92f63bd96813a47a270099b3c98ed824.ppt

- Количество слайдов: 76

Construction Defect Liability and Captives International Center for Captive Insurance Education Teleconference Presenters: Jim Boone, Alberici Group, Inc. Mike O’Neill, American Contractors Insurance Group Pat Wielinski, Cokinos, Bosien & Young, P. C. 1

Construction Defects Introduction: • Google search for “Construction Defects” yielded 1, 821, 000 hits in. 61 seconds. • Top three paid advertisers on the Google “Construction Defects” page were: #1 Southern California Plaintiff Law Firm #2 Construction Defects Expert Witness #3 Northern California Plaintiff Law Firm 2

Four Categories of Construction Defects The trial courts have recognized that construction defects are tangible and can typically be grouped into the following four major categories: Design Deficiencies • Sometimes design professionals, such as architects or engineers, design builders and systems that, from a performance standpoint, do not always work as intended or specified. • The motivation for the design may be form, function, aesthetics, or cost considerations, but the completed design could result and/or manifest into a defect. 3

Four Categories of Construction Defects Material Deficiencies • or when The use of inferior building materials can cause significant problems, such as windows that leak fail to perform and function adequately, even properly installed. • Example: siding, windows, roofs, plumbing, HVAC 4

Four Categories of Construction Defects Construction Deficiencies (Poor Quality or Substandard Workmanship) • Poor quality workmanship often manifests as water infiltration through some portion of the building structure. • Cracks in foundations, floor slabs, walls, dry rotting of wood or other building materials, termite or other pest infestations, electrical and mechanical problems, plumbing leaks and back-ups, lack of appropriate sound insulation and/or fire-resistive construction between adjacent housing units. 5

Four Categories of Construction Defects Subsurface/Geotechnical Problems • California, Colorado, and other parts of the country have a significant amount of expansive soil conditions. • As a result of this type of terrain, there have been many problems when housing subdivisions and/or developments are built into hills or other sloping areas where it’s difficult to provide a solid and/or stable foundation. 6

Four Categories of Construction Defects Subsurface/Geotechnical Problems (cont. ) • If the subsurface conditions in these subdivisions and/or developments are not properly compacted and prepare for adequate drainage, problems will inevitably result, which can include vertical and horizontal settlement (subsidence), movement (expansion), slope failures, flooding, and in extremely wet/rainy climates, landslides, etc. • These types of conditions typically lead to cracked foundations, floor slabs, and other damage to a building. 7

Four Categories of Construction Defects Subsurface/Geotechnical Problems (cont. ) • A worst-case scenario in some instances could render a building uninhabitable, as well as uninsurable. 8

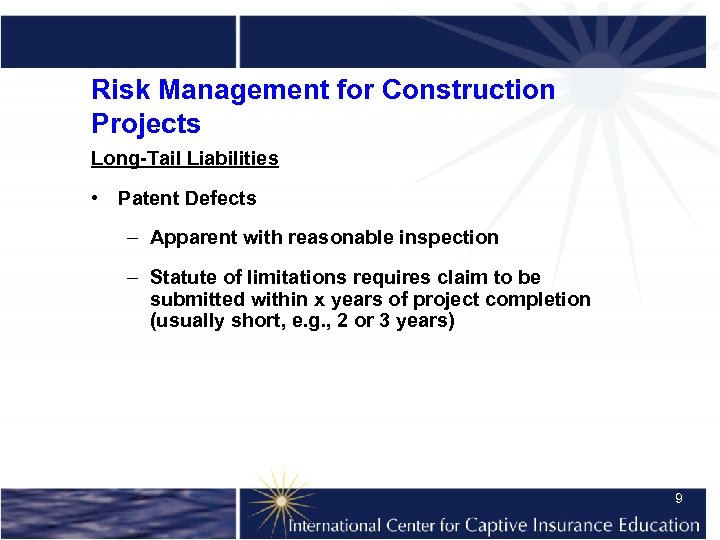

Risk Management for Construction Projects Long-Tail Liabilities • Patent Defects – Apparent with reasonable inspection – Statute of limitations requires claim to be submitted within x years of project completion (usually short, e. g. , 2 or 3 years) 9

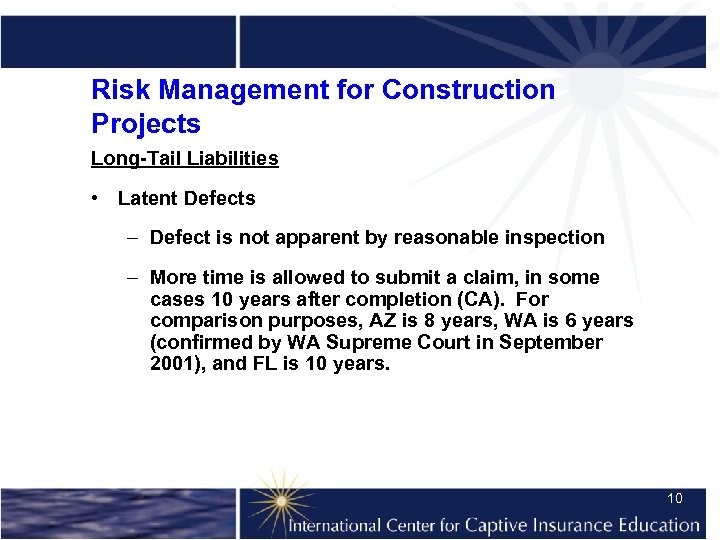

Risk Management for Construction Projects Long-Tail Liabilities • Latent Defects – Defect is not apparent by reasonable inspection – More time is allowed to submit a claim, in some cases 10 years after completion (CA). For comparison purposes, AZ is 8 years, WA is 6 years (confirmed by WA Supreme Court in September 2001), and FL is 10 years. 10

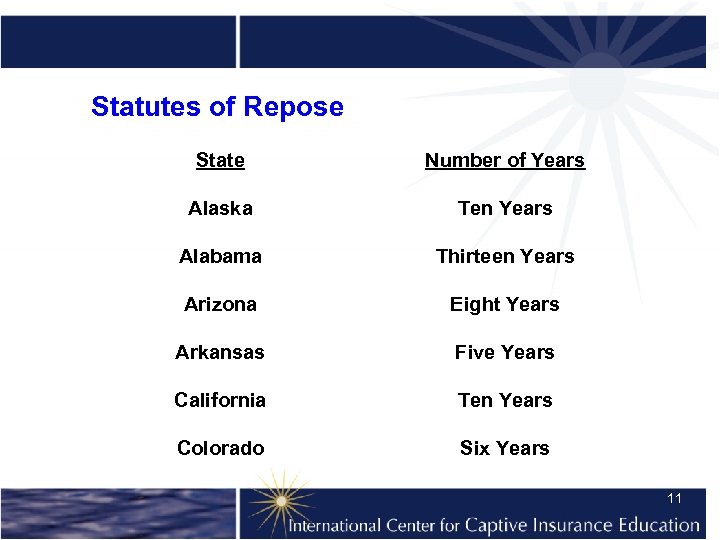

Statutes of Repose State Number of Years Alaska Ten Years Alabama Thirteen Years Arizona Eight Years Arkansas Five Years California Ten Years Colorado Six Years 11

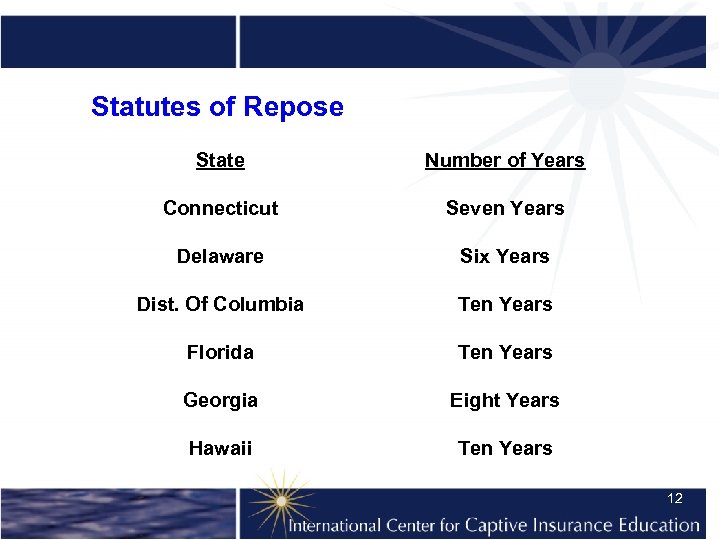

Statutes of Repose State Number of Years Connecticut Seven Years Delaware Six Years Dist. Of Columbia Ten Years Florida Ten Years Georgia Eight Years Hawaii Ten Years 12

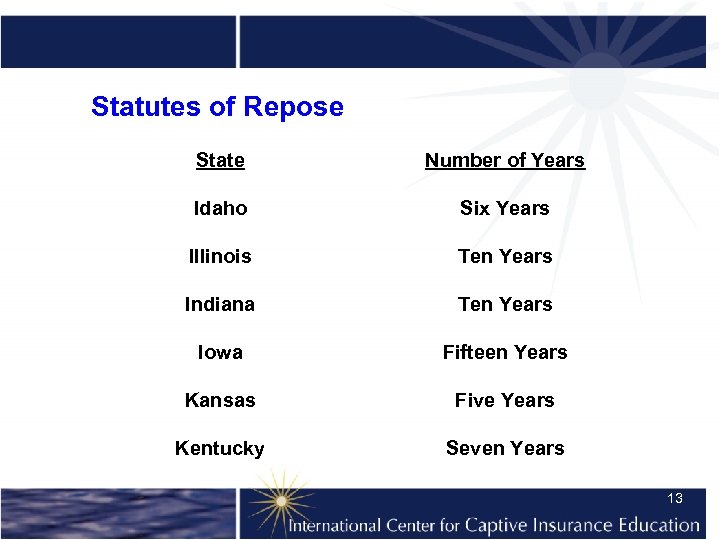

Statutes of Repose State Number of Years Idaho Six Years Illinois Ten Years Indiana Ten Years Iowa Fifteen Years Kansas Five Years Kentucky Seven Years 13

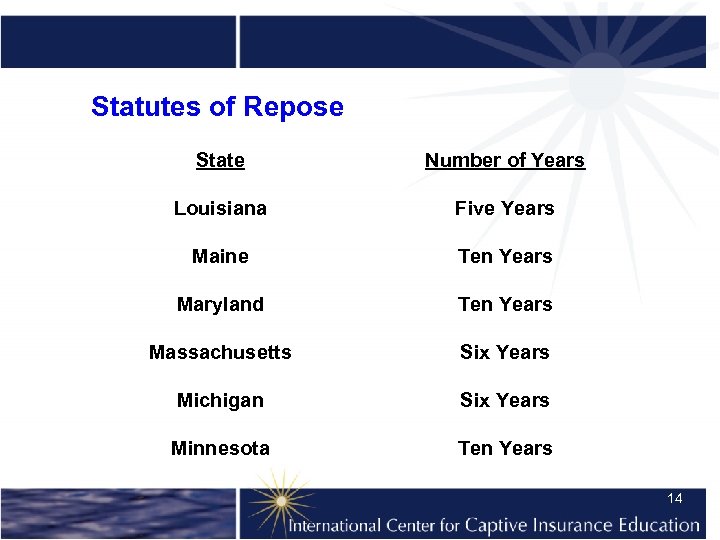

Statutes of Repose State Number of Years Louisiana Five Years Maine Ten Years Maryland Ten Years Massachusetts Six Years Michigan Six Years Minnesota Ten Years 14

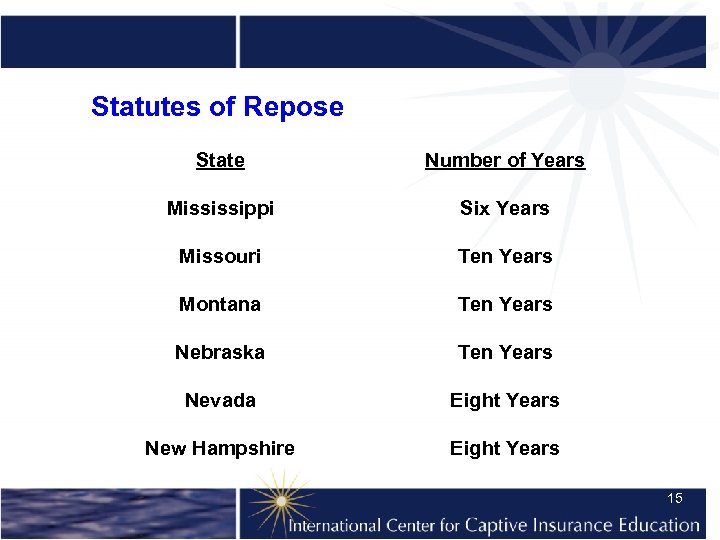

Statutes of Repose State Number of Years Mississippi Six Years Missouri Ten Years Montana Ten Years Nebraska Ten Years Nevada Eight Years New Hampshire Eight Years 15

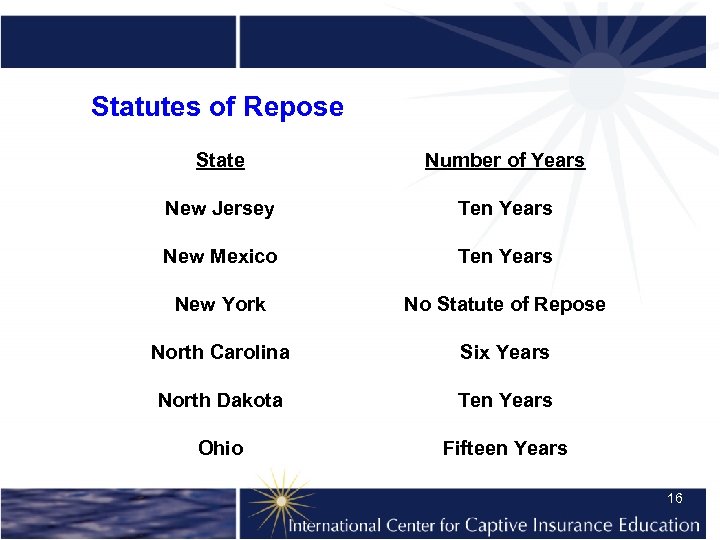

Statutes of Repose State Number of Years New Jersey Ten Years New Mexico Ten Years New York No Statute of Repose North Carolina Six Years North Dakota Ten Years Ohio Fifteen Years 16

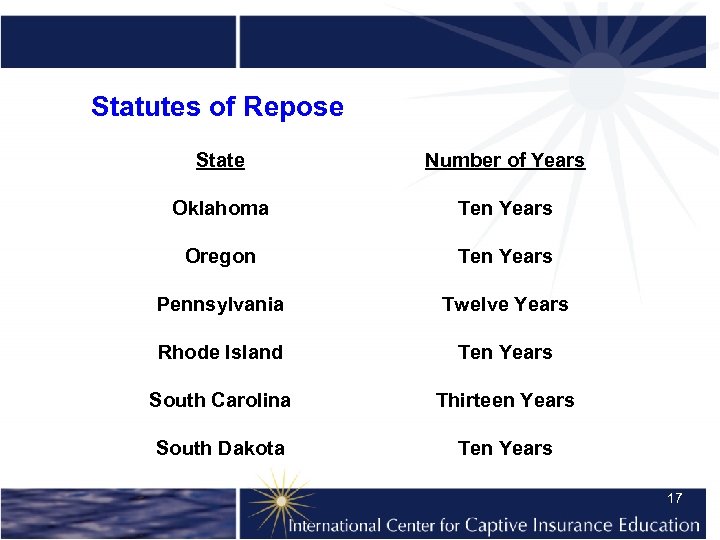

Statutes of Repose State Number of Years Oklahoma Ten Years Oregon Ten Years Pennsylvania Twelve Years Rhode Island Ten Years South Carolina Thirteen Years South Dakota Ten Years 17

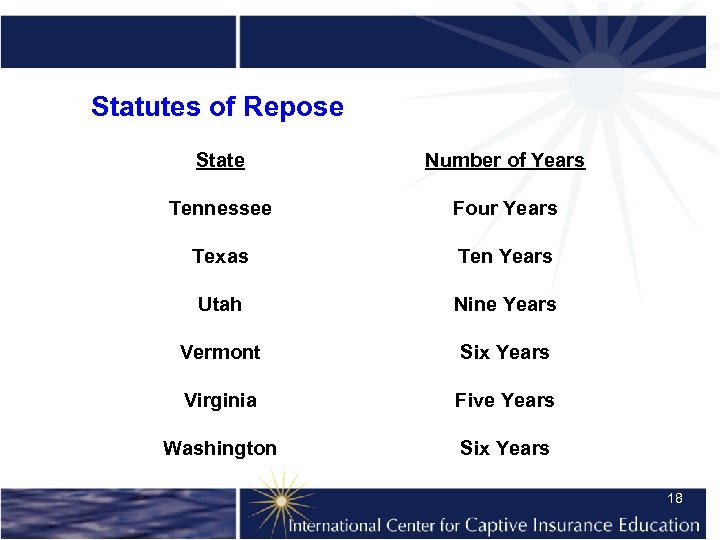

Statutes of Repose State Number of Years Tennessee Four Years Texas Ten Years Utah Nine Years Vermont Six Years Virginia Five Years Washington Six Years 18

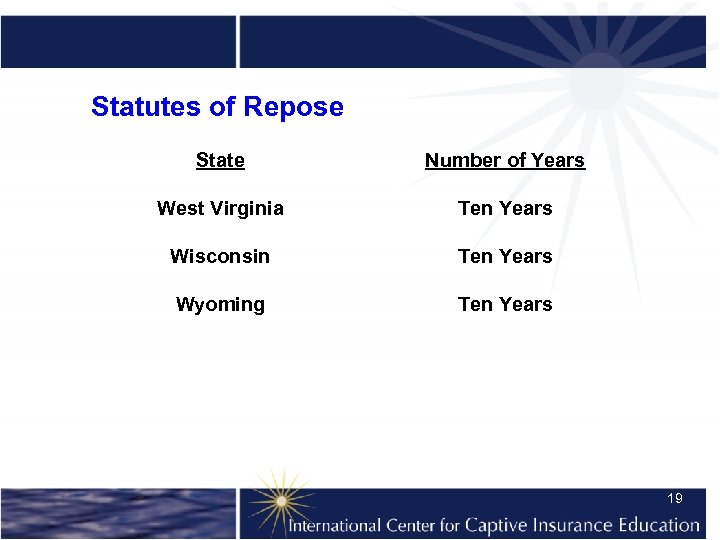

Statutes of Repose State Number of Years West Virginia Ten Years Wisconsin Ten Years Wyoming Ten Years 19

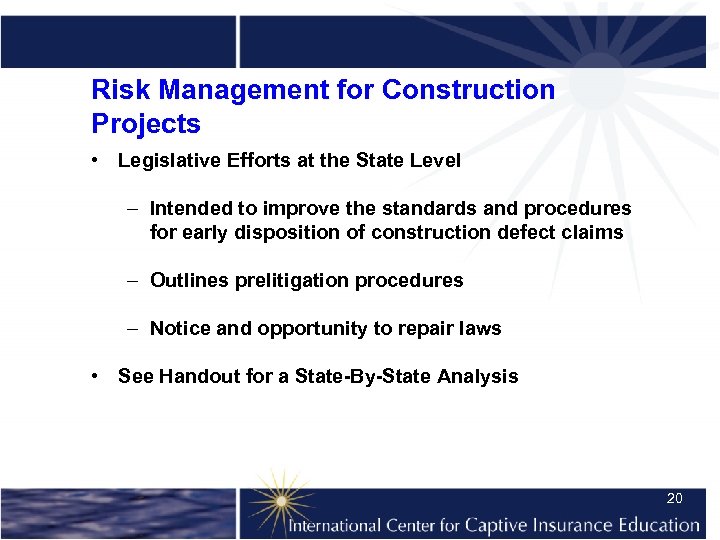

Risk Management for Construction Projects • Legislative Efforts at the State Level – Intended to improve the standards and procedures for early disposition of construction defect claims – Outlines prelitigation procedures – Notice and opportunity to repair laws • See Handout for a State-By-State Analysis 20

Definition of Occurrence • Traditional: property damage neither expected nor intended from the standpoint of the insured is an accident. • Recent: Property damage arising out of an insured contractor’s breach of contract or warranty is natural and foreseeable and not an accident. 21

Your Work Exclusion l. ‘Property Damage’ to ‘your work’ arising out of it or any part of it and included in the ‘products-completed operations hazard. ’ This exclusion does not apply if the damaged work or the work out of which the damage arises was performed on your behalf by a subcontractor. 22

Subcontractor Exception • Major inroad to the “Business Risk Doctrine” • “Subcontractor” is broadly construed to include many entities • Key to completed operations coverage • Source of classic judicial statements of coverage for defective work 23

Restrictive Endorsement CG 22 94 Exclusion 1. of Section I – Coverage A – Bodily Injury and Property Damage Liability is replaced by the following: This insurance does not apply to: “Property damage” to “your work” arising out of it or any part of it and included in the “products-completed operations hazard. ” 24

Additional Insured Endorsement CG 20 10 11 85 WHO IS AN INSURED (Section II) is amended to include as an insured the person or organization shown in the Schedule, but only with respect to liablity arising out of “your work” for that insured by or for you. 25

Additional Insured Endorsement CG 20 10 10 93 WHO IS AN INSURED (Section II) is amended to include as an insured the person or organization shown in the Schedule, but only with respect to liability arising out of your ongoing operations performed for that insured. 26

No More Sole Negligence Coverage Relevant 2004 Endorsement Language Section II – Who Is An Insured is amended to include as an additional insured the person(s) or organization(s) shown in the Schedule, but only with respect to liability for “bodily injury”, “property damage” or “personal and advertising injury” caused, in whole or in part, by: 1. your Your acts or omissions; or 2. The acts or omissions of those acting on ongoing the behalf; in the performance of your operations for the additional insured(s) at location(s) designated above. 27

Additional Insured Endorsement CG 20 37 07 04 WHO IS AN INSURED is amended to include as an insured the person or organization shown in the Schedule, but only with respect to liability arising out of ‘your work’ at the location designated and described in the schedule of this endorsement performed for that insured and included in the ‘products-completed operations hazard. ’ 28

Restrictive Endorsements Habitational Exclusions • Excludes “residential” construction as defined in the endorsement • Varies from insurer to insurer • Apartments, assisted living, condos, co-ops, hospitals, hotels, military housing, nursing homes, single family, dorms, townhouses, tract housing 29

CGL-Common Restrictive Endorsements • Mold • Silica • Lead • EIFS • Subsidence • Employment Practices 30

Controlled Insurance Programs - Pros 1. Reduce insurance costs through a. Projectwide buying power b. Improved loss experience c. Elimination of redundant coverages and premiums d. Reduced litigation between insurers 31

Controlled Insurance Programs - Pros 2. Lower expense factors 3. Improved insurance coverages and uniform policy limits 32

Controlled Insurance Programs - Pros 4. Superior claims management a. Uniform and coordinated claims handling b. Aggressive claim settlement c. Thorough investigation and supervision of claims d. Resist questionable claims e. Common defense – avoids “legal blackmail” f. Can contribute to superior customer relationships 33

Controlled Insurance Programs - Pros 5. Utilizes the general contractor’s relationship and experience with quality subcontractors 34

Controlled Insurance Programs - Cons 1. Complicated 2. Extended period of involvement after completion of project, the “tail” 3. Administrative intense 4. Substantial risk 5. Volatile costs 6. Unexpected cancellation from markets 35

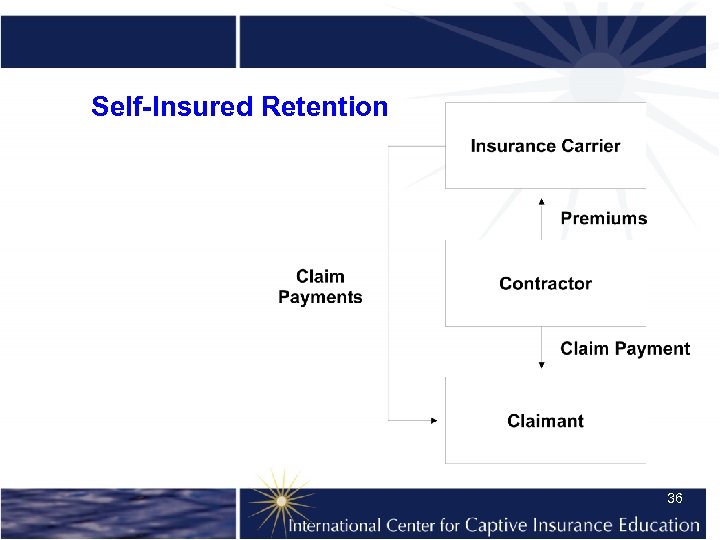

Self-Insured Retention 36

Self-Insured Retention Plan Characteristics • SIR applies on a per-occurrence basis to both indemnity and expense. • Insurer is under no obligation to defend, until the SIR amount has been funded. • In-house vs. TPA to handle losses within the SIR. • Tax Treatment - Premiums are deductible when paid. SIR losses deductible when paid. 37

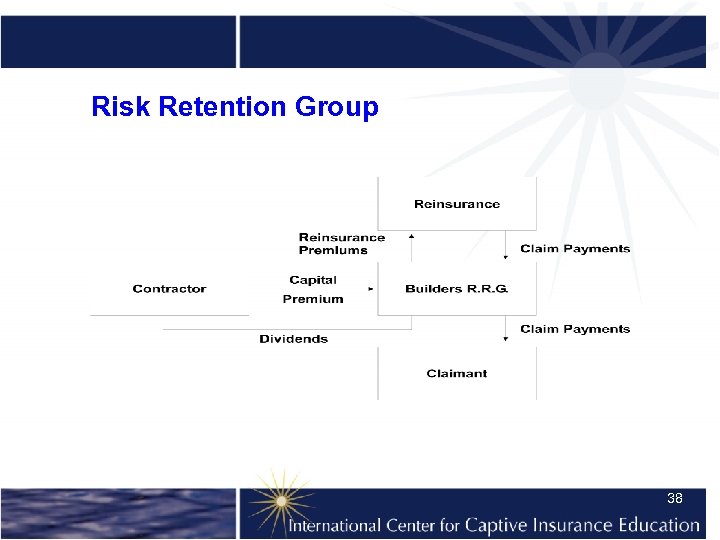

Risk Retention Group 38

Risk Retention Group Plan Characteristics • May need a front for certificates. • In-house TPA claim handling. • Thinly capitalized. • Limited risk retention capability. • Dependent on reinsurance. 39

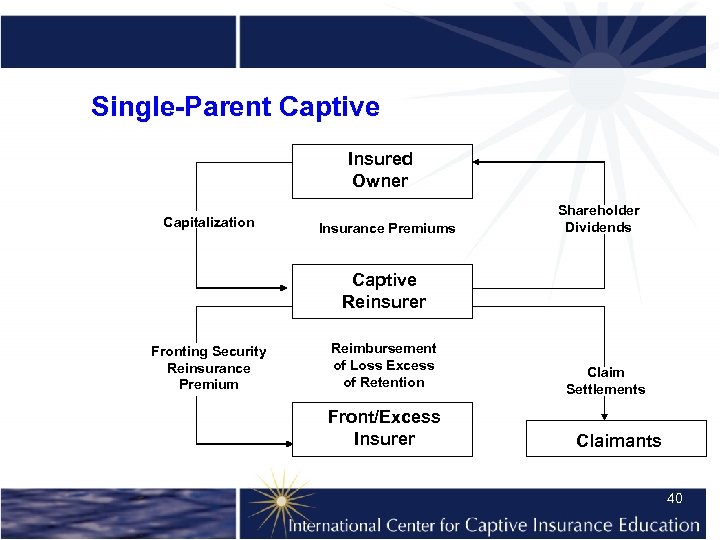

Single-Parent Captive Insured Owner Capitalization Insurance Premiums Shareholder Dividends Captive Reinsurer Fronting Security Reinsurance Premium Reimbursement of Loss Excess of Retention Front/Excess Insurer Claim Settlements Claimants 40

Single-Parent Captive • An insurance subsidiary created by the insured that allows the firm to participate in the underwriting risk and investment profits associated with the firm's risk financing program. • The captive is capitalized and premiums are paid to the captive. • The captive will retain a level of risk and purchase reinsurance for limits in excess of its retention. 41

Single Parent Captive • Tax issues: – Premiums generally deductible for federal income taxes – Dividends taxed similar to any stockholder's dividend – Return premiums taxed as ordinary income at the parent's rate 42

Single-Parent Captive • Fronting issues: – Workers compensation requires a front – Certificate holders may require a front for liability lines – Fronting costs are similar to the basic charges in a retro plan – Wind-down/runoff issues 43

Entity Structuring and Alter Ego Risks Entity selection • Sole proprietorship or dba • Partnership • Corporation • Limited liability company 44

Entity Structuring and Alter Ego Risks • Liability protection offered by corporations and LLCs 45

Entity Structuring and Alter Ego Risks • Use of single purpose entities (SPEs) 46

Entity Structuring and Alter Ego Risks Attacks on the protection of the entity • Alter ego (aka piercing the corporate veil) • Enterprise liability • Parent-subsidiary relationships • Substantive consolidation 47

Entity Structuring and Alter Ego Risks Practical tips for minimizing alter ego risks • Adequate capitalization • Observe formalities – Separate bank accounts, letterhead, contracting procedures – Meetings, minutes, resolutions 48

Entity Structuring and Alter Ego Risks • Intercompany relationships – Use of employees – Loans – Intercompany services – Transfers of assets • Adequate insurance 49

Entity Structuring and Alter Ego Risks Dissolution strategies • Post-dissolution liability of the entity • Post-dissolution liability of the partners, shareholders, members • Does the developer really want to dissolve the entity? 50

Alternative Dispute Resolution (ADR) Provisions Contracts • Alternative dispute resolution (ADR) provisions – Provision governing disputes between the owner or developer and the design professionals/subcontractors – Residential: Provision governing disputes involving homeowners or HOA – Alternatives: • • Mediation Bench trial, with waiver of jury trial Binding arbitration Rent-a-judge, special master 51

Quality Control Programs Why Are QC Programs Important? 1. A risk management best practice – avoid “designed in” defects and errors during construction 2. May be required by the developer’s CGL insurance program 52

Quality Control Programs QC during the design phase Objectives: Maximize constructability of the plans, consistency, code compliance, and appropriate product, material, and systems selections 53

Quality Control Programs • Develop procedures for peer review of plans and specifications • Establish criteria for selecting and managing peer review consultants, including methods for managing the paper trail 54

Quality Control Programs QC during construction operations Objectives: Inspect a statistically relevant sample of units and common area construction and document correct as-built conditions 55

Quality Control Programs • Establish criteria for selecting and managing QC consultants 56

Quality Control Programs • Obtain consultant guidance on the following: – Which components should be inspected? – When to inspect (stages of construction)? – Appropriate sample size – Procedures for identifying defects and for obtaining and documenting corrections – Some or all of these components may be dictated by the developer’s CGL insurance program 57

Quality Control Programs • Role of superintendents; obtaining contractor and subcontractor buy-in 58

Quality Control Programs • Training of subcontractors 59

Quality Control Programs • Consider risk-specific QC initiatives – Windows – Roofs – Other building envelope issues, particularly moisture intrusion – Acoustical issues – Other issues, rated by litigation claims potential 60

Quality Control Programs • Handling field changes or repairs during construction 61

Quality Control Programs • Red flags: – Value engineering – Design-build trades (may be outside coverage of developer’s CGL due to professional services exclusion) 62

Warranties Another powerful but underutilized risk management tool • Legal and practical consequences – Opportunity for disclosure and education – Reinforce ADR structure – Set and manage owners expectations – Owner maintenance 63

Warranties Warranty as the roadmap for performing customer service • Performance standards – Qualitative – Quantitative 64

Warranties Exclusions – Normal wear and tear – Acts of third parties or the homeowner – Lack of required maintenance – Acts of God – Claims covered by homeowners insurance 65

Warranties Stand-alone dispute resolution provisions – Notice, access, inspection, testing, repair – Mediation followed by binding arbitration 66

Warranties Duration of the warranty • One-year warranties increasingly are outdated, may depend on particular system • Relationship of the express warranty to statutes of limitations and statutes of repose 67

Warranties Transferability to subsequent purchasers Binding on subsequent purchasers? 68

Design and Implement Customer Service Program Why customer service is critical: • Radar function and litigation avoidance 69

Design and Implement Customer Service Program When does the customer service process begin and end? • Walk-through – the handoff • Relationship between customer service and statutes of limitations/statutes of repose • Repairs toll (stop the running of) statutes of limitations 70

Design and Implement Customer Service Program Documentation – practical tips • Get it in writing • Make your record • Be objective (don’t editorialize or speculate) • Be precise about dates (tolling of statutes of limitations) • Develop a customer service database and tracking system 71

Design and Implement Customer Service Program Develop issue-specific protocols for high-risk claims • Water intrusion • Mold • Acoustical • Soils • Other 72

Design and Implement Customer Service Program • Train customer service representatives on maintenance manuals and warranties 73

Record Retention Policies Why is record retention important for developers? • Long tail liabilities • Delayed manifestation of defects • Statutes of repose • Critical to defense of claims, prosecution of crossclaims, and insurance recovery 74

Record Retention Policies Effective record retention allows developers to: • Identify potentially responsible parties • Identify potential witnesses • Compile contracts and insurance information from other parties • Marshal the developer’s direct insurance resources 75

Record Retention Policies Effective record retention allows developers to: • Retrieve QC inspection records to demonstrate correct as-built conditions • Help establish defenses, such as statutes of limitations and comparative fault 76

92f63bd96813a47a270099b3c98ed824.ppt