e4d876baa6ea668766dc8e439fec17f0.ppt

- Количество слайдов: 116

Condominium—The Five Key Issues You Know to Insure The Association and Unit Owner Insurance Community University 1 www. Insurance. Community. University. com

Condominium—The Five Key Issues You Know to Insure The Association and Unit Owner Insurance Community University 1 www. Insurance. Community. University. com

Welcome to your Insurance Community University • Thank you for taking your time to join us today • All of you are currently on mute Insurance Community University 2 www. Insurance. Community. University. com

Welcome to your Insurance Community University • Thank you for taking your time to join us today • All of you are currently on mute Insurance Community University 2 www. Insurance. Community. University. com

Audio Information • There are two options to be part of this webinar – Telephone Option • Select Telephone on your screen • Dial in the PIN number so that your number becomes active – Microphone and/or Speaker Option • You can use this option if you have a headset that you use with your computer Insurance Community University 3 www. Insurance. Community. University. com

Audio Information • There are two options to be part of this webinar – Telephone Option • Select Telephone on your screen • Dial in the PIN number so that your number becomes active – Microphone and/or Speaker Option • You can use this option if you have a headset that you use with your computer Insurance Community University 3 www. Insurance. Community. University. com

Communication • Throughout this course you will be receiving information from the monitor in you console in the ‘Chat’ window. • Please locate window now • Your monitor today is Amanda Colby so respond to Amanda Today’s monitor. • Look down your control panel and watch for messages. Insurance Community University 4 www. Insurance. Community. University. com

Communication • Throughout this course you will be receiving information from the monitor in you console in the ‘Chat’ window. • Please locate window now • Your monitor today is Amanda Colby so respond to Amanda Today’s monitor. • Look down your control panel and watch for messages. Insurance Community University 4 www. Insurance. Community. University. com

DOI Information • This class is approved in the following states for two hours of continuing education: Insurance Community University 5 www. Insurance. Community. University. com

DOI Information • This class is approved in the following states for two hours of continuing education: Insurance Community University 5 www. Insurance. Community. University. com

CE Approvals • • • California Florida Indiana Massachusetts Missouri Insurance Community University • Nevada New Hampshire • New York • Tennessee • Texas 6 www. Insurance. Community. University. com

CE Approvals • • • California Florida Indiana Massachusetts Missouri Insurance Community University • Nevada New Hampshire • New York • Tennessee • Texas 6 www. Insurance. Community. University. com

DOI Requirements • Some states require a monitor • For those of you from Massachusetts you need to have a Third Party Proctor monitoring your attendance. This person can not be a friend, relative or colleague. Insurance Community University 7 www. Insurance. Community. University. com

DOI Requirements • Some states require a monitor • For those of you from Massachusetts you need to have a Third Party Proctor monitoring your attendance. This person can not be a friend, relative or colleague. Insurance Community University 7 www. Insurance. Community. University. com

DOI Requirements • We will be checking attendance verification and participation throughout this class by the following methods: – Hand raising – Polling – Tests – Questions Insurance Community University 8 www. Insurance. Community. University. com

DOI Requirements • We will be checking attendance verification and participation throughout this class by the following methods: – Hand raising – Polling – Tests – Questions Insurance Community University 8 www. Insurance. Community. University. com

Hand Raising • The monitor will be taking attendance periodically • The DOI requires us to perform this task to qualify for CE • When you see a slide with the hand up symbol, touch the icon that is on the top, left side of your control panel Insurance Community University 9 www. Insurance. Community. University. com

Hand Raising • The monitor will be taking attendance periodically • The DOI requires us to perform this task to qualify for CE • When you see a slide with the hand up symbol, touch the icon that is on the top, left side of your control panel Insurance Community University 9 www. Insurance. Community. University. com

Hand Raising • If you do not raise your hand, the monitor will be in contact with you in the chat box – so look down your control panel and watch for messages. • If you are in a group, the designated proctor is responsible to make certain you are all in attendance at all times and will be the responsible person to raise your hand Insurance Community University 10 www. Insurance. Community. University. com

Hand Raising • If you do not raise your hand, the monitor will be in contact with you in the chat box – so look down your control panel and watch for messages. • If you are in a group, the designated proctor is responsible to make certain you are all in attendance at all times and will be the responsible person to raise your hand Insurance Community University 10 www. Insurance. Community. University. com

Polling • The instructor can present a poll that is informational in nature. Typically they are “yes”/”no” questions • 100% response is required on the poll • The instructor will share the polling results with the class Insurance Community University 11 www. Insurance. Community. University. com

Polling • The instructor can present a poll that is informational in nature. Typically they are “yes”/”no” questions • 100% response is required on the poll • The instructor will share the polling results with the class Insurance Community University 11 www. Insurance. Community. University. com

Tests • The instructor can conduct tests during the class which are multiple choice. • The tests are technical and relate to the material being presented • 100% participation on the tests is required and the results and correct answer will be shared with the class Insurance Community University 12 www. Insurance. Community. University. com

Tests • The instructor can conduct tests during the class which are multiple choice. • The tests are technical and relate to the material being presented • 100% participation on the tests is required and the results and correct answer will be shared with the class Insurance Community University 12 www. Insurance. Community. University. com

Questions • During class all participants can ask the instructor questions during the session. • You will find the question box on your control panel – please write your question in that box and send it to the instructor • The presenter will attempt to answer all the questions in the order they are submitted Insurance Community University 13 www. Insurance. Community. University. com

Questions • During class all participants can ask the instructor questions during the session. • You will find the question box on your control panel – please write your question in that box and send it to the instructor • The presenter will attempt to answer all the questions in the order they are submitted Insurance Community University 13 www. Insurance. Community. University. com

DOI Requirements • We will file your hours with the DOI after the completion of this webinar • You will be sent a Certificate of Attendance/Completion by email. Please retain this for your records for five years. Insurance Community University 14 www. Insurance. Community. University. com

DOI Requirements • We will file your hours with the DOI after the completion of this webinar • You will be sent a Certificate of Attendance/Completion by email. Please retain this for your records for five years. Insurance Community University 14 www. Insurance. Community. University. com

YOU MUST!!! • At the conclusion of the webinar – Email your signed attendance form – Email your signed proctor form – This will require that you scan the documents and attach them to the email – If you are not able to scan your documents, please fax them to your main office and request that they be emailed to the address on the form. Insurance Community University 15 www. Insurance. Community. University. com

YOU MUST!!! • At the conclusion of the webinar – Email your signed attendance form – Email your signed proctor form – This will require that you scan the documents and attach them to the email – If you are not able to scan your documents, please fax them to your main office and request that they be emailed to the address on the form. Insurance Community University 15 www. Insurance. Community. University. com

YOU MUST!!! • You can find this email address in your chat console throughout this presentation and on the documents. • Please refer back to an email that you received this morning for the appropriate documents Insurance Community University 16 www. Insurance. Community. University. com

YOU MUST!!! • You can find this email address in your chat console throughout this presentation and on the documents. • Please refer back to an email that you received this morning for the appropriate documents Insurance Community University 16 www. Insurance. Community. University. com

Your Instructor Today Laurie Infantino, CIC, AFIS, CISC, ACSR, CISC, CRIS President and Co-Founder of The Insurance Community Center Insurance Community University www. Insurance. Community. University. com

Your Instructor Today Laurie Infantino, CIC, AFIS, CISC, ACSR, CISC, CRIS President and Co-Founder of The Insurance Community Center Insurance Community University www. Insurance. Community. University. com

Condominium The Five Key Issues you Must Know to Insure the Association and the Unit Owner Insurance Community University 18 www. Insurance. Community. University. com

Condominium The Five Key Issues you Must Know to Insure the Association and the Unit Owner Insurance Community University 18 www. Insurance. Community. University. com

What this class will cover 1. Understanding the difference between a Cooperative, Townhouse and Condominium 2. Condominiums: a. b. c. d. Relationships; Responsibility; Requirements Review of the Association CC & Rs Insurance Community University 19 www. Insurance. Community. University. com

What this class will cover 1. Understanding the difference between a Cooperative, Townhouse and Condominium 2. Condominiums: a. b. c. d. Relationships; Responsibility; Requirements Review of the Association CC & Rs Insurance Community University 19 www. Insurance. Community. University. com

What this class will cover 3. Determining what coverages must be provided on the Association Policy for both Property owned in association and the units as defined in the CC & Rs 4. Review of some key coverages the association and management company must carry 5. Review of the Unit Owners Policy Insurance Community University 20 www. Insurance. Community. University. com

What this class will cover 3. Determining what coverages must be provided on the Association Policy for both Property owned in association and the units as defined in the CC & Rs 4. Review of some key coverages the association and management company must carry 5. Review of the Unit Owners Policy Insurance Community University 20 www. Insurance. Community. University. com

#1 --Understanding the difference between a Cooperative, Townhouse and Condominium They can look alike! It is all about “ownership” Insurance Community University 21 www. Insurance. Community. University. com

#1 --Understanding the difference between a Cooperative, Townhouse and Condominium They can look alike! It is all about “ownership” Insurance Community University 21 www. Insurance. Community. University. com

Townhouse § The term “townhouse” is often used as a descriptive term to mean a two story living space. § The term “townhouse” used in this context is a description rather than referring to the “ownership” issues Insurance Community University 22 www. Insurance. Community. University. com

Townhouse § The term “townhouse” is often used as a descriptive term to mean a two story living space. § The term “townhouse” used in this context is a description rather than referring to the “ownership” issues Insurance Community University 22 www. Insurance. Community. University. com

Townhouse § In general a “townhouse” is defined as: - A single or multi-plex building, but is seldom more than three stories high - A townhouse is an attached living unit to another unit - Each townhouse homeowner owns their home up to the middle of the attached wall which is the “unseen” division between the two units. Thus the use of the word row house depicting the houses in a row. Insurance Community University 23 www. Insurance. Community. University. com

Townhouse § In general a “townhouse” is defined as: - A single or multi-plex building, but is seldom more than three stories high - A townhouse is an attached living unit to another unit - Each townhouse homeowner owns their home up to the middle of the attached wall which is the “unseen” division between the two units. Thus the use of the word row house depicting the houses in a row. Insurance Community University 23 www. Insurance. Community. University. com

Townhouse • In a townhouse, the owner of the townhouse owns it as their sole property. The townhouse owner typically has fee simple title to the land under their unit. • The appropriate coverage for a townhouse is a Homeowners Policy (HO OO O 3) which covers the dwelling as well as other structures; personal property and loss of use. Additionally Comprehensive Personal Liability forms part of the package. Insurance Community University 24 www. Insurance. Community. University. com

Townhouse • In a townhouse, the owner of the townhouse owns it as their sole property. The townhouse owner typically has fee simple title to the land under their unit. • The appropriate coverage for a townhouse is a Homeowners Policy (HO OO O 3) which covers the dwelling as well as other structures; personal property and loss of use. Additionally Comprehensive Personal Liability forms part of the package. Insurance Community University 24 www. Insurance. Community. University. com

Townhouse • A townhouse owner may be part of a community that is governed by an association. – The association, which is made up of the townhouse owners, may own common elements such as guard houses, swimming pools, landscaping. – As with a condo association, the C C & Rs must be reviewed and the CC & Rs will determine what categories of regular and special assessments can be made against the townhouse owner. Insurance Community University 25 www. Insurance. Community. University. com

Townhouse • A townhouse owner may be part of a community that is governed by an association. – The association, which is made up of the townhouse owners, may own common elements such as guard houses, swimming pools, landscaping. – As with a condo association, the C C & Rs must be reviewed and the CC & Rs will determine what categories of regular and special assessments can be made against the townhouse owner. Insurance Community University 25 www. Insurance. Community. University. com

Cooperatives • The concept of cooperatives began in 1926 in New York. It is one of the oldest multi family type of housing. • Many Apartments converted to coops as a legal method to sell off units Insurance Community University 26 www. Insurance. Community. University. com

Cooperatives • The concept of cooperatives began in 1926 in New York. It is one of the oldest multi family type of housing. • Many Apartments converted to coops as a legal method to sell off units Insurance Community University 26 www. Insurance. Community. University. com

Cooperatives • A cooperative is a multiple unit building that is typically used for residential purposes. However, there are cooperatives that are used for commercial purposes or mixed occupancies in a building made up of residential and commercial occupancies. • Cooperatives are different from townhouses or condominiums. Cooperatives often resemble apartment houses. The distinction is that individuals purchase their cooperatives as compared with apartment dwellers who are non-owner tenants in a building. Insurance Community University 27 www. Insurance. Community. University. com

Cooperatives • A cooperative is a multiple unit building that is typically used for residential purposes. However, there are cooperatives that are used for commercial purposes or mixed occupancies in a building made up of residential and commercial occupancies. • Cooperatives are different from townhouses or condominiums. Cooperatives often resemble apartment houses. The distinction is that individuals purchase their cooperatives as compared with apartment dwellers who are non-owner tenants in a building. Insurance Community University 27 www. Insurance. Community. University. com

Cooperatives • Often times when someone says they bought their apartment unit, they actually purchased a coop. • As with a condo, the CC & R’s for the coop must be reviewed Insurance Community University 28 www. Insurance. Community. University. com

Cooperatives • Often times when someone says they bought their apartment unit, they actually purchased a coop. • As with a condo, the CC & R’s for the coop must be reviewed Insurance Community University 28 www. Insurance. Community. University. com

Cooperatives • It is the cooperative ownership that is very distinctive. In a cooperative the individual units and the buildings in general are owned by the “cooperative” in common. The “cooperative” is typically a corporation and the owner of each unit is a shareholder in the corporation (cooperative). Insurance Community University 29 www. Insurance. Community. University. com

Cooperatives • It is the cooperative ownership that is very distinctive. In a cooperative the individual units and the buildings in general are owned by the “cooperative” in common. The “cooperative” is typically a corporation and the owner of each unit is a shareholder in the corporation (cooperative). Insurance Community University 29 www. Insurance. Community. University. com

Cooperative • The individual unit owner’s interest in the coop is typically expressed as a undivided fractional owner. For example if there were 18 units in the cooperative building each of equal size, then each unit owner would have an undivided fractional interest of 5. 55%. Insurance Community University 30 www. Insurance. Community. University. com

Cooperative • The individual unit owner’s interest in the coop is typically expressed as a undivided fractional owner. For example if there were 18 units in the cooperative building each of equal size, then each unit owner would have an undivided fractional interest of 5. 55%. Insurance Community University 30 www. Insurance. Community. University. com

Cooperative • For insurance purposes the cooperative building and all common properties are insured on a Commercial Property program similar to that of an apartment form of insurance. • Unit owners purchase individual insurance on the contents in their units on a Tenants Package Policy HOO O 4. Insurance Community University 31 www. Insurance. Community. University. com

Cooperative • For insurance purposes the cooperative building and all common properties are insured on a Commercial Property program similar to that of an apartment form of insurance. • Unit owners purchase individual insurance on the contents in their units on a Tenants Package Policy HOO O 4. Insurance Community University 31 www. Insurance. Community. University. com

Polling Question #1 Poll Insurance Community University 32 www. Insurance. Community. University. com

Polling Question #1 Poll Insurance Community University 32 www. Insurance. Community. University. com

Insuring the Condominium They come in all forms and shapes Insurance Community University 33 www. Insurance. Community. University. com

Insuring the Condominium They come in all forms and shapes Insurance Community University 33 www. Insurance. Community. University. com

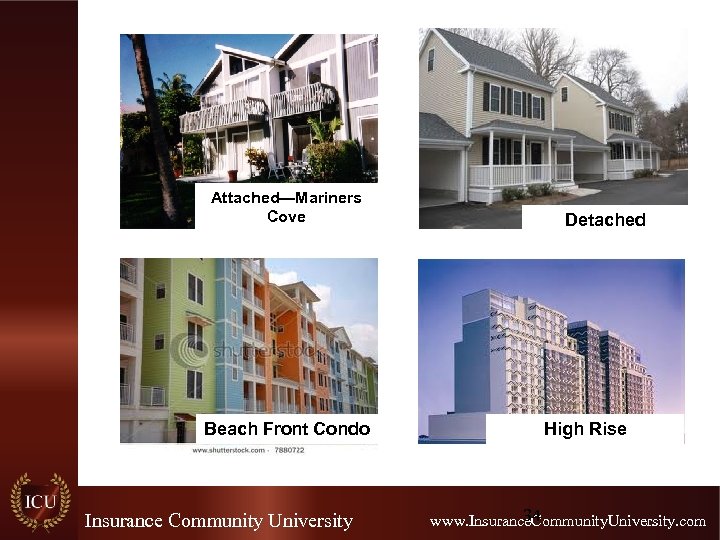

Attached—Mariners Cove Beach Front Condo Insurance Community University Detached High Rise 34 www. Insurance. Community. University. com

Attached—Mariners Cove Beach Front Condo Insurance Community University Detached High Rise 34 www. Insurance. Community. University. com

Mixed Occupancy Condo and Retail Condo zoned residential and commercial The World of Residen. Sea Four Seasons Insurance Community University 35 www. Insurance. Community. University. com

Mixed Occupancy Condo and Retail Condo zoned residential and commercial The World of Residen. Sea Four Seasons Insurance Community University 35 www. Insurance. Community. University. com

Condominium • A condominium may appear as many different types of living spaces: • Single Family • Multi-plex living units (2, 3, 4 family connected units) • Multi residential units in multi-story buildings • Mixed residential and commercial occupancy building Insurance Community University 36 www. Insurance. Community. University. com

Condominium • A condominium may appear as many different types of living spaces: • Single Family • Multi-plex living units (2, 3, 4 family connected units) • Multi residential units in multi-story buildings • Mixed residential and commercial occupancy building Insurance Community University 36 www. Insurance. Community. University. com

Condominium • The word “condominium comes from the Latin word meaning joint ownership or control. • Condominiums were originally developed by the Romans to solve congested living conditions and to promote conservation. Insurance Community University 37 www. Insurance. Community. University. com

Condominium • The word “condominium comes from the Latin word meaning joint ownership or control. • Condominiums were originally developed by the Romans to solve congested living conditions and to promote conservation. Insurance Community University 37 www. Insurance. Community. University. com

Condominium • What is common about all the types of condominiums is the “ownership” of the units and the duality of ownership concerns and considerations between the “unit owner” and the association. • In the condominium risk there are two parties that have ownership interest in the condo complex and “unit”. (Additionally there is ownership interest in the unit if there are lenders involved) Insurance Community University 38 www. Insurance. Community. University. com

Condominium • What is common about all the types of condominiums is the “ownership” of the units and the duality of ownership concerns and considerations between the “unit owner” and the association. • In the condominium risk there are two parties that have ownership interest in the condo complex and “unit”. (Additionally there is ownership interest in the unit if there are lenders involved) Insurance Community University 38 www. Insurance. Community. University. com

Test Question #1 Insurance Community University 39 www. Insurance. Community. University. com

Test Question #1 Insurance Community University 39 www. Insurance. Community. University. com

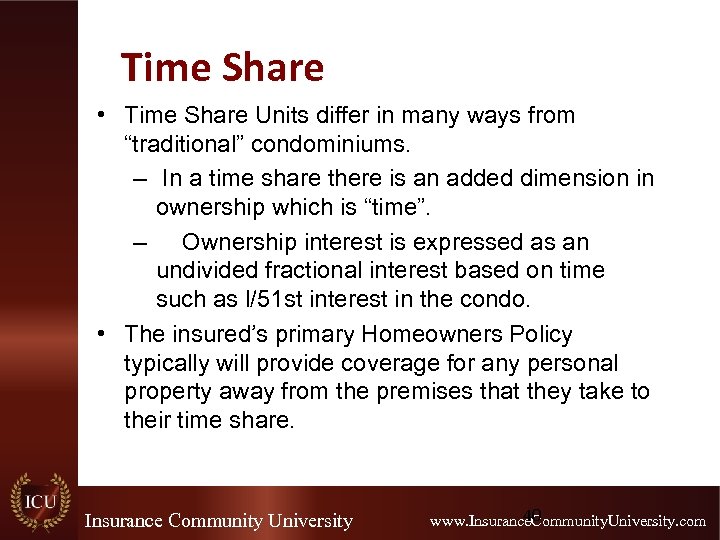

Time Share • Time Share Units differ in many ways from “traditional” condominiums. – In a time share there is an added dimension in ownership which is “time”. – Ownership interest is expressed as an undivided fractional interest based on time such as l/51 st interest in the condo. • The insured’s primary Homeowners Policy typically will provide coverage for any personal property away from the premises that they take to their time share. Insurance Community University 40 www. Insurance. Community. University. com

Time Share • Time Share Units differ in many ways from “traditional” condominiums. – In a time share there is an added dimension in ownership which is “time”. – Ownership interest is expressed as an undivided fractional interest based on time such as l/51 st interest in the condo. • The insured’s primary Homeowners Policy typically will provide coverage for any personal property away from the premises that they take to their time share. Insurance Community University 40 www. Insurance. Community. University. com

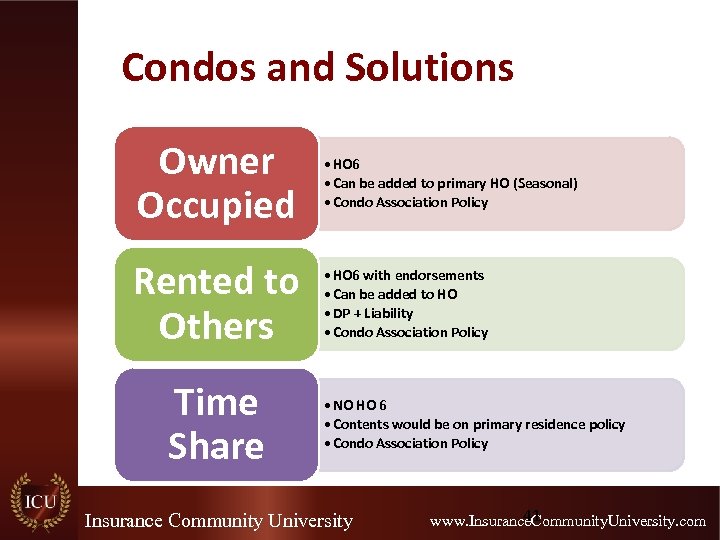

Condos and Solutions Owner Occupied Rented to Others Time Share • HO 6 • Can be added to primary HO (Seasonal) • Condo Association Policy • HO 6 with endorsements • Can be added to HO • DP + Liability • Condo Association Policy • NO HO 6 • Contents would be on primary residence policy • Condo Association Policy Insurance Community University 41 www. Insurance. Community. University. com

Condos and Solutions Owner Occupied Rented to Others Time Share • HO 6 • Can be added to primary HO (Seasonal) • Condo Association Policy • HO 6 with endorsements • Can be added to HO • DP + Liability • Condo Association Policy • NO HO 6 • Contents would be on primary residence policy • Condo Association Policy Insurance Community University 41 www. Insurance. Community. University. com

Polling Question #2 Poll Insurance Community University 42 www. Insurance. Community. University. com

Polling Question #2 Poll Insurance Community University 42 www. Insurance. Community. University. com

Condos and Solutions Commercial Condo • A Commercial Package Policy for the unit • Condo Association Policy Mixed Residential and Single Owner Commercial Condo Units • A Commercial Package Policy for the unit • HO 6 for residential units • Condo Association Policy Insurance Community University 43 www. Insurance. Community. University. com

Condos and Solutions Commercial Condo • A Commercial Package Policy for the unit • Condo Association Policy Mixed Residential and Single Owner Commercial Condo Units • A Commercial Package Policy for the unit • HO 6 for residential units • Condo Association Policy Insurance Community University 43 www. Insurance. Community. University. com

Condominiums: Relationships; Responsibility; Requirements; And Review of the Association CC & Rs Insurance Community University 44 www. Insurance. Community. University. com

Condominiums: Relationships; Responsibility; Requirements; And Review of the Association CC & Rs Insurance Community University 44 www. Insurance. Community. University. com

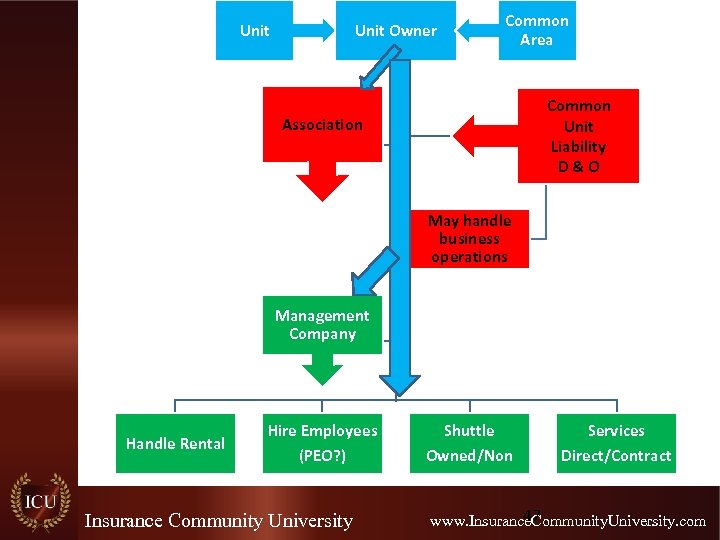

Relationships • The Unit Owners ARE the association • The association elects a board of directors that also forms subcommittees for certain projects • In smaller associations, the association may directly hire an individual/individuals to handle business activities Insurance Community University 45 www. Insurance. Community. University. com

Relationships • The Unit Owners ARE the association • The association elects a board of directors that also forms subcommittees for certain projects • In smaller associations, the association may directly hire an individual/individuals to handle business activities Insurance Community University 45 www. Insurance. Community. University. com

Relationships • Most associations outsource certain business activities OR hire a management company specifically to handle there condos OR the management company may handle many associations • The management company may then outsource some of the business activities Insurance Community University 46 www. Insurance. Community. University. com

Relationships • Most associations outsource certain business activities OR hire a management company specifically to handle there condos OR the management company may handle many associations • The management company may then outsource some of the business activities Insurance Community University 46 www. Insurance. Community. University. com

Unit Owner Common Area Common Unit Liability D&O Association May handle business operations Management Company Handle Rental Hire Employees (PEO? ) Insurance Community University Shuttle Owned/Non Services Direct/Contract 47 www. Insurance. Community. University. com

Unit Owner Common Area Common Unit Liability D&O Association May handle business operations Management Company Handle Rental Hire Employees (PEO? ) Insurance Community University Shuttle Owned/Non Services Direct/Contract 47 www. Insurance. Community. University. com

Polling Question #3 Poll Insurance Community University 48 www. Insurance. Community. University. com

Polling Question #3 Poll Insurance Community University 48 www. Insurance. Community. University. com

Relationships • The importance in identifying “relationships” is to identify: – responsibilities – to make certain that the correct insurance is written – To understand any contractual transfers OR assumptions – To make certain that all interested parties are “named” on the respective policies and affored protection Insurance Community University 49 www. Insurance. Community. University. com

Relationships • The importance in identifying “relationships” is to identify: – responsibilities – to make certain that the correct insurance is written – To understand any contractual transfers OR assumptions – To make certain that all interested parties are “named” on the respective policies and affored protection Insurance Community University 49 www. Insurance. Community. University. com

Responsibility and Requirements • The responsibility and requirements for the unit owner and association are provided in the Covenants, Conditions and Restrictions (CC & Rs) of the association. There also laws that govern condominiums that further define issues such as ownership and requirements. Insurance Community University 50 www. Insurance. Community. University. com

Responsibility and Requirements • The responsibility and requirements for the unit owner and association are provided in the Covenants, Conditions and Restrictions (CC & Rs) of the association. There also laws that govern condominiums that further define issues such as ownership and requirements. Insurance Community University 50 www. Insurance. Community. University. com

CC & Rs • Covenants, Conditions and Restrictions (CC & R’s) are legal instruments created by associations to indicate rules; limitations; and responsibilities of individual unit owners. • The CC & R’s are the governing documents of the association. Insurance Community University 51 www. Insurance. Community. University. com

CC & Rs • Covenants, Conditions and Restrictions (CC & R’s) are legal instruments created by associations to indicate rules; limitations; and responsibilities of individual unit owners. • The CC & R’s are the governing documents of the association. Insurance Community University 51 www. Insurance. Community. University. com

CC & Rs • A condominium typically has bylaws, as well, which set forth the process of elections for the board and officers and duties of same including manner of voting. Sometimes this information is included in the CC & Rs, as well. Insurance Community University 52 www. Insurance. Community. University. com

CC & Rs • A condominium typically has bylaws, as well, which set forth the process of elections for the board and officers and duties of same including manner of voting. Sometimes this information is included in the CC & Rs, as well. Insurance Community University 52 www. Insurance. Community. University. com

CC & Rs • All purchasers of condominium units are provided with a copy of the CC & Rs. • It is imperative that there is a thorough review of the CC & R’s prior to purchasing a unit. • Additionally, the CC & R’s must be reviewed by the agent/broker who issues both the condo association policy and the agent/broker issuing the unit owners policy. • The CC & R’s provide essential information in terms of ownership interest and insurance requirements. Insurance Community University 53 www. Insurance. Community. University. com

CC & Rs • All purchasers of condominium units are provided with a copy of the CC & Rs. • It is imperative that there is a thorough review of the CC & R’s prior to purchasing a unit. • Additionally, the CC & R’s must be reviewed by the agent/broker who issues both the condo association policy and the agent/broker issuing the unit owners policy. • The CC & R’s provide essential information in terms of ownership interest and insurance requirements. Insurance Community University 53 www. Insurance. Community. University. com

CC & R’s and State Laws • When writing association insurance, in particular, the broker/agent must be able to – Understand the CC & Rs and other association documents – Be aware of the specific laws in the state where the condo is located – Become an expert in the differences in the policies available to write the condo coverages Insurance Community University 54 www. Insurance. Community. University. com

CC & R’s and State Laws • When writing association insurance, in particular, the broker/agent must be able to – Understand the CC & Rs and other association documents – Be aware of the specific laws in the state where the condo is located – Become an expert in the differences in the policies available to write the condo coverages Insurance Community University 54 www. Insurance. Community. University. com

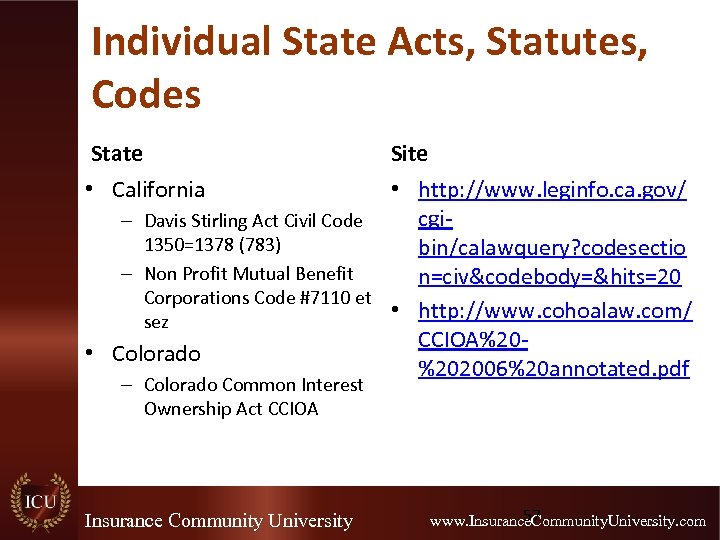

Individual State Acts, Statutes, Codes • Most states have Condo Laws, acts, states and/or codes that apply specifically to that state. • http: //condolawyers. com/nationalaw. htm • http: //www. megalaw. com/top/condo. php • NOTE: Not all links on these sites are active however they do give you the web addresses of the acts so you can access Insurance Community University 55 www. Insurance. Community. University. com

Individual State Acts, Statutes, Codes • Most states have Condo Laws, acts, states and/or codes that apply specifically to that state. • http: //condolawyers. com/nationalaw. htm • http: //www. megalaw. com/top/condo. php • NOTE: Not all links on these sites are active however they do give you the web addresses of the acts so you can access Insurance Community University 55 www. Insurance. Community. University. com

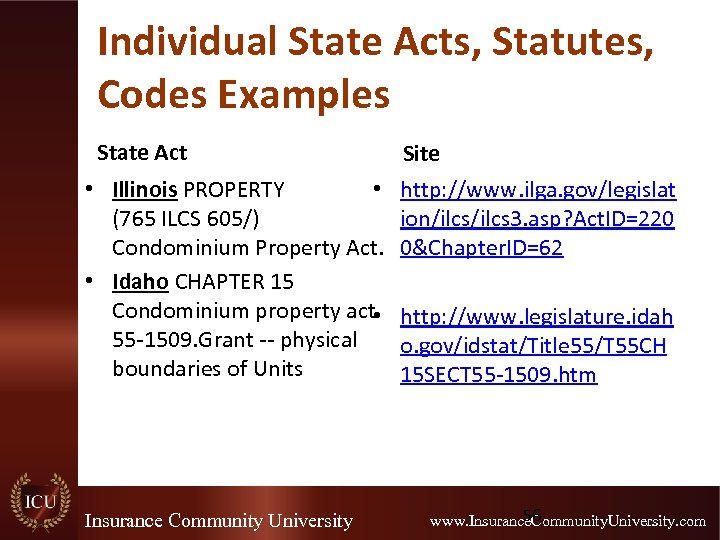

Individual State Acts, Statutes, Codes Examples State Act • Illinois PROPERTY • (765 ILCS 605/) Condominium Property Act. • Idaho CHAPTER 15 Condominium property act • 55 -1509. Grant -- physical boundaries of Units Insurance Community University Site http: //www. ilga. gov/legislat ion/ilcs 3. asp? Act. ID=220 0&Chapter. ID=62 http: //www. legislature. idah o. gov/idstat/Title 55/T 55 CH 15 SECT 55 -1509. htm 56 www. Insurance. Community. University. com

Individual State Acts, Statutes, Codes Examples State Act • Illinois PROPERTY • (765 ILCS 605/) Condominium Property Act. • Idaho CHAPTER 15 Condominium property act • 55 -1509. Grant -- physical boundaries of Units Insurance Community University Site http: //www. ilga. gov/legislat ion/ilcs 3. asp? Act. ID=220 0&Chapter. ID=62 http: //www. legislature. idah o. gov/idstat/Title 55/T 55 CH 15 SECT 55 -1509. htm 56 www. Insurance. Community. University. com

Individual State Acts, Statutes, Codes State Site • California • http: //www. leginfo. ca. gov/ cgi– Davis Stirling Act Civil Code 1350=1378 (783) bin/calawquery? codesectio – Non Profit Mutual Benefit n=civ&codebody=&hits=20 Corporations Code #7110 et • http: //www. cohoalaw. com/ sez CCIOA%20 • Colorado %202006%20 annotated. pdf – Colorado Common Interest Ownership Act CCIOA Insurance Community University 57 www. Insurance. Community. University. com

Individual State Acts, Statutes, Codes State Site • California • http: //www. leginfo. ca. gov/ cgi– Davis Stirling Act Civil Code 1350=1378 (783) bin/calawquery? codesectio – Non Profit Mutual Benefit n=civ&codebody=&hits=20 Corporations Code #7110 et • http: //www. cohoalaw. com/ sez CCIOA%20 • Colorado %202006%20 annotated. pdf – Colorado Common Interest Ownership Act CCIOA Insurance Community University 57 www. Insurance. Community. University. com

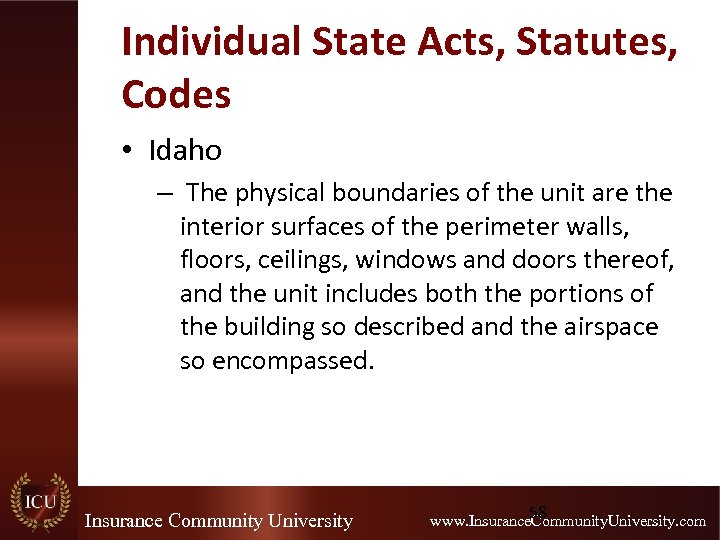

Individual State Acts, Statutes, Codes • Idaho – The physical boundaries of the unit are the interior surfaces of the perimeter walls, floors, ceilings, windows and doors thereof, and the unit includes both the portions of the building so described and the airspace so encompassed. Insurance Community University 58 www. Insurance. Community. University. com

Individual State Acts, Statutes, Codes • Idaho – The physical boundaries of the unit are the interior surfaces of the perimeter walls, floors, ceilings, windows and doors thereof, and the unit includes both the portions of the building so described and the airspace so encompassed. Insurance Community University 58 www. Insurance. Community. University. com

CC & R’s Key Areas of Review • Typically CC & R’s will cite the applicable codes that apply based on law for the definitions in the document. Example in California they will cite 783 and 13501359 Insurance Community University 59 www. Insurance. Community. University. com

CC & R’s Key Areas of Review • Typically CC & R’s will cite the applicable codes that apply based on law for the definitions in the document. Example in California they will cite 783 and 13501359 Insurance Community University 59 www. Insurance. Community. University. com

CC & R’s Key Areas of Review • • • Definition of Common Area Definition of Limited Common Area Definition of Unit Assessments Insurance Requirements Insurance Community University 60 www. Insurance. Community. University. com

CC & R’s Key Areas of Review • • • Definition of Common Area Definition of Limited Common Area Definition of Unit Assessments Insurance Requirements Insurance Community University 60 www. Insurance. Community. University. com

CC & R’s Key Areas of Review • The discussion of “common areas” in the CC & R’s defines property that the association unit owners own in common and have equal right of access and usage. • Insured on the Association Policy Insurance Community University 61 www. Insurance. Community. University. com

CC & R’s Key Areas of Review • The discussion of “common areas” in the CC & R’s defines property that the association unit owners own in common and have equal right of access and usage. • Insured on the Association Policy Insurance Community University 61 www. Insurance. Community. University. com

Examples of Common Areas/Elements Street Fountains Swimming Pools Walks Golf Courses Tennis Courts Guardhouses Restaurants Gyms Gates Club Houses Shops Landscaping Meeting Rooms Ski Lockers Parking Lots Offices Reception Areas Insurance Community University 62 www. Insurance. Community. University. com

Examples of Common Areas/Elements Street Fountains Swimming Pools Walks Golf Courses Tennis Courts Guardhouses Restaurants Gyms Gates Club Houses Shops Landscaping Meeting Rooms Ski Lockers Parking Lots Offices Reception Areas Insurance Community University 62 www. Insurance. Community. University. com

Limited Common Elements • This may be the area in the CC & R’s that the discussion of “ownership” of the “unit” is referenced indicating the insurable interest of both the unit owner and association. • This is one of the most important sections for the unit owner to determine to what extent they should insure their additions and alterations and whether the association is assuming any responsibility to insure the interior additions. Insurance Community University 63 www. Insurance. Community. University. com

Limited Common Elements • This may be the area in the CC & R’s that the discussion of “ownership” of the “unit” is referenced indicating the insurable interest of both the unit owner and association. • This is one of the most important sections for the unit owner to determine to what extent they should insure their additions and alterations and whether the association is assuming any responsibility to insure the interior additions. Insurance Community University 63 www. Insurance. Community. University. com

Unit • This also is a very important area for review as it clarifies the legal description of the unit. • This definition indicates what the unit owner “owns” as their separate property and accordingly must insure on their unit owners policy. Insurance Community University 64 www. Insurance. Community. University. com

Unit • This also is a very important area for review as it clarifies the legal description of the unit. • This definition indicates what the unit owner “owns” as their separate property and accordingly must insure on their unit owners policy. Insurance Community University 64 www. Insurance. Community. University. com

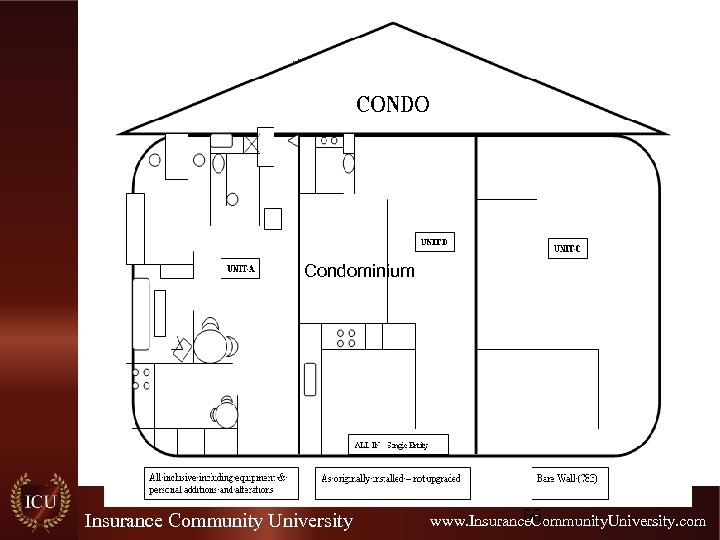

Unit • There are three broad categories of “units” which include • Bare walls, simple condo, airspace • All In • All in Inclusive Insurance Community University 65 www. Insurance. Community. University. com

Unit • There are three broad categories of “units” which include • Bare walls, simple condo, airspace • All In • All in Inclusive Insurance Community University 65 www. Insurance. Community. University. com

Condominium Insurance Community University 66 www. Insurance. Community. University. com

Condominium Insurance Community University 66 www. Insurance. Community. University. com

Bare Walls • The individual unit is often referred to as “airspace”. • What the airspace concept means, in general terms, is that the unit owner owns as their sole and separate property everything structurally in the “unit-building” other than otherwise listed. Insurance Community University 67 www. Insurance. Community. University. com

Bare Walls • The individual unit is often referred to as “airspace”. • What the airspace concept means, in general terms, is that the unit owner owns as their sole and separate property everything structurally in the “unit-building” other than otherwise listed. Insurance Community University 67 www. Insurance. Community. University. com

Bare Walls • Most unit owners do NOT think they have to insure any structural parts of their units • Unit owners typically believe that everything structural is insured on the association policy • The association cannot insure anything that they are not responsible to insure. • Unit owners are responsible in most cases to insure the interior structure of these units. Insurance Community University 68 www. Insurance. Community. University. com

Bare Walls • Most unit owners do NOT think they have to insure any structural parts of their units • Unit owners typically believe that everything structural is insured on the association policy • The association cannot insure anything that they are not responsible to insure. • Unit owners are responsible in most cases to insure the interior structure of these units. Insurance Community University 68 www. Insurance. Community. University. com

Bare Walls • Unit owner insures all the additions and alternations as ORIGINALLY installed any improvements • Association does not insure anything on the interior unless defined like common elements • Associations typically do NOT want to insure these items Insurance Community University 69 www. Insurance. Community. University. com

Bare Walls • Unit owner insures all the additions and alternations as ORIGINALLY installed any improvements • Association does not insure anything on the interior unless defined like common elements • Associations typically do NOT want to insure these items Insurance Community University 69 www. Insurance. Community. University. com

Bare Walls • Many escrow companies are now requirement that the unit owner insure for a minimum of 15% of the unit replacement cost for additions and alterations. Insurance Community University 70 www. Insurance. Community. University. com

Bare Walls • Many escrow companies are now requirement that the unit owner insure for a minimum of 15% of the unit replacement cost for additions and alterations. Insurance Community University 70 www. Insurance. Community. University. com

All In (Single Entity) • In the single entity concept the association CC & Rs require that the additions and alterations of the individual unit “as originally installed” be insured on the association policy. • Therefore the association policy would have a value of what the replacement cost would be for only the original build outs. • . 71 Insurance Community University www. Insurance. Community. University. com

All In (Single Entity) • In the single entity concept the association CC & Rs require that the additions and alterations of the individual unit “as originally installed” be insured on the association policy. • Therefore the association policy would have a value of what the replacement cost would be for only the original build outs. • . 71 Insurance Community University www. Insurance. Community. University. com

All In (Single Entity) • The problem with this is that “as originally installed” would be difficult to determine especially as units age and change ownership. New owners may be making improvements to the units as they remodel. • The unit owner in this case would have to insure for the difference between the original installation cost and the improvements that are made. It may very well be that a new owner would not even know what the “original” installations may have been. Insurance Community University 72 www. Insurance. Community. University. com

All In (Single Entity) • The problem with this is that “as originally installed” would be difficult to determine especially as units age and change ownership. New owners may be making improvements to the units as they remodel. • The unit owner in this case would have to insure for the difference between the original installation cost and the improvements that are made. It may very well be that a new owner would not even know what the “original” installations may have been. Insurance Community University 72 www. Insurance. Community. University. com

All In (Single Entity) • Note: the CC & R’s must be reviewed to determine the responsibility the association has to replace building items in conformance with new building ordinances in effect. • The association policy must be reviewed to determine if there is any Building Ordinance Coverage built in and if so if it is sub-limited in amount of insurance provided. • Typically Building Ordinance Coverage is added by endorsement Insurance Community University 73 www. Insurance. Community. University. com

All In (Single Entity) • Note: the CC & R’s must be reviewed to determine the responsibility the association has to replace building items in conformance with new building ordinances in effect. • The association policy must be reviewed to determine if there is any Building Ordinance Coverage built in and if so if it is sub-limited in amount of insurance provided. • Typically Building Ordinance Coverage is added by endorsement Insurance Community University 73 www. Insurance. Community. University. com

All In Inclusive • “All in Inclusive” is a term that refers to the language in the CC & R’s whereby the insurance requirement for the association is to insure for all of the additions and alterations whether as originally installed or as improved by the unit owner. • The “all in inclusive” is what the unit owners believe is being covered by the association policy. Insurance Community University 74 www. Insurance. Community. University. com

All In Inclusive • “All in Inclusive” is a term that refers to the language in the CC & R’s whereby the insurance requirement for the association is to insure for all of the additions and alterations whether as originally installed or as improved by the unit owner. • The “all in inclusive” is what the unit owners believe is being covered by the association policy. Insurance Community University 74 www. Insurance. Community. University. com

All In Inclusive • The problem with this approach is that the association would have to be advised whenever a unit is improved and increase the coverage on their master policy. Insurance Community University 75 www. Insurance. Community. University. com

All In Inclusive • The problem with this approach is that the association would have to be advised whenever a unit is improved and increase the coverage on their master policy. Insurance Community University 75 www. Insurance. Community. University. com

All In Inclusive • In addition, the policy would be disproportionate as relates the unit owners in that some owners may make substantial improvements while others do not. The premium is divided amount the unit as part of their maintenance fee and individuals would be paying for values that are inflated based on their risk. Insurance Community University 76 www. Insurance. Community. University. com

All In Inclusive • In addition, the policy would be disproportionate as relates the unit owners in that some owners may make substantial improvements while others do not. The premium is divided amount the unit as part of their maintenance fee and individuals would be paying for values that are inflated based on their risk. Insurance Community University 76 www. Insurance. Community. University. com

Insurance Community University 77 www. Insurance. Community. University. com

Insurance Community University 77 www. Insurance. Community. University. com

Insurance For the Condo Association Insurance Community University 78 www. Insurance. Community. University. com

Insurance For the Condo Association Insurance Community University 78 www. Insurance. Community. University. com

Association Policy • Association Policy is a package policy including – Commercial Property – Commercial Liability – Directors and Officers Liability (often separate – Miscellaneous specialty “Condo” enhancement coverages Insurance Community University 79 www. Insurance. Community. University. com

Association Policy • Association Policy is a package policy including – Commercial Property – Commercial Liability – Directors and Officers Liability (often separate – Miscellaneous specialty “Condo” enhancement coverages Insurance Community University 79 www. Insurance. Community. University. com

Management Company Policy • Remember: The Management Company for the Condominium is typically where a lot of coverages will be written because they are responsible for the business end of the operation. • The management company policy must be reviewed and depending on what the operation involve could include the following coverages Insurance Community University 80 www. Insurance. Community. University. com

Management Company Policy • Remember: The Management Company for the Condominium is typically where a lot of coverages will be written because they are responsible for the business end of the operation. • The management company policy must be reviewed and depending on what the operation involve could include the following coverages Insurance Community University 80 www. Insurance. Community. University. com

Management Company Policy • Business Auto – If they own their own vehicles – If contracting then association should be named • Workers Comp • Crime • Most Important is that the association is named on the policies Insurance Community University 81 www. Insurance. Community. University. com

Management Company Policy • Business Auto – If they own their own vehicles – If contracting then association should be named • Workers Comp • Crime • Most Important is that the association is named on the policies Insurance Community University 81 www. Insurance. Community. University. com

Condominium Insurance • MOST important is that the unit owners are named as insureds on the association policy Insurance Community University 82 www. Insurance. Community. University. com

Condominium Insurance • MOST important is that the unit owners are named as insureds on the association policy Insurance Community University 82 www. Insurance. Community. University. com

Condominium Property Insurance (Building) • Insures all common areas • Insures units ONLY to the extent they are required. MANY association policies insure for more then legally responsible for and have NO insurable interest Insurance Community University 83 www. Insurance. Community. University. com

Condominium Property Insurance (Building) • Insures all common areas • Insures units ONLY to the extent they are required. MANY association policies insure for more then legally responsible for and have NO insurable interest Insurance Community University 83 www. Insurance. Community. University. com

Condominium Property Insurance (Building) • Include ALL buildings and structures blanket • Make certain building includes otherwise excluded items such as foundations, pavements, walkways, etc • Landscaping and Hardscape are significant issues and there are usually limitations on trees, etc. • Golf Course properties to include greens • Waterfront to include docks Insurance Community University 84 www. Insurance. Community. University. com

Condominium Property Insurance (Building) • Include ALL buildings and structures blanket • Make certain building includes otherwise excluded items such as foundations, pavements, walkways, etc • Landscaping and Hardscape are significant issues and there are usually limitations on trees, etc. • Golf Course properties to include greens • Waterfront to include docks Insurance Community University 84 www. Insurance. Community. University. com

Condominium Property Insurance (Building) • Replacement cost with either Extended or Guarantees (Margin Clause) • No coinsurance (waive) Insurance Community University 85 www. Insurance. Community. University. com

Condominium Property Insurance (Building) • Replacement cost with either Extended or Guarantees (Margin Clause) • No coinsurance (waive) Insurance Community University 85 www. Insurance. Community. University. com

Condominium Property Insurance (Building) • Review definition of building as relates the “units” • ISO Form has clarity Insurance Community University 86 www. Insurance. Community. University. com

Condominium Property Insurance (Building) • Review definition of building as relates the “units” • ISO Form has clarity Insurance Community University 86 www. Insurance. Community. University. com

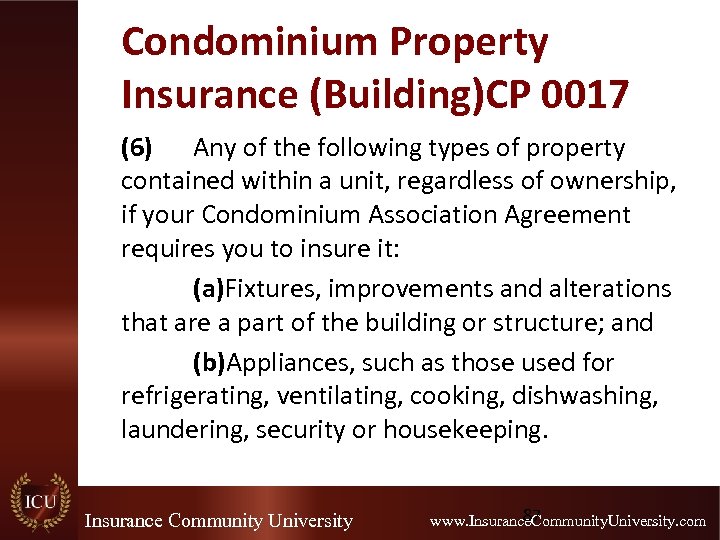

Condominium Property Insurance (Building)CP 0017 (6) Any of the following types of property contained within a unit, regardless of ownership, if your Condominium Association Agreement requires you to insure it: (a)Fixtures, improvements and alterations that are a part of the building or structure; and (b)Appliances, such as those used for refrigerating, ventilating, cooking, dishwashing, laundering, security or housekeeping. Insurance Community University 87 www. Insurance. Community. University. com

Condominium Property Insurance (Building)CP 0017 (6) Any of the following types of property contained within a unit, regardless of ownership, if your Condominium Association Agreement requires you to insure it: (a)Fixtures, improvements and alterations that are a part of the building or structure; and (b)Appliances, such as those used for refrigerating, ventilating, cooking, dishwashing, laundering, security or housekeeping. Insurance Community University 87 www. Insurance. Community. University. com

Condominium Property Insurance (Building) Company A • Typical language: – Business Real Property (Building) • We cover the building at the location which includes completed additions and permanently installed fixtures, machinery and equipment Company A Insurance Community University 88 www. Insurance. Community. University. com

Condominium Property Insurance (Building) Company A • Typical language: – Business Real Property (Building) • We cover the building at the location which includes completed additions and permanently installed fixtures, machinery and equipment Company A Insurance Community University 88 www. Insurance. Community. University. com

Condominium Property Insurance (Building) Company B • Building and structures include: – Completed additions – Fixtures outside of individual units including building structures – Permanently installed machinery and equipment Insurance Community University 89 www. Insurance. Community. University. com

Condominium Property Insurance (Building) Company B • Building and structures include: – Completed additions – Fixtures outside of individual units including building structures – Permanently installed machinery and equipment Insurance Community University 89 www. Insurance. Community. University. com

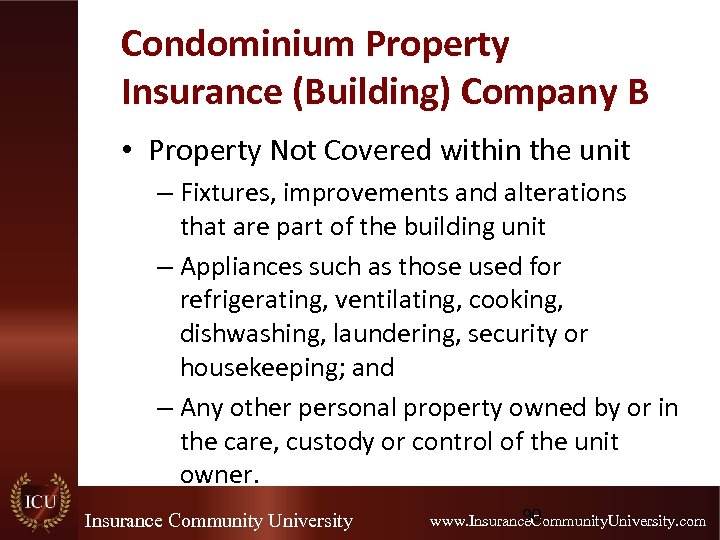

Condominium Property Insurance (Building) Company B • Property Not Covered within the unit – Fixtures, improvements and alterations that are part of the building unit – Appliances such as those used for refrigerating, ventilating, cooking, dishwashing, laundering, security or housekeeping; and – Any other personal property owned by or in the care, custody or control of the unit owner. Insurance Community University 90 www. Insurance. Community. University. com

Condominium Property Insurance (Building) Company B • Property Not Covered within the unit – Fixtures, improvements and alterations that are part of the building unit – Appliances such as those used for refrigerating, ventilating, cooking, dishwashing, laundering, security or housekeeping; and – Any other personal property owned by or in the care, custody or control of the unit owner. Insurance Community University 90 www. Insurance. Community. University. com

Condominium Association Unit Coverage Endorsement • This is a buy back for property contained in residential units Insurance Community University 91 www. Insurance. Community. University. com

Condominium Association Unit Coverage Endorsement • This is a buy back for property contained in residential units Insurance Community University 91 www. Insurance. Community. University. com

Condominium Property Insurance (Building) • Ordinance or Law • Equipment Breakdown – Mechanical, Electrical, on and off • Off Premises • Special Form and appropriate enhancements – Flood, EQ, Sewers Insurance Community University 92 www. Insurance. Community. University. com

Condominium Property Insurance (Building) • Ordinance or Law • Equipment Breakdown – Mechanical, Electrical, on and off • Off Premises • Special Form and appropriate enhancements – Flood, EQ, Sewers Insurance Community University 92 www. Insurance. Community. University. com

Condominium Property Insurance (Personal Property) • Usually a lesser issue • Review of common area personal property and values Insurance Community University 93 www. Insurance. Community. University. com

Condominium Property Insurance (Personal Property) • Usually a lesser issue • Review of common area personal property and values Insurance Community University 93 www. Insurance. Community. University. com

Business Income • Must determine what type of income the association is really earning: fees, rents? , other? • Association Fees. Some policies specifically cover association fees: – We will pay for Association fees you have been unable, after reasonable effort, to collect from any unit owner(s) whose unit(s) has been rendered uninhabitable due to direct physical loss or damage caused by or resulting from any Covered Cause of loos Insurance Community University 94 www. Insurance. Community. University. com

Business Income • Must determine what type of income the association is really earning: fees, rents? , other? • Association Fees. Some policies specifically cover association fees: – We will pay for Association fees you have been unable, after reasonable effort, to collect from any unit owner(s) whose unit(s) has been rendered uninhabitable due to direct physical loss or damage caused by or resulting from any Covered Cause of loos Insurance Community University 94 www. Insurance. Community. University. com

Business Income – We will only pay for loss of Association Fees that you sustain during the “period of restoration” and occurs within 12 consecutive months after the date of direct physical loss of damage • If there is a property management company then they are receiving rental income from properties and they would be insuring the loss of rents Insurance Community University 95 www. Insurance. Community. University. com

Business Income – We will only pay for loss of Association Fees that you sustain during the “period of restoration” and occurs within 12 consecutive months after the date of direct physical loss of damage • If there is a property management company then they are receiving rental income from properties and they would be insuring the loss of rents Insurance Community University 95 www. Insurance. Community. University. com

Condominium Liability Insurance key areas of review • Normal CGL issues to include “normal” enhancements such as Personal Injury, Advertising Injury • Fungi as a result of a covered cause of loss (typically sub-limited) • Pollution? ? • Hired and Non-Owned • EPL (may be included in management company policy as they are transactional) Insurance Community University 96 www. Insurance. Community. University. com

Condominium Liability Insurance key areas of review • Normal CGL issues to include “normal” enhancements such as Personal Injury, Advertising Injury • Fungi as a result of a covered cause of loss (typically sub-limited) • Pollution? ? • Hired and Non-Owned • EPL (may be included in management company policy as they are transactional) Insurance Community University 96 www. Insurance. Community. University. com

The Claim—This could and did happen! • 10 year old boy becomes very ill after swimming in the community pool. After being admitted for E-Coli bacterial infection, the boy developed Guillain. Barre Syndrome which is a disorder that occurs when the body’s immune system mistakenly attacks part of the nervous system which left him paralyzed. Insurance Community University 97 www. Insurance. Community. University. com

The Claim—This could and did happen! • 10 year old boy becomes very ill after swimming in the community pool. After being admitted for E-Coli bacterial infection, the boy developed Guillain. Barre Syndrome which is a disorder that occurs when the body’s immune system mistakenly attacks part of the nervous system which left him paralyzed. Insurance Community University 97 www. Insurance. Community. University. com

The Claim—This could and did happen! • Cause: fecal matter had been “deposited” in the pool and got stuck in the filtration system. Because the swimming pool cleaning company (not insured) did not put the correct amount of chlorine in the pool, the bacteria was not killed and multiplied rapidly in the warm water environment. Insurance Community University 98 www. Insurance. Community. University. com

The Claim—This could and did happen! • Cause: fecal matter had been “deposited” in the pool and got stuck in the filtration system. Because the swimming pool cleaning company (not insured) did not put the correct amount of chlorine in the pool, the bacteria was not killed and multiplied rapidly in the warm water environment. Insurance Community University 98 www. Insurance. Community. University. com

The Claim—This could and did happen! • The claim (for $8, 000 plus) was filed against the association policy and denied due to two exclusions: – the mold/fungus exclusion, which includes any microorganism or bacteria – the pollution exclusion contained in the liability policy. • The insurance company denied both defense as well as damages. Insurance Community University 99 www. Insurance. Community. University. com

The Claim—This could and did happen! • The claim (for $8, 000 plus) was filed against the association policy and denied due to two exclusions: – the mold/fungus exclusion, which includes any microorganism or bacteria – the pollution exclusion contained in the liability policy. • The insurance company denied both defense as well as damages. Insurance Community University 99 www. Insurance. Community. University. com

Polling Question #4 Poll Insurance Community University 100 www. Insurance. Community. University. com

Polling Question #4 Poll Insurance Community University 100 www. Insurance. Community. University. com

Directors and Officers Liability • Directors and Officers Liability is one of the most important coverages to provide for a Condominium Association. • Directors and officers have a responsibility to the association to manage the association in their best interest. • Directors and officers are fiduciaries and MAY be held personally liable for their actions or inaction. • D & O’s have several layers of legal duties including: duty of care; duty of loyalty; duty of obedience and duty of disclosure. Insurance Community University 101 www. Insurance. Community. University. com

Directors and Officers Liability • Directors and Officers Liability is one of the most important coverages to provide for a Condominium Association. • Directors and officers have a responsibility to the association to manage the association in their best interest. • Directors and officers are fiduciaries and MAY be held personally liable for their actions or inaction. • D & O’s have several layers of legal duties including: duty of care; duty of loyalty; duty of obedience and duty of disclosure. Insurance Community University 101 www. Insurance. Community. University. com

Directors and Officers Liability • Some considerations: – Verify “who the insured is” on the D & O Policy. The following are consideration – - Insured = Committee Members, Volunteers & Employees – - Association as an Entity – - Builder/Developer Representatives as Board Members – - Property Manager – - Property Management Company Insurance Community University 102 www. Insurance. Community. University. com

Directors and Officers Liability • Some considerations: – Verify “who the insured is” on the D & O Policy. The following are consideration – - Insured = Committee Members, Volunteers & Employees – - Association as an Entity – - Builder/Developer Representatives as Board Members – - Property Manager – - Property Management Company Insurance Community University 102 www. Insurance. Community. University. com

Directors and Officers Liability Full Prior Acts Duty to Defend Pay on Behalf Coverage for Non-Monetary Damage Claims (injunctive & declaratory relief • Definition of “wrongful acts” to include employment practices • • Insurance Community University 103 www. Insurance. Community. University. com

Directors and Officers Liability Full Prior Acts Duty to Defend Pay on Behalf Coverage for Non-Monetary Damage Claims (injunctive & declaratory relief • Definition of “wrongful acts” to include employment practices • • Insurance Community University 103 www. Insurance. Community. University. com

Directors and Officers Liability • Coverage for Alleged Breach of Contract Claims and Discrimination Claims • Defense outside the limit • NO libel, slander and defamation exclusion Insurance Community University 104 www. Insurance. Community. University. com

Directors and Officers Liability • Coverage for Alleged Breach of Contract Claims and Discrimination Claims • Defense outside the limit • NO libel, slander and defamation exclusion Insurance Community University 104 www. Insurance. Community. University. com

Unit Owners Policy Insurance Community University 105 www. Insurance. Community. University. com

Unit Owners Policy Insurance Community University 105 www. Insurance. Community. University. com

Unit Owners Policy • The CC & R’s will not only define the “unit” but will also typically require that the unit owners insure their units. The CC & R’s must be reviewed to determine: – The definition of unit – What coverages are required for each unit for property insurance in terms of perils and any other requirements Insurance Community University 106 www. Insurance. Community. University. com

Unit Owners Policy • The CC & R’s will not only define the “unit” but will also typically require that the unit owners insure their units. The CC & R’s must be reviewed to determine: – The definition of unit – What coverages are required for each unit for property insurance in terms of perils and any other requirements Insurance Community University 106 www. Insurance. Community. University. com

Unit Owners Policy • What coverages are required for each unit for liability insurance. • Determine if the association is requiring that they be named on the unit owner’s policy • Determine if the association is requiring a copy of the unit owners policy • Determine if the association is requiring a notice of cancellation on the unit owners policy Insurance Community University 107 www. Insurance. Community. University. com

Unit Owners Policy • What coverages are required for each unit for liability insurance. • Determine if the association is requiring that they be named on the unit owner’s policy • Determine if the association is requiring a copy of the unit owners policy • Determine if the association is requiring a notice of cancellation on the unit owners policy Insurance Community University 107 www. Insurance. Community. University. com

Unit Owners Policy • The unit owner will purchase an HO 00 06 form which includes both property and liability • Coverage A is for Additions and Alterations • Coverage C is provided for the personal property • Coverage D is for the Loss of Use Insurance Community University 108 www. Insurance. Community. University. com

Unit Owners Policy • The unit owner will purchase an HO 00 06 form which includes both property and liability • Coverage A is for Additions and Alterations • Coverage C is provided for the personal property • Coverage D is for the Loss of Use Insurance Community University 108 www. Insurance. Community. University. com

Condominium • The individual Unit Owner is responsible for: – Their own personal property – That portion of the unit in which they have a sole interest – Additions or alterations within their unit (for which they have sole interest) – Loss of Use of the unit – Special condominium assessments Insurance Community University 109 www. Insurance. Community. University. com

Condominium • The individual Unit Owner is responsible for: – Their own personal property – That portion of the unit in which they have a sole interest – Additions or alterations within their unit (for which they have sole interest) – Loss of Use of the unit – Special condominium assessments Insurance Community University 109 www. Insurance. Community. University. com

Important Coverage Consideration • Additions and Alterations – Building Ordinance • Personal Property • Loss of Use to include rents • Loss Assessment Insurance Community University 110 www. Insurance. Community. University. com

Important Coverage Consideration • Additions and Alterations – Building Ordinance • Personal Property • Loss of Use to include rents • Loss Assessment Insurance Community University 110 www. Insurance. Community. University. com

Unit Owners Policy • Loss Assessment coverage is another very important coverage for a unit owner. There are normally two types of assessments that can be made by an association: general assessments and special assessments. – General Assessments are normal maintenance charges that are part of the association dues. – Then there are “special assessments”. In looking at assessments, the unit owner should determine the reserves of the association to determine if there are sufficient funds to pay normal costs of operation and normal improvements Insurance Community University 111 www. Insurance. Community. University. com

Unit Owners Policy • Loss Assessment coverage is another very important coverage for a unit owner. There are normally two types of assessments that can be made by an association: general assessments and special assessments. – General Assessments are normal maintenance charges that are part of the association dues. – Then there are “special assessments”. In looking at assessments, the unit owner should determine the reserves of the association to determine if there are sufficient funds to pay normal costs of operation and normal improvements Insurance Community University 111 www. Insurance. Community. University. com

Unit Owners Policy • From an insurance standpoint the concern is when the “special assessments” are made because of a covered insurance loss wherein the association policy may not have coverage; the coverage is inadequate in limits; or there is a large deductible. • In these situations, individual unit owners would be assessed for the costs associated with these losses. • Loss Assessment Coverage is typically provided in Unit Owners Policies for minimum limits of insurance. Insurance Community University 112 www. Insurance. Community. University. com

Unit Owners Policy • From an insurance standpoint the concern is when the “special assessments” are made because of a covered insurance loss wherein the association policy may not have coverage; the coverage is inadequate in limits; or there is a large deductible. • In these situations, individual unit owners would be assessed for the costs associated with these losses. • Loss Assessment Coverage is typically provided in Unit Owners Policies for minimum limits of insurance. Insurance Community University 112 www. Insurance. Community. University. com

Unit Owners Policy • Earthquake Damage Loss Assessment is a separate endorsement • Review how it responds to an EQ deductible on the Association Policy Insurance Community University 113 www. Insurance. Community. University. com

Unit Owners Policy • Earthquake Damage Loss Assessment is a separate endorsement • Review how it responds to an EQ deductible on the Association Policy Insurance Community University 113 www. Insurance. Community. University. com

Insurance Community University 114 www. Insurance. Community. University. com

Insurance Community University 114 www. Insurance. Community. University. com

Disclaimer Insurance forms and endorsements vary based on insurance company; changes in edition dates; regulations; court decisions; and state jurisdiction. This instructional materials provided by Insight is intended as a general guideline and any interpretations provided by Insight do not modify or revise insurance policy language. The authors of these materials, Insight Insurance Consultants is a division of Insight Consulting and Management Inc. In providing these materials, Insight assumes neither liability nor responsibility to any person or business with respect to any loss that is alleged to be caused directly or indirectly as a result of the instructional materials provided. Copyright 2010 - 2011 All Rights Reserved www. insurancecommunitycenter. com Laurie: 714. 803. 5830 laurie@insurancecommunitycenter. com Marjorie: 714. 206. 9583 Marjorie@insurancecommunitycenter. com Insurance Community University 115 www. Insurance. Community. University. com

Disclaimer Insurance forms and endorsements vary based on insurance company; changes in edition dates; regulations; court decisions; and state jurisdiction. This instructional materials provided by Insight is intended as a general guideline and any interpretations provided by Insight do not modify or revise insurance policy language. The authors of these materials, Insight Insurance Consultants is a division of Insight Consulting and Management Inc. In providing these materials, Insight assumes neither liability nor responsibility to any person or business with respect to any loss that is alleged to be caused directly or indirectly as a result of the instructional materials provided. Copyright 2010 - 2011 All Rights Reserved www. insurancecommunitycenter. com Laurie: 714. 803. 5830 laurie@insurancecommunitycenter. com Marjorie: 714. 206. 9583 Marjorie@insurancecommunitycenter. com Insurance Community University 115 www. Insurance. Community. University. com

Thank You! Upcoming Lectures & Courses • For CE Credit – 7/20 -21 Ethics for Insurance Agents – 7/27 Homeowners' Valuation (CA Only) – 8/10 Workers’ Compensation – 8/16 Errors & Omissions • Informational Webinar – 8/9 Target Marketing Insurance Community University 116 www. Insurance. Community. University. com

Thank You! Upcoming Lectures & Courses • For CE Credit – 7/20 -21 Ethics for Insurance Agents – 7/27 Homeowners' Valuation (CA Only) – 8/10 Workers’ Compensation – 8/16 Errors & Omissions • Informational Webinar – 8/9 Target Marketing Insurance Community University 116 www. Insurance. Community. University. com