03a5a674b6412bcc8ac7f9c13d1f0a9a.ppt

- Количество слайдов: 15

Comparing Private Equity Fund Domiciles 26 April 2012

Comparing Private Equity Fund Domiciles 26 April 2012

Introduction • • • AIFMD, more politics and jurisdictional competition Private equity focus Parallels are not easy: o o o different laws and different needs different industries beware simple comparisons: o a fund is not a fund o when is regulation?

Introduction • • • AIFMD, more politics and jurisdictional competition Private equity focus Parallels are not easy: o o o different laws and different needs different industries beware simple comparisons: o a fund is not a fund o when is regulation?

Introduction (cont. ) • Subjective criteria can be decisive: o o • Fiduciary responsibility o o • location investor sentiment market trends the preference of particular advisers multi-jurisdiction businesses product improvement Focussing on facts o o understanding context making a direct comparison

Introduction (cont. ) • Subjective criteria can be decisive: o o • Fiduciary responsibility o o • location investor sentiment market trends the preference of particular advisers multi-jurisdiction businesses product improvement Focussing on facts o o understanding context making a direct comparison

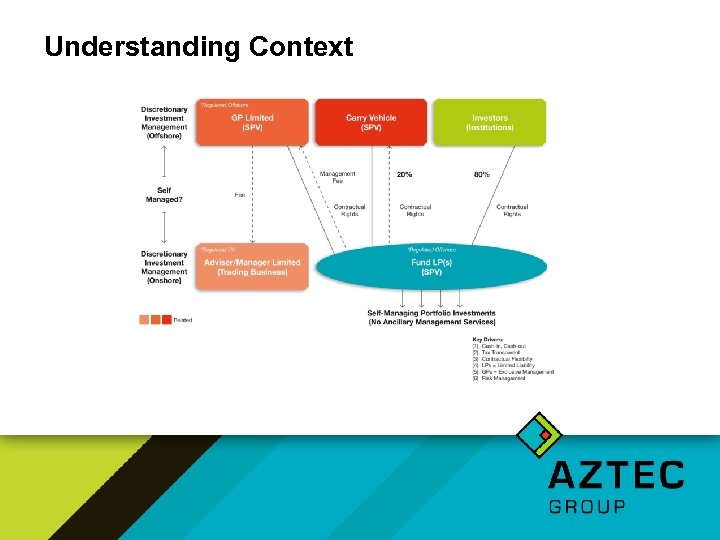

Understanding Context

Understanding Context

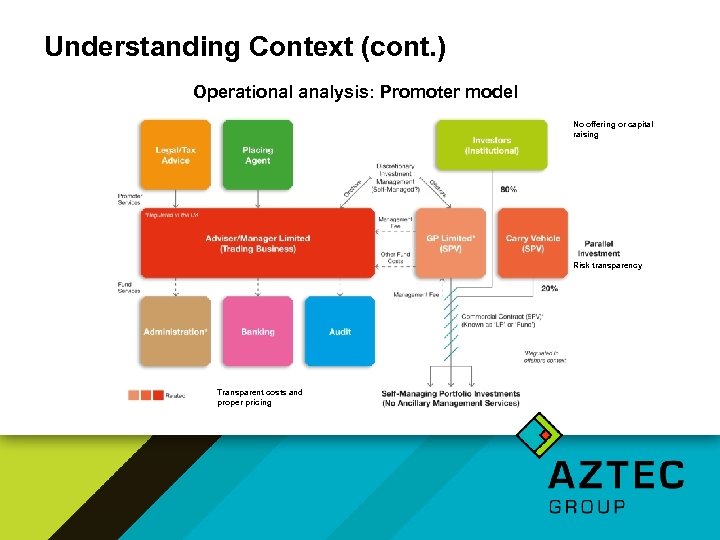

Understanding Context (cont. ) Operational analysis: Promoter model No offering or capital raising Risk transparency Transparent costs and proper pricing

Understanding Context (cont. ) Operational analysis: Promoter model No offering or capital raising Risk transparency Transparent costs and proper pricing

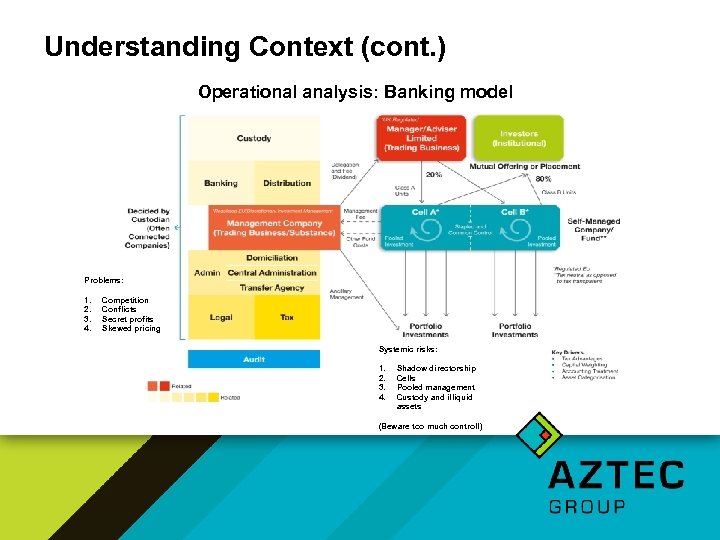

Understanding Context (cont. ) Operational analysis: Banking model Problems: 1. 2. 3. 4. Competition Conflicts Secret profits Skewed pricing Systemic risks: 1. 2. 3. 4. Shadow directorship Cells Pooled management Custody and illiquid assets (Beware too much control!)

Understanding Context (cont. ) Operational analysis: Banking model Problems: 1. 2. 3. 4. Competition Conflicts Secret profits Skewed pricing Systemic risks: 1. 2. 3. 4. Shadow directorship Cells Pooled management Custody and illiquid assets (Beware too much control!)

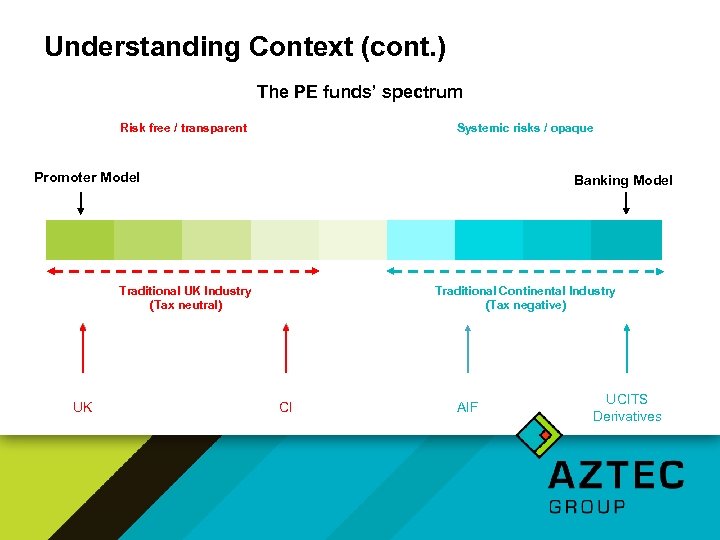

Understanding Context (cont. ) The PE funds’ spectrum Risk free / transparent Systemic risks / opaque Promoter Model Banking Model Traditional UK Industry (Tax neutral) UK Traditional Continental Industry (Tax negative) CI AIF UCITS Derivatives

Understanding Context (cont. ) The PE funds’ spectrum Risk free / transparent Systemic risks / opaque Promoter Model Banking Model Traditional UK Industry (Tax neutral) UK Traditional Continental Industry (Tax negative) CI AIF UCITS Derivatives

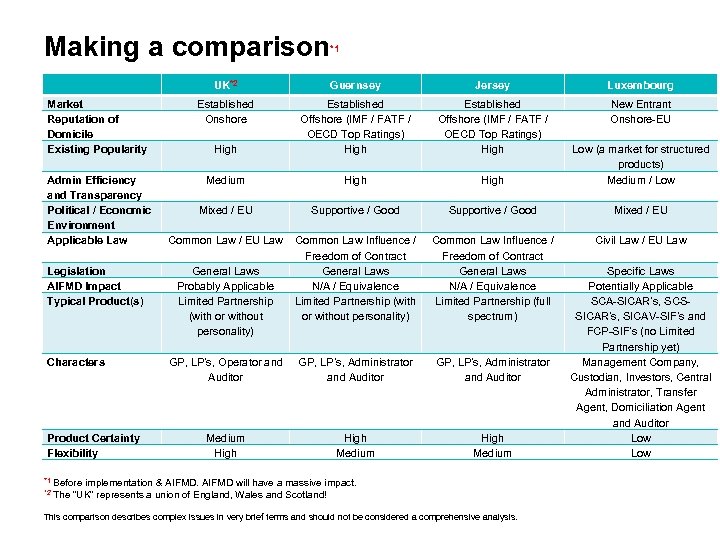

Making a comparison *1 UK*2 Market Reputation of Domicile Existing Popularity Admin Efficiency and Transparency Political / Economic Environment Applicable Law Legislation AIFMD Impact Typical Product(s) Characters Product Certainty Flexibility Guernsey Jersey Luxembourg Established Onshore Established Offshore (IMF / FATF / OECD Top Ratings) High New Entrant Onshore-EU High Established Offshore (IMF / FATF / OECD Top Ratings) High Medium High Low (a market for structured products) Medium / Low Mixed / EU Supportive / Good Mixed / EU Common Law / EU Law Common Law Influence / Freedom of Contract General Laws N/A / Equivalence Limited Partnership (with or without personality) Common Law Influence / Freedom of Contract General Laws N/A / Equivalence Limited Partnership (full spectrum) Civil Law / EU Law GP, LP’s, Operator and Auditor GP, LP’s, Administrator and Auditor Medium High Medium General Laws Probably Applicable Limited Partnership (with or without personality) *1 Before *2 implementation & AIFMD will have a massive impact. The “UK” represents a union of England, Wales and Scotland! This comparison describes complex issues in very brief terms and should not be considered a comprehensive analysis. Specific Laws Potentially Applicable SCA-SICAR’s, SCSSICAR’s, SICAV-SIF’s and FCP-SIF’s (no Limited Partnership yet) Management Company, Custodian, Investors, Central Administrator, Transfer Agent, Domiciliation Agent and Auditor Low

Making a comparison *1 UK*2 Market Reputation of Domicile Existing Popularity Admin Efficiency and Transparency Political / Economic Environment Applicable Law Legislation AIFMD Impact Typical Product(s) Characters Product Certainty Flexibility Guernsey Jersey Luxembourg Established Onshore Established Offshore (IMF / FATF / OECD Top Ratings) High New Entrant Onshore-EU High Established Offshore (IMF / FATF / OECD Top Ratings) High Medium High Low (a market for structured products) Medium / Low Mixed / EU Supportive / Good Mixed / EU Common Law / EU Law Common Law Influence / Freedom of Contract General Laws N/A / Equivalence Limited Partnership (with or without personality) Common Law Influence / Freedom of Contract General Laws N/A / Equivalence Limited Partnership (full spectrum) Civil Law / EU Law GP, LP’s, Operator and Auditor GP, LP’s, Administrator and Auditor Medium High Medium General Laws Probably Applicable Limited Partnership (with or without personality) *1 Before *2 implementation & AIFMD will have a massive impact. The “UK” represents a union of England, Wales and Scotland! This comparison describes complex issues in very brief terms and should not be considered a comprehensive analysis. Specific Laws Potentially Applicable SCA-SICAR’s, SCSSICAR’s, SICAV-SIF’s and FCP-SIF’s (no Limited Partnership yet) Management Company, Custodian, Investors, Central Administrator, Transfer Agent, Domiciliation Agent and Auditor Low

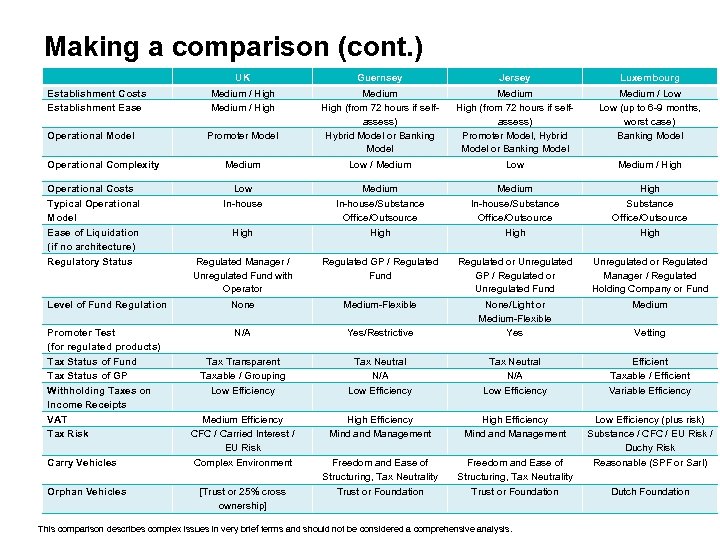

Making a comparison (cont. ) Establishment Costs Establishment Ease Operational Model UK Guernsey Jersey Luxembourg Medium / High Medium High (from 72 hours if selfassess) Hybrid Model or Banking Model Medium High (from 72 hours if selfassess) Promoter Model, Hybrid Model or Banking Model Medium / Low (up to 6 -9 months, worst case) Banking Model Promoter Model Operational Complexity Medium Low / Medium Low Medium / High Operational Costs Typical Operational Model Low In-house Medium In-house/Substance Office/Outsource High High Regulated Manager / Unregulated Fund with Operator Regulated GP / Regulated Fund Regulated or Unregulated GP / Regulated or Unregulated Fund Unregulated or Regulated Manager / Regulated Holding Company or Fund None Medium-Flexible Medium N/A Yes/Restrictive None/Light or Medium-Flexible Yes Tax Transparent Taxable / Grouping Low Efficiency Tax Neutral N/A Low Efficiency Efficient Taxable / Efficient Variable Efficiency VAT Tax Risk Medium Efficiency CFC / Carried Interest / EU Risk High Efficiency Mind and Management Low Efficiency (plus risk) Substance / CFC / EU Risk / Duchy Risk Carry Vehicles Complex Environment Freedom and Ease of Structuring, Tax Neutrality Reasonable (SPF or Sarl) [Trust or 25% cross ownership] Trust or Foundation Dutch Foundation Ease of Liquidation (if no architecture) Regulatory Status Level of Fund Regulation Promoter Test (for regulated products) Tax Status of Fund Tax Status of GP Withholding Taxes on Income Receipts Orphan Vehicles This comparison describes complex issues in very brief terms and should not be considered a comprehensive analysis. Vetting

Making a comparison (cont. ) Establishment Costs Establishment Ease Operational Model UK Guernsey Jersey Luxembourg Medium / High Medium High (from 72 hours if selfassess) Hybrid Model or Banking Model Medium High (from 72 hours if selfassess) Promoter Model, Hybrid Model or Banking Model Medium / Low (up to 6 -9 months, worst case) Banking Model Promoter Model Operational Complexity Medium Low / Medium Low Medium / High Operational Costs Typical Operational Model Low In-house Medium In-house/Substance Office/Outsource High High Regulated Manager / Unregulated Fund with Operator Regulated GP / Regulated Fund Regulated or Unregulated GP / Regulated or Unregulated Fund Unregulated or Regulated Manager / Regulated Holding Company or Fund None Medium-Flexible Medium N/A Yes/Restrictive None/Light or Medium-Flexible Yes Tax Transparent Taxable / Grouping Low Efficiency Tax Neutral N/A Low Efficiency Efficient Taxable / Efficient Variable Efficiency VAT Tax Risk Medium Efficiency CFC / Carried Interest / EU Risk High Efficiency Mind and Management Low Efficiency (plus risk) Substance / CFC / EU Risk / Duchy Risk Carry Vehicles Complex Environment Freedom and Ease of Structuring, Tax Neutrality Reasonable (SPF or Sarl) [Trust or 25% cross ownership] Trust or Foundation Dutch Foundation Ease of Liquidation (if no architecture) Regulatory Status Level of Fund Regulation Promoter Test (for regulated products) Tax Status of Fund Tax Status of GP Withholding Taxes on Income Receipts Orphan Vehicles This comparison describes complex issues in very brief terms and should not be considered a comprehensive analysis. Vetting

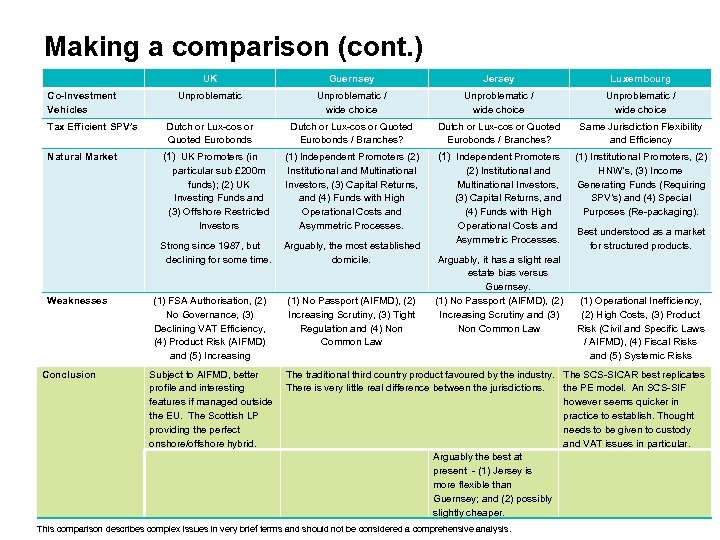

Making a comparison (cont. ) Tax Efficient SPV’s Natural Market Weaknesses Conclusion Guernsey Jersey Luxembourg Unproblematic / wide choice Dutch or Lux-cos or Quoted Eurobonds / Branches? Same Jurisdiction Flexibility and Efficiency (1) UK Promoters (in particular sub £ 200 m funds); (2) UK Investing Funds and (3) Offshore Restricted Investors (1) Independent Promoters (2) Institutional and Multinational Investors, (3) Capital Returns, and (4) Funds with High Operational Costs and Asymmetric Processes. Arguably, the most established domicile. (1) Independent Promoters (2) Institutional and Multinational Investors, (3) Capital Returns, and (4) Funds with High Operational Costs and Asymmetric Processes. (1) Institutional Promoters, (2) HNW’s, (3) Income Generating Funds (Requiring SPV’s) and (4) Special Purposes (Re-packaging). Strong since 1987, but declining for some time. Co-Investment Vehicles UK (1) FSA Authorisation, (2) No Governance, (3) Declining VAT Efficiency, (4) Product Risk (AIFMD) and (5) Increasing Disclosure Subject to AIFMD, better profile and interesting features if managed outside the EU. The Scottish LP providing the perfect onshore/offshore hybrid. (1) No Passport (AIFMD), (2) Increasing Scrutiny, (3) Tight Regulation and (4) Non Common Law Arguably, it has a slight real estate bias versus Guernsey. (1) No Passport (AIFMD), (2) Increasing Scrutiny and (3) Non Common Law Best understood as a market for structured products. (1) Operational Inefficiency, (2) High Costs, (3) Product Risk (Civil and Specific Laws / AIFMD), (4) Fiscal Risks and (5) Systemic Risks (Custody and Platform) The traditional third country product favoured by the industry. The SCS-SICAR best replicates There is very little real difference between the jurisdictions. the PE model. An SCS-SIF however seems quicker in practice to establish. Thought needs to be given to custody and VAT issues in particular. Arguably the best at present - (1) Jersey is more flexible than Guernsey; and (2) possibly slightly cheaper. This comparison describes complex issues in very brief terms and should not be considered a comprehensive analysis.

Making a comparison (cont. ) Tax Efficient SPV’s Natural Market Weaknesses Conclusion Guernsey Jersey Luxembourg Unproblematic / wide choice Dutch or Lux-cos or Quoted Eurobonds / Branches? Same Jurisdiction Flexibility and Efficiency (1) UK Promoters (in particular sub £ 200 m funds); (2) UK Investing Funds and (3) Offshore Restricted Investors (1) Independent Promoters (2) Institutional and Multinational Investors, (3) Capital Returns, and (4) Funds with High Operational Costs and Asymmetric Processes. Arguably, the most established domicile. (1) Independent Promoters (2) Institutional and Multinational Investors, (3) Capital Returns, and (4) Funds with High Operational Costs and Asymmetric Processes. (1) Institutional Promoters, (2) HNW’s, (3) Income Generating Funds (Requiring SPV’s) and (4) Special Purposes (Re-packaging). Strong since 1987, but declining for some time. Co-Investment Vehicles UK (1) FSA Authorisation, (2) No Governance, (3) Declining VAT Efficiency, (4) Product Risk (AIFMD) and (5) Increasing Disclosure Subject to AIFMD, better profile and interesting features if managed outside the EU. The Scottish LP providing the perfect onshore/offshore hybrid. (1) No Passport (AIFMD), (2) Increasing Scrutiny, (3) Tight Regulation and (4) Non Common Law Arguably, it has a slight real estate bias versus Guernsey. (1) No Passport (AIFMD), (2) Increasing Scrutiny and (3) Non Common Law Best understood as a market for structured products. (1) Operational Inefficiency, (2) High Costs, (3) Product Risk (Civil and Specific Laws / AIFMD), (4) Fiscal Risks and (5) Systemic Risks (Custody and Platform) The traditional third country product favoured by the industry. The SCS-SICAR best replicates There is very little real difference between the jurisdictions. the PE model. An SCS-SIF however seems quicker in practice to establish. Thought needs to be given to custody and VAT issues in particular. Arguably the best at present - (1) Jersey is more flexible than Guernsey; and (2) possibly slightly cheaper. This comparison describes complex issues in very brief terms and should not be considered a comprehensive analysis.

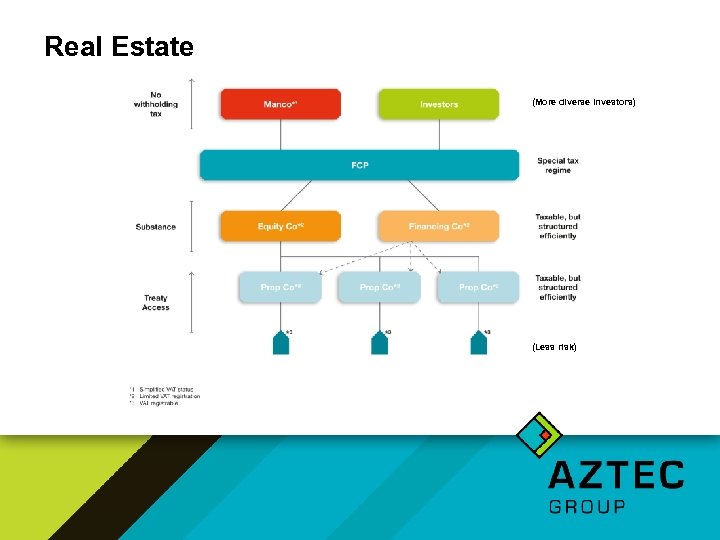

Real Estate (More diverse investors) (Less risk)

Real Estate (More diverse investors) (Less risk)

Conclusion • • • Comparisons are not easy No clear answers, no winners Established patterns exist o o • • • asset classes products Nothing happens by chance The equation is always changing No room for jurisdictional hubris, focus on: o o o efficiency and established benefits service standards and integrity a proportionate, internationally acceptable framework

Conclusion • • • Comparisons are not easy No clear answers, no winners Established patterns exist o o • • • asset classes products Nothing happens by chance The equation is always changing No room for jurisdictional hubris, focus on: o o o efficiency and established benefits service standards and integrity a proportionate, internationally acceptable framework

Contact details Visit our website for more information: www. aztecgroup. co. uk James Bermingham Tel: +352 24 616 000 Email: james. bermingham@aztecgroup. co. uk Aztec Financial Services (Luxembourg) S. A. 9 A, Rue Gabriel Lippmann L-5365, Munsbach Grand-Duché de Luxembourg

Contact details Visit our website for more information: www. aztecgroup. co. uk James Bermingham Tel: +352 24 616 000 Email: james. bermingham@aztecgroup. co. uk Aztec Financial Services (Luxembourg) S. A. 9 A, Rue Gabriel Lippmann L-5365, Munsbach Grand-Duché de Luxembourg

www. aztecgroup. co. uk

www. aztecgroup. co. uk