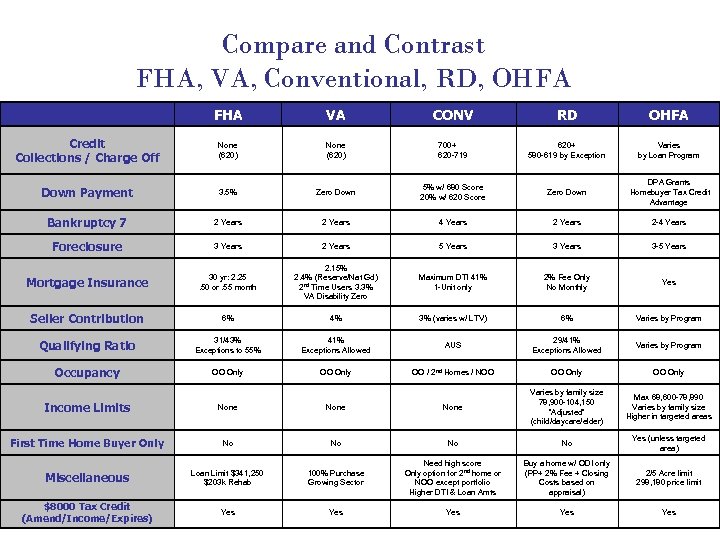

Compare and Contrast FHA, VA, Conventional, RD, OHFA FHA VA CONV RD OHFA Credit Collections / Charge Off None (620) 700+ 620 -719 620+ 580 -619 by Exception Varies by Loan Program Down Payment 3. 5% Zero Down 5% w/ 680 Score 20% w/ 620 Score Zero Down DPA Grants Homebuyer Tax Credit Advantage Bankruptcy 7 2 Years 4 Years 2 -4 Years Foreclosure 3 Years 2 Years 5 Years 3 -5 Years Mortgage Insurance 30 yr: 2. 25. 50 or. 55 month 2. 15% 2. 4% (Reserve/Nat Gd) 2 nd Time Users 3. 3% VA Disability Zero Maximum DTI 41% 1 -Unit only 2% Fee Only No Monthly Yes Seller Contribution 6% 4% 3% (varies w/ LTV) 6% Varies by Program Qualifying Ratio 31/43% Exceptions to 55% 41% Exceptions Allowed AUS 29/41% Exceptions Allowed Varies by Program Occupancy OO Only OO / 2 nd Homes / NOO OO Only Max 68, 600 -78, 890 Varies by family size Higher in targeted areas Income Limits None Varies by family size 78, 900 -104, 150 “Adjusted” (child/daycare/elder) First Time Home Buyer Only No No Yes (unless targeted area) Miscellaneous Loan Limit $341, 250 $203 k Rehab 100% Purchase Growing Sector Need high score Only option for 2 nd home or NOO except portfolio Higher DTI & Loan Amts Buy a home w/ ODI only (PP+ 2% Fee + Closing Costs based on appraisal) 2/5 Acre limit 298, 180 price limit $8000 Tax Credit (Amend/Income/Expires) Yes Yes Yes

Compare and Contrast FHA, VA, Conventional, RD, OHFA FHA VA CONV RD OHFA Credit Collections / Charge Off None (620) 700+ 620 -719 620+ 580 -619 by Exception Varies by Loan Program Down Payment 3. 5% Zero Down 5% w/ 680 Score 20% w/ 620 Score Zero Down DPA Grants Homebuyer Tax Credit Advantage Bankruptcy 7 2 Years 4 Years 2 -4 Years Foreclosure 3 Years 2 Years 5 Years 3 -5 Years Mortgage Insurance 30 yr: 2. 25. 50 or. 55 month 2. 15% 2. 4% (Reserve/Nat Gd) 2 nd Time Users 3. 3% VA Disability Zero Maximum DTI 41% 1 -Unit only 2% Fee Only No Monthly Yes Seller Contribution 6% 4% 3% (varies w/ LTV) 6% Varies by Program Qualifying Ratio 31/43% Exceptions to 55% 41% Exceptions Allowed AUS 29/41% Exceptions Allowed Varies by Program Occupancy OO Only OO / 2 nd Homes / NOO OO Only Max 68, 600 -78, 890 Varies by family size Higher in targeted areas Income Limits None Varies by family size 78, 900 -104, 150 “Adjusted” (child/daycare/elder) First Time Home Buyer Only No No Yes (unless targeted area) Miscellaneous Loan Limit $341, 250 $203 k Rehab 100% Purchase Growing Sector Need high score Only option for 2 nd home or NOO except portfolio Higher DTI & Loan Amts Buy a home w/ ODI only (PP+ 2% Fee + Closing Costs based on appraisal) 2/5 Acre limit 298, 180 price limit $8000 Tax Credit (Amend/Income/Expires) Yes Yes Yes

![]()