70362935cf37c7b72fbdab3da43b261a.ppt

- Количество слайдов: 34

Construction Industry Development Board Business Plan for 2007/2008 Presentation to Parliamentary Portfolio Committee 15 March 2007 development through partnership

Presentation Content • Overview – Distilled mandate – Achievements – Challenges • BP approval process • Key Focus for 2007/08 • Key Internal Focus for 2007/08 • Performance measurement • Long-term staffing structure • Budget development through partnership

Context – Purpose of cidb Act - Distilled Mandate to provide: leadership and an enabling regulatory and development framework for: • A total construction delivery capability to achieve South Africa’s economic and social growth • Sustainable growth and empowerment of historically disadvantaged • Global standards of performance and value to clients and society sustainable industry development

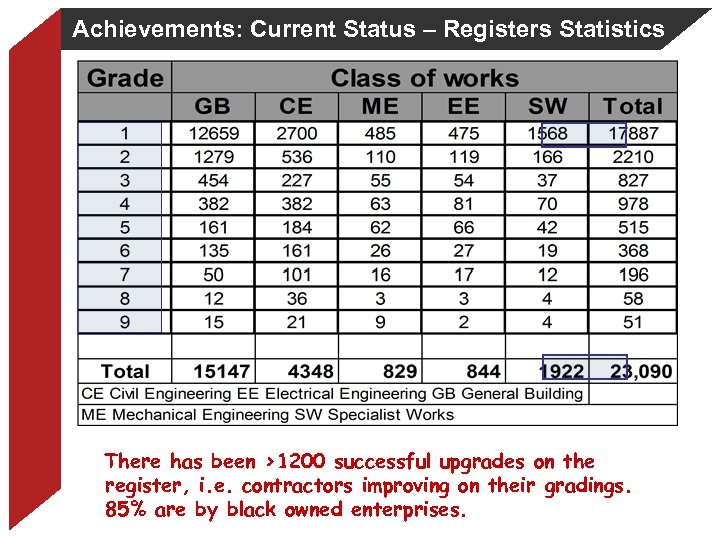

Progress and building momentum Achievements: Beginning to see impact • Improved public spend (26, 8% higher) • Now > 23 000 registrations (4000 Oct 2005) • More than 1200 contractors upgraded (ca 85% black) • 500 applications per week • Over 800 projects registered – 150 000 i-Tender notifications (e-mail/ sms) to contractors – with more than 80 clients using the system • More clients are registering daily • Over 1800 officials/ consultants trained in last financial year-has increased this financial year after all municipalities capacitated New implementation challenges!

Achievements: Current Status – Registers Statistics There has been >1200 successful upgrades on the register, i. e. contractors improving on their gradings. 85% are by black owned enterprises.

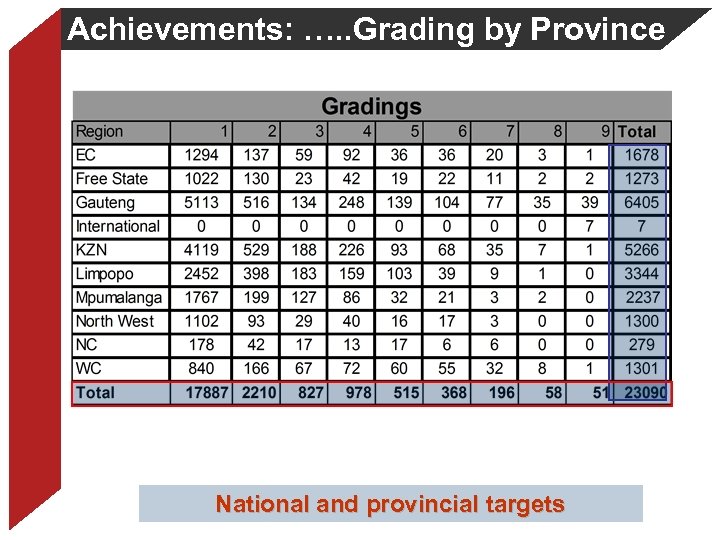

Achievements: …. . Grading by Province National and provincial targets

Progress and building momentum Achievements: …. . Continued • Developed Code of Conduct-already incorporated in the UCT curriculum for Construction Management • Standard for Uniformity Sf. U) incorporated into UCT’s library of resources • Toolkit/IDIP (Infrastructure Delivery Improvement Programme) Rollout • 2010 Procure Manual

Progress and building momentum Achievements: …. . Continued • Client capacitation workshop on construction procurement now accredited by ECSA • GCC training guidelines completed and JBCC in first draft • 5 -Year Independent Review

Achievements: …. . Continued • 5 Year review: – Done in week of 29 Jan-02 Feb – Review Team • Review Panel: 2 international experts & 3 South African • Secretariat: 1 International expert and 1 South African – Draft report - being reviewed • Report generally positive and encouraging • Leadership role of cidb recognised • Recommended specific improvements – Final report to Board, then from Board to Minister development through partnership

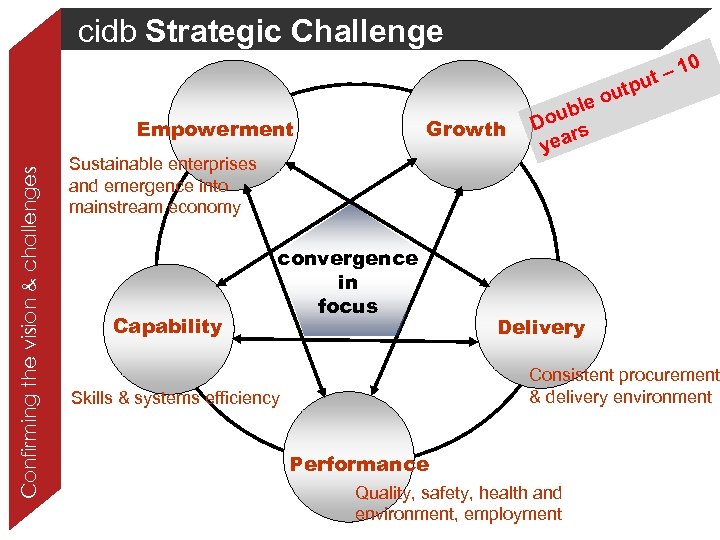

cidb Strategic Challenge – 10 ut p Confirming the vision & challenges Empowerment Growth Sustainable enterprises and emergence into mainstream economy Capability convergence in focus out le b Dou s r yea Delivery Consistent procurement & delivery environment Skills & systems efficiency Performance Quality, safety, health and environment, employment

Challenges • • Shifting priorities Revenue model-registers Structure as a national organisation Alignment of register with the Construction Charter • Unprecedented volume of registered contractors, esp grade 1 contractors development through partnership

BP Approval Process • Review by Board Oct 06 • Incorporation of Board inputs and submission to DPW for approval by Minister Oct 06 • Progress review Feb 07 • Updating of BP based on review Feb 07 • (will present to Board-April 07) • Submission of final BP to DPW March 07 • Approval by Minister development through partnership

Key Focus for 2007/08 (i) • Contractor Registration – “Operation Improve” – BPR and clearing of the backlog – Resolution of specific Contractor problems – Linkage to Construction Contact Centres • Project Registration – Promote through focused client registration – Fast track and prioritise I-Tender Ro. P (DPW regional and provincial, then others) development through partnership

Key Focus for 2007/08 (ii) • Public sector infrastructure delivery: – Public sector procurement reform – streamlining, public sector capacitation, – Register of Professional Services Providers – Public sector delivery improvement – continue with IDIP: DPW & Do. E; Do. H – National Infrastructure Maintenance Strategy – cidb role, programme manager and staff for implementation development through partnership

Key Focus for 2007/08 (iii) • Contractor development: – National Contractor Development Programme – In conjunction with DPW – 1 st draft of NCDP Framework – Targets-indicative – W/shops with Gauteng, KZN, WC & EC • Outreach into provinces – Construction Contact Centres (CCC): KZN, Gauteng, EC, WC –to be launched by Minister later this year development through partnership

Key Focus for 2007/08 (iv) • Skills: – Report on Restoring the Supply Pipeline • JIPSA – Framework for Employment Skills Delivery Agency (ESDA) development through partnership

Key Focus for 2007/08 (ii) • 5 Year review: lessons learnt to be incorporated – Specific recommendations – General observations • Stakeholder Forum – Planned for May – Consulting with Minister for date – Provincial stakeholder workshops: March. April development through partnership

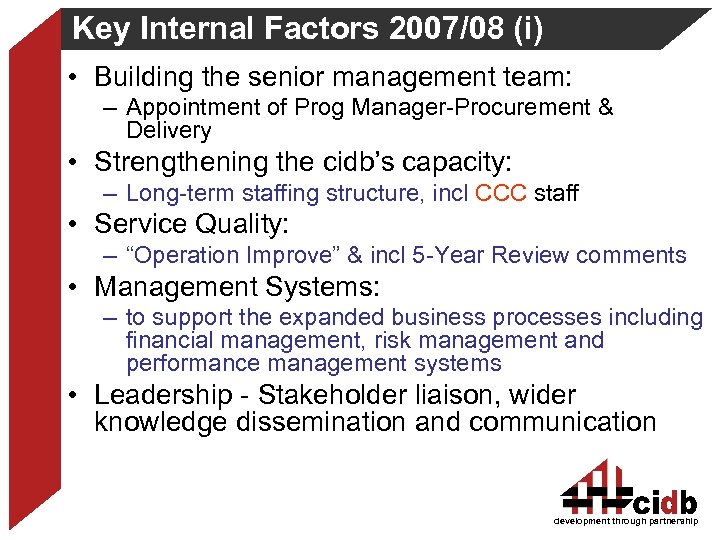

Key Internal Factors 2007/08 (i) • Building the senior management team: – Appointment of Prog Manager-Procurement & Delivery • Strengthening the cidb’s capacity: – Long-term staffing structure, incl CCC staff • Service Quality: – “Operation Improve” & incl 5 -Year Review comments • Management Systems: – to support the expanded business processes including financial management, risk management and performance management systems • Leadership - Stakeholder liaison, wider knowledge dissemination and communication development through partnership

Performance Measurement (i) • Output targets set for each focus area (Section 6 of Business Plan) • Example development through partnership

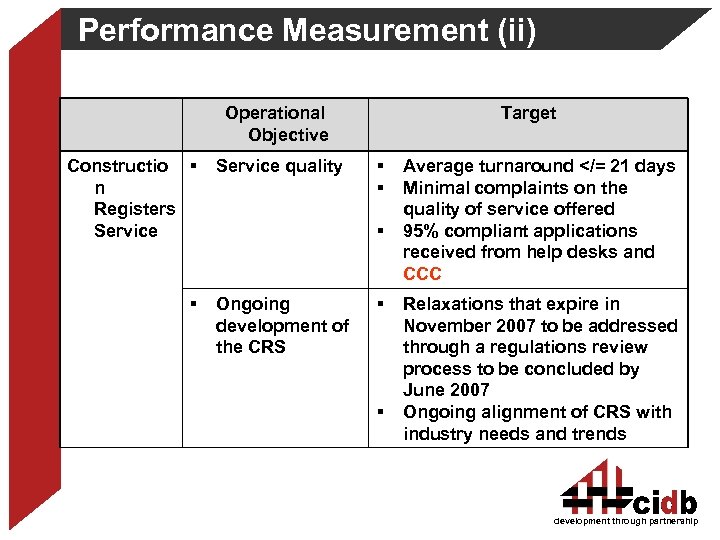

Performance Measurement (ii) Operational Objective Constructio n Registers Service quality Target Ongoing development of the CRS Average turnaround </= 21 days Minimal complaints on the quality of service offered 95% compliant applications received from help desks and CCC Relaxations that expire in November 2007 to be addressed through a regulations review process to be concluded by June 2007 Ongoing alignment of CRS with industry needs and trends development through partnership

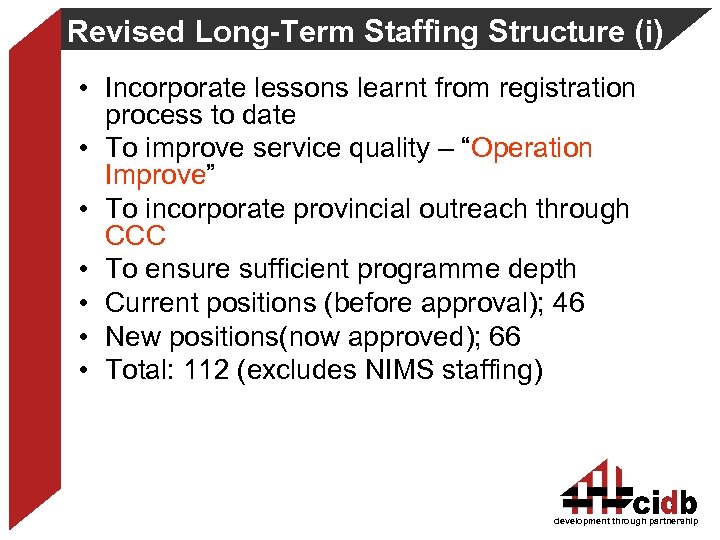

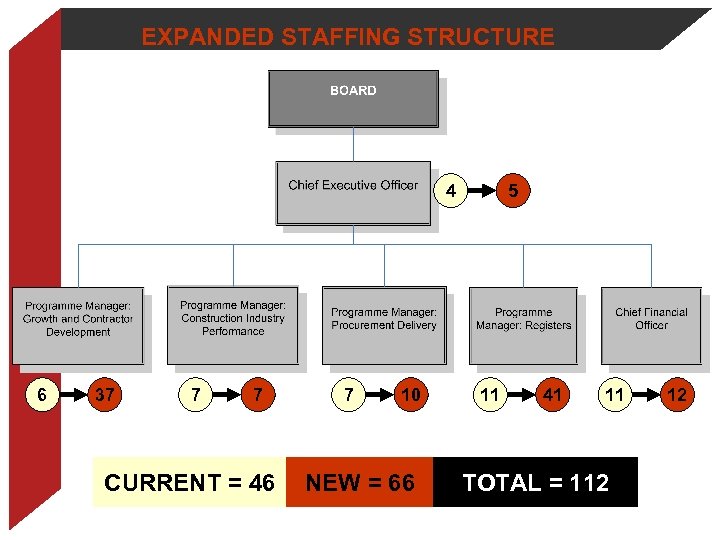

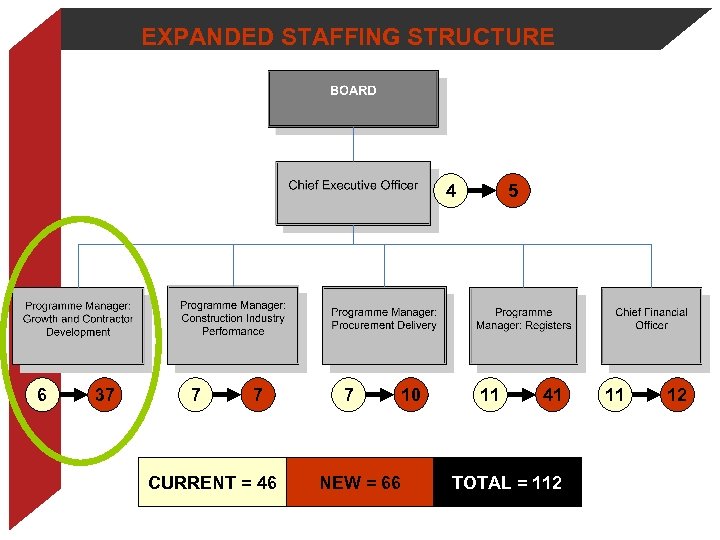

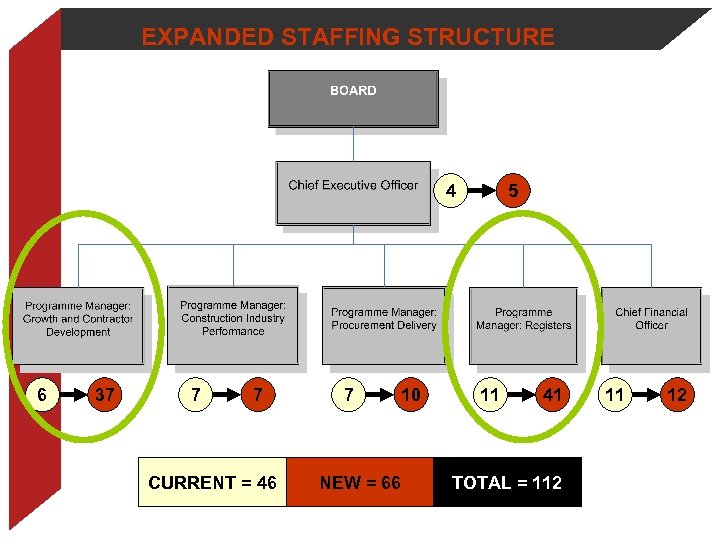

Revised Long-Term Staffing Structure (i) • Incorporate lessons learnt from registration process to date • To improve service quality – “Operation Improve” • To incorporate provincial outreach through CCC • To ensure sufficient programme depth • Current positions (before approval); 46 • New positions(now approved); 66 • Total: 112 (excludes NIMS staffing) development through partnership

Revised Long-Term Staffing Structure (ii) • Approval process, including system of remuneration – Minister of Public Works – approved w. e. f. Feb 07 – Staff expansion – Recruitment and retention at programme manager and CEO levels development through partnership

2007/2008 BUDGET development through partnership

Focus of 2007/2008 Budget • Building human resource capacity • Establishment of Construction Contact Centers • Improvement of Registers service delivery • NIMS staffing excluded in this Business Plan development through partnership

EXPANDED STAFFING STRUCTURE 4 6 37 7 7 CURRENT = 46 7 10 NEW = 66 5 11 41 11 TOTAL = 112 12

EXPANDED STAFFING STRUCTURE 4 6 37 7 7 CURRENT = 46 7 10 NEW = 66 5 11 41 TOTAL = 112 11 12

EXPANDED STAFFING STRUCTURE 4 6 37 7 7 CURRENT = 46 7 10 NEW = 66 5 11 41 TOTAL = 112 11 12

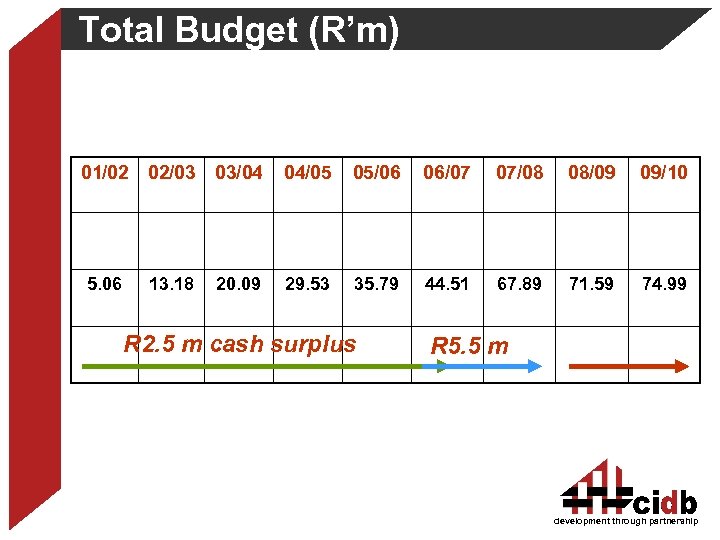

Total Budget (R’m) 01/02 02/03 03/04 04/05 05/06 06/07 07/08 08/09 09/10 5. 06 13. 18 20. 09 29. 53 35. 79 44. 51 67. 89 71. 59 74. 99 R 2. 5 m cash surplus R 5. 5 m development through partnership

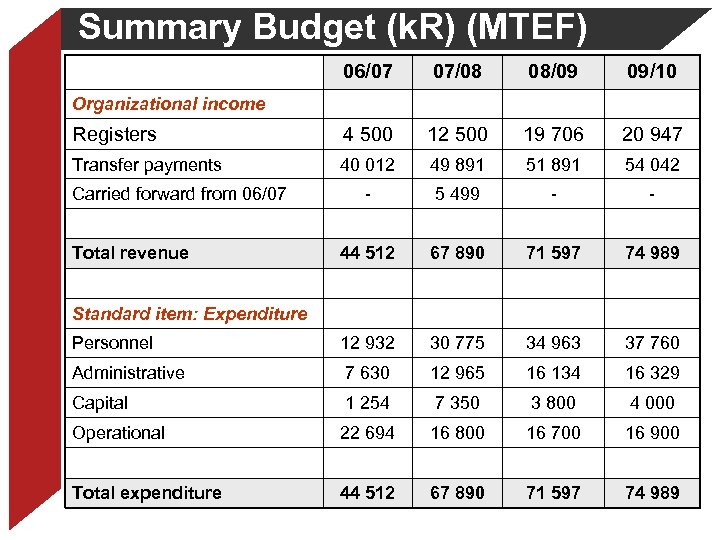

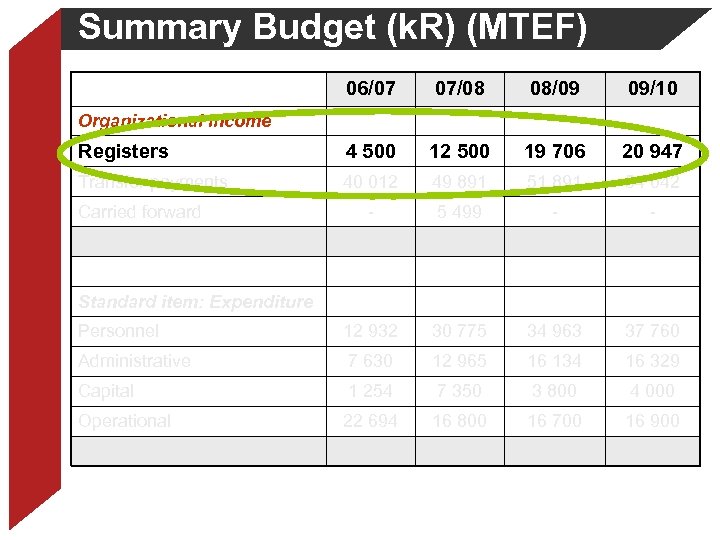

Summary Budget (k. R) (MTEF) 06/07 07/08 08/09 09/10 Registers 4 500 12 500 19 706 20 947 Transfer payments 40 012 49 891 51 891 54 042 - 5 499 - - 44 512 67 890 71 597 74 989 Personnel 12 932 30 775 34 963 37 760 Administrative 7 630 12 965 16 134 16 329 Capital 1 254 7 350 3 800 4 000 Operational 22 694 16 800 16 700 16 900 Total expenditure 44 512 67 890 71 597 74 989 Organizational income Carried forward from 06/07 Total revenue Standard item: Expenditure

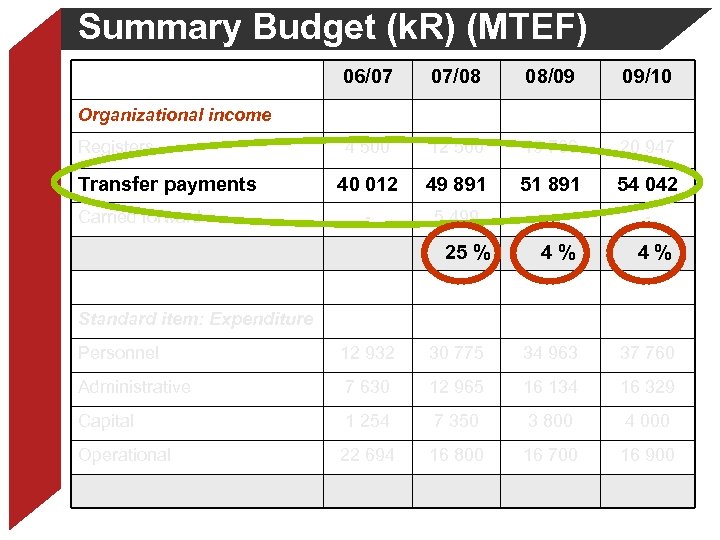

Summary Budget (k. R) (MTEF) 06/07 07/08 08/09 09/10 4 500 12 500 19 706 20 947 40 012 49 891 51 891 54 042 Carried forward - 5 499 - - Total revenue 44 512 67 890 25 % 714 % 597 744 % 989 Personnel 12 932 30 775 34 963 37 760 Administrative 7 630 12 965 16 134 16 329 Capital 1 254 7 350 3 800 4 000 Operational 22 694 16 800 16 700 16 900 Total expenditure 44 512 67 890 71 597 74 989 Organizational income Registers Transfer payments Standard item: Expenditure

Summary Budget (k. R) (MTEF) 06/07 07/08 08/09 09/10 Registers 4 500 12 500 19 706 20 947 Transfer payments 40 012 49 891 51 891 54 042 Carried forward - 5 499 - - Total revenue 44 512 67 890 71 597 74 989 Personnel 12 932 30 775 34 963 37 760 Administrative 7 630 12 965 16 134 16 329 Capital 1 254 7 350 3 800 4 000 Operational 22 694 16 800 16 700 16 900 Total expenditure 44 512 67 890 71 597 74 989 Organizational income Standard item: Expenditure

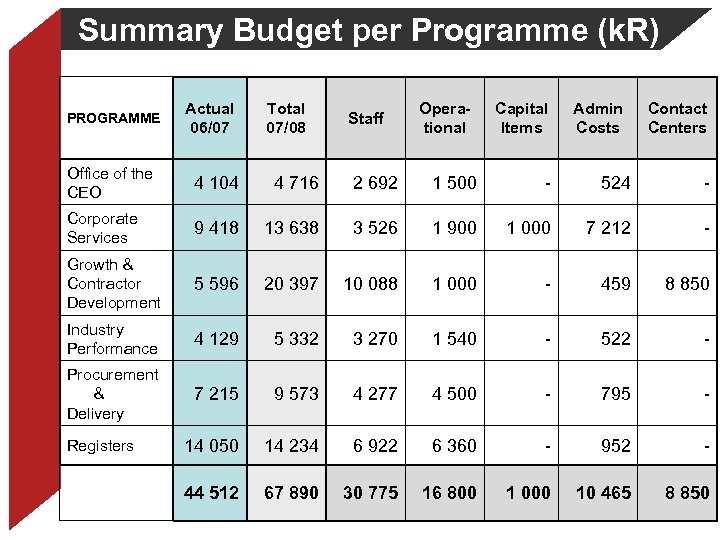

Summary Budget per Programme (k. R) PROGRAMME Actual 06/07 Total 07/08 Staff Operational Capital Items Admin Costs Contact Centers Office of the CEO 4 104 4 716 2 692 1 500 - 524 - Corporate Services 9 418 13 638 3 526 1 900 1 000 7 212 - Growth & Contractor Development 5 596 20 397 10 088 1 000 - 459 8 850 Industry Performance 4 129 5 332 3 270 1 540 - 522 - Procurement & Delivery 7 215 9 573 4 277 4 500 - 795 - 14 050 14 234 6 922 6 360 - 952 - 44 512 67 890 30 775 16 800 1 000 10 465 8 850 Registers

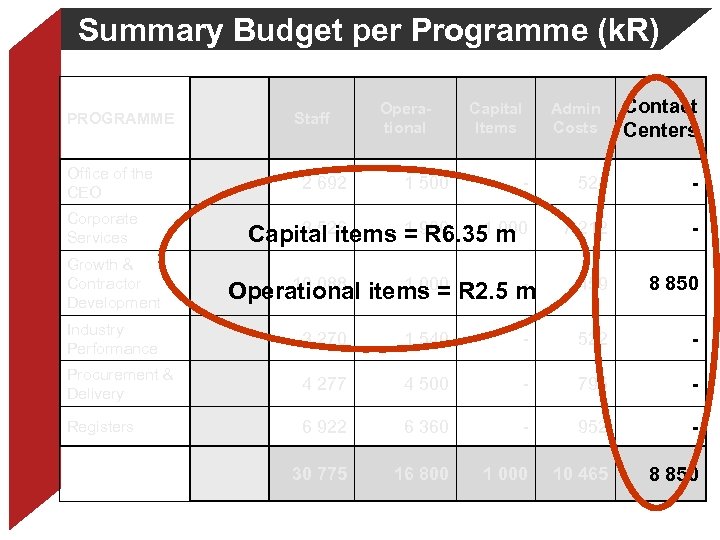

Summary Budget per Programme (k. R) PROGRAMME Office of the CEO Total Staff Operational Capital Items Admin Costs Contact Centers - 524 - Corporate Services 13 638 3 526 1 R 6. 35 000 Capital items = 900 1 m 7 212 - Growth & Contractor Development 20 397 459 8 850 Industry Performance 5 332 3 270 1 540 - 522 - Procurement & Delivery 9 573 4 277 4 500 - 795 - 14 234 6 922 6 360 - 952 - 67 890 30 775 16 800 1 000 10 465 8 850 Registers 4 716 2 692 1 500 10 088 1 000 Operational items = R 2. 5 m

………. . Thank You development through partnership

70362935cf37c7b72fbdab3da43b261a.ppt