dec50d5428fdb3d717c7ae1e54ef72b9.ppt

- Количество слайдов: 27

Competitive Strategies: Modes of Entry and FDI © Professor Daniel F. Spulber

Competitive Strategies: Modes of Entry and FDI © Professor Daniel F. Spulber

Enron India What risks did Enron face going into the Dabhol project? • Political risk: expropriation of investment • Political risk: renegotiation of contracts after investment • Contract risk: problems with local partners • Currency risk • Market risk: costs of energy and demand for electric power • Recovery of investment costs (FDI) 2

Enron India What risks did Enron face going into the Dabhol project? • Political risk: expropriation of investment • Political risk: renegotiation of contracts after investment • Contract risk: problems with local partners • Currency risk • Market risk: costs of energy and demand for electric power • Recovery of investment costs (FDI) 2

Enron India How did Enron prepare for the risks of the project? • Long term contracts: purchase agreement, Maharashtra State Electrical Board was a credible buyer • Political risk: participation of Overseas Private Investment Corp, US Export. Import Bank, International Finance Corp. • Revenues tied to US dollar • Partners GE and Bechtel • Substantial research 3

Enron India How did Enron prepare for the risks of the project? • Long term contracts: purchase agreement, Maharashtra State Electrical Board was a credible buyer • Political risk: participation of Overseas Private Investment Corp, US Export. Import Bank, International Finance Corp. • Revenues tied to US dollar • Partners GE and Bechtel • Substantial research 3

Enron India How could Enron have dealt with risk more effectively? • Enron could have relied less on FDI • Enron could have emphasized transactions, making arrangements for construction, power supply contracts, and technology transfer • More reliance on local partners to construct and operate project • Greater participation of other Indian institutions 4

Enron India How could Enron have dealt with risk more effectively? • Enron could have relied less on FDI • Enron could have emphasized transactions, making arrangements for construction, power supply contracts, and technology transfer • More reliance on local partners to construct and operate project • Greater participation of other Indian institutions 4

Enron India Why did Enron choose ownership (FDI)? • To exercise control over assets in investment projects • To control technology due to limits on intellectual property rights • To improve operational effectiveness • To learn about market for future projects • To avoid expected contract risk 5

Enron India Why did Enron choose ownership (FDI)? • To exercise control over assets in investment projects • To control technology due to limits on intellectual property rights • To improve operational effectiveness • To learn about market for future projects • To avoid expected contract risk 5

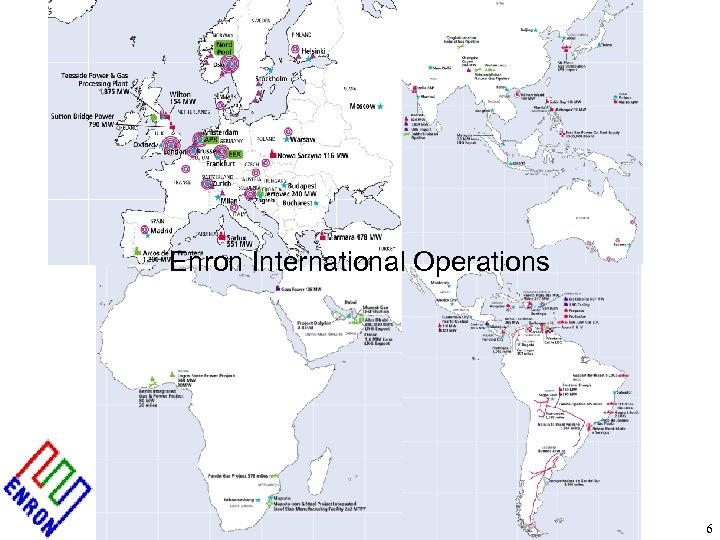

Enron International Operations 6

Enron International Operations 6

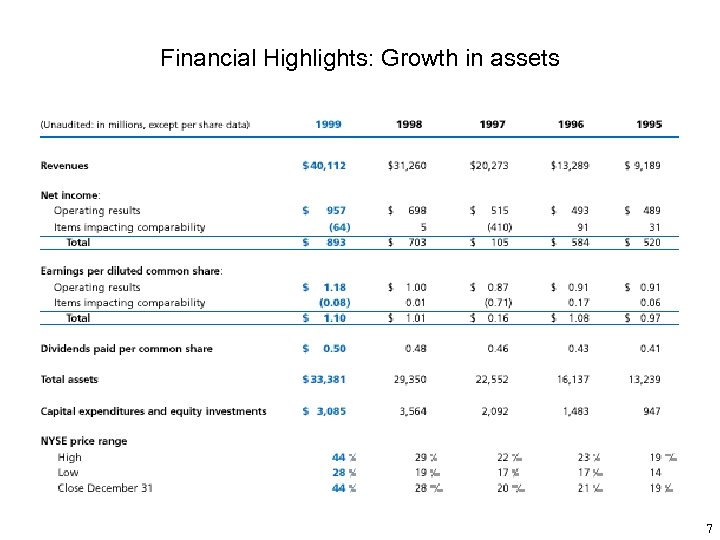

Financial Highlights: Growth in assets 7

Financial Highlights: Growth in assets 7

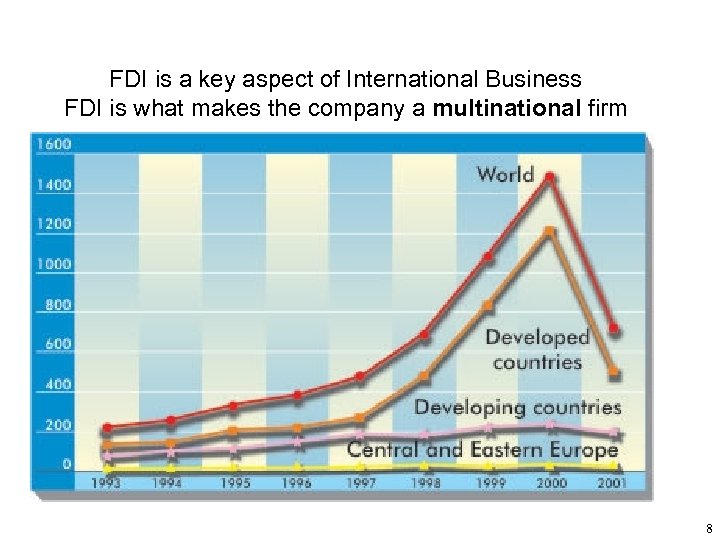

FDI is a key aspect of International Business FDI is what makes the company a multinational firm 8

FDI is a key aspect of International Business FDI is what makes the company a multinational firm 8

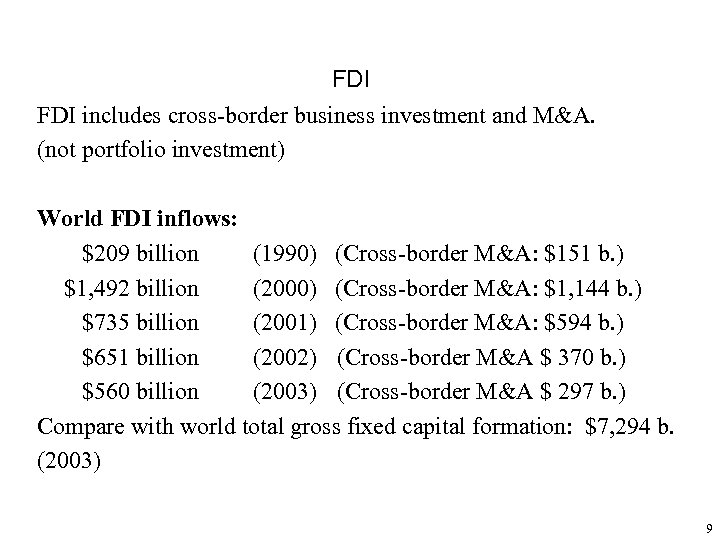

FDI includes cross-border business investment and M&A. (not portfolio investment) World FDI inflows: $209 billion (1990) (Cross-border M&A: $151 b. ) $1, 492 billion (2000) (Cross-border M&A: $1, 144 b. ) $735 billion (2001) (Cross-border M&A: $594 b. ) $651 billion (2002) (Cross-border M&A $ 370 b. ) $560 billion (2003) (Cross-border M&A $ 297 b. ) Compare with world total gross fixed capital formation: $7, 294 b. (2003) 9

FDI includes cross-border business investment and M&A. (not portfolio investment) World FDI inflows: $209 billion (1990) (Cross-border M&A: $151 b. ) $1, 492 billion (2000) (Cross-border M&A: $1, 144 b. ) $735 billion (2001) (Cross-border M&A: $594 b. ) $651 billion (2002) (Cross-border M&A $ 370 b. ) $560 billion (2003) (Cross-border M&A $ 297 b. ) Compare with world total gross fixed capital formation: $7, 294 b. (2003) 9

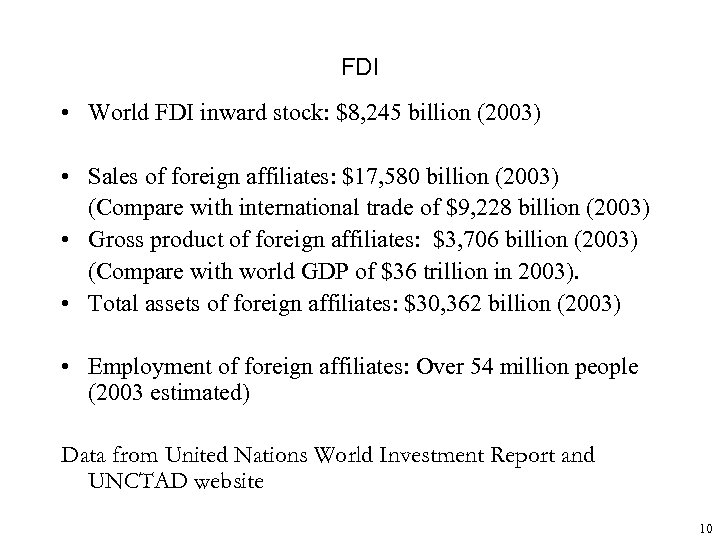

FDI • World FDI inward stock: $8, 245 billion (2003) • Sales of foreign affiliates: $17, 580 billion (2003) (Compare with international trade of $9, 228 billion (2003) • Gross product of foreign affiliates: $3, 706 billion (2003) (Compare with world GDP of $36 trillion in 2003). • Total assets of foreign affiliates: $30, 362 billion (2003) • Employment of foreign affiliates: Over 54 million people (2003 estimated) Data from United Nations World Investment Report and UNCTAD website 10

FDI • World FDI inward stock: $8, 245 billion (2003) • Sales of foreign affiliates: $17, 580 billion (2003) (Compare with international trade of $9, 228 billion (2003) • Gross product of foreign affiliates: $3, 706 billion (2003) (Compare with world GDP of $36 trillion in 2003). • Total assets of foreign affiliates: $30, 362 billion (2003) • Employment of foreign affiliates: Over 54 million people (2003 estimated) Data from United Nations World Investment Report and UNCTAD website 10

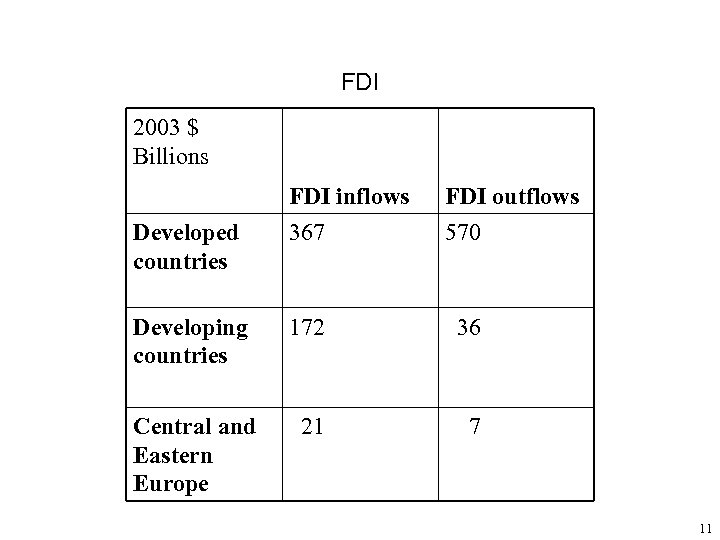

FDI 2003 $ Billions Developed countries FDI inflows 367 FDI outflows 570 Developing countries 172 36 Central and Eastern Europe 21 7 11

FDI 2003 $ Billions Developed countries FDI inflows 367 FDI outflows 570 Developing countries 172 36 Central and Eastern Europe 21 7 11

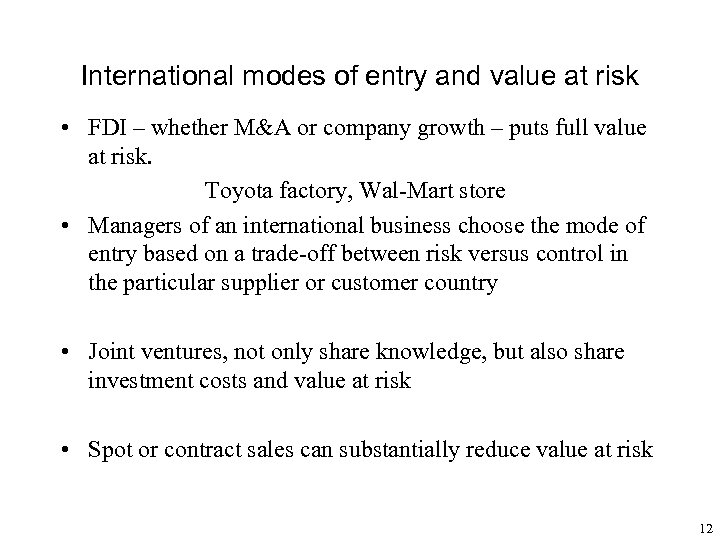

International modes of entry and value at risk • FDI – whether M&A or company growth – puts full value at risk. Toyota factory, Wal-Mart store • Managers of an international business choose the mode of entry based on a trade-off between risk versus control in the particular supplier or customer country • Joint ventures, not only share knowledge, but also share investment costs and value at risk • Spot or contract sales can substantially reduce value at risk 12

International modes of entry and value at risk • FDI – whether M&A or company growth – puts full value at risk. Toyota factory, Wal-Mart store • Managers of an international business choose the mode of entry based on a trade-off between risk versus control in the particular supplier or customer country • Joint ventures, not only share knowledge, but also share investment costs and value at risk • Spot or contract sales can substantially reduce value at risk 12

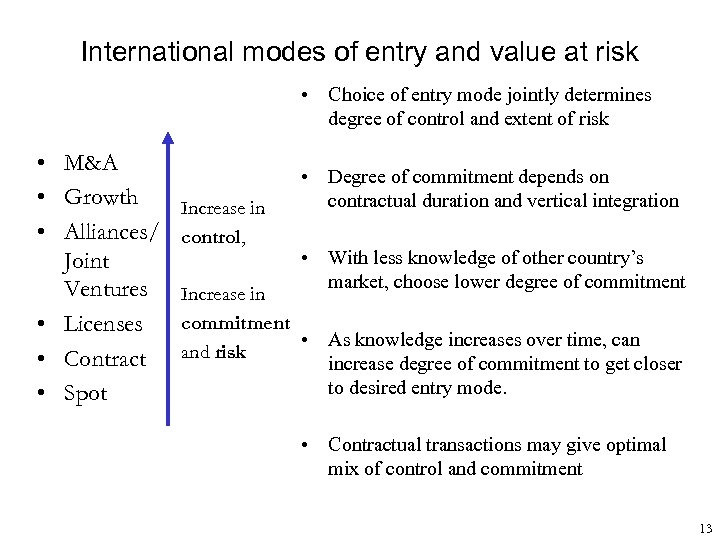

International modes of entry and value at risk • Choice of entry mode jointly determines degree of control and extent of risk • M&A • Growth • Alliances/ Joint Ventures • Licenses • Contract • Spot Increase in control, • Degree of commitment depends on contractual duration and vertical integration • With less knowledge of other country’s market, choose lower degree of commitment Increase in commitment • As knowledge increases over time, can and risk increase degree of commitment to get closer to desired entry mode. • Contractual transactions may give optimal mix of control and commitment 13

International modes of entry and value at risk • Choice of entry mode jointly determines degree of control and extent of risk • M&A • Growth • Alliances/ Joint Ventures • Licenses • Contract • Spot Increase in control, • Degree of commitment depends on contractual duration and vertical integration • With less knowledge of other country’s market, choose lower degree of commitment Increase in commitment • As knowledge increases over time, can and risk increase degree of commitment to get closer to desired entry mode. • Contractual transactions may give optimal mix of control and commitment 13

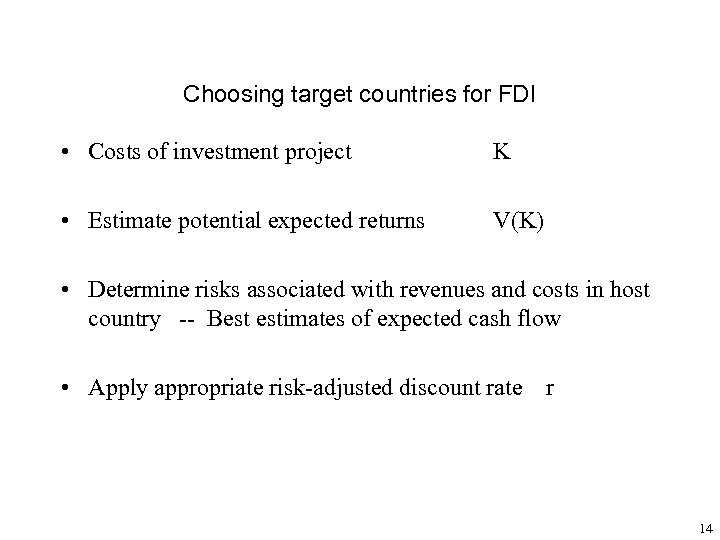

Choosing target countries for FDI • Costs of investment project K • Estimate potential expected returns V(K) • Determine risks associated with revenues and costs in host country -- Best estimates of expected cash flow • Apply appropriate risk-adjusted discount rate r 14

Choosing target countries for FDI • Costs of investment project K • Estimate potential expected returns V(K) • Determine risks associated with revenues and costs in host country -- Best estimates of expected cash flow • Apply appropriate risk-adjusted discount rate r 14

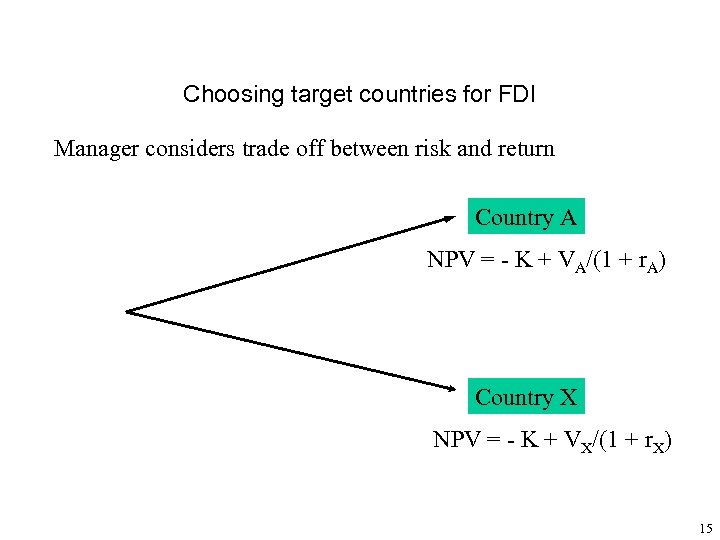

Choosing target countries for FDI Manager considers trade off between risk and return Country A NPV = - K + VA/(1 + r. A) Country X NPV = - K + VX/(1 + r. X) 15

Choosing target countries for FDI Manager considers trade off between risk and return Country A NPV = - K + VA/(1 + r. A) Country X NPV = - K + VX/(1 + r. X) 15

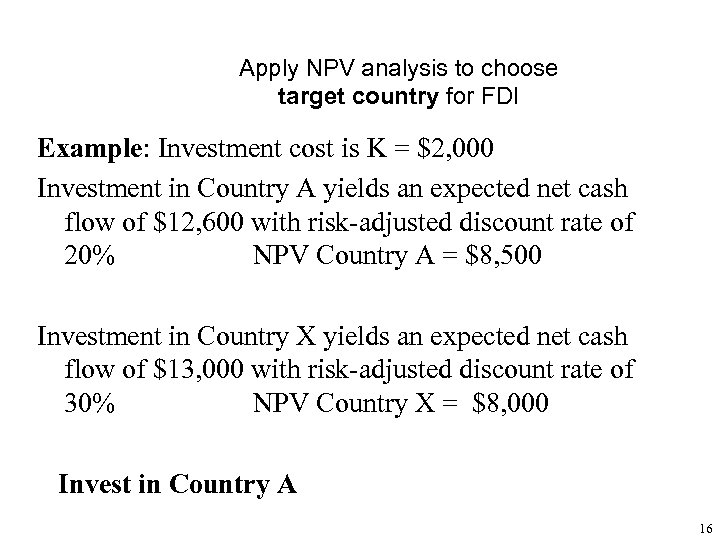

Apply NPV analysis to choose target country for FDI Example: Investment cost is K = $2, 000 Investment in Country A yields an expected net cash flow of $12, 600 with risk-adjusted discount rate of 20% NPV Country A = $8, 500 Investment in Country X yields an expected net cash flow of $13, 000 with risk-adjusted discount rate of 30% NPV Country X = $8, 000 Invest in Country A 16

Apply NPV analysis to choose target country for FDI Example: Investment cost is K = $2, 000 Investment in Country A yields an expected net cash flow of $12, 600 with risk-adjusted discount rate of 20% NPV Country A = $8, 500 Investment in Country X yields an expected net cash flow of $13, 000 with risk-adjusted discount rate of 30% NPV Country X = $8, 000 Invest in Country A 16

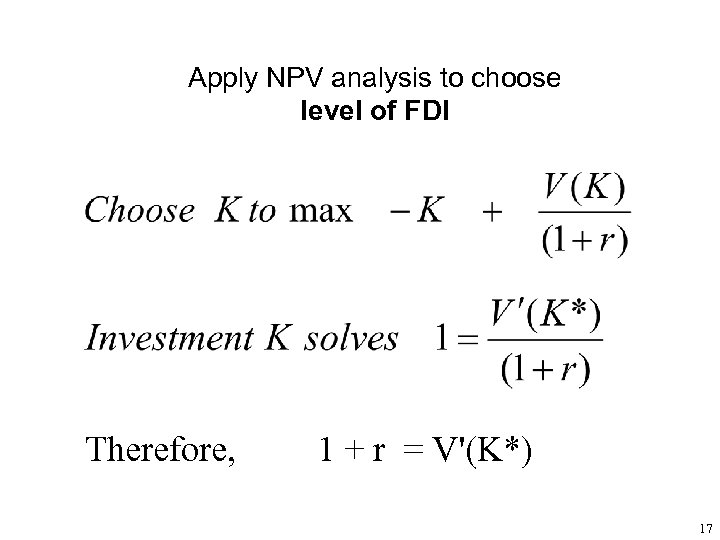

Apply NPV analysis to choose level of FDI Therefore, 1 + r = V'(K*) 17

Apply NPV analysis to choose level of FDI Therefore, 1 + r = V'(K*) 17

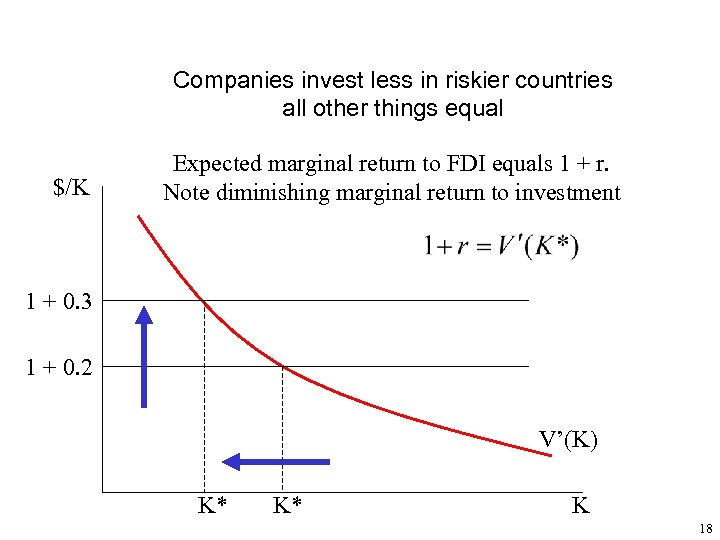

Companies invest less in riskier countries all other things equal $/K Expected marginal return to FDI equals 1 + r. Note diminishing marginal return to investment 1 + 0. 3 1 + 0. 2 V’(K) K* K* K 18

Companies invest less in riskier countries all other things equal $/K Expected marginal return to FDI equals 1 + r. Note diminishing marginal return to investment 1 + 0. 3 1 + 0. 2 V’(K) K* K* K 18

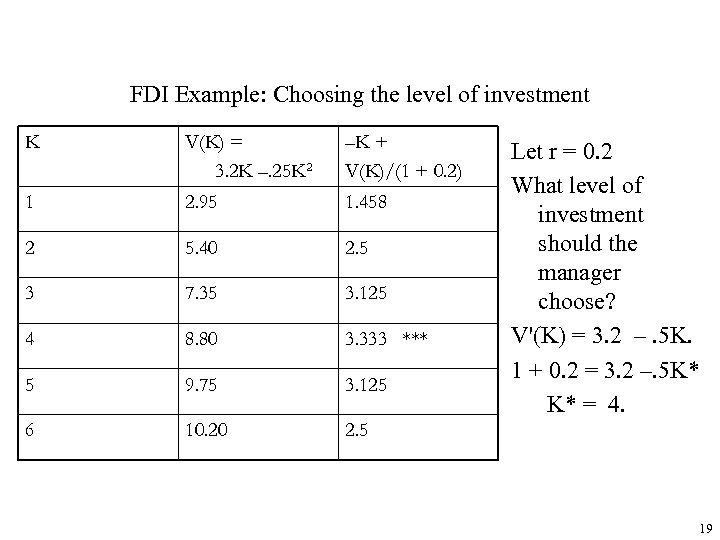

FDI Example: Choosing the level of investment K V(K) = 3. 2 K –. 25 K 2 –K + V(K)/(1 + 0. 2) 1 2. 95 1. 458 2 5. 40 2. 5 3 7. 35 3. 125 4 8. 80 3. 333 *** 5 9. 75 3. 125 6 10. 20 2. 5 Let r = 0. 2 What level of investment should the manager choose? V'(K) = 3. 2 –. 5 K. 1 + 0. 2 = 3. 2 –. 5 K* K* = 4. 19

FDI Example: Choosing the level of investment K V(K) = 3. 2 K –. 25 K 2 –K + V(K)/(1 + 0. 2) 1 2. 95 1. 458 2 5. 40 2. 5 3 7. 35 3. 125 4 8. 80 3. 333 *** 5 9. 75 3. 125 6 10. 20 2. 5 Let r = 0. 2 What level of investment should the manager choose? V'(K) = 3. 2 –. 5 K. 1 + 0. 2 = 3. 2 –. 5 K* K* = 4. 19

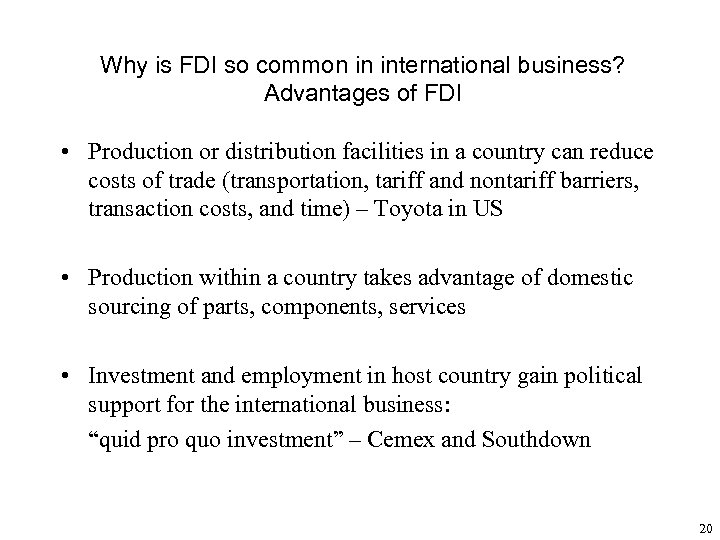

Why is FDI so common in international business? Advantages of FDI • Production or distribution facilities in a country can reduce costs of trade (transportation, tariff and nontariff barriers, transaction costs, and time) – Toyota in US • Production within a country takes advantage of domestic sourcing of parts, components, services • Investment and employment in host country gain political support for the international business: “quid pro quo investment” – Cemex and Southdown 20

Why is FDI so common in international business? Advantages of FDI • Production or distribution facilities in a country can reduce costs of trade (transportation, tariff and nontariff barriers, transaction costs, and time) – Toyota in US • Production within a country takes advantage of domestic sourcing of parts, components, services • Investment and employment in host country gain political support for the international business: “quid pro quo investment” – Cemex and Southdown 20

Why is FDI so common in international business? Advantages of FDI • Closer to customers for manufacturers • Necessary for retail and wholesale companies – Wal Mart, Carrefour, Ingram Micro • Take advantage of low-cost labor, highly-skilled labor, and proximity to resources • Reduce costs of trade from import/export 21

Why is FDI so common in international business? Advantages of FDI • Closer to customers for manufacturers • Necessary for retail and wholesale companies – Wal Mart, Carrefour, Ingram Micro • Take advantage of low-cost labor, highly-skilled labor, and proximity to resources • Reduce costs of trade from import/export 21

Advantages of vertical FDI • Coordination advantages through the value chain • Access to production facilities, sourcing networks and distribution networks • Keeping technology and intellectual property in-house • Substitution of internal transactions for market transactions 22

Advantages of vertical FDI • Coordination advantages through the value chain • Access to production facilities, sourcing networks and distribution networks • Keeping technology and intellectual property in-house • Substitution of internal transactions for market transactions 22

Advantages of Horizontal FDI • M&A acquisition of competitors for market power or cost savings • M&A to achieve economies of scale and scope (Daimler/Chrysler, VW) • M&A to purchase of technology • M&A to acquire brand names • Production avoids costs of trade relative to export • As hedge against demand supply fluctuations -- Cemex • Market power in international purchasing (e. g. Vodaphone/Airtouch purchases wireless equipment for its many operations) 23

Advantages of Horizontal FDI • M&A acquisition of competitors for market power or cost savings • M&A to achieve economies of scale and scope (Daimler/Chrysler, VW) • M&A to purchase of technology • M&A to acquire brand names • Production avoids costs of trade relative to export • As hedge against demand supply fluctuations -- Cemex • Market power in international purchasing (e. g. Vodaphone/Airtouch purchases wireless equipment for its many operations) 23

Disadvantages of FDI • Risk that firm many not recover investment and returns to investment in supplier country • FDI increases capital investment, reduces flexibility • FDI ties business to particular country locations for production or distribution • Vertical FDI makes the firm more vertically integrated 24

Disadvantages of FDI • Risk that firm many not recover investment and returns to investment in supplier country • FDI increases capital investment, reduces flexibility • FDI ties business to particular country locations for production or distribution • Vertical FDI makes the firm more vertically integrated 24

FDI Trends • Shift of investment mix toward services About half in 1990, about two thirds in 2000 • Shift of investment to outsourcing abroad (offshoring + outsourcing) – reduction in vertical integration • Globalization (lower costs of trade) leading to reduction in vertical FDI • Globalization (market integration) likely to lead to increases in horizontal FDI UNCTAD World Investment Report 2004 25

FDI Trends • Shift of investment mix toward services About half in 1990, about two thirds in 2000 • Shift of investment to outsourcing abroad (offshoring + outsourcing) – reduction in vertical integration • Globalization (lower costs of trade) leading to reduction in vertical FDI • Globalization (market integration) likely to lead to increases in horizontal FDI UNCTAD World Investment Report 2004 25

Licensing versus FDI Why is FDI more prevalent than technology licensing? • Licensing agreements depend heavily on international enforcement of intellectual property rights • International licensing also entails costs of trade • International licensing is quite common amongst developed countries, reaching levels up to 1/3 of domestic R&D expenditures • International licensing experiencing rapid growth 26

Licensing versus FDI Why is FDI more prevalent than technology licensing? • Licensing agreements depend heavily on international enforcement of intellectual property rights • International licensing also entails costs of trade • International licensing is quite common amongst developed countries, reaching levels up to 1/3 of domestic R&D expenditures • International licensing experiencing rapid growth 26

Overview and Take-Away Points • FDI a major feature of international business – composition of FDI undergoing transformation – from vertical to horizontal • FDI offers advantages in terms of ownership and control and avoiding trade barriers • Choose target countries based on expected cash flow and costs of investment and discount using risk adjusted rate of return • Adjust level of investment to reflect expected cash flow and risk-adjusted rate of return 27

Overview and Take-Away Points • FDI a major feature of international business – composition of FDI undergoing transformation – from vertical to horizontal • FDI offers advantages in terms of ownership and control and avoiding trade barriers • Choose target countries based on expected cash flow and costs of investment and discount using risk adjusted rate of return • Adjust level of investment to reflect expected cash flow and risk-adjusted rate of return 27