e2e12507c4715ec01eaae931e72fce11.ppt

- Количество слайдов: 40

Company LOGO COUNTRY REPORT (Republic of the Philippines) Presented during the Performance Based Budgeting Training Program Civil Service College, Singapore 25 February to 7 March, 2008 By: Ms. Luz M. Cantor Ms. Jocelyn Cuaresma Mr. Julian D. Pacificador, Jr. Ms. Vicitacion A. Ugalino Ms. Marlene R. Vinluan

Company LOGO I. Introduction A. Geography and Demography B. History C. Economy Background of Public Financial Management (PFM) in the Philippines A. The Legal Framework for PFM B. The Institutional Framework 1. Four Phases of the Budget Process or Budget Cycle a. Budget Preparation b. Budget Legislation c. Budget Execution d. Budget Accountability 2. Salient Features of Appropriations

Company LOGO III. Successes Achieved in the Area of Performance Based Budgeting (PBB) A. Public Expenditure Management (PEM) B. Organizational Performance Indicator Framework (OPIF) 1. Advantages of OPIF 2. The OPIF Process C. Little “Victories” in OPIF IV. An Analysis of Gaps in the PFM and Areas of Potential Reform A. Weaknesses of the PEM 1. 2. 3. 4. Weak revenue administration, Unpredictability of funding, Inadequate management information system, and Weak internal control system in spending agencies V. Challenge and Issues A. Sustaining and Enhancing the OPIF Process B. Prospects for Reform Planning and Implementation

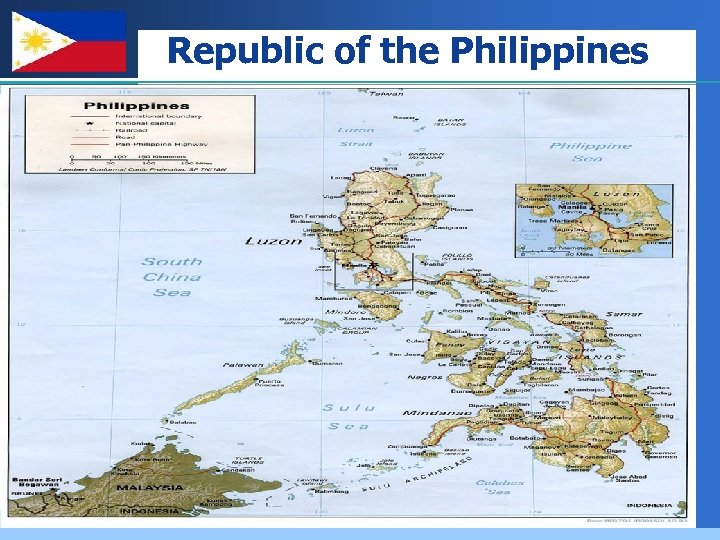

Company LOGO Republic of the Philippines

Company LOGO Republic of the Philippines Capital: Manila Population : approaching 87 million (12 th) Government: Unitary presidential constitutional republic Total Land Area: 300, 000 km / 115, 831 sq mi Religion: Predominantly Roman Catholic Official Language: Filipino and English

Company LOGO Republic of the Philippines Economy GDP (nominal) : Total - $117. 562 billion 2006 Per capita - $1, 351. 718

Company LOGO II. Background of Public Financial Management (PFM) in the Philippines

Company LOGO A. The Legal Framework for PFM Article VI, Section 29 of the Philippine Constitution sets the basic rule for the use of government funds where it states: “ No money shall be paid by the Treasury except in pursuance of an appropriation made by law”.

Company LOGO B. THE INSTITUTIONAL FRAMEWORK FOR PFM

Company LOGO Four Phases of the Budget Process or the Budget Cycle a) Budget Preparation b) Budget Legislation c) Budget Execution d) Budget Accountability

Company LOGO a) Budget Preparation Executive branch consolidates the annual budget proposal of the executive, legislative, and judicial branch of the government. § estimation of revenues § determination of budgetary priorities consistent within the MTPDP § translation of approved priorities into expenditure levels

Company LOGO Submission of the Budget The President shall submit within thirty (30) days from the opening of each regular session of the Congress as the basis for the preparation of the General Appropriation Act, a national government budget, consisting of estimated receipts based on the existing and proposed revenue measures, and of estimated expenditures. Article VII, Section 22 (1) Philippine Constitution

Company LOGO Development Budget Coordinating Committee A top level inter agency committee that sets the budget parameters - framework

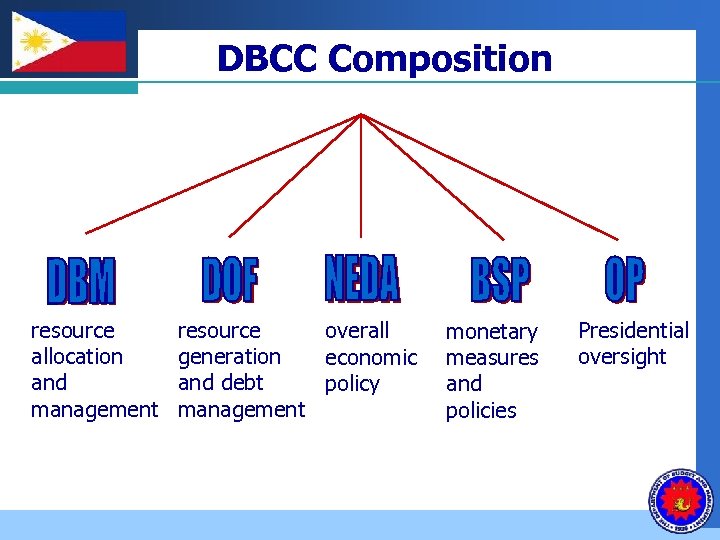

Company LOGO resource allocation and management DBCC Composition resource overall generation economic and debt policy management monetary measures and policies Presidential oversight

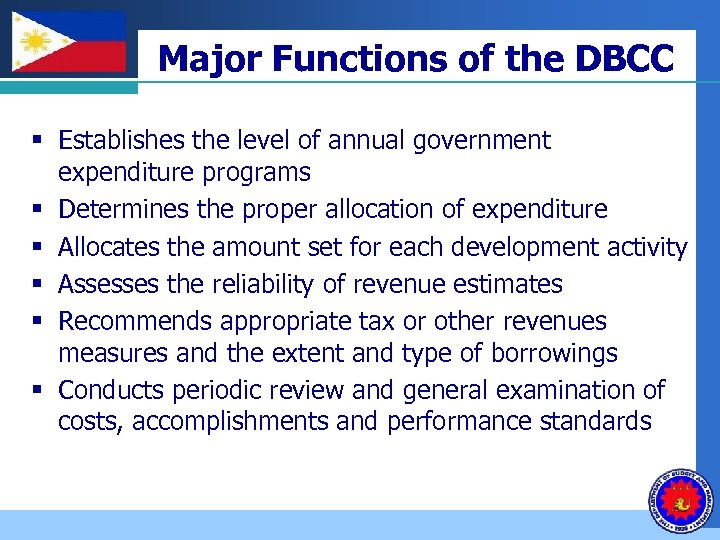

Company LOGO Major Functions of the DBCC § Establishes the level of annual government expenditure programs § Determines the proper allocation of expenditure § Allocates the amount set for each development activity § Assesses the reliability of revenue estimates § Recommends appropriate tax or other revenues measures and the extent and type of borrowings § Conducts periodic review and general examination of costs, accomplishments and performance standards

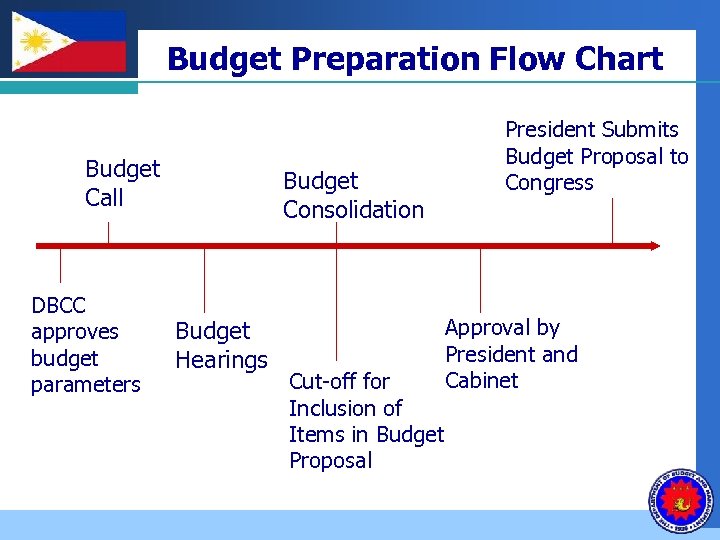

Company LOGO Budget Preparation Flow Chart Budget Call DBCC approves budget parameters Budget Consolidation Budget Hearings Cut-off for Inclusion of Items in Budget Proposal President Submits Budget Proposal to Congress Approval by President and Cabinet

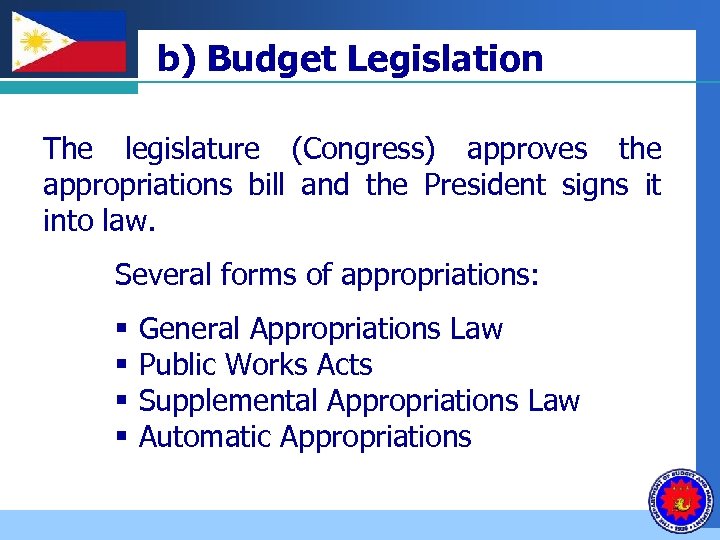

Company b) Budget Legislation LOGO The legislature (Congress) approves the appropriations bill and the President signs it into law. Several forms of appropriations: § § General Appropriations Law Public Works Acts Supplemental Appropriations Law Automatic Appropriations

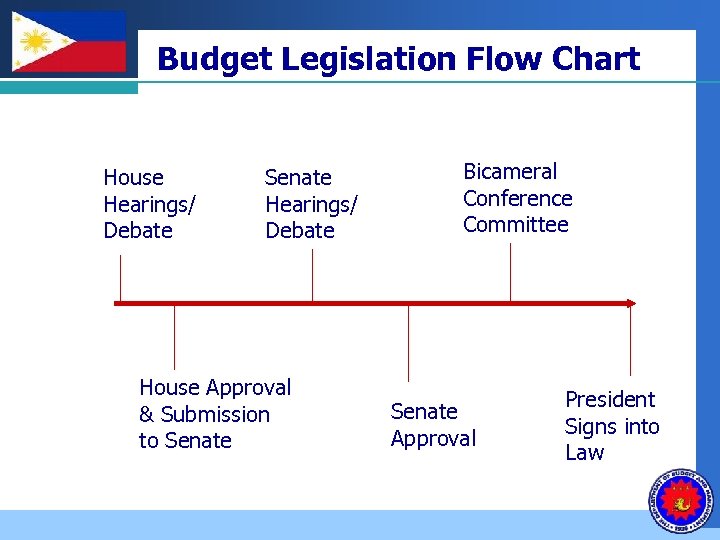

Company LOGO Budget Legislation Flow Chart House Hearings/ Debate Senate Hearings/ Debate House Approval & Submission to Senate Bicameral Conference Committee Senate Approval President Signs into Law

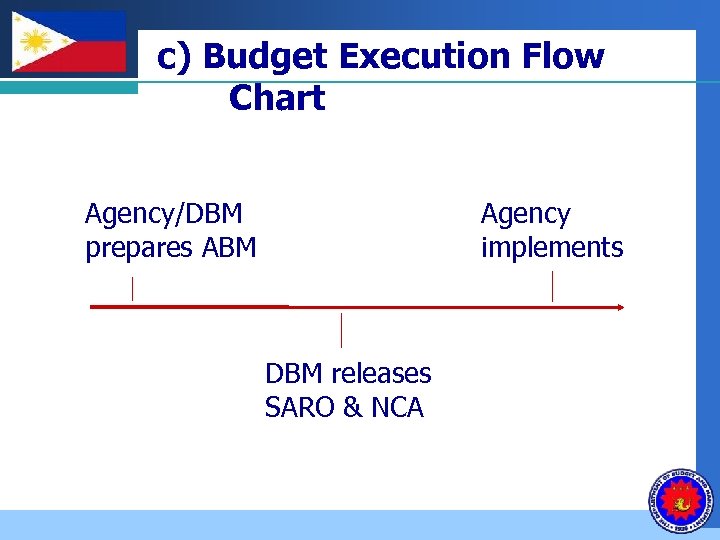

Company LOGO c) Budget Execution Flow Chart Agency/DBM prepares ABM Agency implements DBM releases SARO & NCA

Company LOGO d) Budget Accountability § Monitoring of agency budgetary performance § Comparison and evaluation of actual performance with initially-approved work targets in terms of: Øfinancial ØPhysical ØRevenue Collected (for agencies mandated to collect taxes and fees)

Company LOGO Rationale/Purpose § Monitor the efficiency of government’s fund utilization § Assess agency performance § Provide a vital basis for sound decision and policy making for rational allocation of scarce resources

Company LOGO The Commission on Audit (COA) Article IX-D of the Philippine Constitution provides the following functions of COA: a. Examine, audit and settle all accounts pertaining to the revenue and receipts of, and expenditures or uses of funds and property owned or held in trust by, or pertaining to the government;

Company LOGO b. c. d. e. The Commission on Audit (COA) Promulgate accounting and auditing rules and regulations including those for the prevention and disallowance or irregular, unnecessary, excessive, extravagant or unconscionable expenditures, or uses of government funds and properties; Submit annual reports to the President and the Congress on the financial condition and operation of the government, Recommend measures to improve the efficiency and effectiveness of government operations; and Keep general accounts of government and preserve the vouchers and supporting papers pertaining thereto.

Company LOGO Salient Features of Appropriations 1. Once an appropriation is released in the form of an allotment covered by either an Agency Budget Matrix (ABM) or a Special Allotment Release Order (SARO), it becomes available for incurrence of an obligation. 2. Appropriation for personal services are valid only for the year, while those for MOOE and CO are treated as continuing appropriations for 2 years: unused portions of appropriation for MOOE & CO are carried forward for another year.

Company LOGO 3. Salient Features of Appropriations (cont. ) Automatic appropriations are those appropriations authorized under existing laws other than the General Appropriations Act which are programmed annually in accordance with Section 26, Book VI of EO 292. Examples of these are: • • • Internal revenue taxes and import duties associated with foreign loans and grants, Tax expenditure subsidies, Debt servicing, Retirement and life insurance premium of government employees, Drawdown on guaranteed lending to government corporations, and Various special accounts and funds.

Company LOGO III. Successes Achieved in the Area of Performance Based Budgeting

PUBLIC EXPENDITURE MANAGEMENT: OBJECTIVES Company LOGO § Aggregate Fiscal Discipline § Allocative Efficiency § living within our means spending on the “right things” or “right priorities” Operational/Technical Efficiency obtaining the best value for money

Company LOGO PUBLIC EXPENDITURE MANAGEMENT: Key components in the Philippines THREE MAJOR COMPONENTS - mutually supportive § Medium-Term Expenditure Framework (MTEF) § Organizational Performance Indicator Framework (OPIF) § Procurement Reform

Company LOGO ORGANIZATIONAL PERFORMANCE INDICATOR FRAMEWORK (OPIF) OPIF is an accountability framework based on: Explicit recognition by agencies of the Government’s expenditure priorities (sector goals and organizational outcomes) Identification of Major Final Outputs (MFOs) and PAPs to achieve those priorities Identification of performance indicators by agencies that show well they are delivering services (outputs) to achieve Government outcomes/objectives Monitoring performance and publicly reporting results (both successes and failures) to ensure transparency and accountability of government operations

Company LOGO OPIF OBJECTIVES § To shift emphasis from ‘input’ to ‘output’ focused budgeting Inputs still important in costing MFOs & assessing efficiency § To Encourage departments & agencies to focus on the delivery of outputs (goods & services) to achieve Government goals (outcomes/objectives) § To specify and document expected performance of each agency and hold them accountable for its achievement § To report to the President, Congress and the public on the efficiency of output delivery by agencies § To provide the Government with a better basis for assessing the effectiveness of agency outputs in meeting intended outcomes

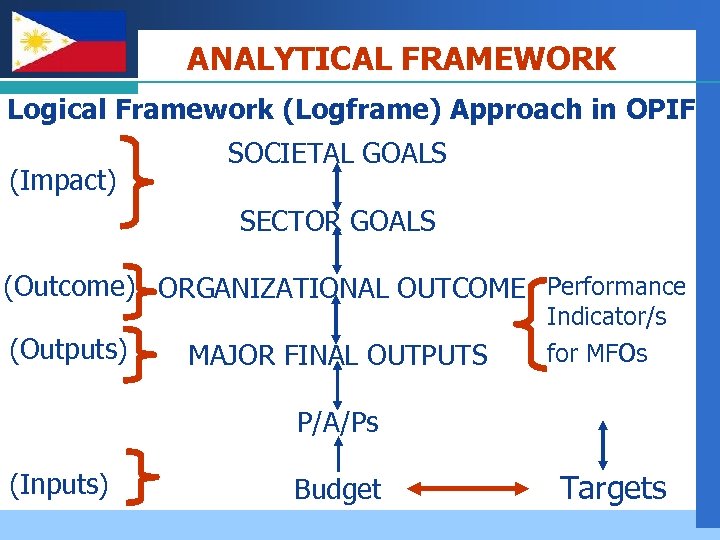

Company LOGO ANALYTICAL FRAMEWORK Logical Framework (Logframe) Approach in OPIF (Impact) SOCIETAL GOALS SECTOR GOALS (Outcome) ORGANIZATIONAL OUTCOME Performance Indicator/s (Outputs) MAJOR FINAL OUTPUTS for MFOs P/A/Ps (Inputs) Budget Targets

Company LOGO Attributes of Good Performance Indicators S – Specific M – Measurable A – Achievable R – Relevant T – Time-bound

Company LOGO Attributes of Good Performance Indicators C – Clear R – Relevant E – Economic A – Adequate M – Monitorable

Company LOGO OPIF Successes 1. Publication of 2007 OPIF book 2. Publication of 2008 OPIF book * Available at DBM website (www. dbm. gov. ph)

Company LOGO IV. An Analysis of Gaps in PFM and Areas of Potential Reforms

Company LOGO An Analysis of Gaps in PFM and Areas of Potential Reforms A. Weaknesses in the present PFM: 1) Weak revenue administration, 2) Unpredictability of funding, 3) 4) Inadequate management information system, and Weak internal control system in spending agencies

Company LOGO V. Challenges and Issues in the Way Forward

Company LOGO 1. 2. 3. 4. 5. 6. 7. 8. A. Sustaining and enhancing the OPIF process Mainstreaming of OPIF to all agencies of government including the legislative, judiciary, constitutional offices and SUCS; Establishment of unit costs for a more realistic targeting and budget estimate exercise; Enhancement of the cascading process at the agency and department levels; Calibration/adjustments in the budget preparation, budget execution, and budget accountability systems to make them OPIF compliant; Selection of “key” performance indicators and measures at the major organizations level (department) which shall be the focus of monitoring and evaluation at oversight level; Development of an enhanced performance monitoring and evaluation system along with an agency performance review and rating structure; Harmonization of the OPIF reporting system with those adopted by other oversight and monitoring authorities; and Conduct of continued capacity building and advocacy activities for better understanding, appreciation, and adoption of the OPIF in other national government agencies and instrumentalities;

Company LOGO B. Prospects for Reform Planning and Implementation Challenges: § § Systematic improvement would require concerted and coordinated efforts on multiple fronts. Certain features of the Philippine PFM system are inconsistent with the notion of international “standard” behind the PEFA framework due to the country’s constitutional design and other long-held practices.

Company LOGO B. Prospects for Reform Planning and Implementation Challenges (cont. ) 3) The political reality in the country.

e2e12507c4715ec01eaae931e72fce11.ppt