5ac5996145ed49b38f7e1daf92ed85f6.ppt

- Количество слайдов: 75

Compliance Handbook For NSE Members Updated till April 10, 2014 1

Preamble Compliance requirements pertaining to members of the Exchange are given in byelaws, regulations and circulars of the Sebi , Exchange and the Clearing Corporation. In order to facilitate quick reference to such requirements, an attempt has been made to collate them in a single handbook. This compliance handbook is presented as a guiding document for carrying out internal compliance checks by members in their head office, branch offices and offices of sub broker(s)/authorized person(s). In case of ambiguity or conflict, the contents of the related circular shall be final. 2

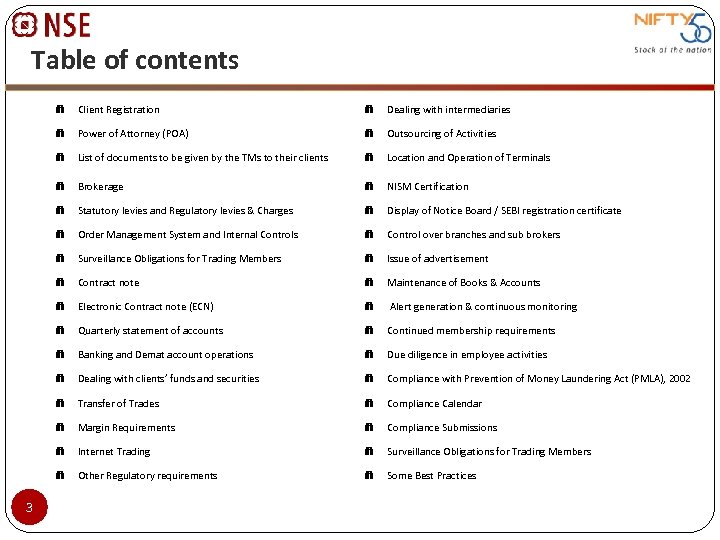

Table of contents e e Dealing with intermediaries e Power of Attorney (POA) e Outsourcing of Activities e List of documents to be given by the TMs to their clients e Location and Operation of Terminals e Brokerage e NISM Certification e Statutory levies and Regulatory levies & Charges e Display of Notice Board / SEBI registration certificate e Order Management System and Internal Controls e Control over branches and sub brokers e Surveillance Obligations for Trading Members e Issue of advertisement e Contract note e Maintenance of Books & Accounts e Electronic Contract note (ECN) e Alert generation & continuous monitoring e Quarterly statement of accounts e Continued membership requirements e Banking and Demat account operations e Due diligence in employee activities e Dealing with clients’ funds and securities e Compliance with Prevention of Money Laundering Act (PMLA), 2002 e Transfer of Trades e Compliance Calendar e Margin Requirements e Compliance Submissions e Internet Trading e Surveillance Obligations for Trading Members e 3 Client Registration Other Regulatory requirements e Some Best Practices

Client Registration Duly filled in client registration documents are to be submitted by any new client before commencing transactions for the client. Constituent registration form should consist of an Index Page listing all the documents contained in it and indicating briefly significance of each document. Client registration documents are to be segregated into mandatory and non- mandatory parts. Mandatory part should contain the KYC form, document capturing trading details, Policies & Procedures, Risk Disclosure Document, Guidance note dealing with Do's & Don’ts Document listing the Rights and Obligations of the client and Tariff Sheet. All additional and voluntary clauses should be taken in voluntary documents separated from the mandatory part. 4

Client Registration (contd. ) Mandatory documents Know your client form capturing the basic information about the client Documents capturing additional information about the client related to trading account. Document stating the Rights & Obligations of stock broker, sub-broker and client for trading on stock Exchanges. Uniform Risk Disclosure Documents Guidance Note to the client detailing Do’s and Don’ts for trading on Exchanges Document describing Policies and Procedures of Stock Brokers Document detailing the rate/amount of brokerage and other charges levied (Tariff Sheet). Voluntary Documents /Additional Documents 5 Any additional clauses/documents included , shall not be in contravention of any of the clauses specified by SEBI and also the Rules, Regulations, Articles, Bye laws , directives and guidelines of SEBI and Exchanges. Exchange may levy penalty if any contravening clauses are found.

Client Registration (contd. ) In KYC ensure that Complete details of Client information / Status, Bank and Depository Account details, Financial details of the client , Investment/ Trading experience, Financial documents (for Non Individual Constituents) and Signature of client are provided. Photograph, Proof of identity and address, Board Resolution from corporate clients permitting trading in derivative products are attached. The segments in which a client wants to transact are selected and marked by the client clearly and the client has countersigned against stock exchange as well as market segment where client intends to trade. Aadhaar card issued by UIDAI shall be admissible as Proof of Address and Proof of Identity in addition to the approved documents. 6

Client Registration (contd. ) e-KYC service launched by UIDAI shall be treated as sufficient proof of Identity and Address of the client. The same shall be allowed only if the client has authorized the intermediary to access his data through UIDAI system. Sebi vide its circular CIR/MIRSD/ 13 /2013 December 26, 2013 issued a circular to shift certain information related to income , occupation, net worth etc. of client in Section C of Part I to Part II of the Account Opening Form (for both individuals and non-individuals). As per the above Sebi circular, Part II shall be modified by the Member accordingly and a time period of six months, effective from the date of the circular* is provided to bring about the aforementioned modifications in the KYC form. *Exchange circular NSE/INSP/25392 dated December 26, 2013 7

Client Registration (contd. ) In Risk Disclosure Document ensure that : Client acknowledges the risk disclosure document and is aware that certain basic risks are involved in trading in equity and derivative products. Client should be made aware that contracts cannot be rescinded on the ground of lack of awareness or any other ground In Rights and Obligation document ensure that : Contains all the mandatory clauses as stipulated by SEBI / Exchanges Preserve acknowledgement regarding issue of Rights and Obligations document In Guidance Note detailing Do’s and Don’ts ensure that : Risk disclosure document / Guidance Note detailing Do’s and Don’ts for trading on exchanges is issued as per the prescribed format Preservation of acknowledged Risk Disclosure Document / Guidance Note detailing Do’s and Don’ts for trading on exchanges Brokerage should be charged as mutually agreed between member and client 8 and as mentioned in the tariff sheet.

Client Registration (contd. ) Collect PAN card copy of client, verify the same with the web site of Income tax Department and upload details of the client to the Exchange before placing orders for the client. Allot a unique client code to each client and maintain a file mapping the client codes and the PAN’s. Provide copies of all the executed documents to the clients within 7 days from the date of execution of documents start i. e. from the day of upload of UCC to the Exchange by the trading member TMs shall comply with the guidelines and circulars issued on determination of Beneficial Ownership. Trading member has made provisions to capture details of action taken against a client by SEBI or other financial sector regulator 9

Client Registration (contd. ) In-Person Verification • It shall be the responsibility of the stock broker to ensure in-person verification. • Subrokers/Authorised Persons can perform IPV. • Name of the Person doing In-Person verification, designation, organization, signature, date are to be recorded. • The IPV carried out by one SEBI registered intermediary can be relied upon by another intermediary. Stock broker has an option of doing ‘in-person’ verification through web camera at the branch office of the stock broker/sub-broker’s office. In case of NRI clients, attestation of KYC documents by Notary Public, Court, 10 Magistrate, Judge, Local Bankers , Indian Embassy/Consulate General in the country where the client resides is permitted

Client Registration (contd. ) For derivatives segment, Trading Members are required to obtain any of the following documentary evidence in support of financial information provided by the Client. List of Illustrative documents 1. 2. 3. 4. 5. 6. 7. 8. 9. Copy of ITR Acknowledgement Copy of Annual Accounts Copy of Form 16 in case of salary income Net-worth certificate Salary Slip Bank account statement for last 6 months Copy of Holding statement of de-mat account Any other relevant documents substantiating ownership of assets Self declaration along with relevant supporting For segments other than derivative segment trading members are required to obtain documents in accordance with their risk management policy. Trading members are required to ensure periodic review (at-least annually) of clients financial information and if any changes are observed with respect to client’s last submission , trading member is required to collect documentary evidence pertaining to client’s current financial information. 11

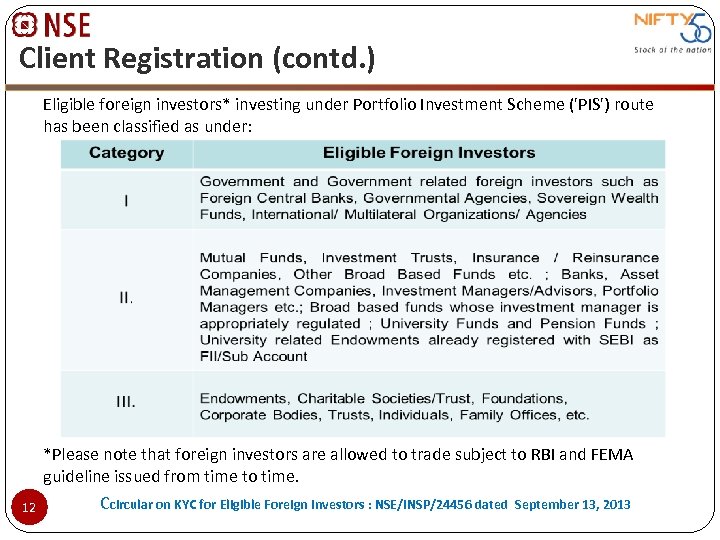

Client Registration (contd. ) Eligible foreign investors* investing under Portfolio Investment Scheme ('PIS') route has been classified as under: *Please note that foreign investors are allowed to trade subject to RBI and FEMA guideline issued from time to time. 12 Ccircular on KYC for Eligible Foreign Investors : NSE/INSP/24456 dated September 13, 2013

Client Registration (contd. ) Clarifications on KYC requirements for Foreign Investors viz. FIIs, Sub Accounts and QFIs In case of foreign entities either CIN no. or equivalent registration number of the respective country of client or SEBI registration number (as applicable) may be obtained. Custodians shall verify the Sebi registration copy with the originals or with the details available on Sebi website and provide duly certified copy of such verified Sebi registration certificate to the intermediary. In person verification is applicable only in case of QFI – Individual Client and shall be carried out by SEBI registered intermediary. As per Annexure 3 of Exchange circular no. 18677 dated August 22, 2012 for QFI, the intermediary shall collect Bank Account details, Depository account and Regulatory Actions as mentioned above. Further, for FIIs and Sub Accounts, Intermediaries shall update details of any action taken or proceedings initiated against the entity by the foreign regulators of SEBI / Stock exchanges. 13

Client Registration (contd. ) Clarifications on KYC requirements for Foreign Investors viz. FIIs, Sub Accounts and QFIs (cont’d) Financial data is required for category III investors ( Individuals, Family Offices, Endowments , Charitable Societies / Trust, Foundations, Corporate Bodies, Trusts, etc. ) PAN Card is now compulsory for all category of investors List of Senior Management personnel are required for all categories of foreign investors. However proof of identity and address of such Senior Management personnel shall be required by way of declaration on letter head foreign investors in category III In case the original of any document is not produced for verification, then the copies should be properly attested by entities authorized for attesting the documents, as per the SEBI circular no. MIRSD/SE/Cir-21/2011 dated October 5, 2011. 14

Client Registration (contd. ) Clarifications on KYC requirements for Foreign Investors viz. FIIs, Sub Accounts and QFIs (cont’d) Power of Attorney, mentioning the address is acceptable as address proof for Category I and II type of Investors however Address of proof has to be submitted by Individuals, Family Offices, Endowments, Charitable Societies/Trust, Foundations, Corporate Bodies, Trusts, etc. Proof of Identity (i. e. copy of passport, PIO, OCI Card) for Individuals , Family Offices , Endowments , Charitable Societies / Trust , Foundations, Corporate Bodies, Trusts etc. Ultimate Beneficial Owner q q 15 List of beneficial owners with shareholding or beneficial interest in the client to be obtained only for Category II and Category III foreign investors. Category II investors can provide a declaration in case there is no Ultimate BO over 25%. Proof of identity of the beneficial owner is also required in case of Category III investors. If Global Custodian / Local Custodian provides an undertaking to submit these details, then intermediary may take such undertaking only. Any change in the list to be obtained based on risk profile of the client.

Client Registration (contd. ) Clarifications on KYC requirements for Foreign Investors viz. FIIs, Sub Accounts and QFIs (cont’d. ) Intermediary shall display standard documents prescribed by SEBI on its web site, intimate the clients regarding the link and email a copy of the same to the client. If place of incorporation is not available, intermediary should take Registered office address / principal place of business of entity. If FII or Sub Account does not have certificate of Incorporation or Memorandum and Articles of Association, then any reasonable equivalent legal document evidencing formation of entity may be allowed. Copy of Board Resolution is required for Category II and III Foreign investors Copies of all the documents, wherever applicable, to be submitted by the applicant should be self-attested and accompanied by originals for verification. 16

Client Registration (contd. ) KRA Compliance Upload the KYC information on the system of the KYC Registration Agency (KRA) system and furnish scanned images of the KYC documents of the within 10 working days from the date of execution of documents by clients. Download the KYC information from KRA system for clients who are already registered with KRA. In case of existing clients, upload the modifications or additions if any. No requirement of sending original physical KYC documents of the clients to the KRA unless specifically desired by KRA. It is compulsory to upload KYC data of the existing clients who trade / invest or deal after Feb 28, 2013. 17

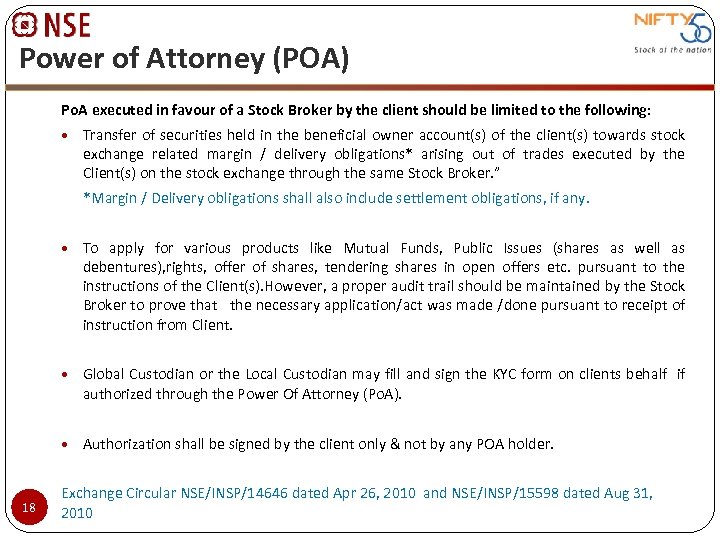

Power of Attorney (POA) Po. A executed in favour of a Stock Broker by the client should be limited to the following: Transfer of securities held in the beneficial owner account(s) of the client(s) towards stock exchange related margin / delivery obligations* arising out of trades executed by the Client(s) on the stock exchange through the same Stock Broker. ” *Margin / Delivery obligations shall also include settlement obligations, if any. To apply for various products like Mutual Funds, Public Issues (shares as well as debentures), rights, offer of shares, tendering shares in open offers etc. pursuant to the instructions of the Client(s). However, a proper audit trail should be maintained by the Stock Broker to prove that the necessary application/act was made /done pursuant to receipt of instruction from Client. Global Custodian or the Local Custodian may fill and sign the KYC form on clients behalf if authorized through the Power Of Attorney (Po. A). Authorization shall be signed by the client only & not by any POA holder. 18 Exchange Circular NSE/INSP/14646 dated Apr 26, 2010 and NSE/INSP/15598 dated Aug 31, 2010

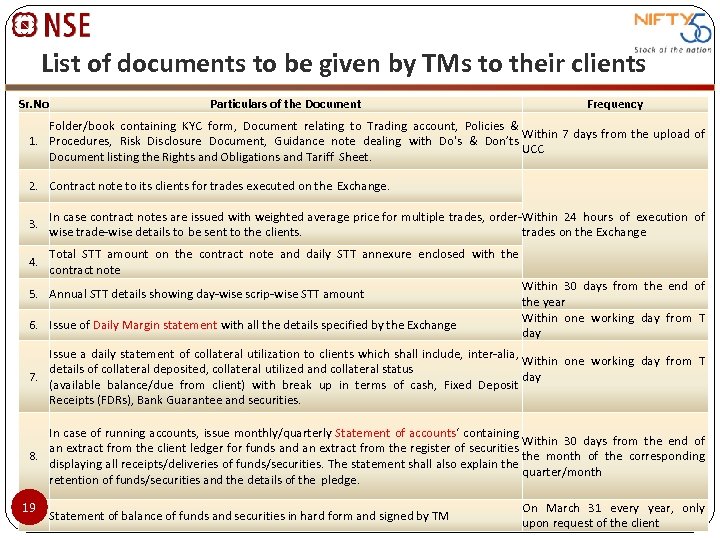

List of documents to be given by TMs to their clients Sr. No Particulars of the Document Frequency Folder/book containing KYC form, Document relating to Trading account, Policies & Within 7 days from the upload of 1. Procedures, Risk Disclosure Document, Guidance note dealing with Do's & Don’ts UCC Document listing the Rights and Obligations and Tariff Sheet. 2. Contract note to its clients for trades executed on the Exchange. 3. In case contract notes are issued with weighted average price for multiple trades, order-Within 24 hours of execution of wise trade-wise details to be sent to the clients. trades on the Exchange 4. Total STT amount on the contract note and daily STT annexure enclosed with the contract note 5. Annual STT details showing day-wise scrip-wise STT amount 6. Issue of Daily Margin statement with all the details specified by the Exchange Within 30 days from the end of the year Within one working day from T day Issue a daily statement of collateral utilization to clients which shall include, inter-alia, Within one working day from T details of collateral deposited, collateral utilized and collateral status 7. day (available balance/due from client) with break up in terms of cash, Fixed Deposit Receipts (FDRs), Bank Guarantee and securities. In case of running accounts, issue monthly/quarterly Statement of accounts‘ containing Within 30 days from the end of an extract from the client ledger for funds and an extract from the register of securities 8. the month of the corresponding displaying all receipts/deliveries of funds/securities. The statement shall also explain the quarter/month retention of funds/securities and the details of the pledge. 19 9. Statement of balance of funds and securities in hard form and signed by TM On March 31 every year, only upon request of the client

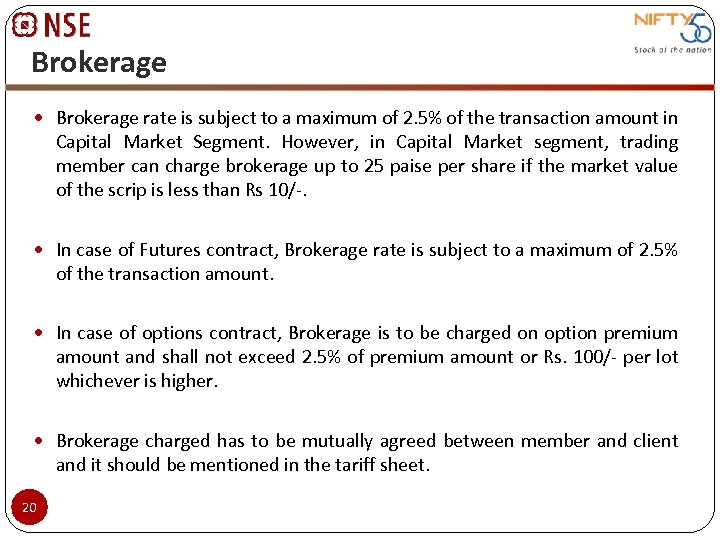

Brokerage rate is subject to a maximum of 2. 5% of the transaction amount in Capital Market Segment. However, in Capital Market segment, trading member can charge brokerage up to 25 paise per share if the market value of the scrip is less than Rs 10/-. In case of Futures contract, Brokerage rate is subject to a maximum of 2. 5% of the transaction amount. In case of options contract, Brokerage is to be charged on option premium amount and shall not exceed 2. 5% of premium amount or Rs. 100/- per lot whichever is higher. Brokerage charged has to be mutually agreed between member and client and it should be mentioned in the tariff sheet. 20

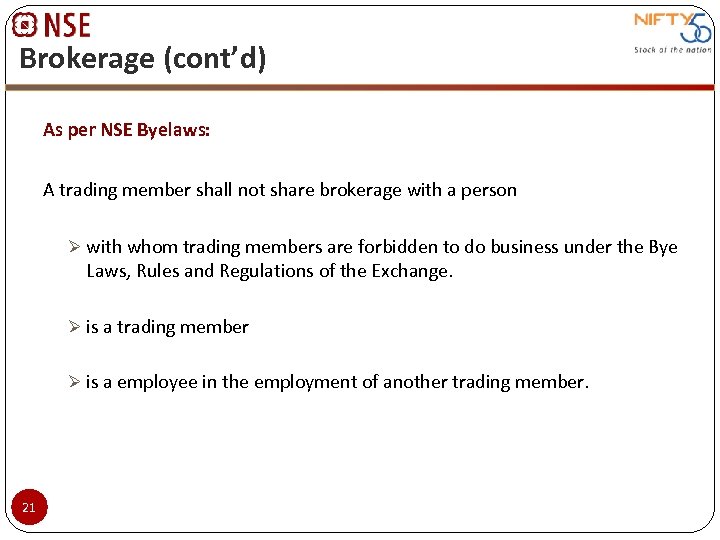

Brokerage (cont’d) As per NSE Byelaws: A trading member shall not share brokerage with a person Ø with whom trading members are forbidden to do business under the Bye Laws, Rules and Regulations of the Exchange. Ø is a trading member Ø is a employee in the employment of another trading member. 21

Statutory Levies and Regulatory Levies & Charges Following levies can only be charged to client in the contract note: Ø Statutory levies: These are charges levied by Central/ State governments eg. Service Tax, Security Transaction Tax (STT), Stamp Duty, etc. and may be recovered from client only at actuals paid/ Payable. Ø Regulatory levies/charges: These are charges levied by SEBI / Exchanges / Clearing Corporations eg. SEBI turnover fees, Exchange transaction charges, etc. If such charges are separately recovered from client, they may be specified in contract notes or may be given under the head “Other levies, if any”. The above charges may be recovered from client only at actuals paid/ Payable. 22

Order Management System and Internal Controls Procedures to be put in place for receipt of orders, recording the same and placing the orders in the trading system of the Exchange. Client-wise and security-wise limits on exposure, open position, etc. to be set up. Trading Members shall review, define and maintain logs of the limits placed on execution of orders in Cash Segment : Quantity limit for each order, Value limit for each order , User value limit for each user ID, Branch value limit for each branch ID. Setting of security wise limit for user id is optional and members may set security wise limits for user ids based on their risk management policies and internal controls. Trading Members shall review, define and maintain logs of the limits placed on execution of Orders in Derivatives Segment : Quantity limit for each order, Value limit for each order, User value limit for each user ID, Branch value limit for each branch ID, Spread order Quantity and Value Limit 23

Order Management System and Internal Controls (cont’d) Establish and maintain contingency plans, including a plan for disaster recovery & periodic testing of backup facilities of outsourcing activities as well as the protection of confidential outsourced data of members and their clients Ensure that adequate systems are in place that capture IP details of trades done using the IBT / wireless technology platform Ensure monitoring mechanism for client’s debits / obligations and appropriate collection procedures. Risk mitigation measures to be documented and made accessible to clients. Put in place systems to ensure that cumulative value of all unexecuted orders placed from their terminals are below a threshold limit. * Member has implemented appropriate checks for value and / or quantity based on the respective risk profile of their clients. * *SEBI Circular CIR/MRD/DP/34/2012 dated December 13, 2012 24

Contract note Trading Member has to ensure that contract notes are issued in the prescribed format within 24 hours of execution of trades on the Exchange. Copies of contract notes and proof of Delivery / Dispatch to be maintained. The broker member should maintain record of time when the client has placed the order and reflect the same in contract note along with the time of execution of the order To be signed by an Authorized Signatory mentioning name. Unique Client Code , Trading / Back office code (if different from UCC) and PAN of the client to be printed. With running serial number (reset to one at the beginning of the Financial Year). Registration Number, Dealing office details , PAN of the Trading Member and compliance officer details to be printed. Where Contract notes have been issued at weighted average price, separate Annexure to the contract note to be issued to the clients containing details of all individual trades for a given order for which a weighted average price (WAP) is provided in the contract note. 25

Contract Note (cont’d) Trade price and brokerage to be mentioned separately. In case of equity segment all the institutional trades mandatorily needs to be processed through STP system. Format of contract notes have been prescribed by the Exchange vide Circulars: Exchange Circular dated June 24 th 2013 having number NSE/INSP/23739 (Segment wise Contract Note) 26 Exchange Circular dated November 18, 2013 having number NSE/INSP/25030 (Common Contract Note) Exchange Circular dated Nov 08 th 2013 NSE/INSP/24937(Negotiated Trades in Debt Segment) Common contract note across segments and Exchanges shall be issued after June 02, 2014 (Exchange Circular dated NSE/INSP/26233 dated March 20, 2014)

Electronic Contract note (ECN) ECNs can be issued only if specifically consented by client. ECNs to be digitally signed, encrypted, non-tamperable and in compliance with provisions of IT Act, 2000. Delivery of ECNs to be made by sending e-mail to the mail id provided by client. Log reports for sent mails and rejected / bounced mails to be maintained. In case of non-delivery of ECNs, contract note should be sent in physical form. ECNs are required to be simultaneously published on the web-site of trading member and clients are given secured access to the same by way of client specific logon and password. 27

Contract Notes Common irregularities found during Inspection Contract notes are signed by persons other then authorized signatories. Not having pre-printed serial numbers. Not having SEBI registration number. Not maintaining copies of contract notes. Dispatching contract notes after 24 hours. Dealing office details not printed on the contract notes. Both trading code and unique client code not printed on contract notes. Contract notes are issued with weighted average price , clubbed across various orders. 28 Brokerage is not shown separately on contract notes. Mentioning of charges other than Statutory and regulatory levies on contract note.

Quarterly statement of accounts Send statement of accounts for funds and securities to all the clients in such periodicity not exceeding three months (calendar quarter) within a month of the expiry of the said period. The statements should have an account of all receipts and deliveries / payments during the relevant period and not simply, the details of holdings as at the end of the period. Maintain proof of dispatch / delivery for the same. An error reporting clause giving 30 days time is to be incorporated Registration number , address, compliance office details and logo (if any) to be displayed on the statements. In case of running account authorizations, the periodical statement of 29 accounts to the clients, to mention therein that their running account authorization would continue until it is revoked by the clients

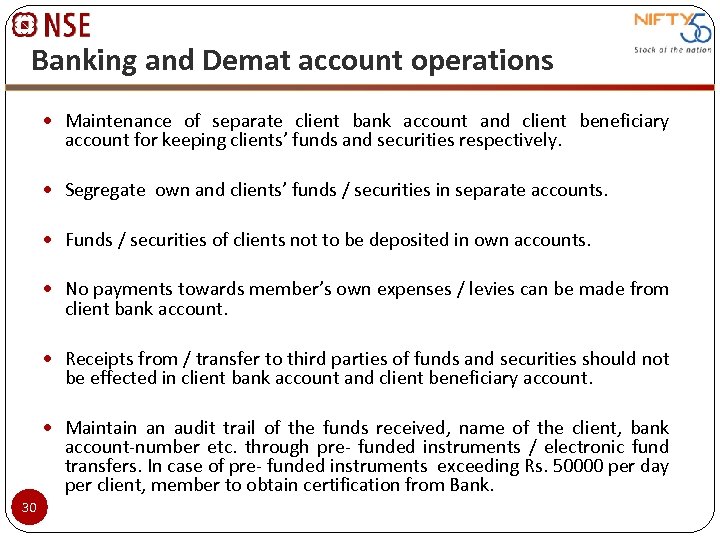

Banking and Demat account operations Maintenance of separate client bank account and client beneficiary account for keeping clients’ funds and securities respectively. Segregate own and clients’ funds / securities in separate accounts. Funds / securities of clients not to be deposited in own accounts. No payments towards member’s own expenses / levies can be made from client bank account. Receipts from / transfer to third parties of funds and securities should not be effected in client bank account and client beneficiary account. Maintain an audit trail of the funds received, name of the client, bank account-number etc. through pre- funded instruments / electronic fund transfers. In case of pre- funded instruments exceeding Rs. 50000 per day per client, member to obtain certification from Bank. 30

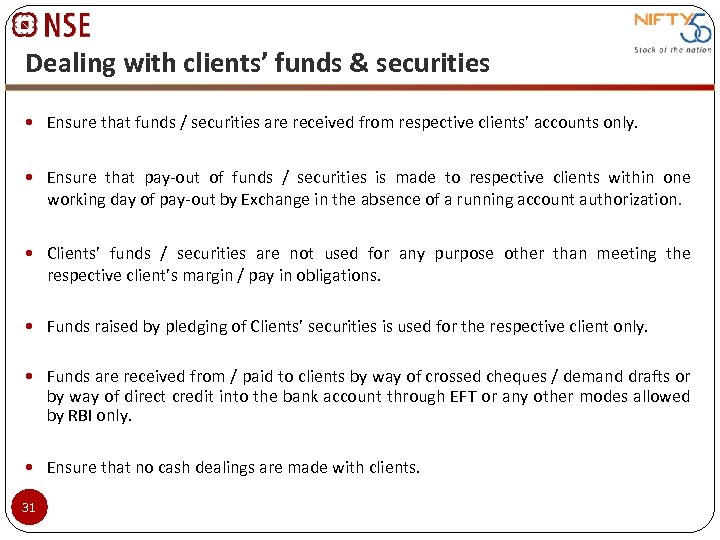

Dealing with clients’ funds & securities Ensure that funds / securities are received from respective clients’ accounts only. Ensure that pay-out of funds / securities is made to respective clients within one working day of pay-out by Exchange in the absence of a running account authorization. Clients’ funds / securities are not used for any purpose other than meeting the respective client’s margin / pay in obligations. Funds raised by pledging of Clients’ securities is used for the respective client only. Funds are received from / paid to clients by way of crossed cheques / demand drafts or by way of direct credit into the bank account through EFT or any other modes allowed by RBI only. Ensure that no cash dealings are made with clients. 31

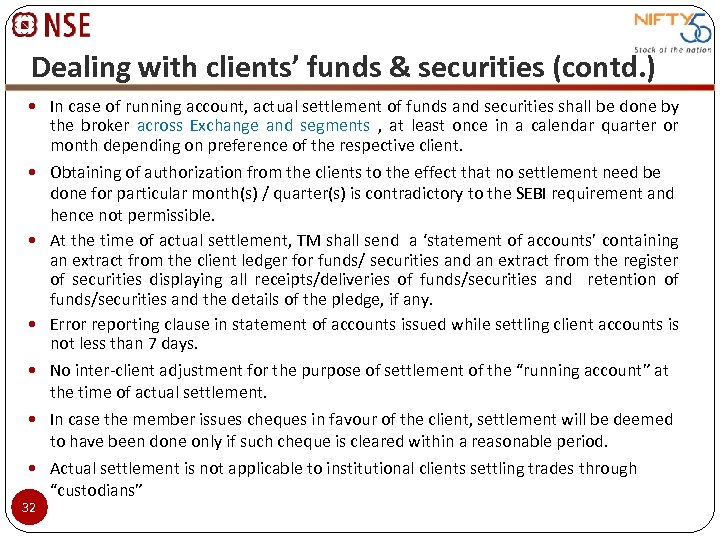

Dealing with clients’ funds & securities (contd. ) In case of running account, actual settlement of funds and securities shall be done by the broker across Exchange and segments , at least once in a calendar quarter or month depending on preference of the respective client. Obtaining of authorization from the clients to the effect that no settlement need be done for particular month(s) / quarter(s) is contradictory to the SEBI requirement and hence not permissible. At the time of actual settlement, TM shall send a ‘statement of accounts’ containing an extract from the client ledger for funds/ securities and an extract from the register of securities displaying all receipts/deliveries of funds/securities and retention of funds/securities and the details of the pledge, if any. Error reporting clause in statement of accounts issued while settling client accounts is not less than 7 days. No inter-client adjustment for the purpose of settlement of the “running account” at the time of actual settlement. In case the member issues cheques in favour of the client, settlement will be deemed to have been done only if such cheque is cleared within a reasonable period. Actual settlement is not applicable to institutional clients settling trades through 32 “custodians”

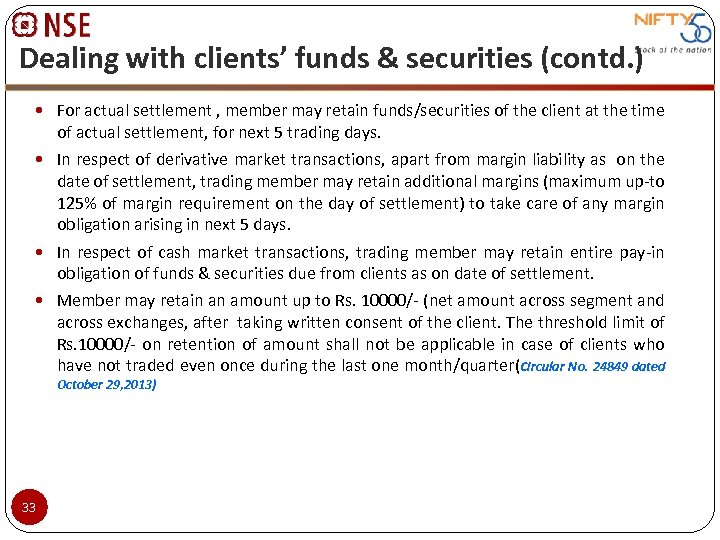

Dealing with clients’ funds & securities (contd. ) For actual settlement , member may retain funds/securities of the client at the time of actual settlement, for next 5 trading days. In respect of derivative market transactions, apart from margin liability as on the date of settlement, trading member may retain additional margins (maximum up-to 125% of margin requirement on the day of settlement) to take care of any margin obligation arising in next 5 days. In respect of cash market transactions, trading member may retain entire pay-in obligation of funds & securities due from clients as on date of settlement. Member may retain an amount up to Rs. 10000/- (net amount across segment and across exchanges, after taking written consent of the client. The threshold limit of Rs. 10000/- on retention of amount shall not be applicable in case of clients who have not traded even once during the last one month/quarter(Circular No. 24849 dated October 29, 2013) 33

Transfer of Trades Trading member should have a well-documented error policy to handle client code modifications, approved by their board/management. No Transfer of trades from PRO to client and vice versa. No transfer of trades from one client to another. Online code modifications/ non-institutional trades only to rectify a genuine error in entry of client code at the time of placing / modifying the related order. Shifting of any trade (institutional or non-institutional) to the error account of the trading member shall not be treated as modification of client code Trading members would be required to disclose the client codes which are classified as ‘Error Accounts’ to the Exchange at the time of UCC upload. Regulatory provisions & Circulars Exchange consolidated Circular dated Sep 10 th , 2009 NSE/CMPT/13061 Exchange consolidated Circular dated Sep 10 th , 2009 NSE/INSP/13060 Exchange Circular dated Aug 26 th , 2011 NSE/INVG/2011/670 34

Margin Requirements Margins from Constituents (Derivatives Segment) In case of Futures and Option segment, Clearing / Trading Members are required to collect upfront initial margins from all their Trading Members/ Constituents. Trading member can report client margin details to clearing corporation up-to T+5 day. ( here ‘T’ is the trade date). In case of Currency Derivative segment, it is mandatory for Clearing / Trading members to collect initial margins and extreme loss margins (MTM) from their Trading Members /Constituents on an upfront basis. Daily reporting of Margins Collected Non reporting would be considered as 100 % shortfall Penalty would be imposed in case of shortfall False reporting (Considered as serious violation with stringent actions) disciplinary Marked to Market (MTM) settlement needs to be settled up-to T+1 (T= trade date) day. 35

Margin Requirements (contd. ) Bank guarantees and Fixed deposits received towards margin, issued by approved banks and discharged in favour of the member. Government securities and Treasury bills, Units of mutual funds in dematerialized / electronic form and any other such collaterals, as may be specified by Clearing Corporation from time to time. For the purpose of client Margin collection and reporting, the member shall compute the value of such securities as per the closing rate on T-1 day as reduced by the appropriate haircut at a rate not less than the VAR margin rate of the security on that day i. e. T-1 day. Securities in dematerialized form actively traded on the National Exchanges, not declared as illiquid securities by any of such Exchanges (List of illiquid securities are declared on a regular basis by the Exchanges) Circular Number 25612 dated January – FAQs on Margin Collection and Reporting 36

Margin Requirements (contd. ) Cheques received / recorded in the books of trading member on or before T day 37 and deposited by member by T+1 day (excluding bank holiday, if any) and cleared subsequently. Securities given as margin which are sold in the cash market and the securities are in the pool account of the trading member but are not given as early pay in towards an obligation to deliver shares in the Capital Market Segment, benefit of margin be given to the client till T+1 day from the sale of securities. Margin collected/available in approved form from entities related to the client and certified by independent professionals. Margin details are issued to clients on a daily basis. Members should ensure that only cheques which are cleared should be considered and cheques dishonored or not cleared up to T+5 working days should not be reported as margin collected (Circular 24805 dated October 23, 2013).

Margin Requirements (contd. ) Margins from Constituents ( Capital Market Segment) Members should have a prudent system of risk management to protect themselves from client default. Margins are likely to be an important element of such a system. The same shall be well documented and be made accessible to the clients and the Stock Exchanges. However, the quantum of these margins and the form and mode of collection are left to the discretion of the members. 38

Internet Trading Commencement of internet trading should be with prior approval of the 39 Exchange. Ensure reliability, security and confidentiality of internet trading system and requirements as per System Audit from time to time. Client specific user id and password to be used for execution of trades by the respective client. Password policy to be adhered (secrecy, periodic change and other aspects). Internet clients shall trade through internet trading system and only in case of connectivity problems, their orders can be entered through back up system (like call and trade facility) after proper identification of the client. Ensure that clients do not deal on behalf of others. Ensure that two-factor authentication for login session has been implemented for all orders emanating using Internet Protocol.

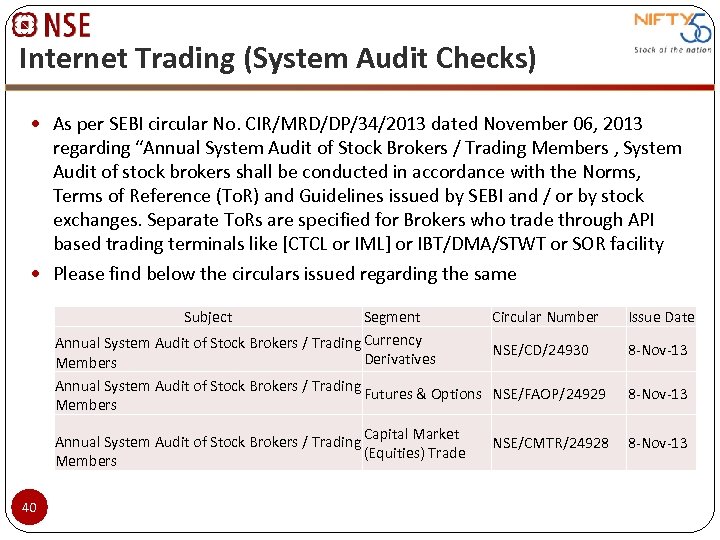

Internet Trading (System Audit Checks) As per SEBI circular No. CIR/MRD/DP/34/2013 dated November 06, 2013 regarding “Annual System Audit of Stock Brokers / Trading Members , System Audit of stock brokers shall be conducted in accordance with the Norms, Terms of Reference (To. R) and Guidelines issued by SEBI and / or by stock exchanges. Separate To. Rs are specified for Brokers who trade through API based trading terminals like [CTCL or IML] or IBT/DMA/STWT or SOR facility Please find below the circulars issued regarding the same Subject Segment Annual System Audit of Stock Brokers / Trading Currency Derivatives Members Circular Number Issue Date NSE/CD/24930 8 -Nov-13 Annual System Audit of Stock Brokers / Trading Futures & Options NSE/FAOP/24929 Members Capital Market Annual System Audit of Stock Brokers / Trading (Equities) Trade Members 40 8 -Nov-13 NSE/CMTR/24928

Internet Trading (System Audit Checks) As per the Sebi circular the System controls and capabilities (CTCL / IML terminals and servers) : Order Tracking – The system auditor should verify system process and controls at CTCL / IML terminals and CTCL/ IML servers covering order entry, capturing of IP address of order entry terminals, modification / deletion of orders, status of current order/outstanding orders and trade confirmation. Order Status/ Capture – Whether the system has capability to generate / capture order id, time stamping, order type, scrip details, action, quantity, price and validity, etc. Rejection of orders – Whether system has capability to reject orders which do not go through order level validation at CTCL servers and at the servers of respective stock exchanges. Communication of Trade Confirmation / Order Status – Whether the system has capability to timely communicate to Client regarding the Acceptance/ Rejection of an Order / Trade via various media including e-mail; facility of viewing trade log. Client ID Verification – Whether the system has capability to recognize only authorized Client Orders and mapping of Specific user Ids to specific predefined location for proprietary orders. Order type distinguishing capability – Whether system has capability to distinguish the 41 orders originating from (CTCL or IML) / IBT/ DMA / STWT.

Other Regulatory requirements Issue contract notes for all trades in respect of the constituents including clients 42 introduced by sub-brokers. Have direct dealings with clients introduced by a sub-broker and ensure that the sub-broker does not issue any contract notes to the clients nor deal with the clients’ funds and securities in any manner. Reconcile dividend account periodically and ensure that dividend received on behalf of clients is credited to the respective clients without delay. Inform all the constituents if you are engaged in own trading. Trading member is required to maintain complaint register. Trading members are required to designate an exclusive e-mail ID for grievance redressal in which the investors would be able to register their complaints and also display it on their website (if any) & contract note.

Other Regulatory requirements (contd. ) Maintain confidentiality of all client related information. ‘Statement of Securities Transaction tax’ to be issued on an annual (financial 43 year) basis within one month from the close of the financial year, unless required by the clients otherwise as to receive the STT statement on a daily basis. (Exchange's circular no. NSE/INSP/8108 dated 16 -Nov-06) Categorize the clients into high, medium or low risk category based on clients background, type of business relationship or transaction Enhance Client Due Diligence for high risk category clients and clients of special category. Have Client acceptance policies & procedures with the aim to identify types of clients that are likely to pose higher than average risk. Power of Attorney executed by the Constituent in favour of the member, only for the limited purpose of operating Constituent’s bank and demat account should be subject to terms & conditions prescribed by the Exchange.

Other Regulatory requirements (contd. ) Funding to clients Scenario wherein debit balances in clients account would not be construed as violation relating to funding Ø If debit balance arises out of client’s failure to pay such amount for less than fifth trading day reckoned from date of pay-in. Ø If debit balance arises out of client’s failure to pay such amount for more than fifth trading day reckoned from date of pay-in, and no further exposure is granted to client from the sixth trading day reckoned from the date of pay-in. Scenario wherein debit balances in clients account would be construed as violation relating to funding Ø If debit balances arise out of client’s failure to pay such amount for more than fifth trading day reckoned from date of pay-in and further exposure is granted to client. Ø Delayed Payment Charges or interest charge for the funds deployed by the member may be charged at the rate/s consented by the client 44

Dealing with intermediaries Deal directly with clients, registered sub broker in CM segment and authorized person in F&O segment. Ensure that you do not act through or on behalf of another trading member / sub-broker of the Exchange either for proprietary trading or for trading on behalf of clients without prior approval of the Exchange. Ensure that you deal with only one broker of another stock exchange for own transactions with prior intimation to the Exchange. Ensure that dealings on behalf of constituents, through a broker of another stock exchange are done only after necessary registration as a sub-broker. Access to blogs/chat forums/ messenger site etc. is either restricted under supervision or access is not allowed. 45 Maintain logs pertaining to such Blogs/Chat forums/ Messenger sites

Outsourcing of Activities • Core Activities not to be outsourced e. g. . execution of orders and monitoring of trading activities (RMS) and Compliance function. • Prepare comprehensive policy for activities to be outsourced • Due diligence of third party and monitoring of performance • Written contract, terms of performance and confidentiality • Plans for disaster recovery and back up 46

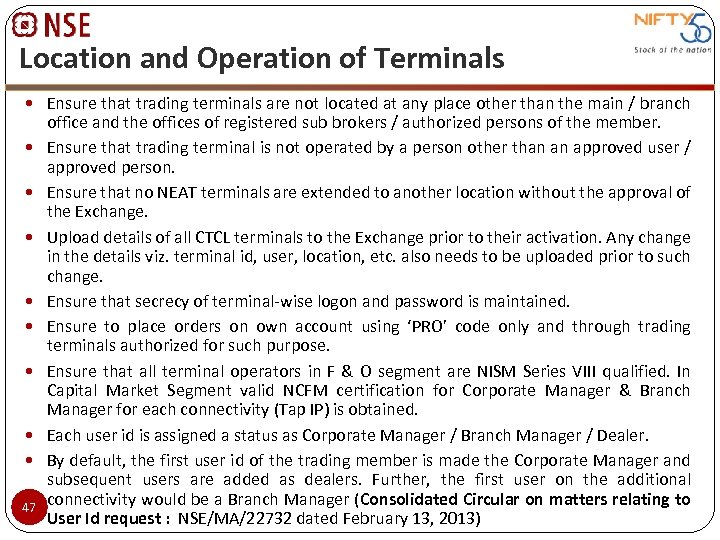

Location and Operation of Terminals Ensure that trading terminals are not located at any place other than the main / branch 47 office and the offices of registered sub brokers / authorized persons of the member. Ensure that trading terminal is not operated by a person other than an approved user / approved person. Ensure that no NEAT terminals are extended to another location without the approval of the Exchange. Upload details of all CTCL terminals to the Exchange prior to their activation. Any change in the details viz. terminal id, user, location, etc. also needs to be uploaded prior to such change. Ensure that secrecy of terminal-wise logon and password is maintained. Ensure to place orders on own account using ‘PRO’ code only and through trading terminals authorized for such purpose. Ensure that all terminal operators in F & O segment are NISM Series VIII qualified. In Capital Market Segment valid NCFM certification for Corporate Manager & Branch Manager for each connectivity (Tap IP) is obtained. Each user id is assigned a status as Corporate Manager / Branch Manager / Dealer. By default, the first user id of the trading member is made the Corporate Manager and subsequent users are added as dealers. Further, the first user on the additional connectivity would be a Branch Manager (Consolidated Circular on matters relating to User Id request : NSE/MA/22732 dated February 13, 2013)

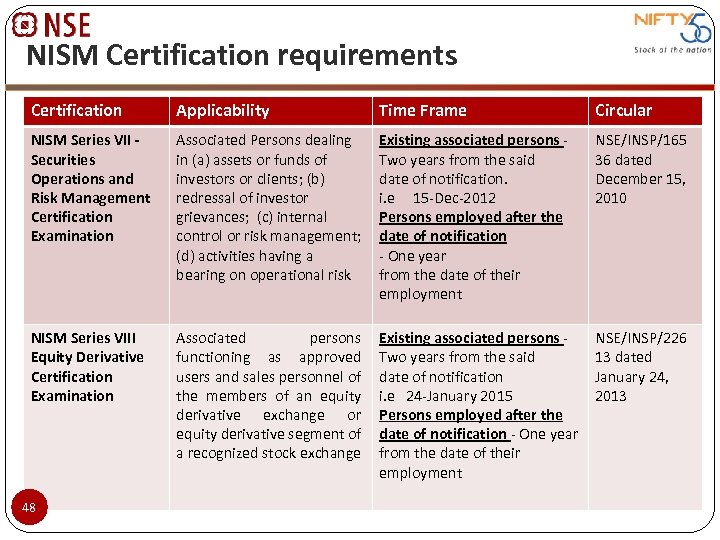

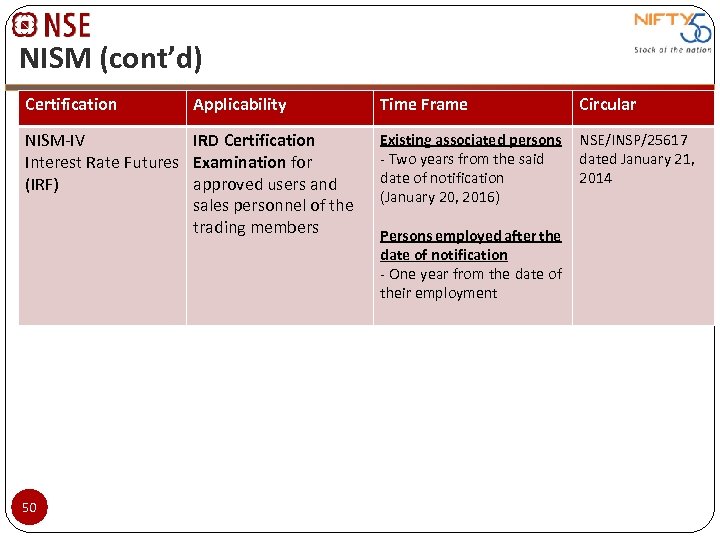

NISM Certification requirements Certification Applicability Time Frame Circular NISM Series VII Securities Operations and Risk Management Certification Examination Associated Persons dealing in (a) assets or funds of investors or clients; (b) redressal of investor grievances; (c) internal control or risk management; (d) activities having a bearing on operational risk Existing associated persons Two years from the said date of notification. i. e 15 -Dec-2012 Persons employed after the date of notification - One year from the date of their employment NSE/INSP/165 36 dated December 15, 2010 NISM Series VIII Equity Derivative Certification Examination Associated persons functioning as approved users and sales personnel of the members of an equity derivative exchange or equity derivative segment of a recognized stock exchange Existing associated persons Two years from the said date of notification i. e 24 -January 2015 Persons employed after the date of notification - One year from the date of their employment NSE/INSP/226 13 dated January 24, 2013 48

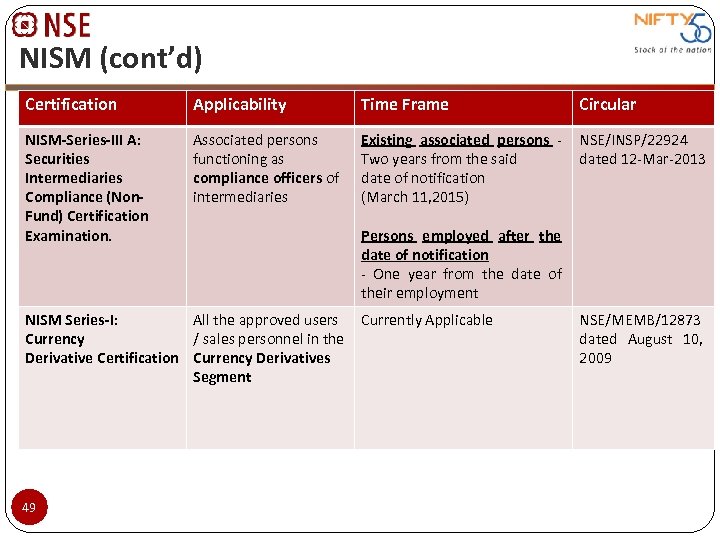

NISM (cont’d) Certification Applicability Time Frame Circular NISM-Series-III A: Securities Intermediaries Compliance (Non. Fund) Certification Examination. Associated persons functioning as compliance officers of intermediaries Existing associated persons Two years from the said date of notification (March 11, 2015) NSE/INSP/22924 dated 12 -Mar-2013 NISM Series-I: All the approved users Currency / sales personnel in the Derivative Certification Currency Derivatives Segment 49 Persons employed after the date of notification - One year from the date of their employment Currently Applicable NSE/MEMB/12873 dated August 10, 2009

NISM (cont’d) Certification Applicability NISM-IV IRD Certification Interest Rate Futures Examination for (IRF) approved users and sales personnel of the trading members 50 Time Frame Circular Existing associated persons NSE/INSP/25617 - Two years from the said dated January 21, date of notification 2014 (January 20, 2016) Persons employed after the date of notification - One year from the date of their employment

Display of Notice Board / SEBI registration certificate Trading Members shall display, in all their offices / offices of their registered Sub brokers / Authorized Persons where trading terminals are located, notice boards/plates at prominently visible locations, painted / printed in a permanent manner, in a font and colour which enables easy reading of the subject matter and containing prescribed details. Display copy of SEBI registration certificate in the above said offices. 51

Control over branches and sub brokers Ensure due diligence and credentials of entities proposed to be appointed as 52 sub brokers/authorized persons. Ensure proper procedures while opening and closing branches. Ensure that clients are informed in advance in case of closure of branch and consent obtained for transfer of account and dealing office. Ensure that branches, sub-brokers, authorized persons do not indulge in unauthorized trading activities. Monitor the activities of sub brokers/relationship managers /officials incharge of branches to avoid unregistered intermediation, fraudulent activities, misuse of clients’ accounts, etc. Display of permanent nature Notice Board (viz. painted board) containing required details, at all places where trading terminals are located including registered offices and branch offices of trading member /sub-broker. Display of copy of SEBI Registration Certificate. Trading member should have adequate mechanism to monitor/redress complaints lodged with branches/sub brokers.

Control over branches and sub brokers (contd. ) Ensure proper procedure for accounting of demand drafts and pay orders received from clients in the respective clients’ accounts. Obtain and analyze periodic reports and information from all branches/sub brokers, to address various risk areas. Take feedback from the clients of sub brokers and branches on their dealings with the sub brokers and branch officials. Trading member to inspect on a yearly basis. - 10% of active branches - 53 10% of active sub-brokers each active sub-broker/ branch to be inspected at-least once in every 5 years

Issue of advertisement Before releasing any advertisement for business promotion, a copy of the advertisement has to be submitted to the Exchange at least seven days in advance and written permission of the Exchange is to be obtained before the advertisement is published. Ensure to abide by the code of advertisement given by the Exchange. The trading members shall apply for approval of advertisement as per the prescribed format on ENIT only and no physical/hardcopies are to be submitted for approval. 54

Maintenance of Books & Accounts Members to maintain Exchange-wise separate books of accounts, other records and documents, in accordance with the Rules, Regulations, Bye-laws and relevant circulars of Stock Exchanges. All these books of accounts and other records are to be preserved by the broker for a minimum period of five years as per Regulation 18 of SEBI (Stock Brokers and Sub Brokers) Regulations, 1992. Every trading member shall preserve for a period of not less than six years after the closing of any constituent's account any records which relate to the terms and conditions with respect to the opening and maintenance of such account. Every trading Members shall maintain and preserve for a period of seven years a mapping of client IDs used at the time of order entry in the trading system with those unique client IDs along with client name, address and other particulars given in the Know Your Client form. Regulatory provisions & Circulars 55 • • Exchange's Circular no. NSE/MEMB/3574 dated 29 -Aug-02 Exchange’s Circular no. NSE/MEMB/3635 dated 25 -Sep-02 Exchange's Circular no. NSE/CMTR/4460 dated 03 -Oct-03 Exchange's circular no. NSE/F&O/4464 dated 03 -Oct-03

Alert generation & continuous monitoring System for monitoring transaction of clients Identify and generate alerts Payment through DD/ Cash/NEFT/RTGS to be closely monitored. Analysis of such alerts generated. Use of complete KYC information including details of occupation and financial status at the time of analyzing alerts. Reporting of suspicious transactions to FIU-IND Employee training & sensitize customers. 56

Surveillance Obligations of Trading Members • • • 57 Members are required to carry out the Due Diligence of its client(s) on a continuous basis. Key KYC parameters needs to be updated on a periodic basis and latest information of the client is updated in UCC database of the Exchange. Based on this information the Trading Member shall establish groups / association amongst clients to identify multiple accounts / common account / group of clients. Various transaction alerts based on the trading activity on the Exchange are being downloaded by the Exchange In case of alerts, Members to seek explanation from such identified Client(s) / Group of Client(s) for entering into such transactions and seek documentary evidence. TM to record and in case of adverse observations, Member shall report all such instances to the Exchange within 45 days of the alert generation. Member needs to have appropriate surveillance policy in this regard which has been approved by its Board / Partners / Proprietor.

Surveillance Obligations of Trading Members (cont’d) Internal auditor shall review the surveillance policy, its implementation, effectiveness and review the alerts generated during the period of audit and record the observations with respect to the same in their report. The trading members are required to disclose their holdings of 1% or more of the share capital of companies listed on the Exchange, on their own behalf and/or collectively on behalf of their client/s (NSE/INVG/26056 dated March 05, 2014) 58

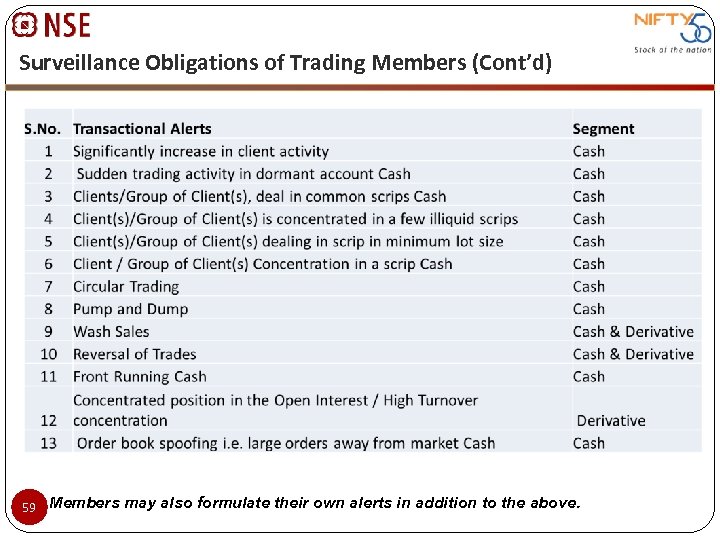

Surveillance Obligations of Trading Members (Cont’d) 59 Members may also formulate their own alerts in addition to the above.

Continued membership requirements Trading Member should obtain prior permission of Exchange and SEBI before effecting any change in shareholding / sharing pattern or change in directors / partners. Any change in name of the trading member must be intimated to the Exchange forthwith along with the necessary records, for the purpose of effecting the change in the SEBI registration certificate. Net worth of a trading member and clearing member shall always be maintained above the minimum requirement prescribed by the Exchange. Details of Compliance Officer and any changes thereof to be intimated to the Exchange 60

Due diligence in employee activities Trading Member should have adequate systems & procedures in place to ensure screening of employees while hiring. Trading Member shall establish and enforce procedures to supervise its business and the activities of its employees that are reasonably designed to achieve compliance with all the relevant regulatory requirements. Trading Member shall specifically authorise in writing persons, who may be authorised to transact on behalf of the member and do such acts which the member delegates to such persons. NISM certifications obtained by specified employees and associated persons Employees / Temporary staff/Voluntary workers etc. employed/working in the offices of market intermediaries do not encourage circulate/ rumours /unverified information obtained from any source without verification 61

Compliance with Prevention of Money Laundering Act (PMLA), 2002 Applicability of PMLA : “Provisions of PMLA are applicable to every banking company, financial institution and intermediary (includes a stock broker, sub broker, share transfer agent, banker to an issue, trustee to a trust deed, registrar to an issue, asset management company, depository participant, merchant banker, Investment adviser and any other intermediary associated with the securities market and registered under section 12 of SEBI Act. ” The AML requirements are also applicable to intermediary branches and subsidiaries located abroad. Irrespective of amount of investment , no minimum threshold or exemption is available to registered intermediary from obtaining the minimum information/documents from clients as stipulated in the PMLA rules/SEBI circulars The member should document the risk assessment carried out and give it to Exchanges / Regulatory bodies as and when required. 62

PMLA (Cont’d) Maintain records and registers relating to business for a period of five* years either in hard form or non tamper able soft form as per PMLA requirements and they including the following: Statements of funds and securities obligations received from NSCCL. Client ledger, Margin register, Register of complaints. Records in respect of brokerage collected separately from constituents. Register of transactions. Register or Ledger Account of Securities : Client wise and Security wise. Records to be sufficient to permit reconstruction of transactions. Records related to investigations to be kept for 5 years from the date of the transaction between the client and the intermediary. Records related to Complex/ High value large transactions to be preserved till 5 years 63

PMLA (Cont’d) Designate a ‘Principal Officer’ and a 'Designated Director‘ who would be responsible for ensuring compliance of the provisions of the PMLA. Intimate Name, designation and addresses (including e-mail addresses) of ‘Principal Officer’ and “ Designated Director” to the Office of the Director-FIU. Adopt written procedures to implement anti money laundering provisions as envisaged under PMLA Act 2002. Issue a statement of policies & procedures, on a group basis where ever applicable and ensure that content of these directives are understood by all staff members Regularly review the policies & procedures on the prevention of money laundering to ensure their effectiveness. 64

PMLA (Cont’d) Policies & Procedures Member should have written polices & procedures to prevent and impede ML & TF. Policies & procedures to be effective and in compliance with regulatory requirements. Ensure complete understanding of policies & procedures to relevant employees Communicate group policies to relevant persons at branches, department and subsidiaries also. Policies & procedures shall also cover client acceptance policy, KYC guidelines, role of internal audit/ compliance function. The procedures should include client due diligence process including three specific parameters: Ø Policy for acceptance of clients Ø Procedure for identifying clients. Ø Transaction Monitoring & Reporting. 65

PMLA (Cont’d) Clients identification procedures Adhere to KYC & in person verification policy to ensure that identification procedure is carried out. client Ensure that sufficient documents /information is obtained. Update client information periodically. Each original document should be verified with copy. Verify clients identity using reliable, independent source documents data or information 66

PMLA (Cont’d) Client Due Diligence Obtain sufficient information to identify persons who beneficially own or control the securities account by using client identification and verification procedures. Verify identity of beneficial owner* and understand ownership and control of the client. For high risk category clients obtain additional information as may be required. Identify clients of special category (CSC) - Non resident clients, HNIs, Trust, Charities, Non-Governmental Organizations (NGOs) and organizations receiving donations, Politically Exposed Persons, Clients in high risk countries etc. * Exchange Circular dated January 24 th , 2013 NSE/INSP/22614 67

PMLA (Cont’d) Categorize the clients into high, medium or low risk category based on clients background, type of business relationship or transaction. Enhance CDD for high risk category clients and category. clients of special Client acceptance policies & procedures with the aim to identify types of clients that are likely to pose higher than average risk Client not to be accepted where information is suspected to be non genuine or there is perceived non co-operation. Checks & balances to ensure that person with criminal background or banned entity do not enter. 68

PMLA (Cont’d) Fictitious/Benami or anonymous client accounts should not be opened. Account not to be opened where unable to apply appropriate Client Due Diligence (CDD) measures/KYC policy. No exemption from carrying out CDD exists in respect of any category of clients . Member should have process to verify if the country from which funds originated i. e. whether sanctions are levied on the country under the various United Nations' Security Council Resolutions. Registered intermediaries may rely on a third party for the purpose of (a) identification and verification of the identity of a client and (b) determination of whether the client is acting on behalf of a beneficial owner, identification of the beneficial owner and verification of the identity of the beneficial owner. 69 *Exchange circular NSE/INVG/26173 dated March 13, 2014

Compliance Calendar A consolidated checklist of reports / statements / certificates / data / submissions to be made by members to the Exchange / NSCCL is made available at http: //www. nseindia. com/membership/content/complinc_tradin g_mem. htm 70

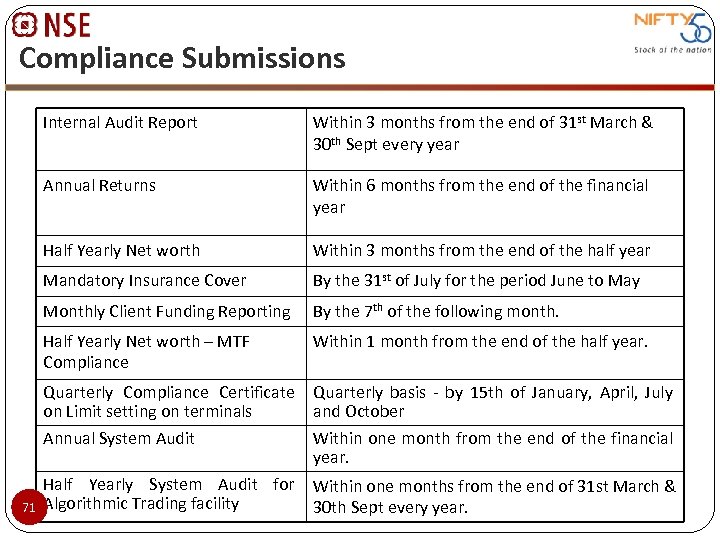

Compliance Submissions Internal Audit Report Annual Returns Within 6 months from the end of the financial year Half Yearly Net worth Within 3 months from the end of the half year Mandatory Insurance Cover By the 31 st of July for the period June to May Monthly Client Funding Reporting By the 7 th of the following month. Half Yearly Net worth – MTF Compliance Within 1 month from the end of the half year. Quarterly Compliance Certificate on Limit setting on terminals Annual System Audit 71 Within 3 months from the end of 31 st March & 30 th Sept every year Quarterly basis - by 15 th of January, April, July and October Within one month from the end of the financial year. Half Yearly System Audit for Algorithmic Trading facility Within one months from the end of 31 st March & 30 th Sept every year.

Guidelines for dealing with Conflicts of Interest of Intermediaries As per SEBI* CIR/MIRSD/5/2013 dated August 27, 2013, all intermediaries and associated persons are required to have Policies and internal procedures to identify and avoid or manage actual or potential conflict of interest. Maintain high standards of integrity Ensuring fair treatment of their clients and not discriminate amongst them Not deal in securities while in possession of material non published information Not in any way contribute to manipulate the demand for or supply of securities Make appropriate disclosure to the clients of possible areas of conflict of interest Entities to comply with the same and bring their policies in line with the above within 6 months from the date of the circular. *Exchange Circular : NSE/INSP/24301 dated Aug 29, 2013 72

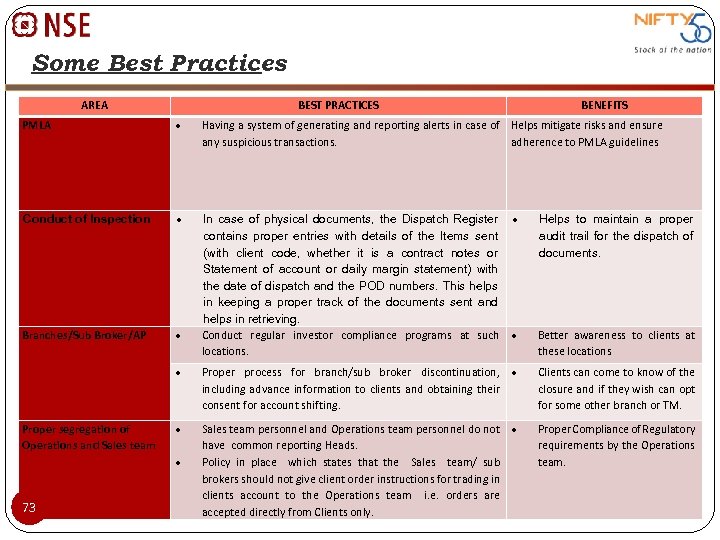

Some Best Practices AREA BEST PRACTICES BENEFITS PMLA Having a system of generating and reporting alerts in case of Helps mitigate risks and ensure any suspicious transactions. adherence to PMLA guidelines Conduct of Inspection Branches/Sub Broker/AP In case of physical documents, the Dispatch Register contains proper entries with details of the Items sent (with client code, whether it is a contract notes or Statement of account or daily margin statement) with the date of dispatch and the POD numbers. This helps in keeping a proper track of the documents sent and helps in retrieving. Conduct regular investor compliance programs at such locations. Better awareness to clients at these locations Proper process for branch/sub broker discontinuation, including advance information to clients and obtaining their consent for account shifting. Clients can come to know of the closure and if they wish can opt for some other branch or TM. Sales team personnel and Operations team personnel do not have common reporting Heads. Policy in place which states that the Sales team/ sub brokers should not give client order instructions for trading in clients account to the Operations team i. e. orders are accepted directly from Clients only. Proper Compliance of Regulatory requirements by the Operations team. Proper segregation of Operations and Sales team 73 Helps to maintain a proper audit trail for the dispatch of documents.

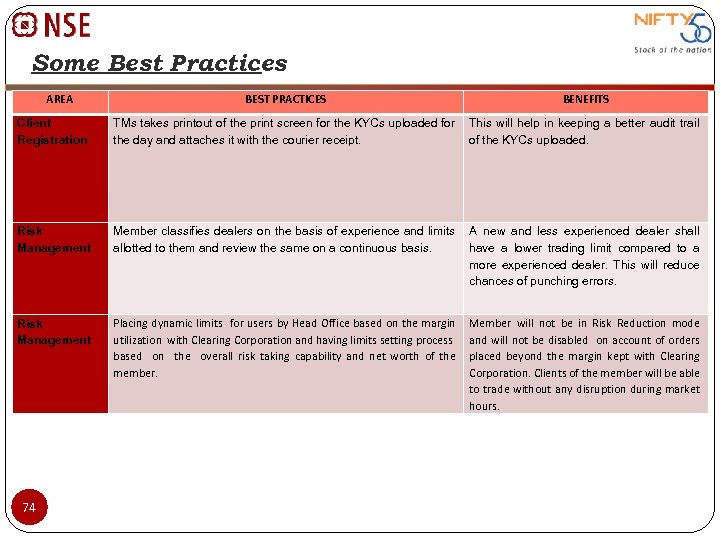

Some Best Practices AREA BEST PRACTICES BENEFITS Client Registration TMs takes printout of the print screen for the KYCs uploaded for This will help in keeping a better audit trail the day and attaches it with the courier receipt. of the KYCs uploaded. Risk Management Member classifies dealers on the basis of experience and limits A new and less experienced dealer shall allotted to them and review the same on a continuous basis. have a lower trading limit compared to a more experienced dealer. This will reduce chances of punching errors. Risk Management Placing dynamic limits for users by Head Office based on the margin utilization with Clearing Corporation and having limits setting process based on the overall risk taking capability and net worth of the member. 74 Member will not be in Risk Reduction mode and will not be disabled on account of orders placed beyond the margin kept with Clearing Corporation. Clients of the member will be able to trade without any disruption during market hours.

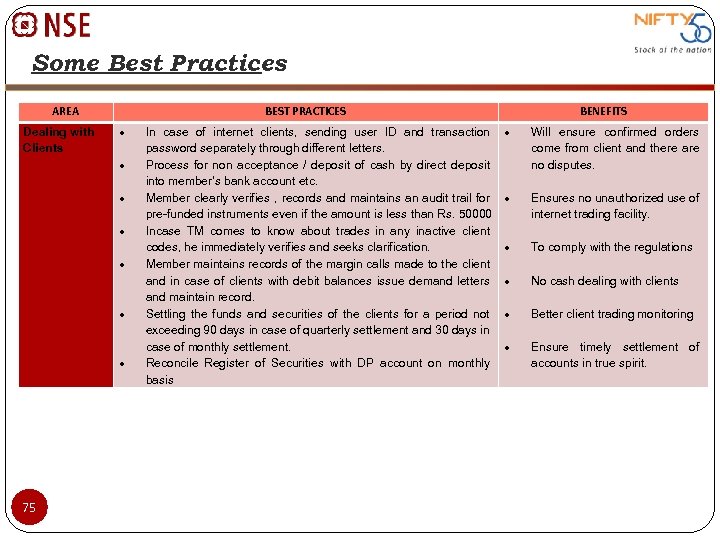

Some Best Practices AREA Dealing with Clients BEST PRACTICES 75 In case of internet clients, sending user ID and transaction password separately through different letters. Process for non acceptance / deposit of cash by direct deposit into member’s bank account etc. Member clearly verifies , records and maintains an audit trail for pre-funded instruments even if the amount is less than Rs. 50000 Incase TM comes to know about trades in any inactive client codes, he immediately verifies and seeks clarification. Member maintains records of the margin calls made to the client and in case of clients with debit balances issue demand letters and maintain record. Settling the funds and securities of the clients for a period not exceeding 90 days in case of quarterly settlement and 30 days in case of monthly settlement. Reconcile Register of Securities with DP account on monthly basis BENEFITS Will ensure confirmed orders come from client and there are no disputes. Ensures no unauthorized use of internet trading facility. To comply with the regulations No cash dealing with clients Better client trading monitoring Ensure timely settlement of accounts in true spirit.

5ac5996145ed49b38f7e1daf92ed85f6.ppt