51cf108dc989f0c5c79b2ab458133e26.ppt

- Количество слайдов: 23

Comparing Economic Alternatives Using time value of money to choose between two or more options

Comparing Economic Alternatives Using time value of money to choose between two or more options

Examples of Engineering Decisions • • • Is it better to invest in an automated process or a manual process? Is it better to buy a high efficiency appliance or a low efficiency appliance? Should we buy a new machine or keep the old one?

Examples of Engineering Decisions • • • Is it better to invest in an automated process or a manual process? Is it better to buy a high efficiency appliance or a low efficiency appliance? Should we buy a new machine or keep the old one?

Economically Different Alternatives One may require more initial investment than the other. • One may have smaller operating cost than the other. • One may last longer than the other. • One may have a different salvage than the other. They differ because they have different cash flows. Yet we must make a choice. Sometimes, we are allowed the choice of neither, but not always. •

Economically Different Alternatives One may require more initial investment than the other. • One may have smaller operating cost than the other. • One may last longer than the other. • One may have a different salvage than the other. They differ because they have different cash flows. Yet we must make a choice. Sometimes, we are allowed the choice of neither, but not always. •

Example • Two machines are being considered to manufacture some product. The first machine costs $1100 initially and has a $100 salvage value after ten years. It costs $200 a year to operate. The second costs $1300 initially. It has a salvage value of $100 after ten years and costs $150 per year to operate. At the minimum rate of return of 15%, which machine should you select?

Example • Two machines are being considered to manufacture some product. The first machine costs $1100 initially and has a $100 salvage value after ten years. It costs $200 a year to operate. The second costs $1300 initially. It has a salvage value of $100 after ten years and costs $150 per year to operate. At the minimum rate of return of 15%, which machine should you select?

Example (cont’d) • • How do we make a choice? Recall the steps seen earlier. – – Describe the cash flow of each alternative Specify a Minimal Acceptable Rate of Return Compute the equivalent NPW, NAW or FW Select the alternative that has the greatest NPW, NAW or FW

Example (cont’d) • • How do we make a choice? Recall the steps seen earlier. – – Describe the cash flow of each alternative Specify a Minimal Acceptable Rate of Return Compute the equivalent NPW, NAW or FW Select the alternative that has the greatest NPW, NAW or FW

Cash Flows of First Machine (F) NPW costs = 1100 - 100 (P/F, 0. 15, 10) + 200 (P/A, 0. 15, 10) = 2079

Cash Flows of First Machine (F) NPW costs = 1100 - 100 (P/F, 0. 15, 10) + 200 (P/A, 0. 15, 10) = 2079

Cash Flows of Second Machine (S) NPW costs = 1300 - 100(P/F, 0. 15, 10) + 150(P/A, 0. 15, 10) = 2028

Cash Flows of Second Machine (S) NPW costs = 1300 - 100(P/F, 0. 15, 10) + 150(P/A, 0. 15, 10) = 2028

Which do we select? • First machine: NPW costs = 1100 - 100 (P/F, 0. 15, 10) + 200 (P/A, 0. 15, 10) = 2079 • Second machine: NPW costs = 1300 - 100(P/F, 0. 15, 10) + 150(P/A, 0. 15, 10) = 2028 • Which do we select? – Select the second machine, with the lowest NPW of the costs.

Which do we select? • First machine: NPW costs = 1100 - 100 (P/F, 0. 15, 10) + 200 (P/A, 0. 15, 10) = 2079 • Second machine: NPW costs = 1300 - 100(P/F, 0. 15, 10) + 150(P/A, 0. 15, 10) = 2028 • Which do we select? – Select the second machine, with the lowest NPW of the costs.

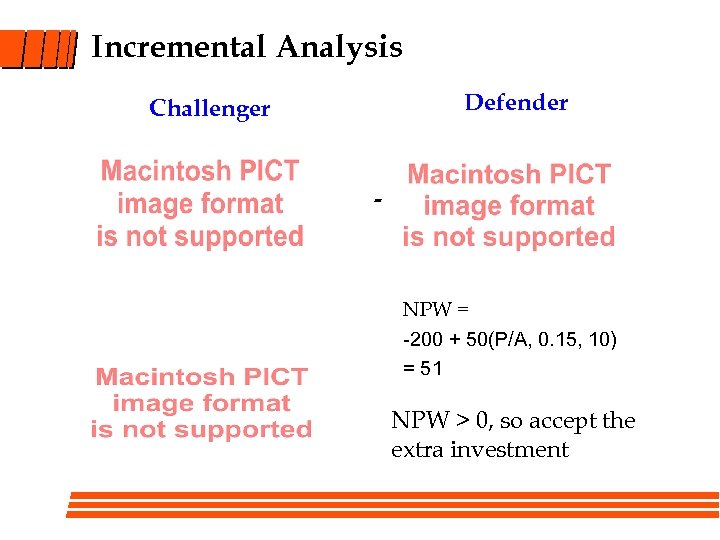

Incremental Analysis Defender Challenger - NPW = -200 + 50(P/A, 0. 15, 10) = 51 NPW > 0, so accept the extra investment

Incremental Analysis Defender Challenger - NPW = -200 + 50(P/A, 0. 15, 10) = 51 NPW > 0, so accept the extra investment

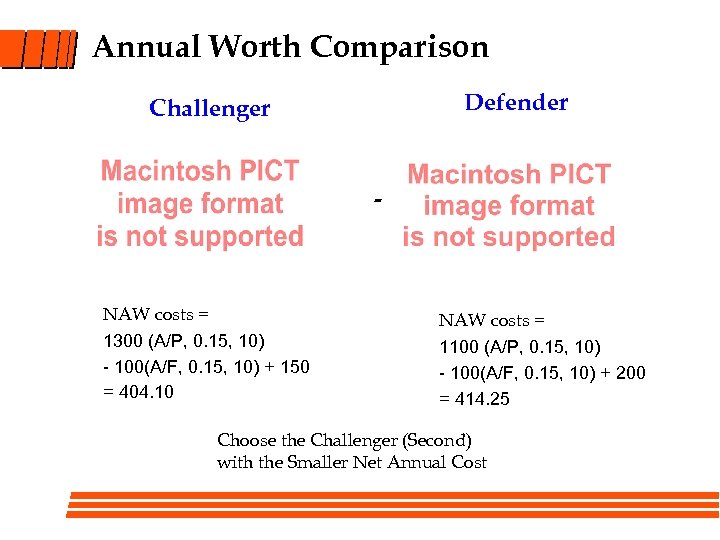

Annual Worth Comparison Defender Challenger - NAW costs = 1300 (A/P, 0. 15, 10) - 100(A/F, 0. 15, 10) + 150 = 404. 10 NAW costs = 1100 (A/P, 0. 15, 10) - 100(A/F, 0. 15, 10) + 200 = 414. 25 Choose the Challenger (Second) with the Smaller Net Annual Cost

Annual Worth Comparison Defender Challenger - NAW costs = 1300 (A/P, 0. 15, 10) - 100(A/F, 0. 15, 10) + 150 = 404. 10 NAW costs = 1100 (A/P, 0. 15, 10) - 100(A/F, 0. 15, 10) + 200 = 414. 25 Choose the Challenger (Second) with the Smaller Net Annual Cost

NAW of the Increment • • We can also use incremental analysis with NAW Incremental Analysis: S - F: – NAW S-F: -200(A/P, 0. 15, 10) + 50 = 10. 15 • Accept the extra investment of S over F? Accept the extra investment of S over F. Choose S.

NAW of the Increment • • We can also use incremental analysis with NAW Incremental Analysis: S - F: – NAW S-F: -200(A/P, 0. 15, 10) + 50 = 10. 15 • Accept the extra investment of S over F? Accept the extra investment of S over F. Choose S.

Example: Broom versus Vacuum • To sweep the floor of a machine shop a company is considering two alternatives. – An automatic broom is available that costs $35. The broom must be replaced every year. The old broom is thrown away. – A vacuum cleaner is available for $90 with an annual expense of $10. This machine will last four years with no salvage value. – The company’s minimum rate of return is 15%. – Do a present worth analysis.

Example: Broom versus Vacuum • To sweep the floor of a machine shop a company is considering two alternatives. – An automatic broom is available that costs $35. The broom must be replaced every year. The old broom is thrown away. – A vacuum cleaner is available for $90 with an annual expense of $10. This machine will last four years with no salvage value. – The company’s minimum rate of return is 15%. – Do a present worth analysis.

Present Worth Broom versus Vacuum NP Cost = 35 NP Cost= 90 + 10(P/A, . 15, 4) = 118. 55

Present Worth Broom versus Vacuum NP Cost = 35 NP Cost= 90 + 10(P/A, . 15, 4) = 118. 55

Example: Broom versus Vacuum (cont’d) • • Can we use the Present Worth Analysis? If so, which is alternative best? – – NPW of Broom = 35 NPW of Vacuum = 90 + 10(P/A, . 15, 4) = 118. 55 Select the broom? No. The analysis here is wrong because the alternatives are compared over unequal periods.

Example: Broom versus Vacuum (cont’d) • • Can we use the Present Worth Analysis? If so, which is alternative best? – – NPW of Broom = 35 NPW of Vacuum = 90 + 10(P/A, . 15, 4) = 118. 55 Select the broom? No. The analysis here is wrong because the alternatives are compared over unequal periods.

Present Worth: Broom versus Vacuum • Select a common study period for each alternative. Use a study period of 4 years. NPW = 35 + 35(P/A, 0. 15, 3) = 114. 91 NPW = 90 +10(P/A, 0. 15, 4) = 118. 55

Present Worth: Broom versus Vacuum • Select a common study period for each alternative. Use a study period of 4 years. NPW = 35 + 35(P/A, 0. 15, 3) = 114. 91 NPW = 90 +10(P/A, 0. 15, 4) = 118. 55

NPW when Useful Lives are Not Equal • We can also use the NPW method when lives are not equal. – Select a common study period for each alternative. Often we use the least common multiple of the lives. – Compute the NPW Benefits or NPW of Costs for each alternative for the study period. – Select the alternative that has the greatest NPW of Benefits or smallest NPW of Costs

NPW when Useful Lives are Not Equal • We can also use the NPW method when lives are not equal. – Select a common study period for each alternative. Often we use the least common multiple of the lives. – Compute the NPW Benefits or NPW of Costs for each alternative for the study period. – Select the alternative that has the greatest NPW of Benefits or smallest NPW of Costs

Annual Worth: Broom versus Vacuum NAC = 35(A/P, 0. 15, 1) = 40. 25 per yr. • NAC = 90(A/P, 0. 15, 4)+ 10 = 41. 52/year Select the broom, the alternative with the smallest net annual cost.

Annual Worth: Broom versus Vacuum NAC = 35(A/P, 0. 15, 1) = 40. 25 per yr. • NAC = 90(A/P, 0. 15, 4)+ 10 = 41. 52/year Select the broom, the alternative with the smallest net annual cost.

Useful Lives • • Differences among alternatives occur in many forms. The useful life of an asset is the time period during which it is kept in productive use in a trade or business. In many cases, alternatives will not have the same useful lives. In this case, the Annual Worth Method is often the best way to compare them.

Useful Lives • • Differences among alternatives occur in many forms. The useful life of an asset is the time period during which it is kept in productive use in a trade or business. In many cases, alternatives will not have the same useful lives. In this case, the Annual Worth Method is often the best way to compare them.

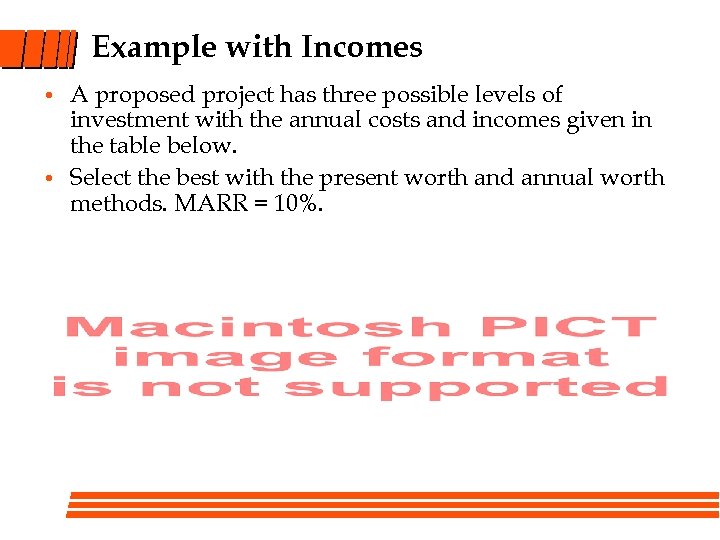

Example with Incomes • • A proposed project has three possible levels of investment with the annual costs and incomes given in the table below. Select the best with the present worth and annual worth methods. MARR = 10%.

Example with Incomes • • A proposed project has three possible levels of investment with the annual costs and incomes given in the table below. Select the best with the present worth and annual worth methods. MARR = 10%.

Income Example with Present Worth • • Comparing with the NPW method. Select the one with the greatest NPW over a 45 -year study period. NPW(A) = [-100(A/P, i, 9) + 20](P/A, i, 45) • NPW(B) = [-85(A/P, i, 5) + 24](P/A, i, 45) • = 26. 037 = 15. 554 NPW(C) = [-60(A/P, i, 5) + 18](P/A, i, 45) = 21. 422 Select A since it is the alternative with the greatest NPW

Income Example with Present Worth • • Comparing with the NPW method. Select the one with the greatest NPW over a 45 -year study period. NPW(A) = [-100(A/P, i, 9) + 20](P/A, i, 45) • NPW(B) = [-85(A/P, i, 5) + 24](P/A, i, 45) • = 26. 037 = 15. 554 NPW(C) = [-60(A/P, i, 5) + 18](P/A, i, 45) = 21. 422 Select A since it is the alternative with the greatest NPW

Example with Incomes (cont’d) • • Comparing with the NAW method NAW(A) = -100(A/P, i, 9) + 20 = 2. 64/year • NAW(B) = -85(A/P, i, 5) + 24 = 1. 57/year • NAW(C) = -60(A/P, i, 5) + 18 = 2. 17/year • Select A since it is the alternative with the greatest NAW

Example with Incomes (cont’d) • • Comparing with the NAW method NAW(A) = -100(A/P, i, 9) + 20 = 2. 64/year • NAW(B) = -85(A/P, i, 5) + 24 = 1. 57/year • NAW(C) = -60(A/P, i, 5) + 18 = 2. 17/year • Select A since it is the alternative with the greatest NAW

Summary • Equal Useful Lives – Use the MARR for equivalence computations – Pick the best alternative using the NPW or NAW. Both methods give the same result. • Unequal Useful Lives – Use the MARR for equivalence computations – Select a common study period. – Pick the best alternative using the NPW or NAW. Both methods give the same result. • Incremental Analysis – Common components cancel out. Necessary for ROR comparisons.

Summary • Equal Useful Lives – Use the MARR for equivalence computations – Pick the best alternative using the NPW or NAW. Both methods give the same result. • Unequal Useful Lives – Use the MARR for equivalence computations – Select a common study period. – Pick the best alternative using the NPW or NAW. Both methods give the same result. • Incremental Analysis – Common components cancel out. Necessary for ROR comparisons.

Incremental Analysis 1. Arrange (rank order) the feasible alternatives based on increasing initial investment. 2. Select the alternative with the smallest investment to be the defender (D). 3. From the remaining alternatives (not including the defender or those already eliminated) chose the challenger (C) as the alternative with the least initial investment. 4. Evaluate the increment of investment C – D by computing NPW(C –D), NAW(C – D), ROR(C – D). Accept of reject (C – D) based on the evaluation. If (C – D) is accepted, delete D from the list, and make C the defender. If (C – D) is rejected, delete C from the list. If any alternatives remain, return to step 3, otherwise quit. The current defender is the best alternative.

Incremental Analysis 1. Arrange (rank order) the feasible alternatives based on increasing initial investment. 2. Select the alternative with the smallest investment to be the defender (D). 3. From the remaining alternatives (not including the defender or those already eliminated) chose the challenger (C) as the alternative with the least initial investment. 4. Evaluate the increment of investment C – D by computing NPW(C –D), NAW(C – D), ROR(C – D). Accept of reject (C – D) based on the evaluation. If (C – D) is accepted, delete D from the list, and make C the defender. If (C – D) is rejected, delete C from the list. If any alternatives remain, return to step 3, otherwise quit. The current defender is the best alternative.