63f28b292a8fcac6f7c31bb8966e45cf.ppt

- Количество слайдов: 6

Commercial Banking Foreign Exchange Presented by: Lee Aduculesi VP FX Specialist Citibank, N. A. Tel - 718 -248 -3850 leon. aduculesi@citi. com

What’s Been Happening in the Currency Market EUR/USD gained 16% from Jan. 2011 to May 2011 and dropped 13% from May 2011 to present GBP/USD gained 9% from Jan 2011 to May 2011 and dropped 8% to 1. 56 range 2 USD/JPY is currently down 10% from April 2011 and has reached historic lows

Cross-border Exchange Rate Volatility WHY DO CUSTOMERS NEED FOREIGN EXCHANGE Companies that trade or have operations overseas are likely to be exposed to foreign exchange risk arising from volatility in currency markets The most common cause of foreign exchange exposure arises from having to pay invoices for imported goods priced in foreign currency or receiving foreign currency for exported finished goods FX exposure can also arise from: § Assets located overseas § Foreign currency borrowing or surplus cash balances of overseas subsidiaries § Competitors having a cost basis and/or selling product in foreign currency For many companies, the impact that exchange rate fluctuations have on profitability will vary and in many cases can be significant As one of the world's leading providers of foreign exchange services, Citibank has a dedicated team of foreign exchange specialists available to advise clients on developing an appropriate strategy for their unique business needs 3

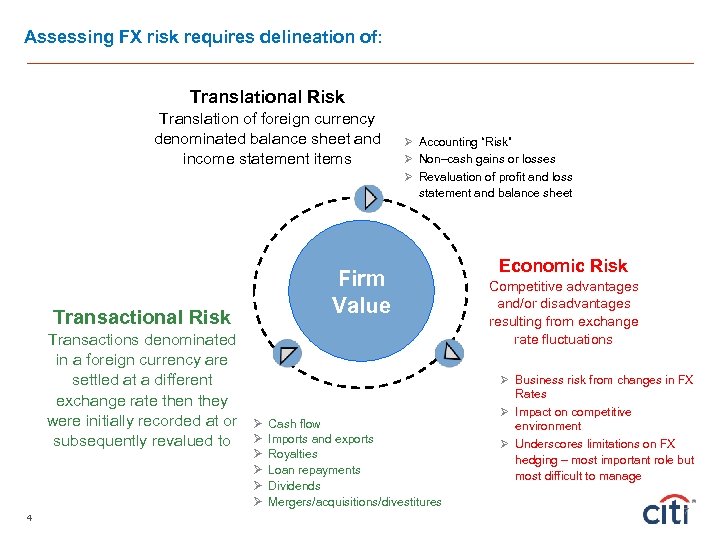

Assessing FX risk requires delineation of: Translational Risk Translation of foreign currency denominated balance sheet and income statement items Ø Accounting “Risk” Ø Non–cash gains or losses Ø Revaluation of profit and loss statement and balance sheet Firm Value Transactional Risk Transactions denominated in a foreign currency are settled at a different exchange rate then they were initially recorded at or subsequently revalued to 4 Ø Ø Ø Cash flow Imports and exports Royalties Loan repayments Dividends Mergers/acquisitions/divestitures Economic Risk Competitive advantages and/or disadvantages resulting from exchange rate fluctuations Ø Business risk from changes in FX Rates Ø Impact on competitive environment Ø Underscores limitations on FX hedging – most important role but most difficult to manage 7

Risks of Dealing in USD Overseas Is There Really “No Currency Risk” When Dealing in USD? ØBuying in USD – USD weakens • Supplier raises prices – USD strengthens • Supplier keeps price firm as long as possible – Mark-up costs • Supplier mark-up prices for taking on the currency risk. 5 Ø Selling in USD – USD weakens • Client is happy – paying less – USD strengthens • Client complains about price – Competitive Disadvantage • Excluded from a market group that deals in local currency.

Market Leader in Foreign Exchange As a leader in FX services, we can develop a foreign exchange strategy that helps you protect your company’s profits. Innovative services that simplify execution, transaction confirmations, settlement and position monitoring • Multiple Access points – FX Desk – FX specialists dedicated exclusively to the Commercial Banking segment – Citi. FX Pulse – Streaming live rates and fully automated booking of spot, forward and swap deals – World. Link® Multicurrency Transaction Services – Global multicurrency payment and receivables system – Citi. Business Online – Live rates and fully automated booking of spot transactions only • Industry-leading FX services – We provide market-making for more than $100 billon each day on all FX products – Deal in 150 currencies – 24 -hour sales and trading services – Innovative structured solutions – Commentaries and research from our international economists 6

63f28b292a8fcac6f7c31bb8966e45cf.ppt