6b84f31c9ec4382ba8c552fbff5e6a21.ppt

- Количество слайдов: 60

Community Infrastructure Levy The Evidence PAS Seminar Series

Community Infrastructure Levy The Evidence PAS Seminar Series

Infrastructure Evidence

Infrastructure Evidence

WHO ARE WE The CIL Knowledge Partnership brings together several organisations with long established track records in the planning and development sectors: • BNP Paribas Real Estate: development viability • House: specialise in regeneration, spatial planning policy. • Inner Circle Consulting: infrastructure delivery planning.

WHO ARE WE The CIL Knowledge Partnership brings together several organisations with long established track records in the planning and development sectors: • BNP Paribas Real Estate: development viability • House: specialise in regeneration, spatial planning policy. • Inner Circle Consulting: infrastructure delivery planning.

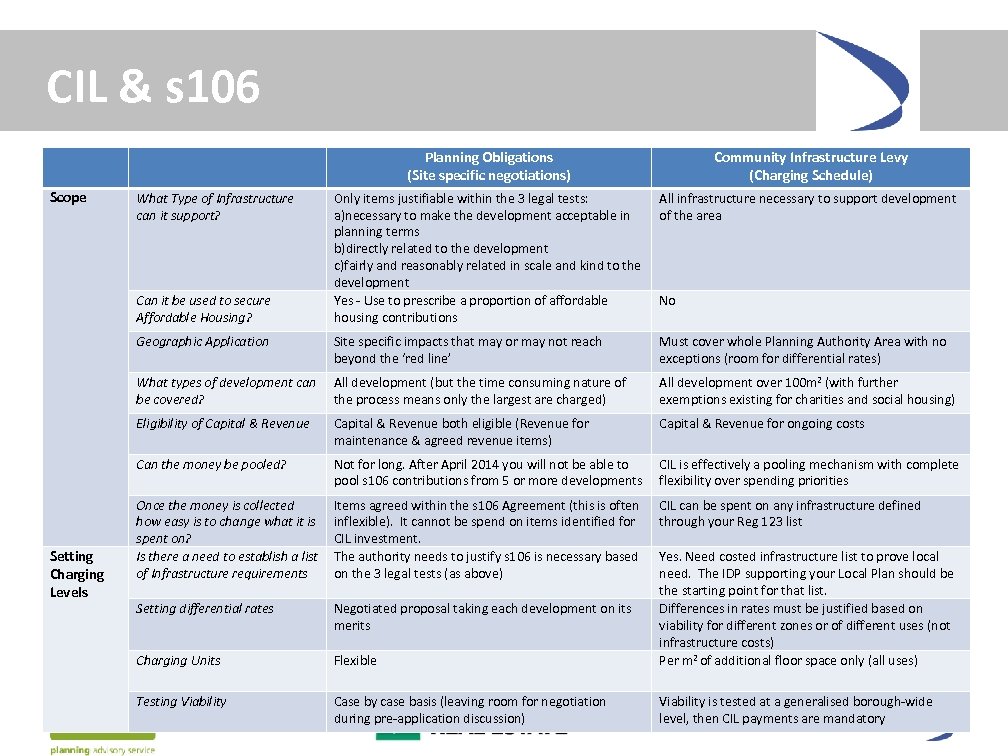

CIL & s 106 Planning Obligations (Site specific negotiations) Only items justifiable within the 3 legal tests: a)necessary to make the development acceptable in planning terms b)directly related to the development c)fairly and reasonably related in scale and kind to the development Yes - Use to prescribe a proportion of affordable housing contributions All infrastructure necessary to support development of the area Geographic Application Site specific impacts that may or may not reach beyond the ‘red line’ Must cover whole Planning Authority Area with no exceptions (room for differential rates) What types of development can be covered? All development (but the time consuming nature of the process means only the largest are charged) All development over 100 m 2 (with further exemptions existing for charities and social housing) Eligibility of Capital & Revenue both eligible (Revenue for maintenance & agreed revenue items) Capital & Revenue for ongoing costs Can the money be pooled? Scope Community Infrastructure Levy (Charging Schedule) Not for long. After April 2014 you will not be able to pool s 106 contributions from 5 or more developments CIL is effectively a pooling mechanism with complete flexibility over spending priorities Once the money is collected how easy is to change what it is spent on? Is there a need to establish a list of Infrastructure requirements Items agreed within the s 106 Agreement (this is often inflexible). It cannot be spend on items identified for CIL investment. The authority needs to justify s 106 is necessary based on the 3 legal tests (as above) CIL can be spent on any infrastructure defined through your Reg 123 list Setting differential rates Negotiated proposal taking each development on its merits Charging Units Flexible Yes. Need costed infrastructure list to prove local need. The IDP supporting your Local Plan should be the starting point for that list. Differences in rates must be justified based on viability for different zones or of different uses (not infrastructure costs) Per m 2 of additional floor space only (all uses) Testing Viability Case by case basis (leaving room for negotiation during pre-application discussion) Viability is tested at a generalised borough-wide level, then CIL payments are mandatory What Type of Infrastructure can it support? Can it be used to secure Affordable Housing? Setting Charging Levels No

CIL & s 106 Planning Obligations (Site specific negotiations) Only items justifiable within the 3 legal tests: a)necessary to make the development acceptable in planning terms b)directly related to the development c)fairly and reasonably related in scale and kind to the development Yes - Use to prescribe a proportion of affordable housing contributions All infrastructure necessary to support development of the area Geographic Application Site specific impacts that may or may not reach beyond the ‘red line’ Must cover whole Planning Authority Area with no exceptions (room for differential rates) What types of development can be covered? All development (but the time consuming nature of the process means only the largest are charged) All development over 100 m 2 (with further exemptions existing for charities and social housing) Eligibility of Capital & Revenue both eligible (Revenue for maintenance & agreed revenue items) Capital & Revenue for ongoing costs Can the money be pooled? Scope Community Infrastructure Levy (Charging Schedule) Not for long. After April 2014 you will not be able to pool s 106 contributions from 5 or more developments CIL is effectively a pooling mechanism with complete flexibility over spending priorities Once the money is collected how easy is to change what it is spent on? Is there a need to establish a list of Infrastructure requirements Items agreed within the s 106 Agreement (this is often inflexible). It cannot be spend on items identified for CIL investment. The authority needs to justify s 106 is necessary based on the 3 legal tests (as above) CIL can be spent on any infrastructure defined through your Reg 123 list Setting differential rates Negotiated proposal taking each development on its merits Charging Units Flexible Yes. Need costed infrastructure list to prove local need. The IDP supporting your Local Plan should be the starting point for that list. Differences in rates must be justified based on viability for different zones or of different uses (not infrastructure costs) Per m 2 of additional floor space only (all uses) Testing Viability Case by case basis (leaving room for negotiation during pre-application discussion) Viability is tested at a generalised borough-wide level, then CIL payments are mandatory What Type of Infrastructure can it support? Can it be used to secure Affordable Housing? Setting Charging Levels No

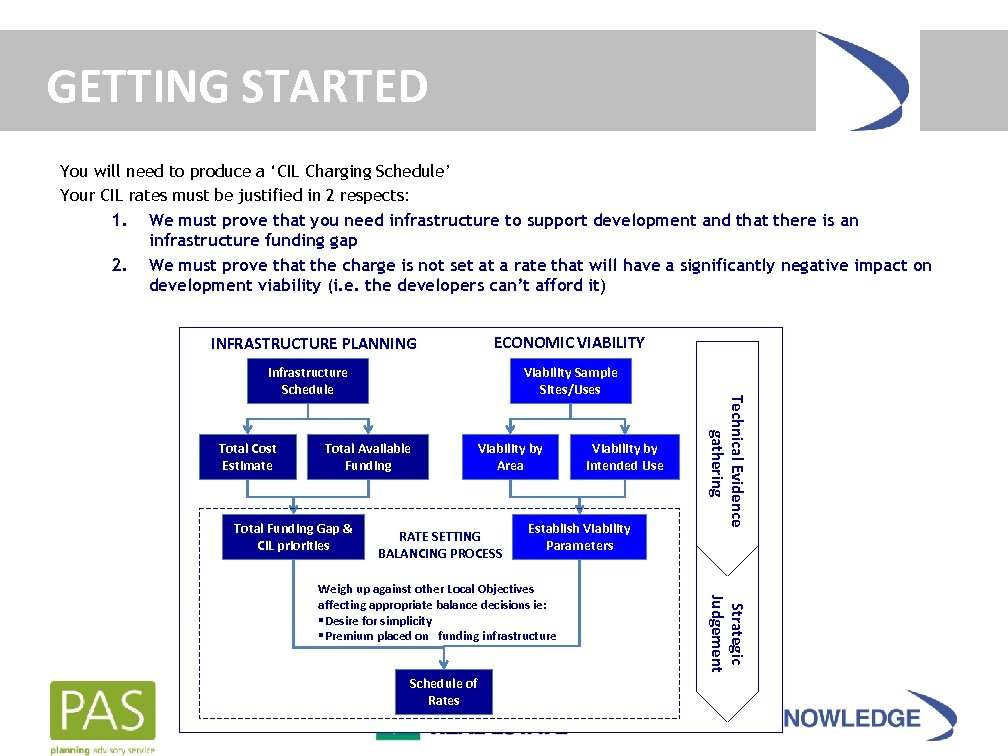

GETTING STARTED You will need to produce a ‘CIL Charging Schedule’ Your CIL rates must be justified in 2 respects: 1. We must prove that you need infrastructure to support development and that there is an infrastructure funding gap 2. We must prove that the charge is not set at a rate that will have a significantly negative impact on development viability (i. e. the developers can’t afford it) ECONOMIC VIABILITY INFRASTRUCTURE PLANNING Total Cost Estimate Viability Sample Sites/Uses Total Available Funding Total Funding Gap & CIL priorities Viability by Area RATE SETTING BALANCING PROCESS Establish Viability Parameters Strategic Judgement Weigh up against other Local Objectives affecting appropriate balance decisions ie: §Desire for simplicity §Premium placed on funding infrastructure Schedule of Rates Viability by Intended Use Technical Evidence gathering Infrastructure Schedule

GETTING STARTED You will need to produce a ‘CIL Charging Schedule’ Your CIL rates must be justified in 2 respects: 1. We must prove that you need infrastructure to support development and that there is an infrastructure funding gap 2. We must prove that the charge is not set at a rate that will have a significantly negative impact on development viability (i. e. the developers can’t afford it) ECONOMIC VIABILITY INFRASTRUCTURE PLANNING Total Cost Estimate Viability Sample Sites/Uses Total Available Funding Total Funding Gap & CIL priorities Viability by Area RATE SETTING BALANCING PROCESS Establish Viability Parameters Strategic Judgement Weigh up against other Local Objectives affecting appropriate balance decisions ie: §Desire for simplicity §Premium placed on funding infrastructure Schedule of Rates Viability by Intended Use Technical Evidence gathering Infrastructure Schedule

The New Guidance

The New Guidance

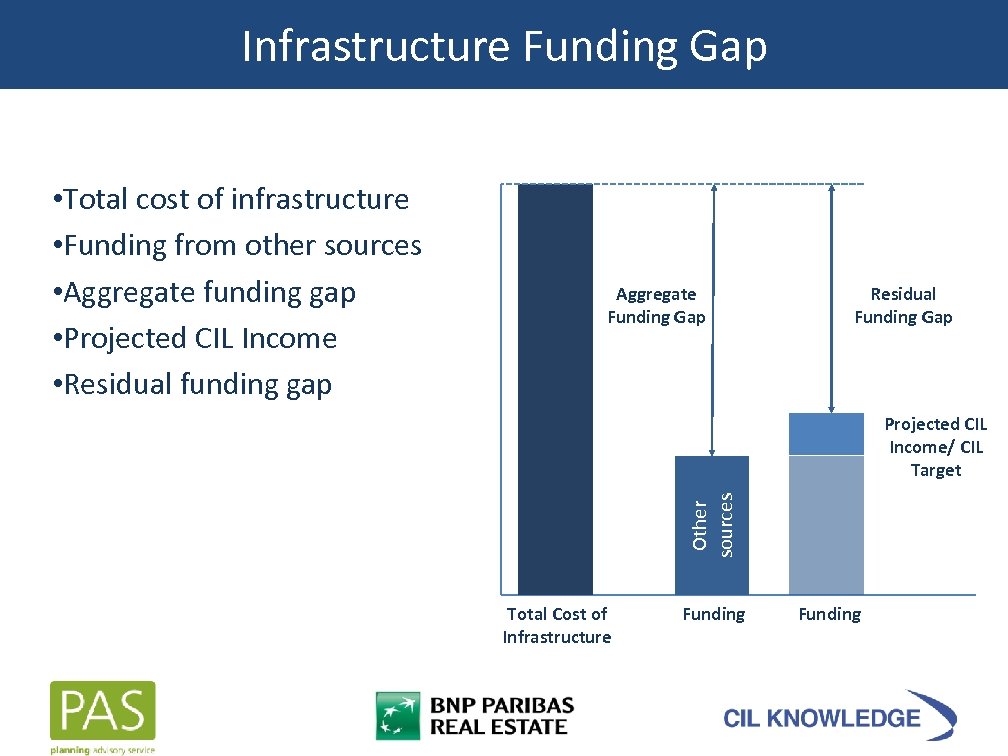

Infrastructure Funding Gap Aggregate Funding Gap Residual Funding Gap Projected CIL Income/ CIL Target Other sources • Total cost of infrastructure • Funding from other sources • Aggregate funding gap • Projected CIL Income • Residual funding gap Total Cost of Infrastructure Funding

Infrastructure Funding Gap Aggregate Funding Gap Residual Funding Gap Projected CIL Income/ CIL Target Other sources • Total cost of infrastructure • Funding from other sources • Aggregate funding gap • Projected CIL Income • Residual funding gap Total Cost of Infrastructure Funding

Main difference imparted by new guidance

Main difference imparted by new guidance

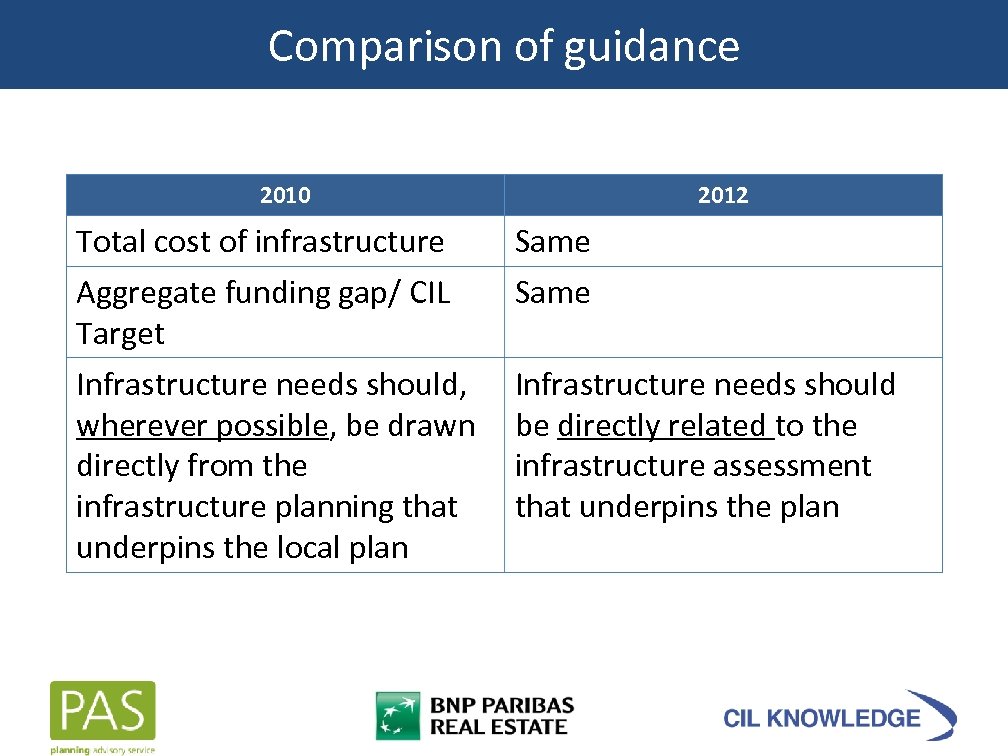

Comparison of guidance 2010 Total cost of infrastructure Aggregate funding gap/ CIL Target Infrastructure needs should, wherever possible, be drawn directly from the infrastructure planning that underpins the local plan 2012 Same Infrastructure needs should be directly related to the infrastructure assessment that underpins the plan

Comparison of guidance 2010 Total cost of infrastructure Aggregate funding gap/ CIL Target Infrastructure needs should, wherever possible, be drawn directly from the infrastructure planning that underpins the local plan 2012 Same Infrastructure needs should be directly related to the infrastructure assessment that underpins the plan

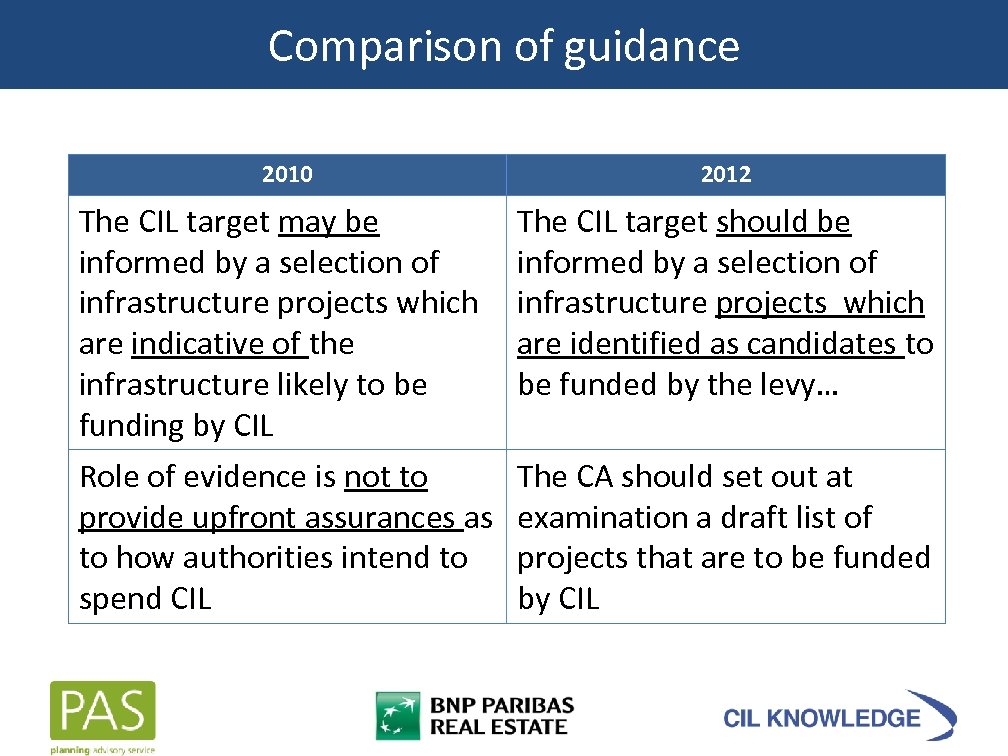

Comparison of guidance 2010 2012 The CIL target may be informed by a selection of infrastructure projects which are indicative of the infrastructure likely to be funding by CIL Role of evidence is not to provide upfront assurances as to how authorities intend to spend CIL The CIL target should be informed by a selection of infrastructure projects which are identified as candidates to be funded by the levy… The CA should set out at examination a draft list of projects that are to be funded by CIL

Comparison of guidance 2010 2012 The CIL target may be informed by a selection of infrastructure projects which are indicative of the infrastructure likely to be funding by CIL Role of evidence is not to provide upfront assurances as to how authorities intend to spend CIL The CIL target should be informed by a selection of infrastructure projects which are identified as candidates to be funded by the levy… The CA should set out at examination a draft list of projects that are to be funded by CIL

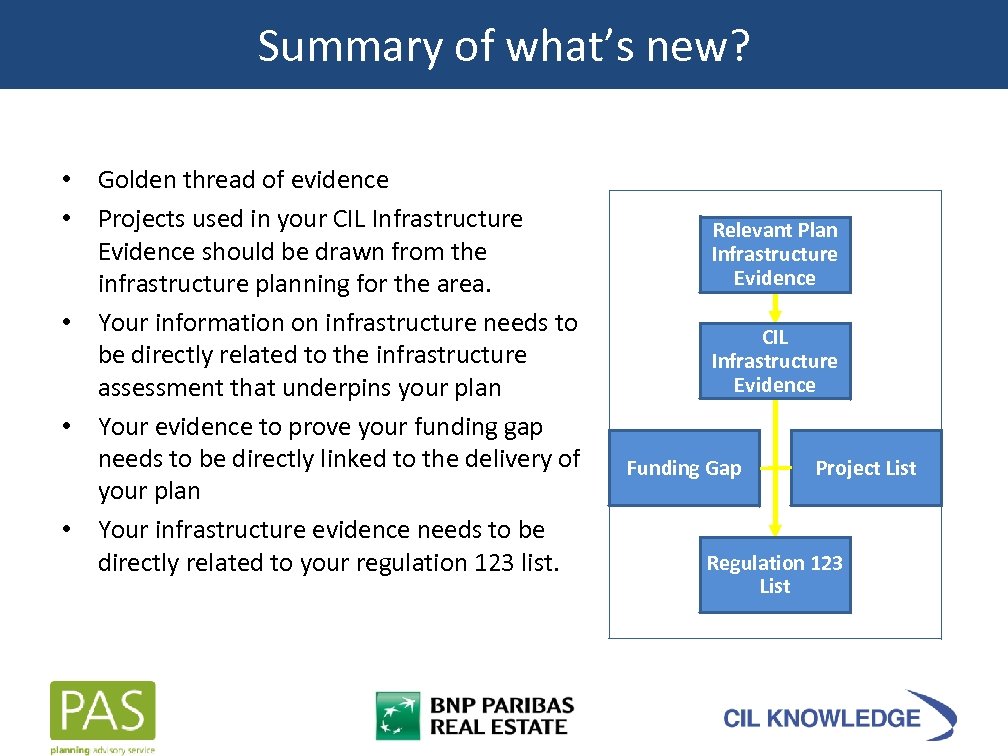

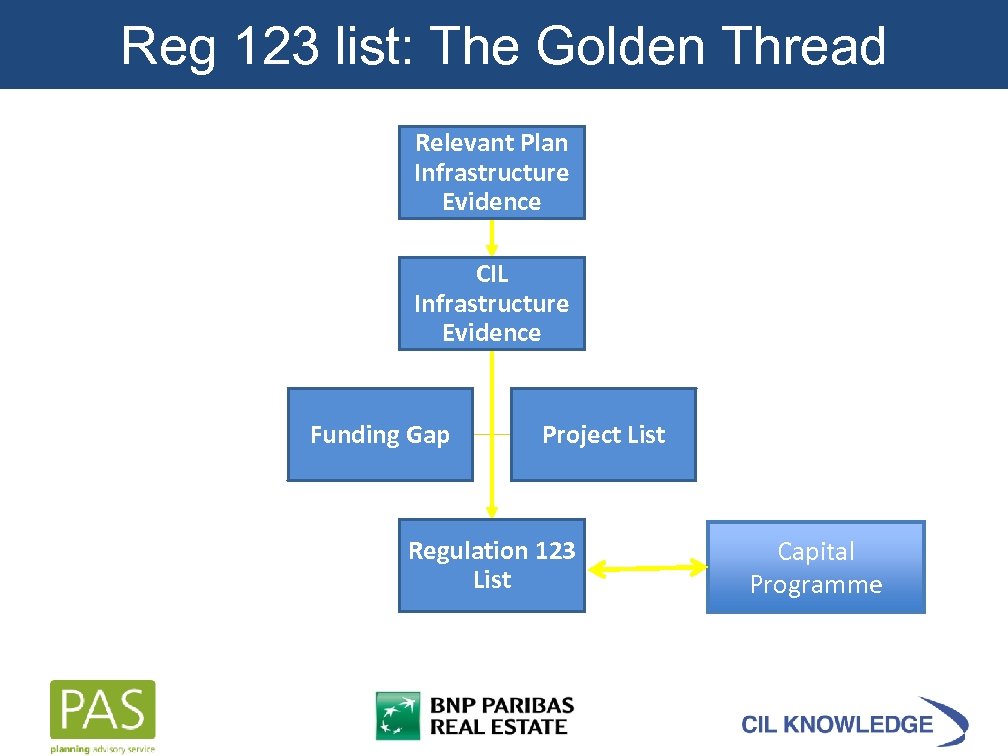

Summary of what’s new? • Golden thread of evidence • Projects used in your CIL Infrastructure Evidence should be drawn from the infrastructure planning for the area. • Your information on infrastructure needs to be directly related to the infrastructure assessment that underpins your plan • Your evidence to prove your funding gap needs to be directly linked to the delivery of your plan • Your infrastructure evidence needs to be directly related to your regulation 123 list. Relevant Plan Infrastructure Evidence CIL Infrastructure Evidence Funding Gap Project List Regulation 123 List

Summary of what’s new? • Golden thread of evidence • Projects used in your CIL Infrastructure Evidence should be drawn from the infrastructure planning for the area. • Your information on infrastructure needs to be directly related to the infrastructure assessment that underpins your plan • Your evidence to prove your funding gap needs to be directly linked to the delivery of your plan • Your infrastructure evidence needs to be directly related to your regulation 123 list. Relevant Plan Infrastructure Evidence CIL Infrastructure Evidence Funding Gap Project List Regulation 123 List

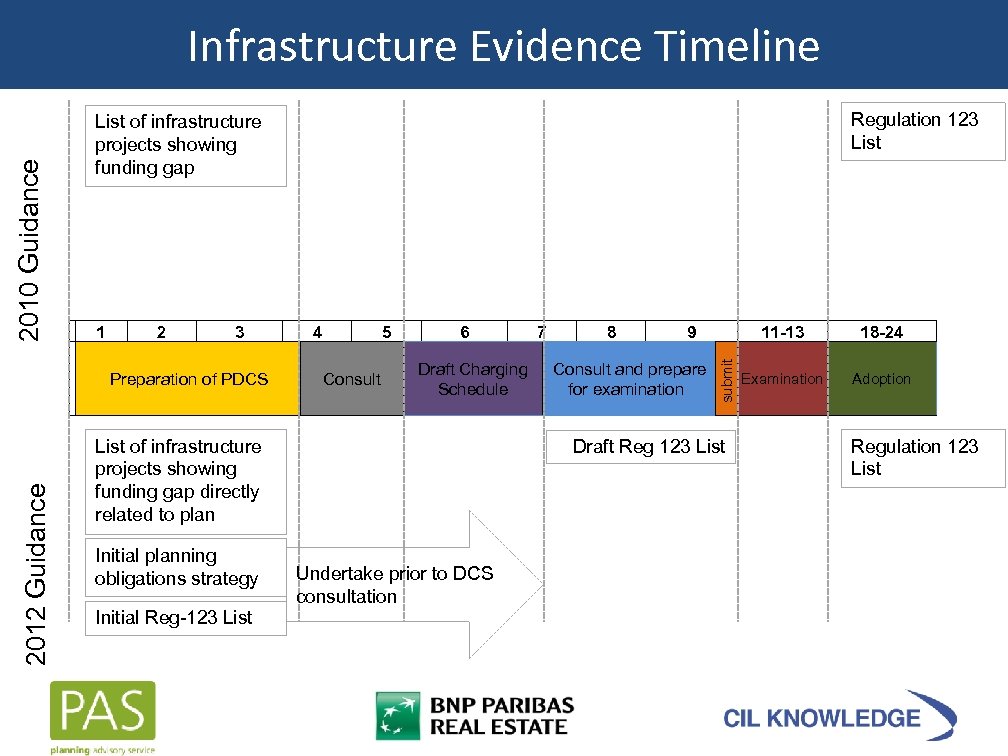

Regulation 123 List of infrastructure projects showing funding gap 1 2 3 Preparation of PDCS 4 5 Consult 6 Draft Charging Schedule 7 8 9 Consult and prepare for examination 11 -13 submit 2010 Guidance Infrastructure Evidence Timeline 18 -24 Examination Adoption 2012 Guidance List of infrastructure projects showing funding gap directly related to plan Initial planning obligations strategy Initial Reg-123 List Draft Reg 123 List Undertake prior to DCS consultation Regulation 123 List

Regulation 123 List of infrastructure projects showing funding gap 1 2 3 Preparation of PDCS 4 5 Consult 6 Draft Charging Schedule 7 8 9 Consult and prepare for examination 11 -13 submit 2010 Guidance Infrastructure Evidence Timeline 18 -24 Examination Adoption 2012 Guidance List of infrastructure projects showing funding gap directly related to plan Initial planning obligations strategy Initial Reg-123 List Draft Reg 123 List Undertake prior to DCS consultation Regulation 123 List

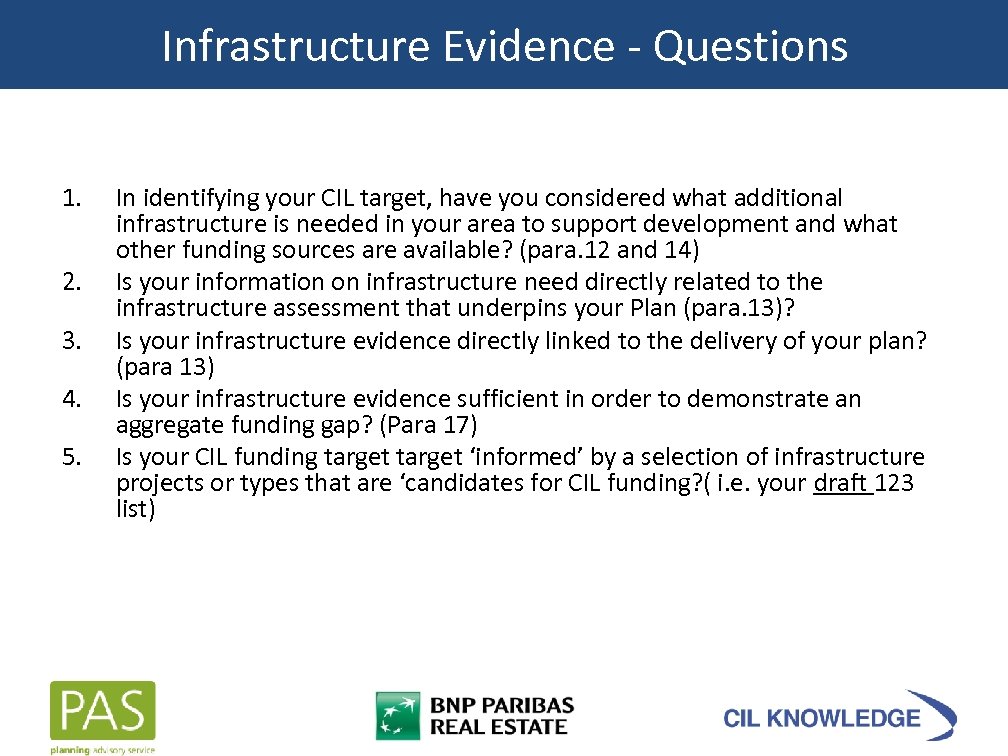

Infrastructure Evidence - Questions 1. 2. 3. 4. 5. In identifying your CIL target, have you considered what additional infrastructure is needed in your area to support development and what other funding sources are available? (para. 12 and 14) Is your information on infrastructure need directly related to the infrastructure assessment that underpins your Plan (para. 13)? Is your infrastructure evidence directly linked to the delivery of your plan? (para 13) Is your infrastructure evidence sufficient in order to demonstrate an aggregate funding gap? (Para 17) Is your CIL funding target ‘informed’ by a selection of infrastructure projects or types that are ‘candidates for CIL funding? ( i. e. your draft 123 list)

Infrastructure Evidence - Questions 1. 2. 3. 4. 5. In identifying your CIL target, have you considered what additional infrastructure is needed in your area to support development and what other funding sources are available? (para. 12 and 14) Is your information on infrastructure need directly related to the infrastructure assessment that underpins your Plan (para. 13)? Is your infrastructure evidence directly linked to the delivery of your plan? (para 13) Is your infrastructure evidence sufficient in order to demonstrate an aggregate funding gap? (Para 17) Is your CIL funding target ‘informed’ by a selection of infrastructure projects or types that are ‘candidates for CIL funding? ( i. e. your draft 123 list)

Questions

Questions

Viability Evidence

Viability Evidence

Viability and the new SG What’s new? Preparing evidence Viability and ‘delivery of the plan’ Area based rates

Viability and the new SG What’s new? Preparing evidence Viability and ‘delivery of the plan’ Area based rates

The key test – regulation 14 Charging authorities ‘must aim to strike what appears to the charging authority to be an appropriate balance between’ - Raising funds for infrastructure and - ‘The potential effects (taken as a whole) of the imposition of CIL on the economic viability of development across its area’

The key test – regulation 14 Charging authorities ‘must aim to strike what appears to the charging authority to be an appropriate balance between’ - Raising funds for infrastructure and - ‘The potential effects (taken as a whole) of the imposition of CIL on the economic viability of development across its area’

Emphasis on delivering the Plan “…It is for charging authorities to decide…’how much’ development to put at risk…” “…As set out in the NPPF in England, the ability to develop viably the sites and the scale of development identified in the Local Plan should not be threatened…”

Emphasis on delivering the Plan “…It is for charging authorities to decide…’how much’ development to put at risk…” “…As set out in the NPPF in England, the ability to develop viably the sites and the scale of development identified in the Local Plan should not be threatened…”

Preparing evidence “…a CA may want to sample directly a few sites across its area to supplement existing data…” “a CA should sample directly an appropriate range of types of sites across its area…subject to receiving support from local developers … in particular on strategic sites”

Preparing evidence “…a CA may want to sample directly a few sites across its area to supplement existing data…” “a CA should sample directly an appropriate range of types of sites across its area…subject to receiving support from local developers … in particular on strategic sites”

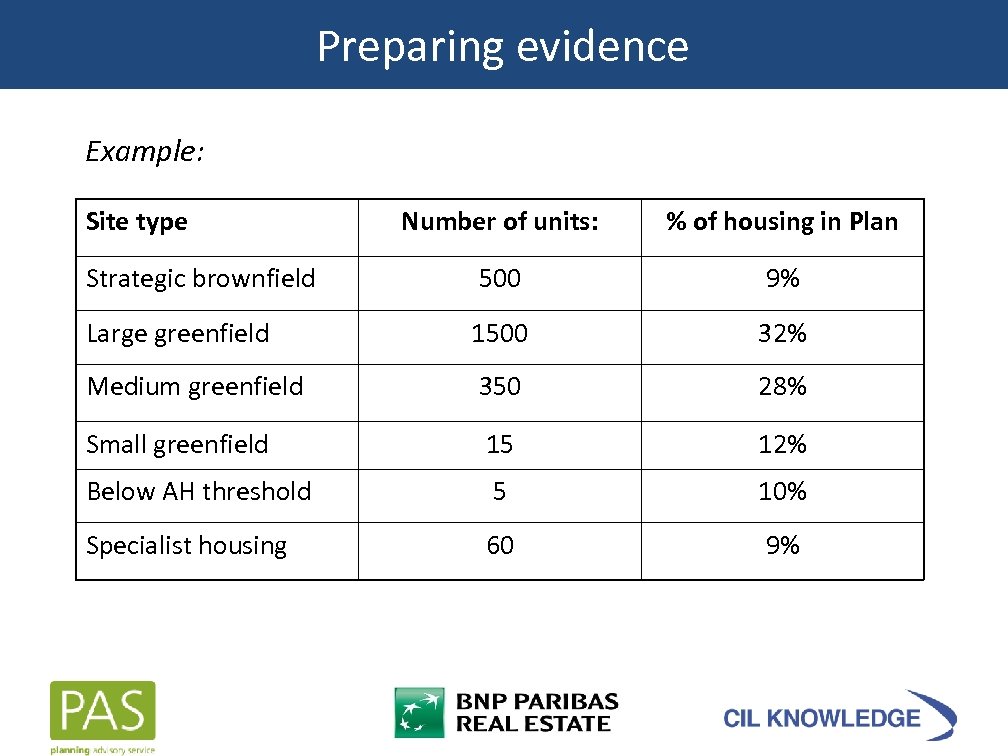

Preparing evidence Example: Site type Number of units: % of housing in Plan Strategic brownfield 500 9% Large greenfield 1500 32% Medium greenfield 350 28% Small greenfield 15 12% Below AH threshold 5 10% Specialist housing 60 9%

Preparing evidence Example: Site type Number of units: % of housing in Plan Strategic brownfield 500 9% Large greenfield 1500 32% Medium greenfield 350 28% Small greenfield 15 12% Below AH threshold 5 10% Specialist housing 60 9%

Preparing evidence – area based rates “…where a CA is proposing to set differential rates, they will want to undertake more fine grain sampling (of a higher percentage of total sites…to identify…the boundaries of particular zones…” Does this miss the point?

Preparing evidence – area based rates “…where a CA is proposing to set differential rates, they will want to undertake more fine grain sampling (of a higher percentage of total sites…to identify…the boundaries of particular zones…” Does this miss the point?

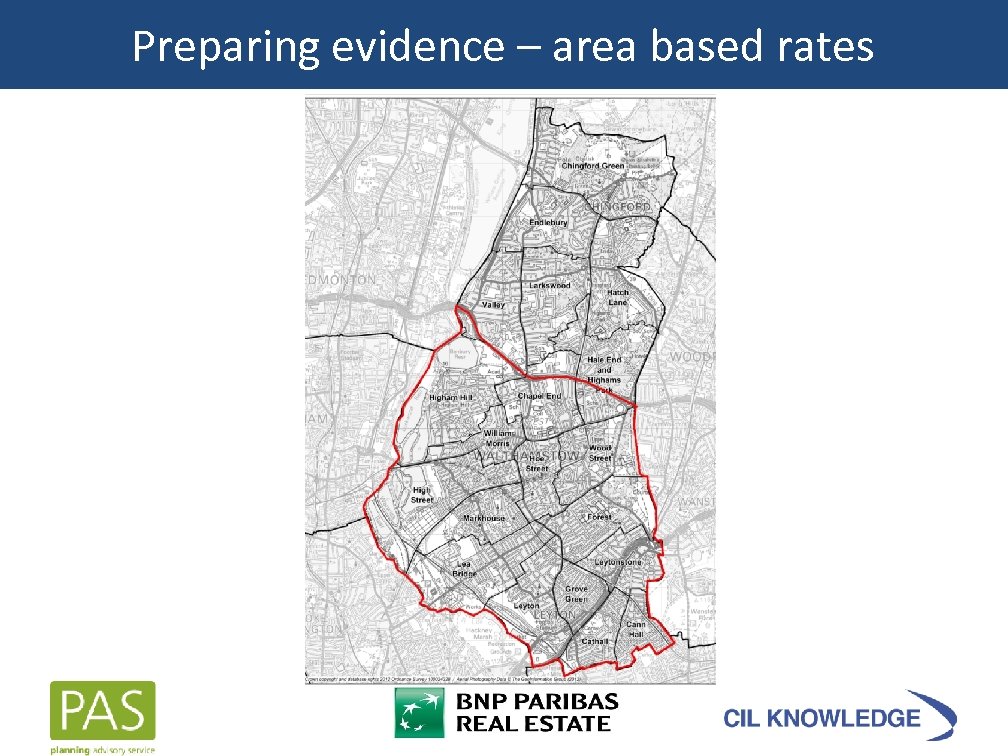

Preparing evidence – area based rates

Preparing evidence – area based rates

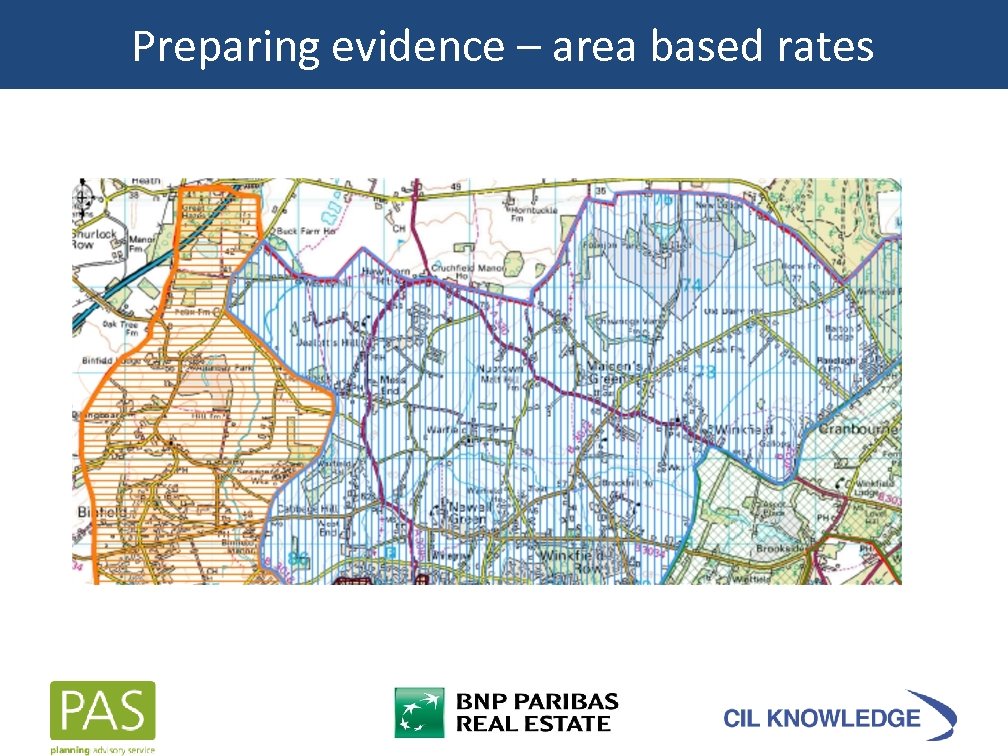

Preparing evidence – area based rates

Preparing evidence – area based rates

Preparing evidence – area based rates How to establish boundaries (particularly in urban areas)? - Postcodes – of relevance to housing markets -‘Natural’ barriers – railways, major roads - settlements (if area is not contiguous built up area) - combined approach of (a) Site testing (b) Land Registry sales value data by sub-postcode – in

Preparing evidence – area based rates How to establish boundaries (particularly in urban areas)? - Postcodes – of relevance to housing markets -‘Natural’ barriers – railways, major roads - settlements (if area is not contiguous built up area) - combined approach of (a) Site testing (b) Land Registry sales value data by sub-postcode – in

Rates based on different uses Differential rates for supermarkets and other retail - Borough of Poole and Sainsburys - Size doesn’t matter - Key driver is yield differential - ‘Big four’ – yield sub 5% - Corner Store operator – 7. 5% - 500 sq ft store, rent of £ 25 psf with 5% yield = cap val £ 250 k - 500 sq ft store, rent of £ 25 psf with 7. 5% yield = cap val £ 167 k - A ‘Sainsburys Local’ is just as viable as a superstore - Its all about the yield, but clearly can’t have a ‘Sainsburys’ CIL – in

Rates based on different uses Differential rates for supermarkets and other retail - Borough of Poole and Sainsburys - Size doesn’t matter - Key driver is yield differential - ‘Big four’ – yield sub 5% - Corner Store operator – 7. 5% - 500 sq ft store, rent of £ 25 psf with 5% yield = cap val £ 250 k - 500 sq ft store, rent of £ 25 psf with 7. 5% yield = cap val £ 167 k - A ‘Sainsburys Local’ is just as viable as a superstore - Its all about the yield, but clearly can’t have a ‘Sainsburys’ CIL – in

Rates based on different uses Wycombe appear to have cracked it: “Convenience based supermarkets and superstores 1 and retail warehousing 2 (net retail selling space of over 280 sq metres) 1 Superstores/supermarkets are shopping destinations in their own right where weekly food shopping needs are met and which can also include nonfood floorspace as part of the overall mix of the unit. 2 Retail warehouses are large stores specialising in the sale of household goods (such as carpets, furniture and electrical goods), DIY items and other ranges of goods, catering for mainly car-borne customers. ” – in

Rates based on different uses Wycombe appear to have cracked it: “Convenience based supermarkets and superstores 1 and retail warehousing 2 (net retail selling space of over 280 sq metres) 1 Superstores/supermarkets are shopping destinations in their own right where weekly food shopping needs are met and which can also include nonfood floorspace as part of the overall mix of the unit. 2 Retail warehouses are large stores specialising in the sale of household goods (such as carpets, furniture and electrical goods), DIY items and other ranges of goods, catering for mainly car-borne customers. ” – in

Additional requirements – S 106 receipts - As ‘background evidence’ provide information on amounts raised through Section 106 - Extent to which affordable housing targets have been met Issues - Test of ‘reasonableness’ against Section 106 - Implication that you can’t have CIL if not meeting AH targets - Implication that CIL shouldn’t be higher than Section 106(? ) - Not all authorities have maxed out on Section 106 - But… isn’t CIL about what schemes can viably afford?

Additional requirements – S 106 receipts - As ‘background evidence’ provide information on amounts raised through Section 106 - Extent to which affordable housing targets have been met Issues - Test of ‘reasonableness’ against Section 106 - Implication that you can’t have CIL if not meeting AH targets - Implication that CIL shouldn’t be higher than Section 106(? ) - Not all authorities have maxed out on Section 106 - But… isn’t CIL about what schemes can viably afford?

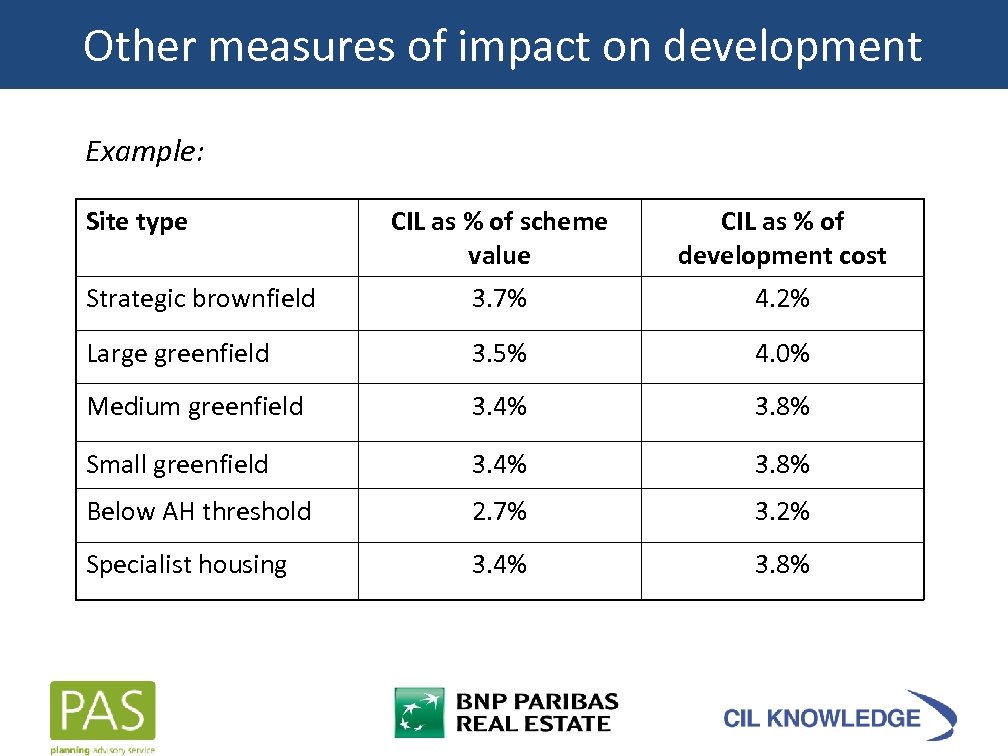

Other measures of impact on development Example: Site type CIL as % of scheme value CIL as % of development cost Strategic brownfield 3. 7% 4. 2% Large greenfield 3. 5% 4. 0% Medium greenfield 3. 4% 3. 8% Small greenfield 3. 4% 3. 8% Below AH threshold 2. 7% 3. 2% Specialist housing 3. 4% 3. 8%

Other measures of impact on development Example: Site type CIL as % of scheme value CIL as % of development cost Strategic brownfield 3. 7% 4. 2% Large greenfield 3. 5% 4. 0% Medium greenfield 3. 4% 3. 8% Small greenfield 3. 4% 3. 8% Below AH threshold 2. 7% 3. 2% Specialist housing 3. 4% 3. 8%

Strategic Sites What’s different about them and why separate testing “CAs could treat a major strategic site as a separate geographical zone where it is supported by robust evidence on economic viability” - On site infrastructure/utilities etc - £ 750, 000 per ha - On site community infrastructure (schools etc) - Significant upfront costs; long build out periods - BUT do not assume they cannot afford CIL as well…some can - Is Section 106 sometimes preferable on large schemes?

Strategic Sites What’s different about them and why separate testing “CAs could treat a major strategic site as a separate geographical zone where it is supported by robust evidence on economic viability” - On site infrastructure/utilities etc - £ 750, 000 per ha - On site community infrastructure (schools etc) - Significant upfront costs; long build out periods - BUT do not assume they cannot afford CIL as well…some can - Is Section 106 sometimes preferable on large schemes?

Meaningful consultation with stakeholders ‘…early engagement with local developers and others in the property industry is clearly good practice and should help the CS consultation and examination process run more smoothly…’ ‘…the extent to which charging authorities can do this will depend on the level of engagement from local developers…’ Is this about getting the right answer, or is this a negotiation?

Meaningful consultation with stakeholders ‘…early engagement with local developers and others in the property industry is clearly good practice and should help the CS consultation and examination process run more smoothly…’ ‘…the extent to which charging authorities can do this will depend on the level of engagement from local developers…’ Is this about getting the right answer, or is this a negotiation?

Meaningful consultation with stakeholders Most developers will be hoping to minimise CIL! - Those who bought land pre-CIL but do not have consent - Those who have taken out options to purchase - Developers looking for land to purchase - Savills’ remit through NHBF ‘consortium’ – not about getting to the right answer: “Savills, on behalf of the Consortium, also wishes to meet with the Borough Council and BNP Paribas to discuss how the viability appraisal may be improved, and notably how the proposed CIL rate can be reduced. ”

Meaningful consultation with stakeholders Most developers will be hoping to minimise CIL! - Those who bought land pre-CIL but do not have consent - Those who have taken out options to purchase - Developers looking for land to purchase - Savills’ remit through NHBF ‘consortium’ – not about getting to the right answer: “Savills, on behalf of the Consortium, also wishes to meet with the Borough Council and BNP Paribas to discuss how the viability appraisal may be improved, and notably how the proposed CIL rate can be reduced. ”

Meaningful consultation with stakeholders Do CAs achieve anything meaningful from consultation? - Lots of moaning and criticism (particularly from advisors) - Very little (if any) hard evidence is submitted - Views expressed must be taken with pinch (bucket? ) of salt - Consulting early does not stop developers objecting - Moral high ground at examination?

Meaningful consultation with stakeholders Do CAs achieve anything meaningful from consultation? - Lots of moaning and criticism (particularly from advisors) - Very little (if any) hard evidence is submitted - Views expressed must be taken with pinch (bucket? ) of salt - Consulting early does not stop developers objecting - Moral high ground at examination?

Examination of viability evidence “…The examiner should check that…the proposed rates are informed by and consistent with the evidence on… viability…” “…The examiner should establish that…” “…Examiner should be ready to…modify or reject the draft CS if it puts at serious risk the overall development of the area…” “…Examiner should be ready to…reject the draft CS if it threatens the delivery of the relevant plan as a whole…”

Examination of viability evidence “…The examiner should check that…the proposed rates are informed by and consistent with the evidence on… viability…” “…The examiner should establish that…” “…Examiner should be ready to…modify or reject the draft CS if it puts at serious risk the overall development of the area…” “…Examiner should be ready to…reject the draft CS if it threatens the delivery of the relevant plan as a whole…”

Exceptional relief ‘…use of an exceptions policy enables the CA to avoid rendering sites unviable should exceptional circumstances arise…’ 3 tests: - Cost relating to the Section 106 are greater than the CIL - A test of viability has been submitted and agreed - Granting relief would not constitute state aid - Key unanswered question – do ‘costs’ include the aff hsg? - If so, all sites providing aff hsg could be eligible - How might this be resolved?

Exceptional relief ‘…use of an exceptions policy enables the CA to avoid rendering sites unviable should exceptional circumstances arise…’ 3 tests: - Cost relating to the Section 106 are greater than the CIL - A test of viability has been submitted and agreed - Granting relief would not constitute state aid - Key unanswered question – do ‘costs’ include the aff hsg? - If so, all sites providing aff hsg could be eligible - How might this be resolved?

Other guidance – RICS and LHDG (Harman) Land value assumption is a critical issue to viability testing! Choice of benchmark can result in significant differences - Brief account of basic principles - What the guidance says

Other guidance – RICS and LHDG (Harman) Land value assumption is a critical issue to viability testing! Choice of benchmark can result in significant differences - Brief account of basic principles - What the guidance says

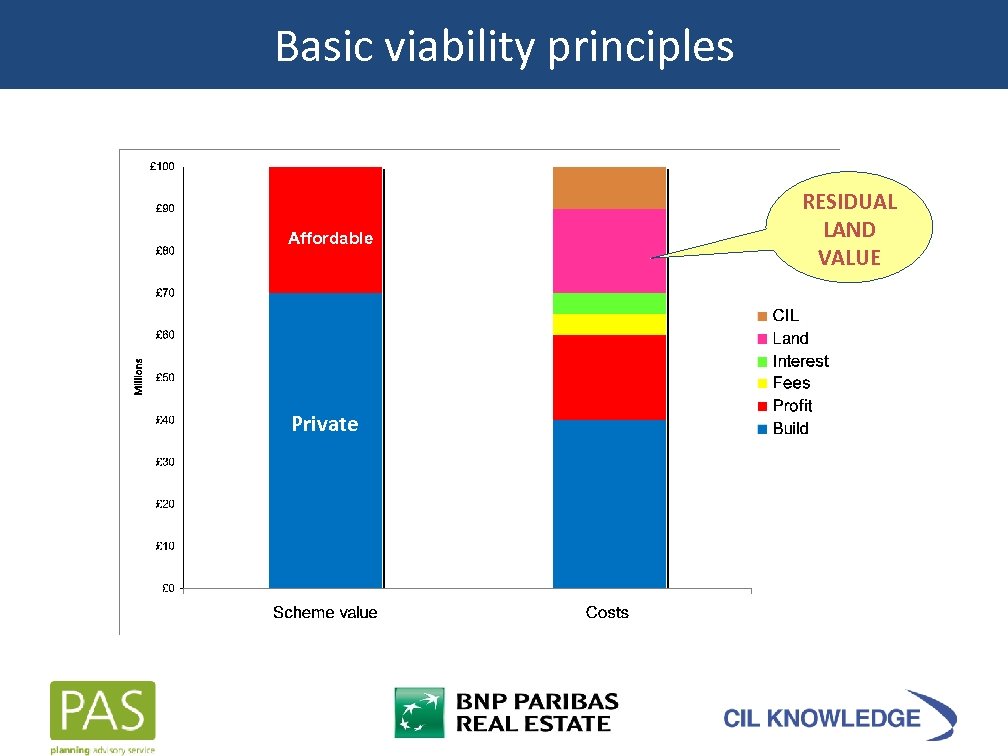

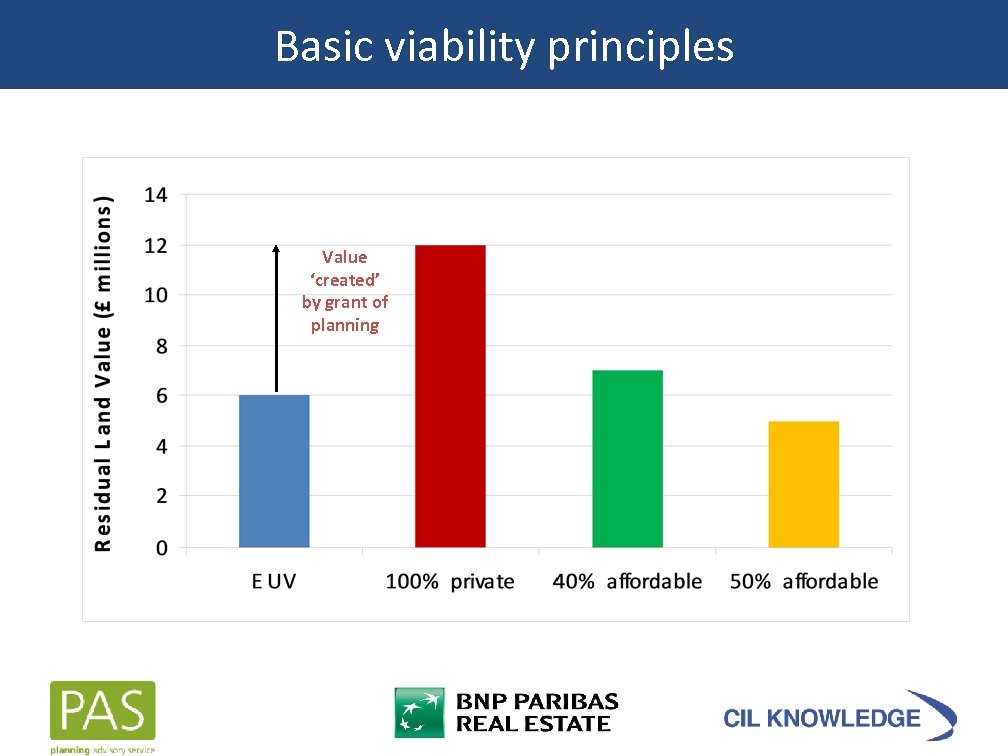

Basic viability principles Affordable Private RESIDUAL LAND VALUE

Basic viability principles Affordable Private RESIDUAL LAND VALUE

Basic viability principles Value ‘created’ by grant of planning

Basic viability principles Value ‘created’ by grant of planning

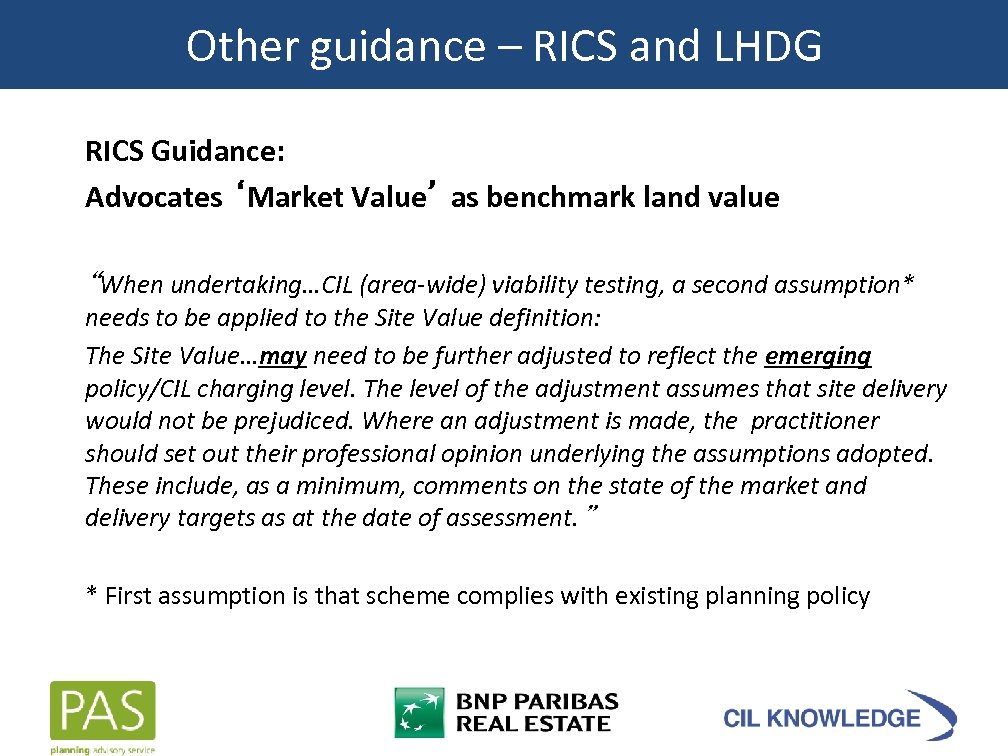

Other guidance – RICS and LHDG RICS Guidance: Advocates ‘Market Value’ as benchmark land value “When undertaking…CIL (area-wide) viability testing, a second assumption* needs to be applied to the Site Value definition: The Site Value…may need to be further adjusted to reflect the emerging policy/CIL charging level. The level of the adjustment assumes that site delivery would not be prejudiced. Where an adjustment is made, the practitioner should set out their professional opinion underlying the assumptions adopted. These include, as a minimum, comments on the state of the market and delivery targets as at the date of assessment. ” * First assumption is that scheme complies with existing planning policy

Other guidance – RICS and LHDG RICS Guidance: Advocates ‘Market Value’ as benchmark land value “When undertaking…CIL (area-wide) viability testing, a second assumption* needs to be applied to the Site Value definition: The Site Value…may need to be further adjusted to reflect the emerging policy/CIL charging level. The level of the adjustment assumes that site delivery would not be prejudiced. Where an adjustment is made, the practitioner should set out their professional opinion underlying the assumptions adopted. These include, as a minimum, comments on the state of the market and delivery targets as at the date of assessment. ” * First assumption is that scheme complies with existing planning policy

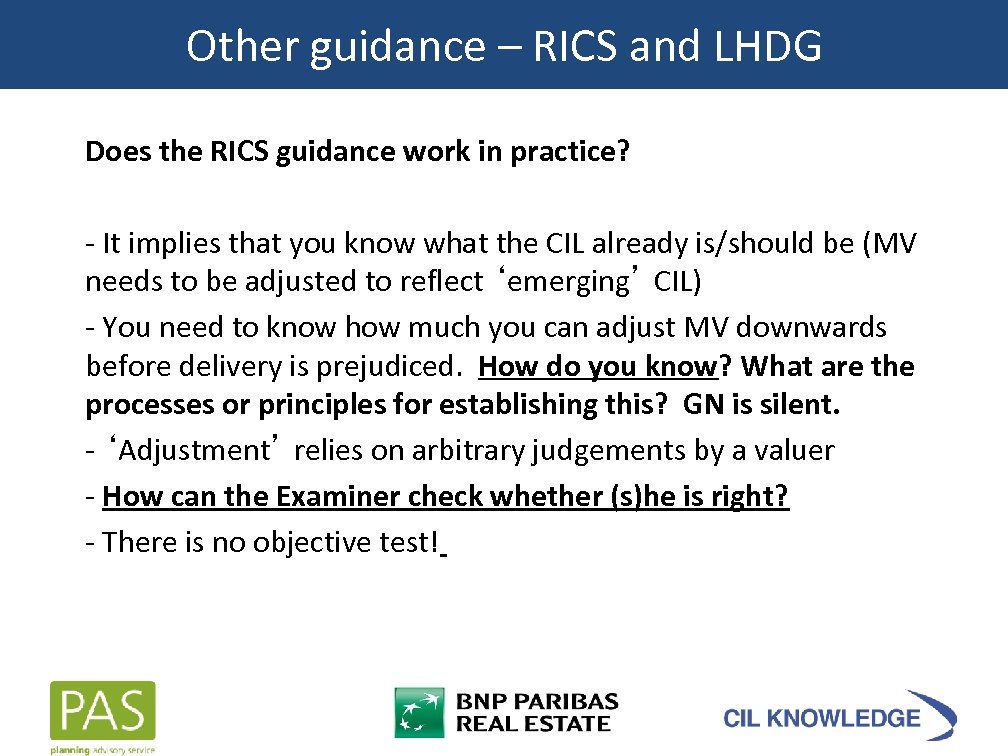

Other guidance – RICS and LHDG Does the RICS guidance work in practice? - It implies that you know what the CIL already is/should be (MV needs to be adjusted to reflect ‘emerging’ CIL) - You need to know how much you can adjust MV downwards before delivery is prejudiced. How do you know? What are the processes or principles for establishing this? GN is silent. - ‘Adjustment’ relies on arbitrary judgements by a valuer - How can the Examiner check whether (s)he is right? - There is no objective test!

Other guidance – RICS and LHDG Does the RICS guidance work in practice? - It implies that you know what the CIL already is/should be (MV needs to be adjusted to reflect ‘emerging’ CIL) - You need to know how much you can adjust MV downwards before delivery is prejudiced. How do you know? What are the processes or principles for establishing this? GN is silent. - ‘Adjustment’ relies on arbitrary judgements by a valuer - How can the Examiner check whether (s)he is right? - There is no objective test!

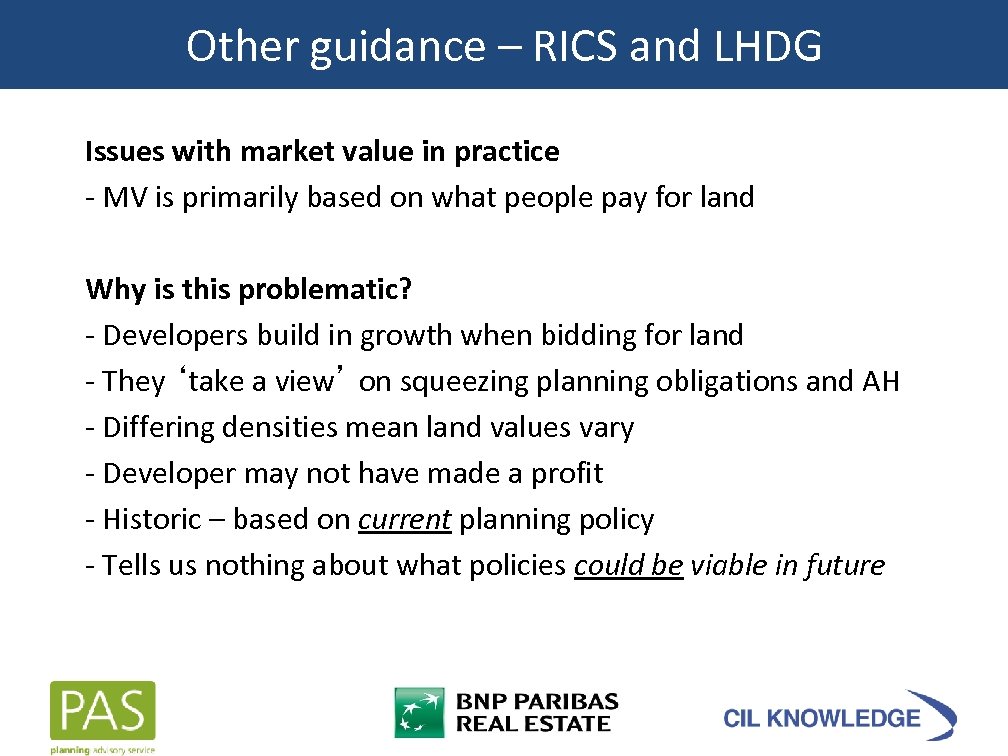

Other guidance – RICS and LHDG Issues with market value in practice - MV is primarily based on what people pay for land Why is this problematic? - Developers build in growth when bidding for land - They ‘take a view’ on squeezing planning obligations and AH - Differing densities mean land values vary - Developer may not have made a profit - Historic – based on current planning policy - Tells us nothing about what policies could be viable in future

Other guidance – RICS and LHDG Issues with market value in practice - MV is primarily based on what people pay for land Why is this problematic? - Developers build in growth when bidding for land - They ‘take a view’ on squeezing planning obligations and AH - Differing densities mean land values vary - Developer may not have made a profit - Historic – based on current planning policy - Tells us nothing about what policies could be viable in future

Other guidance – RICS and LHDG Issues with market value in practice - MV is primarily based on what people pay for land Why is this problematic? - Developers build in growth when bidding for land - They ‘take a view’ on squeezing planning obligations and AH - Differing densities mean land values vary - Developer may not have made a profit - Historic – based on current planning policy - Tells us nothing about what policies could be viable in future

Other guidance – RICS and LHDG Issues with market value in practice - MV is primarily based on what people pay for land Why is this problematic? - Developers build in growth when bidding for land - They ‘take a view’ on squeezing planning obligations and AH - Differing densities mean land values vary - Developer may not have made a profit - Historic – based on current planning policy - Tells us nothing about what policies could be viable in future

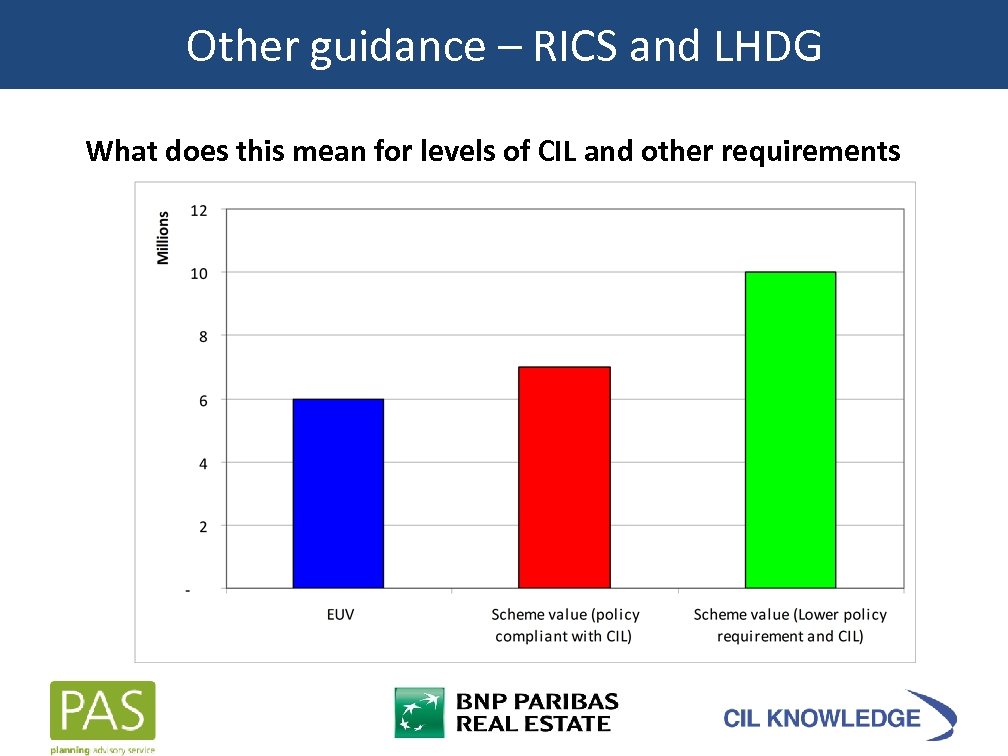

Other guidance – RICS and LHDG What does this mean for levels of CIL and other requirements

Other guidance – RICS and LHDG What does this mean for levels of CIL and other requirements

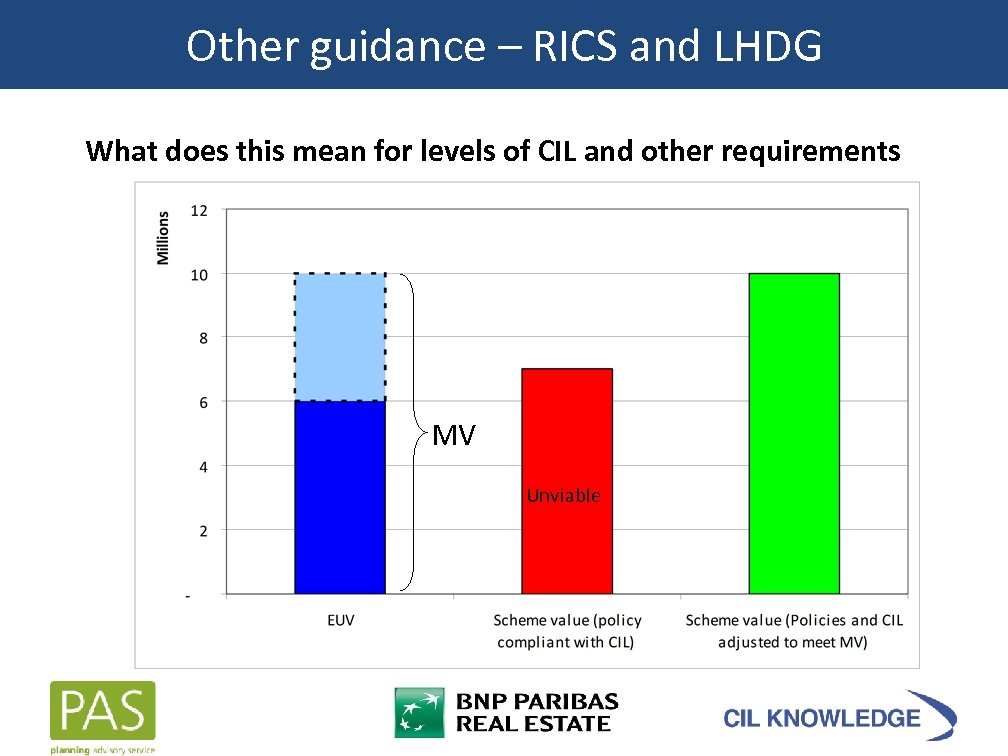

Other guidance – RICS and LHDG What does this mean for levels of CIL and other requirements MV Unviable

Other guidance – RICS and LHDG What does this mean for levels of CIL and other requirements MV Unviable

Other guidance – RICS and LHDG guidance: “using a market value approach as the starting point carries the risk of building-in assumptions of current policy costs rather than helping to inform the potential for future policy” “We recommend that the Threshold Land Value is based on a premium over current use values [which] should be determined locally”

Other guidance – RICS and LHDG guidance: “using a market value approach as the starting point carries the risk of building-in assumptions of current policy costs rather than helping to inform the potential for future policy” “We recommend that the Threshold Land Value is based on a premium over current use values [which] should be determined locally”

Other guidance – RICS and LHDG approach will identify the parameters for CIL - The ‘maximum’ potential CIL rate - SG cautions against setting rates at the ‘margins of viability’ - Need to consider an appropriate discount below maximum - exceptional costs - risk of falling sales values - EUVs will inevitably vary between sites - 25% - 50% is the typical range

Other guidance – RICS and LHDG approach will identify the parameters for CIL - The ‘maximum’ potential CIL rate - SG cautions against setting rates at the ‘margins of viability’ - Need to consider an appropriate discount below maximum - exceptional costs - risk of falling sales values - EUVs will inevitably vary between sites - 25% - 50% is the typical range

Key points - More emphasis on how CIL affects the Plan as a whole - Testing of strategic sites - Comparisons to Section 106 – but consider other measures - Consultation – a necessary evil – needs to be evidence based - Examiner’s task is to establish not check - Benchmark land values are crucial – follow the right guidance

Key points - More emphasis on how CIL affects the Plan as a whole - Testing of strategic sites - Comparisons to Section 106 – but consider other measures - Consultation – a necessary evil – needs to be evidence based - Examiner’s task is to establish not check - Benchmark land values are crucial – follow the right guidance

Questions

Questions

CIL : The Spending

CIL : The Spending

Background and Context

Background and Context

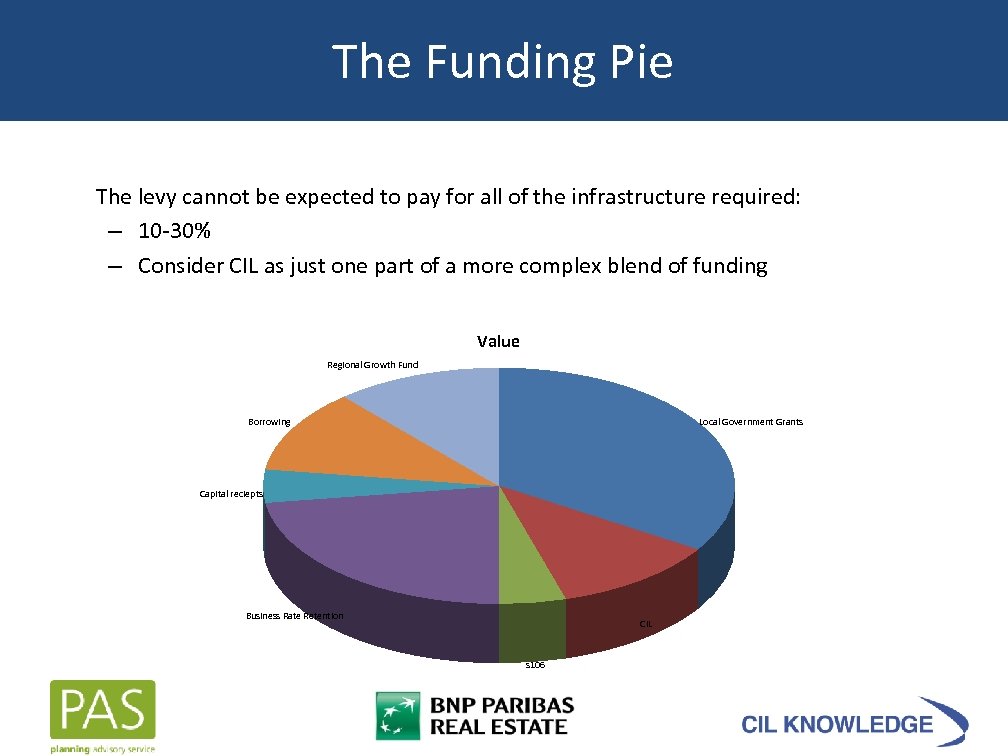

The Funding Pie The levy cannot be expected to pay for all of the infrastructure required: – 10 -30% – Consider CIL as just one part of a more complex blend of funding Value Regional Growth Fund Borrowing Local Government Grants Capital reciepts Business Rate Retention CIL s 106

The Funding Pie The levy cannot be expected to pay for all of the infrastructure required: – 10 -30% – Consider CIL as just one part of a more complex blend of funding Value Regional Growth Fund Borrowing Local Government Grants Capital reciepts Business Rate Retention CIL s 106

Purpose of the Reg 123 list • • • “double dipping” is a concern for Developers Regulation 123 is the requirement for a published list of infrastructure projects or types of infrastructure that the Charging Authority intends will be, or may be, wholly or partly funded by CIL, those infrastructure projects or types of infrastructure. …put another way you cannot collect s 106 to spend on items within your Reg 123 list

Purpose of the Reg 123 list • • • “double dipping” is a concern for Developers Regulation 123 is the requirement for a published list of infrastructure projects or types of infrastructure that the Charging Authority intends will be, or may be, wholly or partly funded by CIL, those infrastructure projects or types of infrastructure. …put another way you cannot collect s 106 to spend on items within your Reg 123 list

Reg 123 list: The Golden Thread Relevant Plan Infrastructure Evidence CIL Infrastructure Evidence Funding Gap Project List Regulation 123 List Capital Programme

Reg 123 list: The Golden Thread Relevant Plan Infrastructure Evidence CIL Infrastructure Evidence Funding Gap Project List Regulation 123 List Capital Programme

Crafting a Reg 123 list Case Study 3 • Flood Risk Management Infrastructure to protect Flood Cell 1 of the XXXXXXX Island Coastal Defence Strategy • Flood Risk Management Infrastructure to protect Flood Cell 4 of the XXXXXXX Island Coastal Defence Strategy • School Places (primary and secondary schools) • Bridge Link XXXX to XXXXXX Island • M 275 Junction at XXXXXX • Park & Ride at XXXXXX • Station Square Transport Interchange • City Centre Public Realm Improvements NB inclusion of infrastructure types in this list does not signify a commitment from the city council to fund all the projects listed, or the entirety of any one project through CIL. The order in the table does not imply any order of preference for spend.

Crafting a Reg 123 list Case Study 3 • Flood Risk Management Infrastructure to protect Flood Cell 1 of the XXXXXXX Island Coastal Defence Strategy • Flood Risk Management Infrastructure to protect Flood Cell 4 of the XXXXXXX Island Coastal Defence Strategy • School Places (primary and secondary schools) • Bridge Link XXXX to XXXXXX Island • M 275 Junction at XXXXXX • Park & Ride at XXXXXX • Station Square Transport Interchange • City Centre Public Realm Improvements NB inclusion of infrastructure types in this list does not signify a commitment from the city council to fund all the projects listed, or the entirety of any one project through CIL. The order in the table does not imply any order of preference for spend.

Crafting a Reg 123 list Case Study 4 • Strategic transport improvements. • State education facilities. • Public health care facilities • Public open space and sports and leisure provision (Unless the need for specific infrastructure contributions are identified in the Planning Obligations Supplementary Planning Document or arises directly from five or fewer developments, where section 106 arrangements may continue to apply if the infrastructure is required to make the development acceptable in planning terms. )

Crafting a Reg 123 list Case Study 4 • Strategic transport improvements. • State education facilities. • Public health care facilities • Public open space and sports and leisure provision (Unless the need for specific infrastructure contributions are identified in the Planning Obligations Supplementary Planning Document or arises directly from five or fewer developments, where section 106 arrangements may continue to apply if the infrastructure is required to make the development acceptable in planning terms. )

Dealing with Strategic Sites • • • On-site mitigation could include substantial infrastructure items: e. g. a School Is it possible to use s 106? When is it preferable to use s 106? – Option 1: Chelmsford Case Study – Option 2: Wycombe Case Study

Dealing with Strategic Sites • • • On-site mitigation could include substantial infrastructure items: e. g. a School Is it possible to use s 106? When is it preferable to use s 106? – Option 1: Chelmsford Case Study – Option 2: Wycombe Case Study

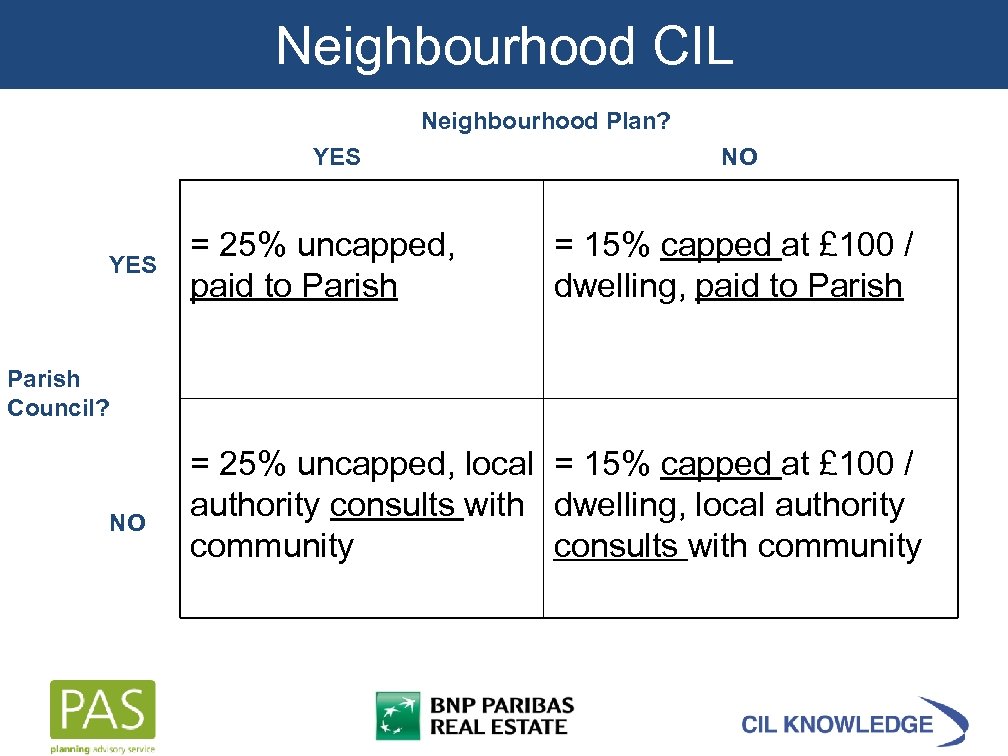

Neighbourhood CIL Neighbourhood Plan? YES NO = 25% uncapped, paid to Parish = 15% capped at £ 100 / dwelling, paid to Parish Council? NO = 25% uncapped, local = 15% capped at £ 100 / authority consults with dwelling, local authority community consults with community

Neighbourhood CIL Neighbourhood Plan? YES NO = 25% uncapped, paid to Parish = 15% capped at £ 100 / dwelling, paid to Parish Council? NO = 25% uncapped, local = 15% capped at £ 100 / authority consults with dwelling, local authority community consults with community

Neighbourhdood CIL Spending A local council must use CIL receipts to fund: a) the provision, improvement, replacement, operation or maintenance of infrastructure; or b) anything else that is concerned with addressing the demands that development places on an area. NB: The Council must give the money back if it has not applied to support the development of its area within 5 years of receipt; or has applied the funding otherwise than in accordance with regulation 59 C

Neighbourhdood CIL Spending A local council must use CIL receipts to fund: a) the provision, improvement, replacement, operation or maintenance of infrastructure; or b) anything else that is concerned with addressing the demands that development places on an area. NB: The Council must give the money back if it has not applied to support the development of its area within 5 years of receipt; or has applied the funding otherwise than in accordance with regulation 59 C

Reporting on CIL expenditure • • A local council must prepare a report for any financial year in which it receives CIL receipts. The report must include: – the total CIL receipts for the reported year – the total CIL expenditure for the reported year – summary of the items to which CIL has been applied and the amount of CIL expenditure on each item

Reporting on CIL expenditure • • A local council must prepare a report for any financial year in which it receives CIL receipts. The report must include: – the total CIL receipts for the reported year – the total CIL expenditure for the reported year – summary of the items to which CIL has been applied and the amount of CIL expenditure on each item

Approach to Spending CIL • • • Consider CIL as just one part of a more complex blend of funding Use Annual Capital budget setting to agree priorities for CIL and therefore set Reg 123 list (need to maintain golden thread with your Local Plan) Consider how you will work with Parishes (and County Council) Areas without Parishes need to build in consultation on infrastructure priorities Officials need to prepare thoroughly to ensure allocation and monitoring mechanisms work efficiently …. Tempted to set high CIL rates? Remember you cannot set CIL differential Value Regional Growth rates based on variation in infrastructure needs Fund Local Government Grants Borrowing Capital reciepts Business Rate Retention CIL s 106

Approach to Spending CIL • • • Consider CIL as just one part of a more complex blend of funding Use Annual Capital budget setting to agree priorities for CIL and therefore set Reg 123 list (need to maintain golden thread with your Local Plan) Consider how you will work with Parishes (and County Council) Areas without Parishes need to build in consultation on infrastructure priorities Officials need to prepare thoroughly to ensure allocation and monitoring mechanisms work efficiently …. Tempted to set high CIL rates? Remember you cannot set CIL differential Value Regional Growth rates based on variation in infrastructure needs Fund Local Government Grants Borrowing Capital reciepts Business Rate Retention CIL s 106

Questions

Questions