b83996868d9b3bae17a9f716549e6828.ppt

- Количество слайдов: 83

Comparison and Analysis of the 4 Market Structures Mo(o) PC Ideal/Best market structure MPC Oligopoly n o p o l y

Comparison and Analysis of the 4 Market Structures Mo(o) PC Ideal/Best market structure MPC Oligopoly n o p o l y

Is There A “Best” Market Structure? Common criterion/yardsticks for comparison Economic Efficiency l Allocative Efficiency l Productive Efficiency 2. Price and output level 3. Variety of products 4. Profitability of firms 5. Research and development 6. Innovation and new products 7. Theory vs empirical evidence 1.

Is There A “Best” Market Structure? Common criterion/yardsticks for comparison Economic Efficiency l Allocative Efficiency l Productive Efficiency 2. Price and output level 3. Variety of products 4. Profitability of firms 5. Research and development 6. Innovation and new products 7. Theory vs empirical evidence 1.

Comparison of Market Structures Economic Efficiency (Revision) Importance of definition

Comparison of Market Structures Economic Efficiency (Revision) Importance of definition

Comparison of Market Structures Economic Efficiency § Pareto Optimum situation § It is not possible to change production in such a way to make everyone better off § It is not possible to make someone better off without making someone worse off. § Efficiency in production (Productive Efficiency) § Efficiency in terms of types of goods produced (Allocative efficiency)

Comparison of Market Structures Economic Efficiency § Pareto Optimum situation § It is not possible to change production in such a way to make everyone better off § It is not possible to make someone better off without making someone worse off. § Efficiency in production (Productive Efficiency) § Efficiency in terms of types of goods produced (Allocative efficiency)

Comparison of Market Structures Allocative Efficiency § Occurs when it is not possible to change the allocation of resources to make everyone better off. § Allocation of resources refer to the distribution of resources among the types of good to be produced. § Main objective: Correct product mix

Comparison of Market Structures Allocative Efficiency § Occurs when it is not possible to change the allocation of resources to make everyone better off. § Allocation of resources refer to the distribution of resources among the types of good to be produced. § Main objective: Correct product mix

Comparison of Market Structures Allocative Efficiency Assuming the absence of externalities and public goods and other sources of market failure, allocative efficiency is achieved when: l P=MC l Price = value of the benefit received by the consumer l MC = opportunity cost of resources used in the production of the additional unit of the good = value of benefit received by consumer of the alternative good

Comparison of Market Structures Allocative Efficiency Assuming the absence of externalities and public goods and other sources of market failure, allocative efficiency is achieved when: l P=MC l Price = value of the benefit received by the consumer l MC = opportunity cost of resources used in the production of the additional unit of the good = value of benefit received by consumer of the alternative good

Eg: l Pair of shoe l Price = $40 l MC = $30 l Value created by the pair of shoe is greater than the value loss by the diversion of resources to produce the shoe. If P > MC, society will benefit further if more resources are allocated to this good. l If P < MC, society will benefit further if less resources are allocated to this good. l Allocative efficiency : P=MC l

Eg: l Pair of shoe l Price = $40 l MC = $30 l Value created by the pair of shoe is greater than the value loss by the diversion of resources to produce the shoe. If P > MC, society will benefit further if more resources are allocated to this good. l If P < MC, society will benefit further if less resources are allocated to this good. l Allocative efficiency : P=MC l

Illustrating Allocative Efficiency Conditions MSB = MSC P = MC 9

Illustrating Allocative Efficiency Conditions MSB = MSC P = MC 9

Allocative efficiency For units above 9 units, e. g. 10 th unit: P (MB) < MC: society values last unit of the good less than opp cost of producing that unit won’t produce that unit For units below 9 units, e. g. 8 th unit: P (MB) > MC : society values last unit of the good more than the opportunity cost of producing that unit will produce that unit 9

Allocative efficiency For units above 9 units, e. g. 10 th unit: P (MB) < MC: society values last unit of the good less than opp cost of producing that unit won’t produce that unit For units below 9 units, e. g. 8 th unit: P (MB) > MC : society values last unit of the good more than the opportunity cost of producing that unit will produce that unit 9

Allocative Efficiency Will the 9 th unit be produced? Yes. P = MC: value society places on consumption of that last unit of good is equal to opportunity cost of producing it. Right amount and type of goods are produced to maximise society’s welfare. SMB = SMC 9

Allocative Efficiency Will the 9 th unit be produced? Yes. P = MC: value society places on consumption of that last unit of good is equal to opportunity cost of producing it. Right amount and type of goods are produced to maximise society’s welfare. SMB = SMC 9

Is society producing what society wants & in the quantities desired by society?

Is society producing what society wants & in the quantities desired by society?

Comparison of Market Structures Productive Efficiency l Firm’s point of view: All points on LRAC curve are productively efficient Represent the lowest average cost in producing that given level of output (X-efficiency) l Society’s point of view: Only minimum LRAC is productively efficient ie. minimum efficient scale (MES). All IEOS have been exploited

Comparison of Market Structures Productive Efficiency l Firm’s point of view: All points on LRAC curve are productively efficient Represent the lowest average cost in producing that given level of output (X-efficiency) l Society’s point of view: Only minimum LRAC is productively efficient ie. minimum efficient scale (MES). All IEOS have been exploited

Comparison of Market Structures PC Firm vs Firms Under Imperfect Markets l Assume ¡Long run equilibrium ¡Profit maximising aim ¡Normal profits l. Take note that PC and MPC firms must and can only make normal profits in the long run (no entry barriers) l. Monopoly and oligopoly make normal profits in the long run but they usually make supernormal profits in the long run due to entry barriers

Comparison of Market Structures PC Firm vs Firms Under Imperfect Markets l Assume ¡Long run equilibrium ¡Profit maximising aim ¡Normal profits l. Take note that PC and MPC firms must and can only make normal profits in the long run (no entry barriers) l. Monopoly and oligopoly make normal profits in the long run but they usually make supernormal profits in the long run due to entry barriers

Comparison of Market Structures Allocative Efficiency: P= MC Firm under Perfect Competition vs Firm under Imperfect Market Is the PC firm allocatively efficient? l Is the firm in imperfect markets allocatively efficient? l

Comparison of Market Structures Allocative Efficiency: P= MC Firm under Perfect Competition vs Firm under Imperfect Market Is the PC firm allocatively efficient? l Is the firm in imperfect markets allocatively efficient? l

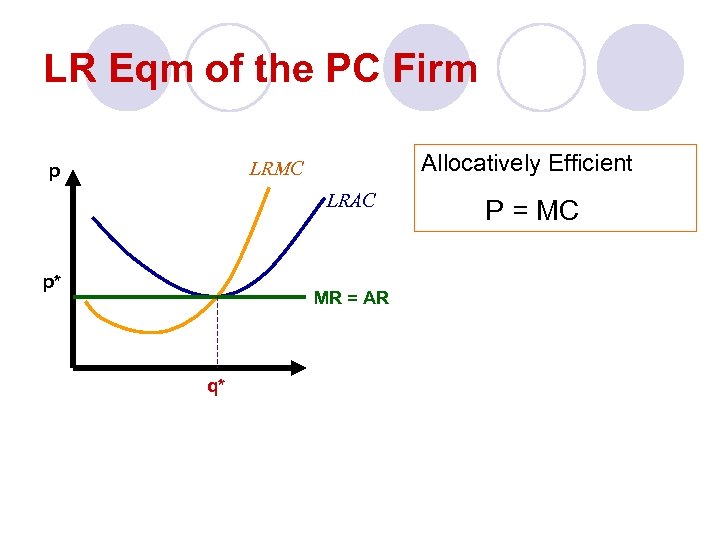

LR Eqm of the PC Firm Allocatively Efficient LRMC p LRAC p* MR = AR q* P = MC

LR Eqm of the PC Firm Allocatively Efficient LRMC p LRAC p* MR = AR q* P = MC

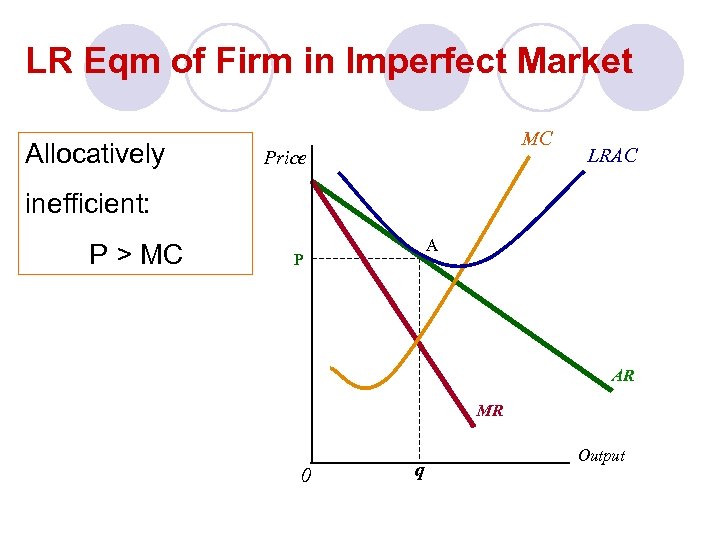

LR Eqm of Firm in Imperfect Market Allocatively MC Price LRAC inefficient: P > MC A P AR MR 0 q Output

LR Eqm of Firm in Imperfect Market Allocatively MC Price LRAC inefficient: P > MC A P AR MR 0 q Output

Comparison of Market Structures Productive Efficiency from society’s viewpoint: Production occurs at minimum LRAC Firm under Perfect Competition vs Firm under Imperfect Market Is the PC firm productively efficient? l Is the firm competing under imperfect market structures productively efficient? l

Comparison of Market Structures Productive Efficiency from society’s viewpoint: Production occurs at minimum LRAC Firm under Perfect Competition vs Firm under Imperfect Market Is the PC firm productively efficient? l Is the firm competing under imperfect market structures productively efficient? l

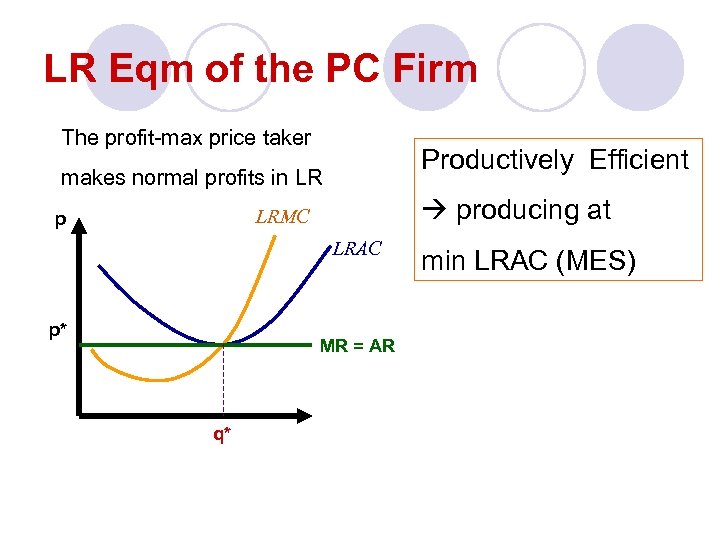

LR Eqm of the PC Firm The profit-max price taker Productively Efficient makes normal profits in LR producing at LRMC p LRAC p* MR = AR q* min LRAC (MES)

LR Eqm of the PC Firm The profit-max price taker Productively Efficient makes normal profits in LR producing at LRMC p LRAC p* MR = AR q* min LRAC (MES)

LR Eqm of Firm in Imperfect Market Productively inefficient from society’s viewpoint: Not producing at min LRAC (MES)

LR Eqm of Firm in Imperfect Market Productively inefficient from society’s viewpoint: Not producing at min LRAC (MES)

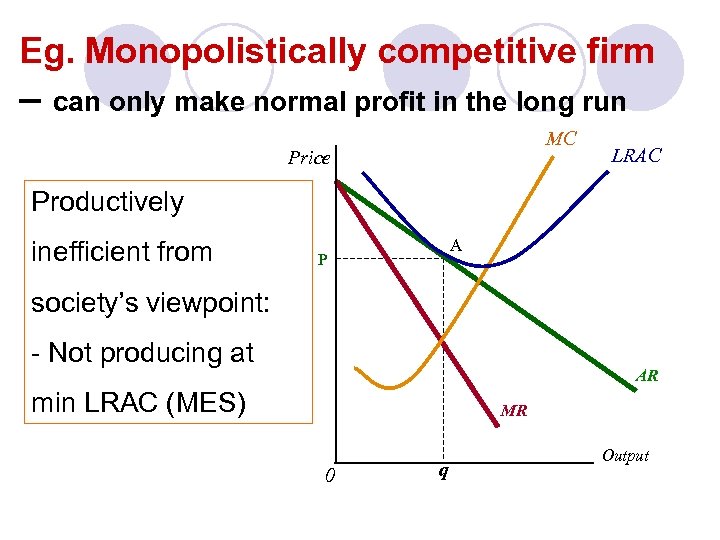

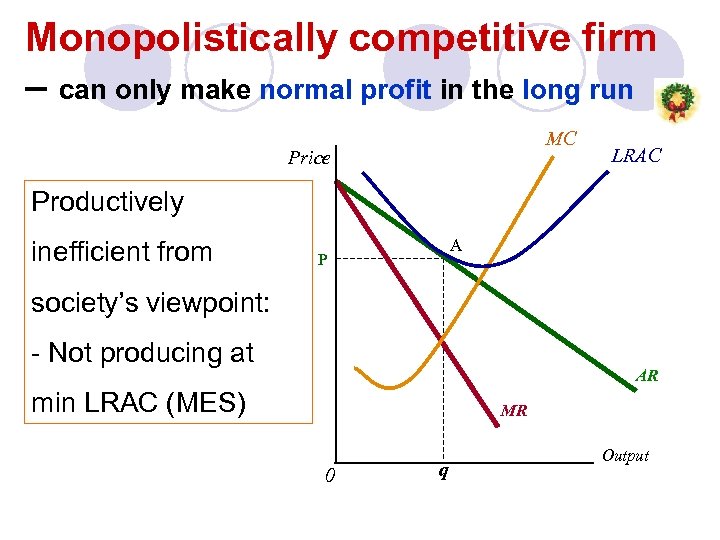

Eg. Monopolistically competitive firm – can only make normal profit in the long run MC Price LRAC Productively inefficient from A P society’s viewpoint: - Not producing at AR min LRAC (MES) MR 0 q Output

Eg. Monopolistically competitive firm – can only make normal profit in the long run MC Price LRAC Productively inefficient from A P society’s viewpoint: - Not producing at AR min LRAC (MES) MR 0 q Output

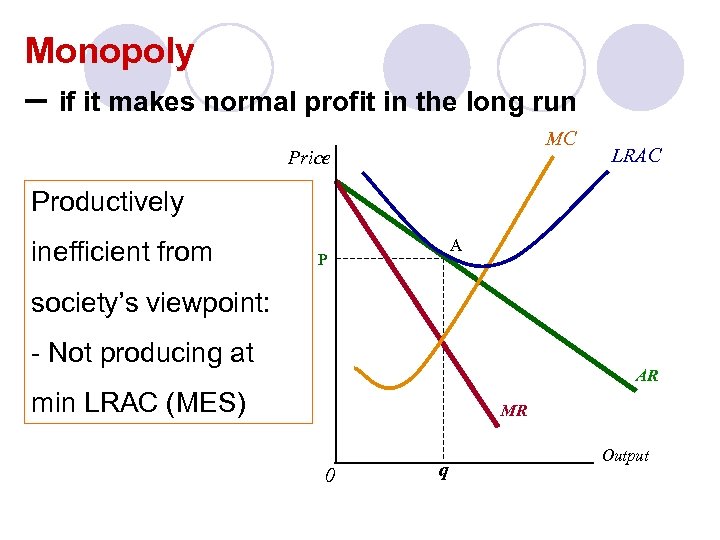

Monopoly – if it makes normal profit in the long run MC Price LRAC Productively inefficient from A P society’s viewpoint: - Not producing at AR min LRAC (MES) MR 0 q Output

Monopoly – if it makes normal profit in the long run MC Price LRAC Productively inefficient from A P society’s viewpoint: - Not producing at AR min LRAC (MES) MR 0 q Output

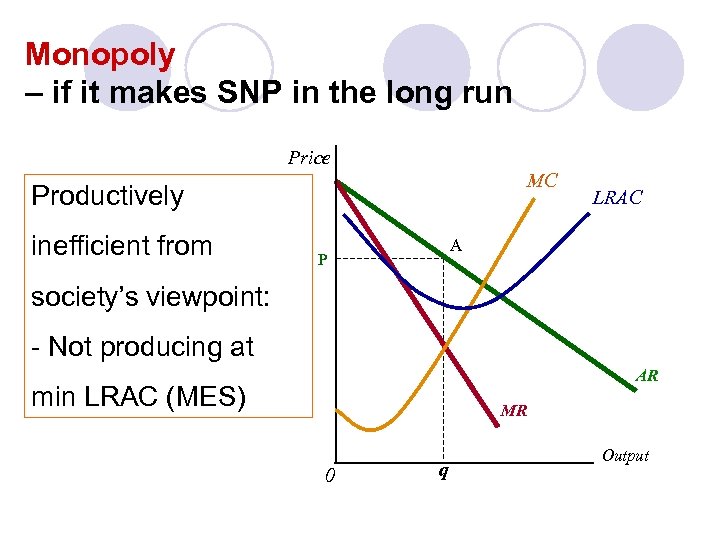

Monopoly – if it makes SNP in the long run Price MC Productively inefficient from LRAC A P society’s viewpoint: - Not producing at AR min LRAC (MES) MR 0 q Output

Monopoly – if it makes SNP in the long run Price MC Productively inefficient from LRAC A P society’s viewpoint: - Not producing at AR min LRAC (MES) MR 0 q Output

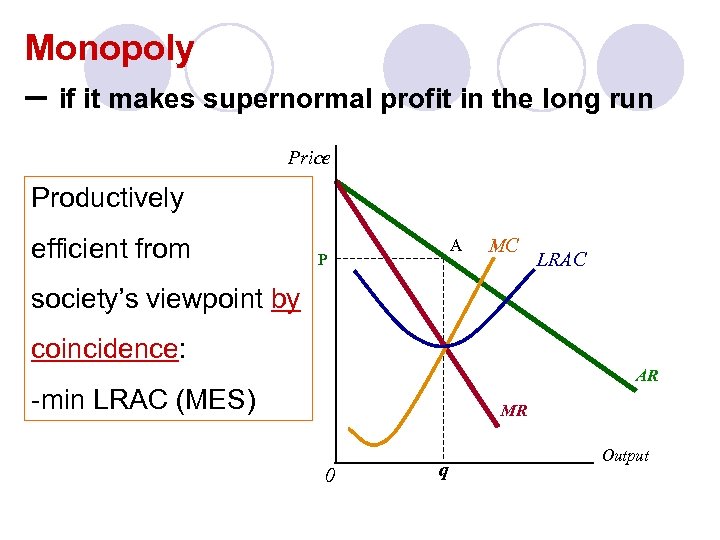

Monopoly – if it makes supernormal profit in the long run Price Productively efficient from A P MC LRAC society’s viewpoint by coincidence: AR -min LRAC (MES) MR 0 q Output

Monopoly – if it makes supernormal profit in the long run Price Productively efficient from A P MC LRAC society’s viewpoint by coincidence: AR -min LRAC (MES) MR 0 q Output

For now, it seems that… Efficiency is used as a yardstick for comparison However, there are other criteria that can be used for comparison between market structures

For now, it seems that… Efficiency is used as a yardstick for comparison However, there are other criteria that can be used for comparison between market structures

Is There A “Best” Market Structure? Common criterion/yardsticks for comparison Economic Efficiency l Allocative Efficiency l Productive Efficiency 2. Price and output level 3. Variety of products 4. Profitability of firms 5. Research and development 6. Innovation and new products 7. Theory vs empirical evidence 1.

Is There A “Best” Market Structure? Common criterion/yardsticks for comparison Economic Efficiency l Allocative Efficiency l Productive Efficiency 2. Price and output level 3. Variety of products 4. Profitability of firms 5. Research and development 6. Innovation and new products 7. Theory vs empirical evidence 1.

Comparison between PC and Monopoly Market Assumption: l Before : Industry is made up of many small : firms (PC). l After: one firm buys out all the other firms and creates a monopoly. l Compare Price and output under PC and Monopoly

Comparison between PC and Monopoly Market Assumption: l Before : Industry is made up of many small : firms (PC). l After: one firm buys out all the other firms and creates a monopoly. l Compare Price and output under PC and Monopoly

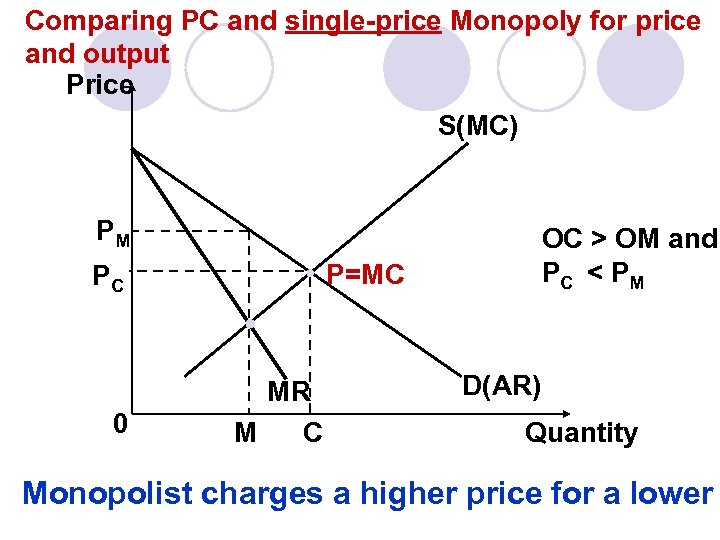

Comparing PC and single-price Monopoly for price and output Price S(MC) PM P=MC PC 0 OC > OM and PC < P M MR C M D(AR) Quantity Monopolist charges a higher price for a lower

Comparing PC and single-price Monopoly for price and output Price S(MC) PM P=MC PC 0 OC > OM and PC < P M MR C M D(AR) Quantity Monopolist charges a higher price for a lower

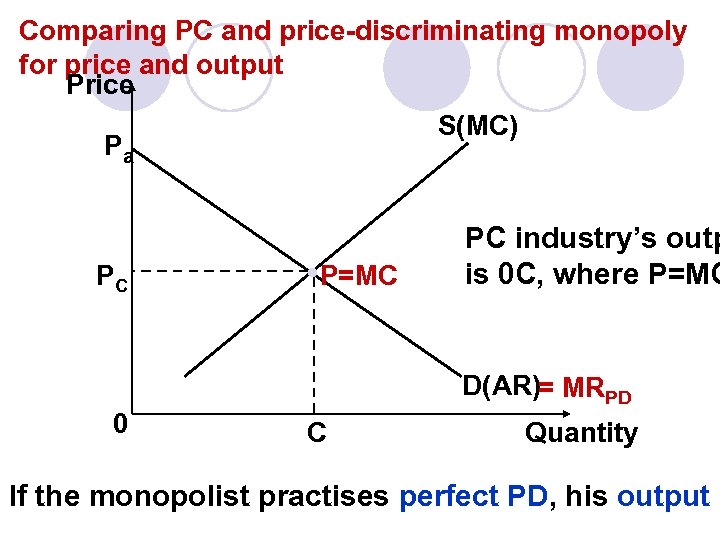

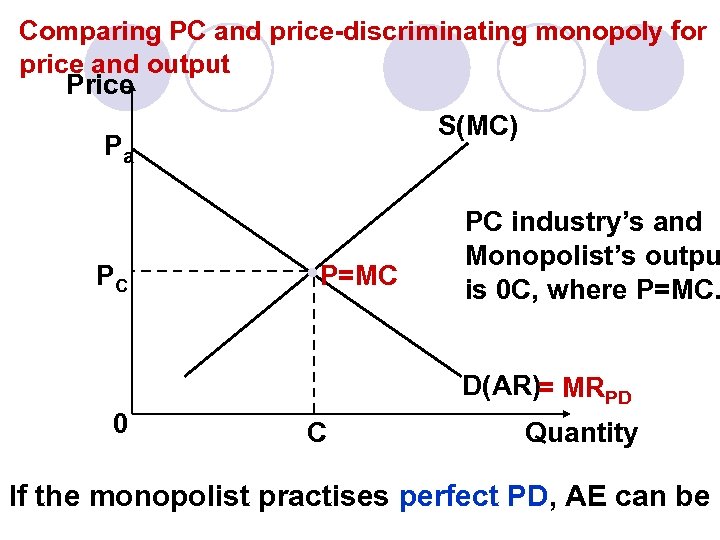

Comparing PC and price-discriminating monopoly for price and output Price S(MC) Pa PC P=MC PC industry’s outp is 0 C, where P=MC D(AR)= MRPD 0 C Quantity If the monopolist practises perfect PD, his output i

Comparing PC and price-discriminating monopoly for price and output Price S(MC) Pa PC P=MC PC industry’s outp is 0 C, where P=MC D(AR)= MRPD 0 C Quantity If the monopolist practises perfect PD, his output i

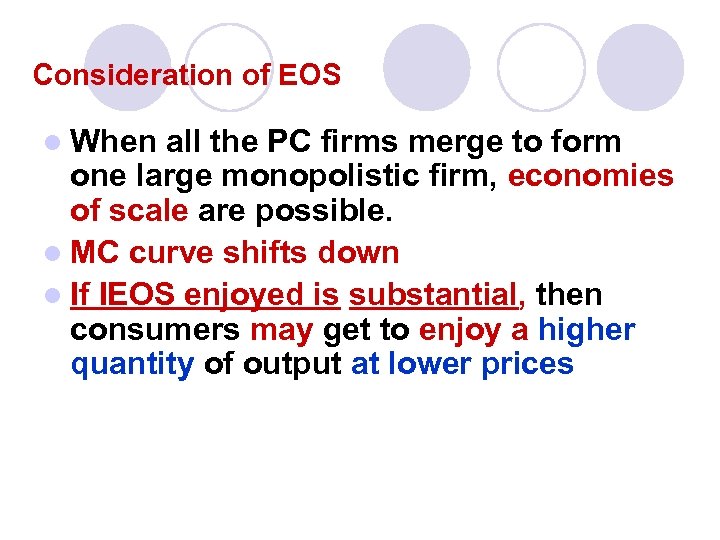

Consideration of EOS l When all the PC firms merge to form one large monopolistic firm, economies of scale are possible. l MC curve shifts down l If IEOS enjoyed is substantial, then consumers may get to enjoy a higher quantity of output at lower prices

Consideration of EOS l When all the PC firms merge to form one large monopolistic firm, economies of scale are possible. l MC curve shifts down l If IEOS enjoyed is substantial, then consumers may get to enjoy a higher quantity of output at lower prices

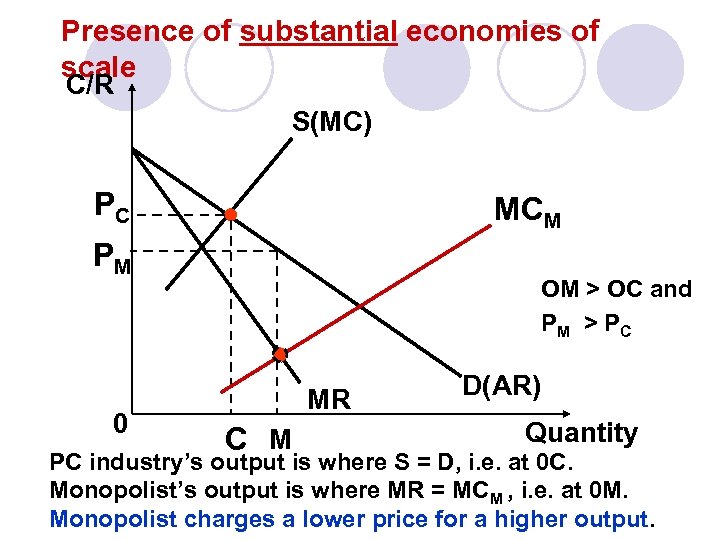

Presence of substantial economies of scale C/R S(MC) PC MCM PM 0 OM > OC and PM > P C MR C M D(AR) Quantity PC industry’s output is where S = D, i. e. at 0 C. Monopolist’s output is where MR = MCM , i. e. at 0 M. Monopolist charges a lower price for a higher output.

Presence of substantial economies of scale C/R S(MC) PC MCM PM 0 OM > OC and PM > P C MR C M D(AR) Quantity PC industry’s output is where S = D, i. e. at 0 C. Monopolist’s output is where MR = MCM , i. e. at 0 M. Monopolist charges a lower price for a higher output.

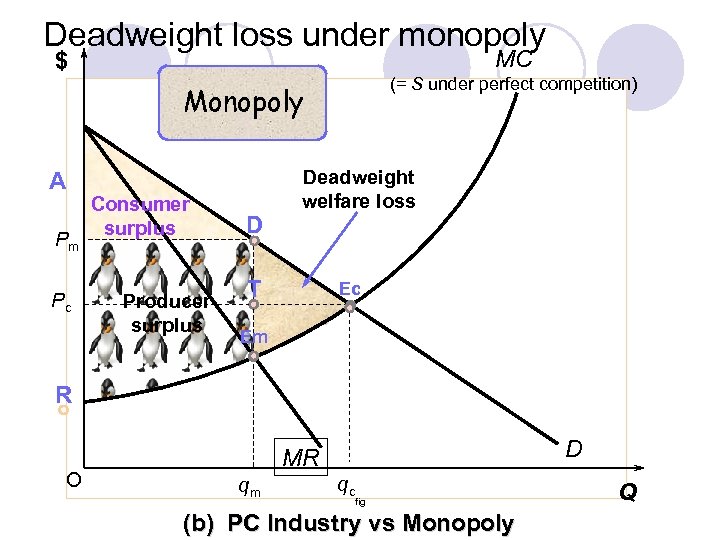

Comparison between PC and Monopoly Market Compare consumer’s surplus and producer’s surplus under PC and Monopoly l Under PC market surpluses are maximised l Under Monopoly a deadweight loss is experienced

Comparison between PC and Monopoly Market Compare consumer’s surplus and producer’s surplus under PC and Monopoly l Under PC market surpluses are maximised l Under Monopoly a deadweight loss is experienced

Deadweight loss under monopoly MC $ (= S under perfect competition) Monopoly A Pm Pc Consumer surplus Producer surplus D Deadweight welfare loss T Ec Em R O D MR qm qc fig (b) PC Industry vs Monopoly Q

Deadweight loss under monopoly MC $ (= S under perfect competition) Monopoly A Pm Pc Consumer surplus Producer surplus D Deadweight welfare loss T Ec Em R O D MR qm qc fig (b) PC Industry vs Monopoly Q

Comparison efficiency between PC and Monopoly Market Compare efficiency under PC and Monopoly l Productive efficiency l Allocative efficiency

Comparison efficiency between PC and Monopoly Market Compare efficiency under PC and Monopoly l Productive efficiency l Allocative efficiency

Comparing PC and Monopoly for productive efficiency Perfect Competition: l In LR each firm produces not only on the LRAC but also at the min. point of its LRAC curve. l Since all firms produce where P=MC and P is the same for every firm, then MC is the same for every firm. productive efficiency (firm’s perspective and society’s) is achieved under PC.

Comparing PC and Monopoly for productive efficiency Perfect Competition: l In LR each firm produces not only on the LRAC but also at the min. point of its LRAC curve. l Since all firms produce where P=MC and P is the same for every firm, then MC is the same for every firm. productive efficiency (firm’s perspective and society’s) is achieved under PC.

Comparing PC and Monopoly for productive efficiency Monopoly: l Monopolist has incentive to operate on the LRAC in order to minimise costs. l However, the equilibrium output will NOT correspond to LRAC’s minimum. productive efficiency (firm’s perspective) can be achieved under a monopoly. However it is productively inefficient from society’s perspective.

Comparing PC and Monopoly for productive efficiency Monopoly: l Monopolist has incentive to operate on the LRAC in order to minimise costs. l However, the equilibrium output will NOT correspond to LRAC’s minimum. productive efficiency (firm’s perspective) can be achieved under a monopoly. However it is productively inefficient from society’s perspective.

X- inefficiency l A firm under perfect competition is a price taker only way for it to stay in business is to be as cost efficient as possible. ¡ l If less efficient than other firms, may not make sufficient profits to stay in business in long term. However for the monopolist, without competitive pressures on profit margins, may allow cost controls to become lax overstaffing ¡ spending on prestige buildings and equipment ¡ l There is also less effort to keep technologically up to date (eg research in new products) or to develop new domestic and export markets.

X- inefficiency l A firm under perfect competition is a price taker only way for it to stay in business is to be as cost efficient as possible. ¡ l If less efficient than other firms, may not make sufficient profits to stay in business in long term. However for the monopolist, without competitive pressures on profit margins, may allow cost controls to become lax overstaffing ¡ spending on prestige buildings and equipment ¡ l There is also less effort to keep technologically up to date (eg research in new products) or to develop new domestic and export markets.

X- inefficiency l Result : ¡ costs will be higher than what is possible ¡ more resources than necessary are used in production less output for the given amount of resources that the economy possess.

X- inefficiency l Result : ¡ costs will be higher than what is possible ¡ more resources than necessary are used in production less output for the given amount of resources that the economy possess.

X- Inefficiency Evaluation: l With globalisation and international competition, even a monopoly may be “competitive”. Why? qmarkets global in scale qless barriers to trade fiercer competition from abroad qthreat of potential competition

X- Inefficiency Evaluation: l With globalisation and international competition, even a monopoly may be “competitive”. Why? qmarkets global in scale qless barriers to trade fiercer competition from abroad qthreat of potential competition

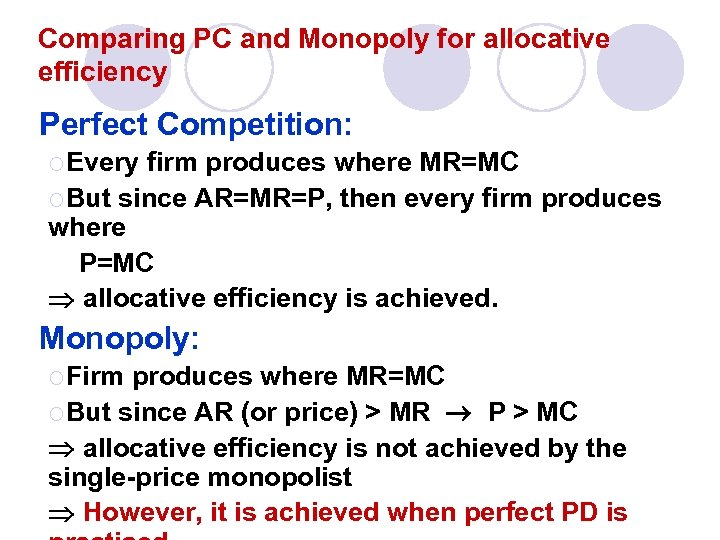

Comparing PC and Monopoly for allocative efficiency Perfect Competition: ¡Every firm produces where MR=MC ¡But since AR=MR=P, then every firm produces where P=MC allocative efficiency is achieved. Monopoly: ¡Firm produces where MR=MC ¡But since AR (or price) > MR P > MC allocative efficiency is not achieved by the single-price monopolist However, it is achieved when perfect PD is

Comparing PC and Monopoly for allocative efficiency Perfect Competition: ¡Every firm produces where MR=MC ¡But since AR=MR=P, then every firm produces where P=MC allocative efficiency is achieved. Monopoly: ¡Firm produces where MR=MC ¡But since AR (or price) > MR P > MC allocative efficiency is not achieved by the single-price monopolist However, it is achieved when perfect PD is

Comparing PC and price-discriminating monopoly for price and output Price S(MC) Pa PC P=MC PC industry’s and Monopolist’s outpu is 0 C, where P=MC. D(AR)= MRPD 0 C Quantity If the monopolist practises perfect PD, AE can be a

Comparing PC and price-discriminating monopoly for price and output Price S(MC) Pa PC P=MC PC industry’s and Monopolist’s outpu is 0 C, where P=MC. D(AR)= MRPD 0 C Quantity If the monopolist practises perfect PD, AE can be a

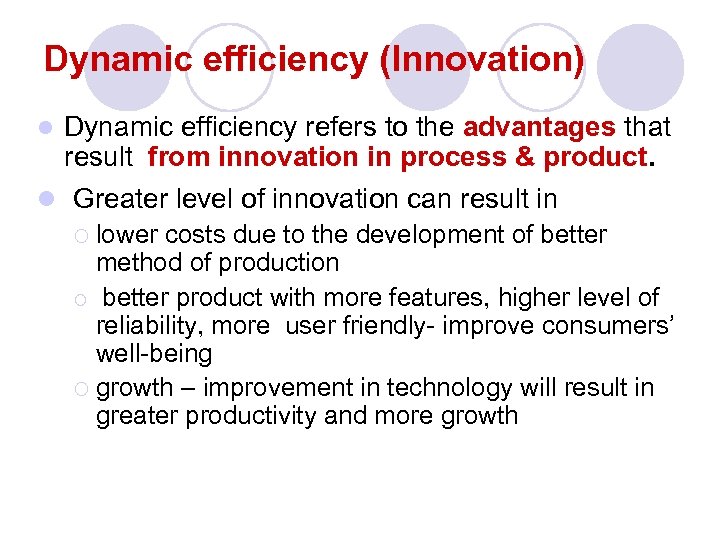

Dynamic efficiency (Innovation) Dynamic efficiency refers to the advantages that result from innovation in process & product. l Greater level of innovation can result in l lower costs due to the development of better method of production ¡ better product with more features, higher level of reliability, more user friendly- improve consumers’ well-being ¡ growth – improvement in technology will result in greater productivity and more growth ¡

Dynamic efficiency (Innovation) Dynamic efficiency refers to the advantages that result from innovation in process & product. l Greater level of innovation can result in l lower costs due to the development of better method of production ¡ better product with more features, higher level of reliability, more user friendly- improve consumers’ well-being ¡ growth – improvement in technology will result in greater productivity and more growth ¡

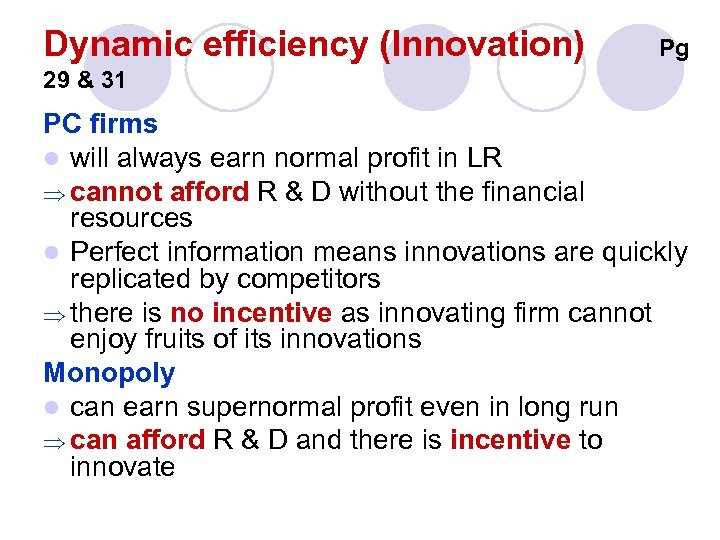

Dynamic efficiency (Innovation) Pg 29 & 31 PC firms l will always earn normal profit in LR Þ cannot afford R & D without the financial resources l Perfect information means innovations are quickly replicated by competitors Þ there is no incentive as innovating firm cannot enjoy fruits of its innovations Monopoly l can earn supernormal profit even in long run Þ can afford R & D and there is incentive to innovate

Dynamic efficiency (Innovation) Pg 29 & 31 PC firms l will always earn normal profit in LR Þ cannot afford R & D without the financial resources l Perfect information means innovations are quickly replicated by competitors Þ there is no incentive as innovating firm cannot enjoy fruits of its innovations Monopoly l can earn supernormal profit even in long run Þ can afford R & D and there is incentive to innovate

Is Perfect Competition the Most Ideal? Counter-argument: Not if other yardsticks are used 1. presence of externalities causes market failure even if it is perfect competition lack of variety of products/services supernormal profits not necessarily undesirable: 2. 3. l Supernormal profits provides funds for R&D l PC firms can only make normal profits in long run

Is Perfect Competition the Most Ideal? Counter-argument: Not if other yardsticks are used 1. presence of externalities causes market failure even if it is perfect competition lack of variety of products/services supernormal profits not necessarily undesirable: 2. 3. l Supernormal profits provides funds for R&D l PC firms can only make normal profits in long run

Is Perfect Competition – Most Ideal? Counter-argument: Not if other yardsticks are used l. PC not a realistic representation of most markets. l. But it helps us to understand how markets work to achieve efficiency in resource allocation under ideal situations. l. Helps government to implement policies to improve efficiency and welfare in markets

Is Perfect Competition – Most Ideal? Counter-argument: Not if other yardsticks are used l. PC not a realistic representation of most markets. l. But it helps us to understand how markets work to achieve efficiency in resource allocation under ideal situations. l. Helps government to implement policies to improve efficiency and welfare in markets

Is Monopoly the Society’s villain? l “No point is better accepted… than that the monopoly price is higher and the output smaller than is socially ideal. The public is the victim. ” JK Galbraith, Economics and the Public Purpose, 1974 l “Monopolies are like babies. Nobody likes them till they’ve got one of their own” Sir John Hicks

Is Monopoly the Society’s villain? l “No point is better accepted… than that the monopoly price is higher and the output smaller than is socially ideal. The public is the victim. ” JK Galbraith, Economics and the Public Purpose, 1974 l “Monopolies are like babies. Nobody likes them till they’ve got one of their own” Sir John Hicks

Is Monopoly the Society’s villain? l 1. Generally not well regarded Allocatively inefficient v v 2. 3. Price > MC Output below optimum output level X – inefficient wastage of resources Unequal income distribution

Is Monopoly the Society’s villain? l 1. Generally not well regarded Allocatively inefficient v v 2. 3. Price > MC Output below optimum output level X – inefficient wastage of resources Unequal income distribution

Is Monopoly the Society’s villain? l However there are merits of monopoly 1. Research and development Supernormal profits used to finance R & D v improved technology v lower costs of production v With reference to a diagram, how does R&D affect the monopoly’s LRAC? v Successful R&D will lead to a downward shift of the LRAC curve v development of new/better quality products (vs perfectly competitive markets inability to earn more than normal profits restricts such investment) 2. Substantial EOS can lead to lower prices and larger output for consumers higher consumer surplus

Is Monopoly the Society’s villain? l However there are merits of monopoly 1. Research and development Supernormal profits used to finance R & D v improved technology v lower costs of production v With reference to a diagram, how does R&D affect the monopoly’s LRAC? v Successful R&D will lead to a downward shift of the LRAC curve v development of new/better quality products (vs perfectly competitive markets inability to earn more than normal profits restricts such investment) 2. Substantial EOS can lead to lower prices and larger output for consumers higher consumer surplus

Is Monopoly the Society’s villain? 3. Innovation and new products v Joseph Schumpeter : Creative Destruction v possibility of monopoly profits stimulates new entrants producing new and competing products. v entry barriers not a serious problem in the VERY long run v entry barriers - very stimulus to the creativity required to destroy the barriers v monopoly profit is ‘the most powerful engine of progress and in particular, the long run expansion of total output’. v “Perfect competition is not only impossible but inferior and has no title to being set up as a model. ”

Is Monopoly the Society’s villain? 3. Innovation and new products v Joseph Schumpeter : Creative Destruction v possibility of monopoly profits stimulates new entrants producing new and competing products. v entry barriers not a serious problem in the VERY long run v entry barriers - very stimulus to the creativity required to destroy the barriers v monopoly profit is ‘the most powerful engine of progress and in particular, the long run expansion of total output’. v “Perfect competition is not only impossible but inferior and has no title to being set up as a model. ”

Is Monopoly the Society’s villain? 4. Reduction of Wasteful Competition 5. Price discrimination, in some instances, may benefit society

Is Monopoly the Society’s villain? 4. Reduction of Wasteful Competition 5. Price discrimination, in some instances, may benefit society

Mo(o) PC Ideal/Best market structure Oligopoly n o p o l y

Mo(o) PC Ideal/Best market structure Oligopoly n o p o l y

Recap: Which is more ideal: PC vs Monopoly? Common criterion/yardsticks for comparison Economic Efficiency PC l Allocative Efficiency l Productive Efficiency 2. Price and output level (it all depends) 3. Variety of products 4. Profitability of firms (it all depends) 5. Research and development 6. Innovation and new products 7. Theory vs empirical evidence (it all depends) 1. Mo(o) n o p o l y

Recap: Which is more ideal: PC vs Monopoly? Common criterion/yardsticks for comparison Economic Efficiency PC l Allocative Efficiency l Productive Efficiency 2. Price and output level (it all depends) 3. Variety of products 4. Profitability of firms (it all depends) 5. Research and development 6. Innovation and new products 7. Theory vs empirical evidence (it all depends) 1. Mo(o) n o p o l y

The following slides will focus on: l Theory of contestability ¡ l Monopolistic competition: ¡ l Alternative to theory of market structure Excess capacity theorem Oligopoly

The following slides will focus on: l Theory of contestability ¡ l Monopolistic competition: ¡ l Alternative to theory of market structure Excess capacity theorem Oligopoly

Alternative theory/perspective to market structure - Theory of Contestable Markets Revise: What is market structure? All those features of a market that affect the behaviour and performance of firms in that market: l the number and sellers l the extent of knowledge about each other’s actions l the degree of freedom of entry l and the degree of product differentiation.

Alternative theory/perspective to market structure - Theory of Contestable Markets Revise: What is market structure? All those features of a market that affect the behaviour and performance of firms in that market: l the number and sellers l the extent of knowledge about each other’s actions l the degree of freedom of entry l and the degree of product differentiation.

Alternative theory/perspective to market structure - Theory of Contestable Markets Background to theory: Markets with few sellers are sometimes more competitive than they seem Why? Because entry into & exit from these markets are costless and unimpeded Constant threat of possible entry by new firms forces even the largest existing firm to behave well to produce efficiently and never to overcharge

Alternative theory/perspective to market structure - Theory of Contestable Markets Background to theory: Markets with few sellers are sometimes more competitive than they seem Why? Because entry into & exit from these markets are costless and unimpeded Constant threat of possible entry by new firms forces even the largest existing firm to behave well to produce efficiently and never to overcharge

Alternative perspective to market structure - Theory of Contestable Markets What is meant by costless and unimpeded entry? l. It means that firms can enter or choose to exit from the industry without losing the money they invested l. If entry turns out to have been a mistake, the entrant is able to withdraw the investment and move to another market without loss l. Such markets usually require that investments are made in highly mobile capital. E. g. airplanes, trucks, river barges

Alternative perspective to market structure - Theory of Contestable Markets What is meant by costless and unimpeded entry? l. It means that firms can enter or choose to exit from the industry without losing the money they invested l. If entry turns out to have been a mistake, the entrant is able to withdraw the investment and move to another market without loss l. Such markets usually require that investments are made in highly mobile capital. E. g. airplanes, trucks, river barges

Alternative perspective to market structure - Theory of Contestable Markets Example of a market where entry and exit is costless: Singapore context: Other bus companies competing with SBS company to serve the general public make a loss convert their bus to serve another market e. g. factory workers or school children or tourists

Alternative perspective to market structure - Theory of Contestable Markets Example of a market where entry and exit is costless: Singapore context: Other bus companies competing with SBS company to serve the general public make a loss convert their bus to serve another market e. g. factory workers or school children or tourists

How can LTA increase contestability of public transport?

How can LTA increase contestability of public transport?

Alternative perspective to market structure - Theory of Contestable Markets What is crucial in determining price & o/p is not the number of firms in the industry BUT whether costs of entry and exit are low The constant threat of entry forces oligopolists l to price its product competitively make normal profits l to be cost efficient

Alternative perspective to market structure - Theory of Contestable Markets What is crucial in determining price & o/p is not the number of firms in the industry BUT whether costs of entry and exit are low The constant threat of entry forces oligopolists l to price its product competitively make normal profits l to be cost efficient

Alternative perspective to market structure - Theory of Contestable Markets Some consider the airline industry to be contestable. Consider the case of the airline route between Singapore and Kuala Lumpur. Lots of traffic Only 2 airlines serve this route directly before Feb 2008

Alternative perspective to market structure - Theory of Contestable Markets Some consider the airline industry to be contestable. Consider the case of the airline route between Singapore and Kuala Lumpur. Lots of traffic Only 2 airlines serve this route directly before Feb 2008

Alternative perspective to market structure - Theory of Contestable Markets To enter and operate an airline along a route requires : - Multimillion-dollar airplanes - Facilities for reservations, ticketing, baggage handling etc. High barriers to entry Few firms The 2 airlines are able to charge a high price, right?

Alternative perspective to market structure - Theory of Contestable Markets To enter and operate an airline along a route requires : - Multimillion-dollar airplanes - Facilities for reservations, ticketing, baggage handling etc. High barriers to entry Few firms The 2 airlines are able to charge a high price, right?

Alternative perspective to market structure - Theory of Contestable Markets However, they might not be able to or want to charge a high price if other airlines are able to enter this market easily or freely Empirical evidence: Entry barriers to the airline industry are much lower than equipment costs suggest as long as there is no problem with renting access to airport facilities.

Alternative perspective to market structure - Theory of Contestable Markets However, they might not be able to or want to charge a high price if other airlines are able to enter this market easily or freely Empirical evidence: Entry barriers to the airline industry are much lower than equipment costs suggest as long as there is no problem with renting access to airport facilities.

Alternative perspective to market structure - Theory of Contestable Markets The KL to Singapore market can be entered simply by -shifting aircraft, personnel and equipment from other locations -renting or leasing the aircraft If the firm wants to leave that market, nearly all invested capital can be recovered, through shifting the aircraft and other capital equipment to other routes, or leasing them to other firms Low costs of entry and exit due to capital costs being recoverable

Alternative perspective to market structure - Theory of Contestable Markets The KL to Singapore market can be entered simply by -shifting aircraft, personnel and equipment from other locations -renting or leasing the aircraft If the firm wants to leave that market, nearly all invested capital can be recovered, through shifting the aircraft and other capital equipment to other routes, or leasing them to other firms Low costs of entry and exit due to capital costs being recoverable

Straits Times Nov 1, 2006 THE COMPETITION ACT AND SINGAPOREKUALA LUMPUR ROUTE NATIONAL carriers Malaysia Airlines (MAS) and Singapore Airlines (SIA) dominate the KLSingapore market with an 85 per cent share. Low-cost carriers Air. Asia and Tiger Air are keen to enter. Due to government regulations, low-cost carriers cannot compete on this route now. To serve the market, they would need air-traffic rights under the Singapore-Malaysia Air Services Agreement (ASA) signed in 1980.

Straits Times Nov 1, 2006 THE COMPETITION ACT AND SINGAPOREKUALA LUMPUR ROUTE NATIONAL carriers Malaysia Airlines (MAS) and Singapore Airlines (SIA) dominate the KLSingapore market with an 85 per cent share. Low-cost carriers Air. Asia and Tiger Air are keen to enter. Due to government regulations, low-cost carriers cannot compete on this route now. To serve the market, they would need air-traffic rights under the Singapore-Malaysia Air Services Agreement (ASA) signed in 1980.

Alternative perspective to market structure - Theory of Contestable Markets Thus, it appears that when there are no legal barriers restricting entry, an airline route is a classic case of contestable market

Alternative perspective to market structure - Theory of Contestable Markets Thus, it appears that when there are no legal barriers restricting entry, an airline route is a classic case of contestable market

New budget airline to fly Singapore-KL route CNA 03 July 2009 The skies are getting more crowded on the Singapore-Kuala Lumpur route.

New budget airline to fly Singapore-KL route CNA 03 July 2009 The skies are getting more crowded on the Singapore-Kuala Lumpur route.

Alternative perspective to market structure - Theory of Contestable Markets Hit and run competition: Firms enter the market for a short period when profits are high and then quickly withdraw. Example: Ø Small delivery company tends to set up parcel services at Christmas time to take advantage of the increased demand. Ø Fear of such competition prevents the national service provider from charging high prices

Alternative perspective to market structure - Theory of Contestable Markets Hit and run competition: Firms enter the market for a short period when profits are high and then quickly withdraw. Example: Ø Small delivery company tends to set up parcel services at Christmas time to take advantage of the increased demand. Ø Fear of such competition prevents the national service provider from charging high prices

Theory of Contestable Market – How useful is it? l Takes into account the possibility of new entrants and allows the following predictions to be made: v. Regardless of whether an industry is made up of small number of firms or one firm, competitive behaviour is observed as long as the market is contestable. As a result, v. SNP may not be that large. v. Inefficient firms including monopolies cannot survive change their ways or leave the industry in the long run. l Shifts in policy perspectives v. Theory suggests a new way to encourage firms to act as perfect competitors v. Rather than direct interference in the behaviour patterns of firms, government efforts should perhaps be directed at lowering entry and exit costs

Theory of Contestable Market – How useful is it? l Takes into account the possibility of new entrants and allows the following predictions to be made: v. Regardless of whether an industry is made up of small number of firms or one firm, competitive behaviour is observed as long as the market is contestable. As a result, v. SNP may not be that large. v. Inefficient firms including monopolies cannot survive change their ways or leave the industry in the long run. l Shifts in policy perspectives v. Theory suggests a new way to encourage firms to act as perfect competitors v. Rather than direct interference in the behaviour patterns of firms, government efforts should perhaps be directed at lowering entry and exit costs

Monopolistic Competition Generally regarded as inefficient: v Allocatively inefficient: Price > MC at equilibrium (output below optimum) v Wasteful competition (advertising)

Monopolistic Competition Generally regarded as inefficient: v Allocatively inefficient: Price > MC at equilibrium (output below optimum) v Wasteful competition (advertising)

Monopolistically competitive firm – can only make normal profit in the long run MC Price LRAC Productively inefficient from A P society’s viewpoint: - Not producing at AR min LRAC (MES) MR 0 q Output

Monopolistically competitive firm – can only make normal profit in the long run MC Price LRAC Productively inefficient from A P society’s viewpoint: - Not producing at AR min LRAC (MES) MR 0 q Output

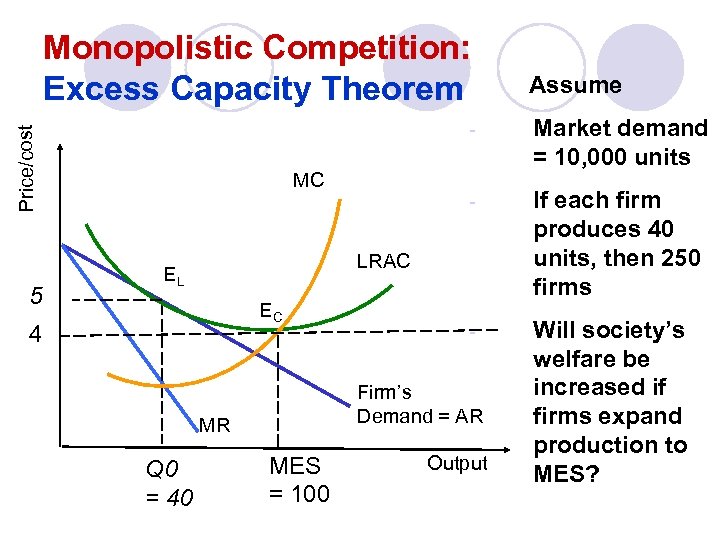

Monopolistic Competition: Excess Capacity Theorem - Price/cost 5 Assume - Will society’s welfare be increased if firms expand production to MES? LRAC EL EC 4 Firm’s Demand = AR MR Q 0 = 40 If each firm produces 40 units, then 250 firms - MC Market demand = 10, 000 units MES = 100 Output

Monopolistic Competition: Excess Capacity Theorem - Price/cost 5 Assume - Will society’s welfare be increased if firms expand production to MES? LRAC EL EC 4 Firm’s Demand = AR MR Q 0 = 40 If each firm produces 40 units, then 250 firms - MC Market demand = 10, 000 units MES = 100 Output

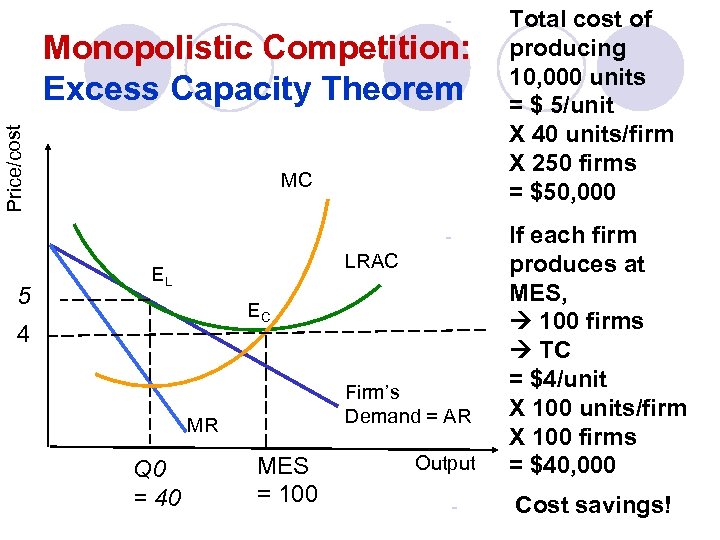

- Total cost of producing 10, 000 units = $ 5/unit X 40 units/firm X 250 firms = $50, 000 - If each firm produces at MES, 100 firms TC = $4/unit X 100 units/firm X 100 firms = $40, 000 Price/cost Monopolistic Competition: Excess Capacity Theorem 5 MC LRAC EL EC 4 Firm’s Demand = AR MR Q 0 = 40 MES = 100 Output - Cost savings!

- Total cost of producing 10, 000 units = $ 5/unit X 40 units/firm X 250 firms = $50, 000 - If each firm produces at MES, 100 firms TC = $4/unit X 100 units/firm X 100 firms = $40, 000 Price/cost Monopolistic Competition: Excess Capacity Theorem 5 MC LRAC EL EC 4 Firm’s Demand = AR MR Q 0 = 40 MES = 100 Output - Cost savings!

Monopolistic Competition l Excess Capacity Theorem: v LR equilibrium not at MES l Evaluation: v Larger variety of products – increases consumer welfare v But is this necessarily true? v Advertising closes information gap v But is this necessarily true?

Monopolistic Competition l Excess Capacity Theorem: v LR equilibrium not at MES l Evaluation: v Larger variety of products – increases consumer welfare v But is this necessarily true? v Advertising closes information gap v But is this necessarily true?

Oligopoly - Demerits o Allocatively inefficient: o Price > MC; output below optimum o High price rigidity o Possible monopoly power through collusion o Wasteful competition

Oligopoly - Demerits o Allocatively inefficient: o Price > MC; output below optimum o High price rigidity o Possible monopoly power through collusion o Wasteful competition

Demerits: Wasteful competition l Extensive advertising compared to monopolist and others: v Expensive in terms of resource costs v Create barriers to entry which reduces competition

Demerits: Wasteful competition l Extensive advertising compared to monopolist and others: v Expensive in terms of resource costs v Create barriers to entry which reduces competition

Demerits: Wasteful competition ? v However, advertising may benefit consumers Ø encourages price competition Ø increased sales volume and reaping of economies of scale, prices can be further reduced Ø Provides information about quality and gives firms an incentive to maintain high quality ØBrand name useful as a way of judging the quality of what consumers are about to buy

Demerits: Wasteful competition ? v However, advertising may benefit consumers Ø encourages price competition Ø increased sales volume and reaping of economies of scale, prices can be further reduced Ø Provides information about quality and gives firms an incentive to maintain high quality ØBrand name useful as a way of judging the quality of what consumers are about to buy

Demerits: Wasteful competition l Multiple branding - firm produces essentially the same product under different brand names v 3 -firm oligopoly. A potential entrant – can gain 25% of the market. v But the 3 existing firms producing a total of five ‘competing’ brands. v The potential entrant might gain only 6. 25% (1/6 th) of the market - much less attractive.

Demerits: Wasteful competition l Multiple branding - firm produces essentially the same product under different brand names v 3 -firm oligopoly. A potential entrant – can gain 25% of the market. v But the 3 existing firms producing a total of five ‘competing’ brands. v The potential entrant might gain only 6. 25% (1/6 th) of the market - much less attractive.

Merits of Oligopoly - Innovation l l l In the very long run, technological change can occur Such innovation spurs economic growth Likely to see greater degree of innovation than monopoly

Merits of Oligopoly - Innovation l l l In the very long run, technological change can occur Such innovation spurs economic growth Likely to see greater degree of innovation than monopoly

Oligopoly: Empirical evidence l IBM, Microsoft, Kodak and Fuji: (USA in 1988) l 7% of manufacturing firms employing less than 1000 workers had a formal R&D program compared to 91% of large firms with more than 25, 000 employees.

Oligopoly: Empirical evidence l IBM, Microsoft, Kodak and Fuji: (USA in 1988) l 7% of manufacturing firms employing less than 1000 workers had a formal R&D program compared to 91% of large firms with more than 25, 000 employees.

Oligopoly: Policy implication l Harness the advantages of large scale production while minimizing the drawbacks ¡ Through government intervention – taxes, state ownership, regulation and legislation

Oligopoly: Policy implication l Harness the advantages of large scale production while minimizing the drawbacks ¡ Through government intervention – taxes, state ownership, regulation and legislation

Mo(o) PC Ideal/Best market structure MPC Oligopoly n o p o l y

Mo(o) PC Ideal/Best market structure MPC Oligopoly n o p o l y

Recap: Which market structure is the most ideal? Common criterion/yardsticks for comparison Economic Efficiency PC l Allocative Efficiency l Productive Efficiency 2. Price and output level (it all depends) 3. Variety of products (it all depends) MPC 4. Profitability of firms (it all depends) 5. Research and development (it all depends) 6. Innovation and new products (it all depends) 7. Theory vs empirical evidence (it all depends) 1. Oligopoly Mo(o) n o p o l y

Recap: Which market structure is the most ideal? Common criterion/yardsticks for comparison Economic Efficiency PC l Allocative Efficiency l Productive Efficiency 2. Price and output level (it all depends) 3. Variety of products (it all depends) MPC 4. Profitability of firms (it all depends) 5. Research and development (it all depends) 6. Innovation and new products (it all depends) 7. Theory vs empirical evidence (it all depends) 1. Oligopoly Mo(o) n o p o l y

Another issue: Which is the most common market structure in modern economies? Common criterion/yardsticks for comparison Characteristics PC 2. Behaviour of firms l Price & non-price competition 3. Performance of firms MPC l Price-output Oligopoly l Profit Mo(o) l Efficiency n o It all depends on p l Type of industry o l l How narrowly or broadly you define the industry y l Whether competition from abroad is included l Geographical location 1.

Another issue: Which is the most common market structure in modern economies? Common criterion/yardsticks for comparison Characteristics PC 2. Behaviour of firms l Price & non-price competition 3. Performance of firms MPC l Price-output Oligopoly l Profit Mo(o) l Efficiency n o It all depends on p l Type of industry o l l How narrowly or broadly you define the industry y l Whether competition from abroad is included l Geographical location 1.

Another issue: Which is the most realistic in modern economies? Common criterion/yardsticks for comparison 1. 2. 3. Characteristics PC Behaviour of firms l Price & non-price competition Performance of firms MPC l Price-output l Profitability l Efficiency Alternative theory to market structures l Theory of contestability Oligopoly Mo(o) n o p o l y

Another issue: Which is the most realistic in modern economies? Common criterion/yardsticks for comparison 1. 2. 3. Characteristics PC Behaviour of firms l Price & non-price competition Performance of firms MPC l Price-output l Profitability l Efficiency Alternative theory to market structures l Theory of contestability Oligopoly Mo(o) n o p o l y