Completing the Accounting Cycle 1– 1

Completing the Accounting Cycle 1– 1

Learning Objectives 1. State all the steps in the accounting cycle. 2. Explain and prepare closing entries. 3. Prepare the post-closing trial balance. 4. Prepare reversing entries as appropriate. 5. Prepare and use a work sheet. Copyright © Houghton Mifflin Company. All rights reserved. 4– 2

Learning Objectives 1. State all the steps in the accounting cycle. 2. Explain and prepare closing entries. 3. Prepare the post-closing trial balance. 4. Prepare reversing entries as appropriate. 5. Prepare and use a work sheet. Copyright © Houghton Mifflin Company. All rights reserved. 4– 2

Overview of the Accounting Cycle • Objective 1 – State all the steps in the accounting cycle Copyright © Houghton Mifflin Company. All rights reserved. 4– 3

Overview of the Accounting Cycle • Objective 1 – State all the steps in the accounting cycle Copyright © Houghton Mifflin Company. All rights reserved. 4– 3

The Accounting Cycle • A series of steps in the accounting system • Purpose – Measure business activities in the form of transactions – Transform these transactions into financial statements – Communicate useful information to decision makers Copyright © Houghton Mifflin Company. All rights reserved. 4– 4

The Accounting Cycle • A series of steps in the accounting system • Purpose – Measure business activities in the form of transactions – Transform these transactions into financial statements – Communicate useful information to decision makers Copyright © Houghton Mifflin Company. All rights reserved. 4– 4

Steps in the Accounting Cycle 1. Analyze 2. Record 3. Post business transactions from source documents the entries in the journal the entries to the ledger and prepare a trial balance 4. Adjust the accounts and prepare an adjusted trial balance 5. Close the accounts and prepare a post-closing trial balance 6. Prepare financial statements The order of these steps can vary depending on the system in place • Step 6 may be completed before Step 5 Copyright © Houghton Mifflin Company. All rights reserved. 4– 5

Steps in the Accounting Cycle 1. Analyze 2. Record 3. Post business transactions from source documents the entries in the journal the entries to the ledger and prepare a trial balance 4. Adjust the accounts and prepare an adjusted trial balance 5. Close the accounts and prepare a post-closing trial balance 6. Prepare financial statements The order of these steps can vary depending on the system in place • Step 6 may be completed before Step 5 Copyright © Houghton Mifflin Company. All rights reserved. 4– 5

Overview of the Accounting Cycle Input Output Accounting System Copyright © Houghton Mifflin Company. All rights reserved. 4– 6

Overview of the Accounting Cycle Input Output Accounting System Copyright © Houghton Mifflin Company. All rights reserved. 4– 6

Discussion Q. Is it necessary to complete all six steps in the accounting cycle? A. Yes. All six steps must be accomplished to complete the accounting cycle. However, the order of these steps can vary somewhat depending on the system in place Copyright © Houghton Mifflin Company. All rights reserved. 4– 7

Discussion Q. Is it necessary to complete all six steps in the accounting cycle? A. Yes. All six steps must be accomplished to complete the accounting cycle. However, the order of these steps can vary somewhat depending on the system in place Copyright © Houghton Mifflin Company. All rights reserved. 4– 7

Closing Entries • Objective 2 – Explain and prepare closing entries Copyright © Houghton Mifflin Company. All rights reserved. 4– 8

Closing Entries • Objective 2 – Explain and prepare closing entries Copyright © Houghton Mifflin Company. All rights reserved. 4– 8

Two Account Types • Permanent accounts – Balance sheet accounts – Also called real accounts – Carry end-of-period balances into the next accounting period • Temporary accounts – Income statement accounts (revenues and expenses) – Also called nominal accounts – Begin each accounting period with a zero balance Copyright © Houghton Mifflin Company. All rights reserved. 4– 9

Two Account Types • Permanent accounts – Balance sheet accounts – Also called real accounts – Carry end-of-period balances into the next accounting period • Temporary accounts – Income statement accounts (revenues and expenses) – Also called nominal accounts – Begin each accounting period with a zero balance Copyright © Houghton Mifflin Company. All rights reserved. 4– 9

Closing Entries • Journal entries made at the end of an accounting period • Two purposes 1. Clear revenue, expense, and Withdrawal accounts (temporary accounts) of their balances 2. Summarize a period's revenues and expenses Revenue and expense accounts must begin each new period with zero balances for the income statement to present the activity of a single period Copyright © Houghton Mifflin Company. All rights reserved. 4– 10

Closing Entries • Journal entries made at the end of an accounting period • Two purposes 1. Clear revenue, expense, and Withdrawal accounts (temporary accounts) of their balances 2. Summarize a period's revenues and expenses Revenue and expense accounts must begin each new period with zero balances for the income statement to present the activity of a single period Copyright © Houghton Mifflin Company. All rights reserved. 4– 10

Income Summary Account • Summarizes revenues and expenses for a period • Temporary account • Used only in the closing process • Never appears in the financial statements • Appears in chart of accounts after Withdrawals and before revenue accounts Copyright © Houghton Mifflin Company. All rights reserved. 4– 11

Income Summary Account • Summarizes revenues and expenses for a period • Temporary account • Used only in the closing process • Never appears in the financial statements • Appears in chart of accounts after Withdrawals and before revenue accounts Copyright © Houghton Mifflin Company. All rights reserved. 4– 11

Income Summary Account (cont’d) • All revenue and expense account balances are transferred to Income Summary during the closing process • The balance in Income Summary equals net income or loss reported on the income statement • This balance is then transferred to the Capital account (an owner's equity account) – Revenue and expense accounts represent increases and decreases to owner's equity Copyright © Houghton Mifflin Company. All rights reserved. 4– 12

Income Summary Account (cont’d) • All revenue and expense account balances are transferred to Income Summary during the closing process • The balance in Income Summary equals net income or loss reported on the income statement • This balance is then transferred to the Capital account (an owner's equity account) – Revenue and expense accounts represent increases and decreases to owner's equity Copyright © Houghton Mifflin Company. All rights reserved. 4– 12

Required Closing Entries 1. Close credit balances from income statement accounts to Income Summary 2. Close debit balances from income statement accounts to Income Summary 3. Close the Income Summary account balance to the Capital account 4. Close the Withdrawals account balance to the Capital account Copyright © Houghton Mifflin Company. All rights reserved. 4– 13

Required Closing Entries 1. Close credit balances from income statement accounts to Income Summary 2. Close debit balances from income statement accounts to Income Summary 3. Close the Income Summary account balance to the Capital account 4. Close the Withdrawals account balance to the Capital account Copyright © Houghton Mifflin Company. All rights reserved. 4– 13

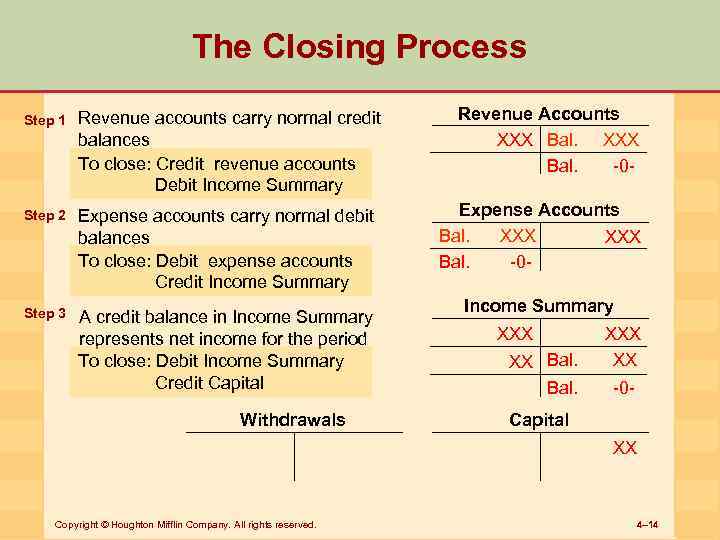

The Closing Process Step 1 Revenue accounts carry normal credit balances To close: Credit revenue accounts Debit Income Summary Step 2 Expense accounts carry normal debit balances To close: Debit expense accounts Credit Income Summary Step 3 A credit balance in Income Summary represents net income for the period To close: Debit Income Summary Credit Capital Withdrawals Revenue Accounts XXX Bal. -0 Expense Accounts Bal. XXX Bal. -0 Income Summary XXX XX Bal. XXX XX -0 - Capital XX Copyright © Houghton Mifflin Company. All rights reserved. 4– 14

The Closing Process Step 1 Revenue accounts carry normal credit balances To close: Credit revenue accounts Debit Income Summary Step 2 Expense accounts carry normal debit balances To close: Debit expense accounts Credit Income Summary Step 3 A credit balance in Income Summary represents net income for the period To close: Debit Income Summary Credit Capital Withdrawals Revenue Accounts XXX Bal. -0 Expense Accounts Bal. XXX Bal. -0 Income Summary XXX XX Bal. XXX XX -0 - Capital XX Copyright © Houghton Mifflin Company. All rights reserved. 4– 14

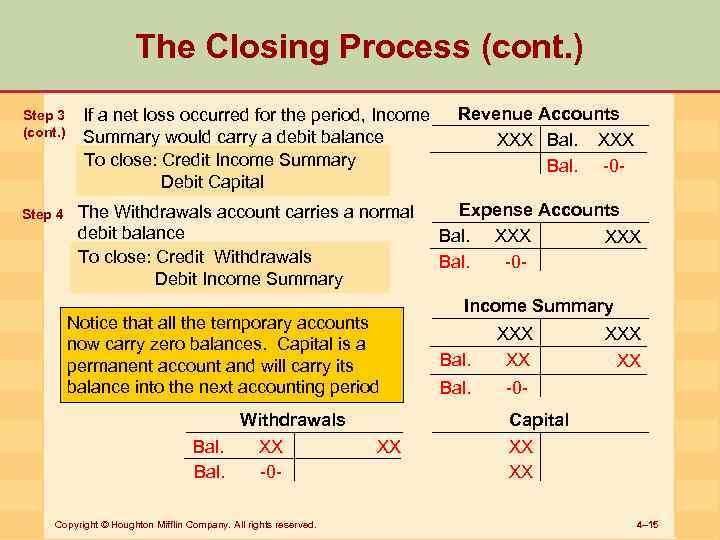

The Closing Process (cont. ) Step 3 (cont. ) Step 4 If a net loss occurred for the period, Income Summary would carry a debit balance To close: Credit Income Summary Debit Capital The Withdrawals account carries a normal debit balance To close: Credit Withdrawals Debit Income Summary Notice that all the temporary accounts now carry zero balances. Capital is a permanent account and will carry its balance into the next accounting period Withdrawals Bal. XX -0 - Copyright © Houghton Mifflin Company. All rights reserved. Revenue Accounts XXX Bal. -0 Expense Accounts Bal. XXX Bal. -0 Income Summary Bal. XXX XX -0 Capital XX XX XX 4– 15

The Closing Process (cont. ) Step 3 (cont. ) Step 4 If a net loss occurred for the period, Income Summary would carry a debit balance To close: Credit Income Summary Debit Capital The Withdrawals account carries a normal debit balance To close: Credit Withdrawals Debit Income Summary Notice that all the temporary accounts now carry zero balances. Capital is a permanent account and will carry its balance into the next accounting period Withdrawals Bal. XX -0 - Copyright © Houghton Mifflin Company. All rights reserved. Revenue Accounts XXX Bal. -0 Expense Accounts Bal. XXX Bal. -0 Income Summary Bal. XXX XX -0 Capital XX XX XX 4– 15

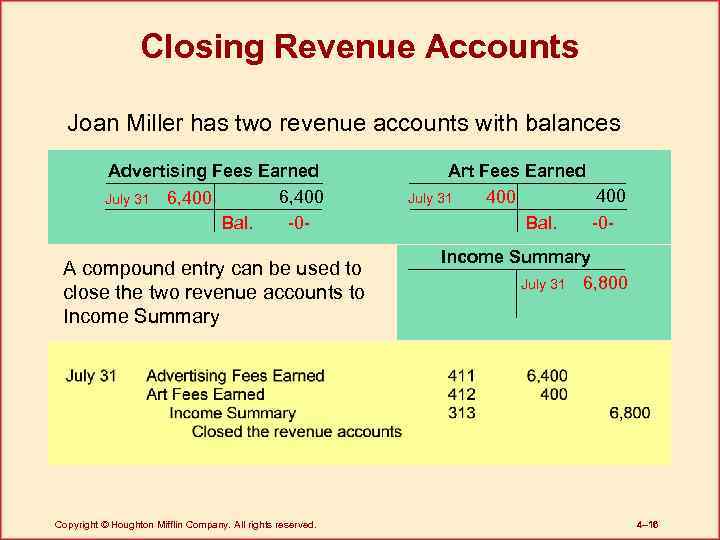

Closing Revenue Accounts Joan Miller has two revenue accounts with balances Advertising Fees Earned 6, 400 July 31 6, 400 Bal. -0 - A compound entry can be used to close the two revenue accounts to Income Summary Copyright © Houghton Mifflin Company. All rights reserved. Art Fees Earned 400 July 31 400 Bal. -0 Income Summary July 31 6, 800 4– 16

Closing Revenue Accounts Joan Miller has two revenue accounts with balances Advertising Fees Earned 6, 400 July 31 6, 400 Bal. -0 - A compound entry can be used to close the two revenue accounts to Income Summary Copyright © Houghton Mifflin Company. All rights reserved. Art Fees Earned 400 July 31 400 Bal. -0 Income Summary July 31 6, 800 4– 16

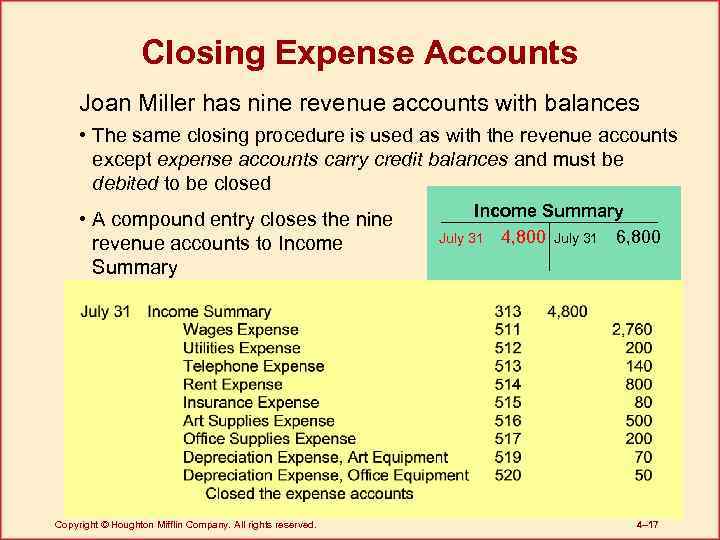

Closing Expense Accounts Joan Miller has nine revenue accounts with balances • The same closing procedure is used as with the revenue accounts except expense accounts carry credit balances and must be debited to be closed • A compound entry closes the nine revenue accounts to Income Summary Copyright © Houghton Mifflin Company. All rights reserved. Income Summary July 31 4, 800 July 31 6, 800 4– 17

Closing Expense Accounts Joan Miller has nine revenue accounts with balances • The same closing procedure is used as with the revenue accounts except expense accounts carry credit balances and must be debited to be closed • A compound entry closes the nine revenue accounts to Income Summary Copyright © Houghton Mifflin Company. All rights reserved. Income Summary July 31 4, 800 July 31 6, 800 4– 17

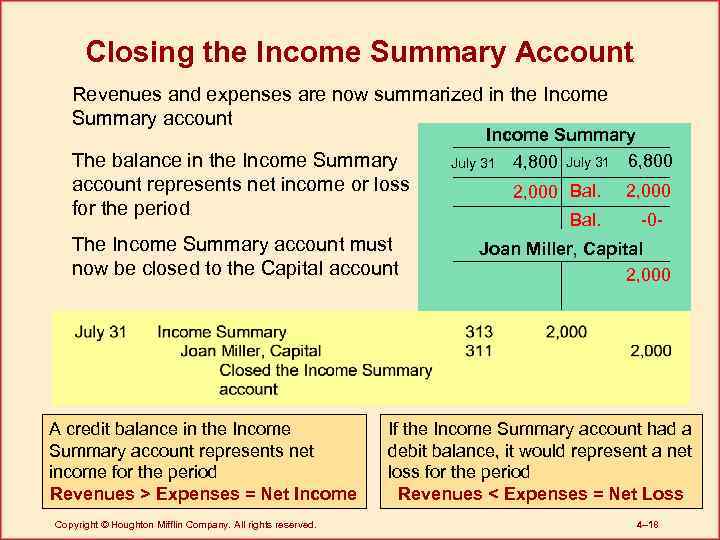

Closing the Income Summary Account Revenues and expenses are now summarized in the Income Summary account The balance in the Income Summary account represents net income or loss for the period The Income Summary account must now be closed to the Capital account A credit balance in the Income Summary account represents net income for the period Revenues > Expenses = Net Income Copyright © Houghton Mifflin Company. All rights reserved. Income Summary July 31 4, 800 July 31 6, 800 2, 000 Bal. 2, 000 -0 - Joan Miller, Capital 2, 000 If the Income Summary account had a debit balance, it would represent a net loss for the period Revenues < Expenses = Net Loss 4– 18

Closing the Income Summary Account Revenues and expenses are now summarized in the Income Summary account The balance in the Income Summary account represents net income or loss for the period The Income Summary account must now be closed to the Capital account A credit balance in the Income Summary account represents net income for the period Revenues > Expenses = Net Income Copyright © Houghton Mifflin Company. All rights reserved. Income Summary July 31 4, 800 July 31 6, 800 2, 000 Bal. 2, 000 -0 - Joan Miller, Capital 2, 000 If the Income Summary account had a debit balance, it would represent a net loss for the period Revenues < Expenses = Net Loss 4– 18

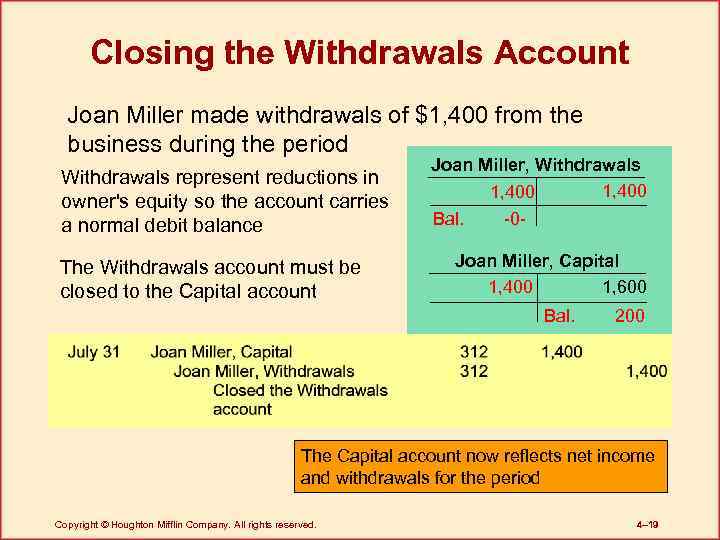

Closing the Withdrawals Account Joan Miller made withdrawals of $1, 400 from the business during the period Withdrawals represent reductions in owner's equity so the account carries a normal debit balance The Withdrawals account must be closed to the Capital account Joan Miller, Withdrawals 1, 400 Bal. -0 - Joan Miller, Capital 1, 400 1, 600 Bal. 200 The Capital account now reflects net income and withdrawals for the period Copyright © Houghton Mifflin Company. All rights reserved. 4– 19

Closing the Withdrawals Account Joan Miller made withdrawals of $1, 400 from the business during the period Withdrawals represent reductions in owner's equity so the account carries a normal debit balance The Withdrawals account must be closed to the Capital account Joan Miller, Withdrawals 1, 400 Bal. -0 - Joan Miller, Capital 1, 400 1, 600 Bal. 200 The Capital account now reflects net income and withdrawals for the period Copyright © Houghton Mifflin Company. All rights reserved. 4– 19

The Accounts After Closing • Revenue, expense, and Withdrawals accounts have zero balances • The Capital account reflects – Net income or loss – Withdrawals • Balance sheet accounts reflect correct balances to be carried forward into the next accounting period Copyright © Houghton Mifflin Company. All rights reserved. 4– 20

The Accounts After Closing • Revenue, expense, and Withdrawals accounts have zero balances • The Capital account reflects – Net income or loss – Withdrawals • Balance sheet accounts reflect correct balances to be carried forward into the next accounting period Copyright © Houghton Mifflin Company. All rights reserved. 4– 20

Discussion Q. Could the Income Summary account have a debit balance when the income statement accounts are closed to it? A. Yes, if a net loss has been incurred Copyright © Houghton Mifflin Company. All rights reserved. 4– 21

Discussion Q. Could the Income Summary account have a debit balance when the income statement accounts are closed to it? A. Yes, if a net loss has been incurred Copyright © Houghton Mifflin Company. All rights reserved. 4– 21

The Post-Closing Trial Balance • Objective 3 – Prepare the post-closing trial balance Copyright © Houghton Mifflin Company. All rights reserved. 4– 22

The Post-Closing Trial Balance • Objective 3 – Prepare the post-closing trial balance Copyright © Houghton Mifflin Company. All rights reserved. 4– 22

The Post-Closing Trial Balance • The final trial balance • Used to verify that total debits equal total credits • Only balance sheet accounts show balances because income statement accounts and Withdrawals have been closed • The Capital account now reflects previous revenue, expense, and Withdrawals balances Copyright © Houghton Mifflin Company. All rights reserved. 4– 23

The Post-Closing Trial Balance • The final trial balance • Used to verify that total debits equal total credits • Only balance sheet accounts show balances because income statement accounts and Withdrawals have been closed • The Capital account now reflects previous revenue, expense, and Withdrawals balances Copyright © Houghton Mifflin Company. All rights reserved. 4– 23

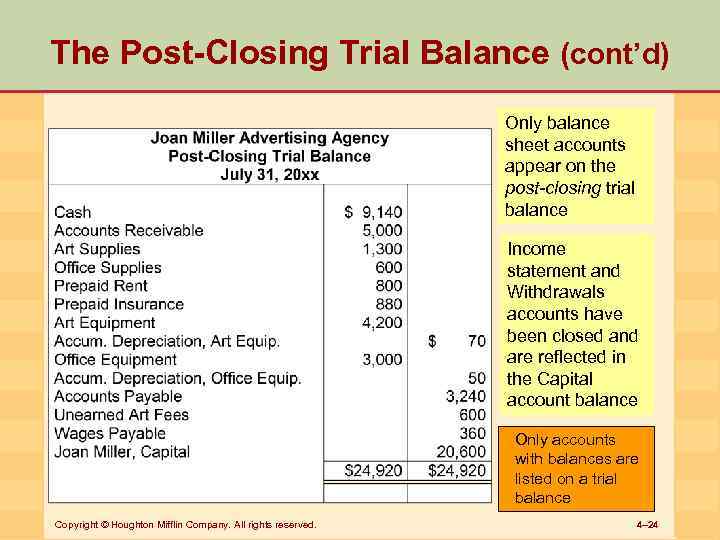

The Post-Closing Trial Balance (cont’d) Only balance sheet accounts appear on the post-closing trial balance Income statement and Withdrawals accounts have been closed and are reflected in the Capital account balance Only accounts with balances are listed on a trial balance Copyright © Houghton Mifflin Company. All rights reserved. 4– 24

The Post-Closing Trial Balance (cont’d) Only balance sheet accounts appear on the post-closing trial balance Income statement and Withdrawals accounts have been closed and are reflected in the Capital account balance Only accounts with balances are listed on a trial balance Copyright © Houghton Mifflin Company. All rights reserved. 4– 24

Discussion Q. What is the significance of the postclosing trial balance? A. The post-closing trial balance checks that • The total debits and total credits in the ledger are equal after the closing entries have been posted • Only balance sheet accounts show balances Copyright © Houghton Mifflin Company. All rights reserved. 4– 25

Discussion Q. What is the significance of the postclosing trial balance? A. The post-closing trial balance checks that • The total debits and total credits in the ledger are equal after the closing entries have been posted • Only balance sheet accounts show balances Copyright © Houghton Mifflin Company. All rights reserved. 4– 25

Reversing Entries: The Optional First Step in the Next Accounting Period • Objective 4 – Prepare reversing entries as appropriate Copyright © Houghton Mifflin Company. All rights reserved. 4– 26

Reversing Entries: The Optional First Step in the Next Accounting Period • Objective 4 – Prepare reversing entries as appropriate Copyright © Houghton Mifflin Company. All rights reserved. 4– 26

Reversing Entries • Are made to reverse adjusting entries recorded at the end of the previous accounting period • Simplify the bookkeeping process • Are optional • Are made on the first day of the new accounting period • Only adjustments for accruals are reversed – Reversing deferrals would not simplify the bookkeeping process Copyright © Houghton Mifflin Company. All rights reserved. 4– 27

Reversing Entries • Are made to reverse adjusting entries recorded at the end of the previous accounting period • Simplify the bookkeeping process • Are optional • Are made on the first day of the new accounting period • Only adjustments for accruals are reversed – Reversing deferrals would not simplify the bookkeeping process Copyright © Houghton Mifflin Company. All rights reserved. 4– 27

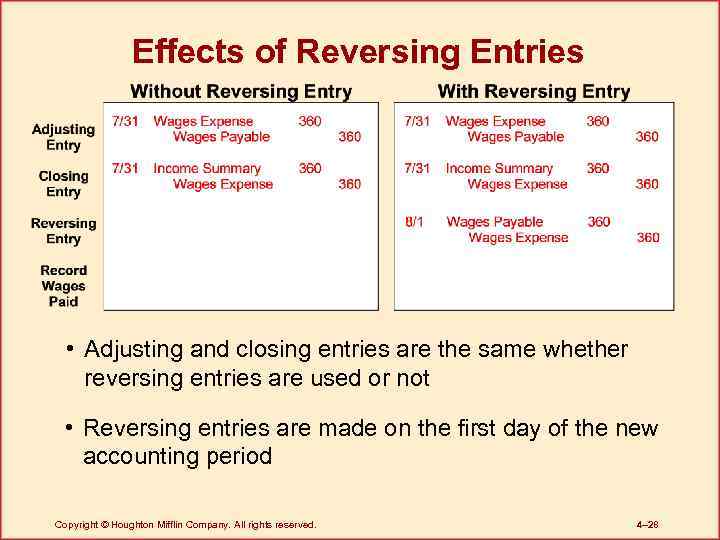

Effects of Reversing Entries • Adjusting and closing entries are the same whether reversing entries are used or not • Reversing entries are made on the first day of the new accounting period Copyright © Houghton Mifflin Company. All rights reserved. 4– 28

Effects of Reversing Entries • Adjusting and closing entries are the same whether reversing entries are used or not • Reversing entries are made on the first day of the new accounting period Copyright © Houghton Mifflin Company. All rights reserved. 4– 28

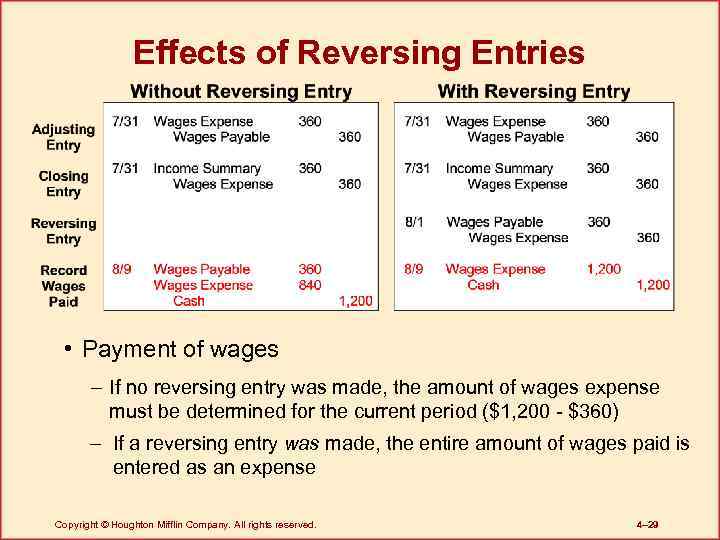

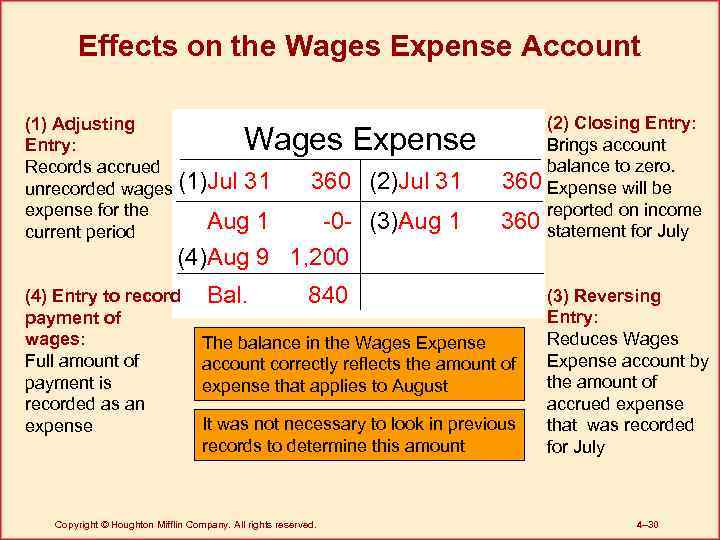

Effects of Reversing Entries • Payment of wages – If no reversing entry was made, the amount of wages expense must be determined for the current period ($1, 200 - $360) – If a reversing entry was made, the entire amount of wages paid is entered as an expense Copyright © Houghton Mifflin Company. All rights reserved. 4– 29

Effects of Reversing Entries • Payment of wages – If no reversing entry was made, the amount of wages expense must be determined for the current period ($1, 200 - $360) – If a reversing entry was made, the entire amount of wages paid is entered as an expense Copyright © Houghton Mifflin Company. All rights reserved. 4– 29

Effects on the Wages Expense Account (1) Adjusting Entry: Records accrued unrecorded wages (1)Jul 31 expense for the Aug 1 current period Wages Expense 360 (2)Jul 31 -0 - (3)Aug 1 (4)Aug 9 1, 200 (4) Entry to record payment of wages: Full amount of payment is recorded as an expense Bal. (2) Closing Entry: Brings account balance to zero. 360 Expense will be reported on income 360 statement for July 840 The balance in the Wages Expense account correctly reflects the amount of expense that applies to August It was not necessary to look in previous records to determine this amount Copyright © Houghton Mifflin Company. All rights reserved. (3) Reversing Entry: Reduces Wages Expense account by the amount of accrued expense that was recorded for July 4– 30

Effects on the Wages Expense Account (1) Adjusting Entry: Records accrued unrecorded wages (1)Jul 31 expense for the Aug 1 current period Wages Expense 360 (2)Jul 31 -0 - (3)Aug 1 (4)Aug 9 1, 200 (4) Entry to record payment of wages: Full amount of payment is recorded as an expense Bal. (2) Closing Entry: Brings account balance to zero. 360 Expense will be reported on income 360 statement for July 840 The balance in the Wages Expense account correctly reflects the amount of expense that applies to August It was not necessary to look in previous records to determine this amount Copyright © Houghton Mifflin Company. All rights reserved. (3) Reversing Entry: Reduces Wages Expense account by the amount of accrued expense that was recorded for July 4– 30

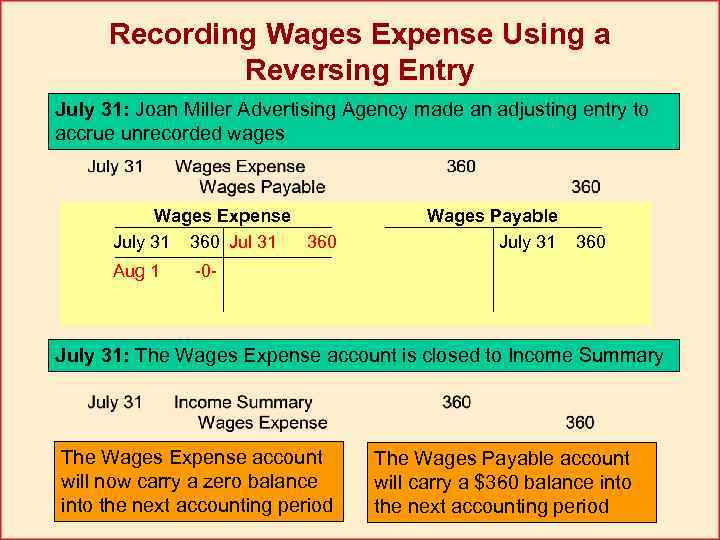

Recording Wages Expense Using a Reversing Entry July 31: Joan Miller Advertising Agency made an adjusting entry to accrue unrecorded wages Wages Expense July 31 360 Jul 31 360 Aug 1 Wages Payable July 31 360 -0 - July 31: The Wages Expense account is closed to Income Summary The Wages Expense account will now carry a zero balance into the next accounting period The Wages Payable account will carry a $360 balance into the next accounting period

Recording Wages Expense Using a Reversing Entry July 31: Joan Miller Advertising Agency made an adjusting entry to accrue unrecorded wages Wages Expense July 31 360 Jul 31 360 Aug 1 Wages Payable July 31 360 -0 - July 31: The Wages Expense account is closed to Income Summary The Wages Expense account will now carry a zero balance into the next accounting period The Wages Payable account will carry a $360 balance into the next accounting period

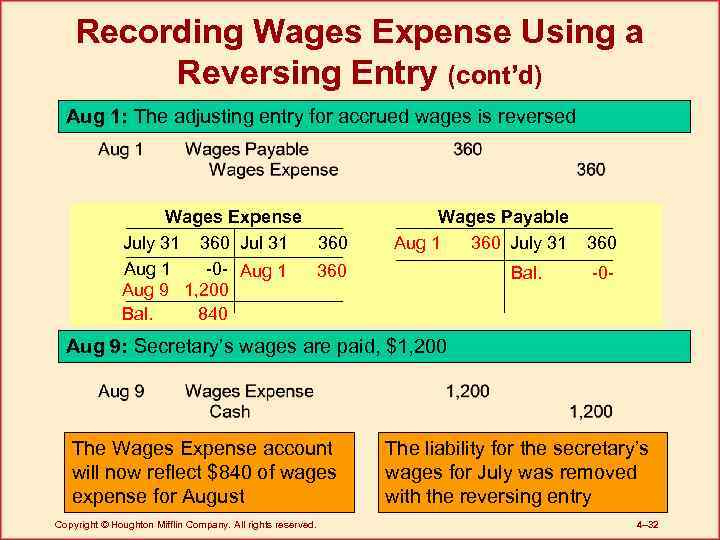

Recording Wages Expense Using a Reversing Entry (cont’d) Aug 1: The adjusting entry for accrued wages is reversed Wages Expense July 31 360 Jul 31 360 Aug 1 -0 - Aug 1 360 Aug 9 1, 200 Bal. 840 Wages Payable Aug 1 360 July 31 360 Bal. -0 - Aug 9: Secretary’s wages are paid, $1, 200 The Wages Expense account will now reflect $840 of wages expense for August Copyright © Houghton Mifflin Company. All rights reserved. The liability for the secretary’s wages for July was removed with the reversing entry 4– 32

Recording Wages Expense Using a Reversing Entry (cont’d) Aug 1: The adjusting entry for accrued wages is reversed Wages Expense July 31 360 Jul 31 360 Aug 1 -0 - Aug 1 360 Aug 9 1, 200 Bal. 840 Wages Payable Aug 1 360 July 31 360 Bal. -0 - Aug 9: Secretary’s wages are paid, $1, 200 The Wages Expense account will now reflect $840 of wages expense for August Copyright © Houghton Mifflin Company. All rights reserved. The liability for the secretary’s wages for July was removed with the reversing entry 4– 32

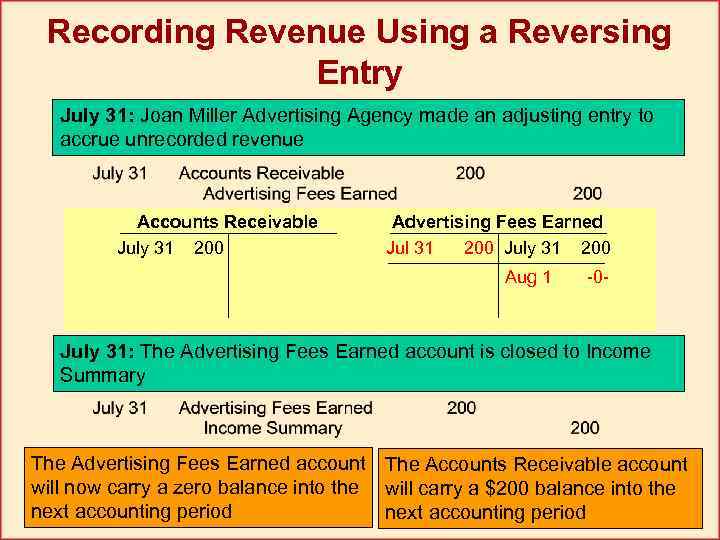

Recording Revenue Using a Reversing Entry July 31: Joan Miller Advertising Agency made an adjusting entry to accrue unrecorded revenue Accounts Receivable July 31 200 Advertising Fees Earned Jul 31 200 July 31 200 Aug 1 -0 - July 31: The Advertising Fees Earned account is closed to Income Summary The Advertising Fees Earned account The Accounts Receivable account will now carry a zero balance into the will carry a $200 balance into the next accounting period

Recording Revenue Using a Reversing Entry July 31: Joan Miller Advertising Agency made an adjusting entry to accrue unrecorded revenue Accounts Receivable July 31 200 Advertising Fees Earned Jul 31 200 July 31 200 Aug 1 -0 - July 31: The Advertising Fees Earned account is closed to Income Summary The Advertising Fees Earned account The Accounts Receivable account will now carry a zero balance into the will carry a $200 balance into the next accounting period

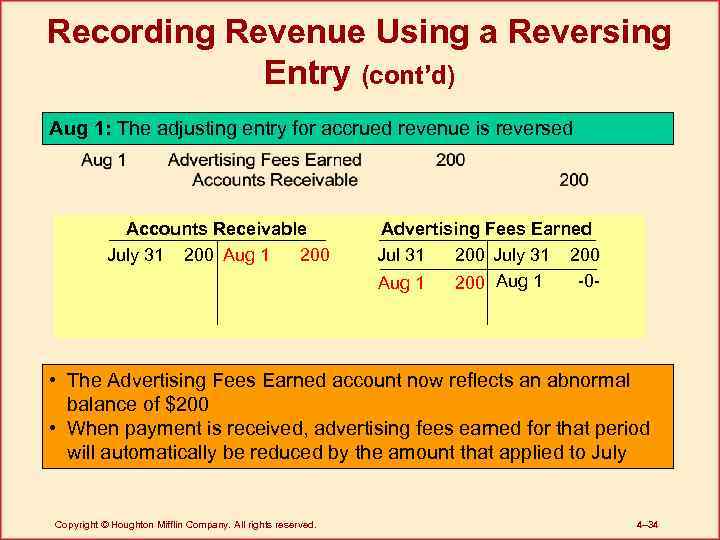

Recording Revenue Using a Reversing Entry (cont’d) Aug 1: The adjusting entry for accrued revenue is reversed Accounts Receivable July 31 200 Aug 1 200 Advertising Fees Earned Jul 31 200 July 31 200 -0 Aug 1 200 Aug 1 • The Advertising Fees Earned account now reflects an abnormal balance of $200 • When payment is received, advertising fees earned for that period will automatically be reduced by the amount that applied to July Copyright © Houghton Mifflin Company. All rights reserved. 4– 34

Recording Revenue Using a Reversing Entry (cont’d) Aug 1: The adjusting entry for accrued revenue is reversed Accounts Receivable July 31 200 Aug 1 200 Advertising Fees Earned Jul 31 200 July 31 200 -0 Aug 1 200 Aug 1 • The Advertising Fees Earned account now reflects an abnormal balance of $200 • When payment is received, advertising fees earned for that period will automatically be reduced by the amount that applied to July Copyright © Houghton Mifflin Company. All rights reserved. 4– 34

Discussion Q. What is the purpose of reversing entries? A. To simplify the bookkeeping process • They enable the bookkeeper to continue preparing routine journal entries in the new accounting period Copyright © Houghton Mifflin Company. All rights reserved. 4– 35

Discussion Q. What is the purpose of reversing entries? A. To simplify the bookkeeping process • They enable the bookkeeper to continue preparing routine journal entries in the new accounting period Copyright © Houghton Mifflin Company. All rights reserved. 4– 35

The Work Sheet: An Accountant’s Tool • Objective 5 – Prepare and use a work sheet Copyright © Houghton Mifflin Company. All rights reserved. 4– 36

The Work Sheet: An Accountant’s Tool • Objective 5 – Prepare and use a work sheet Copyright © Houghton Mifflin Company. All rights reserved. 4– 36

Working Papers • Relevant data collected by accountants – Calculations to determine the amount of • Prepaid insurance that has expired • Depreciation • Inventory of supplies on hand • Accrued wages – Analyses – Preliminary drafts of financial statements Copyright © Houghton Mifflin Company. All rights reserved. 4– 37

Working Papers • Relevant data collected by accountants – Calculations to determine the amount of • Prepaid insurance that has expired • Depreciation • Inventory of supplies on hand • Accrued wages – Analyses – Preliminary drafts of financial statements Copyright © Houghton Mifflin Company. All rights reserved. 4– 37

Working Papers (cont’d) • Important for two reasons 1. Organization • Avoid omitting important data or tasks that affect financial statements 2. Provide evidence of past work • Other accountants or auditors can retrace steps used to prepare financial statements Copyright © Houghton Mifflin Company. All rights reserved. 4– 38

Working Papers (cont’d) • Important for two reasons 1. Organization • Avoid omitting important data or tasks that affect financial statements 2. Provide evidence of past work • Other accountants or auditors can retrace steps used to prepare financial statements Copyright © Houghton Mifflin Company. All rights reserved. 4– 38

The Work Sheet • A working paper; a tool for the accountant • Lessens the possibility of leaving out an adjustment • Essential for larger companies • Helps in checking the accuracy of accounts Copyright © Houghton Mifflin Company. All rights reserved. 4– 39

The Work Sheet • A working paper; a tool for the accountant • Lessens the possibility of leaving out an adjustment • Essential for larger companies • Helps in checking the accuracy of accounts Copyright © Houghton Mifflin Company. All rights reserved. 4– 39

The Work Sheet (cont’d) • Facilitates the preparation of the financial statements • Is never published • Preparation may be aided using a microcomputer – Spreadsheet program – General ledger system Copyright © Houghton Mifflin Company. All rights reserved. 4– 40

The Work Sheet (cont’d) • Facilitates the preparation of the financial statements • Is never published • Preparation may be aided using a microcomputer – Spreadsheet program – General ledger system Copyright © Houghton Mifflin Company. All rights reserved. 4– 40

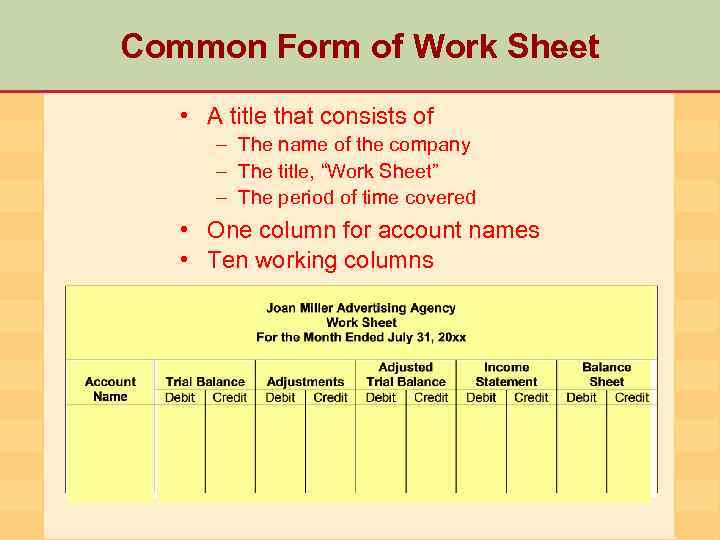

Common Form of Work Sheet • A title that consists of – The name of the company – The title, “Work Sheet” – The period of time covered • One column for account names • Ten working columns

Common Form of Work Sheet • A title that consists of – The name of the company – The title, “Work Sheet” – The period of time covered • One column for account names • Ten working columns

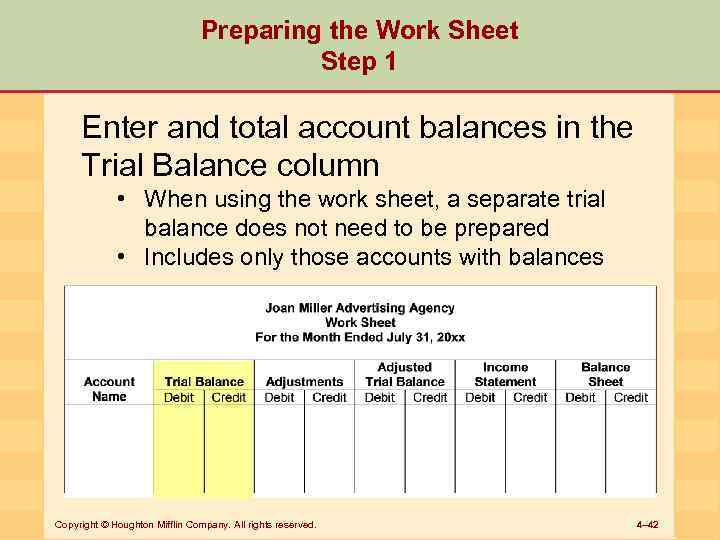

Preparing the Work Sheet Step 1 Enter and total account balances in the Trial Balance column • When using the work sheet, a separate trial balance does not need to be prepared • Includes only those accounts with balances Copyright © Houghton Mifflin Company. All rights reserved. 4– 42

Preparing the Work Sheet Step 1 Enter and total account balances in the Trial Balance column • When using the work sheet, a separate trial balance does not need to be prepared • Includes only those accounts with balances Copyright © Houghton Mifflin Company. All rights reserved. 4– 42

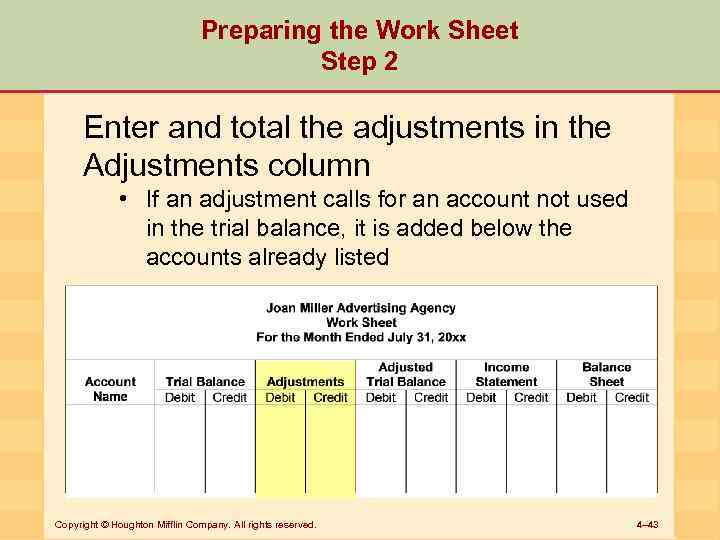

Preparing the Work Sheet Step 2 Enter and total the adjustments in the Adjustments column • If an adjustment calls for an account not used in the trial balance, it is added below the accounts already listed Copyright © Houghton Mifflin Company. All rights reserved. 4– 43

Preparing the Work Sheet Step 2 Enter and total the adjustments in the Adjustments column • If an adjustment calls for an account not used in the trial balance, it is added below the accounts already listed Copyright © Houghton Mifflin Company. All rights reserved. 4– 43

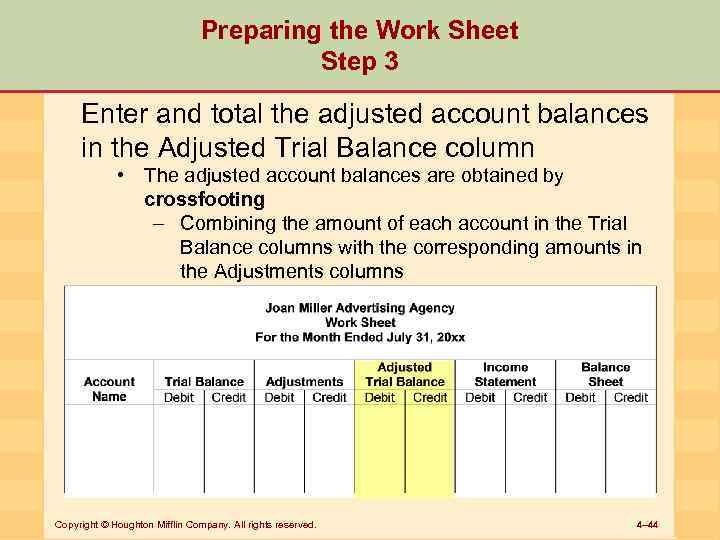

Preparing the Work Sheet Step 3 Enter and total the adjusted account balances in the Adjusted Trial Balance column • The adjusted account balances are obtained by crossfooting – Combining the amount of each account in the Trial Balance columns with the corresponding amounts in the Adjustments columns Copyright © Houghton Mifflin Company. All rights reserved. 4– 44

Preparing the Work Sheet Step 3 Enter and total the adjusted account balances in the Adjusted Trial Balance column • The adjusted account balances are obtained by crossfooting – Combining the amount of each account in the Trial Balance columns with the corresponding amounts in the Adjustments columns Copyright © Houghton Mifflin Company. All rights reserved. 4– 44

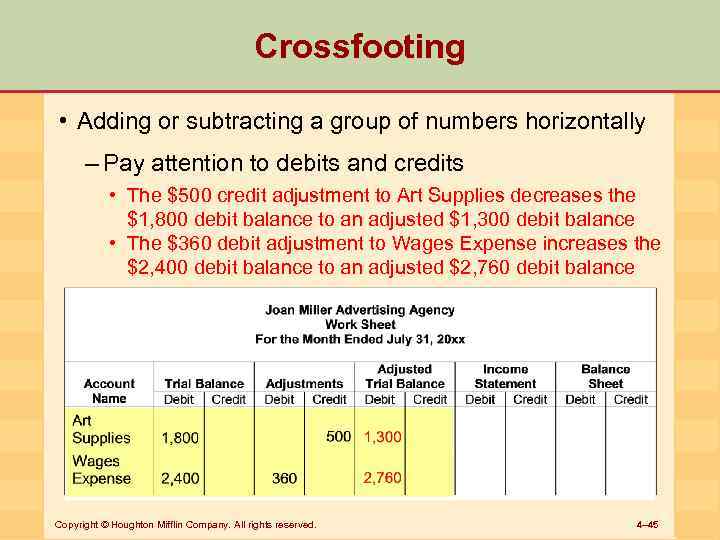

Crossfooting • Adding or subtracting a group of numbers horizontally – Pay attention to debits and credits • The $500 credit adjustment to Art Supplies decreases the $1, 800 debit balance to an adjusted $1, 300 debit balance • The $360 debit adjustment to Wages Expense increases the $2, 400 debit balance to an adjusted $2, 760 debit balance Copyright © Houghton Mifflin Company. All rights reserved. 4– 45

Crossfooting • Adding or subtracting a group of numbers horizontally – Pay attention to debits and credits • The $500 credit adjustment to Art Supplies decreases the $1, 800 debit balance to an adjusted $1, 300 debit balance • The $360 debit adjustment to Wages Expense increases the $2, 400 debit balance to an adjusted $2, 760 debit balance Copyright © Houghton Mifflin Company. All rights reserved. 4– 45

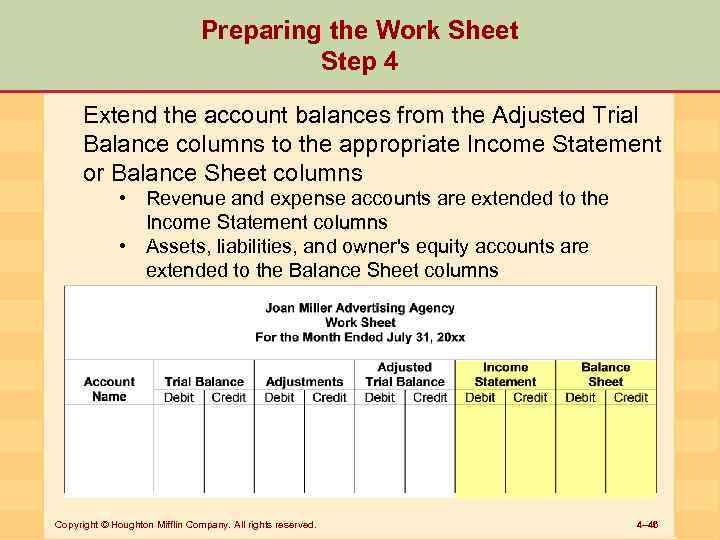

Preparing the Work Sheet Step 4 Extend the account balances from the Adjusted Trial Balance columns to the appropriate Income Statement or Balance Sheet columns • Revenue and expense accounts are extended to the Income Statement columns • Assets, liabilities, and owner's equity accounts are extended to the Balance Sheet columns Copyright © Houghton Mifflin Company. All rights reserved. 4– 46

Preparing the Work Sheet Step 4 Extend the account balances from the Adjusted Trial Balance columns to the appropriate Income Statement or Balance Sheet columns • Revenue and expense accounts are extended to the Income Statement columns • Assets, liabilities, and owner's equity accounts are extended to the Balance Sheet columns Copyright © Houghton Mifflin Company. All rights reserved. 4– 46

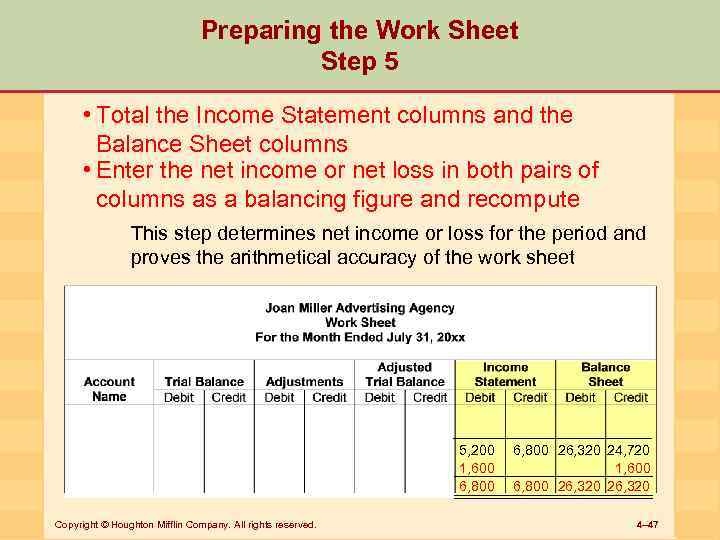

Preparing the Work Sheet Step 5 • Total the Income Statement columns and the Balance Sheet columns • Enter the net income or net loss in both pairs of columns as a balancing figure and recompute This step determines net income or loss for the period and proves the arithmetical accuracy of the work sheet 5, 200 1, 600 6, 800 Copyright © Houghton Mifflin Company. All rights reserved. 6, 800 26, 320 24, 720 1, 600 6, 800 26, 320 4– 47

Preparing the Work Sheet Step 5 • Total the Income Statement columns and the Balance Sheet columns • Enter the net income or net loss in both pairs of columns as a balancing figure and recompute This step determines net income or loss for the period and proves the arithmetical accuracy of the work sheet 5, 200 1, 600 6, 800 Copyright © Houghton Mifflin Company. All rights reserved. 6, 800 26, 320 24, 720 1, 600 6, 800 26, 320 4– 47

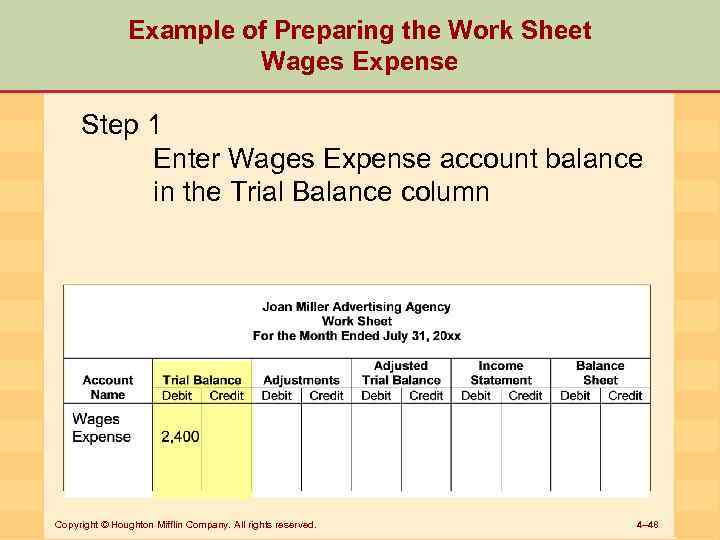

Example of Preparing the Work Sheet Wages Expense Step 1 Enter Wages Expense account balance in the Trial Balance column Copyright © Houghton Mifflin Company. All rights reserved. 4– 48

Example of Preparing the Work Sheet Wages Expense Step 1 Enter Wages Expense account balance in the Trial Balance column Copyright © Houghton Mifflin Company. All rights reserved. 4– 48

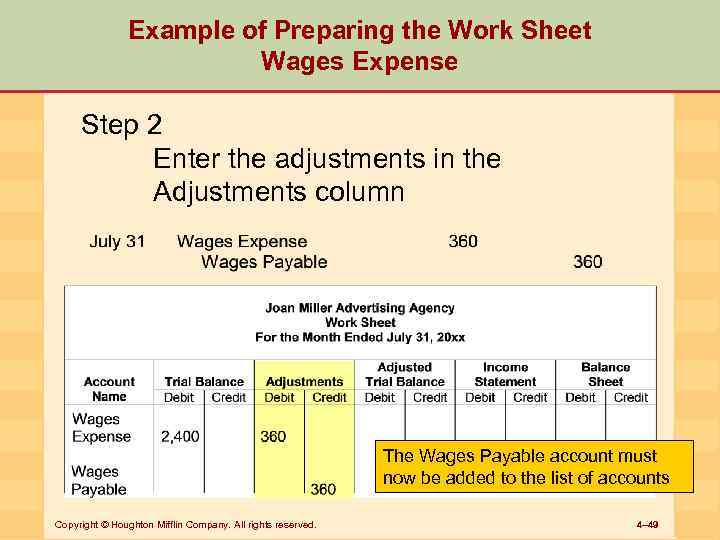

Example of Preparing the Work Sheet Wages Expense Step 2 Enter the adjustments in the Adjustments column The Wages Payable account must now be added to the list of accounts Copyright © Houghton Mifflin Company. All rights reserved. 4– 49

Example of Preparing the Work Sheet Wages Expense Step 2 Enter the adjustments in the Adjustments column The Wages Payable account must now be added to the list of accounts Copyright © Houghton Mifflin Company. All rights reserved. 4– 49

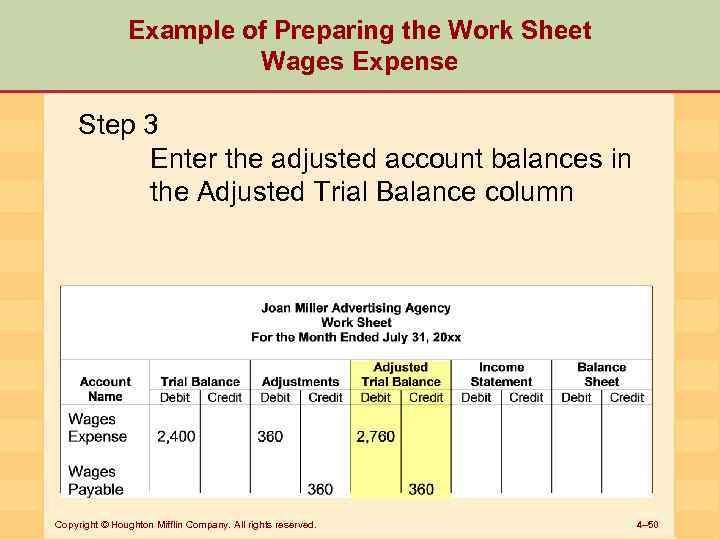

Example of Preparing the Work Sheet Wages Expense Step 3 Enter the adjusted account balances in the Adjusted Trial Balance column Copyright © Houghton Mifflin Company. All rights reserved. 4– 50

Example of Preparing the Work Sheet Wages Expense Step 3 Enter the adjusted account balances in the Adjusted Trial Balance column Copyright © Houghton Mifflin Company. All rights reserved. 4– 50

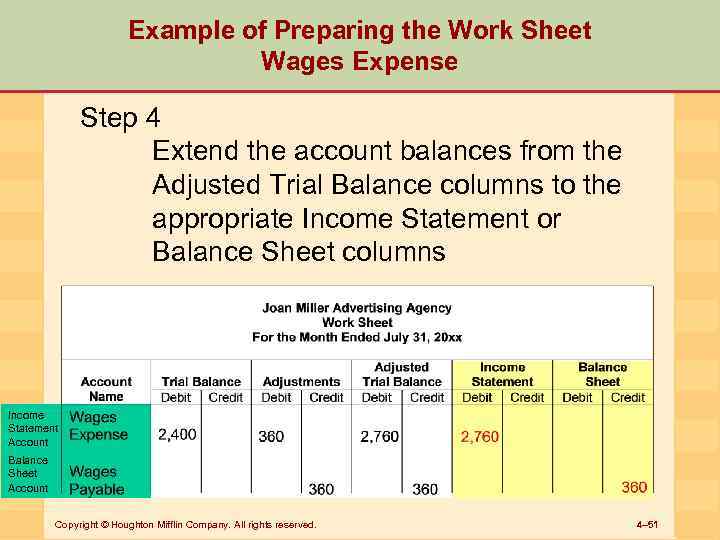

Example of Preparing the Work Sheet Wages Expense Step 4 Extend the account balances from the Adjusted Trial Balance columns to the appropriate Income Statement or Balance Sheet columns Income Statement Account Balance Sheet Account Copyright © Houghton Mifflin Company. All rights reserved. 4– 51

Example of Preparing the Work Sheet Wages Expense Step 4 Extend the account balances from the Adjusted Trial Balance columns to the appropriate Income Statement or Balance Sheet columns Income Statement Account Balance Sheet Account Copyright © Houghton Mifflin Company. All rights reserved. 4– 51

Using the Work Sheet • The work sheet assists the accountant in three principal tasks 1. Recording the adjusting entries 2. Recording the closing entries in the general journal • Prepares the records for the beginning of the next accounting period 3. Preparing the financial statements Copyright © Houghton Mifflin Company. All rights reserved. 4– 52

Using the Work Sheet • The work sheet assists the accountant in three principal tasks 1. Recording the adjusting entries 2. Recording the closing entries in the general journal • Prepares the records for the beginning of the next accounting period 3. Preparing the financial statements Copyright © Houghton Mifflin Company. All rights reserved. 4– 52

Recording the Adjusting Entries • Adjustments are determined while preparing the work sheet • Adjusting entries can be recorded – When determined – Later when closing entries are recorded • Information can be copied from the work sheet and recorded in the general journal – Include appropriate explanations • Post to the general ledger Copyright © Houghton Mifflin Company. All rights reserved. 4– 53

Recording the Adjusting Entries • Adjustments are determined while preparing the work sheet • Adjusting entries can be recorded – When determined – Later when closing entries are recorded • Information can be copied from the work sheet and recorded in the general journal – Include appropriate explanations • Post to the general ledger Copyright © Houghton Mifflin Company. All rights reserved. 4– 53

Recording the Closing Entries • All accounts that need to be closed, except for Withdrawals, may be found in the Income Statement columns of the work sheet • Closing entries are entered in the general journal and posted to the ledger Copyright © Houghton Mifflin Company. All rights reserved. 4– 54

Recording the Closing Entries • All accounts that need to be closed, except for Withdrawals, may be found in the Income Statement columns of the work sheet • Closing entries are entered in the general journal and posted to the ledger Copyright © Houghton Mifflin Company. All rights reserved. 4– 54

Preparing the Financial Statements • Account balances have been sorted into Income Statement and Balance Sheet columns on the work sheet • The income statement is prepared from accounts in the Income Statement columns • The statement of owner’s equity and balance sheet are prepared from accounts in the Balance Sheet columns Copyright © Houghton Mifflin Company. All rights reserved. 4– 55

Preparing the Financial Statements • Account balances have been sorted into Income Statement and Balance Sheet columns on the work sheet • The income statement is prepared from accounts in the Income Statement columns • The statement of owner’s equity and balance sheet are prepared from accounts in the Balance Sheet columns Copyright © Houghton Mifflin Company. All rights reserved. 4– 55

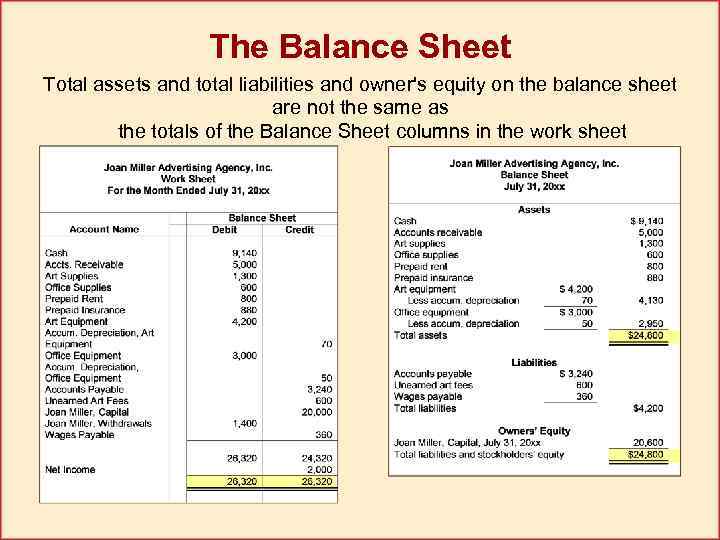

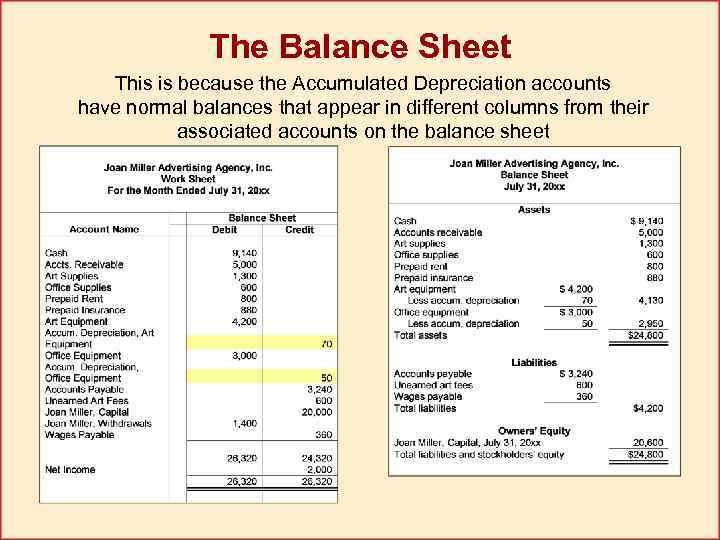

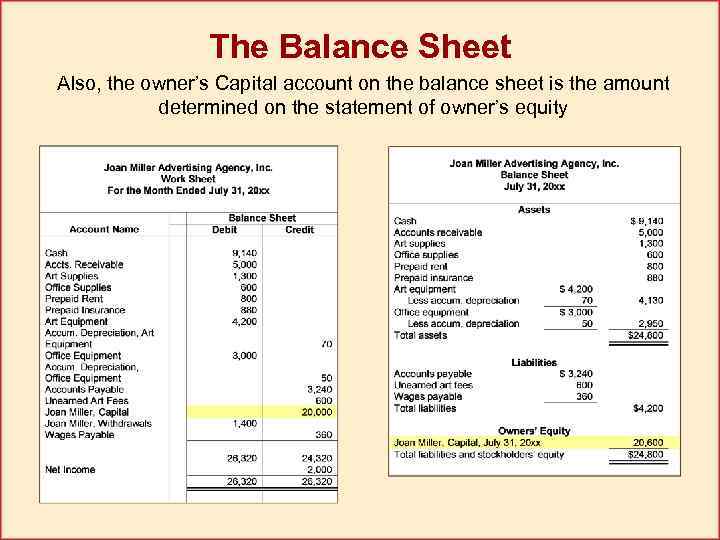

The Balance Sheet Total assets and total liabilities and owner's equity on the balance sheet are not the same as the totals of the Balance Sheet columns in the work sheet

The Balance Sheet Total assets and total liabilities and owner's equity on the balance sheet are not the same as the totals of the Balance Sheet columns in the work sheet

The Balance Sheet This is because the Accumulated Depreciation accounts have normal balances that appear in different columns from their associated accounts on the balance sheet

The Balance Sheet This is because the Accumulated Depreciation accounts have normal balances that appear in different columns from their associated accounts on the balance sheet

The Balance Sheet Also, the owner’s Capital account on the balance sheet is the amount determined on the statement of owner’s equity

The Balance Sheet Also, the owner’s Capital account on the balance sheet is the amount determined on the statement of owner’s equity

Discussion Q. Do the Income Statement columns and the Balance Sheet columns of the work sheet balance after the amounts from the Adjusted Trial Balance columns are extended? A. No, they do not balance by the amount of net income or loss for the period Copyright © Houghton Mifflin Company. All rights reserved. 4– 59

Discussion Q. Do the Income Statement columns and the Balance Sheet columns of the work sheet balance after the amounts from the Adjusted Trial Balance columns are extended? A. No, they do not balance by the amount of net income or loss for the period Copyright © Houghton Mifflin Company. All rights reserved. 4– 59

Time for Review 1. State all the steps in the accounting cycle. 2. Explain and prepare closing entries. 3. Prepare the post-closing trial balance. 4. Prepare reversing entries as appropriate. 5. Prepare and use a work sheet. Copyright © Houghton Mifflin Company. All rights reserved. 4– 60

Time for Review 1. State all the steps in the accounting cycle. 2. Explain and prepare closing entries. 3. Prepare the post-closing trial balance. 4. Prepare reversing entries as appropriate. 5. Prepare and use a work sheet. Copyright © Houghton Mifflin Company. All rights reserved. 4– 60