ab9b9a0ed06f202e11e729a9ebade99e.ppt

- Количество слайдов: 72

Compensation • Used to Serve Organizations Goals • Enhance Employee Needs but Create Profits • Relative Worth of Job • Significant Part of HRM • Formal Policy Essential

Compensation • Used to Serve Organizations Goals • Enhance Employee Needs but Create Profits • Relative Worth of Job • Significant Part of HRM • Formal Policy Essential

Compensation Policy Objectives • • To Reward Past Performance To Remain Competitive in Marketplace To Maintain Equity Among Employees To Motivate Future Performance To Maintain a Realistic Budget To Attract New Employees To Reduce Turnover

Compensation Policy Objectives • • To Reward Past Performance To Remain Competitive in Marketplace To Maintain Equity Among Employees To Motivate Future Performance To Maintain a Realistic Budget To Attract New Employees To Reduce Turnover

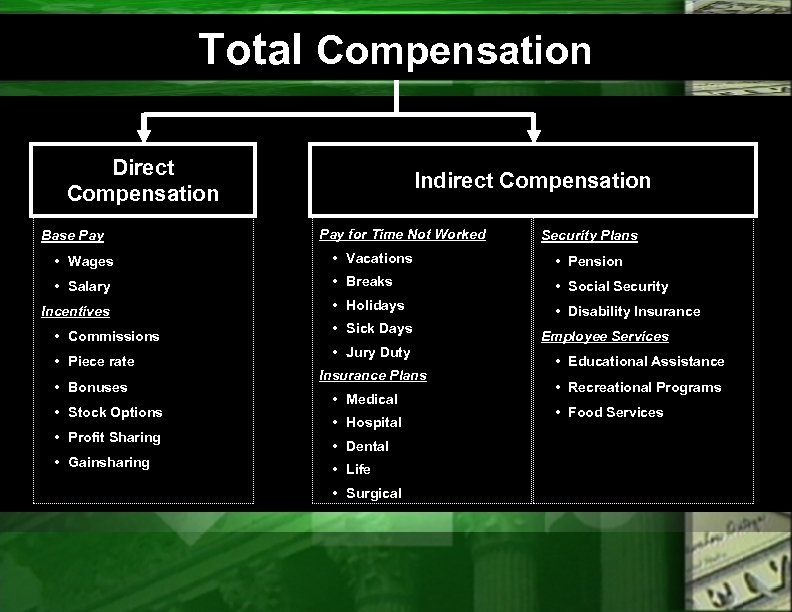

Total Compensation Direct Compensation Base Pay Indirect Compensation Pay for Time Not Worked Security Plans • Wages • Vacations • Pension • Salary • Breaks • Social Security • Holidays • Disability Insurance Incentives • Commissions • Piece rate • Bonuses • Stock Options • Profit Sharing • Gainsharing • Sick Days • Jury Duty Insurance Plans • Medical • Hospital • Dental • Life • Surgical Employee Services • Educational Assistance • Recreational Programs • Food Services

Total Compensation Direct Compensation Base Pay Indirect Compensation Pay for Time Not Worked Security Plans • Wages • Vacations • Pension • Salary • Breaks • Social Security • Holidays • Disability Insurance Incentives • Commissions • Piece rate • Bonuses • Stock Options • Profit Sharing • Gainsharing • Sick Days • Jury Duty Insurance Plans • Medical • Hospital • Dental • Life • Surgical Employee Services • Educational Assistance • Recreational Programs • Food Services

Compensation Policy Concerns • Pay a Fair Base Pay Rate • Reward Enhanced Performance

Compensation Policy Concerns • Pay a Fair Base Pay Rate • Reward Enhanced Performance

Pay-for-Performance Standard by which managers tie compensation to employee effort and performance.

Pay-for-Performance Standard by which managers tie compensation to employee effort and performance.

Pay-for-Performance Standard • • Merit Pay Cash Bonuses Incentive Pay Goal: Increase Performance 15 -35%

Pay-for-Performance Standard • • Merit Pay Cash Bonuses Incentive Pay Goal: Increase Performance 15 -35%

Pay Equity An employee’s perception that compensation received is equal to the value of the work performed.

Pay Equity An employee’s perception that compensation received is equal to the value of the work performed.

Motivating Value of Compensation • Pay Equity (Perception of fair value) • Pay Expectancy (Rewards, Received = Expected) • Pay Secrecy

Motivating Value of Compensation • Pay Equity (Perception of fair value) • Pay Expectancy (Rewards, Received = Expected) • Pay Secrecy

Bases for Compensation • • • Hourly Monthly Daily Annual Piecework Straight Commission

Bases for Compensation • • • Hourly Monthly Daily Annual Piecework Straight Commission

Hourly Work • Work paid on an hourly basis. HOUR

Hourly Work • Work paid on an hourly basis. HOUR

Piecework Work paid according to the number of units produced.

Piecework Work paid according to the number of units produced.

FLSA Classification of Compensation • Exempt (Management/Professional) • Non-Exempt (hourly) • Pay: 1. 5 times hourly rate over 40 hrs/week

FLSA Classification of Compensation • Exempt (Management/Professional) • Non-Exempt (hourly) • Pay: 1. 5 times hourly rate over 40 hrs/week

Exempt Employees not covered by the overtime provisions of the Fair Labor Standards Act. “Management”

Exempt Employees not covered by the overtime provisions of the Fair Labor Standards Act. “Management”

Nonexempt Employees covered by the overtime provisions of the Fair Labor Standards Act. “Labor”

Nonexempt Employees covered by the overtime provisions of the Fair Labor Standards Act. “Labor”

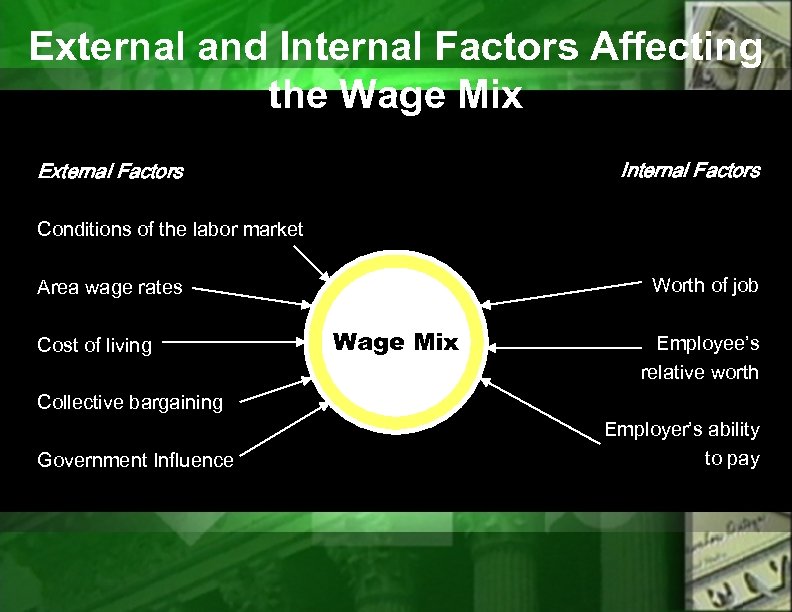

External and Internal Factors Affecting the Wage Mix Internal Factors External Factors Conditions of the labor market Worth of job Area wage rates Cost of living Wage Mix Employee’s relative worth Collective bargaining Government Influence Employer’s ability to pay

External and Internal Factors Affecting the Wage Mix Internal Factors External Factors Conditions of the labor market Worth of job Area wage rates Cost of living Wage Mix Employee’s relative worth Collective bargaining Government Influence Employer’s ability to pay

External Influences on Wage Rates • • • Labor Market Conditions Area Wage Rates (Surveys) Cost of Living (CPI Adjustments) Collective Bargaining Government

External Influences on Wage Rates • • • Labor Market Conditions Area Wage Rates (Surveys) Cost of Living (CPI Adjustments) Collective Bargaining Government

Internal Influences on Wage Rates • Worth of the Job • Employee's Relative Worth (merit) • Employer's Ability to Pay (competitiveness)

Internal Influences on Wage Rates • Worth of the Job • Employee's Relative Worth (merit) • Employer's Ability to Pay (competitiveness)

Consumer Price Index (CPI) • Measure of the average change in prices over time in a fixed “market basket” of goods and services. “Inflation Influence”

Consumer Price Index (CPI) • Measure of the average change in prices over time in a fixed “market basket” of goods and services. “Inflation Influence”

Escalator Clauses • Clauses in labor agreements that provide for quarterly cost -of-living adjustments in wages, basing the adjustments upon changes in the consumer price index.

Escalator Clauses • Clauses in labor agreements that provide for quarterly cost -of-living adjustments in wages, basing the adjustments upon changes in the consumer price index.

Real Wages • Wage increases larger than rises in the consumer price index; that is, the real earning power of wages.

Real Wages • Wage increases larger than rises in the consumer price index; that is, the real earning power of wages.

Job Evaluation Systematic process of determining the relative worth of jobs in order to establish which jobs should be paid more than others within an organization.

Job Evaluation Systematic process of determining the relative worth of jobs in order to establish which jobs should be paid more than others within an organization.

Job Evaluation • • Determine "Relative" Worth of Jobs Hierarchy of Jobs (ranking) Assign Pay Rates Purpose: Establish Internal Equity

Job Evaluation • • Determine "Relative" Worth of Jobs Hierarchy of Jobs (ranking) Assign Pay Rates Purpose: Establish Internal Equity

Four Basic Systems • • Job Ranking Job Grading Point System Factor Comparison

Four Basic Systems • • Job Ranking Job Grading Point System Factor Comparison

Job Ranking System • Simplest and oldest system of job evaluation by which jobs are arrayed on the basis of their relative worth.

Job Ranking System • Simplest and oldest system of job evaluation by which jobs are arrayed on the basis of their relative worth.

Job Ranking System • Establish Committee • Define all Jobs • Identify Critical Factor (Responsibilities of Importance) • Rank Every Job by Critical Factors

Job Ranking System • Establish Committee • Define all Jobs • Identify Critical Factor (Responsibilities of Importance) • Rank Every Job by Critical Factors

Job Classification System • System of job evaluation by which jobs are classified and grouped according to a series of predetermined wage grades.

Job Classification System • System of job evaluation by which jobs are classified and grouped according to a series of predetermined wage grades.

Job Grade System • • Determine Number of Grades (e. g. 20) Describe Each Grade Review Each Job Description Fit Job into Grade “Government”

Job Grade System • • Determine Number of Grades (e. g. 20) Describe Each Grade Review Each Job Description Fit Job into Grade “Government”

Point System • Quantitative job evaluation procedure that determines the relative value of a job by the total points assigned to it.

Point System • Quantitative job evaluation procedure that determines the relative value of a job by the total points assigned to it.

Point System (Quantitative) • Identify Compensatable Factors (e. g. ) – – Skill Responsibility Effort Environment • Establish Degree Within each Factor (e. g. 1 -9) • Create a Point Manual – Defines Factors (3 -9) – Definitive Degrees (1 -9) • Analyze each Job • Assign Points • Rank by Points

Point System (Quantitative) • Identify Compensatable Factors (e. g. ) – – Skill Responsibility Effort Environment • Establish Degree Within each Factor (e. g. 1 -9) • Create a Point Manual – Defines Factors (3 -9) – Definitive Degrees (1 -9) • Analyze each Job • Assign Points • Rank by Points

Hay Profile Method • Job evaluation technique using three factors – knowledge, mental activity, and accountability – to evaluate executive and managerial positions. Knowledge Mental Activity Accountability

Hay Profile Method • Job evaluation technique using three factors – knowledge, mental activity, and accountability – to evaluate executive and managerial positions. Knowledge Mental Activity Accountability

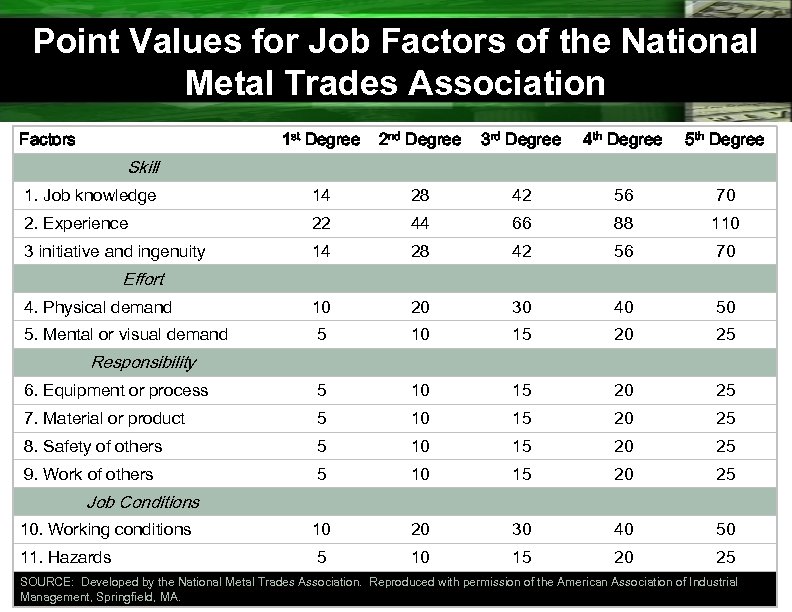

Point Values for Job Factors of the National Metal Trades Association Factors 1 st Degree 2 nd Degree 3 rd Degree 4 th Degree 5 th Degree 1. Job knowledge 14 28 42 56 70 2. Experience 22 44 66 88 110 3 initiative and ingenuity 14 28 42 56 70 4. Physical demand 10 20 30 40 50 5. Mental or visual demand 5 10 15 20 25 6. Equipment or process 5 10 15 20 25 7. Material or product 5 10 15 20 25 8. Safety of others 5 10 15 20 25 9. Work of others 5 10 15 20 25 10. Working conditions 10 20 30 40 50 11. Hazards 5 10 15 20 25 Skill Effort Responsibility Job Conditions SOURCE: Developed by the National Metal Trades Association. Reproduced with permission of the American Association of Industrial Management, Springfield, MA.

Point Values for Job Factors of the National Metal Trades Association Factors 1 st Degree 2 nd Degree 3 rd Degree 4 th Degree 5 th Degree 1. Job knowledge 14 28 42 56 70 2. Experience 22 44 66 88 110 3 initiative and ingenuity 14 28 42 56 70 4. Physical demand 10 20 30 40 50 5. Mental or visual demand 5 10 15 20 25 6. Equipment or process 5 10 15 20 25 7. Material or product 5 10 15 20 25 8. Safety of others 5 10 15 20 25 9. Work of others 5 10 15 20 25 10. Working conditions 10 20 30 40 50 11. Hazards 5 10 15 20 25 Skill Effort Responsibility Job Conditions SOURCE: Developed by the National Metal Trades Association. Reproduced with permission of the American Association of Industrial Management, Springfield, MA.

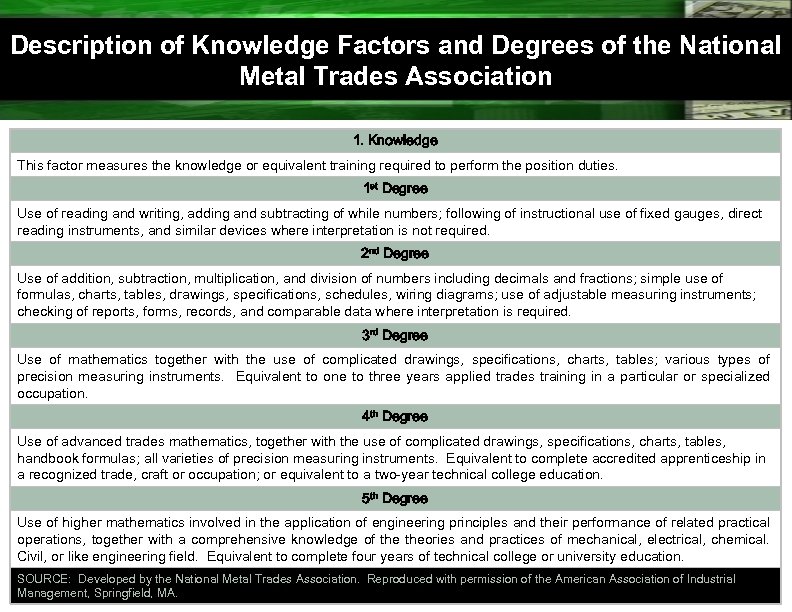

Description of Knowledge Factors and Degrees of the National Metal Trades Association 1. Knowledge This factor measures the knowledge or equivalent training required to perform the position duties. 1 st Degree Use of reading and writing, adding and subtracting of while numbers; following of instructional use of fixed gauges, direct reading instruments, and similar devices where interpretation is not required. 2 nd Degree Use of addition, subtraction, multiplication, and division of numbers including decimals and fractions; simple use of formulas, charts, tables, drawings, specifications, schedules, wiring diagrams; use of adjustable measuring instruments; checking of reports, forms, records, and comparable data where interpretation is required. 3 rd Degree Use of mathematics together with the use of complicated drawings, specifications, charts, tables; various types of precision measuring instruments. Equivalent to one to three years applied trades training in a particular or specialized occupation. 4 th Degree Use of advanced trades mathematics, together with the use of complicated drawings, specifications, charts, tables, handbook formulas; all varieties of precision measuring instruments. Equivalent to complete accredited apprenticeship in a recognized trade, craft or occupation; or equivalent to a two-year technical college education. 5 th Degree Use of higher mathematics involved in the application of engineering principles and their performance of related practical operations, together with a comprehensive knowledge of theories and practices of mechanical, electrical, chemical. Civil, or like engineering field. Equivalent to complete four years of technical college or university education. SOURCE: Developed by the National Metal Trades Association. Reproduced with permission of the American Association of Industrial Management, Springfield, MA.

Description of Knowledge Factors and Degrees of the National Metal Trades Association 1. Knowledge This factor measures the knowledge or equivalent training required to perform the position duties. 1 st Degree Use of reading and writing, adding and subtracting of while numbers; following of instructional use of fixed gauges, direct reading instruments, and similar devices where interpretation is not required. 2 nd Degree Use of addition, subtraction, multiplication, and division of numbers including decimals and fractions; simple use of formulas, charts, tables, drawings, specifications, schedules, wiring diagrams; use of adjustable measuring instruments; checking of reports, forms, records, and comparable data where interpretation is required. 3 rd Degree Use of mathematics together with the use of complicated drawings, specifications, charts, tables; various types of precision measuring instruments. Equivalent to one to three years applied trades training in a particular or specialized occupation. 4 th Degree Use of advanced trades mathematics, together with the use of complicated drawings, specifications, charts, tables, handbook formulas; all varieties of precision measuring instruments. Equivalent to complete accredited apprenticeship in a recognized trade, craft or occupation; or equivalent to a two-year technical college education. 5 th Degree Use of higher mathematics involved in the application of engineering principles and their performance of related practical operations, together with a comprehensive knowledge of theories and practices of mechanical, electrical, chemical. Civil, or like engineering field. Equivalent to complete four years of technical college or university education. SOURCE: Developed by the National Metal Trades Association. Reproduced with permission of the American Association of Industrial Management, Springfield, MA.

Factor Comparison System • Similar to Point System • Distinguished by "Key Jobs" • Compensatable Factors – – – Skill Responsibility Mental Effort Working Conditions Physical Effort • Assign & Value to Factor • Each Job is Assigned a Factor • Add up Values to get Wage Rate

Factor Comparison System • Similar to Point System • Distinguished by "Key Jobs" • Compensatable Factors – – – Skill Responsibility Mental Effort Working Conditions Physical Effort • Assign & Value to Factor • Each Job is Assigned a Factor • Add up Values to get Wage Rate

Characteristics of Key Jobs • Have importance to employees and organizations • Vary in terms of job requirements • Possess relatively stable job content • Are used as important jobs in salary surveys

Characteristics of Key Jobs • Have importance to employees and organizations • Vary in terms of job requirements • Possess relatively stable job content • Are used as important jobs in salary surveys

Compensation Structure • Job Evaluation First • Assign a Wage Rate Second • Base Rate on Wage "Survey" • Geographical Area of Worker Draw

Compensation Structure • Job Evaluation First • Assign a Wage Rate Second • Base Rate on Wage "Survey" • Geographical Area of Worker Draw

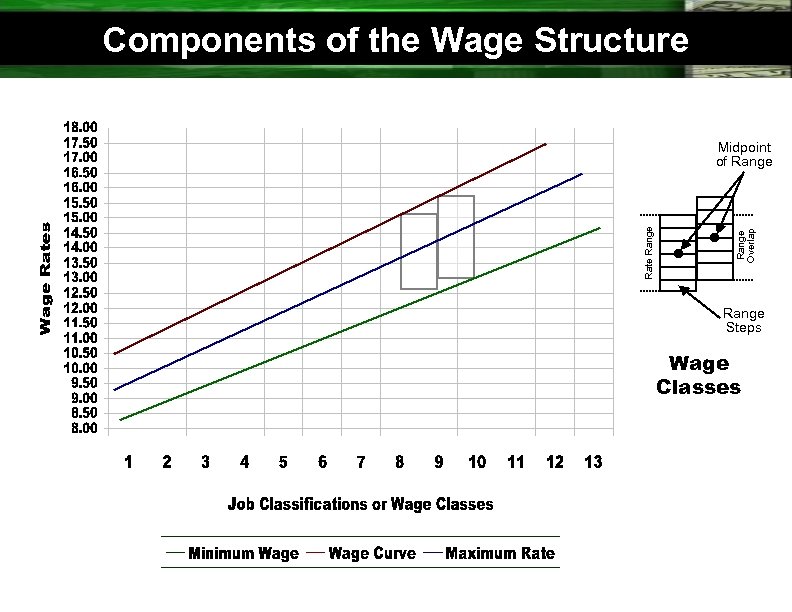

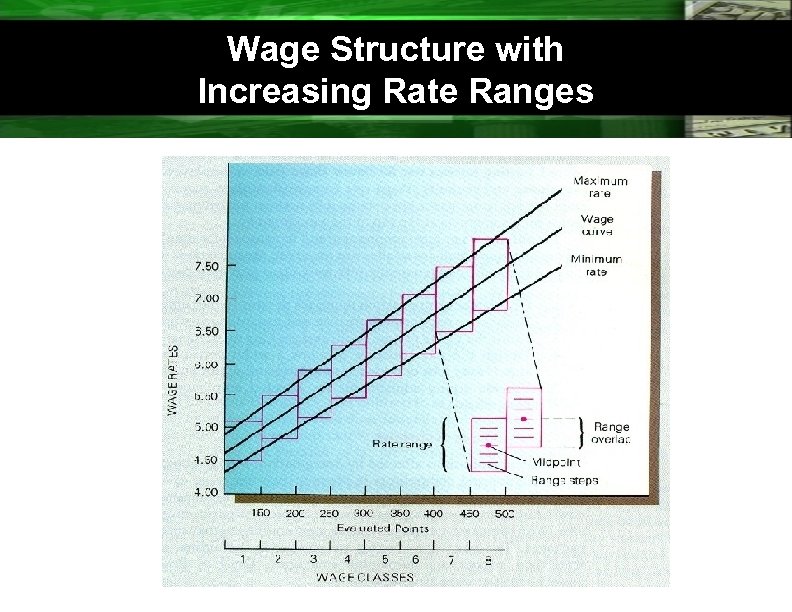

Components of the Wage Structure Range Overlap Rate Range Midpoint of Range Steps Wage Classes

Components of the Wage Structure Range Overlap Rate Range Midpoint of Range Steps Wage Classes

Wage and Salary Survey • Surveys of the wages paid to employees of other employers in the surveying organization’s relevant labor market.

Wage and Salary Survey • Surveys of the wages paid to employees of other employers in the surveying organization’s relevant labor market.

Wage and Salary Surveys 1. 2. 3. 4. Select key jobs. Determine relevant labor market. Select organizations. Decide on information to collect: wages/benefits/pay policies. 5. Compile data received. 6. Determine wages and benefits to pay.

Wage and Salary Surveys 1. 2. 3. 4. Select key jobs. Determine relevant labor market. Select organizations. Decide on information to collect: wages/benefits/pay policies. 5. Compile data received. 6. Determine wages and benefits to pay.

Wage Curve • Curve in a scattergram representing the relationship between relative worth of jobs and wage rates.

Wage Curve • Curve in a scattergram representing the relationship between relative worth of jobs and wage rates.

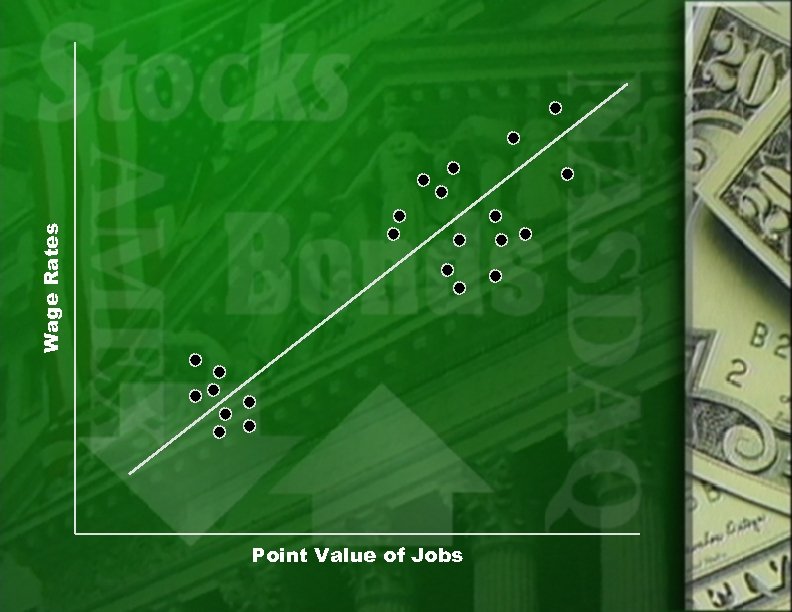

Wage Rates Point Value of Jobs

Wage Rates Point Value of Jobs

Survey Data • Government Statistical Survey • Employer Initiated Survey • By Job Classification • World Wide Web

Survey Data • Government Statistical Survey • Employer Initiated Survey • By Job Classification • World Wide Web

Pay Grades Groups of jobs within a particular class that are paid the same rate or rate range.

Pay Grades Groups of jobs within a particular class that are paid the same rate or rate range.

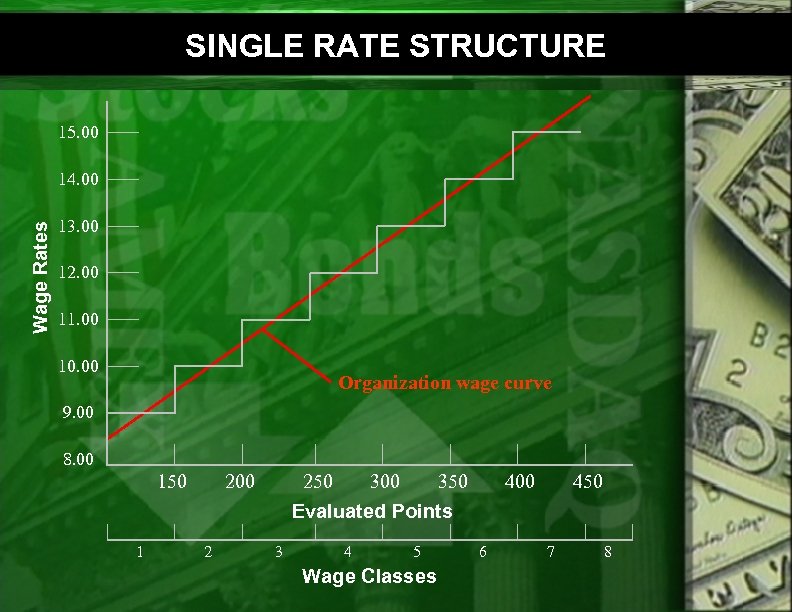

SINGLE RATE STRUCTURE 15. 00 Wage Rates 14. 00 13. 00 12. 00 11. 00 10. 00 Organization wage curve 9. 00 8. 00 150 1 200 2 250 300 350 Evaluated Points 3 4 5 Wage Classes 400 6 450 7 8

SINGLE RATE STRUCTURE 15. 00 Wage Rates 14. 00 13. 00 12. 00 11. 00 10. 00 Organization wage curve 9. 00 8. 00 150 1 200 2 250 300 350 Evaluated Points 3 4 5 Wage Classes 400 6 450 7 8

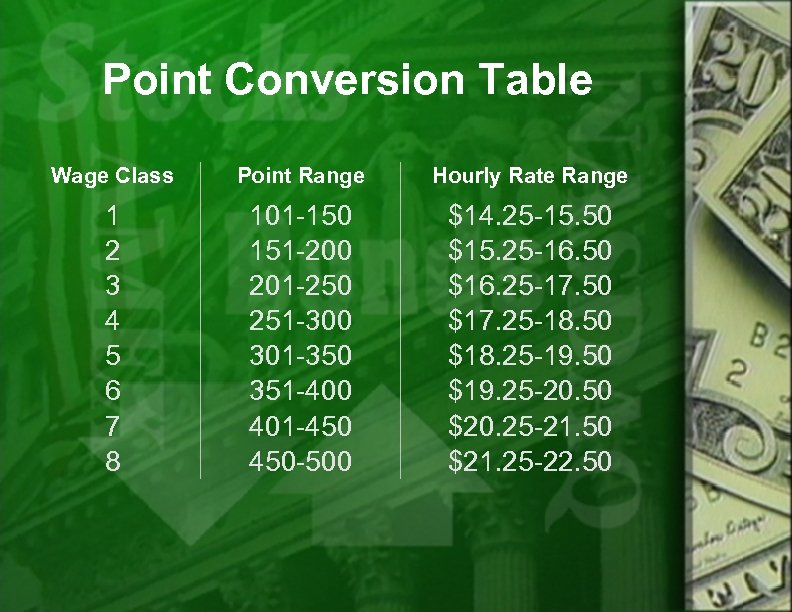

Point Conversion Table Wage Class Point Range Hourly Rate Range 1 2 3 4 5 6 7 8 101 -150 151 -200 201 -250 251 -300 301 -350 351 -400 401 -450 450 -500 $14. 25 -15. 50 $15. 25 -16. 50 $16. 25 -17. 50 $17. 25 -18. 50 $18. 25 -19. 50 $19. 25 -20. 50 $20. 25 -21. 50 $21. 25 -22. 50

Point Conversion Table Wage Class Point Range Hourly Rate Range 1 2 3 4 5 6 7 8 101 -150 151 -200 201 -250 251 -300 301 -350 351 -400 401 -450 450 -500 $14. 25 -15. 50 $15. 25 -16. 50 $16. 25 -17. 50 $17. 25 -18. 50 $18. 25 -19. 50 $19. 25 -20. 50 $20. 25 -21. 50 $21. 25 -22. 50

Wage Structure with Increasing Rate Ranges

Wage Structure with Increasing Rate Ranges

Issues in Rate Structures • • • Wage Rate Compression Narrow Difference from Job to Job White-Grey-Blue Collar Impact Low Morale/Turnover/Behavior Two Tier Wage Systems A/B Scales Time of Employment Grandfathering Cost of Living Comparison (COLA)

Issues in Rate Structures • • • Wage Rate Compression Narrow Difference from Job to Job White-Grey-Blue Collar Impact Low Morale/Turnover/Behavior Two Tier Wage Systems A/B Scales Time of Employment Grandfathering Cost of Living Comparison (COLA)

Government Regulations • Overtime Mandate (1 1/2 times over 40 hours) • Pay Prevailing Rates in Area • Minimum Wages • Child Labor (16 -19 yrs) • Equal Rights for All

Government Regulations • Overtime Mandate (1 1/2 times over 40 hours) • Pay Prevailing Rates in Area • Minimum Wages • Child Labor (16 -19 yrs) • Equal Rights for All

Comparable Worth • The concept that male and female jobs that are dissimilar, but equal in terms of value or worth to the employer, should be paid the same.

Comparable Worth • The concept that male and female jobs that are dissimilar, but equal in terms of value or worth to the employer, should be paid the same.

Wage-Rate Compression • Compression of differentials between job classes, particularly the differential between hourly workers and their managers.

Wage-Rate Compression • Compression of differentials between job classes, particularly the differential between hourly workers and their managers.

Advantages of Incentive Pay Programs • Employee effort is focused on important targets • Rewards are variable costs linked to results • Incentives are directly related to improved performance • Incentives reward those responsible for higher performance

Advantages of Incentive Pay Programs • Employee effort is focused on important targets • Rewards are variable costs linked to results • Incentives are directly related to improved performance • Incentives reward those responsible for higher performance

Straight Piecework • Incentive plan under which employees receive a certain rate for each unit produced.

Straight Piecework • Incentive plan under which employees receive a certain rate for each unit produced.

Differential Piece Rate • Compensation rate under which employees whose production exceeds the standard amount of output receive a higher rate for all of their work than the rate paid to those who do not exceed the standard amount.

Differential Piece Rate • Compensation rate under which employees whose production exceeds the standard amount of output receive a higher rate for all of their work than the rate paid to those who do not exceed the standard amount.

Employee Opposition to Incentive Plans • Production standards are set unfairly. • Incentive plans are really “work speedup. ” • Incentive plans create competition among workers. • Increased earnings result in tougher standards. • Payout formulas are complex and difficult to understand. • Incentive plans cause friction between employees and management.

Employee Opposition to Incentive Plans • Production standards are set unfairly. • Incentive plans are really “work speedup. ” • Incentive plans create competition among workers. • Increased earnings result in tougher standards. • Payout formulas are complex and difficult to understand. • Incentive plans cause friction between employees and management.

Six Components of Effective Incentive Plan Administration 1. Grant incentives based on performance 2. Adequate financial resources to reward performance 3. Clearly defined and accepted performance standards 4. Easily understood payout formula 5. Reasonable administrative costs 6. Wide coverage of employees

Six Components of Effective Incentive Plan Administration 1. Grant incentives based on performance 2. Adequate financial resources to reward performance 3. Clearly defined and accepted performance standards 4. Easily understood payout formula 5. Reasonable administrative costs 6. Wide coverage of employees

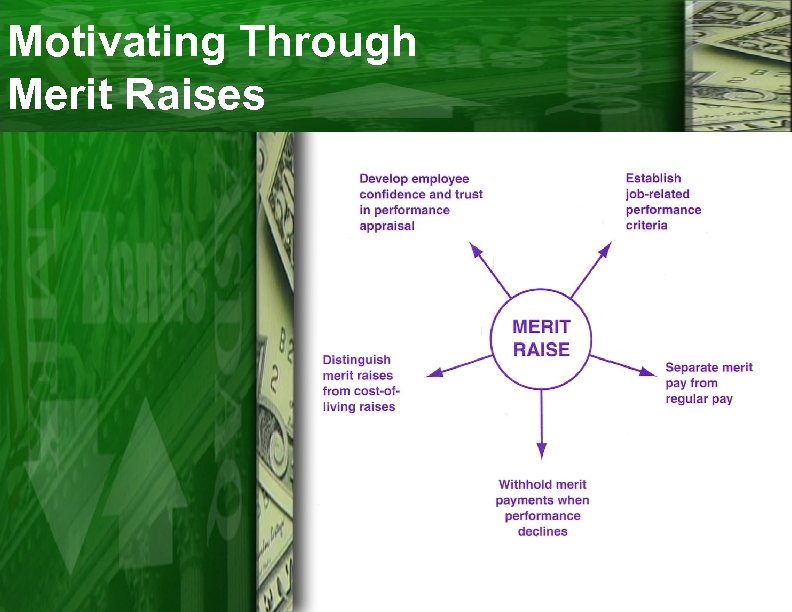

Merit Guidelines for awarding merit raises that are ties to performance objectives.

Merit Guidelines for awarding merit raises that are ties to performance objectives.

Motivating Through Merit Raises

Motivating Through Merit Raises

Bonus • Incentive payment that is supplemented to the base wage.

Bonus • Incentive payment that is supplemented to the base wage.

Team or Group Incentive Plan Compensation plan where all team members receive an incentive bonus payment when productive or services standards are met or exceeded.

Team or Group Incentive Plan Compensation plan where all team members receive an incentive bonus payment when productive or services standards are met or exceeded.

Standard Hourly Plan • Incentive plan that sets rates based upon the completion of a job in a predetermined standard time.

Standard Hourly Plan • Incentive plan that sets rates based upon the completion of a job in a predetermined standard time.

Criticisms of Executive Incentive Plans • Incentive payments are excessive compared with return to stockholders. • Time periods for judging and rewarding performance are too short. • Quarterly earnings growth is emphasized at the expense of research and development. • Emphasis is placed upon equaling or exceeding executive salary survey averages. • Benefits do no relate closely to individual performance

Criticisms of Executive Incentive Plans • Incentive payments are excessive compared with return to stockholders. • Time periods for judging and rewarding performance are too short. • Quarterly earnings growth is emphasized at the expense of research and development. • Emphasis is placed upon equaling or exceeding executive salary survey averages. • Benefits do no relate closely to individual performance

Perquisites Special benefits given to executives; often referred to as perks.

Perquisites Special benefits given to executives; often referred to as perks.

Executive Perquisites • • • • Company-provided car Free financial consulting Club memberships Use of company plane and yacht Low-cost or no-cost loans Special travel allowances Limousine service Kidnap and ransom protection Free legal counseling Family member travel allowances Home entertainment allowance Payment of children’s educational expense Executive dining room Estate planning

Executive Perquisites • • • • Company-provided car Free financial consulting Club memberships Use of company plane and yacht Low-cost or no-cost loans Special travel allowances Limousine service Kidnap and ransom protection Free legal counseling Family member travel allowances Home entertainment allowance Payment of children’s educational expense Executive dining room Estate planning

Straight Commission Plan Compensation plan based upon a percentage of sales.

Straight Commission Plan Compensation plan based upon a percentage of sales.

Straight Salary Plan Compensation plan that permits salespeople to be paid for performing various duties that are not reflected immediately in their sales volume.

Straight Salary Plan Compensation plan that permits salespeople to be paid for performing various duties that are not reflected immediately in their sales volume.

Combined Salary and Commission Plan Compensation plan that includes a straight salary and a commission.

Combined Salary and Commission Plan Compensation plan that includes a straight salary and a commission.

Gainsharing Plans Programs under which both employees and the organization share the financial gains according to a predetermined formula that reflects improved productivity and profitability.

Gainsharing Plans Programs under which both employees and the organization share the financial gains according to a predetermined formula that reflects improved productivity and profitability.

Profit Sharing Any procedure by which an employer pays, or makes available to all regular employees, in addition to base pay, special current or deferred sums based upon the profits of the enterprise.

Profit Sharing Any procedure by which an employer pays, or makes available to all regular employees, in addition to base pay, special current or deferred sums based upon the profits of the enterprise.

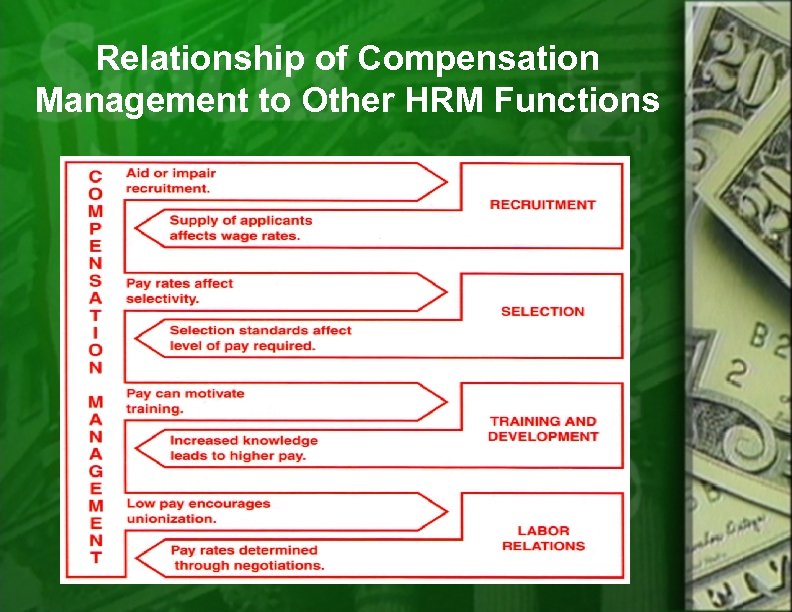

Relationship of Compensation Management to Other HRM Functions

Relationship of Compensation Management to Other HRM Functions

Compensation Hot Links Abbott, Langer, and Associates ERI Hewitt Associates Office Team Robert Half America’s Job Bank World at Work (Formerly ACA)

Compensation Hot Links Abbott, Langer, and Associates ERI Hewitt Associates Office Team Robert Half America’s Job Bank World at Work (Formerly ACA)