHP’s Legislative Cousins: Health Savings Accounts Ø Ø Introduced in the 2003 Medicare Reform Law What it enables: • • • Any U. S. citizen can create a ‘qualified’ HSA account. Must have ‘catastrophic health insurance’ with minimum deductible of $2, 000. Max is $10, 000 for a family contract. Individuals or employers can make annual pre-tax contribution to an HSA, separate from the insurance policy, of 100% of the deductible (max of $5, 150).

Version 2. 0 - CDHP’s Legislative Cousins: Health Savings Accounts Ø Ø Introduced in the 2003 Medicare Reform Law What it enables: • • • Any U. S. citizen can create a ‘qualified’ HSA account. Must have ‘catastrophic health insurance’ with minimum deductible of $2, 000. Max is $10, 000 for a family contract. Individuals or employers can make annual pre-tax contribution to an HSA, separate from the insurance policy, of 100% of the deductible (max of $5, 150).

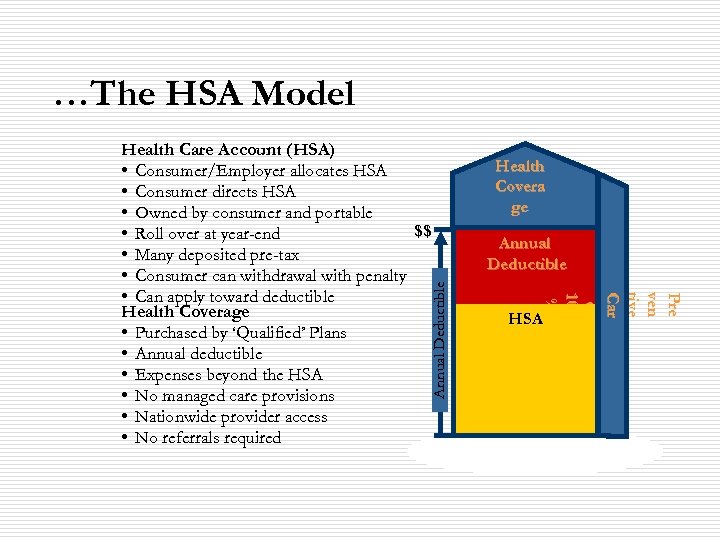

…The HSA Model Annual Deductible Health Covera ge Annual Deductible Pre ve n t iv e C ar e e 1 00 % % Health Care Account (HSA) • Consumer/Employer allocates HSA • Consumer directs HSA • Owned by consumer and portable $$ • Roll over at year-end • Many deposited pre-tax • Consumer can withdrawal with penalty • Can apply toward deductible Health Coverage • Purchased by ‘Qualified’ Plans • Annual deductible • Expenses beyond the HSA • No managed care provisions • Nationwide provider access • No referrals required HSA

…The HSA Model Annual Deductible Health Covera ge Annual Deductible Pre ve n t iv e C ar e e 1 00 % % Health Care Account (HSA) • Consumer/Employer allocates HSA • Consumer directs HSA • Owned by consumer and portable $$ • Roll over at year-end • Many deposited pre-tax • Consumer can withdrawal with penalty • Can apply toward deductible Health Coverage • Purchased by ‘Qualified’ Plans • Annual deductible • Expenses beyond the HSA • No managed care provisions • Nationwide provider access • No referrals required HSA

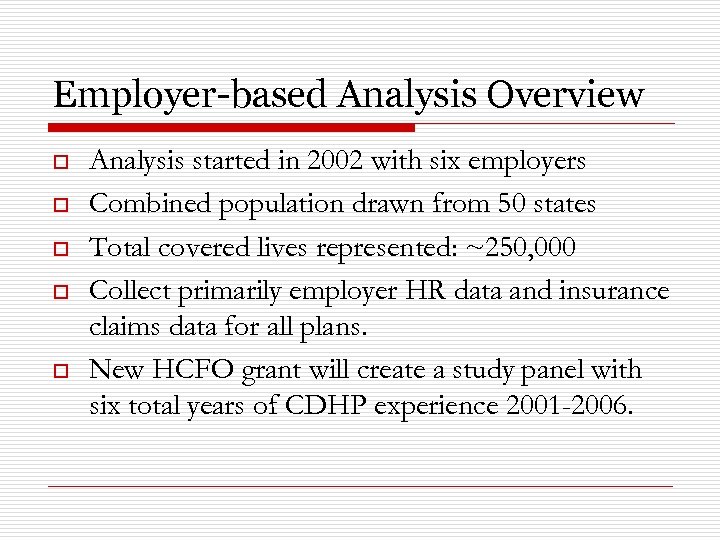

Employer-based Analysis Overview o o o Analysis started in 2002 with six employers Combined population drawn from 50 states Total covered lives represented: ~250, 000 Collect primarily employer HR data and insurance claims data for all plans. New HCFO grant will create a study panel with six total years of CDHP experience 2001 -2006.

Employer-based Analysis Overview o o o Analysis started in 2002 with six employers Combined population drawn from 50 states Total covered lives represented: ~250, 000 Collect primarily employer HR data and insurance claims data for all plans. New HCFO grant will create a study panel with six total years of CDHP experience 2001 -2006.

CDHP Questions o o Do CDHPs (in the form of HRAs) have national appeal? What are the longer-run cost & use consequences of CDHPs? n n n o o Where do they save money? Where are they more expensive? What is the impact on utilization of key services? Do HSAs have potential national appeal? Are HSAs a viable approach to addressing the problem of the uninsured? General Caveat: We are just approaching the half-way point of our research.

CDHP Questions o o Do CDHPs (in the form of HRAs) have national appeal? What are the longer-run cost & use consequences of CDHPs? n n n o o Where do they save money? Where are they more expensive? What is the impact on utilization of key services? Do HSAs have potential national appeal? Are HSAs a viable approach to addressing the problem of the uninsured? General Caveat: We are just approaching the half-way point of our research.

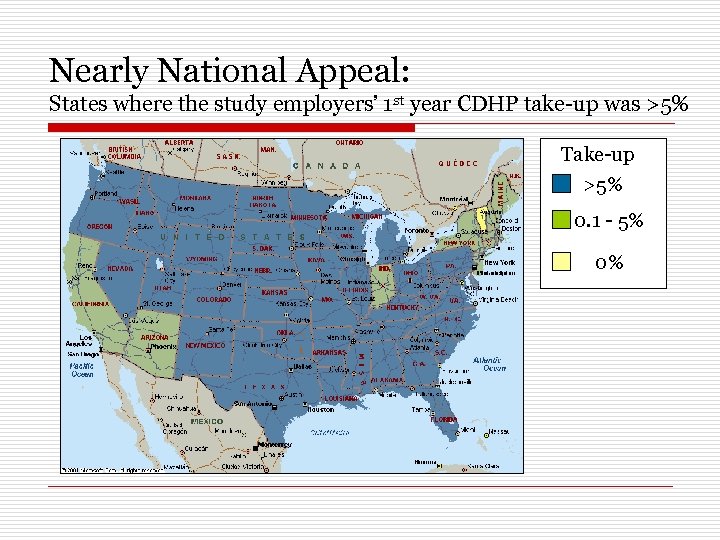

Nearly National Appeal: States where the study employers’ 1 st year CDHP take-up was >5% Take-up >5% 0. 1 - 5% 0%

Nearly National Appeal: States where the study employers’ 1 st year CDHP take-up was >5% Take-up >5% 0. 1 - 5% 0%

Take-up Summary from the Study Employers o o All states have take-up above 5% with the exception of New York, New England States, Indiana, California and Arizona. Differences may by driven by: n n n o Dominance of managed care in CA, AZ Insurer/provider choices in Northeast Not enough data from only six employers Grand experiment in 2005: FEHBP

Take-up Summary from the Study Employers o o All states have take-up above 5% with the exception of New York, New England States, Indiana, California and Arizona. Differences may by driven by: n n n o Dominance of managed care in CA, AZ Insurer/provider choices in Northeast Not enough data from only six employers Grand experiment in 2005: FEHBP

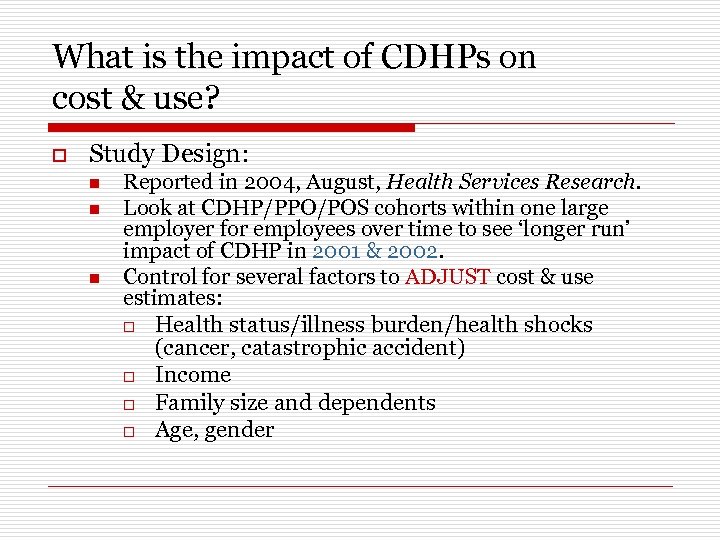

What is the impact of CDHPs on cost & use? o Study Design: n n n Reported in 2004, August, Health Services Research. Look at CDHP/PPO/POS cohorts within one large employer for employees over time to see ‘longer run’ impact of CDHP in 2001 & 2002. Control for several factors to ADJUST cost & use estimates: o Health status/illness burden/health shocks (cancer, catastrophic accident) o Income o Family size and dependents o Age, gender

What is the impact of CDHPs on cost & use? o Study Design: n n n Reported in 2004, August, Health Services Research. Look at CDHP/PPO/POS cohorts within one large employer for employees over time to see ‘longer run’ impact of CDHP in 2001 & 2002. Control for several factors to ADJUST cost & use estimates: o Health status/illness burden/health shocks (cancer, catastrophic accident) o Income o Family size and dependents o Age, gender

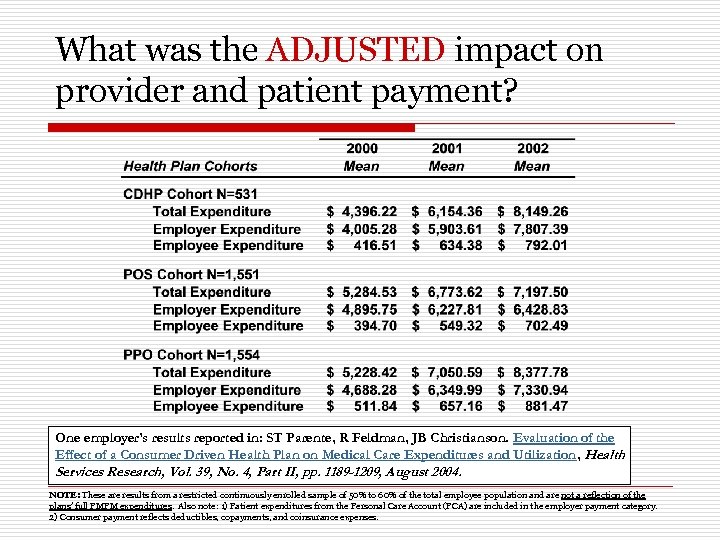

What was the ADJUSTED impact on provider and patient payment? One employer’s results reported in: ST Parente, R Feldman, JB Christianson. Evaluation of the Effect of a Consumer Driven Health Plan on Medical Care Expenditures and Utilization, Health Services Research, Vol. 39, No. 4, Part II, pp. 1189 -1209, August 2004. NOTE: These are results from a restricted continuously enrolled sample of 50% to 60% of the total employee population and are not a reflection of the plans’ full PMPM expenditures. Also note: 1) Patient expenditures from the Personal Care Account (PCA) are included in the employer payment category. 2) Consumer payment reflects deductibles, copayments, and coinsurance expenses.

What was the ADJUSTED impact on provider and patient payment? One employer’s results reported in: ST Parente, R Feldman, JB Christianson. Evaluation of the Effect of a Consumer Driven Health Plan on Medical Care Expenditures and Utilization, Health Services Research, Vol. 39, No. 4, Part II, pp. 1189 -1209, August 2004. NOTE: These are results from a restricted continuously enrolled sample of 50% to 60% of the total employee population and are not a reflection of the plans’ full PMPM expenditures. Also note: 1) Patient expenditures from the Personal Care Account (PCA) are included in the employer payment category. 2) Consumer payment reflects deductibles, copayments, and coinsurance expenses.

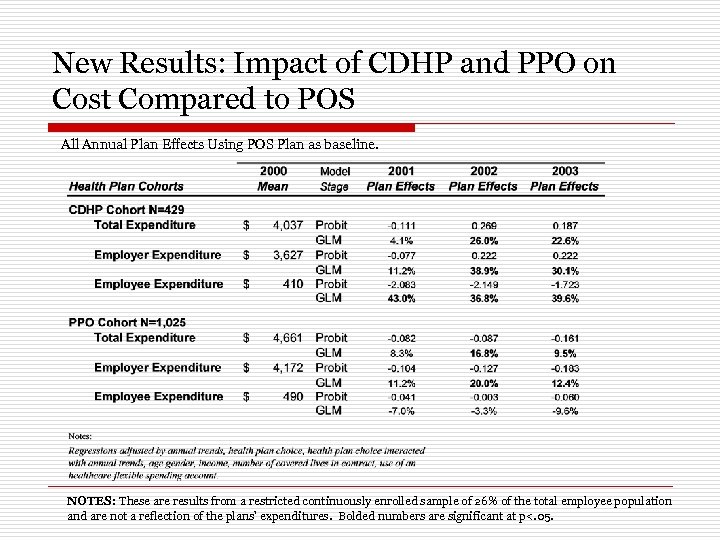

New Results: Impact of CDHP and PPO on Cost Compared to POS All Annual Plan Effects Using POS Plan as baseline. NOTES: These are results from a restricted continuously enrolled sample of 26% of the total employee population and are not a reflection of the plans’ expenditures. Bolded numbers are significant at p<. 05.

New Results: Impact of CDHP and PPO on Cost Compared to POS All Annual Plan Effects Using POS Plan as baseline. NOTES: These are results from a restricted continuously enrolled sample of 26% of the total employee population and are not a reflection of the plans’ expenditures. Bolded numbers are significant at p<. 05.

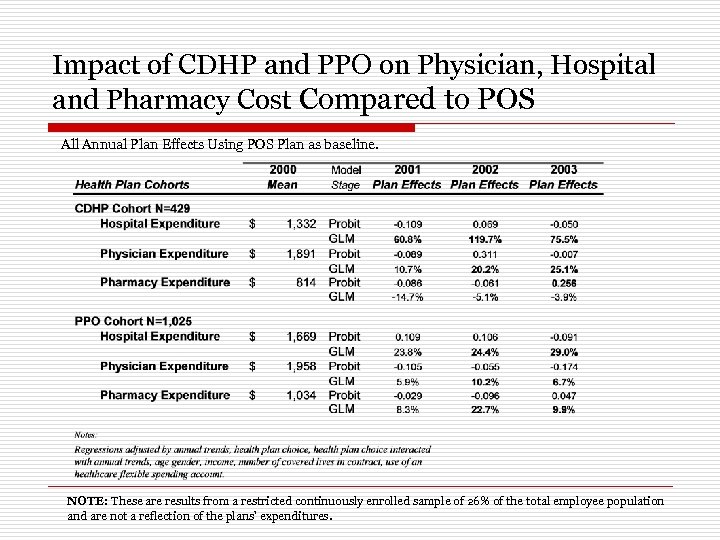

Impact of CDHP and PPO on Physician, Hospital and Pharmacy Cost Compared to POS All Annual Plan Effects Using POS Plan as baseline. NOTE: These are results from a restricted continuously enrolled sample of 26% of the total employee population and are not a reflection of the plans’ expenditures.

Impact of CDHP and PPO on Physician, Hospital and Pharmacy Cost Compared to POS All Annual Plan Effects Using POS Plan as baseline. NOTE: These are results from a restricted continuously enrolled sample of 26% of the total employee population and are not a reflection of the plans’ expenditures.

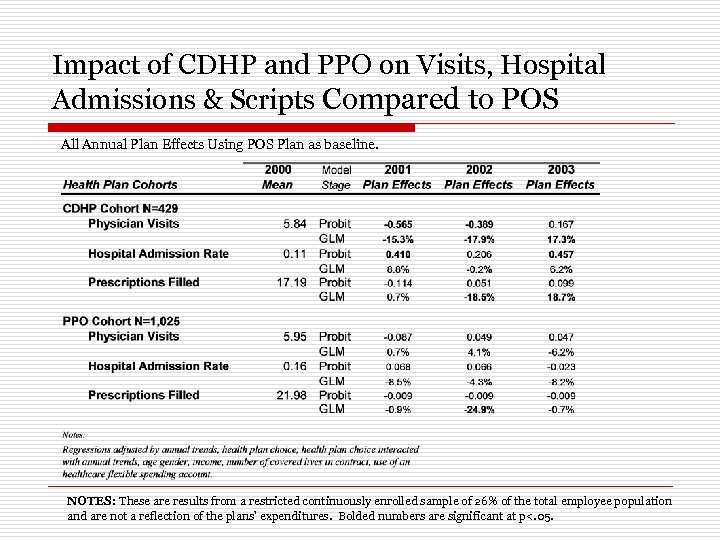

Impact of CDHP and PPO on Visits, Hospital Admissions & Scripts Compared to POS All Annual Plan Effects Using POS Plan as baseline. NOTES: These are results from a restricted continuously enrolled sample of 26% of the total employee population and are not a reflection of the plans’ expenditures. Bolded numbers are significant at p<. 05.

Impact of CDHP and PPO on Visits, Hospital Admissions & Scripts Compared to POS All Annual Plan Effects Using POS Plan as baseline. NOTES: These are results from a restricted continuously enrolled sample of 26% of the total employee population and are not a reflection of the plans’ expenditures. Bolded numbers are significant at p<. 05.

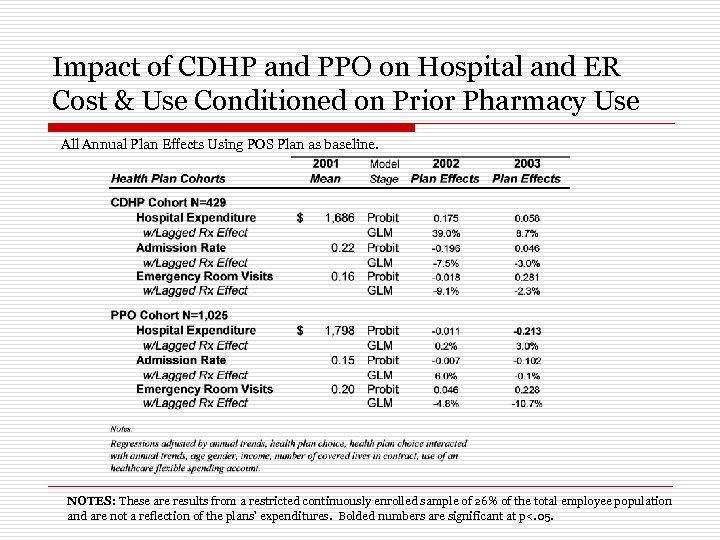

Impact of CDHP and PPO on Hospital and ER Cost & Use Conditioned on Prior Pharmacy Use All Annual Plan Effects Using POS Plan as baseline. NOTES: These are results from a restricted continuously enrolled sample of 26% of the total employee population and are not a reflection of the plans’ expenditures. Bolded numbers are significant at p<. 05.

Impact of CDHP and PPO on Hospital and ER Cost & Use Conditioned on Prior Pharmacy Use All Annual Plan Effects Using POS Plan as baseline. NOTES: These are results from a restricted continuously enrolled sample of 26% of the total employee population and are not a reflection of the plans’ expenditures. Bolded numbers are significant at p<. 05.

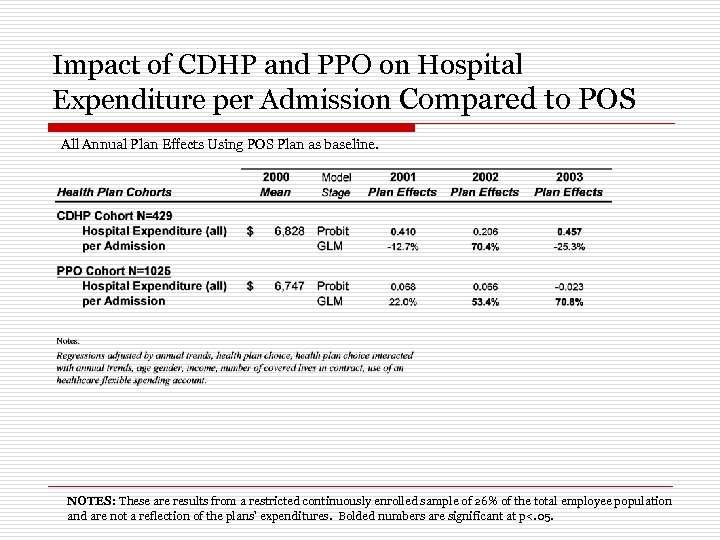

Impact of CDHP and PPO on Hospital Expenditure per Admission Compared to POS All Annual Plan Effects Using POS Plan as baseline. NOTES: These are results from a restricted continuously enrolled sample of 26% of the total employee population and are not a reflection of the plans’ expenditures. Bolded numbers are significant at p<. 05.

Impact of CDHP and PPO on Hospital Expenditure per Admission Compared to POS All Annual Plan Effects Using POS Plan as baseline. NOTES: These are results from a restricted continuously enrolled sample of 26% of the total employee population and are not a reflection of the plans’ expenditures. Bolded numbers are significant at p<. 05.

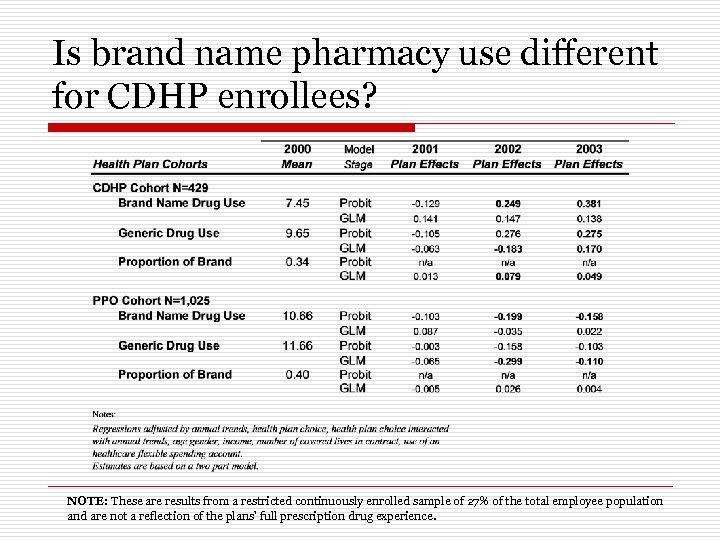

Is brand name pharmacy use different for CDHP enrollees? NOTE: These are results from a restricted continuously enrolled sample of 27% of the total employee population and are not a reflection of the plans’ full prescription drug experience.

Is brand name pharmacy use different for CDHP enrollees? NOTE: These are results from a restricted continuously enrolled sample of 27% of the total employee population and are not a reflection of the plans’ full prescription drug experience.

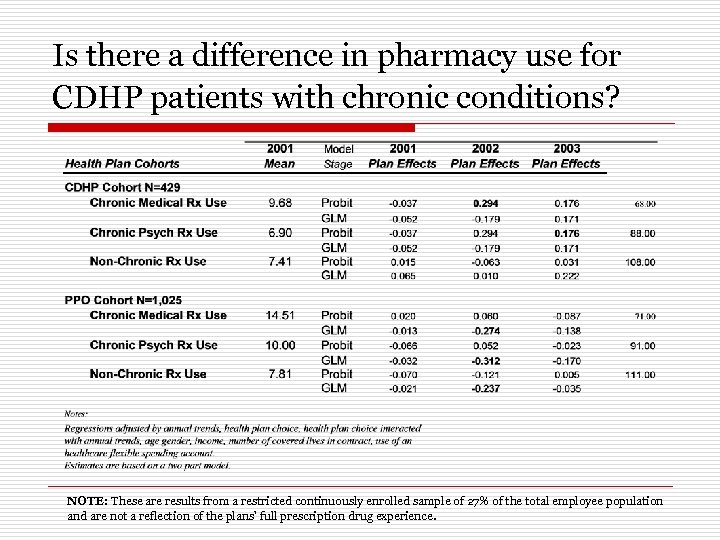

Is there a difference in pharmacy use for CDHP patients with chronic conditions? NOTE: These are results from a restricted continuously enrolled sample of 27% of the total employee population and are not a reflection of the plans’ full prescription drug experience.

Is there a difference in pharmacy use for CDHP patients with chronic conditions? NOTE: These are results from a restricted continuously enrolled sample of 27% of the total employee population and are not a reflection of the plans’ full prescription drug experience.

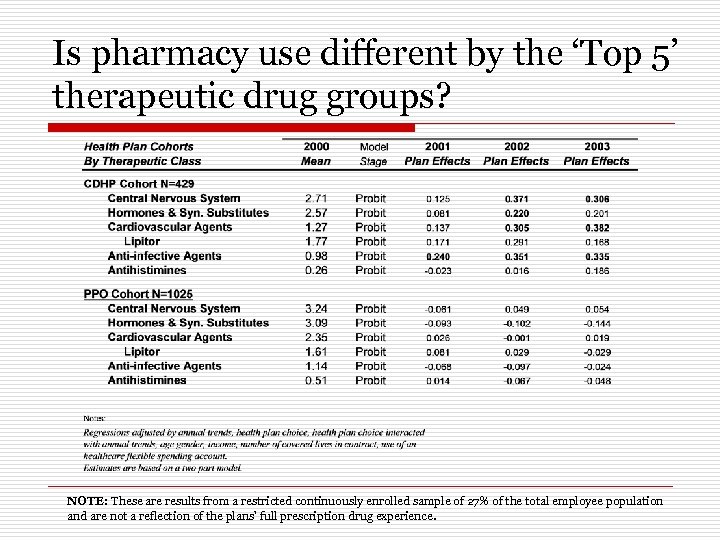

Is pharmacy use different by the ‘Top 5’ therapeutic drug groups? NOTE: These are results from a restricted continuously enrolled sample of 27% of the total employee population and are not a reflection of the plans’ full prescription drug experience.

Is pharmacy use different by the ‘Top 5’ therapeutic drug groups? NOTE: These are results from a restricted continuously enrolled sample of 27% of the total employee population and are not a reflection of the plans’ full prescription drug experience.

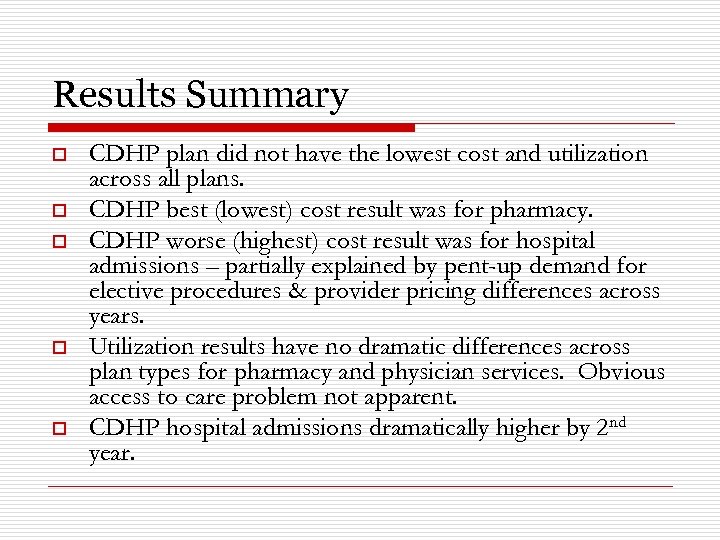

Results Summary o o o CDHP plan did not have the lowest cost and utilization across all plans. CDHP best (lowest) cost result was for pharmacy. CDHP worse (highest) cost result was for hospital admissions – partially explained by pent-up demand for elective procedures & provider pricing differences across years. Utilization results have no dramatic differences across plan types for pharmacy and physician services. Obvious access to care problem not apparent. CDHP hospital admissions dramatically higher by 2 nd year.

Results Summary o o o CDHP plan did not have the lowest cost and utilization across all plans. CDHP best (lowest) cost result was for pharmacy. CDHP worse (highest) cost result was for hospital admissions – partially explained by pent-up demand for elective procedures & provider pricing differences across years. Utilization results have no dramatic differences across plan types for pharmacy and physician services. Obvious access to care problem not apparent. CDHP hospital admissions dramatically higher by 2 nd year.

Using HRA Results to Explore HSA Market Question & Opportunities o o What is the expected take-up rate of HSAs in the individual market? What is the likely impact of the Administration’s proposed HSA subsidies? n n n o Take-up rate of HSAs with subsidies Reduction in the number of uninsured Cost of the subsidy What is the impact of other possible subsidy designs?

Using HRA Results to Explore HSA Market Question & Opportunities o o What is the expected take-up rate of HSAs in the individual market? What is the likely impact of the Administration’s proposed HSA subsidies? n n n o Take-up rate of HSAs with subsidies Reduction in the number of uninsured Cost of the subsidy What is the impact of other possible subsidy designs?

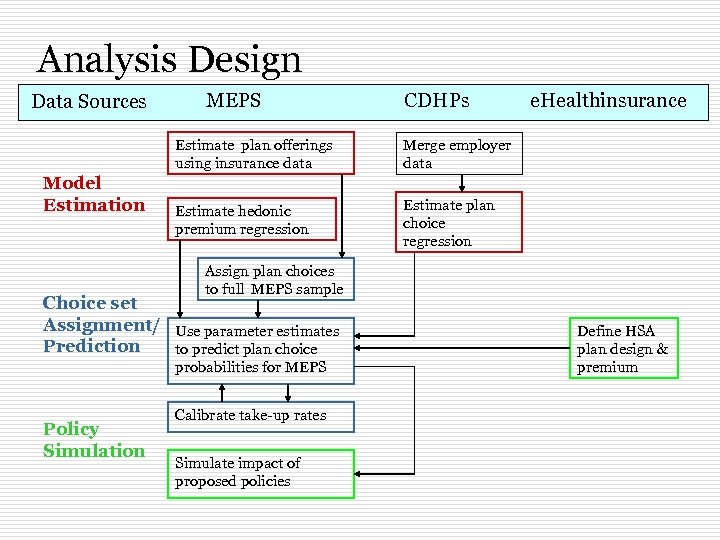

Analysis Design Data Sources MEPS CDHPs Estimate plan offerings using insurance data Model Estimation Merge employer data Estimate hedonic premium regression e. Healthinsurance Estimate plan choice regression Assign plan choices to full MEPS sample Choice set Assignment/ Use parameter estimates Prediction to predict plan choice probabilities for MEPS Policy Simulation Calibrate take-up rates Simulate impact of proposed policies Define HSA plan design & premium

Analysis Design Data Sources MEPS CDHPs Estimate plan offerings using insurance data Model Estimation Merge employer data Estimate hedonic premium regression e. Healthinsurance Estimate plan choice regression Assign plan choices to full MEPS sample Choice set Assignment/ Use parameter estimates Prediction to predict plan choice probabilities for MEPS Policy Simulation Calibrate take-up rates Simulate impact of proposed policies Define HSA plan design & premium

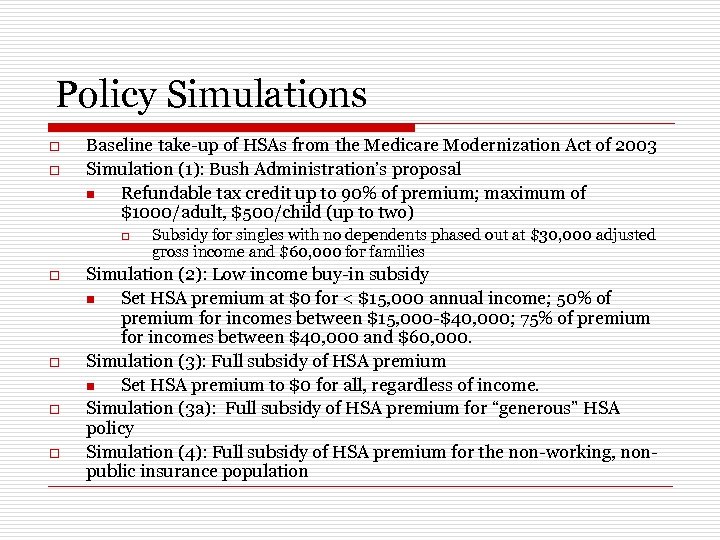

Policy Simulations o o Baseline take-up of HSAs from the Medicare Modernization Act of 2003 Simulation (1): Bush Administration’s proposal n Refundable tax credit up to 90% of premium; maximum of $1000/adult, $500/child (up to two) o o o Subsidy for singles with no dependents phased out at $30, 000 adjusted gross income and $60, 000 for families Simulation (2): Low income buy-in subsidy n Set HSA premium at $0 for < $15, 000 annual income; 50% of premium for incomes between $15, 000 -$40, 000; 75% of premium for incomes between $40, 000 and $60, 000. Simulation (3): Full subsidy of HSA premium n Set HSA premium to $0 for all, regardless of income. Simulation (3 a): Full subsidy of HSA premium for “generous” HSA policy Simulation (4): Full subsidy of HSA premium for the non-working, nonpublic insurance population

Policy Simulations o o Baseline take-up of HSAs from the Medicare Modernization Act of 2003 Simulation (1): Bush Administration’s proposal n Refundable tax credit up to 90% of premium; maximum of $1000/adult, $500/child (up to two) o o o Subsidy for singles with no dependents phased out at $30, 000 adjusted gross income and $60, 000 for families Simulation (2): Low income buy-in subsidy n Set HSA premium at $0 for < $15, 000 annual income; 50% of premium for incomes between $15, 000 -$40, 000; 75% of premium for incomes between $40, 000 and $60, 000. Simulation (3): Full subsidy of HSA premium n Set HSA premium to $0 for all, regardless of income. Simulation (3 a): Full subsidy of HSA premium for “generous” HSA policy Simulation (4): Full subsidy of HSA premium for the non-working, nonpublic insurance population

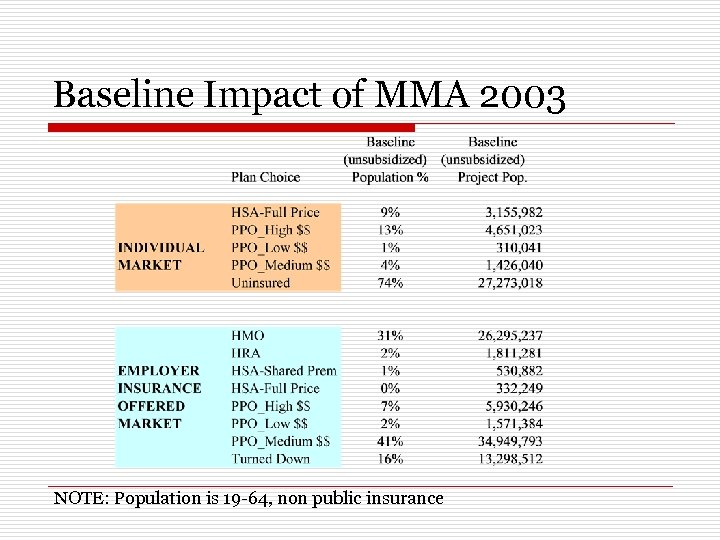

Baseline Impact of MMA 2003 NOTE: Population is 19 -64, non public insurance

Baseline Impact of MMA 2003 NOTE: Population is 19 -64, non public insurance

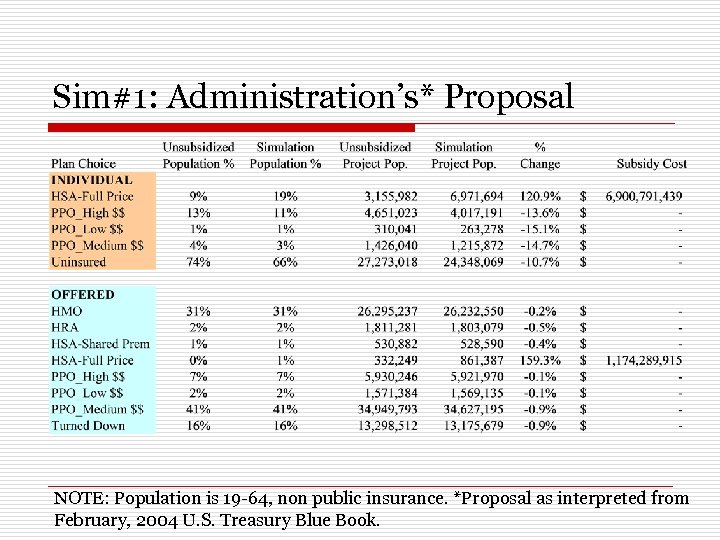

Sim#1: Administration’s* Proposal NOTE: Population is 19 -64, non public insurance. *Proposal as interpreted from February, 2004 U. S. Treasury Blue Book.

Sim#1: Administration’s* Proposal NOTE: Population is 19 -64, non public insurance. *Proposal as interpreted from February, 2004 U. S. Treasury Blue Book.

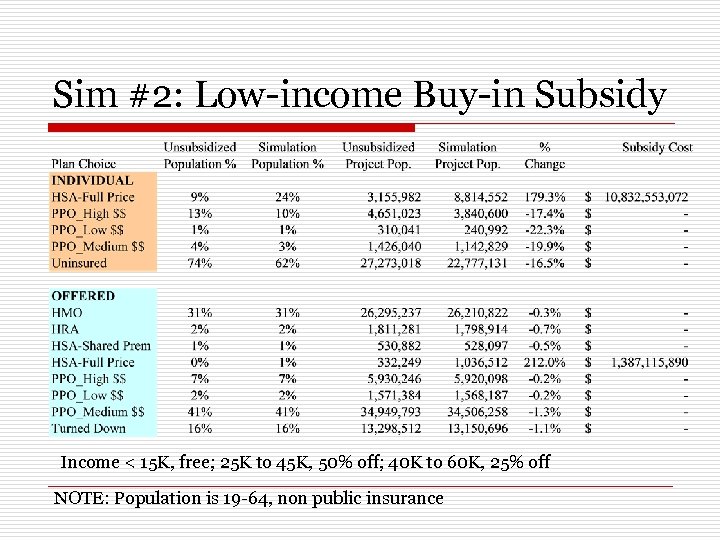

Sim #2: Low-income Buy-in Subsidy Income < 15 K, free; 25 K to 45 K, 50% off; 40 K to 60 K, 25% off NOTE: Population is 19 -64, non public insurance

Sim #2: Low-income Buy-in Subsidy Income < 15 K, free; 25 K to 45 K, 50% off; 40 K to 60 K, 25% off NOTE: Population is 19 -64, non public insurance

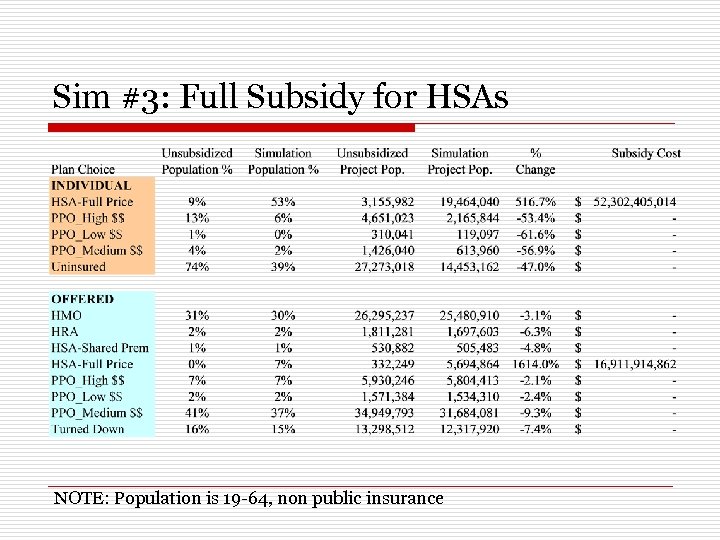

Sim #3: Full Subsidy for HSAs NOTE: Population is 19 -64, non public insurance

Sim #3: Full Subsidy for HSAs NOTE: Population is 19 -64, non public insurance

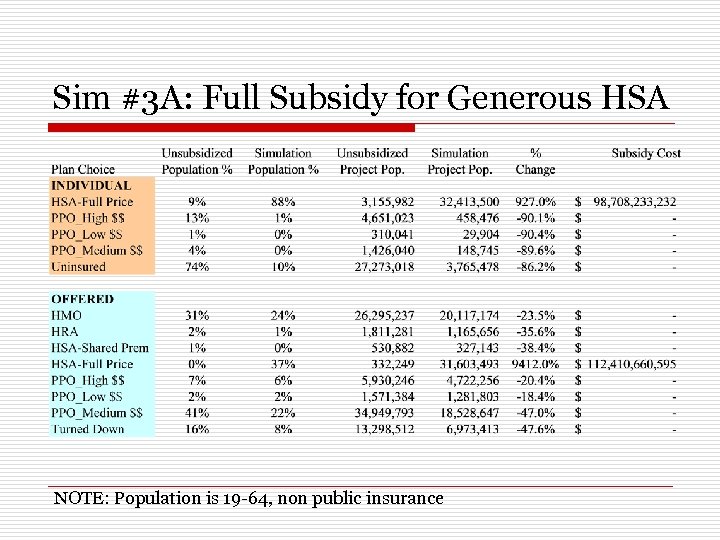

Sim #3 A: Full Subsidy for Generous HSA NOTE: Population is 19 -64, non public insurance

Sim #3 A: Full Subsidy for Generous HSA NOTE: Population is 19 -64, non public insurance

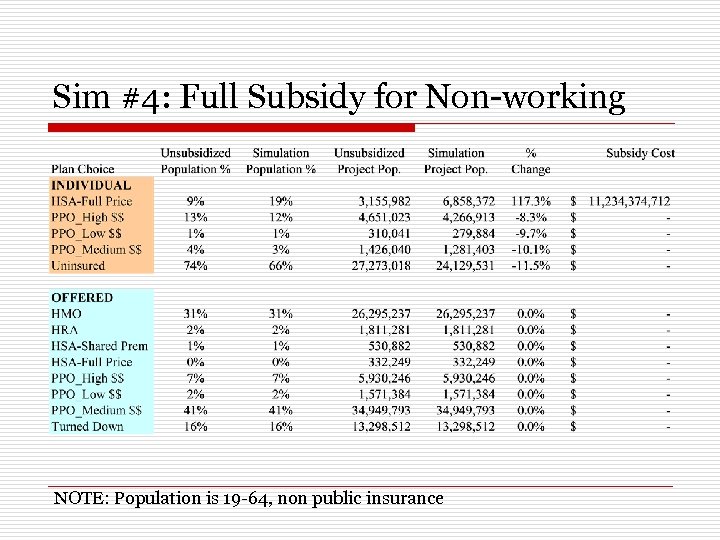

Sim #4: Full Subsidy for Non-working NOTE: Population is 19 -64, non public insurance

Sim #4: Full Subsidy for Non-working NOTE: Population is 19 -64, non public insurance

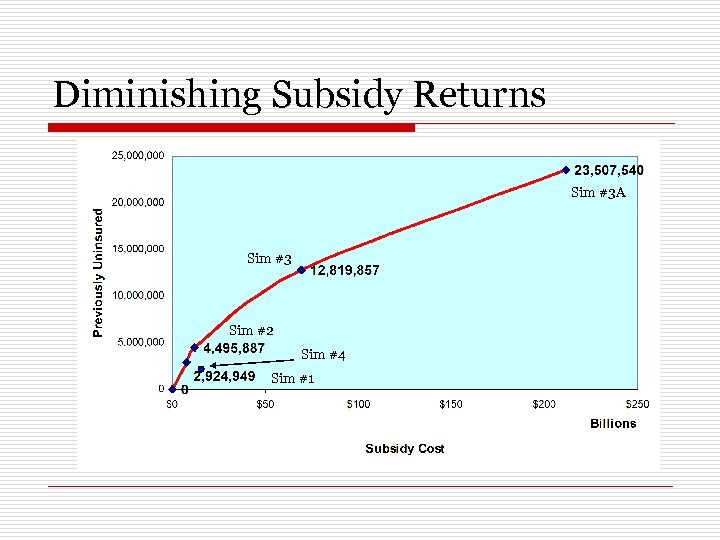

Diminishing Subsidy Returns Sim #3 A Sim #3 Sim #2 Sim #4 Sim #1

Diminishing Subsidy Returns Sim #3 A Sim #3 Sim #2 Sim #4 Sim #1

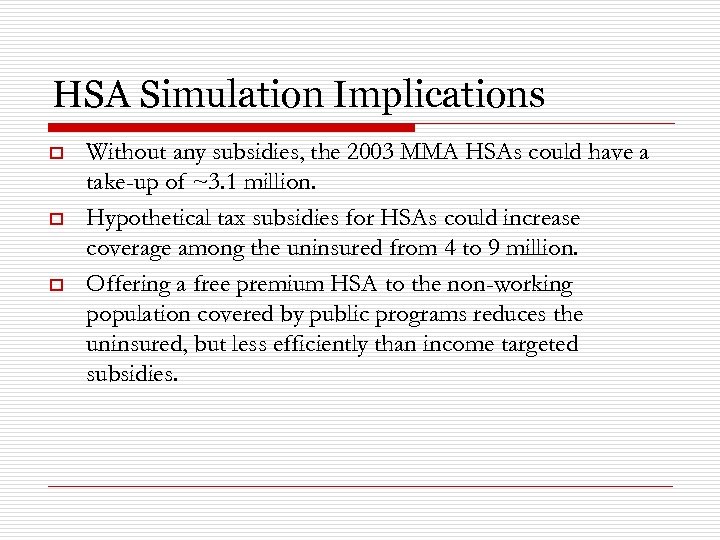

HSA Simulation Implications o o o Without any subsidies, the 2003 MMA HSAs could have a take-up of ~3. 1 million. Hypothetical tax subsidies for HSAs could increase coverage among the uninsured from 4 to 9 million. Offering a free premium HSA to the non-working population covered by public programs reduces the uninsured, but less efficiently than income targeted subsidies.

HSA Simulation Implications o o o Without any subsidies, the 2003 MMA HSAs could have a take-up of ~3. 1 million. Hypothetical tax subsidies for HSAs could increase coverage among the uninsured from 4 to 9 million. Offering a free premium HSA to the non-working population covered by public programs reduces the uninsured, but less efficiently than income targeted subsidies.

Big Questions to Ask? o How will the consumers ‘drive’? n ‘Pull’ information where consumers search? n ‘Push’ information where consumers are actively guided? n What information has enough signal for consumers to: o o o Understand Take action Have the action affect (positively) their health status Are current market conditions conducive for CDHPs to grow and realize the original intent of having consumers be ‘more engaged in the health care purchases than a status quo PPO market’? Can the two ‘flavors of the year’ CDHP and Health IT be combined to make something more than just the sum of their parts?

Big Questions to Ask? o How will the consumers ‘drive’? n ‘Pull’ information where consumers search? n ‘Push’ information where consumers are actively guided? n What information has enough signal for consumers to: o o o Understand Take action Have the action affect (positively) their health status Are current market conditions conducive for CDHPs to grow and realize the original intent of having consumers be ‘more engaged in the health care purchases than a status quo PPO market’? Can the two ‘flavors of the year’ CDHP and Health IT be combined to make something more than just the sum of their parts?

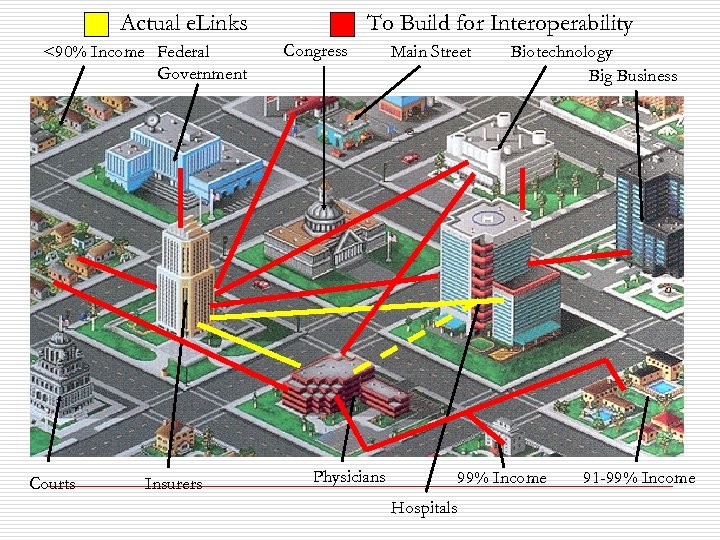

Actual e. Links <90% Income Federal Government Courts Insurers To Build for Interoperability Congress Main Street Physicians Biotechnology Big Business 99% Income Hospitals 91 -99% Income

Actual e. Links <90% Income Federal Government Courts Insurers To Build for Interoperability Congress Main Street Physicians Biotechnology Big Business 99% Income Hospitals 91 -99% Income

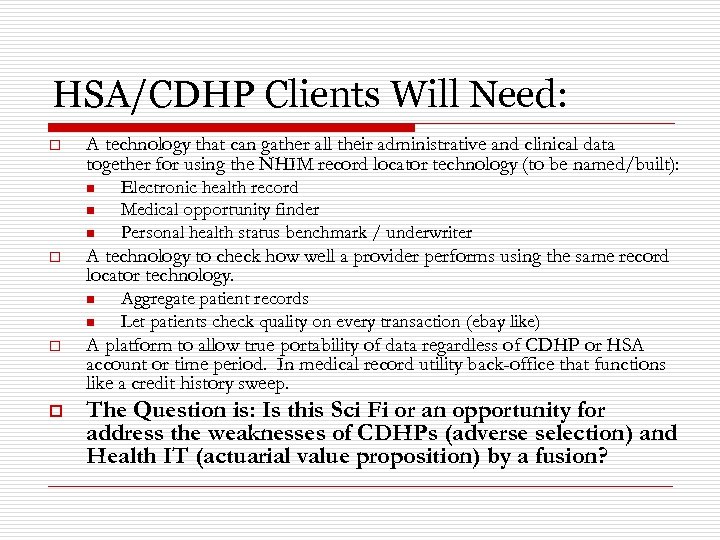

HSA/CDHP Clients Will Need: o A technology that can gather all their administrative and clinical data together for using the NHIM record locator technology (to be named/built): n n n o Electronic health record Medical opportunity finder Personal health status benchmark / underwriter A technology to check how well a provider performs using the same record locator technology. n n Aggregate patient records Let patients check quality on every transaction (ebay like) o A platform to allow true portability of data regardless of CDHP or HSA account or time period. In medical record utility back-office that functions like a credit history sweep. o The Question is: Is this Sci Fi or an opportunity for address the weaknesses of CDHPs (adverse selection) and Health IT (actuarial value proposition) by a fusion?

HSA/CDHP Clients Will Need: o A technology that can gather all their administrative and clinical data together for using the NHIM record locator technology (to be named/built): n n n o Electronic health record Medical opportunity finder Personal health status benchmark / underwriter A technology to check how well a provider performs using the same record locator technology. n n Aggregate patient records Let patients check quality on every transaction (ebay like) o A platform to allow true portability of data regardless of CDHP or HSA account or time period. In medical record utility back-office that functions like a credit history sweep. o The Question is: Is this Sci Fi or an opportunity for address the weaknesses of CDHPs (adverse selection) and Health IT (actuarial value proposition) by a fusion?

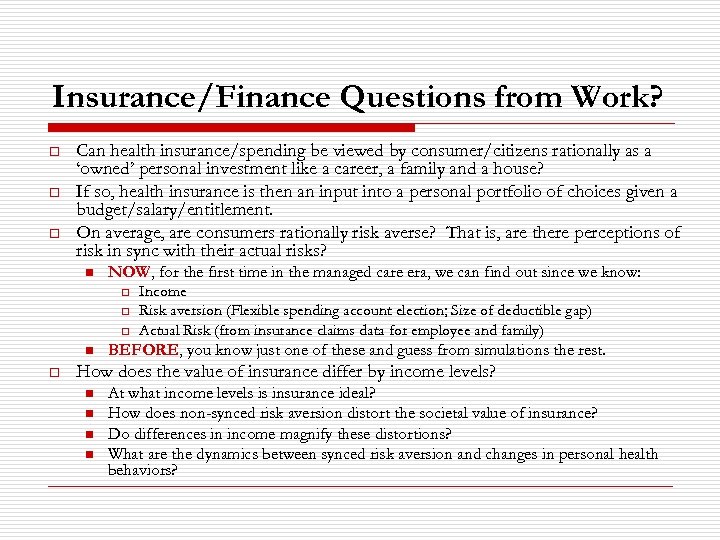

Insurance/Finance Questions from Work? o o o Can health insurance/spending be viewed by consumer/citizens rationally as a ‘owned’ personal investment like a career, a family and a house? If so, health insurance is then an input into a personal portfolio of choices given a budget/salary/entitlement. On average, are consumers rationally risk averse? That is, are there perceptions of risk in sync with their actual risks? n NOW, for the first time in the managed care era, we can find out since we know: o o o n o Income Risk aversion (Flexible spending account election; Size of deductible gap) Actual Risk (from insurance claims data for employee and family) BEFORE, you know just one of these and guess from simulations the rest. How does the value of insurance differ by income levels? n n At what income levels is insurance ideal? How does non-synced risk aversion distort the societal value of insurance? Do differences in income magnify these distortions? What are the dynamics between synced risk aversion and changes in personal health behaviors?

Insurance/Finance Questions from Work? o o o Can health insurance/spending be viewed by consumer/citizens rationally as a ‘owned’ personal investment like a career, a family and a house? If so, health insurance is then an input into a personal portfolio of choices given a budget/salary/entitlement. On average, are consumers rationally risk averse? That is, are there perceptions of risk in sync with their actual risks? n NOW, for the first time in the managed care era, we can find out since we know: o o o n o Income Risk aversion (Flexible spending account election; Size of deductible gap) Actual Risk (from insurance claims data for employee and family) BEFORE, you know just one of these and guess from simulations the rest. How does the value of insurance differ by income levels? n n At what income levels is insurance ideal? How does non-synced risk aversion distort the societal value of insurance? Do differences in income magnify these distortions? What are the dynamics between synced risk aversion and changes in personal health behaviors?

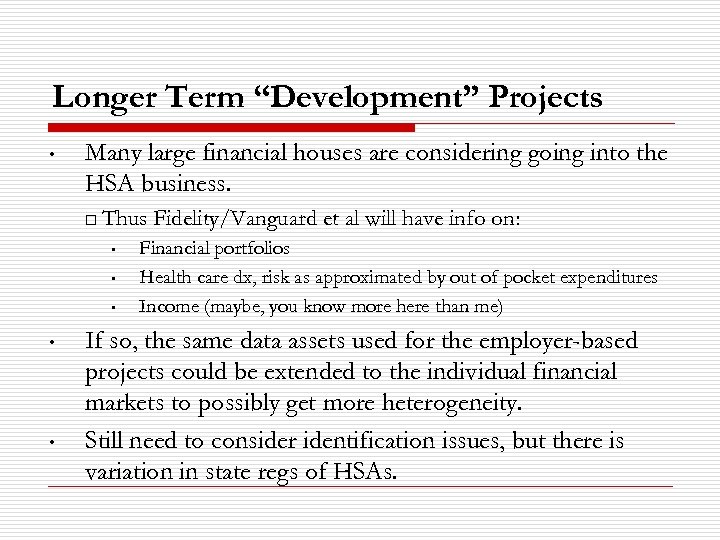

Longer Term “Development” Projects • Many large financial houses are considering going into the HSA business. o Thus Fidelity/Vanguard et al will have info on: • • • Financial portfolios Health care dx, risk as approximated by out of pocket expenditures Income (maybe, you know more here than me) If so, the same data assets used for the employer-based projects could be extended to the individual financial markets to possibly get more heterogeneity. Still need to consider identification issues, but there is variation in state regs of HSAs.

Longer Term “Development” Projects • Many large financial houses are considering going into the HSA business. o Thus Fidelity/Vanguard et al will have info on: • • • Financial portfolios Health care dx, risk as approximated by out of pocket expenditures Income (maybe, you know more here than me) If so, the same data assets used for the employer-based projects could be extended to the individual financial markets to possibly get more heterogeneity. Still need to consider identification issues, but there is variation in state regs of HSAs.

Summary o o Working CDHP market that was spawned by ecommerce has arrived. The opportunities for business and society from CDHPs have never been higher in the health insurance field. The stakes have never been greater. Good and timely research can address whether the potential of this market is real and what tangible mileposts can be observed to move beyond the hyperbole, conjecture, anecdote and science fiction.

Summary o o Working CDHP market that was spawned by ecommerce has arrived. The opportunities for business and society from CDHPs have never been higher in the health insurance field. The stakes have never been greater. Good and timely research can address whether the potential of this market is real and what tangible mileposts can be observed to move beyond the hyperbole, conjecture, anecdote and science fiction.