554a0af6807c09d285b57f4eef7d45cb.ppt

- Количество слайдов: 11

Competitive Intelligence

Competitive Intelligence

AGENDA • What Coalition does • Competitive Intelligence – why, who and what value? • Case Study • Summary • Q&A

AGENDA • What Coalition does • Competitive Intelligence – why, who and what value? • Case Study • Summary • Q&A

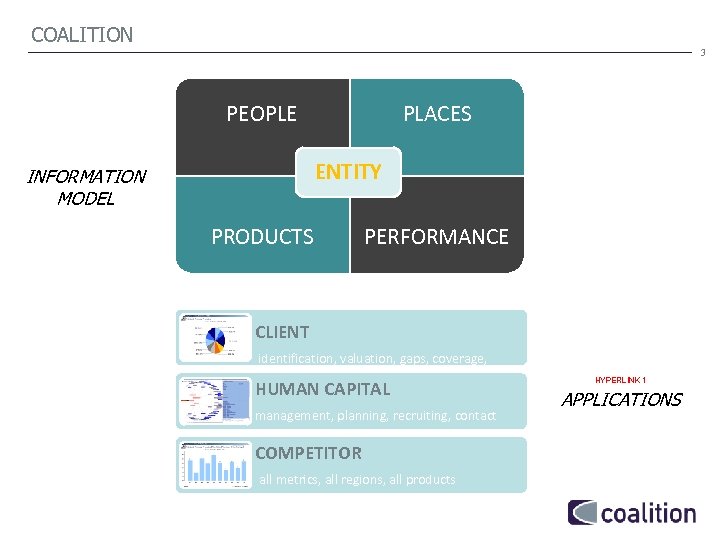

COALITION 3 PEOPLE PLACES ENTITY INFORMATION MODEL PRODUCTS PERFORMANCE CLIENT identification, valuation, gaps, coverage, contact HUMAN CAPITAL management, planning, recruiting, contact COMPETITOR all metrics, all regions, all products HYPERLINK 1 APPLICATIONS

COALITION 3 PEOPLE PLACES ENTITY INFORMATION MODEL PRODUCTS PERFORMANCE CLIENT identification, valuation, gaps, coverage, contact HUMAN CAPITAL management, planning, recruiting, contact COMPETITOR all metrics, all regions, all products HYPERLINK 1 APPLICATIONS

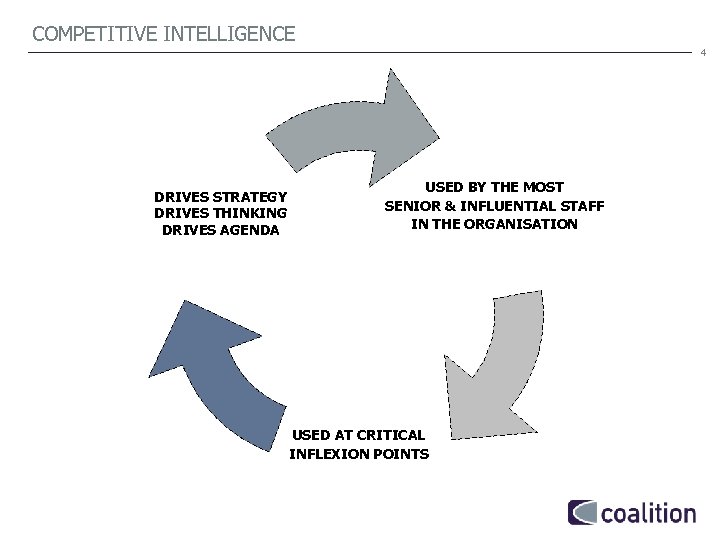

COMPETITIVE INTELLIGENCE 4 DRIVES STRATEGY DRIVES THINKING DRIVES AGENDA USED BY THE MOST SENIOR & INFLUENTIAL STAFF IN THE ORGANISATION USED AT CRITICAL INFLEXION POINTS

COMPETITIVE INTELLIGENCE 4 DRIVES STRATEGY DRIVES THINKING DRIVES AGENDA USED BY THE MOST SENIOR & INFLUENTIAL STAFF IN THE ORGANISATION USED AT CRITICAL INFLEXION POINTS

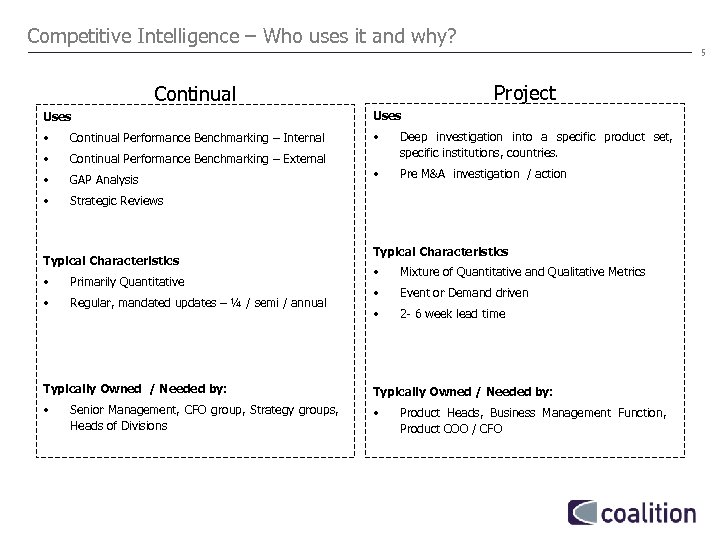

Competitive Intelligence – Who uses it and why? 5 Project Continual Uses • Continual Performance Benchmarking – Internal • • Continual Performance Benchmarking – External Deep investigation into a specific product set, specific institutions, countries. • GAP Analysis • Pre M&A investigation / action • Strategic Reviews Typical Characteristics • Primarily Quantitative • Regular, mandated updates – ¼ / semi / annual Typical Characteristics • Mixture of Quantitative and Qualitative Metrics • Event or Demand driven • 2 - 6 week lead time Typically Owned / Needed by: • • Senior Management, CFO group, Strategy groups, Heads of Divisions Product Heads, Business Management Function, Product COO / CFO

Competitive Intelligence – Who uses it and why? 5 Project Continual Uses • Continual Performance Benchmarking – Internal • • Continual Performance Benchmarking – External Deep investigation into a specific product set, specific institutions, countries. • GAP Analysis • Pre M&A investigation / action • Strategic Reviews Typical Characteristics • Primarily Quantitative • Regular, mandated updates – ¼ / semi / annual Typical Characteristics • Mixture of Quantitative and Qualitative Metrics • Event or Demand driven • 2 - 6 week lead time Typically Owned / Needed by: • • Senior Management, CFO group, Strategy groups, Heads of Divisions Product Heads, Business Management Function, Product COO / CFO

Case Study - Project “Sequent” 6 THE ASK Investment Bank A wanted to explore the options available to them in establishing a major presence in Russia Step 1 – Needs Assessment Step 2 – Define the Metrics At a MACRO level the client wanted a data map of the region that allowed them to assess the overall value (in revenue terms) of the market in Credit Cards, Investment Banking (Primary and Secondary) and Commercial banking. MACRO At an ACTION level the client was focussed on the Investment Banking segment as the first step in their expansion in the region ACTION Options open to the client were defined as Organic growth Joint Venture / Minority Purchase with existing domestic entity Acquisition of domestic entity High Level view of revenue and opportunities in Credit Cards and Commercial Banking Organic Growth : Map 4 Major Peers across : People, Places , Products , Performance Joint Venture : Track performance of the existing peer owned 2 relevant JV’s - quantitative and qualitative Acquisition: 4 Domestic entities fit the profile - People, Places, Products , Performance

Case Study - Project “Sequent” 6 THE ASK Investment Bank A wanted to explore the options available to them in establishing a major presence in Russia Step 1 – Needs Assessment Step 2 – Define the Metrics At a MACRO level the client wanted a data map of the region that allowed them to assess the overall value (in revenue terms) of the market in Credit Cards, Investment Banking (Primary and Secondary) and Commercial banking. MACRO At an ACTION level the client was focussed on the Investment Banking segment as the first step in their expansion in the region ACTION Options open to the client were defined as Organic growth Joint Venture / Minority Purchase with existing domestic entity Acquisition of domestic entity High Level view of revenue and opportunities in Credit Cards and Commercial Banking Organic Growth : Map 4 Major Peers across : People, Places , Products , Performance Joint Venture : Track performance of the existing peer owned 2 relevant JV’s - quantitative and qualitative Acquisition: 4 Domestic entities fit the profile - People, Places, Products , Performance

Case Study – Project “Sequent” 7 THE DATA Investment Bank A wanted to explore the options available to them in establishing a major presence in Russia Step 3 – Standard Data Sources PUBLIC DOMAIN FSA register, NASD register, Annual Report and Accounts, Websites, Publicity material, Press releases, Trade Journals, Investor Conferences, 10 k’s, 10 Q’s Step 3 a – Bespoke Data Sources PUBLIC DOMAIN + Russian Central Bank, local social websites, local business journals, specialist regional publications IN-HOUSE Knowledge holders, thought leaders Identified 44 key ‘knowledge holders ‘nternally COMMISIONED RESEARCH COALITION RESEARCH NETWORK 2 X Domestic Financial Business Journalists

Case Study – Project “Sequent” 7 THE DATA Investment Bank A wanted to explore the options available to them in establishing a major presence in Russia Step 3 – Standard Data Sources PUBLIC DOMAIN FSA register, NASD register, Annual Report and Accounts, Websites, Publicity material, Press releases, Trade Journals, Investor Conferences, 10 k’s, 10 Q’s Step 3 a – Bespoke Data Sources PUBLIC DOMAIN + Russian Central Bank, local social websites, local business journals, specialist regional publications IN-HOUSE Knowledge holders, thought leaders Identified 44 key ‘knowledge holders ‘nternally COMMISIONED RESEARCH COALITION RESEARCH NETWORK 2 X Domestic Financial Business Journalists

Case Study - Project “Sequent” 8 THE PROCESS Step 5 – Strawman Step 6 – Execution and Data Gathering - Sets and manages expectations from day one EXECUTION AND DATA GATHERING - Highlights areas of weakness / concern for data gathering - Central holding file – agreed ownership and rights - Layer Public and Internal knowledge - Commission bespoke research to gap fill / verify - Walk through … HYPERLINK 2 HYPERLINK 3

Case Study - Project “Sequent” 8 THE PROCESS Step 5 – Strawman Step 6 – Execution and Data Gathering - Sets and manages expectations from day one EXECUTION AND DATA GATHERING - Highlights areas of weakness / concern for data gathering - Central holding file – agreed ownership and rights - Layer Public and Internal knowledge - Commission bespoke research to gap fill / verify - Walk through … HYPERLINK 2 HYPERLINK 3

Case Study – Project “Sequent” 9 THE PRESENTATION NOTES THE OUTPUT BEFORE • Ensure all stakeholders have given feedback • HYPERLINK 4 Ensure any remaining “data differences” are reconciled or highlighted in advance DURING • Highlight methodology, limitations, error margins and any unreconciled data issues at the start • Use visuals / graphics • Leave plenty of time for Q&A HYPERLINK 5

Case Study – Project “Sequent” 9 THE PRESENTATION NOTES THE OUTPUT BEFORE • Ensure all stakeholders have given feedback • HYPERLINK 4 Ensure any remaining “data differences” are reconciled or highlighted in advance DURING • Highlight methodology, limitations, error margins and any unreconciled data issues at the start • Use visuals / graphics • Leave plenty of time for Q&A HYPERLINK 5

Summary 10 • How we look at Information • Benefits to your Company • Benefits to You • Basic Principles • Case Study

Summary 10 • How we look at Information • Benefits to your Company • Benefits to You • Basic Principles • Case Study

11 Q&A

11 Q&A