6ed6d4469fdd8a0f4c454342dba99281.ppt

- Количество слайдов: 28

CONFIDENTIAL Developing a Sustainable Economic Model for Public Television May 29, 2003

PROJECT ASPIRATIONS AND KEY QUESTIONS How severe and long lasting are the financial pressures on the system? Identify and drive major changes that will put public television on a more sound economic footing and ensure its future success Which performance improvement opportunities offer the most promise? How should we launch these initiatives and effect lasting change? 1

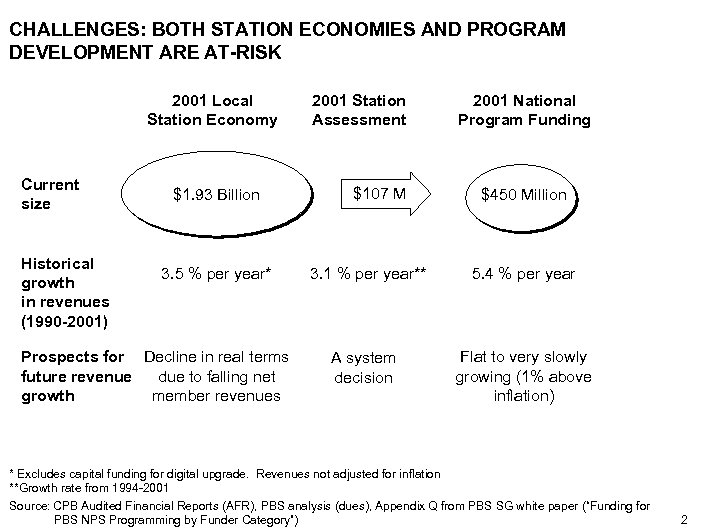

CHALLENGES: BOTH STATION ECONOMIES AND PROGRAM DEVELOPMENT ARE AT-RISK 2001 Local Station Economy Current size Historical growth in revenues (1990 -2001) $1. 93 Billion 3. 5 % per year* Prospects for Decline in real terms future revenue due to falling net growth member revenues 2001 Station Assessment $107 M 2001 National Program Funding $450 Million 3. 1 % per year** 5. 4 % per year A system decision Flat to very slowly growing (1% above inflation) * Excludes capital funding for digital upgrade. Revenues not adjusted for inflation **Growth rate from 1994 -2001 Source: CPB Audited Financial Reports (AFR), PBS analysis (dues), Appendix Q from PBS SG white paper (“Funding for PBS NPS Programming by Funder Category”) 2

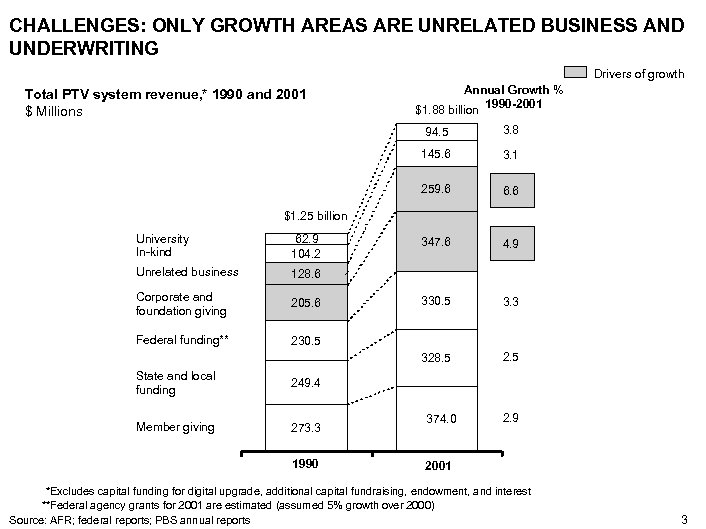

CHALLENGES: ONLY GROWTH AREAS ARE UNRELATED BUSINESS AND UNDERWRITING Drivers of growth Total PTV system revenue, * 1990 and 2001 $ Millions Annual Growth % $1. 88 billion 1990 -2001 94. 5 3. 8 145. 6 3. 1 259. 6 6. 6 347. 6 4. 9 330. 5 3. 3 328. 5 2. 5 $1. 25 billion University In-kind 62. 9 104. 2 Unrelated business 128. 6 Corporate and foundation giving 205. 6 Federal funding** 230. 5 State and local funding 249. 4 Member giving 273. 3 1990 374. 0 2. 9 2001 *Excludes capital funding for digital upgrade, additional capital fundraising, endowment, and interest **Federal agency grants for 2001 are estimated (assumed 5% growth over 2000) Source: AFR; federal reports; PBS annual reports 3

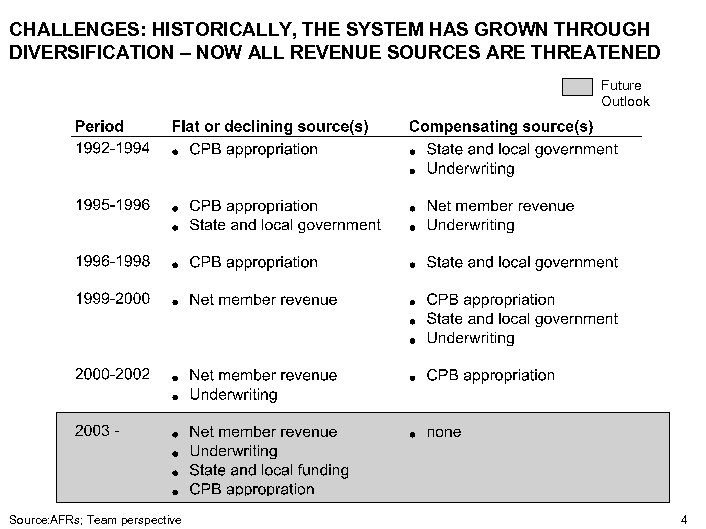

CHALLENGES: HISTORICALLY, THE SYSTEM HAS GROWN THROUGH DIVERSIFICATION – NOW ALL REVENUE SOURCES ARE THREATENED Future Outlook Source: AFRs; Team perspective 4

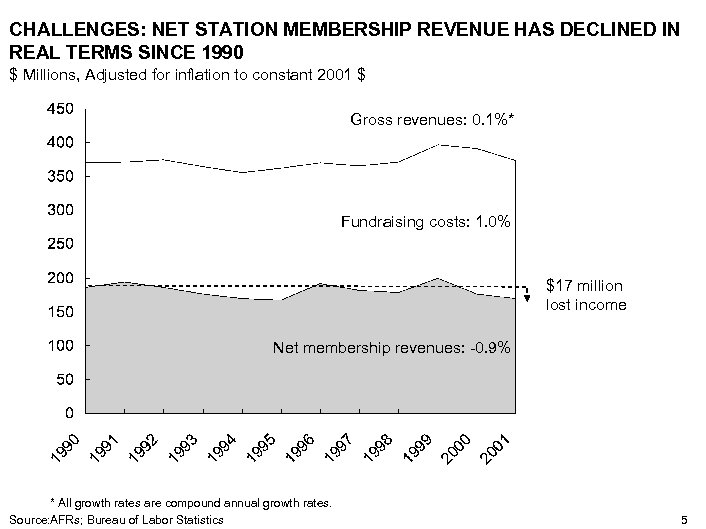

CHALLENGES: NET STATION MEMBERSHIP REVENUE HAS DECLINED IN REAL TERMS SINCE 1990 $ Millions, Adjusted for inflation to constant 2001 $ Gross revenues: 0. 1%* Fundraising costs: 1. 0% $17 million lost income Net membership revenues: -0. 9% * All growth rates are compound annual growth rates. Source: AFRs; Bureau of Labor Statistics 5

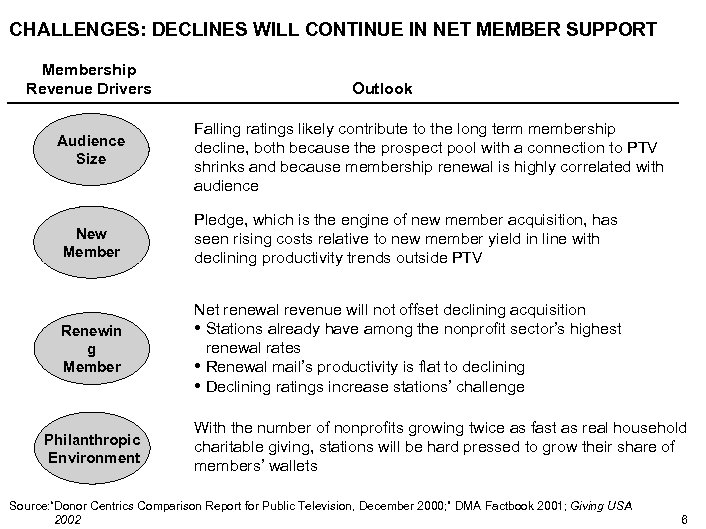

CHALLENGES: DECLINES WILL CONTINUE IN NET MEMBER SUPPORT Membership Revenue Drivers Audience Size Outlook Falling ratings likely contribute to the long term membership decline, both because the prospect pool with a connection to PTV shrinks and because membership renewal is highly correlated with audience New Member Pledge, which is the engine of new member acquisition, has seen rising costs relative to new member yield in line with declining productivity trends outside PTV Renewin g Member Net renewal revenue will not offset declining acquisition • Stations already have among the nonprofit sector’s highest renewal rates • Renewal mail’s productivity is flat to declining • Declining ratings increase stations’ challenge Philanthropic Environment With the number of nonprofits growing twice as fast as real household charitable giving, stations will be hard pressed to grow their share of members’ wallets Source: “Donor Centrics Comparison Report for Public Television, December 2000; ” DMA Factbook 2001; Giving USA 2002 6

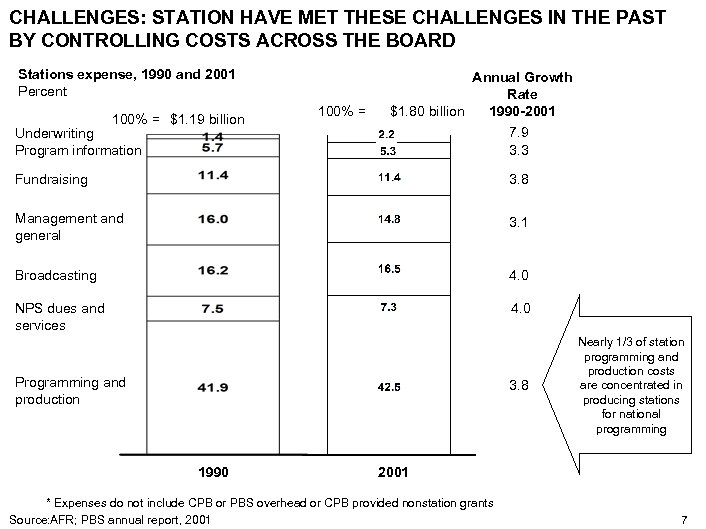

CHALLENGES: STATION HAVE MET THESE CHALLENGES IN THE PAST BY CONTROLLING COSTS ACROSS THE BOARD Stations expense, 1990 and 2001 Percent 100% = $1. 19 billion Underwriting Program information 100% = Annual Growth Rate 1990 -2001 $1. 80 billion 7. 9 3. 3 Fundraising 3. 8 Management and general 3. 1 Broadcasting 4. 0 NPS dues and services 4. 0 Programming and production 3. 8 1990 Nearly 1/3 of station programming and production costs are concentrated in producing stations for national programming 2001 * Expenses do not include CPB or PBS overhead or CPB provided nonstation grants Source: AFR; PBS annual report, 2001 7

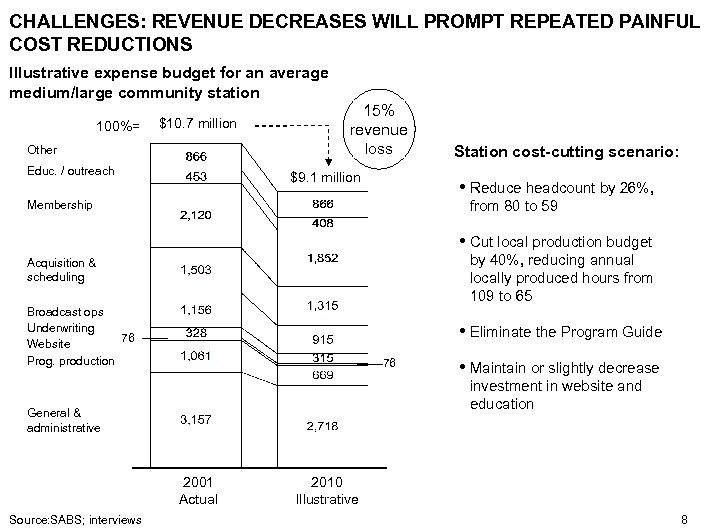

CHALLENGES: REVENUE DECREASES WILL PROMPT REPEATED PAINFUL COST REDUCTIONS Illustrative expense budget for an average medium/large community station 100%= $10. 7 million Other Educ. / outreach 15% revenue loss $9. 1 million Station cost-cutting scenario: • Reduce headcount by 26%, from 80 to 59 Membership • Cut local production budget by 40%, reducing annual locally produced hours from 109 to 65 Acquisition & scheduling Broadcast ops Underwriting 76 Website Prog. production • Eliminate the Program Guide 76 investment in website and education General & administrative 2001 Actual Source: SABS; interviews • Maintain or slightly decrease 2010 Illustrative 8

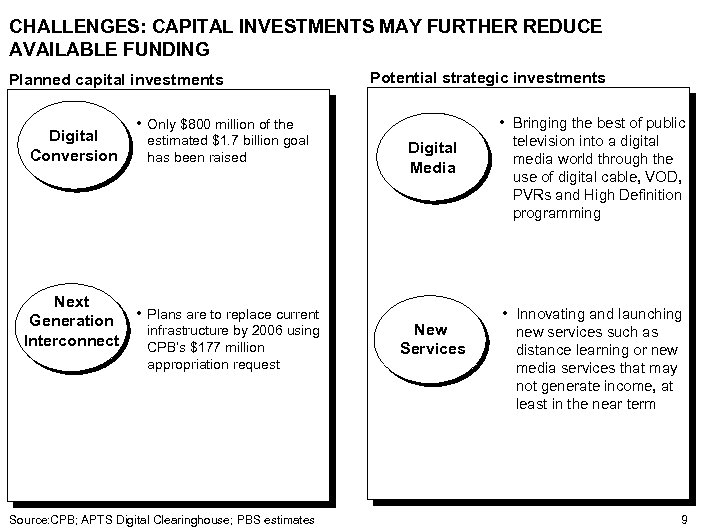

CHALLENGES: CAPITAL INVESTMENTS MAY FURTHER REDUCE AVAILABLE FUNDING Planned capital investments Digital Conversion Next Generation Interconnect Potential strategic investments • Only $800 million of the estimated $1. 7 billion goal has been raised • Plans are to replace current infrastructure by 2006 using CPB’s $177 million appropriation request Source: CPB; APTS Digital Clearinghouse; PBS estimates Digital Media New Services • Bringing the best of public television into a digital media world through the use of digital cable, VOD, PVRs and High Definition programming • Innovating and launching new services such as distance learning or new media services that may not generate income, at least in the near term 9

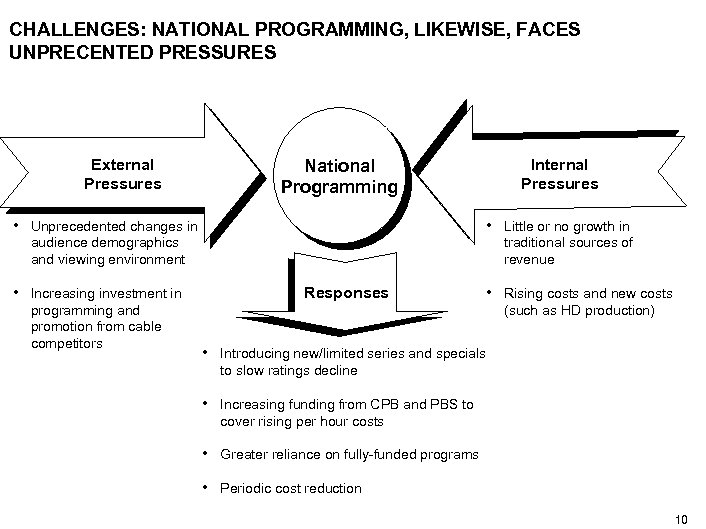

CHALLENGES: NATIONAL PROGRAMMING, LIKEWISE, FACES UNPRECENTED PRESSURES External Pressures Internal Pressures National Programming • Unprecedented changes in • Little or no growth in audience demographics and viewing environment • Increasing investment in programming and promotion from cable competitors traditional sources of revenue Responses • Rising costs and new costs (such as HD production) • Introducing new/limited series and specials to slow ratings decline • Increasing funding from CPB and PBS to cover rising per hour costs • Greater reliance on fully-funded programs • Periodic cost reduction 10

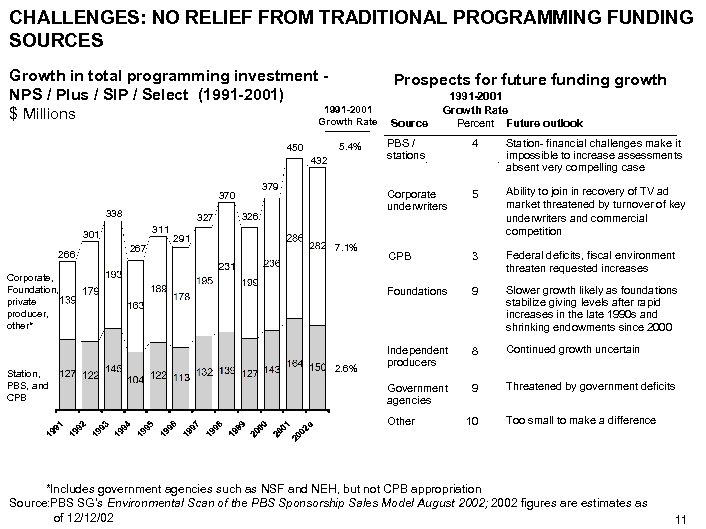

CHALLENGES: NO RELIEF FROM TRADITIONAL PROGRAMMING FUNDING SOURCES Growth in total programming investment Prospects for future funding growth NPS / Plus / SIP / Select (1991 -2001) 1991 -2001 Growth Rate $ Millions Growth Rate Source Percent Future outlook 379 370 338 327 311 301 266 267 291 326 7. 1% Corporate, Foundation, private producer, other* Station, PBS, and CPB 2. 6% 4 Station- financial challenges make it impossible to increase assessments absent very compelling case 5 Ability to join in recovery of TV ad market threatened by turnover of key underwriters and commercial competition CPB 3 Federal deficits, fiscal environment threaten requested increases Foundations 432 PBS / stations Corporate underwriters 5. 4% 450 9 Slower growth likely as foundations stabilize giving levels after rapid increases in the late 1990 s and shrinking endowments since 2000 Independent producers 8 Continued growth uncertain Government agencies 9 Threatened by government deficits Other 10 Too small to make a difference *Includes government agencies such as NSF and NEH, but not CPB appropriation Source: PBS SG’s Environmental Scan of the PBS Sponsorship Sales Model August 2002; 2002 figures are estimates as of 12/12/02 11

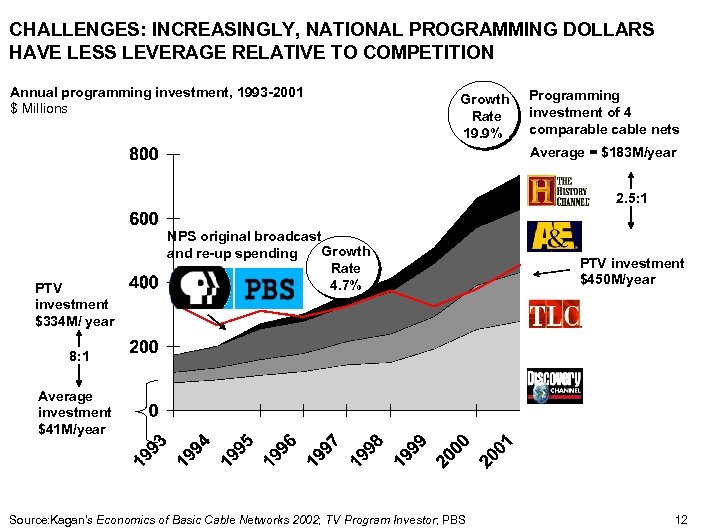

CHALLENGES: INCREASINGLY, NATIONAL PROGRAMMING DOLLARS HAVE LESS LEVERAGE RELATIVE TO COMPETITION Annual programming investment, 1993 -2001 $ Millions Growth Rate 19. 9% Programming investment of 4 comparable cable nets Average = $183 M/year 2. 5: 1 PTV investment $334 M/ year NPS original broadcast Growth and re-up spending Rate 4. 7% PTV investment $450 M/year 8: 1 Average investment $41 M/year Source: Kagan's Economics of Basic Cable Networks 2002; TV Program Investor; PBS 12

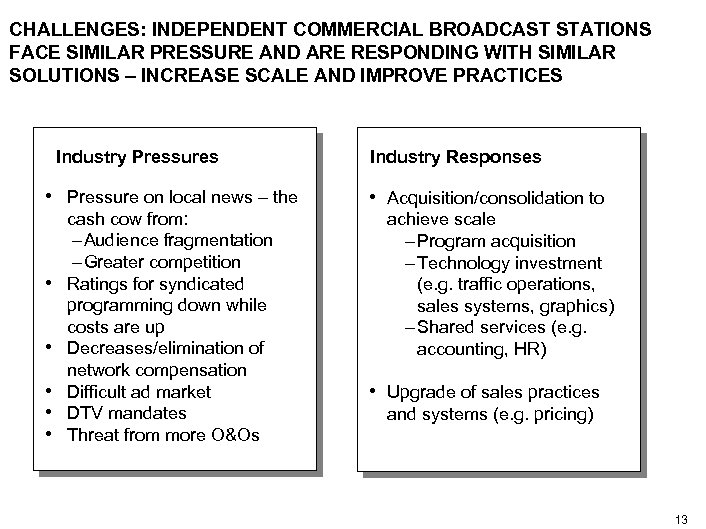

CHALLENGES: INDEPENDENT COMMERCIAL BROADCAST STATIONS FACE SIMILAR PRESSURE AND ARE RESPONDING WITH SIMILAR SOLUTIONS – INCREASE SCALE AND IMPROVE PRACTICES Industry Pressures • Pressure on local news – the • • • cash cow from: – Audience fragmentation – Greater competition Ratings for syndicated programming down while costs are up Decreases/elimination of network compensation Difficult ad market DTV mandates Threat from more O&Os Industry Responses • Acquisition/consolidation to achieve scale – Program acquisition – Technology investment (e. g. traffic operations, sales systems, graphics) – Shared services (e. g. accounting, HR) • Upgrade of sales practices and systems (e. g. pricing) 13

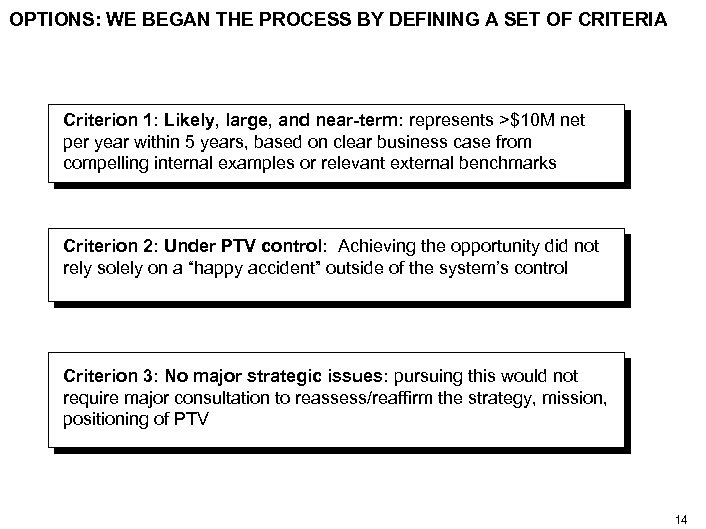

OPTIONS: WE BEGAN THE PROCESS BY DEFINING A SET OF CRITERIA Criterion 1: Likely, large, and near-term: represents >$10 M net per year within 5 years, based on clear business case from compelling internal examples or relevant external benchmarks Criterion 2: Under PTV control: Achieving the opportunity did not rely solely on a “happy accident” outside of the system’s control Criterion 3: No major strategic issues: pursuing this would not require major consultation to reassess/reaffirm the strategy, mission, positioning of PTV 14

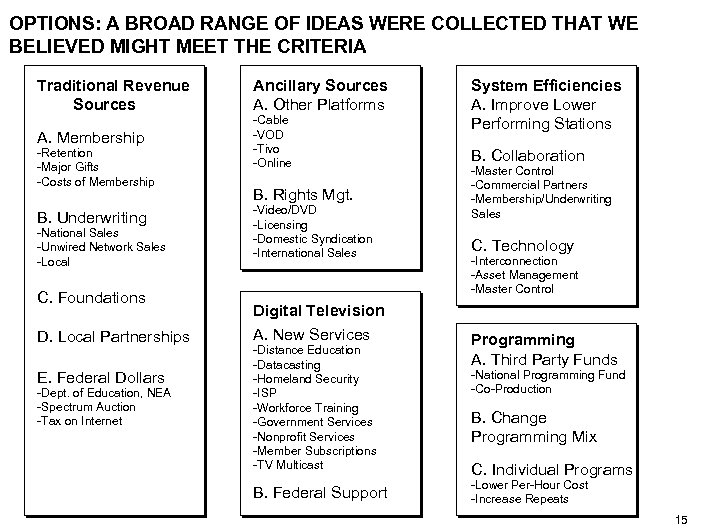

OPTIONS: A BROAD RANGE OF IDEAS WERE COLLECTED THAT WE BELIEVED MIGHT MEET THE CRITERIA Traditional Revenue Sources A. Membership -Retention -Major Gifts -Costs of Membership B. Underwriting -National Sales -Unwired Network Sales -Local C. Foundations D. Local Partnerships E. Federal Dollars -Dept. of Education, NEA -Spectrum Auction -Tax on Internet Ancillary Sources A. Other Platforms -Cable -VOD -Tivo -Online B. Rights Mgt. -Video/DVD -Licensing -Domestic Syndication -International Sales Digital Television A. New Services -Distance Education -Datacasting -Homeland Security -ISP -Workforce Training -Government Services -Nonprofit Services -Member Subscriptions -TV Multicast B. Federal Support System Efficiencies A. Improve Lower Performing Stations B. Collaboration -Master Control -Commercial Partners -Membership/Underwriting Sales C. Technology -Interconnection -Asset Management -Master Control Programming A. Third Party Funds -National Programming Fund -Co-Production B. Change Programming Mix C. Individual Programs -Lower Per-Hour Cost -Increase Repeats 15

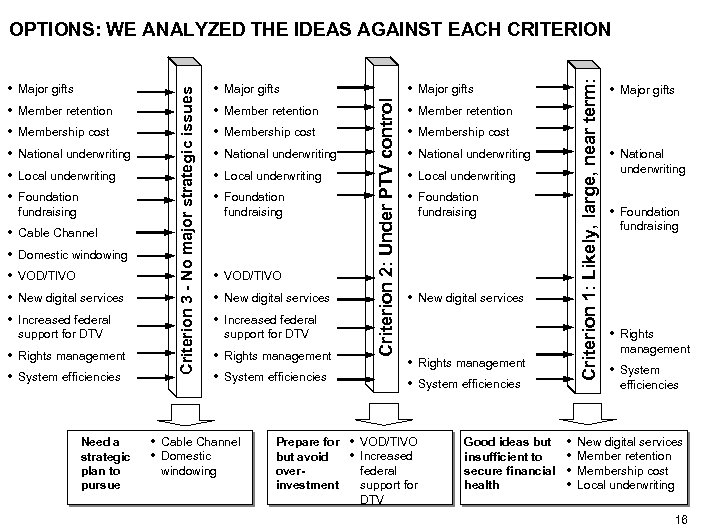

• • • Cable Channel Member retention Membership cost National underwriting Local underwriting Foundation fundraising Domestic windowing VOD/TIVO New digital services Increased federal support for DTV • Rights management • System efficiencies Need a strategic plan to pursue • • • Major gifts Member retention Membership cost National underwriting Local underwriting Foundation fundraising • VOD/TIVO • New digital services • Increased federal support for DTV • Rights management • System efficiencies • Cable Channel • Domestic windowing Prepare for but avoid overinvestment • • • Criterion 1: Likely, large, near term: Major gifts Criterion 2: Under PTV control • • • Criterion 3 - No major strategic issues OPTIONS: WE ANALYZED THE IDEAS AGAINST EACH CRITERION Major gifts Member retention Membership cost National underwriting Local underwriting Foundation fundraising • New digital services • Rights management • System efficiencies • VOD/TIVO • Increased federal support for DTV Good ideas but insufficient to secure financial health • • • Major gifts • National underwriting • Foundation fundraising • Rights management • System efficiencies New digital services Member retention Membership cost Local underwriting 16

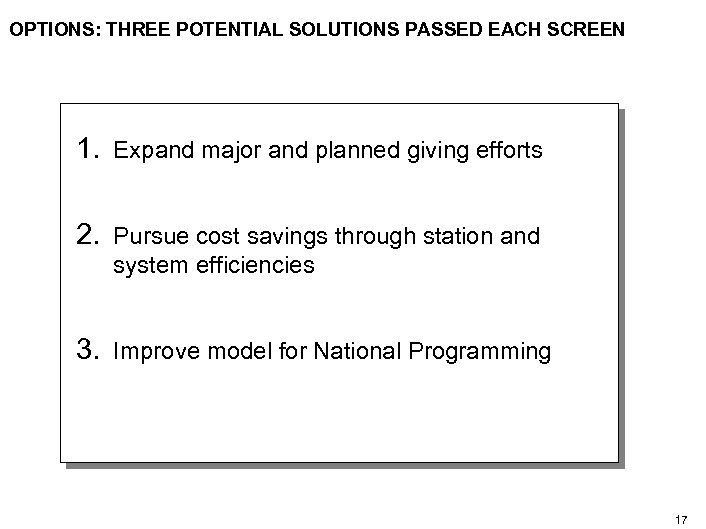

OPTIONS: THREE POTENTIAL SOLUTIONS PASSED EACH SCREEN 1. Expand major and planned giving efforts 2. Pursue cost savings through station and system efficiencies 3. Improve model for National Programming 17

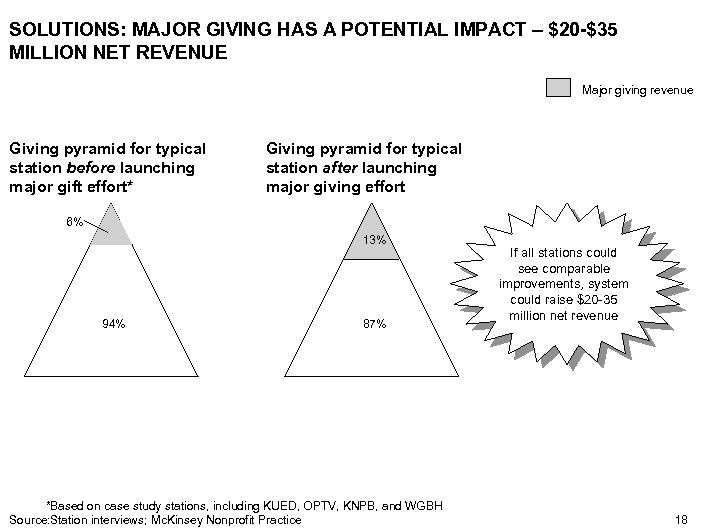

SOLUTIONS: MAJOR GIVING HAS A POTENTIAL IMPACT – $20 -$35 MILLION NET REVENUE Major giving revenue Giving pyramid for typical station before launching major gift effort* Giving pyramid for typical station after launching major giving effort 6% 13% 94% 87% *Based on case study stations, including KUED, OPTV, KNPB, and WGBH Source: Station interviews; Mc. Kinsey Nonprofit Practice If all stations could see comparable improvements, system could raise $20 -35 million net revenue 18

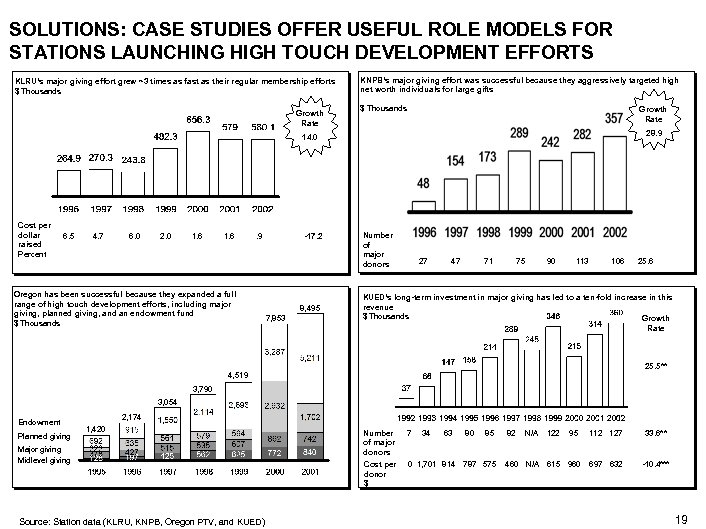

SOLUTIONS: CASE STUDIES OFFER USEFUL ROLE MODELS FOR STATIONS LAUNCHING HIGH TOUCH DEVELOPMENT EFFORTS KLRU’s major giving effort grew ~3 times as fast as their regular membership efforts $ Thousands Growth Rate KNPB’s major giving effort was successful because they aggressively targeted high net worth individuals for large gifts $ Thousands Growth Rate 28. 9 14. 0 Cost per dollar raised Percent 6. 5 4. 7 6. 0 2. 0 1. 6 . 9 Oregon has been successful because they expanded a full range of high touch development efforts, including major giving, planned giving, and an endowment fund $ Thousands -17. 2 8, 495 7, 853 Number of major donors 27 47 71 75 90 113 106 25. 6 KUED’s long-term investment in major giving has led to a ten-fold increase in this revenue $ Thousands Growth Rate 25. 5** 4, 519 3, 790 3, 054 Endowment Planned giving 2, 174 1, 420 Major giving Midlevel giving Source: Station data (KLRU, KNPB, Oregon PTV, and KUED) Number of major donors 7 34 63 80 85 Cost per donor $ 0 1, 701 814 787 575 82 N/A 122 95 460 N/A 615 960 112 127 33. 6** 697 632 -10. 4*** 19

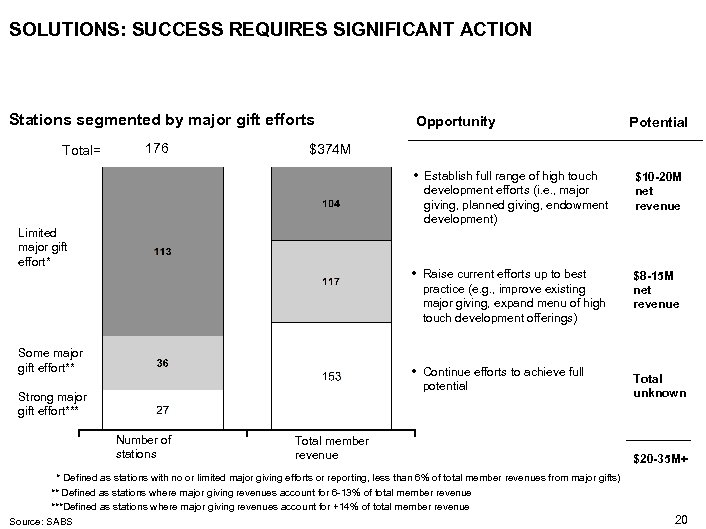

SOLUTIONS: SUCCESS REQUIRES SIGNIFICANT ACTION Stations segmented by major gift efforts Total= 176 Opportunity $374 M • Establish full range of high touch development efforts (i. e. , major giving, planned giving, endowment development) Limited major gift effort* • Raise current efforts up to best practice (e. g. , improve existing major giving, expand menu of high touch development offerings) Some major gift effort** • Continue efforts to achieve full potential Strong major gift effort*** Number of stations Potential Total member revenue * Defined as stations with no or limited major giving efforts or reporting, less than 6% of total member revenues from major gifts) ** Defined as stations where major giving revenues account for 6 -13% of total member revenue ***Defined as stations where major giving revenues account for +14% of total member revenue Source: SABS $10 -20 M net revenue $8 -15 M net revenue Total unknown $20 -35 M+ 20

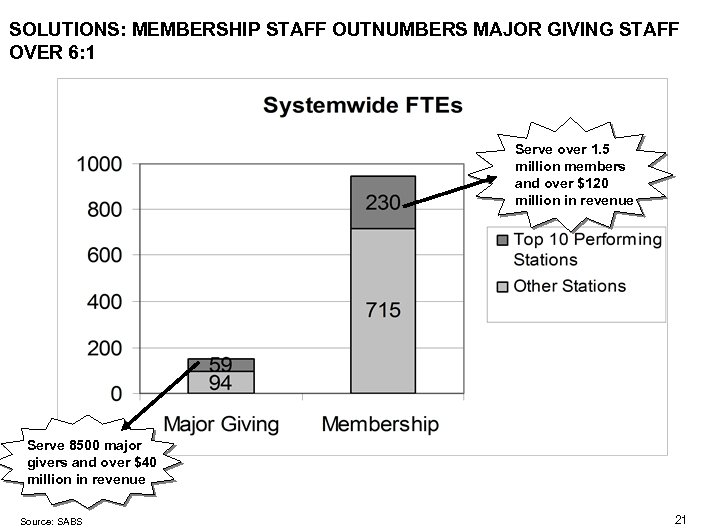

SOLUTIONS: MEMBERSHIP STAFF OUTNUMBERS MAJOR GIVING STAFF OVER 6: 1 Serve over 1. 5 million members and over $120 million in revenue Serve 8500 major givers and over $40 million in revenue Source: SABS 21

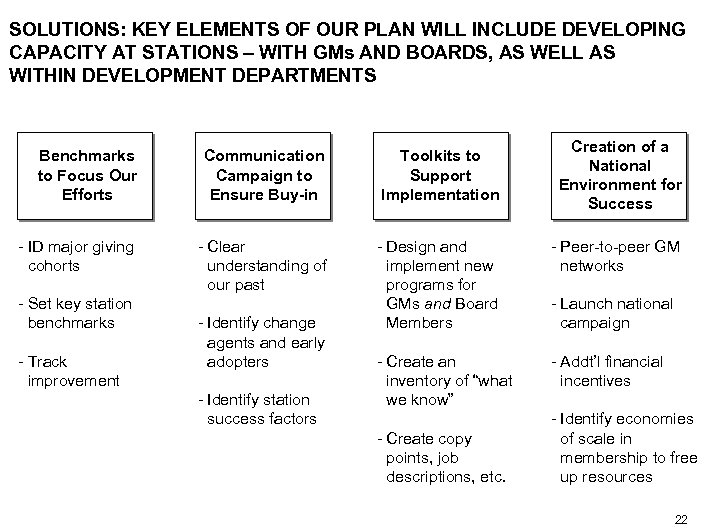

SOLUTIONS: KEY ELEMENTS OF OUR PLAN WILL INCLUDE DEVELOPING CAPACITY AT STATIONS – WITH GMs AND BOARDS, AS WELL AS WITHIN DEVELOPMENT DEPARTMENTS Creation of a National Environment for Success Benchmarks to Focus Our Efforts Communication Campaign to Ensure Buy-in Toolkits to Support Implementation - ID major giving cohorts - Clear understanding of our past - Design and implement new programs for GMs and Board Members - Peer-to-peer GM networks - Create an inventory of “what we know” - Addt’l financial incentives - Set key station benchmarks - Track improvement - Identify change agents and early adopters - Identify station success factors - Create copy points, job descriptions, etc. - Launch national campaign - Identify economies of scale in membership to free up resources 22

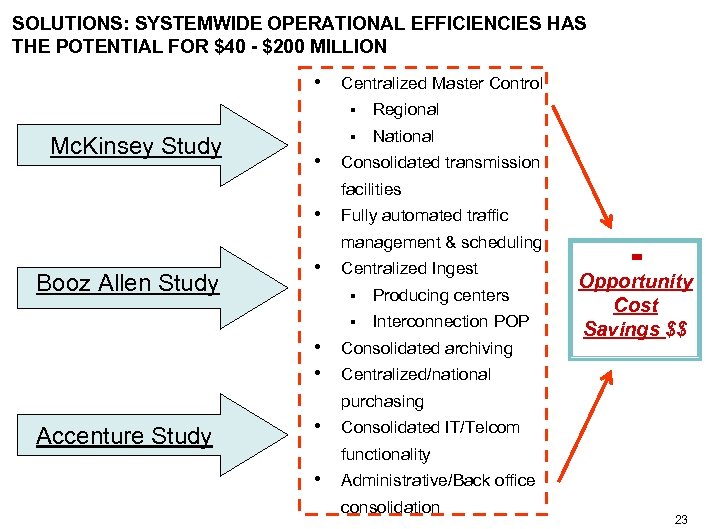

SOLUTIONS: SYSTEMWIDE OPERATIONAL EFFICIENCIES HAS THE POTENTIAL FOR $40 - $200 MILLION • Centralized Master Control § Mc. Kinsey Study Regional § National • Consolidated transmission facilities • Fully automated traffic management & scheduling Booz Allen Study • Centralized Ingest § Producing centers § Interconnection POP • Consolidated archiving • Centralized/national = Opportunity Cost Savings $$ purchasing Accenture Study • Consolidated IT/Telcom functionality • Administrative/Back office consolidation 23

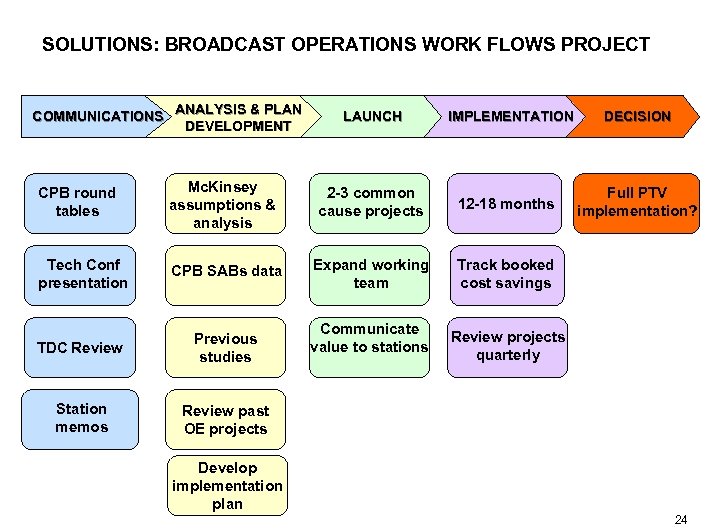

SOLUTIONS: BROADCAST OPERATIONS WORK FLOWS PROJECT ANALYSIS & PLAN COMMUNICATIONS DEVELOPMENT LAUNCH IMPLEMENTATION CPB round tables Mc. Kinsey assumptions & analysis 2 -3 common cause projects 12 -18 months Tech Conf presentation CPB SABs data Expand working team Track booked cost savings TDC Review Previous studies Communicate value to stations Review projects quarterly Station memos DECISION Review past OE projects Full PTV implementation? Develop implementation plan 24

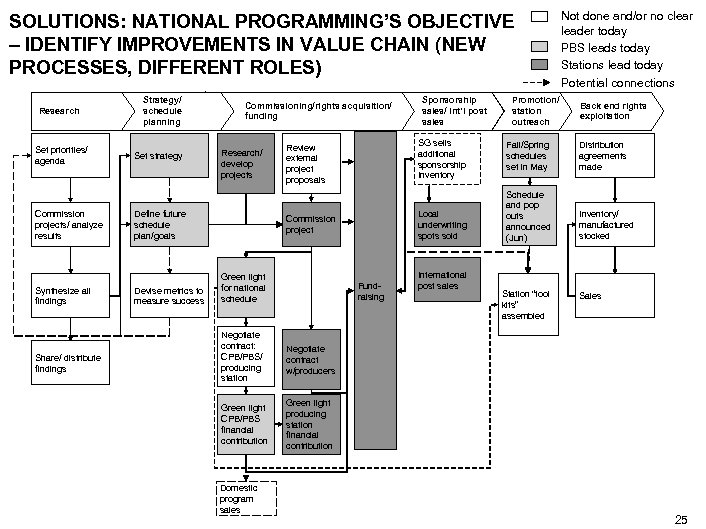

SOLUTIONS: NATIONAL PROGRAMMING’S OBJECTIVE – IDENTIFY IMPROVEMENTS IN VALUE CHAIN (NEW PROCESSES, DIFFERENT ROLES) Research Set priorities/ agenda Commission projects/ analyze results Synthesize all findings Share/ distribute findings Strategy/ schedule planning Set strategy Commissioning/rights acquisition/ funding Research/ develop projects Define future schedule plan/goals Devise metrics to measure success SG sells additional sponsorship Inventory Review external project proposals Local underwriting spots sold Commission project Green light for national schedule Fundraising Negotiate contract: CPB/PBS/ producing station International post sales Promotion/ station outreach Back end rights exploitation Fall/Spring schedules set in May Distribution agreements made Schedule and pop outs announced (Jun) Inventory/ manufactured stocked Station “tool kits” assembled Sales Negotiate contract w/producers Green light CPB/PBS financial contribution Sponsorship sales/ int’l post sales Not done and/or no clear leader today PBS leads today Stations lead today Potential connections Green light producing station financial contribution Domestic program sales 25

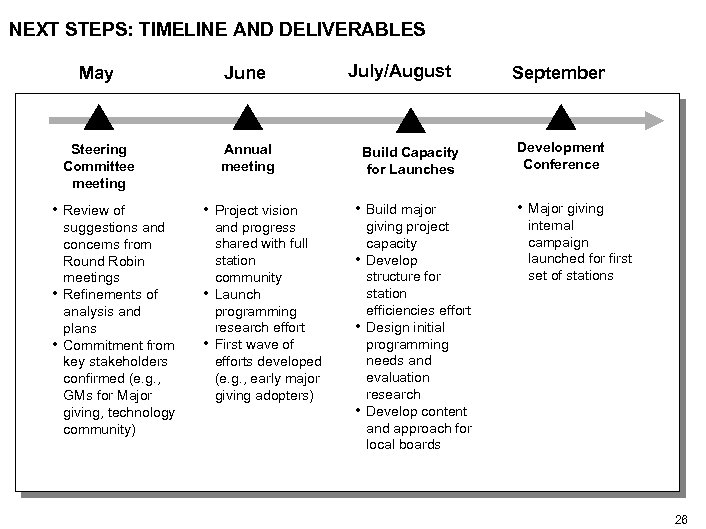

NEXT STEPS: TIMELINE AND DELIVERABLES May June Steering Committee meeting Annual meeting • Review of • • July/August suggestions and concerns from Round Robin meetings Refinements of analysis and plans Commitment from key stakeholders confirmed (e. g. , GMs for Major giving, technology community) • Project vision • • and progress shared with full station community Launch programming research effort First wave of efforts developed (e. g. , early major giving adopters) Build Capacity for Launches • Build major • • • giving project capacity Develop structure for station efficiencies effort Design initial programming needs and evaluation research Develop content and approach for local boards September Development Conference • Major giving internal campaign launched for first set of stations 26

DISCUSSION QUESTIONS • Do you agree with the financial findings? • What questions do you have about the analysis? • What will be required for success in major giving? Station efficiencies? • What role can your functional areas play in ensuring success? 27

6ed6d4469fdd8a0f4c454342dba99281.ppt