85a5585a9faa0170c3d522e1e5160ffb.ppt

- Количество слайдов: 64

COLUMBIA UNIVERSITY Technology Transfer. An Overview Dr. Michael Cleare Executive Director Science and Technology Ventures

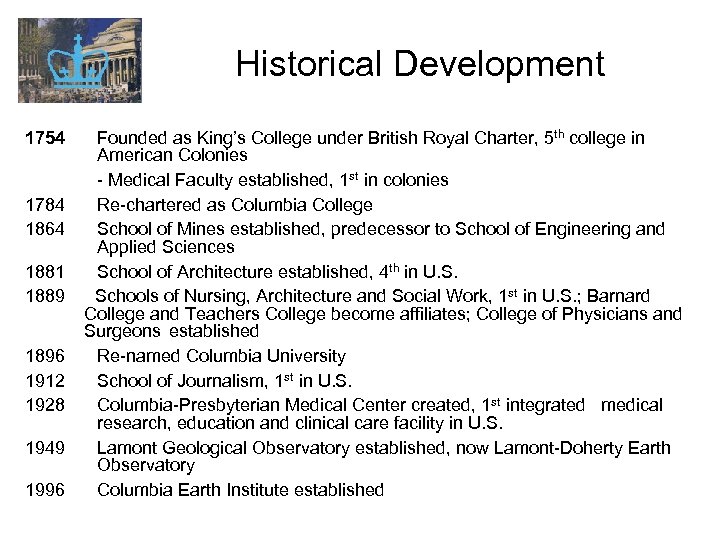

Historical Development 1754 1784 1864 1881 1889 1896 1912 1928 1949 1996 Founded as King’s College under British Royal Charter, 5 th college in American Colonies - Medical Faculty established, 1 st in colonies Re-chartered as Columbia College School of Mines established, predecessor to School of Engineering and Applied Sciences School of Architecture established, 4 th in U. S. Schools of Nursing, Architecture and Social Work, 1 st in U. S. ; Barnard College and Teachers College become affiliates; College of Physicians and Surgeons established Re-named Columbia University School of Journalism, 1 st in U. S. Columbia-Presbyterian Medical Center created, 1 st integrated medical research, education and clinical care facility in U. S. Lamont Geological Observatory established, now Lamont-Doherty Earth Observatory Columbia Earth Institute established

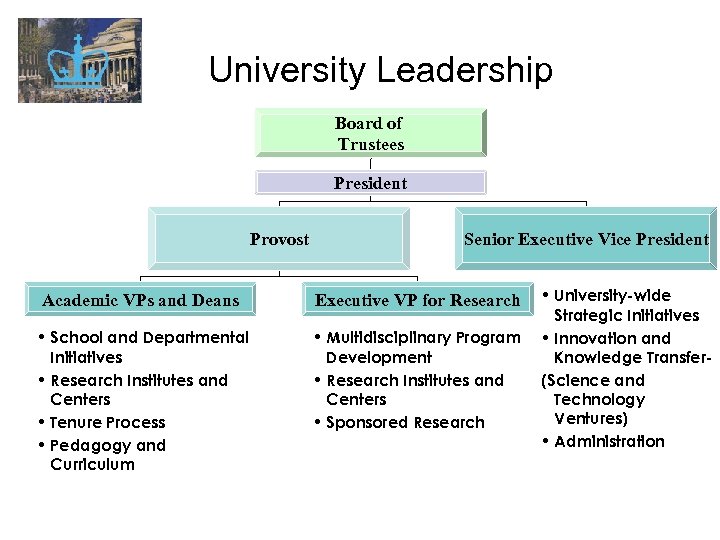

University Leadership Board of Trustees President Provost Senior Executive Vice President Academic VPs and Deans Executive VP for Research • School and Departmental Initiatives • Research Institutes and Centers • Tenure Process • Pedagogy and Curriculum • Multidisciplinary Program Development • Research Institutes and Centers • Sponsored Research • University-wide Strategic Initiatives • Innovation and Knowledge Transfer(Science and Technology Ventures) • Administration

Key Mechanisms for Transferring Academic Knowledge to Industry • • • Faculty contacts and consulting Published papers, talks at meetings, patents and applications Columbia graduates STV industry contacts Deals- Licensing/Spin Outs STV web site (www. stv. columbia. edu)

Before Bayh- Dole • “Science - The Endless Frontier” (1945) • Expansion of federally funded research investments since 1950 s • Recognition of unrealized public benefit and commercial potential from research results from federally funded research (28, 000 patents, < 5% licensed)

Bayh-Dole Act (Patent and Trademark Act of 1980) • Non-profits can obtain title to inventions made with federal funding (e. g. National Institute of Health grants) • Bayh-Dole places obligations on non-profits, including: – Disclose the existence of inventions – Seek patent protection for inventions – Diligent commercialization – Annual reports on commercialization efforts – Exclusive licensee must manufacture substantially in U. S. – Preference for small businesses as licensee – Share revenue with inventors – Net revenue used for educational and research mission

Bayh- Dole Provisions • encourage collaboration with industry to promote the utilization of inventions; • universities must file patents on inventions they elect to own; • government retains non- exclusive license and march- in rights.

Bayh-Dole Act Key Program. Requirements • Disclosure to Agency • Election of Title – Within 2 years of disclosure • File Application – Designate U. S. Funding Source • Occasional Reporting • Inventor Shares

SCIENCE & TECHNOLOGY VENTURES MISSION STATEMENT - Transfer inventions and innovative knowledge to outside organizations for the benefit of society on a local and global basis - Whenever appropriate this is to be carried out at going commercial rates so discretionary funds are brought into the university to improve educational and research activities and capabilities

Science and Technology Ventures Principal Activities • Work with faculty members to identify and patent new inventions • Facilitate research collaborations between faculty members and industry • License inventions and technology developed in University laboratories – Established Companies – Start-ups • Provide support to licensees and start-ups • Incubator • Compliance with government regulations, reporting.

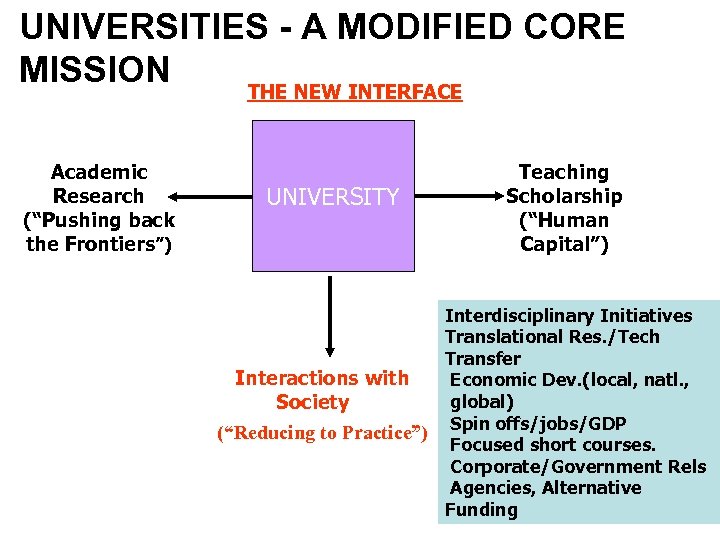

UNIVERSITIES - A MODIFIED CORE MISSION THE NEW INTERFACE Academic Research (“Pushing back the Frontiers”) UNIVERSITY Teaching Scholarship (“Human Capital”) Interdisciplinary Initiatives Translational Res. /Tech Transfer Interactions with Economic Dev. (local, natl. , global) Society (“Reducing to Practice”) Spin offs/jobs/GDP Focused short courses. Corporate/Government Rels Agencies, Alternative Funding

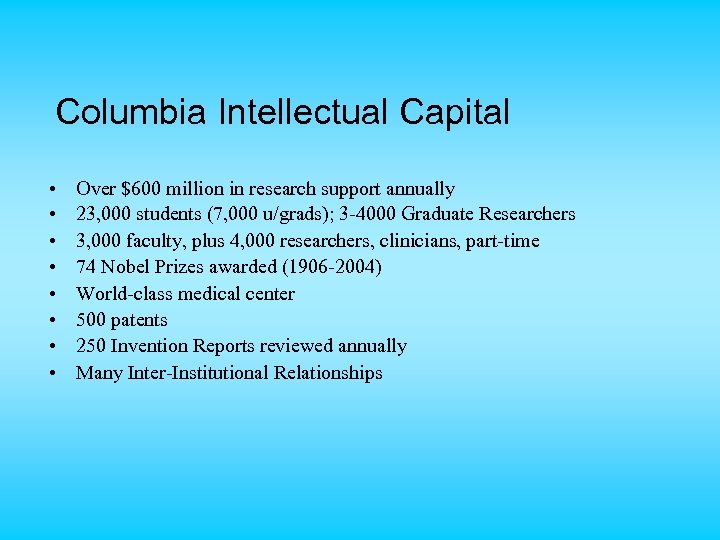

Columbia Intellectual Capital • • Over $600 million in research support annually 23, 000 students (7, 000 u/grads); 3 -4000 Graduate Researchers 3, 000 faculty, plus 4, 000 researchers, clinicians, part-time 74 Nobel Prizes awarded (1906 -2004) World-class medical center 500 patents 250 Invention Reports reviewed annually Many Inter-Institutional Relationships

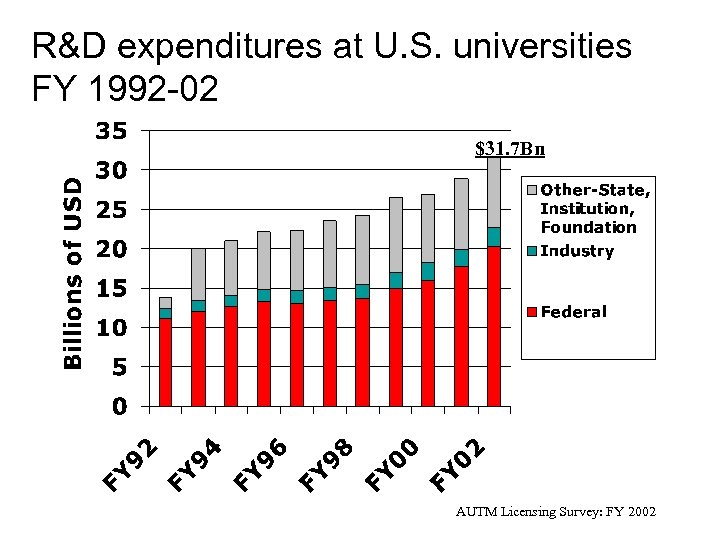

R&D expenditures at U. S. universities FY 1992 -02 $31. 7 Bn AUTM Licensing Survey: FY 2002

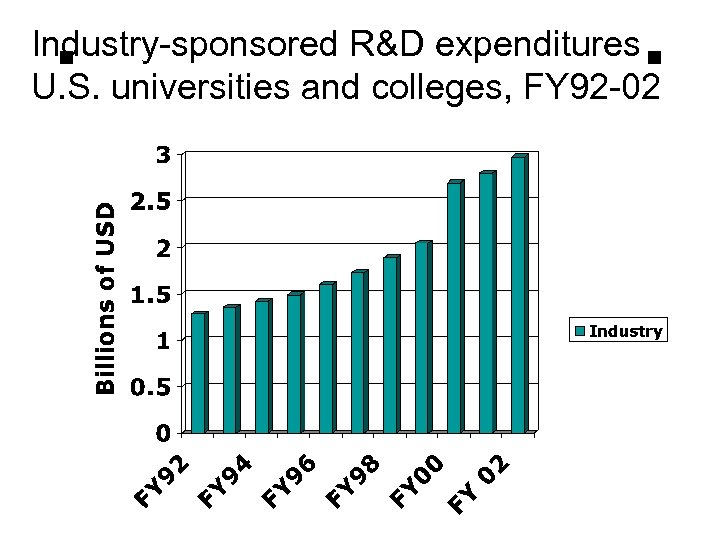

Industry-sponsored R&D expenditures U. S. universities and colleges, FY 92 -02

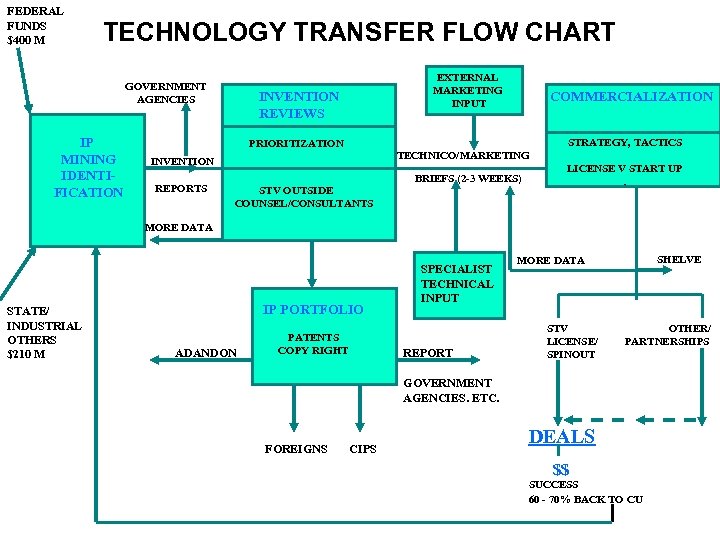

FEDERAL FUNDS $400 M TECHNOLOGY TRANSFER FLOW CHART GOVERNMENT AGENCIES IP MINING IDENTIFICATION EXTERNAL MARKETING INPUT INVENTION REVIEWS STRATEGY, TACTICS PRIORITIZATION TECHNICO/MARKETING INVENTION REPORTS COMMERCIALIZATION STV OUTSIDE COUNSEL/CONSULTANTS BRIEFS (2 -3 WEEKS) LICENSE V START UP. MORE DATA STATE/ INDUSTRIAL OTHERS $210 M IP PORTFOLIO ADANDON PATENTS COPY RIGHT SPECIALIST TECHNICAL INPUT REPORT SHELVE MORE DATA STV LICENSE/ SPINOUT OTHER/ PARTNERSHIPS GOVERNMENT AGENCIES. ETC. FOREIGNS CIPS DEALS $$ SUCCESS 60 - 70% BACK TO CU

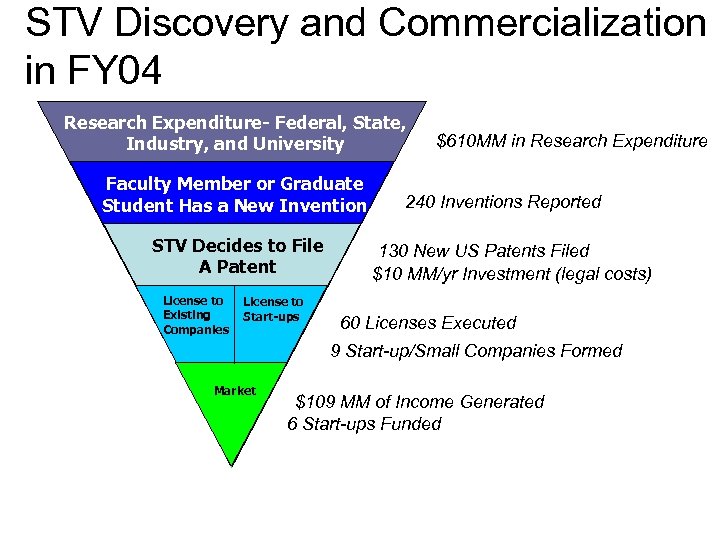

STV Discovery and Commercialization in FY 04 Research Expenditure- Federal, State, Industry, and University Faculty Member or Graduate Student Has a New Invention STV Decides to File A Patent License to Existing Companies License to Start-ups $610 MM in Research Expenditure 240 Inventions Reported 130 New US Patents Filed $10 MM/yr Investment (legal costs) 60 Licenses Executed 9 Start-up/Small Companies Formed Market $109 MM of Income Generated 6 Start-ups Funded

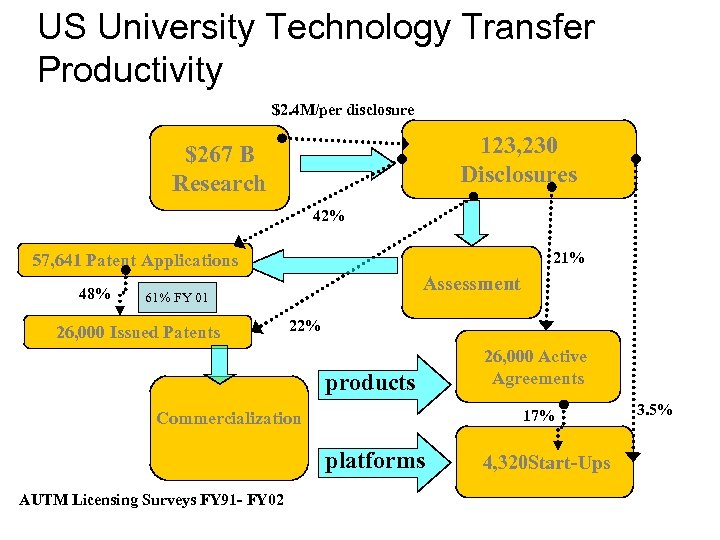

US University Technology Transfer Productivity $2. 4 M/per disclosure 123, 230 Disclosures $267 B Research 42% 21% 57, 641 Patent Applications 48% Assessment 61% FY 01 26, 000 Issued Patents 22% products 17% Commercialization platforms AUTM Licensing Surveys FY 91 - FY 02 26, 000 Active Agreements 4, 320 Start-Ups 3. 5%

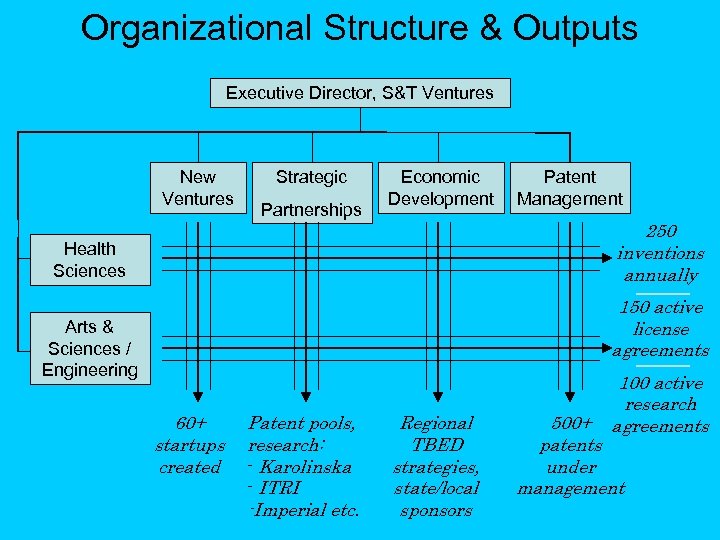

Organizational Structure & Outputs Executive Director, S&T Ventures New Ventures Strategic Partnerships Economic Development Patent Management 250 inventions annually Health Sciences 150 active license agreements Arts & Sciences / Engineering 60+ startups created Patent pools, research: - Karolinska - ITRI -Imperial etc. Regional TBED strategies, state/local sponsors 100 active research agreements 500+ patents under management

Advantages of Working with Universities • • Major source of new technologies Basic and pioneering research Leverage many existing academic - industry ties Ongoing relationship allows easy monitoring of opportunities Technology Transfer offices offer one stop shopping Research agreements, License Agreement, Research/License options Flexible deal making plus competitive research costs We strive to make integration easier across the board - Many T. T. directors with industry experience

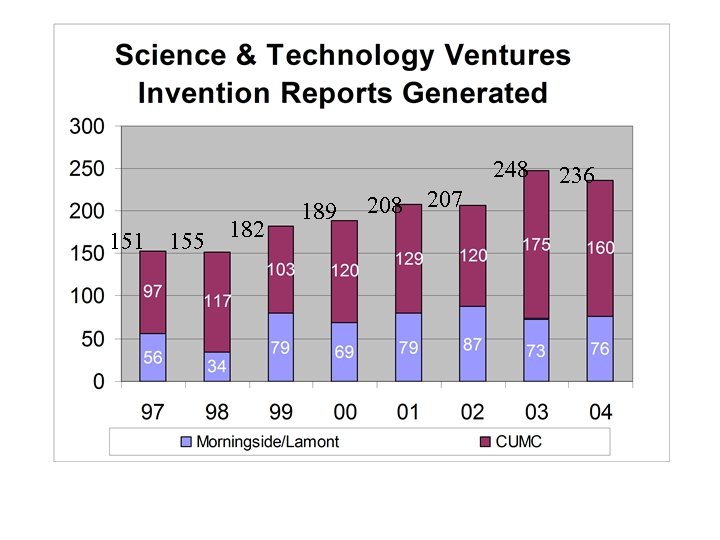

Columbia Inventions Submitted to STV 248 151 155 182 189 208 207 236

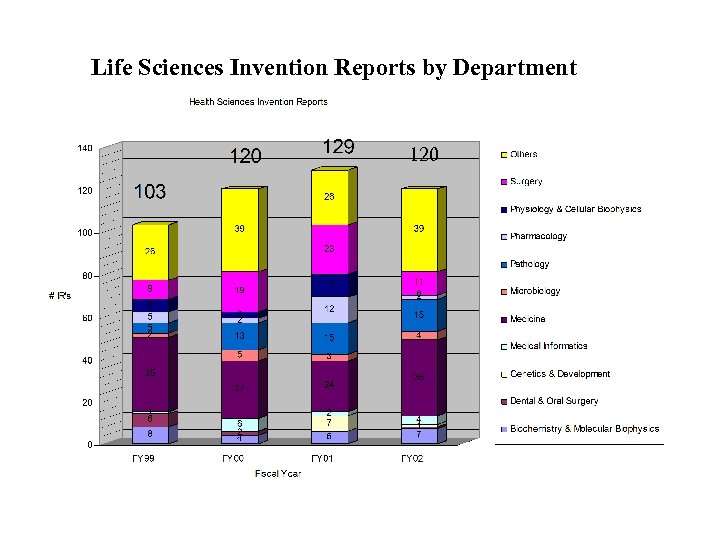

Life Sciences Invention Reports by Department 120

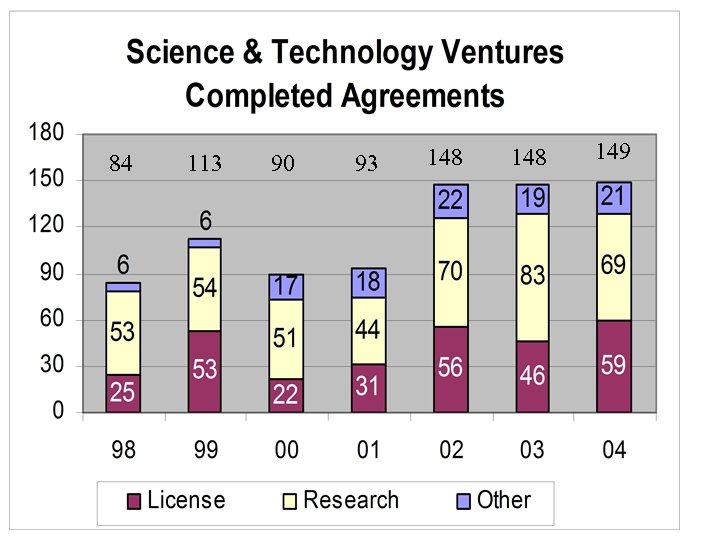

STV Completed Agreements 84 113 90 93 148 149

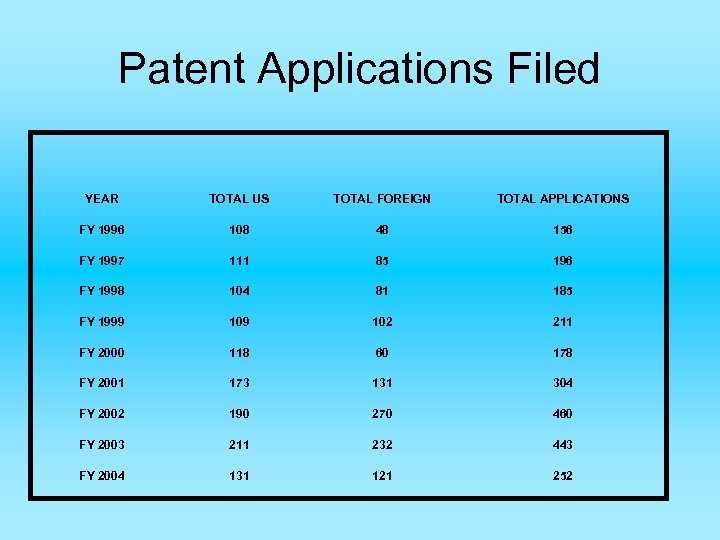

Patent Applications Filed YEAR TOTAL US TOTAL FOREIGN TOTAL APPLICATIONS FY 1996 108 48 156 FY 1997 111 85 196 FY 1998 104 81 185 FY 1999 102 211 FY 2000 118 60 178 FY 2001 173 131 304 FY 2002 190 270 460 FY 2003 211 232 443 FY 2004 131 121 252

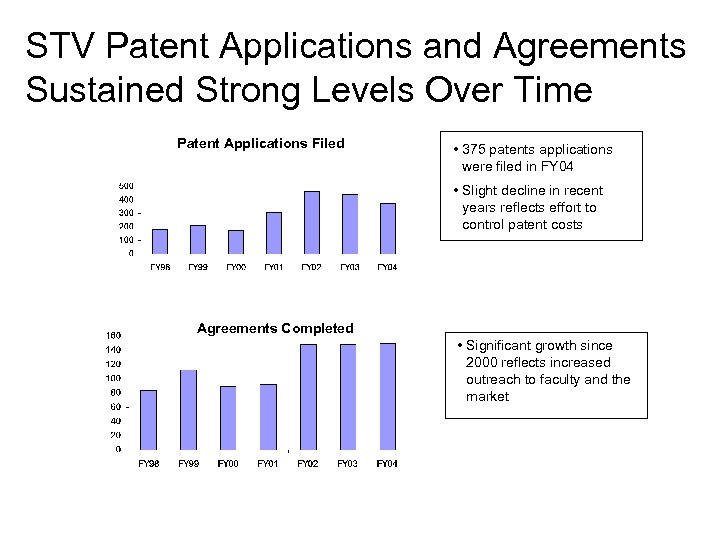

STV Patent Applications and Agreements Sustained Strong Levels Over Time Patent Applications Filed • 375 patents applications were filed in FY 04 • Slight decline in recent years reflects effort to control patent costs Agreements Completed • Significant growth since 2000 reflects increased outreach to faculty and the market

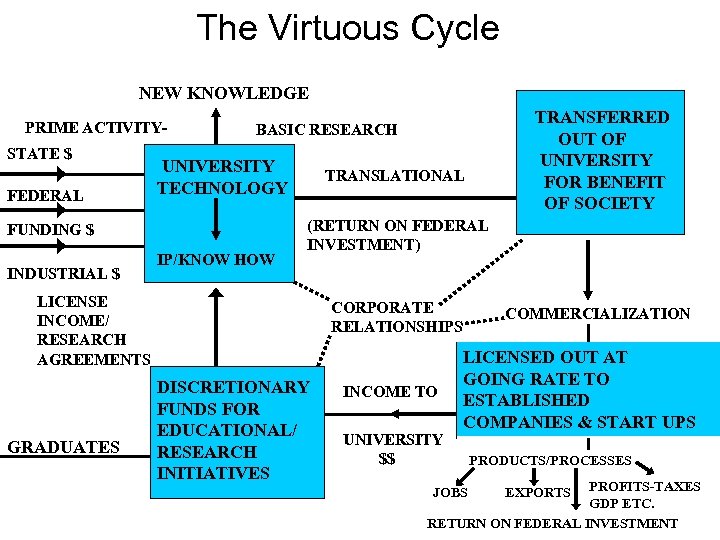

The Virtuous Cycle NEW KNOWLEDGE PRIME ACTIVITYSTATE $ FEDERAL UNIVERSITY TECHNOLOGY FUNDING $ INDUSTRIAL $ IP/KNOW HOW TRANSLATIONAL (RETURN ON FEDERAL INVESTMENT) LICENSE INCOME/ RESEARCH AGREEMENTS GRADUATES TRANSFERRED OUT OF UNIVERSITY FOR BENEFIT OF SOCIETY BASIC RESEARCH CORPORATE RELATIONSHIPS DISCRETIONARY FUNDS FOR EDUCATIONAL/ RESEARCH INITIATIVES INCOME TO UNIVERSITY $$ COMMERCIALIZATION LICENSED OUT AT GOING RATE TO ESTABLISHED COMPANIES & START UPS PRODUCTS/PROCESSES PROFITS-TAXES GDP ETC. RETURN ON FEDERAL INVESTMENT JOBS EXPORTS

Selected Products Benefiting from Columbia Inventions SIPquest* * * Chalfie’s GFP* Arrow Catheter (Modak) CHO cell line (Chasin), not patented (1980 PNAS) Blackberry 7100 T (Im)*

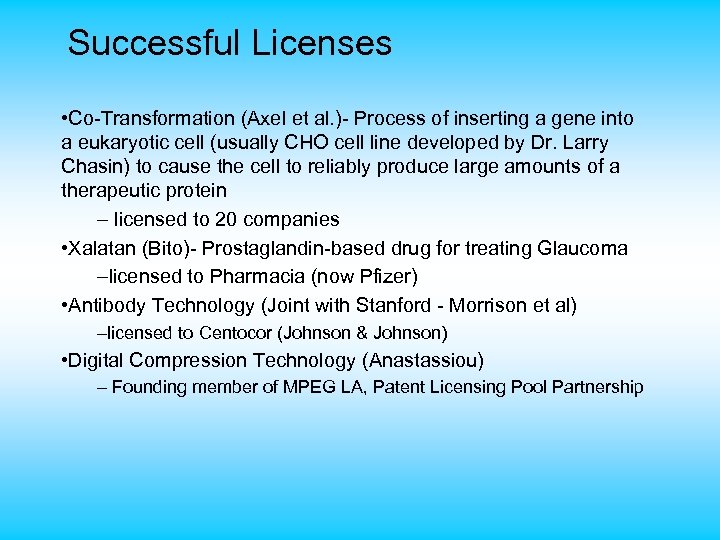

Successful Licenses • Co-Transformation (Axel et al. )- Process of inserting a gene into a eukaryotic cell (usually CHO cell line developed by Dr. Larry Chasin) to cause the cell to reliably produce large amounts of a therapeutic protein – licensed to 20 companies • Xalatan (Bito)- Prostaglandin-based drug for treating Glaucoma –licensed to Pharmacia (now Pfizer) • Antibody Technology (Joint with Stanford - Morrison et al) –licensed to Centocor (Johnson & Johnson) • Digital Compression Technology (Anastassiou) – Founding member of MPEG LA, Patent Licensing Pool Partnership

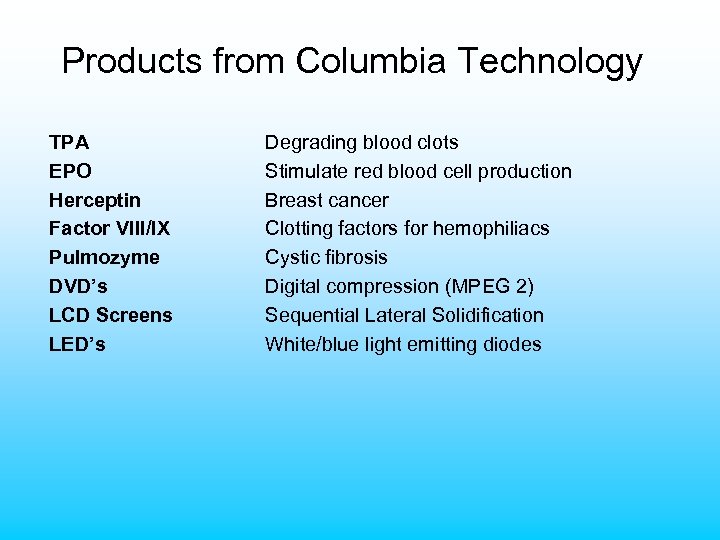

Products from Columbia Technology TPA EPO Herceptin Factor VIII/IX Pulmozyme DVD’s LCD Screens LED’s Degrading blood clots Stimulate red blood cell production Breast cancer Clotting factors for hemophiliacs Cystic fibrosis Digital compression (MPEG 2) Sequential Lateral Solidification White/blue light emitting diodes

Commercialization of Academic Research Plays a Major Role in the Economy Ÿ Funding for university research exceeded $30 billion in 2000 ($mm) Ÿ Gross license income in 2000 totaled $1. 26 billion from over 9, 059 licenses Ÿ Estimated $40 bn of US economic activity attributed to results of academic licensing, supporting 270, 000 jobs Ÿ Since 1980, 3, 400 new companies were formed based on licenses from academic institutions Ÿ Sales of products-417 in 1999 - raised $5 bn in taxes Ÿ NIH report estimates 15 x return on funding (2000) Ÿ NSF 1998, AUTM 1999, 2000. Bayh-Dole Act 1980

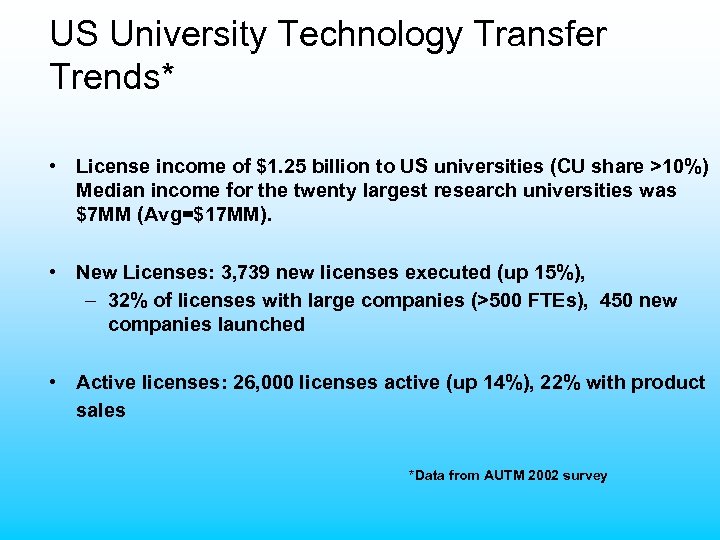

US University Technology Transfer Trends* • License income of $1. 25 billion to US universities (CU share >10%) Median income for the twenty largest research universities was $7 MM (Avg=$17 MM). • New Licenses: 3, 739 new licenses executed (up 15%), – 32% of licenses with large companies (>500 FTEs), 450 new companies launched • Active licenses: 26, 000 licenses active (up 14%), 22% with product sales *Data from AUTM 2002 survey

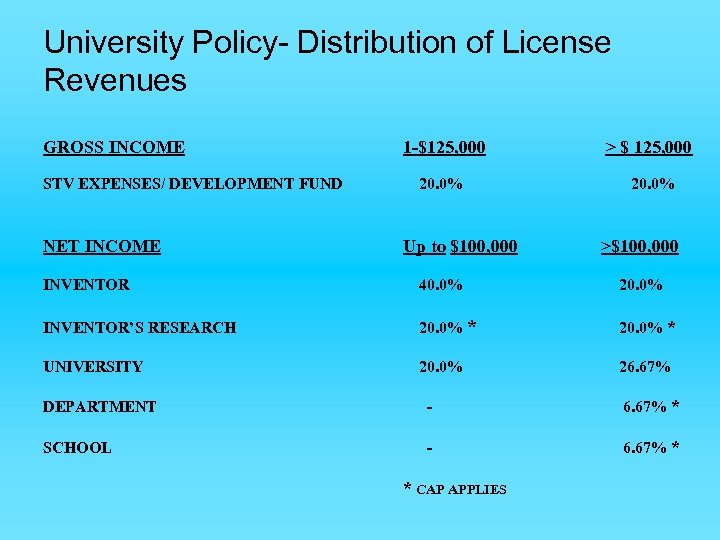

University Policy- Distribution of License Revenues GROSS INCOME STV EXPENSES/ DEVELOPMENT FUND NET INCOME 1 -$125, 000 > $ 125, 000 20. 0% Up to $100, 000 >$100, 000 INVENTOR 40. 0% 20. 0% INVENTOR’S RESEARCH 20. 0% * UNIVERSITY 20. 0% 26. 67% DEPARTMENT - 6. 67% * SCHOOL - 6. 67% * * CAP APPLIES

Criteria for Licensing to Start-ups • Higher potential ROI than licensing opportunity – Broad basis for multiple products – Ideally a disruptive technology likely to be adopted in near term – Development work and proof of principle required to attract licensees – Best (often only) route to exploitation • Faculty member must have requisite contacts, drive and abilities • Must meet current investor criteria – Business model, quality management interest, alignment of interests, large market size • Low risk of negative public relations relating to technology and stakeholders

STV Approach to Spinouts • Low up front money, patent costs reimbursed • License fee phased in line with milestones and/or funding rounds • Case by case balance of equity & royalties, strategic decision based on business and the IP’s likely productization • STV support before and after first round of Funding • Columbia portfolio company status

Best Practices for Adding and Retaining Value in Spinouts • Help on business plan-staff experience/business school • Make introductions to potential mgmt (VC Network) • Introduce faculty members to each other, eg. molecular biologists to chemists • Introduction to venture community-extensive networks • Lower up front fees in exchange for equity • Bundle IP with complementary inventions at other universities, both domestic and international • Add experts to SAB, take a board observer seat, lend world class expertise- “the halo effect” • Pay patent costs, stretch dates of reimbursement • Facilitate turnarounds

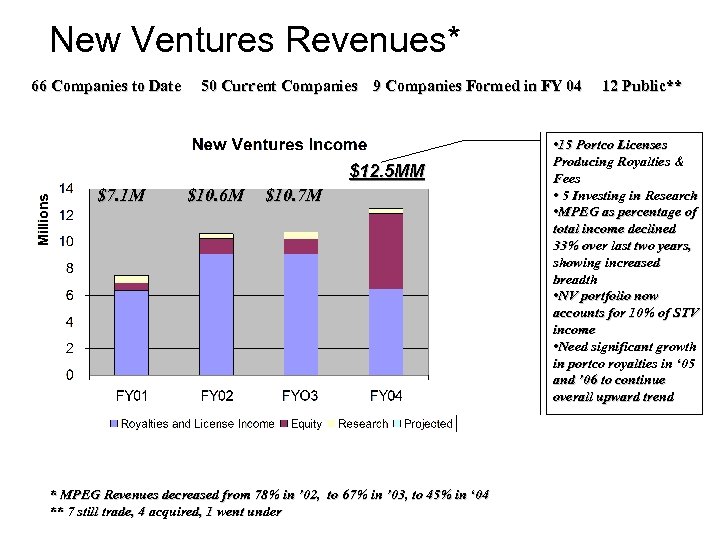

New Ventures Revenues* 66 Companies to Date 50 Current Companies 9 Companies Formed in FY 04 $12. 5 MM $7. 1 M $10. 6 M $10. 7 M * MPEG Revenues decreased from 78% in ’ 02, to 67% in ’ 03, to 45% in ‘ 04 ** 7 still trade, 4 acquired, 1 went under 12 Public** • 15 Portco Licenses Producing Royalties & Fees • 5 Investing in Research • MPEG as percentage of total income declined 33% over last two years, showing increased breadth • NV portfolio now accounts for 10% of STV income • Need significant growth in portco royalties in ‘ 05 and ’ 06 to continue overall upward trend

Summary on University Startups • Universities help to launch startups when they are realistic businesses • Startups should provide fair value for the technology and reward risks by university • Equity is only part of the deal value, not the driver • Companies need to recognize the complexity in university policies • Both sides need to be creative and flexible, and have fun throughout the negotiation • Outstanding management at the earliest stages makes all the difference • Even failed startups can benefit Columbia

Value of STV’s Portfolio of New Ventures has Increased Over Time • Since its inception, STV has been involved in 66 start-ups, in many cases taking an equity stake – 50 companies still active – 15 currently produce income through royalties, equity payments and milestone fees – 5 are investing in sponsored research at Columbia University • 2004 was an extremely positive year for creating shareholder exits – 7 companies acquired, went public or announced exit events, for a total of $8 million (estimate) in income to Columbia over FY 04 and FY 05 – Compared to 5 such events over past 19 years • Latest valuation for STV’s private equity is $40 million

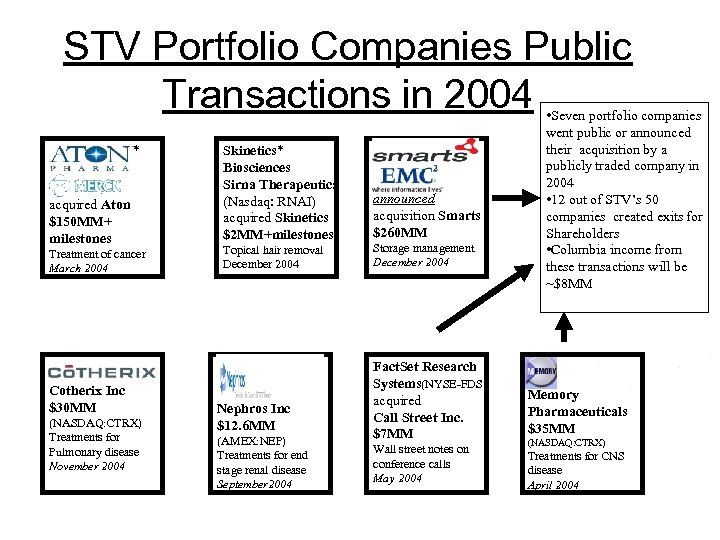

STV Portfolio Companies Public Transactions in 2004 * acquired Aton $150 MM+ milestones Treatment of cancer March 2004 Cotherix Inc $30 MM (NASDAQ: CTRX) Treatments for Pulmonary disease November 2004 Skinetics* Biosciences Sirna Therapeutics (Nasdaq: RNAI) acquired Skinetics $2 MM+milestones Topical hair removal December 2004 Nephros Inc $12. 6 MM (AMEX: NEP) Treatments for end stage renal disease September 2004 announced acquisition Smarts $260 MM Storage management December 2004 Fact. Set Research Systems(NYSE-FDS) acquired Call Street Inc. $7 MM Wall street notes on conference calls May 2004 • Seven portfolio companies went public or announced their acquisition by a publicly traded company in 2004 • 12 out of STV’s 50 companies created exits for Shareholders • Columbia income from these transactions will be ~$8 MM Memory Pharmaceuticals $35 MM (NASDAQ: CTRX) Treatments for CNS disease April 2004

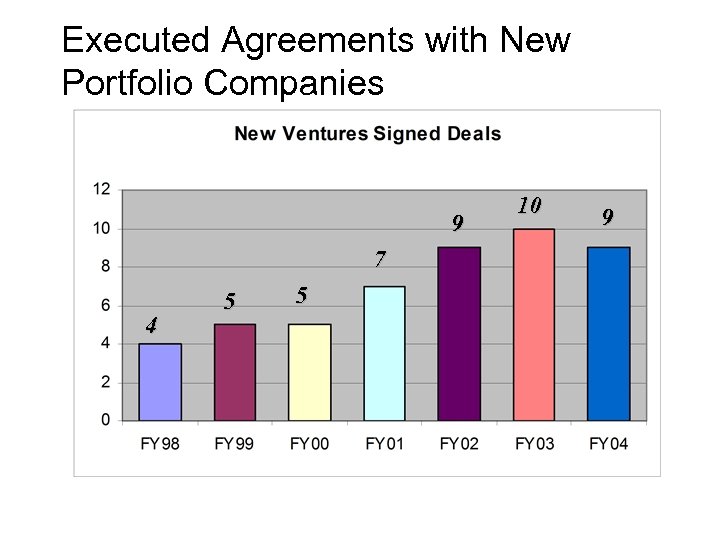

Executed Agreements with New Portfolio Companies 9 7 4 5 5 10 9

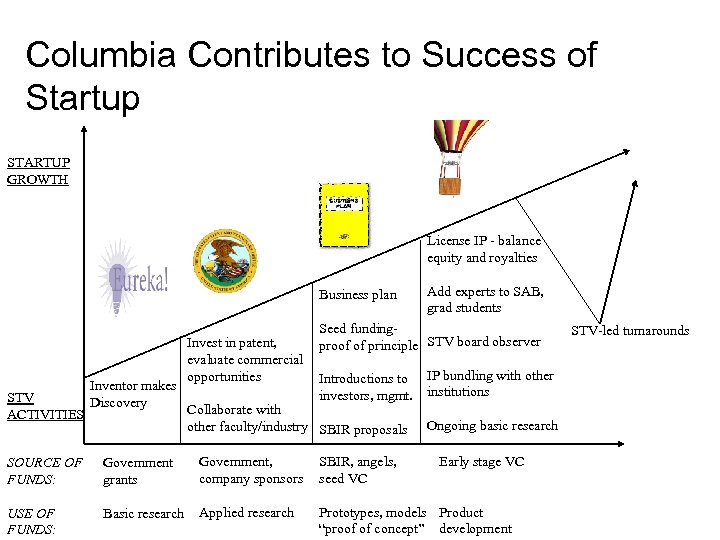

Columbia Contributes to Success of Startup STARTUP GROWTH License IP - balance equity and royalties Business plan STV ACTIVITIES Inventor makes Discovery Invest in patent, evaluate commercial opportunities Add experts to SAB, grad students Seed fundingproof of principle STV board observer Introductions to investors, mgmt. Collaborate with other faculty/industry SBIR proposals IP bundling with other institutions Ongoing basic research SOURCE OF FUNDS: Government grants Government, company sponsors SBIR, angels, seed VC Early stage VC USE OF FUNDS: Basic research Applied research Prototypes, models Product “proof of concept” development STV-led turnarounds

Lessons Learned from Startups • Carefully evaluated balance of royalties, fees and equity maximizes return – In some cases Columbia should agree to equity split with scientific founder before company’s inception. • Launch startup when there is a realistic business plan • Startups should provide fair value and reward risks undertaken by university • Outstanding management at the earliest stages is vital

Startup Policies • No sponsored research allowed from company if faculty member holds equity • No management role for faculty, most act as Chief Scientific Advisor one day per week • Sell equity as soon as possible post-IPO • STV takes board observer seats in exceptional cases

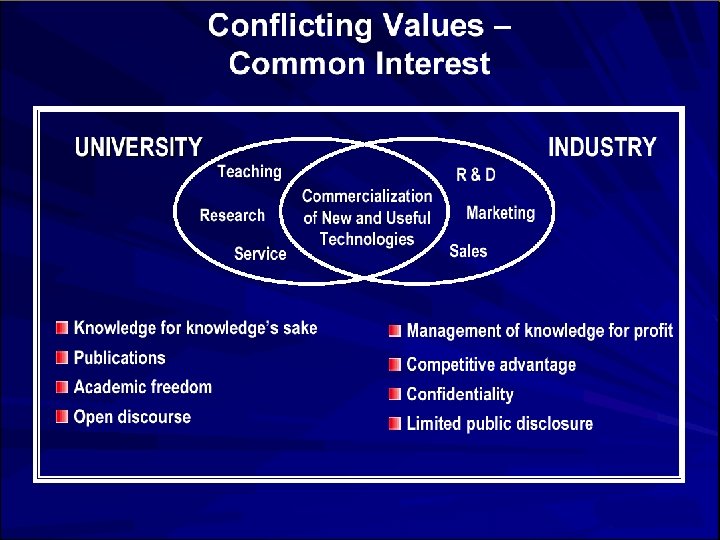

COMMON UNIVERSITY TECHNOLOGY TRANSFER ISSUES ØEffect on traditional university role. ØReturn on federal investment: Scientific, cash, equity, societal ØConflicts of interest situations - rules & management ØGeneral availability of technologies - e. g. research tools/targets. ØDeal structure - Going commercial rate? - Back v front loading - Start ups; equity, royalties, license fees, research - Small v large companies. ØTimeliness/Responsiveness: internal & external ØGlobal Issues - Provisions for poor countries - Patent status/enforceability

What is Next in Technology Transfer? • Technology gap funding increasingly common as Universities seek to maximize returns • Industry university partnerships • Humanitarian considerations • Increasing number of high quality startups – Proof of concept gap funding enabling more and better opportunities – Young tenured faculty more interested in startups

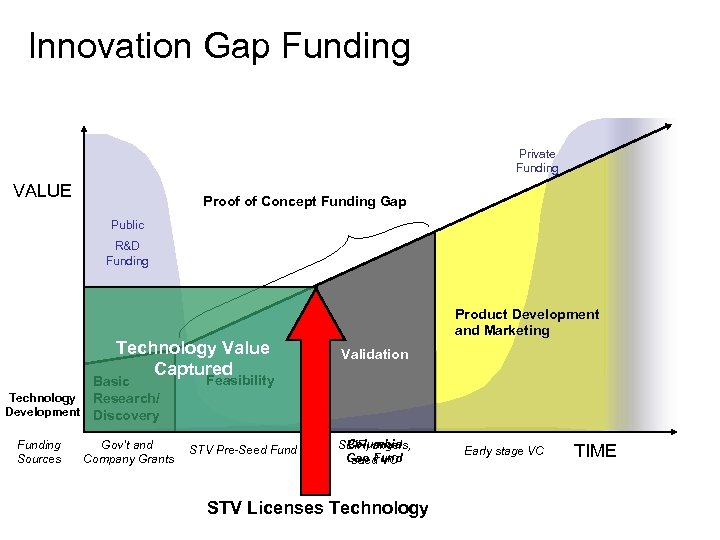

Innovation Gap Funding Private Funding VALUE Proof of Concept Funding Gap Public R&D Funding Technology Value Captured Basic Technology Research/ Development Discovery Funding Sources Gov’t and Company Grants Product Development and Marketing Validation Feasibility STV Pre-Seed Fund Columbia SBIR, angels, Gap Fund seed VC STV Licenses Technology Early stage VC TIME

Models to Bridge the Proof of Concept Gap at Universities • Government funded seed funds - University Challenge Seed Fund - UK, STTR program - US • Philanthropy funded interdisciplinary drug discovery centers Broad Institute - MIT /Harvard • Venture-backed specialty investment companies /incubators- Synecor - Duke, Frazier Health Care, Guidant, GE Medical, Delphi and Deutsche Bank • University Seed Funds- There are over 60 universities with some kind of seed funding available, ranging from granting small amounts of money to advance research projects, to venture capital funds, with endowment capital, that invest exclusively in university spinouts.

Summary Effective University Technology Transfer Needs: • • Clear Title (e. g. Bayh Dole) University’s Commitment Office with Critical Mass, Appropriate Experience Supply of Excellent Research This can provide: • • • Value to Society and Economy Discretionary Funds to University Retention/Recruitment Incentive

Academic Partnerships – STV Partnerships • Develop collaboration with other academic research centers around the world - joint research, licensing and start-ups • Many new inventions are complex and research is multi-centergenomics, proteomics and new digital technologies • Collaboration brings together more knowledge and skills to make major new developments, allowing for more rapid development and greater success • Encourages earlier collaboration of commercial partners • University collaborators include: Stanford, Cold Spring Harbor, Oxford, Pasteur, Mc. Gill, Karolinska, ITRI

Rationale • Complexity of technology-no one Institution will have all the answers • Provides another option to exploit IP/technology • Affords leverage through access to partners’ marketing network- cross marketing • Unlocks new funding sources • Enables transfer of know how/best practices • Develops broader relationships Internationally

STV Partnerships’ Mission To develop and manage external collaborations with academic/technology development organizations and to commercialize Columbia/partner IP for the benefit of society and Columbia

Strategy • Identify areas of Research strength at Columbia which are complemented at another institution • Increase value by combining existing technology/IP into a more valuable package for licensing • Facilitate joint research, increase funding, create more valuable joint IP, license technology to obtain better deals from industry

ITRI-Taiwan • Research Foundry- industry/government funded • SLS Agreement executed- LCD/OLED flat panel displays – PDAs/cellphones//automotive • Framework agreement drafted for IP specific deals/ joint research collaborations/IP pooling • Major Agency/Research Agreement over next several years- SLS Help Desk for Taiwan industry, will license to major players - AU Optronics/Toppoly • License agreements in negotiation

Imperial/Exploit Alliance • Tripartite Alliance formed 2003 between Columbia, Imperial College London and Exploit, Singapore • Intent is to bundle technology/IP and form joint research collaborations for licensing • Bioinformatics (Functional Genomics) is first project, with Diabetes/obesity area under consideration • Cardiac Pacemaker (joint IP) strategy in development

Karolinska Institute, Stockholm • Stem cells, neurology, cancer identified as key areas for collaboration with Columbia • Joint gender specific research potential(cardiovascular/ osteoporosis/ CNS/ Diabetes) • Institutional connection through Dean’s Office, Health Sciences Division, Columbia

Mc. Gill University, Montreal • Areas for collaboration-nanotechnology, metals, sensors, cancer, parasitology, display/”smart” electric grid technology • Facilitated Faculty contact on Biosensors • Canadian Consulate/Consultant meetings -possible collaborations with Alberta, Toronto, Waterloo, Vancouver

Ireland • Dublin-UCD/DCU/Trinity contacts-MOU signed with DCU • Investigated EE collaboration potential • Genomics and high throughput screening also pursued • Science Foundation Ireland relationship with Columbia established

Ben Gurion University, Israel • Two research areas identified-tissue necrosis/drug delivery • Potential collaboration on vaccine (smallpox) and antibodies research and funding (joint project-Homeland Security funding) with Columbia start-up company • Weizmann and Technion discussions initiated

Stanford University • Radioprotection (cellular level), microarrays, bomb detection and network security of interest • Columbia Radiation /Physiology/Cellular Biophysics Faculty reviewing information • Photonics area a possibility • Bioarrays for viral/infectious disease detection – Joint IP

China • Visit in November’ 03 with CUMC personnel • Meetings with Ministry of Science and Technology, Academy of Sciences, Peking Union Medical College and Fudan University (Shanghai) • Public Health Initiatives- SARS- ongoing • Teachers’ College hosted NAEA delegation of top University administrators- STV Partnerships ran week long research management/Tech transfer seminar for group • Hosted Zhejiang IP delegation in December ‘ 03

Successful Deal. Lilly • Lilly/Columbia/British Diabetes Association/Pasteur Institute • Multi-year deal researching genetic basis of diabetes • $25 MM in corporate funding • Complexities of culture and legal frameworks overcome, all partners benefited

CSFs for International Collaborations • • Focused, dedicated resources Identification of true research synergy Faculty relationships-identify/facilitate Commercial/legal/licensing framework defined up front • Pragmatic approach to funding/resource challenges • Sense of urgency

Corporate Outreach • Integrated Business Development strategy • Coordinate across Life Sciences/Physical Sciences • Contacts Database • Presentation to highlight platform capabilities at Columbia • Incent “Proof of Concept” funding approach for industry

85a5585a9faa0170c3d522e1e5160ffb.ppt