b5599179dd7452e6992d2013be618990.ppt

- Количество слайдов: 35

Community Planning Academy Atlanta Metro 2040 FUTURE SHOCK Arthur C. Nelson, Ph. D, FAICP Professor & Director, Urban Affairs & Planning Virginia Tech – Alexandria Center March 23, 2006

Community Planning Academy Atlanta Metro 2040 FUTURE SHOCK Arthur C. Nelson, Ph. D, FAICP Professor & Director, Urban Affairs & Planning Virginia Tech – Alexandria Center March 23, 2006

Front Page December 4, 2004

Front Page December 4, 2004

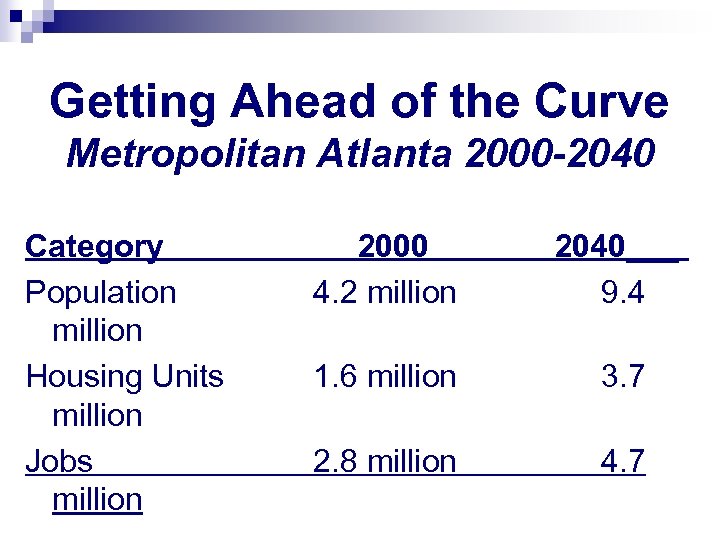

Getting Ahead of the Curve Metropolitan Atlanta 2000 -2040 Category Population million Housing Units million Jobs million 2000 4. 2 million 2040___ 9. 4 1. 6 million 3. 7 2. 8 million 4. 7

Getting Ahead of the Curve Metropolitan Atlanta 2000 -2040 Category Population million Housing Units million Jobs million 2000 4. 2 million 2040___ 9. 4 1. 6 million 3. 7 2. 8 million 4. 7

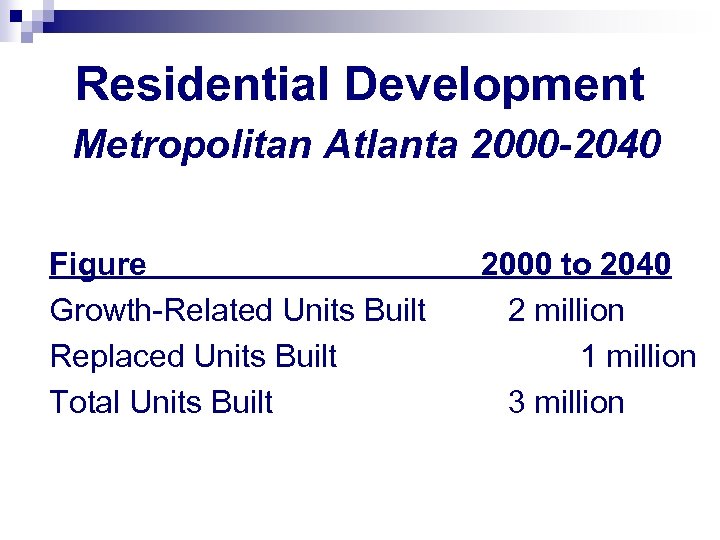

Residential Development Metropolitan Atlanta 2000 -2040 Figure Growth-Related Units Built Replaced Units Built Total Units Built 2000 to 2040 2 million 1 million 3 million

Residential Development Metropolitan Atlanta 2000 -2040 Figure Growth-Related Units Built Replaced Units Built Total Units Built 2000 to 2040 2 million 1 million 3 million

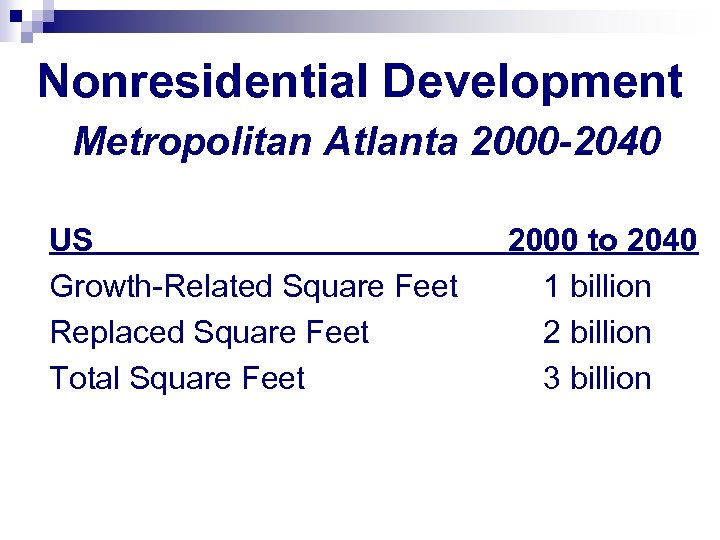

Nonresidential Development Metropolitan Atlanta 2000 -2040 US Growth-Related Square Feet Replaced Square Feet Total Square Feet 2000 to 2040 1 billion 2 billion 3 billion

Nonresidential Development Metropolitan Atlanta 2000 -2040 US Growth-Related Square Feet Replaced Square Feet Total Square Feet 2000 to 2040 1 billion 2 billion 3 billion

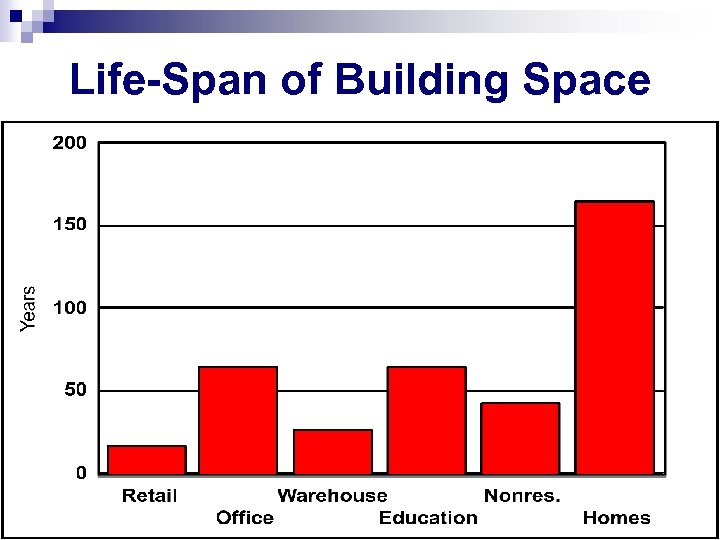

Life-Span of Building Space

Life-Span of Building Space

What About …. ? Telecommuting? n Office hotelling? n Internet retailing? n Emerging technologies? n And their effect on future space needs?

What About …. ? Telecommuting? n Office hotelling? n Internet retailing? n Emerging technologies? n And their effect on future space needs?

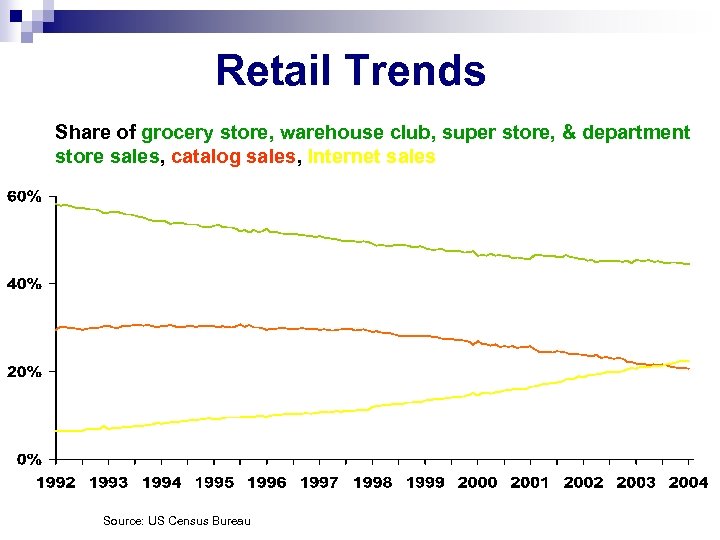

Retail Trends Share of grocery store, warehouse club, super store, & department store sales, catalog sales, Internet sales Source: US Census Bureau

Retail Trends Share of grocery store, warehouse club, super store, & department store sales, catalog sales, Internet sales Source: US Census Bureau

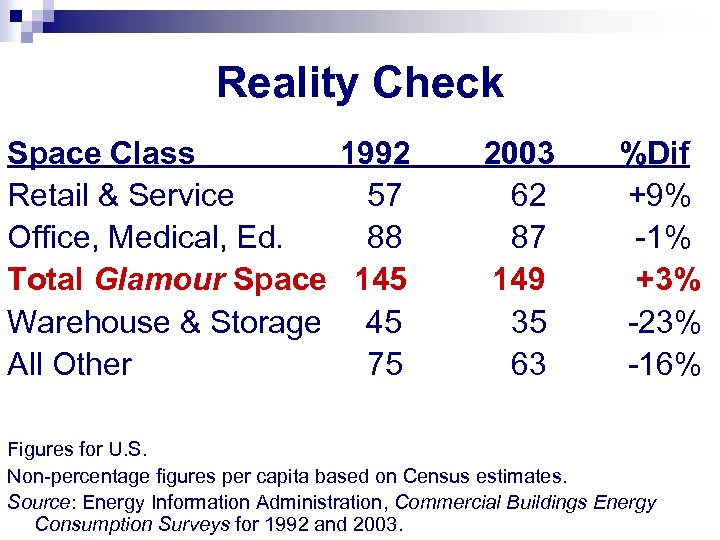

Reality Check Space Class 1992 Retail & Service 57 Office, Medical, Ed. 88 Total Glamour Space 145 Warehouse & Storage 45 All Other 75 2003 62 87 149 35 63 %Dif +9% -1% +3% -23% -16% Figures for U. S. Non-percentage figures per capita based on Census estimates. Source: Energy Information Administration, Commercial Buildings Energy Consumption Surveys for 1992 and 2003.

Reality Check Space Class 1992 Retail & Service 57 Office, Medical, Ed. 88 Total Glamour Space 145 Warehouse & Storage 45 All Other 75 2003 62 87 149 35 63 %Dif +9% -1% +3% -23% -16% Figures for U. S. Non-percentage figures per capita based on Census estimates. Source: Energy Information Administration, Commercial Buildings Energy Consumption Surveys for 1992 and 2003.

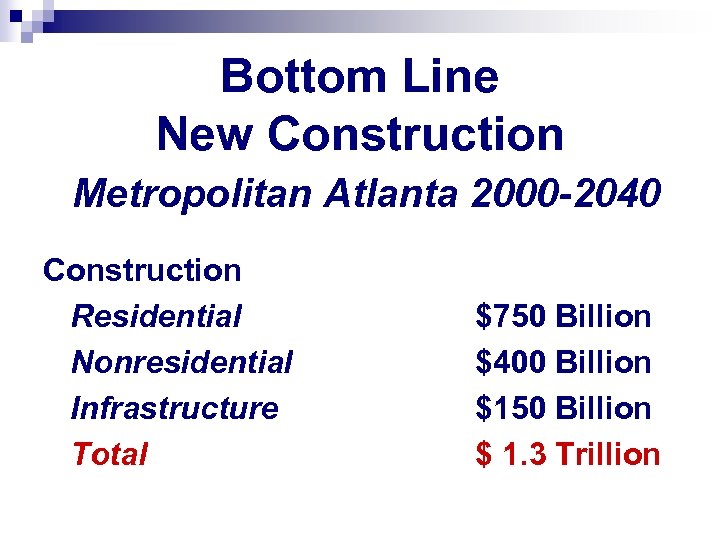

Bottom Line New Construction Metropolitan Atlanta 2000 -2040 Construction Residential Nonresidential Infrastructure Total $750 Billion $400 Billion $150 Billion $ 1. 3 Trillion

Bottom Line New Construction Metropolitan Atlanta 2000 -2040 Construction Residential Nonresidential Infrastructure Total $750 Billion $400 Billion $150 Billion $ 1. 3 Trillion

Where Does It Grow?

Where Does It Grow?

Market Analysts Finding Changing Preferences National Association of Realtors National Association of Home Builders Nationally Recognized Market Analysts Urban Land Institute Lend Lease/Price. Waterhouse. Coopers Joint Center for Housing Policy at Harvard Golfing Buddies and Taxi Drivers

Market Analysts Finding Changing Preferences National Association of Realtors National Association of Home Builders Nationally Recognized Market Analysts Urban Land Institute Lend Lease/Price. Waterhouse. Coopers Joint Center for Housing Policy at Harvard Golfing Buddies and Taxi Drivers

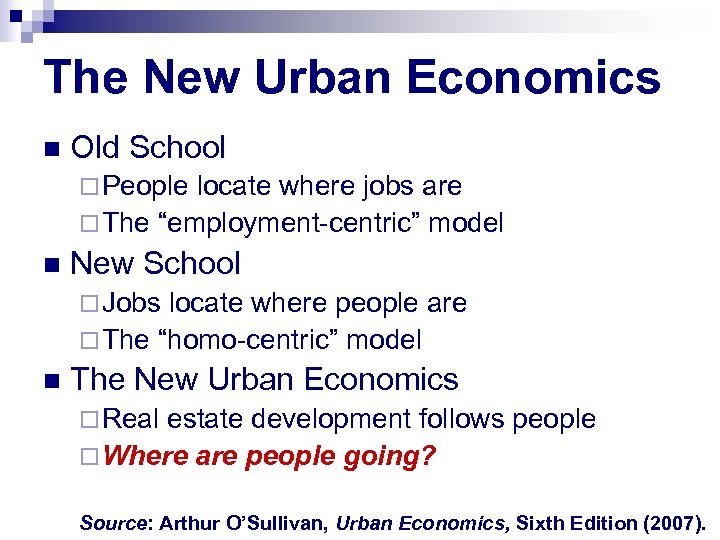

The New Urban Economics n Old School ¨ People locate where jobs are ¨ The “employment-centric” model n New School ¨ Jobs locate where people are ¨ The “homo-centric” model n The New Urban Economics ¨ Real estate development follows people ¨ Where are people going? Source: Arthur O’Sullivan, Urban Economics, Sixth Edition (2007).

The New Urban Economics n Old School ¨ People locate where jobs are ¨ The “employment-centric” model n New School ¨ Jobs locate where people are ¨ The “homo-centric” model n The New Urban Economics ¨ Real estate development follows people ¨ Where are people going? Source: Arthur O’Sullivan, Urban Economics, Sixth Edition (2007).

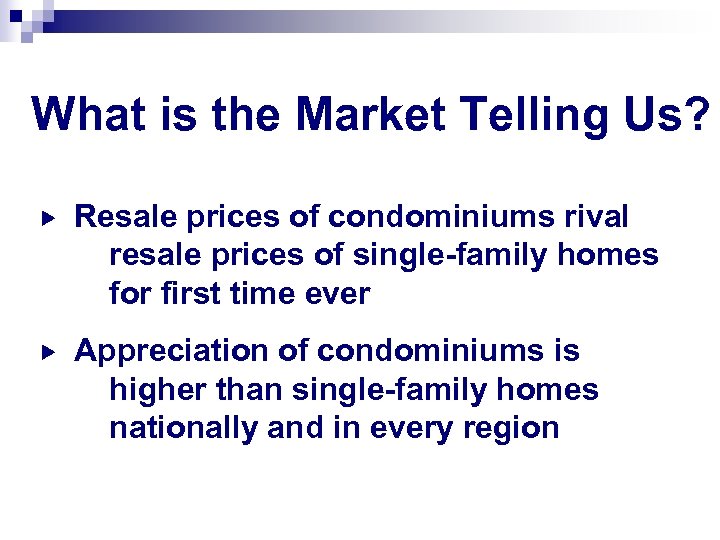

What is the Market Telling Us? Resale prices of condominiums rival resale prices of single-family homes for first time ever Appreciation of condominiums is higher than single-family homes nationally and in every region

What is the Market Telling Us? Resale prices of condominiums rival resale prices of single-family homes for first time ever Appreciation of condominiums is higher than single-family homes nationally and in every region

![Resale Prices 2002 -2005 [SF = detached + townhouse, CC = condominium + cooperative] Resale Prices 2002 -2005 [SF = detached + townhouse, CC = condominium + cooperative]](https://present5.com/presentation/b5599179dd7452e6992d2013be618990/image-15.jpg) Resale Prices 2002 -2005 [SF = detached + townhouse, CC = condominium + cooperative] Region US NE MW S W 2002 SF $158 $164 $136 $147 $215 2005 SF $207 $244 $166 $178 $314 Figures in thousands of dollars. Source: National Association of Realtors 2006. 2002 CC $142 $147 $149 $115 $172 2005 CC $218 $252 $189 $195 $261

Resale Prices 2002 -2005 [SF = detached + townhouse, CC = condominium + cooperative] Region US NE MW S W 2002 SF $158 $164 $136 $147 $215 2005 SF $207 $244 $166 $178 $314 Figures in thousands of dollars. Source: National Association of Realtors 2006. 2002 CC $142 $147 $149 $115 $172 2005 CC $218 $252 $189 $195 $261

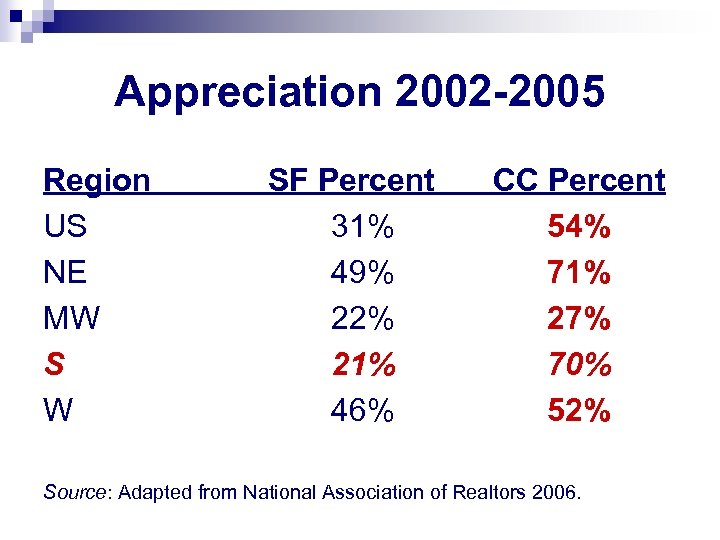

Appreciation 2002 -2005 Region US NE MW S W SF Percent 31% 49% 22% 21% 46% CC Percent 54% 71% 27% 70% 52% Source: Adapted from National Association of Realtors 2006.

Appreciation 2002 -2005 Region US NE MW S W SF Percent 31% 49% 22% 21% 46% CC Percent 54% 71% 27% 70% 52% Source: Adapted from National Association of Realtors 2006.

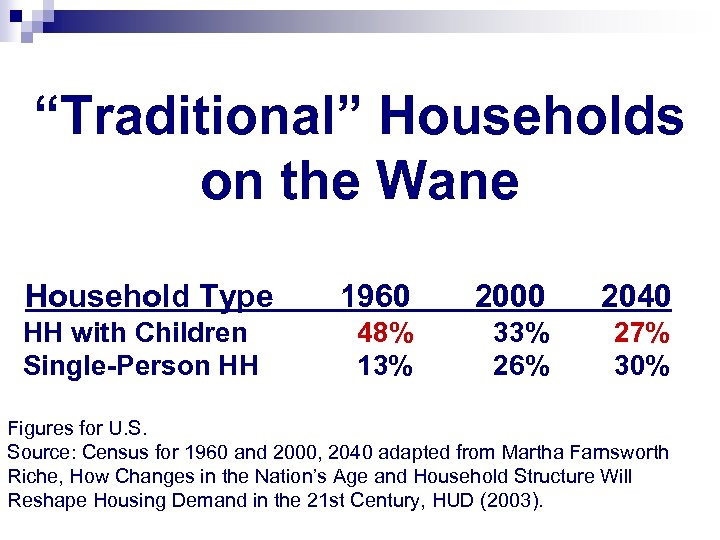

“Traditional” Households on the Wane Household Type HH with Children Single-Person HH 1960 2000 2040 48% 13% 33% 26% 27% 30% Figures for U. S. Source: Census for 1960 and 2000, 2040 adapted from Martha Farnsworth Riche, How Changes in the Nation’s Age and Household Structure Will Reshape Housing Demand in the 21 st Century, HUD (2003).

“Traditional” Households on the Wane Household Type HH with Children Single-Person HH 1960 2000 2040 48% 13% 33% 26% 27% 30% Figures for U. S. Source: Census for 1960 and 2000, 2040 adapted from Martha Farnsworth Riche, How Changes in the Nation’s Age and Household Structure Will Reshape Housing Demand in the 21 st Century, HUD (2003).

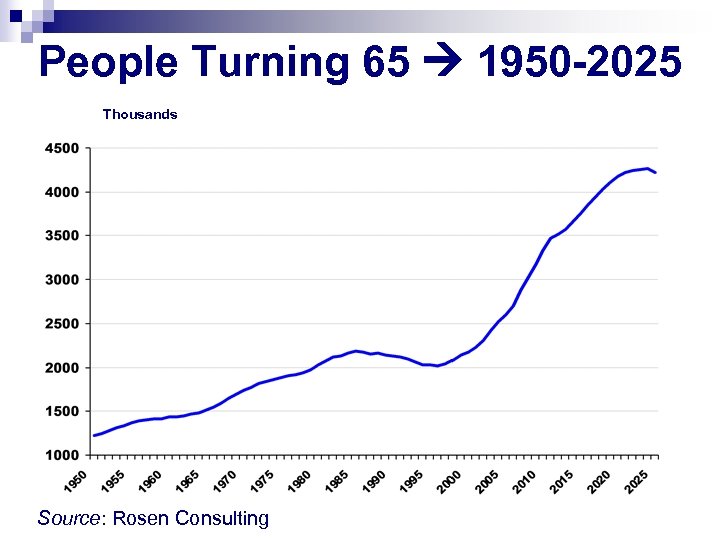

People Turning 65 1950 -2025 Thousands Source: Rosen Consulting

People Turning 65 1950 -2025 Thousands Source: Rosen Consulting

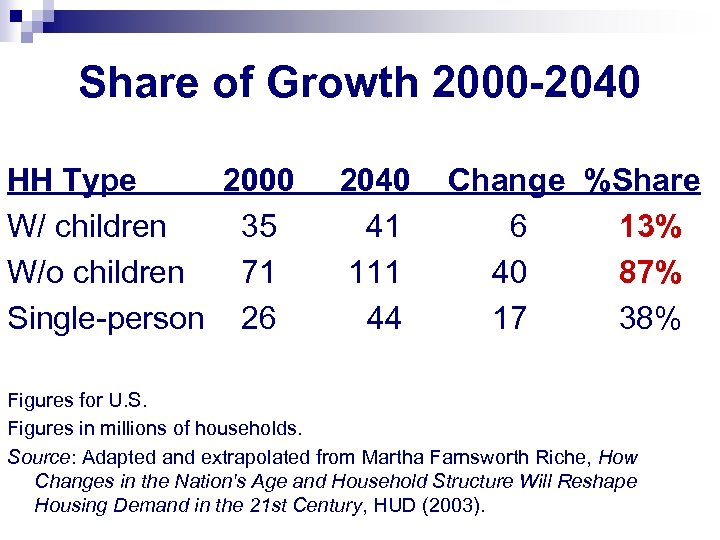

Share of Growth 2000 -2040 HH Type 2000 W/ children 35 W/o children 71 Single-person 26 2040 41 111 44 Change %Share 6 13% 40 87% 17 38% Figures for U. S. Figures in millions of households. Source: Adapted and extrapolated from Martha Farnsworth Riche, How Changes in the Nation's Age and Household Structure Will Reshape Housing Demand in the 21 st Century, HUD (2003).

Share of Growth 2000 -2040 HH Type 2000 W/ children 35 W/o children 71 Single-person 26 2040 41 111 44 Change %Share 6 13% 40 87% 17 38% Figures for U. S. Figures in millions of households. Source: Adapted and extrapolated from Martha Farnsworth Riche, How Changes in the Nation's Age and Household Structure Will Reshape Housing Demand in the 21 st Century, HUD (2003).

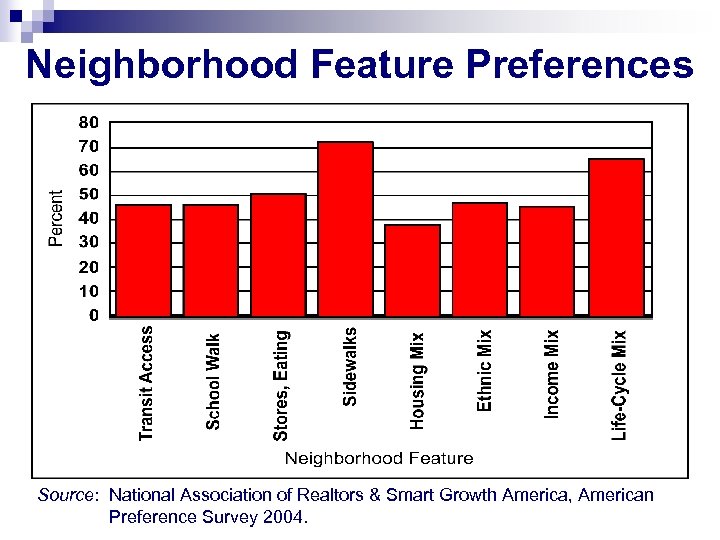

Neighborhood Feature Preferences Source: National Association of Realtors & Smart Growth America, American Preference Survey 2004.

Neighborhood Feature Preferences Source: National Association of Realtors & Smart Growth America, American Preference Survey 2004.

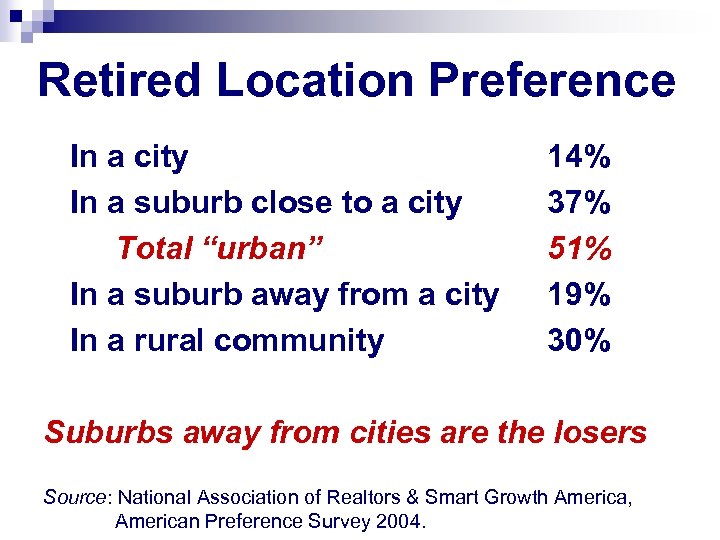

Retired Location Preference In a city In a suburb close to a city Total “urban” In a suburb away from a city In a rural community 14% 37% 51% 19% 30% Suburbs away from cities are the losers Source: National Association of Realtors & Smart Growth America, American Preference Survey 2004.

Retired Location Preference In a city In a suburb close to a city Total “urban” In a suburb away from a city In a rural community 14% 37% 51% 19% 30% Suburbs away from cities are the losers Source: National Association of Realtors & Smart Growth America, American Preference Survey 2004.

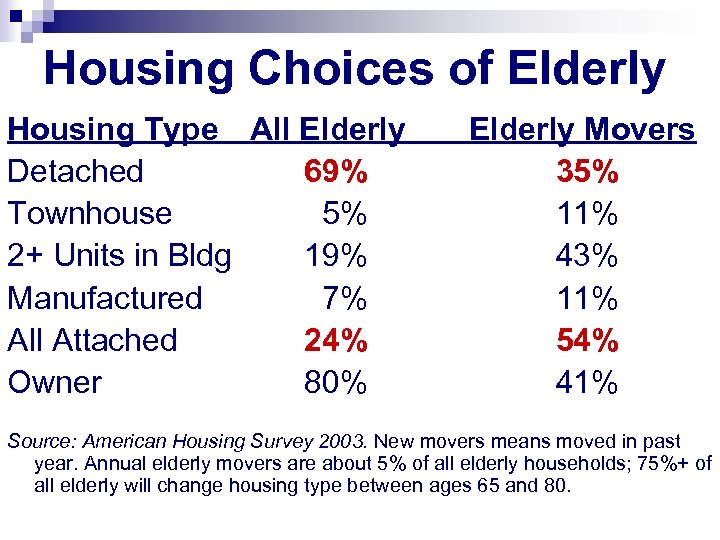

Housing Choices of Elderly Housing Type All Elderly Detached 69% Townhouse 5% 2+ Units in Bldg 19% Manufactured 7% All Attached 24% Owner 80% Elderly Movers 35% 11% 43% 11% 54% 41% Source: American Housing Survey 2003. New movers means moved in past year. Annual elderly movers are about 5% of all elderly households; 75%+ of all elderly will change housing type between ages 65 and 80.

Housing Choices of Elderly Housing Type All Elderly Detached 69% Townhouse 5% 2+ Units in Bldg 19% Manufactured 7% All Attached 24% Owner 80% Elderly Movers 35% 11% 43% 11% 54% 41% Source: American Housing Survey 2003. New movers means moved in past year. Annual elderly movers are about 5% of all elderly households; 75%+ of all elderly will change housing type between ages 65 and 80.

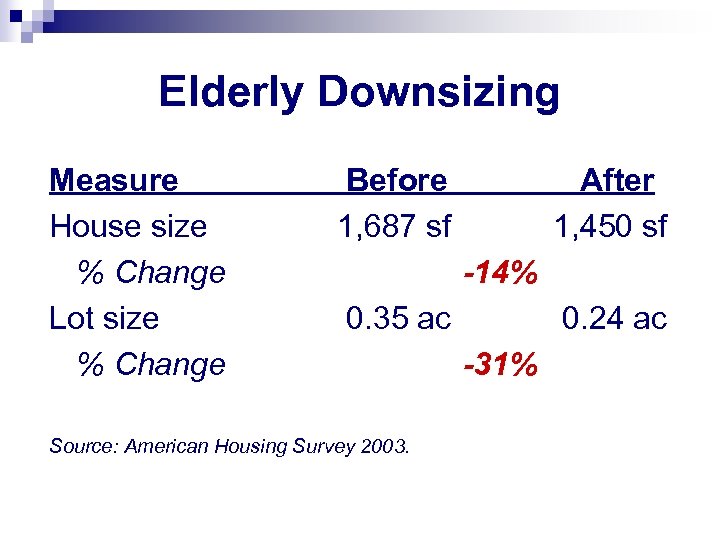

Elderly Downsizing Measure House size % Change Lot size % Change Before 1, 687 sf After 1, 450 sf -14% 0. 35 ac Source: American Housing Survey 2003. 0. 24 ac -31%

Elderly Downsizing Measure House size % Change Lot size % Change Before 1, 687 sf After 1, 450 sf -14% 0. 35 ac Source: American Housing Survey 2003. 0. 24 ac -31%

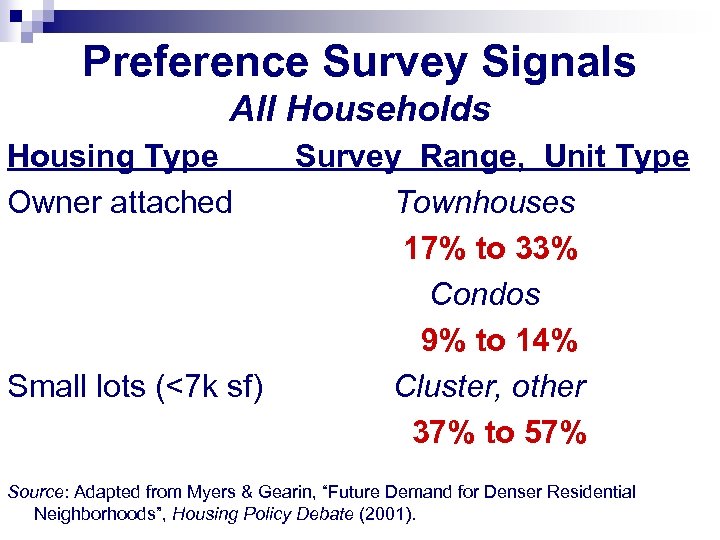

Preference Survey Signals All Households Housing Type Owner attached Small lots (<7 k sf) Survey Range, Unit Type Townhouses 17% to 33% Condos 9% to 14% Cluster, other 37% to 57% Source: Adapted from Myers & Gearin, “Future Demand for Denser Residential Neighborhoods”, Housing Policy Debate (2001).

Preference Survey Signals All Households Housing Type Owner attached Small lots (<7 k sf) Survey Range, Unit Type Townhouses 17% to 33% Condos 9% to 14% Cluster, other 37% to 57% Source: Adapted from Myers & Gearin, “Future Demand for Denser Residential Neighborhoods”, Housing Policy Debate (2001).

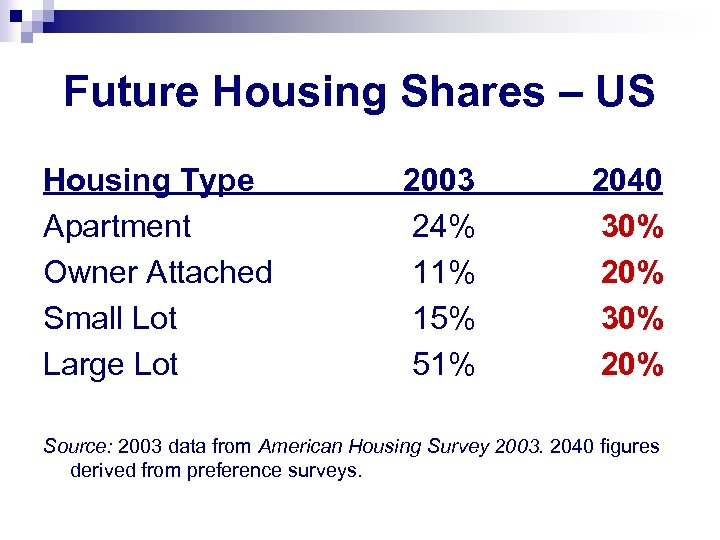

Future Housing Shares – US Housing Type Apartment Owner Attached Small Lot Large Lot 2003 24% 11% 15% 51% 2040 30% 20% Source: 2003 data from American Housing Survey 2003. 2040 figures derived from preference surveys.

Future Housing Shares – US Housing Type Apartment Owner Attached Small Lot Large Lot 2003 24% 11% 15% 51% 2040 30% 20% Source: 2003 data from American Housing Survey 2003. 2040 figures derived from preference surveys.

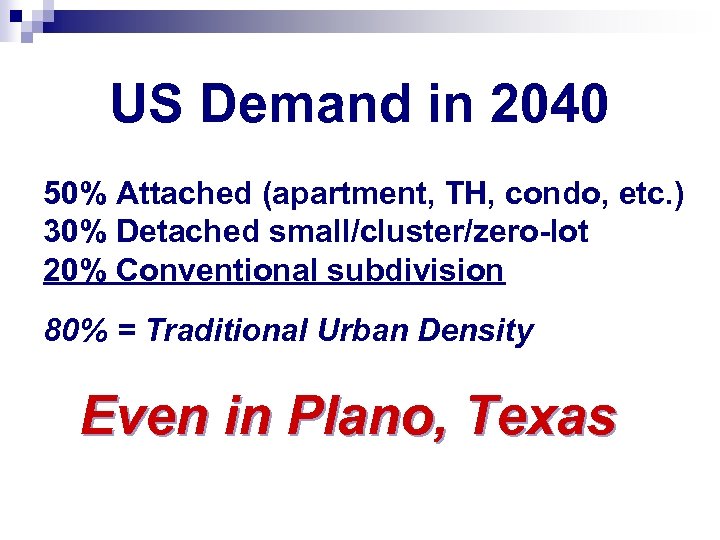

US Demand in 2040 50% Attached (apartment, TH, condo, etc. ) 30% Detached small/cluster/zero-lot 20% Conventional subdivision 80% = Traditional Urban Density Even in Plano, Texas

US Demand in 2040 50% Attached (apartment, TH, condo, etc. ) 30% Detached small/cluster/zero-lot 20% Conventional subdivision 80% = Traditional Urban Density Even in Plano, Texas

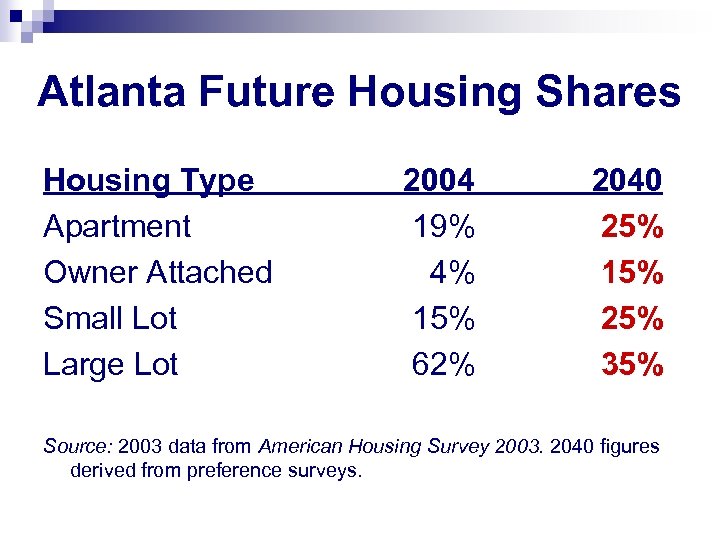

Atlanta Future Housing Shares Housing Type Apartment Owner Attached Small Lot Large Lot 2004 19% 4% 15% 62% 2040 25% 15% 25% 35% Source: 2003 data from American Housing Survey 2003. 2040 figures derived from preference surveys.

Atlanta Future Housing Shares Housing Type Apartment Owner Attached Small Lot Large Lot 2004 19% 4% 15% 62% 2040 25% 15% 25% 35% Source: 2003 data from American Housing Survey 2003. 2040 figures derived from preference surveys.

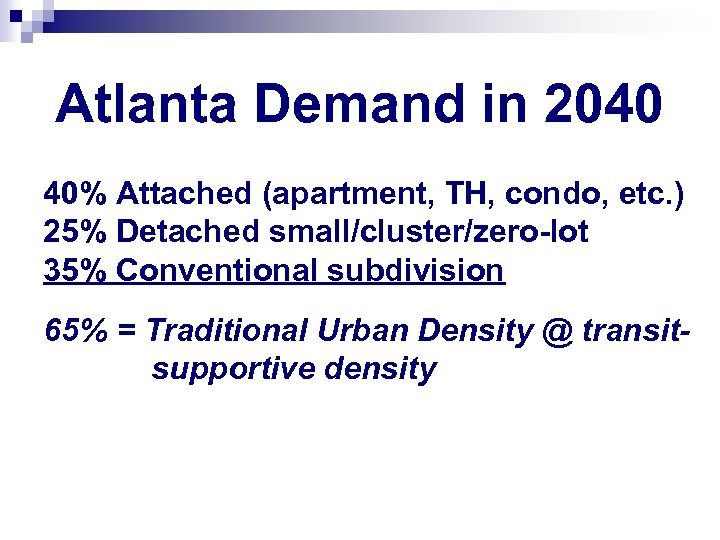

Atlanta Demand in 2040 40% Attached (apartment, TH, condo, etc. ) 25% Detached small/cluster/zero-lot 35% Conventional subdivision 65% = Traditional Urban Density @ transitsupportive density

Atlanta Demand in 2040 40% Attached (apartment, TH, condo, etc. ) 25% Detached small/cluster/zero-lot 35% Conventional subdivision 65% = Traditional Urban Density @ transitsupportive density

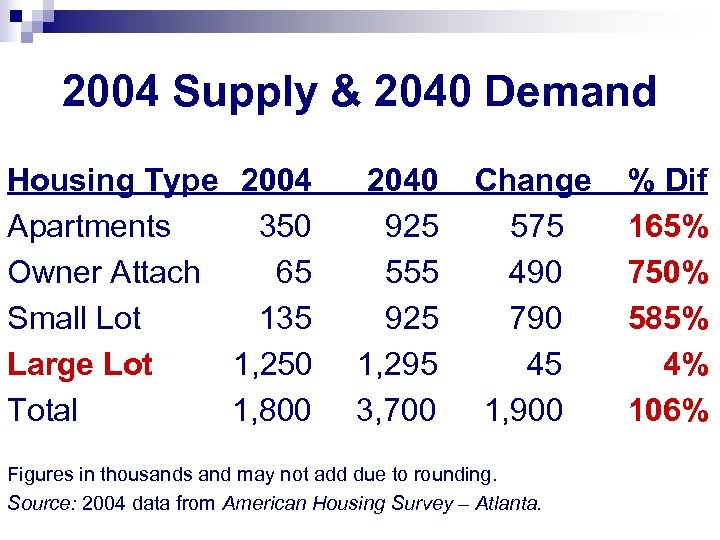

2004 Supply & 2040 Demand Housing Type 2004 Apartments 350 Owner Attach 65 Small Lot 135 Large Lot 1, 250 Total 1, 800 2040 925 555 925 1, 295 3, 700 Change 575 490 790 45 1, 900 Figures in thousands and may not add due to rounding. Source: 2004 data from American Housing Survey – Atlanta. % Dif 165% 750% 585% 4% 106%

2004 Supply & 2040 Demand Housing Type 2004 Apartments 350 Owner Attach 65 Small Lot 135 Large Lot 1, 250 Total 1, 800 2040 925 555 925 1, 295 3, 700 Change 575 490 790 45 1, 900 Figures in thousands and may not add due to rounding. Source: 2004 data from American Housing Survey – Atlanta. % Dif 165% 750% 585% 4% 106%

What Futurists Tell Us Cheap energy is over. Rising global competition for construction materials. Bio-medical advances will extend lifetimes. Another 20 years added?

What Futurists Tell Us Cheap energy is over. Rising global competition for construction materials. Bio-medical advances will extend lifetimes. Another 20 years added?

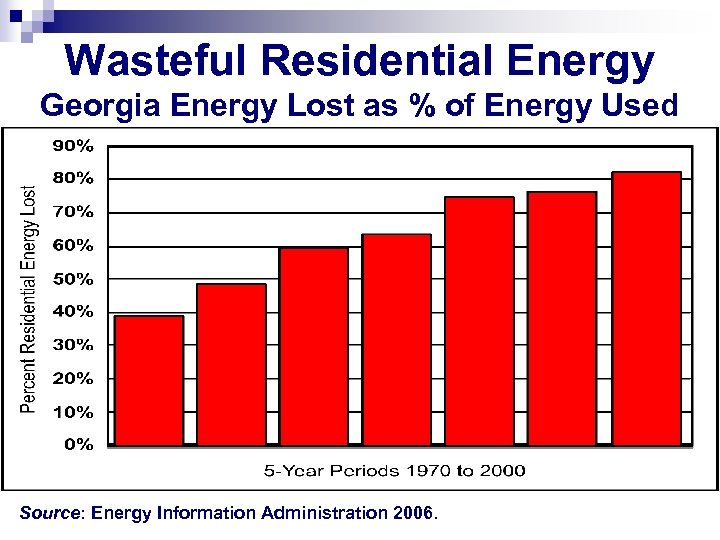

Wasteful Residential Energy Georgia Energy Lost as % of Energy Used Source: Energy Information Administration 2006.

Wasteful Residential Energy Georgia Energy Lost as % of Energy Used Source: Energy Information Administration 2006.

Invest Where the People Will Be 71% of elderly want transit options (AARP) n 50% of public want expanded transit investment but only 25% want new roads (NAR) n Large-scale home builders want transit options n ULI, Price. Waterhouse. Coopers, others n Do not invest in suburban fringe n Highest rates of return in redevelopment, infill n n Understand changing preferences Affluent elderly who want urbane opportunities n Young professions who delay child-rearing n Some shifting preferences even in families with children n

Invest Where the People Will Be 71% of elderly want transit options (AARP) n 50% of public want expanded transit investment but only 25% want new roads (NAR) n Large-scale home builders want transit options n ULI, Price. Waterhouse. Coopers, others n Do not invest in suburban fringe n Highest rates of return in redevelopment, infill n n Understand changing preferences Affluent elderly who want urbane opportunities n Young professions who delay child-rearing n Some shifting preferences even in families with children n

Planners Need To … Know implications of demographic changes. n Anticipate rising prices in energy, construction. n Understand market responsiveness to New Atlanta Metropolis development. n Invent new financing tools to earn high long-term gains in the New Atlanta Metropolis investments despite short-term low returns. n Create win-win public-private partnerships. n

Planners Need To … Know implications of demographic changes. n Anticipate rising prices in energy, construction. n Understand market responsiveness to New Atlanta Metropolis development. n Invent new financing tools to earn high long-term gains in the New Atlanta Metropolis investments despite short-term low returns. n Create win-win public-private partnerships. n

THANK YOU!

THANK YOU!