3e8d6f3108cfa49b4c5e045a88c437ec.ppt

- Количество слайдов: 16

CONFIDENTIAL DRAFT NEW YORK SILICON VALLEY BOSTON The Current Technology M&A and Capital Market Environment LONDON Prepared for Tele. Soft Partners Annual Venture Capital Eco. System Meeting Robert Abbe, Managing Director Broadview International October 29, 2004 BROADVIEW INTERNATIONAL A DIVISION OF JEFFERIES & COMPANY, INC

CONFIDENTIAL DRAFT The Changing Landscape For Emerging Growth Technology Companies n 2004 forecast IT spending up 3. 9%…but a $2. 1 trillion market 1 n NASDAQ up slightly over last twelve months n IPO market thawed but “bar” remains very high n M&A continues to rebound…sector specific n Regulatory / structural changes driving rationalization of US public companies IT Companies Must Adapt Their Exit Strategies To The New Environment 1 Source: Gartner Dataquest Global Market Sizing – January 2004 2

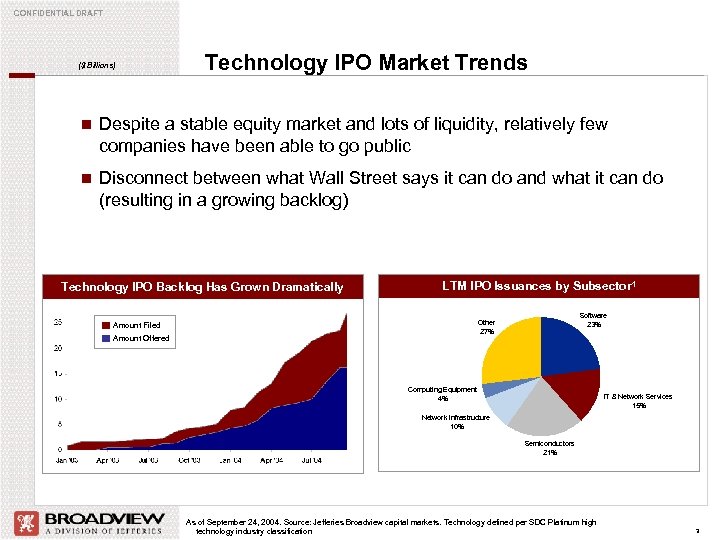

CONFIDENTIAL DRAFT ($ Billions) Technology IPO Market Trends n Despite a stable equity market and lots of liquidity, relatively few companies have been able to go public n Disconnect between what Wall Street says it can do and what it can do (resulting in a growing backlog) Technology IPO Backlog Has Grown Dramatically LTM IPO Issuances by Subsector 1 Software 23% Other 27% Amount Filed Amount Offered Computing Equipment 4% IT & Network Services 15% Network Infrastructure 10% Semiconductors 21% As of September 24, 2004. Source: Jefferies Broadview capital markets. Technology defined per SDC Platinum high technology industry classification 3

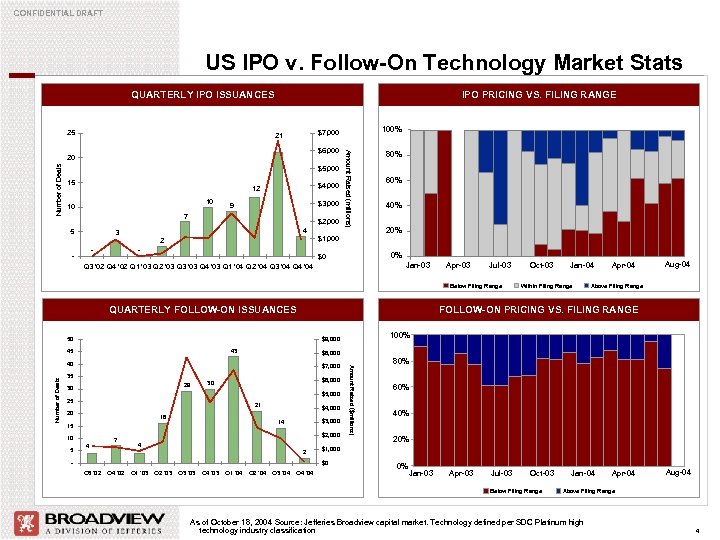

CONFIDENTIAL DRAFT US IPO v. Follow-On Technology Market Stats QUARTERLY IPO ISSUANCES 25 IPO PRICING VS. FILING RANGE Number of Deals $5, 000 $4, 000 12 10 10 $3, 000 9 7 5 $2, 000 4 3 - 80% 60% 40% 20% $1, 000 2 - Amount Raised (millions) $6, 000 20 15 100% $7, 000 21 - 0% $0 Jan-03 Q 3 '02 Q 4 '02 Q 1 '03 Q 2 '03 Q 3 '03 Q 4 '03 Q 1 '04 Q 2 '04 Q 3 '04 Q 4 '04 Apr-03 Jul-03 Below Filing Range QUARTERLY FOLLOW-ON ISSUANCES 43 Number of Deals $6, 000 30 $5, 000 25 21 20 16 5 4 7 $3, 000 14 15 10 $4, 000 $2, 000 4 2 Q 4 '02 Q 1 '03 Q 2 '03 Q 3 '03 Q 4 '03 Q 1 '04 Above Filing Range Q 2 '04 Q 3 '04 Q 4 '04 80% 60% 40% 20% $1, 000 $0 Q 3 '02 Amount Raised ($millions) $7, 000 29 Aug-04 $8, 000 40 30 Within Filing Range Apr-04 100% $9, 000 35 Jan-04 FOLLOW-ON PRICING VS. FILING RANGE 50 45 Oct-03 0% Jan-03 Apr-03 Jul-03 Oct-03 Below Filing Range Jan-04 Apr-04 Aug-04 Above Filing Range As of October 18, 2004 Source: Jefferies Broadview capital market. Technology defined per SDC Platinum high technology industry classification 4

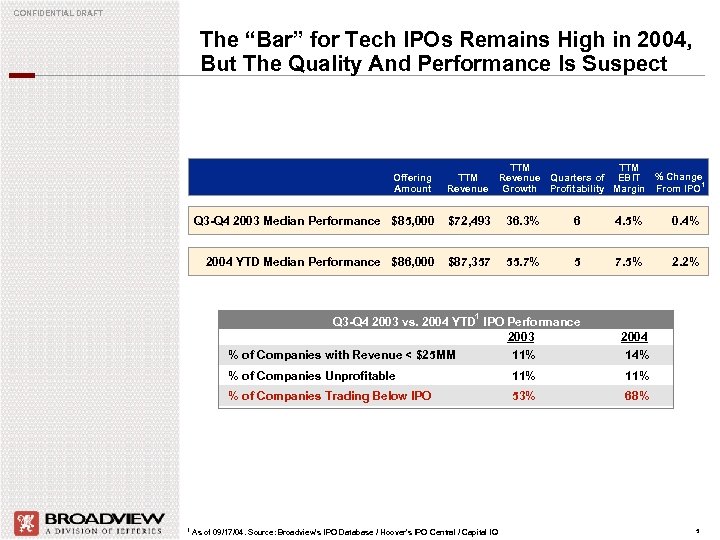

CONFIDENTIAL DRAFT The “Bar” for Tech IPOs Remains High in 2004, But The Quality And Performance Is Suspect TTM Revenue Quarters of EBIT % Change Growth Profitability Margin From IPO 1 Offering Amount TTM Revenue Q 3 -Q 4 2003 Median Performance $85, 000 $72, 493 36. 3% 6 4. 5% 0. 4% 2004 YTD Median Performance $86, 000 $87, 357 55. 7% 5 7. 5% 2. 2% 1 Q 3 -Q 4 2003 vs. 2004 YTD IPO Performance 2003 % of Companies with Revenue < $25 MM 11% 2004 14% % of Companies Unprofitable 11% % of Companies Trading Below IPO 1 11% 53% 68% As of 09/17/04. Source: Broadview’s IPO Database / Hoover’s IPO Central / Capital IQ 5

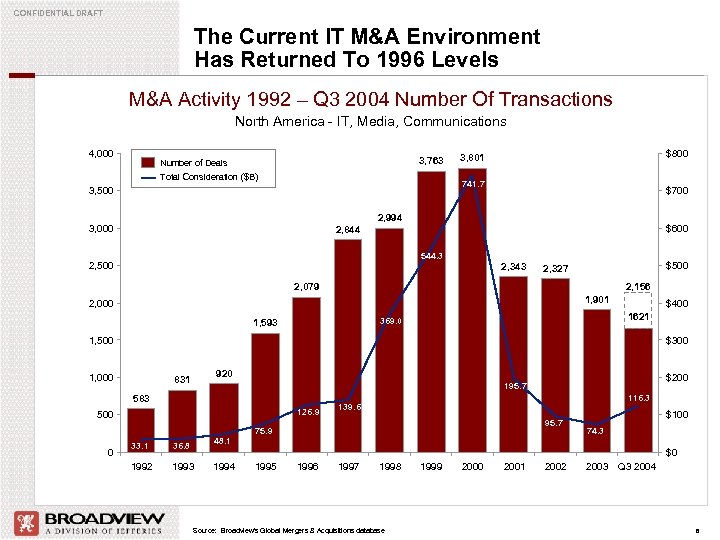

CONFIDENTIAL DRAFT The Current IT M&A Environment Has Returned To 1996 Levels M&A Activity 1992 – Q 3 2004 Number Of Transactions North America - IT, Media, Communications 4, 000 3, 763 Number of Deals Total Consideration ($B) $800 3, 801 741. 7 3, 500 $700 2, 994 3, 000 $600 2, 844 544. 3 2, 500 2, 343 $500 2, 327 2, 156 2, 079 1, 901 2, 000 1621 369. 0 1, 593 $400 1, 500 $300 1, 000 920 831 583 126. 9 500 116. 3 139. 6 95. 7 75. 9 0 $200 195. 7 33. 1 36. 8 48. 1 1992 1993 1994 $100 74. 3 $0 1995 1996 1997 1998 Source: Broadview's Global Mergers & Acquisitions database 1999 2000 2001 2002 2003 Q 3 2004 6

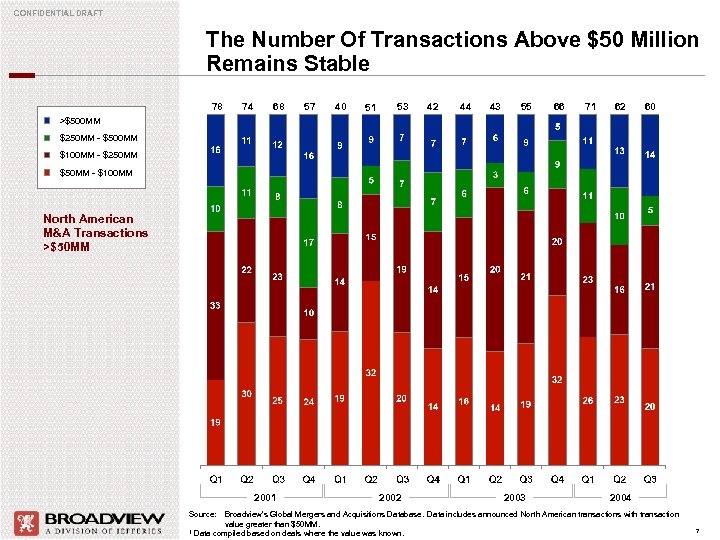

CONFIDENTIAL DRAFT The Number Of Transactions Above $50 Million Remains Stable 78 74 68 57 40 51 53 42 44 43 55 66 71 62 60 >$500 MM $250 MM - $500 MM $100 MM - $250 MM $50 MM - $100 MM North American M&A Transactions >$50 MM 2001 2002 2003 2004 Source: Broadview’s Global Mergers and Acquisitions Database. Data includes announced North American transactions with transaction value greater than $50 MM. 1 Data compiled based on deals where the value was known. 7

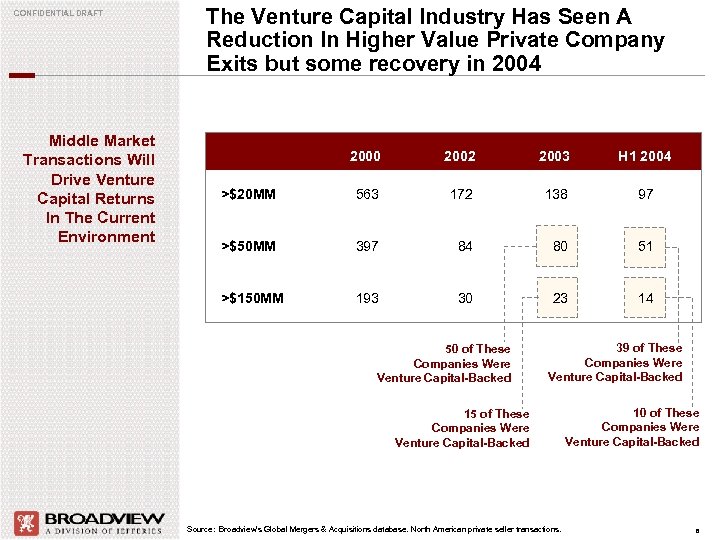

CONFIDENTIAL DRAFT Middle Market Transactions Will Drive Venture Capital Returns In The Current Environment The Venture Capital Industry Has Seen A Reduction In Higher Value Private Company Exits but some recovery in 2004 2000 2002 2003 H 1 2004 >$20 MM 563 172 138 97 >$50 MM 397 84 80 51 >$150 MM 193 30 23 14 50 of These Companies Were Venture Capital-Backed 39 of These Companies Were Venture Capital-Backed 15 of These Companies Were Venture Capital-Backed Source: Broadview's Global Mergers & Acquisitions database. North American private seller transactions. 10 of These Companies Were Venture Capital-Backed 8

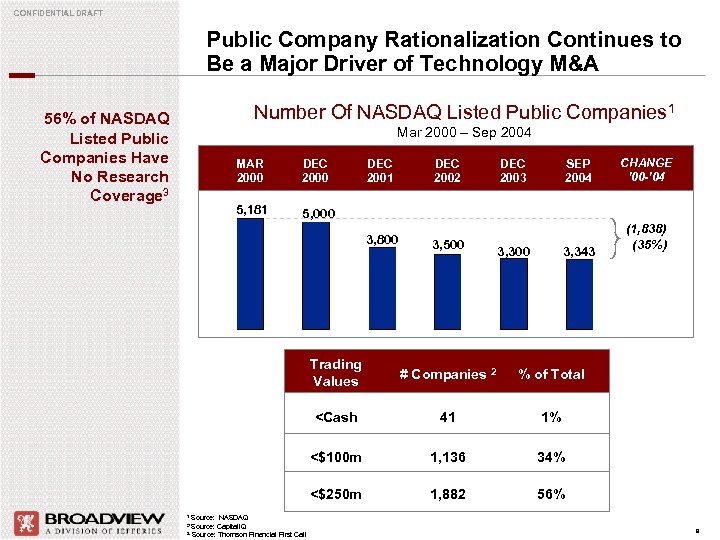

CONFIDENTIAL DRAFT Public Company Rationalization Continues to Be a Major Driver of Technology M&A Number Of NASDAQ Listed Public Companies 1 56% of NASDAQ Listed Public Companies Have No Research Coverage 3 Mar 2000 – Sep 2004 MAR 2000 DEC 2000 5, 181 DEC 2001 5, 000 3, 800 DEC 2002 3, 500 DEC 2003 SEP 2004 3, 300 3, 343 Trading Values 41 1% <$100 m 1, 136 34% <$250 m 1, 882 (1, 838) (35%) % of Total <Cash NASDAQ Capital. IQ Source: Thomson Financial First Call # Companies 2 CHANGE ’ 00 -’ 04 56% 1 Source: 2 Source: 3 9

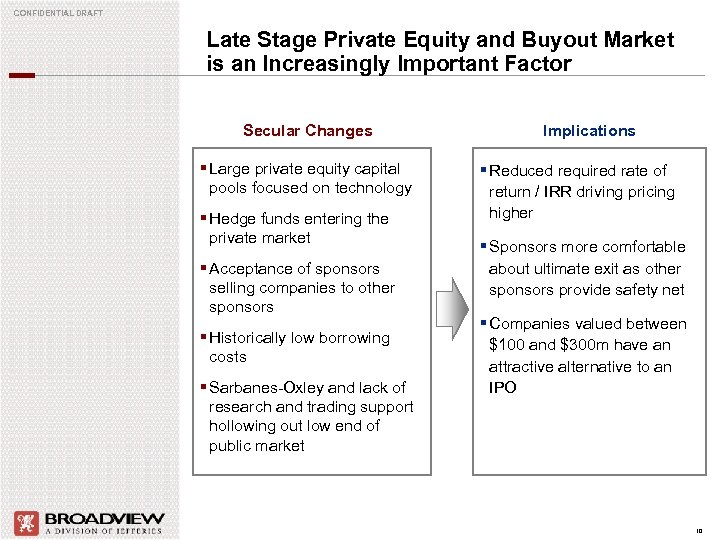

CONFIDENTIAL DRAFT Late Stage Private Equity and Buyout Market is an Increasingly Important Factor Secular Changes § Large private equity capital pools focused on technology § Hedge funds entering the private market § Acceptance of sponsors selling companies to other sponsors § Historically low borrowing costs § Sarbanes-Oxley and lack of research and trading support hollowing out low end of public market Implications § Reduced required rate of return / IRR driving pricing higher § Sponsors more comfortable about ultimate exit as other sponsors provide safety net § Companies valued between $100 and $300 m have an attractive alternative to an IPO 10

CONFIDENTIAL DRAFT The Quest For Growth In EARNINGS Is Driving Even “Strategic” M&A n Higher gross margins n Leveraging sales/channel costs n Responding to customers rationalizing vendors n Access to new/larger markets n Make vs. Buy (avoiding P&L hit) 11

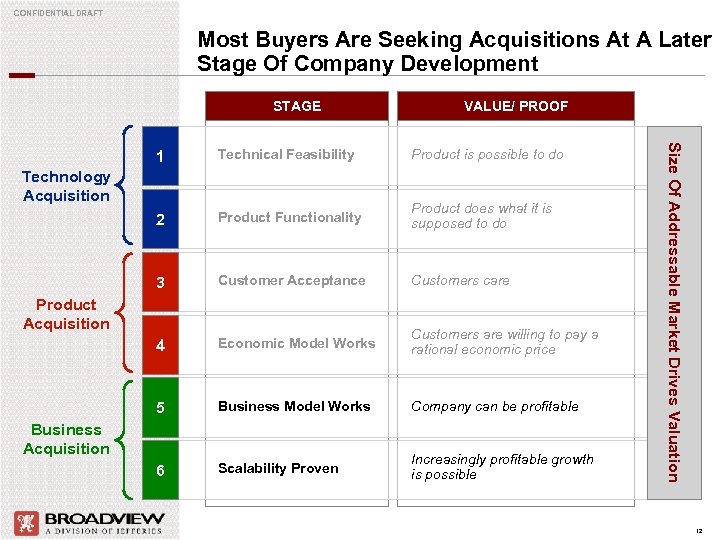

CONFIDENTIAL DRAFT Most Buyers Are Seeking Acquisitions At A Later Stage Of Company Development STAGE VALUE/ PROOF Technical Feasibility Product is possible to do 2 Product Functionality Product does what it is supposed to do 3 Customer Acceptance Customers care 4 Economic Model Works Customers are willing to pay a rational economic price 5 Business Model Works Company can be profitable 6 Scalability Proven Increasingly profitable growth is possible Technology Acquisition Product Acquisition Business Acquisition Size Of Addressable Market Drives Valuation 1 12

CONFIDENTIAL DRAFT The M&A Environment: The Challenges n Proven business model (not just technology) a requirement for most buyers n Few Buyers can stomach dilution, pursue early stages companies (Cisco, Symantec, etc. ) n Bias towards partnership versus M&A n Mid-cap buyers only beginning to consider M&A again n Valuation disconnect and preference structures 13

CONFIDENTIAL DRAFT The M&A Environment: The Good News n Convergence, open standards are driving renewed focus on growth verses consolidation (in some segments) n Positive Wall Street reaction to recent M&A – Computer Associates / Netegrity – Verisign / Jamba – Juniper / Netscreen n Many large and mid caps substantially reduced R&D as they right sized their businesses n Customers seek complete solutions from fewer vendors n Lines between software and hardware blurring – – Many software companies open to selling standards based appliances Systems companies increasingly look like software and services companies 14

CONFIDENTIAL DRAFT The Resulting “New Rules of the Road” n Develop visibility and partnerships with marketplace gorillas Don’t fight industry rationalization … like fighting the rising/falling tide n VCs n n Young Company CEOs Drive to profitability first Restructure liquidation preferences NOW n Target IRR on the first $75 MM of enterprise value … the best deals will use <$20 MM total investment 15

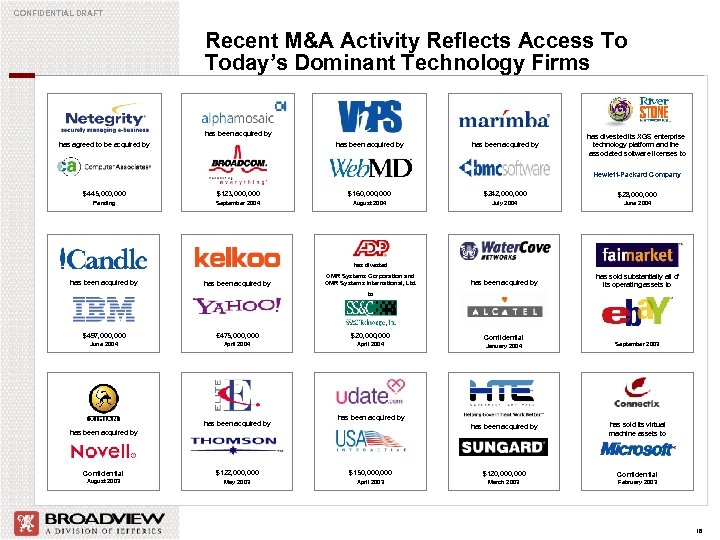

CONFIDENTIAL DRAFT Recent M&A Activity Reflects Access To Today’s Dominant Technology Firms has been acquired by has agreed to be acquired by has been acquired by has divested its XGS enterprise technology platform and the associated software licenses to Hewlett-Packard Company $445, 000 $123, 000 $160, 000 $242, 000 $28, 000 Pending September 2004 August 2004 July 2004 June 2004 has been acquired by OMR Systems Corporation and OMR Systems International, Ltd. has been acquired by has sold substantially all of its operating assets to has divested has been acquired by to $497, 000 € 475, 000 $20, 000 June 2004 April 2004 has been acquired by Confidential January 2004 September 2003 has been acquired by has sold its virtual machine assets to has been acquired by Confidential $122, 000 $150, 000 $120, 000 August 2003 Confidential May 2003 April 2003 March 2003 February 2003 16

3e8d6f3108cfa49b4c5e045a88c437ec.ppt