b22d743f599474643118e687774436cb.ppt

- Количество слайдов: 36

Commodity Bundling and Tie-In Sales Chapter 8: Commodity Bundling and Tie-In Sales 1

Introduction • Firms often bundle the goods that they offer – Microsoft bundles Windows and Explorer – Office bundles Word, Excel, Power. Point, Access • Bundled package is usually offered at a discount • Bundling may increase market power – GE merger with Honeywell • Tie-in sales ties the sale of one product to the purchase of another • Tying may be contractual or technological – IBM computer card machines and computer cards – Kodak tie service to sales of large-scale photocopiers – Tie computer printers and printer cartridges • Why? To make money! Chapter 8: Commodity Bundling and Tie-In Sales 2

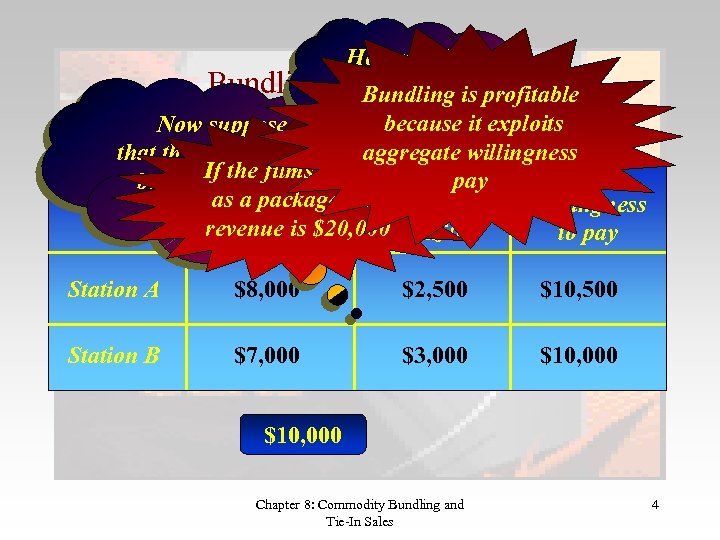

Bundling: an example How much can • Two television stations offered two old Hollywood films How much can be charged for – Casablanca and Son of Godzilla be If the films are sold charged for • Arbitrage is possible between the stations. Godzilla? separately total Casablanca? • Willingness revenue is $19, 000 to pay is: $7, 000 Willingness to pay for Casablanca Godzilla Station A $8, 000 $2, 500 Station B $7, 000 $2, 500 $3, 000 Chapter 8: Commodity Bundling and Tie-In Sales 3

Bundling: How much can an charged is profitable be example 2 Bundling for thebecause it exploits package? Now suppose aggregate willingness that the two films are If the sold Willingness to Total pay bundled and films are sold as pay for a package total pay for Willingness as a package revenue is $20, 000 Godzilla Casablanca to pay Station A $8, 000 $2, 500 $10, 500 Station B $7, 000 $3, 000 $10, 000 Chapter 8: Commodity Bundling and Tie-In Sales 4

Bundling • Extend this example to allow for – costs – mixed bundling: offering products in a bundle and separately Chapter 8: Commodity Bundling and Tie-In Sales 5

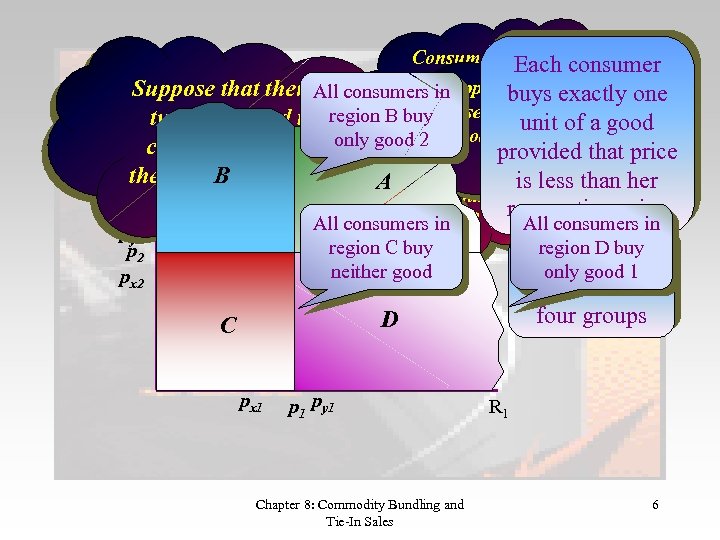

Consumer y Each consumer has reservation price py 1 firm Supposebuysthe that exactly one Suppose that there. All consumers in are for good 1 and consumers in sets All py 2 1 for price p region B buy two goods and that unit of p for good and price a good region A buy good 1 2 R 2 only good 2 2 consumers differ in Consumer x has good 2 that price provided for both goods reservation price px 1 less than her their reservation prices A B is for good 1 and px 2 for these goods reservation price for good Allyconsumers in 2 All consumers in py 2 region C buy region D buy p 2 Consumers x neither good only good 1 px 2 Bundling: another example split into four groups D C px 1 py 1 Chapter 8: Commodity Bundling and Tie-In Sales R 1 6

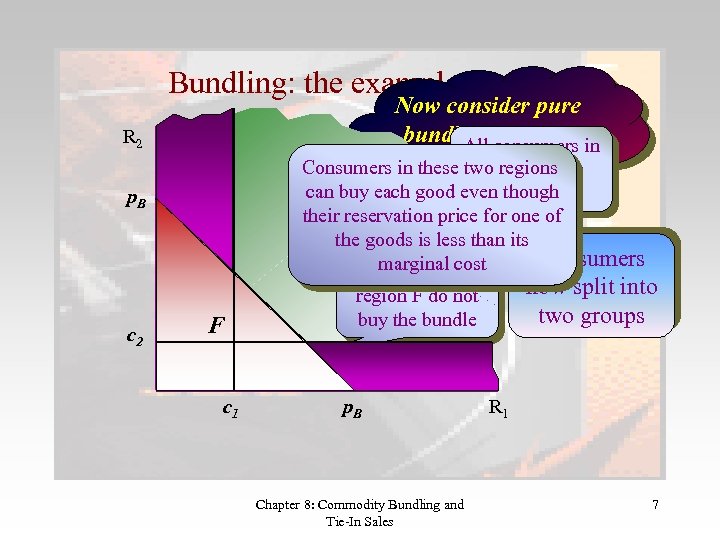

Bundling: the example (cont. ) Now consider pure bundling consumers in at some All price p. B E buy Consumers in these two regions region R 2 can buy each good even though the bundle their reservation price for one of Ethe goods is less than its Consumers All marginal cost consumers in p. B c 2 F c 1 now split into two groups region F do not buy the bundle p. B Chapter 8: Commodity Bundling and Tie-In Sales R 1 7

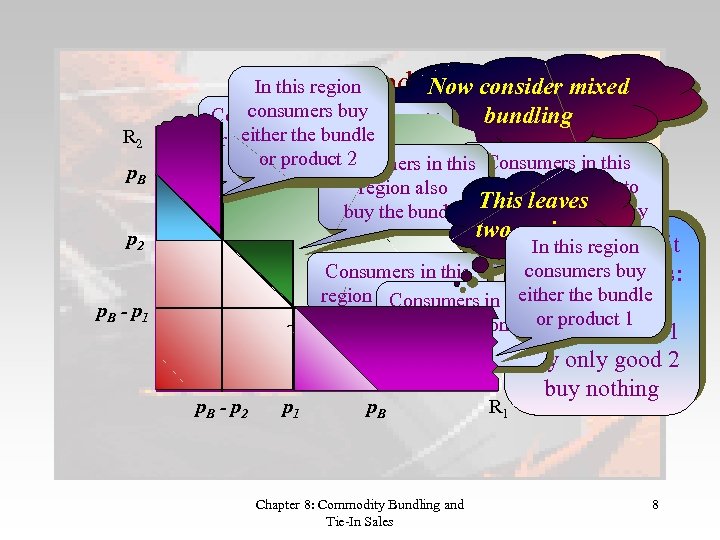

Mixed bundling R 2 p. B p 2 p. B - p 1 In this region Now consider mixed consumers buy Consumers in Good 1 is sold this bundling either the bundle region buy only price p at 1 or product 2 good 2 Consumers in this 2 is sold Good Consumers in this region also at price p are willing to This 2 leaves buy the bundle buy both goods. They two regions buy the bundle Consumers split In this region consumers buy Consumers in this into four groups: either the bundle region buy nothing in thisbuy the bundle Consumers The bundle is sold region < p only or product 1 at price p. Bbuy 1 + pbuy only good 1 2 good 1 p. B - p 2 p 1 p. B Chapter 8: Commodity Bundling and Tie-In Sales R 1 buy only good 2 buy nothing 8

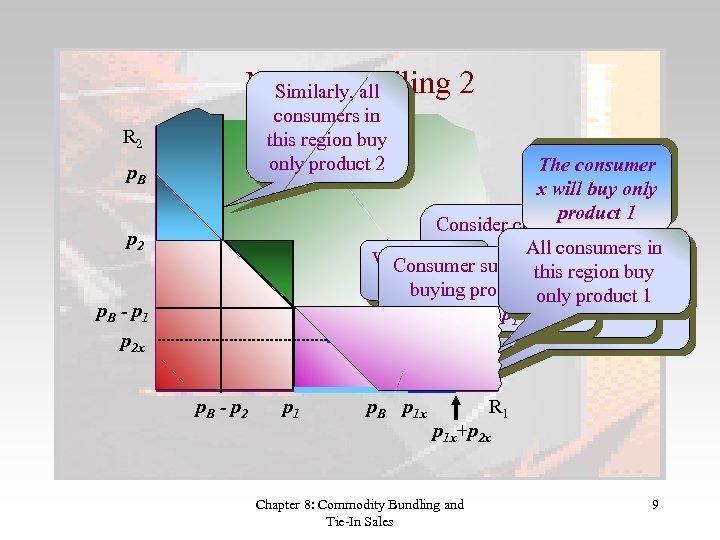

Mixed bundling 2 Similarly, all consumers in this region buy only product 2 R 2 The consumer x will buy only product 1 Consider consumer x with All consumers reservation prices p for in Which is this surplus from 1 x Consumerthis region buy surplus from product 1 and p 2 x for measure Her aggregate willingness buying theis 2 product 1 product only 1 bundle is product to pay for bundle is p 1 x -pp 1 + p thep - B 1 x 2 x p 1 x + p 2 x x p. B p 2 p. B - p 1 p 2 x p. B - p 2 p 1 p. B p 1 x R 1 p 1 x+p 2 x Chapter 8: Commodity Bundling and Tie-In Sales 9

Mixed bundling 3 • What should a firm actually do? • There is no simple answer – mixed bundling is generally better than pure bundling – but bundling is not always the best strategy • Each case needs to be worked out on its merits Chapter 8: Commodity Bundling and Tie-In Sales 10

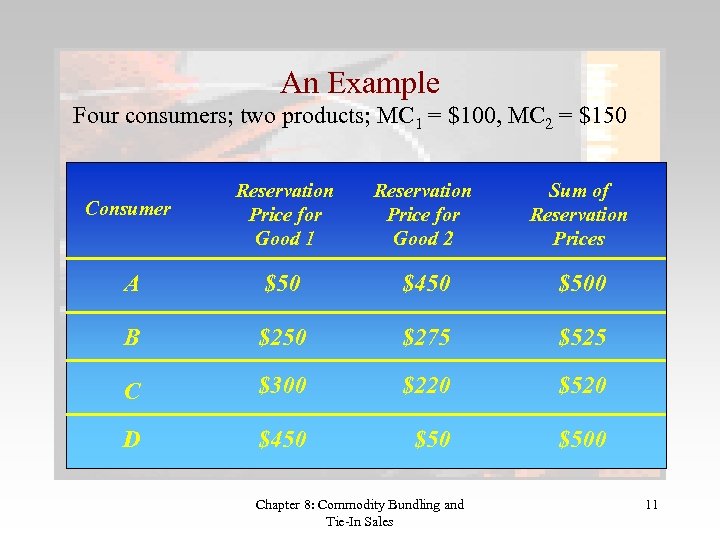

An Example Four consumers; two products; MC 1 = $100, MC 2 = $150 Consumer Reservation Price for Good 1 Reservation Price for Good 2 Sum of Reservation Prices A $50 $450 $500 B $250 $275 $525 C $300 $220 $520 D $450 $500 Chapter 8: Commodity Bundling and Tie-In Sales 11

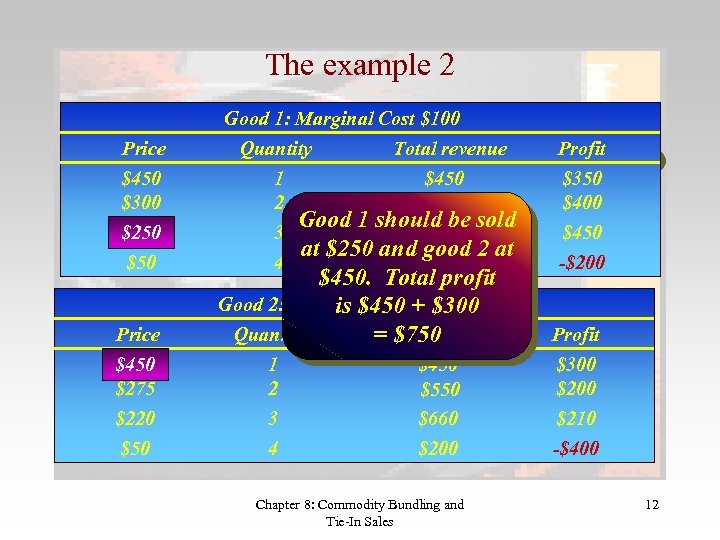

The example 2 Good 1: Marginal Cost $100 Price $450 $300 $250 $50 Price $450 $275 $220 $50 Consider Quantity Total revenue simple Profit monopoly pricing 1 $450 $350 2 $400 $600 Good 1 should be sold 3 $750 $450 at $250 and good 2 at 4 $200 -$200 $450. Total profit Good 2: Marginal Cost + $300 is $450 $150 Quantity =Total revenue $750 1 2 3 4 $450 $550 $660 $200 Chapter 8: Commodity Bundling and Tie-In Sales Profit $300 $210 -$400 12

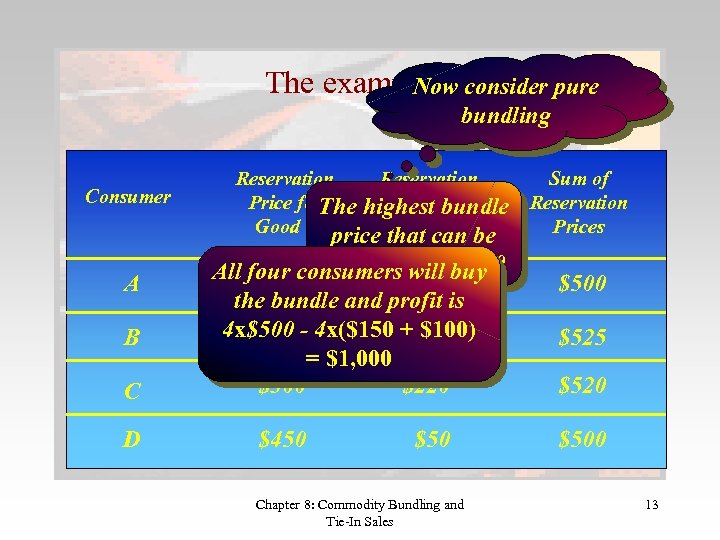

The example 3 consider pure Now bundling Consumer A B C D Reservation Price for. The highest for Price bundle Good 1 price that can be Good 2 considered is $500 All four consumers$450 buy will $50 the bundle and profit is 4 x$500 - 4 x($150 + $100) $250 $275 = $1, 000 $300 $220 $450 $50 Chapter 8: Commodity Bundling and Tie-In Sales Sum of Reservation Prices $500 $525 $520 $500 13

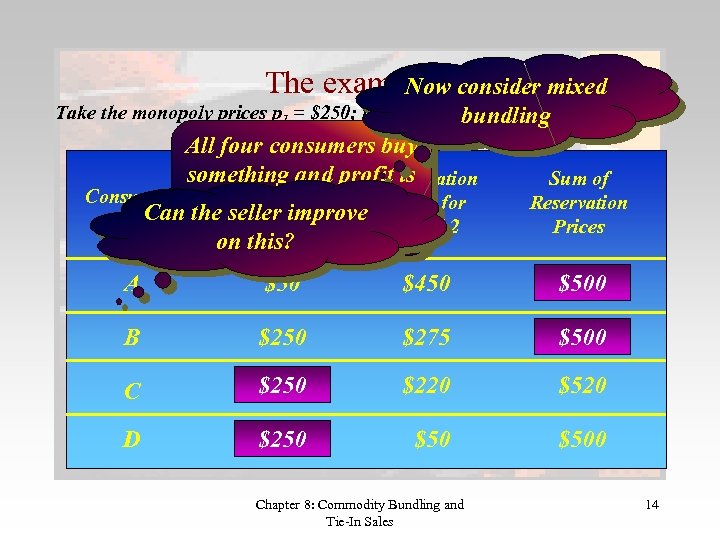

The example 4 consider mixed Now Take the monopoly prices p 1 = $250; p 2 = $450 and a bundle price p. B = $500 bundling All four consumers buy something and profit is Reservation Consumer Price for $250 x 2 + $150 x 2 Can the seller improve Price for Good 1 Good 2 = $800 on this? Sum of Reservation Prices A $50 $450 $500 B $250 $275 $500 $525 C $250 $300 $220 $520 D $250 $450 $500 Chapter 8: Commodity Bundling and Tie-In Sales 14

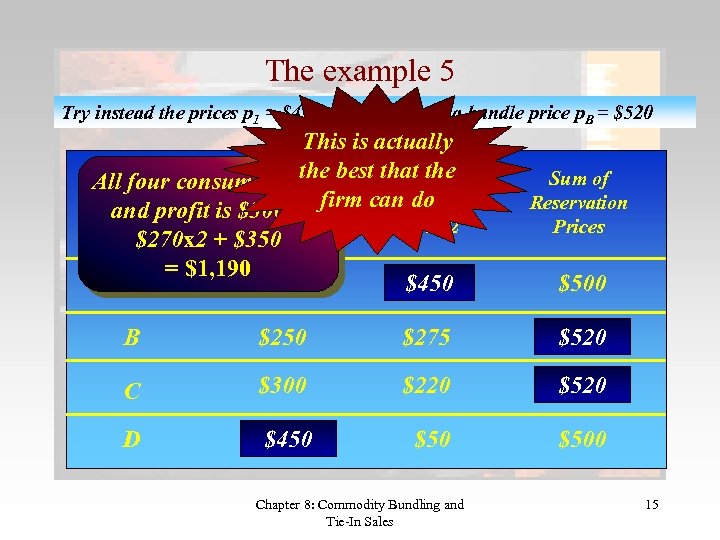

The example 5 Try instead the prices p 1 = $450; p 2 = $450 and a bundle price p. B = $520 This is actually the that the Reservation All four consumers buy best Reservation Consumer Price for Price and profit is $300 + firm can do for Good 1 $270 x 2 + $350 = $1, 190 A $50 Good 2 Sum of Reservation Prices $450 $500 B $250 $275 $520 $525 C $300 $220 $520 D $450 $500 Chapter 8: Commodity Bundling and Tie-In Sales 15

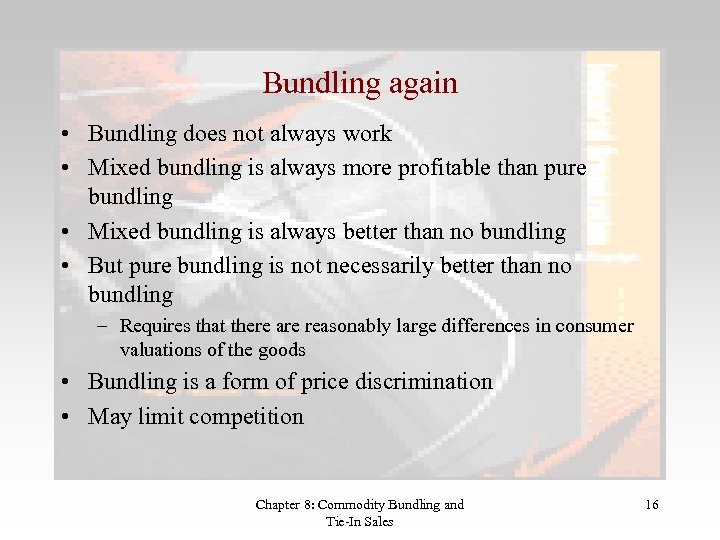

Bundling again • Bundling does not always work • Mixed bundling is always more profitable than pure bundling • Mixed bundling is always better than no bundling • But pure bundling is not necessarily better than no bundling – Requires that there are reasonably large differences in consumer valuations of the goods • Bundling is a form of price discrimination • May limit competition Chapter 8: Commodity Bundling and Tie-In Sales 16

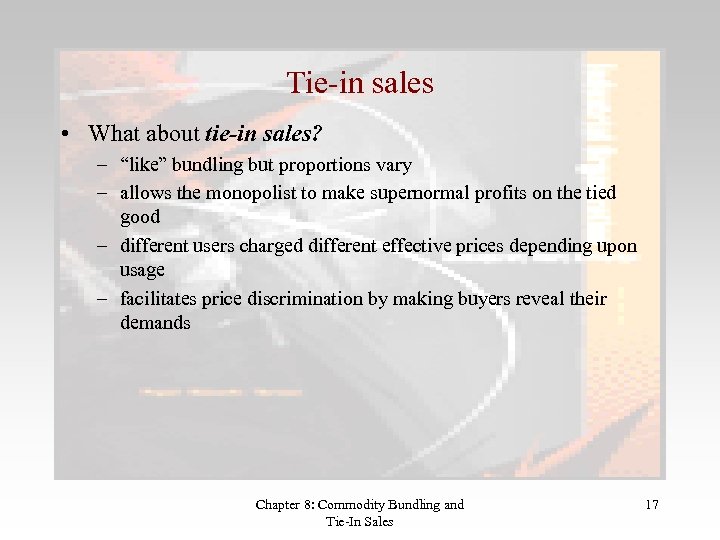

Tie-in sales • What about tie-in sales? – “like” bundling but proportions vary – allows the monopolist to make supernormal profits on the tied good – different users charged different effective prices depending upon usage – facilitates price discrimination by making buyers reveal their demands Chapter 8: Commodity Bundling and Tie-In Sales 17

Tie-in sales 2 • Suppose that a firm offers a specialized product – a camera – that uses highly specialized film cartridges • Then it has effectively tied the sales of film cartridges to the purchase of the camera – this is actually what has happened with computer printers and ink cartridges • How should it price the camera and film? – suppose also that there are two types of consumer, high-demand low-demand, with one-thousand of each type – high demand P = 16 – Qh; low demand P = 12 - Ql – the company does not know which type is which Chapter 8: Commodity Bundling and Tie-In Sales 18

Tie-in sales 3 • Film is produced competitively at $2 per picture – so film is priced at $2 per picture • Suppose that the company leases its cameras – if priced so that all consumers lease then we can ignore production costs of the camera • these are fixed at 2000 c • Now consider the lease terms Chapter 8: Commodity Bundling and Tie-In Sales 19

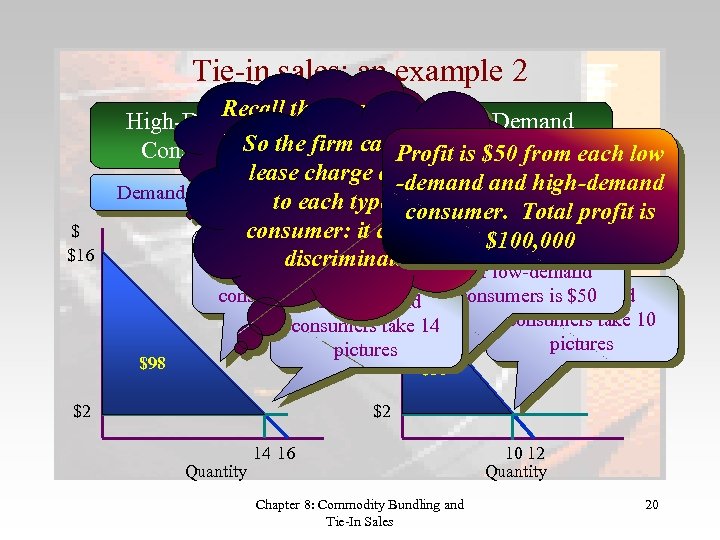

Tie-in sales: an example 2 $ $16 Recall that the High-Demand Low-Demand film sells at $2 So set a is $50 from Consumers the firm can. Profit. Consumers each low per picture of $50 lease charge -demand high-demand Demand: P = 16 - Q each type of Demand: P = 12 - Q to consumer. Total profit is consumer: it cannot $ $100, 000 Consumer surplus discriminate for high-demand for low-demand $12 $98 consumers is $50 Low-demand High-demand consumers take 10 consumers take 14 pictures $50 $2 $2 Quantity 14 16 Chapter 8: Commodity Bundling and Tie-In Sales 10 12 Quantity 20

Tie-in sales example 3 • This is okay but there may be room for improvement • Redesign the camera to tie the camera and the film – technological change that makes the camera work only with the firm’s film cartridge • Suppose that the firm can produce film at a cost of $2 per picture • Implement a tying strategy that makes it impossible to use the camera without this film Chapter 8: Commodity Bundling and Tie-In Sales 21

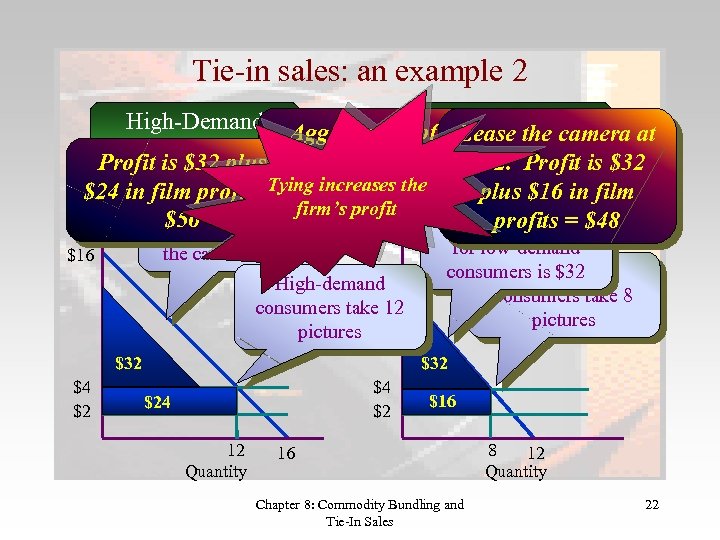

Tie-in sales: an example 2 High-Demand Aggregate profit is now the camera at Low-Demand Lease Consumers $48, 000 + $56, 000 = Profit is $32 plus $32. $104, 000 plus $16 Q $24 Demand: P = 16 - Q in film profits Tying increases the Demand: P = 12 -in film = Each high-demand firm’s profit $56 profits = $48 Consumer surplus consumer will lease $ $ the camera at $32 High-demand $12 consumers take 12 pictures $16 $32 $4 $2 for low-demand consumers is $32 Low-demand consumers take 8 pictures $32 $4 $2 $24 12 Quantity $16 16 Chapter 8: Commodity Bundling and Tie-In Sales 8 12 Quantity 22

Tie-in sales example 3 • Why does tying increase profits? – high-demand consumers are offered a quantity discount under both the original and the tied lease arrangement – but tying solves the identification and arbitrage problems • • film exploits monopoly in film supply high-demand consumers are revealed by their film purchases quantity discount is then used to increase profit arbitrage is not an issue: both types of consumers pay the same lease and the same unit price for film Chapter 8: Commodity Bundling and Tie-In Sales 23

Tie-in sales example 4 • Can the firm do even better? • Redesign the camera so that the film cartridge is integral – offer two types of integrated camera/film package: high capacity and low capacity – what capacities? • This is similar to second-degree price discrimination – design two cameras with socially efficient capacities: 10 picture and 14 picture – lease these as integrated packages Chapter 8: Commodity Bundling and Tie-In Sales 24

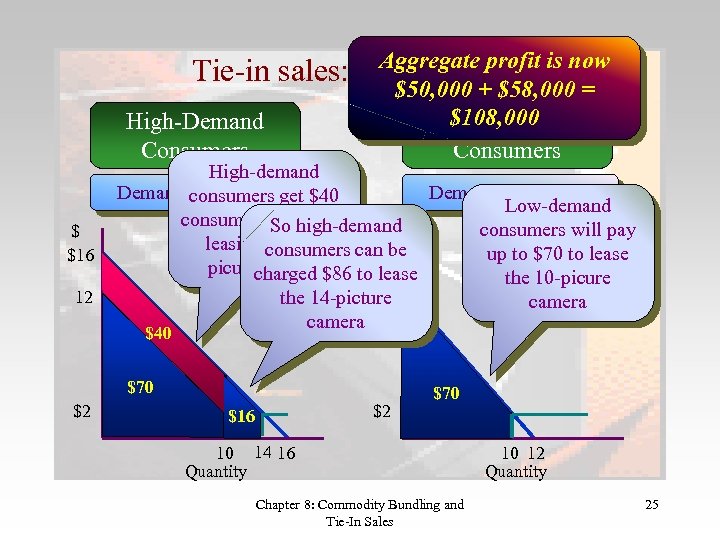

Tie-in sales: High-Demand Consumers $ $16 12 Aggregate profit is now an $50, 000 + $58, 000 = example 2 $108, 000 Low-Demand Consumers High-demand Demand: consumers get $40 P = 16 - Q Demand: P = 12 - Q Low-demand consumer surplus by So high-demand consumers will pay $ leasing consumers can be the 10 up to $70 to lease picurecharged $86 to lease camera the 10 -picure $12 the 14 -picture camera $40 $70 $2 $2 $16 $70 10 14 16 Quantity Chapter 8: Commodity Bundling and Tie-In Sales 10 12 Quantity 25

Complementary goods • Complementary goods are goods that are consumed together – nuts and bolts – PC monitors and computer processors • How should these goods be produced? • How should they be priced? • Take the example of nuts and bolts – these are perfect complements: need one of each! • Assume that demand for nut/bolt pairs is: Q = A - (PB + PN) Chapter 8: Commodity Bundling and Tie-In Sales 26

Complementary goods 2 This demand curve can be written individually for nuts and bolts For bolts: QB = A - (PB + PN) For nuts: QN = A - (PB + PN) This gives the inverse demands: PB = (A - PN) - QB PN = (A - PB) - QN These allow us to calculate profit maximizing prices Assume that nuts and bolts are produced by independent firms Each sets MR = MC to maximize profits MRB = (A - PN) - 2 QB MRN = (A - PB) - 2 QN Assume MCB = MCN = 0 Chapter 8: Commodity Bundling and Tie-In Sales 27

Complementary goods 3 Therefore QB = (A - PN)/2 and PB = (A - PN) - QB = (A - PN)/2 by a symmetric argument PN = (A - PB)/2 The price set by each firm is affected by the price set by the other firm In equilibrium the price set by the two firms must be consistent Chapter 8: Commodity Bundling and Tie-In Sales 28

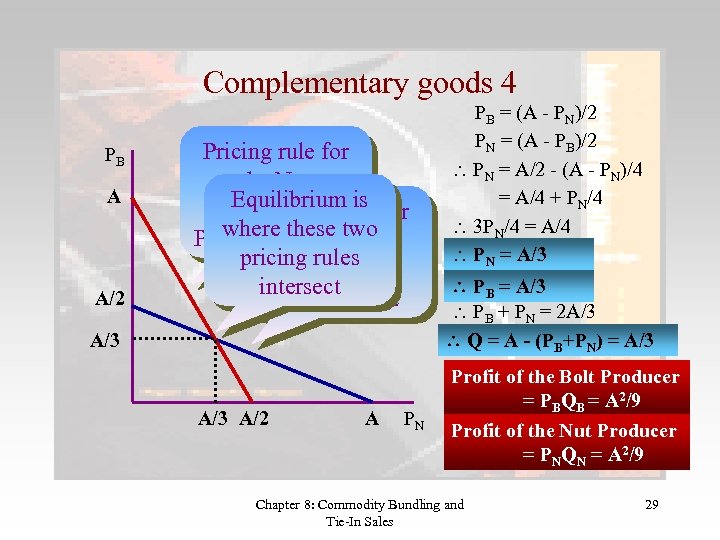

Complementary goods 4 PB A A/2 Pricing rule for the Nut Equilibrium is Producer: rule for Pricing PN where these. Bolt = (A - PB)/2 two the pricing rules Producer: intersect PB = (A - PN)/2 A/3 A/2 A PN PB = (A - PN)/2 PN = (A - PB)/2 PN = A/2 - (A - PN)/4 = A/4 + PN/4 3 PN/4 = A/4 PN = A/3 PB + PN = 2 A/3 Q = A - (PB+PN) = A/3 Profit of the Bolt Producer = PBQB = A 2/9 Profit of the Nut Producer = PNQN = A 2/9 Chapter 8: Commodity Bundling and Tie-In Sales 29

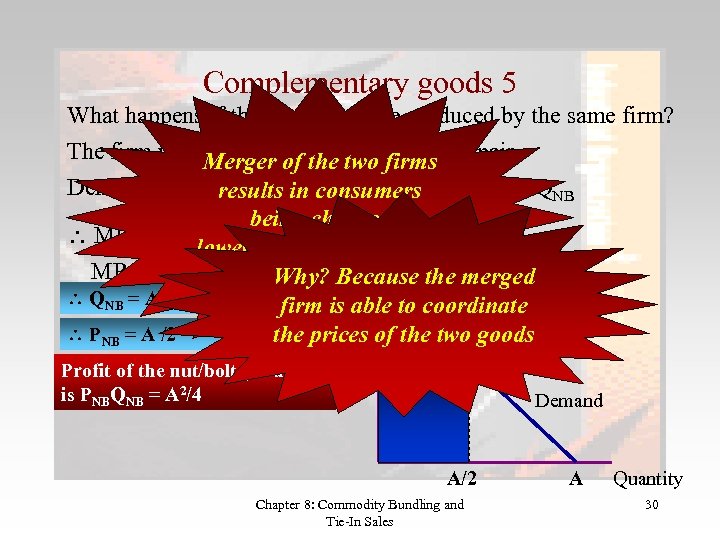

Complementary goods 5 What happens if the two goods are produced by the same firm? The firm will set a price PNB twoa nut/bolt pair. Merger of the for firms Demand is nowresults A - PNB so that PNB = A - QNB = in consumers being charged $ MRNB = A - 2 QNB lower prices and the firm MR = MC =making greater. Aprofits merged 0 Why? Because the QNB = A /2 firm is able to coordinate PNB = A /2 the prices of the two goods Profit of the nut/bolt producer is PNBQNB = A 2/4 A/2 Demand MR A/2 Chapter 8: Commodity Bundling and Tie-In Sales A Quantity 30

Complementary goods 6 • Don’t necessarily need a merger to get these benefits – product network • ATM networks • airline booking systems – one of the markets is competitive • price equals marginal cost in this market • leads to the “merger” outcome • There may also be a countervailing force – network externalities • value of a good to consumers increases when more consumers use the good Chapter 8: Commodity Bundling and Tie-In Sales 31

Network externalities • Product complementarities can generate network effects – Windows and software applications • substantial economies of scale • strong network effects – leads to an applications barrier to entry • new operating system will sell only if applications are written for it • but… • So product complementarities can lead to monopoly power being extended Chapter 8: Commodity Bundling and Tie-In Sales 32

Anti-trust and bundling • The Microsoft case is central – accusation that used power in operating system (OS) to gain control of browser market by bundling browser into the OS – need to show • monopoly power in OS • OS and browser are separate products that do not need to be bundled • abuse of power to maintain or extend monopoly position – Microsoft argued that technology required integration – further argued that it was not “acting badly” • consumers would benefit from lower price because of the complementarity between OS and browser Chapter 8: Commodity Bundling and Tie-In Sales 33

Microsoft and Netscape • Complementarity products – – so merge? what if Netscape refuses? then Microsoft can develop its own browser MC ≈ 0 so competition in the browser market drives price close to zero – but then get the outcome of merger firm through competition • So Microsoft is not “acting badly” • But – JAVA allows applications to be run on Internet browsers – Netscape then constitutes a threat – need to reduce their market share Chapter 8: Commodity Bundling and Tie-In Sales 34

And now… • This view gained more force and support in Europe – bundling of Media Player into Windows – Competition Directorate found against Microsoft • no on appeal Chapter 8: Commodity Bundling and Tie-In Sales 35

Antitrust and tying arrangements • Tying arrangements have been the subject of extensive litigation • Current policy – tie-in violates antitrust laws if • there exists distinct products: tying product and tied one • firm tying the products has sufficient monopoly power in the tying market to force purchase of the tied good • tying arrangement forecloses or has the potential to foreclose a substantial volume of trade Chapter 8: Commodity Bundling and Tie-In Sales 36

b22d743f599474643118e687774436cb.ppt