9ed333d79ac15ad56f08b6e968cfbe16.ppt

- Количество слайдов: 41

CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER Purchasing Card Best Practices : Reduce Costs and Generate Income 0

CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER Purchasing Card Best Practices : Reduce Costs and Generate Income 0

Agenda § 9: 00 a. m. Welcome and Introductions § Charlie Pride and John Rogers § 9: 15 a. m. Purchasing Card Best Practices § Presentation – Brian Rodgers § 9: 35 a. m. City of Westfield - Efficiencies & Benefits Recognized through a Card Program CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER § Presentation – John Rogers § 9: 55 a. m. Q & A § Charlie Pride, John Rogers and Brian Rodgers § 10: 15 a. m. Adjournment 1 1

Agenda § 9: 00 a. m. Welcome and Introductions § Charlie Pride and John Rogers § 9: 15 a. m. Purchasing Card Best Practices § Presentation – Brian Rodgers § 9: 35 a. m. City of Westfield - Efficiencies & Benefits Recognized through a Card Program CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER § Presentation – John Rogers § 9: 55 a. m. Q & A § Charlie Pride, John Rogers and Brian Rodgers § 10: 15 a. m. Adjournment 1 1

Welcome and Introductions J. P. Morgan Chase State Board of Accounts City of Westfield, Enterprise Division City of Westfield, Clerk Treasurers Office ◦ Brian Rodgers, Commercial Card Solutions Manager ◦ Charlie Pride, Cities, Towns and Libraries Office Supervisor ◦ John Rogers, Director of Enterprise ◦ Tammy Havard, Financial Strategist ◦ Teresa Evans, Project Manager ◦ Cindy Gossard, Clerk Treasurer ◦ Kerri Gagnon, Deputy Clerk Treasurer ◦ Micha Farrar, Deputy Clerk Treasurer 2 www. westfield. in. gov

Welcome and Introductions J. P. Morgan Chase State Board of Accounts City of Westfield, Enterprise Division City of Westfield, Clerk Treasurers Office ◦ Brian Rodgers, Commercial Card Solutions Manager ◦ Charlie Pride, Cities, Towns and Libraries Office Supervisor ◦ John Rogers, Director of Enterprise ◦ Tammy Havard, Financial Strategist ◦ Teresa Evans, Project Manager ◦ Cindy Gossard, Clerk Treasurer ◦ Kerri Gagnon, Deputy Clerk Treasurer ◦ Micha Farrar, Deputy Clerk Treasurer 2 www. westfield. in. gov

p. Cards and Westfield We evaluated everyday tasks and activities: ◦ ◦ Are they value-add? Is this the best way to get this task done? Are there best practices? Is Apple going to announce an i. Clerk to do this for us? 3 www. westfield. in. gov

p. Cards and Westfield We evaluated everyday tasks and activities: ◦ ◦ Are they value-add? Is this the best way to get this task done? Are there best practices? Is Apple going to announce an i. Clerk to do this for us? 3 www. westfield. in. gov

The Numbers How many invoices were we processing last year? ◦ How many are we averaging this year? How much did it cost us to invoice? 4 www. westfield. in. gov

The Numbers How many invoices were we processing last year? ◦ How many are we averaging this year? How much did it cost us to invoice? 4 www. westfield. in. gov

Pop Quiz! When does authorization for spending occur? ◦ When the budget is approved by the common council? ◦ When the claims docket is approved? ◦ When Charlie says so…. A: When the budget is approved by the common council. 5 www. westfield. in. gov

Pop Quiz! When does authorization for spending occur? ◦ When the budget is approved by the common council? ◦ When the claims docket is approved? ◦ When Charlie says so…. A: When the budget is approved by the common council. 5 www. westfield. in. gov

Pop Quiz! What do the State auditors require as proof for all expenses? ◦ Paper receipts and signed approval vouchers ◦ Images of receipts and electronic approvals ◦ Let’s ask CHARLIE…… A: Charlie has the answer! 6 www. westfield. in. gov

Pop Quiz! What do the State auditors require as proof for all expenses? ◦ Paper receipts and signed approval vouchers ◦ Images of receipts and electronic approvals ◦ Let’s ask CHARLIE…… A: Charlie has the answer! 6 www. westfield. in. gov

Charlie Pride, State Board of Accounts 7 www. westfield. in. gov

Charlie Pride, State Board of Accounts 7 www. westfield. in. gov

Agenda Purchasing Card Best Practices : Reduce Costs and Generate Income Presented by: Brian Rodgers, Commercial Card Solutions Manager 8

Agenda Purchasing Card Best Practices : Reduce Costs and Generate Income Presented by: Brian Rodgers, Commercial Card Solutions Manager 8

This presentation was prepared exclusively for the benefit and internal use of the J. P. Morgan client or potential client to whom it is directly delivered and/or addressed (including subsidiaries and affiliates, the “Company”) in order to assist the Company in evaluating, on a preliminary basis, the feasibility of a possible transaction or transactions or other business relationship and does not carry any right of publication or disclosure, in whole or in part, to any other party. This presentation is for discussion purposes only and is incomplete without reference to, and should be viewed solely in conjunction with, the oral briefing provided by J. P. Morgan. Neither this presentation nor any of its contents may be disclosed or used for any other purpose without the prior written consent of J. P. Morgan. CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER To the extent that the information in this presentation is based upon any management forecasts or other information supplied to us by or on behalf of the Company, it reflects such information as well as prevailing conditions and our views as of this date, all of which are accordingly subject to change. J. P. Morgan’s opinions and estimates constitute J. P. Morgan’s judgment and should be regarded as indicative, preliminary and for illustrative purposes only. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Company or which was otherwise reviewed by us. J. P. Morgan makes no representations as to the actual value which may be received in connection with a transaction nor the legal, tax or accounting effects of consummating a transaction. Unless expressly contemplated hereby, the information in this presentation does not take into account the effects of a possible transaction or transactions involving an actual or potential change of control, which may have significant valuation and other effects. Notwithstanding anything herein to the contrary, the Company and each of its employees, representatives or other agents may disclose to any and all persons, without limitation of any kind, the U. S. federal and state income tax treatment and the U. S. federal and state income tax structure (if applicable) of the transactions contemplated hereby and all materials of any kind (including opinions or other tax analyses) that are provided to the Company insofar as such treatment and/or structure relates to a U. S. federal or state income tax strategy provided to the Company by J. P. Morgan's policies on data privacy can be found at http: //www. jpmorgan. com/pages/privacy. IRS Circular 230 Disclosure: JPMorgan Chase & Co. and its affiliates do not provide tax advice. Accordingly, any discussion of U. S. tax matters included herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone not affiliated with JPMorgan Chase & Co. of any of the matters addressed herein or for the purpose of avoiding U. S. tax-related penalties. Chase, JPMorgan and JPMorgan Chase are marketing names for certain businesses of JPMorgan Chase & Co. and its subsidiaries worldwide (collectively, “JPMC”) and if and as used herein may include as applicable employees or officers of any or all of such entities irrespective of the marketing name used. Products and services may be provided by commercial bank affiliates, securities affiliates or other JPMC affiliates or entities. In particular, securities brokerage services other than those which can be provided by commercial bank affiliates under applicable law will be provided by registered broker/dealer affiliates such as J. P. Morgan Securities LLC, J. P. Morgan Institutional Investments Inc. or Chase Investment Services Corporation or by such other affiliates as may be appropriate to provide such services under applicable law. Such securities are not deposits or other obligations of any such commercial bank, are not guaranteed by any such commercial bank and are not insured by the Federal Deposit Insurance Corporation. This presentation does not constitute a commitment by any JPMC entity to extend or arrange credit or to provide any other services. 9 9

This presentation was prepared exclusively for the benefit and internal use of the J. P. Morgan client or potential client to whom it is directly delivered and/or addressed (including subsidiaries and affiliates, the “Company”) in order to assist the Company in evaluating, on a preliminary basis, the feasibility of a possible transaction or transactions or other business relationship and does not carry any right of publication or disclosure, in whole or in part, to any other party. This presentation is for discussion purposes only and is incomplete without reference to, and should be viewed solely in conjunction with, the oral briefing provided by J. P. Morgan. Neither this presentation nor any of its contents may be disclosed or used for any other purpose without the prior written consent of J. P. Morgan. CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER To the extent that the information in this presentation is based upon any management forecasts or other information supplied to us by or on behalf of the Company, it reflects such information as well as prevailing conditions and our views as of this date, all of which are accordingly subject to change. J. P. Morgan’s opinions and estimates constitute J. P. Morgan’s judgment and should be regarded as indicative, preliminary and for illustrative purposes only. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Company or which was otherwise reviewed by us. J. P. Morgan makes no representations as to the actual value which may be received in connection with a transaction nor the legal, tax or accounting effects of consummating a transaction. Unless expressly contemplated hereby, the information in this presentation does not take into account the effects of a possible transaction or transactions involving an actual or potential change of control, which may have significant valuation and other effects. Notwithstanding anything herein to the contrary, the Company and each of its employees, representatives or other agents may disclose to any and all persons, without limitation of any kind, the U. S. federal and state income tax treatment and the U. S. federal and state income tax structure (if applicable) of the transactions contemplated hereby and all materials of any kind (including opinions or other tax analyses) that are provided to the Company insofar as such treatment and/or structure relates to a U. S. federal or state income tax strategy provided to the Company by J. P. Morgan's policies on data privacy can be found at http: //www. jpmorgan. com/pages/privacy. IRS Circular 230 Disclosure: JPMorgan Chase & Co. and its affiliates do not provide tax advice. Accordingly, any discussion of U. S. tax matters included herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone not affiliated with JPMorgan Chase & Co. of any of the matters addressed herein or for the purpose of avoiding U. S. tax-related penalties. Chase, JPMorgan and JPMorgan Chase are marketing names for certain businesses of JPMorgan Chase & Co. and its subsidiaries worldwide (collectively, “JPMC”) and if and as used herein may include as applicable employees or officers of any or all of such entities irrespective of the marketing name used. Products and services may be provided by commercial bank affiliates, securities affiliates or other JPMC affiliates or entities. In particular, securities brokerage services other than those which can be provided by commercial bank affiliates under applicable law will be provided by registered broker/dealer affiliates such as J. P. Morgan Securities LLC, J. P. Morgan Institutional Investments Inc. or Chase Investment Services Corporation or by such other affiliates as may be appropriate to provide such services under applicable law. Such securities are not deposits or other obligations of any such commercial bank, are not guaranteed by any such commercial bank and are not insured by the Federal Deposit Insurance Corporation. This presentation does not constitute a commitment by any JPMC entity to extend or arrange credit or to provide any other services. 9 9

Agenda CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER § What is a Purchasing Card § What Can a Purchasing Card Do For You? § Generate Income § Prevent Fraud and Misuse § Reporting § Implementation and Support 10

Agenda CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER § What is a Purchasing Card § What Can a Purchasing Card Do For You? § Generate Income § Prevent Fraud and Misuse § Reporting § Implementation and Support 10

Agenda CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER § What is a Purchasing Card § What Can a Purchasing Card Do For You? § Generate Income § Prevent Fraud and Misuse § Reporting § Implementation and Support 11

Agenda CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER § What is a Purchasing Card § What Can a Purchasing Card Do For You? § Generate Income § Prevent Fraud and Misuse § Reporting § Implementation and Support 11

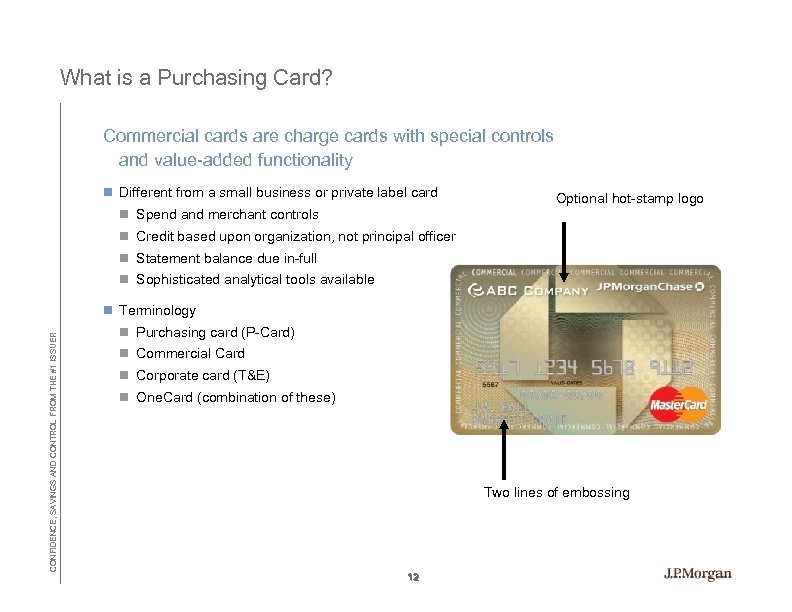

What is a Purchasing Card? Commercial cards are charge cards with special controls and value-added functionality n Different from a small business or private label card Optional hot-stamp logo n Spend and merchant controls n Credit based upon organization, not principal officer n Statement balance due in-full n Sophisticated analytical tools available CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Terminology n Purchasing card (P-Card) n Commercial Card n Corporate card (T&E) n One. Card (combination of these) Two lines of embossing 12

What is a Purchasing Card? Commercial cards are charge cards with special controls and value-added functionality n Different from a small business or private label card Optional hot-stamp logo n Spend and merchant controls n Credit based upon organization, not principal officer n Statement balance due in-full n Sophisticated analytical tools available CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Terminology n Purchasing card (P-Card) n Commercial Card n Corporate card (T&E) n One. Card (combination of these) Two lines of embossing 12

Agenda CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER § What is a Purchasing Card § What Can a Purchasing Card Do For You? § Generate Income § Prevent Fraud and Misuse § Reporting § Implementation and Support 13

Agenda CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER § What is a Purchasing Card § What Can a Purchasing Card Do For You? § Generate Income § Prevent Fraud and Misuse § Reporting § Implementation and Support 13

With a card program you can… n Gain efficiencies n Reduce costs n Optimize cash flow n Earn financial incentives n Improve vendor relations CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Empower employees If 90% of your invoices make up 10% of your dollars ~ does that mean that accounts payable is spending 90% of their time on 10% of your dollars? 14

With a card program you can… n Gain efficiencies n Reduce costs n Optimize cash flow n Earn financial incentives n Improve vendor relations CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Empower employees If 90% of your invoices make up 10% of your dollars ~ does that mean that accounts payable is spending 90% of their time on 10% of your dollars? 14

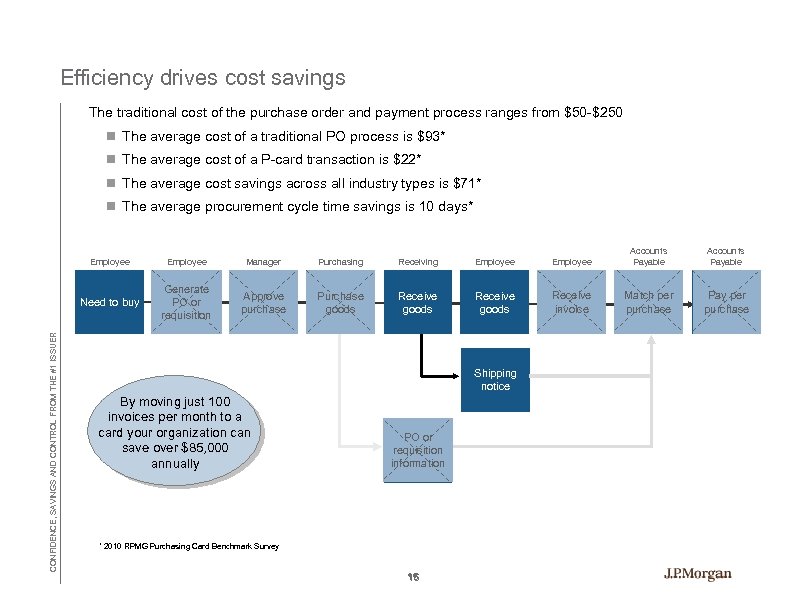

Efficiency drives cost savings The traditional cost of the purchase order and payment process ranges from $50 -$250 n The average cost of a traditional PO process is $93* n The average cost of a P-card transaction is $22* n The average cost savings across all industry types is $71* n The average procurement cycle time savings is 10 days* Employee Manager Purchasing Receiving Employee Accounts Payable Need to buy CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER Employee Generate PO or requisition Approve purchase Purchase goods Receive invoice Match per purchase Pay per purchase Shipping notice By moving just 100 invoices per month to a card your organization can save over $85, 000 annually PO or requisition information * 2010 RPMG Purchasing Card Benchmark Survey 15

Efficiency drives cost savings The traditional cost of the purchase order and payment process ranges from $50 -$250 n The average cost of a traditional PO process is $93* n The average cost of a P-card transaction is $22* n The average cost savings across all industry types is $71* n The average procurement cycle time savings is 10 days* Employee Manager Purchasing Receiving Employee Accounts Payable Need to buy CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER Employee Generate PO or requisition Approve purchase Purchase goods Receive invoice Match per purchase Pay per purchase Shipping notice By moving just 100 invoices per month to a card your organization can save over $85, 000 annually PO or requisition information * 2010 RPMG Purchasing Card Benchmark Survey 15

The expense category may determine the payment method n ACH/EDI/Wires n ACH/EDI for your top tier suppliers n Wires transfers for immediate needs n AP Cards n Use commercial cards in AP to reduce CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER check volume n Checks continue to decline n Commercial Cards and Direct Deposit n Commercial Cards for low dollar procurement and travel n Direct Deposit and Payroll Cards for payroll 16

The expense category may determine the payment method n ACH/EDI/Wires n ACH/EDI for your top tier suppliers n Wires transfers for immediate needs n AP Cards n Use commercial cards in AP to reduce CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER check volume n Checks continue to decline n Commercial Cards and Direct Deposit n Commercial Cards for low dollar procurement and travel n Direct Deposit and Payroll Cards for payroll 16

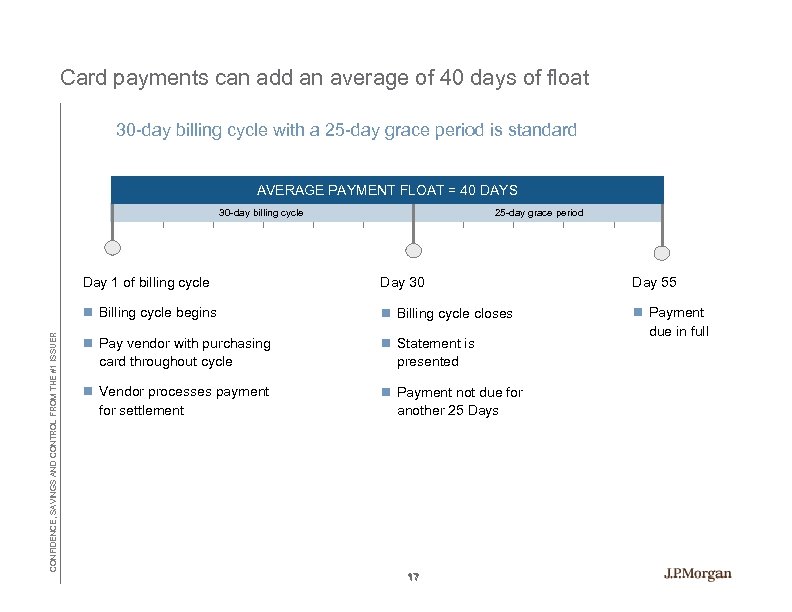

Card payments can add an average of 40 days of float 30 -day billing cycle with a 25 -day grace period is standard AVERAGE PAYMENT FLOAT = 40 DAYS 30 -day billing cycle 25 -day grace period Day 30 Day 55 n Billing cycle begins CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER Day 1 of billing cycle n Billing cycle closes n Pay vendor with purchasing card throughout cycle n Statement is presented n Payment due in full n Vendor processes payment for settlement n Payment not due for another 25 Days 17

Card payments can add an average of 40 days of float 30 -day billing cycle with a 25 -day grace period is standard AVERAGE PAYMENT FLOAT = 40 DAYS 30 -day billing cycle 25 -day grace period Day 30 Day 55 n Billing cycle begins CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER Day 1 of billing cycle n Billing cycle closes n Pay vendor with purchasing card throughout cycle n Statement is presented n Payment due in full n Vendor processes payment for settlement n Payment not due for another 25 Days 17

Empower your employees with controlled purchasing ability n Accounts payable n Central purchasing n Administrative assistants n Maintenance (facilities/transportation) n IT staff members n Office and department managers CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Parks and recreation n Fire and police n Courts n Conference and meeting planners Commercial cards benefit anyone in your organization that needs to make purchases as a regular part of their daily job routine. n Principals and teachers n Athletics and theater n Travelers 18

Empower your employees with controlled purchasing ability n Accounts payable n Central purchasing n Administrative assistants n Maintenance (facilities/transportation) n IT staff members n Office and department managers CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Parks and recreation n Fire and police n Courts n Conference and meeting planners Commercial cards benefit anyone in your organization that needs to make purchases as a regular part of their daily job routine. n Principals and teachers n Athletics and theater n Travelers 18

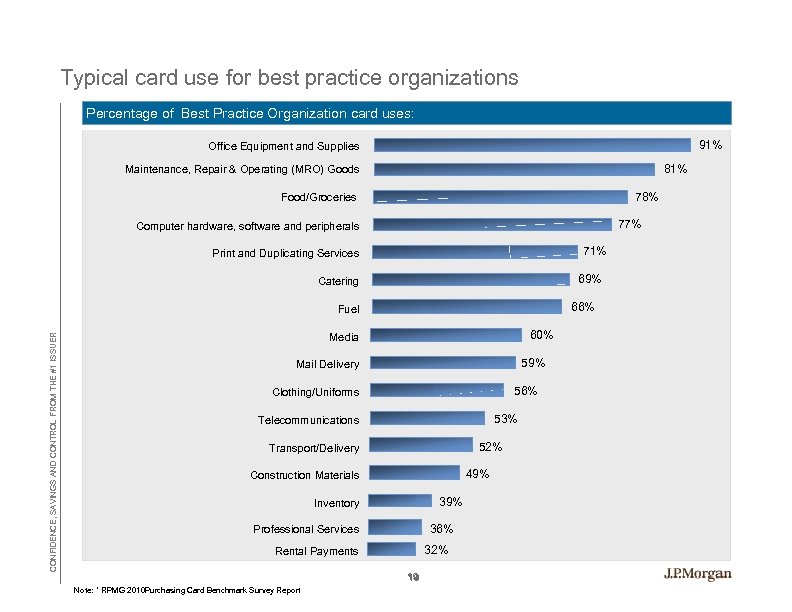

Typical card use for best practice organizations Percentage of Best Practice Organization card uses: 91% Office Equipment and Supplies 81% Maintenance, Repair & Operating (MRO) Goods 78% Food/Groceries 77% Computer hardware, software and peripherals 71% Print and Duplicating Services 69% Catering 66% CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER Fuel 60% Media 59% Mail Delivery 56% Clothing/Uniforms 53% Telecommunications 52% Transport/Delivery 49% Construction Materials 39% Inventory 36% Professional Services 32% Rental Payments 19 Note: * RPMG 2010 Purchasing Card Benchmark Survey Report Aberdeen Research

Typical card use for best practice organizations Percentage of Best Practice Organization card uses: 91% Office Equipment and Supplies 81% Maintenance, Repair & Operating (MRO) Goods 78% Food/Groceries 77% Computer hardware, software and peripherals 71% Print and Duplicating Services 69% Catering 66% CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER Fuel 60% Media 59% Mail Delivery 56% Clothing/Uniforms 53% Telecommunications 52% Transport/Delivery 49% Construction Materials 39% Inventory 36% Professional Services 32% Rental Payments 19 Note: * RPMG 2010 Purchasing Card Benchmark Survey Report Aberdeen Research

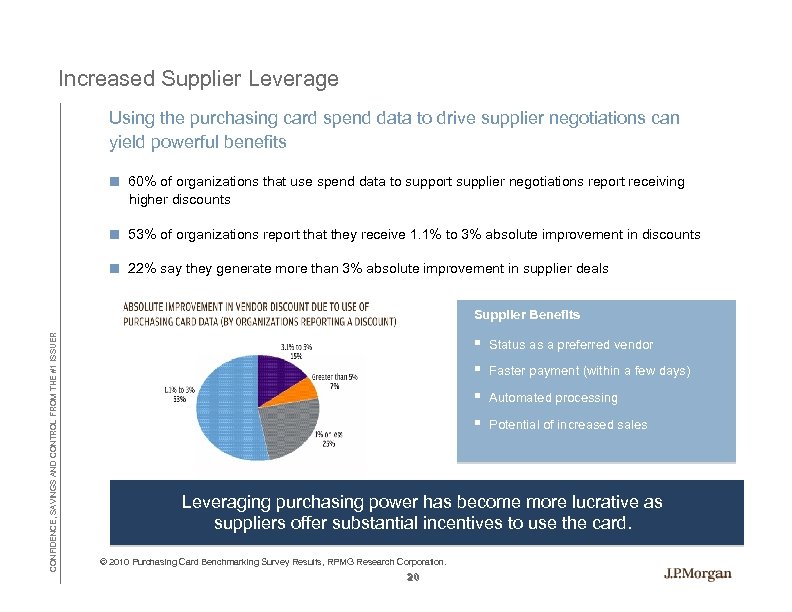

Increased Supplier Leverage Using the purchasing card spend data to drive supplier negotiations can yield powerful benefits ■ 60% of organizations that use spend data to support supplier negotiations report receiving higher discounts ■ 53% of organizations report that they receive 1. 1% to 3% absolute improvement in discounts ■ 22% say they generate more than 3% absolute improvement in supplier deals CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER Supplier Benefits § Status as a preferred vendor § Faster payment (within a few days) § Automated processing § Potential of increased sales Leveraging purchasing power has become more lucrative as suppliers offer substantial incentives to use the card. © 2010 Purchasing Card Benchmarking Survey Results, RPMG Research Corporation. 20

Increased Supplier Leverage Using the purchasing card spend data to drive supplier negotiations can yield powerful benefits ■ 60% of organizations that use spend data to support supplier negotiations report receiving higher discounts ■ 53% of organizations report that they receive 1. 1% to 3% absolute improvement in discounts ■ 22% say they generate more than 3% absolute improvement in supplier deals CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER Supplier Benefits § Status as a preferred vendor § Faster payment (within a few days) § Automated processing § Potential of increased sales Leveraging purchasing power has become more lucrative as suppliers offer substantial incentives to use the card. © 2010 Purchasing Card Benchmarking Survey Results, RPMG Research Corporation. 20

Agenda CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER § What is a Purchasing Card § What Can a Purchasing Card Do For You? § Generate Income § Prevent Fraud and Misuse § Reporting § Implementation and Support 21

Agenda CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER § What is a Purchasing Card § What Can a Purchasing Card Do For You? § Generate Income § Prevent Fraud and Misuse § Reporting § Implementation and Support 21

Rebates have become commonplace for qualified programs n Factors that affect rebate earning potential n Annual volume n Billing cycle length n Speed of pay n Program dynamics n While cost/incentive is a large factor, other factors should weigh in: * n Technology CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Experience and expertise n Customer and cardholder services * Source: Best Practices Task Force Report: Optimizing Revenue Sharing, NAPCP, November 2006 22

Rebates have become commonplace for qualified programs n Factors that affect rebate earning potential n Annual volume n Billing cycle length n Speed of pay n Program dynamics n While cost/incentive is a large factor, other factors should weigh in: * n Technology CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Experience and expertise n Customer and cardholder services * Source: Best Practices Task Force Report: Optimizing Revenue Sharing, NAPCP, November 2006 22

Agenda CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER § What is a Purchasing Card § What Can a Purchasing Card Do For You? § Generate Income § Prevent Fraud and Misuse § Reporting § Implementation and Support 23

Agenda CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER § What is a Purchasing Card § What Can a Purchasing Card Do For You? § Generate Income § Prevent Fraud and Misuse § Reporting § Implementation and Support 23

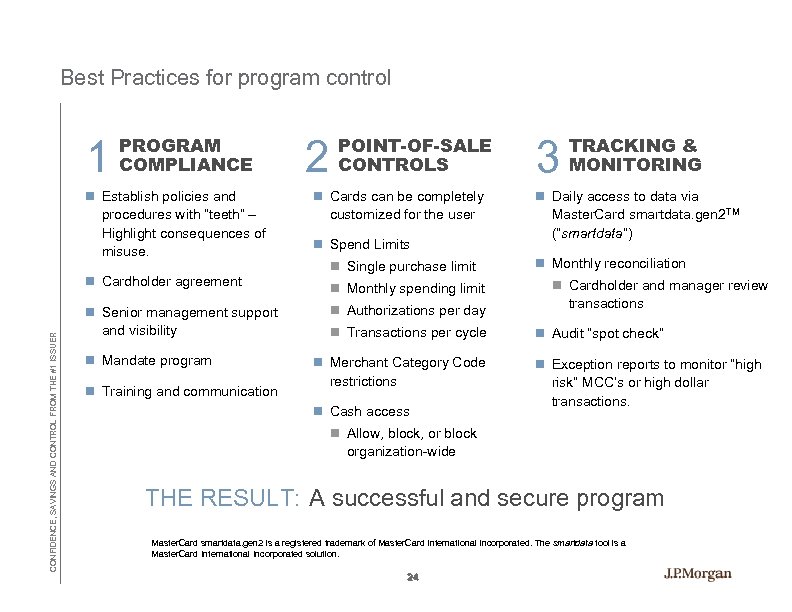

Best Practices for program control 1 PROGRAM COMPLIANCE n Establish policies and procedures with “teeth” – Highlight consequences of misuse. CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Cardholder agreement n Senior management support and visibility n Mandate program n Training and communication 2 POINT-OF-SALE CONTROLS n Cards can be completely customized for the user n Spend Limits n Single purchase limit n Monthly spending limit n Authorizations per day n Transactions per cycle n Merchant Category Code restrictions n Cash access 3 TRACKING & MONITORING n Daily access to data via Master. Card smartdata. gen 2 TM (“smartdata”) n Monthly reconciliation n Cardholder and manager review transactions n Audit “spot check” n Exception reports to monitor “high risk” MCC’s or high dollar transactions. n Allow, block, or block organization-wide THE RESULT: A successful and secure program Master. Card smartdata. gen 2 is a registered trademark of Master. Card International Incorporated. The smartdata tool is a Master. Card International Incorporated solution. 24

Best Practices for program control 1 PROGRAM COMPLIANCE n Establish policies and procedures with “teeth” – Highlight consequences of misuse. CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Cardholder agreement n Senior management support and visibility n Mandate program n Training and communication 2 POINT-OF-SALE CONTROLS n Cards can be completely customized for the user n Spend Limits n Single purchase limit n Monthly spending limit n Authorizations per day n Transactions per cycle n Merchant Category Code restrictions n Cash access 3 TRACKING & MONITORING n Daily access to data via Master. Card smartdata. gen 2 TM (“smartdata”) n Monthly reconciliation n Cardholder and manager review transactions n Audit “spot check” n Exception reports to monitor “high risk” MCC’s or high dollar transactions. n Allow, block, or block organization-wide THE RESULT: A successful and secure program Master. Card smartdata. gen 2 is a registered trademark of Master. Card International Incorporated. The smartdata tool is a Master. Card International Incorporated solution. 24

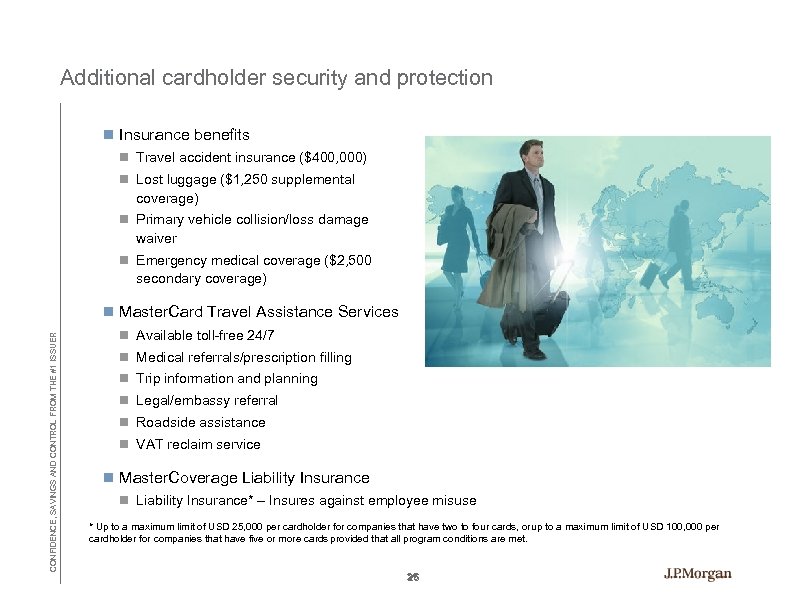

Additional cardholder security and protection n Insurance benefits n Travel accident insurance ($400, 000) n Lost luggage ($1, 250 supplemental coverage) n Primary vehicle collision/loss damage waiver n Emergency medical coverage ($2, 500 secondary coverage) CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Master. Card Travel Assistance Services n Available toll-free 24/7 n Medical referrals/prescription filling n Trip information and planning n Legal/embassy referral n Roadside assistance n VAT reclaim service n Master. Coverage Liability Insurance n Liability Insurance* – Insures against employee misuse * Up to a maximum limit of USD 25, 000 per cardholder for companies that have two to four cards, or up to a maximum limit of USD 100, 000 per cardholder for companies that have five or more cards provided that all program conditions are met. 25

Additional cardholder security and protection n Insurance benefits n Travel accident insurance ($400, 000) n Lost luggage ($1, 250 supplemental coverage) n Primary vehicle collision/loss damage waiver n Emergency medical coverage ($2, 500 secondary coverage) CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Master. Card Travel Assistance Services n Available toll-free 24/7 n Medical referrals/prescription filling n Trip information and planning n Legal/embassy referral n Roadside assistance n VAT reclaim service n Master. Coverage Liability Insurance n Liability Insurance* – Insures against employee misuse * Up to a maximum limit of USD 25, 000 per cardholder for companies that have two to four cards, or up to a maximum limit of USD 100, 000 per cardholder for companies that have five or more cards provided that all program conditions are met. 25

Agenda CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER § What is a Purchasing Card § What Can a Purchasing Card Do For You? § Generate Income § Prevent Fraud and Misuse § Reporting § Implementation and Support 26

Agenda CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER § What is a Purchasing Card § What Can a Purchasing Card Do For You? § Generate Income § Prevent Fraud and Misuse § Reporting § Implementation and Support 26

Web-based reporting for your program management and reporting tool n Multiple user types to provide appropriate access to data n Program level administrator n Manager/supervisor n Cardholder n Create and maintain a reporting hierarchy to mirror your organizational structure n Able to run reports at hierarchy levels n Allow manager access based on hierarchy level CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Email messages to managers and/or cardholders n One-off or scheduled messaging n Filter messages by reviewed status n Card maintenance n Request new cards n Real-time access for limit changes 27

Web-based reporting for your program management and reporting tool n Multiple user types to provide appropriate access to data n Program level administrator n Manager/supervisor n Cardholder n Create and maintain a reporting hierarchy to mirror your organizational structure n Able to run reports at hierarchy levels n Allow manager access based on hierarchy level CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Email messages to managers and/or cardholders n One-off or scheduled messaging n Filter messages by reviewed status n Card maintenance n Request new cards n Real-time access for limit changes 27

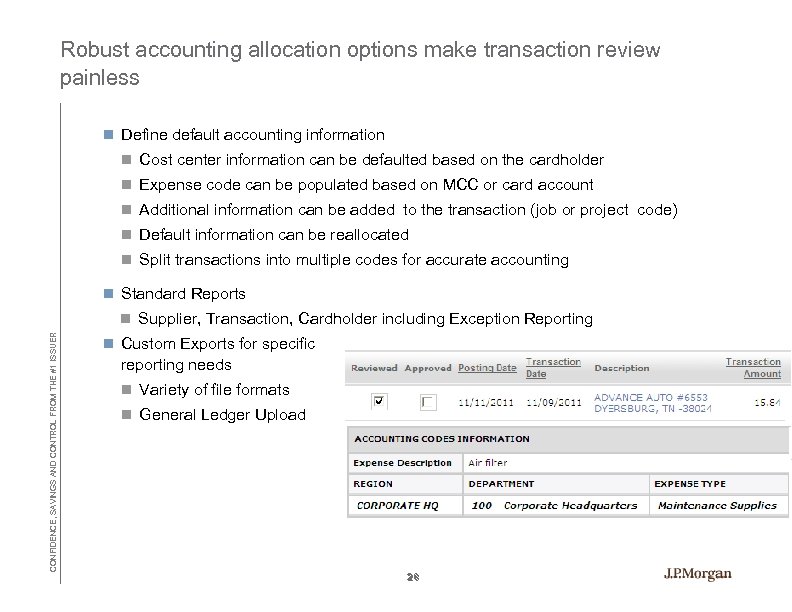

Robust accounting allocation options make transaction review painless n Define default accounting information n Cost center information can be defaulted based on the cardholder n Expense code can be populated based on MCC or card account n Additional information can be added to the transaction (job or project code) n Default information can be reallocated n Split transactions into multiple codes for accurate accounting n Standard Reports CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Supplier, Transaction, Cardholder including Exception Reporting n Custom Exports for specific reporting needs n Variety of file formats n General Ledger Upload 28

Robust accounting allocation options make transaction review painless n Define default accounting information n Cost center information can be defaulted based on the cardholder n Expense code can be populated based on MCC or card account n Additional information can be added to the transaction (job or project code) n Default information can be reallocated n Split transactions into multiple codes for accurate accounting n Standard Reports CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Supplier, Transaction, Cardholder including Exception Reporting n Custom Exports for specific reporting needs n Variety of file formats n General Ledger Upload 28

Agenda CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER § What is a Purchasing Card § What Can a Purchasing Card Do For You? § Generate Income § Prevent Fraud and Misuse § Reporting § Implementation and Support 29

Agenda CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER § What is a Purchasing Card § What Can a Purchasing Card Do For You? § Generate Income § Prevent Fraud and Misuse § Reporting § Implementation and Support 29

Keys to a successful implementation n Clearly define program goals n Allows you to benchmark and quantify successes n Do a Vendor Match to help estimate the size of your program and rebate potential n Garner senior management and oversight body support and approval n Program champion n Involve key areas during the planning process n Oversight Body, Accounts Payable, Purchasing and Auditing CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Establish and enforce policies and procedures n Be sure your policies are ‘enforceable’ n Determine program administrator n Decision-making abilities and authority n Comprehensive training n Cardholders n Management 30

Keys to a successful implementation n Clearly define program goals n Allows you to benchmark and quantify successes n Do a Vendor Match to help estimate the size of your program and rebate potential n Garner senior management and oversight body support and approval n Program champion n Involve key areas during the planning process n Oversight Body, Accounts Payable, Purchasing and Auditing CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Establish and enforce policies and procedures n Be sure your policies are ‘enforceable’ n Determine program administrator n Decision-making abilities and authority n Comprehensive training n Cardholders n Management 30

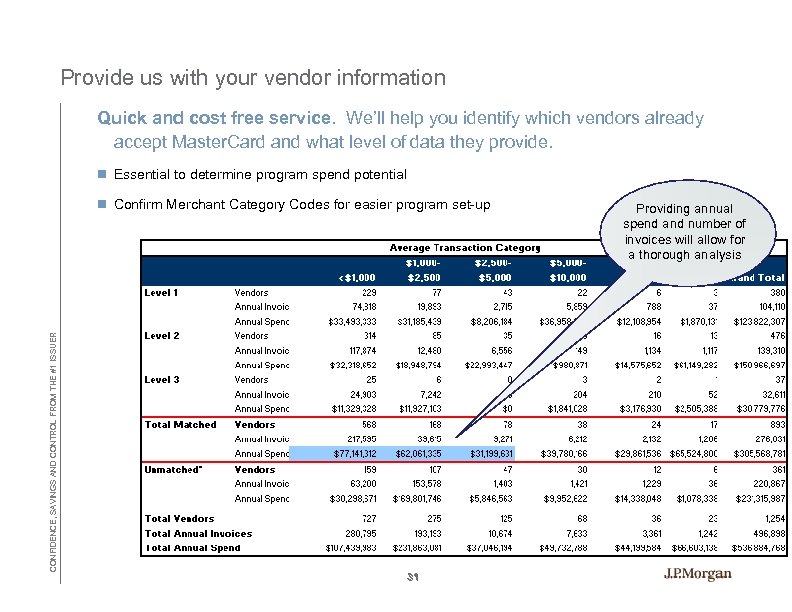

Provide us with your vendor information Quick and cost free service. We’ll help you identify which vendors already accept Master. Card and what level of data they provide. n Essential to determine program spend potential CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Confirm Merchant Category Codes for easier program set-up 31 Providing annual spend and number of invoices will allow for a thorough analysis

Provide us with your vendor information Quick and cost free service. We’ll help you identify which vendors already accept Master. Card and what level of data they provide. n Essential to determine program spend potential CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Confirm Merchant Category Codes for easier program set-up 31 Providing annual spend and number of invoices will allow for a thorough analysis

Implementation and Support Dedicated specialists guide and support your program before, during and after implementation CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER Understand Requirements § Identify project resources § Review technical and reporting requirements § Develop policies § Determine readiness Implement and Train § Attend Program Administrator Training § Launch solution within clients needs and parameters § Train Users to provide faster ramp-up Service & Support § Program Coordinator Team • Day-to-day servicing and maintenance • Program Administrator’s main point of contact § Technical Support Team § Cardholder Support Team 32

Implementation and Support Dedicated specialists guide and support your program before, during and after implementation CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER Understand Requirements § Identify project resources § Review technical and reporting requirements § Develop policies § Determine readiness Implement and Train § Attend Program Administrator Training § Launch solution within clients needs and parameters § Train Users to provide faster ramp-up Service & Support § Program Coordinator Team • Day-to-day servicing and maintenance • Program Administrator’s main point of contact § Technical Support Team § Cardholder Support Team 32

Training Successful implementation continues with effective training n Dedicated trainers are responsible for product training and consulting n Program Administrator training n Online through our Learning Website CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Telephone consultations n Train-the-trainer sessions n Smart. Data® “how-to” guide n Quick reference cards n On-demand Webcasts 33

Training Successful implementation continues with effective training n Dedicated trainers are responsible for product training and consulting n Program Administrator training n Online through our Learning Website CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER n Telephone consultations n Train-the-trainer sessions n Smart. Data® “how-to” guide n Quick reference cards n On-demand Webcasts 33

Purchasing Card Best Practices : Reduce Costs, Generate Income and Prevent Fraud CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER Questions 34

Purchasing Card Best Practices : Reduce Costs, Generate Income and Prevent Fraud CONFIDENCE, SAVINGS AND CONTROL FROM THE #1 ISSUER Questions 34

How to Get Started Ask Why ◦ Why does the procure-topay process take so long? ◦ Why are we paying two different prices for a similar product or service? ◦ Why are we cutting checks to the bank in lieu of ACH payments? ◦ Why are there interstate highways in Hawaii? http: //www. aaroads. com/shields/show. php? image=HI 19790012 t 100010. jpg&view=1 35 www. westfield. in. gov

How to Get Started Ask Why ◦ Why does the procure-topay process take so long? ◦ Why are we paying two different prices for a similar product or service? ◦ Why are we cutting checks to the bank in lieu of ACH payments? ◦ Why are there interstate highways in Hawaii? http: //www. aaroads. com/shields/show. php? image=HI 19790012 t 100010. jpg&view=1 35 www. westfield. in. gov

The Solution is p. Cards! A p. Card program reduces the steps of the procure-to-pay process by: ◦ Moving some aspects of the back office support closer to the transaction ◦ Settlement of the transactions (less invoices) ◦ Account reconciliation ◦ Reporting 36 www. westfield. in. gov

The Solution is p. Cards! A p. Card program reduces the steps of the procure-to-pay process by: ◦ Moving some aspects of the back office support closer to the transaction ◦ Settlement of the transactions (less invoices) ◦ Account reconciliation ◦ Reporting 36 www. westfield. in. gov

The Solution is p. Cards! The p. Card can provide more efficient control of purchasing activity ◦ Clerk’s office can adjust or limit spend by sector, day and time (much more effective than open PO’s at local suppliers ◦ Limit maverick spend by placing tight controls on the p. Card 37 www. westfield. in. gov

The Solution is p. Cards! The p. Card can provide more efficient control of purchasing activity ◦ Clerk’s office can adjust or limit spend by sector, day and time (much more effective than open PO’s at local suppliers ◦ Limit maverick spend by placing tight controls on the p. Card 37 www. westfield. in. gov

The Solution is p. Cards! Additionally, the p. Card data organizes our vendor and spend information for analysis ◦ Facilitating a review of purchase activity/inconsistencies enterprise-wide through a single database ◦ Allowing for vendor and spend management A vehicle for increasing revenue ◦ The annual rebate currently competes with the interest received on short-term investment notes 38 www. westfield. in. gov

The Solution is p. Cards! Additionally, the p. Card data organizes our vendor and spend information for analysis ◦ Facilitating a review of purchase activity/inconsistencies enterprise-wide through a single database ◦ Allowing for vendor and spend management A vehicle for increasing revenue ◦ The annual rebate currently competes with the interest received on short-term investment notes 38 www. westfield. in. gov

Success is Paperless! 39 www. westfield. in. gov

Success is Paperless! 39 www. westfield. in. gov

Why ask Why? Because everything we do affects the quality of life of our citizens. 40 www. westfield. in. gov

Why ask Why? Because everything we do affects the quality of life of our citizens. 40 www. westfield. in. gov