53a9a84f6ec3cce718e39af4ec9f356c.ppt

- Количество слайдов: 52

CONSERVATION EASEMENTS – LEGAL ASPECTS AGRICULTURE MEETING HON. PHILLIP PELLETIER HENDRY COUNTY PROPERTY APPRAISER JANUARY 21, 2010

CONSERVATION EASEMENTS – LEGAL ASPECTS AGRICULTURE MEETING HON. PHILLIP PELLETIER HENDRY COUNTY PROPERTY APPRAISER JANUARY 21, 2010

Gaylord A. Wood, Jr. Wood & Stuart, P. A. Bunnell FL 32110 © 2010 All Rights Reserved

Gaylord A. Wood, Jr. Wood & Stuart, P. A. Bunnell FL 32110 © 2010 All Rights Reserved

Gaylord A. Wood, Jr. n n n Limited practice principally to ad valorem tax cases since 1968 Firm exclusively represents Property Appraisers in 14 counties including Hendry County since 1979 or so Regular Member of International Association of Assessing Officers and Member of the Legal Committee

Gaylord A. Wood, Jr. n n n Limited practice principally to ad valorem tax cases since 1968 Firm exclusively represents Property Appraisers in 14 counties including Hendry County since 1979 or so Regular Member of International Association of Assessing Officers and Member of the Legal Committee

WHAT IS PROPERTY? n n A House and Lot? A Diamond ring? Water Rights? A Pet Boar Hog?

WHAT IS PROPERTY? n n A House and Lot? A Diamond ring? Water Rights? A Pet Boar Hog?

WHAT IS PROPERTY? Answer: n n A House and Lot? A Diamond ring? Water Rights! A Pet Boar Hog?

WHAT IS PROPERTY? Answer: n n A House and Lot? A Diamond ring? Water Rights! A Pet Boar Hog?

PROPERTY is the rights flowing out of the ownership of an object. If you can see it, smell it, touch it, hear it or taste it, it is not property.

PROPERTY is the rights flowing out of the ownership of an object. If you can see it, smell it, touch it, hear it or taste it, it is not property.

What are conservation easements? Conservation easements are, in principle, voluntary legal agreements between landowners and a land trust or government agency that permanently limit land uses in order to protect wildlife habitat and other natural resources, while allowing certain carefully planned activities that will not damage these conservation values.

What are conservation easements? Conservation easements are, in principle, voluntary legal agreements between landowners and a land trust or government agency that permanently limit land uses in order to protect wildlife habitat and other natural resources, while allowing certain carefully planned activities that will not damage these conservation values.

Florida Statutes define conservation easements: n n Section 704. 06, F. S. “…a right or interest in real property which is appropriate to retaining land or water areas predominantly in their natural, scenic, open, agricultural, or wooded condition; retaining such areas as suitable habitat for fish, plants, or wildlife; retaining the structural integrity or physical appearance of sites or properties of historical, architectural, archaeological, or cultural significance…. ” A N D

Florida Statutes define conservation easements: n n Section 704. 06, F. S. “…a right or interest in real property which is appropriate to retaining land or water areas predominantly in their natural, scenic, open, agricultural, or wooded condition; retaining such areas as suitable habitat for fish, plants, or wildlife; retaining the structural integrity or physical appearance of sites or properties of historical, architectural, archaeological, or cultural significance…. ” A N D

Section 704. 06 Prohibits: n n Construction or placing of buildings, roads, signs, billboards or other advertising, utilities, or other structures on or above the ground Dumping or placing of soil or other substance or material as landfill or dumping or placing of trash, waste, or unsightly or offensive materials

Section 704. 06 Prohibits: n n Construction or placing of buildings, roads, signs, billboards or other advertising, utilities, or other structures on or above the ground Dumping or placing of soil or other substance or material as landfill or dumping or placing of trash, waste, or unsightly or offensive materials

Section 704. 06 Prohibits n n n Removal or destruction of trees, shrubs, or other vegetation Excavation, dredging, or removal of loam, peat, gravel, soil, rock, or other material substance in such manner as to affect the surface Surface use except for purposes that permit the land or water area to remain predominantly in its natural condition

Section 704. 06 Prohibits n n n Removal or destruction of trees, shrubs, or other vegetation Excavation, dredging, or removal of loam, peat, gravel, soil, rock, or other material substance in such manner as to affect the surface Surface use except for purposes that permit the land or water area to remain predominantly in its natural condition

Section 704. 06 Prohibits: n n n Activities detrimental to drainage, flood control, water conservation, erosion control, soil conservation, or fish and wildlife habitat preservation Acts or uses detrimental to such retention of land or water areas Acts or uses detrimental to the preservation of the structural integrity or physical appearance of sites or properties of historical, architectural, archaeological, or cultural significance

Section 704. 06 Prohibits: n n n Activities detrimental to drainage, flood control, water conservation, erosion control, soil conservation, or fish and wildlife habitat preservation Acts or uses detrimental to such retention of land or water areas Acts or uses detrimental to the preservation of the structural integrity or physical appearance of sites or properties of historical, architectural, archaeological, or cultural significance

Section 2 – How created? n By restriction, easement, covenant, or condition in any deed, will, or other instrument executed by or on behalf of the owner of the property, or in any order of taking

Section 2 – How created? n By restriction, easement, covenant, or condition in any deed, will, or other instrument executed by or on behalf of the owner of the property, or in any order of taking

Property Owner Incentives: Owner receives a huge tax deduction! Up to 50% of Adjusted Gross Income for 15 years Farm property – 100% through end of 2009

Property Owner Incentives: Owner receives a huge tax deduction! Up to 50% of Adjusted Gross Income for 15 years Farm property – 100% through end of 2009

Landowner Incentives Section 170, Internal Revenue Code n Preservation of land areas for n outdoor recreation by, or the education n of, the general public, n n n Protection of a relatively natural habitat of fish, wildlife, or plants, or similar ecosystem, Preservation of an historically important land area or a certified historic structure, or

Landowner Incentives Section 170, Internal Revenue Code n Preservation of land areas for n outdoor recreation by, or the education n of, the general public, n n n Protection of a relatively natural habitat of fish, wildlife, or plants, or similar ecosystem, Preservation of an historically important land area or a certified historic structure, or

Landowner Incentives (Cont’d) n n n the preservation of open space (including farmland forest land) where such preservation is either: for the scenic enjoyment of the general public and will yield a significant public benefit or Pursuant to a clearly delineated federal, state, or local governmental conservation policy and will yield a significant public benefit.

Landowner Incentives (Cont’d) n n n the preservation of open space (including farmland forest land) where such preservation is either: for the scenic enjoyment of the general public and will yield a significant public benefit or Pursuant to a clearly delineated federal, state, or local governmental conservation policy and will yield a significant public benefit.

But, IRS will deny deduction… n n If the landowner contends it is creating an “open space” easement and Retains rights to develop and use the land that could interfere with the essential scenic quality of the land or the governmental conservation policy being furthered by the donation. (“Inconsistent Use” test)

But, IRS will deny deduction… n n If the landowner contends it is creating an “open space” easement and Retains rights to develop and use the land that could interfere with the essential scenic quality of the land or the governmental conservation policy being furthered by the donation. (“Inconsistent Use” test)

Some Concerns about Conservation Easements n n n How do you measure whether they provide a public benefit equal or greater to the public subsidy from tax deductibility? How do you appraise the easements for IRS and tax purposes? Will the holder of the easement enforce them in perpetuity?

Some Concerns about Conservation Easements n n n How do you measure whether they provide a public benefit equal or greater to the public subsidy from tax deductibility? How do you appraise the easements for IRS and tax purposes? Will the holder of the easement enforce them in perpetuity?

Conservation Easements come in two flavors: n n Public Easements Private Easements

Conservation Easements come in two flavors: n n Public Easements Private Easements

Private Easements (704. 06) n May be acquired by “a charitable corporation or trust whose purposes include protecting natural, scenic, or open space values of real property, assuring its availability for agricultural, forest, recreational, or open space use, protecting natural resources, maintaining or enhancing air or water quality, or preserving sites or properties of historical, architectural, archaeological, or cultural significance. ”

Private Easements (704. 06) n May be acquired by “a charitable corporation or trust whose purposes include protecting natural, scenic, or open space values of real property, assuring its availability for agricultural, forest, recreational, or open space use, protecting natural resources, maintaining or enhancing air or water quality, or preserving sites or properties of historical, architectural, archaeological, or cultural significance. ”

HUGE LOOPHOLE: n n “A conservation easement may be released by the holder of the easement to the holder of the fee even though the holder of the fee may not be a governmental body or a charitable corporation or trust. ” Washington Post 2003 – “Nonprofit sells scenic acreage to allies at a loss” (Nature Conservancy)

HUGE LOOPHOLE: n n “A conservation easement may be released by the holder of the easement to the holder of the fee even though the holder of the fee may not be a governmental body or a charitable corporation or trust. ” Washington Post 2003 – “Nonprofit sells scenic acreage to allies at a loss” (Nature Conservancy)

PUBLIC EASEMENTS n n n “Conservation easements may be acquired by any governmental body or agency. ” (704. 06) No central registry from which one can determine which governmental body holds which easements. Nationally, believed that 1, 700 trusts hold 37, 000 acres of land in fee and conservation easements.

PUBLIC EASEMENTS n n n “Conservation easements may be acquired by any governmental body or agency. ” (704. 06) No central registry from which one can determine which governmental body holds which easements. Nationally, believed that 1, 700 trusts hold 37, 000 acres of land in fee and conservation easements.

Is there a “Standard Conservation Easement? ”

Is there a “Standard Conservation Easement? ”

Is there a “Standard Conservation Easement? ” Short answer – “No!”

Is there a “Standard Conservation Easement? ” Short answer – “No!”

FISHEATING CREEK – GLADES COUNTY

FISHEATING CREEK – GLADES COUNTY

FISHEATING CREEK n n n Lykes Bros. owns 320, 000 acres in Glades and Highlands Counties. Creek: “Place Where Fish are Eaten” Lykes Bros. had two concessions for canoeing and public access Closed the waterway when faced with poaching and vandalism State of Florida sued to declare Fisheating Creek a public navigable waterway.

FISHEATING CREEK n n n Lykes Bros. owns 320, 000 acres in Glades and Highlands Counties. Creek: “Place Where Fish are Eaten” Lykes Bros. had two concessions for canoeing and public access Closed the waterway when faced with poaching and vandalism State of Florida sued to declare Fisheating Creek a public navigable waterway.

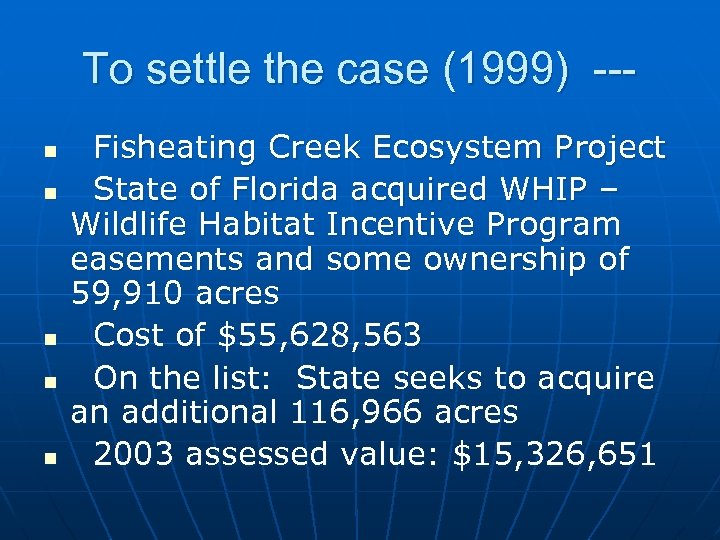

To settle the case (1999) --n n n Fisheating Creek Ecosystem Project State of Florida acquired WHIP – Wildlife Habitat Incentive Program easements and some ownership of 59, 910 acres Cost of $55, 628, 563 On the list: State seeks to acquire an additional 116, 966 acres 2003 assessed value: $15, 326, 651

To settle the case (1999) --n n n Fisheating Creek Ecosystem Project State of Florida acquired WHIP – Wildlife Habitat Incentive Program easements and some ownership of 59, 910 acres Cost of $55, 628, 563 On the list: State seeks to acquire an additional 116, 966 acres 2003 assessed value: $15, 326, 651

2003 Proposed Acquisition n n 24, 000 acres – proposed agreement with State of Florida for $24, 000 Stated Purpose: To protect delicate wetlands, forest and native range ecosystems. Limit some of Lykes’ agricultural uses Limit the number of times the land could be subdivided and sold….

2003 Proposed Acquisition n n 24, 000 acres – proposed agreement with State of Florida for $24, 000 Stated Purpose: To protect delicate wetlands, forest and native range ecosystems. Limit some of Lykes’ agricultural uses Limit the number of times the land could be subdivided and sold….

B U T – Also permitted: n n Developing commercial wellfields that could dry up the wetlands ecosystem Drill oil and gas wells, build roads and pipelines over 71% of the land Cover the land with deep resevoirs for water storage Conduct “Water Management Activities” like deep well injection…

B U T – Also permitted: n n Developing commercial wellfields that could dry up the wetlands ecosystem Drill oil and gas wells, build roads and pipelines over 71% of the land Cover the land with deep resevoirs for water storage Conduct “Water Management Activities” like deep well injection…

Conclusion of Florida Department of Environmental Protection (2003): "This proposal wasn't a conservation easement, it was a development permit, with taxpayers footing the bill, " said Nina Baliga of the Florida Public Interest Research Group. "Allowing this proposal to go forward would have undermined the very concept of the conservation easement, and opened the door to all sorts of shady deals aimed at exploiting our natural heritage. "

Conclusion of Florida Department of Environmental Protection (2003): "This proposal wasn't a conservation easement, it was a development permit, with taxpayers footing the bill, " said Nina Baliga of the Florida Public Interest Research Group. "Allowing this proposal to go forward would have undermined the very concept of the conservation easement, and opened the door to all sorts of shady deals aimed at exploiting our natural heritage. "

Property Tax Ramifications: Exemption Assessment

Property Tax Ramifications: Exemption Assessment

Florida Constitution n n 2008 Tax and Budget Reform Commission, Amendment 4 Art. VII, Sec. 3 – Provides exemption for real property dedicated in perpetuity for conservation purposes, including property encumbered by perpetual conservation easements, as defined by general law.

Florida Constitution n n 2008 Tax and Budget Reform Commission, Amendment 4 Art. VII, Sec. 3 – Provides exemption for real property dedicated in perpetuity for conservation purposes, including property encumbered by perpetual conservation easements, as defined by general law.

Florida Constitution n n Article VII, Section 4(b) “As provided by general law and subject to conditions, limitations, and reasonable definitions specified therein, land used for conservation purposes shall be classified by general law and assessed solely on the basis of character or use. ”

Florida Constitution n n Article VII, Section 4(b) “As provided by general law and subject to conditions, limitations, and reasonable definitions specified therein, land used for conservation purposes shall be classified by general law and assessed solely on the basis of character or use. ”

Article VII, Sec. 4(b) n n Implemented by Section 193. 501, Florida Statutes Land qualified as environmentally endangered pursuant to paragraph (6)(i) and so designated by formal resolution of the governing board of the municipality or county within which such land is located;

Article VII, Sec. 4(b) n n Implemented by Section 193. 501, Florida Statutes Land qualified as environmentally endangered pursuant to paragraph (6)(i) and so designated by formal resolution of the governing board of the municipality or county within which such land is located;

Section 193. 501 n “land designated as conservation land in a comprehensive plan adopted by the appropriate municipal or county governing body; or any land which is utilized for outdoor recreational or park purposes may, by appropriate instrument, for a term of not less than 10 years… ”

Section 193. 501 n “land designated as conservation land in a comprehensive plan adopted by the appropriate municipal or county governing body; or any land which is utilized for outdoor recreational or park purposes may, by appropriate instrument, for a term of not less than 10 years… ”

Section 193. 501 n n “or any land which is utilized for outdoor recreational or park purposes ” Where the development right is conveyed to a public agency or private trust,

Section 193. 501 n n “or any land which is utilized for outdoor recreational or park purposes ” Where the development right is conveyed to a public agency or private trust,

Section 193. 501, F. S. n “If the covenant or conveyance extends for a period of not less than 10 years from January 1 in the year such assessment is made, the property appraiser, in valuing such land for tax purposes, shall consider no factors other than those relative to its value for the present use, as restricted by any conveyance or covenant under this section. ”

Section 193. 501, F. S. n “If the covenant or conveyance extends for a period of not less than 10 years from January 1 in the year such assessment is made, the property appraiser, in valuing such land for tax purposes, shall consider no factors other than those relative to its value for the present use, as restricted by any conveyance or covenant under this section. ”

Section 193. 501 n “If the covenant or conveyance extends for a period less than 10 years, the land shall be assessed under the provisions of s. 193. 011, recognizing the nature and length thereof of any restriction placed on the use of the land under the provisions of subsection (1). ”

Section 193. 501 n “If the covenant or conveyance extends for a period less than 10 years, the land shall be assessed under the provisions of s. 193. 011, recognizing the nature and length thereof of any restriction placed on the use of the land under the provisions of subsection (1). ”

Why has no one used 193. 501? n n In a word --- RECAPTURE!

Why has no one used 193. 501? n n In a word --- RECAPTURE!

Section 193. 501 n n Also, “A person or organization that, on January 1, has the legal title to land that is entitled by law to assessment under this section shall, on or before March 1 of each year, file an application for assessment under this section with the county property appraiser. ” No application, no problem.

Section 193. 501 n n Also, “A person or organization that, on January 1, has the legal title to land that is entitled by law to assessment under this section shall, on or before March 1 of each year, file an application for assessment under this section with the county property appraiser. ” No application, no problem.

EXEMPTION

EXEMPTION

2009 Legislature Issues were: n n n n What form of easement required? Who permitted to hold the easement? Minimum size of land? What environmental values? What Best Management Practices if other uses also permitted? What Payments in Lieu of Taxes? What other uses also permitted?

2009 Legislature Issues were: n n n n What form of easement required? Who permitted to hold the easement? Minimum size of land? What environmental values? What Best Management Practices if other uses also permitted? What Payments in Lieu of Taxes? What other uses also permitted?

“conservation purpose, as defined in 26 U. S. C. s. 170(h)(4)(A)(i)-(iii)” n n (i) the preservation of land areas for outdoor recreation by, or the education of, the general public, (ii) the protection of a relatively natural habitat of fish, wildlife, or plants, or similar ecosystem,

“conservation purpose, as defined in 26 U. S. C. s. 170(h)(4)(A)(i)-(iii)” n n (i) the preservation of land areas for outdoor recreation by, or the education of, the general public, (ii) the protection of a relatively natural habitat of fish, wildlife, or plants, or similar ecosystem,

(iii) n n n (iii) the preservation of open space (including farmland forest land) where such preservation is (I) for the scenic enjoyment of the general public, or (II) pursuant to a clearly delineated Federal, State, or local governmental conservation policy, and will yield a significant public benefit.

(iii) n n n (iii) the preservation of open space (including farmland forest land) where such preservation is (I) for the scenic enjoyment of the general public, or (II) pursuant to a clearly delineated Federal, State, or local governmental conservation policy, and will yield a significant public benefit.

TOTAL EXEMPTION n “(2) Land that is dedicated in perpetuity “ for conservation purposes and that is used exclusively for conservation purposes is exempt from ad valorem taxation. Such exclusive use does not preclude the receipt of income from activities that are consistent with a management plan when the income is used to implement, maintain, and manage the management plan. ” Also: > 40 acres.

TOTAL EXEMPTION n “(2) Land that is dedicated in perpetuity “ for conservation purposes and that is used exclusively for conservation purposes is exempt from ad valorem taxation. Such exclusive use does not preclude the receipt of income from activities that are consistent with a management plan when the income is used to implement, maintain, and manage the management plan. ” Also: > 40 acres.

PARTIAL EXEMPTION n “(3) Land that is dedicated in perpetuity for conservation purposes and that is used for allowed commercial uses is exempt from ad valorem taxation to the extent of 50 percent of the assessed value of the land. ”

PARTIAL EXEMPTION n “(3) Land that is dedicated in perpetuity for conservation purposes and that is used for allowed commercial uses is exempt from ad valorem taxation to the extent of 50 percent of the assessed value of the land. ”

40 ACRE WEASEL n “(4) Land that comprises less than 40 “ contiguous acres does not qualify for the exemption provided in this section unless, in addition to meeting the other requirements of this section, the use of the land for conservation purposes is determined by the Acquisition and Restoration Council created in s. 259. 035 to fulfill a clearly delineated state conservation policy and yield a significant public benefit. ”

40 ACRE WEASEL n “(4) Land that comprises less than 40 “ contiguous acres does not qualify for the exemption provided in this section unless, in addition to meeting the other requirements of this section, the use of the land for conservation purposes is determined by the Acquisition and Restoration Council created in s. 259. 035 to fulfill a clearly delineated state conservation policy and yield a significant public benefit. ”

Buildings and Improvements n “Buildings, structures, and other improvements situated on land receiving the exemption provided in this section and the land area immediately surrounding the buildings, structures, and improvements must be assessed separately pursuant to chapter 193. However, structures and other improvements that are auxiliary to the use of the land for conservation purposes are exempt to the same extent as the underlying land. ”

Buildings and Improvements n “Buildings, structures, and other improvements situated on land receiving the exemption provided in this section and the land area immediately surrounding the buildings, structures, and improvements must be assessed separately pursuant to chapter 193. However, structures and other improvements that are auxiliary to the use of the land for conservation purposes are exempt to the same extent as the underlying land. ”

ENFORCEMENT n “Water management districts with “W jurisdiction over lands receiving the exemption provided in this section have a third-party right of enforcement to enforce the terms of the applicable conservation easement for any easement that is not enforceable by a federal or state agency, county, municipality, or water management district when the holder of the easement is unable or unwilling to enforce the terms of the easement. ”

ENFORCEMENT n “Water management districts with “W jurisdiction over lands receiving the exemption provided in this section have a third-party right of enforcement to enforce the terms of the applicable conservation easement for any easement that is not enforceable by a federal or state agency, county, municipality, or water management district when the holder of the easement is unable or unwilling to enforce the terms of the easement. ”

Fiscally Constrained Counties n n After November 1, 2010 May apply for grants to replace taxes lost as a result of Amendment 4.

Fiscally Constrained Counties n n After November 1, 2010 May apply for grants to replace taxes lost as a result of Amendment 4.

QUESTIONS?

QUESTIONS?