742b26795a7808ce0b96659d47782d6c.ppt

- Количество слайдов: 54

Conclusion of “tools” chapters Today: Welfare economics Some cost-benefit analysis tools Certainty equivalent value

Conclusion of “tools” chapters Today: Welfare economics Some cost-benefit analysis tools Certainty equivalent value

Last week n Introduction to Econ 130 and public finance q n Chapter 1 q n What is public finance? Parts of Chapter 2 q n Read syllabus if you have not done so Empirical tools to test theory Tiebout model q “Voting with your feet”

Last week n Introduction to Econ 130 and public finance q n Chapter 1 q n What is public finance? Parts of Chapter 2 q n Read syllabus if you have not done so Empirical tools to test theory Tiebout model q “Voting with your feet”

Today n Conclusion of our “tools” lectures q Welfare economics n n q Market failure n q Common in markets we will be examining this quarter Cost-benefit analysis n q Pure exchange economy Pareto improvements What projects should be done? Certainty equivalent value n How much money are risk-averse people willing to give up to get a sure thing?

Today n Conclusion of our “tools” lectures q Welfare economics n n q Market failure n q Common in markets we will be examining this quarter Cost-benefit analysis n q Pure exchange economy Pareto improvements What projects should be done? Certainty equivalent value n How much money are risk-averse people willing to give up to get a sure thing?

Welfare economics n Begin study using Edgeworth boxes q Pure exchange economy n n R/G chapter 3 For an in-depth look, see also Varian’s Intermediate Micro book, chapters 30 -33

Welfare economics n Begin study using Edgeworth boxes q Pure exchange economy n n R/G chapter 3 For an in-depth look, see also Varian’s Intermediate Micro book, chapters 30 -33

Edgeworth boxes n Simple study of distribution q q We will make extensive use of Edgeworth boxes, Pareto efficiency, and Pareto improvements Edgeworth boxes are used for a two-person economy n n q Bottom left of Edgeworth box is origin for one person Top right of Edgeworth box is origin for other person See Figures 3. 1 and 3. 2

Edgeworth boxes n Simple study of distribution q q We will make extensive use of Edgeworth boxes, Pareto efficiency, and Pareto improvements Edgeworth boxes are used for a two-person economy n n q Bottom left of Edgeworth box is origin for one person Top right of Edgeworth box is origin for other person See Figures 3. 1 and 3. 2

Pareto efficiency n n Nobody can be made better off without making another person worse off In cases with “standard” indifference curves (ICs), the two ICs will be tangent to each other when Pareto efficiency is achieved

Pareto efficiency n n Nobody can be made better off without making another person worse off In cases with “standard” indifference curves (ICs), the two ICs will be tangent to each other when Pareto efficiency is achieved

Pareto improvement n Reallocation of goods or resources that meets the following requirement q n At least one person is made better off without anybody else being made worse off See Figures 3. 3, 3. 4, 3. 5, and 3. 6

Pareto improvement n Reallocation of goods or resources that meets the following requirement q n At least one person is made better off without anybody else being made worse off See Figures 3. 3, 3. 4, 3. 5, and 3. 6

Contract curve n n The set of all Pareto efficient points Usually goes from one person’s origin to the other person’s origin q n Origin of each person is Pareto efficient Note that efficient points may or may not be “fair” in your mind q q Fairness is often not a topic brought up by economists More on “fairness” later See also Figure 3. 7

Contract curve n n The set of all Pareto efficient points Usually goes from one person’s origin to the other person’s origin q n Origin of each person is Pareto efficient Note that efficient points may or may not be “fair” in your mind q q Fairness is often not a topic brought up by economists More on “fairness” later See also Figure 3. 7

Moving on to production n n We have found the efficient points on the consumption side Now, let’s do the same on the production side q Production possibilities curves

Moving on to production n n We have found the efficient points on the consumption side Now, let’s do the same on the production side q Production possibilities curves

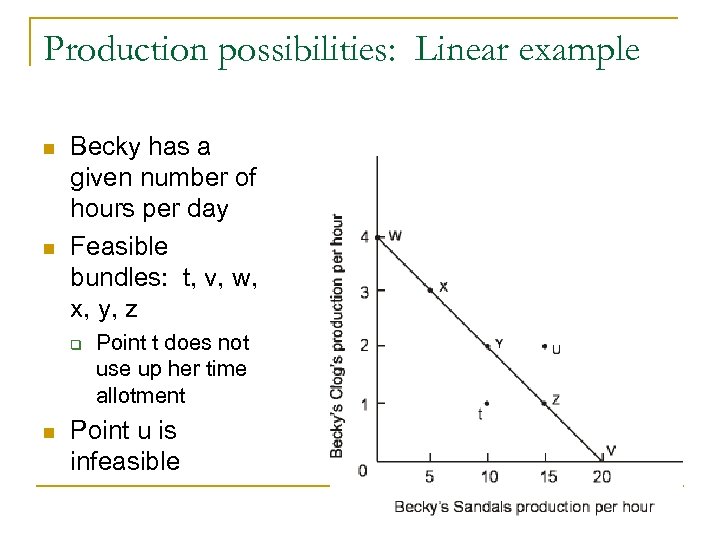

Production possibilities: Linear example n n Becky has a given number of hours per day Feasible bundles: t, v, w, x, y, z q n Point t does not use up her time allotment Point u is infeasible

Production possibilities: Linear example n n Becky has a given number of hours per day Feasible bundles: t, v, w, x, y, z q n Point t does not use up her time allotment Point u is infeasible

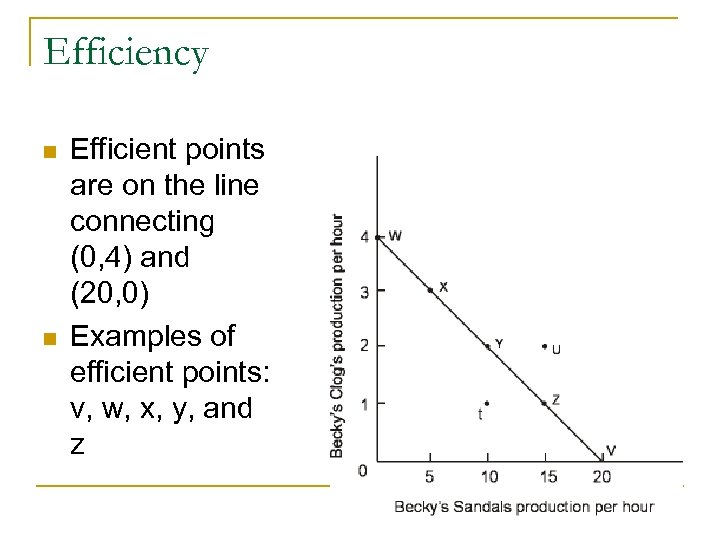

Efficiency n n Efficient points are on the line connecting (0, 4) and (20, 0) Examples of efficient points: v, w, x, y, and z

Efficiency n n Efficient points are on the line connecting (0, 4) and (20, 0) Examples of efficient points: v, w, x, y, and z

Efficiency n n At efficient points, increasing production of one good must result in another good having decreased production We will typically assume efficient points are chosen q No satiation assumption: More is better

Efficiency n n At efficient points, increasing production of one good must result in another good having decreased production We will typically assume efficient points are chosen q No satiation assumption: More is better

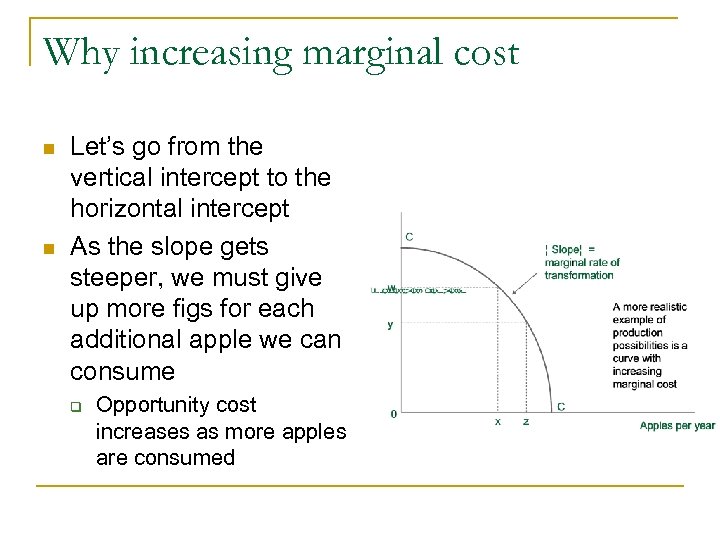

Why increasing marginal cost n n Let’s go from the vertical intercept to the horizontal intercept As the slope gets steeper, we must give up more figs for each additional apple we can consume q Opportunity cost increases as more apples are consumed

Why increasing marginal cost n n Let’s go from the vertical intercept to the horizontal intercept As the slope gets steeper, we must give up more figs for each additional apple we can consume q Opportunity cost increases as more apples are consumed

Market failure n There are instances in which market efficiency cannot be achieved q Market power n q Many ways to control price Nonexistence of markets n Asymmetric information q n n Important in health care and retirement: Chapters 9 -11 Externalities: Chapter 5 Public goods: Chapter 4

Market failure n There are instances in which market efficiency cannot be achieved q Market power n q Many ways to control price Nonexistence of markets n Asymmetric information q n n Important in health care and retirement: Chapters 9 -11 Externalities: Chapter 5 Public goods: Chapter 4

Market failure due to market power n How Do Firms Gain Market Power? q q q Exclusive control over important inputs Patents and copyrights Government licenses or franchises Economies of scale Natural monopoly Networks

Market failure due to market power n How Do Firms Gain Market Power? q q q Exclusive control over important inputs Patents and copyrights Government licenses or franchises Economies of scale Natural monopoly Networks

Exclusive control over important inputs n If a company controls a significant portion of the important inputs to a product, it can have significant influence on price

Exclusive control over important inputs n If a company controls a significant portion of the important inputs to a product, it can have significant influence on price

Exclusive control over important inputs n Example: De Beers q q q Rough diamond explorer Around 40% of world diamond production by value Sales and marketing through the Diamond Trading Company n This company sells almost half of the world’s rough diamonds by value (Information from http: //en. wikipedia. org/wiki/De_Beers, checked Feb. 3, 2008)

Exclusive control over important inputs n Example: De Beers q q q Rough diamond explorer Around 40% of world diamond production by value Sales and marketing through the Diamond Trading Company n This company sells almost half of the world’s rough diamonds by value (Information from http: //en. wikipedia. org/wiki/De_Beers, checked Feb. 3, 2008)

De Beers n Such large control over the market makes De Beers able to act similarly to a monopolist q Marketing of diamond jewelry does not have to be brand specific n q "A Diamond is Forever" attempts to prevent old jewelry from entering the market De Beers does have some control over world prices

De Beers n Such large control over the market makes De Beers able to act similarly to a monopolist q Marketing of diamond jewelry does not have to be brand specific n q "A Diamond is Forever" attempts to prevent old jewelry from entering the market De Beers does have some control over world prices

Patents and copyrights n Patents and copyrights prohibit others from copying private work and discoveries q Example: Copying songs and movies that are copyrighted are typically prohibited by law

Patents and copyrights n Patents and copyrights prohibit others from copying private work and discoveries q Example: Copying songs and movies that are copyrighted are typically prohibited by law

Government licenses or franchises n n Government-owned property often allows exclusive operation of the property for various uses This is to prevent competition that could deteriorate a natural destination

Government licenses or franchises n n Government-owned property often allows exclusive operation of the property for various uses This is to prevent competition that could deteriorate a natural destination

Government licenses or franchises n Example: Yosemite National Park q q q Limited parking Tasteful hotels Most of the park is undeveloped n n Most of park development is in only 7 square miles Park is 1, 200 square miles Bridal Veil Falls

Government licenses or franchises n Example: Yosemite National Park q q q Limited parking Tasteful hotels Most of the park is undeveloped n n Most of park development is in only 7 square miles Park is 1, 200 square miles Bridal Veil Falls

Economies of scale n Some technologies are such that as the quantity produced increases, ATC decreases for all reasonable quantities produced q This is due to increasing returns to scale n n This happens when ALL inputs double and production MORE THAN doubles Often happens with large fixed costs and nearly-linear variable costs

Economies of scale n Some technologies are such that as the quantity produced increases, ATC decreases for all reasonable quantities produced q This is due to increasing returns to scale n n This happens when ALL inputs double and production MORE THAN doubles Often happens with large fixed costs and nearly-linear variable costs

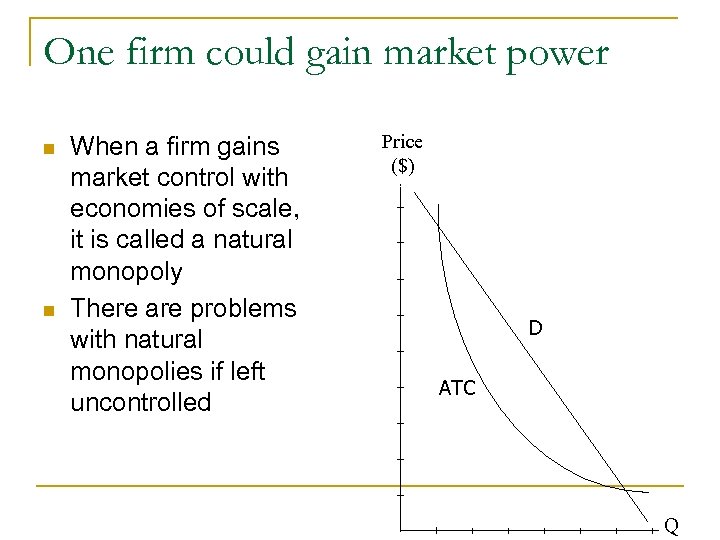

One firm could gain market power n n When a firm gains market control with economies of scale, it is called a natural monopoly There are problems with natural monopolies if left uncontrolled Price ($) D ATC Q

One firm could gain market power n n When a firm gains market control with economies of scale, it is called a natural monopoly There are problems with natural monopolies if left uncontrolled Price ($) D ATC Q

Network economies example n Picture phones q q Each company in this industry is trying to become the leader in video calling programs This technology has improved since the Picture. Phone (at right) was unveiled in 1964

Network economies example n Picture phones q q Each company in this industry is trying to become the leader in video calling programs This technology has improved since the Picture. Phone (at right) was unveiled in 1964

Market failure & government intervention n In some of the topics this quarter, government intervention will be justified by market failure q Governments can fail, too n More in Chapter 6

Market failure & government intervention n In some of the topics this quarter, government intervention will be justified by market failure q Governments can fail, too n More in Chapter 6

Cost-benefit analysis/CE value n We now move on to parts of Chapter 8 for the last “tools” chapter q Cost-benefit analysis n n q Present value Internal rate of return Benefit-cost ratio Valuing public projects Certainty equivalent value

Cost-benefit analysis/CE value n We now move on to parts of Chapter 8 for the last “tools” chapter q Cost-benefit analysis n n q Present value Internal rate of return Benefit-cost ratio Valuing public projects Certainty equivalent value

Present value n Present value shows how much future payments are worth today q Example: $100 paid today is not worth the same as $100 paid a year from now n Lost interest in safe investments

Present value n Present value shows how much future payments are worth today q Example: $100 paid today is not worth the same as $100 paid a year from now n Lost interest in safe investments

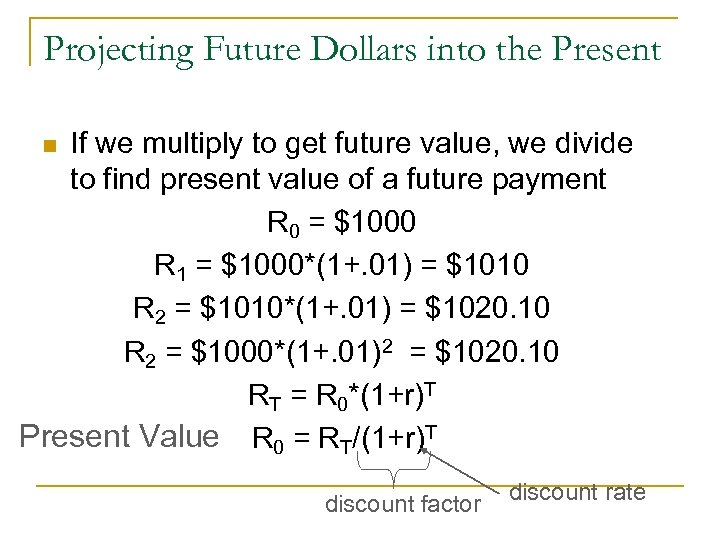

Using future value to derive present value n Suppose we put $1, 000 into the bank today, earning 1% per year on it q q Value today: $1, 000 Value 1 year from now: $1, 010 n q $1, 000 * (1 + 0. 01) Value 2 years from now: $1, 020. 10 n n $1, 000 * (1 + 0. 01)2 $1, 010 * (1 + 0. 01)

Using future value to derive present value n Suppose we put $1, 000 into the bank today, earning 1% per year on it q q Value today: $1, 000 Value 1 year from now: $1, 010 n q $1, 000 * (1 + 0. 01) Value 2 years from now: $1, 020. 10 n n $1, 000 * (1 + 0. 01)2 $1, 010 * (1 + 0. 01)

Projecting Future Dollars into the Present If we multiply to get future value, we divide to find present value of a future payment R 0 = $1000 R 1 = $1000*(1+. 01) = $1010 R 2 = $1010*(1+. 01) = $1020. 10 R 2 = $1000*(1+. 01)2 = $1020. 10 RT = R 0*(1+r)T Present Value R 0 = RT/(1+r)T n discount factor discount rate

Projecting Future Dollars into the Present If we multiply to get future value, we divide to find present value of a future payment R 0 = $1000 R 1 = $1000*(1+. 01) = $1010 R 2 = $1010*(1+. 01) = $1020. 10 R 2 = $1000*(1+. 01)2 = $1020. 10 RT = R 0*(1+r)T Present Value R 0 = RT/(1+r)T n discount factor discount rate

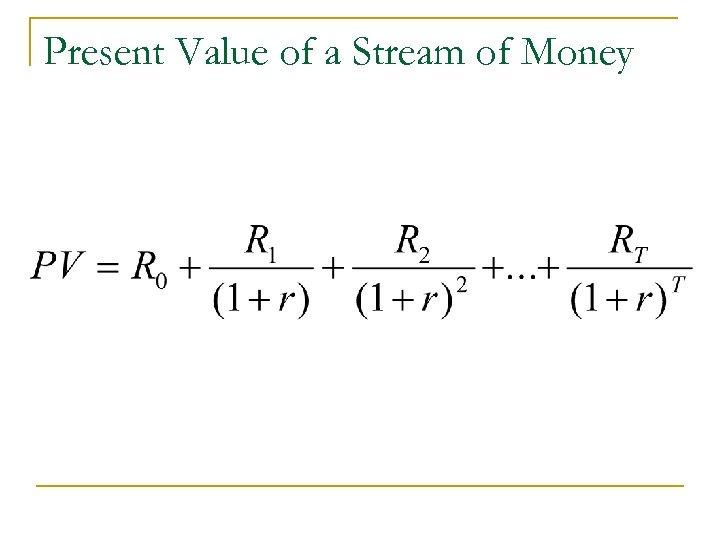

Present Value of a Stream of Money

Present Value of a Stream of Money

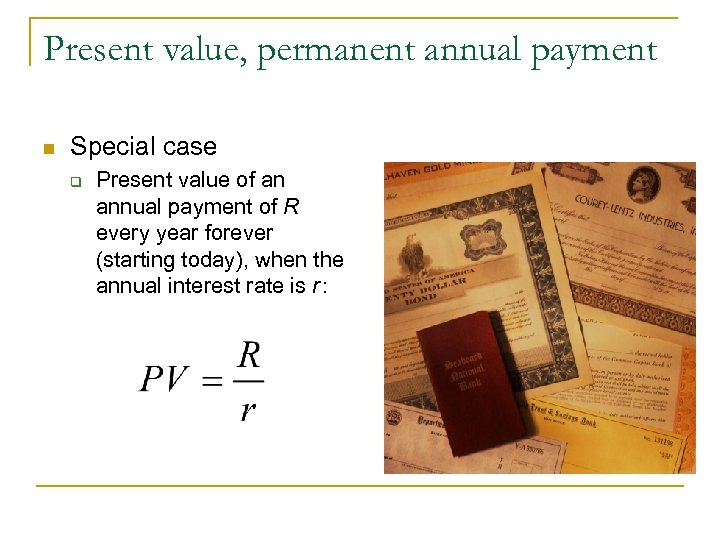

Present value, permanent annual payment n Special case q Present value of an annual payment of R every year forever (starting today), when the annual interest rate is r :

Present value, permanent annual payment n Special case q Present value of an annual payment of R every year forever (starting today), when the annual interest rate is r :

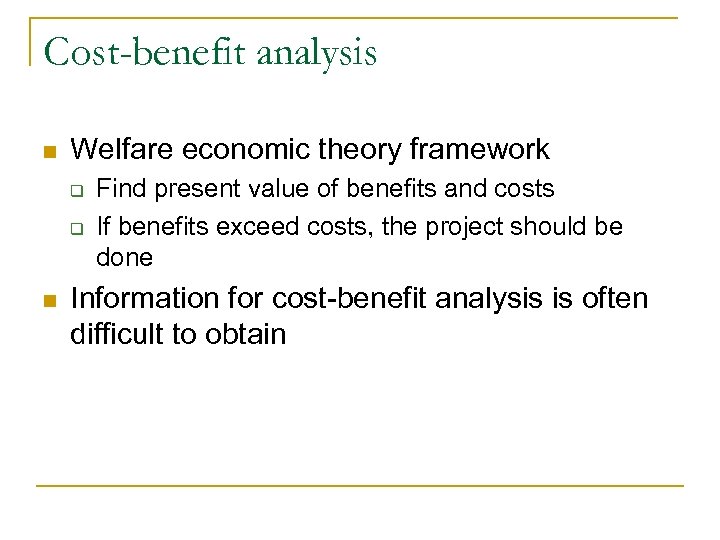

Cost-benefit analysis n Welfare economic theory framework q q n Find present value of benefits and costs If benefits exceed costs, the project should be done Information for cost-benefit analysis is often difficult to obtain

Cost-benefit analysis n Welfare economic theory framework q q n Find present value of benefits and costs If benefits exceed costs, the project should be done Information for cost-benefit analysis is often difficult to obtain

Cost-benefit analysis n Present value criteria q n When there are two mutually exclusive projects, the preferred project is the one with the highest net present value (assuming it is positive) What about “fairness? ”

Cost-benefit analysis n Present value criteria q n When there are two mutually exclusive projects, the preferred project is the one with the highest net present value (assuming it is positive) What about “fairness? ”

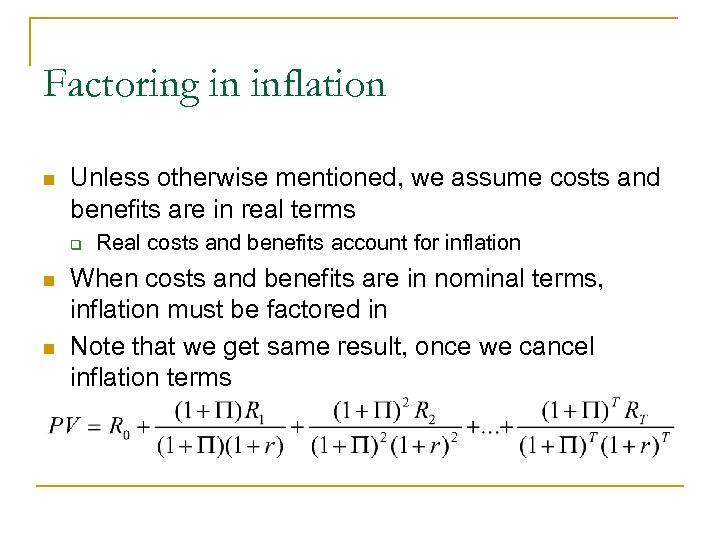

Factoring in inflation n Unless otherwise mentioned, we assume costs and benefits are in real terms q n n Real costs and benefits account for inflation When costs and benefits are in nominal terms, inflation must be factored in Note that we get same result, once we cancel inflation terms

Factoring in inflation n Unless otherwise mentioned, we assume costs and benefits are in real terms q n n Real costs and benefits account for inflation When costs and benefits are in nominal terms, inflation must be factored in Note that we get same result, once we cancel inflation terms

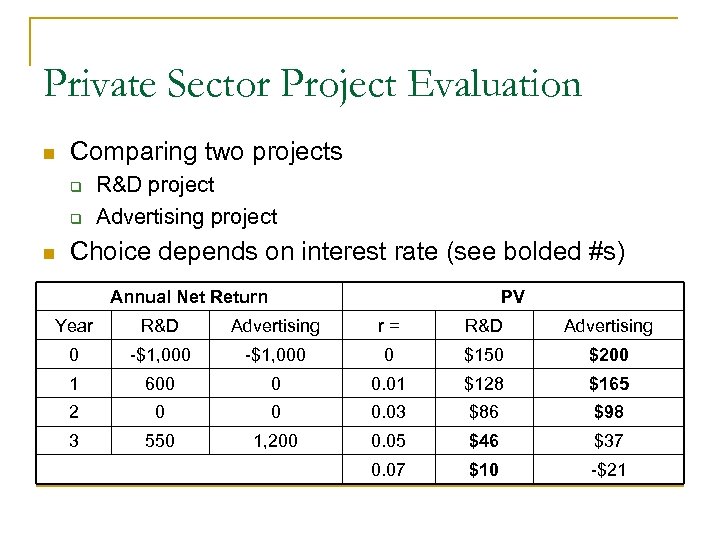

Private Sector Project Evaluation n Comparing two projects q q n R&D project Advertising project Choice depends on interest rate (see bolded #s) Annual Net Return PV Year R&D Advertising r= R&D Advertising 0 -$1, 000 0 $150 $200 1 600 0 0. 01 $128 $165 2 0 0 0. 03 $86 $98 3 550 1, 200 0. 05 $46 $37 0. 07 $10 -$21

Private Sector Project Evaluation n Comparing two projects q q n R&D project Advertising project Choice depends on interest rate (see bolded #s) Annual Net Return PV Year R&D Advertising r= R&D Advertising 0 -$1, 000 0 $150 $200 1 600 0 0. 01 $128 $165 2 0 0 0. 03 $86 $98 3 550 1, 200 0. 05 $46 $37 0. 07 $10 -$21

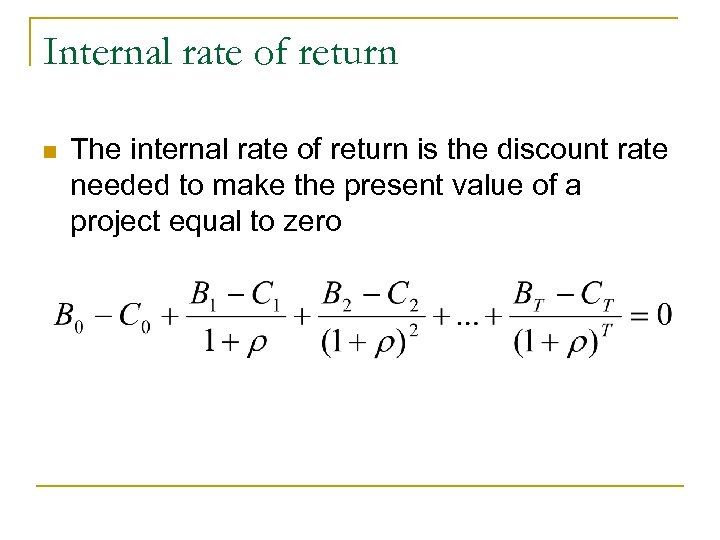

Internal rate of return n The internal rate of return is the discount rate needed to make the present value of a project equal to zero

Internal rate of return n The internal rate of return is the discount rate needed to make the present value of a project equal to zero

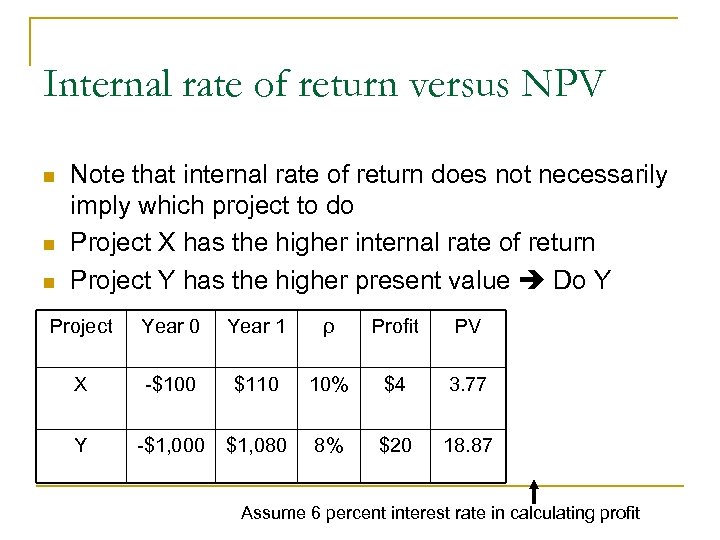

Internal rate of return versus NPV n n n Note that internal rate of return does not necessarily imply which project to do Project X has the higher internal rate of return Project Y has the higher present value Do Y Project Year 0 Year 1 ρ Profit PV X -$100 $110 10% $4 3. 77 Y -$1, 000 $1, 080 8% $20 18. 87 Assume 6 percent interest rate in calculating profit

Internal rate of return versus NPV n n n Note that internal rate of return does not necessarily imply which project to do Project X has the higher internal rate of return Project Y has the higher present value Do Y Project Year 0 Year 1 ρ Profit PV X -$100 $110 10% $4 3. 77 Y -$1, 000 $1, 080 8% $20 18. 87 Assume 6 percent interest rate in calculating profit

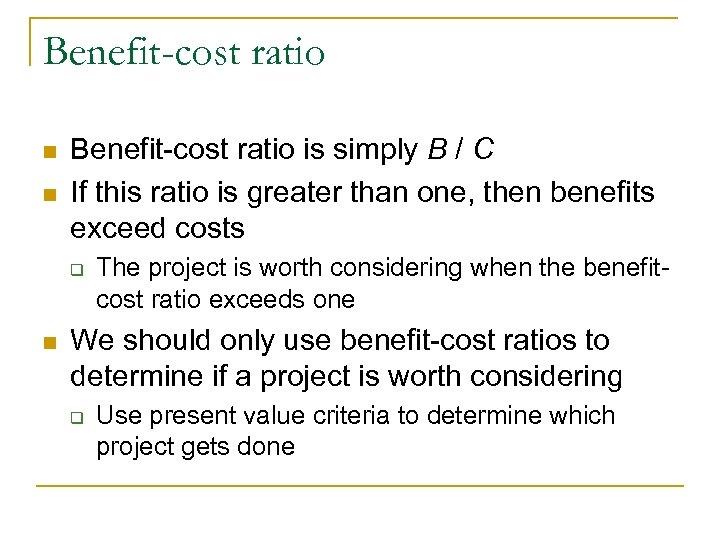

Benefit-cost ratio n n Benefit-cost ratio is simply B / C If this ratio is greater than one, then benefits exceed costs q n The project is worth considering when the benefitcost ratio exceeds one We should only use benefit-cost ratios to determine if a project is worth considering q Use present value criteria to determine which project gets done

Benefit-cost ratio n n Benefit-cost ratio is simply B / C If this ratio is greater than one, then benefits exceed costs q n The project is worth considering when the benefitcost ratio exceeds one We should only use benefit-cost ratios to determine if a project is worth considering q Use present value criteria to determine which project gets done

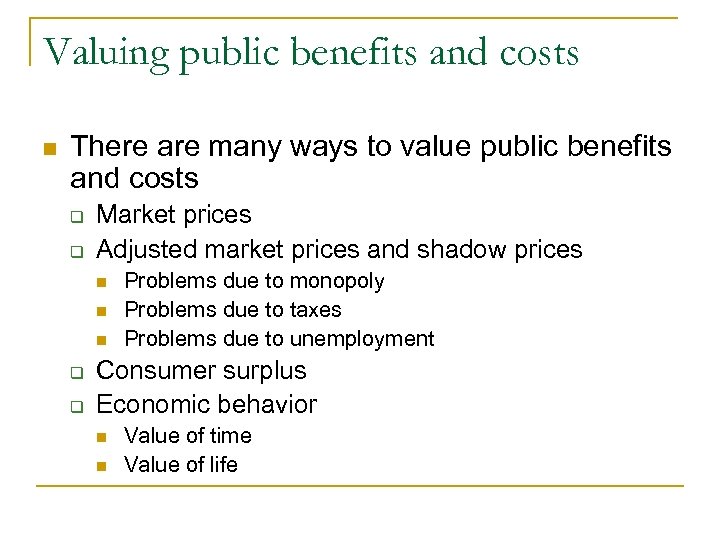

Valuing public benefits and costs n There are many ways to value public benefits and costs q q Market prices Adjusted market prices and shadow prices n n n q q Problems due to monopoly Problems due to taxes Problems due to unemployment Consumer surplus Economic behavior n n Value of time Value of life

Valuing public benefits and costs n There are many ways to value public benefits and costs q q Market prices Adjusted market prices and shadow prices n n n q q Problems due to monopoly Problems due to taxes Problems due to unemployment Consumer surplus Economic behavior n n Value of time Value of life

Market prices n Market price is a good measure of marginal social cost if the market is perfectly competitive with no government intervention q Problem: Many markets have market power

Market prices n Market price is a good measure of marginal social cost if the market is perfectly competitive with no government intervention q Problem: Many markets have market power

Adjusted market prices n There are instances in which social marginal cost is not clear q n Underlying social MC is known as shadow price Examples where social MC is not clear q q q Monopoly: Market power controls price Taxes: Taxes change price Unemployment: Lack of employment makes valuing a worker’s skills difficult

Adjusted market prices n There are instances in which social marginal cost is not clear q n Underlying social MC is known as shadow price Examples where social MC is not clear q q q Monopoly: Market power controls price Taxes: Taxes change price Unemployment: Lack of employment makes valuing a worker’s skills difficult

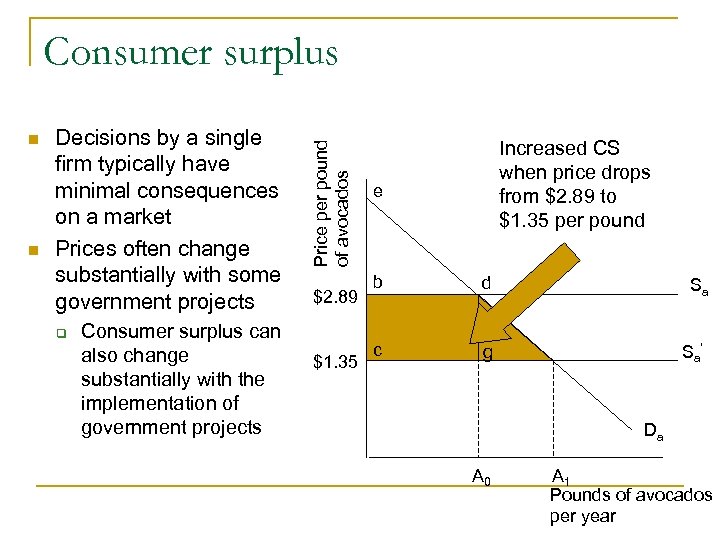

n n Decisions by a single firm typically have minimal consequences on a market Prices often change substantially with some government projects q Consumer surplus can also change substantially with the implementation of government projects Price per pound of avocados Consumer surplus $2. 89 $1. 35 Increased CS when price drops from $2. 89 to $1. 35 per pound e b d Sa c g Sa’ Da A 0 A 1 Pounds of avocados per year

n n Decisions by a single firm typically have minimal consequences on a market Prices often change substantially with some government projects q Consumer surplus can also change substantially with the implementation of government projects Price per pound of avocados Consumer surplus $2. 89 $1. 35 Increased CS when price drops from $2. 89 to $1. 35 per pound e b d Sa c g Sa’ Da A 0 A 1 Pounds of avocados per year

Economic behavior n Some things that are valuable are not formally traded q Time n q Convenience n q “Time is money” for each person Driving versus public transit Life n How much is a life worth? q q Lost earnings and value of leisure time Probability of death versus wages in dangerous industries

Economic behavior n Some things that are valuable are not formally traded q Time n q Convenience n q “Time is money” for each person Driving versus public transit Life n How much is a life worth? q q Lost earnings and value of leisure time Probability of death versus wages in dangerous industries

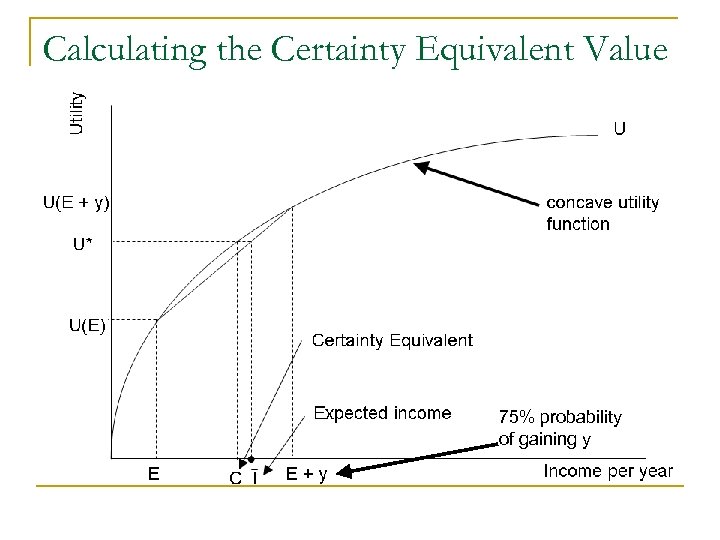

Certainty equivalent n n If people were risk neutral, utility would be linear Most people are risk averse q q n Concave utility function Expected utility of a gamble is less than the utility of the expected value More on uncertainty in Chapter 9

Certainty equivalent n n If people were risk neutral, utility would be linear Most people are risk averse q q n Concave utility function Expected utility of a gamble is less than the utility of the expected value More on uncertainty in Chapter 9

Calculating the Certainty Equivalent Value 75% probability of gaining y

Calculating the Certainty Equivalent Value 75% probability of gaining y

CE Value: An example n Let our two possible incomes be $6, 400 (E) and $10, 000 (E + y) q n Each possible income has probability of 0. 5 of occurring U(x) = x½

CE Value: An example n Let our two possible incomes be $6, 400 (E) and $10, 000 (E + y) q n Each possible income has probability of 0. 5 of occurring U(x) = x½

A gamble versus a sure thing n Let our two possible incomes be $6, 400 (E) and $10, 000 (E + y) q n n Each possible income has probability of 0. 5 of occurring U(x) = x½ How much money am I willing to take to be indifferent to the above gamble?

A gamble versus a sure thing n Let our two possible incomes be $6, 400 (E) and $10, 000 (E + y) q n n Each possible income has probability of 0. 5 of occurring U(x) = x½ How much money am I willing to take to be indifferent to the above gamble?

Expected income of the gamble n n Recall expected value from last Wednesday’s lecture ½ ($10, 000) + ½ ($6, 400) = $8, 200

Expected income of the gamble n n Recall expected value from last Wednesday’s lecture ½ ($10, 000) + ½ ($6, 400) = $8, 200

Expected utility of the gamble n n n U($10, 000) = 100 U($6, 400) = 80 Expected utility of the gamble q ½ (100) + ½ (80) = 90

Expected utility of the gamble n n n U($10, 000) = 100 U($6, 400) = 80 Expected utility of the gamble q ½ (100) + ½ (80) = 90

Certainty equivalent value n This risk averse person will be indifferent between the following two options q q $10, 000 with probability 0. 5 and $6, 400 with probability 0. 5 Some amount of money with certainty n n How much? Notice that the first option has an expected utility of 90 q How much money (paid with certainty) will lead to a utility of 90?

Certainty equivalent value n This risk averse person will be indifferent between the following two options q q $10, 000 with probability 0. 5 and $6, 400 with probability 0. 5 Some amount of money with certainty n n How much? Notice that the first option has an expected utility of 90 q How much money (paid with certainty) will lead to a utility of 90?

Certainty equivalent value n We need to find some y such that U(y) = 90 q q n y½ = 90 y = 8100 The certainty equivalent value is 8100 Recall that the expected income of the gamble is 8200 q This risk-averse person is willing to lose $100 in expected income to remove all risk

Certainty equivalent value n We need to find some y such that U(y) = 90 q q n y½ = 90 y = 8100 The certainty equivalent value is 8100 Recall that the expected income of the gamble is 8200 q This risk-averse person is willing to lose $100 in expected income to remove all risk

Summary n n Welfare economics is important in determining what outcomes are efficient Market failure can occur when there are not competitive and complete markets Cost-benefit analysis helps to determine which projects are most useful to society Certainty equivalent value determines how much money a risk-averse person is willing to give up in order to remove risk

Summary n n Welfare economics is important in determining what outcomes are efficient Market failure can occur when there are not competitive and complete markets Cost-benefit analysis helps to determine which projects are most useful to society Certainty equivalent value determines how much money a risk-averse person is willing to give up in order to remove risk

End of Unit 1 n n This concludes our tools lectures Beginning Wednesday: Unit 2 q q q n Public goods Externalities Voting Government growth Education For Wednesday: Read Ch. 4 q Public goods

End of Unit 1 n n This concludes our tools lectures Beginning Wednesday: Unit 2 q q q n Public goods Externalities Voting Government growth Education For Wednesday: Read Ch. 4 q Public goods

See you Wednesday What type of utility function do you think gamblers have?

See you Wednesday What type of utility function do you think gamblers have?