0f2bfa9bd20703339e0a47eae47abf72.ppt

- Количество слайдов: 155

Commercial Transactions Module 7 Electronic Commerce Summer 2016/17 ©MNoonan 2009

Commercial Transactions Module 7 Electronic Commerce Summer 2016/17 ©MNoonan 2009

This presentation and Copyright therein is the property of Maureen Noonan and is prepared for the benefit of students enrolled in the Commercial Transactions course conducted by the Law Extension Committee and is available for their individual study. Any other use or reproduction, including reproduction by those students for sale without consent is prohibited. ©MNoonan 2009

This presentation and Copyright therein is the property of Maureen Noonan and is prepared for the benefit of students enrolled in the Commercial Transactions course conducted by the Law Extension Committee and is available for their individual study. Any other use or reproduction, including reproduction by those students for sale without consent is prohibited. ©MNoonan 2009

In this module, we will look at e-commerce and related legal fields: -Communications in negotiations and contract formation -Relevance and application in legal practice and proceedings -Aspects of Contract in relation to Sale of goods and services -Data management and security, including privacy -Electronic commerce in action-electronic banking and payment methods-including their avenue of ADR. In assignment or examination questions, facts may occur in a physical or virtual environment, or both. This reflects real life and issues students will deal after completing their course. ©MNoonan 2009

In this module, we will look at e-commerce and related legal fields: -Communications in negotiations and contract formation -Relevance and application in legal practice and proceedings -Aspects of Contract in relation to Sale of goods and services -Data management and security, including privacy -Electronic commerce in action-electronic banking and payment methods-including their avenue of ADR. In assignment or examination questions, facts may occur in a physical or virtual environment, or both. This reflects real life and issues students will deal after completing their course. ©MNoonan 2009

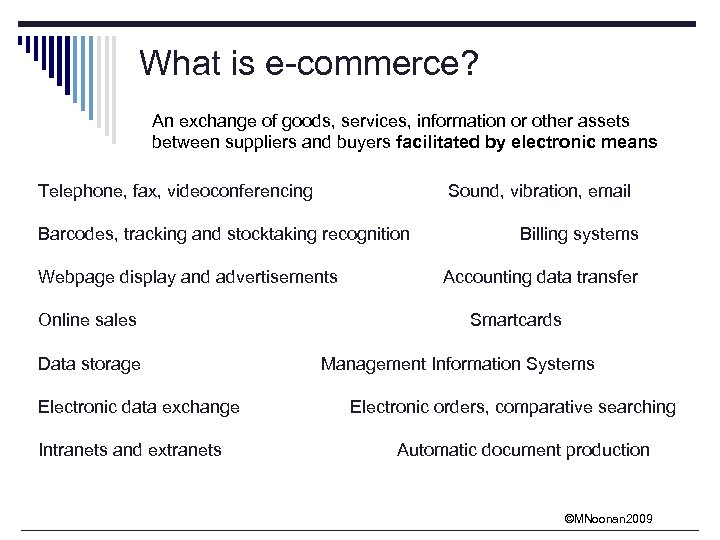

What is e-commerce? An exchange of goods, services, information or other assets between suppliers and buyers facilitated by electronic means Telephone, fax, videoconferencing Sound, vibration, email Barcodes, tracking and stocktaking recognition Webpage display and advertisements Online sales Data storage Electronic data exchange Intranets and extranets Billing systems Accounting data transfer Smartcards Management Information Systems Electronic orders, comparative searching Automatic document production ©MNoonan 2009

What is e-commerce? An exchange of goods, services, information or other assets between suppliers and buyers facilitated by electronic means Telephone, fax, videoconferencing Sound, vibration, email Barcodes, tracking and stocktaking recognition Webpage display and advertisements Online sales Data storage Electronic data exchange Intranets and extranets Billing systems Accounting data transfer Smartcards Management Information Systems Electronic orders, comparative searching Automatic document production ©MNoonan 2009

Electronic Commerce We can see Electronic Commerce at work in many ways - a communications perspective - a business process perspective - a service perspective - an online perspective - a transaction perspective - a legal perspective - a business-to-business and business-to-consumer perspective. ©MNoonan 2009

Electronic Commerce We can see Electronic Commerce at work in many ways - a communications perspective - a business process perspective - a service perspective - an online perspective - a transaction perspective - a legal perspective - a business-to-business and business-to-consumer perspective. ©MNoonan 2009

Communications What is communicated? To whom? How? Why? ©MNoonan 2009

Communications What is communicated? To whom? How? Why? ©MNoonan 2009

Communications Perspective From a communications perspective, electronic commerce is the delivery of information, products / services, or payments via telephone lines, computer networks, websites or any other electronic or wireless means. When looking at the arrangements in place, we normally look to contract law. For example, offer and acceptance may occur electronically via the telephone, or an exchange of emails or faxes. It can also be a service and ACL ss. 6063/(old s. 74 TPA) can be relevant. If misleading or deceptive s. 18 ACL can be very relevant. ©MNoonan 2009

Communications Perspective From a communications perspective, electronic commerce is the delivery of information, products / services, or payments via telephone lines, computer networks, websites or any other electronic or wireless means. When looking at the arrangements in place, we normally look to contract law. For example, offer and acceptance may occur electronically via the telephone, or an exchange of emails or faxes. It can also be a service and ACL ss. 6063/(old s. 74 TPA) can be relevant. If misleading or deceptive s. 18 ACL can be very relevant. ©MNoonan 2009

![Take Care-Visscher v. Maritime Union of Australia (No 6) [2014] NSWSC 350 In ecommerce Take Care-Visscher v. Maritime Union of Australia (No 6) [2014] NSWSC 350 In ecommerce](https://present5.com/presentation/0f2bfa9bd20703339e0a47eae47abf72/image-8.jpg) Take Care-Visscher v. Maritime Union of Australia (No 6) [2014] NSWSC 350 In ecommerce communications can include hyperlinked material. Upheld Mr. Visscher’s claim for defamation and confirmed Australian approach to liability for defamation via hyperlinked material. Feb 2011 during Cyclone Dianne, Mr. V, commanding an ocean tugboat made the decision to anchor at Shark Bay as the cyclone hit. MUA published an article expressing concern about this decision and included a hyperlink to an article in the Cootamundra Herald which expanded the concerns. The Herald article was found to contain defamatory imputations. Held that the MUA, by way of the hyperlink had accepted responsibility for the linked publication and at the very lest had adopted or promoted it. Note that hyperlinked content can be updated by third parties at any time, affecting your liability. ©MNoonan 2009

Take Care-Visscher v. Maritime Union of Australia (No 6) [2014] NSWSC 350 In ecommerce communications can include hyperlinked material. Upheld Mr. Visscher’s claim for defamation and confirmed Australian approach to liability for defamation via hyperlinked material. Feb 2011 during Cyclone Dianne, Mr. V, commanding an ocean tugboat made the decision to anchor at Shark Bay as the cyclone hit. MUA published an article expressing concern about this decision and included a hyperlink to an article in the Cootamundra Herald which expanded the concerns. The Herald article was found to contain defamatory imputations. Held that the MUA, by way of the hyperlink had accepted responsibility for the linked publication and at the very lest had adopted or promoted it. Note that hyperlinked content can be updated by third parties at any time, affecting your liability. ©MNoonan 2009

Communications As well as communication between individual parties, we should recognise the expanding role of electronic means in the dissemination of information or communication between multiple persons and networks. FOCUS---- social networks They pose problems for law enforcement-beyond national boundaries---e. g. a suspect name was suppressed by a court, but was already widely known via Facebook (murder of family at Kapunda). They also provide new opportunities-e. g. expanding investigative processes, gathering ideas or evidence, finding information and those with information, sorting information, serving legal process, targeted marketing, IP harvesting, new businesses using capabilities. ©MNoonan 2009

Communications As well as communication between individual parties, we should recognise the expanding role of electronic means in the dissemination of information or communication between multiple persons and networks. FOCUS---- social networks They pose problems for law enforcement-beyond national boundaries---e. g. a suspect name was suppressed by a court, but was already widely known via Facebook (murder of family at Kapunda). They also provide new opportunities-e. g. expanding investigative processes, gathering ideas or evidence, finding information and those with information, sorting information, serving legal process, targeted marketing, IP harvesting, new businesses using capabilities. ©MNoonan 2009

Liability and Social Media If a business uses social media as part of its marketing strategy, it needs to manage the risk of liability for misleading deceptive or defamatory words by ocarefully monitoring platforms (using people with the appropriate skills) and odealing with any dangerous material. o. Take care that use of social media is not in conflict with occupation or role. ©MNoonan 2009

Liability and Social Media If a business uses social media as part of its marketing strategy, it needs to manage the risk of liability for misleading deceptive or defamatory words by ocarefully monitoring platforms (using people with the appropriate skills) and odealing with any dangerous material. o. Take care that use of social media is not in conflict with occupation or role. ©MNoonan 2009

Lawyers and social media o In the UK, a juror contacted a defendant through o o Facebook during proceedings, used internet to conduct research, updated her page with inappropriate material…contempt. UK Magistrate tweeted details of criminal cases he had dealt with. Live streaming of court proceedings Court may order communication via social media Lawyers should resist using updates on Facebook to provide details of current cases to avoid prejudice to case or construct such updates carefully. E. g. class actions ©MNoonan 2009

Lawyers and social media o In the UK, a juror contacted a defendant through o o Facebook during proceedings, used internet to conduct research, updated her page with inappropriate material…contempt. UK Magistrate tweeted details of criminal cases he had dealt with. Live streaming of court proceedings Court may order communication via social media Lawyers should resist using updates on Facebook to provide details of current cases to avoid prejudice to case or construct such updates carefully. E. g. class actions ©MNoonan 2009

ACCC v. Allergy Pathway In 2009, ACCC took court action against a company for misleading and deceptive statements. A number of orders were made including undertakings by the company and its Director not to repeat the statements. In ACCC v. Allergy Pathway Pty Ltd (No 2)(2011) FCA 74, the ACCC again took action for contempt of court for material published on their website and publication on Twitter by means of links (admitted) and for testimonials posted by clients on the “wall” and “fan” page Allergy had set up on Facebook (denied). Federal court found Allergy had published the testimonials because it knew of the testimonials and although Allergy and the Director Kerr could have removed them, they did not. Fined $7, 500 each and ordered to pay ACCC’s costs and extensive orders for corrective advertising, including on Facebook and Twitter. ©MNoonan 2009

ACCC v. Allergy Pathway In 2009, ACCC took court action against a company for misleading and deceptive statements. A number of orders were made including undertakings by the company and its Director not to repeat the statements. In ACCC v. Allergy Pathway Pty Ltd (No 2)(2011) FCA 74, the ACCC again took action for contempt of court for material published on their website and publication on Twitter by means of links (admitted) and for testimonials posted by clients on the “wall” and “fan” page Allergy had set up on Facebook (denied). Federal court found Allergy had published the testimonials because it knew of the testimonials and although Allergy and the Director Kerr could have removed them, they did not. Fined $7, 500 each and ordered to pay ACCC’s costs and extensive orders for corrective advertising, including on Facebook and Twitter. ©MNoonan 2009

Social Media Policy Do businesses need a Policy? Many believe they do and have implemented them. E. g. Telstra “In brief, the 3 Rs ask that when engaging in social media you be clear about who you are representing, you take responsibility for ensuring that any references to Telstra are factually correct and accurate and do not breach confidentiality requirements and that you show respect for the individual and communities with which you interact” What if employees give away information, discuss business, staff, management on social media? See Data Management also. What if employees put an enterprise at risk of legal action? What if they are active on Linkedin during their employment and take those connections with them to the next employer? ©MNoonan 2009

Social Media Policy Do businesses need a Policy? Many believe they do and have implemented them. E. g. Telstra “In brief, the 3 Rs ask that when engaging in social media you be clear about who you are representing, you take responsibility for ensuring that any references to Telstra are factually correct and accurate and do not breach confidentiality requirements and that you show respect for the individual and communities with which you interact” What if employees give away information, discuss business, staff, management on social media? See Data Management also. What if employees put an enterprise at risk of legal action? What if they are active on Linkedin during their employment and take those connections with them to the next employer? ©MNoonan 2009

Activities on social media incompatible with work obligations In Bradford Pedley v. IPMS Pty Ltd T/A peckvonhartel [2013] FWC 4832 the Fair Work Commission upheld a complaint that an architect was using Linked. In to solicit business from clients of his employer in order to increase his private client basis for his own practice. He was dismissed and complained to FWC that his dismissal was unfair. Clearly incompatible with his employment contract So, private activity outside work hours not always “private”. ©MNoonan 2009

Activities on social media incompatible with work obligations In Bradford Pedley v. IPMS Pty Ltd T/A peckvonhartel [2013] FWC 4832 the Fair Work Commission upheld a complaint that an architect was using Linked. In to solicit business from clients of his employer in order to increase his private client basis for his own practice. He was dismissed and complained to FWC that his dismissal was unfair. Clearly incompatible with his employment contract So, private activity outside work hours not always “private”. ©MNoonan 2009

Social media issues o Beware that tweets, posts, comment etc may be defamatory or in contempt of court o There are risks that confidential information may be disclosed in such communications accidentally, or, on purpose. o Unintended client relationships may be created by communications with clients or colleagues. o Are Linked In profiles and contacts created by your employees your trade secrets or theirs? ©MNoonan 2009

Social media issues o Beware that tweets, posts, comment etc may be defamatory or in contempt of court o There are risks that confidential information may be disclosed in such communications accidentally, or, on purpose. o Unintended client relationships may be created by communications with clients or colleagues. o Are Linked In profiles and contacts created by your employees your trade secrets or theirs? ©MNoonan 2009

Employment contracts o What clauses /policies would you include regarding social media and its use? o Only use Linked. In for private use o Use specific branded profile set up by employer for benefit of employer only and not mix with private profile? o Delete employer related connections? Is this practical? o Request social media provider to preserve data? ©MNoonan 2009

Employment contracts o What clauses /policies would you include regarding social media and its use? o Only use Linked. In for private use o Use specific branded profile set up by employer for benefit of employer only and not mix with private profile? o Delete employer related connections? Is this practical? o Request social media provider to preserve data? ©MNoonan 2009

Workplace surveillance Common issues: Can a business implement electronic surveillance of employees? -to prevent theft, to monitor access, safety, to enable remote monitoring Can a business access private emails sent using workplace facilities-to use for disciplinary purposes or to collect evidence? ©MNoonan 2009

Workplace surveillance Common issues: Can a business implement electronic surveillance of employees? -to prevent theft, to monitor access, safety, to enable remote monitoring Can a business access private emails sent using workplace facilities-to use for disciplinary purposes or to collect evidence? ©MNoonan 2009

![Surveillance In NSW, Workplace Surveillance Act 2005 [NSW] 14 days notice required which indicates: Surveillance In NSW, Workplace Surveillance Act 2005 [NSW] 14 days notice required which indicates:](https://present5.com/presentation/0f2bfa9bd20703339e0a47eae47abf72/image-18.jpg) Surveillance In NSW, Workplace Surveillance Act 2005 [NSW] 14 days notice required which indicates: Kind of surveillance (e. g. camera) How it will be carried out When it will start Whether it will be continuous or intermittent Whether it will be for a specified time or always ©MNoonan 2009

Surveillance In NSW, Workplace Surveillance Act 2005 [NSW] 14 days notice required which indicates: Kind of surveillance (e. g. camera) How it will be carried out When it will start Whether it will be continuous or intermittent Whether it will be for a specified time or always ©MNoonan 2009

Email and Internet Policy o The usual policies state that the email and computer systems belong to the employer and employer reserves the right to monitor them. o The right to access private information in such systems and use the information is separate and must be gained by contract ©MNoonan 2009

Email and Internet Policy o The usual policies state that the email and computer systems belong to the employer and employer reserves the right to monitor them. o The right to access private information in such systems and use the information is separate and must be gained by contract ©MNoonan 2009

Venting on social media Seafolly P/L v. Madden Ms M thought she had original swimwear designs. She noticed a Seafolly catalogue with designs similar to hers and took to Facebook posting…”the most sincere form of flattery”…plus photos of her designs next to the Seafolly designs and comments…”seriously, almost an entire line-line ripoff of my Shipwrecked collection”…and emailed media. Ms M liable for misleading and deceptive conduct. She could have done some simple fact checking before venting…did not care whether statements were true or false. After seeing her Facebook posts, Seafolly had issued press releases describing her claims as “completely false and without foundation” and “made maliciously to injury Seafolly”. Ms M sued S for defamation. S also succeeded on defamation claim as Court found press releases justified as true in substance and fact. Moral of the story…. check your facts before taking to Facebook or Twitter. ©MNoonan 2009

Venting on social media Seafolly P/L v. Madden Ms M thought she had original swimwear designs. She noticed a Seafolly catalogue with designs similar to hers and took to Facebook posting…”the most sincere form of flattery”…plus photos of her designs next to the Seafolly designs and comments…”seriously, almost an entire line-line ripoff of my Shipwrecked collection”…and emailed media. Ms M liable for misleading and deceptive conduct. She could have done some simple fact checking before venting…did not care whether statements were true or false. After seeing her Facebook posts, Seafolly had issued press releases describing her claims as “completely false and without foundation” and “made maliciously to injury Seafolly”. Ms M sued S for defamation. S also succeeded on defamation claim as Court found press releases justified as true in substance and fact. Moral of the story…. check your facts before taking to Facebook or Twitter. ©MNoonan 2009

Legal practice and procedure Increasing use of ecommerce in all aspects-filing, serving, dispute resolution, noticeboards, analysis of discovery documents, communications. Development of interaction and delivery platforms. Lawyers will need more than basic knowledge in future as technology platforms become more important in delivery of legal services. Scope for lawyers with creativity, programming and application skills and training to specialise. ©MNoonan 2009

Legal practice and procedure Increasing use of ecommerce in all aspects-filing, serving, dispute resolution, noticeboards, analysis of discovery documents, communications. Development of interaction and delivery platforms. Lawyers will need more than basic knowledge in future as technology platforms become more important in delivery of legal services. Scope for lawyers with creativity, programming and application skills and training to specialise. ©MNoonan 2009

Legal Perspective/Issues arising v Applications to court and other dispute resolution processes e. g. Electronic service, electronic discovery, gathering information, publicising/linking participants in class action proceedings, remote proceedings, evidence by videolink and decisions. v Evidence Act provisions about best evidence. Other evidentiary Matters including elements of contract formation, effect of service of notices by electronic means, attribution of electronic conduct and Intellectual property issues. v When does an electronic signature suffice? v Consumer protection in relation to business-to-consumer transactions or business-to-business (small business) transactions carried out electronically, rather than physically. Consider the role of the End User Licence Agreement for these transactions. o Potential liability e. g. platforms-auctions, Google ©MNoonan 2009

Legal Perspective/Issues arising v Applications to court and other dispute resolution processes e. g. Electronic service, electronic discovery, gathering information, publicising/linking participants in class action proceedings, remote proceedings, evidence by videolink and decisions. v Evidence Act provisions about best evidence. Other evidentiary Matters including elements of contract formation, effect of service of notices by electronic means, attribution of electronic conduct and Intellectual property issues. v When does an electronic signature suffice? v Consumer protection in relation to business-to-consumer transactions or business-to-business (small business) transactions carried out electronically, rather than physically. Consider the role of the End User Licence Agreement for these transactions. o Potential liability e. g. platforms-auctions, Google ©MNoonan 2009

Service of legal documents o Generally, in NSW personal service is required for originating process, such as a statement of claim. (See Uniform Civil Procedure Rules 2005 NSW). o Sometimes this is not possible because the party to be served cannot be located or is a celebrity surrounded by security cordons. o Substituted service is possible by order of the court-methods? -post to last address-post on electronic Facebook page? ©MNoonan 2009

Service of legal documents o Generally, in NSW personal service is required for originating process, such as a statement of claim. (See Uniform Civil Procedure Rules 2005 NSW). o Sometimes this is not possible because the party to be served cannot be located or is a celebrity surrounded by security cordons. o Substituted service is possible by order of the court-methods? -post to last address-post on electronic Facebook page? ©MNoonan 2009

Service on Facebook There are cases where courts have permitted or refused substituted service via social network sites. If the court is satisfied that personal service is impracticable and the site is that of the person, they are likely to grant service. However, if they are not satisfied that a party created a particular page, because identity can be mimicked, they are likely to decline. ©MNoonan 2009

Service on Facebook There are cases where courts have permitted or refused substituted service via social network sites. If the court is satisfied that personal service is impracticable and the site is that of the person, they are likely to grant service. However, if they are not satisfied that a party created a particular page, because identity can be mimicked, they are likely to decline. ©MNoonan 2009

Service via Facebook In September 2010 Victorian police were asked to assist in service of an intervention order where an individual was being bullied via Facebook…cyberbullying. All papers etc were typed out into private messages and sent to his account. In addition, a video of Senior Constable Walton reading the order was also sent. ©MNoonan 2009

Service via Facebook In September 2010 Victorian police were asked to assist in service of an intervention order where an individual was being bullied via Facebook…cyberbullying. All papers etc were typed out into private messages and sent to his account. In addition, a video of Senior Constable Walton reading the order was also sent. ©MNoonan 2009

Service on Facebook approved MKM Capital P/L v. Cobo & Poyser, unreported judgement of ACT Supreme Court. Substituted service permitted by lender on two defaulting mortgagees. Lenders lawyers able to match personal ID by way of their Facebook profiles…e. g. birth dates, email addresses. In May 2012, NSW DC permitted promoter of an Australian music festival to serve a statement of claim on Flo Rida, an American rapper, via Facebook. He did not appear despite being paid a $55, 000 performance fee. ©MNoonan 2009

Service on Facebook approved MKM Capital P/L v. Cobo & Poyser, unreported judgement of ACT Supreme Court. Substituted service permitted by lender on two defaulting mortgagees. Lenders lawyers able to match personal ID by way of their Facebook profiles…e. g. birth dates, email addresses. In May 2012, NSW DC permitted promoter of an Australian music festival to serve a statement of claim on Flo Rida, an American rapper, via Facebook. He did not appear despite being paid a $55, 000 performance fee. ©MNoonan 2009

![Service on Facebook denied o Citigroup P/L v. Weerakoon [2008] QDC 174. QLD D Service on Facebook denied o Citigroup P/L v. Weerakoon [2008] QDC 174. QLD D](https://present5.com/presentation/0f2bfa9bd20703339e0a47eae47abf72/image-27.jpg) Service on Facebook denied o Citigroup P/L v. Weerakoon [2008] QDC 174. QLD D C refused to permit substituted service via Facebook, but permitted it via post to last known address. Judge was not satisfied that some of the information on the Facebook page “does not show me with any real force that the person who created the Facebook page might indeed be the defendant, even though practically speaking it may well indeed be the person who is the defendant”. ©MNoonan 2009

Service on Facebook denied o Citigroup P/L v. Weerakoon [2008] QDC 174. QLD D C refused to permit substituted service via Facebook, but permitted it via post to last known address. Judge was not satisfied that some of the information on the Facebook page “does not show me with any real force that the person who created the Facebook page might indeed be the defendant, even though practically speaking it may well indeed be the person who is the defendant”. ©MNoonan 2009

Taken from the news-1 Aug 14 Texan woman suing Facebook for $123 m claiming it failed to remove a “revenge porn” profile created in her name by a former friend…which contained photoshopped pictures of her head on naked bodies…”clearly offensive, disparaging and defamatory”…accused the social media site of serious privacy violation for failing to deactivate the profile……identity of poster revealed when Houston police subpoenaed Facebook to reveal the creator of the profile…damages of $123 m calculated by charging 10 c for every one of Facebook’s 1. 23 billion users. NOTE that US privacy laws different to ours. This example clearly shows how people can create a false profile pretending to be someone else. ©MNoonan 2009

Taken from the news-1 Aug 14 Texan woman suing Facebook for $123 m claiming it failed to remove a “revenge porn” profile created in her name by a former friend…which contained photoshopped pictures of her head on naked bodies…”clearly offensive, disparaging and defamatory”…accused the social media site of serious privacy violation for failing to deactivate the profile……identity of poster revealed when Houston police subpoenaed Facebook to reveal the creator of the profile…damages of $123 m calculated by charging 10 c for every one of Facebook’s 1. 23 billion users. NOTE that US privacy laws different to ours. This example clearly shows how people can create a false profile pretending to be someone else. ©MNoonan 2009

Electronic contracts and changes in conveyancing practice Colin Biggers & Paisley has reported dramatic slashing of costs and improving efficiency (up to 90%) of high volume contract production, transmission, signing, receipt storage, archiving. Docu. Sign digital transaction platform eliminates the need to manually check each page and improves security. Purchasers can read and sign on any digital device, anywhere in the world and soft copies are immediately available for download to all parties. ©MNoonan 2009

Electronic contracts and changes in conveyancing practice Colin Biggers & Paisley has reported dramatic slashing of costs and improving efficiency (up to 90%) of high volume contract production, transmission, signing, receipt storage, archiving. Docu. Sign digital transaction platform eliminates the need to manually check each page and improves security. Purchasers can read and sign on any digital device, anywhere in the world and soft copies are immediately available for download to all parties. ©MNoonan 2009

Aspects of contract Sales and supplies of goods and services. ©MNoonan 2009

Aspects of contract Sales and supplies of goods and services. ©MNoonan 2009

Business Process Perspective From a business process perspective, electronic commerce is the application of technology to the automation of business transactions and work flows…e. g. ordering processes, payments, machine software. In order to analyse the process/transactions for legal purposes, we need to understand what is being achieved, the steps and the relationships. If a new way of doing something, it may be IP, protected by Copyright and/or be entitled to a Patent. E. g. Amazon. com ordering system, subjects of Apple/Samsung patent disputes. ©MNoonan 2009

Business Process Perspective From a business process perspective, electronic commerce is the application of technology to the automation of business transactions and work flows…e. g. ordering processes, payments, machine software. In order to analyse the process/transactions for legal purposes, we need to understand what is being achieved, the steps and the relationships. If a new way of doing something, it may be IP, protected by Copyright and/or be entitled to a Patent. E. g. Amazon. com ordering system, subjects of Apple/Samsung patent disputes. ©MNoonan 2009

Service Perspective From a service perspective, electronic commerce is a tool that addresses the desire of firms, consumers and management to cut service costs while improving the quality of goods and increasing the speed of service or delivery. ©MNoonan 2009

Service Perspective From a service perspective, electronic commerce is a tool that addresses the desire of firms, consumers and management to cut service costs while improving the quality of goods and increasing the speed of service or delivery. ©MNoonan 2009

Online Perspective From an online perspective, electronic commerce provides the capability of buying and selling products, services and information on the internet. This can save businesses from having the costs and inconvenience associated with physical premises and permit them to have a much wider reach. By use of logistical services…. transport and storage…that need not be theirs…. they can have large operations and cover wide areas more easily than formerly. They can also sometimes do things which were not possible /very difficult before-e. g. online auctions, avoid GST. There can also be new dangers for business e. g. Hacktivism, loss of information/data. ©MNoonan 2009

Online Perspective From an online perspective, electronic commerce provides the capability of buying and selling products, services and information on the internet. This can save businesses from having the costs and inconvenience associated with physical premises and permit them to have a much wider reach. By use of logistical services…. transport and storage…that need not be theirs…. they can have large operations and cover wide areas more easily than formerly. They can also sometimes do things which were not possible /very difficult before-e. g. online auctions, avoid GST. There can also be new dangers for business e. g. Hacktivism, loss of information/data. ©MNoonan 2009

New businesses and new legal challenges Consider Qui. Bids business model. o It is different to normal auction houses in that it charges 60 c to customers each time they bid. o The amount collected enables them to sell products for less than retail. A marketing gimmick? o It combines a game with an auction…working out what to bid and how many times is the game. Each time someone bids, no more than 20 c added to auction clock. Last person to bid claims the right to purchase the item at the discounted price. Those who lose have the option to purchase at the retail price (less the amount they spent on bidding). ©MNoonan 2009

New businesses and new legal challenges Consider Qui. Bids business model. o It is different to normal auction houses in that it charges 60 c to customers each time they bid. o The amount collected enables them to sell products for less than retail. A marketing gimmick? o It combines a game with an auction…working out what to bid and how many times is the game. Each time someone bids, no more than 20 c added to auction clock. Last person to bid claims the right to purchase the item at the discounted price. Those who lose have the option to purchase at the retail price (less the amount they spent on bidding). ©MNoonan 2009

Reflection on new businesses and legal complications which can arise. UBER A recent article discussed the link between a Microsoft Windows 10 app and Uber…voice related…easier to tell the app by voice that I need an Uber ride than manipulate fingers. Increasing link between software and other functions-e. g. assisted parking, cruise control, driverless cars, remote control of household appliances and services, implanted health devices. ©MNoonan 2009

Reflection on new businesses and legal complications which can arise. UBER A recent article discussed the link between a Microsoft Windows 10 app and Uber…voice related…easier to tell the app by voice that I need an Uber ride than manipulate fingers. Increasing link between software and other functions-e. g. assisted parking, cruise control, driverless cars, remote control of household appliances and services, implanted health devices. ©MNoonan 2009

UBER again Is UBER a taxi company or a platform that enables customers to find drivers? Raises issues regarding regulation and competition with other business models providing the same or similar services. Court of Justice of the European Union to decide question for Europe in approx. April 17. Is AIRbnb a hotel chain or a platform? ©MNoonan 2009

UBER again Is UBER a taxi company or a platform that enables customers to find drivers? Raises issues regarding regulation and competition with other business models providing the same or similar services. Court of Justice of the European Union to decide question for Europe in approx. April 17. Is AIRbnb a hotel chain or a platform? ©MNoonan 2009

E-Commerce - Contract Formation · · · · Ways of forming contracts Exchange of written correspondence by post, fax Oral in person or by telephone Written formal agreement or Exchange of emails Acceptance of an offer by conduct Types of Contracts Sale/supply of physical goods Licences (e. g. software, music, film) Supply of services…banking, shares, advice. Combination contracts ©MNoonan 2009

E-Commerce - Contract Formation · · · · Ways of forming contracts Exchange of written correspondence by post, fax Oral in person or by telephone Written formal agreement or Exchange of emails Acceptance of an offer by conduct Types of Contracts Sale/supply of physical goods Licences (e. g. software, music, film) Supply of services…banking, shares, advice. Combination contracts ©MNoonan 2009

Contract formation - exchange of emails Evolving area Caution is required with communications during negotiations lest a court finds a contract has been formed prior to the formal contract being signed, even where specified in an email as “subject to contract”. See the following non NSW cases. Stellard Pty Ltd & Anor v. North Queensland Fuel Pty Ltd [2015] QSC 119 Vantage Systems Pty Ltd v. Priolo Corporation Pty Ltd [2015] WASC 21 ©MNoonan 2009

Contract formation - exchange of emails Evolving area Caution is required with communications during negotiations lest a court finds a contract has been formed prior to the formal contract being signed, even where specified in an email as “subject to contract”. See the following non NSW cases. Stellard Pty Ltd & Anor v. North Queensland Fuel Pty Ltd [2015] QSC 119 Vantage Systems Pty Ltd v. Priolo Corporation Pty Ltd [2015] WASC 21 ©MNoonan 2009

![Stellard Pty Ltd v. North Queensland Fuel Pty Ltd [2015]QSC 119 Negotiations to buy Stellard Pty Ltd v. North Queensland Fuel Pty Ltd [2015]QSC 119 Negotiations to buy](https://present5.com/presentation/0f2bfa9bd20703339e0a47eae47abf72/image-39.jpg) Stellard Pty Ltd v. North Queensland Fuel Pty Ltd [2015]QSC 119 Negotiations to buy service station (ss) +freehold land. 30/10 -V emailed draft contract (C) -willing to sell at price, deposit amt, stock at cost, fuel tank, line testing, environmental investigations, settlement place and date. 31/10 -telephone conversations-use one C for ss & land, and C in form supplied. V asked for offer in writing. P sent email with offer “subject to contract”. 45 minutes later, V sent email confirming acceptance but subject to execution of C with agreed amendments. 3/11 -P emailed amended contract identifying purchaser, removing a guarantee and adding special conditions re due diligence and environmental investigations. 7/11 V emailed that it was not accepted as it contained changes that were not agreed and sold it to someone else. P argued that 30 and 31/10 emails and conversations were binding C. V said not. Court found YES for P after looking at all surrounding emails, conduct and previous conversations. ©MNoonan 2009

Stellard Pty Ltd v. North Queensland Fuel Pty Ltd [2015]QSC 119 Negotiations to buy service station (ss) +freehold land. 30/10 -V emailed draft contract (C) -willing to sell at price, deposit amt, stock at cost, fuel tank, line testing, environmental investigations, settlement place and date. 31/10 -telephone conversations-use one C for ss & land, and C in form supplied. V asked for offer in writing. P sent email with offer “subject to contract”. 45 minutes later, V sent email confirming acceptance but subject to execution of C with agreed amendments. 3/11 -P emailed amended contract identifying purchaser, removing a guarantee and adding special conditions re due diligence and environmental investigations. 7/11 V emailed that it was not accepted as it contained changes that were not agreed and sold it to someone else. P argued that 30 and 31/10 emails and conversations were binding C. V said not. Court found YES for P after looking at all surrounding emails, conduct and previous conversations. ©MNoonan 2009

How do we protect a V in a similar situation? Be very clear at the beginning of negotiations that V will not be bound in any way until final contract agreed, signed and exchanged. Note the issues that can arise with this…. saying things that one does not think can be binding…. but might be vulnerable to s. 18 ACL claims. ©MNoonan 2009

How do we protect a V in a similar situation? Be very clear at the beginning of negotiations that V will not be bound in any way until final contract agreed, signed and exchanged. Note the issues that can arise with this…. saying things that one does not think can be binding…. but might be vulnerable to s. 18 ACL claims. ©MNoonan 2009

![Vantage Systems Pty Ltd v. Priolo Corporation Pty Ltd [2015] WASC 21 Landlord and Vantage Systems Pty Ltd v. Priolo Corporation Pty Ltd [2015] WASC 21 Landlord and](https://present5.com/presentation/0f2bfa9bd20703339e0a47eae47abf72/image-41.jpg) Vantage Systems Pty Ltd v. Priolo Corporation Pty Ltd [2015] WASC 21 Landlord and Tenant negotiating renewal by email. Found to be a binding agreement, despite subsequent negotiations, dealings and communications. Intention to create contractual relations-objective, not subjective test…. previous conversations, email exchanges and surrounding circumstances. ©MNoonan 2009

Vantage Systems Pty Ltd v. Priolo Corporation Pty Ltd [2015] WASC 21 Landlord and Tenant negotiating renewal by email. Found to be a binding agreement, despite subsequent negotiations, dealings and communications. Intention to create contractual relations-objective, not subjective test…. previous conversations, email exchanges and surrounding circumstances. ©MNoonan 2009

Formation of contract-From the news 9/8/2013 Daily Telegraph London Dmitry Argarkov was sent a letter offering him a credit card in the usual way. Instead of binning it, he scanned it into his computer, altered the terms and sent it back to Tinkoff Credit Systems duly signed. His version contained a 0% interest rate, no fees and no credit limit. Every time the bank failed to comply with the rules, he would fine them 3 m roubles AUD 100, 000 and if Tinkoff tried to cancel the contract it would have to pay him 6 million roubles. Tinkoff failed to read the amended contract and sent DA a credit card. The Russian court found the contract binding on Tinkhoff. They had signed the contract and were legally bound to it. They said what borrowers usually said…. We have not read it…. . but, this did not help them. ©MNoonan 2009

Formation of contract-From the news 9/8/2013 Daily Telegraph London Dmitry Argarkov was sent a letter offering him a credit card in the usual way. Instead of binning it, he scanned it into his computer, altered the terms and sent it back to Tinkoff Credit Systems duly signed. His version contained a 0% interest rate, no fees and no credit limit. Every time the bank failed to comply with the rules, he would fine them 3 m roubles AUD 100, 000 and if Tinkoff tried to cancel the contract it would have to pay him 6 million roubles. Tinkoff failed to read the amended contract and sent DA a credit card. The Russian court found the contract binding on Tinkhoff. They had signed the contract and were legally bound to it. They said what borrowers usually said…. We have not read it…. . but, this did not help them. ©MNoonan 2009

Reflection point Consider e. Bay auctions/transactions. Does e. Bay provide a platform or participate as an auctioneer? Who is the contract between? Some differences with physical auctions-e. g. no physical presence to check bona fides or conducted ethically, sometimes over a considerable period, proxy/maximum bids enable online system to place bids, anonymity of sellers/buyers etc. A problem can arise with enforcement of a contract ©MNoonan 2009

Reflection point Consider e. Bay auctions/transactions. Does e. Bay provide a platform or participate as an auctioneer? Who is the contract between? Some differences with physical auctions-e. g. no physical presence to check bona fides or conducted ethically, sometimes over a considerable period, proxy/maximum bids enable online system to place bids, anonymity of sellers/buyers etc. A problem can arise with enforcement of a contract ©MNoonan 2009

Peter Smythe v. Thomas (2007) NSWSC 844 PS bid $150, 000 for a 1946 Wirraway plane, one of only 5 in the world still flying. T refused to deliver as he had changed his mind and sold to another buyer for $250, 000. He argued there was no contract to enforce between PS and him because the only contracts were between each of them and e. Bay. Court ordered T to complete the sale-granted specific performancebecause it found a contract between them based on the e. Bay rules. . Court examined e. Bay Rules…”if you receive at least one bid at or above your stated minimum price (or in the case of reserve auctions, at or above the reserve price), you are obligated to complete the transaction to the highest bidder upon the item’s completion”. Offer accepted when PS made highest bid, even though payment terms had not yet been concluded. Auction and therefore a sale of goods. Court also intimated that e. Bay was agent of Vendor and therefore under an obligation to monitor and superintend the conduct of vendors. ©MNoonan 2009

Peter Smythe v. Thomas (2007) NSWSC 844 PS bid $150, 000 for a 1946 Wirraway plane, one of only 5 in the world still flying. T refused to deliver as he had changed his mind and sold to another buyer for $250, 000. He argued there was no contract to enforce between PS and him because the only contracts were between each of them and e. Bay. Court ordered T to complete the sale-granted specific performancebecause it found a contract between them based on the e. Bay rules. . Court examined e. Bay Rules…”if you receive at least one bid at or above your stated minimum price (or in the case of reserve auctions, at or above the reserve price), you are obligated to complete the transaction to the highest bidder upon the item’s completion”. Offer accepted when PS made highest bid, even though payment terms had not yet been concluded. Auction and therefore a sale of goods. Court also intimated that e. Bay was agent of Vendor and therefore under an obligation to monitor and superintend the conduct of vendors. ©MNoonan 2009

Decisions outside Australia Note that there had been various inconsistent overseas decisions re obligations of e. Bay concerning the sale of counterfeit items US-Tiffany (NJ) In. v. e. Bay Inc -Lars Gentry v. e. Bay Inc - fake sports memorabilia Germany-Rolex SA v. e. Bay Gmb. H 2004 France- e. Bay v. Dior LV 2008 ©MNoonan 2009

Decisions outside Australia Note that there had been various inconsistent overseas decisions re obligations of e. Bay concerning the sale of counterfeit items US-Tiffany (NJ) In. v. e. Bay Inc -Lars Gentry v. e. Bay Inc - fake sports memorabilia Germany-Rolex SA v. e. Bay Gmb. H 2004 France- e. Bay v. Dior LV 2008 ©MNoonan 2009

Effect of Peter Smythe decision re consumer protection Because online “auctions” were auctions, they were excluded from TPA protections. See now ACL –e. g. s. 54…guarantee as to acceptable quality…. sale by auction excluded…definition of “sale by auction” in s. 2…in relation to the supply of goods by a person means a sale by auction that is conducted by an agent of the person (whether the agent acts in person or by electronic means) See s. 60 SOGA. ©MNoonan 2009

Effect of Peter Smythe decision re consumer protection Because online “auctions” were auctions, they were excluded from TPA protections. See now ACL –e. g. s. 54…guarantee as to acceptable quality…. sale by auction excluded…definition of “sale by auction” in s. 2…in relation to the supply of goods by a person means a sale by auction that is conducted by an agent of the person (whether the agent acts in person or by electronic means) See s. 60 SOGA. ©MNoonan 2009

e. Bay NOTE that e. Bay terms and conditions vary from time to time and are not the same now as they were in the Peter Smythe decision. See current T&C-e. g. 7 -”…You acknowledge that we are not an auctioneer. Instead, our sites are venues to allow anyone to offer, sell and buy…. We are not involved in the actual transaction…We have no control over and do not guarantee the quality, safety or legality of items…When you enter into a transaction you create a legally binding contract with another user, unless the item is listed …under the Nonbinding Bid Policy…. ” ©MNoonan 2009

e. Bay NOTE that e. Bay terms and conditions vary from time to time and are not the same now as they were in the Peter Smythe decision. See current T&C-e. g. 7 -”…You acknowledge that we are not an auctioneer. Instead, our sites are venues to allow anyone to offer, sell and buy…. We are not involved in the actual transaction…We have no control over and do not guarantee the quality, safety or legality of items…When you enter into a transaction you create a legally binding contract with another user, unless the item is listed …under the Nonbinding Bid Policy…. ” ©MNoonan 2009

Ecommerce. Subject to the same laws as physical transactions Some need for special legislation Electronic Transaction Acts from about 2000. In 2010 a model Electronic Transactions Act was agreed to by all State and Territory Attorneys General and the Commonwealth Attorney General and relevant amendments passed to existing Acts. The laws post 2010 reflect the most recent UN convention on the use of electronic communications in business, are meant to ensure rules are consistent to support growth of ecommerce Electronic Transactions Act 1999 –Commonwealth Electronic Transactions Act 2000 -NSW ©MNoonan 2009

Ecommerce. Subject to the same laws as physical transactions Some need for special legislation Electronic Transaction Acts from about 2000. In 2010 a model Electronic Transactions Act was agreed to by all State and Territory Attorneys General and the Commonwealth Attorney General and relevant amendments passed to existing Acts. The laws post 2010 reflect the most recent UN convention on the use of electronic communications in business, are meant to ensure rules are consistent to support growth of ecommerce Electronic Transactions Act 1999 –Commonwealth Electronic Transactions Act 2000 -NSW ©MNoonan 2009

Electronic Transaction Acts These Acts generally (but, subject to some exceptions) provide equivalence to electronic and physical requirements of Federal and State law. However, drafting of individual contract provisions remains very important so as to enable parties to determine the rights between themselves and cover particular circumstances. ©MNoonan 2009

Electronic Transaction Acts These Acts generally (but, subject to some exceptions) provide equivalence to electronic and physical requirements of Federal and State law. However, drafting of individual contract provisions remains very important so as to enable parties to determine the rights between themselves and cover particular circumstances. ©MNoonan 2009

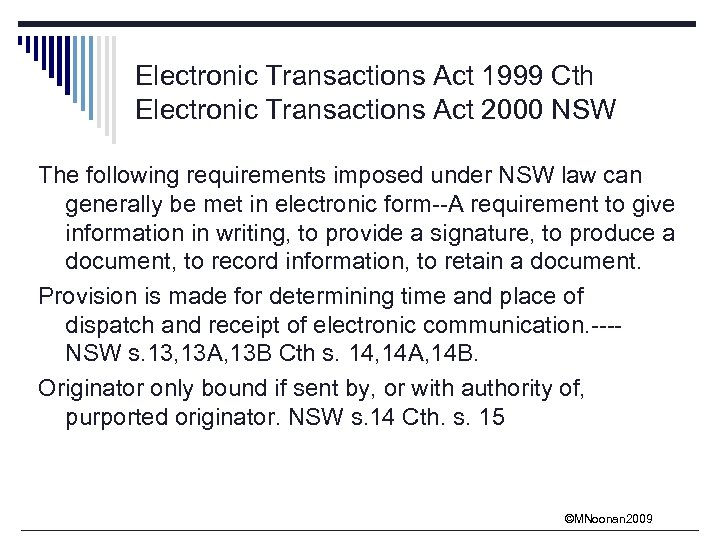

Electronic Transactions Act 1999 Cth Electronic Transactions Act 2000 NSW The following requirements imposed under NSW law can generally be met in electronic form--A requirement to give information in writing, to provide a signature, to produce a document, to record information, to retain a document. Provision is made for determining time and place of dispatch and receipt of electronic communication. ---NSW s. 13, 13 A, 13 B Cth s. 14, 14 A, 14 B. Originator only bound if sent by, or with authority of, purported originator. NSW s. 14 Cth. s. 15 ©MNoonan 2009

Electronic Transactions Act 1999 Cth Electronic Transactions Act 2000 NSW The following requirements imposed under NSW law can generally be met in electronic form--A requirement to give information in writing, to provide a signature, to produce a document, to record information, to retain a document. Provision is made for determining time and place of dispatch and receipt of electronic communication. ---NSW s. 13, 13 A, 13 B Cth s. 14, 14 A, 14 B. Originator only bound if sent by, or with authority of, purported originator. NSW s. 14 Cth. s. 15 ©MNoonan 2009

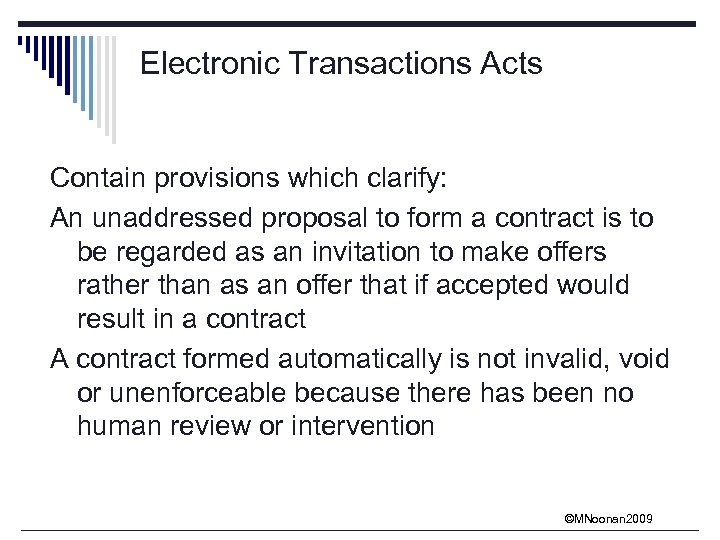

Electronic Transactions Acts Contain provisions which clarify: An unaddressed proposal to form a contract is to be regarded as an invitation to make offers rather than as an offer that if accepted would result in a contract A contract formed automatically is not invalid, void or unenforceable because there has been no human review or intervention ©MNoonan 2009

Electronic Transactions Acts Contain provisions which clarify: An unaddressed proposal to form a contract is to be regarded as an invitation to make offers rather than as an offer that if accepted would result in a contract A contract formed automatically is not invalid, void or unenforceable because there has been no human review or intervention ©MNoonan 2009

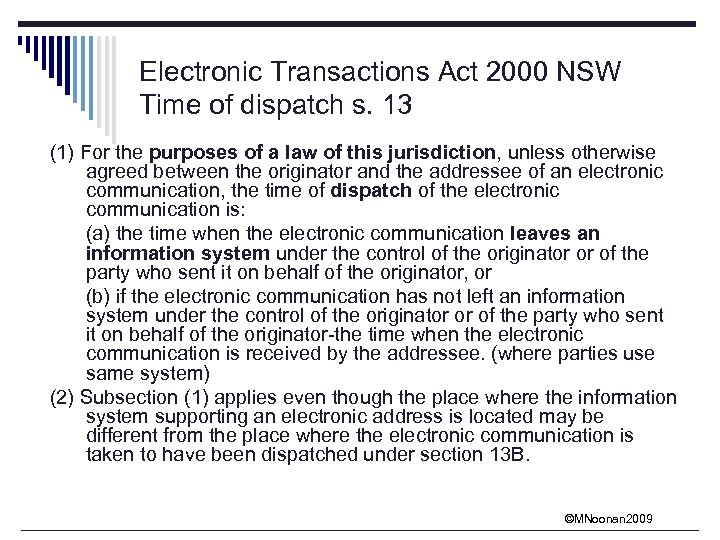

Electronic Transactions Act 2000 NSW Time of dispatch s. 13 (1) For the purposes of a law of this jurisdiction, unless otherwise agreed between the originator and the addressee of an electronic communication, the time of dispatch of the electronic communication is: (a) the time when the electronic communication leaves an information system under the control of the originator or of the party who sent it on behalf of the originator, or (b) if the electronic communication has not left an information system under the control of the originator or of the party who sent it on behalf of the originator-the time when the electronic communication is received by the addressee. (where parties use same system) (2) Subsection (1) applies even though the place where the information system supporting an electronic address is located may be different from the place where the electronic communication is taken to have been dispatched under section 13 B. ©MNoonan 2009

Electronic Transactions Act 2000 NSW Time of dispatch s. 13 (1) For the purposes of a law of this jurisdiction, unless otherwise agreed between the originator and the addressee of an electronic communication, the time of dispatch of the electronic communication is: (a) the time when the electronic communication leaves an information system under the control of the originator or of the party who sent it on behalf of the originator, or (b) if the electronic communication has not left an information system under the control of the originator or of the party who sent it on behalf of the originator-the time when the electronic communication is received by the addressee. (where parties use same system) (2) Subsection (1) applies even though the place where the information system supporting an electronic address is located may be different from the place where the electronic communication is taken to have been dispatched under section 13 B. ©MNoonan 2009

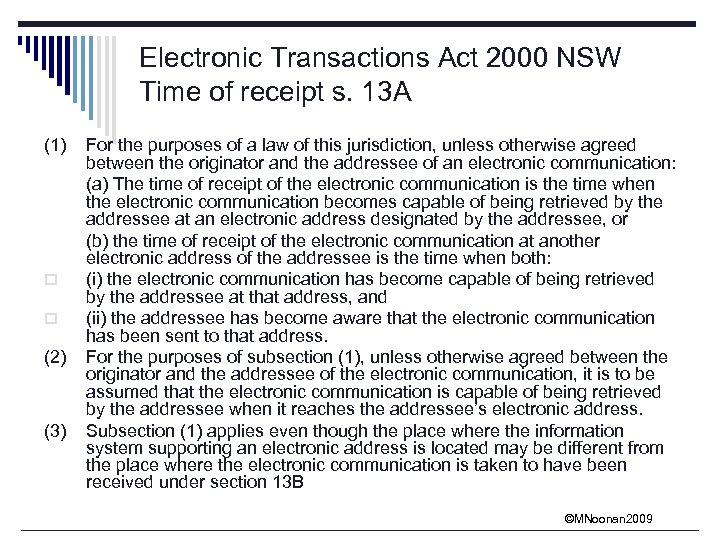

Electronic Transactions Act 2000 NSW Time of receipt s. 13 A (1) o o (2) (3) For the purposes of a law of this jurisdiction, unless otherwise agreed between the originator and the addressee of an electronic communication: (a) The time of receipt of the electronic communication is the time when the electronic communication becomes capable of being retrieved by the addressee at an electronic address designated by the addressee, or (b) the time of receipt of the electronic communication at another electronic address of the addressee is the time when both: (i) the electronic communication has become capable of being retrieved by the addressee at that address, and (ii) the addressee has become aware that the electronic communication has been sent to that address. For the purposes of subsection (1), unless otherwise agreed between the originator and the addressee of the electronic communication, it is to be assumed that the electronic communication is capable of being retrieved by the addressee when it reaches the addressee’s electronic address. Subsection (1) applies even though the place where the information system supporting an electronic address is located may be different from the place where the electronic communication is taken to have been received under section 13 B ©MNoonan 2009

Electronic Transactions Act 2000 NSW Time of receipt s. 13 A (1) o o (2) (3) For the purposes of a law of this jurisdiction, unless otherwise agreed between the originator and the addressee of an electronic communication: (a) The time of receipt of the electronic communication is the time when the electronic communication becomes capable of being retrieved by the addressee at an electronic address designated by the addressee, or (b) the time of receipt of the electronic communication at another electronic address of the addressee is the time when both: (i) the electronic communication has become capable of being retrieved by the addressee at that address, and (ii) the addressee has become aware that the electronic communication has been sent to that address. For the purposes of subsection (1), unless otherwise agreed between the originator and the addressee of the electronic communication, it is to be assumed that the electronic communication is capable of being retrieved by the addressee when it reaches the addressee’s electronic address. Subsection (1) applies even though the place where the information system supporting an electronic address is located may be different from the place where the electronic communication is taken to have been received under section 13 B ©MNoonan 2009

Electronic Transactions Acts Issues What is an electronic communication? What is an information system? Who is the originator? Who is the addressee? ©MNoonan 2009

Electronic Transactions Acts Issues What is an electronic communication? What is an information system? Who is the originator? Who is the addressee? ©MNoonan 2009

What is an information system? Contrast Smith FM in American Express Ausralia Limited v. Michaels [2010] FMCA 103, paras 26, 27, 28 with Associate Justice Macready in Reed v. Eire [2009]NSWSC 678 paras 29 -35 incl. ©MNoonan 2009

What is an information system? Contrast Smith FM in American Express Ausralia Limited v. Michaels [2010] FMCA 103, paras 26, 27, 28 with Associate Justice Macready in Reed v. Eire [2009]NSWSC 678 paras 29 -35 incl. ©MNoonan 2009

NOTE that there are exceptions to the general rule that electronic communications are equivalent to physical by virtue of the Electronic Transactions Acts e. g. Insurance Contracts Act The Insurance Contracts Act specifies that some communications must be in writing. Most provisions impose obligations on the insurer to advise the insured of something in writing (ss. 22, 35, 37, 39, 40, 44, 49, 58, 62, 68 and 74). s, 69 permits oral information, provided later given in writing. The ETA 1999 (Cth) provides that in general where a commonwealth law requires a notice in writing, it may be given by electronic means provided that the recipient consents. However, the ET regulations exclude the ICA from the scope of these provisions! Because of the seriousness of some of these notices e. g. cancellation, in a Treasury review of the ICA in 2004, a recommendation was made that E communications be possible with consent and provided a record could be printed. See later insurance module for more details. Increasing scope in all aspects of legal practice. E. g. Land conveyancing practice See Regulations to the Acts ©MNoonan 2009

NOTE that there are exceptions to the general rule that electronic communications are equivalent to physical by virtue of the Electronic Transactions Acts e. g. Insurance Contracts Act The Insurance Contracts Act specifies that some communications must be in writing. Most provisions impose obligations on the insurer to advise the insured of something in writing (ss. 22, 35, 37, 39, 40, 44, 49, 58, 62, 68 and 74). s, 69 permits oral information, provided later given in writing. The ETA 1999 (Cth) provides that in general where a commonwealth law requires a notice in writing, it may be given by electronic means provided that the recipient consents. However, the ET regulations exclude the ICA from the scope of these provisions! Because of the seriousness of some of these notices e. g. cancellation, in a Treasury review of the ICA in 2004, a recommendation was made that E communications be possible with consent and provided a record could be printed. See later insurance module for more details. Increasing scope in all aspects of legal practice. E. g. Land conveyancing practice See Regulations to the Acts ©MNoonan 2009

Discussion point Is it wise to use email to communicate formal notices under contracts? In Reed Constructions Pty Limited v. Eire Contractors Pty Limited [2009] NSWSC 678 time of receipt of an email attaching a payment claim was crucial to the validity of an adjudicator’s determination under the Building and Construction Industry Security of Payment Act 1999. Recipient wanted court to conclude it was received 6 Nov. Evidence indicated that the email was sent 6 November and read on 7 th. Recipient did not produce evidence that email was received by its email server on 6 th, so NSWSC refused to overturn adjudicator’s determination against recipient. ©MNoonan 2009

Discussion point Is it wise to use email to communicate formal notices under contracts? In Reed Constructions Pty Limited v. Eire Contractors Pty Limited [2009] NSWSC 678 time of receipt of an email attaching a payment claim was crucial to the validity of an adjudicator’s determination under the Building and Construction Industry Security of Payment Act 1999. Recipient wanted court to conclude it was received 6 Nov. Evidence indicated that the email was sent 6 November and read on 7 th. Recipient did not produce evidence that email was received by its email server on 6 th, so NSWSC refused to overturn adjudicator’s determination against recipient. ©MNoonan 2009

Using email to send notices Bauen Constructions Pty Ltd v. Sky General Services P/L [2012]NSWSC 1123 What was time of receipt of an email of an adjudication response under Security of Payment Act? Sent by email 21 June 2012 to Adjudicate Today, but they were unaware of it until it was discovered on 12 September in their spam filter. Court decided that “lodged” in s. 20 BCISPA meant “presented” and relied on the rues in the Electronic Transactions Act to establish receipt was when the email was capable of being retrieved…. 21 June. ©MNoonan 2009

Using email to send notices Bauen Constructions Pty Ltd v. Sky General Services P/L [2012]NSWSC 1123 What was time of receipt of an email of an adjudication response under Security of Payment Act? Sent by email 21 June 2012 to Adjudicate Today, but they were unaware of it until it was discovered on 12 September in their spam filter. Court decided that “lodged” in s. 20 BCISPA meant “presented” and relied on the rues in the Electronic Transactions Act to establish receipt was when the email was capable of being retrieved…. 21 June. ©MNoonan 2009

What is the solution? o Prohibit use of email for contractual communications when drafting contracts? o Draft detailed clause setting out when receipt deemed, methods of proving time of receipt, permissible formats for attachments? ©MNoonan 2009

What is the solution? o Prohibit use of email for contractual communications when drafting contracts? o Draft detailed clause setting out when receipt deemed, methods of proving time of receipt, permissible formats for attachments? ©MNoonan 2009

Evidence Meta data-data about data-e. g. when prepared or changed Becoming common in litigation to ask for it as part of discovery to check claims concerning documents. Student in former semester gave example of a case where a plaintiff made certain claims but did not produce meta data for the relevant documents. Negative inference possible. ©MNoonan 2009

Evidence Meta data-data about data-e. g. when prepared or changed Becoming common in litigation to ask for it as part of discovery to check claims concerning documents. Student in former semester gave example of a case where a plaintiff made certain claims but did not produce meta data for the relevant documents. Negative inference possible. ©MNoonan 2009

E-commerce Is there a valid Contract? Valid offer? o Wording and display? . Limits? Systems? Interactive or active site? o Automated interactive sites? Vending machines…offer made when proprietor holds it out as being ready to receive money. Contract formed when consumer places money into the slot and selects item. Acceptance? o Effective at the time communicated to offeror. When is it communicated? Email? Instantaneous? Press Send, goes to ISP, goes via a number of servers and received when recipient logs on and downloads. May go around the world to get to the next building. Is it similar to the postal system? Difficulties with certainty in time of communication. EDI is instantaneous. Fax? What if noone there to receive it? Intention to create legal relations? Capacity? Consideration? Terms are certain? ©MNoonan 2009

E-commerce Is there a valid Contract? Valid offer? o Wording and display? . Limits? Systems? Interactive or active site? o Automated interactive sites? Vending machines…offer made when proprietor holds it out as being ready to receive money. Contract formed when consumer places money into the slot and selects item. Acceptance? o Effective at the time communicated to offeror. When is it communicated? Email? Instantaneous? Press Send, goes to ISP, goes via a number of servers and received when recipient logs on and downloads. May go around the world to get to the next building. Is it similar to the postal system? Difficulties with certainty in time of communication. EDI is instantaneous. Fax? What if noone there to receive it? Intention to create legal relations? Capacity? Consideration? Terms are certain? ©MNoonan 2009

Discussion point Can e. Bay change the terms and conditions of its contract by posting a notice on its Website? See e. Bay terms of use ©MNoonan 2009

Discussion point Can e. Bay change the terms and conditions of its contract by posting a notice on its Website? See e. Bay terms of use ©MNoonan 2009

Electronic Dispute Resolution Various procedures can be carried out electronically Some dispute resolution tribunals etc choose electronic proceedings e. g. Domain Name disputes. Some Arbitrations reliant on documents can be carried out remotely and thereby lower costs. Our courts regularly use various electronic methods-for service (e. g. on parties via their Lawyer, or if personal service not feasible on respondent’s Facebook page), discovery, videoconferencing for overseas witnesses or parties. ©MNoonan 2009

Electronic Dispute Resolution Various procedures can be carried out electronically Some dispute resolution tribunals etc choose electronic proceedings e. g. Domain Name disputes. Some Arbitrations reliant on documents can be carried out remotely and thereby lower costs. Our courts regularly use various electronic methods-for service (e. g. on parties via their Lawyer, or if personal service not feasible on respondent’s Facebook page), discovery, videoconferencing for overseas witnesses or parties. ©MNoonan 2009

Electronic Signatures Electronic Signature A signature used on an electronic document or transaction. Digital Signature ©MNoonan 2009

Electronic Signatures Electronic Signature A signature used on an electronic document or transaction. Digital Signature ©MNoonan 2009

Electronic signatures When dealing with a company one is normally entitled to rely on s. 127 of the Corporations Act 2001 and assume that the document has been duly executed and is binding. A company may sign a document by having any 2 directors, a director and company secretary or a sole director who is also the sole company secretary, sign the document. ETA does not apply to the Corporations Act but s 127 does not prohibit electronic signatures. Directors upload their signatures electronically for convenience. Only liable if use of that electronic signature authorised. Onus therefore back on you to check whether the signatories have agreed to / authorised the electronic affixing of their signature. ©MNoonan 2009

Electronic signatures When dealing with a company one is normally entitled to rely on s. 127 of the Corporations Act 2001 and assume that the document has been duly executed and is binding. A company may sign a document by having any 2 directors, a director and company secretary or a sole director who is also the sole company secretary, sign the document. ETA does not apply to the Corporations Act but s 127 does not prohibit electronic signatures. Directors upload their signatures electronically for convenience. Only liable if use of that electronic signature authorised. Onus therefore back on you to check whether the signatories have agreed to / authorised the electronic affixing of their signature. ©MNoonan 2009

Shrinkwrap, Clickwrap and Browsewrap licences Usually encountered when purchasing (shrinkwrap) or downloading and using software applications and electronic information distributed online (clickwrap and browsewrap) Shrinkwrap…on the clear plastic wrapper Clickwrap…I agree button Browsewrap…appears on site somewhere…by using this site…. you agree etc… ©MNoonan 2009

Shrinkwrap, Clickwrap and Browsewrap licences Usually encountered when purchasing (shrinkwrap) or downloading and using software applications and electronic information distributed online (clickwrap and browsewrap) Shrinkwrap…on the clear plastic wrapper Clickwrap…I agree button Browsewrap…appears on site somewhere…by using this site…. you agree etc… ©MNoonan 2009

Shrinkwrap Quite often order is made by phone and company promises to send the item. Contract usually formed when order made, accepted, payment etc, and cannot add terms later. However, may be situation where “on consider and agree/or return” basis…sophisticated user with knowledge usual terms…licence terms shown each time program loaded with offer of refund if not acceptable…. If terms desired, need to be made known and agreed to by contracting party at time of contract…conditional on acceptance…return possible? ©MNoonan 2009

Shrinkwrap Quite often order is made by phone and company promises to send the item. Contract usually formed when order made, accepted, payment etc, and cannot add terms later. However, may be situation where “on consider and agree/or return” basis…sophisticated user with knowledge usual terms…licence terms shown each time program loaded with offer of refund if not acceptable…. If terms desired, need to be made known and agreed to by contracting party at time of contract…conditional on acceptance…return possible? ©MNoonan 2009

Good rap for browsewrap in USA: Register. com Inc v Verio Inc Authors: Leaellyn Rich and Irene Zeitler of Freehills Agreement to terms and conditions? Decision affirming the enforceability of browsewrap licences, the U S Court of Appeal for the Second Circuit has upheld a preliminary injunction issued against Verio Inc. (Verio), a website developer and hosting firm, for breaching the browsewrap-style terms of use for the services of the plaintiff, Register. com (Register): Register. com Inc v Verio Inc. 356 F. 3 d 393 (2 d Cir. N. Y. 2004), 2004 U. S. App. LEXIS 1074. ©MNoonan 2009

Good rap for browsewrap in USA: Register. com Inc v Verio Inc Authors: Leaellyn Rich and Irene Zeitler of Freehills Agreement to terms and conditions? Decision affirming the enforceability of browsewrap licences, the U S Court of Appeal for the Second Circuit has upheld a preliminary injunction issued against Verio Inc. (Verio), a website developer and hosting firm, for breaching the browsewrap-style terms of use for the services of the plaintiff, Register. com (Register): Register. com Inc v Verio Inc. 356 F. 3 d 393 (2 d Cir. N. Y. 2004), 2004 U. S. App. LEXIS 1074. ©MNoonan 2009

Facts in Verio Register, a provider of domain name registration services, had agreement with Internet Corporation for Assigned Names and Numbers (ICANN). Register was required to maintain and update a publicly available 'WHOIS' database of registrants' contact information, was not to impose restrictions on use of data, except re electronic spamming. Register established WHOIS database, updated on a daily basis, and provided free public inquiry service for the information it contained. Register's responses to WHOIS queries were captioned by a 'legend' stating that by submitting a query, the user agreed to refrain from using the data to conduct mass solicitations of business by email, direct mail or telephone (a more stringent restriction that envisaged under the ICANN Agreement, which was only in relation to the restriction of mass solicitation by email). Verio developed an automated software program or 'robot' (Robot) to access WHOIS database and compile massive lists of new registrants, who Verio then subjected to a barrage of unsolicited marketing by email, direct mail and telephone. Register demanded Verio stop, but Verio only partially complied, ceasing email solicitations, but continuing direct mail and telephone. Register sued for breach terms. Verio argued not contractually bound because it never received legally enforceable notice of Register's conditions because the restrictive legend did not appear until after Verio had submitted the query and received the WHOIS data. ©MNoonan 2009

Facts in Verio Register, a provider of domain name registration services, had agreement with Internet Corporation for Assigned Names and Numbers (ICANN). Register was required to maintain and update a publicly available 'WHOIS' database of registrants' contact information, was not to impose restrictions on use of data, except re electronic spamming. Register established WHOIS database, updated on a daily basis, and provided free public inquiry service for the information it contained. Register's responses to WHOIS queries were captioned by a 'legend' stating that by submitting a query, the user agreed to refrain from using the data to conduct mass solicitations of business by email, direct mail or telephone (a more stringent restriction that envisaged under the ICANN Agreement, which was only in relation to the restriction of mass solicitation by email). Verio developed an automated software program or 'robot' (Robot) to access WHOIS database and compile massive lists of new registrants, who Verio then subjected to a barrage of unsolicited marketing by email, direct mail and telephone. Register demanded Verio stop, but Verio only partially complied, ceasing email solicitations, but continuing direct mail and telephone. Register sued for breach terms. Verio argued not contractually bound because it never received legally enforceable notice of Register's conditions because the restrictive legend did not appear until after Verio had submitted the query and received the WHOIS data. ©MNoonan 2009

Decision in Verio Court upheld the preliminary injunction, concluding that online contracts do not always require formal acceptance by the offeree. In the circumstances, Register's browsewrap-type terms of use, combined with Verio's actions in repeatedly accessing the WHOIS database constituted a valid offer and acceptance, thereby resulting in a legally enforceable contract. Court distinguished case Specht. Court also disagreed with the Ticketmaster, expressly rejecting that terms were unenforceable because user had not clicked an 'I agree' icon: n'[w]e recognize that contract offers on the Internet often require the offeree to click on an "I agree" icon … no doubt in many circumstances, such a statement is essential to the formation of a contract. But not in all circumstances. . . It is standard contract doctrine that when a benefit is offered subject to stated conditions, and the offeree makes a decision to take the benefit with knowledge of the terms of the offer, the taking constitutes an acceptance of the terms, which accordingly become binding on the offeree. ' Particular significance was attached to the fact that Verio was a commercial entity that was making numerous, successive inquiries of Register's database, as a result of which it had become well aware of the terms exacted by Register. ©MNoonan 2009

Decision in Verio Court upheld the preliminary injunction, concluding that online contracts do not always require formal acceptance by the offeree. In the circumstances, Register's browsewrap-type terms of use, combined with Verio's actions in repeatedly accessing the WHOIS database constituted a valid offer and acceptance, thereby resulting in a legally enforceable contract. Court distinguished case Specht. Court also disagreed with the Ticketmaster, expressly rejecting that terms were unenforceable because user had not clicked an 'I agree' icon: n'[w]e recognize that contract offers on the Internet often require the offeree to click on an "I agree" icon … no doubt in many circumstances, such a statement is essential to the formation of a contract. But not in all circumstances. . . It is standard contract doctrine that when a benefit is offered subject to stated conditions, and the offeree makes a decision to take the benefit with knowledge of the terms of the offer, the taking constitutes an acceptance of the terms, which accordingly become binding on the offeree. ' Particular significance was attached to the fact that Verio was a commercial entity that was making numerous, successive inquiries of Register's database, as a result of which it had become well aware of the terms exacted by Register. ©MNoonan 2009

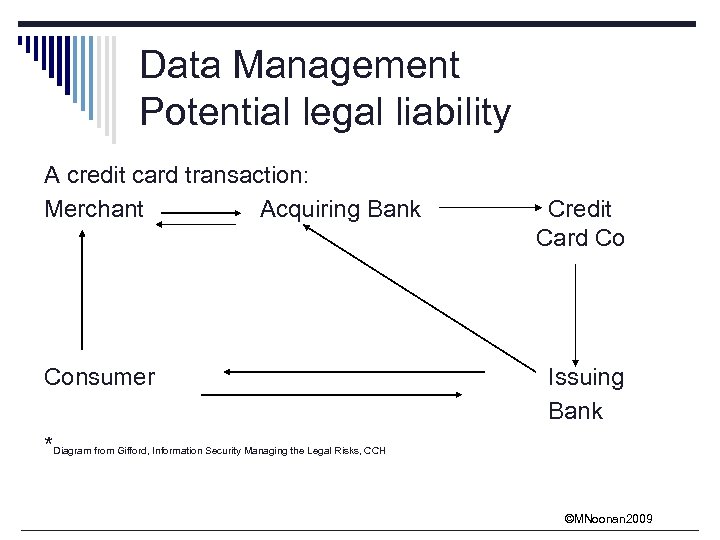

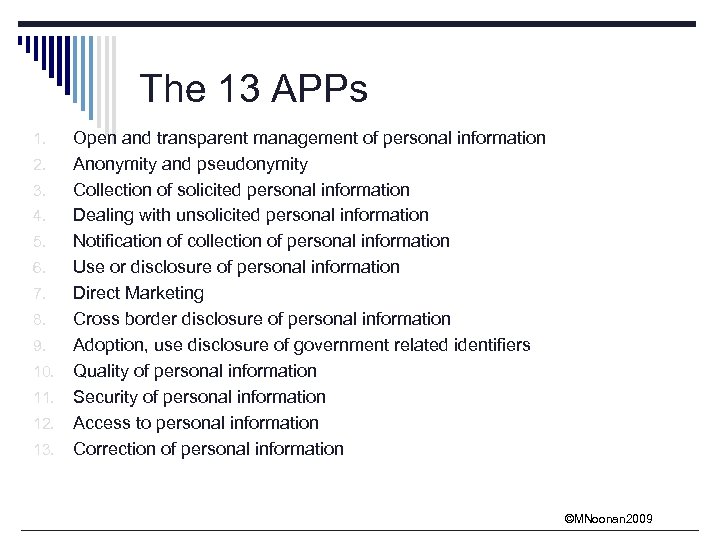

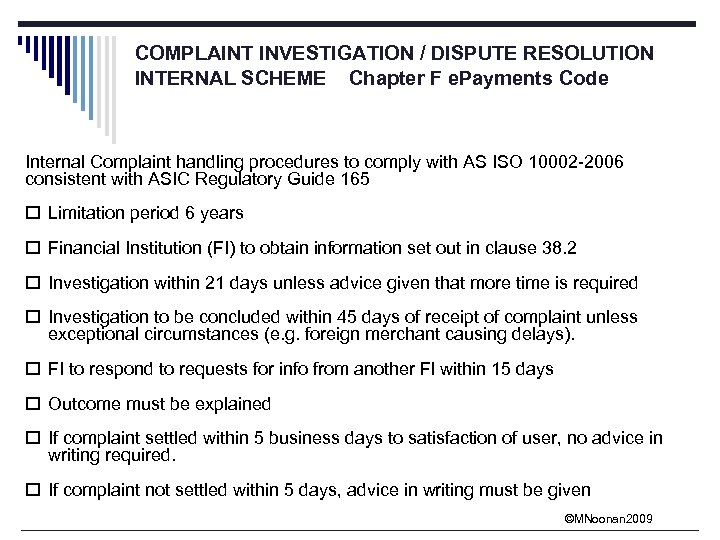

Implications of VERIO US decision As electronic commerce has developed, courts have been confronted with the task of applying age-old principles of contract law to various online permutations of the classic idea of agreement between parties. While, in recent years, courts have become comfortable with enforcing agreements supported by 'clickwrap' procedures, Verio is an authority in relation to the enforceability of 'browsewrap' or 'Web wrap' agreements. This case helps to elucidate contract principles as they apply to browsewrap agreements and, in particular, clarifies the circumstances in which the provisions of browsewrap agreements will be held to be enforceable. Although Australian courts are not bound by American case law, the decision in Verio provides a useful guide as to how an Australian court might deal with the issue. ©MNoonan 2009