0a796cfcfbb23d17c4a040bf845a9701.ppt

- Количество слайдов: 24

COMPETITIVENESS in Romanian Regional Operational Programme 2014 - 2020

COMPETITIVENESS in Romanian Regional Operational Programme 2014 - 2020

REGIONAL OPERATIONAL PROGRAMME 2014 -2020 (1) • It is based on common development priorities proposed in the Regional Development Plans for 2014 -2020, designed by each of the eight Regional Development Agencies, synthesized in the National Strategy for Regional Development 2014 -2020 • It addresses all the five challenges for growth identified within the Partnership Agreement: ü competitiveness and local development, ü population and social aspects, ü infrastructure, ü resources ü administration and governance. 2

REGIONAL OPERATIONAL PROGRAMME 2014 -2020 (1) • It is based on common development priorities proposed in the Regional Development Plans for 2014 -2020, designed by each of the eight Regional Development Agencies, synthesized in the National Strategy for Regional Development 2014 -2020 • It addresses all the five challenges for growth identified within the Partnership Agreement: ü competitiveness and local development, ü population and social aspects, ü infrastructure, ü resources ü administration and governance. 2

REGIONAL OPERATIONAL PROGRAMME 2014 -2020 (2) • It is linked to other sectoral / national strategies in its areas of intervention and operational programmes already in place in Romania for the 20142020 programming period: – Competitiveness Operational Programme, – Human Capital Operational Programme, – National Programme for Rural Development. Main changes/news compared to the previous programming period: • Double number of priority axis (12, compared to 6), • 70% higher financial allocation - 8, 25 bln euro, (3, 54 bln euro more), • New types of investments, • Clear defined and monitored targets and indicators • Use of financial instruments • Performance reserve – 6%, to be used after 2018 3

REGIONAL OPERATIONAL PROGRAMME 2014 -2020 (2) • It is linked to other sectoral / national strategies in its areas of intervention and operational programmes already in place in Romania for the 20142020 programming period: – Competitiveness Operational Programme, – Human Capital Operational Programme, – National Programme for Rural Development. Main changes/news compared to the previous programming period: • Double number of priority axis (12, compared to 6), • 70% higher financial allocation - 8, 25 bln euro, (3, 54 bln euro more), • New types of investments, • Clear defined and monitored targets and indicators • Use of financial instruments • Performance reserve – 6%, to be used after 2018 3

REGIONAL OPERATIONAL PROGRAMME 2014 -2020 (3) Development needs / new types of investments • • • • R & D &I: limited transfer of research results into the market and low assimilation of innovation in SMEs Business incubators SME - the sector is underdeveloped and has a negative impact on the competitiveness of regional economies: ü low level of entrepreneurial culture - reflected by relatively low density of business across all regions ü low resilience of new businesses – 2/3 of new businesses go out of business in the first year of life. Energy efficiency: sustainable energy consumption and high savings potential (public and residential buildings). Environment: high level of pollution in urban areas. Urban mobility Urban development: deprived urban areas, unused or not used properly in the cities of Romania. Heritage resources: poor capitalization of valuable cultural heritage resources. Tourism: valuable potential with balanced territorial distribution – option to revitalize the less developed areas Road infrastructure: the low degree of accessibility of some areas results in low attractivity/ level of investments. Social infrastructure and education: educational, health and social services undersized impede social inclusion and human capital development Community Led Local development (CLLD) Cadaster: low cadastral records, affecting the implementation of development policies of local communities. Administrative capacity: the need to strengthen the administrative capacity of the MA, IB and beneficiaries ROP Integrated Territorial Investments (ITI) 4

REGIONAL OPERATIONAL PROGRAMME 2014 -2020 (3) Development needs / new types of investments • • • • R & D &I: limited transfer of research results into the market and low assimilation of innovation in SMEs Business incubators SME - the sector is underdeveloped and has a negative impact on the competitiveness of regional economies: ü low level of entrepreneurial culture - reflected by relatively low density of business across all regions ü low resilience of new businesses – 2/3 of new businesses go out of business in the first year of life. Energy efficiency: sustainable energy consumption and high savings potential (public and residential buildings). Environment: high level of pollution in urban areas. Urban mobility Urban development: deprived urban areas, unused or not used properly in the cities of Romania. Heritage resources: poor capitalization of valuable cultural heritage resources. Tourism: valuable potential with balanced territorial distribution – option to revitalize the less developed areas Road infrastructure: the low degree of accessibility of some areas results in low attractivity/ level of investments. Social infrastructure and education: educational, health and social services undersized impede social inclusion and human capital development Community Led Local development (CLLD) Cadaster: low cadastral records, affecting the implementation of development policies of local communities. Administrative capacity: the need to strengthen the administrative capacity of the MA, IB and beneficiaries ROP Integrated Territorial Investments (ITI) 4

REGIONAL OPERATIONAL PROGRAMME 2014 -2020 (4) GENERAL OBJECTIVE • Increase the economic competitiveness and improve living conditions of local and regional communities by supporting business development, infrastructure and services for sustainable development of regions, so as to be able to effectively manage resources and their potential for innovation and assimilation of technological progress. 5

REGIONAL OPERATIONAL PROGRAMME 2014 -2020 (4) GENERAL OBJECTIVE • Increase the economic competitiveness and improve living conditions of local and regional communities by supporting business development, infrastructure and services for sustainable development of regions, so as to be able to effectively manage resources and their potential for innovation and assimilation of technological progress. 5

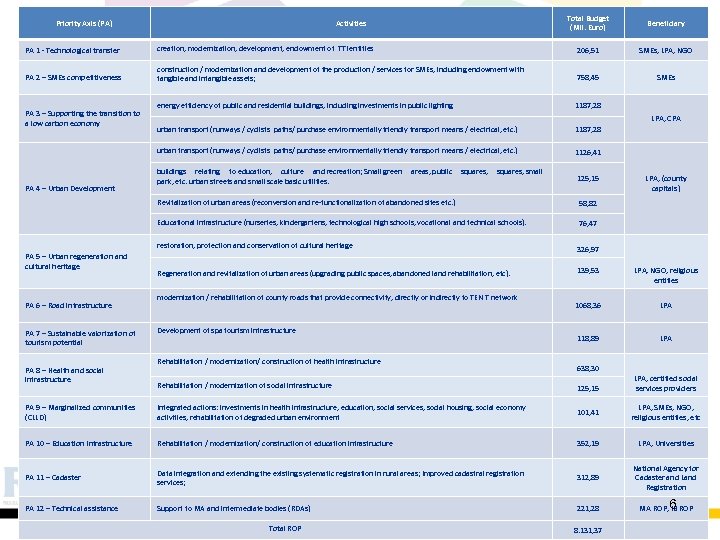

Priority Axis (PA) Activities Total Budget (Mil. Euro) Beneficiary PA 1 - Technological transfer creation, modernization, development, endowment of TTI entities 206, 51 SMEs, LPA, NGO PA 2 – SMEs competitiveness construction / modernization and development of the production / services for SMEs, including endowment with tangible and intangible assets; 758, 45 SMEs energy efficiency of public and residential buildings, including investments in public lighting 1187, 28 urban transport (runways / cyclists paths/ purchase environmentally friendly transport means / electrical, etc. ) 1126, 41 buildings relating to education, culture and recreation; Small green areas, public squares, small park, etc. urban streets and small scale basic utilities. 125, 15 Revitalization of urban areas (reconversion and re-functionalization of abandoned sites etc. ) 58, 82 Educational infrastructure (nurseries, kindergartens, technological high schools, vocational and technical schools). 76, 47 restoration, protection and conservation of cultural heritage 326, 97 Regeneration and revitalization of urban areas (upgrading public spaces, abandoned land rehabilitation, etc). 139, 53 LPA, NGO, religious entities 1068, 36 LPA 118, 89 LPA PA 3 – Supporting the transition to a low carbon economy PA 4 – Urban Development PA 5 – Urban regeneration and cultural heritage PA 6 – Road infrastructure PA 7 – Sustainable valorization of tourism potential PA 8 – Health and social infrastructure LPA, CPA modernization / rehabilitation of county roads that provide connectivity, directly or indirectly to TEN T network Development of spa tourism infrastructure Rehabilitation / modernization/ construction of health infrastructure LPA, (county capitals) 638, 30 LPA, certified social services providers Rehabilitation / modernization of social infrastructure 125, 15 PA 9 – Marginalized communities (CLLD) Integrated actions: investments in health infrastructure, education, social services, social housing, social economy activities, rehabilitation of degraded urban environment 101, 41 LPA, SMEs, NGO, religious entities, etc PA 10 – Education Infrastructure Rehabilitation / modernization/ construction of education infrastructure 352, 19 LPA, Universities PA 11 – Cadaster Data integration and extending the existing systematic registration in rural areas; Improved cadastral registration services; 312, 89 National Agency for Cadaster and Land Registration PA 12 – Technical assistance Support to MA and intermediate bodies (RDAs) 221, 28 MA ROP, IB ROP Total ROP 8. 131, 37 6

Priority Axis (PA) Activities Total Budget (Mil. Euro) Beneficiary PA 1 - Technological transfer creation, modernization, development, endowment of TTI entities 206, 51 SMEs, LPA, NGO PA 2 – SMEs competitiveness construction / modernization and development of the production / services for SMEs, including endowment with tangible and intangible assets; 758, 45 SMEs energy efficiency of public and residential buildings, including investments in public lighting 1187, 28 urban transport (runways / cyclists paths/ purchase environmentally friendly transport means / electrical, etc. ) 1126, 41 buildings relating to education, culture and recreation; Small green areas, public squares, small park, etc. urban streets and small scale basic utilities. 125, 15 Revitalization of urban areas (reconversion and re-functionalization of abandoned sites etc. ) 58, 82 Educational infrastructure (nurseries, kindergartens, technological high schools, vocational and technical schools). 76, 47 restoration, protection and conservation of cultural heritage 326, 97 Regeneration and revitalization of urban areas (upgrading public spaces, abandoned land rehabilitation, etc). 139, 53 LPA, NGO, religious entities 1068, 36 LPA 118, 89 LPA PA 3 – Supporting the transition to a low carbon economy PA 4 – Urban Development PA 5 – Urban regeneration and cultural heritage PA 6 – Road infrastructure PA 7 – Sustainable valorization of tourism potential PA 8 – Health and social infrastructure LPA, CPA modernization / rehabilitation of county roads that provide connectivity, directly or indirectly to TEN T network Development of spa tourism infrastructure Rehabilitation / modernization/ construction of health infrastructure LPA, (county capitals) 638, 30 LPA, certified social services providers Rehabilitation / modernization of social infrastructure 125, 15 PA 9 – Marginalized communities (CLLD) Integrated actions: investments in health infrastructure, education, social services, social housing, social economy activities, rehabilitation of degraded urban environment 101, 41 LPA, SMEs, NGO, religious entities, etc PA 10 – Education Infrastructure Rehabilitation / modernization/ construction of education infrastructure 352, 19 LPA, Universities PA 11 – Cadaster Data integration and extending the existing systematic registration in rural areas; Improved cadastral registration services; 312, 89 National Agency for Cadaster and Land Registration PA 12 – Technical assistance Support to MA and intermediate bodies (RDAs) 221, 28 MA ROP, IB ROP Total ROP 8. 131, 37 6

PA 1 – Promotion of the technological transfer (1) q In order to become/remain competitive on the market, companies have to integrate new knowledge in their commercial vision for future products q Strategic need - Limited transfer of research results in the market and low uptake of innovation in companies ü Support for R &D is extremely low (0. 42 % of GDP in 2012) compared with the targets for 2020 (3 % for the EU and 2 % for Romania), largely inefficient, with a fragmented R&I system, ü A lack of critical mass of quality research results that do not result in applied research and innovative applications. ü Large number of research activities, but weak links between education, research and business, which leads to low transfer of new ideas to the market. ü At EU level (the 2014 “Innovation Union Scoreboard” report), Romania is listed as modest innovators, being the second lowest in terms of technology transfer and marketing innovation and with the lowest percentage of companies which have innovated and marketed in the EU

PA 1 – Promotion of the technological transfer (1) q In order to become/remain competitive on the market, companies have to integrate new knowledge in their commercial vision for future products q Strategic need - Limited transfer of research results in the market and low uptake of innovation in companies ü Support for R &D is extremely low (0. 42 % of GDP in 2012) compared with the targets for 2020 (3 % for the EU and 2 % for Romania), largely inefficient, with a fragmented R&I system, ü A lack of critical mass of quality research results that do not result in applied research and innovative applications. ü Large number of research activities, but weak links between education, research and business, which leads to low transfer of new ideas to the market. ü At EU level (the 2014 “Innovation Union Scoreboard” report), Romania is listed as modest innovators, being the second lowest in terms of technology transfer and marketing innovation and with the lowest percentage of companies which have innovated and marketed in the EU

PA 1 – Promotion of the technological transfer (2) q The main problem - the ability to absorb innovation in companies q The main features of the process of innovation and technology transfer: ü Low cooperation between SMEs and institutions of R&D ü Small number of innovative SMEs participating in knowledge transfer activities ü SMEs are more interested in developing capacities, distribution and assembly than of research and innovation activities ü Low rate of technology transfer and weak entrepreneurial culture. q Innovation and technology transfer infrastructures (Technological Transfer Organization - TTO) act as intermediaries between the demand for and supply of innovation on the market. q Poor performance of TTO Therefore: creating/developing TTOs will improve the absorption capacity of innovation at the SMEs level, by promoting the implementation of research findings through technology transfer in SMEs.

PA 1 – Promotion of the technological transfer (2) q The main problem - the ability to absorb innovation in companies q The main features of the process of innovation and technology transfer: ü Low cooperation between SMEs and institutions of R&D ü Small number of innovative SMEs participating in knowledge transfer activities ü SMEs are more interested in developing capacities, distribution and assembly than of research and innovation activities ü Low rate of technology transfer and weak entrepreneurial culture. q Innovation and technology transfer infrastructures (Technological Transfer Organization - TTO) act as intermediaries between the demand for and supply of innovation on the market. q Poor performance of TTO Therefore: creating/developing TTOs will improve the absorption capacity of innovation at the SMEs level, by promoting the implementation of research findings through technology transfer in SMEs.

PA 1 – Promotion of the technological transfer (3) q Smart specialization strategy: an ex-ante conditionality for Romania in order to access the ESIF - fulfilled by National Strategy for Research and Development: ü limited in its weak territorial focus, ü does not reflect and establish areas of competitive advantage in the regions q Bio economy, ICT, environment, advanced materials, health q At regional level - not all the regions have elaborated a RIS 3 (only 6 out of 8) q RDAs - to develop Regional Concept Notes (CN) based on a common methodology elaborated by the MA ROP (in order to create sub-national capacities) q each CN should, based on following an Entrepreneurial Discovery Process: ü Re/state the smart specialization directions identified at regional level ü set the smart specialization directions in those regions without a strategy q CN - to give recommendations on the location, economic sectors and activities that could benefit from ERDF support q In order to be eligible under Priority Axes 1 from ROP, CN were completed by the end of March 2017

PA 1 – Promotion of the technological transfer (3) q Smart specialization strategy: an ex-ante conditionality for Romania in order to access the ESIF - fulfilled by National Strategy for Research and Development: ü limited in its weak territorial focus, ü does not reflect and establish areas of competitive advantage in the regions q Bio economy, ICT, environment, advanced materials, health q At regional level - not all the regions have elaborated a RIS 3 (only 6 out of 8) q RDAs - to develop Regional Concept Notes (CN) based on a common methodology elaborated by the MA ROP (in order to create sub-national capacities) q each CN should, based on following an Entrepreneurial Discovery Process: ü Re/state the smart specialization directions identified at regional level ü set the smart specialization directions in those regions without a strategy q CN - to give recommendations on the location, economic sectors and activities that could benefit from ERDF support q In order to be eligible under Priority Axes 1 from ROP, CN were completed by the end of March 2017

PA 1 – Promotion of the technological transfer (4) Lagging Behind Regions Initiative - Romania and Poland as pilots q North-West and North-East selected as pilot regions Ø Entrepreneurial discovery - smart and competitive sectors Ø Education, training, skills - links to business and labour market Ø Administrative capacity and national - regional coordination q Tools and support: Ø Joint Research Centre: assistance to smart specialization Ø DG REGIO: external experts business support, tech transfer, cooperation universities – businesses, etc. Ø Regional governance: innovation, competitiveness, skills, catalyzers Ø Governmental support: coordination, follow up Ø No additional funds - ESI funds under operational programmes (ROP, COP) q Replicate the support into the other regions

PA 1 – Promotion of the technological transfer (4) Lagging Behind Regions Initiative - Romania and Poland as pilots q North-West and North-East selected as pilot regions Ø Entrepreneurial discovery - smart and competitive sectors Ø Education, training, skills - links to business and labour market Ø Administrative capacity and national - regional coordination q Tools and support: Ø Joint Research Centre: assistance to smart specialization Ø DG REGIO: external experts business support, tech transfer, cooperation universities – businesses, etc. Ø Regional governance: innovation, competitiveness, skills, catalyzers Ø Governmental support: coordination, follow up Ø No additional funds - ESI funds under operational programmes (ROP, COP) q Replicate the support into the other regions

PA 1 – Promotion of the technological transfer (5) q TO 1 - Strengthening research, technological development and innovation q TO 1 activities financed under PA 1/ROP - Promoting technological transfer q ROP will focus on innovation needs identified by the demand side, in a market driven approach; q Complementarily, the OP Competitiveness – is also financing TO 1 activities, from the supply perspective, focusing on research based activities. q SO - Increasing innovation in businesses by supporting innovation and technology transfer entities in areas of smart specialization q ROP will finance: ü TTOs (creation and development, including both infrastructure and endowment, but also specific services), ü Science and technological parks (creation and development, including both infrastructure and endowment, but also specific services) and ü SMEs in partnership/collaboration with TTOs.

PA 1 – Promotion of the technological transfer (5) q TO 1 - Strengthening research, technological development and innovation q TO 1 activities financed under PA 1/ROP - Promoting technological transfer q ROP will focus on innovation needs identified by the demand side, in a market driven approach; q Complementarily, the OP Competitiveness – is also financing TO 1 activities, from the supply perspective, focusing on research based activities. q SO - Increasing innovation in businesses by supporting innovation and technology transfer entities in areas of smart specialization q ROP will finance: ü TTOs (creation and development, including both infrastructure and endowment, but also specific services), ü Science and technological parks (creation and development, including both infrastructure and endowment, but also specific services) and ü SMEs in partnership/collaboration with TTOs.

PA 1 – Promotion of the technological transfer (6) q Allocated amount– 206, 51 mil euro (ERDF and national contribution) Innovative SMEs collaborating with others q Types of activities Ø Creation and development of the innovation and technological transfer infrastructure (TTO), including scientific and technological parks; construction, modernization, extension and endowments – equipment and software Ø Purchasing the specific technological transfer services Ø Investments for SMEs to implement a research & innovation result – in partnership with a TTO q These entities are intended to be the bridge between research and business, to develop capacity for the swift economic exploitation of new ideas deriving from research and innovation, commercialisation of research results and their translation into products, processes and services from firms.

PA 1 – Promotion of the technological transfer (6) q Allocated amount– 206, 51 mil euro (ERDF and national contribution) Innovative SMEs collaborating with others q Types of activities Ø Creation and development of the innovation and technological transfer infrastructure (TTO), including scientific and technological parks; construction, modernization, extension and endowments – equipment and software Ø Purchasing the specific technological transfer services Ø Investments for SMEs to implement a research & innovation result – in partnership with a TTO q These entities are intended to be the bridge between research and business, to develop capacity for the swift economic exploitation of new ideas deriving from research and innovation, commercialisation of research results and their translation into products, processes and services from firms.

PA 2 - Increasing the competitiveness of SMEs (1) q Romania has serious divergences in competitiveness compared to EU q SME sector - the backbone of the economy (99. 64 % of enterprises) q SME sector - underdeveloped, with a negative impact on the competitiveness Ø ü ü ü The critical mass of SMEs is influenced by: Low entrepreneurial business culture - low density (less than 50 % of the EU average) Low resilience on market (2/3 of the new SMEs disappear in the first year of life) Resisting SMEs – in the same category, not keen on in addressing national/international market Ø SMEs concentrated in low value-added areas, specialisation in labour-intensive industries work: ü Limited access to resources (land, labour, capital) to financing, ü Inefficiency of the production process, not effective links to their own markets ü Low number of innovative SMEs - compared to EU average Ø Decreasing of exporting SMEs number, sectors, destinations.

PA 2 - Increasing the competitiveness of SMEs (1) q Romania has serious divergences in competitiveness compared to EU q SME sector - the backbone of the economy (99. 64 % of enterprises) q SME sector - underdeveloped, with a negative impact on the competitiveness Ø ü ü ü The critical mass of SMEs is influenced by: Low entrepreneurial business culture - low density (less than 50 % of the EU average) Low resilience on market (2/3 of the new SMEs disappear in the first year of life) Resisting SMEs – in the same category, not keen on in addressing national/international market Ø SMEs concentrated in low value-added areas, specialisation in labour-intensive industries work: ü Limited access to resources (land, labour, capital) to financing, ü Inefficiency of the production process, not effective links to their own markets ü Low number of innovative SMEs - compared to EU average Ø Decreasing of exporting SMEs number, sectors, destinations.

PA 2 - Increasing the competitiveness of SMEs (2) q National Strategy for Competitiveness (NSC) identified 10 sectors that showed recent growth and export performance q According to the PA, the investments dedicated to FESI for sustainable growth and national competitiveness will focus on the NSC sectors q For regional level, investments can be financed also in the sectors identified in the Regional Development Plans q TO 3 – enhancing the competitiveness of SMEs q Total allocation – 758 mil euro (ERDF and national contribution) - grants and financial instruments

PA 2 - Increasing the competitiveness of SMEs (2) q National Strategy for Competitiveness (NSC) identified 10 sectors that showed recent growth and export performance q According to the PA, the investments dedicated to FESI for sustainable growth and national competitiveness will focus on the NSC sectors q For regional level, investments can be financed also in the sectors identified in the Regional Development Plans q TO 3 – enhancing the competitiveness of SMEs q Total allocation – 758 mil euro (ERDF and national contribution) - grants and financial instruments

PA 2 - Increasing the competitiveness of SMEs (3) Investment Priority 3 a – promoting entrepreneurship by facilitating the economic exploitation of new ideas and fostering the creation of new firms (including business incubators) SO 1 - Strengthen the market position of SMEs (grants) Ø Micro-enterprises (de minimis, 25. 000 - 200. 000 euro, 234 mil euro) ü Survival rate of microenterprises (the first 3 years) Ø Business incubators (de minimis for services/GBER for investments, 116 mil. euro)

PA 2 - Increasing the competitiveness of SMEs (3) Investment Priority 3 a – promoting entrepreneurship by facilitating the economic exploitation of new ideas and fostering the creation of new firms (including business incubators) SO 1 - Strengthen the market position of SMEs (grants) Ø Micro-enterprises (de minimis, 25. 000 - 200. 000 euro, 234 mil euro) ü Survival rate of microenterprises (the first 3 years) Ø Business incubators (de minimis for services/GBER for investments, 116 mil. euro)

PA 2 - Increasing the competitiveness of SMEs (4) q Investment priority 3 c — supporting the creation and the extension of advanced capacities for product and service development q SO 2 - Improve economic competitiveness in SMEs by increasing labour productivity q Grants and financial instruments identified by he ex-ante evaluation (art. 37 1303/2013) Ø SMES ( grant, GBER 200. 000 – 1 mil euro, 172 mil euro) ü Labour productivity in SMEs Ø Equity Fund (58 mil euro) – Funding Agreement with EIF to be signed Ø Portfolio Risk Sharing Loan (117 mil euro) – to be negotiated

PA 2 - Increasing the competitiveness of SMEs (4) q Investment priority 3 c — supporting the creation and the extension of advanced capacities for product and service development q SO 2 - Improve economic competitiveness in SMEs by increasing labour productivity q Grants and financial instruments identified by he ex-ante evaluation (art. 37 1303/2013) Ø SMES ( grant, GBER 200. 000 – 1 mil euro, 172 mil euro) ü Labour productivity in SMEs Ø Equity Fund (58 mil euro) – Funding Agreement with EIF to be signed Ø Portfolio Risk Sharing Loan (117 mil euro) – to be negotiated

PA 2 - Increasing the competitiveness of SMEs (5) q Types of activities Ø Construction / modernization and SMEs production / services spaces, including endowment with tangible and intangible assets; Ø Creation / modernization/ development of the business incubators/ accelerators, including development of related services; Ø implementation of the certification of products, services and processes; Ø promoting products and services, creation of sites for work, promoted product or service presentation Ø Specific activities for internalization process q Potential beneficiaries Ø SMEs - acting within the competitive fields identified within the National Strategy for Competitiveness and RDPs.

PA 2 - Increasing the competitiveness of SMEs (5) q Types of activities Ø Construction / modernization and SMEs production / services spaces, including endowment with tangible and intangible assets; Ø Creation / modernization/ development of the business incubators/ accelerators, including development of related services; Ø implementation of the certification of products, services and processes; Ø promoting products and services, creation of sites for work, promoted product or service presentation Ø Specific activities for internalization process q Potential beneficiaries Ø SMEs - acting within the competitive fields identified within the National Strategy for Competitiveness and RDPs.

SME Initiative (1): q Art. 39 (1303/2013) - MS may use the ERDF and EAFDR to provide a financial contribution to financial instruments, managed indirectly by the EC with implementation tasks entrusted to the EIB: Ø Uncapped guarantees instrument for portfolios of new SME loans; Ø Securitization of existing portfolios q SME Initiative – a Joint European Commission / EIB / EIF initiative q Aims to leverage private sector capital market investments in SMEs and reduce market fragmentations q No budgetary contributions from MS are required q An implementation option for COSME, Horizon 2020 and the ESIF 1 q MS make voluntarily available a designated amount of national ESIF allocations towards SMEI • 1 Common Provisions Regulation (CPR) governing the implementation of the ESIF allows ESIF contributions to be brought together with EU programmes managed directly by EIB/EIF for the achievement of the same policy objectives as EU instruments, using the same delivery mechanism and applying the same requirements. Differences apply only to the eligibility criteria related to the final beneficiaries.

SME Initiative (1): q Art. 39 (1303/2013) - MS may use the ERDF and EAFDR to provide a financial contribution to financial instruments, managed indirectly by the EC with implementation tasks entrusted to the EIB: Ø Uncapped guarantees instrument for portfolios of new SME loans; Ø Securitization of existing portfolios q SME Initiative – a Joint European Commission / EIB / EIF initiative q Aims to leverage private sector capital market investments in SMEs and reduce market fragmentations q No budgetary contributions from MS are required q An implementation option for COSME, Horizon 2020 and the ESIF 1 q MS make voluntarily available a designated amount of national ESIF allocations towards SMEI • 1 Common Provisions Regulation (CPR) governing the implementation of the ESIF allows ESIF contributions to be brought together with EU programmes managed directly by EIB/EIF for the achievement of the same policy objectives as EU instruments, using the same delivery mechanism and applying the same requirements. Differences apply only to the eligibility criteria related to the final beneficiaries.

SME Initiative (2): q TO 3 – enhancing the competitiveness of SMEs q Investment priority 3 d – supporting the capacity of SMEs to grow in regional, national and international markets, and to engage in innovation processes q SO: improve SME access to finance by addressing challenges that banks face: Ø Covering 60% of losses for defaulted loans (with no cap at portfolio level), addresses credit risk and/or lack of collateral at the SME level Ø Providing capital relief to the banks due to the involvement of EIF (0% risk weighting on the guaranteed part of each loan under CRD IV), addresses regulatory capital scarcity at the banks’ level q Result indicator – proportion of credit requests approved

SME Initiative (2): q TO 3 – enhancing the competitiveness of SMEs q Investment priority 3 d – supporting the capacity of SMEs to grow in regional, national and international markets, and to engage in innovation processes q SO: improve SME access to finance by addressing challenges that banks face: Ø Covering 60% of losses for defaulted loans (with no cap at portfolio level), addresses credit risk and/or lack of collateral at the SME level Ø Providing capital relief to the banks due to the involvement of EIF (0% risk weighting on the guaranteed part of each loan under CRD IV), addresses regulatory capital scarcity at the banks’ level q Result indicator – proportion of credit requests approved

SME Initiative (3): q Improvement in the access to finance for SMEs is materialised through: Ø Attractive guarantee pricing due to zero pricing on the ESIF first-loss contribution, attractive pricing for the ESIF second-loss contribution and EIB Group’s competitive pricing Ø Higher-risk SMEs gaining access to credit, reduced collateral requirements and/or improved pricing Ø More flexible eligibility criteria: no geographical restrictions will apply, working capital may be financed, credit line facilities will be permitted q Constraints: Ø Does not provide liquidity to the banks (but could be combined with e. g. EIB funding) Ø Covers only new loans Ø Provides gradual capital relief to banks as portfolios of new SME loans are being built up

SME Initiative (3): q Improvement in the access to finance for SMEs is materialised through: Ø Attractive guarantee pricing due to zero pricing on the ESIF first-loss contribution, attractive pricing for the ESIF second-loss contribution and EIB Group’s competitive pricing Ø Higher-risk SMEs gaining access to credit, reduced collateral requirements and/or improved pricing Ø More flexible eligibility criteria: no geographical restrictions will apply, working capital may be financed, credit line facilities will be permitted q Constraints: Ø Does not provide liquidity to the banks (but could be combined with e. g. EIB funding) Ø Covers only new loans Ø Provides gradual capital relief to banks as portfolios of new SME loans are being built up

SME Initiative (4): Benefits to Member States q Reduced interest rate and collateral requirements: SMEI earmarks bank credit to SMEs, while the originating bank will have to clearly demonstrate the transfer of benefits to SMEs by accepting riskier clients (start-ups, young companies, low scoring companies, etc. ), reducing collateral requirements and interest rates spreads. q Favorable pricing: SMEI is very attractive due to the zero pricing of ESIF contributions for the expected portfolio losses (junior tranche) and the competitive EIB Group pricing for the mezzanine and senior tranches. The guarantee pricing should be seen as a crisis time measure encouraging lending within a short time span. q Strong multiplier effects: The SMEI is supposed to scale up available resources and ensure swift and critical market impact. Contributions from MS’ national funds are not required, while EIB Group’s own resources commitment should bring greater leverage and more liquid markets. q Substantial capital relief: Guarantees under SMEI will take up 60% of the risk on each SME loan from the originating banks thus providing a corresponding amount of capital relief due to the 0% risk weighting of EIF.

SME Initiative (4): Benefits to Member States q Reduced interest rate and collateral requirements: SMEI earmarks bank credit to SMEs, while the originating bank will have to clearly demonstrate the transfer of benefits to SMEs by accepting riskier clients (start-ups, young companies, low scoring companies, etc. ), reducing collateral requirements and interest rates spreads. q Favorable pricing: SMEI is very attractive due to the zero pricing of ESIF contributions for the expected portfolio losses (junior tranche) and the competitive EIB Group pricing for the mezzanine and senior tranches. The guarantee pricing should be seen as a crisis time measure encouraging lending within a short time span. q Strong multiplier effects: The SMEI is supposed to scale up available resources and ensure swift and critical market impact. Contributions from MS’ national funds are not required, while EIB Group’s own resources commitment should bring greater leverage and more liquid markets. q Substantial capital relief: Guarantees under SMEI will take up 60% of the risk on each SME loan from the originating banks thus providing a corresponding amount of capital relief due to the 0% risk weighting of EIF.

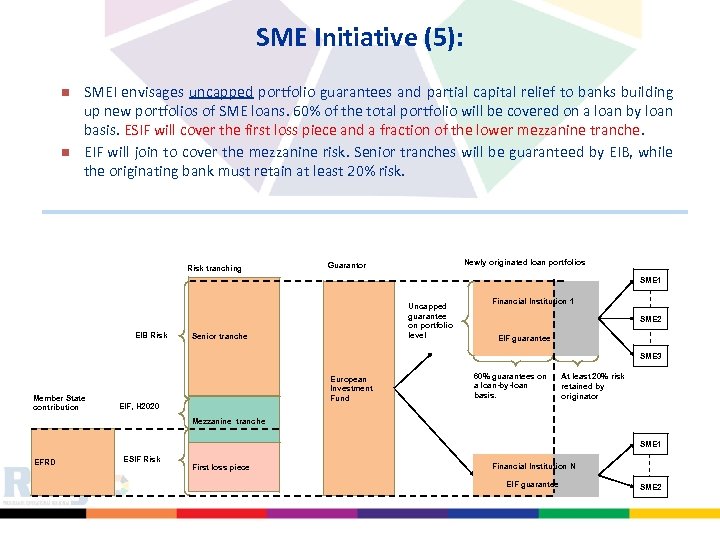

SME Initiative (5): n n SMEI envisages uncapped portfolio guarantees and partial capital relief to banks building up new portfolios of SME loans. 60% of the total portfolio will be covered on a loan by loan basis. ESIF will cover the first loss piece and a fraction of the lower mezzanine tranche. EIF will join to cover the mezzanine risk. Senior tranches will be guaranteed by EIB, while the originating bank must retain at least 20% risk. Risk tranching Newly originated loan portfolios Guarantor SME 1 EIB Risk Uncapped guarantee on portfolio level Senior tranche Financial Institution 1 SME 2 EIF guarantee SME 3 Member State contribution European Investment Fund EIF, H 2020 60% guarantees on a loan-by-loan basis. At least 20% risk retained by originator Mezzanine tranche SME 1 EFRD ESIF Risk First loss piece Financial Institution N EIF guarantee SME 2

SME Initiative (5): n n SMEI envisages uncapped portfolio guarantees and partial capital relief to banks building up new portfolios of SME loans. 60% of the total portfolio will be covered on a loan by loan basis. ESIF will cover the first loss piece and a fraction of the lower mezzanine tranche. EIF will join to cover the mezzanine risk. Senior tranches will be guaranteed by EIB, while the originating bank must retain at least 20% risk. Risk tranching Newly originated loan portfolios Guarantor SME 1 EIB Risk Uncapped guarantee on portfolio level Senior tranche Financial Institution 1 SME 2 EIF guarantee SME 3 Member State contribution European Investment Fund EIF, H 2020 60% guarantees on a loan-by-loan basis. At least 20% risk retained by originator Mezzanine tranche SME 1 EFRD ESIF Risk First loss piece Financial Institution N EIF guarantee SME 2

SME Initiative in Romania (6) q Memorandum of the Government: Participation of Romania in SME Initiative from ERDF allocation (8 July 2015) - 100 mil. Euro; q Modification of Partnership Agreement/ROP 2014 – 2020 in order to include the new OP; q The elaboration, negotiation and approval of SMEI OP (23. 03. 2016); q The signature of the Funding Agreement between Romania and EIF and of the Intercreditor Agreement between Romania, EIF, EIB and EC (20. 10. 2016); q First meeting of the Monitoring Committee and Investment Board (20. 10. 2016) q Launching the call of expression of interest to select financial intermediaries (21. 10. 2016) – deadline 31 March 2017 q Designing and approval of de minimis scheme (April 2017) q Signing of the first operational contract – 5 May 2017. Signature event with all the financial intermediaries selected – 21 June 2017.

SME Initiative in Romania (6) q Memorandum of the Government: Participation of Romania in SME Initiative from ERDF allocation (8 July 2015) - 100 mil. Euro; q Modification of Partnership Agreement/ROP 2014 – 2020 in order to include the new OP; q The elaboration, negotiation and approval of SMEI OP (23. 03. 2016); q The signature of the Funding Agreement between Romania and EIF and of the Intercreditor Agreement between Romania, EIF, EIB and EC (20. 10. 2016); q First meeting of the Monitoring Committee and Investment Board (20. 10. 2016) q Launching the call of expression of interest to select financial intermediaries (21. 10. 2016) – deadline 31 March 2017 q Designing and approval of de minimis scheme (April 2017) q Signing of the first operational contract – 5 May 2017. Signature event with all the financial intermediaries selected – 21 June 2017.

Thank you! Ministry of Regional Development, Public Administration and European Funds The Managing Authority for the ROP Tel: 0372 11 1661, Fax: 0372 111 630 email: madalina. istrate@mdrap. ro

Thank you! Ministry of Regional Development, Public Administration and European Funds The Managing Authority for the ROP Tel: 0372 11 1661, Fax: 0372 111 630 email: madalina. istrate@mdrap. ro