4aa60d29ac12fdfd0252c9c4d10370bb.ppt

- Количество слайдов: 83

COMMON REPORTING STANDARD AND THE TRUST An application of the Inland Revenue (Amendment) (No. 3) Ordinance 2016 (No. 22 of 2016) Prepared by Kau Kin Wah March 2017 ©KW Kau March 2017 1

COMMON REPORTING STANDARD AND THE TRUST An application of the Inland Revenue (Amendment) (No. 3) Ordinance 2016 (No. 22 of 2016) Prepared by Kau Kin Wah March 2017 ©KW Kau March 2017 1

DISCLAIMER • The following presentation is for information and reference only. It is NOT legal or professional advice and should not be relied upon as such. • Whilst every effort is made to ensure the accuracy and reliability of the information and materials presented, no warranty regarding accuracy, reliability, noninfringement, completeness, security, timeliness, or fitness for a particular purpose is given in connection with such information and materials. No liability whatsoever is accepted for any error, inaccuracy or omission in such information and materials. ©KW Kau March 2017 2

DISCLAIMER • The following presentation is for information and reference only. It is NOT legal or professional advice and should not be relied upon as such. • Whilst every effort is made to ensure the accuracy and reliability of the information and materials presented, no warranty regarding accuracy, reliability, noninfringement, completeness, security, timeliness, or fitness for a particular purpose is given in connection with such information and materials. No liability whatsoever is accepted for any error, inaccuracy or omission in such information and materials. ©KW Kau March 2017 2

Background • OECD released in July 2014 the standard on automatic exchange of financial account information in tax matters (AEOI), calling on governments to collect from their financial institutions (FIs) financial account information of overseas tax residents and exchange the information with jurisdictions of residence of the relevant account holders on an annual basis. The Common Reporting Standard (CRS) is therefore the single global standard for the collection, reporting and exchange of financial account information on foreign tax residents. ©KW Kau March 2017 3

Background • OECD released in July 2014 the standard on automatic exchange of financial account information in tax matters (AEOI), calling on governments to collect from their financial institutions (FIs) financial account information of overseas tax residents and exchange the information with jurisdictions of residence of the relevant account holders on an annual basis. The Common Reporting Standard (CRS) is therefore the single global standard for the collection, reporting and exchange of financial account information on foreign tax residents. ©KW Kau March 2017 3

• The AEOI standard comprises (a) Model Competent Authority Agreement ("Model CAA"), (b) Common Reporting Standard ("CRS"), (c) Commentaries on the Model CAA and CRS, and (d) Guidance on Technical Solutions. • The CRS has been implemented in Hong Kong by the passing of the Inland Revenue (Amendment) (No. 3) Ordinance (No. 22 of 2016) which has come into operation since 30 June 2016. ©KW Kau March 2017 4

• The AEOI standard comprises (a) Model Competent Authority Agreement ("Model CAA"), (b) Common Reporting Standard ("CRS"), (c) Commentaries on the Model CAA and CRS, and (d) Guidance on Technical Solutions. • The CRS has been implemented in Hong Kong by the passing of the Inland Revenue (Amendment) (No. 3) Ordinance (No. 22 of 2016) which has come into operation since 30 June 2016. ©KW Kau March 2017 4

©KW Kau March 2017 5

©KW Kau March 2017 5

Timeline for fulfilling CRS due diligence obligations • Reporting year 2018 for Japan & UK of Great Britain and Ireland (Schedule 17 E Part 1) • For new accounts at the opening of such accounts • For financial accounts existing at 31 December 2016, for high value individual accounts (i. e. aggregate value exceeding $7, 800, 000) review must be completed on or before 31 December 2017 and for low value individual accounts (i. e. aggregate value not exceeding $7, 800, 000) on or before 31 December 2018 (Schedule 17 D Part 3 section 5) ©KW Kau March 2017 6

Timeline for fulfilling CRS due diligence obligations • Reporting year 2018 for Japan & UK of Great Britain and Ireland (Schedule 17 E Part 1) • For new accounts at the opening of such accounts • For financial accounts existing at 31 December 2016, for high value individual accounts (i. e. aggregate value exceeding $7, 800, 000) review must be completed on or before 31 December 2017 and for low value individual accounts (i. e. aggregate value not exceeding $7, 800, 000) on or before 31 December 2018 (Schedule 17 D Part 3 section 5) ©KW Kau March 2017 6

• For financial accounts existing at 31 December 2016, for entity accounts whose aggregate value exceeding $1, 950, 000 review must be completed before 31 December 2018 and for entity accounts not exceeding $1, 950, 000 review must be completed in the calendar year after the year in which the aggregate value of the accounts exceeds $1, 950, 000. (Schedule 17 D Part 5 section 10) ©KW Kau March 2017 7

• For financial accounts existing at 31 December 2016, for entity accounts whose aggregate value exceeding $1, 950, 000 review must be completed before 31 December 2018 and for entity accounts not exceeding $1, 950, 000 review must be completed in the calendar year after the year in which the aggregate value of the accounts exceeds $1, 950, 000. (Schedule 17 D Part 5 section 10) ©KW Kau March 2017 7

Basic Concept • Under CRS, FIs are required to identify persons or corporations having foreign tax residence and report the required information of such entities to domestic tax authorities. Such information will then be exchanged via AEOI on a reciprocal basis annually to the tax authority of an entity’s country of tax residence. ©KW Kau March 2017 8

Basic Concept • Under CRS, FIs are required to identify persons or corporations having foreign tax residence and report the required information of such entities to domestic tax authorities. Such information will then be exchanged via AEOI on a reciprocal basis annually to the tax authority of an entity’s country of tax residence. ©KW Kau March 2017 8

The due diligence obligations of FI l. A reporting FI has the obligation to n establish procedures to Ø identify the tax residence of the account holder (AH) of a financial account maintained with FI (If the AH is a non-financial entity (NFE), the tax residence of the controlling person) Ø identify whether the financial account is a reportable account Ø secure evidence relied on and record of procedures taken to be kept for 6 years from the date of completion of the procedures Ø enable the FI to collect the required information within the meaning of section 50 C(3) n incorporate into the procedures the due diligence requirements of Schedule 17 D Ø ©KW Kau March 2017 (Section 50 B(1)) 9

The due diligence obligations of FI l. A reporting FI has the obligation to n establish procedures to Ø identify the tax residence of the account holder (AH) of a financial account maintained with FI (If the AH is a non-financial entity (NFE), the tax residence of the controlling person) Ø identify whether the financial account is a reportable account Ø secure evidence relied on and record of procedures taken to be kept for 6 years from the date of completion of the procedures Ø enable the FI to collect the required information within the meaning of section 50 C(3) n incorporate into the procedures the due diligence requirements of Schedule 17 D Ø ©KW Kau March 2017 (Section 50 B(1)) 9

1. A reporting FI must maintain and apply the procedures established in compliance with section 50 B(1) (a) and (b) (required procedures) (a) to identify reportable accounts, and to identify and collect the required information; and (b) to ensure that the purpose mentioned in subsection (1)(a)(iii) can be achieved. (Section 50 B(2)) ©KW Kau March 2017 10

1. A reporting FI must maintain and apply the procedures established in compliance with section 50 B(1) (a) and (b) (required procedures) (a) to identify reportable accounts, and to identify and collect the required information; and (b) to ensure that the purpose mentioned in subsection (1)(a)(iii) can be achieved. (Section 50 B(2)) ©KW Kau March 2017 10

Analysis • Basic components of due diligence obligations ØWho has to report? ØWho is reportable? ØWhat are the required information? ØHow to obtain the required information? ©KW Kau March 2017 11

Analysis • Basic components of due diligence obligations ØWho has to report? ØWho is reportable? ØWhat are the required information? ØHow to obtain the required information? ©KW Kau March 2017 11

Reporting financial institution • A FI resident in HK (excluding all branches located outside HK) • A branch located in HK of a FI not resident in HK • Excluding non-reporting FIs (Section 50 A(1)) ©KW Kau March 2017 12

Reporting financial institution • A FI resident in HK (excluding all branches located outside HK) • A branch located in HK of a FI not resident in HK • Excluding non-reporting FIs (Section 50 A(1)) ©KW Kau March 2017 12

Non-reporting Financial Institution • A FI which is described as non-reporting FI in Part 2 of Schedule 17 C. (section 50 A(1)) • Non-reporting FI described in Part 2 of Schedule 17 C: - 1. Government entity 2. International organization 3. Central Bank ©KW Kau March 2017 13

Non-reporting Financial Institution • A FI which is described as non-reporting FI in Part 2 of Schedule 17 C. (section 50 A(1)) • Non-reporting FI described in Part 2 of Schedule 17 C: - 1. Government entity 2. International organization 3. Central Bank ©KW Kau March 2017 13

4. Hong Kong Monetary Authority 5. Pension fund of governmental entity, international organization, central bank or Hong Kong Monetary Authority 1. to provide retirement, disability, or death benefits to beneficiaries or participants who— 2. are current or former employees; or 3. if the benefits provided to such beneficiaries or participants are in consideration of personal services rendered ©KW Kau March 2017 14

4. Hong Kong Monetary Authority 5. Pension fund of governmental entity, international organization, central bank or Hong Kong Monetary Authority 1. to provide retirement, disability, or death benefits to beneficiaries or participants who— 2. are current or former employees; or 3. if the benefits provided to such beneficiaries or participants are in consideration of personal services rendered ©KW Kau March 2017 14

6. Broad participation retirement fund Øestablished to provide retirement, disability or death benefits, or any combination of the above, to beneficiaries that are current or former employees (or persons designated by such employees) of one or more employers in consideration for services rendered; and 6. (i) does not have a single beneficiary with a right to more than 5% of the fund’s assets; (ii) is subject to government regulation and provides information reporting to the tax authorities; and (iii) meets any of the following conditions— ©KW Kau March 2017 15

6. Broad participation retirement fund Øestablished to provide retirement, disability or death benefits, or any combination of the above, to beneficiaries that are current or former employees (or persons designated by such employees) of one or more employers in consideration for services rendered; and 6. (i) does not have a single beneficiary with a right to more than 5% of the fund’s assets; (ii) is subject to government regulation and provides information reporting to the tax authorities; and (iii) meets any of the following conditions— ©KW Kau March 2017 15

(A) the fund is generally exempt from tax on investment income, or taxation of such income is deferred or taxed at a reduced rate, owing to its status as a retirement or pension plan; (B) the fund receives at least 50% of its total contributions from the sponsoring employers; (C) distributions or withdrawals from the fund are allowed only on the occurrence of specified events related to retirement, disability or death, or penalties apply to distributions or withdrawals made before such specified events ©KW Kau March 2017 16

(A) the fund is generally exempt from tax on investment income, or taxation of such income is deferred or taxed at a reduced rate, owing to its status as a retirement or pension plan; (B) the fund receives at least 50% of its total contributions from the sponsoring employers; (C) distributions or withdrawals from the fund are allowed only on the occurrence of specified events related to retirement, disability or death, or penalties apply to distributions or withdrawals made before such specified events ©KW Kau March 2017 16

(D) contributions (other than certain permitted make-up contributions) by employees to the fund are limited by reference to the earned income of the employee, or may not exceed $390, 000 annually. 7. Narrow participation retirement fund Ø established to provide retirement, disability or death benefits to beneficiaries that are current or former employees (or persons designated by such employees) of one or more employers in consideration for services rendered; and ©KW Kau March 2017 17

(D) contributions (other than certain permitted make-up contributions) by employees to the fund are limited by reference to the earned income of the employee, or may not exceed $390, 000 annually. 7. Narrow participation retirement fund Ø established to provide retirement, disability or death benefits to beneficiaries that are current or former employees (or persons designated by such employees) of one or more employers in consideration for services rendered; and ©KW Kau March 2017 17

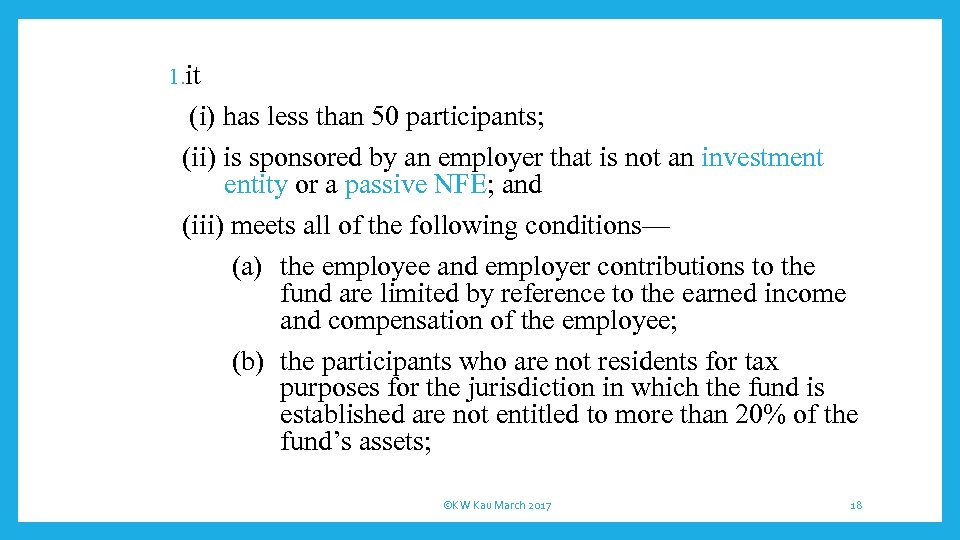

1. it (i) has less than 50 participants; (ii) is sponsored by an employer that is not an investment entity or a passive NFE; and (iii) meets all of the following conditions— (a) the employee and employer contributions to the fund are limited by reference to the earned income and compensation of the employee; (b) the participants who are not residents for tax purposes for the jurisdiction in which the fund is established are not entitled to more than 20% of the fund’s assets; ©KW Kau March 2017 18

1. it (i) has less than 50 participants; (ii) is sponsored by an employer that is not an investment entity or a passive NFE; and (iii) meets all of the following conditions— (a) the employee and employer contributions to the fund are limited by reference to the earned income and compensation of the employee; (b) the participants who are not residents for tax purposes for the jurisdiction in which the fund is established are not entitled to more than 20% of the fund’s assets; ©KW Kau March 2017 18

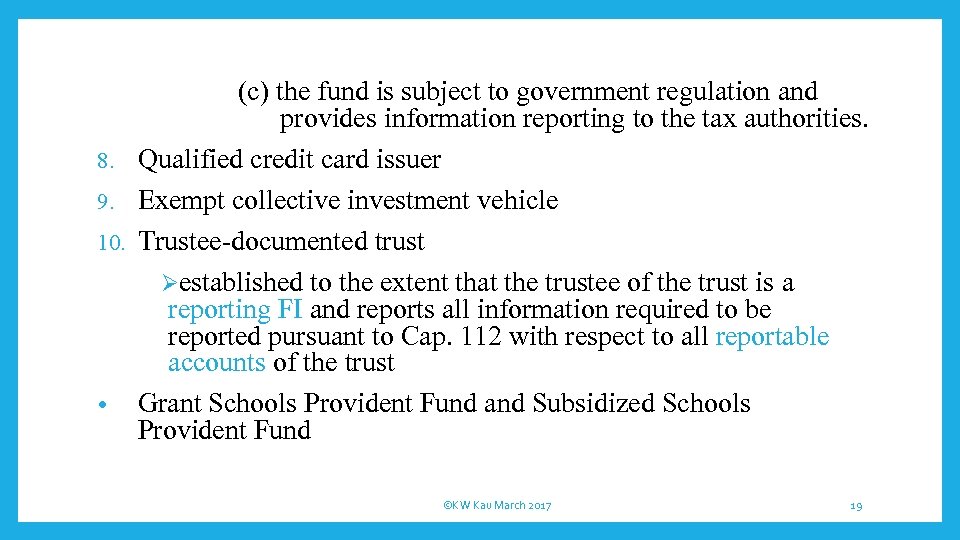

(c) the fund is subject to government regulation and provides information reporting to the tax authorities. 8. Qualified credit card issuer 9. Exempt collective investment vehicle 10. Trustee-documented trust Øestablished to the extent that the trustee of the trust is a reporting FI and reports all information required to be reported pursuant to Cap. 112 with respect to all reportable accounts of the trust • Grant Schools Provident Fund and Subsidized Schools Provident Fund ©KW Kau March 2017 19

(c) the fund is subject to government regulation and provides information reporting to the tax authorities. 8. Qualified credit card issuer 9. Exempt collective investment vehicle 10. Trustee-documented trust Øestablished to the extent that the trustee of the trust is a reporting FI and reports all information required to be reported pursuant to Cap. 112 with respect to all reportable accounts of the trust • Grant Schools Provident Fund and Subsidized Schools Provident Fund ©KW Kau March 2017 19

12. Mandatory provident fund schemes and occupational retirement schemes 13. Credit union ©KW Kau March 2017 20

12. Mandatory provident fund schemes and occupational retirement schemes 13. Credit union ©KW Kau March 2017 20

Financial Institution means • a custodial institution; • a depository institution; • an • a investment entity; or specified insurance company (Section 50 A(1)) ©KW Kau March 2017 21

Financial Institution means • a custodial institution; • a depository institution; • an • a investment entity; or specified insurance company (Section 50 A(1)) ©KW Kau March 2017 21

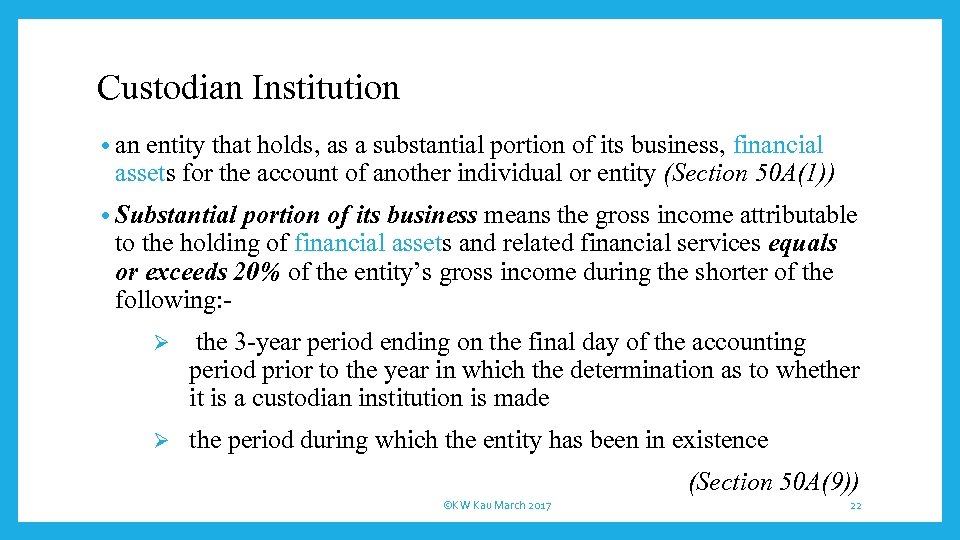

Custodian Institution • an entity that holds, as a substantial portion of its business, financial assets for the account of another individual or entity (Section 50 A(1)) • Substantial portion of its business means the gross income attributable to the holding of financial assets and related financial services equals or exceeds 20% of the entity’s gross income during the shorter of the following: Ø the 3 -year period ending on the final day of the accounting period prior to the year in which the determination as to whether it is a custodian institution is made Ø the period during which the entity has been in existence (Section 50 A(9)) ©KW Kau March 2017 22

Custodian Institution • an entity that holds, as a substantial portion of its business, financial assets for the account of another individual or entity (Section 50 A(1)) • Substantial portion of its business means the gross income attributable to the holding of financial assets and related financial services equals or exceeds 20% of the entity’s gross income during the shorter of the following: Ø the 3 -year period ending on the final day of the accounting period prior to the year in which the determination as to whether it is a custodian institution is made Ø the period during which the entity has been in existence (Section 50 A(9)) ©KW Kau March 2017 22

Financial asset (a) any security (including share units of a stock in a corporation; partnership or beneficial ownership interest in a widely held or publicly traded partnership or trust; note, bond, debenture, or other evidence of indebtedness); • (b) partnership interest; • (c) commodity; • (d) swap (including interest rate swaps, currency swaps, basis swaps, interest rate caps, interest rate floors, commodity swaps, equity index swaps, and similar agreements); • (e) insurance contract or annuity contract; and • (f) any interest (including a futures or forward contract or option) in any of the assets mentioned in paragraphs (a), (b), (c), (d) and (e), • but does not include a non-debt direct interest in real property (Section 50 A(1)) • ©KW Kau March 2017 23

Financial asset (a) any security (including share units of a stock in a corporation; partnership or beneficial ownership interest in a widely held or publicly traded partnership or trust; note, bond, debenture, or other evidence of indebtedness); • (b) partnership interest; • (c) commodity; • (d) swap (including interest rate swaps, currency swaps, basis swaps, interest rate caps, interest rate floors, commodity swaps, equity index swaps, and similar agreements); • (e) insurance contract or annuity contract; and • (f) any interest (including a futures or forward contract or option) in any of the assets mentioned in paragraphs (a), (b), (c), (d) and (e), • but does not include a non-debt direct interest in real property (Section 50 A(1)) • ©KW Kau March 2017 23

Depository Institution • (a) an authorized institution as defined by section 2(1) of the Banking Ordinance (Cap. 155); or • (b) an entity that accepts deposits in the ordinary course of a banking business or similar business (Section 50 A(1)) ©KW Kau March 2017 24

Depository Institution • (a) an authorized institution as defined by section 2(1) of the Banking Ordinance (Cap. 155); or • (b) an entity that accepts deposits in the ordinary course of a banking business or similar business (Section 50 A(1)) ©KW Kau March 2017 24

Investment Entity • A licensed corporation carrying on one or more of type 1 (dealing in securities), 2 (trading in futures contracts), 3 (leverage foreign exchange trading) and 9 (asset management) regulated activities • A licensed institution carrying on one or more of type 1, 2 and 9 regulated activities • A collective investment scheme authorized under Cap. 571 ©KW Kau March 2017 25

Investment Entity • A licensed corporation carrying on one or more of type 1 (dealing in securities), 2 (trading in futures contracts), 3 (leverage foreign exchange trading) and 9 (asset management) regulated activities • A licensed institution carrying on one or more of type 1, 2 and 9 regulated activities • A collective investment scheme authorized under Cap. 571 ©KW Kau March 2017 25

• An entity that primarily conducts as its business one or more of the following activities or operations for its customers— Ø (i) trading in 1. (A) money market instruments, including cheques, bills, certificates of deposit, and derivatives; 2. (B) foreign exchange; 3. (C) exchange, interest rate and index instruments; 4. (D) transferable securities; or 5. (E) commodity futures ©KW Kau March 2017 26

• An entity that primarily conducts as its business one or more of the following activities or operations for its customers— Ø (i) trading in 1. (A) money market instruments, including cheques, bills, certificates of deposit, and derivatives; 2. (B) foreign exchange; 3. (C) exchange, interest rate and index instruments; 4. (D) transferable securities; or 5. (E) commodity futures ©KW Kau March 2017 26

(ii) individual and collective portfolio management Ø (iii) otherwise investing, administering, or managing financial assets or money on behalf of other entity or individual • An entity that is managed by a custodian institution, a depository institution, a specified insurance company or an entity mentioned above whose gross income is primarily attributable to investing, reinvesting, or trading in financial assets • But does not include an active NFE solely because it falls within any of the descriptions of paragraph (d), (e), (f) and (g) of the definition of active NFE (Section 50 A(1)) Ø ©KW Kau March 2017 27

(ii) individual and collective portfolio management Ø (iii) otherwise investing, administering, or managing financial assets or money on behalf of other entity or individual • An entity that is managed by a custodian institution, a depository institution, a specified insurance company or an entity mentioned above whose gross income is primarily attributable to investing, reinvesting, or trading in financial assets • But does not include an active NFE solely because it falls within any of the descriptions of paragraph (d), (e), (f) and (g) of the definition of active NFE (Section 50 A(1)) Ø ©KW Kau March 2017 27

• Primarily conduct or gross income primarily attributable means the gross income of an entity attributable to the relevant activities equal or exceeds 50% of the entity’s income during the shorter of the following periods Ø the 3 -year period ending on the final day of the accounting period prior to the year in which the determination as to whether it is a custodian institution is made Ø the period during which the entity has been in existence (Section 50 A(13) & (14)) ©KW Kau March 2017 28

• Primarily conduct or gross income primarily attributable means the gross income of an entity attributable to the relevant activities equal or exceeds 50% of the entity’s income during the shorter of the following periods Ø the 3 -year period ending on the final day of the accounting period prior to the year in which the determination as to whether it is a custodian institution is made Ø the period during which the entity has been in existence (Section 50 A(13) & (14)) ©KW Kau March 2017 28

Non-financial entity (NFE) • an entity that is not a FI (Section 50 A(1)) Øcomprises of active NFE and passive NFE l. Active NFE Ø an NFE that falls within any of the following descriptions— ü in terms of the NFE’s gross income and its assets— for the calendar year or other appropriate reporting period preceding the year in which the determination as to whether the NFE is an active NFE is made, less than 50% of the NFE’s gross income is passive income; and (ii) less than 50% of the assets held by the NFE during that calendar year or period are assets that produce, or are held for the production of, passive income; (i) ©KW Kau March 2017 29

Non-financial entity (NFE) • an entity that is not a FI (Section 50 A(1)) Øcomprises of active NFE and passive NFE l. Active NFE Ø an NFE that falls within any of the following descriptions— ü in terms of the NFE’s gross income and its assets— for the calendar year or other appropriate reporting period preceding the year in which the determination as to whether the NFE is an active NFE is made, less than 50% of the NFE’s gross income is passive income; and (ii) less than 50% of the assets held by the NFE during that calendar year or period are assets that produce, or are held for the production of, passive income; (i) ©KW Kau March 2017 29

1. the stock of the NFE or the related entity of the NFE is regularly traded on an established securities market 2. the NFE is— (i) a governmental entity; (ii) an international organization; (iii) a central bank; or (iv) an entity wholly owned by one or more of the entities mentioned in subparagraphs (i), (ii) and (iii) ©KW Kau March 2017 30

1. the stock of the NFE or the related entity of the NFE is regularly traded on an established securities market 2. the NFE is— (i) a governmental entity; (ii) an international organization; (iii) a central bank; or (iv) an entity wholly owned by one or more of the entities mentioned in subparagraphs (i), (ii) and (iii) ©KW Kau March 2017 30

ü the NFE does not function, or does not hold itself out, as an investment fund (including a private equity fund, venture capital fund, leveraged buyout fund, or any investment vehicle whose purpose is to acquire or fund companies, and then to hold interests in those companies as capital assets for investment purposes) and— (i) 80% or more of the activities of the NFE consist of holding, in whole or in part, the outstanding stock of, or providing financing and services to, one or more subsidiaries that engage in trades or businesses other than the business of a FI (holding or group finance activities); or ©KW Kau March 2017 31

ü the NFE does not function, or does not hold itself out, as an investment fund (including a private equity fund, venture capital fund, leveraged buyout fund, or any investment vehicle whose purpose is to acquire or fund companies, and then to hold interests in those companies as capital assets for investment purposes) and— (i) 80% or more of the activities of the NFE consist of holding, in whole or in part, the outstanding stock of, or providing financing and services to, one or more subsidiaries that engage in trades or businesses other than the business of a FI (holding or group finance activities); or ©KW Kau March 2017 31

(ii) if less than 80% of the activities of the NFE consist of the NFE’s holding or group finance activities, the sum of the NFE’s holding or group finance activities and the NFE’s other activities that generate income other than passive income constitute in total 80% or more of the activities of the NFE; ü not more than 24 months have elapsed since the date of the incorporation, formation or constitution of the NFE and the NFE— • is not yet operating a business and has no prior operating history; and • is investing capital into assets with the intent to operate a business other than that of a financial institution; ©KW Kau March 2017 32

(ii) if less than 80% of the activities of the NFE consist of the NFE’s holding or group finance activities, the sum of the NFE’s holding or group finance activities and the NFE’s other activities that generate income other than passive income constitute in total 80% or more of the activities of the NFE; ü not more than 24 months have elapsed since the date of the incorporation, formation or constitution of the NFE and the NFE— • is not yet operating a business and has no prior operating history; and • is investing capital into assets with the intent to operate a business other than that of a financial institution; ©KW Kau March 2017 32

ü the NFE was not a FI in the last 5 years, and is in the process of— (i) liquidating its assets; or (ii) is reorganizing with the intent to continue or recommence operations in a business other than that of a FI; ©KW Kau March 2017 33

ü the NFE was not a FI in the last 5 years, and is in the process of— (i) liquidating its assets; or (ii) is reorganizing with the intent to continue or recommence operations in a business other than that of a FI; ©KW Kau March 2017 33

ü the NFE falls within all of the following descriptions— (i) the NFE is primarily engaged in financing and hedging transactions with or for its related entities that are not FIs; (ii) the group of the related entities mentioned in subparagraph (i) is primarily engaged in a business other than that of a FI; (iii) the NFE does not provide financing or hedging services to any entity that is not its related entity; ©KW Kau March 2017 34

ü the NFE falls within all of the following descriptions— (i) the NFE is primarily engaged in financing and hedging transactions with or for its related entities that are not FIs; (ii) the group of the related entities mentioned in subparagraph (i) is primarily engaged in a business other than that of a FI; (iii) the NFE does not provide financing or hedging services to any entity that is not its related entity; ©KW Kau March 2017 34

ü the NFE falls within all of the following descriptions— (i) the NFE is established and operated in its jurisdiction of residence, and— (A) is established and operated exclusively for religious, charitable, scientific, artistic, cultural, athletic or educational purposes; or (B) is a professional organization, business league, chamber of commerce, labour organization, agricultural or horticultural organization, civic league or an organization operated exclusively for the promotion of social welfare; ©KW Kau March 2017 35

ü the NFE falls within all of the following descriptions— (i) the NFE is established and operated in its jurisdiction of residence, and— (A) is established and operated exclusively for religious, charitable, scientific, artistic, cultural, athletic or educational purposes; or (B) is a professional organization, business league, chamber of commerce, labour organization, agricultural or horticultural organization, civic league or an organization operated exclusively for the promotion of social welfare; ©KW Kau March 2017 35

(ii) the NFE is exempt from income tax in its jurisdiction of residence; (iii) the NFE has no shareholders or members who have a proprietary or beneficial interest in its income or assets; (iv) the applicable laws of the NFE’s jurisdiction of residence or the NFE’s formation documents do not permit any income or assets of the NFE to be distributed to, or applied for the benefit of, a private person or non-charitable entity other than— ©KW Kau March 2017 36

(ii) the NFE is exempt from income tax in its jurisdiction of residence; (iii) the NFE has no shareholders or members who have a proprietary or beneficial interest in its income or assets; (iv) the applicable laws of the NFE’s jurisdiction of residence or the NFE’s formation documents do not permit any income or assets of the NFE to be distributed to, or applied for the benefit of, a private person or non-charitable entity other than— ©KW Kau March 2017 36

(A) pursuant to the conduct of the NFE’s charitable activities; (B) as payment of reasonable compensation for services rendered; or (C) as payment representing the fair market value of a property which the NFE has purchased; ©KW Kau March 2017 37

(A) pursuant to the conduct of the NFE’s charitable activities; (B) as payment of reasonable compensation for services rendered; or (C) as payment representing the fair market value of a property which the NFE has purchased; ©KW Kau March 2017 37

(v) the applicable laws of the NFE’s jurisdiction of residence or the NFE’s formation documents require that, on the NFE’s liquidation or dissolution, all of its assets are to be distributed to a governmental entity or other non-profit organization, or be escheated to the government of that jurisdiction or any political subdivision of that government (Section 50 A(1)) ©KW Kau March 2017 38

(v) the applicable laws of the NFE’s jurisdiction of residence or the NFE’s formation documents require that, on the NFE’s liquidation or dissolution, all of its assets are to be distributed to a governmental entity or other non-profit organization, or be escheated to the government of that jurisdiction or any political subdivision of that government (Section 50 A(1)) ©KW Kau March 2017 38

Specified Insurance Company • An insurance company, or the holding company of an insurance company, that issues, or is obliged to make payments with respect to, a cash value insurance contract or an annuity contract, including the following— Øan insurer authorized under the Insurance Companies Ordinance (Cap. 41) Øan entity the gross income of which arising from insurance, reinsurance and annuity contracts exceeds 50% of the entity’s total gross income for the calendar year immediately preceding the calendar year in which the determination as to whether the entity is a specified insurance company is made ©KW Kau March 2017 39

Specified Insurance Company • An insurance company, or the holding company of an insurance company, that issues, or is obliged to make payments with respect to, a cash value insurance contract or an annuity contract, including the following— Øan insurer authorized under the Insurance Companies Ordinance (Cap. 41) Øan entity the gross income of which arising from insurance, reinsurance and annuity contracts exceeds 50% of the entity’s total gross income for the calendar year immediately preceding the calendar year in which the determination as to whether the entity is a specified insurance company is made ©KW Kau March 2017 39

Ø an entity the aggregate value of the assets of which associated with insurance, reinsurance and annuity contracts exceeds 50% of the entity’s total assets at any time during the calendar year immediately preceding the calendar year in which the determination as to whether the entity is a specified insurance company is made (Section 50 A(1)) ©KW Kau March 2017 40

Ø an entity the aggregate value of the assets of which associated with insurance, reinsurance and annuity contracts exceeds 50% of the entity’s total assets at any time during the calendar year immediately preceding the calendar year in which the determination as to whether the entity is a specified insurance company is made (Section 50 A(1)) ©KW Kau March 2017 40

Reportable Account • A financial account Ø identified under due diligence requirements under Schedule 17 D Ø held by at least one reportable person; or a passive NFE with at least one controlling person being a reportable person (Section 50 A(1)) ©KW Kau March 2017 41

Reportable Account • A financial account Ø identified under due diligence requirements under Schedule 17 D Ø held by at least one reportable person; or a passive NFE with at least one controlling person being a reportable person (Section 50 A(1)) ©KW Kau March 2017 41

Financial account • any of the following accounts maintained by a FI— Ø (a) a custodial account; Ø (b) a depository account; Ø (c) (if the FI is an investment entity but not an advising manager within the meaning of subsection (12)) any equity interest or debt interest in the FI; Ø (d) (if the FI is not an investment entity) any equity interest or debt interest in the FI, if the class of interests was established with the purpose of avoiding reporting the required information under section 50 F(1) and (2); ©KW Kau March 2017 42

Financial account • any of the following accounts maintained by a FI— Ø (a) a custodial account; Ø (b) a depository account; Ø (c) (if the FI is an investment entity but not an advising manager within the meaning of subsection (12)) any equity interest or debt interest in the FI; Ø (d) (if the FI is not an investment entity) any equity interest or debt interest in the FI, if the class of interests was established with the purpose of avoiding reporting the required information under section 50 F(1) and (2); ©KW Kau March 2017 42

1. (e) any cash value insurance contract and any annuity contract issued or maintained by the FI, other than a noninvestment-linked, non-transferable immediate life annuity that is issued to an individual and monetizes a pension or disability benefit provided under an account that is an excluded account, but does not include an excluded account. (Section 50 A(1)) ©KW Kau March 2017 43

1. (e) any cash value insurance contract and any annuity contract issued or maintained by the FI, other than a noninvestment-linked, non-transferable immediate life annuity that is issued to an individual and monetizes a pension or disability benefit provided under an account that is an excluded account, but does not include an excluded account. (Section 50 A(1)) ©KW Kau March 2017 43

Excluded account • an account that is described as an excluded account in Part 3 of Schedule 17 C (Section 50 A(1)) • List of excluded account in Part 3 of Schedule 17 C: - 1. Retirement and pension account 2. Non-retirement tax-favoured accounts 3. Term life insurance contracts 4. Estate account ©KW Kau March 2017 44

Excluded account • an account that is described as an excluded account in Part 3 of Schedule 17 C (Section 50 A(1)) • List of excluded account in Part 3 of Schedule 17 C: - 1. Retirement and pension account 2. Non-retirement tax-favoured accounts 3. Term life insurance contracts 4. Estate account ©KW Kau March 2017 44

5. Escrow account 6. Depository account owing to not-returned overpayments 7. Dormant account (that does not exceed $7, 800) ©KW Kau March 2017 45

5. Escrow account 6. Depository account owing to not-returned overpayments 7. Dormant account (that does not exceed $7, 800) ©KW Kau March 2017 45

Custodial account • an account, other than an insurance contract or annuity contract, maintained by a FI to hold one or more financial assets for the benefit of an individual or entity (Section 50 A(1)) ©KW Kau March 2017 46

Custodial account • an account, other than an insurance contract or annuity contract, maintained by a FI to hold one or more financial assets for the benefit of an individual or entity (Section 50 A(1)) ©KW Kau March 2017 46

Depository account • includes the following accounts maintained by a FI in the ordinary course of a banking business or similar business— Ø (a) a commercial, checking, savings, time and thrift account; Ø (b) an account that is evidenced by a certificate of deposit, thrift certificate, investment certificate, certificate of indebtedness, or other similar instrument; and Ø (c) an amount held by an insurance company to pay or credit interest pursuant to a guaranteed investment contract or similar agreement (Section 50 A(1)) ©KW Kau March 2017 47

Depository account • includes the following accounts maintained by a FI in the ordinary course of a banking business or similar business— Ø (a) a commercial, checking, savings, time and thrift account; Ø (b) an account that is evidenced by a certificate of deposit, thrift certificate, investment certificate, certificate of indebtedness, or other similar instrument; and Ø (c) an amount held by an insurance company to pay or credit interest pursuant to a guaranteed investment contract or similar agreement (Section 50 A(1)) ©KW Kau March 2017 47

Reportable person • an individual or entity that is a resident for tax purposes of a reportable jurisdiction • an estate of a decedent who was a resident for tax purposes of a reportable jurisdiction; but • does not include Ø A listed company & its related entity Ø A governmental entity ©KW Kau March 2017 48

Reportable person • an individual or entity that is a resident for tax purposes of a reportable jurisdiction • an estate of a decedent who was a resident for tax purposes of a reportable jurisdiction; but • does not include Ø A listed company & its related entity Ø A governmental entity ©KW Kau March 2017 48

ØAn international organization ØA central bank; or ØA FI (Section 50 A(1)) ©KW Kau March 2017 49

ØAn international organization ØA central bank; or ØA FI (Section 50 A(1)) ©KW Kau March 2017 49

Reportable jurisdiction • A territory outside Hong Kong that is Ø a party to an arrangement having effect under section 49(1 A) and requiring disclosure of information concerning tax of the territory; and Ø specified in column 1 of Part 1 of Schedule 17 E (Section 50 A(1)) ©KW Kau March 2017 50

Reportable jurisdiction • A territory outside Hong Kong that is Ø a party to an arrangement having effect under section 49(1 A) and requiring disclosure of information concerning tax of the territory; and Ø specified in column 1 of Part 1 of Schedule 17 E (Section 50 A(1)) ©KW Kau March 2017 50

Passive NFE • Not an active NFE • Not a FI which is Øwithin paragraph (e) of the definition of Investment Entity Ønot a participating jurisdiction FI Ønot a FI in Hong Kong (Section 50 A(1)) ©KW Kau March 2017 51

Passive NFE • Not an active NFE • Not a FI which is Øwithin paragraph (e) of the definition of Investment Entity Ønot a participating jurisdiction FI Ønot a FI in Hong Kong (Section 50 A(1)) ©KW Kau March 2017 51

Controlling person • in relation to an entity is an individual exercising control over the entity • For a trust, the settlor, trustee, protector, or beneficiary or a member of the class of beneficiaries of the trust • If the settlor, trustee, protector, or beneficiary or a member of the class of beneficiaries of the trust is another entity, an individual who controls that other entity • For entity similar to a trust but not a trust, the individual similar to any of the above described persons (Section 50 A(1)) ©KW Kau March 2017 52

Controlling person • in relation to an entity is an individual exercising control over the entity • For a trust, the settlor, trustee, protector, or beneficiary or a member of the class of beneficiaries of the trust • If the settlor, trustee, protector, or beneficiary or a member of the class of beneficiaries of the trust is another entity, an individual who controls that other entity • For entity similar to a trust but not a trust, the individual similar to any of the above described persons (Section 50 A(1)) ©KW Kau March 2017 52

Required Information • Name • In and identification number of reporting FI relation to each reportable account Ø if the account holder is an individual who is a reportable person—the name, address, jurisdiction of residence, TIN, and the date and place of birth, of the individual Ø if the account holder is an entity that is a reportable person— the name, address, jurisdiction of residence and TIN of the entity ©KW Kau March 2017 53

Required Information • Name • In and identification number of reporting FI relation to each reportable account Ø if the account holder is an individual who is a reportable person—the name, address, jurisdiction of residence, TIN, and the date and place of birth, of the individual Ø if the account holder is an entity that is a reportable person— the name, address, jurisdiction of residence and TIN of the entity ©KW Kau March 2017 53

Ø if the account holder is an entity and at least one controlling person of the entity is a reportable person— uthe name, address, jurisdiction of residence and TIN of the entity; and uthe name, address, jurisdiction of residence, TIN, and the date and place of birth, of each reportable person Ø the account number or (if there is no such number) its functional equivalent ©KW Kau March 2017 54

Ø if the account holder is an entity and at least one controlling person of the entity is a reportable person— uthe name, address, jurisdiction of residence and TIN of the entity; and uthe name, address, jurisdiction of residence, TIN, and the date and place of birth, of each reportable person Ø the account number or (if there is no such number) its functional equivalent ©KW Kau March 2017 54

• the account balance or value (including, for a cash value insurance contract or an annuity contract, the cash value or surrender value) as at the end of the specified information period or other appropriate reporting period, or (if the account was closed during such period) the closure of the account • for a custodial account— 1. the total gross amount of interest paid to the account, or in respect of the account, during the specified information period or other appropriate reporting period ©KW Kau March 2017 55

• the account balance or value (including, for a cash value insurance contract or an annuity contract, the cash value or surrender value) as at the end of the specified information period or other appropriate reporting period, or (if the account was closed during such period) the closure of the account • for a custodial account— 1. the total gross amount of interest paid to the account, or in respect of the account, during the specified information period or other appropriate reporting period ©KW Kau March 2017 55

the total gross amount of dividends paid to the account, or in respect of the account, during the specified information period or other appropriate reporting period Ø the total gross amount of other income generated in respect of the financial assets held in the account, and paid to the account, or in respect of the account, during the specified information period or other appropriate reporting period Ø the total gross proceeds from the sale or redemption of financial assets paid to the account during the specified information period or other appropriate reporting period in respect of which the reporting financial institution acts as a custodian, broker, nominee, or otherwise as an agent for the account holder Ø ©KW Kau March 2017 56

the total gross amount of dividends paid to the account, or in respect of the account, during the specified information period or other appropriate reporting period Ø the total gross amount of other income generated in respect of the financial assets held in the account, and paid to the account, or in respect of the account, during the specified information period or other appropriate reporting period Ø the total gross proceeds from the sale or redemption of financial assets paid to the account during the specified information period or other appropriate reporting period in respect of which the reporting financial institution acts as a custodian, broker, nominee, or otherwise as an agent for the account holder Ø ©KW Kau March 2017 56

• for a depository account—the total gross amount of interest paid to the account during the specified information period or other appropriate reporting period • for any account in respect of which the reporting financial institution is the obligor or debtor, other than a custodial account or a depository account—the total gross amount paid to the account holder in respect of the account during the specified information period or other appropriate reporting period, including the aggregate amount of any redemption payments made to the account holder during that period (Sections 50 C(3) & 50 F) ©KW Kau March 2017 57

• for a depository account—the total gross amount of interest paid to the account during the specified information period or other appropriate reporting period • for any account in respect of which the reporting financial institution is the obligor or debtor, other than a custodial account or a depository account—the total gross amount paid to the account holder in respect of the account during the specified information period or other appropriate reporting period, including the aggregate amount of any redemption payments made to the account holder during that period (Sections 50 C(3) & 50 F) ©KW Kau March 2017 57

The reporting duty of FI • A reporting FI must furnish a return in accordance with a notice given by an assessor • An assessor may give a notice in writing to a reporting FI requiring it to furnish a return reporting the required information in relation to reportable accounts with respect to any reportable jurisdiction that are maintained by the institution at any time during the period specified in the notice ©KW Kau March 2017 58

The reporting duty of FI • A reporting FI must furnish a return in accordance with a notice given by an assessor • An assessor may give a notice in writing to a reporting FI requiring it to furnish a return reporting the required information in relation to reportable accounts with respect to any reportable jurisdiction that are maintained by the institution at any time during the period specified in the notice ©KW Kau March 2017 58

• The return must be furnished Ø within the time specified in the notice Ø in the manner specified in the notice Ø in the form of an electronic record sent by using a system specified by the Board of Inland Revenue (BIR) and contained the required information arranged in a form specified by the BIR (Section 50 C) ©KW Kau March 2017 59

• The return must be furnished Ø within the time specified in the notice Ø in the manner specified in the notice Ø in the form of an electronic record sent by using a system specified by the Board of Inland Revenue (BIR) and contained the required information arranged in a form specified by the BIR (Section 50 C) ©KW Kau March 2017 59

Further obligations of FI • A reporting FI must keep sufficient records to enable the correctness and accuracy of the return furnished under section 50 C(1) to be readily ascertained for a period of 6 years beginning on the date on which the return is furnished • A reporting FI must give notice to the CIR with three months of Øthe first occasion of its commencing to maintain a reportable account Øthe lapse of one year after it has cease to maintain all reportable account Øthe first occasion of its commencing to maintain a reportable account after ceasing to maintain any reportable account ©KW Kau March 2017 60

Further obligations of FI • A reporting FI must keep sufficient records to enable the correctness and accuracy of the return furnished under section 50 C(1) to be readily ascertained for a period of 6 years beginning on the date on which the return is furnished • A reporting FI must give notice to the CIR with three months of Øthe first occasion of its commencing to maintain a reportable account Øthe lapse of one year after it has cease to maintain all reportable account Øthe first occasion of its commencing to maintain a reportable account after ceasing to maintain any reportable account ©KW Kau March 2017 60

• When a FI has given notice of commencing maintaining reportable account and then changes it address, it must notify CIR of its new address within one month of such change. (section 50 D) ©KW Kau March 2017 61

• When a FI has given notice of commencing maintaining reportable account and then changes it address, it must notify CIR of its new address within one month of such change. (section 50 D) ©KW Kau March 2017 61

APPLICATION TO THE TRUST ©KW Kau March 2017 62

APPLICATION TO THE TRUST ©KW Kau March 2017 62

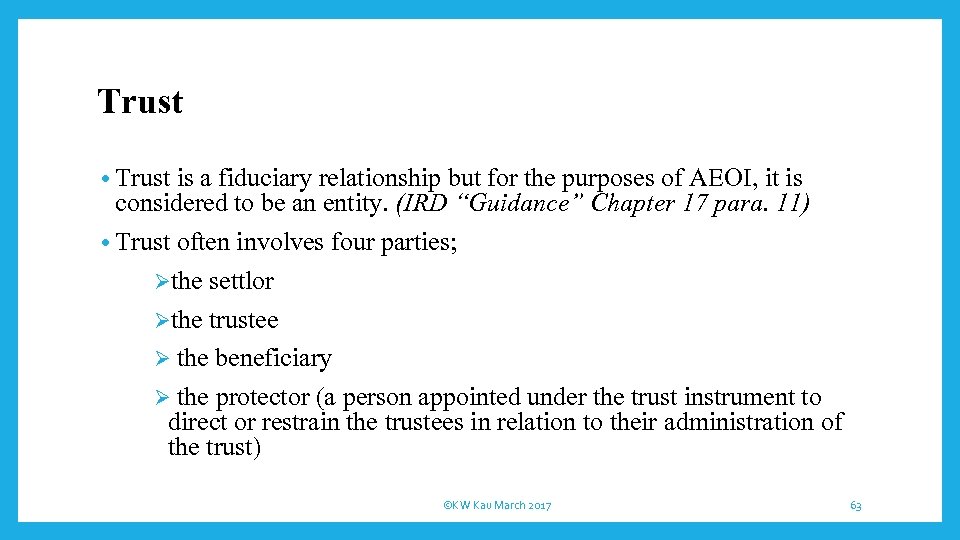

Trust • Trust is a fiduciary relationship but for the purposes of AEOI, it is considered to be an entity. (IRD “Guidance” Chapter 17 para. 11) • Trust often involves four parties; Øthe settlor Øthe trustee Ø the beneficiary Ø the protector (a person appointed under the trust instrument to direct or restrain the trustees in relation to their administration of the trust) ©KW Kau March 2017 63

Trust • Trust is a fiduciary relationship but for the purposes of AEOI, it is considered to be an entity. (IRD “Guidance” Chapter 17 para. 11) • Trust often involves four parties; Øthe settlor Øthe trustee Ø the beneficiary Ø the protector (a person appointed under the trust instrument to direct or restrain the trustees in relation to their administration of the trust) ©KW Kau March 2017 63

• In view of the comprehensiveness of the catch of CRS, when advising in the context of tax planning, it should always be kept in view that even if a trust is not a reporting FI, itself or any component of it may be a reportable account. ©KW Kau March 2017 64

• In view of the comprehensiveness of the catch of CRS, when advising in the context of tax planning, it should always be kept in view that even if a trust is not a reporting FI, itself or any component of it may be a reportable account. ©KW Kau March 2017 64

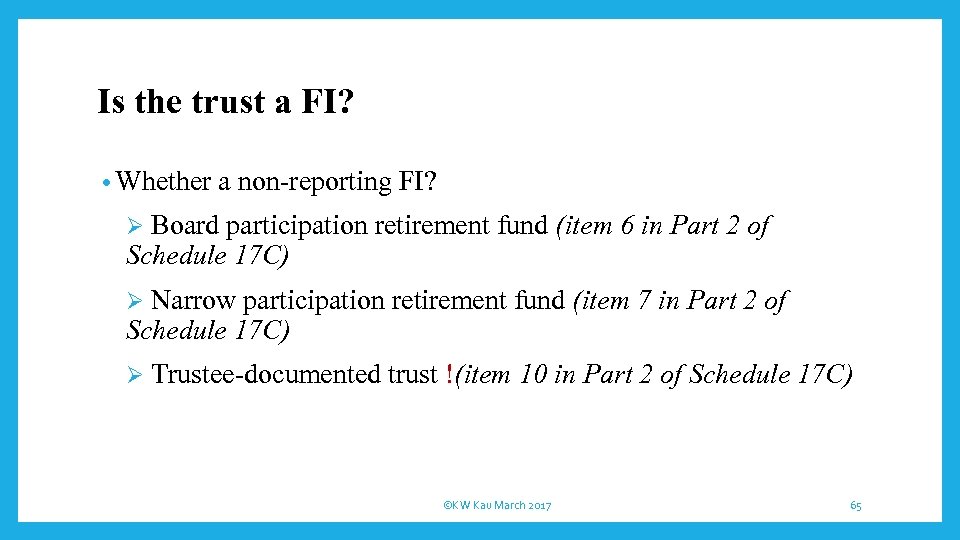

Is the trust a FI? • Whether a non-reporting FI? Board participation retirement fund (item 6 in Part 2 of Schedule 17 C) Ø Narrow participation retirement fund (item 7 in Part 2 of Schedule 17 C) Ø Ø Trustee-documented trust !(item 10 in Part 2 of Schedule 17 C) ©KW Kau March 2017 65

Is the trust a FI? • Whether a non-reporting FI? Board participation retirement fund (item 6 in Part 2 of Schedule 17 C) Ø Narrow participation retirement fund (item 7 in Part 2 of Schedule 17 C) Ø Ø Trustee-documented trust !(item 10 in Part 2 of Schedule 17 C) ©KW Kau March 2017 65

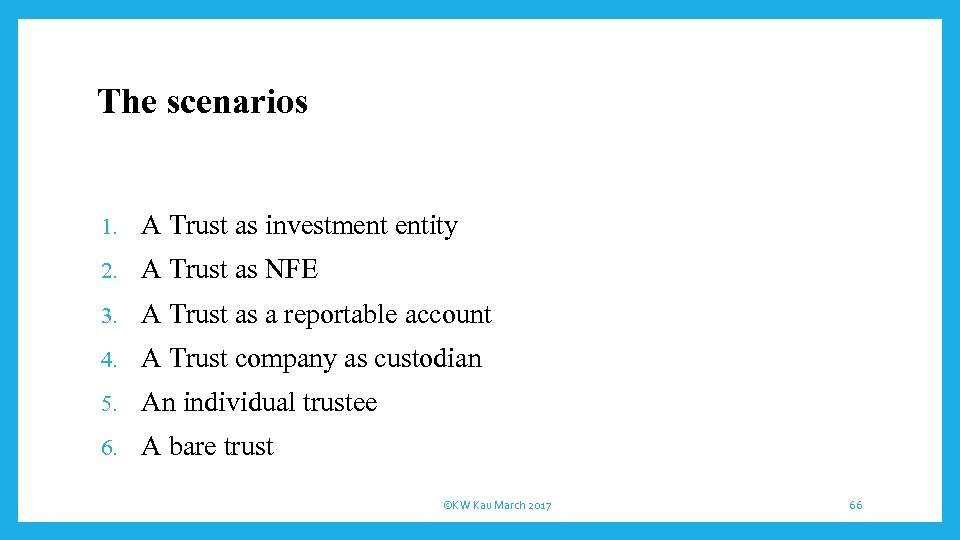

The scenarios 1. A Trust as investment entity 2. A Trust as NFE 3. A Trust as a reportable account 4. A Trust company as custodian 5. An individual trustee 6. A bare trust ©KW Kau March 2017 66

The scenarios 1. A Trust as investment entity 2. A Trust as NFE 3. A Trust as a reportable account 4. A Trust company as custodian 5. An individual trustee 6. A bare trust ©KW Kau March 2017 66

Trust as investment entity • When a trust has gross income primarily attributable to investing, reinvesting, or trading in financial assets and is managed by another entity that is a FI, it is an investment entity. That would include collective investment schemes and other similar investment vehicles established with an investment strategy of investing, reinvesting, or trading in financial assets (IRD “Guidance” Chapter 17 para. 11) • As an investment entity, the trust is a reporting FI if it is resident in Hong Kong and does not qualify as a non-reporting FI. ©KW Kau March 2017 67

Trust as investment entity • When a trust has gross income primarily attributable to investing, reinvesting, or trading in financial assets and is managed by another entity that is a FI, it is an investment entity. That would include collective investment schemes and other similar investment vehicles established with an investment strategy of investing, reinvesting, or trading in financial assets (IRD “Guidance” Chapter 17 para. 11) • As an investment entity, the trust is a reporting FI if it is resident in Hong Kong and does not qualify as a non-reporting FI. ©KW Kau March 2017 67

• A trust is resident in Hong Kong if it is constituted under the laws of Hong Kong, or if constituted outside Hong Kong, it is normally managed or controlled in Hong Kong. A trust will also be considered to be resident where the trustee(s) is resident. If there is more than one trustee, the trust will be a FI in all participating jurisdictions in which a trustee is resident. (IRD “Guidance” Chapter 17 para. 16) ©KW Kau March 2017 68

• A trust is resident in Hong Kong if it is constituted under the laws of Hong Kong, or if constituted outside Hong Kong, it is normally managed or controlled in Hong Kong. A trust will also be considered to be resident where the trustee(s) is resident. If there is more than one trustee, the trust will be a FI in all participating jurisdictions in which a trustee is resident. (IRD “Guidance” Chapter 17 para. 16) ©KW Kau March 2017 68

• Whether a trust is managed by a FI depends on the following considerations: Ø Whether a FI manages the trust Ø Whether a FI manages the financial assets of a trust Ø Whether its trustee is a FI (IRD “Guidance” Chapter 3 para. 47 to 51) ©KW Kau March 2017 69

• Whether a trust is managed by a FI depends on the following considerations: Ø Whether a FI manages the trust Ø Whether a FI manages the financial assets of a trust Ø Whether its trustee is a FI (IRD “Guidance” Chapter 3 para. 47 to 51) ©KW Kau March 2017 69

Trust as NFE • A trust that is not a reporting FI is a NFE. • A NFE could be an active NFE or a passive NFE. • A trust that is a charity or a trading trust carrying on business may be an active NFE. (IRD “Guidance” Chapter 17 para. 12) • A trust that is not an active NEF is a passive NEF. (IRD “Guidance” Chapter 17 para. 13) • A trust that is a passive NFE that has a reportable person as the controlling person could hold a reportable account. ©KW Kau March 2017 70

Trust as NFE • A trust that is not a reporting FI is a NFE. • A NFE could be an active NFE or a passive NFE. • A trust that is a charity or a trading trust carrying on business may be an active NFE. (IRD “Guidance” Chapter 17 para. 12) • A trust that is not an active NEF is a passive NEF. (IRD “Guidance” Chapter 17 para. 13) • A trust that is a passive NFE that has a reportable person as the controlling person could hold a reportable account. ©KW Kau March 2017 70

• A trust holding a reportable account with a reporting FI must be treated by that reporting FI as a passive NFE if it is an investment entity described in paragraph (e) of the definition of investment entity (i. e. managed by a FI and whose gross income is primarily attributable to investing, reinvesting and trading in financial assets) that is not resident or located in a participating jurisdiction. (IRD “Guidance” Chapter 17 para. 13) ©KW Kau March 2017 71

• A trust holding a reportable account with a reporting FI must be treated by that reporting FI as a passive NFE if it is an investment entity described in paragraph (e) of the definition of investment entity (i. e. managed by a FI and whose gross income is primarily attributable to investing, reinvesting and trading in financial assets) that is not resident or located in a participating jurisdiction. (IRD “Guidance” Chapter 17 para. 13) ©KW Kau March 2017 71

Information to be reported • A trust that is a reporting FI will report the account information and the financial activity for the year in respect of each reportable account. • The financial activity includes the account balance or value, as well as gross payments paid or credited during the year. (For details, please refer to the table at para. 28 of Chapter 17 of IRD “Guidance”. ) (IRD “Guidance” Chapter 17 para. 25) • Where an account is closed during the year, the fact of closure is reported. A debt or equity interest in a trust could be considered to be closed, for example, where the debt is retired, or where a beneficiary is removed. (IRD “Guidance” Chapter 17 para. 27) ©KW Kau March 2017 72

Information to be reported • A trust that is a reporting FI will report the account information and the financial activity for the year in respect of each reportable account. • The financial activity includes the account balance or value, as well as gross payments paid or credited during the year. (For details, please refer to the table at para. 28 of Chapter 17 of IRD “Guidance”. ) (IRD “Guidance” Chapter 17 para. 25) • Where an account is closed during the year, the fact of closure is reported. A debt or equity interest in a trust could be considered to be closed, for example, where the debt is retired, or where a beneficiary is removed. (IRD “Guidance” Chapter 17 para. 27) ©KW Kau March 2017 72

Trust as a reportable account • The account held by a trust that is a passive NFE is a reportable account if: (a) the trust is a reportable person; or (b) the trust has one or more controlling persons that are reportable persons. (IRD “Guidance” Chapter 17 para. 31) • The controlling persons of a trust are the settlor(s), trustee(s), beneficiary/ies, protector(s) and any other natural person exercising ultimate effective control over the trust. This definition of controlling person excludes the need to inquire as to whether any of these persons can exercise practical control over the trust. (IRD “Guidance” Chapter 17 para. 33) ©KW Kau March 2017 73

Trust as a reportable account • The account held by a trust that is a passive NFE is a reportable account if: (a) the trust is a reportable person; or (b) the trust has one or more controlling persons that are reportable persons. (IRD “Guidance” Chapter 17 para. 31) • The controlling persons of a trust are the settlor(s), trustee(s), beneficiary/ies, protector(s) and any other natural person exercising ultimate effective control over the trust. This definition of controlling person excludes the need to inquire as to whether any of these persons can exercise practical control over the trust. (IRD “Guidance” Chapter 17 para. 33) ©KW Kau March 2017 73

The trustee company • If the company is a custodian institution, it would be a reporting FI if it is resident in Hong Kong and does not qualify as a non-reporting FI. • If the company is a FI and is also tax resident in another jurisdiction with which Hong Kong automatically exchanges financial account information, and the trust reports all the information required to be reported with respect to reportable accounts maintained by the trust to that jurisdiction, that will relieve the company from reporting in Hong Kong. (IRD “Guidance” Chapter 17 para. 17) • If the company is only a service provider, it is not a reporting FI but the reporting FI that has engaged its services must report any reportable account. ©KW Kau March 2017 74

The trustee company • If the company is a custodian institution, it would be a reporting FI if it is resident in Hong Kong and does not qualify as a non-reporting FI. • If the company is a FI and is also tax resident in another jurisdiction with which Hong Kong automatically exchanges financial account information, and the trust reports all the information required to be reported with respect to reportable accounts maintained by the trust to that jurisdiction, that will relieve the company from reporting in Hong Kong. (IRD “Guidance” Chapter 17 para. 17) • If the company is only a service provider, it is not a reporting FI but the reporting FI that has engaged its services must report any reportable account. ©KW Kau March 2017 74

An individual trustee unless he or she is a FI is not a reporting FI. l ©KW Kau March 2017 75

An individual trustee unless he or she is a FI is not a reporting FI. l ©KW Kau March 2017 75

A bare trust • A bare trust is not a FI and consequently not a reporting FI. • The obvious exception may be where the trustee of a bare trust is a FI but then it is the trust that may be a reportable account. ©KW Kau March 2017 76

A bare trust • A bare trust is not a FI and consequently not a reporting FI. • The obvious exception may be where the trustee of a bare trust is a FI but then it is the trust that may be a reportable account. ©KW Kau March 2017 76

Who is reportable in the context of a trust that is a FI? l. If the trust is an investment entity, its financial accounts are defined as the debt and equity interests in the entity. (Section 50 A(1) def. of “financial account” para. (c) ) • A debt interest will be determined under the domestic law of Hong Kong. In general, a debt interest is any interest created when a lender lends money to a borrower. • The equity interests are held by any person treated as a settlor or beneficiary of all or a portion of the trust, or any other natural person exercising ultimate effective control over the trust. ©KW Kau March 2017 77

Who is reportable in the context of a trust that is a FI? l. If the trust is an investment entity, its financial accounts are defined as the debt and equity interests in the entity. (Section 50 A(1) def. of “financial account” para. (c) ) • A debt interest will be determined under the domestic law of Hong Kong. In general, a debt interest is any interest created when a lender lends money to a borrower. • The equity interests are held by any person treated as a settlor or beneficiary of all or a portion of the trust, or any other natural person exercising ultimate effective control over the trust. ©KW Kau March 2017 77

• If a settlor, beneficiary or other person exercising ultimate effective control over the trust is itself an entity, that entity must be looked through, and the ultimate natural controlling person(s) behind that entity must be treated as the equity interest holder(s). (IRD “Guidance” Chapter 17 para. 20) • The debt and equity interests of the trust are reportable accounts if they are held by a reportable person. ©KW Kau March 2017 78

• If a settlor, beneficiary or other person exercising ultimate effective control over the trust is itself an entity, that entity must be looked through, and the ultimate natural controlling person(s) behind that entity must be treated as the equity interest holder(s). (IRD “Guidance” Chapter 17 para. 20) • The debt and equity interests of the trust are reportable accounts if they are held by a reportable person. ©KW Kau March 2017 78

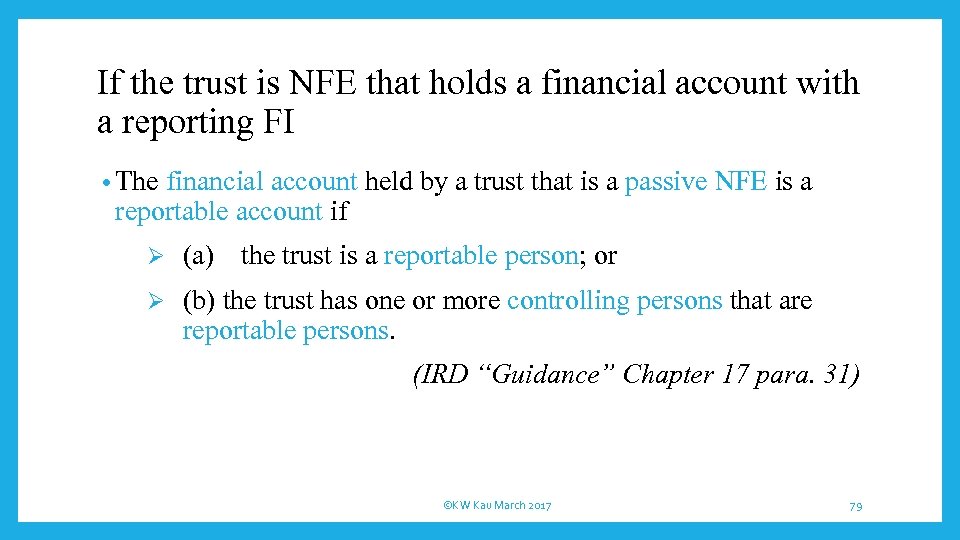

If the trust is NFE that holds a financial account with a reporting FI • The financial account held by a trust that is a passive NFE is a reportable account if Ø (a) the trust is a reportable person; or Ø (b) the trust has one or more controlling persons that are reportable persons. (IRD “Guidance” Chapter 17 para. 31) ©KW Kau March 2017 79

If the trust is NFE that holds a financial account with a reporting FI • The financial account held by a trust that is a passive NFE is a reportable account if Ø (a) the trust is a reportable person; or Ø (b) the trust has one or more controlling persons that are reportable persons. (IRD “Guidance” Chapter 17 para. 31) ©KW Kau March 2017 79

A trust is reportable person only if it is subject to taxation as a resident in a reportable jurisdiction and is not excluded from the definition of reportable person. (IRD “Guidance” Chapter 17 para. 33) l ©KW Kau March 2017 80

A trust is reportable person only if it is subject to taxation as a resident in a reportable jurisdiction and is not excluded from the definition of reportable person. (IRD “Guidance” Chapter 17 para. 33) l ©KW Kau March 2017 80

Appendix • A brief comparison between CRS and AML ©KW Kau March 2017 81

Appendix • A brief comparison between CRS and AML ©KW Kau March 2017 81

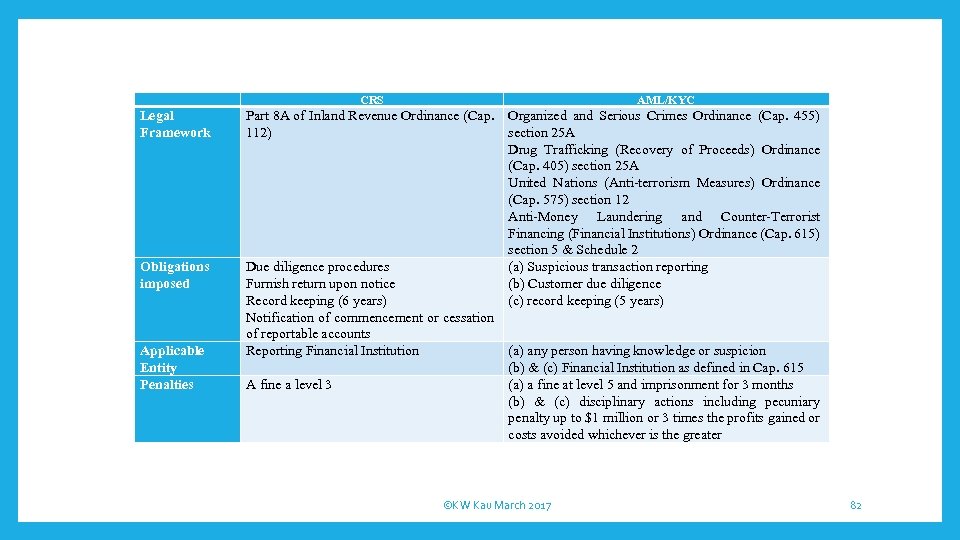

CRS AML/KYC Legal Framework Part 8 A of Inland Revenue Ordinance (Cap. 112) Obligations imposed Due diligence procedures Furnish return upon notice Record keeping (6 years) Notification of commencement or cessation of reportable accounts Reporting Financial Institution Organized and Serious Crimes Ordinance (Cap. 455) section 25 A Drug Trafficking (Recovery of Proceeds) Ordinance (Cap. 405) section 25 A United Nations (Anti-terrorism Measures) Ordinance (Cap. 575) section 12 Anti-Money Laundering and Counter-Terrorist Financing (Financial Institutions) Ordinance (Cap. 615) section 5 & Schedule 2 (a) Suspicious transaction reporting (b) Customer due diligence (c) record keeping (5 years) Applicable Entity Penalties A fine a level 3 (a) any person having knowledge or suspicion (b) & (c) Financial Institution as defined in Cap. 615 (a) a fine at level 5 and imprisonment for 3 months (b) & (c) disciplinary actions including pecuniary penalty up to $1 million or 3 times the profits gained or costs avoided whichever is the greater ©KW Kau March 2017 82

CRS AML/KYC Legal Framework Part 8 A of Inland Revenue Ordinance (Cap. 112) Obligations imposed Due diligence procedures Furnish return upon notice Record keeping (6 years) Notification of commencement or cessation of reportable accounts Reporting Financial Institution Organized and Serious Crimes Ordinance (Cap. 455) section 25 A Drug Trafficking (Recovery of Proceeds) Ordinance (Cap. 405) section 25 A United Nations (Anti-terrorism Measures) Ordinance (Cap. 575) section 12 Anti-Money Laundering and Counter-Terrorist Financing (Financial Institutions) Ordinance (Cap. 615) section 5 & Schedule 2 (a) Suspicious transaction reporting (b) Customer due diligence (c) record keeping (5 years) Applicable Entity Penalties A fine a level 3 (a) any person having knowledge or suspicion (b) & (c) Financial Institution as defined in Cap. 615 (a) a fine at level 5 and imprisonment for 3 months (b) & (c) disciplinary actions including pecuniary penalty up to $1 million or 3 times the profits gained or costs avoided whichever is the greater ©KW Kau March 2017 82

The End ©KW Kau March 2017 83

The End ©KW Kau March 2017 83