3c08d3e657d4d6ca71d4f78a0c686bc3.ppt

- Количество слайдов: 52

Compensation Decision Making Bergmann & Scarpello 4 th edition Chapter 13 Employee Benefits Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc. All rights reserved. Requests for permission to make copies of any part of the work should be mailed to the following address: Permissions Department, Harcourt, Inc. , 6277 Sea Harbor Drive, Orlando, Florida 32887 -6777.

Why Employers Provide Benefits Golden Handcuffs: a name given to employee benefits because they tend to tie the employee to the organization-just what the employer wants Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Role of Benefits in Achieving Compensation Goals 1. Do benefits motivate joining? Answer : Somewhat 2. Do benefits motivate staying? Answer : Yes 3. Do benefits motivate superior performance? Answer : No Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

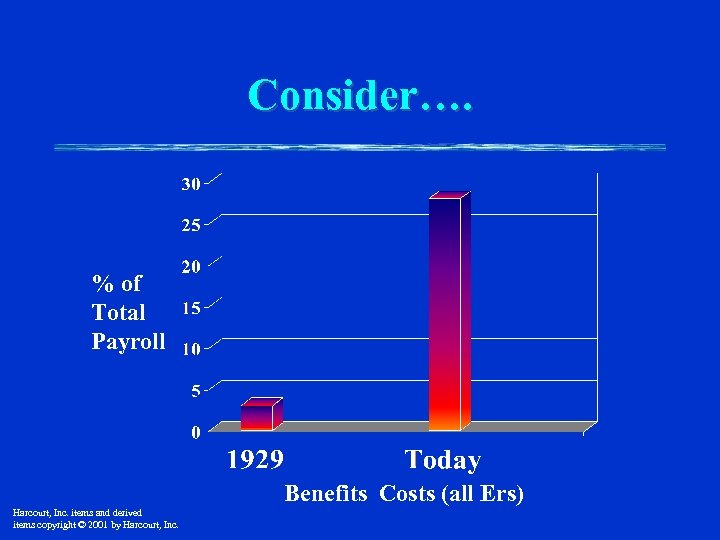

Consider…. % of Total Payroll Benefits Costs (all Ers) Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

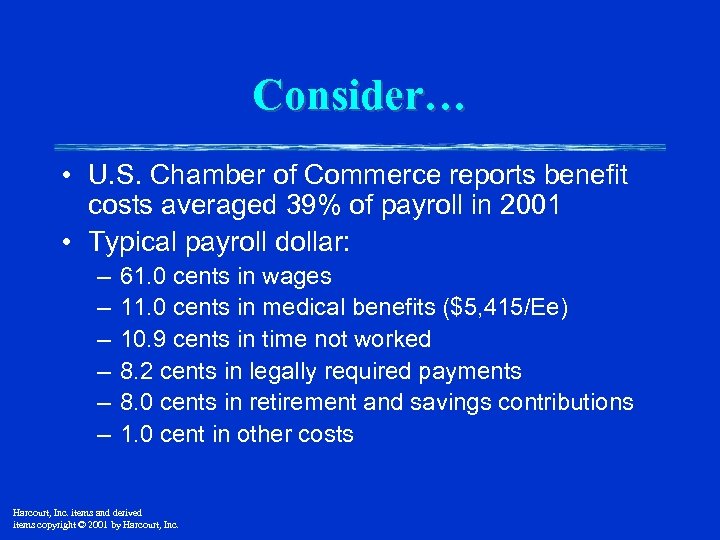

Consider… • U. S. Chamber of Commerce reports benefit costs averaged 39% of payroll in 2001 • Typical payroll dollar: – – – 61. 0 cents in wages 11. 0 cents in medical benefits ($5, 415/Ee) 10. 9 cents in time not worked 8. 2 cents in legally required payments 8. 0 cents in retirement and savings contributions 1. 0 cent in other costs Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Consider…. Health Care Since 1980: Rise in other Since 1980: Rise in wages benefits costs compared & salaries to rise in health care costs compared to Health Care rise in health care costs Other Wages Benefits Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

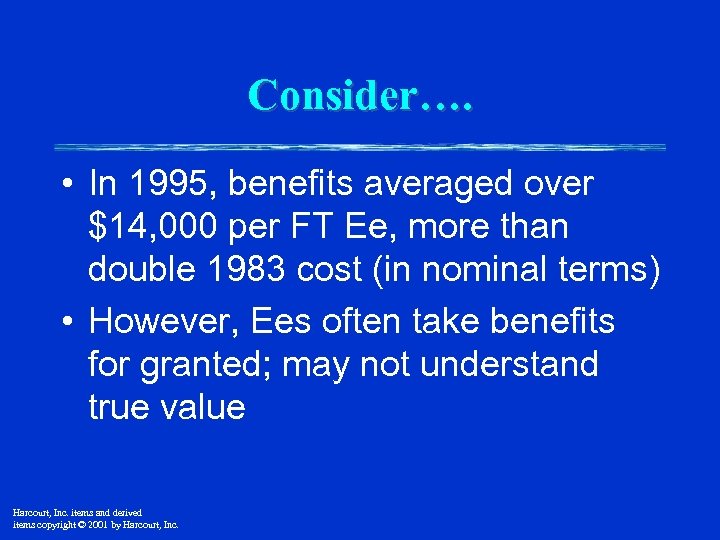

Consider…. • In 1995, benefits averaged over $14, 000 per FT Ee, more than double 1983 cost (in nominal terms) • However, Ees often take benefits for granted; may not understand true value Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

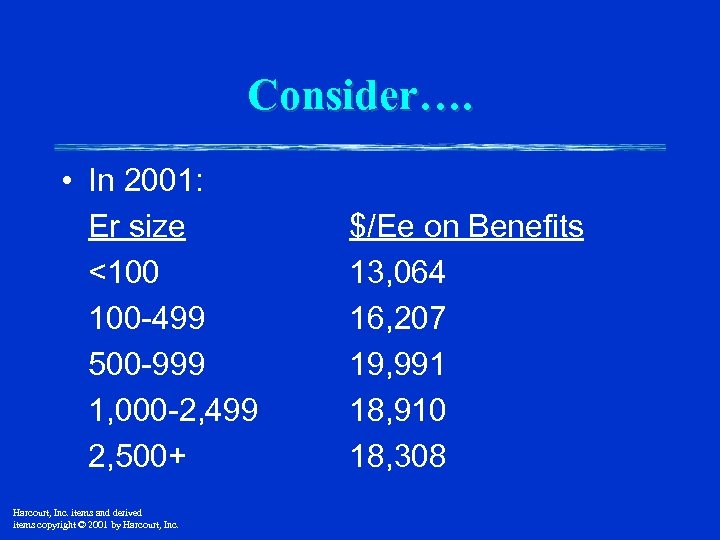

Consider…. • In 2001: Er size <100 100 -499 500 -999 1, 000 -2, 499 2, 500+ Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc. $/Ee on Benefits 13, 064 16, 207 19, 991 18, 910 18, 308

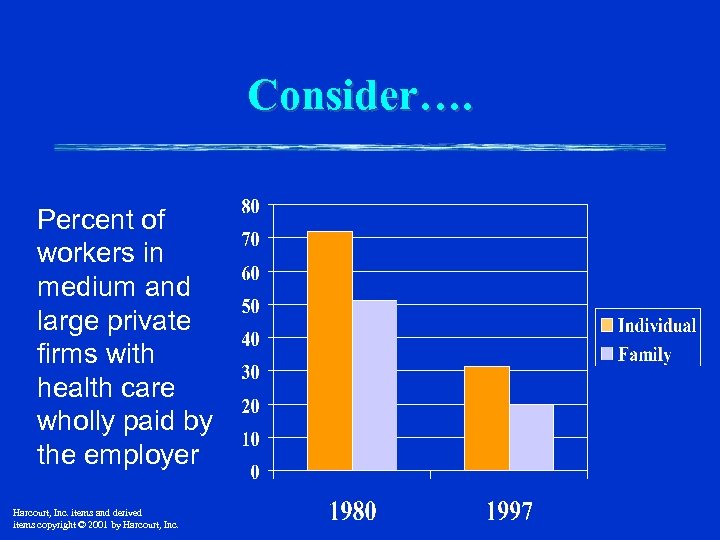

Consider…. Percent of workers in medium and large private firms with health care wholly paid by the employer Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Consider… • Health-care benefits per Ee expected to increase 9. 6% in 2005 – Considerable cost-shifting to Ees – Expected increase in 2004, 13. 0% • Fourth consecutive year of double-digit increases – Costs increased 10. 1% in 2003 • Biggest cost drivers: more prescriptions of heavily-marketed drugs, increases in hospital prices, more expensive diagnostic tests, increase in visits to specialists (given shift from more restrictive HMOs) • Average cost per Ee, 2003: $6, 215 – Up 73% since 1997 ($3, 594) • 15. 6% of U. S. population (~45 m) now uninsured – 63% of Americans covered by Er-sponsored health benefits » Source: Mercer Human Resource Consulting, Census Bureau, Wall Street Journal, 10/6/04 Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Consider… • GM, Ford, and Chrysler spend ~$1, 200 per vehicle on Ee health care • Competition prevents passing on cost to customers – Japanese competitors have younger workforces with lower costs • As of 2003, Big Three had 524, 000 hourly retirees, Toyota 49 • Expense impacts bottom-line and investment in R&D – See also “As Benefits for Veterans Climb, Military Spending Feels Squeeze, ” Wall Street Journal, 1/25/05 • Adding prescription drug benefit to Medicare will save automakers millions – Companies lobbied for legislation that would cover all over 65, even those with retiree health coverage thru Er – GM spends $924 million annually on prescription drugs for retirees, including those under age 65, Ford spends $300 million Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc. » Source: Fortune, 9/29/03

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Current Developments • Misleading statement in text, p. 508 – Sentence should read “Thus, from 1992 to 1998, the rate of increase of employer health insurance costs steadily declined. ” Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Reasons behind Growth in Employee Benefits • Unions • Societal attitudes – Growing desire to insulate Ees from most severe forms of economic dislocation • Governmentally-mandated benefits include workers’ compensation, unemployment insurance, Social Security (retirement income), family and medical leave (unpaid) • Discussed previously in ch. 6, which you all remember!! • Other types of benefits discretionary • Recall that ERISA doesn’t require Er to provide pension, but must meet guidelines if provided • Changing philosophies about people and work – Benefits satisfy safety and security needs Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Reasons behind Growth in Employee Benefits • Cost advantages – Favorable tax treatment (for qualified plans) • Requires benefit nondiscrimination based on compensation within org – Many benefits group-based, can be purchased at lower rates • Employer self-interest – Healthier workforce – Moral obligation? (paternalistic view) – Labor market competiveness Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

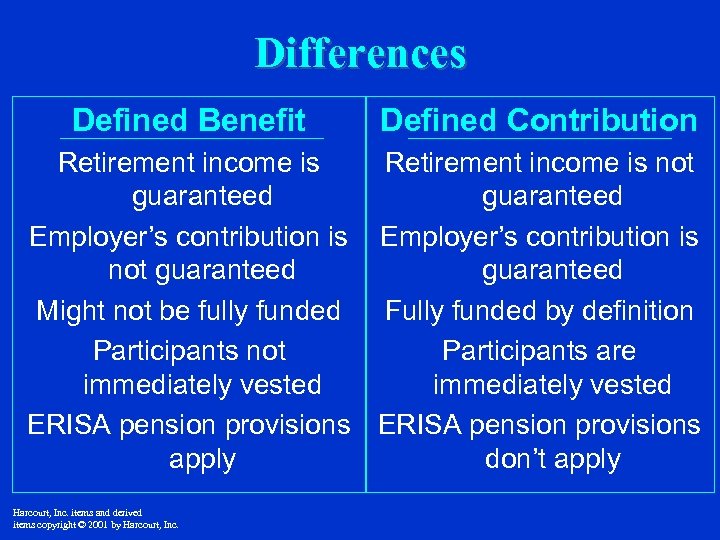

Differences Defined Benefit Defined Contribution Retirement income is not guaranteed Employer’s contribution is not guaranteed Might not be fully funded Fully funded by definition Participants not Participants are immediately vested ERISA pension provisions apply don’t apply Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Pension Plans • In late ’ 70 s, ~60% of American ees had defined-benefit pension plans – Today, <15% • In late ’ 70 s, ~15% of American ees had defined contribution plan – Today, >60% • • Due in part to shift in employment away from large, unionized manufacturing cos Defined contribution plans by definition subject to market fluctuation – Ee who went to work at 25, put 6% of pay into 401(k) every year for 40 years, retired at 65, withdrew balance and bought annuity in 2000, would receive 134% of pre-retirement income • But if turned 65 in 2003, 401(k) savings would only buy annuity paying 57% of preretirement income • Because women have longer life expectancy than men, they pay more when buying annuities (however, courts have ruled illegal for definedbenefit pension plan to pay out less to women based on life expectancy) » Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc. Source: New York Times 1/9/06

Cash Balance Plans • Defined benefit plan that looks similar to defined contribution plan – Accounts established, receives contribution credit from Er (% of pay that may vary with age/yrs service) and interest credit – Benefits accrue evenly over course of employment – Insured by PBGC (unlike defined contribution) – Benefits portable (available as lump sum at separation – May require “grandfathering” for Ees nearing retirement (if defined benefit plan had been in place) Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

“Judge Says I. B. M. Pension Shift Illegally Harmed Older Workers” • “Cash Balance” Hybrid Pension Plans discussed @ p. 516 • Federal court ruled in July 2003 that IBM violated age discrimination laws in way it changed its traditional pension plan in 1990 s – Decision could cast doubt over similar changes hundreds of Cos have made – IBM indicated it would appeal • IRS regulatory approach had been that cash-balance plans are not inherently discriminatory • Legislation pending in Congress that would resolve legal issues raised by pension conversions • Source: New York Times, 8/1/03 Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

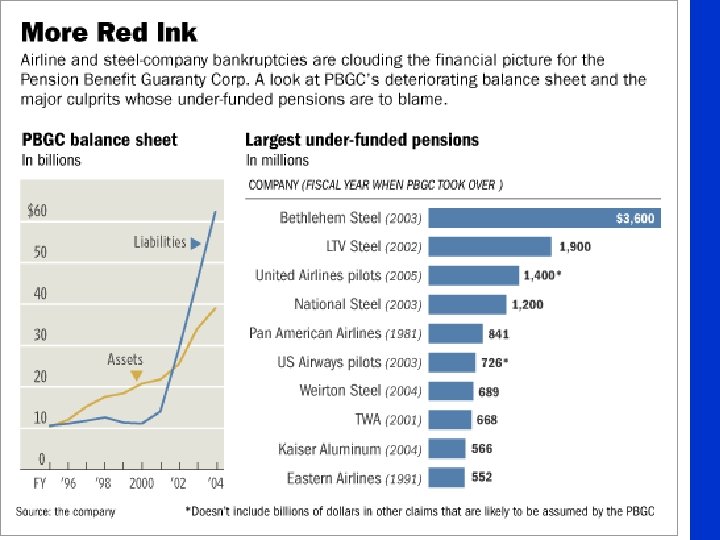

Pension Agency Puts Pressure on Congress • PBGC’s growing liabilities – which stem from decline of steel industry as well as troubles among airlines – fueling fears that taxpayer-funded bailout of agency is inevitable unless Congress overhauls pension -insurance system » Source: Wall Street Journal, 1/7/05 Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Common Reasons Employers Pay for Time Not Worked Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc. Holidays Vacation Days Personal Leave Funeral Leave Jury Duty Leave Military Leave Sick Leave Family Leave

“A Good Idea, But…” • 16. 5% of U. S. workforce took leave of absence for family or medical reasons under FMLA in 2000 • Ers pushing Congress to include better definition of “serious medical condition” and to prevent ees from taking leave in small time increments – More than 25% of leave is taken intermittently – Law currently defines serious medical condition as something that requires inpatient treatment, such as hospital stay, chronic illness, or period of incapacitation of more than three consecutive days accompanied by two treatments by doctor • SHRM reports half of HR professionals surveyed indicated they have granted FMLA requests they felt were not legitimate – Ers say condition is hard to verify – Physicians, fearful of violating medical privacy laws, usually tightlipped » Source: Wall Street Journal, 1/24/05 Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Medical Care Programs Medical Insurance Managed Medical Care Coalition Plans Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Medical Insurance • Traditional method • Fee-for-service • Employer pays monthly premium to outside provider for each employee • Greatest freedom, but often fewer benefits or higher cost Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Managed Medical Care • Limits the individual’s choices of health care provider • Eliminates fee-for-service (one fee for all services provided) • Provides employers with contained costs but employees have reported reduced services Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Managed Medical care Best Known Plans • Health Maintenance Organizations (HMOs) – Participants use only doctors, etc. , designated by the plan – Employer provides coverage equal to cost of conventional insurance but coverage need not be equal (often greater, w/emphasis on preventative care) Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Managed Medical care Best Known Plans • Preferred Provider Organizations (PPOs) – Compromise between traditional insurance and HMO – Employer negotiates discounted fee with select group of doctors, etc. to provide coverage Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Managed Medical Care Best Known Plans – Employees usually pay nothing to see the selected group – Employees who see physicians outside the group usually pay 20% of the cost of the service Point-of-Service (POS): new term for use of a primary-care physician through whom savings is greatest Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Coalition Plans • Organizations of multiple employers who pool their health care funds • Economies of scale • Substantial savings but companies lose autonomy Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Cost Control Strategies • Increasing deductible • Changing coinsurance rate • Coordinating benefits with Ees and spouses • Auditing charges • Requiring preauthorization for visits • Requiring mandatory second opinion for procedures Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

“Toyota Rolls Out a New Economy -Class Drug Plan” • Toyota opening its own pharmacies at its U. S. operations – Contracted w/ CHD Meridian Healthcare (also provides service to U. S. Steel, Smithfield Foods, GE) – Amount Toyota spends on prescription-drug costs has more than tripled since 1998; 15% increase projected for 2004 • For medications taken on regular basis, ees can save by using Co pharmacy or mail-order service • Co will pay entire cost of some medicines if ee uses generic – Ee use of brand-name drug may have co-pay as high as 20% » Source: Fortune, 1/24/05 Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

“Consumer-Driven” Health Plans (CDHPs), Health Savings Accounts (HSAs), Health Reimbursement Accounts (HRAs) • Congress authorized HSAs in 2003, HRAs evolved in late 90 s and early 00 s • Lower premiums, higher deductible (e. g. , $2, 000/yr), more consumer control of health care expenditures – Er can match part or all of Ee contribution to account • Pre-tax dollars into HSA, up to amount of deductible • If you don’t spend all your allowance on medical care, you carry over unused balance – Once deductible is paid, traditional insurance policy takes over • Maximum out-of-pocket spending limits ($5 k for individuals, $10 k for families) Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

“Consumer-Driven” Health Plans (CDHPs), Health Savings Accounts (HSAs), Health Reimbursement Accounts (HRAs) • Encourages consumers to take active role in keeping health-care costs down – Ers will provide detailed information about prices and quality of doctors and hospitals in area • Critics fear plans will discourage people from getting care they need – Recent research indicates that when co-payments for prescription drugs increase, health of patients w/ certain chronic illnesses (e. g. , diabetes and asthma) can suffer • Further, if healthy Ees sign up for HSAs while lesshealthy Ees stick w/ traditional plans, costs of those plans will increase at even faster rate… – Tax breaks benefit wealthy more than low-income workers – Less-educated workers may have trouble taking advantage of Web-based information Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

“Consumer-Driven” Health Plans (CDHPs), Health Savings Accounts (HSAs), Health Reimbursement Accounts (HRAs) • Percentage of Ers adding high-deductible plans rose from 7 percent in 2004 to 13 percent in 2005, 29 percent in 2006, and 33 percent plan to offer them in 2007 • CDHPs that are most successful at controlling costs rely on variety of programs that encourage smart Ee consumerism – 53 percent use incentive to encourage ees to complete health risk appraisals – 43 percent use incentives to encourage ees to improve their health » Source: USA Today, 10/31/03; Wall Street Journal, 6/23/04; Wall Street Journal, 5/19/04; Business Week, 11/8/04; SHRM HRNews Online, 3/21/06 Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

“One Cure for High Health Costs: In-House Clinics at Companies” • Quad/Graphics (one of biggest printing cos in U. S. ) spent ~$6 k/ee on medical costs in 2004, 30% less than average Co in Wisconsin • Has brought nearly all primary care in-house – Doctors’ bonuses tied to patient evaluations and health outcomes • Quad pays doctors ~$130 -160 k/yr, comparable to average general practitioner in Milwaukee area – Quad spends more on primary care than most cos ($715/ee in 2003, cf. $375/ee at other local cos) • Quad spent $1, 540/ee in 2003 on hospital costs, cf. local average of $2, 250 Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

“One Cure for High Health Costs: In-House Clinics at Companies” • Others considering building inhouse clinics include Toyota – Need to have large number of ees concentrated in a few places to make economic sense • Also need harmonious relations w/ ees (Quad is non-union) » Source: Wall Street Journal, 2/11/05 Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

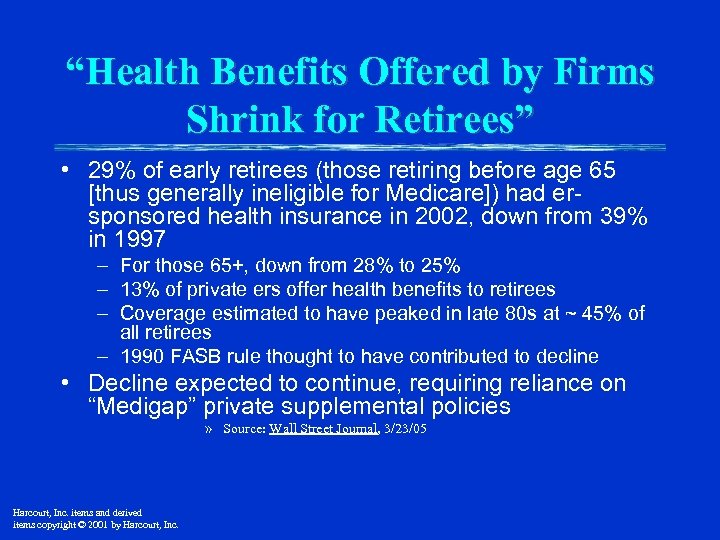

“Health Benefits Offered by Firms Shrink for Retirees” • 29% of early retirees (those retiring before age 65 [thus generally ineligible for Medicare]) had ersponsored health insurance in 2002, down from 39% in 1997 – For those 65+, down from 28% to 25% – 13% of private ers offer health benefits to retirees – Coverage estimated to have peaked in late 80 s at ~ 45% of all retirees – 1990 FASB rule thought to have contributed to decline • Decline expected to continue, requiring reliance on “Medigap” private supplemental policies » Source: Wall Street Journal, 3/23/05 Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

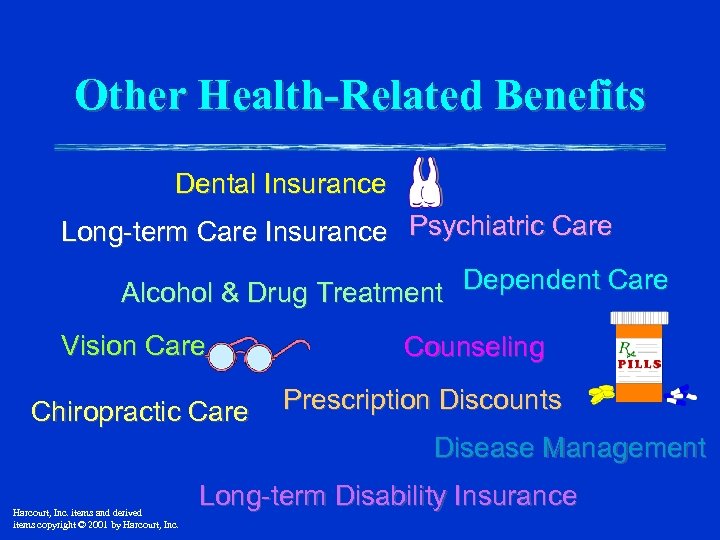

Other Health-Related Benefits Dental Insurance Long-term Care Insurance Psychiatric Care Alcohol & Drug Treatment Dependent Care Vision Care Chiropractic Care Counseling Prescription Discounts Disease Management Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc. Long-term Disability Insurance

Other Employee Benefits • Life and Accident Insurance • Stock Options • Wellness Programs • Discount on Goods and Services Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

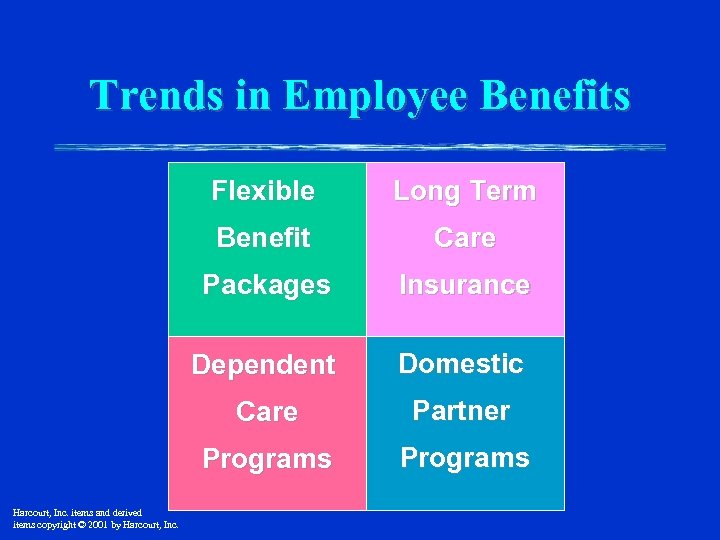

Trends in Employee Benefits Flexible Benefit Care Packages Insurance Dependent Domestic Care Partner Programs Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc. Long Term Programs

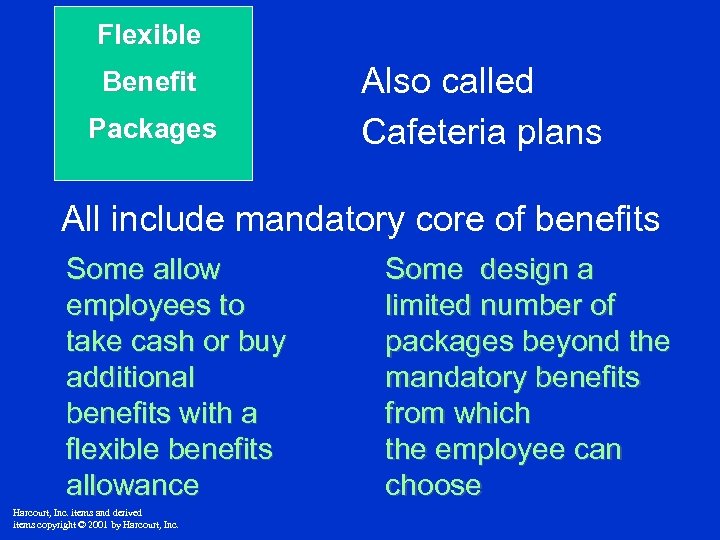

Flexible Benefit Packages Also called Cafeteria plans All include mandatory core of benefits Some allow employees to take cash or buy additional benefits with a flexible benefits allowance Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc. Some design a limited number of packages beyond the mandatory benefits from which the employee can choose

Advantages of Flexible Benefits • Helps firm meet changing needs of changing workforce • Increased involvement of Ees improves understanding of benefits • Makes introduction of new benefits less costly • Facilitates cost containment – Org sets budget, Ee chooses within constraint Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Disadvantages of Flexible Benefits • Ees may make bad choices, find themselves not covered for predictable emergencies • Administrative burdens and expenses increase • Adverse selection: Ees pick benefits they are most likely to use – high utilization increases cost Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Long Term Care Insurance • Can cover adult day care, assisted living facilities, custodial care, home care, hospice care, informal care, respite care, and nursing home services • Few employees select this option – Considered expensive – Inaccurate belief that health care plans cover long term care – Expectation of never needing it Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Dependent Care Programs • Family leave time is legally accessible, but an employer’s decision to provide financial compensation is voluntary (other than California) • Child care programs are being included in many benefits packages • Dependent care is often integrated into flexible work schedules • Dependent care is more than child care Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Domestic Partner Programs • Involves same-sex and opposite-sex partners & their children • Evolved due to tight market conditions & shifting demographics • Includes benefits such as health care, life insurance, child-care, family leave • Advanced by nondiscrimination policies Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Trends in Employee Benefits Administration • Self-insuring in some areas of health and welfare offerings • Multiple organizations joining together • Instituting communication programs • Outsourcing • Financing issue – Noncontributory (Er pays), contributory (Ee pays part), Ee financed Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Benefits and the Law • Major compensation laws • Revenue acts • IRS codes • Outcomes of benefits related cases Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Some Comments on ESOPs (Employee Stock Ownership Plans) • Why ESOPs (Advantages for employers) – Changes in tax codes – Merger & acquisition problems (threat of hostile takeovers) • Disadvantages for employees – No protection as a pension plan – Portability allowed, but impractical and unenforceable Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

Benefits Decision Making • Choice of benefits constrained by government incentives, disincentives, & regulation • Benefit level constrained by product market considerations • Benefit structure constrained by labor market considerations & employee preferences Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

How to Decide What Benefits to Offer • Conduct benefits surveys or buy thirdparty surveys to learn what product and labor market competitors are offering • Survey present employees • Use an integrated health data management system (IHDMS) to analyze the relationship between a company’s benefit plan & its results Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

3c08d3e657d4d6ca71d4f78a0c686bc3.ppt