f99dd97a008efd79fde59e017e0b706d.ppt

- Количество слайдов: 24

Confidence Games & Other Forms of Fraud By Alex E. Ward, CPP

Confidence Games and other Frauds Overview History – What is a Confidence Game? Perception is Reality! Investment Fraud Empowerment Strategies

Program Objective: Train fraud fighters to carry the prevention message into their communities and warn others about Confidence Games and other frauds.

Perception is Reality Confidence criminals allow you to talk about yourself They create the perception they want you to have by using your information to meet their needs They get you to get excited about what they want you to do and that excitement automatically takes away from your ability to logically examine their reality

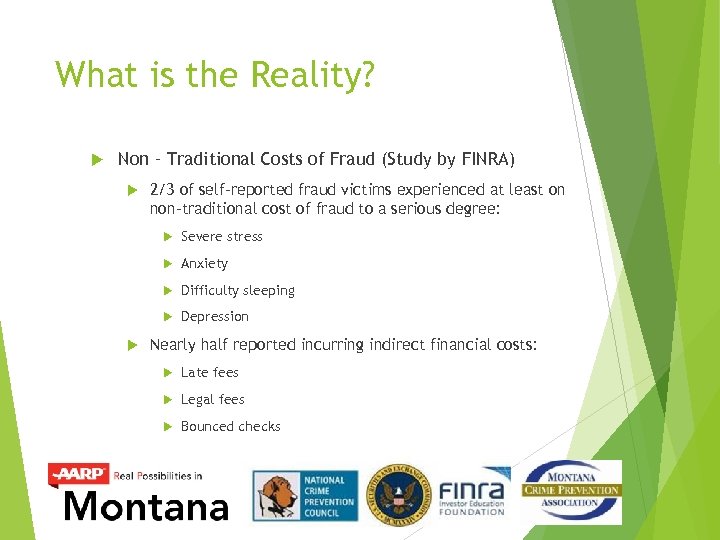

What is the Reality? Non – Traditional Costs of Fraud (Study by FINRA) 2/3 of self-reported fraud victims experienced at least on non-traditional cost of fraud to a serious degree: Severe stress Anxiety Difficulty sleeping Depression Nearly half reported incurring indirect financial costs: Late fees Legal fees Bounced checks

What is the Reality? 29 percent reported Incurring more than $1, 000 in indirect costs 9 percent declared bankruptcy as a result Nearly half of the victims blame themselves for the fraud

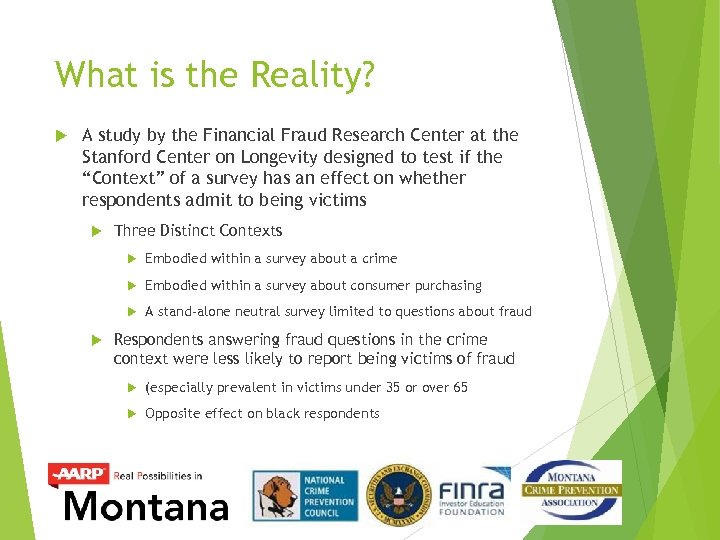

What is the Reality? A study by the Financial Fraud Research Center at the Stanford Center on Longevity designed to test if the “Context” of a survey has an effect on whether respondents admit to being victims Three Distinct Contexts Embodied within a survey about a crime Embodied within a survey about consumer purchasing A stand-alone neutral survey limited to questions about fraud Respondents answering fraud questions in the crime context were less likely to report being victims of fraud (especially prevalent in victims under 35 or over 65 Opposite effect on black respondents

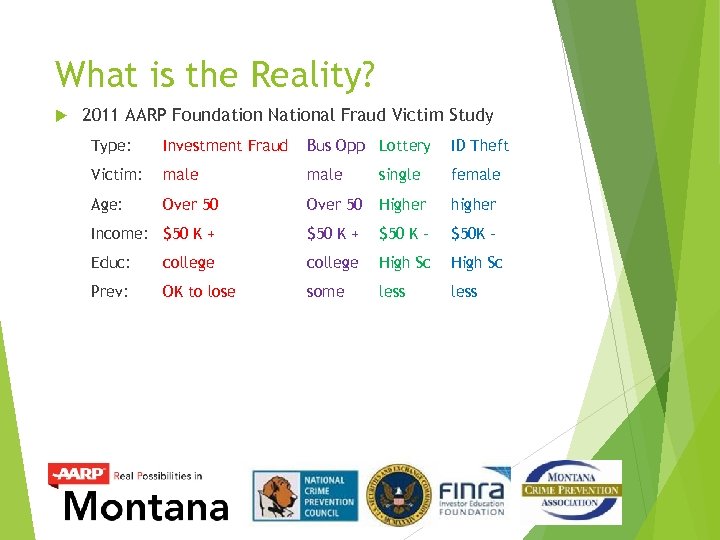

What is the Reality? 2011 AARP Foundation National Fraud Victim Study Type: Investment Fraud Bus Opp Lottery ID Theft Victim: male single female Age: Over 50 Higher higher Income: $50 K + $50 K – $50 K - Educ: college High Sc Prev: OK to lose some less

What is the Reality? 2011 AARP Foundation National Fraud Victim Study Other findings: Victims 55 years of age and older were significantly less likely to acknowledge they were defrauded than victims under 55 Victims 55 years of age and older were significantly less likely to report their victimization than victims under 55. Individuals 55 years of age or older in the general population were less upset by the prospect of losing money in the future than individuals under 55.

Common Features of Scams are creative and consistently changing: • Disaster Relief • Green Energy • Oil & Gas • “China” Stocks • Bird Flu • Taxes • Grandchildren in trouble • Lottery

Common Features of Scams New distribution channels are constantly being created Seminars Email & Internet Direct Mail Word of Mouth Telephone Text Messages Voice mail (Answering machines)

Why Are Confidence Criminals Successful? Ø They know how to get into your head and short circuit your ability to think logically! Ø They Always get to know personal things about you and make sure you believe they are like you! Ø They don’t let you catch your breath – they keep you off balance! Ø They use tried and true marketing techniques!

Frank Abignail

Spotting Persuasion Techniques Most Frequently Used Tactics Phantom Riches: Dangling the prospect of wealth; something you want but can’t have Source Credibility: It is better to deal with credible people or individuals in positions of authority Social Consensus: If everybody wants it, it must be good Reciprocity: Doing a small favor in return for a big favor Scarcity: If something is rare or scarce, it must be more valuable

Investment Fraud Key Risk Factors for all victims Own high-risk investments Relying on friends, family, co-workers for advice Open to new investment information Failing to check background and registration of financial professional and product Inability to spot persuasion used by fraudsters

Investment Fraud Who is Victimized? Victim demographic trends: ► ► ► ► Male Married 55 -65 years old More financially literate College-educated Self-reliant Recent change in financial or health status Risk-takers

Investment Fraud Preventing Investment Fraud Reduce your exposure to sales pitches from con men. Look for persuasion red flags Ask and check the registration status of the professional and the investment ASK if they are licensed to sell the investment and if the product is registered CHECK that they are licensed and the product is registered – Save. And. Invest. org or (888) 295 -7422 or Commissioner of Securities & Insurance at 406 -444 -2040

Investment Fraud

Empowerment Strategies ü If it sounds too good to be true – it probably is ü You can’t get something for nothing no matter what anyone says ü If you think you know someone who is a potential victim of fraud, do something about it ü Ask too many questions ü Don’t send money after a phone call ü Ask for written information and then check before you buy ü Ask and check

Investment Fraud

We are able to be manipulated! Some More than others!

Questions?

f99dd97a008efd79fde59e017e0b706d.ppt