793265fd9138bda22fcbf9064e4c5eb6.ppt

- Количество слайдов: 27

“Constructed” preferences n n Study effects relative to “complete, transitive” u(x) “Constructed” means expression of preference is like problemsolving: n n n n Will you vote for John Kerry? Answered by rapid intuition (tall, good hair) and deliberate logic (positions on issues) Context-dependence (comparative) Description-dependent “framing (descriptions guide attention) Reference-dependence (changes, not levels; anchoring) Some values “protected”/sacred (health, environment) Is too much choice bad? Open questions: n n Are effects smaller with familiar choices? Experts? Markets? New predictions (e. g. “big tip” labor supply experiment)

“Constructed” preferences n n Study effects relative to “complete, transitive” u(x) “Constructed” means expression of preference is like problemsolving: n n n n Will you vote for John Kerry? Answered by rapid intuition (tall, good hair) and deliberate logic (positions on issues) Context-dependence (comparative) Description-dependent “framing (descriptions guide attention) Reference-dependence (changes, not levels; anchoring) Some values “protected”/sacred (health, environment) Is too much choice bad? Open questions: n n Are effects smaller with familiar choices? Experts? Markets? New predictions (e. g. “big tip” labor supply experiment)

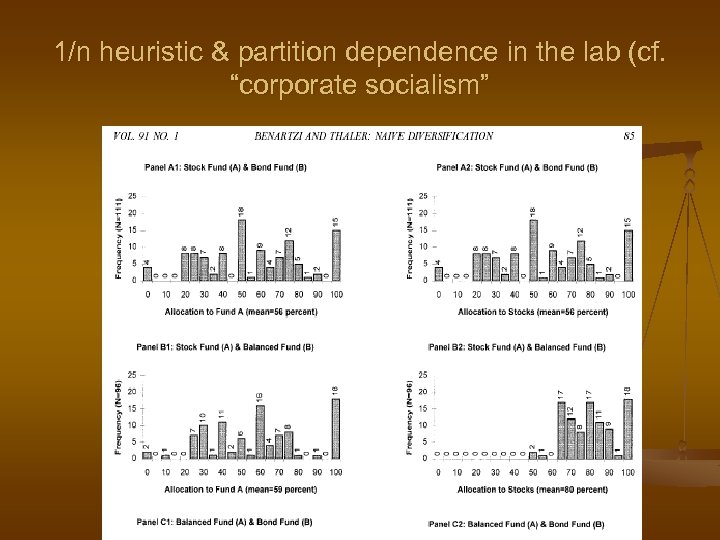

1/n heuristic & partition dependence in the lab (cf. “corporate socialism”

1/n heuristic & partition dependence in the lab (cf. “corporate socialism”

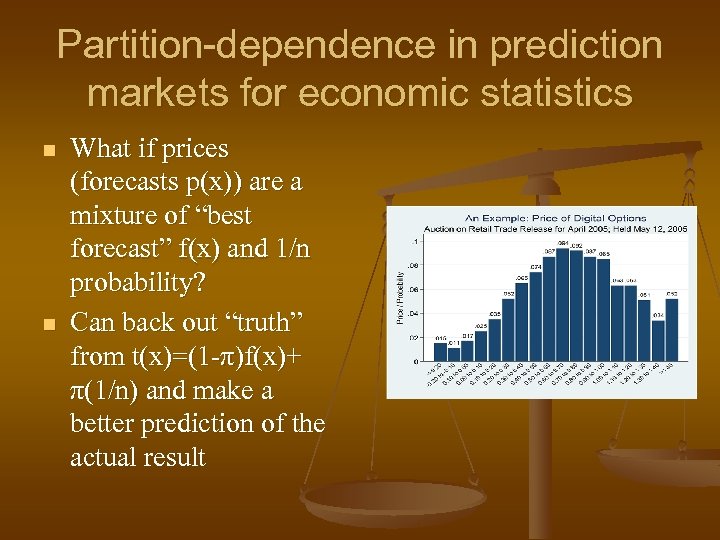

Partition-dependence in prediction markets for economic statistics n n What if prices (forecasts p(x)) are a mixture of “best forecast” f(x) and 1/n probability? Can back out “truth” from t(x)=(1 -π)f(x)+ π(1/n) and make a better prediction of the actual result

Partition-dependence in prediction markets for economic statistics n n What if prices (forecasts p(x)) are a mixture of “best forecast” f(x) and 1/n probability? Can back out “truth” from t(x)=(1 -π)f(x)+ π(1/n) and make a better prediction of the actual result

Context-dependence (comparative) n Objects judged relative to others in a choice set Asymmetric dominance n Compromise effects n n Economic question: What is seller’s optimal choice set given contextdependent preferences?

Context-dependence (comparative) n Objects judged relative to others in a choice set Asymmetric dominance n Compromise effects n n Economic question: What is seller’s optimal choice set given contextdependent preferences?

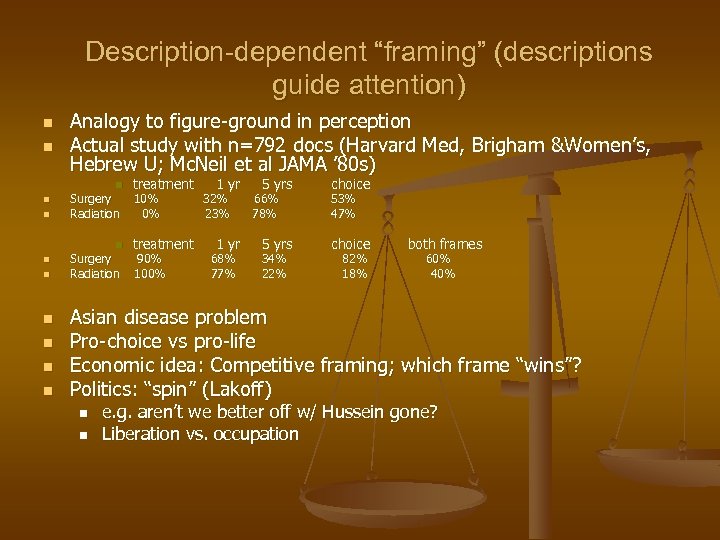

Description-dependent “framing” (descriptions guide attention) n n Analogy to figure-ground in perception Actual study with n=792 docs (Harvard Med, Brigham &Women’s, Hebrew U; Mc. Neil et al JAMA ’ 80 s) n n n Surgery Radiation treatment 10% 0% treatment 90% 100% 1 yr 32% 23% 1 yr 68% 77% 5 yrs choice 66% 78% 34% 22% 53% 47% 82% 18% both frames 60% 40% Asian disease problem Pro-choice vs pro-life Economic idea: Competitive framing; which frame “wins”? Politics: “spin” (Lakoff) n n e. g. aren’t we better off w/ Hussein gone? Liberation vs. occupation

Description-dependent “framing” (descriptions guide attention) n n Analogy to figure-ground in perception Actual study with n=792 docs (Harvard Med, Brigham &Women’s, Hebrew U; Mc. Neil et al JAMA ’ 80 s) n n n Surgery Radiation treatment 10% 0% treatment 90% 100% 1 yr 32% 23% 1 yr 68% 77% 5 yrs choice 66% 78% 34% 22% 53% 47% 82% 18% both frames 60% 40% Asian disease problem Pro-choice vs pro-life Economic idea: Competitive framing; which frame “wins”? Politics: “spin” (Lakoff) n n e. g. aren’t we better off w/ Hussein gone? Liberation vs. occupation

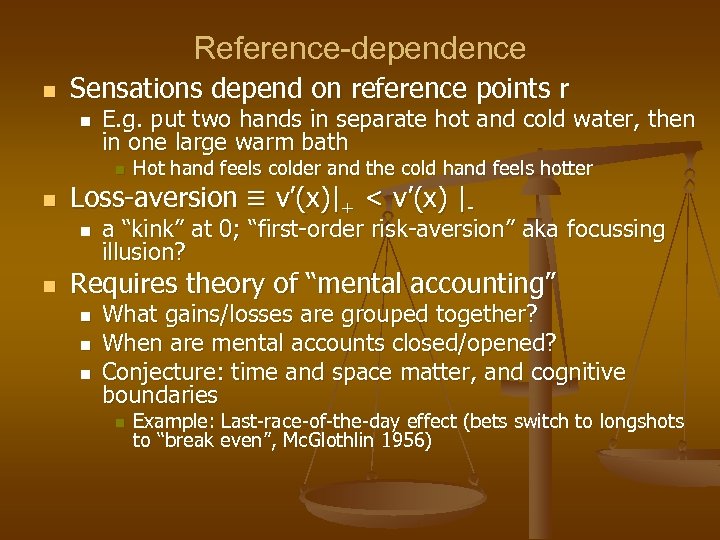

Reference-dependence n Sensations depend on reference points r n E. g. put two hands in separate hot and cold water, then in one large warm bath n n Loss-aversion ≡ v’(x)|+ < v’(x) |n n Hot hand feels colder and the cold hand feels hotter a “kink” at 0; “first-order risk-aversion” aka focussing illusion? Requires theory of “mental accounting” n n n What gains/losses are grouped together? When are mental accounts closed/opened? Conjecture: time and space matter, and cognitive boundaries n Example: Last-race-of-the-day effect (bets switch to longshots to “break even”, Mc. Glothlin 1956)

Reference-dependence n Sensations depend on reference points r n E. g. put two hands in separate hot and cold water, then in one large warm bath n n Loss-aversion ≡ v’(x)|+ < v’(x) |n n Hot hand feels colder and the cold hand feels hotter a “kink” at 0; “first-order risk-aversion” aka focussing illusion? Requires theory of “mental accounting” n n n What gains/losses are grouped together? When are mental accounts closed/opened? Conjecture: time and space matter, and cognitive boundaries n Example: Last-race-of-the-day effect (bets switch to longshots to “break even”, Mc. Glothlin 1956)

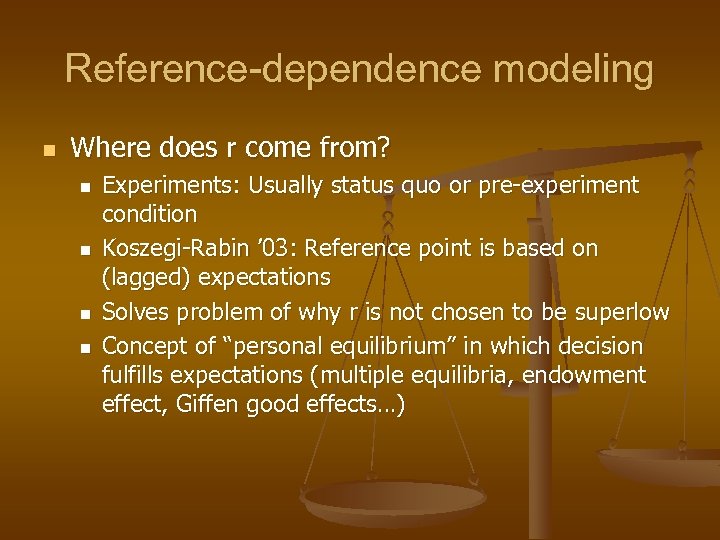

Reference-dependence modeling n Where does r come from? n n Experiments: Usually status quo or pre-experiment condition Koszegi-Rabin ’ 03: Reference point is based on (lagged) expectations Solves problem of why r is not chosen to be superlow Concept of “personal equilibrium” in which decision fulfills expectations (multiple equilibria, endowment effect, Giffen good effects…)

Reference-dependence modeling n Where does r come from? n n Experiments: Usually status quo or pre-experiment condition Koszegi-Rabin ’ 03: Reference point is based on (lagged) expectations Solves problem of why r is not chosen to be superlow Concept of “personal equilibrium” in which decision fulfills expectations (multiple equilibria, endowment effect, Giffen good effects…)

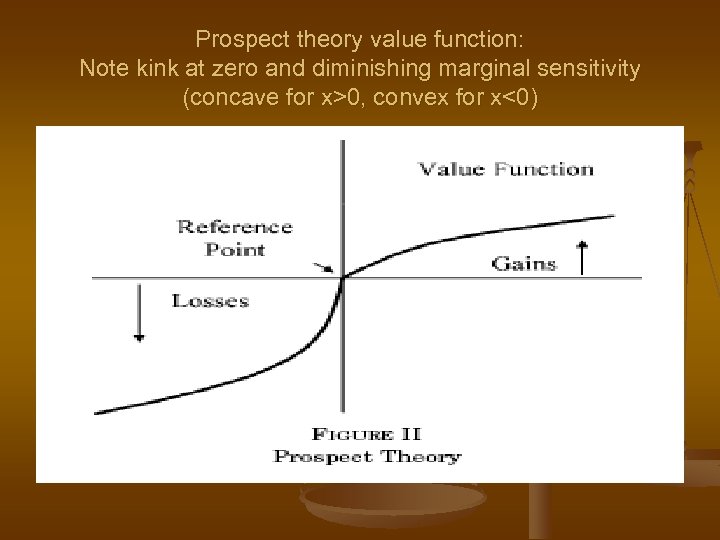

Prospect theory value function: Note kink at zero and diminishing marginal sensitivity (concave for x>0, convex for x<0)

Prospect theory value function: Note kink at zero and diminishing marginal sensitivity (concave for x>0, convex for x<0)

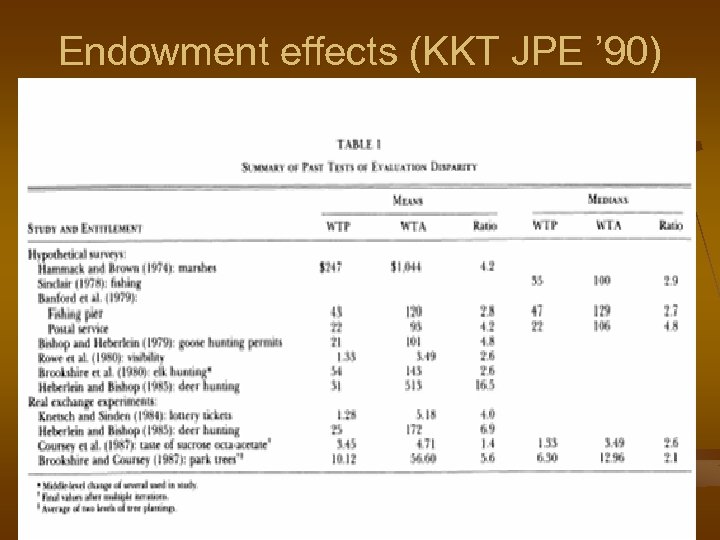

Endowment effects (KKT JPE ’ 90)

Endowment effects (KKT JPE ’ 90)

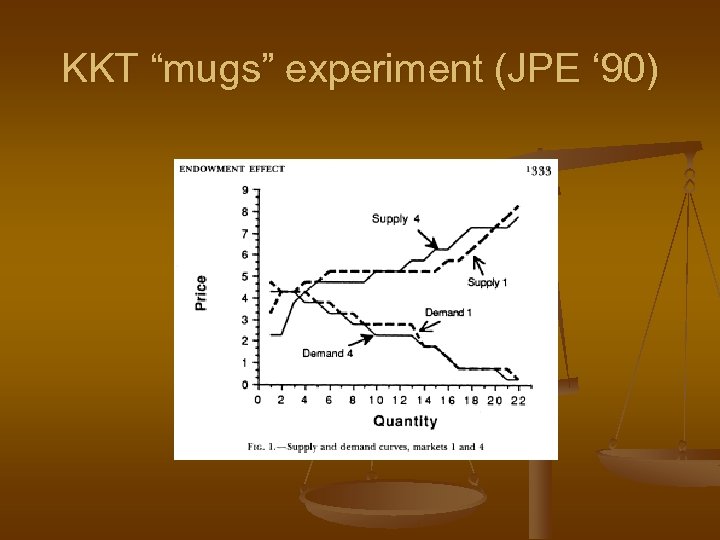

KKT “mugs” experiment (JPE ‘ 90)

KKT “mugs” experiment (JPE ‘ 90)

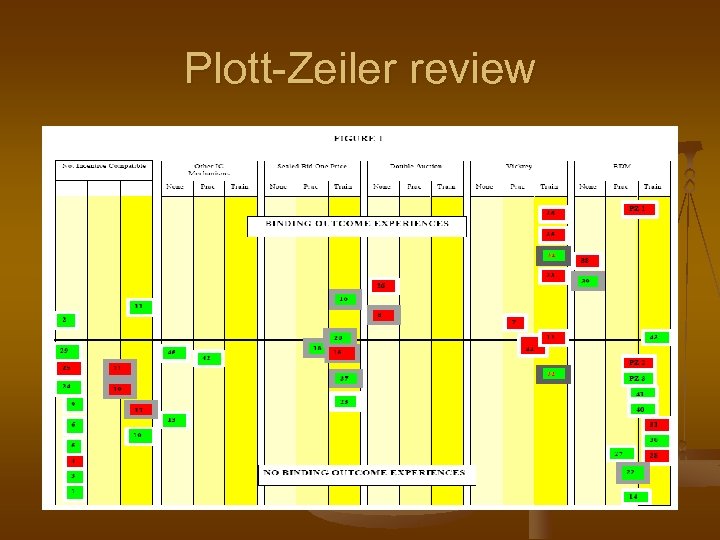

Plott-Zeiler review

Plott-Zeiler review

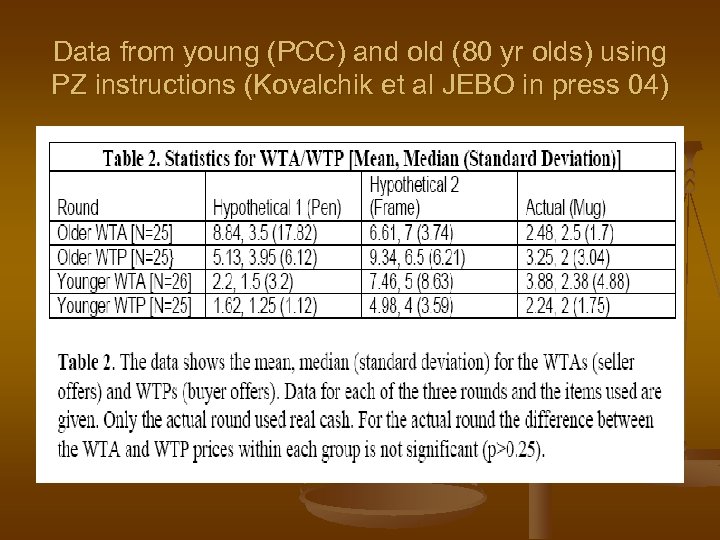

Data from young (PCC) and old (80 yr olds) using PZ instructions (Kovalchik et al JEBO in press 04)

Data from young (PCC) and old (80 yr olds) using PZ instructions (Kovalchik et al JEBO in press 04)

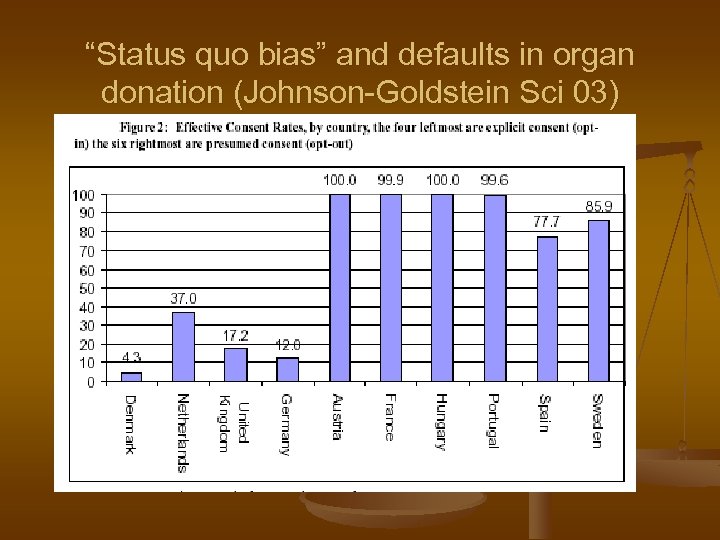

“Status quo bias” and defaults in organ donation (Johnson-Goldstein Sci 03)

“Status quo bias” and defaults in organ donation (Johnson-Goldstein Sci 03)

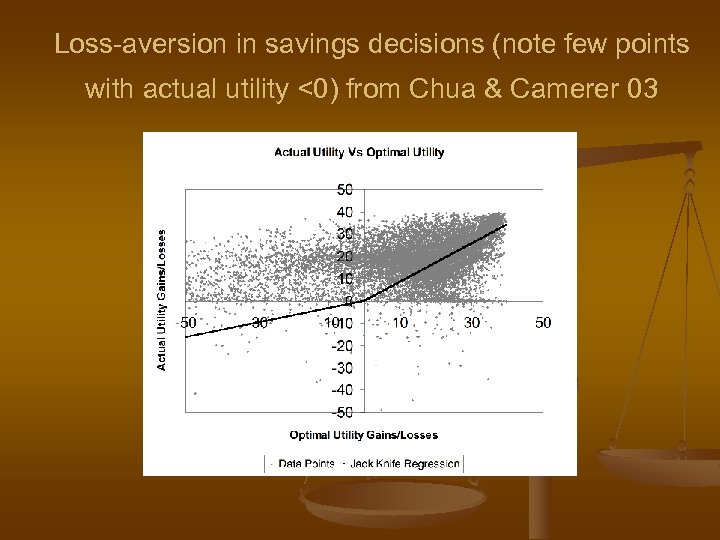

Loss-aversion in savings decisions (note few points with actual utility <0) from Chua & Camerer 03

Loss-aversion in savings decisions (note few points with actual utility <0) from Chua & Camerer 03

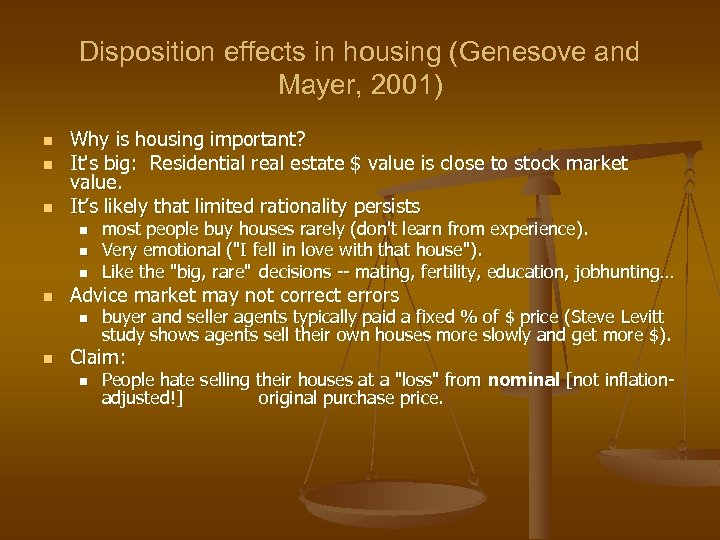

Disposition effects in housing (Genesove and Mayer, 2001) n n n Why is housing important? It's big: Residential real estate $ value is close to stock market value. It’s likely that limited rationality persists n n Advice market may not correct errors n n most people buy houses rarely (don't learn from experience). Very emotional ("I fell in love with that house"). Like the "big, rare" decisions -- mating, fertility, education, jobhunting… buyer and seller agents typically paid a fixed % of $ price (Steve Levitt study shows agents sell their own houses more slowly and get more $). Claim: n People hate selling their houses at a "loss" from nominal [not inflationadjusted!] original purchase price.

Disposition effects in housing (Genesove and Mayer, 2001) n n n Why is housing important? It's big: Residential real estate $ value is close to stock market value. It’s likely that limited rationality persists n n Advice market may not correct errors n n most people buy houses rarely (don't learn from experience). Very emotional ("I fell in love with that house"). Like the "big, rare" decisions -- mating, fertility, education, jobhunting… buyer and seller agents typically paid a fixed % of $ price (Steve Levitt study shows agents sell their own houses more slowly and get more $). Claim: n People hate selling their houses at a "loss" from nominal [not inflationadjusted!] original purchase price.

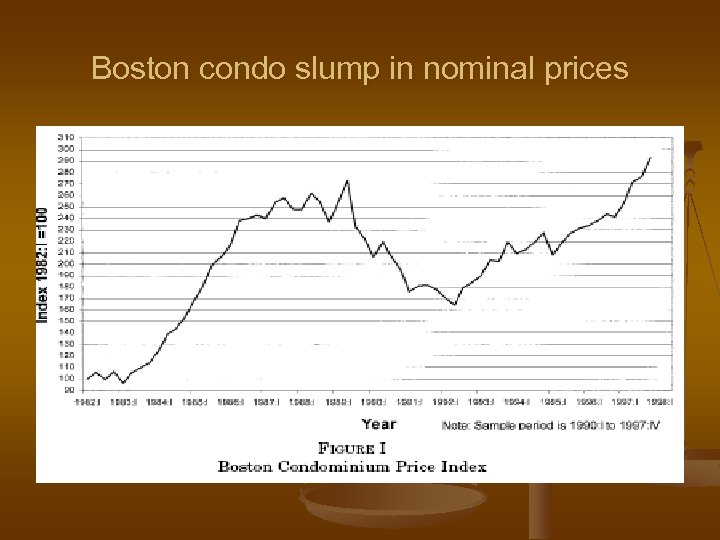

Boston condo slump in nominal prices

Boston condo slump in nominal prices

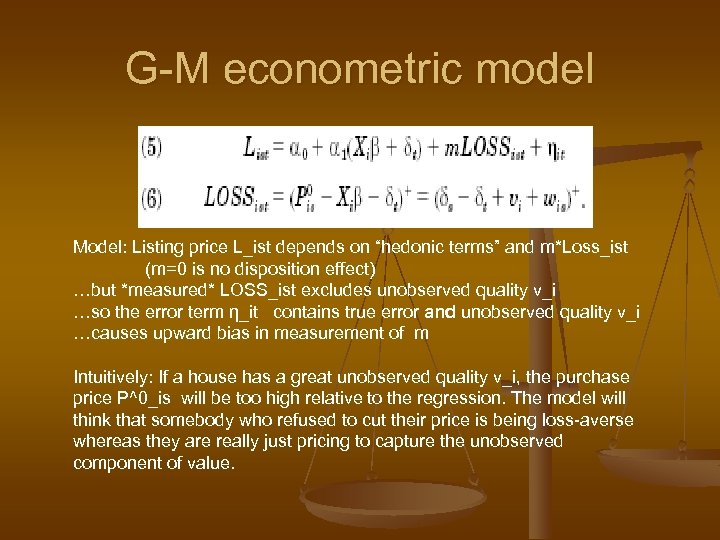

G-M econometric model Model: Listing price L_ist depends on “hedonic terms” and m*Loss_ist (m=0 is no disposition effect) …but *measured* LOSS_ist excludes unobserved quality v_i …so the error term η_it contains true error and unobserved quality v_i …causes upward bias in measurement of m Intuitively: If a house has a great unobserved quality v_i, the purchase price P^0_is will be too high relative to the regression. The model will think that somebody who refused to cut their price is being loss-averse whereas they are really just pricing to capture the unobserved component of value.

G-M econometric model Model: Listing price L_ist depends on “hedonic terms” and m*Loss_ist (m=0 is no disposition effect) …but *measured* LOSS_ist excludes unobserved quality v_i …so the error term η_it contains true error and unobserved quality v_i …causes upward bias in measurement of m Intuitively: If a house has a great unobserved quality v_i, the purchase price P^0_is will be too high relative to the regression. The model will think that somebody who refused to cut their price is being loss-averse whereas they are really just pricing to capture the unobserved component of value.

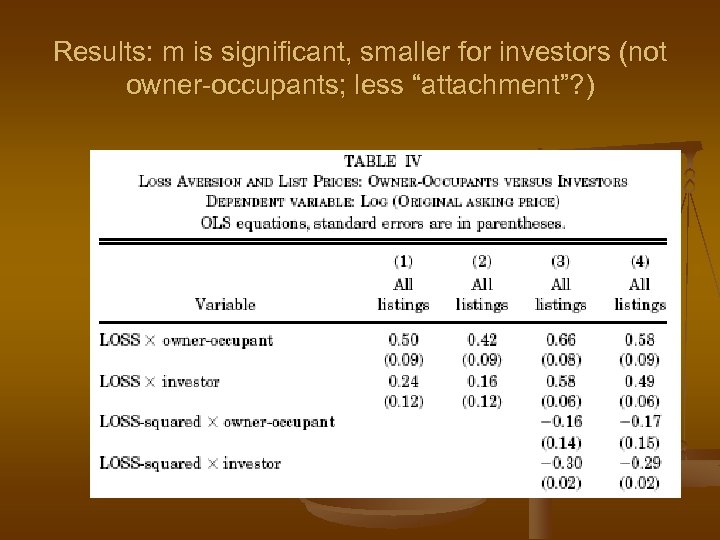

Results: m is significant, smaller for investors (not owner-occupants; less “attachment”? )

Results: m is significant, smaller for investors (not owner-occupants; less “attachment”? )

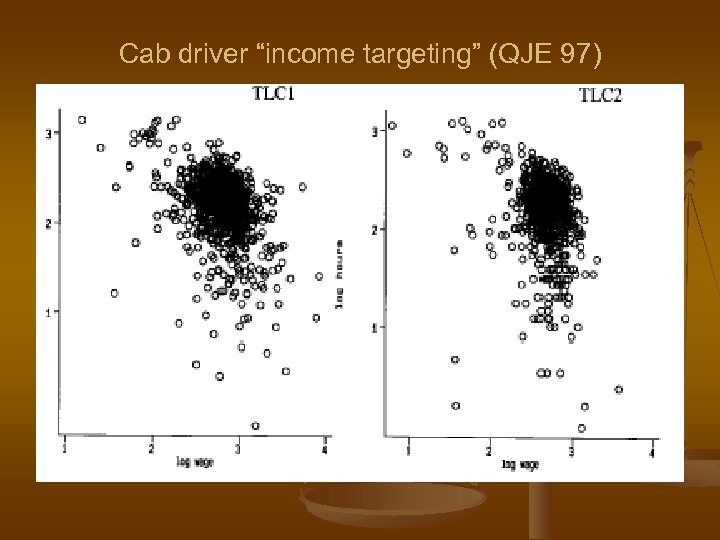

Cab driver “income targeting” (QJE 97)

Cab driver “income targeting” (QJE 97)

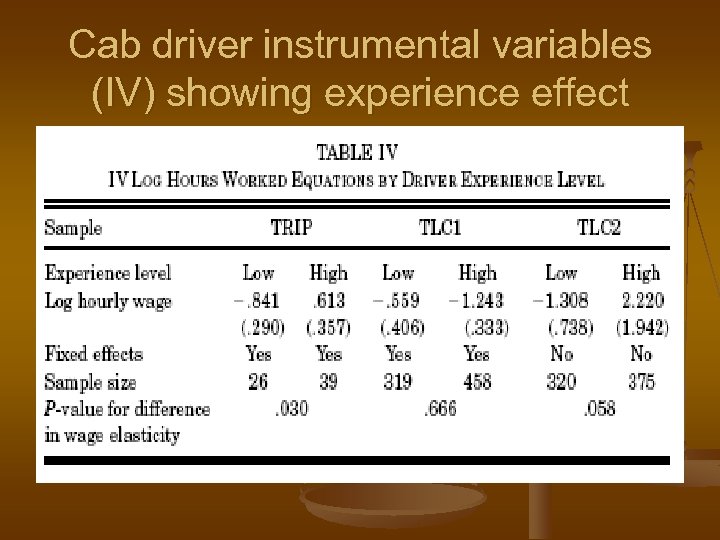

Cab driver instrumental variables (IV) showing experience effect

Cab driver instrumental variables (IV) showing experience effect

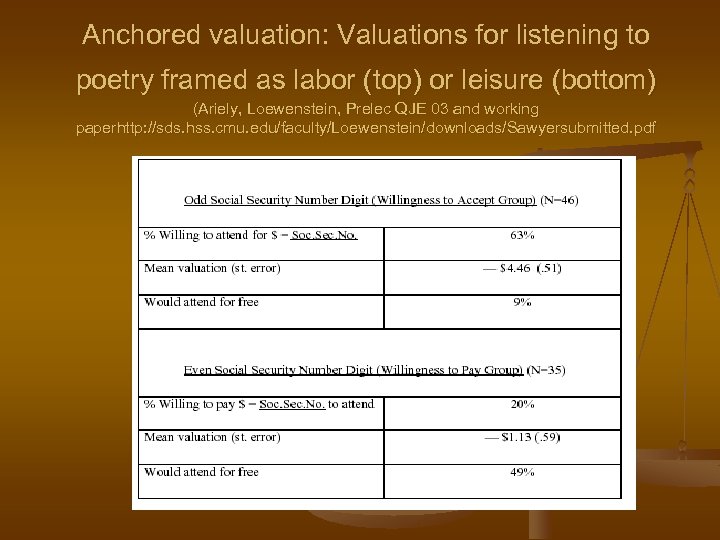

Anchored valuation: Valuations for listening to poetry framed as labor (top) or leisure (bottom) (Ariely, Loewenstein, Prelec QJE 03 and working paperhttp: //sds. hss. cmu. edu/faculty/Loewenstein/downloads/Sawyersubmitted. pdf

Anchored valuation: Valuations for listening to poetry framed as labor (top) or leisure (bottom) (Ariely, Loewenstein, Prelec QJE 03 and working paperhttp: //sds. hss. cmu. edu/faculty/Loewenstein/downloads/Sawyersubmitted. pdf

“Arbitrary” valuations n n Stock prices? Wages (what are different jobs really worth? ) n n n Depends on value to firm (hard to measure) & “compensating differentials/disutility (hard to measure) Exotic new products Housing (SF Pittsburgh tend to buy “too much house”; Simonsohn and Loewenstein 03) Exec comp'n (govt e. g. $150 k for senator, vs CEO's, $38. 5 million Britney Spears)

“Arbitrary” valuations n n Stock prices? Wages (what are different jobs really worth? ) n n n Depends on value to firm (hard to measure) & “compensating differentials/disutility (hard to measure) Exotic new products Housing (SF Pittsburgh tend to buy “too much house”; Simonsohn and Loewenstein 03) Exec comp'n (govt e. g. $150 k for senator, vs CEO's, $38. 5 million Britney Spears)

What econ. would happen if valuations are arbitrary? n n n n n Perfect competition price=marginal cost…anchoring influences quantity, not price; expect large Q variations for similar products Attempts to influence the anchor (QVC home shopping, etc. , "for you just $59. 95”). Advertising!!! If social comparison/imitation is an anchor, expect geographical, temporal, social clustering (see this in law & medical practice) E. g. , CEO pay linked to pay of Directors on Board's comp'n committee. Geographical differences in housing prices, London, Tokyo, NYC, SF. Interindustry wage differentials for the same work (Stanford contracts out janitorial service so it doesn't have to pay as much; cf. airline security personnel? ? ) Sports salaries: $100 k/yr Miami Dolphins 1972 vs $10 million/yr modern football Huge rise in CEO comp'n from 1990 (42 times worker wage) to 2000 (531 times); big differentials between US and Europe Consumers who are most anchorable or influenceable will be most faddish -- children and toys!!? (Mc. Donald's happy meal etc)

What econ. would happen if valuations are arbitrary? n n n n n Perfect competition price=marginal cost…anchoring influences quantity, not price; expect large Q variations for similar products Attempts to influence the anchor (QVC home shopping, etc. , "for you just $59. 95”). Advertising!!! If social comparison/imitation is an anchor, expect geographical, temporal, social clustering (see this in law & medical practice) E. g. , CEO pay linked to pay of Directors on Board's comp'n committee. Geographical differences in housing prices, London, Tokyo, NYC, SF. Interindustry wage differentials for the same work (Stanford contracts out janitorial service so it doesn't have to pay as much; cf. airline security personnel? ? ) Sports salaries: $100 k/yr Miami Dolphins 1972 vs $10 million/yr modern football Huge rise in CEO comp'n from 1990 (42 times worker wage) to 2000 (531 times); big differentials between US and Europe Consumers who are most anchorable or influenceable will be most faddish -- children and toys!!? (Mc. Donald's happy meal etc)

Is too much choice bad? n Jams study (Iyengar-Lepper): n n n Assignment study: n n n Short list Long list 40% stopped, 30% purchased 60% stopped, 3% purchased 74% did the extra credit assignment 60% did the extra credit assignment Participation in 401(k) goes down 2% for every 10 extra funds Shoe salesman: Never show more than 3 pairs of shoes… Medical n n 6 jams 24 jams 65% of nonpatients said they would want to be in charge of medical treatment…but only 12% of ex-cancer patients said they would Camerer conjecture: The curse of the composite n n Paraphrased personals ad: “I want a man with the good looks of Brad Pitt, the compassion of Denzel Washington…” Is there “too much” mate choice in big cities?

Is too much choice bad? n Jams study (Iyengar-Lepper): n n n Assignment study: n n n Short list Long list 40% stopped, 30% purchased 60% stopped, 3% purchased 74% did the extra credit assignment 60% did the extra credit assignment Participation in 401(k) goes down 2% for every 10 extra funds Shoe salesman: Never show more than 3 pairs of shoes… Medical n n 6 jams 24 jams 65% of nonpatients said they would want to be in charge of medical treatment…but only 12% of ex-cancer patients said they would Camerer conjecture: The curse of the composite n n Paraphrased personals ad: “I want a man with the good looks of Brad Pitt, the compassion of Denzel Washington…” Is there “too much” mate choice in big cities?

Choice-aversion n How to model “too much choice”? n n Anticipated regret from making a mistake “grass is greener”/buyer’s remorse Direct disutility for too-large choice set (e. g. too complex) Policy question: n n Markets are good at expanding choice…what is a good institution for limiting choice? Example: Bottled water in supermarkets Limit “useless” substitution? What is the right amount? Pro-govt example: Swedish privatized social security n n n Offered hundreds of funds Default fund is low-fee global index (not too popular) Most popular fund is local tech, down 80% 1 st yr

Choice-aversion n How to model “too much choice”? n n Anticipated regret from making a mistake “grass is greener”/buyer’s remorse Direct disutility for too-large choice set (e. g. too complex) Policy question: n n Markets are good at expanding choice…what is a good institution for limiting choice? Example: Bottled water in supermarkets Limit “useless” substitution? What is the right amount? Pro-govt example: Swedish privatized social security n n n Offered hundreds of funds Default fund is low-fee global index (not too popular) Most popular fund is local tech, down 80% 1 st yr

Experimental markets & prob judgment 1. Abstract stimuli vs natural events? ? pro: can precisely control information of individuals can conpute a Bayesian prediction con: maybe be fundamentally different mechanisms than for concrete events. . . 2. Do markets eliminate biases? Yes: specialization n n n Market is a dollar-weighted average opinion Uninformed traders follow informed ones Bankruptcy No: Short-selling constraints Confidence (and trade size) uncorrelated with information Camerer (1987): Experience reduces pricing biases but *increases* allocation biases Contingent claims markets: Markets enforce correct prices. . BUT probability judgment influences allocations and volume of trade (example: Iowa political markets)

Experimental markets & prob judgment 1. Abstract stimuli vs natural events? ? pro: can precisely control information of individuals can conpute a Bayesian prediction con: maybe be fundamentally different mechanisms than for concrete events. . . 2. Do markets eliminate biases? Yes: specialization n n n Market is a dollar-weighted average opinion Uninformed traders follow informed ones Bankruptcy No: Short-selling constraints Confidence (and trade size) uncorrelated with information Camerer (1987): Experience reduces pricing biases but *increases* allocation biases Contingent claims markets: Markets enforce correct prices. . BUT probability judgment influences allocations and volume of trade (example: Iowa political markets)

Illusions of transparency n “Curse of knowledge” Difficult to recover coarse partition from fine-grained one Piaget example: New Ph. D’s teaching EA Poe, “telltale heart” Computer manuals “ The tapper” study (tapping out songs with a pencil) Hindsight bias Recollection of P_t(X) at t+1 biased by whether X occurred “I should have known!” “You should have known” (“ignored warning signs”) --> juries in legal cases (securities cases) implications for principal-agent relations? n Spotlight effect (Tom Gilovich et al) n n n n Eating/movies alone Wearing a Barry Manilow t-shirt psychology: Shows how much we think others are attending when they’re not

Illusions of transparency n “Curse of knowledge” Difficult to recover coarse partition from fine-grained one Piaget example: New Ph. D’s teaching EA Poe, “telltale heart” Computer manuals “ The tapper” study (tapping out songs with a pencil) Hindsight bias Recollection of P_t(X) at t+1 biased by whether X occurred “I should have known!” “You should have known” (“ignored warning signs”) --> juries in legal cases (securities cases) implications for principal-agent relations? n Spotlight effect (Tom Gilovich et al) n n n n Eating/movies alone Wearing a Barry Manilow t-shirt psychology: Shows how much we think others are attending when they’re not