2430991c9c268f775d03db757c0d6457.ppt

- Количество слайдов: 35

Commodities: How to Invest in the New Bull Market Presented by: David Cox, CFA, CMT, FCSI, FMA, BMath Portfolio Manager April 29, 2014 The National Club, Toronto, ON

What Do I Do? § Provide clients with a way to comfortably grow and protect wealth irrespective of the underlying state of global investment markets § Offer a comprehensive wealth planning approach 2

Who Am I? § Bachelor of Mathematics – University of Waterloo § My family recently relocated to Guelph after 13 years in B. C. § One of 206 dual holders, globally, of both the Chartered Financial Analyst (CFA) and Chartered Market Technician (CMT) designations § Passionate about the investment markets, skiing, golfing, wine, poker and music 3

My Beliefs § Buy & Hold DOES NOT work § Stocks/markets/assets go through bullish (rising) periods, which are followed by bearish (falling) periods – extract profits regularly § Holding equities in a bear market/downtrend is akin to financial suicide § ANYTHING is possible § Small losses are preferred to big losses 4

My Research Process Fundamental Technical My Process Macro Economic Quantitative 5

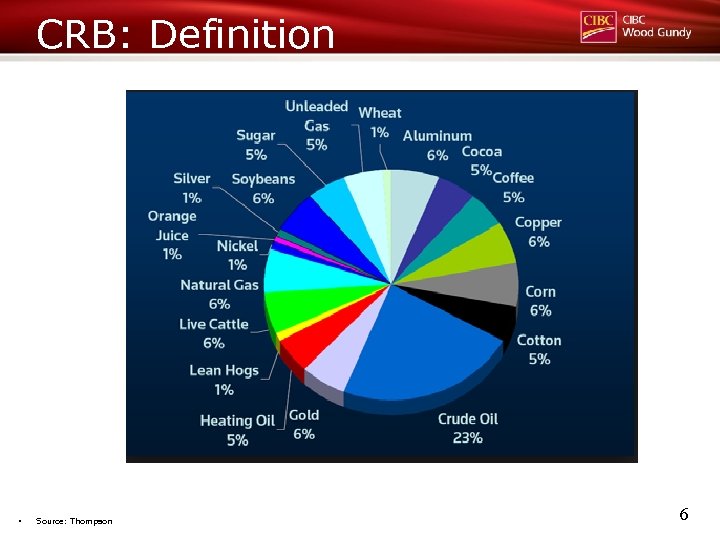

CRB: Definition § Source: Thompson 6

4 -Year Big Picture § Source: Metastock 7

Peak To Trough § Source: Metastock 8

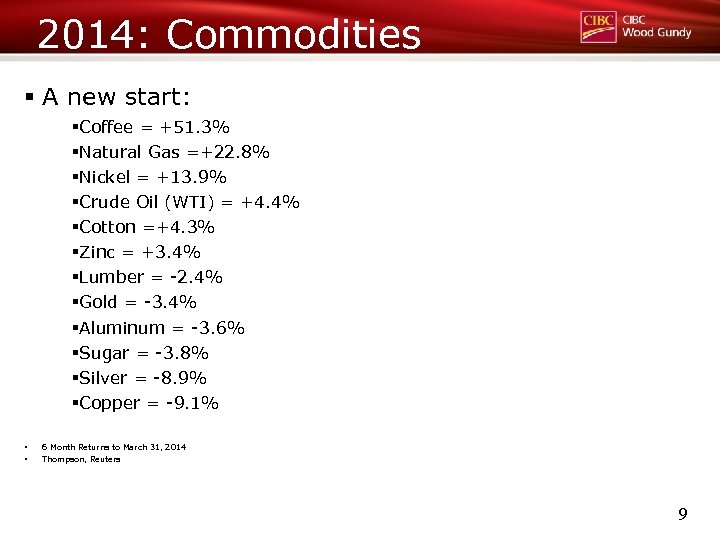

2014: Commodities § A new start: §Coffee = +51. 3% §Natural Gas =+22. 8% §Nickel = +13. 9% §Crude Oil (WTI) = +4. 4% §Cotton =+4. 3% §Zinc = +3. 4% §Lumber = -2. 4% §Gold = -3. 4% §Aluminum = -3. 6% §Sugar = -3. 8% §Silver = -8. 9% §Copper = -9. 1% § § 6 Month Returns to March 31, 2014 Thompson, Reuters 9

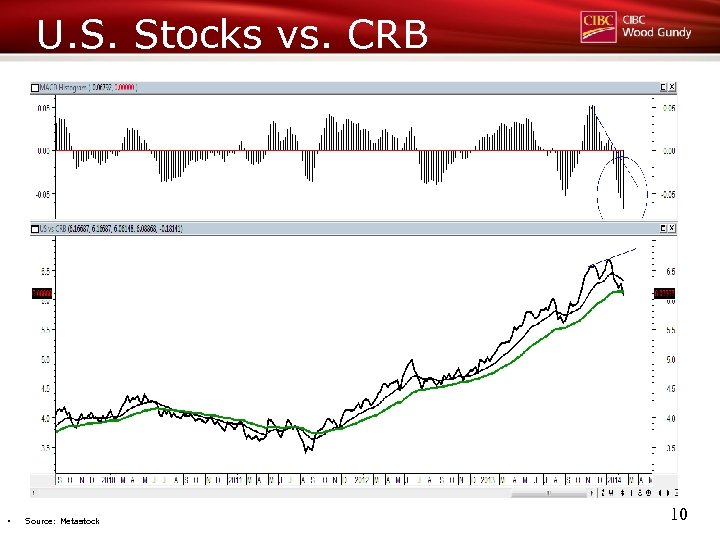

U. S. Stocks vs. CRB § Source: Metastock 10

Gold Prices: Weekly § Source: Metastock 11

Coal Prices: Weekly § Source: Metastock 12

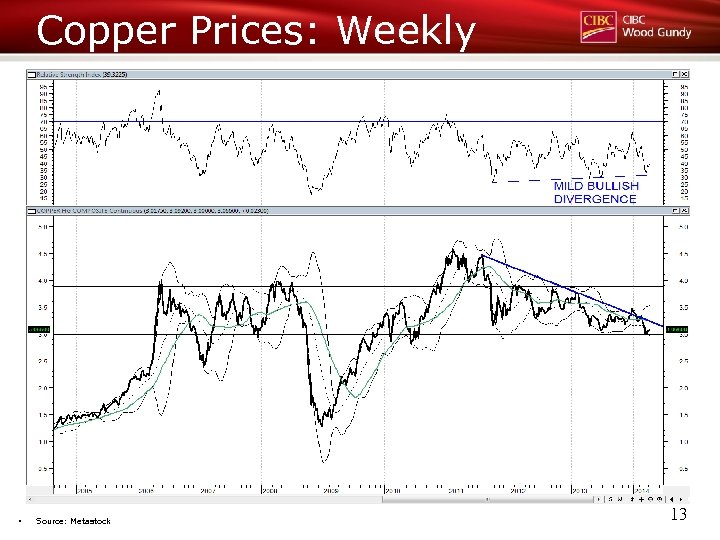

Copper Prices: Weekly § Source: Metastock 13

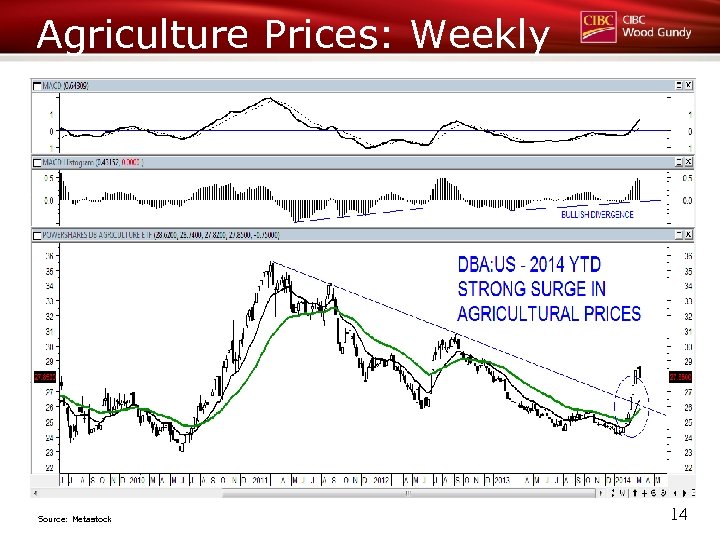

Agriculture Prices: Weekly Source: Metastock 14

TSX vs. World Source: Metastock 15

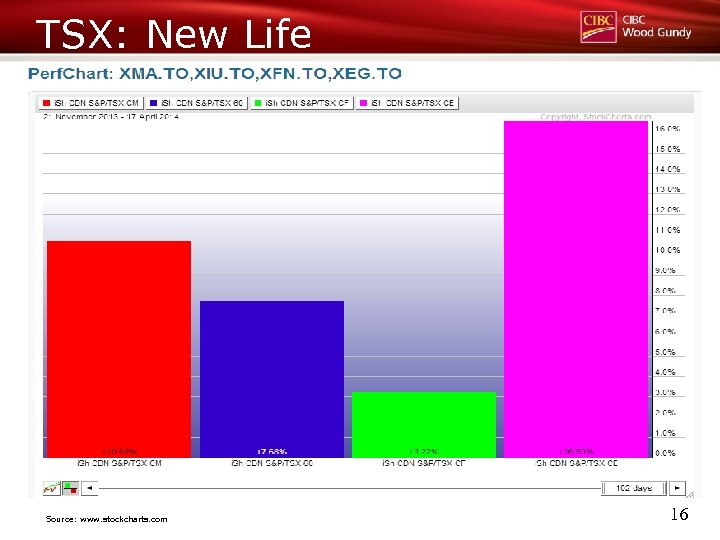

TSX: New Life Source: www. stockcharts. com 16

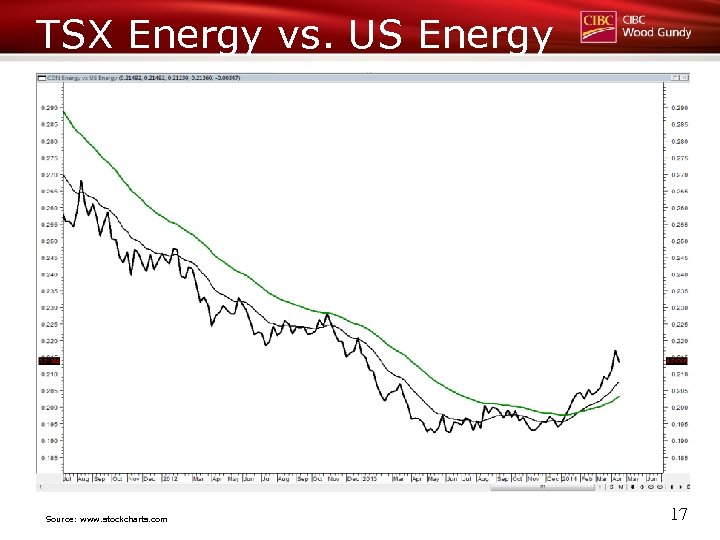

TSX Energy vs. US Energy Source: www. stockcharts. com 17

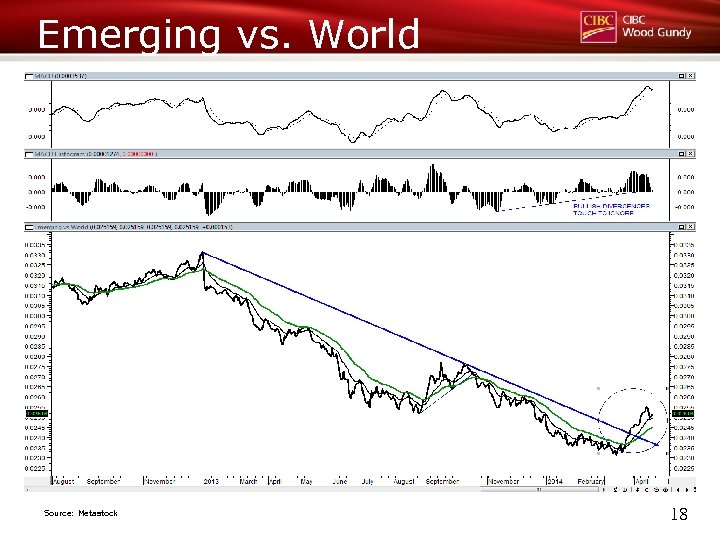

Emerging vs. World Source: Metastock 18

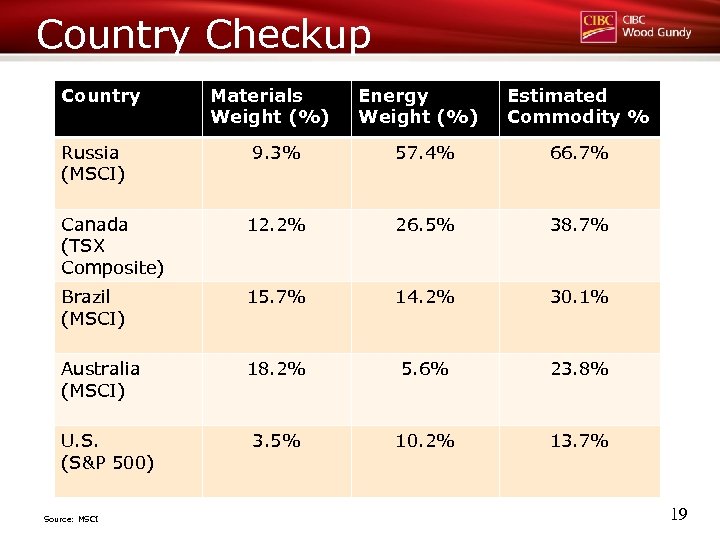

Country Checkup Country Russia (MSCI) Materials Weight (%) Energy Weight (%) Estimated Commodity % 9. 3% 57. 4% 66. 7% Canada (TSX Composite) 12. 2% 26. 5% 38. 7% Brazil (MSCI) 15. 7% 14. 2% 30. 1% Australia (MSCI) 18. 2% 5. 6% 23. 8% 3. 5% 10. 2% 13. 7% U. S. (S&P 500) Source: MSCI 19

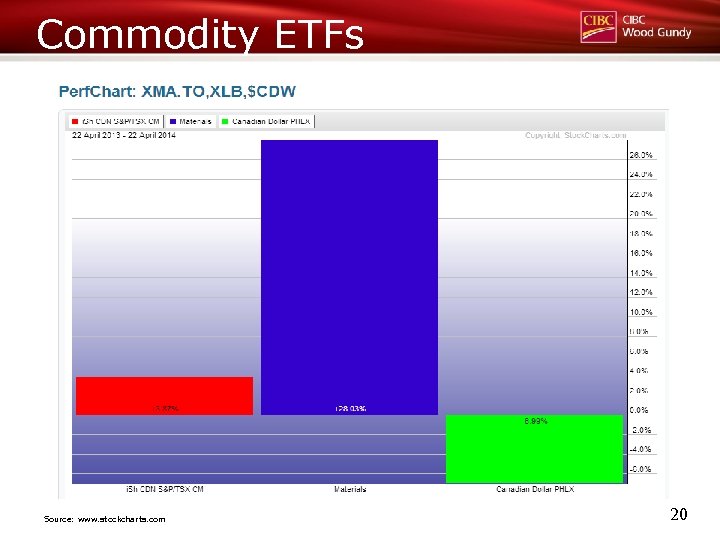

Commodity ETFs Source: www. stockcharts. com 20

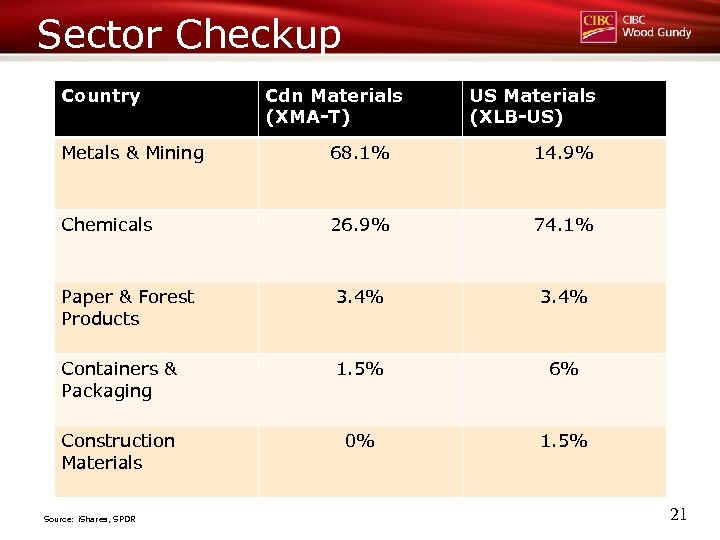

Sector Checkup Country Cdn Materials (XMA-T) US Materials (XLB-US) Metals & Mining 68. 1% 14. 9% Chemicals 26. 9% 74. 1% Paper & Forest Products 3. 4% Containers & Packaging 1. 5% 6% Construction Materials 0% 1. 5% Source: i. Shares, SPDR 21

U. S. Materials vs. World Source: Metastock 22

XMA: T – Top Holdings § 14. 9% Potash Corp. § 11. 0% Barrick Gold § 10. 5% Goldcorp § 6. 8% Agrium § 5. 2% First Quantum Minerals § 5. 0% Teck Resources § 4. 2% Silver Wheaton § 3. 5% Yamana Gold § 3. 4% Franco Nevada § 3. 2% Methanex Source: i. Shares 23

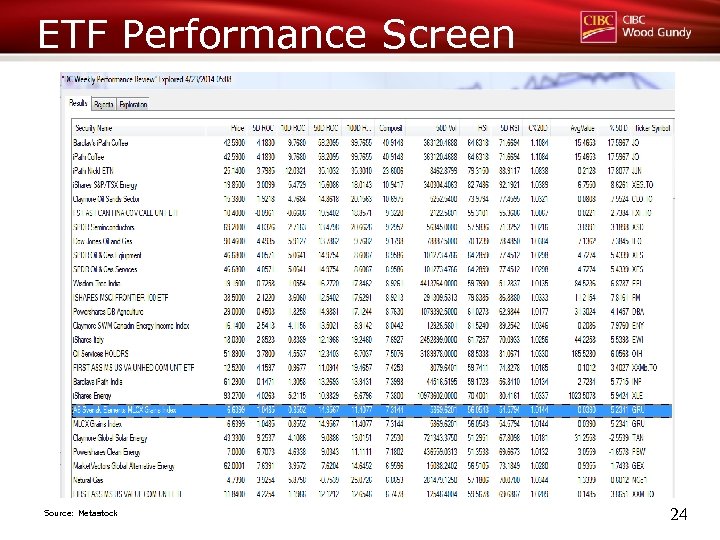

ETF Performance Screen Source: Metastock 24

Commodity ETFs § DBC-US § DJP-US § DBA-US § JJG-US § JJS-US § GLD-US § SLV-US 25

Commodity Stock ETFs § GDX-US – Gold § KOL-US - Coal § SLX-US – Steel § XME-US - Mining § MOO-US – Agriculture/Fertilizer § XES-US – Energy Services § NLR-US – Nuclear § TAN-US - Solar 26

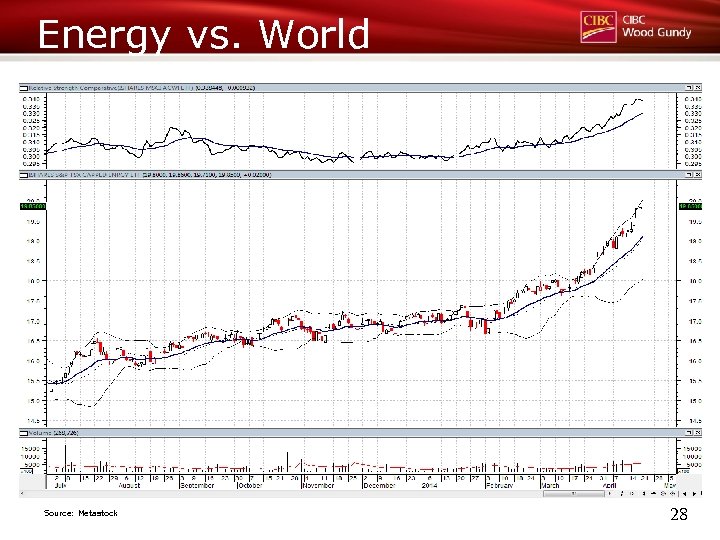

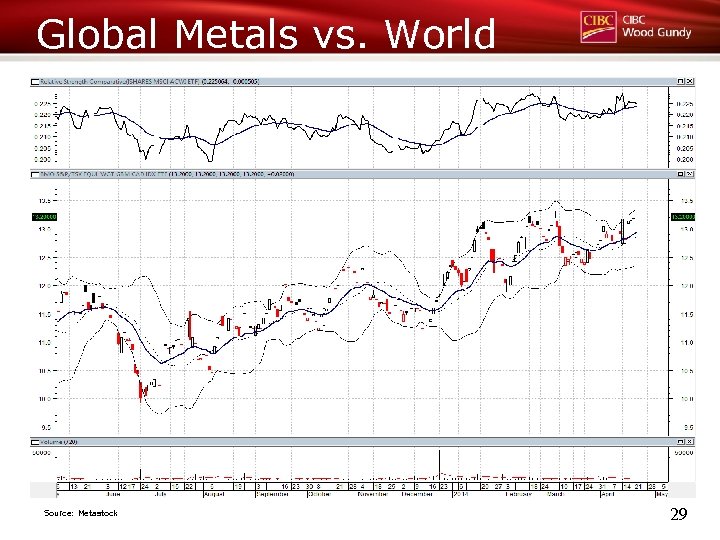

Are the Stocks Leading? § Look at the relative strength comparative charts 27

Energy vs. World Source: Metastock 28

Global Metals vs. World Source: Metastock 29

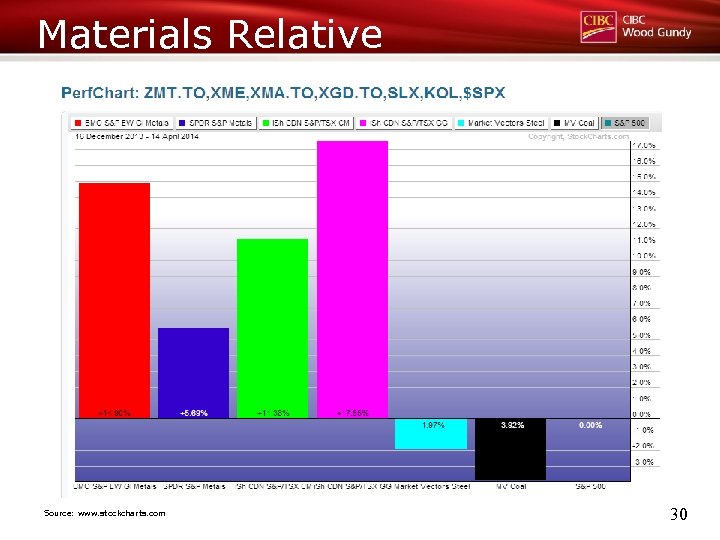

Materials Relative Source: www. stockcharts. com 30

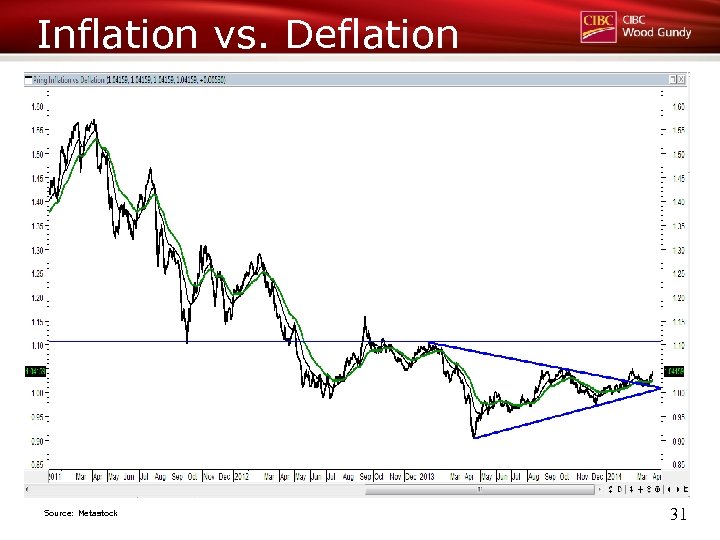

Inflation vs. Deflation Source: Metastock 31

Upcoming Seminars § “What Every Investor Ought To Know…” § Saturday, May 31 st – Burlington, ON (9 am-4 pm) § Email: events@markettradingconcepts. com for more details 32

Useful Stuff § Monthly Market Chit Chat” – monthly e-publication that discusses the risks and opportunities facing investors – email me to subscribe § Twitter: http: //www. twitter. com/David. Cox. WG § Facebook: http: //www. facebook. com/David. Cox. WG § Linked. In: http: //ca. linkedin. com/in/David. Cox. WG § www. davidcox. ca – a variety of seminars, webinars and publications are published along with David’s travel schedule 33

Questions & Answers 34

Thank You 42 Wyndham St. N, Suite 201 | Guelph | Ontario | N 1 H 4 E 6 (519) 823 -4411 | 1 855 -246 -4076 CIBC Wood Gundy is a division of CIBC World Markets Inc. , a subsidiary of CIBC and a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor. This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc. , their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2014.

2430991c9c268f775d03db757c0d6457.ppt