9d9910bbec635560b66306aea8936385.ppt

- Количество слайдов: 13

Common Payment Services - EFT Electronic Funds Transfer (EFT) Banking method in which computers and electronic technology is used as a substitute for checks and other paper forms of banking Electronic Funds Transfer Options: » Automated Teller Machines (ATM’S) » Pay-By-Phone Systems » Direct Deposit or Withdrawals Paychecks, automated bill payment » Point-of-Sale Transfers Debit Cards » Automatic Deposits and Payments 1

Common Payment Services - EFT Electronic Funds Transfer (EFT) Banking method in which computers and electronic technology is used as a substitute for checks and other paper forms of banking Electronic Funds Transfer Options: » Automated Teller Machines (ATM’S) » Pay-By-Phone Systems » Direct Deposit or Withdrawals Paychecks, automated bill payment » Point-of-Sale Transfers Debit Cards » Automatic Deposits and Payments 1

Checking Accounts • Used by business and individuals to manage cash transactions • Check– A preprinted form issued by the financial institution – Account holder directs withdrawals by writing checks – Parties to a Check • Payee, Drawer

Checking Accounts • Used by business and individuals to manage cash transactions • Check– A preprinted form issued by the financial institution – Account holder directs withdrawals by writing checks – Parties to a Check • Payee, Drawer

Parties to a Check Drawer’s Name & Address Joint Account Payee ABA # Check Date Melanie Paige Charles Paige 619 Main Street Raleigh, NC 27601 Check Number 319 2 -131/1034 July 16, 2010 Pay To the Order of _____Donnie Tatum___________$100. 50 _One hundred and 50/100 --------------------------DOLLARS State Credit Union For ________ Charles Paige 2131/1034: 78434 234320 100. 50 07 -18 -2010 2251 Memo Bank Name - Drawee Drawer’s Signature Last item completed on check! MICR Banking #s 3

Parties to a Check Drawer’s Name & Address Joint Account Payee ABA # Check Date Melanie Paige Charles Paige 619 Main Street Raleigh, NC 27601 Check Number 319 2 -131/1034 July 16, 2010 Pay To the Order of _____Donnie Tatum___________$100. 50 _One hundred and 50/100 --------------------------DOLLARS State Credit Union For ________ Charles Paige 2131/1034: 78434 234320 100. 50 07 -18 -2010 2251 Memo Bank Name - Drawee Drawer’s Signature Last item completed on check! MICR Banking #s 3

Record Keeping • IMPORTANT: Keep a current balance in check register or on check stub by: • Recording deposits • Recording withdrawals – Checks written – EFTs – Bank Fees

Record Keeping • IMPORTANT: Keep a current balance in check register or on check stub by: • Recording deposits • Recording withdrawals – Checks written – EFTs – Bank Fees

Common Payment Services • Special Checks – Travelers check • Requires 1 st signature when check issued • Requires 2 nd signature when check used Go to link below and read about traveler’s checks and how they work. http: //usa. visa. com/download/merchants/visa_travelers_cheques_acceptance. pdf

Common Payment Services • Special Checks – Travelers check • Requires 1 st signature when check issued • Requires 2 nd signature when check used Go to link below and read about traveler’s checks and how they work. http: //usa. visa. com/download/merchants/visa_travelers_cheques_acceptance. pdf

Traveler’s Checks – Draft drawn by a well-known financial institution on itself or its agent, used when traveling • Go to website • http: //www 212. americanexpress. com/d smlive/dsm/dom/us/en/personal/cardm ember/additionalproductsandservices/ giftcardsandtravelerscheques/travelers chequesandforeigncurrency. do? vgnext oid=6 d 17 fc 671492 a 110 Vgn. VCM 10000 0 defaad 94 RCRD Write questions 1 -3 on notebook paper. Use the website to answer the questions. Click on Learn More about Travelers Checks. 1. List the 4 steps in how to use travelers checks. 2. List 5 ways Travelers Checks mean Peace of Mind. 3. What is the benefit of Cheques for Two?

Traveler’s Checks – Draft drawn by a well-known financial institution on itself or its agent, used when traveling • Go to website • http: //www 212. americanexpress. com/d smlive/dsm/dom/us/en/personal/cardm ember/additionalproductsandservices/ giftcardsandtravelerscheques/travelers chequesandforeigncurrency. do? vgnext oid=6 d 17 fc 671492 a 110 Vgn. VCM 10000 0 defaad 94 RCRD Write questions 1 -3 on notebook paper. Use the website to answer the questions. Click on Learn More about Travelers Checks. 1. List the 4 steps in how to use travelers checks. 2. List 5 ways Travelers Checks mean Peace of Mind. 3. What is the benefit of Cheques for Two?

Certified Check • A certified check is • Go to website: written by a bank for http: //www. superpage you from your bank s. com/supertips/whataccount to give to is-a-certifiedsomeone. check. html • It's guaranteed funds • Write Certified Check that the bank reserves questions 1 -5 from your account. next slide on notebook paper. Use the website to answer the questions.

Certified Check • A certified check is • Go to website: written by a bank for http: //www. superpage you from your bank s. com/supertips/whataccount to give to is-a-certifiedsomeone. check. html • It's guaranteed funds • Write Certified Check that the bank reserves questions 1 -5 from your account. next slide on notebook paper. Use the website to answer the questions.

Certified Check Questions 1. Who issues a certified check? 2. Give two examples of when you might need a certified check? 3. Why can’t a certified check bounce? 4. Why does a creditor require a certified check? 5. Do banks charge a fee for a certified check?

Certified Check Questions 1. Who issues a certified check? 2. Give two examples of when you might need a certified check? 3. Why can’t a certified check bounce? 4. Why does a creditor require a certified check? 5. Do banks charge a fee for a certified check?

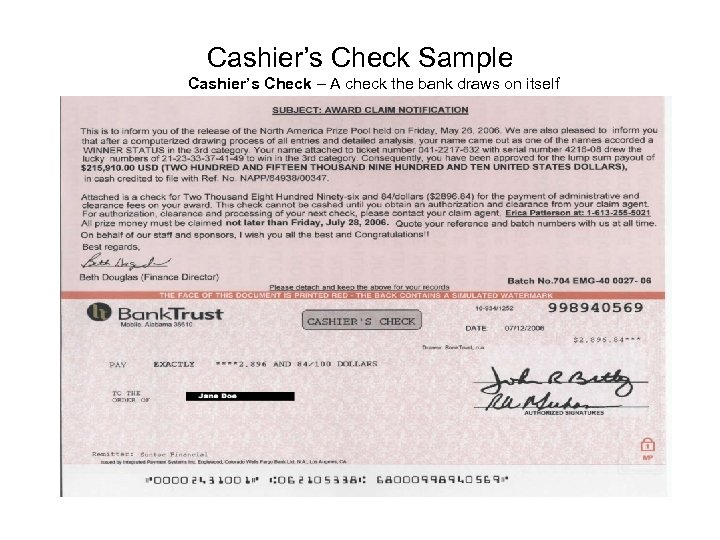

Cashier’s Check Sample Cashier’s Check – A check the bank draws on itself

Cashier’s Check Sample Cashier’s Check – A check the bank draws on itself

Common Payment Services • Money Order • Draft issued by a post office, bank, express company, or telegraph company for use in paying or transferring funds for the purchaser • Orders issuing agency to pay amount printed on form to another party • Types of Money Orders: – Postal money order – Express money order – Telegraphic money order • Go to website http: //en. wikipedia. org/wiki/Money _order Write questions 1 -5 from next slide on notebook paper. Use the website to answer the questions.

Common Payment Services • Money Order • Draft issued by a post office, bank, express company, or telegraph company for use in paying or transferring funds for the purchaser • Orders issuing agency to pay amount printed on form to another party • Types of Money Orders: – Postal money order – Express money order – Telegraphic money order • Go to website http: //en. wikipedia. org/wiki/Money _order Write questions 1 -5 from next slide on notebook paper. Use the website to answer the questions.

Money Order Questions 1. For what amount of 4. Who usually sells money is a money orders in the order issued? United States? 2. When was the Postal 5. Name 5 security Order system features of a postal established? money order. 3. What is a concern about using money orders?

Money Order Questions 1. For what amount of 4. Who usually sells money is a money orders in the order issued? United States? 2. When was the Postal 5. Name 5 security Order system features of a postal established? money order. 3. What is a concern about using money orders?

Common payment services • Opening a checking account – Signing a signature card is the first step • Writing a check for payment • Endorsing a check for deposit – An endorsement allows the payee to cash the check, deposit the check or transfer payment of the check to someone else. – Different types of endorsements: • Blank • Full • Restrictive

Common payment services • Opening a checking account – Signing a signature card is the first step • Writing a check for payment • Endorsing a check for deposit – An endorsement allows the payee to cash the check, deposit the check or transfer payment of the check to someone else. – Different types of endorsements: • Blank • Full • Restrictive

Check Endorsements Definition: Signature on the back of a check What does an endorsement do? • Allows payee to cash, deposit or transfer payment of the check to someone else • Provides proof that the payee cashed or transferred payment of the check to someone else How should a check be endorsed? • Endorser (payee who is signing) should sign the check the way it is on the front of the check and if the name is misspelled, correct the signature directly up under the first endorsement 13

Check Endorsements Definition: Signature on the back of a check What does an endorsement do? • Allows payee to cash, deposit or transfer payment of the check to someone else • Provides proof that the payee cashed or transferred payment of the check to someone else How should a check be endorsed? • Endorser (payee who is signing) should sign the check the way it is on the front of the check and if the name is misspelled, correct the signature directly up under the first endorsement 13